Commentary

30th August 2019

Mr. Anoop Bhaskar

Head - Equity

WHAT WENT BY

US-China trade war continues to rattle global equities: Global equities witnessed a volatile month amid US-China trade

disputes. On 1 August, President Trump imposed a 10% tariff on the remaining $300 billion of imports from China. The CNY

broke the psychologically sensitive 7 threshold (currently at 7.15) and the US Treasury labelled China a currency manipulator.

Trade tensions intensified again on August 23, with China announcing additional tariffs on $75bn of imported products from

the US, and re-imposing tariffs on auto and auto parts imported from the US from December 15. Meanwhile, President Trump

announced an increase in tariffs from 25% to 30% for $250bn of Chinese imports, and from 10% to 15% for certain products.

President Trump also tweeted that he had the "absolute right" to "order" US companies to stop doing business with China.

Rush for safety: Safe-haven assets such as gold, long-dated US treasuries and Japanese Yen were the best performing asset class last month. In contrast, risk assets such as equities, commodities and EM currencies fell. Also, the US 10Y-2Y yield curve inverted, leading to a spike in recession fears. European currencies didn't move much but Asian currencies dropped, led by a 4% depreciation in the Chinese Yuan. Pace of outflow from EM equities accelerated, further highlighting a significant retreat from risk assets. Globally, defensive sectors such as staples, utilities and property (Reits) outperformed while energy, banks and insurance underperformed the most.

Yields continue to fall: Global yields closed lower amidst US-China trade talks, political turmoil in Britain and impending fear of recession (inverted US yield curve). US 10 year yields fell 52 bps in the month, ending at 1.5%. Yields across most EMs fell 10- 25bps in the month. Safe haven assets continued to outperform as seen from the Dollar Index (+0.4% MoM, 4% YoY), Japanese Yen (+2.3% MoM, +4.5% YoY) and Gold (+7.5% MoM, 26.6% YoY in $ terms). INR, after being stable to positive since its bottom in Oct-18, saw a sharp fall again in the month, falling 3.6% MoM. Prices of most industrial metals fell for the month on account of recession fears.

Global Markets: Rising global worries saw a broad based selling across global equity markets with the MSCI Developed Markets falling 2.2% and MSCI Emerging Markets Index falling 5.1%. Among DMs, UK (-5.4% MoM) and Germany (-3.3% MoM) fell the most on account of Brexit challenges whereas among BRICS, India (-4.1% MoM) was the best performer whereas Brazil (-9.7% MoM) and South Africa (-9.2% MoM) were the worst performers.

Crude stable: Crude continued to hover at levels of $60-$65/barrel, ending the month 7% lower at $60.43/barrel. Crude continues to remain in the comfort zone as far as the Indian economy is concerned. Crude prices are expected to be range bound going forward. Global growth slowdown and US shale supplies should act as a dampener for crude prices. But at the same time coordinated supply cuts by OPEC and political tensions in Iran and Venezuela could counter the effect, keeping crude range bound.

Domestic Markets: To boost the flagging economy, the Finance Minister announced a series of measures during the month to address growth concerns. The surcharge on capital gains for both domestic and foreign investors announced in the Union Budget on 5 July was reversed. Around 40% of the FPIs, which follow the 'Trust' route, were impacted by the surcharge. Other measures were also announced to address interest rate transmission, improve liquidity and credit flow and the auto sector slowdown. Late in the month, the Government announced the amalgamation of ten Public Sector Banks into four, leading to larger banks with bigger balance sheets and benefits from merger synergies to revive credit growth in the economy.

Despite the measures, liquidity remains a key concern for the system. Though headline rates have come down for highly reputed borrowers, the spread between a few highly rated borrowers and the rest of the market continues to be abnormally high. The rate of borrowing for the average borrower remains high, with NBFCs facing the brunt of the credit crunch.

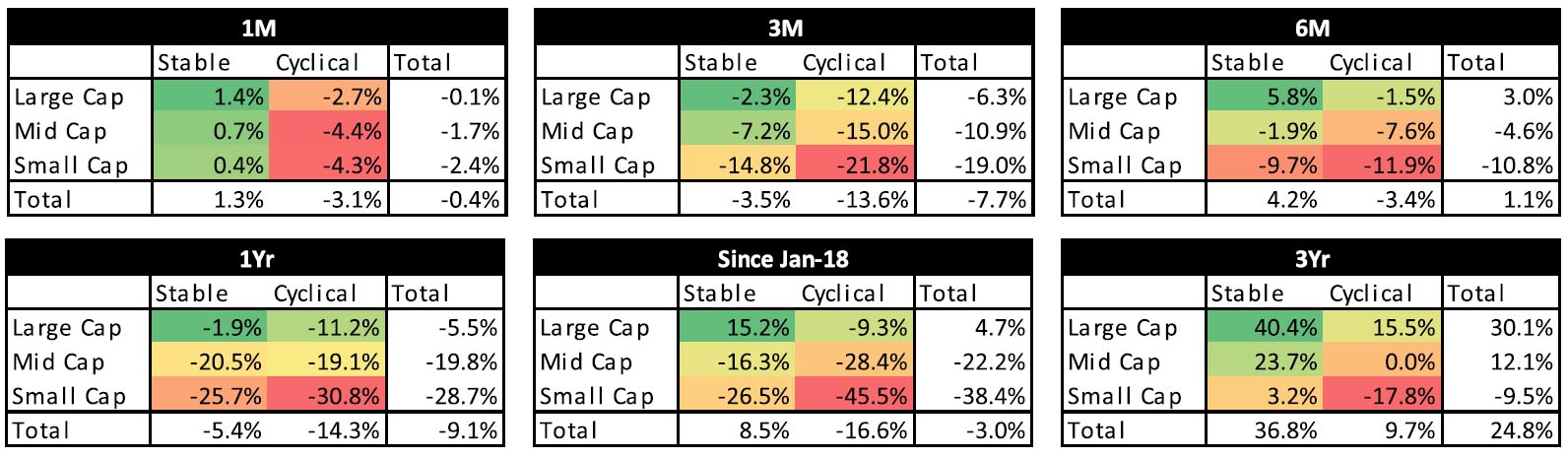

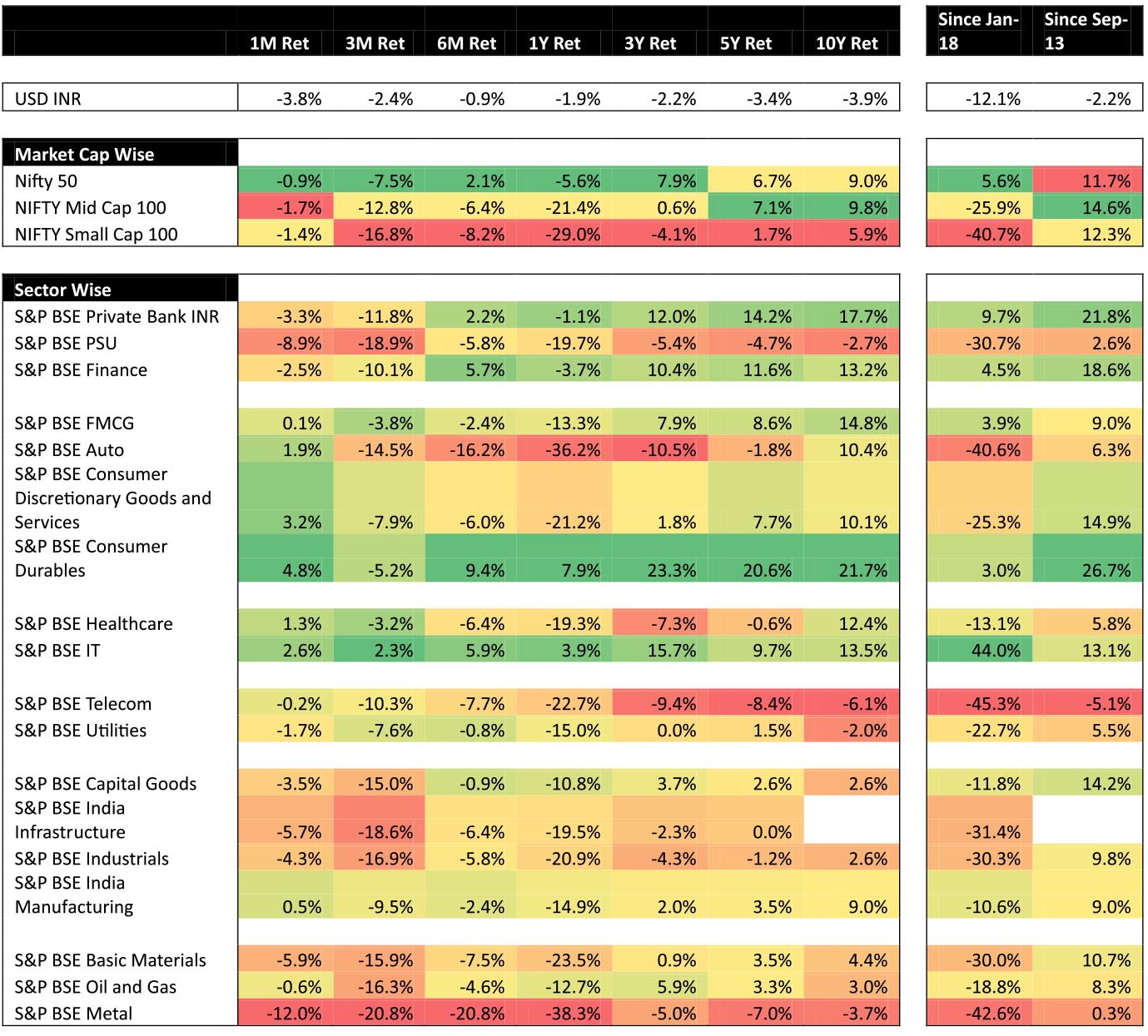

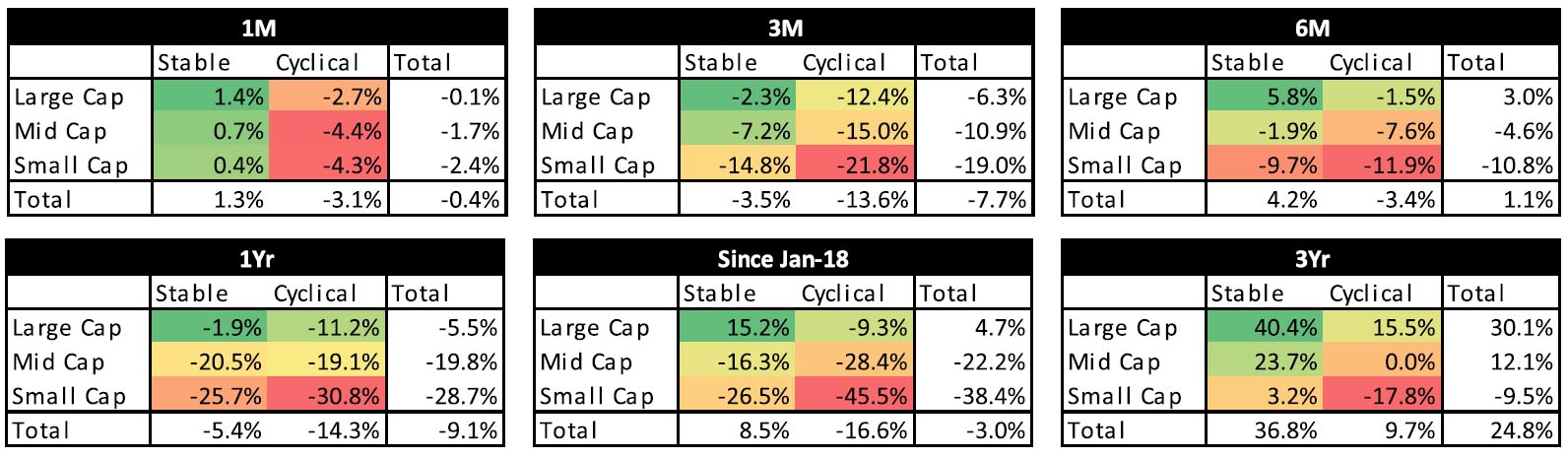

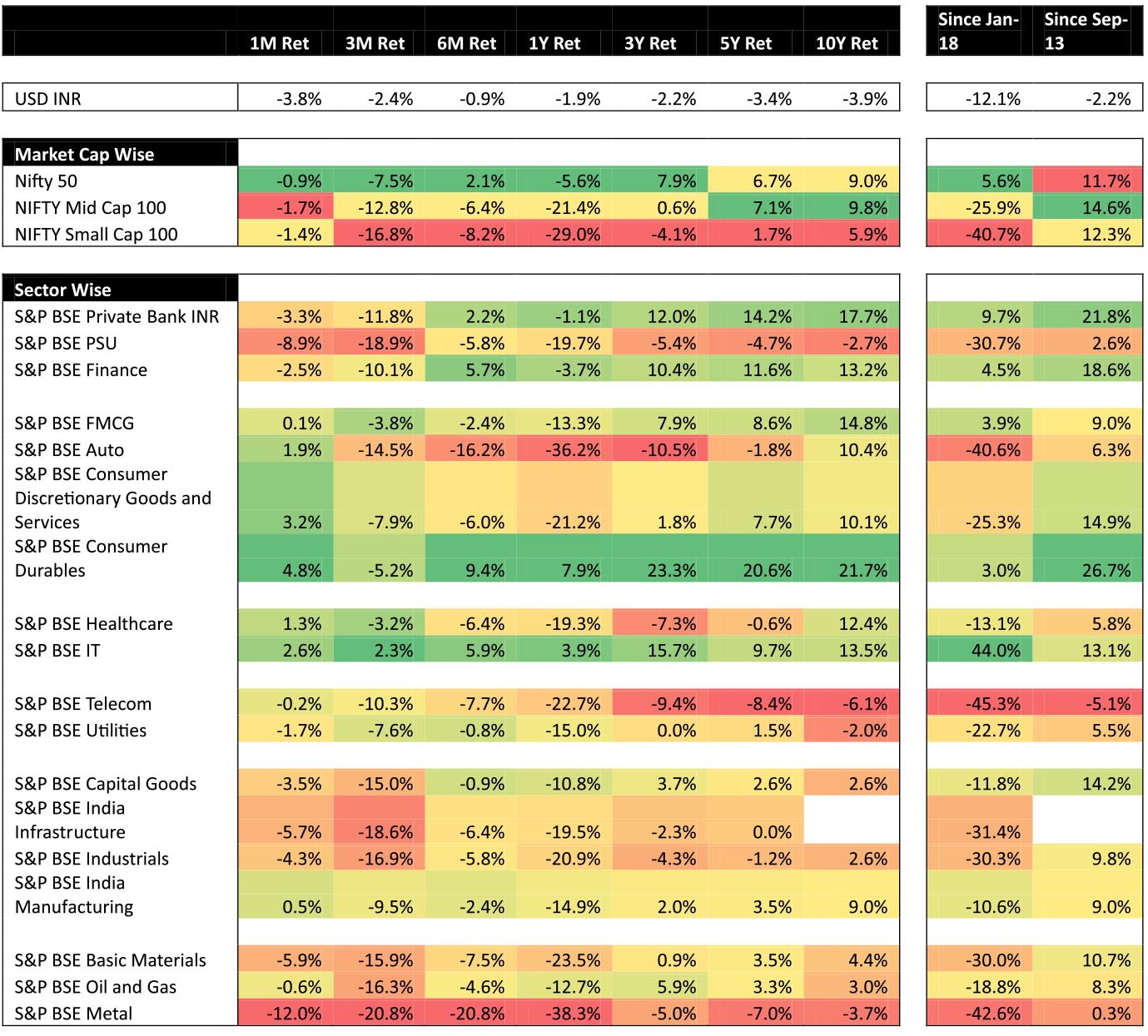

Indian equities showed no signs of a recovery as a weak earnings season and poor macro data prints continued to dampen spirits. The NIFTY, NSE Mid and NSE Small Cap Indices fell 0.9%, 1.7% and 1.4% respectively. From the peak of Jan-18, the divergence in returns for the 3 indices has been very high with respective returns of +5.6%, -25.9% and -40.7% respectively. Stable sectors continued to outperform cyclical sectors in the quarter as they have done since Jan-18.

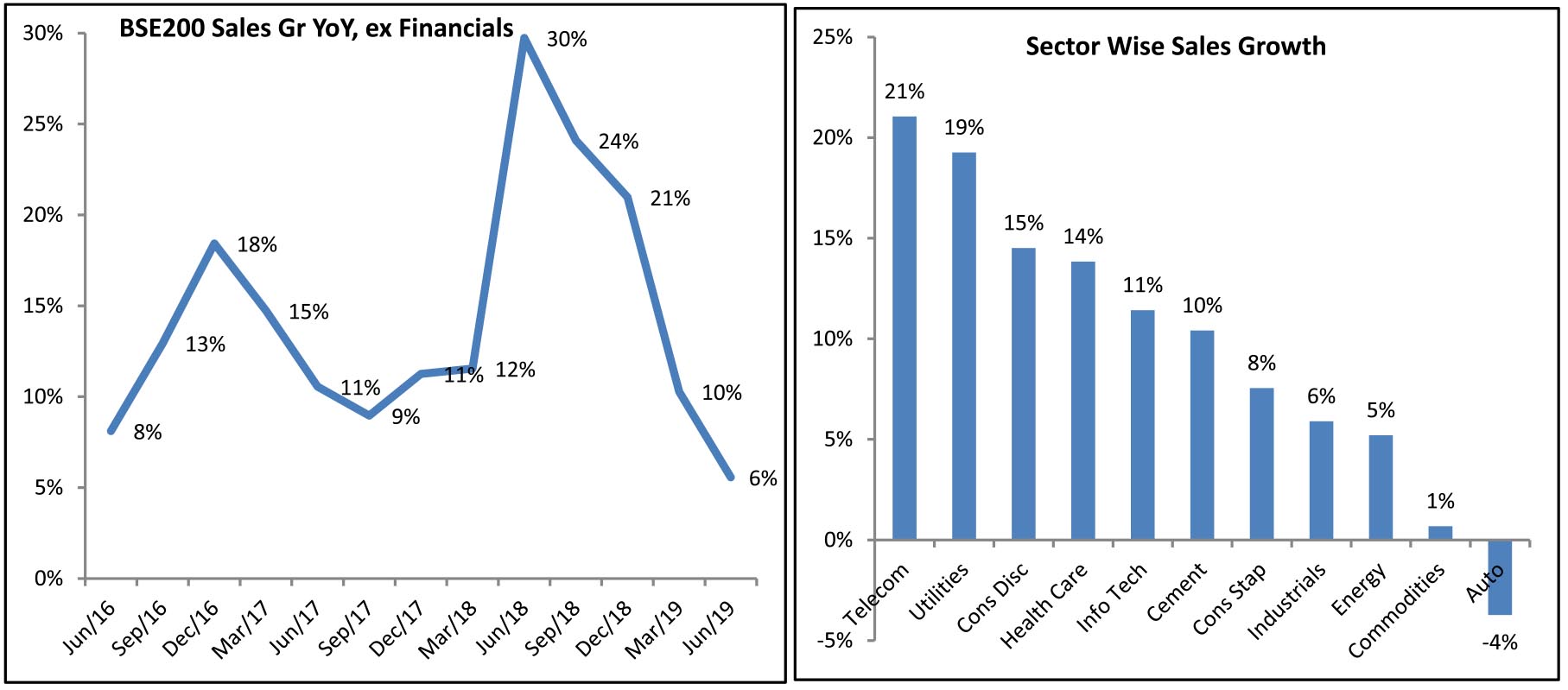

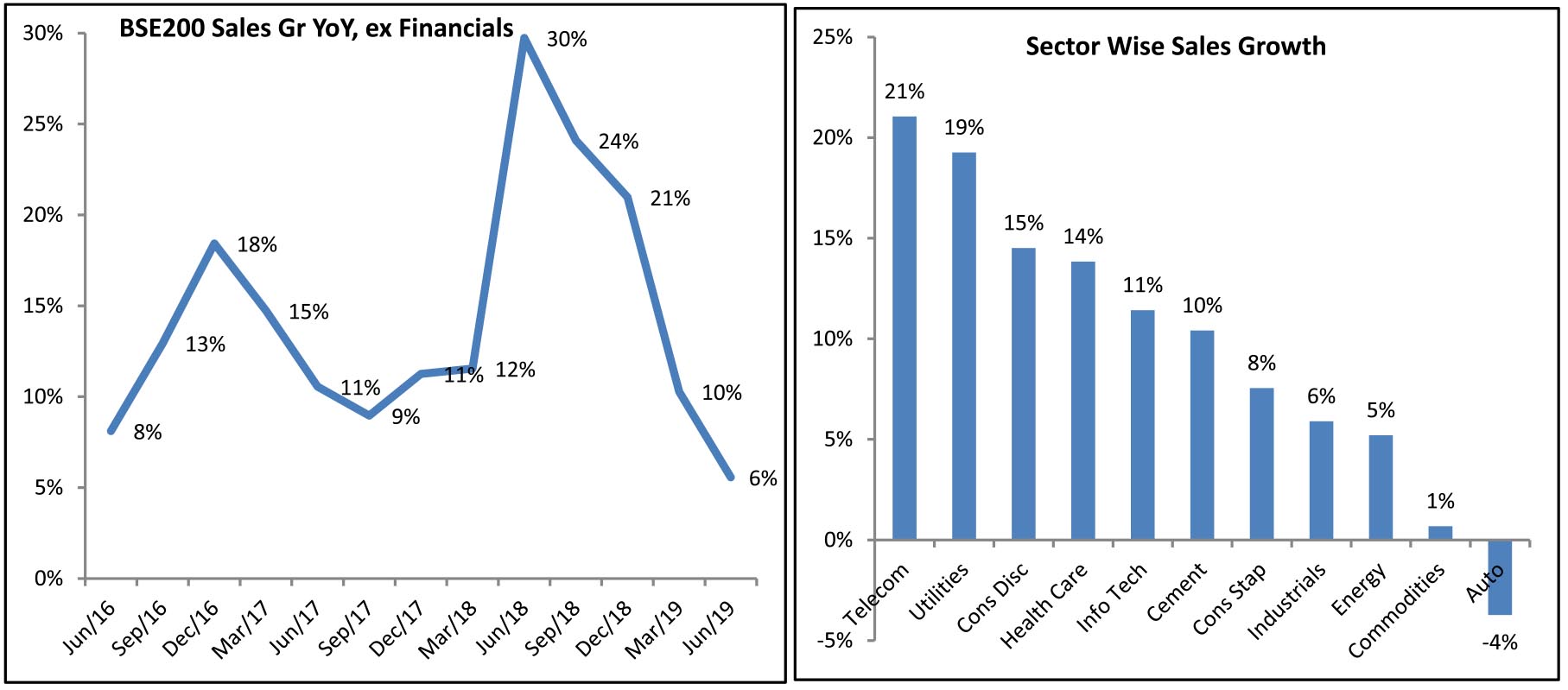

Earnings: The slowdown in growth was clearly visible in the Sales growth of BSE200 - falling for the 4th consecutive quarter; and at 6% - the lowest since Mar-16. Deceleration was visible both in cyclical as well as stable segment but more pronounced in cyclical. Cyclical segment Sales growth slowed to 5% YoY from the levels of 20%+ seen in FY 19, whereas Stable segment sales growth was 8% YoY as compared to peak of 16% in Dec-18 quarter.

• Positives

• Negatives

Rush for safety: Safe-haven assets such as gold, long-dated US treasuries and Japanese Yen were the best performing asset class last month. In contrast, risk assets such as equities, commodities and EM currencies fell. Also, the US 10Y-2Y yield curve inverted, leading to a spike in recession fears. European currencies didn't move much but Asian currencies dropped, led by a 4% depreciation in the Chinese Yuan. Pace of outflow from EM equities accelerated, further highlighting a significant retreat from risk assets. Globally, defensive sectors such as staples, utilities and property (Reits) outperformed while energy, banks and insurance underperformed the most.

Yields continue to fall: Global yields closed lower amidst US-China trade talks, political turmoil in Britain and impending fear of recession (inverted US yield curve). US 10 year yields fell 52 bps in the month, ending at 1.5%. Yields across most EMs fell 10- 25bps in the month. Safe haven assets continued to outperform as seen from the Dollar Index (+0.4% MoM, 4% YoY), Japanese Yen (+2.3% MoM, +4.5% YoY) and Gold (+7.5% MoM, 26.6% YoY in $ terms). INR, after being stable to positive since its bottom in Oct-18, saw a sharp fall again in the month, falling 3.6% MoM. Prices of most industrial metals fell for the month on account of recession fears.

Global Markets: Rising global worries saw a broad based selling across global equity markets with the MSCI Developed Markets falling 2.2% and MSCI Emerging Markets Index falling 5.1%. Among DMs, UK (-5.4% MoM) and Germany (-3.3% MoM) fell the most on account of Brexit challenges whereas among BRICS, India (-4.1% MoM) was the best performer whereas Brazil (-9.7% MoM) and South Africa (-9.2% MoM) were the worst performers.

Crude stable: Crude continued to hover at levels of $60-$65/barrel, ending the month 7% lower at $60.43/barrel. Crude continues to remain in the comfort zone as far as the Indian economy is concerned. Crude prices are expected to be range bound going forward. Global growth slowdown and US shale supplies should act as a dampener for crude prices. But at the same time coordinated supply cuts by OPEC and political tensions in Iran and Venezuela could counter the effect, keeping crude range bound.

Domestic Markets: To boost the flagging economy, the Finance Minister announced a series of measures during the month to address growth concerns. The surcharge on capital gains for both domestic and foreign investors announced in the Union Budget on 5 July was reversed. Around 40% of the FPIs, which follow the 'Trust' route, were impacted by the surcharge. Other measures were also announced to address interest rate transmission, improve liquidity and credit flow and the auto sector slowdown. Late in the month, the Government announced the amalgamation of ten Public Sector Banks into four, leading to larger banks with bigger balance sheets and benefits from merger synergies to revive credit growth in the economy.

Despite the measures, liquidity remains a key concern for the system. Though headline rates have come down for highly reputed borrowers, the spread between a few highly rated borrowers and the rest of the market continues to be abnormally high. The rate of borrowing for the average borrower remains high, with NBFCs facing the brunt of the credit crunch.

Indian equities showed no signs of a recovery as a weak earnings season and poor macro data prints continued to dampen spirits. The NIFTY, NSE Mid and NSE Small Cap Indices fell 0.9%, 1.7% and 1.4% respectively. From the peak of Jan-18, the divergence in returns for the 3 indices has been very high with respective returns of +5.6%, -25.9% and -40.7% respectively. Stable sectors continued to outperform cyclical sectors in the quarter as they have done since Jan-18.

Earnings: The slowdown in growth was clearly visible in the Sales growth of BSE200 - falling for the 4th consecutive quarter; and at 6% - the lowest since Mar-16. Deceleration was visible both in cyclical as well as stable segment but more pronounced in cyclical. Cyclical segment Sales growth slowed to 5% YoY from the levels of 20%+ seen in FY 19, whereas Stable segment sales growth was 8% YoY as compared to peak of 16% in Dec-18 quarter.

• Positives

- A few sectors such as banks, construction materials & pharmaceuticals delivered strong growth in net income on a yoy basis.

- The banking sector reported triple-digit yoy growth in profits on the back of low base in 1QFY19 and decline in provisions (base quarter had high provisions).

- Consumption stocks did not see a slowdown anywhere close to what some of the big-ticket discretionary consumption items like 4Ws/2Ws etc. Prolonged summer season led to strong demand in air-conditioners and refrigerators.

- Recovering US revenues of most pharmaceutical companies resulted in a strong yoy growth in the net income of pharmaceuticals companies.

- Cement sector posted strong numbers with several companies reporting all time high EBITDA/tonne on account of price hikes taken from the end of March; volumes though disappointed with industry de-growing 3-4%

• Negatives

- Performance of auto industry remained under pressure due to weak retail sales, increase in vehicle prices due to regulatory changes, inventory correction by OEMs and spill over of liquidity crisis and financing constraints.

- The June quarter was weak for IT companies as well. Cost increase, higher visa applications and large deal transition costs contributed to the pressure while consumer companies showed the mixed trend.

- Downstream companies' results on a yoy basis were marred by (1) muted refining and petrochemicals margins and (2) lower inventory gains on account of falling oil prices, even though the companies reported higher-than expected adventitious gains versus our expectations of losses.

- Metals saw a weak quarter on account of decline in prices of most metals on a yoy basis.

- The telecom sector saw another quarter of decline in net profits due to continued aggressive pricing strategy of R-Jio

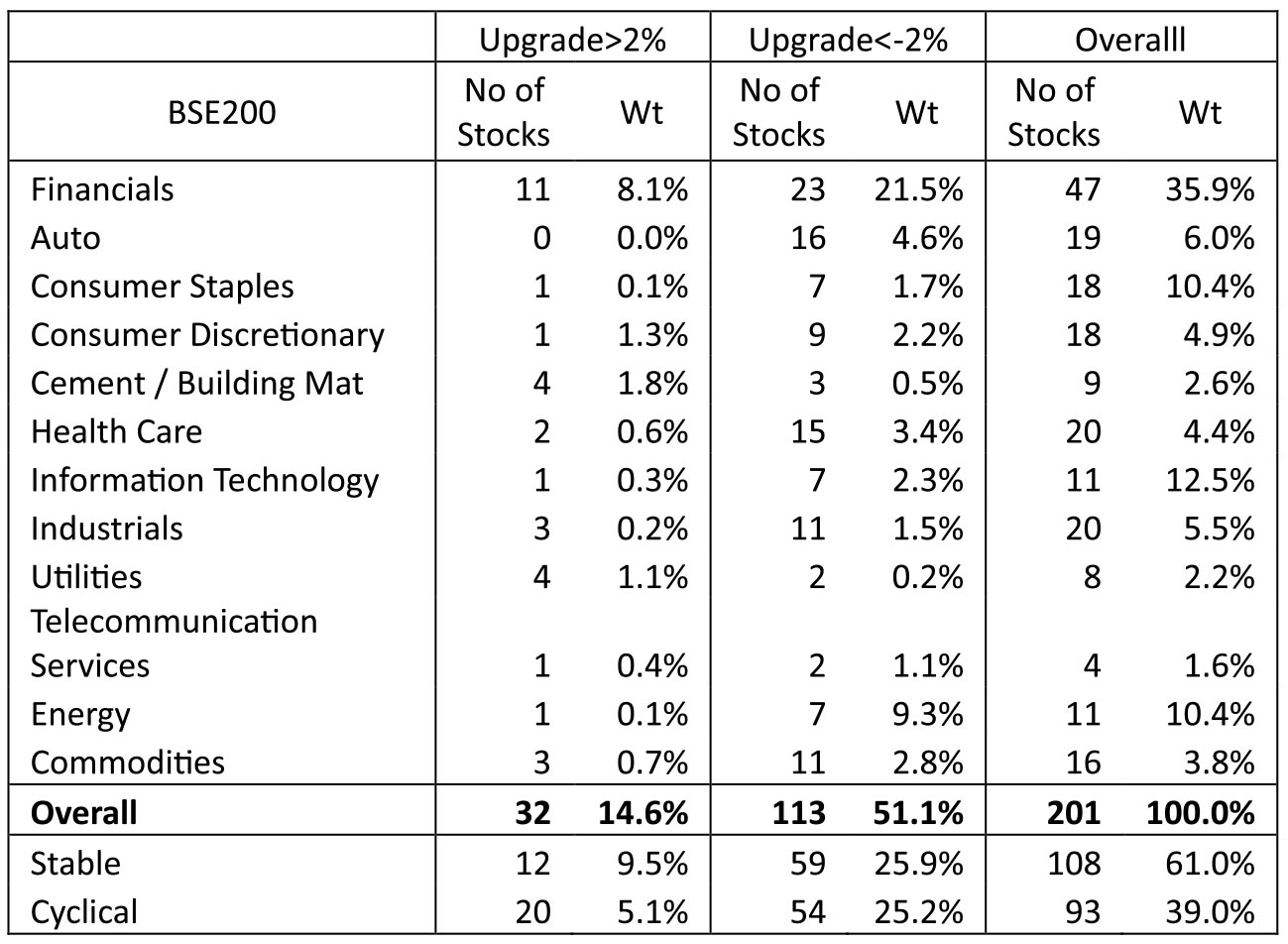

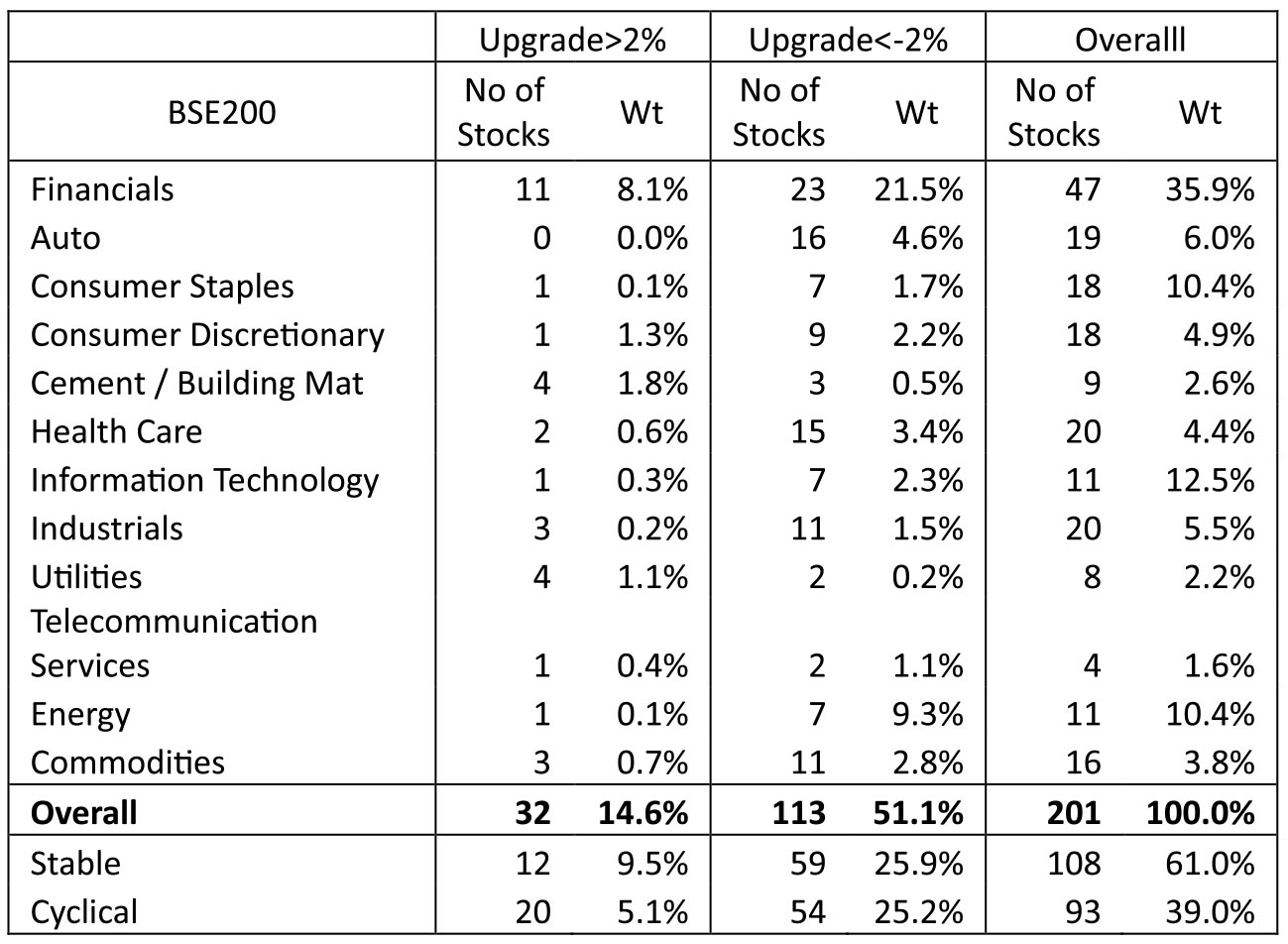

In summary, Q1 FY 20 witnessed more downgrades than upgrades. Of the 200 stocks in the BSE200 Index, 26 (weight of 14.3%)

saw an EPS upgrade of >2% whereas 114 (weight of 53.8%) saw EPS downgrade of <2%. The mix of downgrades was spread

evenly among stables and cyclicals whereas upgrades were more skewed toward stables.

GDP Growth continues to trend lower: 1QFY20 real GDP growth fell to 6-year low of 5% yoy led by a sharp decline in private

consumption. Nominal GDP growth at 8% YoY touched new post-GFC lows.

RBI continues to be dovish: In its last MPC meeting on 6th August, RBI cut policy rates by an unconventional 35bps cut (vs. consensus expectations of 25bps cut). This was the 4th consecutive rate cut by RBI (cumulative easing of 110bps ytd). Moreover, RBI forecasts inflation to average 3.6% over the next three quarters, well below the 4% target.

Yields may have bottomed, for now: Benchmark 10 year treasury yields averaged at 6.50% in August (3bps lower vs. July avg.). However, on month end values the yields have increased 19bps (-81bps ytd) as slowing growth concerns have raised expectations of a fiscal stimulus. Yields are still close to 2 year lows as inflation remains well behaved and the RBI's dovish policy stance is holding up hopes of more rate cuts. RBI has reduced the policy rate by 110bps ytd (including an unconventional 35bps cut in the August meeting).

FX Reserves comfortable: India's FX reserves are close to all-time high of US$429.1bn as of 23rd August (-598mn from July end). Fiscal deficit for Apr-Jul 2020 came at Rs.5.5tn or 77.8% of the budgeted FY20 deficit (Rs.7.04tn). This compares to 85.2% reached in the last fiscal during the same time frame. GST collection for August came at Rs982bn (+4.5%oya) and fell below the Rs1tn mark.

Monsoon normal, better than predicted: Cumulative rainfall is now at its LPA on an aggregate basis as of end August. Out of 36 meteorological subdivisions, rainfall so far has been normal in 22 (~ 69% of the country), excessive in 7 (~ 17%) and deficient in 7 (~ 14%). Rainfall has significantly improved in the past 2 months as cumulative deficit was running at ~9% as of end-July and ~33% as of end-June.

FIIs continue to Sell: FII selling accelerated in Aug to ~$2.1bn (vs ~$1.9bn last month) reducing the YTD net inflows to ~$7.1bn whereas DIIs remained net buyers to the tune of ~$2.9bn (vs ~$2.9bn last month) taking the YTD net inflows to ~$4.8bn. DMFs were buyers in the month with net inflows of ~$5.8bn YTD. Insurance cos were buyers in Aug reducing net outflows ~$1bn YTD.

Outlook: In FY 19, despite outperforming Stable segment in terms of Sales & PAT growth, Cyclical sectors saw a significant derating and underperformance in terms of stock performance. Even for FY 19-21, as per consensus estimate, Cyclical segment is expected to lead the earnings growth, driven by Corporate Banks. Despite this, cyclicals have significantly underperformed stables and Mid and Small Caps have significantly underperformed NIFTY in the last 2 years. The key worry for investors especially in the cyclical segment is visibility beyond FY 21 as government ordering has slowed down.

Mid and Small Cap indices now trade at a discount to NIFTY This is in marked contrast to the position in Jan-18 when the NIFTY was trading significantly cheaper to the mid and small cap indices.

Of the various factors needed for Cyclicals and Mid and small Cap outperformance, quite a few are in favour namely - a good and above expected monsoon, government and RBI attention to turn around the flagging economy, favourable valuations, crude prices closer to $60, yields below 6.5% and last but not the least a stable government at the centre.

The key concerns that are faced by the markets are (1) ongoing NBFC credit crunch (2) slowdown in both domestic consumption and government spend on infra (3) global slowdown and trade wars. Improvement in domestic and global growth outlook can be a key trigger for the broader markets going forward though the NIFTY may not see a significant uptick. After a fairly normal monsoon, the festive season will be keenly watched for signs of pickup in demand

Despite the doom & gloom, the only silver lining for investors is reasonable valuations, especially for small and mid-caps and a reasonable base for H2 earnings. Since the peak of Jan-18, NSE Mid Cap Index has corrected ~25% whereas the Small Cap Index has corrected 40%. NIFTY, on the other hand is up 6% for the same period. The NSE Small Cap Index trades at 15.0x on Positive PE basis; 12.9x on FY20 estimate earnings and 0.8x Price to Book. NIFTY, trades at 21.0x positive PE; 17.1x FY20 earnings and 2.7x Price to Book. The gap between NIFTY and small Cap returns from Jan-18 is around 46%, which can give an attractive entry point for long term investors, notwithstanding the short term headwinds.

RBI continues to be dovish: In its last MPC meeting on 6th August, RBI cut policy rates by an unconventional 35bps cut (vs. consensus expectations of 25bps cut). This was the 4th consecutive rate cut by RBI (cumulative easing of 110bps ytd). Moreover, RBI forecasts inflation to average 3.6% over the next three quarters, well below the 4% target.

Yields may have bottomed, for now: Benchmark 10 year treasury yields averaged at 6.50% in August (3bps lower vs. July avg.). However, on month end values the yields have increased 19bps (-81bps ytd) as slowing growth concerns have raised expectations of a fiscal stimulus. Yields are still close to 2 year lows as inflation remains well behaved and the RBI's dovish policy stance is holding up hopes of more rate cuts. RBI has reduced the policy rate by 110bps ytd (including an unconventional 35bps cut in the August meeting).

FX Reserves comfortable: India's FX reserves are close to all-time high of US$429.1bn as of 23rd August (-598mn from July end). Fiscal deficit for Apr-Jul 2020 came at Rs.5.5tn or 77.8% of the budgeted FY20 deficit (Rs.7.04tn). This compares to 85.2% reached in the last fiscal during the same time frame. GST collection for August came at Rs982bn (+4.5%oya) and fell below the Rs1tn mark.

Monsoon normal, better than predicted: Cumulative rainfall is now at its LPA on an aggregate basis as of end August. Out of 36 meteorological subdivisions, rainfall so far has been normal in 22 (~ 69% of the country), excessive in 7 (~ 17%) and deficient in 7 (~ 14%). Rainfall has significantly improved in the past 2 months as cumulative deficit was running at ~9% as of end-July and ~33% as of end-June.

FIIs continue to Sell: FII selling accelerated in Aug to ~$2.1bn (vs ~$1.9bn last month) reducing the YTD net inflows to ~$7.1bn whereas DIIs remained net buyers to the tune of ~$2.9bn (vs ~$2.9bn last month) taking the YTD net inflows to ~$4.8bn. DMFs were buyers in the month with net inflows of ~$5.8bn YTD. Insurance cos were buyers in Aug reducing net outflows ~$1bn YTD.

Outlook: In FY 19, despite outperforming Stable segment in terms of Sales & PAT growth, Cyclical sectors saw a significant derating and underperformance in terms of stock performance. Even for FY 19-21, as per consensus estimate, Cyclical segment is expected to lead the earnings growth, driven by Corporate Banks. Despite this, cyclicals have significantly underperformed stables and Mid and Small Caps have significantly underperformed NIFTY in the last 2 years. The key worry for investors especially in the cyclical segment is visibility beyond FY 21 as government ordering has slowed down.

Mid and Small Cap indices now trade at a discount to NIFTY This is in marked contrast to the position in Jan-18 when the NIFTY was trading significantly cheaper to the mid and small cap indices.

Of the various factors needed for Cyclicals and Mid and small Cap outperformance, quite a few are in favour namely - a good and above expected monsoon, government and RBI attention to turn around the flagging economy, favourable valuations, crude prices closer to $60, yields below 6.5% and last but not the least a stable government at the centre.

The key concerns that are faced by the markets are (1) ongoing NBFC credit crunch (2) slowdown in both domestic consumption and government spend on infra (3) global slowdown and trade wars. Improvement in domestic and global growth outlook can be a key trigger for the broader markets going forward though the NIFTY may not see a significant uptick. After a fairly normal monsoon, the festive season will be keenly watched for signs of pickup in demand

Despite the doom & gloom, the only silver lining for investors is reasonable valuations, especially for small and mid-caps and a reasonable base for H2 earnings. Since the peak of Jan-18, NSE Mid Cap Index has corrected ~25% whereas the Small Cap Index has corrected 40%. NIFTY, on the other hand is up 6% for the same period. The NSE Small Cap Index trades at 15.0x on Positive PE basis; 12.9x on FY20 estimate earnings and 0.8x Price to Book. NIFTY, trades at 21.0x positive PE; 17.1x FY20 earnings and 2.7x Price to Book. The gap between NIFTY and small Cap returns from Jan-18 is around 46%, which can give an attractive entry point for long term investors, notwithstanding the short term headwinds.

| Equity Markets | Index | % Change YTD | % Change MTD | P/E |

| Nifty | 11,023.25 | 1.48% | -0.85% | 18.12 |

| Sensex | 37,332.79 | 3.51% | -0.40% | 19.02 |

| Dow Jones | 26,403.28 | 13.19% | -1.72% | 17.63 |

| Shanghai | 2,886.24 | 15.73% | -1.58% | 11.90 |

| Nikkei | 20,704.37 | 3.45% | -3.80% | 15.43 |

| Hang Sang | 25,724.73 | -0.47% | -7.39% | 10.78 |

| FTSE | 7,207.18 | 7.12% | -5.00% | 12.85 |

| MSCI E.M. (USD) | 984.33 | 1.92% | -5.08% | 13.11 |

| MSCI D.M.(USD) | 2,138.52 | 13.52% | -2.24% | 16.61 |

| MSCI India (INR) | 1,265.41 | 0.21% | 0.54% | 18.31 |

| Currency & Commodities | Last Price % | Change YTD % | Change MTD |

| USD / INR | 71.406 | 2.35% | 3.79% |

| Dollar Index | 98.92 | 2.85 | % 0.41% |

| Gold | 1,520.30 | 18.55% | 7.53% |

| WTI (Nymex) | 55.10 | 21.34% | -5.94% |

| Brent Crude | 60.43 | 12.32% | -7.27% |

| India Macro Analysis | Latest | Equity Flows | USD Mn |

| GDP | 5.00 | FII (USD mln) | |

| IIP | 2.00 | YTD | 7,208.39 |

| Inflation (WPI Monthly) | 1.08 | MTD | -2,198.56 |

| Inflation (CPI Monthly) | 3.15 | *DII (USD mln) | |

| Commodity (CRB Index) | 387.15 | YTD | 5,763.71 |

| Source: Bloomberg | MTD | 2,425.58 | |

| *DII : Domestic Mutual Funds Data as on Data as on 30thAugust 2019 | |||

Mr. Suyash Choudhary

Head - Fixed Income

WHAT WENT BY

Bonds continued to rally in August on positive domestic as well as global cues as Government refrained from announcing any fiscal stimulus to arrest the slowdown while global growth concerns continued to linger on US-China trade stand-off with 10 year treasuries declining from 2% at start of the month to 1.5% by end of the month. The 10 year Government bond benchmark, however was an underperformer ending at 6.56% compared to 6.37% at beginning of the month as illiquidity premium started setting in as the outstanding amount on the 10-year benchmark paper reached towards the estimated borrowing cap after switch auction. The curve steepened with 10 year to 5 year Government bond spread widening from 6bps to 30bps.

India's July trade deficit improved to USD 13.4 bn vs USD 15.3 bn previously. This was mainly driven by a rebound in petro export volumes after weakness in June. Imports of petro and precious time were lower in the month, but this was offset by electronics and others. The numbers took exports growth back positive at 2.25% YoY vs -9.7% prev.

RBI central board accepted all the recommendations of the Bimal Jalan Committee report and decided to transfer INR 1.76 tn to the government of India which comprised INR 1.23 tn of dividend income for 2018-19 and INR 526.37 bn of excess capital that was identified in line with the new Economic Capital Framework. Of the Rs. 1.23 tn, INR 280 bn has been transferred as interim dividend to the government for FY 2019. This leaves Rs. 950 bn to be transferred in FY 2020 (Budget estimate was Rs. 900 bn approximately). Effectively this leads to an excess transfer of INR 576.37 bn to the government for the year FY 2020, translating to ~0.27% of GDP. However, this still leaves open market operations (OMO) purchase of bonds in play from the RBI although they will probably now shift to the January - March quarter and will be of a smaller amount then earlier assumed.

India Q1 FY20 GDP growth weakened sharply to 5% YoY vs 5.3% consensus expectations (slowest pace since March 2013), pulled back by an acute slowdown in manufacturing and financial services. On the demand side, investment (fixed capital formation) remained low at 4% (vs 3.6% previous). However, there was a significant drop in private consumption growth, which fell from an average 8.1% in FY19 to 3.1%. Nominal GDP growth fell to 8.0% YoY lowest since June 2009.

Outlook:

Both the macro and micro frameworks remain reasonably bond bullish and we are happy to continue to participate, although our instruments of choice may keep shifting depending upon relative value within the core interest rate buckets (AAA/SDL/sovereign). Our preference for duration building is now via sovereign papers given the very benign supply environment for government bonds that is likely to come over the second half of the financial year. This may also help further compress term spreads of sovereign versus repo, which otherwise have generally been quite elevated since late 2017 owing to diminishing risk appetites and excess supply overhang.

Also while past comparisons are useful, they must be made with caution. For instance, while demonetization was a significant local development, it must be remembered that a global reflation trade had begun in earnest at the same time with expectations of a US fiscal stimulus from the Trump administration. Also, RBI had embarked in 2017 on a significant OMO sale program thereby significantly adding to gross bond supply just as post demonetization deposit accretion was beginning to fall away. Whereas, the current phase is that of a synchronized global slowdown where local fiscal policy so far has been relatively disciplined. Thus it is not necessary that 'demonetization lows' should actually form some sort of a lower bound to yields in the current environment.

As always, investments need to be considered in 3 buckets of liquidity, core and satellite. In our view it remains a very constructive environment to continue to allocate to AAA front end that chiefly forms part of core allocation bucket.