Commentary

27th November 2020

WHAT WENT BY

Global Markets

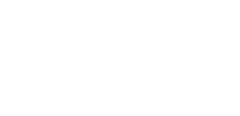

Global equities recorded their best month ever

in November with MSCI ACWI up +12.2% (USD)

after two consecutive months of declines.

European equities (SXXP +17%) outperformed

their US counterparts (SPX +11%) in November.

The VIX index declined 46% MoM to end the

month at 21. Despite increasing Covid-19 cases

and local lockdowns in much of the US and the

EU, risk assets saw a remarkable rally aided

by positive news flow around highly effective

potential vaccines and a stock market favourable

US election result.

US Elections: The much awaited global event of 2020, the US presidential election, is finally behind us and broadly in line with the market expectations, Democratic President nominee Joe Biden is projected to become the next President of the United States. For the global economy, a Biden-led administration could potentially imply a more "conventional" foreign policy from the US relatively to the Trump administration. Hence, a less vocal, more nuanced policy actions could be expected from the new administration. China, may remain the biggest challenge, which even a Democrat President, would not cede ground to. However, trade issues with Western European countries may see a swift conclusion. Most analysts expect a Biden administration would also resort to a lesser restrictive immigration policy that would be favourable as well.

US Elections: The much awaited global event of 2020, the US presidential election, is finally behind us and broadly in line with the market expectations, Democratic President nominee Joe Biden is projected to become the next President of the United States. For the global economy, a Biden-led administration could potentially imply a more "conventional" foreign policy from the US relatively to the Trump administration. Hence, a less vocal, more nuanced policy actions could be expected from the new administration. China, may remain the biggest challenge, which even a Democrat President, would not cede ground to. However, trade issues with Western European countries may see a swift conclusion. Most analysts expect a Biden administration would also resort to a lesser restrictive immigration policy that would be favourable as well.

Covid-19 & Vaccine: Covid-19 vaccines being developed by Pfizer/BioNTech and Moderna achieved 90%+ efficacy in stage 3 trials. The Aztra Zenca/Oxford vaccine on the other hand reported 70% efficacy on average, with efficacy of 90% in a particular dosing phenomenon. More importantly, no participant who got the vaccine developed severe symptoms of Covid-19. With vaccine efficacy established, focus will now shift to approvals and distribution.

Though vaccine efficacy has been established injecting sufficient people so as to achieve herd immunity will still take time. In the meanwhile, cases and deaths globally continue to rise. This could potentially result in lockdowns and other measures to control the "second wave".

Domestic Markets

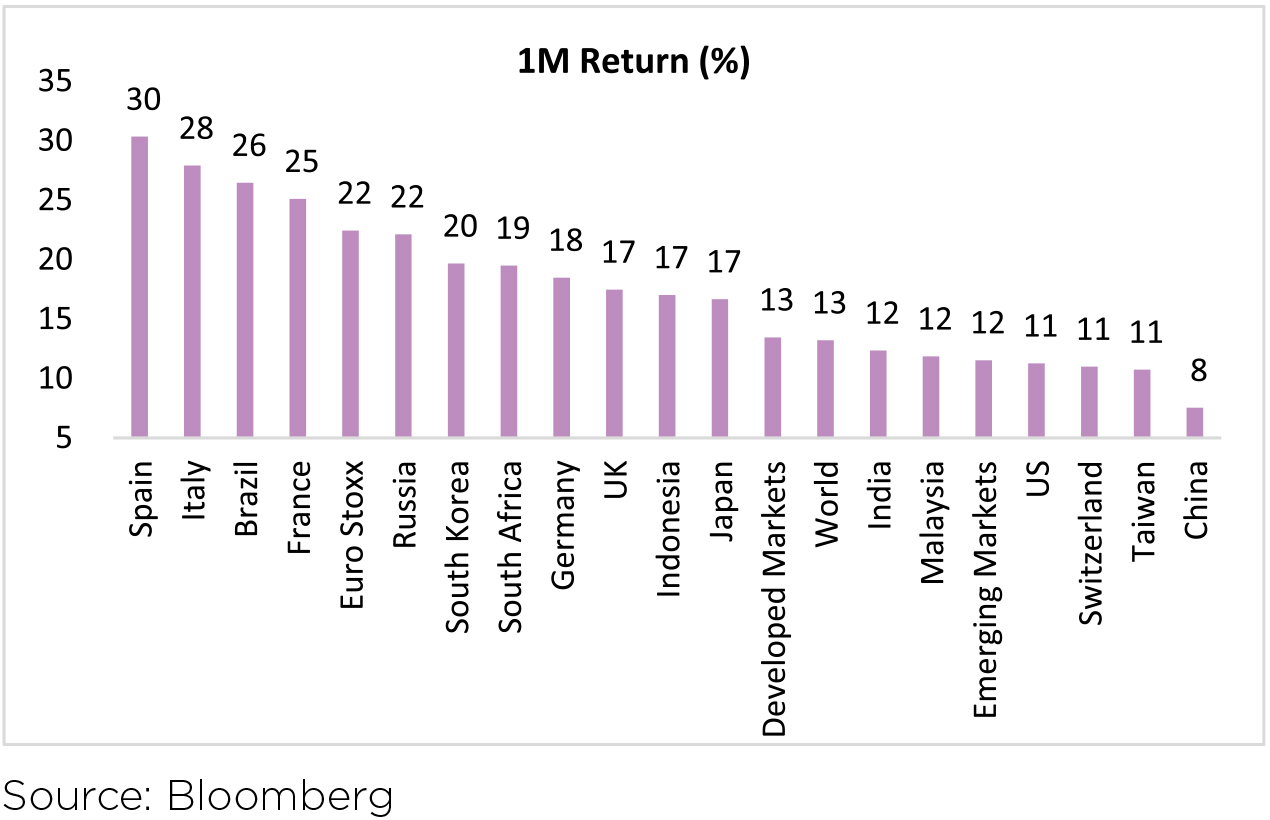

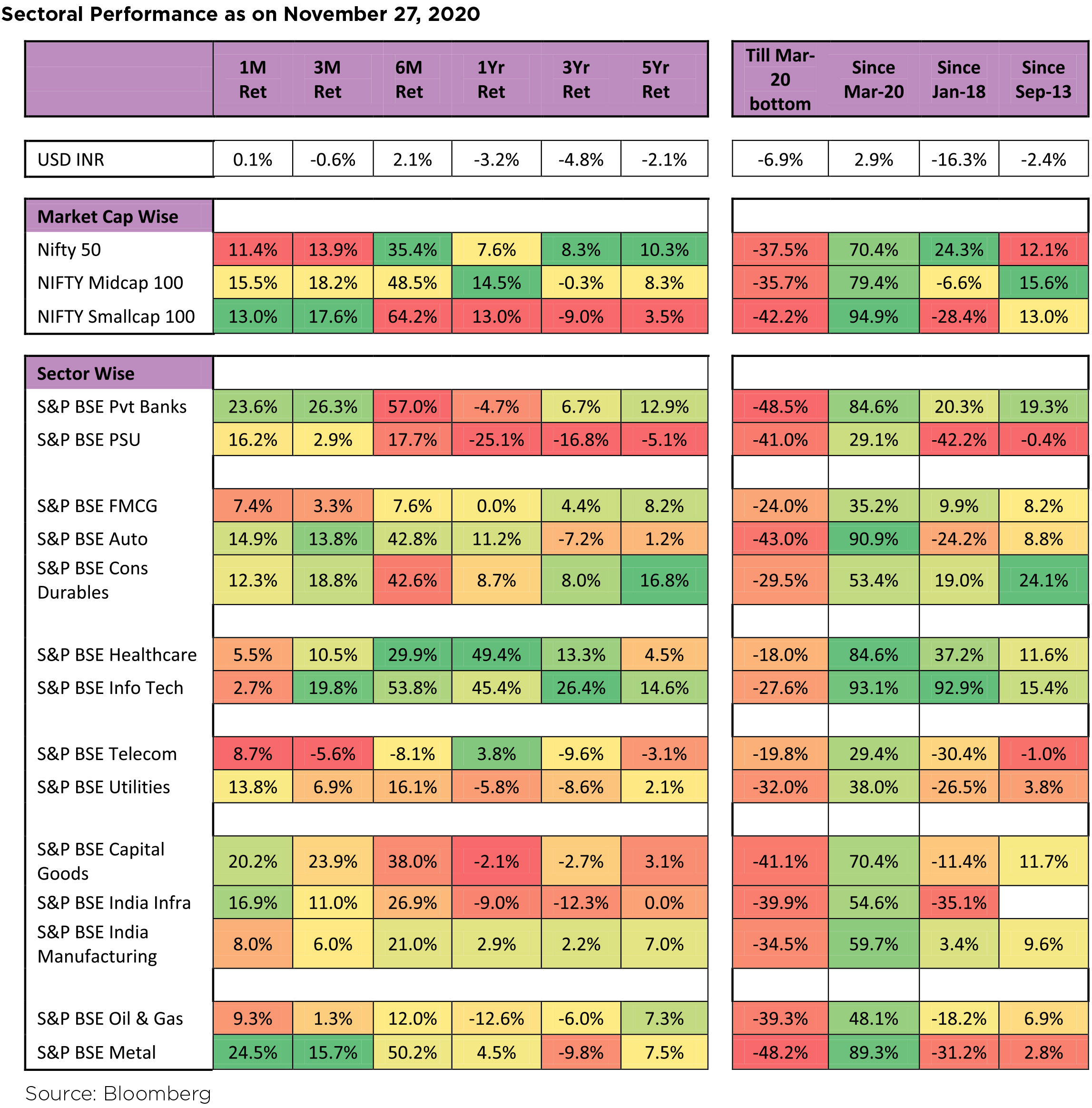

In line with global equities, Indian equities also saw a sharp rally in November. Domestically, the focus was on 2QFY21 earnings and a gradual reopening of the economy. Covid-19 cases in India continue to decline from their peak in mid-September even as the EU and the US are witnessing increases in Covid-19 cases. Q2 FY21 earnings season was much better than expected, with broadbased beats and upgrades. NIFTY and BSE200 FY22 earnings were upgraded for the first time in 23 quarters. NIFTY, NSE Mid Cap and NSE Small Cap were higher 11%, 16% and 13% respectively for the month. Since the market bottom of 23-Mar-20, Small Cap index has almost doubled (+95%), whereas NIFTY and NSE Mid Cap indices are up 70% and 79% respectively.

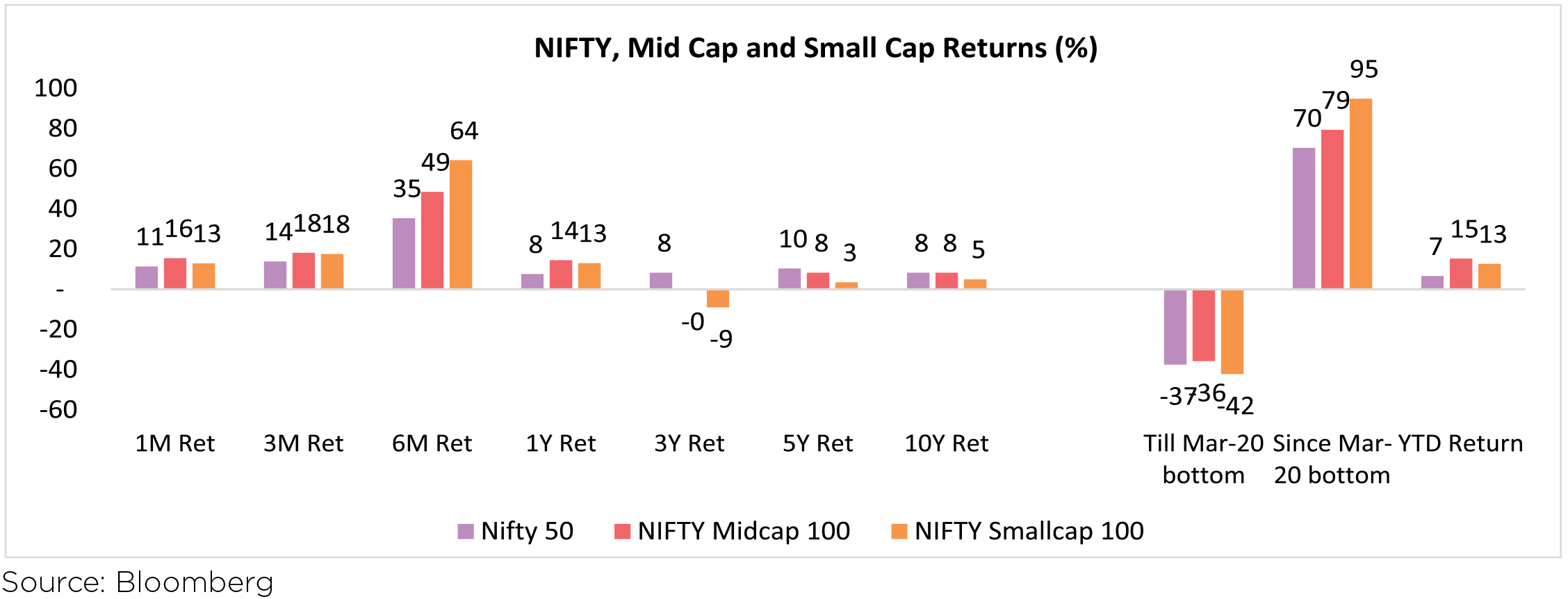

Q2 FY21 Earnings Season

Q2 FY21 was one of the best quarters in the last many years in terms of ratio of positive to negative surprises on

earnings, though earnings estimates were significantly lowered after the last 2 quarters. Ex Financials, Sales degrew

7%, slightly above estimates. Margins beat even most optimistic estimates with EBITDA growing 12%. Including

Financials, PBT grew 20% and PAT grew 21%. PAT YoY is not exactly comparable as base had many one-offs due

to the changes in tax rate in the base quarter. For 1H, Financials have supported profits with PAT falling 9% overall

but down 26% ex financials. On all accounts even Sales (-20% YoY) were much better than initial estimates when

the lockdown started. While sales growth was in-line, (1) better-than-expected demand recovery, (2) continued cost

control measures, and (3) lower-than-expected provisioning costs for the BFSI segment drove a spectacular profit

beat.

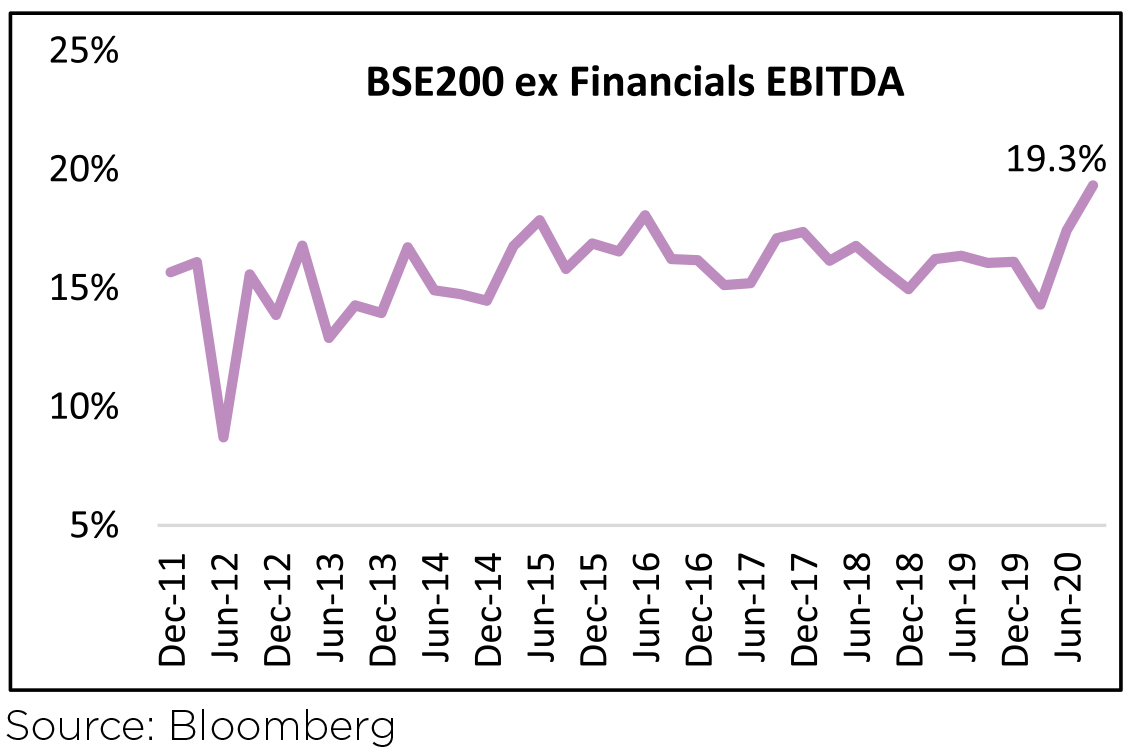

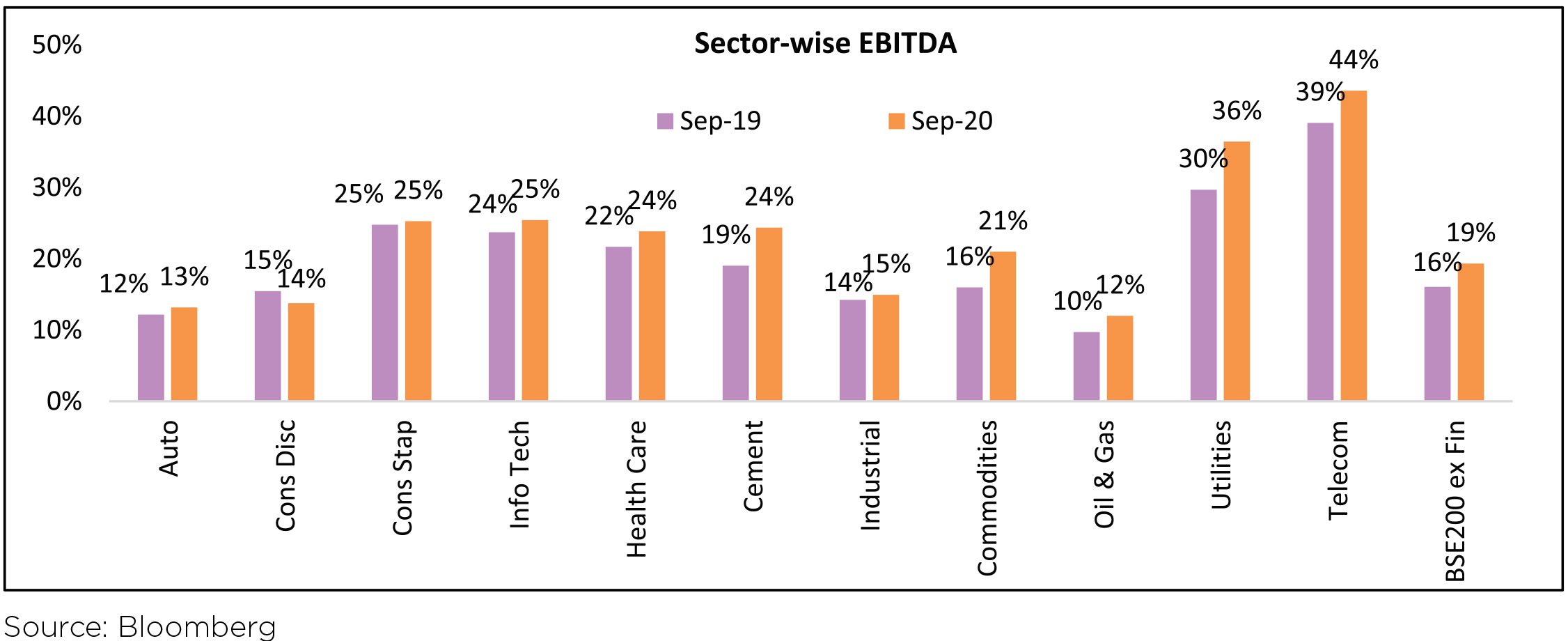

Sales have seen de-growth for five consecutive

quarters, including a 32% degrowth in Q1 of this

year. This sets a very low base of sales for the next 5

quarters. EBITDA grew 12% YoY led by broad-based

margin expansion across sectors as can be seen in the

chart. Even in Q1, EBITDA fell lower than Sales. Four

of the last five quarters, EBITDA has done better than

Sales. EBITDA Margin for BSE200 ex Financials came

at 19.3%, highest since 2011 atleast. Margin expansion

was broad-based across sectors except in Consumer

Discretionary. Margins expanded on the back of: 1)

Lower discounts across sectors like Auto, Cement etc.

2) Significant curtailment in discretionary spends like

ad spends, travel etc. 3) Temporary salary cuts in and

temporary reduction in rents in sectors with higher

impact like Retail, Industrials etc. and 4) Reversal of inventory losses in sectors like Oil & Gas, Metals etc.

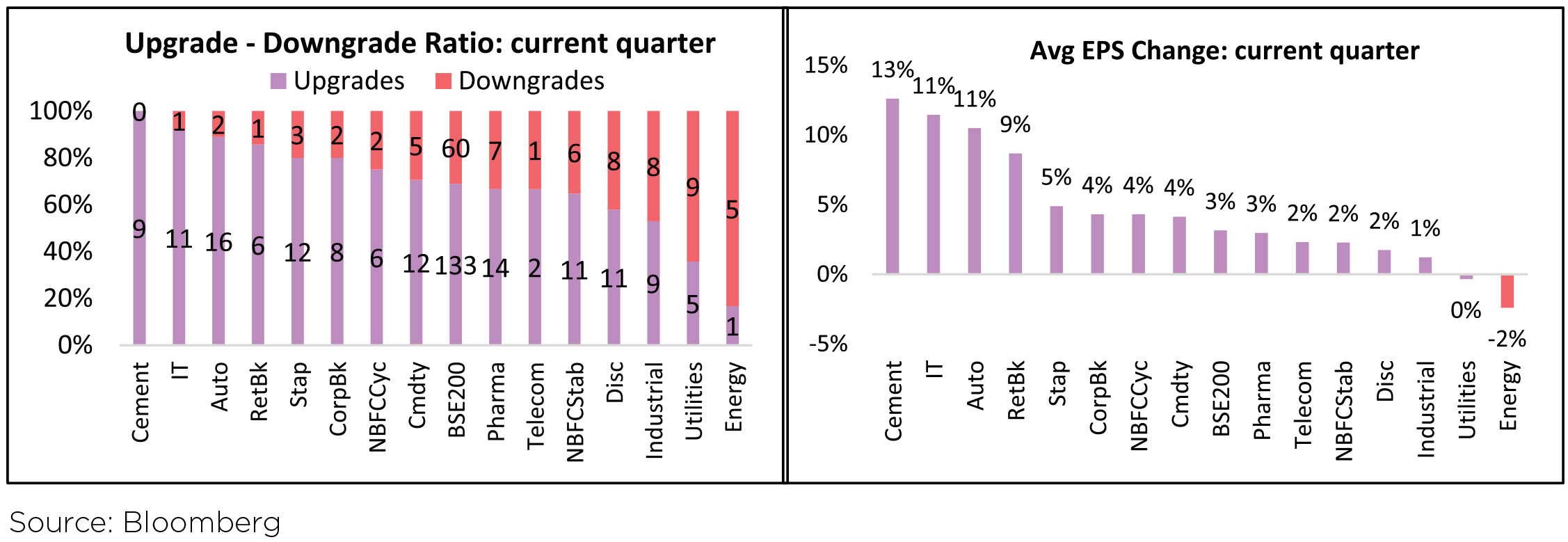

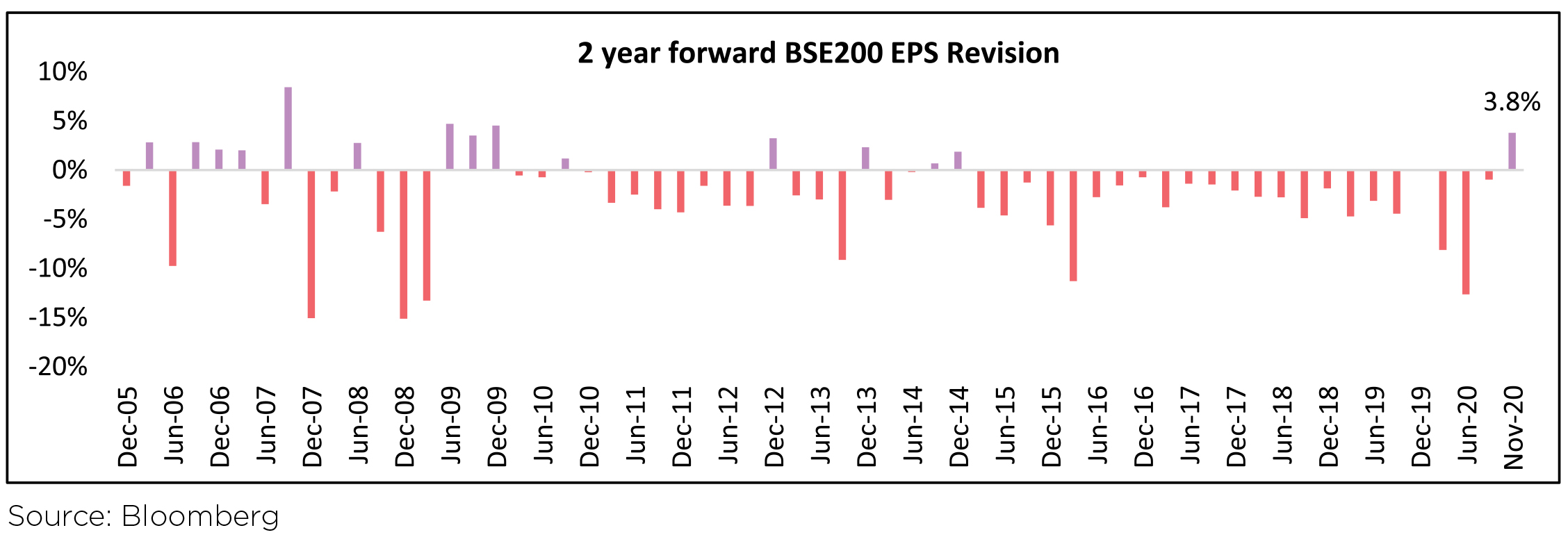

Q2 FY21 saw broad-based upgrades to 2 year forward (FY22) estimates. EPS for 133 companies was upgraded as compared to 60 downgrades. Cement saw upgrades in earnings of all 9 companies, whereas IT and Auto saw upgrades in 11 of 12 and 16 of 18 companies respectively. Average EPS for BSE200 was up 3% in the quarter led by Cement (+13%), IT (+11%) and Auto (+11%).

After 23 quarters of continuous downgrades, this was the first reporting season when consensus lifted its BSE200 EPS. This has resulted in the first material earnings upgrade for EPS estimates in many years. More importantly, corporate commentaries across the sector suggest continued demand recovery in 3QFY21, underpinned by a healthy start to the festive season.

Covid-19 in India: India reached the peak of the Covid-19 pandemic in mid-September and has witnessed a decline in daily cases and number of deaths since then. Daily new Covid-19 cases averaged ~43k in November vs. ~60k in October and ~87k in September. Daily deaths averaged at 517 in November lower than October (756) and September (1,113). Although daily tests at 1.02mn/day in November were lower vs. October (1.12mn/day), the positive rate continued to decline to 3.8% in end-November vs. 4.3% in end-October and 7.3% in end-September. Globally, India has the third-highest number of deaths at ~138k behind the US and Brazil. However, the mortality rate has been trending lower at ~1.5% while the recovery rate continues to pick up ~94% (vs. ~91% in end- Sep).

Capital Flows: FPIs recorded their highest-ever monthly inflows of USD8.3bn into Indian equities in the month of November (vs. inflows of USD2.5bn in October). YTD, FPIs remain net buyers at USD14.9bn in Indian equities. FPIs turned net sellers in the debt markets with outflows of USD308mn in November (vs. inflows of USD450mn in October). YTD, FPIs have sold USD14.5bn in the debt markets.

DIIs remained net equity sellers in November with outflows of USD6.5bn (vs. outflows of USD2.4bn in October). This was the highest monthly outflow since the first month of available DII data (May-07).

Sectoral Impact

After underperforming since the start of the pandemic, Banks saw a sharp rebound in October, and were up 12%

MoM. November saw a continuation of these gains as Private Banks were up 24% MoM. With the announcement

of vaccine trial results and strong earnings season, cyclical sectors were the key outperformers with Metals (+25%

MoM), Cap Goods (+20% MoM) and Infra (+17% MoM) leading the recovery.

The Macro Picture

India's Finance Minister announced a third set of measures to aid the economic recovery. The focus remained on

supply-side reforms, including a temporary wage subsidy program to buffer unemployment, efforts to enhance

and extend the credit guarantee scheme, more production-linked incentives to attract multi-national companies to

relocate to India, and more resources to bolster infrastructure and housing.GDP: The 2QFY21 GDP contraction of 7.5% YoY (vs. 23.9% contraction in 1QFY21) came in better than the consensus estimate (-8.2%). The contraction in private consumption narrowed from 27% YoY to 11% YoY in 2QFY21, reflecting the unlocking of the economy. Government consumption declined 22% YoY in 2QFY21 following 16% YoY growth in 1QFY21 (1HFY21 government consumption declined by 4% YoY).

PMI: Composite PMI gained 3.4pt MoM to print at 58.0 (highest since Jan-12) in October following an 8.6pt MoM gain in September. The Indian economy is experiencing a two-speed recovery with services lagging manufacturing, similar to trends seen globally. India's services PMI gained +4.3pts MoM and improved to 54.1 in October (this was the first print above 50 since Feb-20) while the Manufacturing PMI printed at 58.9 in October (+2.1pt MoM and the highest print in 8+ years).

Within the forward-looking demand indicators recovery was seen in Composite PMI new orders which came in at 57.4 (+5.1pt) and Composite PMI new export orders at 47.6 (+1.8pt). While output and new orders have surged in the last two months, employment indices remain subdued and much below pre Covid-19 levels.

Inflation: October CPI at 7.6% YoY came in ahead of consensus 7.3% largely led by food inflation (11.1% in October vs. 10.7% in September).

While, India's monthly merchandise trade balance for October at USD8.7bn came in slightly below consensus (USD8.8bn) and widened from USD2.7bn in September. Merchandise exports were down 5% YoY in October (vs. 6% gain in September) while imports were down 12% YoY in October (vs. a 20% decline in September). Imports ex Oil and Gold declined 5% YoY (vs. a 13% decline in September), the 21st consecutive month of YoY decline.

IIP (Index of Industrial Production): IIP gained +0.2% YoY in September (vs. -8.0% in August) and came in ahead of the consensus forecast (consensus: -1.9%). This was the first monthly YoY gain since Feb-20. Consumer durables were at 96% of the pre-pandemic level in September improving from 86% in August. Non-durables improved to 101% of the pre-pandemic level in September from 98% in August.

Fiscal Deficit: Fiscal deficit for Apr-Oct came in at Rs9.1tn or 120% of the budgeted FY21 deficit (Rs.8.0tn). This compares to 94% reached during the same time frame in FY20. GST collections in November came in at Rs1.04tn (+1.4% YoY). This was the second consecutive month with collections of more than Rs1tn (Rs1.05tn in Oct).

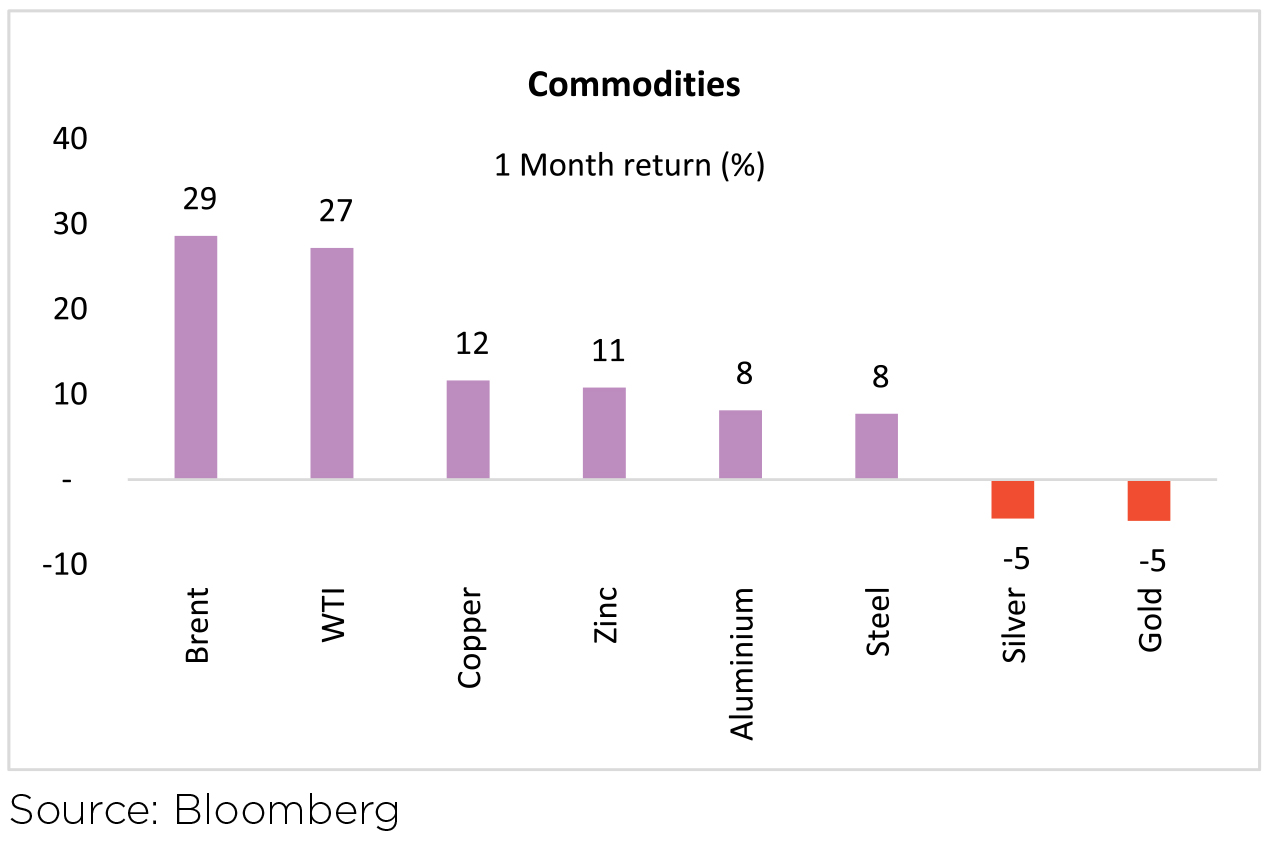

Commodities: Safe haven assets - gold & silver were negative for the month given the vaccine announcements. While, Brent and WTI gained (+29% MoM) and (+27% MoM), respectively.

Bond Markets and Currency: Benchmark 10-year treasury yields averaged at 5.89% in November (4bps lower vs. October avg.). On month-end values, 10Y yield were up 3bps to end the month at 5.91%. US 10Y yields are at 0.84% (-3bps MoM, -94bps YoY).

INR gained 0.1% and ended the month at 74.05 per USD in November. YTD, INR (-3.6%) has significantly outperformed the broader EM FX (-8.3%). DXY declined -2.3% in November (vs. +0.2% in Oct) and ended the month at 91.87 (-4.7% YTD).

India's Forex (FX) reserves are at their all-time peak at USD575.3bn as of 20 November 2020. FX reserves have increased by USD14.8bn in the last four weeks.

Outlook

The markets have completed a stunning turnaround. Few, would have been able to predict in March'20, that Nifty

will cross its historic high within the same calendar year. The rally, unlike 2018-19 has also been broad based, with

Mid and Small caps also participating. Every sector, even banks, have participated in this upswing since 23rd March

'20. Globally, too, such a wide spread movement across markets has been evident.With favourable news on the vaccine front and the increasing possibility of another fiscal stimulus package getting passed by the US legislature, equities are enjoying an optimistic mood across the globe, led by the US markets. In India, the economic devastation from the pandemic, thankfully, has been at a scale much lower than earlier predicted with a healthy recovery expected for FY22. Thus, the chance of a "melt up" rather than a "meltdown" appear to have a higher possibility. Markets have shown, since 2008 GFC (Global Financial Crisis) to overshoot the near term trend on the down and the upside. This, puts all investors in a quandary, raise cash early and one could underperform; on the other hand, stay invested and the ride down could be fast and vicious. At current levels, the possibility of a near term upside, yielding to a "correction" remains the highest probability course for the near term - next 3 Month-6 Month. For the longer term (1 Year+), the effectiveness of the vaccine and the speed of its roll out helping bring back the "old" normal will decide the course of the market.

Stay safe and wishing you and your loved ones a safe 2021.

WHAT WENT BY

Bonds remained mostly range-bound through November although the 2-5 year segment rallied on the

increased liquidity possibly due to RBI's FX intervention resulting in a marginal steepening of the curve.

While the 10 year Government bond benchmark ended the month 3bps higher at 5.91%, the 5 year

government bond ended 15bps lower at 5.03%.

The government announced its 3rd set of fiscal measures aimed primarily at stressed sectors, urban consumption and employment generation. The fiscal cost of these measures amounts to INR 2.65trn, i.e. ~1.4% of GDP, but the current year's budgetary impact is estimated between 0.5% to 0.6% of GDP. Some of the measures are listed as below:

▶ Government launched a credit guarantee support for 26 stressed sectors identified by Kamath Committee along with health sector with credit outstanding of above INR 0.5bn and upto INR 5.0bn as on February 29, 2020. The tenor of additional credit provided is for 5 years with 1 year moratorium and 4 year of repayment.

▶ An additional INR 180bn was provided for the affordable urban housing scheme is intended to help start 1.2mn new houses/finish 1.8mn, implying a subsidy of INR 60-100k/ house. INR 100bn was added to the NREGA budget.

▶ The INR 3,000bn ECLGS (Emergency Credit Line Guarantee Scheme) announced for entities such as MSME's, business enterprises and individuals was extended till Mar-21 from a previous revision of Nov-20.

▶ Subsidies for fertilizers: Provision of INR 650bn was made in order to ensure adequate and timely availability of fertilizers to farmers in the upcoming crop season.

▶ Equity Infusion in NIIF (National Investment and Infrastructure Fund) Debt Platform: NIIF will provide infrastructure project financing to the tune of INR 1,100bn by 2025. The government will invest INR 60bn as equity and the rest of the equity will be raised from private investors.

▶ Extension of PLI (production-linked incentive) scheme to 10 sectors: The government extended the PLI scheme to 10 sectors with incentives amounting to INR 1460bn over the next five years to promote domestic manufacturing. Earlier the government had approved PLI scheme for mobile phones, pharmaceutical products and medical devices at a cost of INR 514bn.

October CPI inflation rose to 7.61% higher than market expectations & a slightly downward revised print of 7.27% in September amidst an increase in momentum across Food & core components. Food inflation rose 11.1% (10.7% in September) led by vegetables (22.5%), meat and fish (18.7%), egg (21.8%), pulses and products (18.3%), oils and fats (15.2%), and spices (11.3%). Core inflation rose to 5.5% and was led by inflation in the personal care segment (12.1%) and transport and communication segment (11.2%). Prices of petrol (10%), gold (34%), and diesel (9%) were some of the major contributors to core inflation

Headline industrial production entered positive territory in September after contracting for six straight months, printing at 0.2% YoY (better than expected), compared to a 7.4% YoY (revised higher) contraction in August. On a sectoral basis, mining and electricity production were up 1.4% and 4.9%, respectively, while manufacturing production was nearly back to last year's levels.

Indian economy entered a technical recession as Q2 real GDP declined 7.5% YoY in Q2FY21. On the supply side, GVA growth picked up to -7.0% y-o-y in Q2 vs -22.8% in Q1. Agricultural GVA rose a robust 3.4% y-o-y while manufacturing GVA growth rebounded sharply to 0.1% y-o-y, from -33.8% in Q1FY21. Both Personal and Government consumption dragged down the GDP growth.

The gross GST revenue was INR 1.05trn in Nov'20, up 1.4% y/y and flat m-m. All the 28 States and 3 UT's have decided to go for Option-1 to meet the revenue shortfall arising out of the GST implementation. Under the terms of Option-1, besides getting the facility of a special window for borrowings to meet the shortfall arising out of GST implementation, the States are also entitled to unconditional borrowing of 0.5% of GSDP.

The MPC decided to keep all rates unchanged as expected on its December 4, 2020 MPC policy. In a welcome relief at least to certain quarters of the market, it persisted with its time based dovish forward guidance as well. There was a view before the policy that the RBI may announce steps to re-anchor the overnight rate which had fallen substantially below the reverse repo rate for much of November, closer to the reverse repo rate. The fear was that in doing so, it may end up signaling some sort of a reversal to the level of accommodation that is currently in play. However, no measures were announced for now to re-anchor the overnight rate. While pressures on inflation have been noted, the predominant imperative of nurturing growth impulses at this juncture was well articulated.

The fund manager has to examine the steepness of the curve and position at points where the carry adjusted for duration seems to be the most optimal. That is to say, even if yields are to go up there are points on the curve where the extra carry compensates enough for a limited rise in yields so that the trade still earns better than the rate on offer on (let's say) 1 year treasury bills today. Whereas if such a rise were to not materialize, then returns from the trade could be considerably more. It is such nuances that we are considering quite actively in the current context. Consistent with this, we have reverted to an overweight position in our long preferred 6 - 9 year segment in government bonds, in our actively managed duration products. Again, these are active mandates and strategy can change at any time.

Disclaimer: MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

The Disclosures of opinions/in house views/strategy incorporated herein is provided solely to enhance the transparency about the investment strategy / theme of the Scheme and should not be treated as endorsement of the views / opinions or as an investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document has been prepared on the basis of information, which is already available in publicly accessible media or developed through analysis of IDFC Mutual Fund. The information/ views / opinions provided is for informative purpose only and may have ceased to be current by the time it may reach the recipient, which should be taken into account before interpreting this document. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision and the security may or may not continue to form part of the scheme's portfolio in future. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. The decision of the Investment Manager may not always be profitable; as such decisions are based on the prevailing market conditions and the understanding of the Investment Manager. Actual market movements may vary from the anticipated trends. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alterations to this statement as may be required from time to time. Neither IDFC Mutual Fund / IDFC AMC Trustee Co. Ltd./ IDFC Asset Management Co. Ltd nor IDFC, its Directors or representatives shall be liable for any damages whether direct or indirect, incidental, punitive special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information.

The government announced its 3rd set of fiscal measures aimed primarily at stressed sectors, urban consumption and employment generation. The fiscal cost of these measures amounts to INR 2.65trn, i.e. ~1.4% of GDP, but the current year's budgetary impact is estimated between 0.5% to 0.6% of GDP. Some of the measures are listed as below:

▶ Government launched a credit guarantee support for 26 stressed sectors identified by Kamath Committee along with health sector with credit outstanding of above INR 0.5bn and upto INR 5.0bn as on February 29, 2020. The tenor of additional credit provided is for 5 years with 1 year moratorium and 4 year of repayment.

▶ An additional INR 180bn was provided for the affordable urban housing scheme is intended to help start 1.2mn new houses/finish 1.8mn, implying a subsidy of INR 60-100k/ house. INR 100bn was added to the NREGA budget.

▶ The INR 3,000bn ECLGS (Emergency Credit Line Guarantee Scheme) announced for entities such as MSME's, business enterprises and individuals was extended till Mar-21 from a previous revision of Nov-20.

▶ Subsidies for fertilizers: Provision of INR 650bn was made in order to ensure adequate and timely availability of fertilizers to farmers in the upcoming crop season.

▶ Equity Infusion in NIIF (National Investment and Infrastructure Fund) Debt Platform: NIIF will provide infrastructure project financing to the tune of INR 1,100bn by 2025. The government will invest INR 60bn as equity and the rest of the equity will be raised from private investors.

▶ Extension of PLI (production-linked incentive) scheme to 10 sectors: The government extended the PLI scheme to 10 sectors with incentives amounting to INR 1460bn over the next five years to promote domestic manufacturing. Earlier the government had approved PLI scheme for mobile phones, pharmaceutical products and medical devices at a cost of INR 514bn.

October CPI inflation rose to 7.61% higher than market expectations & a slightly downward revised print of 7.27% in September amidst an increase in momentum across Food & core components. Food inflation rose 11.1% (10.7% in September) led by vegetables (22.5%), meat and fish (18.7%), egg (21.8%), pulses and products (18.3%), oils and fats (15.2%), and spices (11.3%). Core inflation rose to 5.5% and was led by inflation in the personal care segment (12.1%) and transport and communication segment (11.2%). Prices of petrol (10%), gold (34%), and diesel (9%) were some of the major contributors to core inflation

Headline industrial production entered positive territory in September after contracting for six straight months, printing at 0.2% YoY (better than expected), compared to a 7.4% YoY (revised higher) contraction in August. On a sectoral basis, mining and electricity production were up 1.4% and 4.9%, respectively, while manufacturing production was nearly back to last year's levels.

Indian economy entered a technical recession as Q2 real GDP declined 7.5% YoY in Q2FY21. On the supply side, GVA growth picked up to -7.0% y-o-y in Q2 vs -22.8% in Q1. Agricultural GVA rose a robust 3.4% y-o-y while manufacturing GVA growth rebounded sharply to 0.1% y-o-y, from -33.8% in Q1FY21. Both Personal and Government consumption dragged down the GDP growth.

The gross GST revenue was INR 1.05trn in Nov'20, up 1.4% y/y and flat m-m. All the 28 States and 3 UT's have decided to go for Option-1 to meet the revenue shortfall arising out of the GST implementation. Under the terms of Option-1, besides getting the facility of a special window for borrowings to meet the shortfall arising out of GST implementation, the States are also entitled to unconditional borrowing of 0.5% of GSDP.

The MPC decided to keep all rates unchanged as expected on its December 4, 2020 MPC policy. In a welcome relief at least to certain quarters of the market, it persisted with its time based dovish forward guidance as well. There was a view before the policy that the RBI may announce steps to re-anchor the overnight rate which had fallen substantially below the reverse repo rate for much of November, closer to the reverse repo rate. The fear was that in doing so, it may end up signaling some sort of a reversal to the level of accommodation that is currently in play. However, no measures were announced for now to re-anchor the overnight rate. While pressures on inflation have been noted, the predominant imperative of nurturing growth impulses at this juncture was well articulated.

Outlook

With the market's mind relieved for now on the overnight anchor, interest with respect to front end

rates should get re-established. A more fruitful approach probably is to envisage that some gentle (and

hopefully non disruptive) reversals to the level of overnight rates is to be expected over the next year or

so, even as the process hasn't started with the December policy. This should be viewed as a transition

of monetary policy from emergency support levels currently to a more sustainable level where it is still

relatively accommodative in light of the weaker trajectory of growth in the 'new normal' that may lie ahead.

Put in the bond market's perspective, the current difference between 10 year bond yield to overnight

rate is roughly around 300 bps. This will likely fall over the year ahead, although it may still be higher

than the last few years' average given higher continued fiscal stress as well as likelihood of relatively

accommodative monetary policy. Given the overnight rate is operating below the reverse repo rate, the

bulk of this adjustment could be made by the very front end. While Long end rates might also normalize,

the magnitude might not be similar as the front end.The fund manager has to examine the steepness of the curve and position at points where the carry adjusted for duration seems to be the most optimal. That is to say, even if yields are to go up there are points on the curve where the extra carry compensates enough for a limited rise in yields so that the trade still earns better than the rate on offer on (let's say) 1 year treasury bills today. Whereas if such a rise were to not materialize, then returns from the trade could be considerably more. It is such nuances that we are considering quite actively in the current context. Consistent with this, we have reverted to an overweight position in our long preferred 6 - 9 year segment in government bonds, in our actively managed duration products. Again, these are active mandates and strategy can change at any time.

Disclaimer: MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

The Disclosures of opinions/in house views/strategy incorporated herein is provided solely to enhance the transparency about the investment strategy / theme of the Scheme and should not be treated as endorsement of the views / opinions or as an investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document has been prepared on the basis of information, which is already available in publicly accessible media or developed through analysis of IDFC Mutual Fund. The information/ views / opinions provided is for informative purpose only and may have ceased to be current by the time it may reach the recipient, which should be taken into account before interpreting this document. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision and the security may or may not continue to form part of the scheme's portfolio in future. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. The decision of the Investment Manager may not always be profitable; as such decisions are based on the prevailing market conditions and the understanding of the Investment Manager. Actual market movements may vary from the anticipated trends. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alterations to this statement as may be required from time to time. Neither IDFC Mutual Fund / IDFC AMC Trustee Co. Ltd./ IDFC Asset Management Co. Ltd nor IDFC, its Directors or representatives shall be liable for any damages whether direct or indirect, incidental, punitive special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information.