Commentary

28th June 2019

Mr. Anoop Bhaskar

Head - Equity

WHAT WENT BY

Receding worries on US-China trade war post one-on-one meetings of President Trump and China Supremo Xi Jinping. After banning Huawei from participating in 5G roll out in the US and ban on US vendors to supply the Chinese company

with critical components and software, fears of trade war getting out of hand receded after the meeting of the two State

heads on the sidelines of the G 20 Summit. President Trump also deferred his plans to add more Chinese items which

would attract higher import tariffs. While India will not be directly impacted by these on-going tussle, more protective

and insular US trade sentiments always increase the possibility of Indian exports facing some tariff barrier.

US Fed continues dovish stance: Post the Fed's June MPC meeting, economists have pulled forward their expectations of 25bps rate cuts to July and September (vs. Sep and Dec previously). While the risk of more than 50bps of cuts is still not in their baseline outlook, they note that any further evidence of deterioration in labor market activity should motivate well more than 50bps of total cuts this cycle.

Global Markets bounce back: Global Markets surged in June with the MSCI world Index rising 6.4% MoM, up 3.4% for the quarter with equal contribution from Developed Markets (+6.5% MoM and +3.4% QoQ) and Emerging Markets (+5.7% MoM and -0.3% QoQ). Indian markets were flat but have outperformed most markets on a 1 Year basis (+10.4% YoY). Oil rose sharply in June with WTI rising 9% and Brent rising 3% MoM to close at $66.5/barrel. For the quarter though, Brent fell 3% QoQ and still trades at a comfortable range for the India economy.

Benchmark 10 year treasury yields averaged at 6.93% in June (37bps lower vs. May avg.). On month end values the yields have declined 15bps (-49bps YTD) and are now close to 20-month lows as inflation remains well behaved and the RBI's policy stance turned dovish, buoying hopes of more rate cuts. RBI has reduced the policy rate by 75bps YTD. Street forecasts additional 50bps of rate cuts in the current easing cycle (25bps each in Sep and Dec quarter). The global yields have also declined meaningfully with US 10Y yields at 2.01% (-68bps YTD).

Cumulative rainfall is running 33% below the normal on an aggregate basis as of June end. Out of 36 meteorological subdivisions, rainfall so far has been deficient in 30 (~ 82% of the country). Rainfall has been significantly below normal across regions although there has been marginal improvement in the 2nd half of June as cumulative deficit was running at ~40% in mid-June. Hopefully, given the deluge which Mumbai faced during the first few days of the delayed monsoon wiping out the deficit for the month of June, the same phenomenon plays out in the rest of the country as well!

RBI cut policy rate by 25bps to 5.75% in its last MPC meeting on 6 June and changed stance from neutral to accommodative. The MPC also marked down its FY20 growth forecast to 7% from 7.2% previously. The MPC highlighted that there is scope to accommodate growth concerns by supporting efforts to boost aggregate demand, and in particular, reinvigorate private investment activity, while remaining consistent with its flexible inflation targeting mandate. But they highlight that a disappointing monsoon (33% deficient as of June end), could constitute a negative supply-shock to the economy, and is the biggest risk to their view.

Headline CPI remained flat at 3.05% YoY in May (vs. consensus estimates of 3.1%). Food prices rose sequentially for the sixth consecutive month, increasing by 0.6% MoM, seasonally adjusted in May, taking year-on-year food inflation to 2.0% in May from 1.4% in April. Importantly, core-core inflation (standard core adjusted for gasoline, diesel, and housing) has slowed sharply to 4.4% in May (vs. 5.0% in April and 5.5% in March). WPI inflation for May at 2.5% (vs. 3.1% in April) came below expectations of 3.0% and was the lowest print in the last 22 months.

April IP came meaningfully above expectations at 3.4% YoY (consensus: 0.7%). On a sequential basis, industrial activity jumped by 2.1% MoM, seasonally adjusted after three consecutive sequential declines averaging 0.5% m/m, sa. All the sub-sectors except infra goods rose sequentially in April. On a 3m basis IP and IP-ex-cap goods remains weak, printing at -2.6% and -1.3% in April. Moreover, given the monthly volatility of IP, one should remain cautious on over-interpreting one data point, especially given the continued weakness of other high frequency data.

Domestic Markets

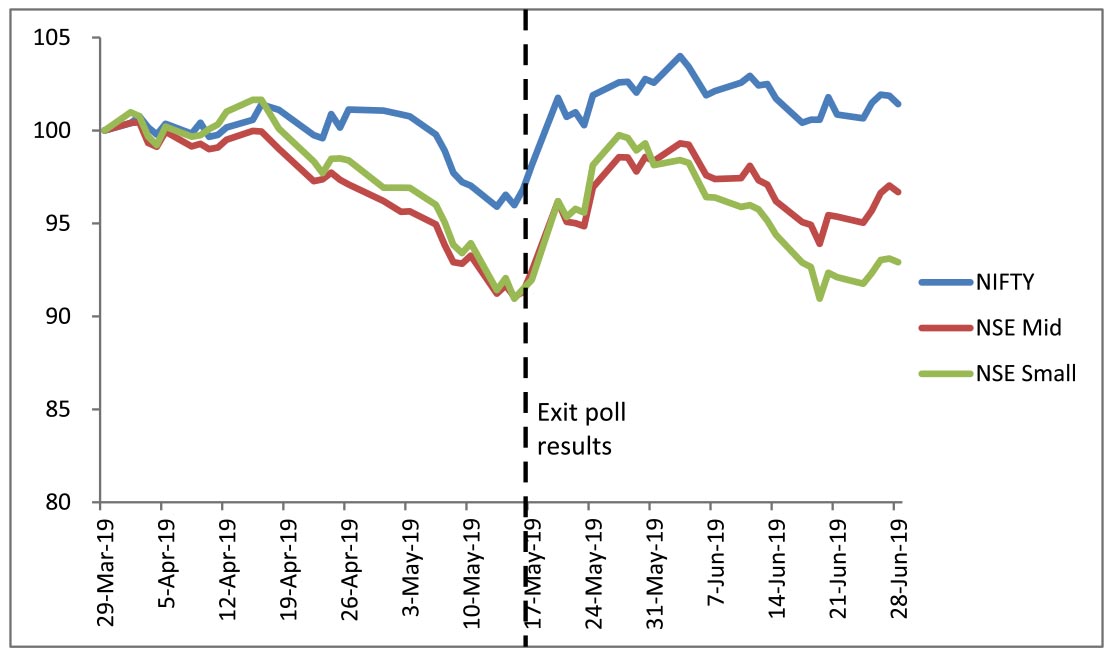

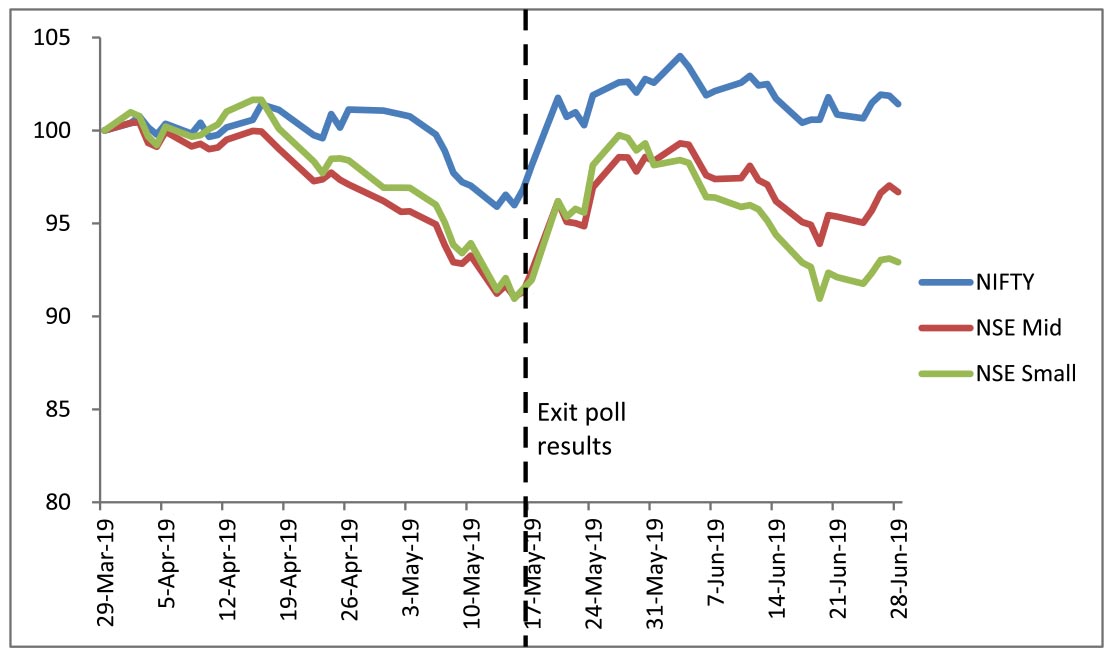

Prior to the general election results in May-19, 'election uncertainty' was cited as one of the key reasons, by many experts for the tepid performance of equity markets starting from Jan-2018. After the election results in May, markets surged as can be seen above, leading many to believe that the period of pain was mostly over. But since May, mid and small caps again corrected and this time the correction has been attributed to concerns around trade wars, domestic growth and the patchy monsoon.

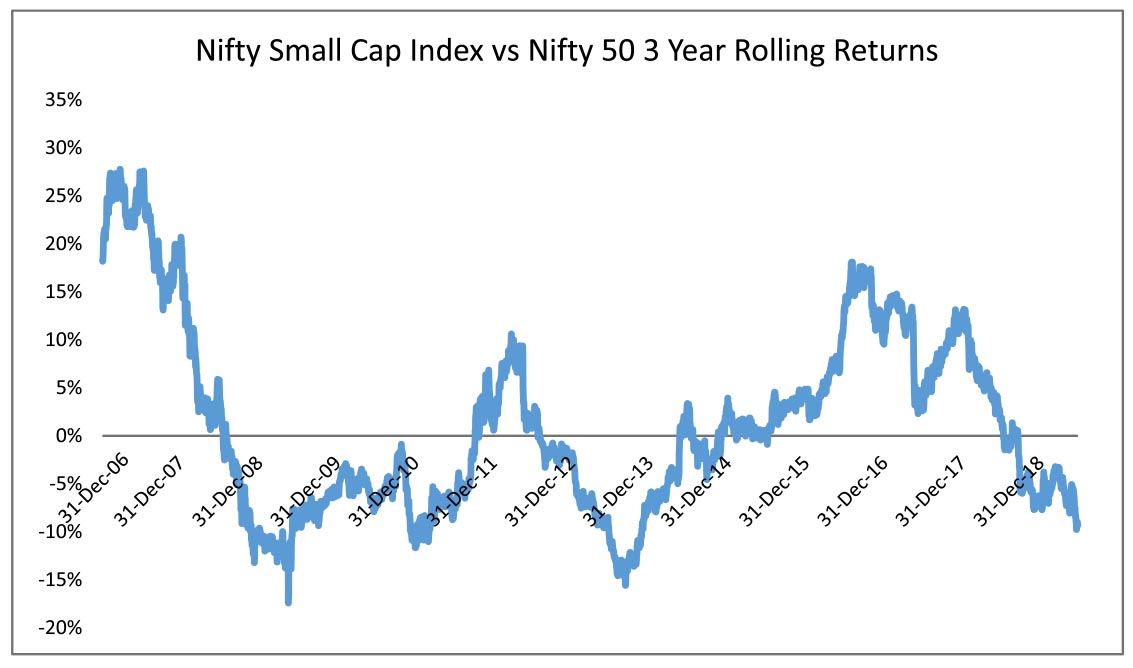

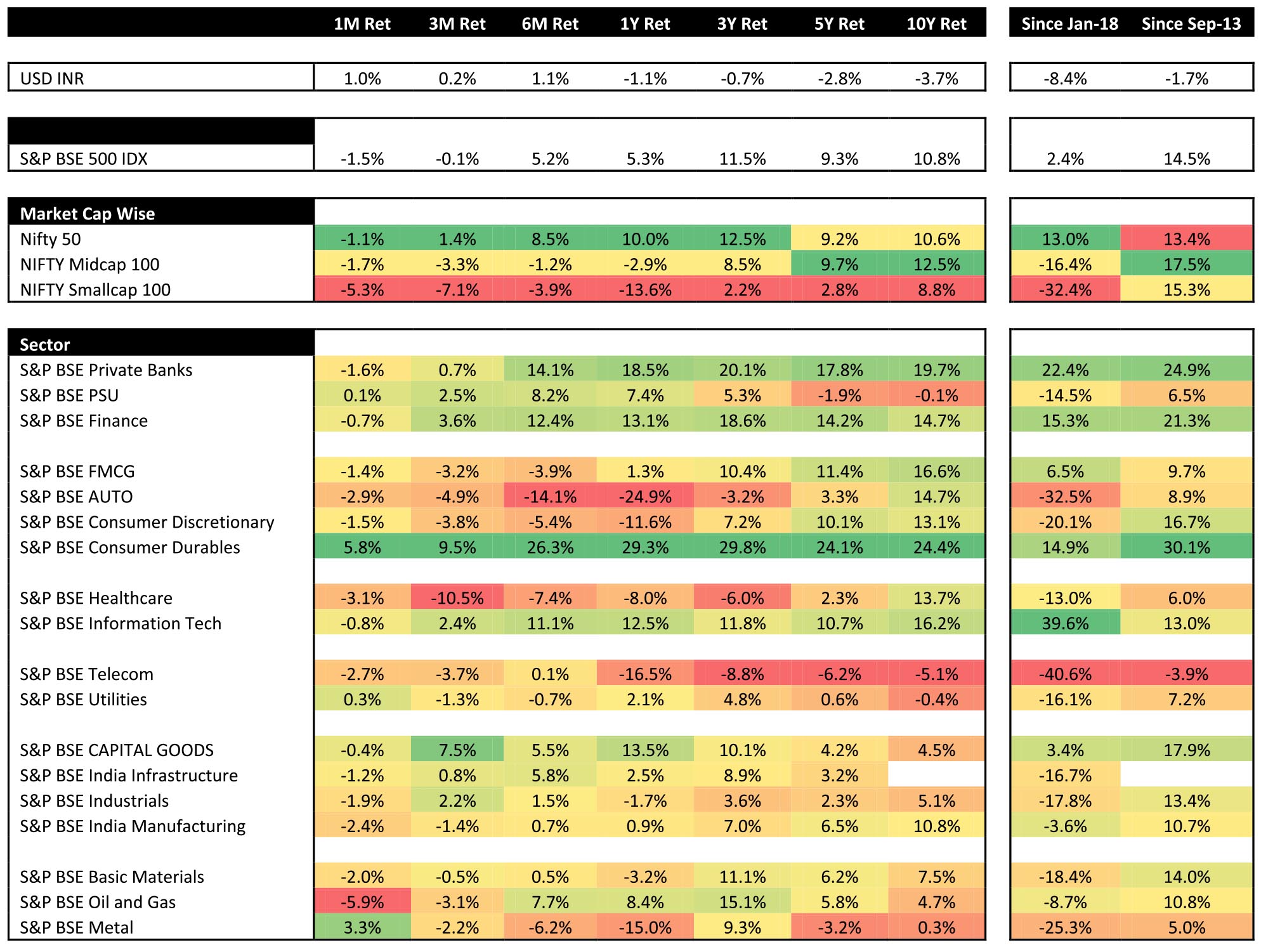

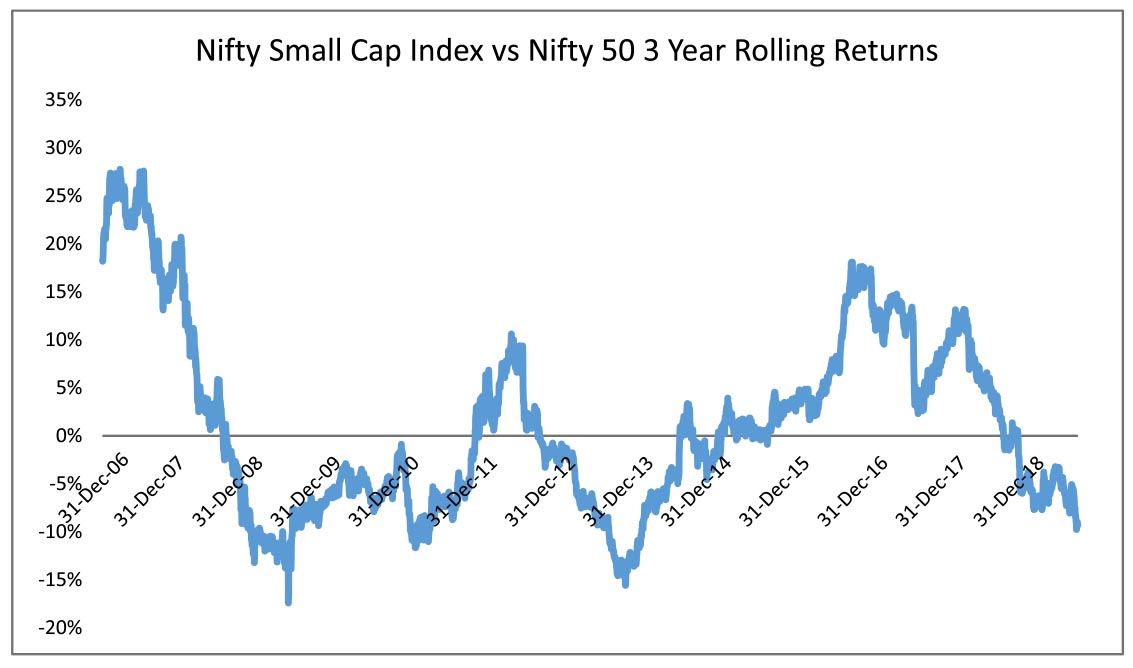

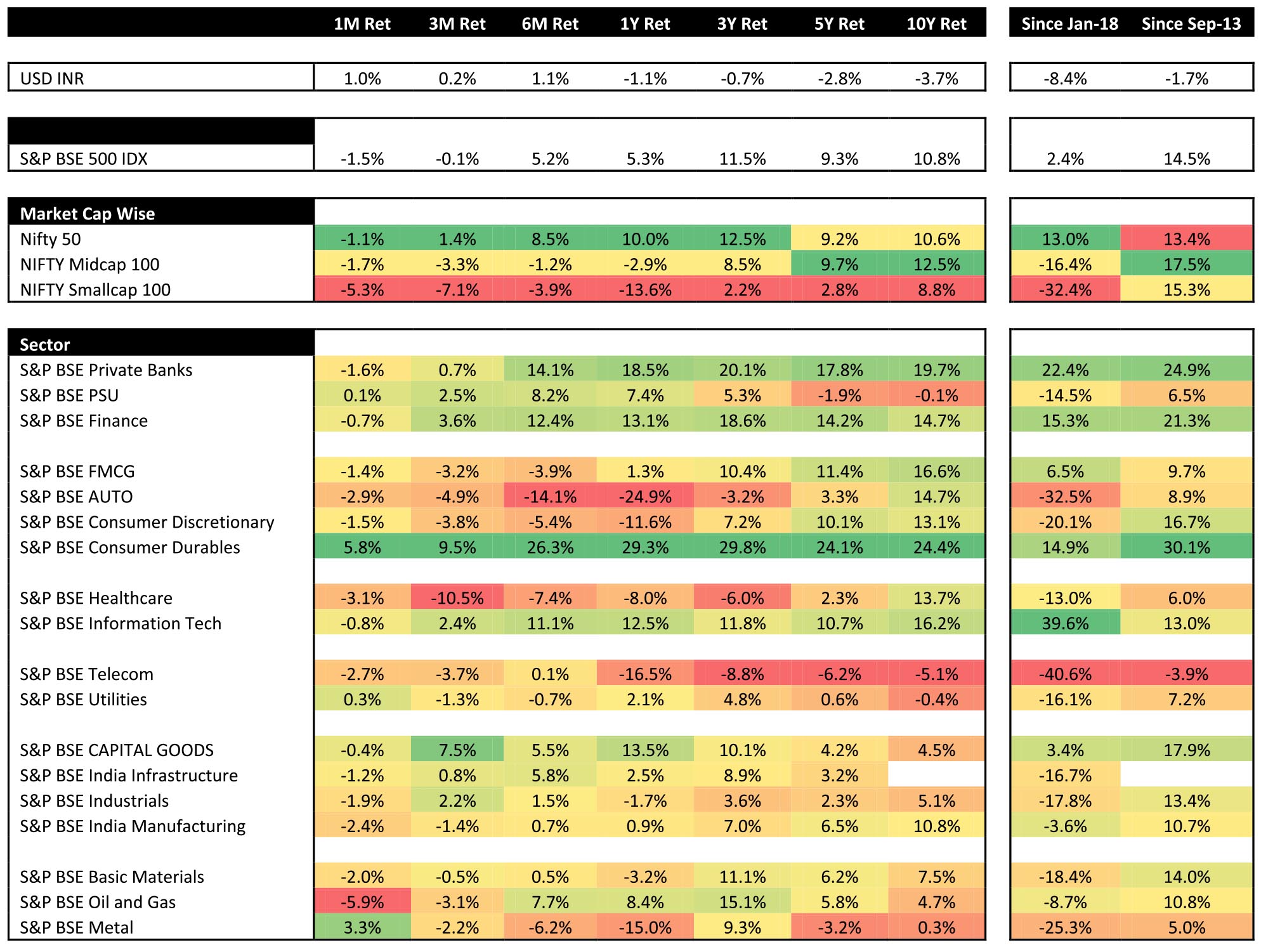

For the quarter, NIFTY (+1.4% QoQ) has again walloped the mid cap (-3.3% QoQ) and small cap (-7.1% QoQ) indices. Since the market peak in Jan-18, NIFTY (+13%) has outperformed mid-cap (-16.4%) by ~30% and small-cap (-32.4%) by ~45%. Even on a 3-Yr rolling basis, which includes the bull year of 2017, NIFTY has outperformed small cap index by around 9% annualized.

Post the incumbent NDA Government receiving a thumping mandate in the May 2019 General Elections, markets took a breather awaiting the Union Budget and subsequent measures to counter the growth slowdown. RBI cut policy rate by 25bps to 5.75% in its last MPC meeting on 06 June (YTD total of 75bps policy rate cuts) and changed stance from neutral to accommodative. Monetary policy is likely to remain supportive with our economists penciling in another 50bp cuts in this cycle (25bps each in Sep and Dec Q), particularly as economic growth indicators remain soft. 10Y yields have declined meaningfully to 6.9%, down 50bps in the last two months. However, the key risk emanates from a disappointing monsoon (33% deficient as of 30th June), which would constitute a negative supply-shock to the economy and higher crude oil prices. (+9% from lows in June).

Conclusion:

With the budget and elections behind us, focus should now shift to earnings. Q4 Earnings season concluded on a mixed note – the BSE200 earnings reported a strong growth off a weak base (mainly aided by Corporate Banks), worries of a slowdown in consumption led by Auto dampened market mood. In the June quarter 11.3% of the BSE200 Index saw an upgrade of >2% in FY 20 earnings whereas 55.3% of the Index saw a downgrade. Downgrades were more visible in Stable segment with 40% Stables and 15.3% Cyclicals witnessing downgrades in excess of 2%. Similarly, 8.4% of Cyclicals were upgraded >2% and only 2.8% of Stables were upgraded >2%. Though June quarter earnings are expected to be tepid as most high frequency indicators indicate a slowdown, management commentary w.r.t. growth outlook across industries will be keenly watched.

US Fed continues dovish stance: Post the Fed's June MPC meeting, economists have pulled forward their expectations of 25bps rate cuts to July and September (vs. Sep and Dec previously). While the risk of more than 50bps of cuts is still not in their baseline outlook, they note that any further evidence of deterioration in labor market activity should motivate well more than 50bps of total cuts this cycle.

Global Markets bounce back: Global Markets surged in June with the MSCI world Index rising 6.4% MoM, up 3.4% for the quarter with equal contribution from Developed Markets (+6.5% MoM and +3.4% QoQ) and Emerging Markets (+5.7% MoM and -0.3% QoQ). Indian markets were flat but have outperformed most markets on a 1 Year basis (+10.4% YoY). Oil rose sharply in June with WTI rising 9% and Brent rising 3% MoM to close at $66.5/barrel. For the quarter though, Brent fell 3% QoQ and still trades at a comfortable range for the India economy.

Benchmark 10 year treasury yields averaged at 6.93% in June (37bps lower vs. May avg.). On month end values the yields have declined 15bps (-49bps YTD) and are now close to 20-month lows as inflation remains well behaved and the RBI's policy stance turned dovish, buoying hopes of more rate cuts. RBI has reduced the policy rate by 75bps YTD. Street forecasts additional 50bps of rate cuts in the current easing cycle (25bps each in Sep and Dec quarter). The global yields have also declined meaningfully with US 10Y yields at 2.01% (-68bps YTD).

Cumulative rainfall is running 33% below the normal on an aggregate basis as of June end. Out of 36 meteorological subdivisions, rainfall so far has been deficient in 30 (~ 82% of the country). Rainfall has been significantly below normal across regions although there has been marginal improvement in the 2nd half of June as cumulative deficit was running at ~40% in mid-June. Hopefully, given the deluge which Mumbai faced during the first few days of the delayed monsoon wiping out the deficit for the month of June, the same phenomenon plays out in the rest of the country as well!

RBI cut policy rate by 25bps to 5.75% in its last MPC meeting on 6 June and changed stance from neutral to accommodative. The MPC also marked down its FY20 growth forecast to 7% from 7.2% previously. The MPC highlighted that there is scope to accommodate growth concerns by supporting efforts to boost aggregate demand, and in particular, reinvigorate private investment activity, while remaining consistent with its flexible inflation targeting mandate. But they highlight that a disappointing monsoon (33% deficient as of June end), could constitute a negative supply-shock to the economy, and is the biggest risk to their view.

Headline CPI remained flat at 3.05% YoY in May (vs. consensus estimates of 3.1%). Food prices rose sequentially for the sixth consecutive month, increasing by 0.6% MoM, seasonally adjusted in May, taking year-on-year food inflation to 2.0% in May from 1.4% in April. Importantly, core-core inflation (standard core adjusted for gasoline, diesel, and housing) has slowed sharply to 4.4% in May (vs. 5.0% in April and 5.5% in March). WPI inflation for May at 2.5% (vs. 3.1% in April) came below expectations of 3.0% and was the lowest print in the last 22 months.

April IP came meaningfully above expectations at 3.4% YoY (consensus: 0.7%). On a sequential basis, industrial activity jumped by 2.1% MoM, seasonally adjusted after three consecutive sequential declines averaging 0.5% m/m, sa. All the sub-sectors except infra goods rose sequentially in April. On a 3m basis IP and IP-ex-cap goods remains weak, printing at -2.6% and -1.3% in April. Moreover, given the monthly volatility of IP, one should remain cautious on over-interpreting one data point, especially given the continued weakness of other high frequency data.

Domestic Markets

Prior to the general election results in May-19, 'election uncertainty' was cited as one of the key reasons, by many experts for the tepid performance of equity markets starting from Jan-2018. After the election results in May, markets surged as can be seen above, leading many to believe that the period of pain was mostly over. But since May, mid and small caps again corrected and this time the correction has been attributed to concerns around trade wars, domestic growth and the patchy monsoon.

For the quarter, NIFTY (+1.4% QoQ) has again walloped the mid cap (-3.3% QoQ) and small cap (-7.1% QoQ) indices. Since the market peak in Jan-18, NIFTY (+13%) has outperformed mid-cap (-16.4%) by ~30% and small-cap (-32.4%) by ~45%. Even on a 3-Yr rolling basis, which includes the bull year of 2017, NIFTY has outperformed small cap index by around 9% annualized.

Post the incumbent NDA Government receiving a thumping mandate in the May 2019 General Elections, markets took a breather awaiting the Union Budget and subsequent measures to counter the growth slowdown. RBI cut policy rate by 25bps to 5.75% in its last MPC meeting on 06 June (YTD total of 75bps policy rate cuts) and changed stance from neutral to accommodative. Monetary policy is likely to remain supportive with our economists penciling in another 50bp cuts in this cycle (25bps each in Sep and Dec Q), particularly as economic growth indicators remain soft. 10Y yields have declined meaningfully to 6.9%, down 50bps in the last two months. However, the key risk emanates from a disappointing monsoon (33% deficient as of 30th June), which would constitute a negative supply-shock to the economy and higher crude oil prices. (+9% from lows in June).

Conclusion:

With the budget and elections behind us, focus should now shift to earnings. Q4 Earnings season concluded on a mixed note – the BSE200 earnings reported a strong growth off a weak base (mainly aided by Corporate Banks), worries of a slowdown in consumption led by Auto dampened market mood. In the June quarter 11.3% of the BSE200 Index saw an upgrade of >2% in FY 20 earnings whereas 55.3% of the Index saw a downgrade. Downgrades were more visible in Stable segment with 40% Stables and 15.3% Cyclicals witnessing downgrades in excess of 2%. Similarly, 8.4% of Cyclicals were upgraded >2% and only 2.8% of Stables were upgraded >2%. Though June quarter earnings are expected to be tepid as most high frequency indicators indicate a slowdown, management commentary w.r.t. growth outlook across industries will be keenly watched.

| Equity Markets | Index | % Change YTD | % Change MTD | P/E |

| Nifty | 11,788.85 | 8.53% | -1.12% | 18.72 |

| Sensex | 39,394.64 | 9.22% | -0.80% | 19.53 |

| Dow Jones | 26,599.96 | 14.03% | 7.19% | 16.73 |

| Shanghai | 2,978.88 | 19.45% | 2.77% | 11.40 |

| Nikkei | 21,275.92 | 6.30% | 3.28% | 15.32 |

| Hang Sang | 28,542.62 | 10.43% | 6.10% | 11.12 |

| FTSE | 7,425.63 | 10.37% | 3.69% | 13.02 |

| MSCI E.M. (USD) | 1,054.86 | 9.22% | 5.70% | 13.06 |

| MSCI D.M.(USD) | 2,178.35 | 15.63% | 6.46% | 16.48 |

| MSCI India (INR) | 1,336.42 | 5.84% | -1.44% | 18.81 |

| Currency & Commodities | Last Price % | Change YTD % | Change MTD |

| USD / INR | 69.028 | -1.06% | -0.96% |

| Dollar Index | 96.13 | -0.04% | -1.66% |

| Gold | 1,409.45 | 9.90% | 7.97% |

| WTI (Nymex) | 58.47 | 28.76% | 9.29% |

| Brent Crude | 66.55 | 23.70% | 3.19% |

| India Macro Analysis | Latest | Equity Flows | USD Mn |

| GDP | 5.80 | FII (USD mln) | |

| IIP | 3.40 | YTD | 11,341.18 |

| Inflation (WPI Monthly) | 2.45 | MTD | 150.68 |

| Inflation (CPI Monthly) | 3.05 | *DII (USD mln) | |

| Commodity (CRB Index) | 407.87 | YTD | 1,145.92 |

| Source: Bloomberg | MTD | 897.24 | |

| *DII : Domestic Mutual Funds Data as on Data as on 28thJune 2019 | |||

Mr. Suyash Choudhary

Head - Fixed Income

WHAT WENT BY

Bond yields eased in month of June with the 10-year benchmark bond yield ending 16bps lower on account of a dovish RBI policy and positive global cues.

The RBI in its June policy cut the repo rate by 25bps to 5.75% and changed its monetary policy stance to "accommodative" from "neutral". While the market was broadly expecting a 25bps cut, the change in stance with a first unanimous 6-0 decision in the current rate cycle imparted further rate cut expectations down the line. Acknowledging the softness in global & domestic growth, the RBI revised down its FY20 GDP growth forecast further by 20bps to 7.0%. RBI continued to see inflation comfortably below 4.0% in FY20.

The RBI also decided to set up an internal working group to review the current liquidity management framework to enable better transmission. The group will suggest measures to (i) simplify the current framework; and (ii) clearly communicate the objectives, quantitative measures and toolkit of liquidity management. The report is expected before the next MPC.

RBI's Monetary Policy Committee published the minutes of its meeting held over Jun 3-6, 2019. There seemed to be broad consensus between the members that economic growth momentum has weakened and is likely to stay subdued in the near term. There was consensus on broader expectation of slowing global growth amidst ongoing trade uncertainty, which could have a negative spillover impact on domestic growth impulses. Members also took into account the moderation in most of the various survey based indicators of inflation (Household Survey, SPF, etc.). While most members acknowledged the unpredictability of oil prices, the global demand downdraft was expected to keep a lid on any upside risk. Overall, most members derived comfort from RBI's inflation trajectory, which continues to point at a sub 4% trajectory until end of FY20.

CPI inflation inched up to 3.05% y-o-y from an upwardly revised 3% in April (previously 2.9%), broadly in line with expectations. Food inflation picked up, increasing to 1.8% from 1.1% in April, while core inflation (CPI ex-food and beverages, fuel) eased as expected to 4.1% from an upwardly revised 4.7% in April. IIP growth improved to 3.4% y-o-y in April from an upwardly revised 0.4% in March (previously -0.1%), much better than expected driven by growth across all sectors.

The Federal Open Market Committee (FOMC) meeting held in June delivered a dovish message with the key takeaway being broad support for easier policy sooner than market expectations. At the press conference, the Fed Chair said that "Market-based measures of inflation compensation have moved down since our May meeting and some survey based expectations measures are near the bottom of their historic ranges. Combining these factors with the risks to growth already noted, participants expressed concerns about a more sustained shortfall of inflation." Overall, by dropping the word "patient," the statement conveyed that the Fed is looking to ease shortly.

Outlook:

The FY20 final Union budget provided an exceptional challenge to sound credible without deviating heavily from the interim budget targets. Given this, the finance minister delivered a remarkable balancing act. As with almost all budgets, revenue numbers will still get challenged especially given the ongoing economic slowdown. However, this is a creditworthy optimising given constraints and leaves the bond market reasonably satisfied. Also noteworthy is the fact that RBI Governor Mr. Das, alongside to other Monetary Policy Committee (MPC) members, has seemingly been sympathetic towards some fiscal expansion and would likely have not considered this as a constraint for further easing. With the finance minister actually showing further consolidation, the trigger for further monetary easing becomes even stronger. This alongside RBI's move to positive liquidity (core system liquidity is already around INR 80,000 crores positive and is likely to go towards INR 2,00,000 crores by September post RBI dividend) and the global backdrop of sharply lower yields paints a continued bullish environment for quality interest rates.