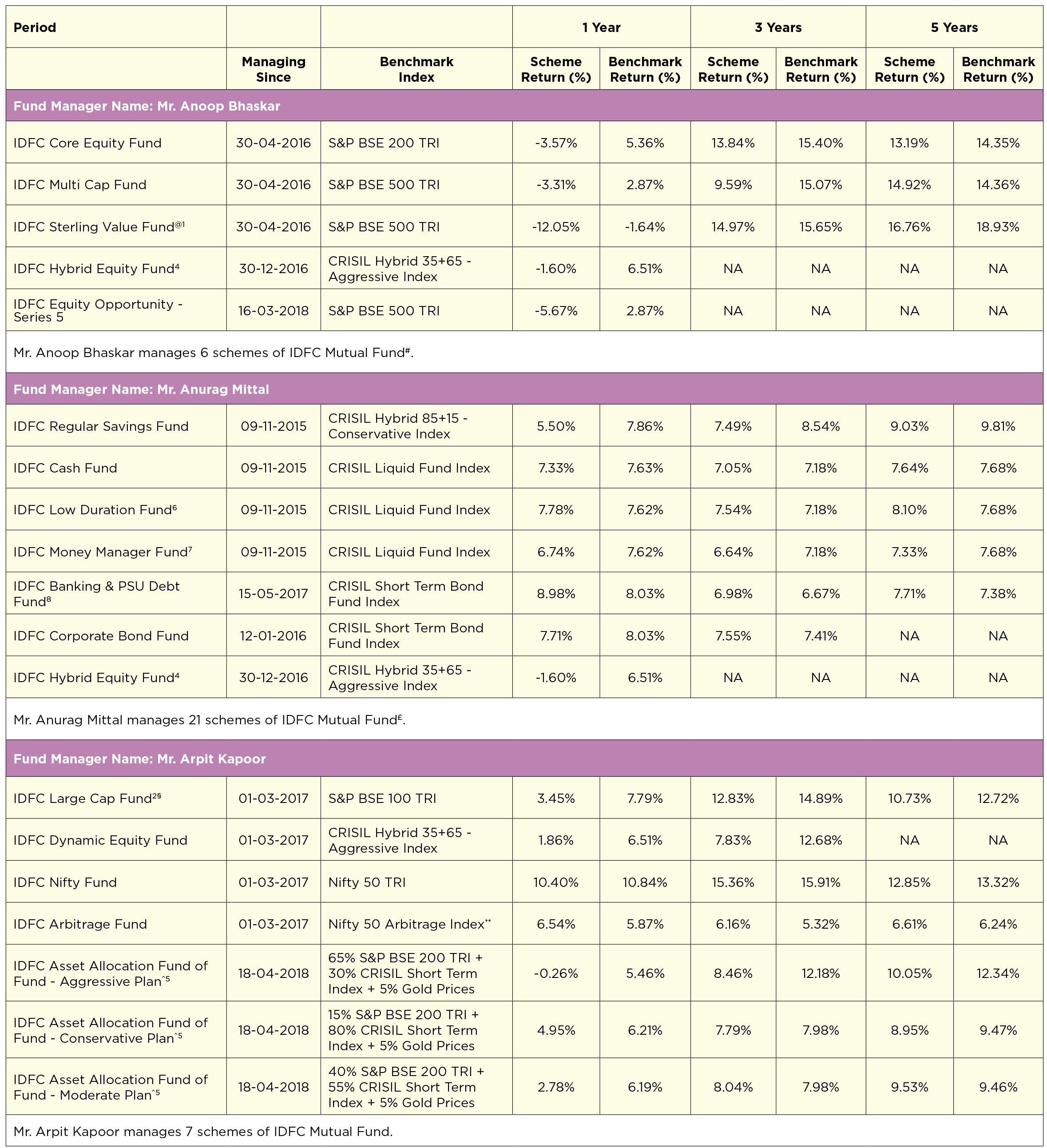

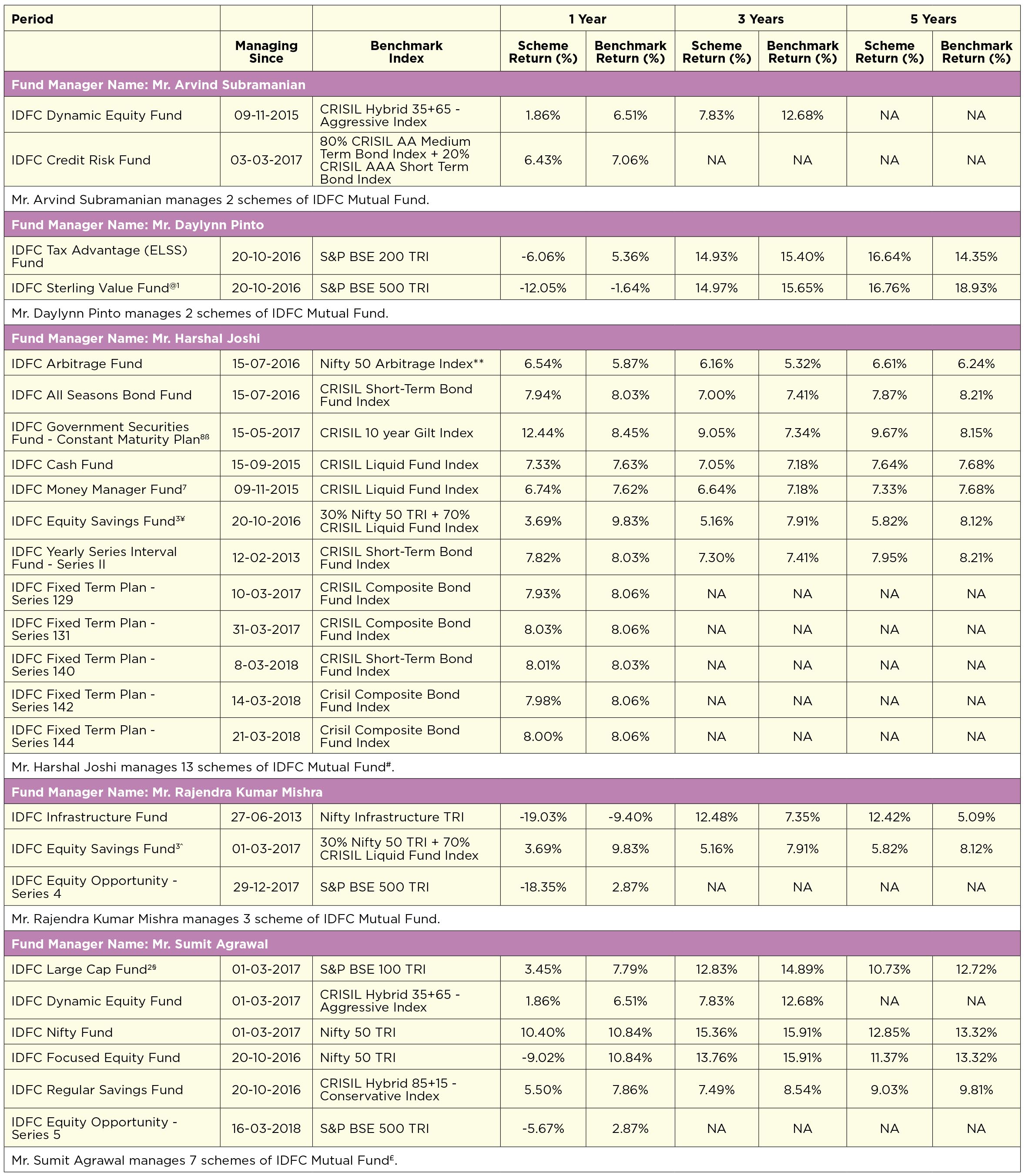

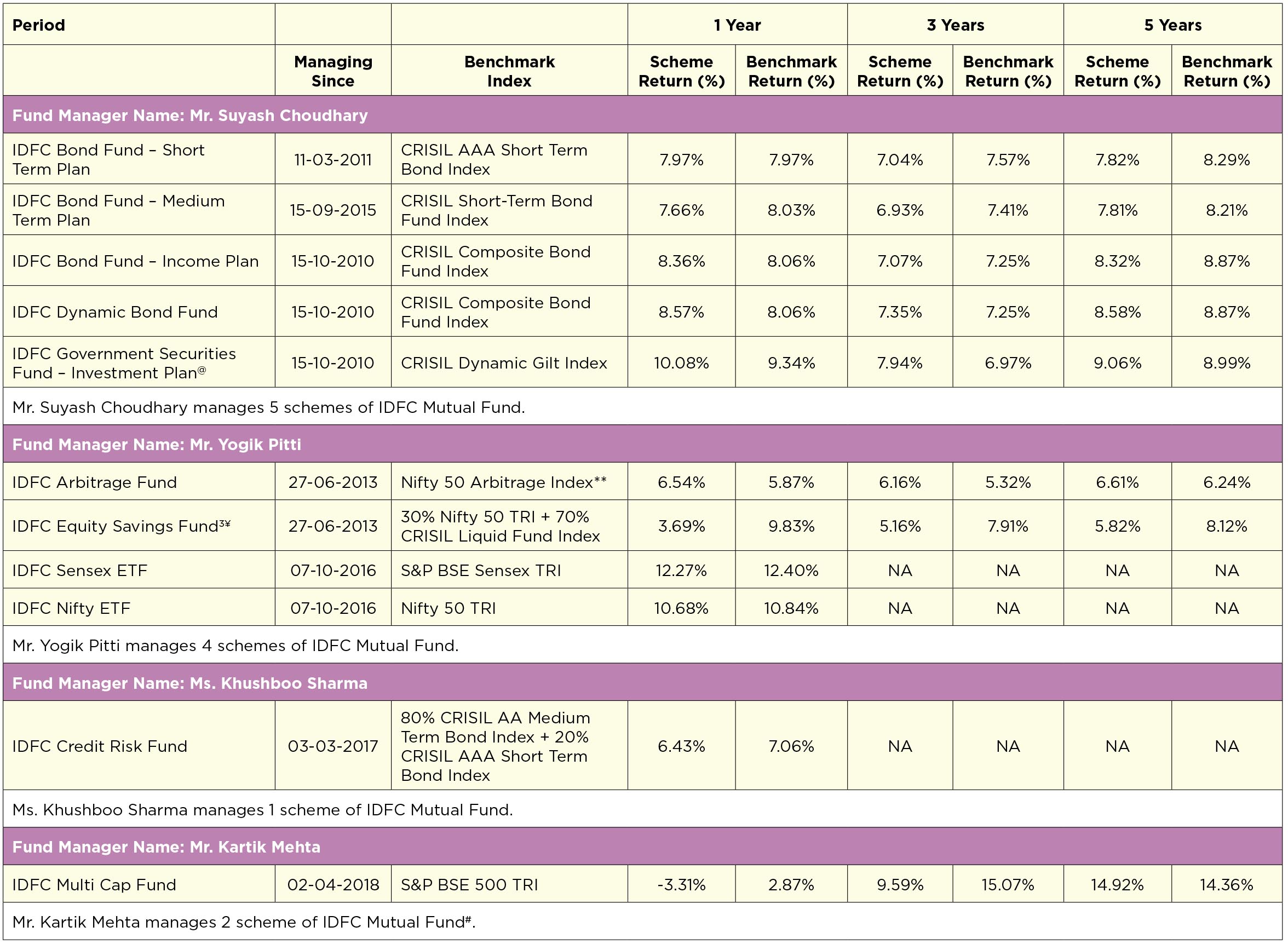

Performance Table

(Others Funds Managed by the Fund Managers)

ICRA Credit Risk Rating

DFC MMF-TP, IDFC MMF-IP, IDFC SSIF-ST, SSIF-MT, IDFC CBF : "Credit Risk Rating AAAmfs" - The Fund carries the lowest credit risk, similar to that associated

with long-term debt obligations rated in the highest credit- quality category.

IDFC CASH FUND, IDFC USTF: "Credit Risk Rating A1+mfs" - The highest-credit-quality short-term rating assigned by ICRA to debt funds. Debt funds rated in

this category carry the lowest credit risk in the short term and are similar to that of fixed income obligations of highest credit- quality category with maturity of

upto one year. This rating should however, not be construed as an indication of the performance of the Mutual Fund scheme or of volatility in its returns.

Source: ICRA Ltd.

CRISIL Credit Quality Rating

IDFC SSIF-IP, IDFC DBF: "CRISIL AAA mfs" - Schemes with this rating are considered to have the highest degree of safety regarding timely receipt of payments from the investments that they have made. The rating of CRISIL is not an opinion on the Asset Management Company's willingness or ability to make timely payments to the investor. The rating is also not an opinion on the stability of the NAV of the Fund, which could vary with market developments.

CRISIL Credit Quality Rating Methodology

CRISIL's credit quality ratings are based on the analysis of the credit risk of securities held by the fund. CRISIL has developed a Credit Quality Matrix to evaluate fund's overall level of protection against losses associated with credit default. The matrix is a set of credit factors and credit scores derived scientifically from CRISIL's rating default and transition rates. For details on closed ended funds, please refer the website www.idfcmf.com

FITCH Credit Quality Rating

IDFC Cash fund: "IND A1+ mfs" - Schemes with this rating are considered to have very strong degree of safety regarding timely receipt of payments from the investments that they have made