Commentary

30th September 2019

Mr. Anoop Bhaskar

Head - Equity

WHAT WENT BY

Global growth worries continue: Manufacturing flash PMIs from the G-3 disappointed on net, with both the Euro

area and Japan much weaker than anticipated even as the US inched up. Global employment growth has been

slowing and looks to be slowing further in 3Q19. Despite slowing down, US remains the fastest growing developed

market (DM) economy.

Global markets volatile: Given the global slowdown, US China trade war and geopolitical risks, markets continued to be volatile. Developed markets were flat led by US (+1.2% QoQ) and Japan (+2% QoQ) whereas Emerging Markets fell 5.1% in the quarter. Indian markets fell 4.3% in USD terms, in line with other Emerging Markets. Flight to safety resulted in USD rising +3.4% QoQ. INR was relatively stable, depreciating 2.4% whereas the Pound and EURO fell 3.2% and 4.1% respectively. Gold also appreciated 4% for the quarter and has appreciated 24% in USD terms over the last 1 year. Most industrial metals were flat to lower on account of weak global demand and are lower by more than 10% over the year ago period.

Geopolitical risks escalated: Drone attacks carried out on September 14 on two oil producing facilities in Saudi Arabia, resulted in a 50% supply cut in Saudi oil production. On the 1st day of trading post this event, crude oil shot 20% in early trading, before settling for the day +14% to $69/bbl as a result. However, the rally was short lived as Saudi officials indicated a speedy recovery of the impacted facilities. Crude ended the month at $61/bbl (+0.6% MoM). Concerns on global growth impacted crude oil prices more than fears of supply disruption.

DM central banks cut policy rates in September as the growth outlook deteriorated: In the US, the Fed cut the policy rate by 25bps. In the Euro Area, ECB cut the deposit rate by 10bps to -0.50% and relaunched QE at a pace of 20bn/month. In Japan, the BoJ kept its policy rates unchanged.

US politics and US-China trade war continue to be the news makers: US politics dominated in the latter part of the month, after House Speaker Nancy Pelosi announced the launch of a formal impeachment inquiry of President Trump over his dealing with Ukraine. US-China trade disputes continued to generate headlines during the month. US and China held mid-level trade talks in Washington in September and are expected to hold high-level trade talks in October.

Domestic Markets:

Growth: Concerns emerged with GDP print for June quarter at sub-6%, the lowest in the last decade. The decline in PMI was led by services which declined 1.4pts to 52.4 while the manufacturing PMI declined 1.1pts to 51.4 in August. The internals of the PMI report were also disappointing with the forward-looking composite new orders declining by 2.7pts (vs. 2.8pts gain last month).

To boost the flagging economy, the Finance Minister announced a series of measures during the quarter to address growth concerns. In August, the surcharge on capital gains for both domestic and foreign investors announced in the Union Budget on 5 July was reversed. Around 40% of the FPIs, which follow the 'Trust' route, were impacted by the surcharge. Other measures were also announced to address interest rate transmission, improve liquidity and credit flow and the auto sector slowdown. Late in August, the Government announced the amalgamation of ten Public Sector Banks into four, leading to larger banks with bigger balance sheets and benefits from merger synergies to revive credit growth in the economy.

In September, Indian Markets logged its highest single-day gain in almost a decade during the month when the Finance Minister announced large tax rate cuts for corporates. Nifty rallied 8% in two consecutive sessions post the announcement. The peak corporate tax rate (excluding cess and surcharge) was reduced from 30% to 22%. Inclusive of cess and surcharge, the peak corporate tax rate was reduced to 25.17% (vs ~35% previously). For FY19 the aggregate and median effective tax rate for Nifty/BSE100 indices was ~30%. We estimate that the lower tax rates announced should, ceteris paribus, increase Nifty FY20 EPS by ~8%.

Sectorally, beneficiaries of lower corporate tax rates are likely to be Consumer Staples, Financials, Energy and Materials. Healthcare, IT Services, Industrials and Utilities are likely to benefit relatively less as these sectors have a lower effective tax rate due to export / investment related exemptions.

The equity market's gain was however the bond market's loss. Yields on the benchmark 10 year bond rose a meaningful 15bps from 6.64% to 6.79% given concerns on fiscal deficit. In this construct, we believe a more aggressive divestment program by the Government would be required to restore macro stability and equilibrium. Note the Government has targeted Rs.1.05trillion from divestments for FY20E.

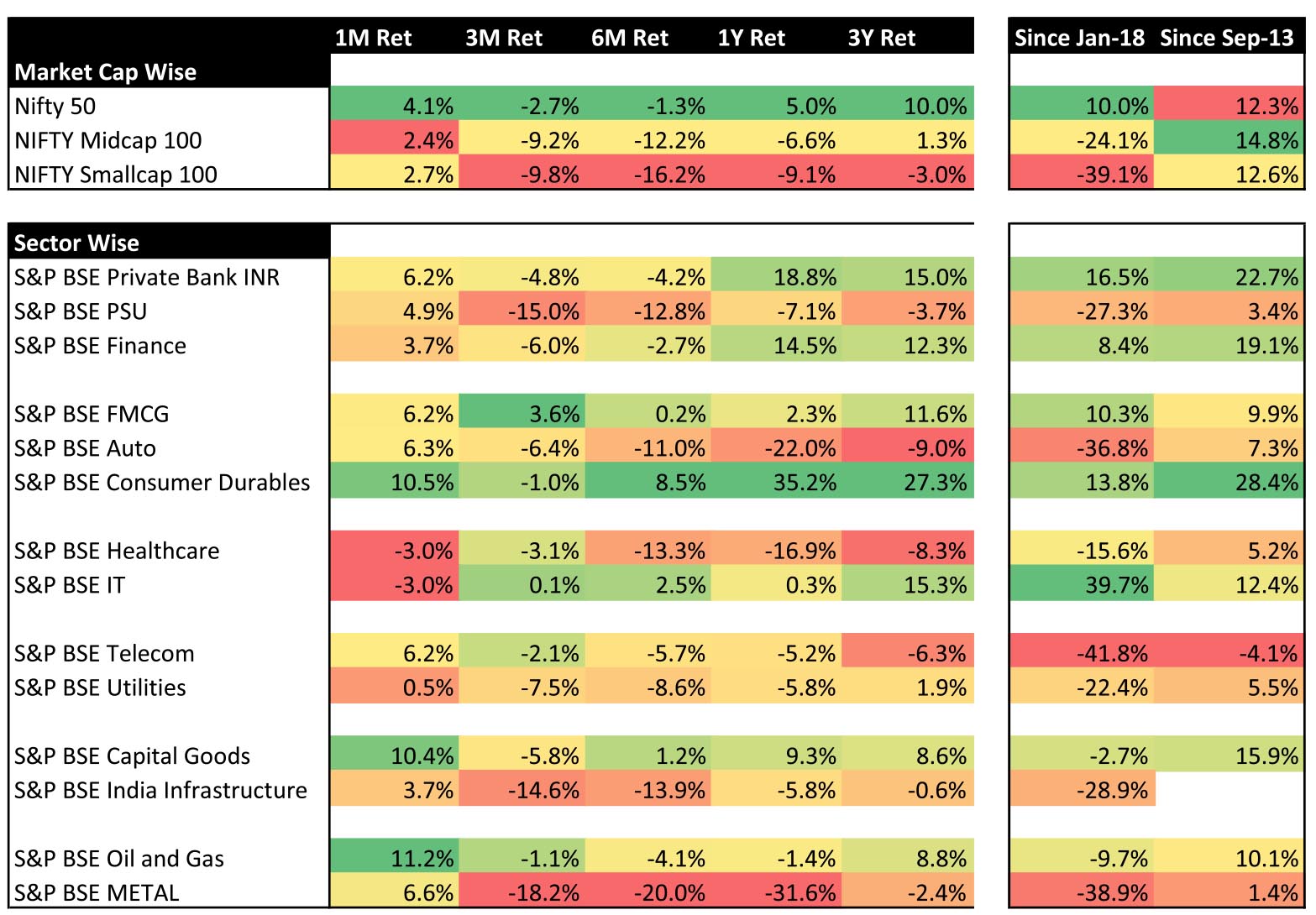

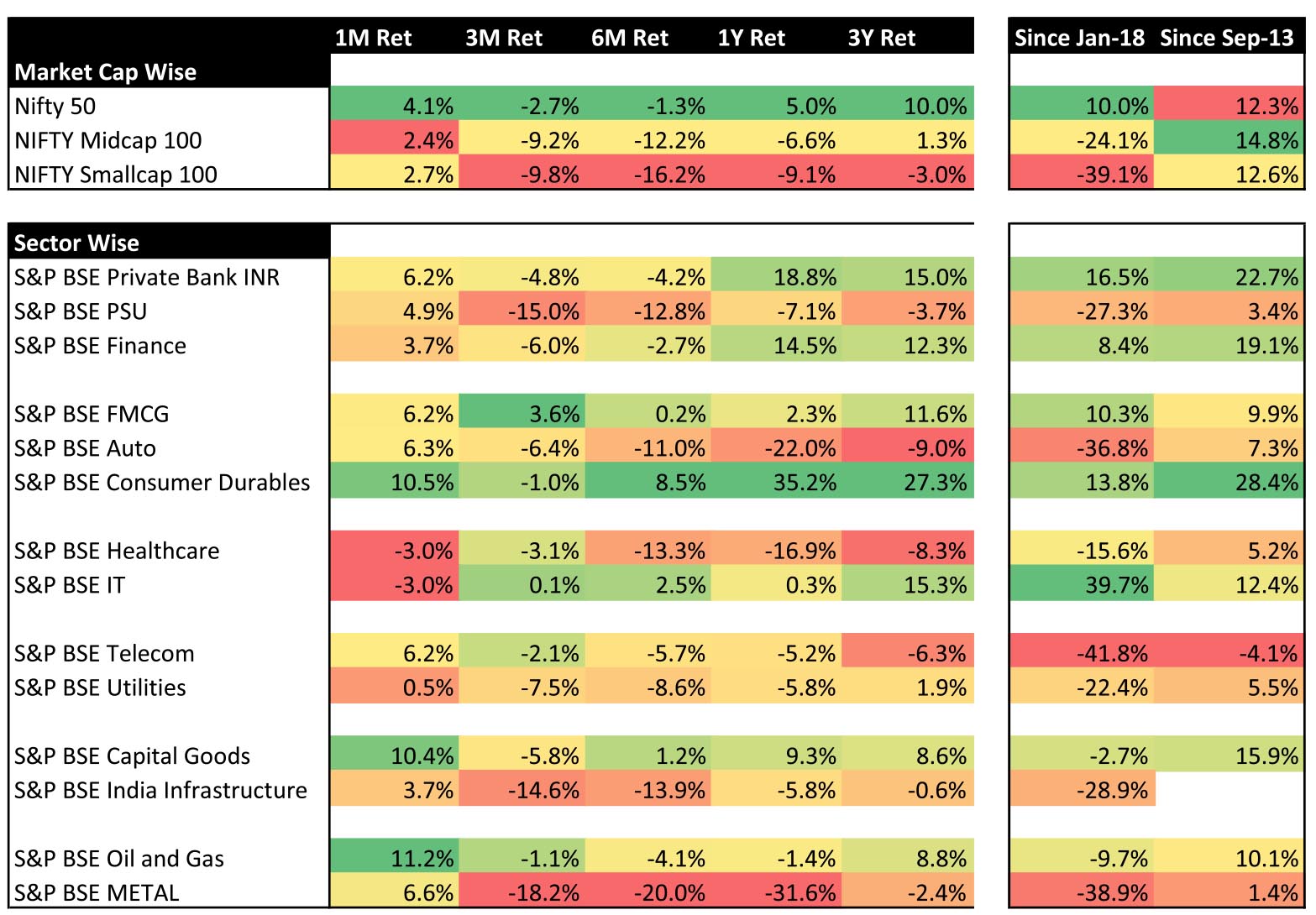

Stocks which are beneficiaries of the lower corporate taxes as well as potential divestment targets for the Government (for filling the Revenue gap on account of the tax cuts and lower tax collections amidst H1 FY20 slowdown) in general outperformed during the month. For the month of September, Industrials (+9.5% MoM), Energy (+11.2% MoM) and Consumer Durables (+10.5% MoM) were key outperformers while IT (-3% MoM) and Healthcare (-3% MoM) were notable laggards.

Sector Wise Returns

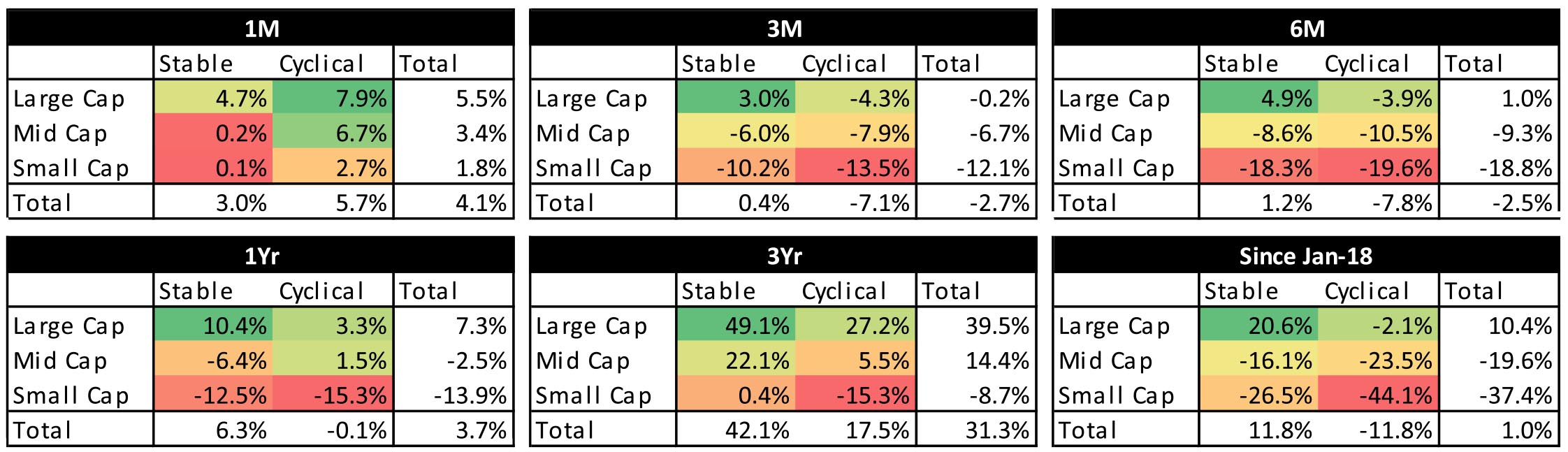

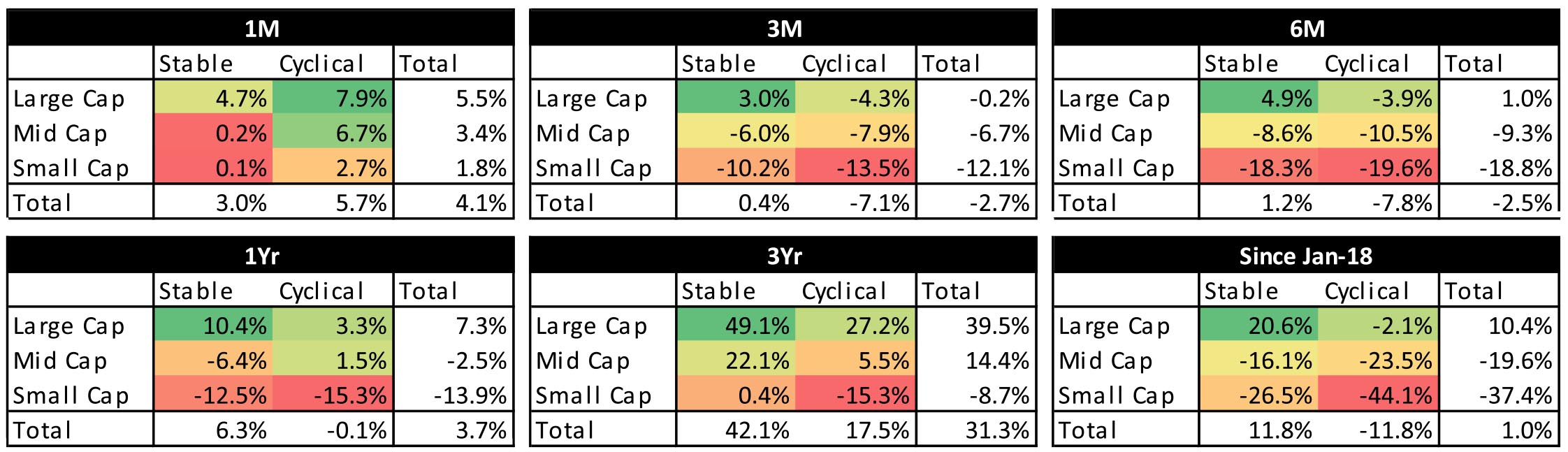

Performance of Stable and Cyclical across market cap

Inflation under control: Headline CPI remained flat at 3.2%YoY in August (vs. consensus estimates of 3.3%YoY). Headline inflation remains well below the RBI's 4% target. Food prices accelerated to 3.0%YoY in August from 2.3%YoY in July. The core-core inflation (standard core adjusted for gasoline, diesel, and housing) at 4.6% eased in August (vs. 4.9% in July). WPI inflation for August came at 1.1%YoY, in-line with last month's print which was the lowest in the last 2 years.

Trade and Reserves: India's monthly trade deficit at $13.5bn in August was flat vs. last month ($13.4bn), and came in-line with consensus expectations. The trade deficit was consistent with an annual current account deficit (CAD) of under 2.0% of GDP. However, India's CAD and Balance of Payment (BoP) figures are highly sensitive to crude oil prices and given the recent disruption to the Saudi oil production, there is a risk to CAD. Exports were down -6%YoY while Imports were down -13%YoY in August. Gold imports declined -63%YoY (vs. 42%YoY decline last month). Imports (ex Oil and Gold) declined -9%YoY(vs -2% decline last month), the 10th consecutive month of YoY decline. India's FX reserves are at US$428.6bn as of 20th September (down $1.9bn from the peak in August). India's CAD for 2QCY19 at $14.3bn (2% of GDP) came better than consensus estimates ($16bn).

Monsoon bountiful: Cumulative rainfall as of end-September came 10% above the normal on an aggregate basis (vs. close to LPA as of end-Aug and cumulative deficit of 9% as of end-July). Out of 36 meteorological subdivisions, rainfall was deficient in 5 (~ 15% of the country) while 12 subdivisions got excessive rainfall (~ 30% of the country).

Outlook:

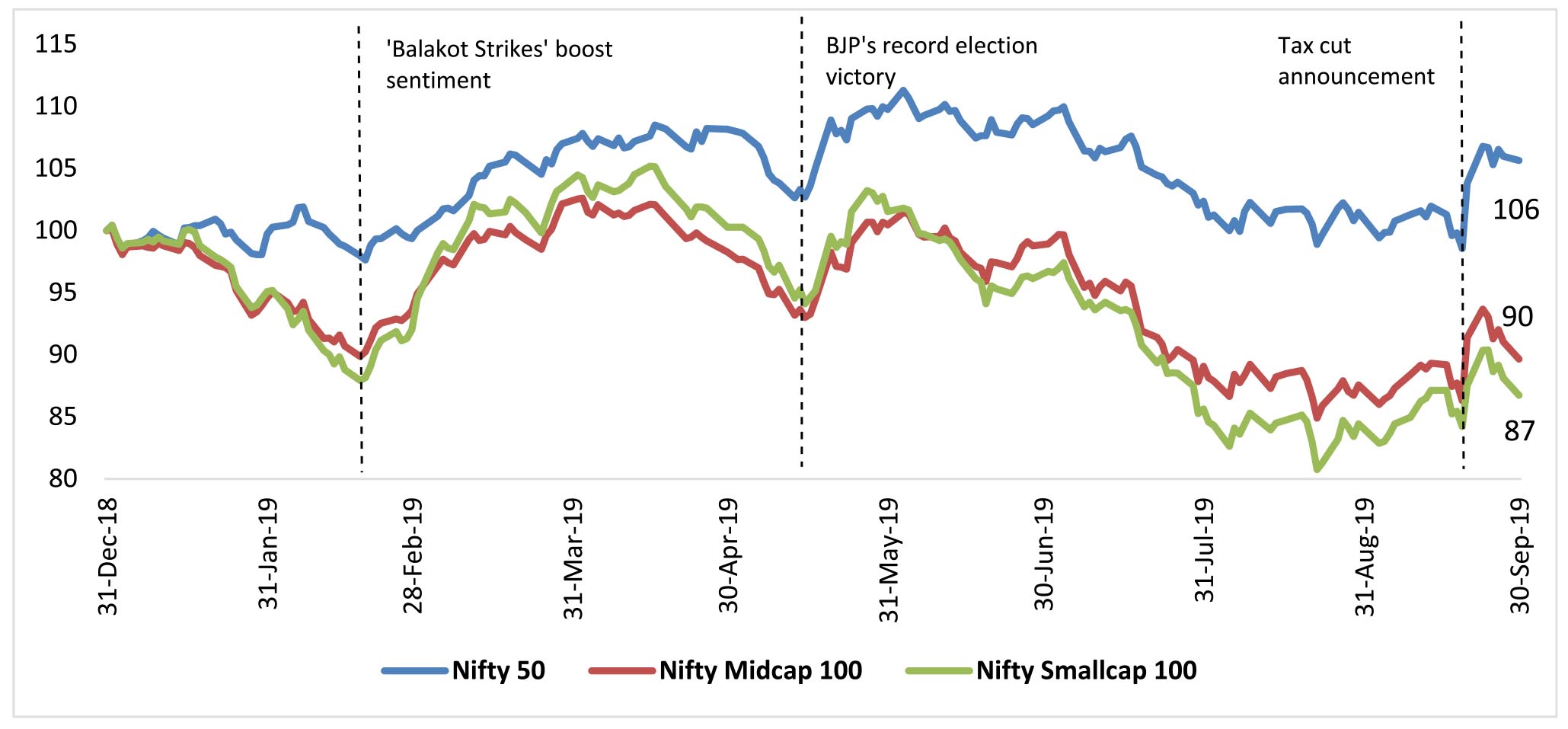

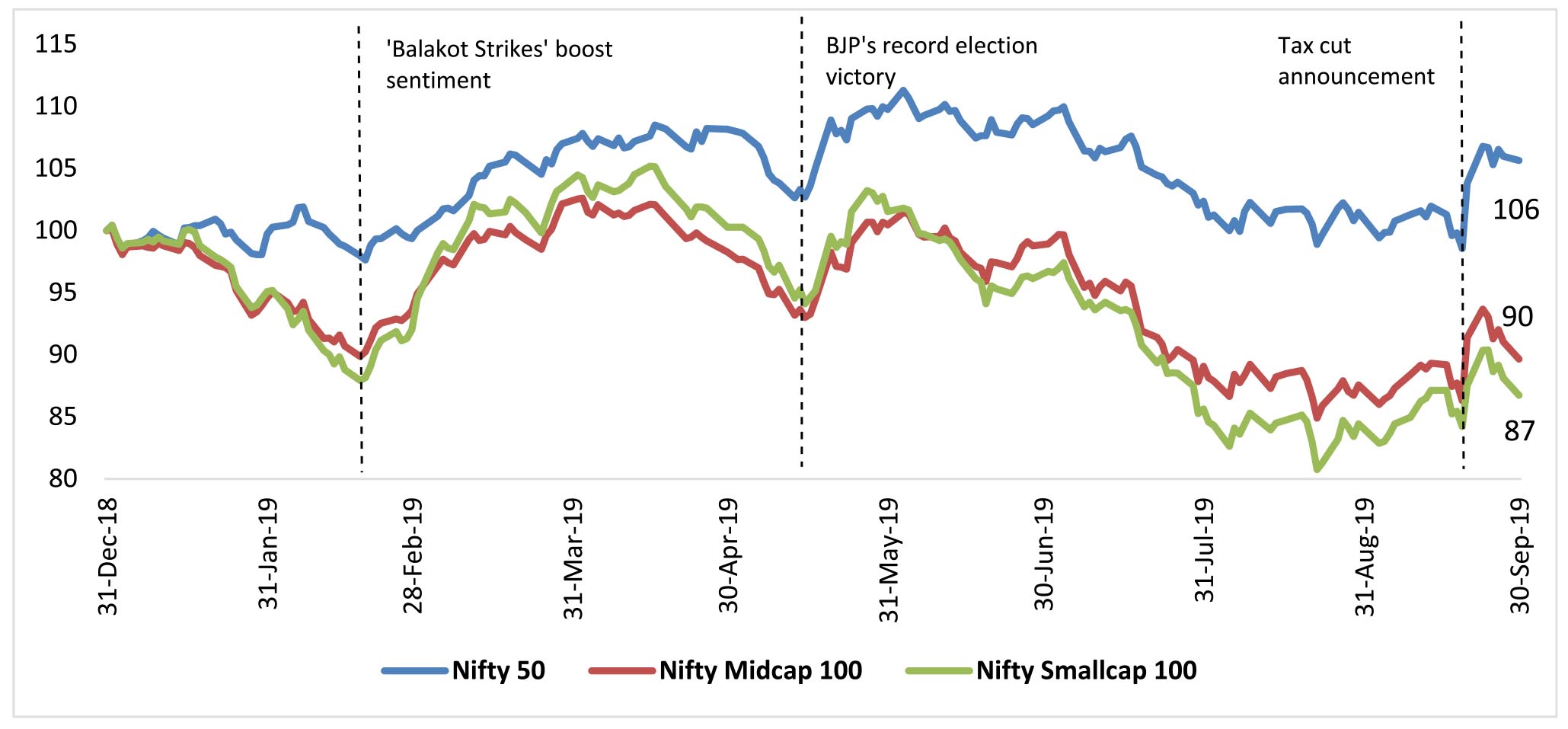

Current downturn is now ~600 days. Though Mid and Small Cap indices have seen a significant correction, NIFTY is still up 4%. The difference between 2 Year rolling returns of NIFTY and broader markets are close to historical lows. For Small Caps, 55% of stocks in 2017-2019 are down >40% as compared to 62% in 2011-13. In case of both Mid & Small cap indices, market cap as a % of NIFTY market cap is less than 2013 bottom levels and approaching 2008 bottom levels for Mid Cap. Valuations for broader market as compared to Large Caps now appear moderate to cheap. Small Cap Index volumes tend to peak out at market peaks and bottom at market bottoms, current volumes for the small cap Index are lower than 2013 bottom levels. Most data points presented above suggest broader markets may be closer to the bottom than the top, atleast on a relative basis when companies with NIFTY/Large Caps. Key question for investors is whether past trends will sustain or markets will form a new trend and find a bottom lower than most historical data points.

After a disappointing Union Budget, the Government redefined its economic policy narrative with the announcement of the boldest tax cuts since 1997. 2019 has witnessed the best monsoon in last 25 years, though, dispersion of rain remained an issue. October quarter results could be the weakest or bottoming out of earnings with the October results - Glass half empty vs Glass half full. The continued under performance of broader market versus Nifty - valuations, volume and market cap point towards bottoming out process well under way. Will investors continue to favour safety and consistency of moderate earnings growth in select pockets or seek deep value as is reflected across swathes of the broader market?

We believe, valuations are currently moderate across broader market. Sentiments are weak outside of narrow pack of gainers. Fundamentals hopefully should get better after the 2nd Quarter results!

Global markets volatile: Given the global slowdown, US China trade war and geopolitical risks, markets continued to be volatile. Developed markets were flat led by US (+1.2% QoQ) and Japan (+2% QoQ) whereas Emerging Markets fell 5.1% in the quarter. Indian markets fell 4.3% in USD terms, in line with other Emerging Markets. Flight to safety resulted in USD rising +3.4% QoQ. INR was relatively stable, depreciating 2.4% whereas the Pound and EURO fell 3.2% and 4.1% respectively. Gold also appreciated 4% for the quarter and has appreciated 24% in USD terms over the last 1 year. Most industrial metals were flat to lower on account of weak global demand and are lower by more than 10% over the year ago period.

Geopolitical risks escalated: Drone attacks carried out on September 14 on two oil producing facilities in Saudi Arabia, resulted in a 50% supply cut in Saudi oil production. On the 1st day of trading post this event, crude oil shot 20% in early trading, before settling for the day +14% to $69/bbl as a result. However, the rally was short lived as Saudi officials indicated a speedy recovery of the impacted facilities. Crude ended the month at $61/bbl (+0.6% MoM). Concerns on global growth impacted crude oil prices more than fears of supply disruption.

DM central banks cut policy rates in September as the growth outlook deteriorated: In the US, the Fed cut the policy rate by 25bps. In the Euro Area, ECB cut the deposit rate by 10bps to -0.50% and relaunched QE at a pace of 20bn/month. In Japan, the BoJ kept its policy rates unchanged.

US politics and US-China trade war continue to be the news makers: US politics dominated in the latter part of the month, after House Speaker Nancy Pelosi announced the launch of a formal impeachment inquiry of President Trump over his dealing with Ukraine. US-China trade disputes continued to generate headlines during the month. US and China held mid-level trade talks in Washington in September and are expected to hold high-level trade talks in October.

Domestic Markets:

Growth: Concerns emerged with GDP print for June quarter at sub-6%, the lowest in the last decade. The decline in PMI was led by services which declined 1.4pts to 52.4 while the manufacturing PMI declined 1.1pts to 51.4 in August. The internals of the PMI report were also disappointing with the forward-looking composite new orders declining by 2.7pts (vs. 2.8pts gain last month).

To boost the flagging economy, the Finance Minister announced a series of measures during the quarter to address growth concerns. In August, the surcharge on capital gains for both domestic and foreign investors announced in the Union Budget on 5 July was reversed. Around 40% of the FPIs, which follow the 'Trust' route, were impacted by the surcharge. Other measures were also announced to address interest rate transmission, improve liquidity and credit flow and the auto sector slowdown. Late in August, the Government announced the amalgamation of ten Public Sector Banks into four, leading to larger banks with bigger balance sheets and benefits from merger synergies to revive credit growth in the economy.

In September, Indian Markets logged its highest single-day gain in almost a decade during the month when the Finance Minister announced large tax rate cuts for corporates. Nifty rallied 8% in two consecutive sessions post the announcement. The peak corporate tax rate (excluding cess and surcharge) was reduced from 30% to 22%. Inclusive of cess and surcharge, the peak corporate tax rate was reduced to 25.17% (vs ~35% previously). For FY19 the aggregate and median effective tax rate for Nifty/BSE100 indices was ~30%. We estimate that the lower tax rates announced should, ceteris paribus, increase Nifty FY20 EPS by ~8%.

Sectorally, beneficiaries of lower corporate tax rates are likely to be Consumer Staples, Financials, Energy and Materials. Healthcare, IT Services, Industrials and Utilities are likely to benefit relatively less as these sectors have a lower effective tax rate due to export / investment related exemptions.

The equity market's gain was however the bond market's loss. Yields on the benchmark 10 year bond rose a meaningful 15bps from 6.64% to 6.79% given concerns on fiscal deficit. In this construct, we believe a more aggressive divestment program by the Government would be required to restore macro stability and equilibrium. Note the Government has targeted Rs.1.05trillion from divestments for FY20E.

Stocks which are beneficiaries of the lower corporate taxes as well as potential divestment targets for the Government (for filling the Revenue gap on account of the tax cuts and lower tax collections amidst H1 FY20 slowdown) in general outperformed during the month. For the month of September, Industrials (+9.5% MoM), Energy (+11.2% MoM) and Consumer Durables (+10.5% MoM) were key outperformers while IT (-3% MoM) and Healthcare (-3% MoM) were notable laggards.

Sector Wise Returns

Performance of Stable and Cyclical across market cap

Inflation under control: Headline CPI remained flat at 3.2%YoY in August (vs. consensus estimates of 3.3%YoY). Headline inflation remains well below the RBI's 4% target. Food prices accelerated to 3.0%YoY in August from 2.3%YoY in July. The core-core inflation (standard core adjusted for gasoline, diesel, and housing) at 4.6% eased in August (vs. 4.9% in July). WPI inflation for August came at 1.1%YoY, in-line with last month's print which was the lowest in the last 2 years.

Trade and Reserves: India's monthly trade deficit at $13.5bn in August was flat vs. last month ($13.4bn), and came in-line with consensus expectations. The trade deficit was consistent with an annual current account deficit (CAD) of under 2.0% of GDP. However, India's CAD and Balance of Payment (BoP) figures are highly sensitive to crude oil prices and given the recent disruption to the Saudi oil production, there is a risk to CAD. Exports were down -6%YoY while Imports were down -13%YoY in August. Gold imports declined -63%YoY (vs. 42%YoY decline last month). Imports (ex Oil and Gold) declined -9%YoY(vs -2% decline last month), the 10th consecutive month of YoY decline. India's FX reserves are at US$428.6bn as of 20th September (down $1.9bn from the peak in August). India's CAD for 2QCY19 at $14.3bn (2% of GDP) came better than consensus estimates ($16bn).

Monsoon bountiful: Cumulative rainfall as of end-September came 10% above the normal on an aggregate basis (vs. close to LPA as of end-Aug and cumulative deficit of 9% as of end-July). Out of 36 meteorological subdivisions, rainfall was deficient in 5 (~ 15% of the country) while 12 subdivisions got excessive rainfall (~ 30% of the country).

Outlook:

Current downturn is now ~600 days. Though Mid and Small Cap indices have seen a significant correction, NIFTY is still up 4%. The difference between 2 Year rolling returns of NIFTY and broader markets are close to historical lows. For Small Caps, 55% of stocks in 2017-2019 are down >40% as compared to 62% in 2011-13. In case of both Mid & Small cap indices, market cap as a % of NIFTY market cap is less than 2013 bottom levels and approaching 2008 bottom levels for Mid Cap. Valuations for broader market as compared to Large Caps now appear moderate to cheap. Small Cap Index volumes tend to peak out at market peaks and bottom at market bottoms, current volumes for the small cap Index are lower than 2013 bottom levels. Most data points presented above suggest broader markets may be closer to the bottom than the top, atleast on a relative basis when companies with NIFTY/Large Caps. Key question for investors is whether past trends will sustain or markets will form a new trend and find a bottom lower than most historical data points.

After a disappointing Union Budget, the Government redefined its economic policy narrative with the announcement of the boldest tax cuts since 1997. 2019 has witnessed the best monsoon in last 25 years, though, dispersion of rain remained an issue. October quarter results could be the weakest or bottoming out of earnings with the October results - Glass half empty vs Glass half full. The continued under performance of broader market versus Nifty - valuations, volume and market cap point towards bottoming out process well under way. Will investors continue to favour safety and consistency of moderate earnings growth in select pockets or seek deep value as is reflected across swathes of the broader market?

We believe, valuations are currently moderate across broader market. Sentiments are weak outside of narrow pack of gainers. Fundamentals hopefully should get better after the 2nd Quarter results!

| Equity Markets | Index | % Change YTD | % Change MTD | P/E |

| Nifty | 11,474.45 | 5.63% | 4.09% | 19.52 |

| Sensex | 38,667.33 | 7.21% | 3.57% | 20.24 |

| Dow Jones | 26,916.83 | 15.39% | 1.95% | 17.41 |

| Shanghai | 2,905.19 | 16.49% | 0.66% | 11.57 |

| Nikkei | 21,755.84 | 8.70% | 5.08% | 15.91 |

| Hang Sang | 26,092.27 | 0.95% | 1.43% | 10.32 |

| FTSE | 7,408.21 | 10.11% | 2.79% | 12.67 |

| MSCI E.M. (USD) | 1,001.00 | 3.65% | 1.69% | 12.90 |

| MSCI D.M.(USD) | 2,180.02 | 15.72% | 1.94% | 16.35 |

| MSCI India (INR) | 1,294.49 | 2.52% | 2.30% | 19.42 |

| Currency & Commodities | Last Price % | Change YTD % | Change MTD |

| USD / INR | 70.869 | 1.58% | -0.75% |

| Dollar Index | 99.38 | 3.33% | 0.47% |

| Gold | 1,472.38 | 14.81% | -3.15% |

| WTI (Nymex) | 54.07 | 19.07% | -1.87% |

| Brent Crude | 60.78 | 12.97% | 0.58% |

| India Macro Analysis | Latest | Equity Flows | USD Mn |

| GDP | 5.00 | FII (USD mln) | |

| IIP | 4.30 | YTD | 8,163.01 |

| Inflation (WPI Monthly) | 1.08 | MTD | 954.62 |

| Inflation (CPI Monthly) | 3.21 | *DII (USD mln) | |

| Commodity (CRB Index) | 387.57 | YTD | 7,330.97 |

| Source: Bloomberg | MTD | 1,546.15 | |

| *DII : Domestic Mutual Funds Data as on 30th September 2019 | |||

Mr. Suyash Choudhary

Head - Fixed Income

WHAT WENT BY

Bond yields rose during September with the yield of the 10 year Govt. bond benchmark ending at 6.70%, up 14 bps since August on fiscal concerns after corporate tax cuts. The government announced a major restructuring of corporate income taxes, lowering the 30% corporate tax rate to 22% (without exemptions) and also announcing a lower tax of 15% for newly incorporated domestic manufacturing companies. The tax cuts alongside previous measures announced by the government (ease of accessing duty and tax refunds by exporters, special fund worth INR 200bn to provide last mile funding to housing projects) in the last month amount to a total fiscal expansion of around 0.8% of GDP at face value.

CPI inflation came in as per our expectations at 3.21% vs. 3.15% last month, driven by base effects even while sequential momentum for both food and core inflation moderated. The moderation in food movement was driven by monthly de-growth seen in meat and fish and egg groups, which is mostly seasonal, de-growth in fruits as well as slowing growth momentum in vegetables and pulses.

Oil prices witnessed one of the worst trading days after two major Saudi facilities were struck, destabilizing ~6% of global supply. Brent futures rallied by nearly 20% recording its second largest intra-day gain since its inception in 1988, before stabilizing around USD 66/barrel in the mid-Asian trade, still ~10% higher than its previous close. However, oil prices have since then corrected to USD 58, lower than even its August closing of USD 60 as news reports came of faster than expected restoration of the damaged facilities and partial cease-fire in Yemen between Saudi and Houthis.

As expected, the FOMC lowered the fed funds target rate (FFTR) by 25 bps to 2.00% to 1.75% and the interest on excess reserves (IOER) by 30bps in an effort to push the fed funds effective rate (EFFR) back within the FFTR band. The Summary of Economic Projections (SEP), the statement and the press conference were balanced and largely in line with expectations. Acknowledging weakening business investment and exports was counterbalanced by characterising the consumer spending as strong. In the press conference, Chairman characterised the recent rate cuts as "modest adjustments", a slightly more dovish phrase than "mid-cycle adjustment" in the June press conference.

ECB in its September policy cut its deposit rate by 10bps to -0.5% & reinforced forward guidance on policy rates; announced a two-tier reserves system; tweaked the TLTRO-III terms; and announced a restart of QE from 1st November at a monthly purchase rate of EUR 20 bn. The dovish surprise was that QE was left open-ended and will continue for "as long as necessary".

Outlook:

In its October policy, the monetary policy committee (MPC) voted to cut repo rate by 25 bps to 5.15%. The decision to cut was unanimous although one member wanted a larger 40 bps cut. This is largely in line with market expectations, although lately views of a larger 40 bps cut were also beginning to gain ground.

RBI continues to re-emphasize the important break that the Governor Das RBI has executed from the past: the full deployment of all three pillars of rates, liquidity and guidance. The guidance is the strongest yet with the MPC deciding to continue with an accommodative stance as long as it is necessary to revive growth, while ensuring that inflation remains within the target. Governor Das re-emphasized this in his press conference as well saying that as long as growth momentum remains as it is and till growth revives, RBI will be in accommodative mode. Thus while we may be closer now to the terminal rate in this cycle, investors need to focus on the other more important aspect: that barring an unforeseen global development it is very likely that the policy rate remains around the 5% mark for an extended period of time. The same interpretation will likely hold for the stance around ensuring abundant positive liquidity as well. This will mean that front end rates remain very well anchored. Investors may need to shift focus from looking at only potential mark-to-market gains from falling rates to looking towards 'receiving' the steepness in the curve built into the front end versus the immediate overnight and money market rates. The relative stability that one foresees in policy rates and liquidity should also translate into stability (with easing bias) in quality front end rates. We remain cautious on credit where valuations are still not being backed by narrative.