Commentary

31st May 2019

Global Macro data mixed: After several quarters of robust growth, US growth may be slowing. The Institute for Supply

Management’s (ISM’s) factory gauge unexpectedly dropped in May to 52.1 from 52.8, missing all estimates and hitting

the lowest level since October 2016.The second print on first-quarter GDP in US may be revised down to 3.0% from 3.2%,

economists predict, though initial jobless claims may be little changed at 215,000 from 211,000, indicating a robust jobs

market. US durable goods orders dropped 2.1% last month amid a slowdown in exports and a buildup in inventories. Data

showed German unemployment rose unexpectedly in May for the first time in nearly two years, in a sign that a slowdown

in the euro zone’s top economy is spilling over into the labor market. This is the latest economic data set showing cracks

in the economy while the world’s largest economies engage in a trade war.

US China Trade Tensions continue to rise and fall: US-China trade tensions continue to weigh on stocks after Chinese state media reports underlined the country’s scope to use rare-earth minerals, used in the production of an array of devices such as mobile phones, computer memory chips and rechargeable batteries, as an economic weapon. On the other hand, US officials indicated they would offer some temporary exceptions to an export blacklist against Huawei Technologies Co., which will provide some suppliers and customers of China’s telecom giant a 90-day reprieve from tough trade penalties — a move that appeared to soothe investor anxiety somewhat.

The Fed remains dovish for now: Minutes for the rate-setting Federal Open Market Committee’s April 30-May 1 meeting indicated that the voting members agreed the current accommodative policy can remain for now and that they were comfortable with the wait-and-see approach. They were, however, split on whether higher rates were necessary if the economy continued to evolve along the predicted path while others argued that higher productivity could indicate more economic softness than the low unemployment rate suggests. There was also some concern over the risk of tame inflation readings leading to subdued expectations of future inflation.

Interest Rates continue to fall: The 10-year Treasury note yield fell to its lowest level since September 2017. A portion of the yield curve further inverted as 3-month Treasury bills last yielded 2.36%, well above the 10-year rate. A yield curve inversion is seen by traders as a potential sign that a recession is in the horizon. 10 Year yields fell globaly - US and India lead with a 38 bps fall. Yields in UK and Germany also fell in excess of 20 bps. US 10 Year closed at 2.12% (-59 bps YoY) whereas the Indian 10 Year closed at 7.03% (-79 bps YoY).

Currencies and Commodities: Global growth concerns continued to put downward pressure on prices of most industrial metals with prices having corrected 14 to 22% over the last year. INR, EURO and the USD were relatively flat for the month but the Pound fell 3.1% MoM as the risk and uncertainty around Brexit have been increasing by the day. Crude corrects sharply: Crude corrected significantly in the month with the Brent and WTI falling 11% and 16% respectively MoM. Brent ended the month at $64.5/barrel, 17% lower that its level a year ago.

Global Markets jittery, India stands out: Global equity markets were jittery with the US market falling 6.6% MoM. Developed markets (MSCI Developed Market Index -6.1% MoM) outperformed Emerging Markets (-7.5% MoM) and the fall was broad-based with Germany (-5.5%), UK (-6.5%) and Japan (-4.8%) all posting a fall of around 5%+. Indian market (+1.8%) was the best performing market in the month on account of favourable election result. Even on a 1 Year basis, Indian market was one of the best performing markets (+8.9%) with the MSCI Emerging Market down 10.9% and the MSCI Developed Market Index down 2.2%.

NDA comes back with absolute majority, major overhang behind: The much awaited event of 2019 came to its conclusion on 23rd May with BJP emerging as the single largest party with 303 seats (272 seats for simple majority). It was a remarkable victory for an incumbent – with an increase not only in the number of seats but vote share. This mandate surpassed estimates of most exit polls; vote share figures also tilted firmly in favour of the incumbent BJP as the multiparty opposition combine was unable to dent BJP’s winning streak, while the party made in-roads into key states like West Bengal for the first time. The party inched closer to securing the simple majority in the Upper House of Parliament, aiding its ability to pass key legislation. PM Modi took oath of office for the second time, with several new faces making a debut in the new Cabinet as party chief Amit Shah came in as Home Minister while erstwhile Finance Minister Arun Jaitley announced his withdrawal from the cabinet on health grounds, making way for successor Nirmala Sitharaman. Monsoon: Contrary to IMD’s forecast of a near-normal monsoon, private weather forecaster SkyMet, earlier in the month, cautioned for the likelihood of a weak monsoon as World Meteorological Organization (WMO) also cited persistent weak El Nino conditions from June through August. Monsoon is expected to make landfall on 1 Jun after having weakened in its advance after reaching South Andaman Sea on 18 May. India receives 75% of its annual rainfall in the summer months from Jun-Sep and is crucial to the large agrarian population of the country.

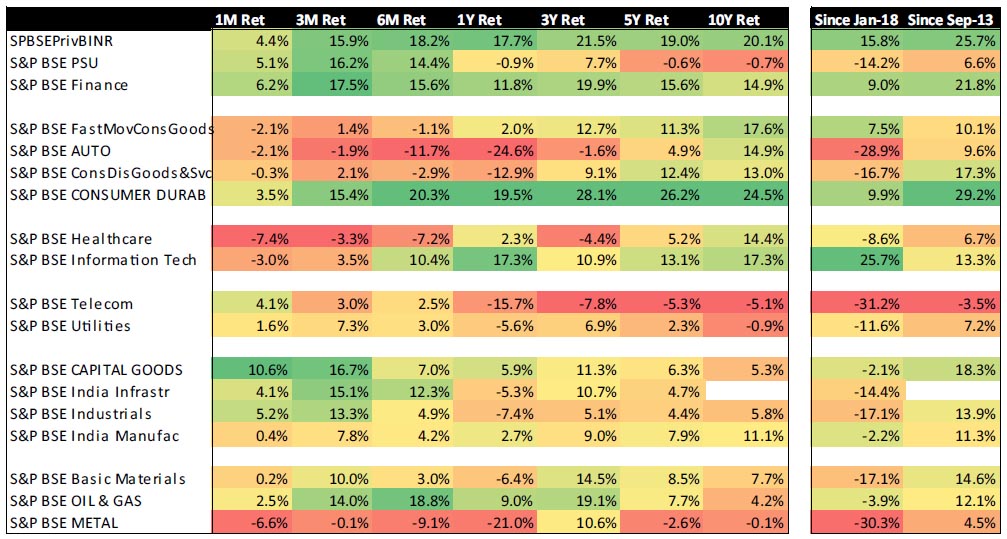

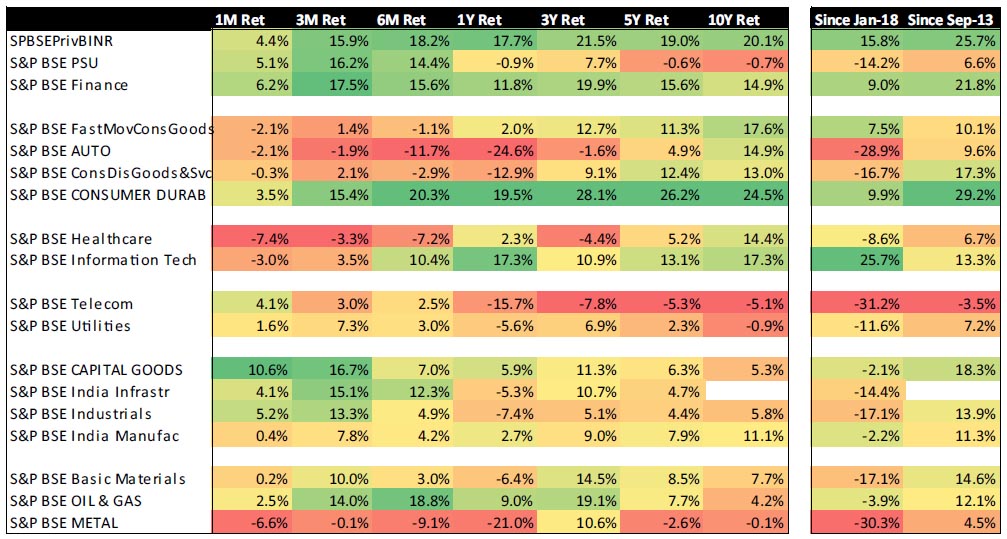

Domestic Markets: With the election uncertainty out of the way, cyclicals made a comeback in the month – BSE Capital goods was the best performing sector (+10.6% MoM) followed by PSU Banks (+6.2% MoM). Most Stable sectors were negative with Pharma (-7.4%) falling the most followed by IT Services (-3%). Over the last year, IT (+17.3%) has been the best performer whereas Auto (-24.6%) has been the worst performing sector. Autos have led the slowdown in consumption witnessed in the last few quarters. May sales for Autos continued the past few months’ trend of subdued retail numbers across the board though 2W numbers were better.

Inflation muted: April CPI print indicated signs of stabilisation as headline CPI came in at 2.9% as weakness in core inflation was squared off by rising food prices. Core inflation was at 18mth low as economic activity remained subdued while food inflation rose by 6.6%. WPI inflation slipped to 3.1% on cheaper fuel and manufactured items.

Trade Deficit: April trade deficit widened to a 5-month high of $15.3bn on the back of a sharp decline in export growth and rising oil import bill. Non-oil trade deficit also rose to 5-month high on weaker exports tracking decline in global trade while domestic slowdown also impacted import demand. Service trade surplus improved to 2.9% of GDP in FY19 (from 2.6% in FY18).

FII flows robust: FIIs maintained the buying trend in May, though of marginally lower quantum, to record inflows of $1.3bn, taking the YTD total to $11bn. DIIs turned buyers with inflows of $750mn with the YTD total standing at net outflows of $1.6bn. DMFs were buyers in the month with net inflows of $730mn while Insurance companies were buyers of very small quantum with inflows of ~$23mn.

Earnings: Q4 Earnings season concluded on a mixed note – the BSE200 earnings reported a strong growth off a weak base, worries of a slowdown in consumption led by Auto dampened market mood. For BSE200, Q4 ex Financials, Sales, EBITDA and PAT grew 10%, 10% and 5% respectively. Including Financials, the growth was a robust 44%, mainly optical on account of lower provisioning by Corporate Banks. Positives

Negatives

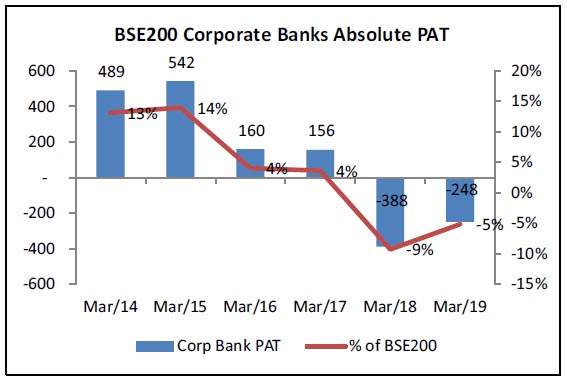

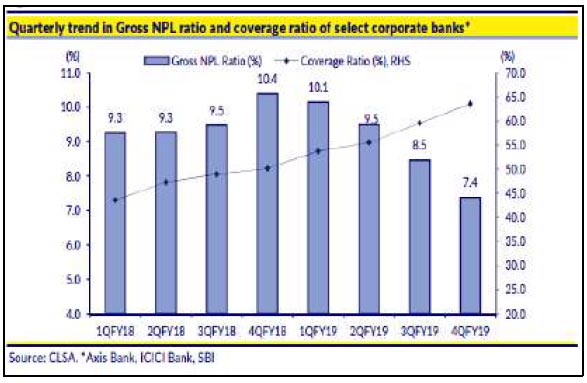

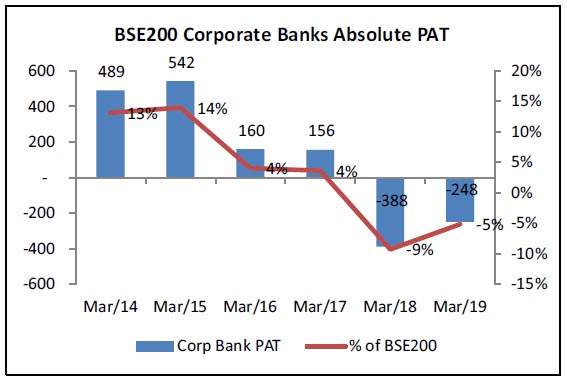

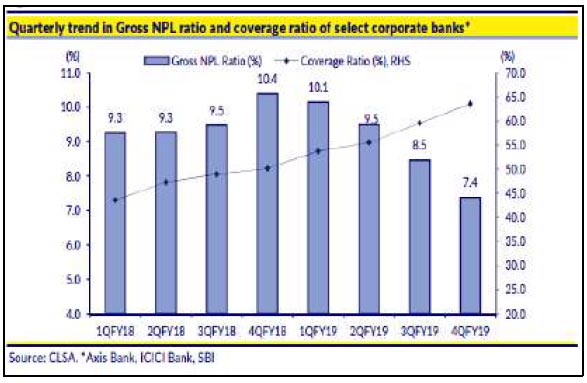

Corporate Bank profitability has fallen from 13-14% of BSE200 PAT to -5%, a 18% swing. Recovery in these is the key to any forward estimates. Though corporate banks (viz, ICICI, Axis and SBI) earnings somewhat disappointed for 4Q, the miss was driven by rising coverage ratios. Slippages moderated and FY20 earnings were actually upgraded for ICICI and SBI. Combined, these three large corporate banks’ gross NPL ratio declined 110bps QoQ to 7.4%. Coverage ratio meanwhile went up 4ppts QoQ to 63.5%. Even for PSU Corporate Banks, the trend in slippages has improved, though a few banks like PNB reported elevated slippages. However, healthy recoveries and write-offs enabled a decline in GNPA/ NNPA ratios.

US China Trade Tensions continue to rise and fall: US-China trade tensions continue to weigh on stocks after Chinese state media reports underlined the country’s scope to use rare-earth minerals, used in the production of an array of devices such as mobile phones, computer memory chips and rechargeable batteries, as an economic weapon. On the other hand, US officials indicated they would offer some temporary exceptions to an export blacklist against Huawei Technologies Co., which will provide some suppliers and customers of China’s telecom giant a 90-day reprieve from tough trade penalties — a move that appeared to soothe investor anxiety somewhat.

The Fed remains dovish for now: Minutes for the rate-setting Federal Open Market Committee’s April 30-May 1 meeting indicated that the voting members agreed the current accommodative policy can remain for now and that they were comfortable with the wait-and-see approach. They were, however, split on whether higher rates were necessary if the economy continued to evolve along the predicted path while others argued that higher productivity could indicate more economic softness than the low unemployment rate suggests. There was also some concern over the risk of tame inflation readings leading to subdued expectations of future inflation.

Interest Rates continue to fall: The 10-year Treasury note yield fell to its lowest level since September 2017. A portion of the yield curve further inverted as 3-month Treasury bills last yielded 2.36%, well above the 10-year rate. A yield curve inversion is seen by traders as a potential sign that a recession is in the horizon. 10 Year yields fell globaly - US and India lead with a 38 bps fall. Yields in UK and Germany also fell in excess of 20 bps. US 10 Year closed at 2.12% (-59 bps YoY) whereas the Indian 10 Year closed at 7.03% (-79 bps YoY).

Currencies and Commodities: Global growth concerns continued to put downward pressure on prices of most industrial metals with prices having corrected 14 to 22% over the last year. INR, EURO and the USD were relatively flat for the month but the Pound fell 3.1% MoM as the risk and uncertainty around Brexit have been increasing by the day. Crude corrects sharply: Crude corrected significantly in the month with the Brent and WTI falling 11% and 16% respectively MoM. Brent ended the month at $64.5/barrel, 17% lower that its level a year ago.

Global Markets jittery, India stands out: Global equity markets were jittery with the US market falling 6.6% MoM. Developed markets (MSCI Developed Market Index -6.1% MoM) outperformed Emerging Markets (-7.5% MoM) and the fall was broad-based with Germany (-5.5%), UK (-6.5%) and Japan (-4.8%) all posting a fall of around 5%+. Indian market (+1.8%) was the best performing market in the month on account of favourable election result. Even on a 1 Year basis, Indian market was one of the best performing markets (+8.9%) with the MSCI Emerging Market down 10.9% and the MSCI Developed Market Index down 2.2%.

NDA comes back with absolute majority, major overhang behind: The much awaited event of 2019 came to its conclusion on 23rd May with BJP emerging as the single largest party with 303 seats (272 seats for simple majority). It was a remarkable victory for an incumbent – with an increase not only in the number of seats but vote share. This mandate surpassed estimates of most exit polls; vote share figures also tilted firmly in favour of the incumbent BJP as the multiparty opposition combine was unable to dent BJP’s winning streak, while the party made in-roads into key states like West Bengal for the first time. The party inched closer to securing the simple majority in the Upper House of Parliament, aiding its ability to pass key legislation. PM Modi took oath of office for the second time, with several new faces making a debut in the new Cabinet as party chief Amit Shah came in as Home Minister while erstwhile Finance Minister Arun Jaitley announced his withdrawal from the cabinet on health grounds, making way for successor Nirmala Sitharaman. Monsoon: Contrary to IMD’s forecast of a near-normal monsoon, private weather forecaster SkyMet, earlier in the month, cautioned for the likelihood of a weak monsoon as World Meteorological Organization (WMO) also cited persistent weak El Nino conditions from June through August. Monsoon is expected to make landfall on 1 Jun after having weakened in its advance after reaching South Andaman Sea on 18 May. India receives 75% of its annual rainfall in the summer months from Jun-Sep and is crucial to the large agrarian population of the country.

Domestic Markets: With the election uncertainty out of the way, cyclicals made a comeback in the month – BSE Capital goods was the best performing sector (+10.6% MoM) followed by PSU Banks (+6.2% MoM). Most Stable sectors were negative with Pharma (-7.4%) falling the most followed by IT Services (-3%). Over the last year, IT (+17.3%) has been the best performer whereas Auto (-24.6%) has been the worst performing sector. Autos have led the slowdown in consumption witnessed in the last few quarters. May sales for Autos continued the past few months’ trend of subdued retail numbers across the board though 2W numbers were better.

Inflation muted: April CPI print indicated signs of stabilisation as headline CPI came in at 2.9% as weakness in core inflation was squared off by rising food prices. Core inflation was at 18mth low as economic activity remained subdued while food inflation rose by 6.6%. WPI inflation slipped to 3.1% on cheaper fuel and manufactured items.

Trade Deficit: April trade deficit widened to a 5-month high of $15.3bn on the back of a sharp decline in export growth and rising oil import bill. Non-oil trade deficit also rose to 5-month high on weaker exports tracking decline in global trade while domestic slowdown also impacted import demand. Service trade surplus improved to 2.9% of GDP in FY19 (from 2.6% in FY18).

FII flows robust: FIIs maintained the buying trend in May, though of marginally lower quantum, to record inflows of $1.3bn, taking the YTD total to $11bn. DIIs turned buyers with inflows of $750mn with the YTD total standing at net outflows of $1.6bn. DMFs were buyers in the month with net inflows of $730mn while Insurance companies were buyers of very small quantum with inflows of ~$23mn.

Earnings: Q4 Earnings season concluded on a mixed note – the BSE200 earnings reported a strong growth off a weak base, worries of a slowdown in consumption led by Auto dampened market mood. For BSE200, Q4 ex Financials, Sales, EBITDA and PAT grew 10%, 10% and 5% respectively. Including Financials, the growth was a robust 44%, mainly optical on account of lower provisioning by Corporate Banks. Positives

- Though corporate banks (viz, ICICI, Axis and SBI) earnings somewhat disappointed for 4Q, the miss was driven by rising coverage ratios. Slippages moderated and FY20 earnings were actually upgraded

- Industrials, especially construction companies continued to report robust numbers and order books

- Consumer discretionary, more so linked with urban consumer, seems to be less impacted as yet. Part of this can be attributed to rising organisation in these sectors

- Cement companies finally started seeing some realisation improvement, which has resulted in upgrades of 2-5% for reporting companies

Negatives

- Weak auto sales are well known and this has raised concerns on a broad consumer slowdown. Auto companies had a weak quarter, as weak volumes and high inventory led to higher discount. Margins saw a 1-5ppt hit, driving downgrades across the board.

- Staples companies had weak-to-in-line volume growth. On the demand side, staples companies said that conditions worsened from Jan-Feb to Mar-Apr, partly as rural consumers have seen a softening

- Three of the four large IT companies, viz, TCS, Infosys and HCLT, gave growth guidance/outlooks implying c.9-10% revenue growth in FY20. Margin outlook is weaker on account of INR appreciation, higher employee costs and supply pressures in the US.

| Sales,ex Fin | EBITDA, ex Fin | PAT, ex Fin | PAT, incl Fin | |

| Stable Segment | 13% | 14% | 10% | 11% |

| Cyclical Segment | 20% | 14% | 8% | 19% |

| Overall | 18% | 14% | 9% | 15% |

Corporate Bank profitability has fallen from 13-14% of BSE200 PAT to -5%, a 18% swing. Recovery in these is the key to any forward estimates. Though corporate banks (viz, ICICI, Axis and SBI) earnings somewhat disappointed for 4Q, the miss was driven by rising coverage ratios. Slippages moderated and FY20 earnings were actually upgraded for ICICI and SBI. Combined, these three large corporate banks’ gross NPL ratio declined 110bps QoQ to 7.4%. Coverage ratio meanwhile went up 4ppts QoQ to 63.5%. Even for PSU Corporate Banks, the trend in slippages has improved, though a few banks like PNB reported elevated slippages. However, healthy recoveries and write-offs enabled a decline in GNPA/ NNPA ratios.

Industrials which include both Capital Goods and Infra saw a robust Sales, EBITDA and PAT growth of 13%, 18% and 5%

respectively. FY 19 Sales EBITDA and PAT for this segment grew 18%, 20% and 35% respectively. Most players performed

well with timely execution of projects, especially on the domestic front. But order inflows declined impacted by weakness

witnessed in domestic ordering due to the general elections. Management commentary suggests small and mediumsized

orders are flowing in; however, large ticket orders are on hold and should see finalization post elections.

There are some signs of consumer slowdown, but these are uneven in severity. Most of the bad news seems to be concentrated in Autos and staples results, with rural demand and liquidity issues taking most of the blame. Urban discretionary hasn’t slowed as much, though is trending weaker. Industrials and corporate banks seem to be well set on the earnings recovery path and the latter remain critical to the 20%+ Nifty earnings growth forecast for FY20.

Conclusion: Post the election verdict, market sentiments have improved even as underlying macros appear mixed with GDP growth coming in at a 20-quarter low, while crude oil fell sharply. Slowdown in consumption across staples and discretionary, mainly autos, was a key concern flagged by most of the companies. However, seasonally strong consumer discretionary spends – air conditioners, coolers recorded strong growth boosted by a hot summer. Hence the outlook on growth remains a mixed bag.

In a repeat of the previous NDA victory, crude oil prices have again corrected ~USD10/barrel. This was one of the key pressure point for Indian macros till now. Inflation remains under control, paving the way for another rate cut in the June RBI monetary policy. 10- year G-Sec yield has corrected to below 7%.

Of the various factors needed for Cyclicals and Mid and small Cap outperformance, quite a few are in favour namely – favourable valuations, crude prices closer to $60, yields below 7% and last but not the least a stable government at the centre. Improvement in domestic and global growth outlook can be a key trigger for the broader markets going forward though the NIFTY may not see a significant uptick.

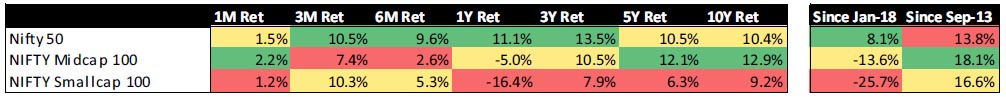

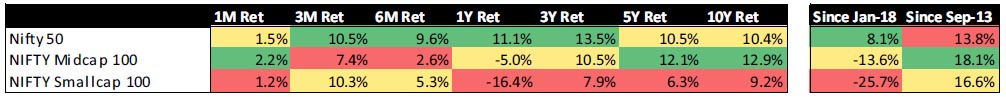

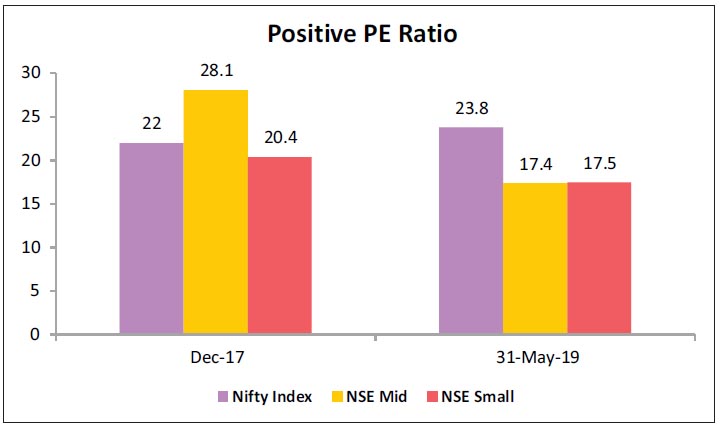

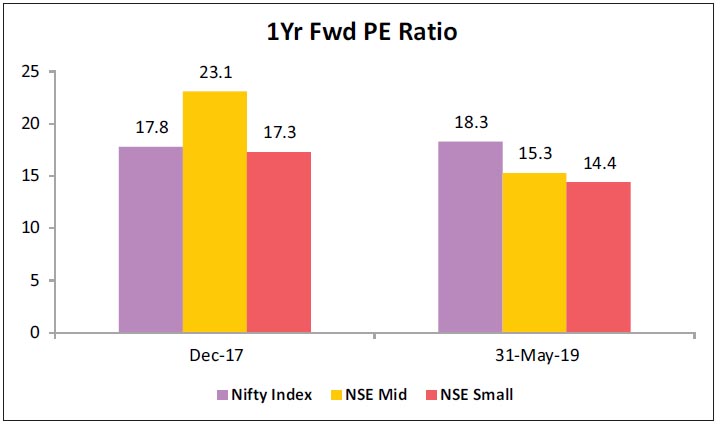

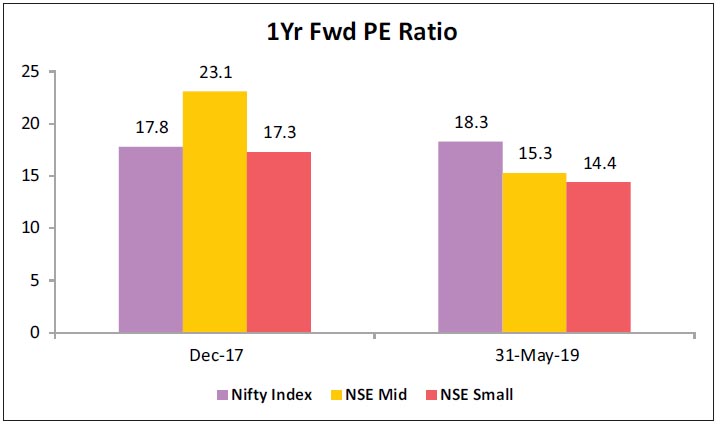

Valuations for the Nifty, meanwhile, remain rich at 20x FY20E EPS. From the peaks of January’18, Small Caps (-28.7% YoY) and Mid Caps (-14.9% YoY) have significantly underperformed the NIFTY (+14.3% YoY) and are trading at cheaper valuations relative to NIFTY. This is in marked contrast to the position in Jan-18 when the NIFTY was trading significantly cheaper to the mid and small cap indices.

There are some signs of consumer slowdown, but these are uneven in severity. Most of the bad news seems to be concentrated in Autos and staples results, with rural demand and liquidity issues taking most of the blame. Urban discretionary hasn’t slowed as much, though is trending weaker. Industrials and corporate banks seem to be well set on the earnings recovery path and the latter remain critical to the 20%+ Nifty earnings growth forecast for FY20.

Conclusion: Post the election verdict, market sentiments have improved even as underlying macros appear mixed with GDP growth coming in at a 20-quarter low, while crude oil fell sharply. Slowdown in consumption across staples and discretionary, mainly autos, was a key concern flagged by most of the companies. However, seasonally strong consumer discretionary spends – air conditioners, coolers recorded strong growth boosted by a hot summer. Hence the outlook on growth remains a mixed bag.

In a repeat of the previous NDA victory, crude oil prices have again corrected ~USD10/barrel. This was one of the key pressure point for Indian macros till now. Inflation remains under control, paving the way for another rate cut in the June RBI monetary policy. 10- year G-Sec yield has corrected to below 7%.

Of the various factors needed for Cyclicals and Mid and small Cap outperformance, quite a few are in favour namely – favourable valuations, crude prices closer to $60, yields below 7% and last but not the least a stable government at the centre. Improvement in domestic and global growth outlook can be a key trigger for the broader markets going forward though the NIFTY may not see a significant uptick.

Valuations for the Nifty, meanwhile, remain rich at 20x FY20E EPS. From the peaks of January’18, Small Caps (-28.7% YoY) and Mid Caps (-14.9% YoY) have significantly underperformed the NIFTY (+14.3% YoY) and are trading at cheaper valuations relative to NIFTY. This is in marked contrast to the position in Jan-18 when the NIFTY was trading significantly cheaper to the mid and small cap indices.

| Equity Markets | Index | % Change YTD | % Change MTD | P/E |

| Nifty | 11,922.80 | 9.76% | 1.49% | 18.82 |

| Sensex | 39,714.20 | 10.11% | 1.75% | 19.45 |

| Dow Jones | 24,815.04 | 6.38% | -6.69% | 15.94 |

| Shanghai | 2,898.70 | 16.23% | -5.84% | 10.91 |

| Nikkei | 20,601.19 | 2.93% | -7.45% | 14.92 |

| Hang Sang | 26,901.09 | 4.08% | -9.42% | 10.65 |

| FTSE | 7,161.71 | 6.44% | -3.46% | 12.73 |

| MSCI E.M. (USD) | 998.00 | 3.34% | -7.53% | 12.42 |

| MSCI D.M.(USD) | 2,046.25 | 8.62% | -6.08% | 15.77 |

| MSCI India (INR) | 1,355.93 | 7.38% | 0.32% | 18.71 |

| Currency & Commodities | Last Price % | Change YTD % | Change MTD |

| USD / INR | 69.699 | -0.10% | 0.19% |

| Dollar Index | 97.75 | 1.64% | 0.28% |

| Gold | 1,305.45 | 1.79% | 1.71% |

| WTI (Nymex) | 53.50 | 17.82% | -16.29% |

| Brent Crude | 64.49 | 19.87% | -11.41% |

| India Macro Analysis | Latest | Equity Flows | USD Mn |

| GDP | 5.80 | FII (USD mln) | |

| IIP | -0.10 | YTD | 11,190.50 |

| Inflation (WPI Monthly) | 3.07 | MTD | 1,422.64 |

| Inflation (CPI Monthly) | 2.92 | *DII (USD mln) | |

| Commodity (CRB Index) | 415.96 | YTD | 248.68 |

| Source: Bloomberg | MTD | 740.08 | |

| *DII : Domestic Mutual Funds Data as on Data as on 31stMay 2019 | |||

Mr. Suyash Choudhary

Head - Fixed Income

WHAT WENT BY

ThBonds rallied with the 10 year benchmark bond yield closing the month 38bps lower at 7.03%. Market took comfort from favourable outcome for incumbent Government while global environment turned increasingly risk off on intensification of US-China trade frictions leading to fears of synchronized global slowdown. The US 10 year/3 month tbill curve which has been keenly watched by market participants as a leading indicator of recession in the past, which had inverted briefly in March but reversed on expectations of trade deal, inverted again to 21bps, highest since 2007.

The incumbent ruling party BJP emerged as the single largest party with 303 seats (272 seats for simple majority) in the general elections with NDA forming the government for the second time round. This was a relief to market participants who feared a hung parliament & will help keep India’s country risk premium stable amongst emerging markets.

Domestic growth (Q4 FY19) significantly undershot consensus expectations and stood at 5.8% compared to 6.6% in the previous quarter. GDP growth for the full year FY19 is now at 6.8% versus 7.2% in FY18. April CPI print came in at 2.92% compared to 2.86% as prices of fruits, vegetables, cereals and pulses continued to firm up was offset by core inflation moderating sharply to 4.5% in April, its 18 month low compared to 5.1% in March.

Wholesale Price inflation (WPI) stood at 3.07% for Apr’19 compared to 3.18% in Mar’19 as the rise in the prices of primary articles was offset by falling prices in the Fuels and Manufactured Products segment.

The India Meteorological Department (IMD) has forecasted monsoon rainfall to be 4% below normal. The current El Niño conditions are likely to continue during the monsoon but are forecasted to be weak. However, currently prevailing neutral Indian Ocean Dipole (IOD) conditions may turn positive in the middle of the monsoon season and persist thereafter, which augur well for the rainfall outlook. Moreover, spatial and temporal distribution of monsoon rainfall alongside timely crop sowing matters more than headline numbers. Additionally, food grain stocks as on May 16, 2019 are at nearly 3.4 times the buffer requirement, which could fill the gap in case of a deficient monsoon. While fruits and vegetables could temporarily rise, effective supply management by the government of other key items in the food basket (cereals, pulses) could arrest any spikes in food inflation.

RBI policy update

In RBI’s June’19 monetary policy, the monetary policy committee (MPC) delivered a unanimous 25 bps rate cut as well a change in stance to accommodative. CPI forecast has been marginally revised upwards for H1 FY 20 to 3 – 3.1% (2.9 – 3% earlier), but is a shade lower for H2 at 3.4 – 3.7% (3.5 – 3.8% earlier). The commentary notes upside pressure to food prices but a broad based decline in core inflation on the back of ‘significant’ weakening of demand conditions. Crude prices are volatile but near term inflation expectations of households have continued to moderate. Acknowledging slowdown in growth drivers Gross Domestic Product (GDP) forecast is revised lower to 6.4 – 6.7% in H1 (6.8 – 7.1% earlier) and 7.2 – 7.5% in H2 (7.3 – 7.4%). The MPC notes that “growth impulses have weakened significantly as reflected in a further widening of the output gap compared to the April 2019 policy”.

Outlook:

World growth expectations have taken a decided turn towards the worse over the past month or so. This is now reflected in expectations of easing by major central banks later in the year. As an example, the US yield curve is now reasonably inverted upto 10 years with market expecting 2 – 3 rate cuts in the future. Locally as well, there has been a marked deterioration in growth drivers with consumption being the latest casualty, probably courtesy an impact to leverage given the ongoing stresses in certain parts of the financing market. Thus, the current monetary easing underway has to be looked at in this overall context. While currently the expectation would be for one last rate cut alongside continued easy liquidity, this can very quickly change towards expecting a deeper further easing should the global outlook further deteriorate.

The next major domestic trigger is going to be the Union Budget in early July. Given the large undershoots in the actual revenue collections in FY 19 versus even the revised numbers presented in February, the numbers targeted in the interim budget are looking truly daunting. This is especially in context of the ongoing growth slowdown. Thus, the new finance minister will have a tall task to present a credible budget while sticking to the assumed deficit target. In this context, the Jalan committee’s report on potential excess RBI reserves and their usage by the government will assume importance.

From a bond market standpoint, the focus should remain on quality rates (sovereign, SDL, AAA) as preferred vehicles to play the current macro environment. As developments continually highlight, the lower rated credit markets are far from settled and the spreads that can effectively be captured there may not yet be compensating for the risks involved.