Commentary

31st January 2020

Mr. Anoop Bhaskar

Head - Equity

WHAT WENT BY

Global Equity Markets:

Global equities witnessed a strong start to the year continuing the strong momentum from

Dec-Q. Rising geopolitical tensions between US and Iran were overshadowed by positive news on US-China trade

talks with the signing of Phase One trade deal. However, gains in the first half were pared in the second half on

concerns about the impact of the Coronavirus in China and its fallout on global growth. The WHO (World Health

Organization) has called the outbreak a global health emergency and stepped up efforts to combat the virus. The

MSCI World Index was down 1.2% for the month, with the MSCI Emerging Market Index down 4.7% and Developed

Market Index almost flat (-0.7%). Indian market was down 1.8% in USD terms, in the middle of the pack. China fell

10.7% MoM, on concerns around Coronavirus.

Coronavirus: The 2019 Coronavirus has caused increasing global concerns with 17,459 confirmed cases; and death toll of 362 people, while 489 have recovered. The death toll is now higher than that from the SARS epidemic, which felled 349 people. The outbreak has battered Chinese stock markets, which have plunged at least 7% after reopening for the first time since they closed for the lunar New Year on 23 January. Trading in several commodities was suspended after losses quickly exceeded their daily limits. China, being a significant part of the global economy as also being the epicenter of most global supply chains, a prolonged pandemic could dent global growth and disrupt supply chains for several companies.

Brexit: Britain formally withdrew from the European Union at 11 p.m. on Friday, January 31st after nearly half a century of EU membership. It concluded three years of fractious debates over whether the country should really leave the bloc, the terms of its departure and the kind of relationship it should forge with Europe. The clear mandate to Boris Johnson in the UK elections and with Brexit behind, uncertainty should reduce going forward. The British pound was flat for the month but has rallied 8.6% over the last 6 months. Despite the strength of the Pound, the UK stock market in USD terms was down almost 4% for the month.

Crude and other metals correct on growth concerns: Coronavirus resulted in fresh spate of global growth concerns with risk of the largest growth engine, China, slowing down further. As a result, most industrial metals and commodities corrected. Brent fell 12% MoM to close at $58.2/barrel. Similarly, metals like Aluminum, Zinc, and Steel etc. were also lower for the month.

Interest rates benign, currencies stable: On the currency side, USD continues to gain strength (+1% MoM). INR fell 0.4% MoM in line with the strong USD. Most global currencies were stable. Interest rates (10 year yields) continue to be benign globally. US 10 year is lower 112 bps from a year ago period and is currently quoting at 1.51%.

Domestic Markets

Budget reasonable but heavily dependent on asset sales: The FY21 Union Budget was presented in parliament on 1 February (Saturday) and the focus was on attracting more foreign capital into the country via both the equity and debt markets and reviving growth gradually. Growth assumptions are well anchored, with nominal GDP forecast to grow by 10%. Tax revenues are forecast to grow at a reasonable 12% (direct taxes at 12.7% and indirect taxes at 11%). Fiscal consolidation has taken a breather, given the growth imperative. The revised fiscal deficit for FY20E is estimated at 3.8% of GDP (vs. the 3.3% targeted initially) and 3.5% for FY21E. Execution remains the key for the FY21E Union Budget. If the asset sale target (including LIC IPO) is not achieved, the underlying fiscal deficit (exasset sales) would widen meaningfully in FY21E to 4.5% of GDP from 4.1% of GDP - which could curb Government spending and impacting economic growth. Equity markets, which were hoping for a spurt in Government spending (to revive economic growth) along with capital market related freebies (abolition of LTCG; DDT) reacted negatively, with the Nifty declining by about 2.5%. Most domestic cyclicals underperformed the benchmark meaningfully, with defensive and export-oriented sectors outperforming.

Key highlights of the budget

▶ A cut in personal income tax rates at the low-to-middle levels of about 500bps, estimated to cost the government about ~US$5.6 billion. But investors can avail themselves of the lower tax rate only if they do not use various exemptions currently available, particularly linked to savings and investments - with a possibility of hurting sale of insurance products.

▶ A 13% increase in government expenditure budgeted.

▶ Abolishing the Dividend Distribution Tax (DDT), estimated to cost the government about US$3.5 billion. For individuals this abolition could be a negative, if they are in a tax bracket over 20%, as Dividend received would be clubbed with their annual income.

▶ Easing the foreign ownership limit in Corporate Bonds to 15% of the outstanding stock (vs. 9% earlier). The government will also consider opening up some sovereign bonds to full foreign ownership.

▶ In order to incentivize investments by Sovereign Wealth Funds of foreign governments in the priority sectors, the Budget proposed to grant a 100% tax exemption to their interest, dividend and capital gains income in respect of investments made in infrastructure before 31 March, 2024 and with a minimum lock-in period of three years.

▶ Government is targeting almost US$30bn from the divestment program in FY21E, vs. about US$10bn in FY20E (vs US$15bn targeted earlier).

▶ Central government capital expenditure has firmed - albeit modestly - in recent years, from 1.6% of GDP FY19 to 1.7% of GDP in FY20 and budgeted to rise to 1.8% of GDP in FY21.

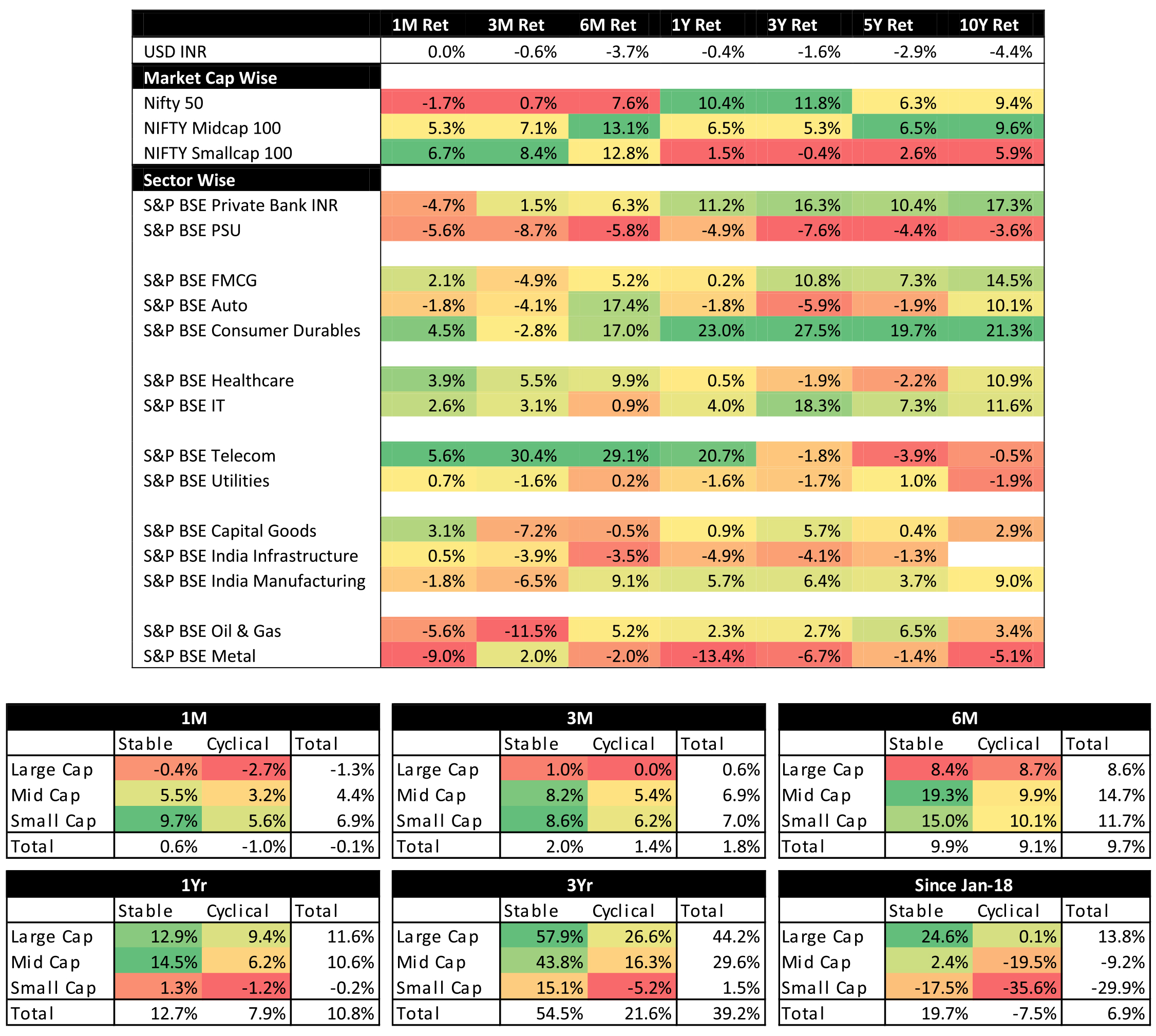

Equity Markets: Broader markets were positive for the month with the Nifty Small Cap 100 (+6.7% MoM) and Nifty Mid Cap 100 (+5.3% MoM) outperforming NIFTY50 (-1.7% MoM). Mid-Caps (+13.1%) and Small Cap (+12.8%) are now outperforming NIFTY (+7.6%) on a 6-month basis, for the first time in 2 years. Budget was a dampener for the markets, so investors will have to wait and watch if this burst of broader market rally continues. On a sectoral front, Telecom continued to outperform (+5.6% MoM) and is now the best performing sector across 3 month (+30.4%), 6 month (+29.1%) and 1 year (+20.7%) timeframes as well. Metals and Oil & gas were the laggards as global commodity prices corrected.

Composite PMI: For December at 53.7 improved sequentially (Nov. print: 52.7). The improvement in December PMI was led by Manufacturing which improved +1.5pt mom to 52.7 while Services gained +0.6pt mom to 53.3. The internals of the PMI report were also encouraging with the forward-looking composite new orders rising +1.3 to 54.1, across both services and manufacturing. Composite new export orders gained +0.2pt mom to 51.9.

IIP rose +1.8% in November: After 3 consecutive months of declining prints and came better than consensus (+0.3%). Sequentially IP increased 4.1% m/m, sa - the highest in 2 years, on the back of 2.4% sequential gain in October. On the use-based front, both consumer durables and non-durables production saw noticeable sequential increases (+10.7% and +3.3% m/m, sa respectively) after three successive declines.

India's monthly trade deficit: At $11.3bn decreased in December vs. prior month ($12.1bn) and came below consensus expectations ($11.6bn). Merchandise exports were down -1.8% while Imports were down -8.8% in December. Gold imports fell -3.9% in December (vs. 6.6% increase in Nov). Imports ex Oil and Gold declined -12.2% in December (vs -12% decline in Nov), the 12th consecutive month of YoY decline.

Benchmark 10 year treasury: Yields averaged at 6.58% in January (5bps lower vs December avg). On month end values, 10Y yields rose (+5bps mom) and ended the month at 6.60%. Global yields eased meaningfully following concerns around negative implications on global growth from the Coronavirus outbreak. US 10Y yields are at 1.51% (-41bps in 1M, -112bps over the last 1 year).

India's FX reserves: Are at an all-time peak of US$467bn as of 24th January (+US$9.2bn in the last 4 weeks). The jump in Fx reserves should be seen in the context of falling current account deficit (CAD), largely driven by a fall in imports, while exports continue to remain limp. At 1.5%, CAD is one of the lowest since 2013 and reflects the marked slowdown in economic activity.

FPI flows continue to be robust: FPIs recorded net inflows of US$2.0bn in Indian equities in the month of January (vs. net inflows of US$862mn in Dec-19). January is the fifth consecutive month of FII inflows in Indian equities. FIIs recorded net outflows in debt markets at US$1.6bn in January (vs. net outflows of US$756mn in Dec-19). January is the third consecutive month of FII outflows from the debt markets. DIIs turned net equity buyers at US$316mn in January (vs. net outflows of US$104mn in Dec-19). Mutual funds were net equity buyers at US$214mn in January (vs. inflows of US$254mn in Dec-19). Insurance funds were net equity sellers of US$475mn in January (vs. outflows of US$358mn in Dec-19). Mutual fund and insurance fund flow data is as of 29-Jan.

Earnings Outlook: Of the BSE 200 companies, 90 companies have reported results. The Sales, EBITDA, PBT and PAT for these companies have been -2.4%, +8.9%, +16% and +26% respectively. Though, sales are expected to degrow for the second quarter running, the trajectory of EBITDA and PBT growth is encouraging. A large chunk of PBT growth is driven by Corporate Banks (ex Financials PBT is up 6%). PAT growth is higher on account of corporate tax cuts.

PBT growth was driven largely by corporate banks. For the 90 companies, absolute PBT was up Rs 17,900 cr from 1,12,700 cr to 1,30,600 cr, of this 11,000 cr was from Corporate Banks. PAT increased more than PBT on account of corporate tax cuts - PAT increased by Rs 20,600cr in absolute terms. Auto and Oil & Gas are other 2 sectors that have contributed to the growth. Commodities led by metals have been the key detractors.

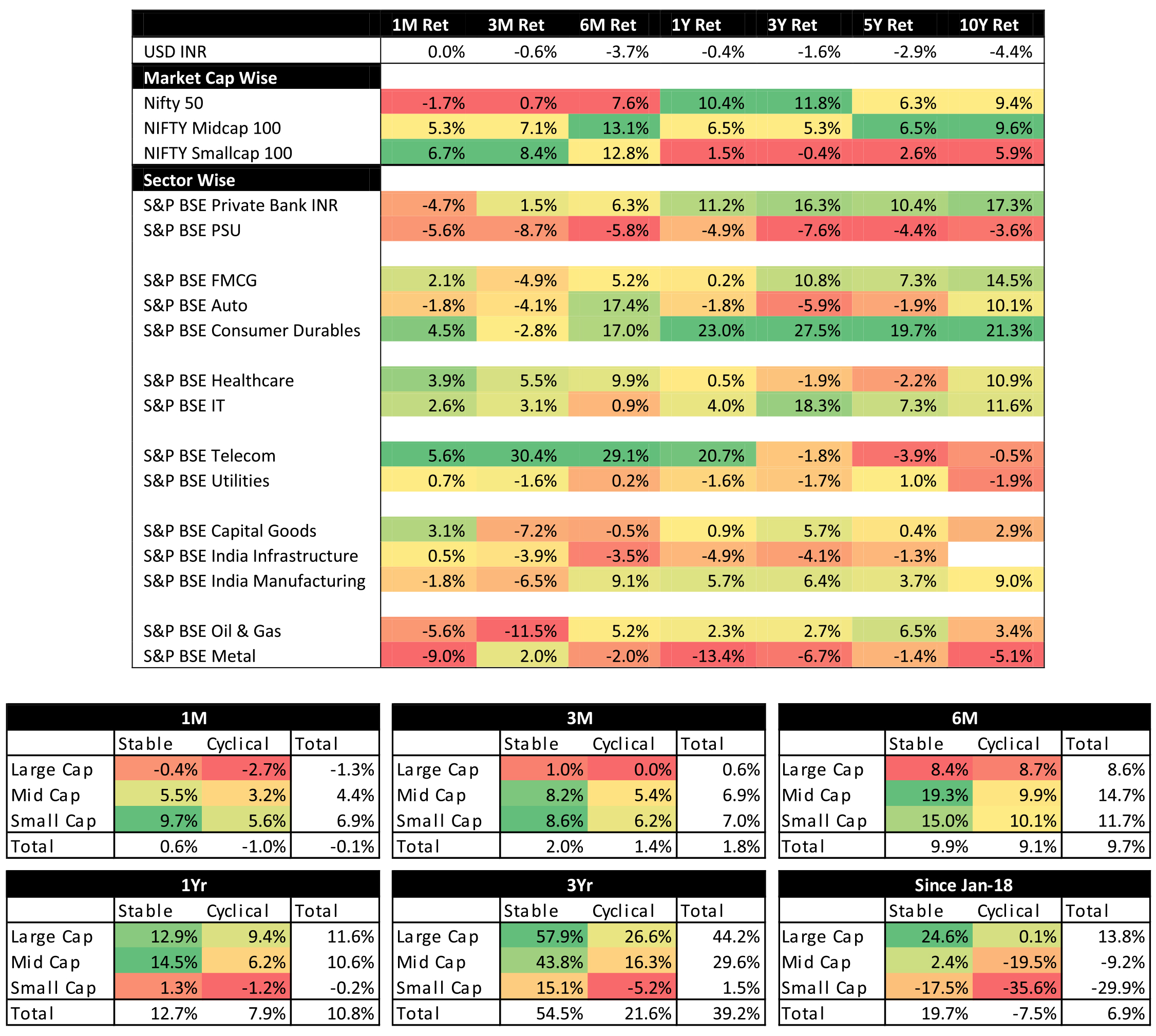

The market, since Jan-18 has been clearly two tiered with 70-80 stocks out of BSE 500 generating positive returns. The focus on "High Quality, Consistent Earnings" has been the most successful play during this period. Valuation gap between the "have beens" and the "has beens" is now at one of the widest levels. Given the slowdown in earnings growth even for the "High Quality Consistent Earnings" segment, a substantial part of the returns during the last 18 months has been derived from P/E re-rating. Is this P/E re-rating an endless exercise? The NSE Small Cap Index trades at 17.5x on Positive PE basis; 14.4x on FY20 estimate earnings and 2.1x Price to Book. NIFTY, trades at 21.1x positive PE; 17.5x FY20 earnings and 2.9x Price to Book.

Continuing from our last month's theme of Sentiment being the first pillar to undergo change for a new market cycle, outperformance of mid-cap and positive returns in Small Cap could indicate early signs of such a reversal. Domestic Sentiments, from being weak, have improved on account of positive Government announcements - Corporate Tax, the 100 trillion INR infra plan, though the budget has been a dampener. Globally, Sentiments did improve as the US-China trade war shows signs of resolving, but the outbreak of the Coronavirus has put a new spanner in the works.

Liquidity, the second "building block", is already being tackled domestically, with increased pressure on PSU banks to re-start lending to NBFCs, payments delayed by Government have also been speeded. Valuations, as mentioned earlier, are more modest for the broader market, approaching appetizing levels. Despite the low GDP growth, earnings growth is expected to be atleast double digit driven by corporate tax cuts and recovery in Corporate Bank NPAs. If the first three "building blocks" of "SLV" converge, a new upswing could commence. The folly, would be to wait for the Fundamentals, alone, as the most critical ingredient for any new upswing.

Coronavirus: The 2019 Coronavirus has caused increasing global concerns with 17,459 confirmed cases; and death toll of 362 people, while 489 have recovered. The death toll is now higher than that from the SARS epidemic, which felled 349 people. The outbreak has battered Chinese stock markets, which have plunged at least 7% after reopening for the first time since they closed for the lunar New Year on 23 January. Trading in several commodities was suspended after losses quickly exceeded their daily limits. China, being a significant part of the global economy as also being the epicenter of most global supply chains, a prolonged pandemic could dent global growth and disrupt supply chains for several companies.

Brexit: Britain formally withdrew from the European Union at 11 p.m. on Friday, January 31st after nearly half a century of EU membership. It concluded three years of fractious debates over whether the country should really leave the bloc, the terms of its departure and the kind of relationship it should forge with Europe. The clear mandate to Boris Johnson in the UK elections and with Brexit behind, uncertainty should reduce going forward. The British pound was flat for the month but has rallied 8.6% over the last 6 months. Despite the strength of the Pound, the UK stock market in USD terms was down almost 4% for the month.

Crude and other metals correct on growth concerns: Coronavirus resulted in fresh spate of global growth concerns with risk of the largest growth engine, China, slowing down further. As a result, most industrial metals and commodities corrected. Brent fell 12% MoM to close at $58.2/barrel. Similarly, metals like Aluminum, Zinc, and Steel etc. were also lower for the month.

Interest rates benign, currencies stable: On the currency side, USD continues to gain strength (+1% MoM). INR fell 0.4% MoM in line with the strong USD. Most global currencies were stable. Interest rates (10 year yields) continue to be benign globally. US 10 year is lower 112 bps from a year ago period and is currently quoting at 1.51%.

Domestic Markets

Budget reasonable but heavily dependent on asset sales: The FY21 Union Budget was presented in parliament on 1 February (Saturday) and the focus was on attracting more foreign capital into the country via both the equity and debt markets and reviving growth gradually. Growth assumptions are well anchored, with nominal GDP forecast to grow by 10%. Tax revenues are forecast to grow at a reasonable 12% (direct taxes at 12.7% and indirect taxes at 11%). Fiscal consolidation has taken a breather, given the growth imperative. The revised fiscal deficit for FY20E is estimated at 3.8% of GDP (vs. the 3.3% targeted initially) and 3.5% for FY21E. Execution remains the key for the FY21E Union Budget. If the asset sale target (including LIC IPO) is not achieved, the underlying fiscal deficit (exasset sales) would widen meaningfully in FY21E to 4.5% of GDP from 4.1% of GDP - which could curb Government spending and impacting economic growth. Equity markets, which were hoping for a spurt in Government spending (to revive economic growth) along with capital market related freebies (abolition of LTCG; DDT) reacted negatively, with the Nifty declining by about 2.5%. Most domestic cyclicals underperformed the benchmark meaningfully, with defensive and export-oriented sectors outperforming.

Key highlights of the budget

▶ A cut in personal income tax rates at the low-to-middle levels of about 500bps, estimated to cost the government about ~US$5.6 billion. But investors can avail themselves of the lower tax rate only if they do not use various exemptions currently available, particularly linked to savings and investments - with a possibility of hurting sale of insurance products.

▶ A 13% increase in government expenditure budgeted.

▶ Abolishing the Dividend Distribution Tax (DDT), estimated to cost the government about US$3.5 billion. For individuals this abolition could be a negative, if they are in a tax bracket over 20%, as Dividend received would be clubbed with their annual income.

▶ Easing the foreign ownership limit in Corporate Bonds to 15% of the outstanding stock (vs. 9% earlier). The government will also consider opening up some sovereign bonds to full foreign ownership.

▶ In order to incentivize investments by Sovereign Wealth Funds of foreign governments in the priority sectors, the Budget proposed to grant a 100% tax exemption to their interest, dividend and capital gains income in respect of investments made in infrastructure before 31 March, 2024 and with a minimum lock-in period of three years.

▶ Government is targeting almost US$30bn from the divestment program in FY21E, vs. about US$10bn in FY20E (vs US$15bn targeted earlier).

▶ Central government capital expenditure has firmed - albeit modestly - in recent years, from 1.6% of GDP FY19 to 1.7% of GDP in FY20 and budgeted to rise to 1.8% of GDP in FY21.

Equity Markets: Broader markets were positive for the month with the Nifty Small Cap 100 (+6.7% MoM) and Nifty Mid Cap 100 (+5.3% MoM) outperforming NIFTY50 (-1.7% MoM). Mid-Caps (+13.1%) and Small Cap (+12.8%) are now outperforming NIFTY (+7.6%) on a 6-month basis, for the first time in 2 years. Budget was a dampener for the markets, so investors will have to wait and watch if this burst of broader market rally continues. On a sectoral front, Telecom continued to outperform (+5.6% MoM) and is now the best performing sector across 3 month (+30.4%), 6 month (+29.1%) and 1 year (+20.7%) timeframes as well. Metals and Oil & gas were the laggards as global commodity prices corrected.

Composite PMI: For December at 53.7 improved sequentially (Nov. print: 52.7). The improvement in December PMI was led by Manufacturing which improved +1.5pt mom to 52.7 while Services gained +0.6pt mom to 53.3. The internals of the PMI report were also encouraging with the forward-looking composite new orders rising +1.3 to 54.1, across both services and manufacturing. Composite new export orders gained +0.2pt mom to 51.9.

IIP rose +1.8% in November: After 3 consecutive months of declining prints and came better than consensus (+0.3%). Sequentially IP increased 4.1% m/m, sa - the highest in 2 years, on the back of 2.4% sequential gain in October. On the use-based front, both consumer durables and non-durables production saw noticeable sequential increases (+10.7% and +3.3% m/m, sa respectively) after three successive declines.

India's monthly trade deficit: At $11.3bn decreased in December vs. prior month ($12.1bn) and came below consensus expectations ($11.6bn). Merchandise exports were down -1.8% while Imports were down -8.8% in December. Gold imports fell -3.9% in December (vs. 6.6% increase in Nov). Imports ex Oil and Gold declined -12.2% in December (vs -12% decline in Nov), the 12th consecutive month of YoY decline.

Benchmark 10 year treasury: Yields averaged at 6.58% in January (5bps lower vs December avg). On month end values, 10Y yields rose (+5bps mom) and ended the month at 6.60%. Global yields eased meaningfully following concerns around negative implications on global growth from the Coronavirus outbreak. US 10Y yields are at 1.51% (-41bps in 1M, -112bps over the last 1 year).

India's FX reserves: Are at an all-time peak of US$467bn as of 24th January (+US$9.2bn in the last 4 weeks). The jump in Fx reserves should be seen in the context of falling current account deficit (CAD), largely driven by a fall in imports, while exports continue to remain limp. At 1.5%, CAD is one of the lowest since 2013 and reflects the marked slowdown in economic activity.

FPI flows continue to be robust: FPIs recorded net inflows of US$2.0bn in Indian equities in the month of January (vs. net inflows of US$862mn in Dec-19). January is the fifth consecutive month of FII inflows in Indian equities. FIIs recorded net outflows in debt markets at US$1.6bn in January (vs. net outflows of US$756mn in Dec-19). January is the third consecutive month of FII outflows from the debt markets. DIIs turned net equity buyers at US$316mn in January (vs. net outflows of US$104mn in Dec-19). Mutual funds were net equity buyers at US$214mn in January (vs. inflows of US$254mn in Dec-19). Insurance funds were net equity sellers of US$475mn in January (vs. outflows of US$358mn in Dec-19). Mutual fund and insurance fund flow data is as of 29-Jan.

Earnings Outlook: Of the BSE 200 companies, 90 companies have reported results. The Sales, EBITDA, PBT and PAT for these companies have been -2.4%, +8.9%, +16% and +26% respectively. Though, sales are expected to degrow for the second quarter running, the trajectory of EBITDA and PBT growth is encouraging. A large chunk of PBT growth is driven by Corporate Banks (ex Financials PBT is up 6%). PAT growth is higher on account of corporate tax cuts.

PBT growth was driven largely by corporate banks. For the 90 companies, absolute PBT was up Rs 17,900 cr from 1,12,700 cr to 1,30,600 cr, of this 11,000 cr was from Corporate Banks. PAT increased more than PBT on account of corporate tax cuts - PAT increased by Rs 20,600cr in absolute terms. Auto and Oil & Gas are other 2 sectors that have contributed to the growth. Commodities led by metals have been the key detractors.

The market, since Jan-18 has been clearly two tiered with 70-80 stocks out of BSE 500 generating positive returns. The focus on "High Quality, Consistent Earnings" has been the most successful play during this period. Valuation gap between the "have beens" and the "has beens" is now at one of the widest levels. Given the slowdown in earnings growth even for the "High Quality Consistent Earnings" segment, a substantial part of the returns during the last 18 months has been derived from P/E re-rating. Is this P/E re-rating an endless exercise? The NSE Small Cap Index trades at 17.5x on Positive PE basis; 14.4x on FY20 estimate earnings and 2.1x Price to Book. NIFTY, trades at 21.1x positive PE; 17.5x FY20 earnings and 2.9x Price to Book.

Continuing from our last month's theme of Sentiment being the first pillar to undergo change for a new market cycle, outperformance of mid-cap and positive returns in Small Cap could indicate early signs of such a reversal. Domestic Sentiments, from being weak, have improved on account of positive Government announcements - Corporate Tax, the 100 trillion INR infra plan, though the budget has been a dampener. Globally, Sentiments did improve as the US-China trade war shows signs of resolving, but the outbreak of the Coronavirus has put a new spanner in the works.

Liquidity, the second "building block", is already being tackled domestically, with increased pressure on PSU banks to re-start lending to NBFCs, payments delayed by Government have also been speeded. Valuations, as mentioned earlier, are more modest for the broader market, approaching appetizing levels. Despite the low GDP growth, earnings growth is expected to be atleast double digit driven by corporate tax cuts and recovery in Corporate Bank NPAs. If the first three "building blocks" of "SLV" converge, a new upswing could commence. The folly, would be to wait for the Fundamentals, alone, as the most critical ingredient for any new upswing.

| Equity Markets | Index | % Change YTD | % Change MTD | P/E |

| Nifty | 11,962.10 | -1.70% | -1.70% | 22.00 |

| Sensex | 40,723.49 | -1.29% | -1.29% | 22.92 |

| Dow Jones | 28,256.03 | -0.99% | -0.99% | 18.50 |

| Shanghai | 2,976.53 | -2.41% | -2.41% | 10.41 |

| Nikkei | 23,205.18 | -1.91% | -1.91% | 18.35 |

| Hang Sang | 26,312.63 | -6.66% | -6.66% | 10.53 |

| FTSE | 7,286.01 | -3.40% | -3.40% | 13.48 |

| MSCI E.M. (USD) | 1,062.34 | -4.69% | -4.69% | 12.95 |

| MSCI D.M.(USD) | 2,342.41 | -0.68% | -0.68% | 17.64 |

| MSCI India (INR) | 1,358.08 | -0.84% | -0.84% | 22.51 |

| Currency & Commodities | Last Price % | Change YTD % | Change MTD |

| USD / INR | 71.355 | -0.04% | -0.04% |

| Dollar Index | 97.39 | 1.04% | 1.04% |

| Gold | 1,589.16 | 4.74% | 4.74% |

| WTI (Nymex) | 51.56 | -15.56% | -15.56% |

| Brent Crude | 58.16 | -11.88% | -11.88% |

| India Macro Analysis | Latest | Equity Flows | USD Mn |

| GDP | 4.50 | FII (USD mln) | |

| IIP | 1.80 | YTD | 1,984.52 |

| Inflation (WPI Monthly) | 2.59 | MTD | 1,984.52 |

| Inflation (CPI Monthly) | 7.35 | *DII (USD mln) | |

| Commodity (CRB Index) | 404.17 | YTD | -311.96 |

| Source: Bloomberg | MTD | -311.96 | |

| *DII : Domestic Mutual Funds Data as on 31st January 2020 | |||

Mr. Suyash Choudhary

Head - Fixed Income

WHAT WENT BY

The ten year benchmark bond yield ended the month at 6.60% compared to 6.51% in the beginning of the month as market awaited directions from the Union budget and RBI monetary policy.

The budget came under obviously difficult circumstances given the need to generate a net positive fiscal impulse in view of weaker economic growth, while honoring the need for some fiscal discipline against an adverse revenue picture. Measured against this ask, the finance minister has broadly delivered. The fiscal deficit numbers for the current year and next are in line with market expectations at 3.8% and 3.5% of GDP respectively. Gross market borrowing for next year at INR 7,81,000 crores is similarly in the ball-park expectation range, while no extra borrowing for the current year is an unequivocal positive surprise for the market. A greater reliance on capital receipts, if fructified, will ensure that the fiscal impulse stays positive even as there is a 0.3% net consolidation in deficit into FY21.

The finance minister has also furthered the opening up of our local bond market to off-shore investors - participating limit for foreign portfolio investors (FPIs) in corporate bonds hiked from 9% of outstanding currently to 15%. Also importantly, certain specified categories of government securities would be opened fully for non-resident investors, apart from being available to domestic investors as well. It may be argued that overall interest in Indian bonds is anyway muted for now and hence these expansions may amount to little in the near term. The other view to take could be that incremental ease of operation does bring in more flow (all other things being equal) and that especially the measure on government bonds could be in the direction of ultimate inclusion in global bond indices.

We had noted our surprise over the December 2019 monetary policy, on not so much the status quo but the possible underplaying of the continued space for countercyclical role for monetary policy in the near term. We had found the larger than anticipated focus on supply side inflation in the face of a 3 - 4% fall in nominal GDP for the year somewhat difficult to square with. We had, however, found some resolution when the RBI subsequently unveiled "Operation Twist" to help accelerate transmission even as near term projected CPI was threatening to cross 7%. The February 2020 policy has offered further the evidence that the RBI is indeed following a practitioner's approach to policy and that while the Monetary Policy Committee (MPC) may not have room currently to cut rates on the back of higher near term CPI, the RBI has other tools in its tool-kit to continue with its countercyclical responses.

First from a MPC standpoint, the status quo delivered on policy rates was fully expected and par for the course. Given the uncertainties with respect to near term inflation trajectory, any prudent committee will await further information. This is especially true since, as noted in the policy document, there are pressures beyond only in vegetables (milk and pulses for instance) in the current trajectory of prices. To its credit, however, the MPC hasn't muddled communication and has clearly recognized space to act in the future. Implicit here seems to be a greater recognition of the growth-inflation trade-off for now rather than a point focus on 4% CPI at all points in time. Thus, the MPC has kept the accommodative stance and guidance for future easing alive on the back of an assessment that CPI slides to 3.2% by Q3 FY 21, even as the average CPI for FY 20 breaches 4% comfortably and so does the average forecast for the next 3 quarters.

The bigger points in the policy concern the liquidity operations of the central bank. The daily fixed rate repo and four 14-day term repos every fortnight being conducted, at present, are being withdrawn. From the fortnight beginning on February 15, 2020, the RBI shall conduct term repos of one-year and three-year tenors of appropriate sizes for up to a total amount of INR 1,00,000 crore at the policy repo rate. This should encourage banks to undertake maturity transformation smoothly and seamlessly so as to augment credit flows to productive sectors, as per the central bank. Additionally, the scheduled commercial banks will be allowed to deduct the equivalent of incremental credit disbursed by them as retail loans for automobiles, residential housing and loans to micro, small and medium enterprises (MSMEs), over and above the outstanding level of credit to these segments as at the end of the fortnight ended January 31, 2020 from their net demand and time liabilities (NDTL) for maintenance of cash reserve ratio (CRR). This exemption will be available for incremental credit extended up to the fortnight ending July 31, 2020.

Going Forward

Our continued assessment over the past few months has been that there possibly has been a general under-appreciation of the gravity of our current slowdown (https://www.idfcmf.com/article/996). We have therefore had great sympathy for continued counter-cyclical responses even as the need for more urgency on structural reforms cannot be underplayed. Our only point has been that there needs to be adequate appreciation of where the maximum depth available is for countercyclical response. We have also been cognizant of the moral hazard issue when exploring the avenues for non-traditional responses. For that reason, while we have been happy to support a twist or outright open market purchases of bonds, we have baulked at endorsing a 'bail-out' package for stressed balance-sheets. The February policy has been quite consistent with the underlying macro-environment. This is especially also given the new threat to global growth in the form of the Coronavirus as well as the obvious limits to fiscal policy that have been clearly evident in the just announced Union Budget.

From a strategy standpoint, the value in quality front end bonds (up to 5 years) stands reaffirmed after the long term repo announcements. These repos will enable participants to lock in the current cost of money for longer and then deploy as per risk appetite. At the very least, it should enable greater appetite for front end sovereign bonds. Importantly, the RBI Deputy Governor has kept these operations distinct from durable liquidity operations like open market purchase of bonds and has clarified that the intent behind twist operations has been to strengthen transmission into corporate bond yields. Sporadic twist operations are thus quite likely in the future, although the urgency may not be as great immediately given new tools for transmission that have been unveiled in the policy (long term repo and selective CRR dispensation).

In our actively managed bond and gilt funds, we have been heavily overweight 'high beta' 13 year government bonds till after the budget, basis our view that the market was perhaps overfearing the event. Since the budget we have shifted these portfolios more in favor of 8 - 10 year government bonds on the higher absolute value offered in this segment and since the "momentum" trade generated post budget may have soon dissipated. We find this positioning conducive to the monetary policy announcements. Government bonds up to 5 years or so may find even greater support in context of the long term repo operations. For 'real money' that wants somewhat higher duration given an otherwise conducive rate environment, the 5 - 10 year part of the curve may thus offer reasonable value. As always, this strategy represents our current thoughts and is subject to change at short notice in light of market dynamics and our own evolving assessment.