Commentary

29th November 2019

Mr. Anoop Bhaskar

Head - Equity

WHAT WENT BY

US China trade tensions poised for a 'short term' relief: At the beginning of the month global equity markets

rallied as US Commerce Secretary Wilbur Ross noted that the US and China were on track to have a deal signed

in November. Positive news flow on trade relations continued into mid-month amid a NYT report suggesting the

Trump administration would extend licenses for American companies doing business with Huawei.

Equity markets rally: Global equity markets rallied during the month with MSCI Developed Markets (+2.6% MoM) outperforming MSCI Emerging Markets (-0.2% MoM). US was the key outperformer (+3.4% MoM) and has been the standout market across timeframes in the last 10 years. Indian markets were flat (+0.7% MoM), in the bottom half of the pack. On a 1 year return basis, Indian markets have given a dollar return of 9.5%, higher than Emerging Markets (+4.2%) but lower than Developed Markets (+12.3%).

Chinese monetary policy continues to be accommodative: In China, October economic activity data was weak. The PBoC addressed slowdown concerns with accommodative monetary policy by lowering the one-year mediumterm lending facility (MLF) by 5bps on 5 Nov (the first cut since early 2016), followed by cutting the seven-day reverse repo rate by 5bps on 18 Nov (the first cut since October 2015) and 5bps cut in the 1-year and 5-year Loan Prime Rate (LPR) on 20 Nov. PBOC also injected RMB180bn into the interbank system.

Crude continues to trade range bound: Brent fell 6% in the month closing at USD 62.43/barrel. The U.S. solidified its status as an energy producer by posting the first full month as a net exporter of crude and petroleum products since government records began in 1949. The nation exported 89,000 barrels a day more than it imported in September, according to data from the EIA. While America has previously reported net exports on a weekly basis, the latest figures mark a milestone which should limit any tear away increase in global crude prices.

Interest rates benign; currencies stable: In Metals, easing geopolitical tensions, signs of stabilizing growth and policy easing boosted Steel prices (+5% MoM). On the currency side, USD continues to gain strength (+0.9% MoM). INR fell 1% MoM in line with the strong USD. Most global currencies were stable. Interest rates (10 year yields) continue to be benign globally. US 10 year is lower 121 bps from a year ago period and is currently quoting at 1.78%.

Domestic Markets:

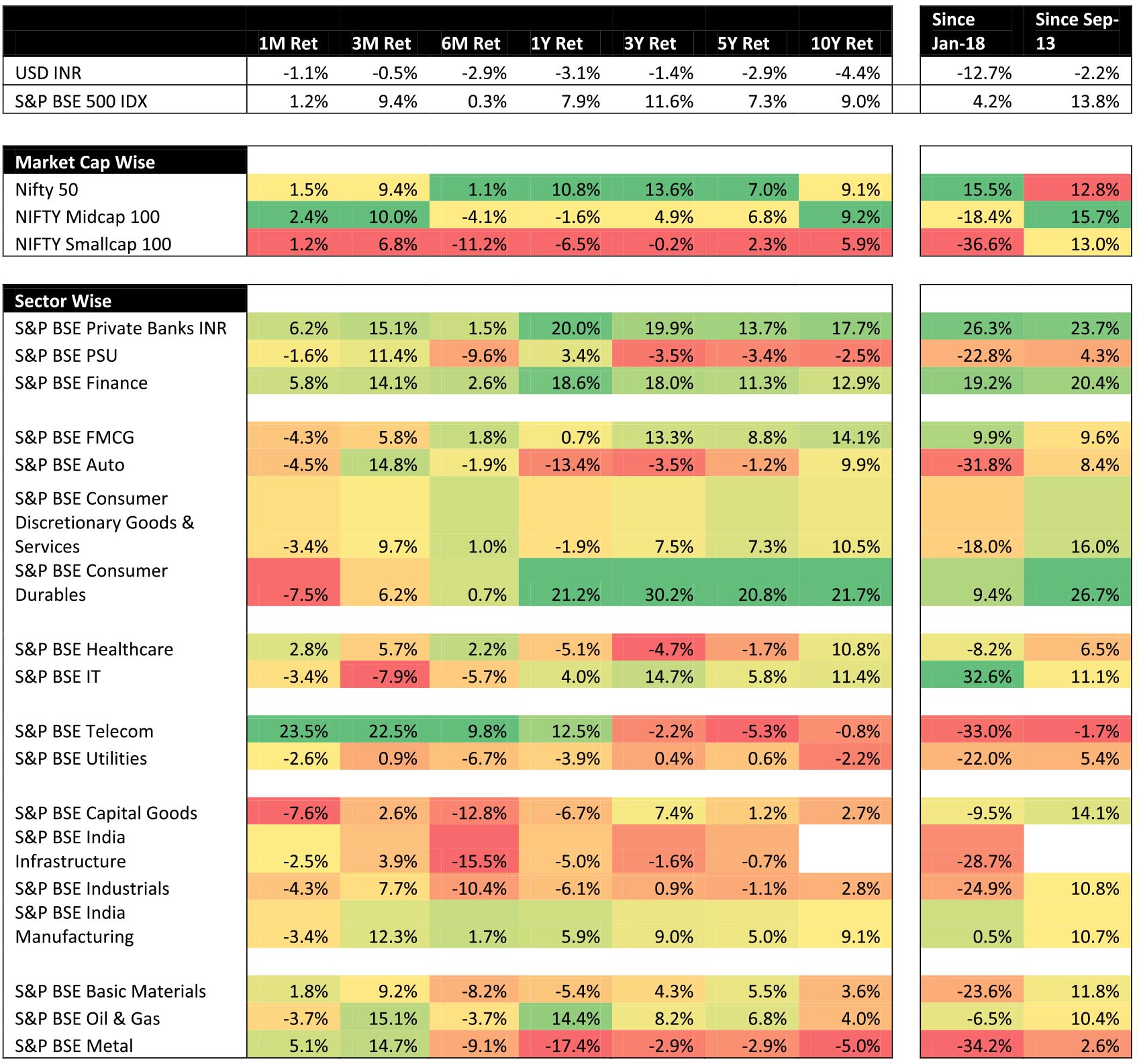

Earnings:2Q FY20 was a particularly noisy quarter for 'reported' profits:

A) big one-offs in telecom (AGR provisioning losses) and financials (deferred tax asset reversals);

B) significant base-effect in PSU banks (sharply lower provisioning YoY);

C) adoption of the new corporate tax rate regime; and d) IndAS 116 adoption impacting reported numbers especially in telecom and retail

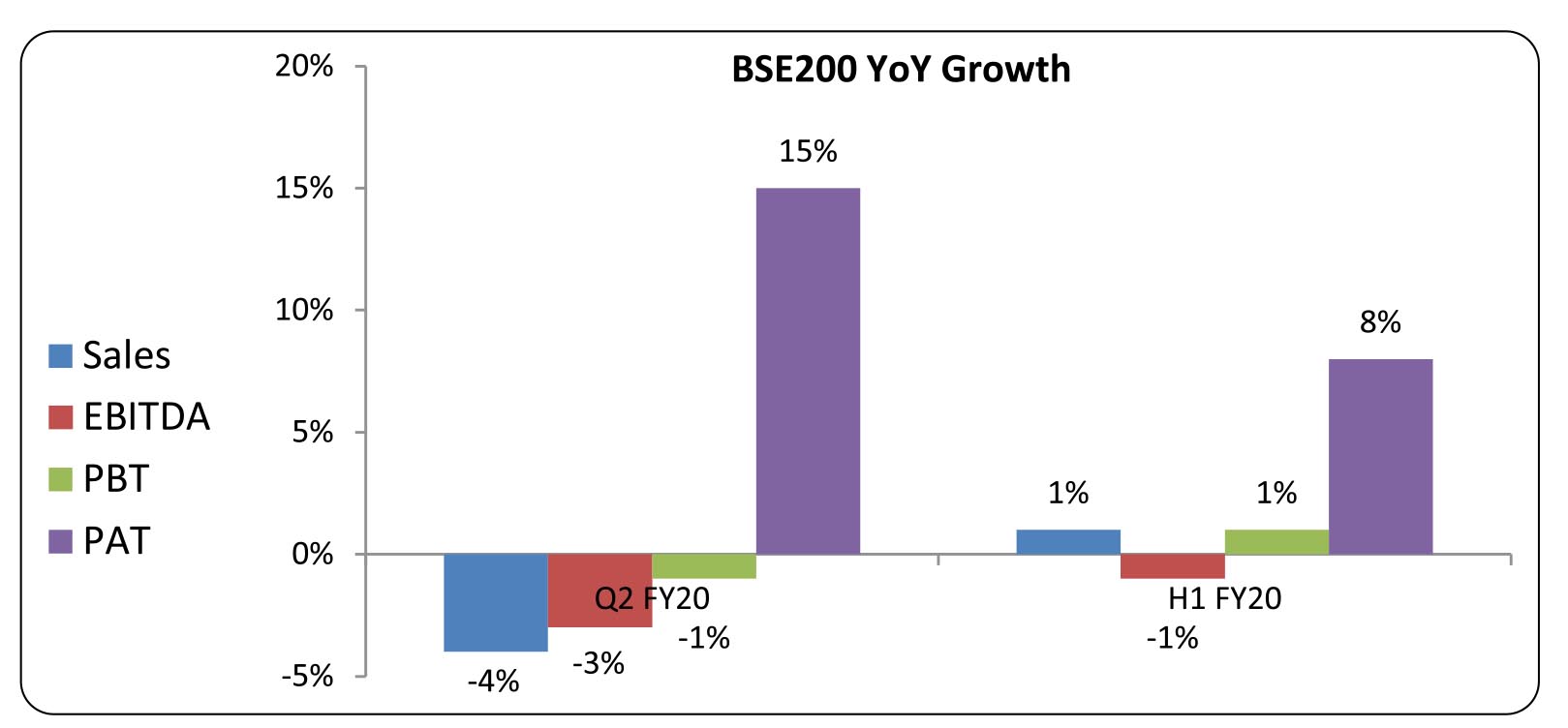

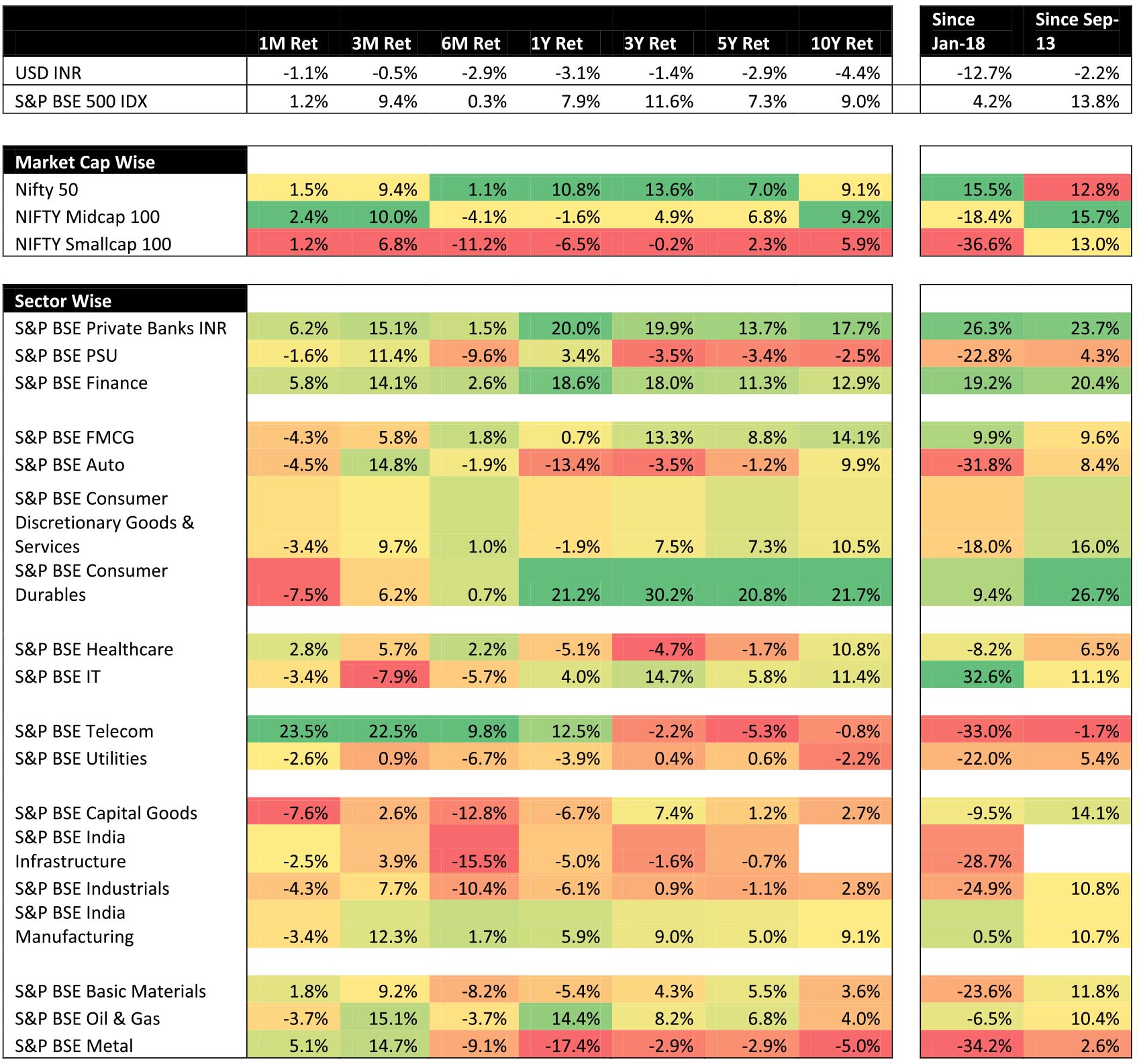

Sector Wise Returns

Muted demand growth was reflected in Sales growth being negative and all sectors seeing a decelerating trajectory of YoY growth

Across all sectors barring energy, operating profits fared better than expected, mostly owing to lower input costs - autos, staples and cement sectors benefited the most. Banks also reported better than expected PPoP trends (largely treasury gains).

● Positives

Domestic Markets: Domestic markets were positive for the month with the NSE Mid Cap (+2.4% MoM) outperforming NIFTY (+1.5% MoM) and Small Cap (+1.2% MoM). The Mid Cap Index (+10.0% MoM) now outperforms the NIFTY (+9.4% MoM) even on a 3-month basis, though the Small Cap Index (+6.8%) continues to lag.

The Communication Services sector was up 23.5% in November buoyed by positive reform developments as the Cabinet decided to provide telecom companies with a two-year moratorium on spectrum-related dues. This is expected to provide much-needed relief to the sector, and reduce the likelihood of defaults. Moreover, all three telcos had announced their intent to increase tariffs in December, ranging from 15% to 47%.

Most of the consumer pack underperformed with BSE Consumer Durable Index (-7.5% MoM) being the worst performer. Cyclicals (+5.5% MoM) outperformed Stable sectors (+2.9% MoM), a small reversal in the trend seen since Jan-2018

Fiscal Policy Measures: CCEA gave in-principle approval for strategic disinvestment of govt. stake in 5 PSUs incl. BPCL and ConCor. These strategic sales are imperative for govt. to meet its disinvestment target of Rs1.05tn out of which only Rs173bn has been realized so far. They also approved bringing down govt. stake below 51% in select PSUs.

State Elections: Political turmoil continued in Maharashtra where BJP's Fadnavis ended the Presidential rule and claimed the CM seat with support of NCP's Ajit Pawar only to later realize that they didn't have the majority. Their resignations paved way for the new government formation under the coalition of Shiv Sena-NCP-Congress.

Economic Growth: Activity moderated further in the Q2 FY20 with real GDP growth at 6.5-year low of 4.5% YoY despite sharp pick-up in government expenditure, without which the real GDP growth would have fell to a post- GFC low of 3.1% YoY.

Inflation: Headline CPI print surprised on the upside at 4.6% for Oct vs consensus expectation of 4.3%, led by a sharp spike in food inflation to 6.9% primarily on account of supply shock led higher vegetable prices.

Sovereign Rating: Moody's downgraded India's outlook to negative while maintaining rating at Baa2 as a reaction to the growth slowdown and fiscal challenges, Moody's rating was a notch higher than others.

Trade Deficit: Oct trade deficit stood at USD 11bn as exports contracted for the third consecutive month (-1%) and imports fell for the fifth month in a row (-16%) driven by a fall in petroleum, coal and precious stones among others.

Fiscal Deficit: 7M FY20 fiscal deficit stood at 102.4% of budgeted (vs 100% last year) driven by record shortfall in gross tax revenue, w/o RBI dividend - the fiscal deficit would have been ~110% of full year target.

FII flows continue: FIIs recorded net inflows of USD 3.0bn in Indian equities in the month of November (vs net inflows of USD 2.1bn in October). YTD, FIIs are net buyers of Indian equities at USD 13.2bn. DIIs were net equity sellers at USD 1.2bn in November (vs net inflows of USD 656mn in October). YTD, DIIs are net buyers at USD 6.0bn inflows. Mutual funds were net equity sellers at USD 288mn in November (as of 22- Nov; vs inflows of USD 481mn in Oct). Insurance funds were net equity sellers of USD 943mn in November (as of 22-Nov; vs inflows of USD 177mn in Oct). YTD, mutual funds are net equity buyers at USD 7.6bn while insurance funds remain net equity sellers at USD 1.6bn.

Outlook:Earnings have been in line with muted expectations with Sales, EBITDA and PBT growth of -4%, -3% and -1% YoY respectively. PAT growth, on the other hand has been 15% YoY aided by tax cuts. Tax cuts helped maintain earnings estimate for FY20.

The market, since Jan-18 has been clearly two tiered with 70-80 stocks out of BSE 500 generating positive returns. The focus on "High Quality, Consistent Earnings" has been the most successful play during this period. Valuation gap between the "have beens" and the "has beens" is now at one of the widest levels. Given the slowdown in earnings growth even for the "High Quality Consistent Earnings" segment, a substantial part of the returns during the last 18 months has been derived from P/E re-rating. Is this P/E re-rating an endless exercise? The NSE Small Cap Index trades at 17.1x on Positive PE basis; 13.7x on FY20 estimate earnings and 0.9x Price to Book. NIFTY, trades at 22.5x positive PE; 18.6x FY20 earnings and 2.9x Price to Book.

Continuing from our last month's theme of Sentiment being the first pillar to undergo change for a new market cycle, outperformance of mid-cap and positive returns in Small Cap could indicate early signs of such a reversal. To build on this, appropriate and positive news flow from the government would be a critical factor. Valuations for the broader market continue to remain benign compared to the narrow band of winners with mid and small caps in general offering more value than the Mega Caps. Fundamentals, as reflected in earnings growth may remain muted for atleast a couple of quarters. However, waiting for surety on this front in the past has been akin to bolting the door after the horse has left.

Equity markets rally: Global equity markets rallied during the month with MSCI Developed Markets (+2.6% MoM) outperforming MSCI Emerging Markets (-0.2% MoM). US was the key outperformer (+3.4% MoM) and has been the standout market across timeframes in the last 10 years. Indian markets were flat (+0.7% MoM), in the bottom half of the pack. On a 1 year return basis, Indian markets have given a dollar return of 9.5%, higher than Emerging Markets (+4.2%) but lower than Developed Markets (+12.3%).

Chinese monetary policy continues to be accommodative: In China, October economic activity data was weak. The PBoC addressed slowdown concerns with accommodative monetary policy by lowering the one-year mediumterm lending facility (MLF) by 5bps on 5 Nov (the first cut since early 2016), followed by cutting the seven-day reverse repo rate by 5bps on 18 Nov (the first cut since October 2015) and 5bps cut in the 1-year and 5-year Loan Prime Rate (LPR) on 20 Nov. PBOC also injected RMB180bn into the interbank system.

Crude continues to trade range bound: Brent fell 6% in the month closing at USD 62.43/barrel. The U.S. solidified its status as an energy producer by posting the first full month as a net exporter of crude and petroleum products since government records began in 1949. The nation exported 89,000 barrels a day more than it imported in September, according to data from the EIA. While America has previously reported net exports on a weekly basis, the latest figures mark a milestone which should limit any tear away increase in global crude prices.

Interest rates benign; currencies stable: In Metals, easing geopolitical tensions, signs of stabilizing growth and policy easing boosted Steel prices (+5% MoM). On the currency side, USD continues to gain strength (+0.9% MoM). INR fell 1% MoM in line with the strong USD. Most global currencies were stable. Interest rates (10 year yields) continue to be benign globally. US 10 year is lower 121 bps from a year ago period and is currently quoting at 1.78%.

Domestic Markets:

Earnings:2Q FY20 was a particularly noisy quarter for 'reported' profits:

A) big one-offs in telecom (AGR provisioning losses) and financials (deferred tax asset reversals);

B) significant base-effect in PSU banks (sharply lower provisioning YoY);

C) adoption of the new corporate tax rate regime; and d) IndAS 116 adoption impacting reported numbers especially in telecom and retail

Sector Wise Returns

Muted demand growth was reflected in Sales growth being negative and all sectors seeing a decelerating trajectory of YoY growth

Across all sectors barring energy, operating profits fared better than expected, mostly owing to lower input costs - autos, staples and cement sectors benefited the most. Banks also reported better than expected PPoP trends (largely treasury gains).

● Positives

- Auto: Demand weakness continues across segments, though some festive seasonal cheer visible. Cost-cutting initiatives and lower commodity prices drive margin surprise across OEMs.

- For construction cos, execution was in line with expectation as companies demonstrated superior execution of the order book and all companies witnessed margin expansion in their EPC business.

- Cement companies reported robust YoY number on back on higher prices. Though volumes have been lower YTD, prices have held up especially in North and West as utilizations are robust.

- Banks witnessed a mixed 2QFY20. While retail banks reported healthy earnings, large corporate banks were impacted by one-time DTA write-downs. Banks reported slowdown in loan growth led by moderation in corporate lending, which reflects the weak economic environment; retail loan growth, however, remained steady.

- Consumer Staples: Demand weakness continued with further deceleration in Sales growth and no signs of immediate recovery.

- Metals: Weakness in demand, domestic as well as global, limiting sales growth. Despite lower input costs, operating leverage coupled with weaker commodity prices globally, impacted profitability.

- Oil and Gas: Marketing margins healthy; refining margins continue contracting. Lower oil prices also resulted in inventory losses.

- IT Services: Organic growth slipped as vendors witnessed muted growth in bigger verticals, such as BFS (>30% of revenues) and Retail (>15% of revenues)

Domestic Markets: Domestic markets were positive for the month with the NSE Mid Cap (+2.4% MoM) outperforming NIFTY (+1.5% MoM) and Small Cap (+1.2% MoM). The Mid Cap Index (+10.0% MoM) now outperforms the NIFTY (+9.4% MoM) even on a 3-month basis, though the Small Cap Index (+6.8%) continues to lag.

The Communication Services sector was up 23.5% in November buoyed by positive reform developments as the Cabinet decided to provide telecom companies with a two-year moratorium on spectrum-related dues. This is expected to provide much-needed relief to the sector, and reduce the likelihood of defaults. Moreover, all three telcos had announced their intent to increase tariffs in December, ranging from 15% to 47%.

Most of the consumer pack underperformed with BSE Consumer Durable Index (-7.5% MoM) being the worst performer. Cyclicals (+5.5% MoM) outperformed Stable sectors (+2.9% MoM), a small reversal in the trend seen since Jan-2018

Fiscal Policy Measures: CCEA gave in-principle approval for strategic disinvestment of govt. stake in 5 PSUs incl. BPCL and ConCor. These strategic sales are imperative for govt. to meet its disinvestment target of Rs1.05tn out of which only Rs173bn has been realized so far. They also approved bringing down govt. stake below 51% in select PSUs.

State Elections: Political turmoil continued in Maharashtra where BJP's Fadnavis ended the Presidential rule and claimed the CM seat with support of NCP's Ajit Pawar only to later realize that they didn't have the majority. Their resignations paved way for the new government formation under the coalition of Shiv Sena-NCP-Congress.

Economic Growth: Activity moderated further in the Q2 FY20 with real GDP growth at 6.5-year low of 4.5% YoY despite sharp pick-up in government expenditure, without which the real GDP growth would have fell to a post- GFC low of 3.1% YoY.

Inflation: Headline CPI print surprised on the upside at 4.6% for Oct vs consensus expectation of 4.3%, led by a sharp spike in food inflation to 6.9% primarily on account of supply shock led higher vegetable prices.

Sovereign Rating: Moody's downgraded India's outlook to negative while maintaining rating at Baa2 as a reaction to the growth slowdown and fiscal challenges, Moody's rating was a notch higher than others.

Trade Deficit: Oct trade deficit stood at USD 11bn as exports contracted for the third consecutive month (-1%) and imports fell for the fifth month in a row (-16%) driven by a fall in petroleum, coal and precious stones among others.

Fiscal Deficit: 7M FY20 fiscal deficit stood at 102.4% of budgeted (vs 100% last year) driven by record shortfall in gross tax revenue, w/o RBI dividend - the fiscal deficit would have been ~110% of full year target.

FII flows continue: FIIs recorded net inflows of USD 3.0bn in Indian equities in the month of November (vs net inflows of USD 2.1bn in October). YTD, FIIs are net buyers of Indian equities at USD 13.2bn. DIIs were net equity sellers at USD 1.2bn in November (vs net inflows of USD 656mn in October). YTD, DIIs are net buyers at USD 6.0bn inflows. Mutual funds were net equity sellers at USD 288mn in November (as of 22- Nov; vs inflows of USD 481mn in Oct). Insurance funds were net equity sellers of USD 943mn in November (as of 22-Nov; vs inflows of USD 177mn in Oct). YTD, mutual funds are net equity buyers at USD 7.6bn while insurance funds remain net equity sellers at USD 1.6bn.

Outlook:Earnings have been in line with muted expectations with Sales, EBITDA and PBT growth of -4%, -3% and -1% YoY respectively. PAT growth, on the other hand has been 15% YoY aided by tax cuts. Tax cuts helped maintain earnings estimate for FY20.

The market, since Jan-18 has been clearly two tiered with 70-80 stocks out of BSE 500 generating positive returns. The focus on "High Quality, Consistent Earnings" has been the most successful play during this period. Valuation gap between the "have beens" and the "has beens" is now at one of the widest levels. Given the slowdown in earnings growth even for the "High Quality Consistent Earnings" segment, a substantial part of the returns during the last 18 months has been derived from P/E re-rating. Is this P/E re-rating an endless exercise? The NSE Small Cap Index trades at 17.1x on Positive PE basis; 13.7x on FY20 estimate earnings and 0.9x Price to Book. NIFTY, trades at 22.5x positive PE; 18.6x FY20 earnings and 2.9x Price to Book.

Continuing from our last month's theme of Sentiment being the first pillar to undergo change for a new market cycle, outperformance of mid-cap and positive returns in Small Cap could indicate early signs of such a reversal. To build on this, appropriate and positive news flow from the government would be a critical factor. Valuations for the broader market continue to remain benign compared to the narrow band of winners with mid and small caps in general offering more value than the Mega Caps. Fundamentals, as reflected in earnings growth may remain muted for atleast a couple of quarters. However, waiting for surety on this front in the past has been akin to bolting the door after the horse has left.

| Equity Markets | Index | % Change YTD | % Change MTD | P/E |

| Nifty | 12,056.05 | 10.99% | 1.50% | 21.24 |

| Sensex | 40,793.81 | 13.10% | 1.66% | 22.32 |

| Dow Jones | 28,051.41 | 20.25% | 3.72% | 18.93 |

| Shanghai | 2,871.98 | 15.16% | -1.95% | 11.71 |

| Nikkei | 23,293.91 | 16.38% | 1.60% | 17.98 |

| Hang Sang | 26,346.49 | 1.94% | -2.08% | 10.52 |

| FTSE | 7,346.53 | 9.19% | 1.35% | 13.39 |

| MSCI E.M. (USD) | 1,040.05 | 7.69% | -0.19% | 13.83 |

| MSCI D.M.(USD) | 2,292.26 | 21.68% | 2.63% | 17.77 |

| MSCI India (INR) | 1,355.92 | 7.38% | 0.55% | 21.37 |

| Currency & Commodities | Last Price % | Change YTD % | Change MTD |

| USD / INR | 71.739 | 2.83% | 1.14% |

| Dollar Index | 98.27 | 2.18% | 0.95% |

| Gold | 1,463.94 | 14.15% | -3.24% |

| WTI (Nymex) | 55.17 | 21.49% | 1.83% |

| Brent Crude | 62.43 | 16.04% | 3.65% |

| India Macro Analysis | Latest | Equity Flows | USD Mn |

| GDP | 4.50 | FII (USD mln) | |

| IIP | -4.30 | YTD | 13,374.68 |

| Inflation (WPI Monthly) | 0.16 | MTD | 3,149.62 |

| Inflation (CPI Monthly) | 4.62 | *DII (USD mln) | |

| Commodity (CRB Index) | 386.44 | YTD | 7,038.87 |

| Source: Bloomberg | MTD | -750.21 | |

| *DII : Domestic Mutual Funds Data as on 29th November 2019 | |||

Mr. Suyash Choudhary

Head - Fixed Income

WHAT WENT BY

Government bond yields remained range-bound during November and the curve steepened marginally as weak macro data was mitigated by continued market concerns on possible fiscal slippage and risk of additional borrowing. 5-10 year AAA Corporate bond rallied driven by banks and insurance sector buying.

Consumer Price Index (CPI) inflation came in higher than consensus expectations at 4.62% vs. 3.99% last month, driven primarily by a sharp spike in vegetable prices even while core inflation moderated further. Moderation in core momentum was led by slowing growth momentum in sin goods and miscellaneous component. Within the miscellaneous group, all categories other than household goods and services saw a slowdown in sequential growth.

Q2 FY20 growth printed in line with the consensus at 4.5% YoY. That marks a deceleration from 5% growth in Q1, and is the second weakest print for the current series extending back to 2012. Slowdown in core Gross Value Added (ex-agriculture and government spend) has slowed by a further 150bps to 3.4%. Looking through industry details, GVA growth slowed to 4.3% in Q2 FY20, with growth in agriculture and mining sector remaining modest, but weakness in manufacturing intensified, with growth in the sector declining by 1.0% YoY. Services growth also dropped, with electricity, construction, wholesale and retail trade all losing momentum. Barring government spending, no material sectoral gains were seen across sectors.

India Oct trade deficit increased to USD 11.01bn vs USD 10.9 bn previously. On a YoY basis, Imports were down 16.3% due to lower petroleum prices and volumes, electronic goods, machinery. Gold imports were higher ahead of the festive season, but imports of pearls and stones was much weaker. Also, exports fell softly 1.1% to USD 26.38 bn, mainly due to lower petro prices but higher volumes, Ready Made Garments (RMG) of all textiles, cotton yarn and products, and plastic and linoleum. On the other hand, sales went up for engineering goods, gems and jewellery, chemicals, drugs and pharmaceuticals, and electronic goods.

Outlook:

The Monetary Policy Committee (MPC) rate decision to hold its policy rate in its December meeting was against market expectations of a 25bps cut. While not acting in the policy, the MPC nevertheless acknowledged monetary policy space for future action. It also reiterated continuation "with the accommodative stance as long as it is necessary to revive growth, while ensuring that inflation remains within the target".

The RBI also downplayed the point about broader transmission, noting that this "has been full and reasonably swift across various money market segments and the private corporate bond market". However, transmission to government bond market has been partial, while credit market transmission remains delayed but is picking up. The issue of elevated term spreads was raised by media in the post policy call but wasn't much entertained by the Governor (determined by market but not as if we are not looking at them). Similarly, there was a somewhat cryptic response to a question with respect to 'twist' operations which entails selling short bonds and buying long in order to influence term spreads.

Investors should probably breathe a sigh of relief insofar that this provides a longer window to keep locking into front end quality interest rates. A 175 bps odd spread between overnight to 4 year AAA bonds is there for the receiving given our high conviction view of a 'lower for longer' policy regime. Longer end rates will struggle for now, but are also cheap given almost 200 bps spread between overnight and long duration government bonds, and with these bonds currently trading close to the year's predicted nominal GDP growth. However, a sustained move here will depend upon the government not overexerting the fiscal lever and fresh risk capital entering the system.

Source: Bloomberg