Commentary

30th April 2019

Mr. Anoop Bhaskar

Head - Equity

WHAT WENT BY

Global Markets: On the global front, US announced an end to waivers on Iranian oil imports as the 2nd May deadline drew closer with crude cruising higher in the month amid supply concerns, despite surprisingly high US inventory levels. Following British Parliament’s rejection of PM May’s Brexit agreement, EU extended the deadline for UK’s departure until 31st Oct from 29th Mar while US-Sino trade talks made significant progress in the latest round of negotiations between the 2 countries. Global growth concerns were marginally assuaged after some mixed macro prints from China, while investors stayed cautious ahead of FOMC policy meet.

Global equity markets were robust with the US market posting MoM returns of 3.9%. Developed markets (MSCI Developed Market Index, +3.4% MoM) outperformed Emerging Markets (MSCI Emerging Market Index +2.0% MoM) and the rally was broad-based with Germany (+7.1%), UK (+2.3%) and Japan (+4.2%) all posting positive returns for the month. After the sharp rally in March (+10.2%), Indian market was a laggard (+0.5% MoM) in April, but it is still the 2nd best performing global market (+20.6% in USD terms) on a 6 month basis, after China (+22.5% in USD).

Currencies and Commodities: Global growth concerns continued to put downward pressure on prices of most industrial metals. Though prices have recovered in the last 6 months, as compared to the previous year, Aluminium (-20%), Zinc (-10%), Copper (-6%) and Steel (-8%) are trading lower. Most global currencies were flat for the quarter. The INR was down 0.3% MoM, but has gained 6.4% over the last 6 months against the Dollar. Yields increased across the board as improving growth outlook reduced the probability of rate cuts by various central banks. Despite this, 10-Year government yields across the globe are significantly lower than the year ago period: India -36bps, US -45bps, UK -23bps, China -55bps and Japan -10bps.

Crude rebounds: After the sharp sell-off seen in November-December, crude continued to rebound with the Brent Index rising 6% MoM to close at USD 72.8/barrel. Though, crude is reaching levels which can pose a concern to the Indian economy, the current rise in prices is mainly due to a curtailment in supply rather than strong global demand. Increasing supplies of US shale, which is now the world’s largest oil producer should compensate the loss of oil supplies due to sanctions on Iran and problems in Venezuela. As a result, crude prices, though expected to be volatile, shouldn’t see a runaway increase towards the $100/barrel mark.

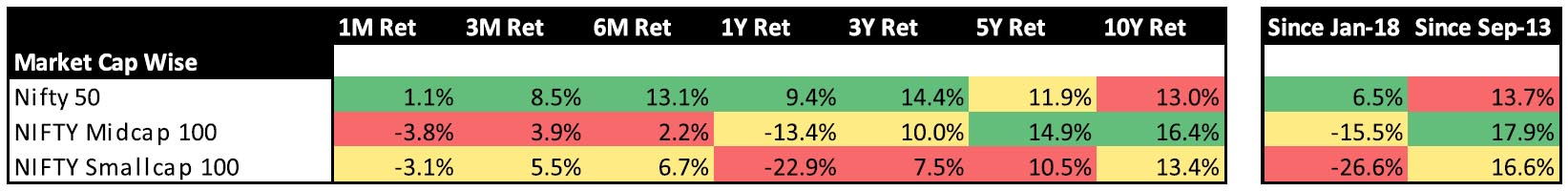

Domestic Markets: With the election results less than a month away, domestic markets continued to be volatile with limited domestic retail participation. As a result, Large Caps continued to outperform on account of continued FII flows into the segment. For the month, NIFTY 50 (+1.1% MoM) was positive whereas NSE Mid cap (-3.8% MoM) and NSE Small cap (-3.1% MoM) were both negative. As can be seen below, NIFTY 50 continued to outperform Mid and Small Cap indices.

Over the last year, IT (+19.9%) has been the best performer whereas Auto (-27.1%) has been the worst performing sector. Autos have led the slowdown in consumption witnessed in the last few quarters, with industry experts attributing the slowdown to pre-election uncertainty. March sales for Autos continued the past few months’ trend of subdued retail numbers across the board. 2-wheelers reported even weaker volumes in the month, while CVs saw mixed trends.

Macro Growth slowdown: Feb’19 Index of Industrial Production (IIP) showed signification stagnation, coming in at a 20-month low of 0.1% vs 1.7% in Jan’19. The drag was led by contraction in manufacturing sector (-0.3% YoY) while capital goods output also declined by 8.8% YoY. In terms of industries, 10 of 23 industry groups recorded positive YoY growth in Feb.

Inflation above estimates, but muted: The Feb’19 Consumer Price Index (CPI) reversal continued in Mar’19 with print advancing to 2.9% (4Q FY19 avg 2.5%), coming in marginally ahead of RBI quarterly forecast of 2.4%. Mar’19 Wholesale Price Index (WPI) also rose to 3.2% vs 2.9% in Feb’19 on the back of spurt in food and fuel prices. Food inflation trajectory persisted with the Mar’19 print coming in at 5.7% (vs 4.3% in Feb’19), while fuel and power prices also witnessed a significant bump MoM (5.4% in Mar’19 vs 2.2% in Feb’19).

RBI Policy stance benign: RBI policy stance unchanged at Neutral, cutting repo rate by 25bps to 6% while revising down FY20 GDP growth forecast by 7.2% (1H forecast lowered by 40bps) on softening growth indicators. 1H CPI forecast was also slashed by ~30bps to 2.9%-3% with 2H inflation expected to fall in 3.5% to 3.8% band.

Trade Deficit: Mar’19 trade deficit rose to USD 10.9bn (vs USD 9.6bn in Feb’19) with the annual FY19 deficit coming in at a 6-yr high of USD 183.5bn. While export growth in Mar’19 surpassed the 3yr avg (11% YoY) and import growth (1.4% YoY), oil import bill increased by 29.8%.

Monsoon outlook mixed: Indian Meteorological Department (IMD) came out with its annual monsoon forecast of a near-normal monsoon (96% of long period average-LPA) with weak El Nino conditions expected. However, earlier in the month, private weather tracking agency, Skymet had come out with a below-normal monsoon expectation (93% of LPA) with a 55% probability of below normal monsoons. The Met department (IMD) had also notified of heat wave conditions in states of MP, Maharashtra and Telangana in 1st week of April’19 as summer set in in major parts of the country.

FII flows robust: Foreign Institutional Investor (FIIs) maintained the buying trend in April, though of smaller quantum, inflows of USD 1.7bn, taking the CYTD total to USD 9.9bn. DIIs remained sellers with outflows of USD 600mn with the CYTD total standing at net outflows of USD 2.4bn. Domestic MFs were sellers with net outflows of USD820mn while Insurance companies turned buyers for the first time in the year with inflows of ~USD220mn.

Indian markets had a volatile month as LS elections, crude and global geo-political developments weighed on investor sentiment. FII flows continued to be positive, whereas domestic investors are still cautious pending election results, resulting in continued outperformance of Large Cap stocks vis-à-vis Mid and Small Cap. On the domestic front, Lok Sabha elections took centre stage as 4 of 7 polling phases were completed in the month with mixed trends in voter turnouts being seen across states. Q4 FY19, the other key monitor able, has started on a mixed note with both significant beats as well as misses. Recovery in Corporate Banks profitability is key to earnings growth and hence Corporate Bank results will be keenly watched. Election uncertainty has driven markets in the last year with cyclical segments witnessing a significant derating despite posting good results and order books. Elections impact returns in the short term, whereas earnings drive returns over the longer term. With the election results getting out of the way in May, focus should shift to earnings growth visibility.

Data Source: Bloomberg

| Equity Markets | Index | % Change YTD | % Change MTD | P/E |

| Nifty | 11,748.15 | 8.15% | 1.07% | 17.98 |

| Sensex | 39,031.55 | 8.22% | 0.93% | 18.43 |

| Dow Jones | 26,592.91 | 14.00% | 2.56% | 16.13 |

| Shanghai | 3,078.34 | 23.43% | -0.40% | 11.20 |

| Nikkei | 22,258.73 | 11.21% | 4.97% | 14.90 |

| Hang Sang | 29,699.11 | 14.91% | 2.23% | 11.28 |

| FTSE | 7,418.22 | 10.26% | 1.91% | 12.75 |

| MSCI E.M. (USD) | 1,079.24 | 11.75% | 2.00% | 12.64 |

| MSCI D.M.(USD) | 2,178.67 | 15.65% | 3.37% | 15.87 |

| MSCI India (INR) | 1,351.55 | 7.03% | 0.96% | 17.80 |

| Currency & Commodities | Last Price % | Change YTD % | Change MTD |

| USD / INR | 69.566 | -0.29% | 0.59% |

| Dollar Index | 97.48 | 1.36% | 0.20% |

| Gold | 1,283.55 | 0.09% | -0.68% |

| WTI (Nymex) | 63.91 | 40.74% | 6.27% |

| Brent Crude | 72.80 | 35.32% | 6.45% |

| India Macro Analysis | Latest | Equity Flows | USD Mn |

| GDP | 6.60 | FII (USD mln) | |

| IIP | 1.10 | YTD | 9,767.86 |

| Inflation (WPI Monthly) | 3.18 | MTD | 2,922.11 |

| Inflation (CPI Monthly) | 2.86 | *DII (USD mln) | |

| Commodity (CRB Index) | 422.09 | YTD | -491.40 |

| Source: Bloomberg, SEBI | MTD | -708.76 | |

| *DII : Domestic Mutual Funds Data as on Data as on 30thApril 2019 | |||

Mr. Suyash Choudhary

Head - Fixed Income

WHAT WENT BY

Despite the 25bps rate cut in April policy, bond markets ended negatively during the month with the 10 year Government bond yielding ended the month 6bps higher at 7.41% while 10 year AAA yields closed higher by 21bps at 8.40%. While the policy rate cut of 25bps was widely expected by the markets, anticipation of a more dovish policy through either a change in stance or a deeper cut, led to the negative reaction, given the heavy positioning of the market pre-policy. Markets were also concerned with the 6% rise in crude to USD72.8 per barrel as US refused to extend waivers for importing Iranian oil to 8 countries including India post its deadline of 2nd May (Iran’s exports in March totalled about 1.3 million barrels a day).

Headline average liquidity deficit increased to INR 710bn in April from INR 575bn in March possibly due to currency leakage & lower Government spending ahead of elections. Money market rates hardened as a result with the 2 months CD levels rising by 50bps while 1 year CD rates went up by 30bps approximately.

Given the tight liquidity conditions, RBI announced open market operations (OMO) auctions of INR250bn in May & the second USDINR swap auction by RBI of USD5bn to further inject liquidity. RBI’s swap auction saw a cutoff of 838p with a weighted average premium of 843.5p significantly higher than the secondary market levels of 800-810p indicating strong demand.

On the inflation front, Consumer price index (CPI) inflation stood at 2.86% in March’19 higher than 2.57% a month prior. The inflation rate of Consumer Food Price Index (CFPI) turned positive and stood at 0.30% in March’19 compared to -0.73% in February’19. The Wholesale price index (WPI) inflation stood at 3.18% for March’19 compared to 2.93% in February’19 on the back of increase in fuel prices. The recent forecast by Indian Meteorological Department (IMD) of a ‘near-normal’ monsoon for India with the seasonal rainfall expected to be 96% of Long Period Average (LPA) with a model error of +/- 5%. While the risk from El-Nino remains, the intensity is likely to weaken in the latter part of the monsoon season.

RBI released its minutes of Monetary Policy Committee (MPC) meeting. The tone of the minutes remained dovish for majority of the members as MPC members shared concerns over growth environment, even as the two dissenting members acknowledged, to some extent, a broadly benign CPI outlook. Governor Shaktikanta Das used the minutes to reiterate his proposal to reconsider the “conventional way” of delivering rate decisions in quantum of 25bps, and consider lower denominations possibly as one of the ways to indicate RBI’s stance.

Concerns on global growth continued with IMF slashing its global growth forecasts for the third time, bringing it down by 20bps to 3.3% from 3.5% in January’19 on account of trade tensions and a potential disorderly Brexit.

Outlook:

Given the global and local backdrop we expect there is more easing in the pipeline. Moreover, RBI is also increasingly focusing on transmission as it continues its FX swap program & OMO auctions to supply durable liquidity & improve transmission. Certainly front end AAA corporate bonds between 2- 5 years are better placed in terms of risk versus reward to play this environment. The duration part of the curve has frustrated lately due to heavy market positioning pre-policy on expectations of change in stance which did not materialise. Our preference here, as indicated before, is via spread assets like SDLs and the best quality AAA corporate bonds due to relatively favourable demand supply dynamics. Market for lower rated credits remains dislocated and we would continue to advise caution there. There is a genuine liquidity issue in the lower rate space and this is constraining true price discovery as well. One will have to wait for some of these issues to settle down, and in particular allow price discovery to start happening through the open market, before taking any sort of a serious relook at this space.

Source: Bloomberg, Ministry of Commerce and Industry, Mospi.nic.in,