IDFC Bond Fund – Income Plan

(The fund has been repositioned to Medium to Long Term category w.e.f. July 12, 2018)

(previously known as IDFC Super Saver Income Fund – Investment Plan)

An open ended medium term debt scheme investing in instruments such that the Macaulay duration of the portfolio is

between 4 years and 7 years

28th February 2019

IDFC Bond Fund – Income Plan

(The fund has been repositioned to Medium to Long Term category w.e.f. July 12, 2018)

(previously known as IDFC Super Saver Income Fund – Investment Plan)

An open ended medium term debt scheme investing in instruments such that the Macaulay duration of the portfolio is

between 4 years and 7 years

28th February 2019

FUND FEATURES

Category: Medium to Long Duration

Monthly Avg AUM: ₹ 699.09 Crores

Monthly end AUM: ₹ 692.88 Crores

Inception Date: 14 July 2000

Fund Manager:

Mr. Suyash Choudhary (Since 15th October 2010)

Other Parameter:

| Standard Deviation (Annualized) | 3.16% |

| Modified Duration | 5.50 years |

| Average Maturity | 8.15 years |

| Yield to Maturity | 8.45% |

| Expense Ratio | |

| Regular | 1.75% |

| Direct | 1.35% |

SIP (Minimum Amount): ₹ 1,000/-

SIP Frequency: Monthly

SIP Dates (Monthly): Investor may choose any day of the month except 29th, 30th and 31st as the date of installment.

Investment Objective: Click here

Minimum Investment Amount : ₹ 5,000/- and any amount thereafter

Option Available: Growth, Dividend - Quarterly, Half Yearly, Annual & Periodic

Exit Load: If redeemed/switched out within 365 days from the date of allotment: For 10% of investment : Nil, For remaining investment : 1%

If redeemed/switched out after 365 days from the date of allotment: Nil

NAV (₹)

| Plan | Option | Freq | NAV |

| Regular Plan | Dividend | Quarterly | 11.4740 |

| Regular Plan | Growth | - | 43.4187 |

| Regular Plan | Dividend | Annual | 11.9355 |

| Regular Plan | Dividend | Half Yearly | 11.9662 |

| Regular Plan | Dividend | Periodic | 14.2580 |

PORTFOLIO

| Name | Rating | % of NAV |

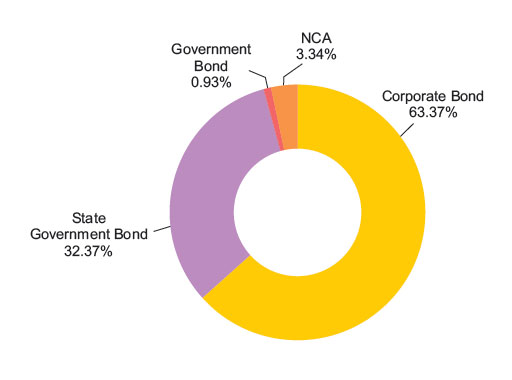

| Corporate Bond | 63.37% | |

| NABARD | AAA | 12.38% |

| Reliance Industries | AAA | 12.27% |

| National Highways Auth of Ind | AAA | 11.45% |

| NTPC | AAA | 11.39% |

| REC | AAA | 8.73% |

| Indian Railway Finance Corporation | AAA | 6.48% |

| Power Grid Corporation of India | AAA | 0.66% |

| State Government Bond | 32.37% | |

| 8.28% Gujarat SDL - 2029 | SOV | 8.33% |

| 8.08% Tamilnadu SDL - 2028 | SOV | 7.36% |

| 8.25% Andhra Pradesh SDL - 2023 | SOV | 5.13% |

| 8.32% Karnataka SDL - 2029 | SOV | 3.60% |

| 8.24% Gujrat SDL - 2023 | SOV | 2.93% |

| 8.3% Karnataka SDL - 2029 | SOV | 1.44% |

| 8.08% Maharashtra SDL - 2028 | SOV | 1.42% |

| 7.95% Tamil Nadu SDL - 2023 | SOV | 0.73% |

| 8.38% Gujarat SDL - 2029 | SOV | 0.72% |

| 8.18% Tamilnadu SDL - 2028 | SOV | 0.71% |

| Government Bond | 0.93% | |

| 7.35% - 2024 G-Sec | SOV | 0.87% |

| 7.73% - 2034 G-Sec | SOV | 0.05% |

| Net Cash and Cash Equivalent | 3.34% | |

| Grand Total | 100.00% |

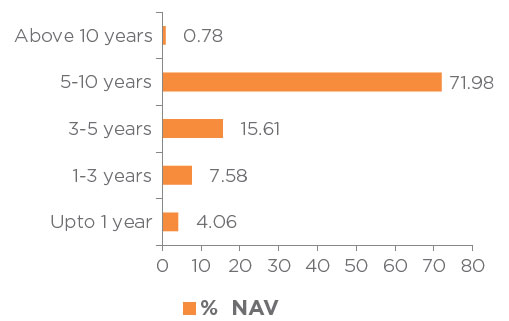

Maturity Bucket

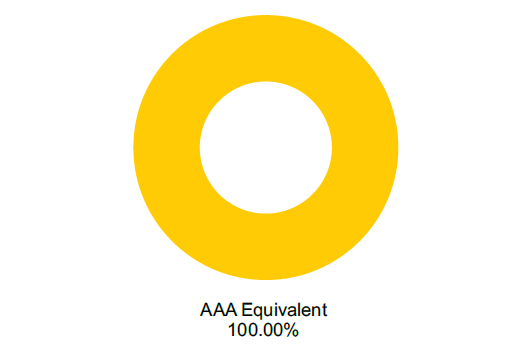

Asset Quality

Asset Allocation

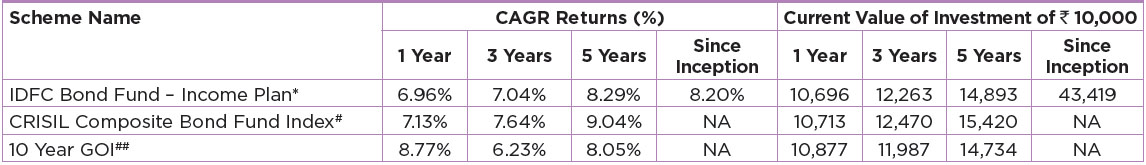

PERFORMANCE TABLE

Performance based on NAV as on 28/02/2019. Past performance may or may not be sustained in future.

The performances given are of regular plan growth option.

Click here for other funds managed by the fund manager and refer to the respective fund pages

#Benchmark Returns. ##Alternate Benchmark Returns. Standard Deviation calculated on the basis of 1 year history of monthly data

*Inception Date of Regular Plan - Growth Jul 14, 2000.

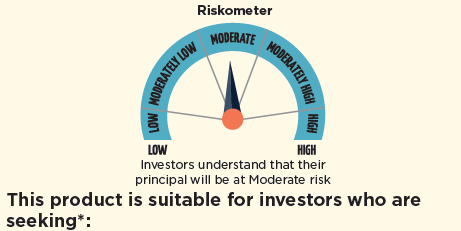

RISKOMETER

- To generate optimal returns over Long term.

- Investments in Debt & Money Market securities such that the Macaulay duration of the portfolio is between 4 years and 7 years

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Regular and Direct Plans have different expense structure. Direct Plan shall have a lower expense ratio excluding distribution expenses, commission expenses etc.

Gsec/SDL yields have been annualized wherever applicable