Commentary

31st July 2019

Mr. Anoop Bhaskar

Head - Equity

WHAT WENT BY

US Fed cuts by 25bps, but turns less dovish: TThe much anticipated US Fed move to cut interest rates became a reality with a 25bps rate cut on 31st July. In true market custom of 'Buy on rumour and Sell on news', markets fell!! Post the rate cut, the press conference addressed by the US Fed Chairman Jerome Powell doused hopes of more such cuts signalling a reversal of Fed's policy in CY 2017 & 2018. The future policy signalling was apparently more hawkish than the market was anticipating. Powell characterized the move as a "mid-cycle adjustment to policy" in contrast to "the beginning of a lengthy cutting cycle."

Global Growth tepid: US real GDP growth slowed to a 2.1% in 2Q19 from 3.1% in 1Q, although the print came better than expectations. Domestic final sales grew at 3.5% which offset a large drag from net trade and inventories. In the Euro area, the continued weakness across several survey data, particularly the extreme weakness in German manufacturing, raises concerns over the growth outlook. Overall, the manufacturing PMI points to German IP contracting.

Global Markets: On the global front, US Fed cut rates for the first time in a decade but disappointed the street by the quantum (25bps) and relatively hawkish commentary. In the UK, Boris Johnson was announced to be the next prime minister as the country struggled to close the deal with the EU. Global equities witnessed divergent trends with Developed markets (MSCI DM +0.4% MoM) outperforming led by US (+1.3% MoM), while EM underperformed (MSCI EM -1.7% MoM) on the back of significant rally in USD. Global equities were buoyed by a US-China trade truce central banks continuing to shift towards a more dovish stance as economic data deteriorated. Indian Equity markets (-4.8% MoM) underperformed significantly on account of domestic issues. On a 1 Year basis, Indian markets (-0.9% YoY) have outperformed Emerging Markets (-4.6% YoY) but lagged Developed Markets (+1.6% YoY) and US (+5.8% YoY).

Currencies and Commodities: Prices of most industrial metals were flat for the month, but are lower -6% for Copper to -14% for Aluminium on a Year on Year basis on account of global growth concerns and US-China trade war. In the currency markets, the strength of the USD (+2.5% MoM) was offset by the weakness in UK pound (-4.2% MoM) and the EURO (-2.6% MoM). The INR was relatively stable, (-0.3% MoM). Interest rates were flat to lower across countries with India 10 Year (-51 bps MoM) leading the fall. The 10 Year yield in India is now 140 bps lower than the year ago period.

Crude stable: Crude was flat for the month, closing at $65.2/barrel and continues to remain in the comfort zone as far as the Indian economy is concerned. Crude prices are expected to be range bound going forward. Global growth slowdown and US shale supplies should act as a dampener for crude prices. But at the same time coordinated supply cuts by OPEC and political tensions in Iran and Venezuela could counter the effect, keeping crude range bound.

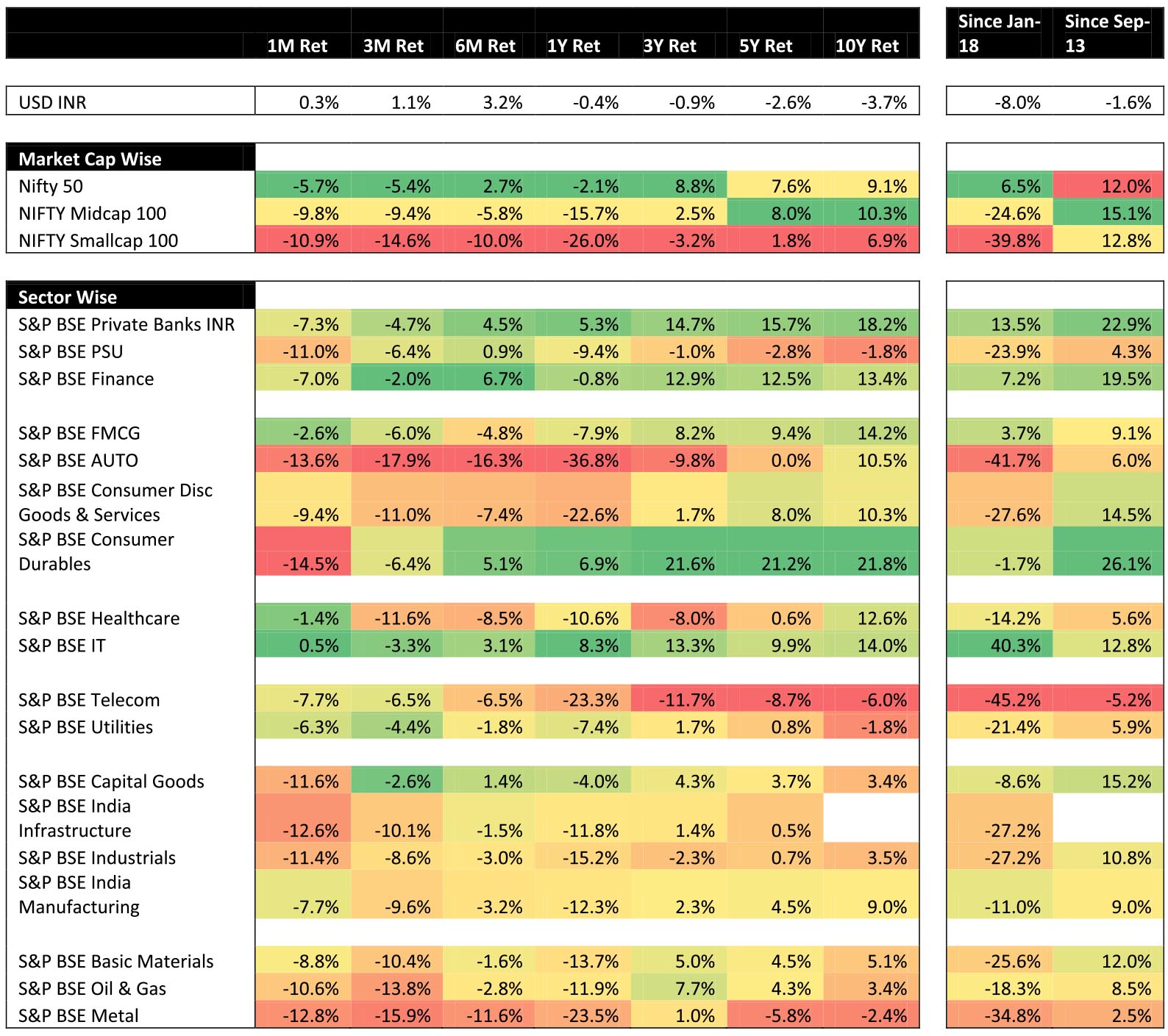

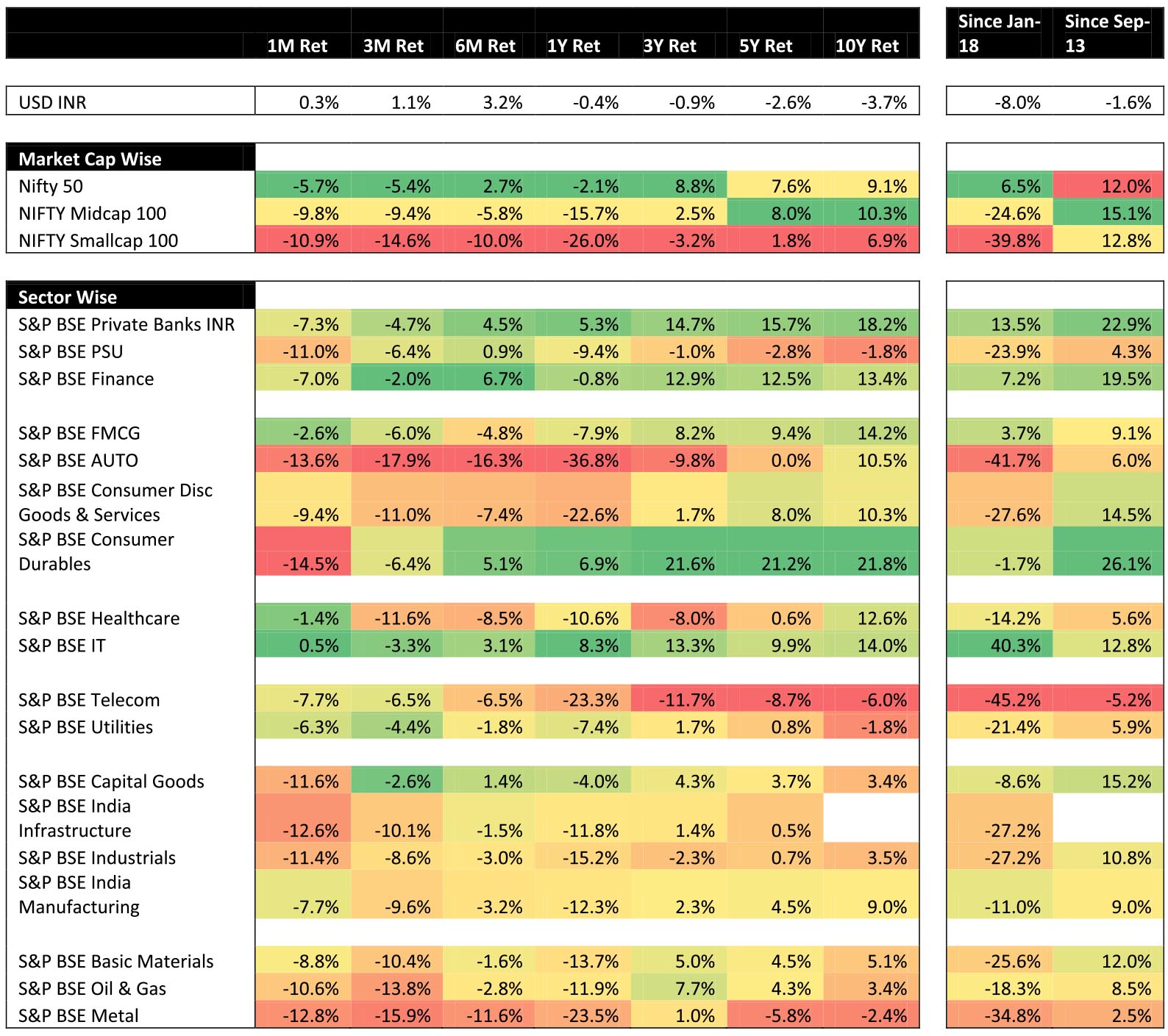

Domestic Markets: Indian markets (Nifty -5.7%) logged the worst July in ~17 years with all sectors falling sharply. Mid and small caps had a sharper fall with the NSE Mid and NSE Small falling -9.8% and -10.9% respectively. On a sectoral front, Auto (-13.6% MoM) and Consumer Durable (-14.5% MoM) have been the worst performers. Most cyclical sectors – Industrials, Metals, Infra, Capgoods, PSU banks fell double digit MoM. As usual, defensives IT (+0.5% MoM), Pharma (-1.4% MoM) and FMCG (-2.6% MoM) were the key outperformers. On a 1 year basis, auto (-36.8% YoY) has been the worst performer whereas IT (+8.3% YoY) has been the key outperformer.

Trade Deficit: After trade deficit widening to 6-m high in May, June trade (deficit of $15.3bn) saw lower imports balancing softer exports. Fall in exports was broad-based with 5 out of 7 key categories declining. Rising gold prices pushed gold imports to multi-quarter highs at $11.4bn. Service trade surplus fell to a 12-m low of $6.1bn in May.

Monsoon: Earlier in the month, IMD came out with a forecast of below-average monsoon with large deficits in central and western regions. However, towards the end of July, southwest monsoon roared back and delivered above-average rainfall, reduced the shortfall to 11% (from 35% at end of June). As of 30th Jul, more than 2/3rd of the country had received normal or excess rainfall.

FII Flows: After being net buyers for 5 months, FIIs turned net sellers in July to the tune of ~$1.9bn reducing the YTD inflows to ~$9.4bn. On the other hand, DIIs ramped up their buying activity with inflows of ~$2.9bn during July taking their YTD inflows to ~$1.8bn. DMFs were buyers in the month with net inflows of $2.7bn YTD while Insurance companies were net sellers with outflows of $0.9bn YTD.

Currency and Yields: Benchmark 10 year treasury yields averaged at 6.53% in July (40bps lower vs. June avg.). On month end values the yields have declined 51bps (-100bps ytd) and are now close to Nov'16 lows as inflation remains well behaved and the RBI's policy stance turned dovish, buoying hopes of more rate cuts. INR was up +0.3%m/m in July and ended the month at 68.8/$. YTD, INR has appreciated by +1.4%. INR outperformed the broader JPM EM FX (-0.7%) in July. India's FX reserves reached an all-time high of US$430.4bn as of 19th July. Fiscal deficit for Apr-Jun 2020 came at Rs.4.3tn or 61.4% of the budgeted FY20 deficit (Rs.7.04tn). This compares to a 67.6% reached in the last fiscal during the same time frame.

Earnings: Q1 FY 20 earnings season has begun on a tepid note with higher misses than beats and most managements sounding cautious about demand and growth outlook. Despite this, NIFTY consensus EPS for FY 20 has been cut by 0.6% as yet. Banks reported mixed set of numbers – some saw lower credit costs/higher recoveries on expected lines whereas others warned of further slippages to come. Most banks witnessed decline in CASA whereas competition among private banks for Term Deposits intensified. Auto OEM's woes were aggravated as Government hiked registration charges on purchase of new vehicles. June Auto sales continued their downward spiral with market leader in PVs reporting a 15% decline. In CVs – June marked the 8th month of down-cycle, volumes declined as both leading CV players were hit by demand sluggishness. IT witnessed challenges of rising visa costs and costs of operations; demand outlook, especially for the Tier-1 players was robust with strong order books and deal pipeline. Consumer companies reported in line numbers but most management have guided for a weak outlook.

Outlook: On the domestic front, overall sentiment remained negative throughout the month on account of (1) lower growth and subdued consumer sentiment (2) credit crunch due to tight liquidity conditions and rising stress especially in NBFCs (3) lack of any measures to boost in the short to medium term. Indian equities corrected meaningfully post the FY20 Union Budget announcement on 5th July 2019 given the uncertainty emanating from a couple of proposals pertaining to: 1) Increase in taxes for FPIs accessing the Indian equity markets through the 'Trust' route; and 2) Supply side pressures for equity markets via increase in free float requirement from 25% to 35%. High frequency economic data and early results in the 1Q FY reporting season have been sedate. The monsoon season has been disappointing with June-July deficit at 9% of Long Period Average (LPA), albeit improving from ~33% deficit in end June.

Despite the doom & gloom, the only silver lining for investors is reasonable valuations, especially for small and mid-caps. Since the peak of Jan-18, NSE Mid Cap 100 Index has corrected ~25% whereas the small cap index has corrected 40%. NIFTY, on the other hand is up 6.5% for the same period. The NSE Small Cap 100 Index trades at 13.6x on Positive PE basis and 11.3x on FY20 estimate earnings. NIFTY, trades at 20.9x positive PE and 17.0x FY20 earnings. The gap between NIFTY and small Cap returns from Jan-18 is around 46%, which we believe can give an attractive entry point for long term investors, notwithstanding the short term headwinds.

Global Growth tepid: US real GDP growth slowed to a 2.1% in 2Q19 from 3.1% in 1Q, although the print came better than expectations. Domestic final sales grew at 3.5% which offset a large drag from net trade and inventories. In the Euro area, the continued weakness across several survey data, particularly the extreme weakness in German manufacturing, raises concerns over the growth outlook. Overall, the manufacturing PMI points to German IP contracting.

Global Markets: On the global front, US Fed cut rates for the first time in a decade but disappointed the street by the quantum (25bps) and relatively hawkish commentary. In the UK, Boris Johnson was announced to be the next prime minister as the country struggled to close the deal with the EU. Global equities witnessed divergent trends with Developed markets (MSCI DM +0.4% MoM) outperforming led by US (+1.3% MoM), while EM underperformed (MSCI EM -1.7% MoM) on the back of significant rally in USD. Global equities were buoyed by a US-China trade truce central banks continuing to shift towards a more dovish stance as economic data deteriorated. Indian Equity markets (-4.8% MoM) underperformed significantly on account of domestic issues. On a 1 Year basis, Indian markets (-0.9% YoY) have outperformed Emerging Markets (-4.6% YoY) but lagged Developed Markets (+1.6% YoY) and US (+5.8% YoY).

Currencies and Commodities: Prices of most industrial metals were flat for the month, but are lower -6% for Copper to -14% for Aluminium on a Year on Year basis on account of global growth concerns and US-China trade war. In the currency markets, the strength of the USD (+2.5% MoM) was offset by the weakness in UK pound (-4.2% MoM) and the EURO (-2.6% MoM). The INR was relatively stable, (-0.3% MoM). Interest rates were flat to lower across countries with India 10 Year (-51 bps MoM) leading the fall. The 10 Year yield in India is now 140 bps lower than the year ago period.

Crude stable: Crude was flat for the month, closing at $65.2/barrel and continues to remain in the comfort zone as far as the Indian economy is concerned. Crude prices are expected to be range bound going forward. Global growth slowdown and US shale supplies should act as a dampener for crude prices. But at the same time coordinated supply cuts by OPEC and political tensions in Iran and Venezuela could counter the effect, keeping crude range bound.

Domestic Markets: Indian markets (Nifty -5.7%) logged the worst July in ~17 years with all sectors falling sharply. Mid and small caps had a sharper fall with the NSE Mid and NSE Small falling -9.8% and -10.9% respectively. On a sectoral front, Auto (-13.6% MoM) and Consumer Durable (-14.5% MoM) have been the worst performers. Most cyclical sectors – Industrials, Metals, Infra, Capgoods, PSU banks fell double digit MoM. As usual, defensives IT (+0.5% MoM), Pharma (-1.4% MoM) and FMCG (-2.6% MoM) were the key outperformers. On a 1 year basis, auto (-36.8% YoY) has been the worst performer whereas IT (+8.3% YoY) has been the key outperformer.

Trade Deficit: After trade deficit widening to 6-m high in May, June trade (deficit of $15.3bn) saw lower imports balancing softer exports. Fall in exports was broad-based with 5 out of 7 key categories declining. Rising gold prices pushed gold imports to multi-quarter highs at $11.4bn. Service trade surplus fell to a 12-m low of $6.1bn in May.

Monsoon: Earlier in the month, IMD came out with a forecast of below-average monsoon with large deficits in central and western regions. However, towards the end of July, southwest monsoon roared back and delivered above-average rainfall, reduced the shortfall to 11% (from 35% at end of June). As of 30th Jul, more than 2/3rd of the country had received normal or excess rainfall.

FII Flows: After being net buyers for 5 months, FIIs turned net sellers in July to the tune of ~$1.9bn reducing the YTD inflows to ~$9.4bn. On the other hand, DIIs ramped up their buying activity with inflows of ~$2.9bn during July taking their YTD inflows to ~$1.8bn. DMFs were buyers in the month with net inflows of $2.7bn YTD while Insurance companies were net sellers with outflows of $0.9bn YTD.

Currency and Yields: Benchmark 10 year treasury yields averaged at 6.53% in July (40bps lower vs. June avg.). On month end values the yields have declined 51bps (-100bps ytd) and are now close to Nov'16 lows as inflation remains well behaved and the RBI's policy stance turned dovish, buoying hopes of more rate cuts. INR was up +0.3%m/m in July and ended the month at 68.8/$. YTD, INR has appreciated by +1.4%. INR outperformed the broader JPM EM FX (-0.7%) in July. India's FX reserves reached an all-time high of US$430.4bn as of 19th July. Fiscal deficit for Apr-Jun 2020 came at Rs.4.3tn or 61.4% of the budgeted FY20 deficit (Rs.7.04tn). This compares to a 67.6% reached in the last fiscal during the same time frame.

Earnings: Q1 FY 20 earnings season has begun on a tepid note with higher misses than beats and most managements sounding cautious about demand and growth outlook. Despite this, NIFTY consensus EPS for FY 20 has been cut by 0.6% as yet. Banks reported mixed set of numbers – some saw lower credit costs/higher recoveries on expected lines whereas others warned of further slippages to come. Most banks witnessed decline in CASA whereas competition among private banks for Term Deposits intensified. Auto OEM's woes were aggravated as Government hiked registration charges on purchase of new vehicles. June Auto sales continued their downward spiral with market leader in PVs reporting a 15% decline. In CVs – June marked the 8th month of down-cycle, volumes declined as both leading CV players were hit by demand sluggishness. IT witnessed challenges of rising visa costs and costs of operations; demand outlook, especially for the Tier-1 players was robust with strong order books and deal pipeline. Consumer companies reported in line numbers but most management have guided for a weak outlook.

Outlook: On the domestic front, overall sentiment remained negative throughout the month on account of (1) lower growth and subdued consumer sentiment (2) credit crunch due to tight liquidity conditions and rising stress especially in NBFCs (3) lack of any measures to boost in the short to medium term. Indian equities corrected meaningfully post the FY20 Union Budget announcement on 5th July 2019 given the uncertainty emanating from a couple of proposals pertaining to: 1) Increase in taxes for FPIs accessing the Indian equity markets through the 'Trust' route; and 2) Supply side pressures for equity markets via increase in free float requirement from 25% to 35%. High frequency economic data and early results in the 1Q FY reporting season have been sedate. The monsoon season has been disappointing with June-July deficit at 9% of Long Period Average (LPA), albeit improving from ~33% deficit in end June.

Despite the doom & gloom, the only silver lining for investors is reasonable valuations, especially for small and mid-caps. Since the peak of Jan-18, NSE Mid Cap 100 Index has corrected ~25% whereas the small cap index has corrected 40%. NIFTY, on the other hand is up 6.5% for the same period. The NSE Small Cap 100 Index trades at 13.6x on Positive PE basis and 11.3x on FY20 estimate earnings. NIFTY, trades at 20.9x positive PE and 17.0x FY20 earnings. The gap between NIFTY and small Cap returns from Jan-18 is around 46%, which we believe can give an attractive entry point for long term investors, notwithstanding the short term headwinds.

| Equity Markets | Index | % Change YTD | % Change MTD | P/E |

| Nifty | 11,118.00 | 2.35% | -5.69% | 17.46 |

| Sensex | 37,481.12 | 3.92% | -4.86% | 18.26 |

| Dow Jones | 26,864.27 | 15.16% | 0.99% | 16.86 |

| Shanghai | 2,932.51 | 17.59% | -1.56% | 10.82 |

| Nikkei | 21,521.53 | 7.53% | 1.15% | 14.78 |

| Hang Sang | 27,777.75 | 7.48% | -2.68% | 10.35 |

| FTSE | 7,586.78 | 12.76% | 2.17% | 12.35 |

| MSCI E.M. (USD) | 1,037.01 | 7.38% | -1.69% | 12.29 |

| MSCI D.M.(USD) | 2,187.56 | 16.12% | 0.42% | 15.94 |

| MSCI India (INR) | 1,258.66 | -0.32% | -5.82% | 17.33 |

| Currency & Commodities | Last Price % | Change YTD % | Change MTD |

| USD / INR | 68.798 | -1.39% | -0.33% |

| Dollar Index | 98.52 | 2.44% | 2.48% |

| Gold | 1,413.90 | 10.25% | 0.32% |

| WTI (Nymex) | 58.58 | 29.00% | 0.19% |

| Brent Crude | 65.17 | 21.13% | -2.07% |

| India Macro Analysis | Latest | Equity Flows | USD Mn |

| GDP | 5.80 | FII (USD mln) | |

| IIP | 3.10 | YTD | 9,406.95 |

| Inflation (WPI Monthly) | 2.02 | MTD | -1934.23 |

| Inflation (CPI Monthly) | 3.18 | *DII (USD mln) | |

| Commodity (CRB Index) | 403.16 | YTD | 3,338.13 |

| Source: Bloomberg | MTD | 2,192.21 | |

| *DII : Domestic Mutual Funds Data as on Data as on 31stJuly 2019 | |||

Mr. Suyash Choudhary

Head - Fixed Income

WHAT WENT BY

Bonds continued their positive run with the 10 year bond yield falling by 51bps while 10 year AAA and 10 year SDL eased by 33 bps on the decision of Government to stick to fiscal consolidation in their FY20 budget, announcement of sovereign bond (which could help balance domestic demand/supply gap) & positive global cues. The curve bull flattened with 10 year to 5 year G-Sec spread reduced to 6.5bps from 15bps on an average in June as market participants started pricing in more easing.

The FY20 Budget surprised the market by lowering the fiscal deficit target to 3.3% of GDP vis-à-vis the indicated level of 3.4% presented earlier in the interim budget in Feb-19. In the final budget, FY20 estimates (vs. the interim budget) were cut by Rs. 51,000 crores for income tax and Rs. 98,000 crores for total GST collections. However, no overall expenditure cuts or higher borrowing is planned. This reduction in revenue estimates is planned to be met by higher customs (Rs. 11,000 crores), excise duties (Rs. 40,000 crores), non-tax revenues (Rs. 41,000 crores from higher RBI and nationalised bank dividends, possible spectrum auctions, etc.) and higher non-debt capital receipts (Rs. 17,000 crores from disinvestments, etc.). Furthermore, the government announced to start raising a part of its gross borrowing programme in external markets in external currencies. Finance secretary has said first bond may take 3 – 5 months and that they will target borrowing 10 – 15% of gross borrowing offshore.

India's merchandise trade deficit was broadly flat m/m at USD 15.3 bn in June (May: USD15.4bn). Exports fell 9.7% y/y in June, the weakest print since January 2016 (May: +3.9%), and imports declined 9.1% (May: +4.3%), a 31-month low.

Industrial production growth for May'19 saw a moderation in growth to 3.1% from 4.3% a month back and 3.8% a year ago. Economic activity wise classification show that this moderation was largely due to manufacturing sector which grew by 2.5%. On the user based classification, strong performance came from consumer non-durables at 7.7% and infra and construction at 5.5%. Growth for Capital and intermediate goods remained weak at 0.8% and 0.6% respectively. The durables segment has remained flat YoY.

June WPI inflation further moderated sharply to 2.02% (Consensus: 2.25%) as against 2.45% in May owing to favourable base effects and moderation in manufacturing and fuel and power inflation.

In a widely expected move, the US Federal Reserve cut interest rates by 25 bps to a new range of 2.00-2.25%. The Fed also announced plans to end the reduction of its $3.8 trillion asset portfolio, effective August 1, two months earlier than previously expected. In the press conference post the meet, the Fed chair described the cut as a mid-cycle 'insurance' cut in order to make sure that the recovery prolongs in the face of global and trade related headwinds and also to give support to inflation. In particular, he was focused on the cumulative change in financial conditions since early in the year during which the Fed has turned from being on a hiking cycle, to being on a patient hold, to finally cutting rates by 25 bps.

Outlook:

The MPC in its August policy cut the repo rate by 35 bps to 5.40%, while maintaining stance of policy as accommodative. The move to cut was decided with the 35 bps to 25 bps vote counting as 4:2. It may be recalled that Governor Das had earlier floated the idea of challenging the conventional 25 bps moves, with unconventional steps like the one today possibly reaffirming the signaling effect of policy direction as well. The policy is largely in line with the dovish end of expectations. There is no decision with respect to the working group on liquidity management framework. However, the Governor did note the very large surpluses in the system today and reaffirmed the commitment to provide abundant liquidity. Thus the implementation basis the recommendations of the framework is very likely to be consistent with the current market view that RBI as already moved to targeting surplus liquidity.

With this clear stance of the current policy objective alongside weak inflation pressures and a probable overestimation of growth, we reiterate our previously expressed view of a terminal repo rate of 5% (see (see https://www.idfcmf.com/insights/managing-financial-conditions/), alongside provisioning of comfortable positive liquidity. With liquidity in surplus and banks' credit growth slowing, term spreads seem to be attractive and this remains a continued bullish backdrop for quality bonds.