Commentary

31st March 2020

Mr. Anoop Bhaskar

Head - Equity

WHAT WENT BY

Global Markets:

The COVID-19 pandemic continues to dominate headlines globally; cases crossed the 1 million mark,

with deaths in excess of 50,000. Europe and US have been severely impacted by the pandemic, whereas Asian and

other Emerging Markets have seen lesser impact to date. Cases in the US are close to 2.5 lakh whereas they have

crossed the 1 lakh mark in both Italy and Spain. US has recorded around 6,000 deaths whereas Italy and Spain have

crossed the 10,000 threshold. Most countries globally have imposed some degree of lockdown to curb the spread

of the epidemic, resulting in severe economic costs and maybe a global recession in CY20. According to some

estimates roughly a half (3.9 billion) of the world's population is under some form of lock down.

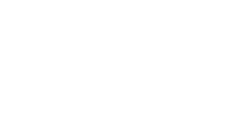

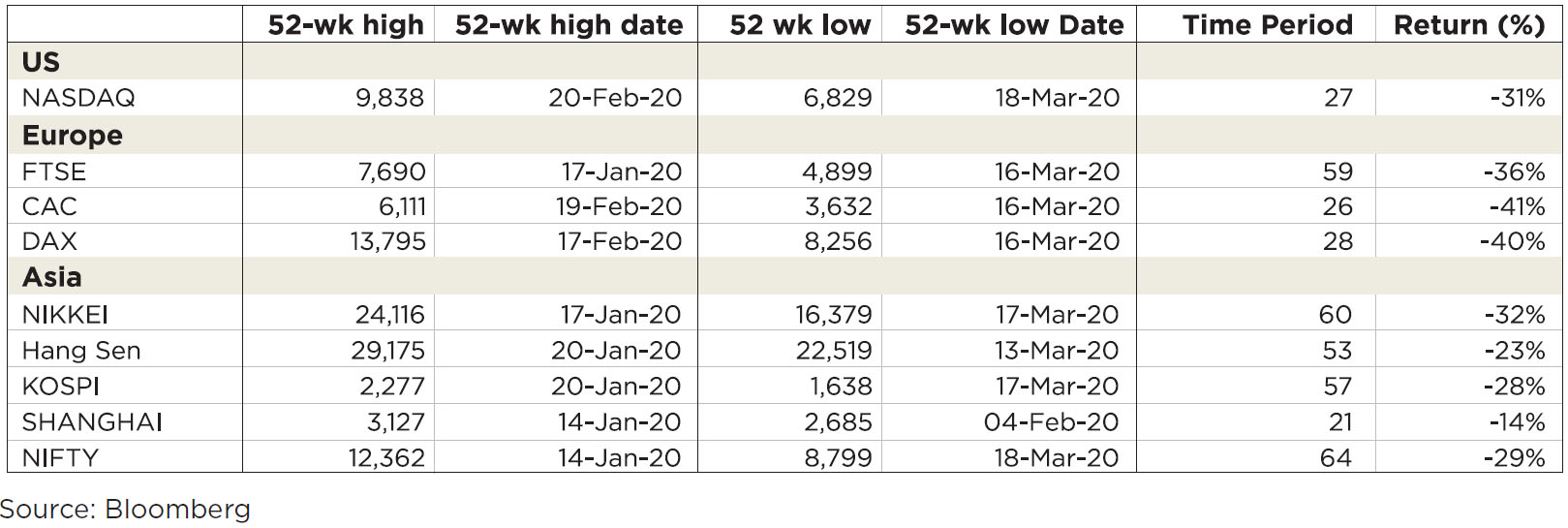

Markets across the world crashed spectacularly in Mar'20 as the extent of the epidemic became clearer. The US stock market which had hit a 52-week high in Feb'20 crashed 31% to hit a 52-week low in March. The speed of the fall was unprecedented as global markets went from 52-week high to 52-week lows in less than a month. The US VIX spiked to above 65, the highest since the 2008 GFC (Global Financial Crisis) when it hit its peak of 80.

Markets across the world have recovered from the panic bottoms seen in mid-March as most countries have announced economic packages to battle the economic downturn. US led the recovery, with S&P 500 recording a decline of 11% for the month of March. This was largely supported by the $2 trillion package, approved by US Senate, amounting to approx.. 10% of GDP. Similarly, countries like France, UK, China etc., have also announced stimulus packages, total global stimulus packages announced have crossed $5 trn, far exceeding those announced at the time of the GFC.

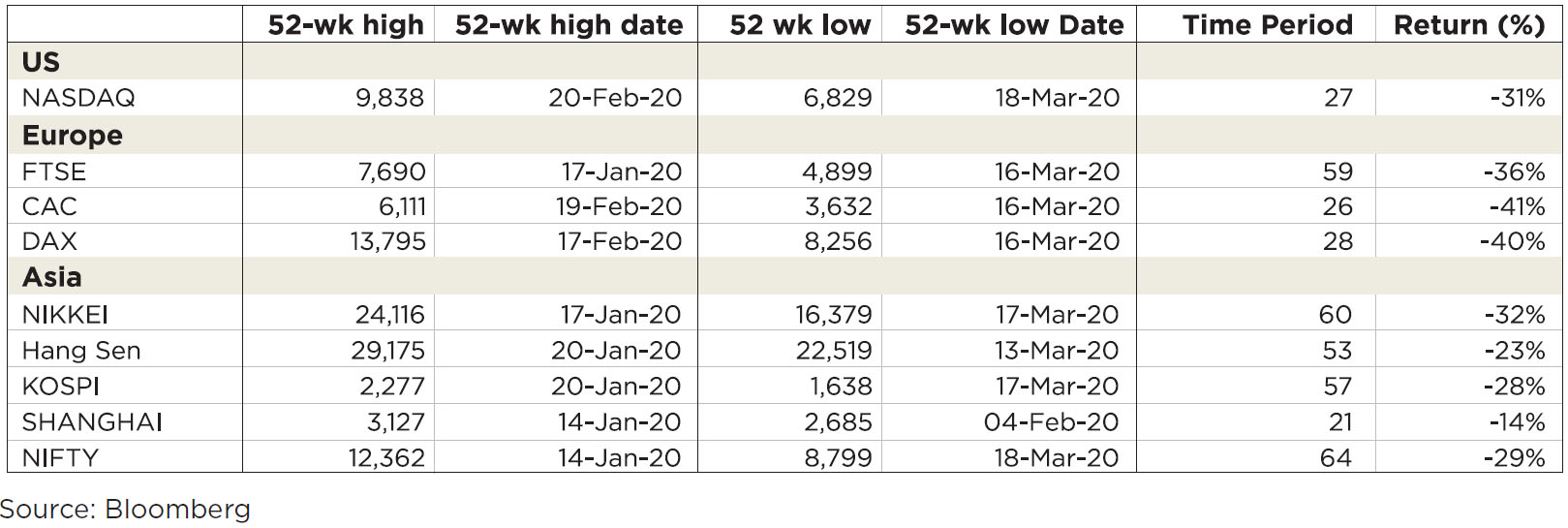

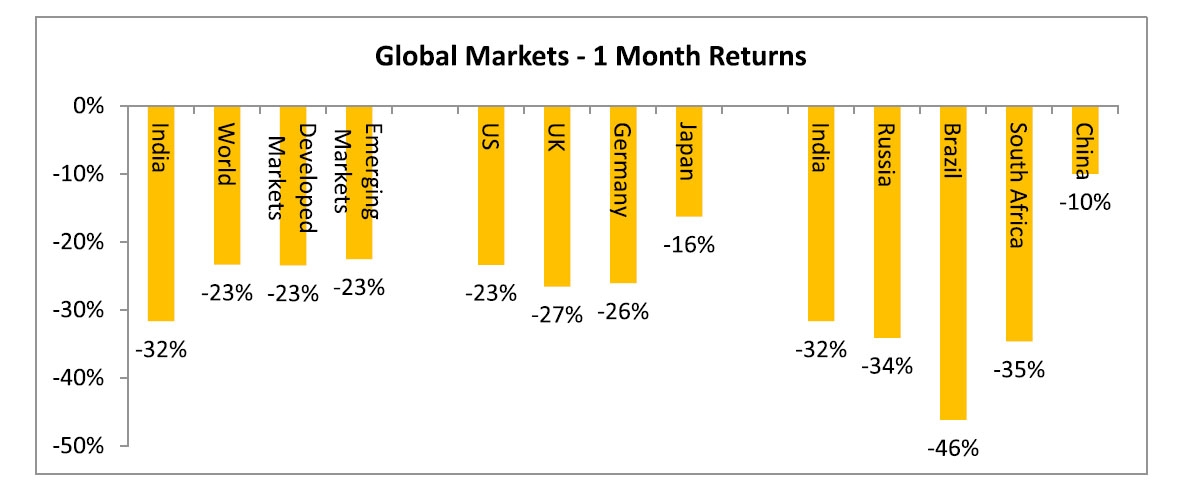

On a headline basis, Emerging Markets (EM) have fallen in line with Developed Markets (DM) (around -23% each). But the fall in individual EMs is much higher - the overall index numbers look better on account of the large weight of China which has fallen only 10%.

The only positive for India from this is the crash in oil prices which was exacerbated by the dispute between Russia and OPEC which could weaken the cartel. Brent corrected 62% MoM to close at $22.74/barrel. The sharp fall in crude will help India's trade deficit as well as fiscal deficit - the government has increased the excise duty on petrol and diesel. Also interest rates have come crashing down globally, with the US 10 year falling 85 bps to close at 0.67%. On the currency front, the Dollar index was flat - UK Pound depreciated 3.6% against the dollar whereas the Euro and JPY yen appreciated 2.3% and 4.2% respectively. The INR depreciated 4.6% MoM to close at 75.34.

Domestic Markets:

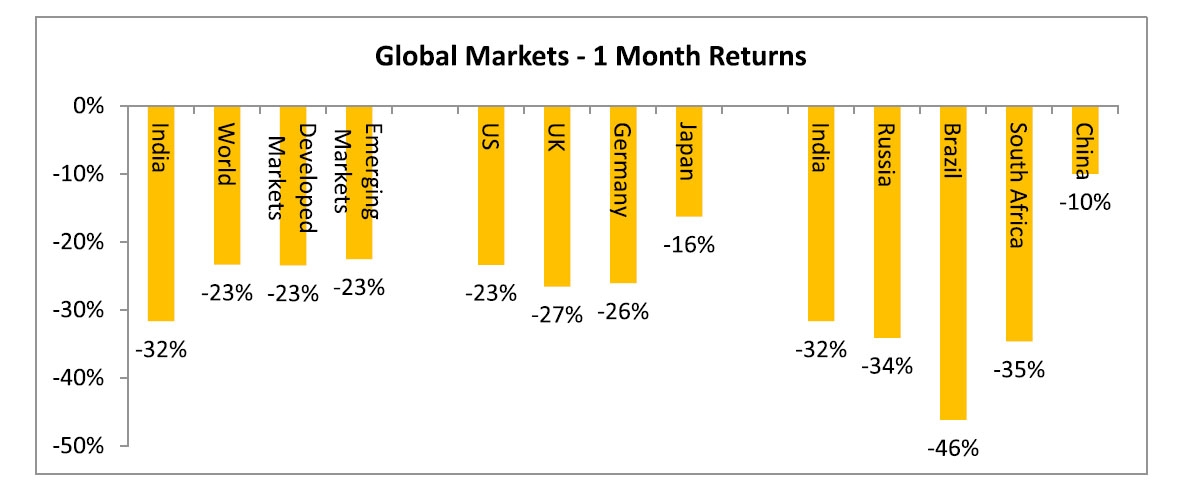

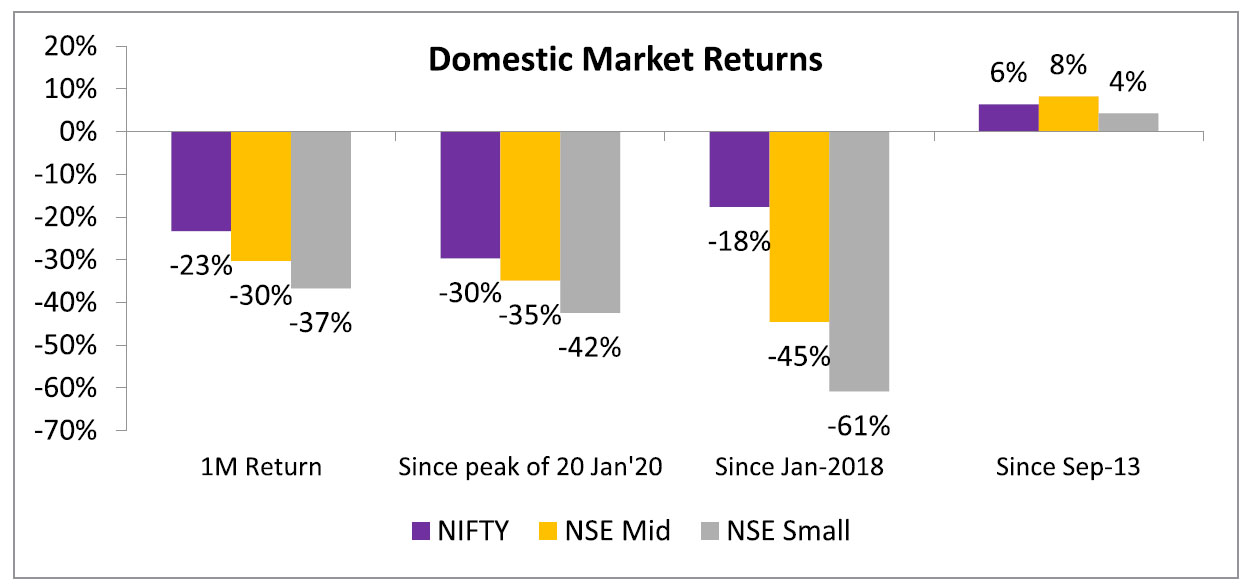

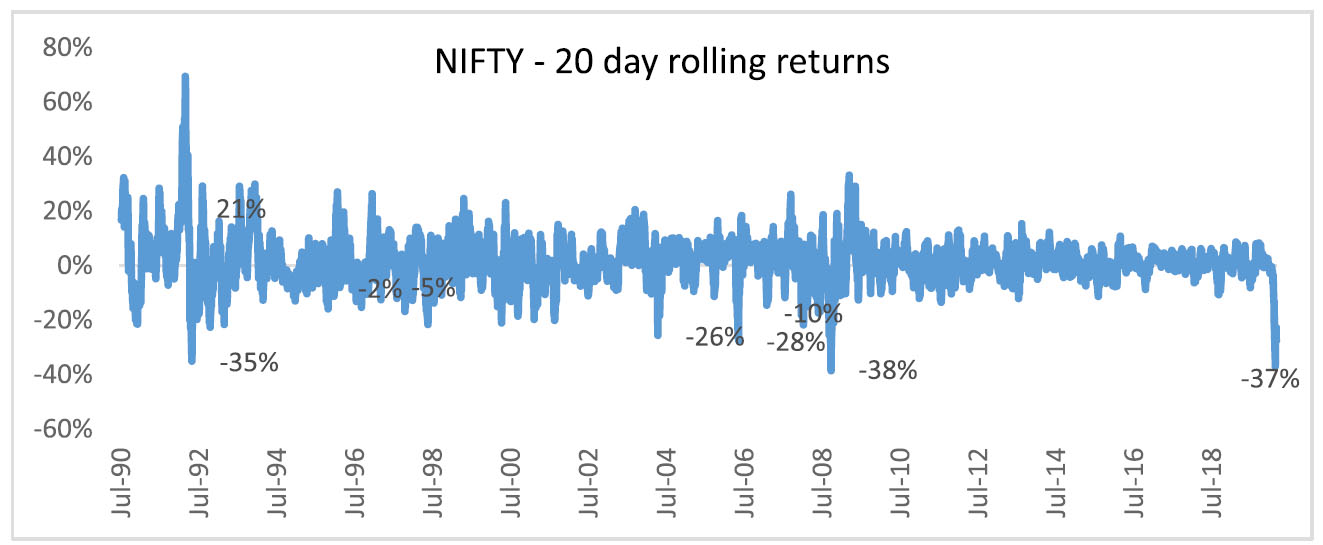

Sharp fall in March in line with Global Markets: Domestic Markets too witnessed a sharp fall, with the NIFTY crashing 37% in a 20-day period, one of the sharpest ever fall. The India VIX climbed to 83 from 14, its highest ever level.

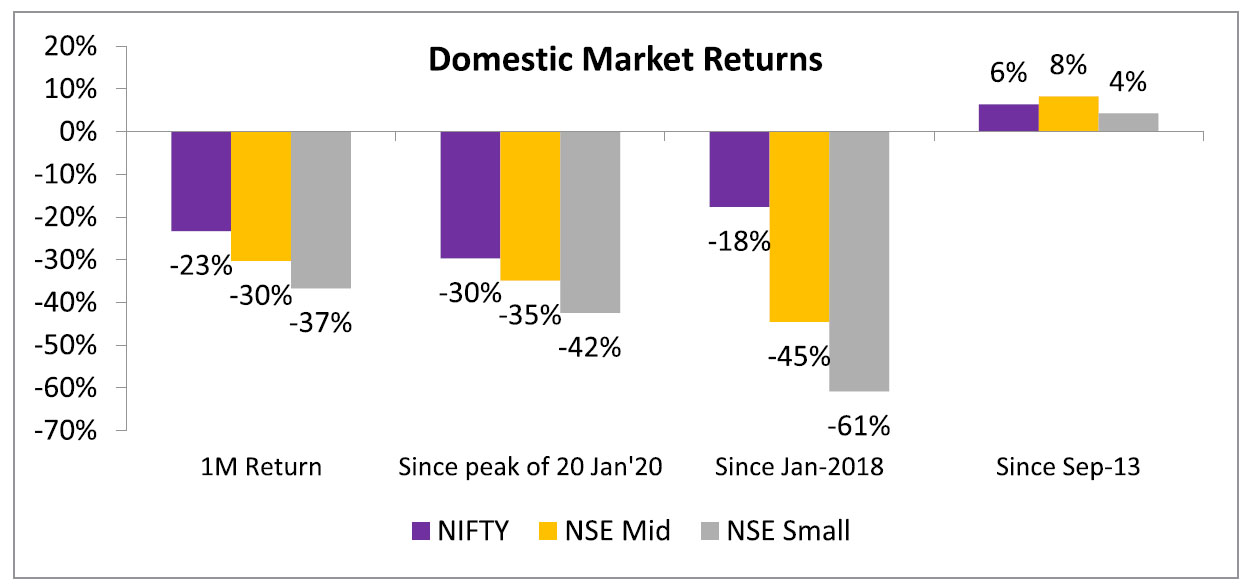

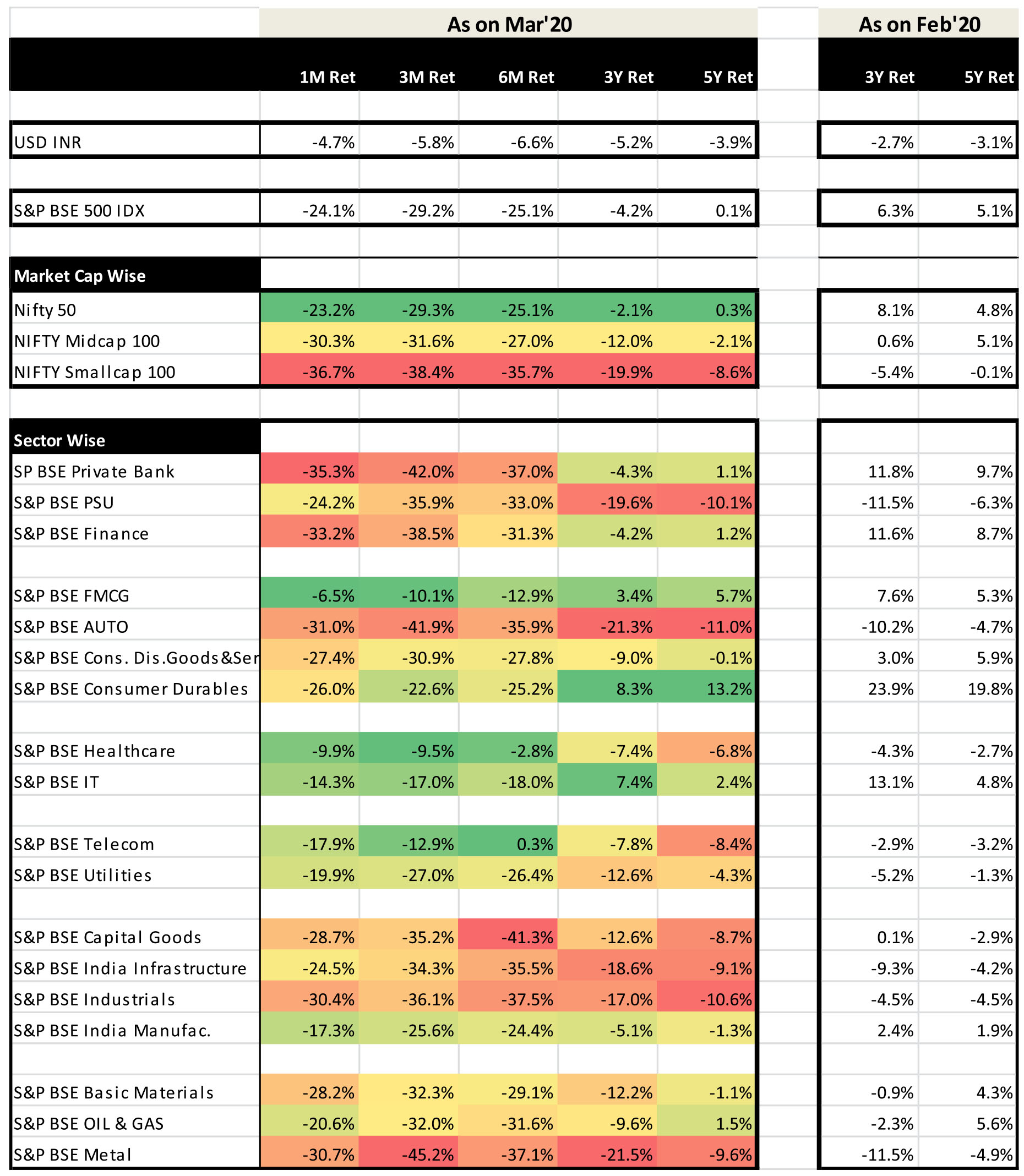

All indices correct - though Large caps outperform in the end: Though, initially, mid and small cap indices fell in line with the NIFTY, NIFTY recovered towards the month-end, whereas the broader markets continued to languish, resulting in significant gap in 1M performance between the NIFTY and broader markets. From the peak of Jan-18 NIFTY, NSE Mid Cap and NSE Small Cap have fallen 29.7%, 34.9% and 42.4% respectively. Interestingly, markets are now at levels close to the Sep-13 bottom.

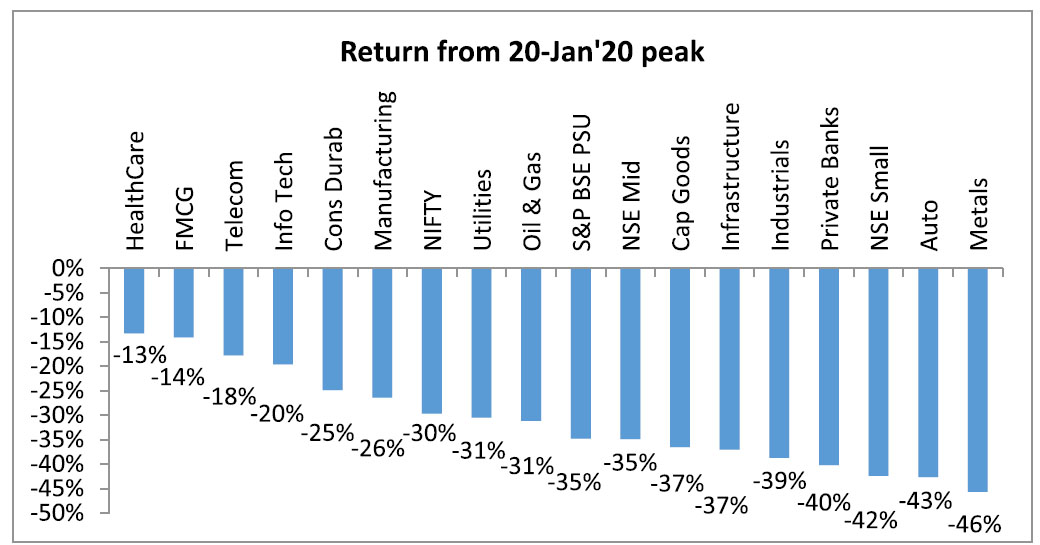

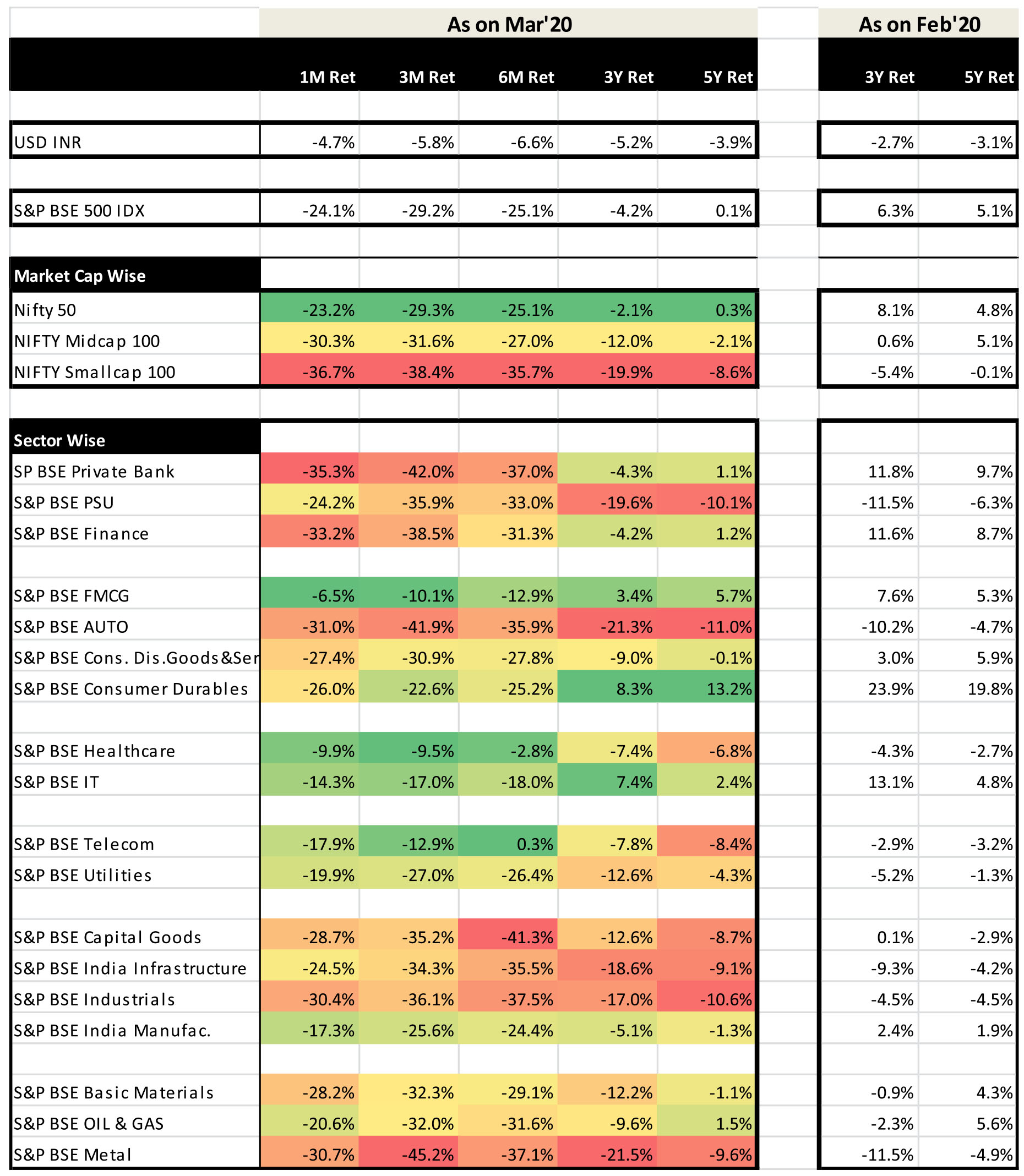

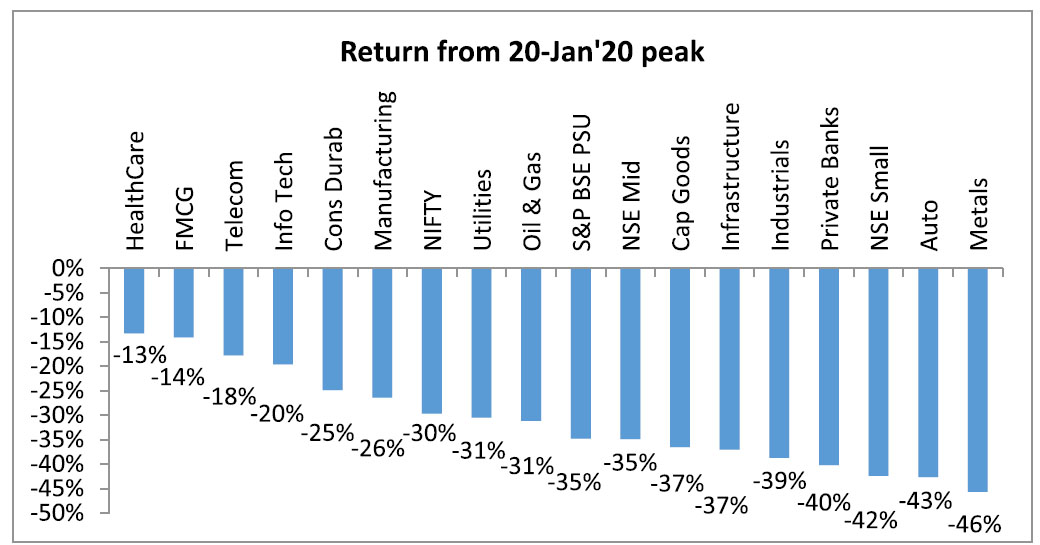

Defensives and Telecom outperform, Private Financials hit: Defensives - HealthCare, FMCG and IT have been the best performing sectors along with Telecom. Telecom has benefited on account of lower competition in the market, expected price hikes in the future and higher data consumption in the extended lockdown. Worst performers have been Metals, Auto and Private Banks. Sharp correction in base metal prices and lower volumes on account of lockdown has impacted metal stocks. Auto stocks have corrected on concerns of plunging sales and BS-IV inventory write-off fears.

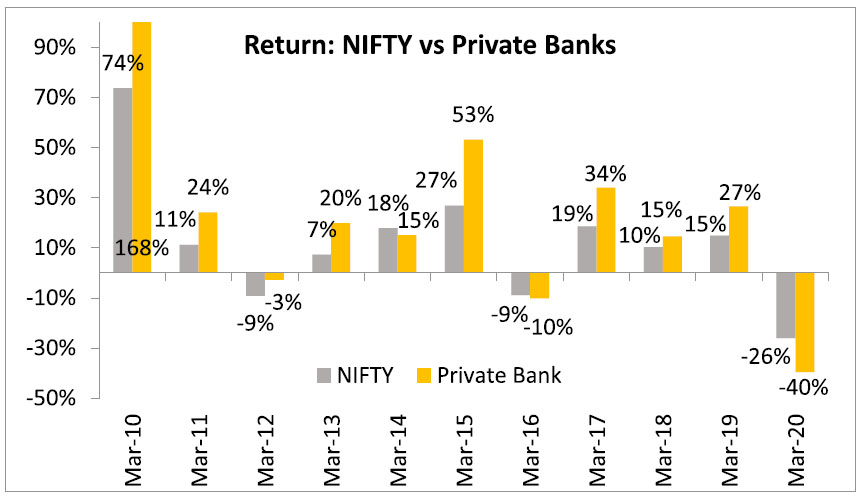

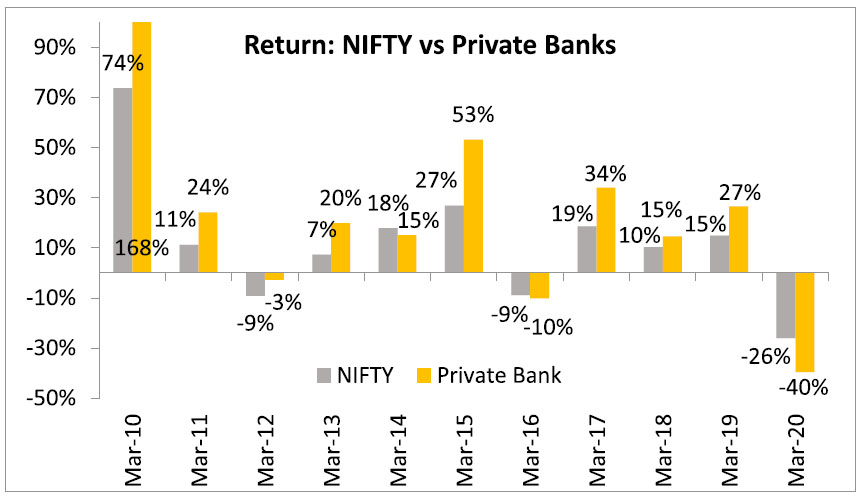

Since the GFC of 2008-09, FY 20 is the first year that Private Banks have significantly underperformed the NIFTY, all due to the last 1-month crash. Private Banks and Consumer NBFCs have been the biggest casualty of this correction - and have fallen more than the market and even PSU banks. Growth for these banks in the recent past was driven by a surge in retail loans and working capital credit. After the NPA concerns for Corporate Lenders over the last few years, given the sharp dislocations seen in the real economy due to COVID-19, fears of NPAs from the unsecured retail book have spooked investors.

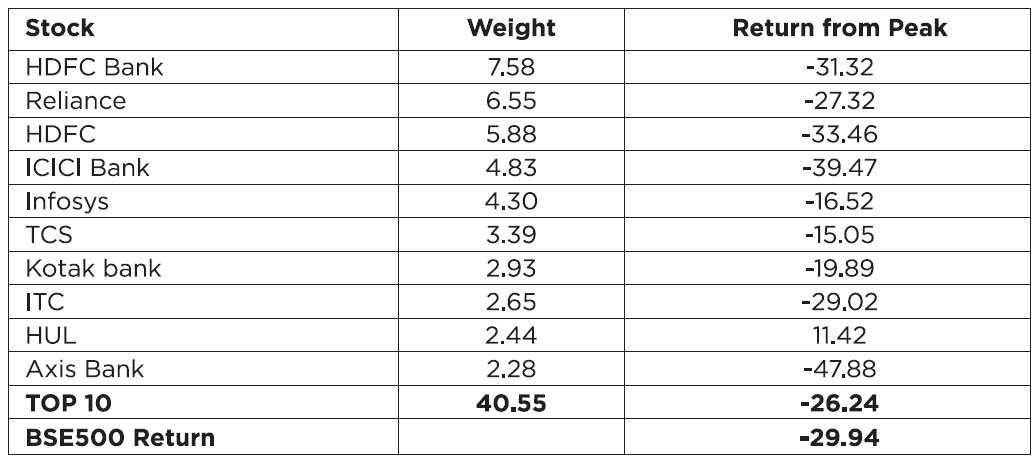

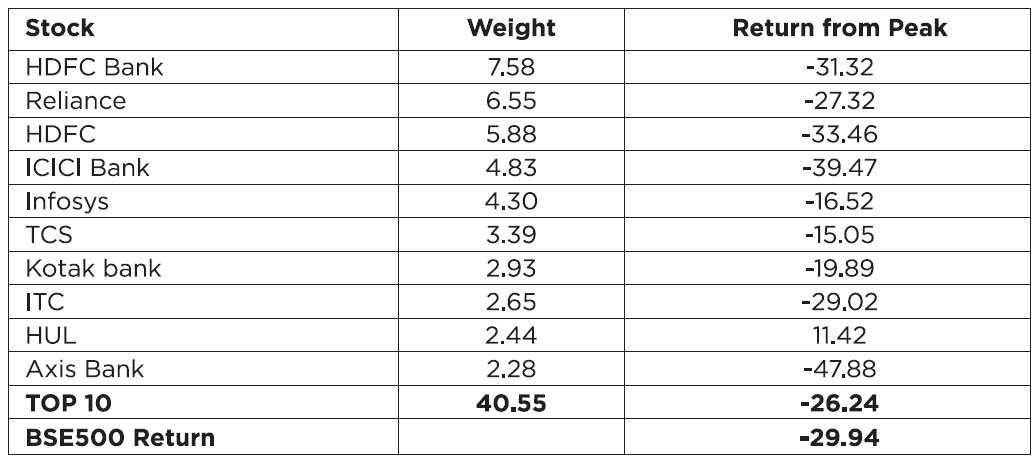

Top 10 stocks fall in line with the market:Since Jan-18, markets have been highly polarized with the top 10 stocks significantly outperforming the broader markets. In this correction though, the top 10 stocks have fallen in line with the broader markets, some higher than the broader markets - HUL, the only positive among the top 10 whereas all three banks fell more than the market.

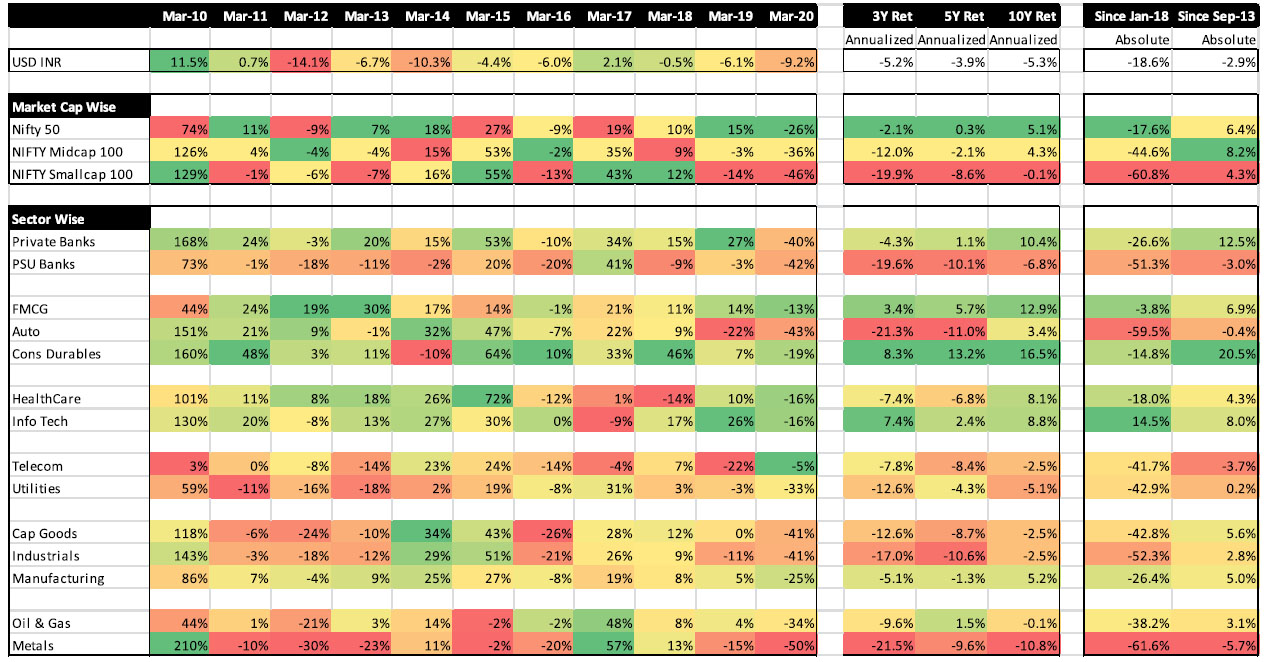

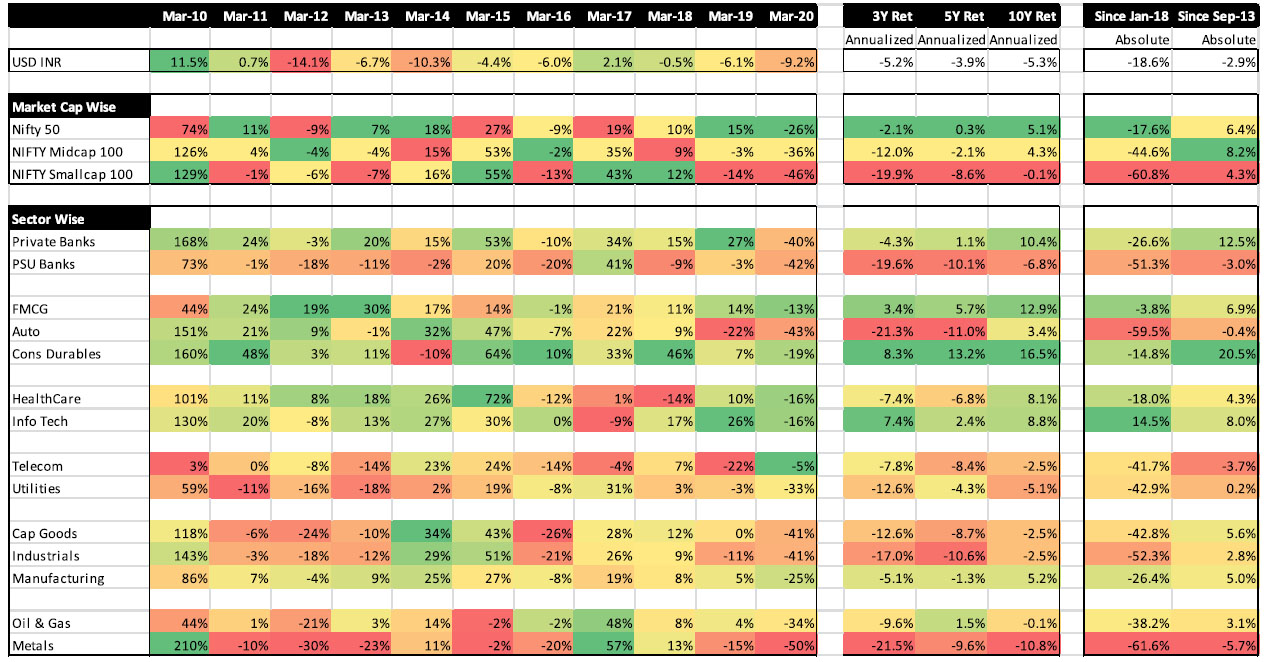

FY 20, worst in last 10 years: For FY 20, the INR has depreciated 9.2%, third worst year in the last 10 years. The NIFTY, Mid and Small Cap indices are down 26%, 36% and 46% respectively, by far the worst FY since the GFC. Telecom has been the key outperformer whereas Defensives - FMCG, IT and HealthCare have also done relatively better. Auto is among the worst performing sectors for a second consecutive year. Apart from the Cyclicals like Metals, Industrials, Infra and PSU Banks, Private Banks are also down 40% for the FY.

Government steps to help migrant labour; RBI enhances liquidity; broader economic package yet to be announced: The Prime Minister, Mr. Narendra Modi, has announced an unprecedented three-week lockdown in the country (effective 25th Mar'20) in a bid to contain the spread of COVID-19. The Finance Minister has also announced several measures to ease the regulatory/compliance burden for taxpayers. Further, the FM has promised an economic relief package, which will be unveiled soon to alleviate the pain of lockdown in the economy. The Reserve Bank of India (RBI) has likewise joined the central government in providing relief to the Indian economy battered by the Covid-19 pandemic. After earlier announcements by the FM on various welfare/relief measures, the RBI unleashed series of steps to soften interest rates, improve liquidity and offer some immediate relief to borrowers. The RBI's announcements include reducing the policy rate by 75bps, providing liquidity in the system, allowing moratorium of term loans for three months to support the affected sections and increasing credit flow in the economy. Moreover, steps have also been taken to iron out issues in the bond markets.

What Next?

As per some estimates, the 21-day lock down would knock-off 4% of GDP. Also, even after the lock down is lifted, economy may not go back to normal immediately. There may be a phased opening of various sectors, consumers too would be hesitant to step out and spend till Corona virus fears subside meaningfully. As many experts have opined - 'a medical problem needs a medical solution'. Till a medical solution, either in form of a vaccine or treatment or the famed Indian immunity is proven effective, concerns could linger. The duration of impact would also vary across sectors. Discretionary spends could be most impacted (multiplexes, Auto, malls, travel, hotels etc) whereas necessities (FMCG, Pharma, Telecom, Utilities) would see a lesser impact. Financials, especially retail oriented could face stress especially w.r.t their unsecured books and loans given to self-employed & SMEs.

Given the nature of the crisis and consequent containment measures, forecasting corporate earnings for FY21E has become difficult with existing earnings estimates facing sharp downside risks. Clearly, Q1 FY 21 will be a quarter like no other, perhaps globally. With sales screeching to close to zero, leverage comes to fore. Companies and sectors with high leverage have always been one of the most impacted in a bear market. In the current one, their infirmities will get magnified. The other segment, which could be impacted are companies trading at high valuations - this is visible in Private sector banks and "high quality" retail oriented" NBFCs, given the impending slowdown in their earnings trajectory, these have registered a sharp knock. Will investor want to pay valuation at 1.5-2 SD higher than their 5yr average, if earnings are going to report a negative y-o-y trajectory for at least next two quarters?

This brings us to another observation - post GFC, private sector banks/ NBFCs - "financial sector" had assumed clear market leadership. Most would not remember, HDFC Bank's weight in the Nifty in September 2008s?* In January 2020, it had crossed 12% weight in the Nifty. If the current down turn develops into a bear market i.e. market fall crosses 3 months duration and over 30% from the peak (One of these two conditions has been achieved) then, like every new bull market, a new sector should assume market leadership. Few "experts" in September'08 thought that Infrastructure would register such shrinkage from the "highs" of Sept'08 levels over the next 10 years. Is financial sector heading for the same fate? This question merits a deep thought; unfortunately, we can only observe and adapt rather than try to make bold predictions. However, such a development has several deep ramifications: Given the weight of Financials in the Nifty, the next highest sector, has a weight of 13%, roughly half. For sector leadership to shift, the sector poised to assume leadership should benefit from - valuation expansion as well as steady earnings growth. Given the valuation of sectors like IT and FMCG trading close to their historic highs, their chances of further multiple expansion remain low, in our view. The next few sectors which could benefit from these twin factors - Pharma and Telecom - have such a low weight that these driving the Nifty appears to be a Herculean task at this juncture.

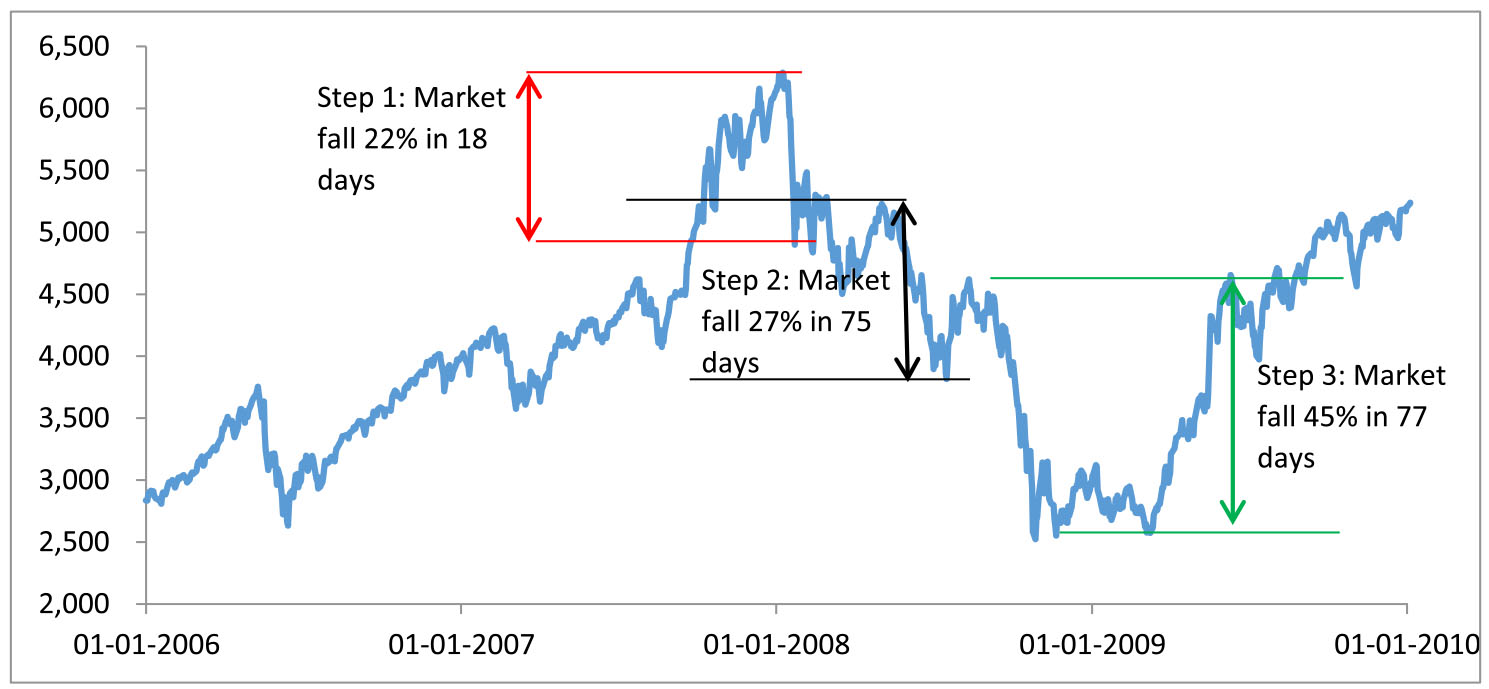

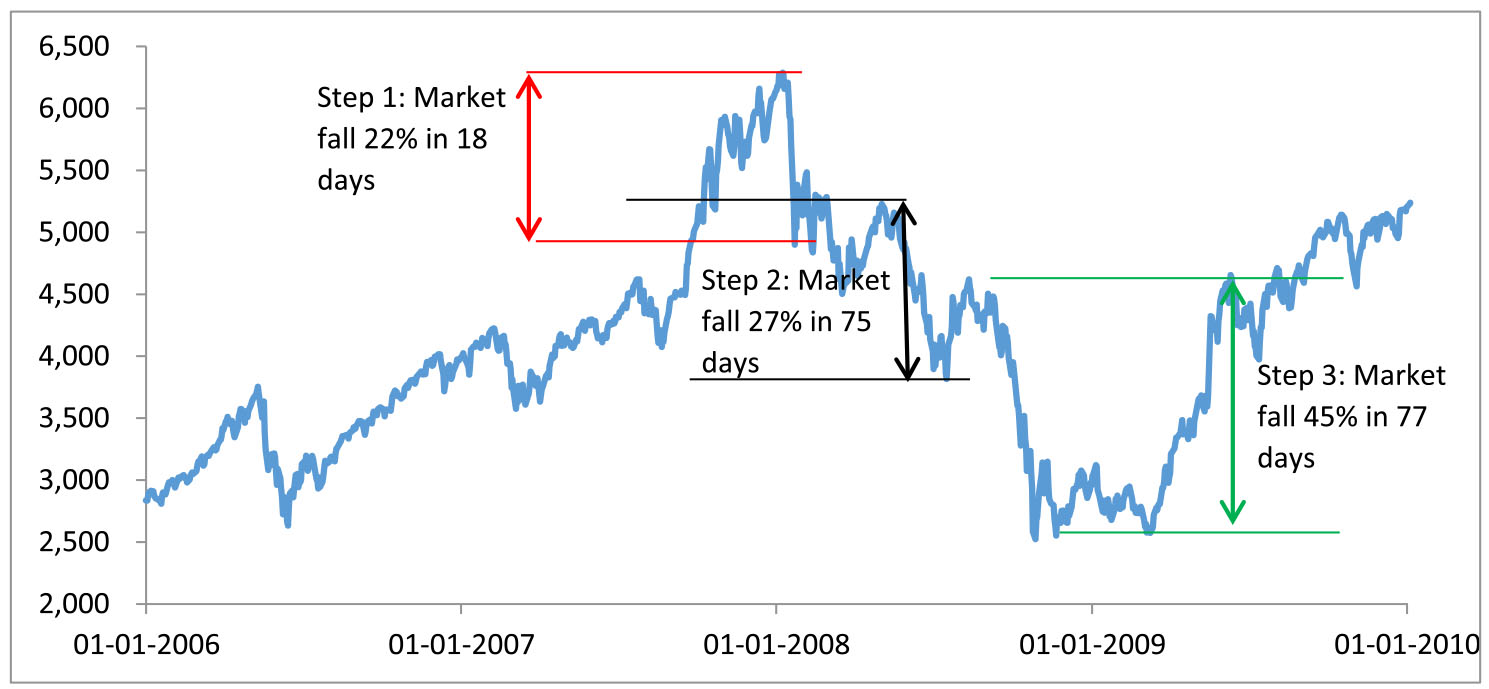

How to play the current market: The 2008 crash lasted around 300 days and the NIFTY fell a total of 60%. But the fall wasn't unidirectional; the market fell in 3 steps as can be seen in the below chart. After each fall, market saw a small (sharp) rebound only to fall lower in the next crash

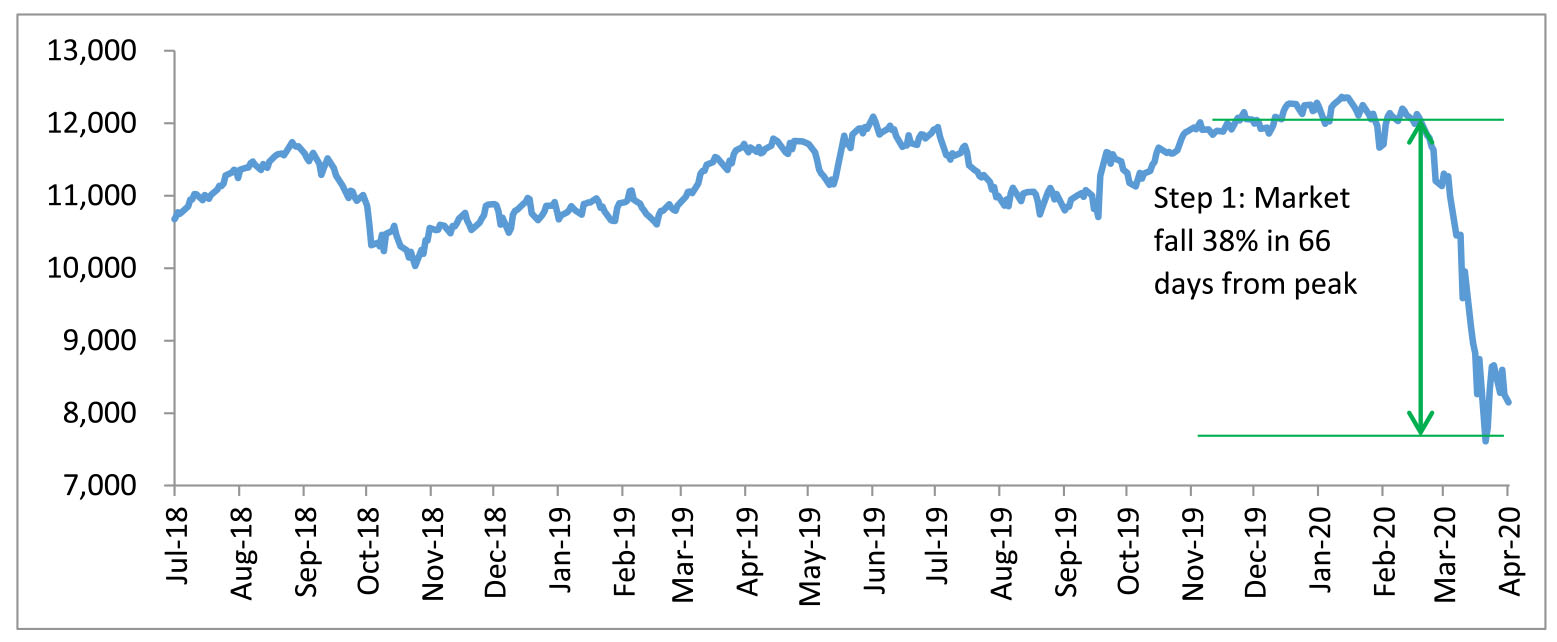

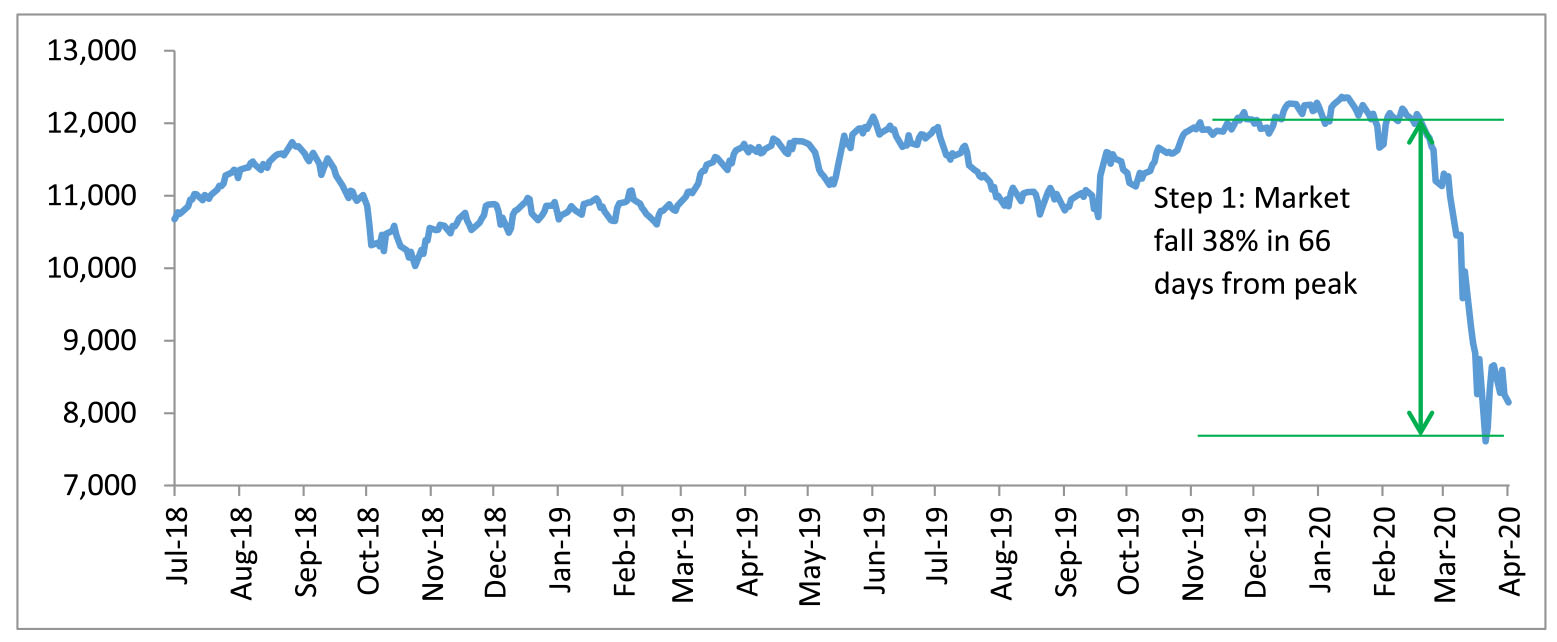

The current crash, as such, has seen only the first step of the crash, though the correction has been much sharper. NIFTY fell 38% from peak to bottom over a period of 66 days. Historically, most bear markets last for at least 3 months. As a result, depending on the extent of the lockdown in India and the rate of spread of COVID-19 across the world, market may see further correction in the coming months. A Big caveat to the above postulation is the discovery of a medical breakthrough in the treatment of Corona Virus leading to a dramatic fall in morbidity rate (currently at 5%). Then markets may have a significant, sharp relief rally and probably creating a base which may not be breached.

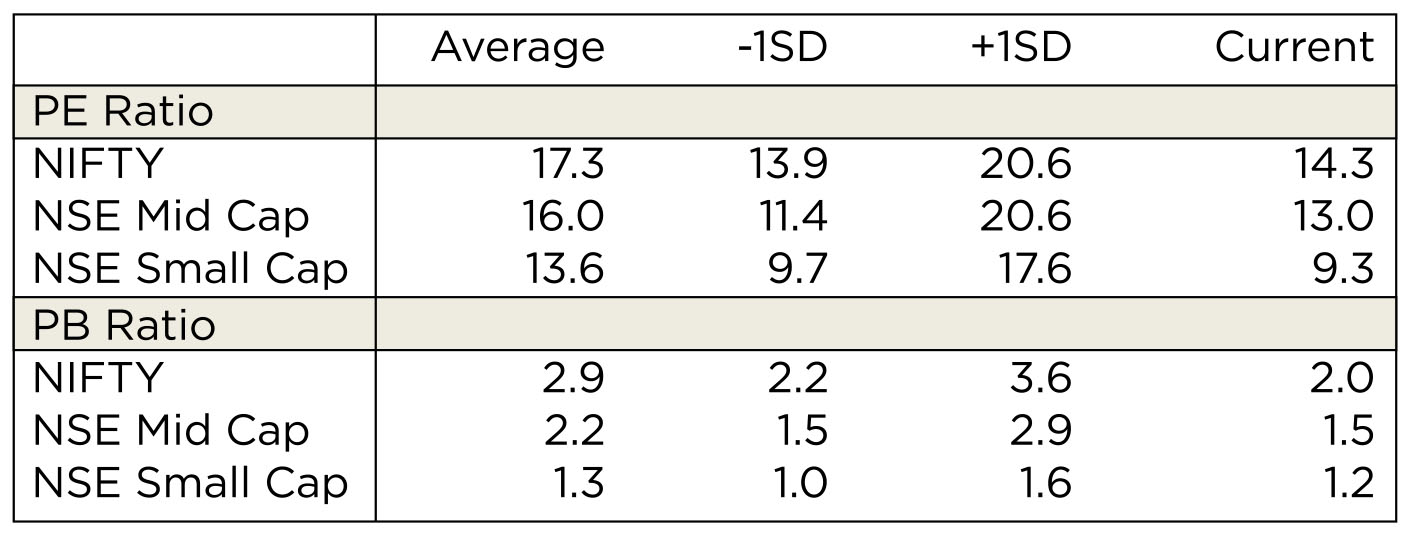

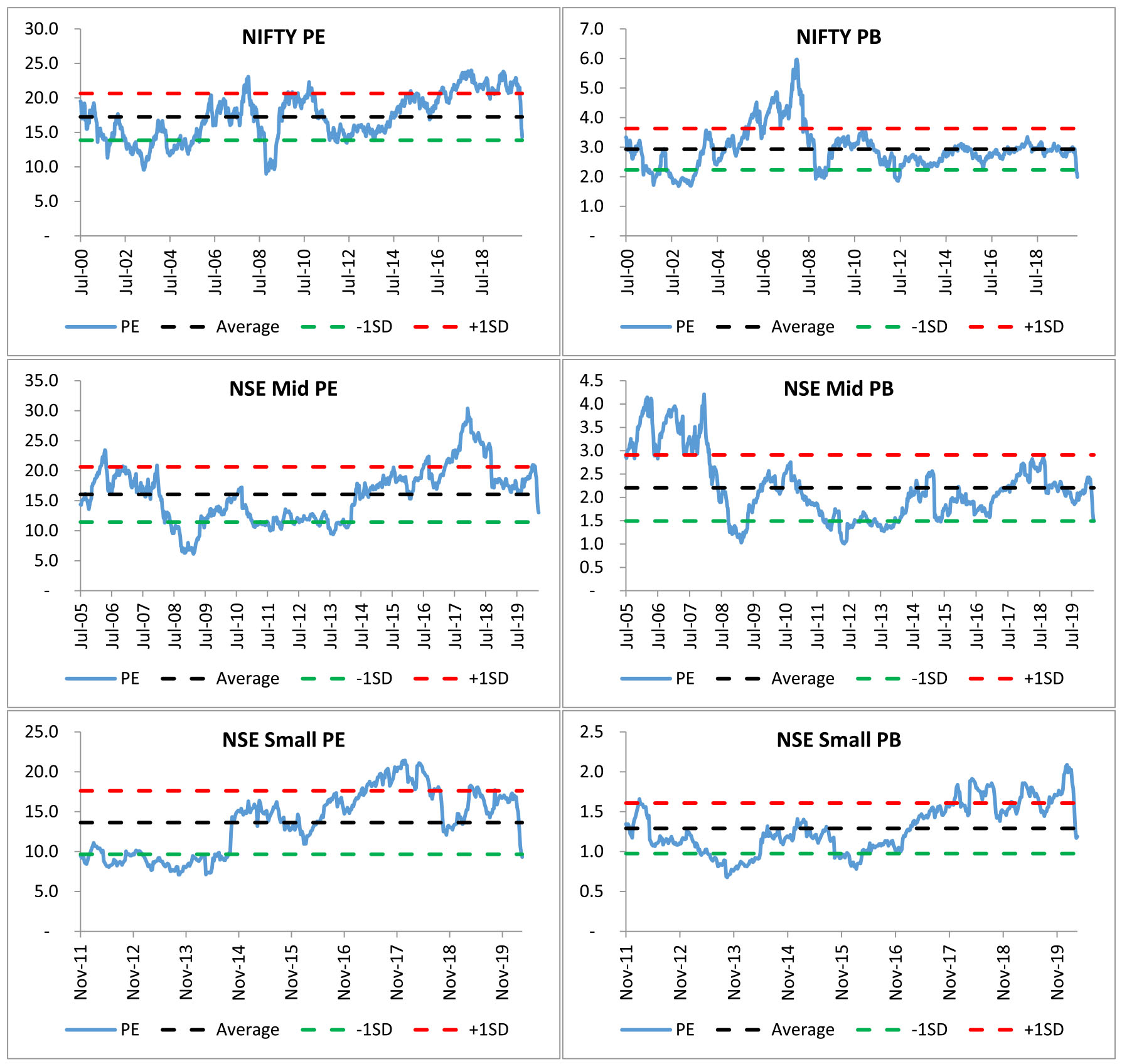

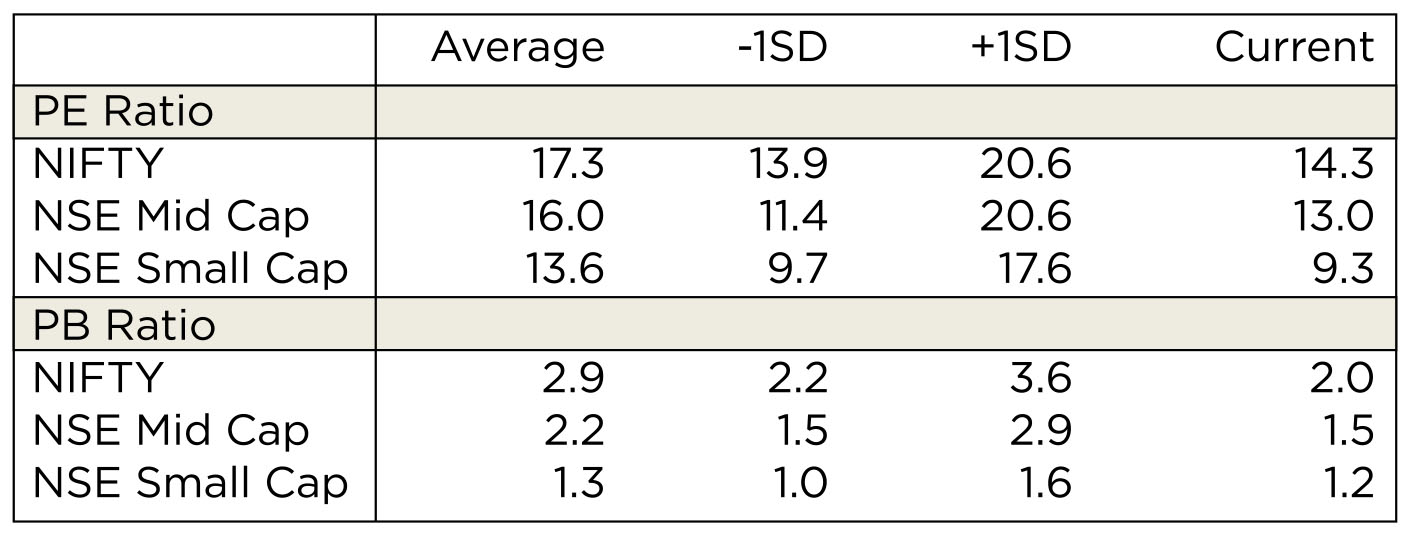

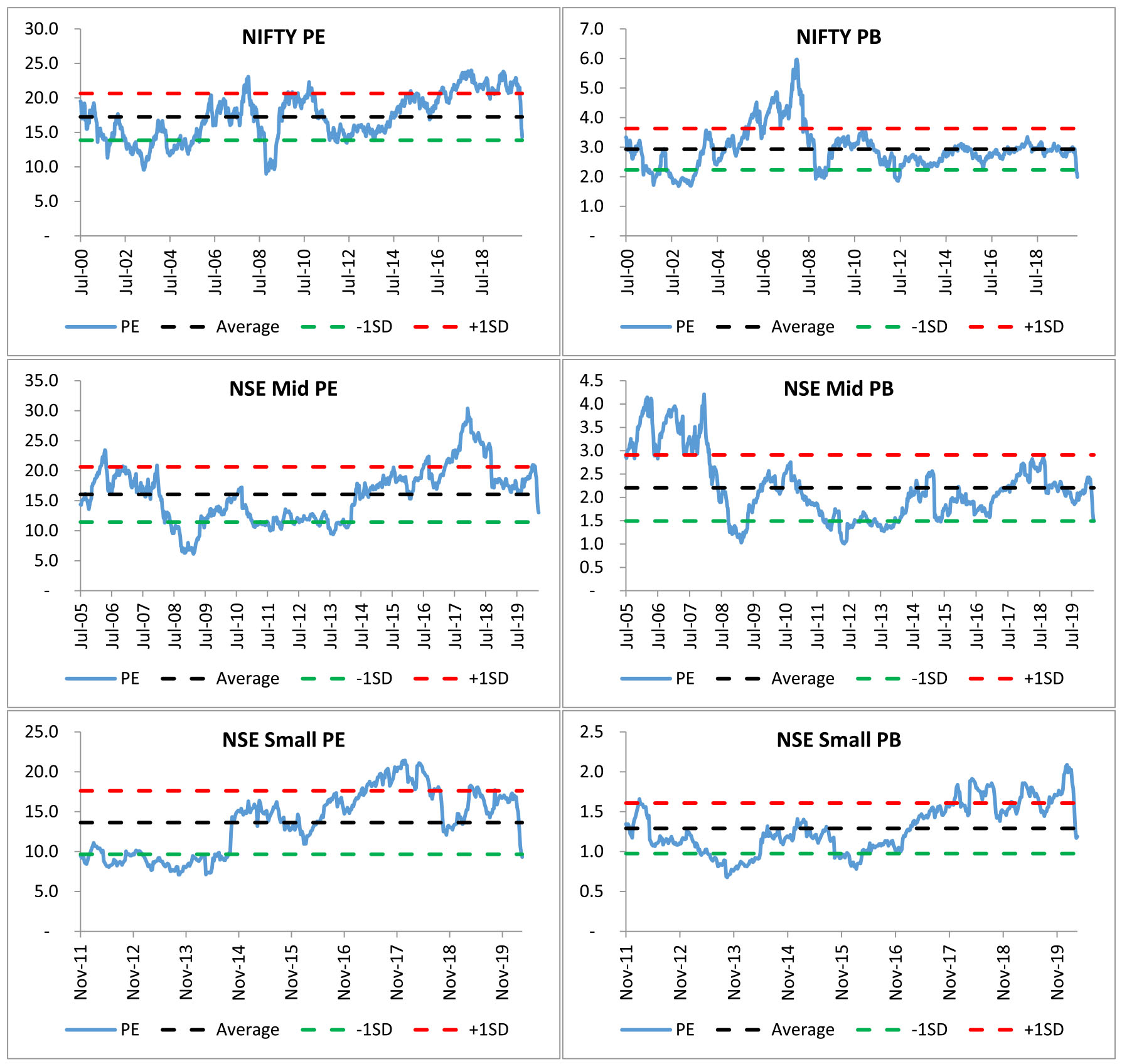

On the positive side, valuations have meaningfully corrected across the board - for Large, Mid and Small Caps as well as for Quality Growth stocks and even most of the largest top 10 stocks. PE ratio for all three indices is close to 1 Standard Deviation (SD) below mean. Currently, earnings uncertainty is high given high uncertainty over the extent of disruption. Even if we look at the PB ratio for these indices, that too is near 1SD below the Long Term average.

Investor Strategy:

Given the sharp fall in the Nifty over the last month and the two years long bear market in Small Caps as well as Mid Caps, we believe market valuations are at attractive levels. However, given the "uniqueness" of the situation, the earnings growth recovery could be uneven and unpredictable across sectors.

Without any medical solution to the medical problem posed by the novel corona virus, market volatility could remain high - sharp falls followed by short surges, though largely conforming to a lower top and lower bottom pattern on the charts. For investors, the current price correction may appear to look attractive and especially in case of individual stocks, buying solely on the basis of %age drop from the peak could be a poor strategy, when applied without factoring in other variables - leverage; Estimated Revenue drop' Management perception etc - which make a company or sector attractive based on its "fundamentals" and not driven solely by the "Price" factor.

It is quite likely, that a medical solution changes the market mood overnight and results in a frantic rally. Chasing such a rally would depend on how long the economy has been held prisoner by the novel Corona Virus. If such a development takes place within the next fortnight to a month, then going "all in" may be a good strategy. If the current uncertainty lingers till the end of June quarter, then the economy may be bruised but not damaged and markets may probably take a few quarters to recover. If the current situation persists beyond these time lines, recovery of equity markets may start getting pushed further and further down the road.

Impact of the recent 1 month return on 3yr/5yr returns

Markets across the world crashed spectacularly in Mar'20 as the extent of the epidemic became clearer. The US stock market which had hit a 52-week high in Feb'20 crashed 31% to hit a 52-week low in March. The speed of the fall was unprecedented as global markets went from 52-week high to 52-week lows in less than a month. The US VIX spiked to above 65, the highest since the 2008 GFC (Global Financial Crisis) when it hit its peak of 80.

Markets across the world have recovered from the panic bottoms seen in mid-March as most countries have announced economic packages to battle the economic downturn. US led the recovery, with S&P 500 recording a decline of 11% for the month of March. This was largely supported by the $2 trillion package, approved by US Senate, amounting to approx.. 10% of GDP. Similarly, countries like France, UK, China etc., have also announced stimulus packages, total global stimulus packages announced have crossed $5 trn, far exceeding those announced at the time of the GFC.

On a headline basis, Emerging Markets (EM) have fallen in line with Developed Markets (DM) (around -23% each). But the fall in individual EMs is much higher - the overall index numbers look better on account of the large weight of China which has fallen only 10%.

The only positive for India from this is the crash in oil prices which was exacerbated by the dispute between Russia and OPEC which could weaken the cartel. Brent corrected 62% MoM to close at $22.74/barrel. The sharp fall in crude will help India's trade deficit as well as fiscal deficit - the government has increased the excise duty on petrol and diesel. Also interest rates have come crashing down globally, with the US 10 year falling 85 bps to close at 0.67%. On the currency front, the Dollar index was flat - UK Pound depreciated 3.6% against the dollar whereas the Euro and JPY yen appreciated 2.3% and 4.2% respectively. The INR depreciated 4.6% MoM to close at 75.34.

Domestic Markets:

Sharp fall in March in line with Global Markets: Domestic Markets too witnessed a sharp fall, with the NIFTY crashing 37% in a 20-day period, one of the sharpest ever fall. The India VIX climbed to 83 from 14, its highest ever level.

All indices correct - though Large caps outperform in the end: Though, initially, mid and small cap indices fell in line with the NIFTY, NIFTY recovered towards the month-end, whereas the broader markets continued to languish, resulting in significant gap in 1M performance between the NIFTY and broader markets. From the peak of Jan-18 NIFTY, NSE Mid Cap and NSE Small Cap have fallen 29.7%, 34.9% and 42.4% respectively. Interestingly, markets are now at levels close to the Sep-13 bottom.

Defensives and Telecom outperform, Private Financials hit: Defensives - HealthCare, FMCG and IT have been the best performing sectors along with Telecom. Telecom has benefited on account of lower competition in the market, expected price hikes in the future and higher data consumption in the extended lockdown. Worst performers have been Metals, Auto and Private Banks. Sharp correction in base metal prices and lower volumes on account of lockdown has impacted metal stocks. Auto stocks have corrected on concerns of plunging sales and BS-IV inventory write-off fears.

Since the GFC of 2008-09, FY 20 is the first year that Private Banks have significantly underperformed the NIFTY, all due to the last 1-month crash. Private Banks and Consumer NBFCs have been the biggest casualty of this correction - and have fallen more than the market and even PSU banks. Growth for these banks in the recent past was driven by a surge in retail loans and working capital credit. After the NPA concerns for Corporate Lenders over the last few years, given the sharp dislocations seen in the real economy due to COVID-19, fears of NPAs from the unsecured retail book have spooked investors.

Top 10 stocks fall in line with the market:Since Jan-18, markets have been highly polarized with the top 10 stocks significantly outperforming the broader markets. In this correction though, the top 10 stocks have fallen in line with the broader markets, some higher than the broader markets - HUL, the only positive among the top 10 whereas all three banks fell more than the market.

FY 20, worst in last 10 years: For FY 20, the INR has depreciated 9.2%, third worst year in the last 10 years. The NIFTY, Mid and Small Cap indices are down 26%, 36% and 46% respectively, by far the worst FY since the GFC. Telecom has been the key outperformer whereas Defensives - FMCG, IT and HealthCare have also done relatively better. Auto is among the worst performing sectors for a second consecutive year. Apart from the Cyclicals like Metals, Industrials, Infra and PSU Banks, Private Banks are also down 40% for the FY.

Government steps to help migrant labour; RBI enhances liquidity; broader economic package yet to be announced: The Prime Minister, Mr. Narendra Modi, has announced an unprecedented three-week lockdown in the country (effective 25th Mar'20) in a bid to contain the spread of COVID-19. The Finance Minister has also announced several measures to ease the regulatory/compliance burden for taxpayers. Further, the FM has promised an economic relief package, which will be unveiled soon to alleviate the pain of lockdown in the economy. The Reserve Bank of India (RBI) has likewise joined the central government in providing relief to the Indian economy battered by the Covid-19 pandemic. After earlier announcements by the FM on various welfare/relief measures, the RBI unleashed series of steps to soften interest rates, improve liquidity and offer some immediate relief to borrowers. The RBI's announcements include reducing the policy rate by 75bps, providing liquidity in the system, allowing moratorium of term loans for three months to support the affected sections and increasing credit flow in the economy. Moreover, steps have also been taken to iron out issues in the bond markets.

What Next?

As per some estimates, the 21-day lock down would knock-off 4% of GDP. Also, even after the lock down is lifted, economy may not go back to normal immediately. There may be a phased opening of various sectors, consumers too would be hesitant to step out and spend till Corona virus fears subside meaningfully. As many experts have opined - 'a medical problem needs a medical solution'. Till a medical solution, either in form of a vaccine or treatment or the famed Indian immunity is proven effective, concerns could linger. The duration of impact would also vary across sectors. Discretionary spends could be most impacted (multiplexes, Auto, malls, travel, hotels etc) whereas necessities (FMCG, Pharma, Telecom, Utilities) would see a lesser impact. Financials, especially retail oriented could face stress especially w.r.t their unsecured books and loans given to self-employed & SMEs.

Given the nature of the crisis and consequent containment measures, forecasting corporate earnings for FY21E has become difficult with existing earnings estimates facing sharp downside risks. Clearly, Q1 FY 21 will be a quarter like no other, perhaps globally. With sales screeching to close to zero, leverage comes to fore. Companies and sectors with high leverage have always been one of the most impacted in a bear market. In the current one, their infirmities will get magnified. The other segment, which could be impacted are companies trading at high valuations - this is visible in Private sector banks and "high quality" retail oriented" NBFCs, given the impending slowdown in their earnings trajectory, these have registered a sharp knock. Will investor want to pay valuation at 1.5-2 SD higher than their 5yr average, if earnings are going to report a negative y-o-y trajectory for at least next two quarters?

This brings us to another observation - post GFC, private sector banks/ NBFCs - "financial sector" had assumed clear market leadership. Most would not remember, HDFC Bank's weight in the Nifty in September 2008s?* In January 2020, it had crossed 12% weight in the Nifty. If the current down turn develops into a bear market i.e. market fall crosses 3 months duration and over 30% from the peak (One of these two conditions has been achieved) then, like every new bull market, a new sector should assume market leadership. Few "experts" in September'08 thought that Infrastructure would register such shrinkage from the "highs" of Sept'08 levels over the next 10 years. Is financial sector heading for the same fate? This question merits a deep thought; unfortunately, we can only observe and adapt rather than try to make bold predictions. However, such a development has several deep ramifications: Given the weight of Financials in the Nifty, the next highest sector, has a weight of 13%, roughly half. For sector leadership to shift, the sector poised to assume leadership should benefit from - valuation expansion as well as steady earnings growth. Given the valuation of sectors like IT and FMCG trading close to their historic highs, their chances of further multiple expansion remain low, in our view. The next few sectors which could benefit from these twin factors - Pharma and Telecom - have such a low weight that these driving the Nifty appears to be a Herculean task at this juncture.

How to play the current market: The 2008 crash lasted around 300 days and the NIFTY fell a total of 60%. But the fall wasn't unidirectional; the market fell in 3 steps as can be seen in the below chart. After each fall, market saw a small (sharp) rebound only to fall lower in the next crash

The current crash, as such, has seen only the first step of the crash, though the correction has been much sharper. NIFTY fell 38% from peak to bottom over a period of 66 days. Historically, most bear markets last for at least 3 months. As a result, depending on the extent of the lockdown in India and the rate of spread of COVID-19 across the world, market may see further correction in the coming months. A Big caveat to the above postulation is the discovery of a medical breakthrough in the treatment of Corona Virus leading to a dramatic fall in morbidity rate (currently at 5%). Then markets may have a significant, sharp relief rally and probably creating a base which may not be breached.

On the positive side, valuations have meaningfully corrected across the board - for Large, Mid and Small Caps as well as for Quality Growth stocks and even most of the largest top 10 stocks. PE ratio for all three indices is close to 1 Standard Deviation (SD) below mean. Currently, earnings uncertainty is high given high uncertainty over the extent of disruption. Even if we look at the PB ratio for these indices, that too is near 1SD below the Long Term average.

Investor Strategy:

Given the sharp fall in the Nifty over the last month and the two years long bear market in Small Caps as well as Mid Caps, we believe market valuations are at attractive levels. However, given the "uniqueness" of the situation, the earnings growth recovery could be uneven and unpredictable across sectors.

Without any medical solution to the medical problem posed by the novel corona virus, market volatility could remain high - sharp falls followed by short surges, though largely conforming to a lower top and lower bottom pattern on the charts. For investors, the current price correction may appear to look attractive and especially in case of individual stocks, buying solely on the basis of %age drop from the peak could be a poor strategy, when applied without factoring in other variables - leverage; Estimated Revenue drop' Management perception etc - which make a company or sector attractive based on its "fundamentals" and not driven solely by the "Price" factor.

It is quite likely, that a medical solution changes the market mood overnight and results in a frantic rally. Chasing such a rally would depend on how long the economy has been held prisoner by the novel Corona Virus. If such a development takes place within the next fortnight to a month, then going "all in" may be a good strategy. If the current uncertainty lingers till the end of June quarter, then the economy may be bruised but not damaged and markets may probably take a few quarters to recover. If the current situation persists beyond these time lines, recovery of equity markets may start getting pushed further and further down the road.

Impact of the recent 1 month return on 3yr/5yr returns

| Equity Markets | Index | % Change YTD | % Change MTD | P/E |

| Nifty | 8,597.75 | -29.34% | -23.25% | 13.12 |

| Sensex | 29,468.49 | -28.57% | -23.05% | 13.85 |

| Dow Jones | 21,917.16 | -23.20% | -13.74% | 16.79 |

| Shanghai | 2,750.30 | -9.83% | -4.51% | 10.78 |

| Nikkei | 18,917.01 | -20.04% | -10.53% | 14.91 |

| Hang Sang | 23,603.48 | -16.27% | -9.67% | 10.23 |

| FTSE 5,671.96 -24.80% -13.81% | 12.45 | |||

| MSCI E.M. (USD) | 848.58 | -23.87% | -15.61% | 11.81 |

| MSCI D.M.(USD) | 1,852.73 | -21.44% | -13.47% | 16.02 |

| MSCI India (INR) | 994.79 | -27.36% | -21.82% | 13.12 |

| Currency & Commodities | Last Price % | Change YTD % | Change MTD |

| USD / INR | 75.543 | 5.83% | 4.66% |

| Dollar Index | 99.05 | 2.76% | 0.93% |

| Gold | 1,577.18 | 3.95% | -0.54% |

| WTI (Nymex) | 20.48 | -66.46% | -54.24% |

| Brent Crude | 22.74 | -65.55% | -54.99% |

| India Macro Analysis | Latest | Equity Flows | USD Mn |

| GDP | 4.70 | FII (USD mln) | |

| IIP | 2.00 | YTD | 2,371.78 |

| Inflation (WPI Monthly) | 2.26/td> | MTD | 395.50 |

| Inflation (CPI Monthly) | 6.58 | *DII (USD mln) | |

| Commodity (CRB Index) | 370.20 | YTD | 925.54 |

| Source: Bloomberg | MTD | 1,237.47 | |

| *DII : Domestic Mutual Funds Data as on 31st March 2020 | |||

Mr. Suyash Choudhary

Head - Fixed Income

WHAT WENT BY

March was a month of unprecedented market volatility especially in Emerging Market (EM) assets as the global risk off trade escalated with the Covid-19 outbreak evolving into a full-blown global pandemic with its rapid spread beyond China & its immediate neighbors. Various countries, including India introduced lockdown measures crippling economic activity, driving unemployment & repressing international trade leading to concerns on deep contraction in global GDP leading to substantial outflows from EMs in favour of dollar. The dollar strengthened against most of the major currencies with dollar index climbing to its 3 year high (102.88) while treasuries rallied to their historic levels with 10 year US treasury bond falling below 0.7% for the 1st time ever. Commodities barring gold fell sharply with oil falling the most (55%) due to the twin shocks of Covid-19 & market share battle between Saudi Arabia & Russia.

Various central banks and governments tried to pull out all stops to quell the impact of Covid-19 on the global economy led by both the Fed and the ECB which delivered on "whatever it takes" sentiment with 'bazooka' policy easing actions.

The federal reserve reduced its Federal funds target range from 1.50-1.75% at the end of February to 0.00-0.25%. Amongst its other noteworthy measures, it also announced buying of potentially unlimited amount of Treasury securities and agency mortgage-backed securities (it has purchased north of $ 1 trillion since the announcement), new programs to support the flow of credit to employers, consumers, and businesses by providing up to $300 billion in new financing. The Treasury, using the Exchange Stabilization fund (ESF), will provide $30 billion in equity (split evenly) across three facilities: (1) $10 billion in the Primary Market Corporate Credit Facility (PMCCF) to support new bond and loan issuance, (2) $10 billion the Secondary Market Corporate Credit Facility (SMCCF) to provide liquidity for outstanding corporate bonds, and (3) $10 billion in the Term Asset-Backed Securities Loan Facility (TALF) to support issuance of asset backed securities (ABS). The size and potentially the scope of the combined $300 billion facility could further expand if Congress were to grant additional capital to the ESF. In response to a freeze in the commercial paper market, it launched a Commercial Paper Funding Facility (CPFF), designed to assure market access to A1/P1/F1 issuers while also launching a Money Market Mutual Fund Liquidity Facility (MMLF) to enable provision of liquidity to prime and municipal money funds. The USD swap line facilities have been opened with numerous central banks to ensure that there is adequate USD liquidity in the global markets.

The US Congress passed the fiscal stimulus package - amounts to ~10% of US GDP at around USD 2.2 tn. Among the most important economic provisions are a (1) $377bn (1.8% of GDP) small business program that will provide affected businesses with loans that they will not need to repay if the proceeds are used to pay wages or other necessities; (2) $500bn (2.4% of GDP) in capital for loans and loan guarantees, including $454bn that the Treasury may use to backstop Fed facilities to provide business credit; (3) $250bn (1.2% of GDP) in payments to individuals ($1200 per adult, $500 per child); (4) approx. $250bn (1.2% of GDP) in expanded unemployment insurance that will replace a worker's lost wages, on average; (5) $150bn (0.7% of GDP) in fiscal aid to states, which should mostly offset the effects of COVID-19 on state/local budgets; and (6) $340bn (1.6% of GDP) in federal spending, of which $130bn is direct to hospitals and health care efforts.

The ECB in an unscheduled meeting on 18th March announced an additional EUR750bn of asset purchases until the end of the year on top of the previous measures. This will take its totally monthly purchases to around EUR110bn per month, although the ECB will have the flexibility to buy when it is most needed. Assets eligible for purchase were expanded to include non-financial Commercial Paper and a waiver was granted to include Greek assets. At the same time, the ECB eased the collateral requirements for its market operations

While bonds initially rallied in March taking comfort from global central bank easing measures with the 10 year India Government bond benchmark hitting 6.06% briefly in early March, it proved to be a temporary reprieve as EM assets continued to sell off on strong safe haven demand due to concerns on the depth & length of the slowdown. With Indian bonds seeing a record FPI selling (Rs. 58,579 crs) & uncertainty on RBI's policy action, the 10 year benchmark yield rose to 6.41% before rallying & ending the month at 6.14% after easing measures by RBI in its preponed MPC meet on 27th. Major policy announcements were as under:

► Repo rate cut by 75 bps and reverse repo by 90 bps to 4.4% and 4% respectively. Thereby the corridor stands wider at 40 bps from 25 bps earlier.

► RBI to conduct Targeted Long Term Repo Operations (TLTROs) for up to 3 years amounting to a total of INR 1 lakh crores. Liquidity availed under the scheme by banks has to be deployed in investment grade corporate bonds, commercial paper, and non-convertible debentures over and above the outstanding level of their investments in these bonds as on March 27, 2020. Investments made by banks under this facility will be classified as held to maturity (HTM) even in excess of 25% of total investment permitted to be included in the HTM portfolio. This led to a major rally in front end of the market with 2-5 year AAA bonds falling by 100-150bps on the expected demand from banking system.

► Cash Reserve Ratio (CRR) was cut by 1% to 3% effective the immediate fortnight for a period of 1 year. This will release INR 1.37 lakh crore liquidity into the system. Also daily CRR maintenance requirement reduced to 80% from 90% till June end.

► MSF limit raised from 2% of SLR to 3% of SLR effective immediately till end June. This will potentially provide access to another INR 1.37 lakh crores under the RBI window.

► Various sorts of moratorium and dispensations on payment and recognitions have been provided without any impact required to be recognized on asset quality or the credit history of the beneficiary. The last tranche of capital conservation buffer has also been deferred. Also, banks' access to the non-deliverable forward (NDF) market in currency has been partially allowed.

The RBI also released the market borrowing calendar for H1FY21. As per the calendar, the central government has pegged the H1 FY21 gross g-sec borrowing at Rs 4.88 trillion (62.6% of the full year budgeted target vs 62.3% in FY20). Indicative SDL borrowing calendar for Q1 FY21 showed Rs 1.27 lakh crs gross borrowing v/s tentative Rs. 1.1 lakh crs & actual borrowing of Rs. 956 Bn in 1QFY20.

In a significant opening up of bond markets, the RBI also announced a new channel for foreign investors to access India bonds, free of investment limits. The RBI and government introduced the 'Fully Accessible Route' or FAR, a new channel for foreign investors to invest in India government bonds, as indicated during the presentation of the FY21 budget. Under this route, foreign investors will be permitted to invest into specific government securities without any limit on foreign ownership. The RBI disclosed the specific bonds that are currently under the FAR but also stated that the, "new issuances of Government securities of 5-year, 10year and 30-year tenors from the financial year 2020-21 will be eligible for investment under the FAR". Separately, the RBI also increased the corporate bond limit to 15% from 9% as previously. While it positive for bond inflows and potential index inclusion in the medium term, it has limited near term implications.

Going Forward:

The RBI has now put to rest the concern that it was failing to appreciate the required pivot to emergency conditions. With these measures, it has addressed 3 of the 4 near term actions that we were expecting (https://www.idfcmf.com/article/1487). Thus an aggressive rate cut and an expansion of LTRO have been delivered whereas the RBI has been much more imaginative than we had been in addressing the stress in corporate and money markets.

While RBI's policy measures, has helped stabilize the market and ease somewhat the very tight financial conditions, more measures can be taken depending upon the efficacy of the first set. It is to be noted that India's last year's growth was already way below its assessed potential growth rate. This underscores the urgency of a meaningful response. Also, the RBI is the only agent in the system currently with the wherewithal to actually provide a sizeable response. An important dimension that remains is for a very large open market operation (OMO) bond buying program. The format globally now is evolving around monetary expansion supporting fiscal policy and India needs to do the same. While the first response fiscal measures announced by the FM address the most susceptible citizens in a targeted way, the government will soon also have to address the wider economy, given the substantial loss in output that is underway currently. However, there are already natural pressures on its finances and we already expect a 100 bps slippage risk in the 3.5% stated deficit. Importantly, the states face their own constraints and may well be ultimately allowed to breach the 3% deficit mark. Forced fiscal consolidation is not an option, whereas an expansion not supported by RBI via government bond absorption risks spiking sovereign yields and thereby working against the objective of financial conditions easing.

Thus it is almost a given that India will also have to ramp up its fiscal stimulus in the months to come. The important necessary condition for it to do so is RBI effectively monetizing the incremental deficit. A fundamental flaw to be avoided is to not recognize the fiscal expansion embedded in expenditure expansion by assuming that the fiscal incentive now will quickly regenerate growth and hence tax revenues. Rather this has to be planned well and monetary policy has to support such expansion from the start in order to not let financial conditions tighten in response.

It is here that speed of action from the central bank is also important alongside the size, since greater speed controls the unnecessary destruction of risk capital in the system. Nevertheless now that RBI's hand is revealed, market volatility should substantially lessen allowing investors to focus on the medium term. From this perspective, quality bonds especially in the front end (up to 5 years) offer immense value in our view. Spreads over repo are substantially higher than the average of the past few years and argue for immediate action from investors.