IDFC Cash Fund

An Open Ended Liquid Fund

31st January 2019

FUND FEATURES

About the Fund: The Fund aims to invest in high

quality debt and money market instruments

with high liquidity and seeks to generate accrual

income with low volatility.

Category: Liquid

Monthly Avg AUM: ₹ 10,567.33 Crores

Monthly end AUM: ₹ 10,707.45 Crores

Inception Date: 2 July 2001

Fund Manager:

Mr. Harshal Joshi (w.e.f. 15th September 2015) & Mr. Anurag Mittal (w.e.f. 09th November 2015)

Other Parameter:

Benchmark: CRISIL Liquid Fund Index

SIP (Minimum Amount): ₹ 100/-

SIP Frequency: Monthly

SIP Dates (Monthly): Investor may choose any day of the month except 29th, 30th and 31st as the date of instalment.

Investment Objective: Click here

Minimum Investment Amount : ₹ 100/- and any amount thereafter

Option Available: Growth, Dividend - Daily, Weekly, Monthly & Periodic

Exit Load: Nil

NAV (₹)

Category: Liquid

Monthly Avg AUM: ₹ 10,567.33 Crores

Monthly end AUM: ₹ 10,707.45 Crores

Inception Date: 2 July 2001

Fund Manager:

Mr. Harshal Joshi (w.e.f. 15th September 2015) & Mr. Anurag Mittal (w.e.f. 09th November 2015)

Other Parameter:

| Standard Deviation (Annualized) | 0.17% |

| Modified Duration | 23 Days |

| Average Maturity | 23 Days |

| Yield to Maturity | 6.82% |

| Expense Ratio | |

| Regular | 0.09% |

| Direct | 0.09% |

SIP (Minimum Amount): ₹ 100/-

SIP Frequency: Monthly

SIP Dates (Monthly): Investor may choose any day of the month except 29th, 30th and 31st as the date of instalment.

Investment Objective: Click here

Minimum Investment Amount : ₹ 100/- and any amount thereafter

Option Available: Growth, Dividend - Daily, Weekly, Monthly & Periodic

Exit Load: Nil

NAV (₹)

| Plan | Option | Freq | NAV |

| Regular Plan | Growth | - | 2231.8794 |

| Regular Plan | Dividend | Daily | 1001.0846 |

| Regular Plan | Dividend | Weekly | 1002.2156 |

| Regular Plan | Dividend | Periodic | 1471.7734 |

| Regular Plan | Dividend | Monthly | 1000.5174 |

PORTFOLIO

| Name | Rating | % of NAV |

| Commercial Paper | 56.88% | |

| Reliance Jio Infocomm | A1+ | 9.67% |

| HDFC | A1+ | 9.15% |

| NABARD | A1+ | 8.62% |

| Bajaj Finance | A1+ | 6.93% |

| Reliance Industries | A1+ | 5.81% |

| Indian Oil Corporation | A1+ | 2.79% |

| UltraTech Cement | A1+ | 2.79% |

| REC | A1+ | 2.33% |

| Power Finance Corporation | A1+ | 2.33% |

| Small Industries Dev Bank of India | A1+ | 2.32% |

| Reliance Retail | A1+ | 1.86% |

| LIC Housing Finance | A1+ | 1.11% |

| NTPC | A1+ | 0.93% |

| Kotak Mahindra Prime | A1+ | 0.23% |

| Treasury Bill | 22.87% | |

| 45 Days CMB - 2018 | SOV | 18.07% |

| 91 Days Tbill - 2018 | SOV | 4.24% |

| 364 Days Tbill - 2018 | SOV | 0.56% |

| Name | Rating | % of NAV |

| Certificate of Deposit | 14.84% | |

| Axis Bank | A1+ | 11.32% |

| ICICI Bank | A1+ | 1.16% |

| Small Industries Dev Bank of India | A1+ | 0.87% |

| Export Import Bank of India | A1+ | 0.79% |

| HDFC Bank | A1+ | 0.46% |

| NABARD | A1+ | 0.23% |

| Corporate Bond | 7.43% | |

| Kotak Mahindra Prime | AAA | 3.18% |

| Small Industries Dev Bank of India | AAA | 1.92% |

| HDFC | AAA | 1.12% |

| LIC Housing Finance | AAA | 0.61% |

| HDB Financial Services | AAA | 0.37% |

| Kotak Mahindra Investments | AAA | 0.23% |

| Bills Rediscounting | 4.64% | |

| Kotak Mahindra Bank | UNRATED | 4.64% |

| Zero Coupon Bond | 1.24% | |

| Kotak Mahindra Prime | AAA | 1.24% |

| Net Cash and Cash Equivalent | -7.90% | |

| Grand Total | 100.00% |

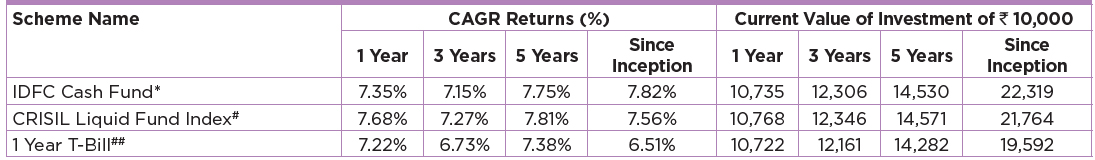

PERFORMANCE TABLE

Performance based on NAV as on 31/01/2019. Past performance may or may not be sustained in future.

The performances given are of regular plan growth option.

Click here for other funds managed by the fund manager and refer to the respective fund pages

#Benchmark Returns. ##Alternate Benchmark Returns. Standard Deviation calculated on the basis of 1 year history of monthly data

*Inception Date of Regular Plan - Growth Jun 04, 2008.

Asset Allocation

Asset Quality

RISKOMETER

- To generate short term optimal returns with stability and high liquidity.

- Investments in money market and debt instruments, with maturity up to 91 days.

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Regular and Direct Plans have different expense structure. Direct Plan shall have a lower expense ratio excluding distribution expenses, commission expenses etc.