Commentary - Equity Outlook

Mr. Anoop Bhaskar

Head - Equity

WHAT WENT BY

US Fed continues its dovish stance: Fed Chair Jerome Powell reiterated the Federal Open Market Committee’s

(FOMC) “patient” mantra in his semi-annual testimony to Congress today, underlining that the Fed is unlikely

to raise interest rates any time soon. In prepared remarks released ahead of his appearance before the Senate

Banking Committee, Powell justified that caution as a response to recent financial market volatility, weaker growth

overseas and the recent softening in domestic inflation. He also emphasised that any future policy moves would

be “data dependent”.

World poised for slowest growth in a decade: After growing by 3.6% in 2018, the world economy is on course to expand at its slowest pace since the global financial crisis as slowdowns in the euro-zone and China continue and the US soon joins the mix. Against that backdrop, fears of a surge in inflationary pressure have now been put to bed, it won’t be long before policy loosening comes back on the agenda.

US-China trade deal a possibility: Recent events have improved market’s confidence in a trade deal being negotiated in 2Q between US and China. Market participants expect a deal in 2Q that would involve assurances from China on forced technology transfer, increased purchase of US goods and either a soft or hard agreement on limiting RMB depreciation. In our opinion, China will probably provide verbal support for free market mechanisms but is unlikely to make major changes to the management of State Owned Enterprises (SOEs) or the objectives of Made in China 2025. The US will likely lower tariffs or offer a schedule for reductions, but will probably insist on an enforcement mechanism largely under its control.

Global Markets rebound: Global Markets rebound: Global markets continued the rebound with the increasing possibility of a US-China trade deal. Developed markets rose +2.8% Month on Month (MoM), led by US (+3% MoM) whereas Emerging Markets were flat (despite Chinese markets increasing +13.9% MoM). Since the start of the year, global markets have seen a rebound with the 3-Month returns for the MSCI Developed Markets and Emerging Markets Indices at +2.6% and 5.7% respectively. India, which was the 2nd best performing market in USD terms for CY 2018, has lagged behind in the current rally. Small rally was witnessed in base metals like Steel (+2%) and Copper (+6%); but most base metals are down significantly on a Year-on-Year basis, given global growth concerns. Crude rebounds: After the sharp sell-off seen in November-December, crude continued to rebound with the Brent Index rising 6% MoM to close at $66.0/barrel. Despite the sharp rise in January, crude is still at a comfortable level for a large oil importer like India and shouldn’t trigger concerns as yet. Indo-Pak tensions: Militant outfit JeM initiated terror attack on a convoy of CRPF jawans in Pulwama, J&K on 14 Feb, killing 40 security personnel. As a counter-measure, IAF claimed to have bombed JeM’s Balakot camp in PoK on 26 Feb, following which Pakistan Air Force apparently targeted Indian military installations on 27 Feb and downed an Indian jet in PoK leading to the capture of an IAF pilot. UN and leading nations urged de-escalation of tensions which was followed by Pakistan announcing the release of the captured pilot as a peace-keeping gesture. The market remained largely unaffected as most participants believed that the probability of this escalating into a full blown war is remote. Domestic Markets: Mid and small caps continued to underperform large caps in January with the NIFTY, NSE Mid Cap and NSE Small cap funds falling 0.4%, 1.1% and 3.2% MoM. With this, Mid and Small Caps are underperforming the NIFTY across most timeframes upto 3 years. The 1 year returns for NIFTY, NSE Mid Cap and NSE Small Cap are 2.9%, -15.0% and -29.0% respectively. Even for the 3 year time frame, the respective CAGR returns are 15.6%, 13.1% and 10.8% respectively. The underperformance of Mid and Small Caps in 2018 has been so severe, it has wiped out the outperformance of CY 17.

On a sectoral basis, there wasn’t any index that significantly outperformed/underperformed. Auto (+1.7%), Consumer Discretionary (+1.6%), Oil and Gas (+1.4%) were positive for the month whereas PSU Banks (-2.4%), Utilities (-2.7%) and FMCG (-2.3%) were the key negatives. Over the past year, Telecom (-31.2%), Metals (-29%), Auto (-24.3%) and Industrials (-23.6%) were the key underperformers whereas IT (+22%), FMCG (+8.1%) and Private Banks (+7.3%) were the outperformers. Telecom stocks have underperformed on account of Jio-led heightened competitive intensity, Metals on account of global growth concerns, Autos on account of falling volume growth and Industrials on account of election-led growth concerns. IT has outperformed on account of the depreciating Rupee and increasing deal flow whereas FMCG on account of expectations of election-sops led rural growth.

Policy: New RBI governor Shaktikanta Das’s maiden policy meet ended with a policy rate cut of 25bps to 6.25% and change in stance to “neutral” from “calibrated tightening” as inflation and growth both continued to moderate. We also saw significant reduction to Consumer Price Index (CPI) forecast by 60-80bps for 1H FY20 to 3.2-3.4%.

Growth: Index of Industrial Production (IIP) stayed subdued at 2.4% in Dec, despite improving significantly from Nov lows of 0.5% on account of contraction in mining segment and poor showing by manufacturing sector. Manufacturing sector recorded a low growth of 2.7% as against an expansion of 8.7% in Nov. In terms of industries, 13 out of 23 industry groups in manufacturing sector showed positive growth.

Inflation: CPI soft patch continued with Jan print declining further to 2.05% with fall in fuel (2.2% vs 4.5% in Dec) and food (-1.3% vs 1.6% in Dec). Core inflation also moderated marginally to 5.4% vs 5.7% in Dec, while health inflation continued to remain sticky as education inflation also saw some moderation.

Trade Deficit: Jan trade deficit widened to $14.7bn from the 10-month low of US$13.1bn in Dec on the back of fall in exports led by fall in petro products. Brent prices jumped up 4.1% in Dec leading to an increase in oil imports from $11.2bn from $10.7bn.

GST Council Meet: GST council cut rates on under-construction properties to 5% (from 12%) and on affordable housing to 1% (from 8%) eff 1 April, 2019. In both cases, the builders will not be eligible to claim input tax credit in the new structure.

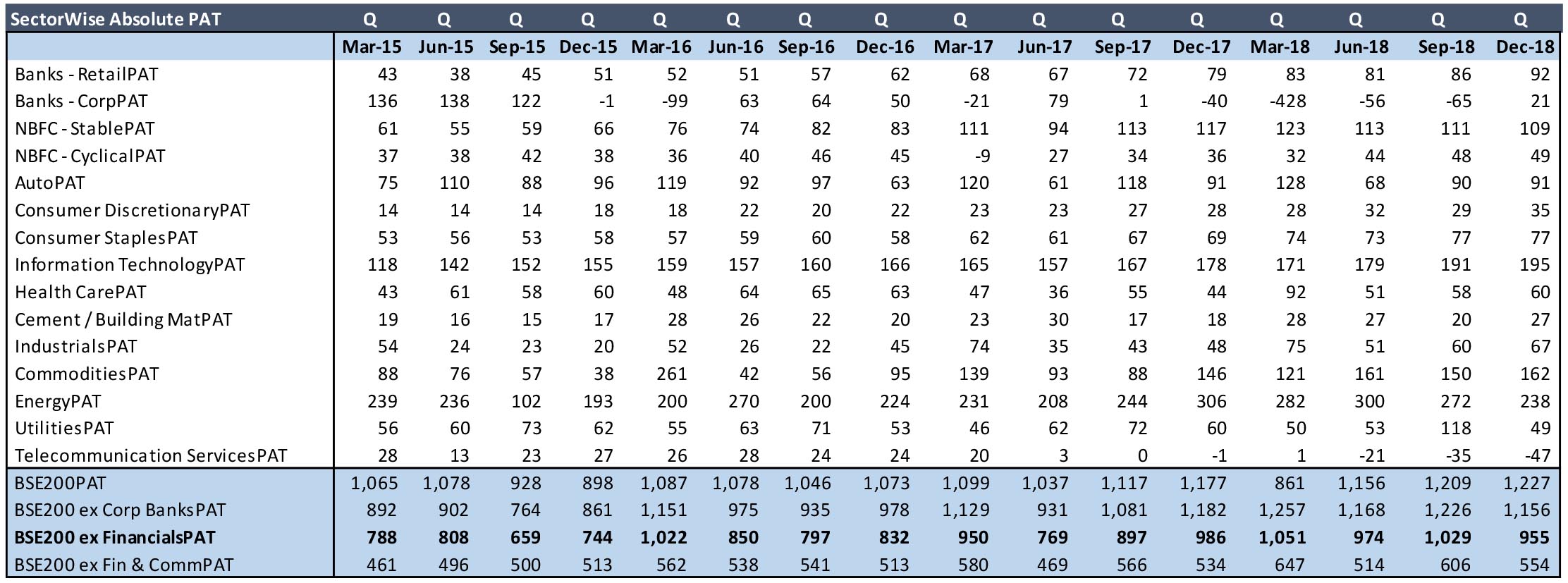

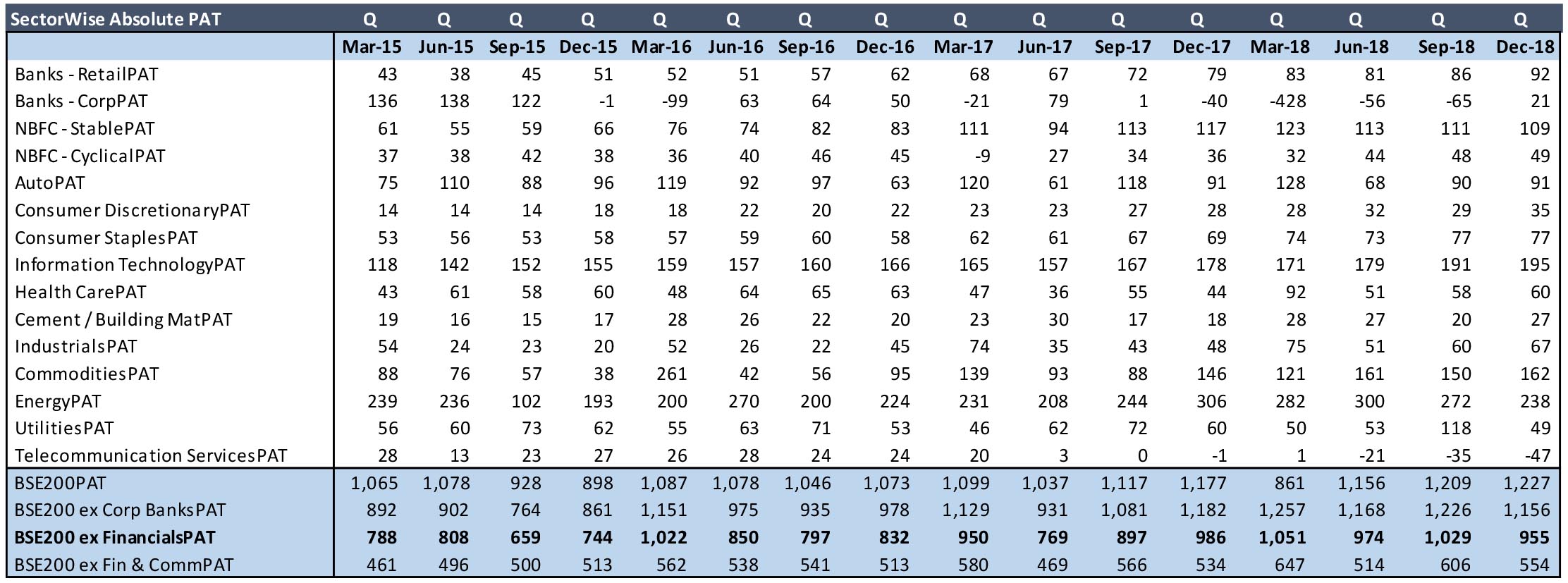

Q3 FY 19 Earnings: The December corporate earnings season for BSE200 were in line with consensus expectations, with domestic cyclicals led by financials picking up the baton from global cyclicals as the driver of earnings growth. Corporate Banks, IT and Consumer delivered a strong performance, while Autos and Cement disappointed.

Q3 marked a third consecutive quarter of Sales growth around the 20% mark. One-offs and company specific issues have marred overall Earnings before Income Tax, Depreciation and Amortization (EBITDA) and Profit After Tax (PAT) growth to levels lower than the Sales Growth. Ex Financials: Sales, EBITDA and PAT grew 21%, 3% and -3% respectively, with performance dragged down mainly by PSU Oil Marketing Companies (OMCs) on account of inventory losses. Corporate Banks, finally saw a quarter of robust earnings growth, PAT including Financials grew 4% YoY. BSE 200, Excluding OMCs and Financials, Sales, EBITDA and PAT grew 20%, 13% and 10% respectively. Excl OMCs but including Financials, PAT grew a robust 16% YoY.

World poised for slowest growth in a decade: After growing by 3.6% in 2018, the world economy is on course to expand at its slowest pace since the global financial crisis as slowdowns in the euro-zone and China continue and the US soon joins the mix. Against that backdrop, fears of a surge in inflationary pressure have now been put to bed, it won’t be long before policy loosening comes back on the agenda.

US-China trade deal a possibility: Recent events have improved market’s confidence in a trade deal being negotiated in 2Q between US and China. Market participants expect a deal in 2Q that would involve assurances from China on forced technology transfer, increased purchase of US goods and either a soft or hard agreement on limiting RMB depreciation. In our opinion, China will probably provide verbal support for free market mechanisms but is unlikely to make major changes to the management of State Owned Enterprises (SOEs) or the objectives of Made in China 2025. The US will likely lower tariffs or offer a schedule for reductions, but will probably insist on an enforcement mechanism largely under its control.

Global Markets rebound: Global Markets rebound: Global markets continued the rebound with the increasing possibility of a US-China trade deal. Developed markets rose +2.8% Month on Month (MoM), led by US (+3% MoM) whereas Emerging Markets were flat (despite Chinese markets increasing +13.9% MoM). Since the start of the year, global markets have seen a rebound with the 3-Month returns for the MSCI Developed Markets and Emerging Markets Indices at +2.6% and 5.7% respectively. India, which was the 2nd best performing market in USD terms for CY 2018, has lagged behind in the current rally. Small rally was witnessed in base metals like Steel (+2%) and Copper (+6%); but most base metals are down significantly on a Year-on-Year basis, given global growth concerns. Crude rebounds: After the sharp sell-off seen in November-December, crude continued to rebound with the Brent Index rising 6% MoM to close at $66.0/barrel. Despite the sharp rise in January, crude is still at a comfortable level for a large oil importer like India and shouldn’t trigger concerns as yet. Indo-Pak tensions: Militant outfit JeM initiated terror attack on a convoy of CRPF jawans in Pulwama, J&K on 14 Feb, killing 40 security personnel. As a counter-measure, IAF claimed to have bombed JeM’s Balakot camp in PoK on 26 Feb, following which Pakistan Air Force apparently targeted Indian military installations on 27 Feb and downed an Indian jet in PoK leading to the capture of an IAF pilot. UN and leading nations urged de-escalation of tensions which was followed by Pakistan announcing the release of the captured pilot as a peace-keeping gesture. The market remained largely unaffected as most participants believed that the probability of this escalating into a full blown war is remote. Domestic Markets: Mid and small caps continued to underperform large caps in January with the NIFTY, NSE Mid Cap and NSE Small cap funds falling 0.4%, 1.1% and 3.2% MoM. With this, Mid and Small Caps are underperforming the NIFTY across most timeframes upto 3 years. The 1 year returns for NIFTY, NSE Mid Cap and NSE Small Cap are 2.9%, -15.0% and -29.0% respectively. Even for the 3 year time frame, the respective CAGR returns are 15.6%, 13.1% and 10.8% respectively. The underperformance of Mid and Small Caps in 2018 has been so severe, it has wiped out the outperformance of CY 17.

On a sectoral basis, there wasn’t any index that significantly outperformed/underperformed. Auto (+1.7%), Consumer Discretionary (+1.6%), Oil and Gas (+1.4%) were positive for the month whereas PSU Banks (-2.4%), Utilities (-2.7%) and FMCG (-2.3%) were the key negatives. Over the past year, Telecom (-31.2%), Metals (-29%), Auto (-24.3%) and Industrials (-23.6%) were the key underperformers whereas IT (+22%), FMCG (+8.1%) and Private Banks (+7.3%) were the outperformers. Telecom stocks have underperformed on account of Jio-led heightened competitive intensity, Metals on account of global growth concerns, Autos on account of falling volume growth and Industrials on account of election-led growth concerns. IT has outperformed on account of the depreciating Rupee and increasing deal flow whereas FMCG on account of expectations of election-sops led rural growth.

Policy: New RBI governor Shaktikanta Das’s maiden policy meet ended with a policy rate cut of 25bps to 6.25% and change in stance to “neutral” from “calibrated tightening” as inflation and growth both continued to moderate. We also saw significant reduction to Consumer Price Index (CPI) forecast by 60-80bps for 1H FY20 to 3.2-3.4%.

Growth: Index of Industrial Production (IIP) stayed subdued at 2.4% in Dec, despite improving significantly from Nov lows of 0.5% on account of contraction in mining segment and poor showing by manufacturing sector. Manufacturing sector recorded a low growth of 2.7% as against an expansion of 8.7% in Nov. In terms of industries, 13 out of 23 industry groups in manufacturing sector showed positive growth.

Inflation: CPI soft patch continued with Jan print declining further to 2.05% with fall in fuel (2.2% vs 4.5% in Dec) and food (-1.3% vs 1.6% in Dec). Core inflation also moderated marginally to 5.4% vs 5.7% in Dec, while health inflation continued to remain sticky as education inflation also saw some moderation.

Trade Deficit: Jan trade deficit widened to $14.7bn from the 10-month low of US$13.1bn in Dec on the back of fall in exports led by fall in petro products. Brent prices jumped up 4.1% in Dec leading to an increase in oil imports from $11.2bn from $10.7bn.

GST Council Meet: GST council cut rates on under-construction properties to 5% (from 12%) and on affordable housing to 1% (from 8%) eff 1 April, 2019. In both cases, the builders will not be eligible to claim input tax credit in the new structure.

Q3 FY 19 Earnings: The December corporate earnings season for BSE200 were in line with consensus expectations, with domestic cyclicals led by financials picking up the baton from global cyclicals as the driver of earnings growth. Corporate Banks, IT and Consumer delivered a strong performance, while Autos and Cement disappointed.

Q3 marked a third consecutive quarter of Sales growth around the 20% mark. One-offs and company specific issues have marred overall Earnings before Income Tax, Depreciation and Amortization (EBITDA) and Profit After Tax (PAT) growth to levels lower than the Sales Growth. Ex Financials: Sales, EBITDA and PAT grew 21%, 3% and -3% respectively, with performance dragged down mainly by PSU Oil Marketing Companies (OMCs) on account of inventory losses. Corporate Banks, finally saw a quarter of robust earnings growth, PAT including Financials grew 4% YoY. BSE 200, Excluding OMCs and Financials, Sales, EBITDA and PAT grew 20%, 13% and 10% respectively. Excl OMCs but including Financials, PAT grew a robust 16% YoY.

Therefore, while the underlying earnings story is improving (better revenue growth trends, corporate banks’ asset

quality turning around, etc.), new risks to earnings are also emerging (Autos, NBFC). Consequently, though the

direction of the earnings revision is still trending down, broad based revenue growth indicates robust demand

environment, which should help companies raise prices in the future. Also, the Corporate Bank cycle seems to be

bottoming which should help reduce loan loss provisions and boost profitability in the future.

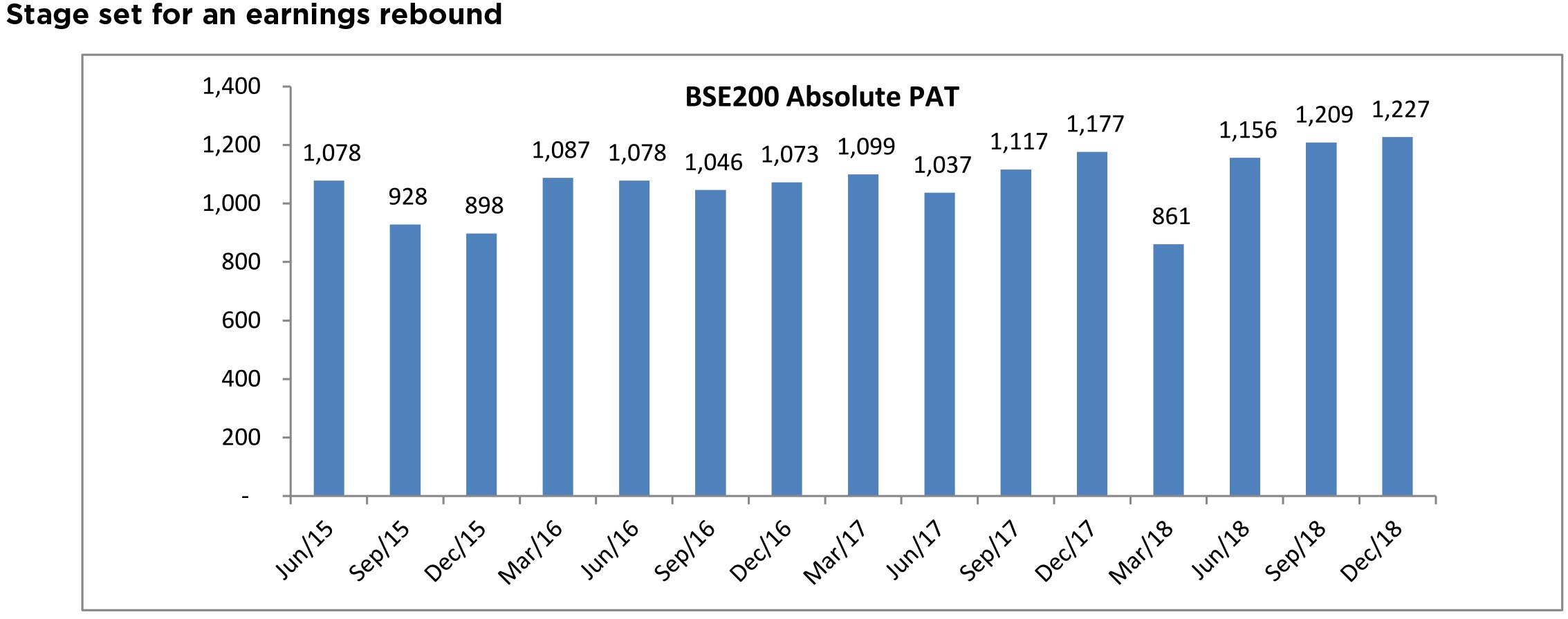

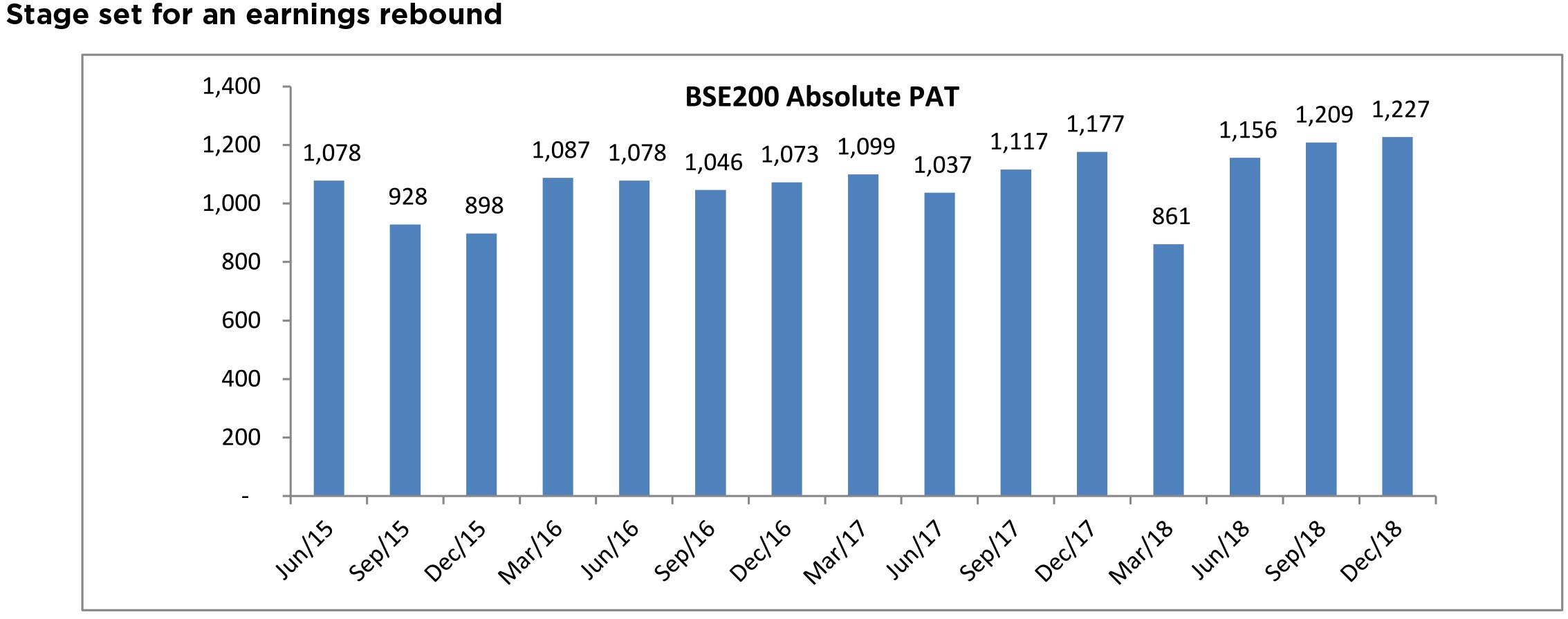

Despite the inventory losses for OMCs and lower than run-rate profit for Corporate Banks, BSE200 aggregate PAT hit a record high in Q3 FY 19, surpassing the record high set in Q2 FY 19. Historically, Q4 PAT has been higher than Q3 PAT. Even assuming the same level of absolute profit in Q4 as compared to Q3 sets the stage for a very robust profit growth in Q4 FY 19, given the low base.

Data Source: Bloomberg

Despite the inventory losses for OMCs and lower than run-rate profit for Corporate Banks, BSE200 aggregate PAT hit a record high in Q3 FY 19, surpassing the record high set in Q2 FY 19. Historically, Q4 PAT has been higher than Q3 PAT. Even assuming the same level of absolute profit in Q4 as compared to Q3 sets the stage for a very robust profit growth in Q4 FY 19, given the low base.

Data Source: Bloomberg

| Equity Markets | Index | % Change YTD | % Change MTD | P/E |

| Nifty | 10,792.50 | -0.64% | -0.36% | 21.17 |

| Sensex | 35,867.44 | -0.56% | -1.07% | 22.60 |

| Dow Jones | 25,916.00 | 11.10% | 3.67% | 15.64 |

| Shanghai | 2,940.95 | 17.93% | 13.79% | 11.55 |

| Nikkei | 21,385.16 | 6.85% | 2.94% | 15.67 |

| Hang Sang | 28,633.18 | 10.79% | 2.47% | 11.16 |

| FTSE | 7,074.73 | 5.15% | 1.52% | 12.62 |

| MSCI E.M. (USD) | 1,050.95 | 8.82% | 0.10% | 12.35 |

| MSCI D.M.(USD) | 2,085.84 | 10.72% | 2.83% | 15.48 |

| MSCI India (INR) | 1,259.61 | -0.25% | -0.09% | 21.65 |

| Currency & Commodities | Last Price % | Change YTD % | Change MTD |

| USD / INR | 70.746 | 1.40% | -0.48% |

| Dollar Index | 96.16 | -0.02% | 0.61% |

| Gold | 1,313.31 | 2.41% | -0.60% |

| WTI (Nymex) | 57.22 | 26.01% | 6.38% |

| Brent Crude | 66.03 | 22.73% | 6.69% |

| India Macro Analysis | Latest | Equity Flows | USD Mn |

| GDP | 6.60 | FII (USD mln) | |

| IIP | 2.40 | YTD | 2,077.91 |

| Inflation (WPI Monthly) | 2.76 | MTD | 2,152.73 |

| Inflation (CPI Monthly) | 2.05 | *DII (USD mln) | |

| Commodity (CRB Index) | 412.83 | YTD | 1,315.23 |

| Source: Bloomberg, SEBI | MTD | 305.13 | |

| *DII : Domestic Mutual Funds Data as on Data as on 28thFebruary 2019 | |||