Commentary

31st October 2019

Mr. Anoop Bhaskar

Head - Equity

WHAT WENT BY

US China trade tensions de-escalate: Mid-month geopolitical risks de-escalated, with the signalling of a

partial deal between the US and China on trade. As part of the agreement, it is suggested that China will

reportedly purchase USD 40-50bn of US agricultural products annually, strengthen intellectual property

provisions, and issue new guidelines on how it manages its currency while the US would delay tariff

increases for Chinese goods. Negotiations over "phase one" of a US-China trade deal are in progress and

will likely be concluded by mid-November.

Brexit uncertainty reduces, though timelines stretched: Despite the UK Prime Minister reaching an agreement with the EU on the terms of a soft Brexit, Brexit got delayed for the third time as the UK Parliament asked for more time to vote on the Brexit deal. EU has granted a 3 month extension to the UK on Brexit. Prior to Brexit, UK general election will be conducted on 12th December.

US Fed signals a pause: US Real GDP growth at 1.9% QoQ in 3QCY19 came better-than-consensus estimates (1.6%). However, GDP growth has slowed down from previous quarters (3.0%/2.0% in 1QCY19/2QCY19). US Fed cut policy rate by 25bps in line with consensus expectations but signalled a pause in the easing cycle. S&P500 reached an all-time high of 3,050 on 30th October on the back of better-than-expected US GDP growth data and monetary policy easing by Fed.

Dollar weakens, boosting risk assets: US-dollar broke below the 200-day moving average (down 2% MoM), despite Fed calling a halt to its rate cut cycle. UK pound (+5.3% MoM) and Euro (+2.3% MoM) rallied on reduced probability of a no-deal Brexit. INR was stable (-0.6% MoM). Crude was flat with Brent closing at USD 60.23/barrel well within comfort levels for India. Most other metals were flat to positive. US 10Y-2Y yield curve continued to steepen, as long-dated treasuries underperformed. In India, the 10- Year G sec rallied 25bps in the month closing at 6.45%.

Equity markets rally: Global equity markets rallied during the month with MSCI Emerging Markets (+4.1% MoM) outperforming MSCI Developed Markets (+2.5% MoM). With USD return of 3.2%, India was in the middle of the pack; though at +21.4%, the SENSEX is one of the best performing global indices over the last 1 year. Japan was the best performing equity market for a second month in a row. Among sectors, global tech and auto sectors did well. Low-risk sectors such as utilities and staples underperformed the most, but energy and materials also failed to outperform.

Domestic Markets:

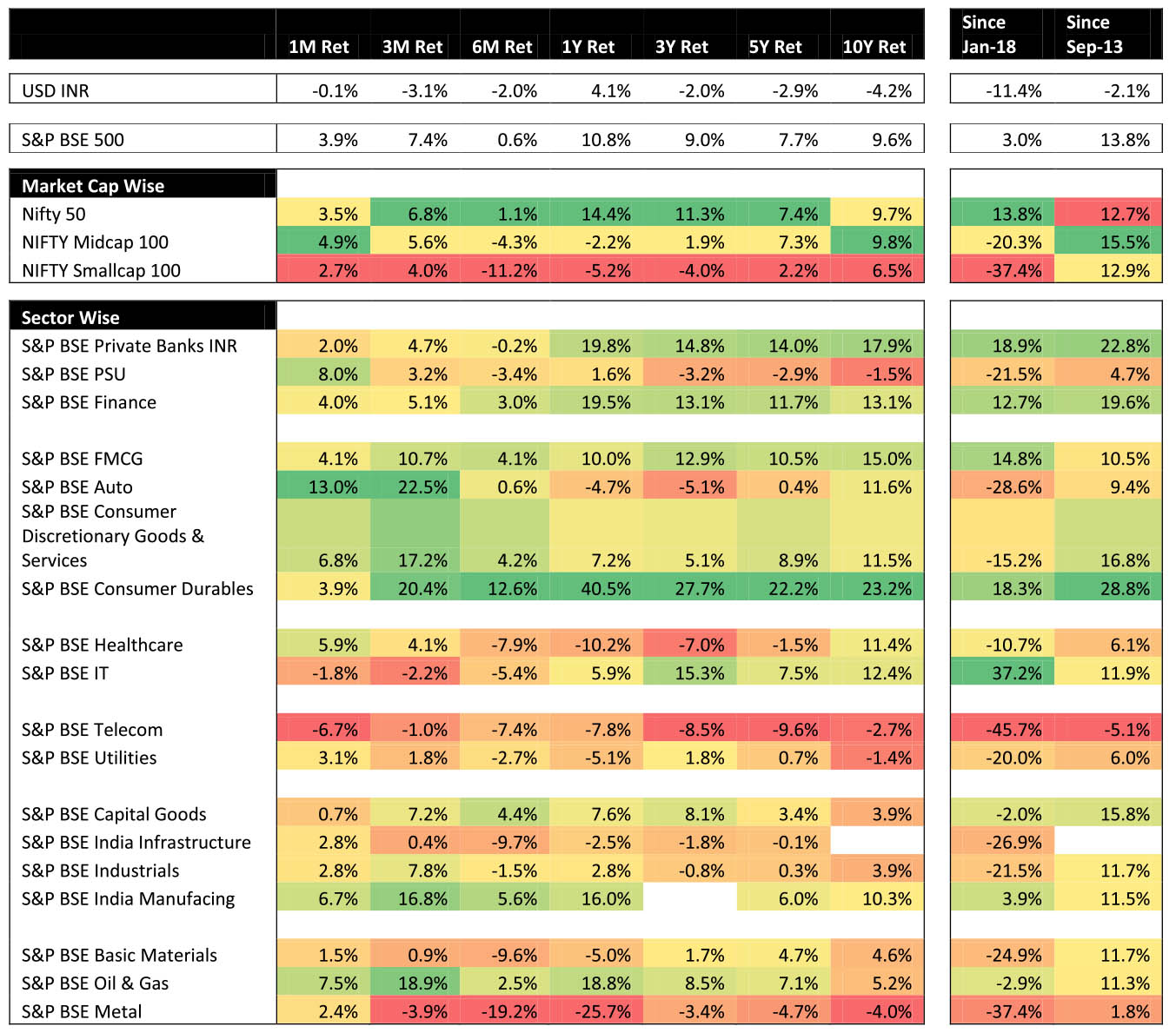

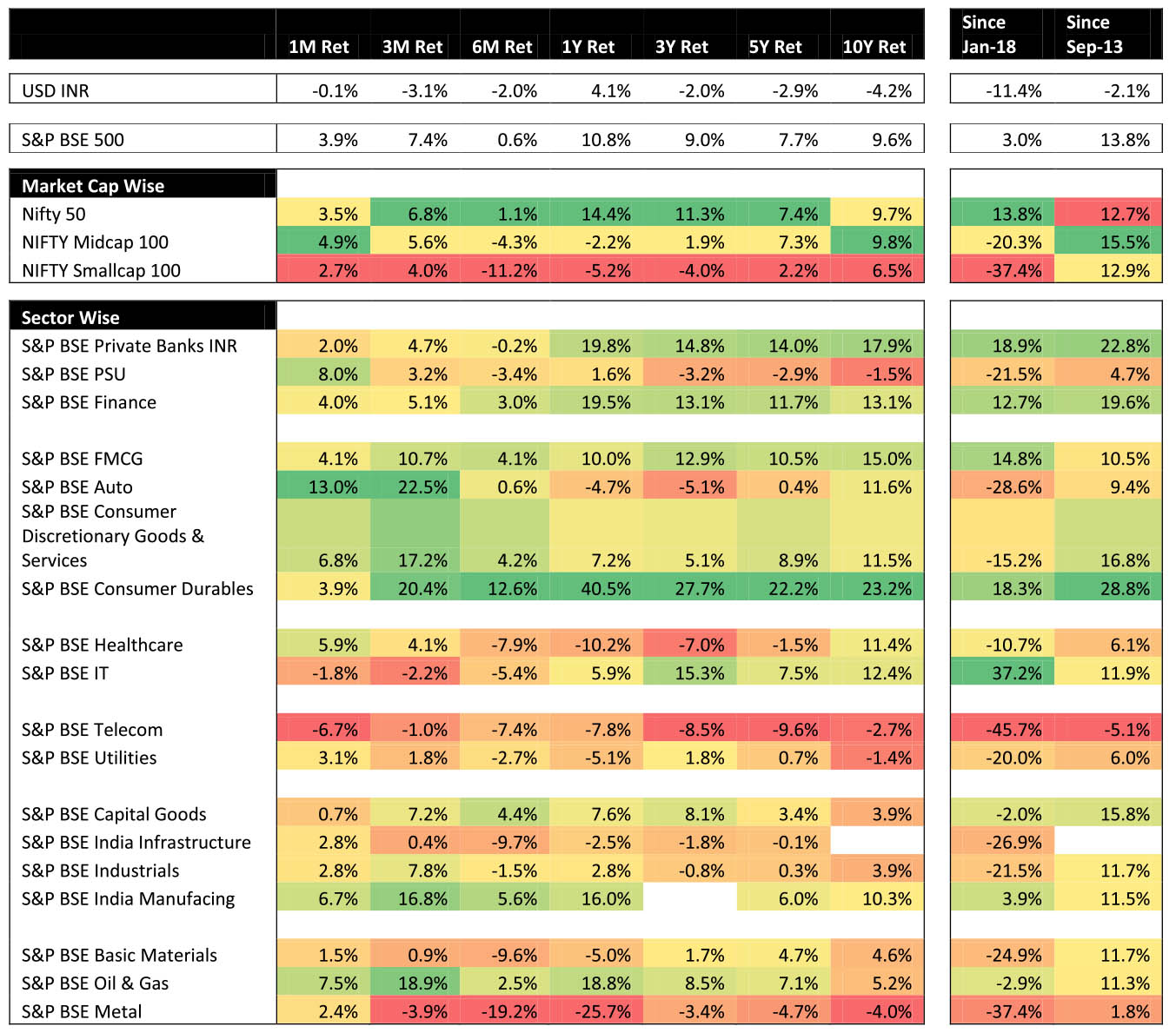

Growth: In sync with global markets, Indian equities also rallied with the NIFTY, NSE Midcap 100 and NSE Smallcap 100 rising 3.5%, 4.9% and 2.7% MoM respectively. The broad index declined in the first week of the month on concerns around weak macroeconomic data. Performance picked up sharply in the later part of the month on the back of a global risk on rally. Sentiment was also boosted by a) companies reporting better-than-expected earnings (albeit of beaten down expectations) and b) media reports that the Government would consider investor friendly measures to boost equity investments including reducing / abolishing long term capital gains tax, dividend distribution tax and securities transaction tax. Auto (+13.0% MoM), Energy (+7.5% MoM) and Banks (+8.0% MoM) outperformed, while Telecom (-6.7% MoM), and IT (-1.8% MoM) underperformed during the month.

Sector Wise Returns

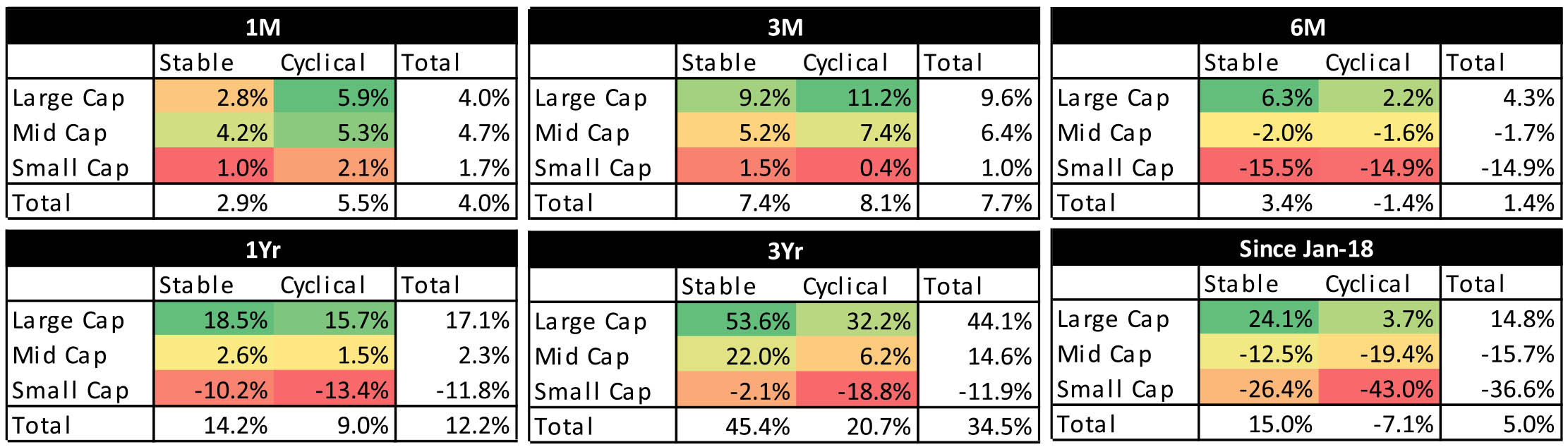

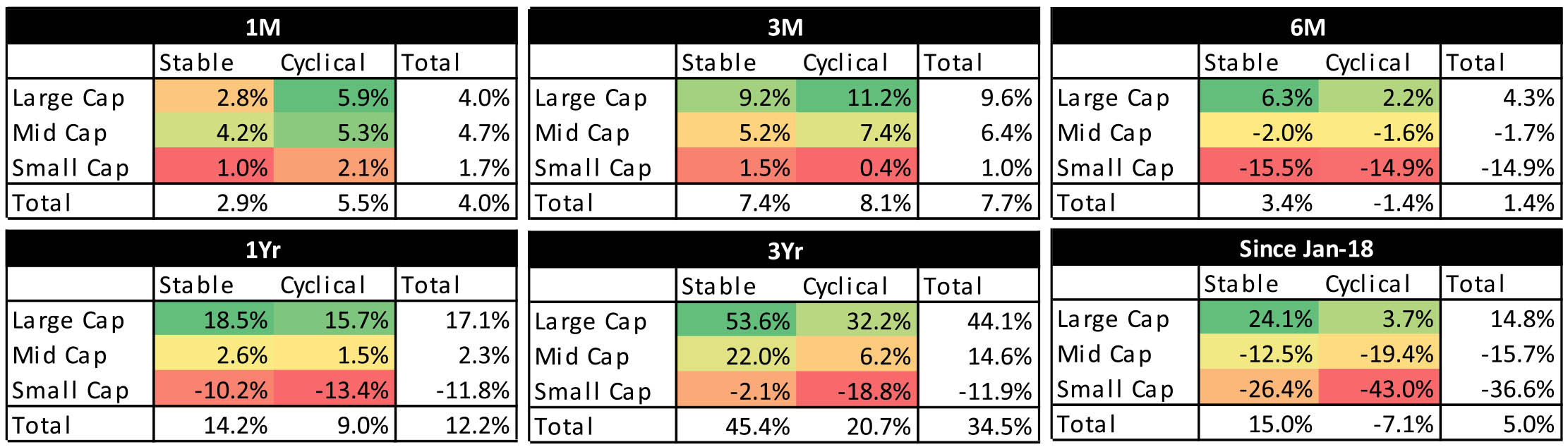

Cyclicals outperformed in the month, led by Large Cap Cyclicals - PSU Banks and Energy.

No clear majority in State election results: In recent state elections in Haryana and Maharashtra which were held on 21st October (results declared on 24th October), the performance of the ruling Bhartiya Janta Party (BJP) came below expectations. BJP emerged as the single largest party in both the states, but lost 17 seats in Maharashtra and 7 seats in Haryana and is dependent on allies to form the Government in both states.

RBI continues to be dovish: As expected, the RBI cut policy rates by 25bps in line with consensus expectations to 5.15% in its last MPC meeting on 4th October. RBI has cut policy rates by a cumulative 135bps since February of this year. The central bank also sharply reduced its FY20 GDP growth forecast from 6.9% to 6.1%.

Headline inflation rises, core benign: Headline CPI rose to 4.0% in September (vs. 3.2% last month) and came above consensus estimates (3.8%). The increase was primarily led by food prices which rose +1.3% MoM led by vegetable prices which were impacted by heavy rains and is likely to reverse in the coming months. WPI inflation for September at 0.3%oya came in below consensus estimates (0.8%), and was the lowest print in the last 39 months.

Growth uptick not visible yet: Composite PMI for September shrunk to a 19-month low and fell into contraction phase at 49.8 (-2.8pts MoM). The decline in PMI was led by services which declined 3.7pts to 48.7 while the manufacturing PMI was flat at 51.4 in September. August IP came below expectations at -1.1% (consensus: +1.7%oya) and printed a 7+ year low, although on a marginally upward-revised July print of 4.6%oya (vs. 4.3% previously).

Imports tepid, trade deficit under control: India's monthly trade deficit at USD 10.9bn narrowed sharply in September vs. last month (USD 13.5bn), and came below consensus expectations (USD 12.9bn). Merchandise exports were down -6.6%oya while imports were down -13.8%oya in September. Gold imports declined -50.8%oya (vs. 62.5%oya decline last month). Imports ex Oil and Gold declined -8.9% oya (vs. -9.3% decline last month), the 11th consecutive month of YoY decline.

India G sec yields continue to remain benign: Yields on the newly issued 10-year bond are broadly unchanged since its issue on 4th October and is now trading at 6.45%. Yields have eased meaningfully YTD (- 92bps). This comes in the backdrop of policy easing by the RBI and fall in global yields.

Strong FII inflows: FIIs recorded net inflows of USD 1.8bn in Indian equities in the month of October. YTD, FIIs are net buyers of Indian equities at USD 9.9bn. FIIs recorded net inflows in debt markets at USD 564mn in October. YTD, FIIs remain net buyers at USD 4.5bn in debt markets. DIIs were net equity buyers at USD 750mn in October. YTD, DIIs are net buyers at USD 7.3bn inflows.

Outlook:

Earnings have beaten expectations led by Autos and Financials with pre-tax profits up 13% YoY and 6% ahead of expectations. Note that the beat continues to be driven more by margins than topline with Revenues and EBITDA growth at 3% / 9% YoY vs 5% / 5% expectations.

Of the various factors needed for Cyclicals and Mid and small Cap outperformance, we believe that quite a few are in favour namely - a good and above expected monsoon, government and RBI attention to turn around the flagging economy, favourable valuations, crude prices closer to USD 60, yields below 6.5% and last but not the least a stable government at the centre.

The market, since Jan-18 has been clearly two tiered with 70-80 stocks out of BSE 500 generating positive returns. The focus on "High Quality, Consistent Earnings" has been the most successful play during this period. Valuation gap between the "haves" and the "have nots" is now at one of the widest levels. Given the slowdown in earnings growth even for the "High Quality Consistent Earnings" segment, a substantial part of the returns during the last 18 months has been derived from P/E re-rating. Is this P/E re-rating an endless exercise? The NSE Small Cap Index trades at 15.0x on Positive PE basis; 12.9x on FY20 estimate earnings and 0.8x Price to Book. NIFTY, trades at 21.0x positive PE; 17.1x FY20 earnings and 2.7x Price to Book.

Given that most forecast assume a slow though steady improvement in India's GDP going forward, this could impact the earnings growth revival. Hence, the wait for a dramatic change in fundamentals may take longer than expected. However, market trends are not driven solely by improving Fundamentals. An uptrend could be initiated by a change in Sentiments driven by improving Liquidity and supported by moderate or cheap Valuations. At the current juncture, Sentiments could improve, driven by positive Government announcement (following on the previous month's Corporate Tax cut) on the domestic front. Globally, sentiments could improve, if a comprehensive trade agreement between US-China, which could be perceived to reduce worries on the much forecasted US recession in 2020. Liquidity, the other "building block" for an upswing, is already being tackled domestically, with increased pressure on PSU banks to re-start lending to NBFCs, payments delayed by Government have also been speeded. The situation on liquidity is far more comfortable today (except for real estate and select HFCs) as compared to the position a few months back. Valuations, as mentioned earlier, are more modest for the broader market, approaching appetizing levels. What will be the trigger for the next upswing is not only difficult, perhaps impossible to predict. However, if these three building "blocks" converge (Sentiments, Liquidity and Valuation), a new upswing could commence. The folly, would be to wait for the Fundamentals, alone, as the most critical ingredient for any new upswing. The mood today, in a way, mirrors the pessimism which was prevalent in H1 2013. Smart investors, will recall, a new market upswing commenced within a couple of quarters!

Brexit uncertainty reduces, though timelines stretched: Despite the UK Prime Minister reaching an agreement with the EU on the terms of a soft Brexit, Brexit got delayed for the third time as the UK Parliament asked for more time to vote on the Brexit deal. EU has granted a 3 month extension to the UK on Brexit. Prior to Brexit, UK general election will be conducted on 12th December.

US Fed signals a pause: US Real GDP growth at 1.9% QoQ in 3QCY19 came better-than-consensus estimates (1.6%). However, GDP growth has slowed down from previous quarters (3.0%/2.0% in 1QCY19/2QCY19). US Fed cut policy rate by 25bps in line with consensus expectations but signalled a pause in the easing cycle. S&P500 reached an all-time high of 3,050 on 30th October on the back of better-than-expected US GDP growth data and monetary policy easing by Fed.

Dollar weakens, boosting risk assets: US-dollar broke below the 200-day moving average (down 2% MoM), despite Fed calling a halt to its rate cut cycle. UK pound (+5.3% MoM) and Euro (+2.3% MoM) rallied on reduced probability of a no-deal Brexit. INR was stable (-0.6% MoM). Crude was flat with Brent closing at USD 60.23/barrel well within comfort levels for India. Most other metals were flat to positive. US 10Y-2Y yield curve continued to steepen, as long-dated treasuries underperformed. In India, the 10- Year G sec rallied 25bps in the month closing at 6.45%.

Equity markets rally: Global equity markets rallied during the month with MSCI Emerging Markets (+4.1% MoM) outperforming MSCI Developed Markets (+2.5% MoM). With USD return of 3.2%, India was in the middle of the pack; though at +21.4%, the SENSEX is one of the best performing global indices over the last 1 year. Japan was the best performing equity market for a second month in a row. Among sectors, global tech and auto sectors did well. Low-risk sectors such as utilities and staples underperformed the most, but energy and materials also failed to outperform.

Domestic Markets:

Growth: In sync with global markets, Indian equities also rallied with the NIFTY, NSE Midcap 100 and NSE Smallcap 100 rising 3.5%, 4.9% and 2.7% MoM respectively. The broad index declined in the first week of the month on concerns around weak macroeconomic data. Performance picked up sharply in the later part of the month on the back of a global risk on rally. Sentiment was also boosted by a) companies reporting better-than-expected earnings (albeit of beaten down expectations) and b) media reports that the Government would consider investor friendly measures to boost equity investments including reducing / abolishing long term capital gains tax, dividend distribution tax and securities transaction tax. Auto (+13.0% MoM), Energy (+7.5% MoM) and Banks (+8.0% MoM) outperformed, while Telecom (-6.7% MoM), and IT (-1.8% MoM) underperformed during the month.

Sector Wise Returns

Cyclicals outperformed in the month, led by Large Cap Cyclicals - PSU Banks and Energy.

No clear majority in State election results: In recent state elections in Haryana and Maharashtra which were held on 21st October (results declared on 24th October), the performance of the ruling Bhartiya Janta Party (BJP) came below expectations. BJP emerged as the single largest party in both the states, but lost 17 seats in Maharashtra and 7 seats in Haryana and is dependent on allies to form the Government in both states.

RBI continues to be dovish: As expected, the RBI cut policy rates by 25bps in line with consensus expectations to 5.15% in its last MPC meeting on 4th October. RBI has cut policy rates by a cumulative 135bps since February of this year. The central bank also sharply reduced its FY20 GDP growth forecast from 6.9% to 6.1%.

Headline inflation rises, core benign: Headline CPI rose to 4.0% in September (vs. 3.2% last month) and came above consensus estimates (3.8%). The increase was primarily led by food prices which rose +1.3% MoM led by vegetable prices which were impacted by heavy rains and is likely to reverse in the coming months. WPI inflation for September at 0.3%oya came in below consensus estimates (0.8%), and was the lowest print in the last 39 months.

Growth uptick not visible yet: Composite PMI for September shrunk to a 19-month low and fell into contraction phase at 49.8 (-2.8pts MoM). The decline in PMI was led by services which declined 3.7pts to 48.7 while the manufacturing PMI was flat at 51.4 in September. August IP came below expectations at -1.1% (consensus: +1.7%oya) and printed a 7+ year low, although on a marginally upward-revised July print of 4.6%oya (vs. 4.3% previously).

Imports tepid, trade deficit under control: India's monthly trade deficit at USD 10.9bn narrowed sharply in September vs. last month (USD 13.5bn), and came below consensus expectations (USD 12.9bn). Merchandise exports were down -6.6%oya while imports were down -13.8%oya in September. Gold imports declined -50.8%oya (vs. 62.5%oya decline last month). Imports ex Oil and Gold declined -8.9% oya (vs. -9.3% decline last month), the 11th consecutive month of YoY decline.

India G sec yields continue to remain benign: Yields on the newly issued 10-year bond are broadly unchanged since its issue on 4th October and is now trading at 6.45%. Yields have eased meaningfully YTD (- 92bps). This comes in the backdrop of policy easing by the RBI and fall in global yields.

Strong FII inflows: FIIs recorded net inflows of USD 1.8bn in Indian equities in the month of October. YTD, FIIs are net buyers of Indian equities at USD 9.9bn. FIIs recorded net inflows in debt markets at USD 564mn in October. YTD, FIIs remain net buyers at USD 4.5bn in debt markets. DIIs were net equity buyers at USD 750mn in October. YTD, DIIs are net buyers at USD 7.3bn inflows.

Outlook:

Earnings have beaten expectations led by Autos and Financials with pre-tax profits up 13% YoY and 6% ahead of expectations. Note that the beat continues to be driven more by margins than topline with Revenues and EBITDA growth at 3% / 9% YoY vs 5% / 5% expectations.

Of the various factors needed for Cyclicals and Mid and small Cap outperformance, we believe that quite a few are in favour namely - a good and above expected monsoon, government and RBI attention to turn around the flagging economy, favourable valuations, crude prices closer to USD 60, yields below 6.5% and last but not the least a stable government at the centre.

The market, since Jan-18 has been clearly two tiered with 70-80 stocks out of BSE 500 generating positive returns. The focus on "High Quality, Consistent Earnings" has been the most successful play during this period. Valuation gap between the "haves" and the "have nots" is now at one of the widest levels. Given the slowdown in earnings growth even for the "High Quality Consistent Earnings" segment, a substantial part of the returns during the last 18 months has been derived from P/E re-rating. Is this P/E re-rating an endless exercise? The NSE Small Cap Index trades at 15.0x on Positive PE basis; 12.9x on FY20 estimate earnings and 0.8x Price to Book. NIFTY, trades at 21.0x positive PE; 17.1x FY20 earnings and 2.7x Price to Book.

Given that most forecast assume a slow though steady improvement in India's GDP going forward, this could impact the earnings growth revival. Hence, the wait for a dramatic change in fundamentals may take longer than expected. However, market trends are not driven solely by improving Fundamentals. An uptrend could be initiated by a change in Sentiments driven by improving Liquidity and supported by moderate or cheap Valuations. At the current juncture, Sentiments could improve, driven by positive Government announcement (following on the previous month's Corporate Tax cut) on the domestic front. Globally, sentiments could improve, if a comprehensive trade agreement between US-China, which could be perceived to reduce worries on the much forecasted US recession in 2020. Liquidity, the other "building block" for an upswing, is already being tackled domestically, with increased pressure on PSU banks to re-start lending to NBFCs, payments delayed by Government have also been speeded. The situation on liquidity is far more comfortable today (except for real estate and select HFCs) as compared to the position a few months back. Valuations, as mentioned earlier, are more modest for the broader market, approaching appetizing levels. What will be the trigger for the next upswing is not only difficult, perhaps impossible to predict. However, if these three building "blocks" converge (Sentiments, Liquidity and Valuation), a new upswing could commence. The folly, would be to wait for the Fundamentals, alone, as the most critical ingredient for any new upswing. The mood today, in a way, mirrors the pessimism which was prevalent in H1 2013. Smart investors, will recall, a new market upswing commenced within a couple of quarters!

| Equity Markets | Index | % Change YTD | % Change MTD | P/E |

| Nifty | 11,877.45 | 9.34% | 3.51% | 20.81 |

| Sensex | 40,129.05 | 11.26% | 3.78% | 21.75 |

| Dow Jones | 27,046.23 | 15.94% | 0.48% | 18.70 |

| Shanghai | 2,929.06 | 17.45% | 0.82% | 11.81 |

| Nikkei | 22,927.04 | 14.55% | 5.38% | 17.48 |

| Hang Sang | 26,906.72 | 4.11% | 3.12% | 10.94 |

| FTSE | 7,248.38 | 7.73% | -2.16% | 13.50 |

| MSCI E.M. (USD) | 1,041.98 | 7.89% | 4.09% | 13.85 |

| MSCI D.M.(USD) | 2,233.53 | 18.56% | 2.45% | 17.40 |

| MSCI India (INR) | 1,348.57 | 6.80% | 4.18% | 20.94 |

| Currency & Commodities | Last Price % | Change YTD % | Change MTD |

| USD / INR | 70.929 | 1.66% | 0.08% |

| Dollar Index | 97.35 | 1.23% | -2.04% |

| Gold | 1,512.93 | 17.97% | 2.75% |

| WTI (Nymex) | 54.18 | 19.31% | 0.20% |

| Brent Crude | 60.23 | 11.95% | -0.90% |

| India Macro Analysis | Latest | Equity Flows | USD Mn |

| GDP | 5.00 | FII (USD mln) | |

| IIP | -1.10 | YTD | 10,225.06 |

| Inflation (WPI Monthly) | 0.33 | MTD | 2,062.05 |

| Inflation (CPI Monthly) | 3.99 | *DII (USD mln) | |

| Commodity (CRB Index) | 389.50 | YTD | 8,783.91 |

| Source: Bloomberg | MTD | 727.94 | |

| *DII : Domestic Mutual Funds Data as on 31st October 2019 | |||

Mr. Suyash Choudhary

Head - Fixed Income

WHAT WENT BY

Government bond yields remained range-bound during October despite growth concerns as market participants awaited clarity on possible fiscal slippage due to lower than budgeted Goods and Services Tax (GST) collections and corporate tax cut. Corporate bonds in the 1- 5 year segment rallied by 25-30bps reflecting effect of surplus liquidity.

CPI inflation came in slightly higher than consensus expectations at 3.99% vs 3.28% last month, driven primarily by base effects. Food inflation rose to 5.1% YoY vs 3% YoY last month on account of rise in meat, egg products and sugar. Vegetable inflation grew by 15.4% YoY driven by an adverse base. Moderation in core momentum was on expected lines driven by slowing growth momentum in housing component, clothing & footwear as well as the miscellaneous basket.

Headline industrial production showed its first contraction after June 2017 (-0.3% YoY), printing at -1.1% YoY in August 2019. On a sectoral basis, manufacturing output re-entered contractionary zone after 6 months despite a favourable base. 15 of 23 industry groups showed negative growth including motor vehicles, machinery and equipment, etc.

India's merchandise trade deficit narrowed sharply to USD 10.9 bn in September compared to USD 13.5 bn in August. Oil deficit fell to the lowest in two years even as global oil prices increased slightly in September probably reflecting the slowdown in consumption. Electronics export continued to grow (+33%). However, they were offset by a broad-based decline in engineering goods, agriculture, textiles, and chemicals.

The cumulative southwest monsoon in FY20 (1st June - 30th September) ended at 10% above the Long Period Average (LPA), the highest since 1994. Spatial variation continued in this year, with the East and North-east region recording a rainfall deficiency. The total crop cultivation was in line with last year's level. According to first advance estimates food grain production this fiscal is expected to be in line with last year's crop season. The overall storage level was at 88% of the total capacity as on beginning of October which is considerably higher than the last year. Going ahead, this bodes well for sowing of the Rabi crop.

The Reserve Bank of India released the minutes of its October monetary policy committee (MPC) meeting which was broadly in line with the MPC policy statement as members acknowledged concerns over a broadbased slowdown in the economy noting the widening of the output gap. While some expressed the need for a multi-pronged approach to address the growth slowdown, the need to maintain an accommodative stance to support growth revival got support from a majority of policymakers.

Outlook:

After the recent monetary policy, RBI / MPC are now emphatically firing on all three cylinders of rates, liquidity, and guidance. There is some appreciation subsequently in the front end of the rate curve of this new reality. The significant growth slowdown globally, amplified in India owing to a noticeably slowing consumer is now well documented. This has triggered monetary easing across most of the world. A new development is the US Fed deciding to restart a measured expansion of its balance sheet in response to recent sharp surges in overnight rates triggered, amongst other things, by banks no longer holding sufficient excess reserves. This marks a reversal from the ‘quantitative tightening' that the Fed had embarked upon since late 2017. India has been proactive amidst emerging markets with 135 bps already delivered backed by liquidity and guidance as well, as noted above. Concurrent data suggests that the growth slowdown is still in play thereby keeping hopes for more easing alive. It is quite noticeable that term spreads should be so elevated at this point of the cycle. This is considering both local and global macro as well as the guidance and liquidity coming through from the RBI. The problem possibly, is the unavailability of enough capital willing to assume the additional market risk. A circa INR 2,00,000 crores positive liquidity is also not necessarily improving risk appetite for market participants. The dominant reason for this of course is continued fiscal fears.

A new thought that we are harboring is also that, while we are quite confident about our ‘lower for longer' hypothesis on policy rates backed by surplus liquidity (which makes front end rates a very obvious lucrative trade), one cannot be definitive about the terminal rate in this cycle. The argument that terminal rate is very close cannot rest on the macro scenario. This requires much more support from policy as the continued spate of weak concurrent data suggests. Rather the judgment call at some juncture will lie in the efficacy of further cuts, as demonstrated in the potential inability of banks to keep passing lower rates. Bond investors don't need a resolution on this debate immediately, given that there is more than adequate room for term spreads to compress on the current curve structure itself.