IDFC Regular Savings Fund

(previously known as IDFC Monthly Income Plan)

An open ended hybrid scheme investing predominantly in debt instruments

28th February 2019

IDFC Regular Savings Fund

(previously known as IDFC Monthly Income Plan)

An open ended hybrid scheme investing predominantly in debt instruments

28th February 2019

FUND FEATURES

Category: Conservative Hybrid

Monthly Avg AUM: ₹ 202.43 Crores

Monthly end AUM: ₹ 199.60 Crores

Inception Date: 25 February 2010

Fund Manager: Equity Portion: Mr. Sumit Agrawal (w.e.f. 20th October 2016)

Debt Portion:

Mr. Anurag Mittal (w.e.f. 09th November 2015)

Other Parameter:

| Modified Duration | 1.52 years |

| Average Maturity | 3.38 years |

| Yield to Maturity* | 7.83% |

| *Monthly income is not assured and is subject to availability of distributable surplus | |

| Expense Ratio | |

| Regular | 2.11% |

| Direct | 1.21% |

SIP (Minimum Amount): ₹ 100/- (Minimum 6 instalments)

SIP Frequency: Monthly

SIP Dates (Monthly): Investor may choose any day of the month except 29th, 30th and 31st as the date of instalment.

Investment Objective: Click here

Minimum Investment Amount : ₹ 5,000/- and any amount thereafter

Option Available: Growth, Dividend - Quarterly, Regular

Exit Load: In respect of each purchase of Units:

- For 10% of investment : Nil

- For remaining investment: 1% if redeemed/ switched-out within 365 days from the date of allotment (w.e.f. 24th August 2017)

NAV (₹)

| Regular Plan | Dividend | 12.4109 |

| Regular Plan | Growth | 20.9381 |

| Regular Plan | Quarterly Dividend | 12.6864 |

PORTFOLIO

| Name | Rating | % of NAV |

| Corporate Bond | 45.01% | |

| HDFC | AAA | 10.06% |

| Reliance Industries | AAA | 9.81% |

| Power Grid Corporation of India | AAA | 7.45% |

| Tata Power Company | AA | 7.27% |

| NABARD | AAA | 2.96% |

| REC | AAA | 2.88% |

| Power Finance Corporation | AAA | 2.47% |

| LIC Housing Finance | AAA | 0.83% |

| Blue Dart Express | AA | 0.73% |

| Bajaj Housing Finance | AAA | 0.30% |

| Gruh Finance | AAA | 0.25% |

| Zero Coupon Bond | 0.57% | |

| Bajaj Finance | AAA | 0.57% |

| Equity | 23.51% | |

| Banks | 7.52% | |

| oHDFC Bank | 2.20% | |

| oICICI Bank | 1.82% | |

| oAxis Bank | 1.02% | |

| oKotak Mahindra Bank | 0.91% | |

| oState Bank of India | 0.78% | |

| City Union Bank | 0.44% | |

| RBL Bank | 0.33% | |

| Consumer Non Durables | 5.08% | |

| oITC | 1.11% | |

| oHindustan Unilever | 1.05% | |

| oMarico | 0.59% | |

| Colgate Palmolive (India) | 0.55% | |

| Dabur India | 0.48% | |

| GlaxoSmithKline Consumer Healthcare | 0.44% | |

| Britannia Industries | 0.44% | |

| Nestle India | 0.43% | |

| Software | 3.80% | |

| oInfosys | 2.00% | |

| Tech Mahindra | 0.45% | |

| Tata Consultancy Services | 0.40% | |

| Wipro | 0.35% | |

| NIIT Technologies | 0.32% | |

| Majesco | 0.29% |

| Name | Rating | % of NAV |

| Petroleum Products | 2.00% | |

| oReliance Industries | 2.00% | |

| Pharmaceuticals | 1.03% | |

| Aurobindo Pharma | 0.46% | |

| Cadila Healthcare | 0.29% | |

| IPCA Laboratories | 0.28% | |

| Auto | 0.96% | |

| Mahindra & Mahindra | 0.39% | |

| Hero MotoCorp | 0.32% | |

| Maruti Suzuki India | 0.25% | |

| Industrial Products | 0.89% | |

| AIA Engineering | 0.50% | |

| Supreme Industries | 0.39% | |

| Consumer Durables | 0.57% | |

| Titan Company | 0.57% | |

| Construction Project | 0.52% | |

| Larsen & Toubro | 0.52% | |

| Chemicals | 0.46% | |

| Fine Organic Industries | 0.46% | |

| Auto Ancillaries | 0.40% | |

| MRF | 0.40% | |

| Retailing | 0.29% | |

| Avenue Supermarts | 0.29% | |

| Net Cash and Cash Equivalent | 30.91% | |

| Grand Total | 100.00% | |

oTop 10 Equity Holdings |

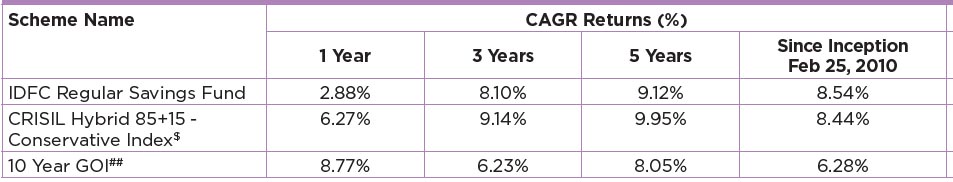

SIP PERFORMANCE

Past performance may or may not be sustained in future.Dividends are assumed to be reinvested and bonus is adjusted. Load is not taken into consideration. To illustrate the advantages of SIP investment, this is how your investment would have grown if you had invested say ₹10,000 systematically on the first business Day of every month over a period of time. Returns are calculated by using XIRR approach. XIRR helps in calculating return on investment given an initial and final value and a series of cash inflows and outflows with the correct allowance for the time impact of the transactions. Data as on 28th February 2019

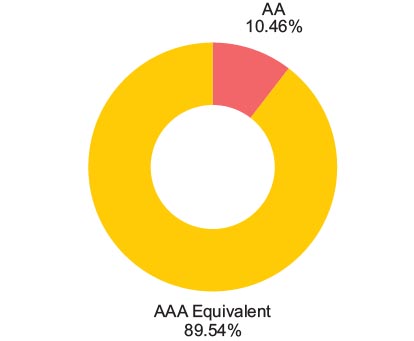

Asset Quality

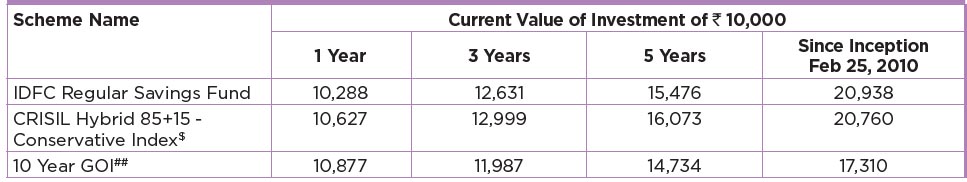

PERFORMANCE TABLE

Performance based on NAV as on 28/02/2019.

Past performance may or may not be sustained in future.

The performances given are of regular plan growth option.

Click here for other funds managed by the fund manager and refer to the respective fund pages

#Benchmark Returns. ##Alternate Benchmark Returns.

RISKOMETER

- To provide regular income and capital appreciation over medium to long term.

- Investment predominantly in debt and money market instruments and balance exposure in equity and equity related securities.

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Regular and Direct Plans have different expense structure. Direct Plan shall have a lower expense ratio excluding distribution expenses, commission expenses etc.

$CRISIL MIP Blended Index has been renamed as CRISIL Hybrid 85+15 - Conservative Index w.e.f. February 2018