Commentary

31st December 2019

Mr. Anoop Bhaskar

Head - Equity

WHAT WENT BY

"Forecasts may tell you a great deal about the forecaster; they tell you nothing about the future."

- Warren Buffett

Our obsession with identifying "trends" to "justify" portfolio positioning and building an investment hypothesis is an exercise which organized money management has indulged (in the past) and will continue in the future as well. However, reflecting back on 2019, the fragility of such trend "spotting" needs to be reviewed with the same degree of humility as was the confidence with which they were made. Here are three of our key "predictions" for 2019.

▶ Strong election mandates translate into strong broad equity market returns: The stock market reaction of the last three General Election results had highlighted the above. Unfortunately, 2019 laid to rest this hypothesis - Mid and Small Cap indices underperformed the Nifty in CY 2019 despite a strong election mandate for BJP & PM Narendra Modi.

▶ Periods of Rupee appreciation are positive for broader markets: Over the last decade, sharp depreciation of the INR has been followed with a period of INR appreciation, during which broader markets outperform the Nifty. CY 2019 also laid to rest this hypothesis.

▶ Over the last ten years, Nifty has not outperformed the Mid and Small caps for two consecutive years: CY 19 ended with Nifty firmly in the "green" outperforming Mid and Small cap indices for two successive calendar years!

Given the markets performance during CY 19, one does venture to modify the outlook for CY 20 to incorporate key issues which could impact market behavior rather than trying to identify "trends".

Here goes a list of 20 issues which could grab the headlines and investors' 'share of mind' during the coming months. How much they impact stocks, portfolios, unfortunately will be known only at the end of the year!

Starting with 10 international issues:

▶ US-China trade "tango": Phase I appears to be a done deal, with the stage set for negotiations on Phase II. Global markets (mainly the US) already seem to have priced in the relief of no further tariff hikes. Be ready for leaks from both sides indicating dissatisfaction on how the Phase II talks are progressing and the impact on markets.

▶ US$ movement. One of the few "predictions" common across strategists of Global brokerage houses and commentators is the impending weakening of the US$. Implicit to the above, is a "consolidation" of the Renminbi. Historically, weakening of US$ has been positive for flows into emerging markets!

▶ US elections: November 2020, US goes to vote, a yet undeclared Democratic Party candidate or President Trump will be the option. A "socialist" leaning Democratic candidate - Bernie Sanders or Elizabeth Warren, may stir the markets or key US sectors like healthcare closer to the elections.

▶ The much discussed US slowdown or recession: Another favourite of forecasters is the expected slowdown of the US economy, the 800 pound gorilla, which keeps on confounding forecasters. A marked slowdown will raise worries, as US Fed has few if any weapons left to further stimulate the economy, chances of a fiscal stimulus in an election year would be non-existent (Democrats would not allow it to be passed). This will be reflected in the debate on "inverted" yield curve in the US, as well.

▶ US market outperformance v/s rest of the World: The last decade post the Great Financial crisis has truly belonged to the US; S&P 500 is up 256% v/s Europe Stoxx up 86% and MSCI Emerging up 48%. In $ terms the gap is even wider. Will the next decade see the continuation of the outperformance forged in the last decade - this debate has great relevance for Institutional money allocators, in a way reflecting our dilemma of "Large Cap v/s Broader market", only, the canvas is global!

▶ Europe, will growth beckon or will negative interest rate continue: After piling up to $17 Trillion, the basket of negative interest rate debt securities came down by $6 Trillion. Will growth in Europe pick up, will Euro come under pressure again, will Germany agree to a fiscal stimulus, questions which will come up during the coming months, each with the ability to stir the markets. Don't forget the Brexit "drama", like the overbearing Sisterin- law in every Indian family soap opera, it will have the ability to create nuisance but can it stir the market?

▶ China economic trajectory: Enough obsession on US/Europe, China remains the most dynamic large economy in the world. Worries about its economic growth trajectory, internal debt, especially corporate bond NPAs; Real estate and if we can mention Hong Kong protests and the Chinese authorities' actions will be attention grabbers. The movement of Chinese renminbi and opening up of its financial sector to US/Western companies; increasing weight in the MSCI global/emerging indices could have the ability to move the market.

▶ Will emerging market moniker survive 2020s? What is common between China; Brazil; India; South Africa; Argentine; Turkey; Indonesia, very little economically except they are all bandied under the "emerging market" moniker for convenience sake. Given the disparate path each of these countries has taken over the last twenty years, questions will be asked why should they be tagged together. Will the impending index weight rebalancing on China within the MSCI Emerging Market index be the proverbial last straw on the camel's back.

▶ Commodities - Crude; Gold; Silver; Industrial Commodities. Can any of these achieve a sustainable comeback within investor portfolio during the next decade? Can crude oil survive the relentless march of renewables and the electrification of personal transport? Can coal survive the wrath of the "Green and ESG" seeking investor? Tech v/s Commodities has been a one-sided race with the former winning hands down during the 2010s, will the push of tech be relentless in the 2020s?

▶ Will "Asset light with unlimited capital" model replace everything: Today Pay Pal trades at 4x price to book while Goldman Sachs flirts going below 1x book? Will the relentless appetite for "Asset light, Unlimited Capital" model of today's tech companies sustain the 2020s - Uber owns no asset (hence asset light) but has run through $ 15 bln of capital to induce you and me to take an Uber ride. Will AirBnB get listed at a market cap exceeding the aggregate market cap of all the leading hotel chains?, Will the appetite for an "Asset light" business in a world of zero cost of capital give them unlimited capital to burn? Will Vision Fund II buy a country, with the aim to convert it to becoming first digital "citizen" of the world?

The following is the list of ten issues which could dominate the shrill business media in the coming months:

▶ Budget; Fiscal Maths and Credibility of Government Accounts: Will the Budget scheduled to be announced on a Saturday (yeah, weekend gayaa for those who prepare post Budget notes) February 1st, may be one of the most anticipated. Will it be a dream or will it be stern? Along with the Budget announcement, will be the spectre of regaining fiscal credibility or will it be labelled as fiscally credulous? Either way, the immediate reaction (on camera) will be monotonous, think a score of 8/10 as par for the course. However, it may set the tone for the stock market for the rest of the year. Expect some MF to come out with a 30 year trend of Budget and equity markets (We promise, not us), if markets dive on February 3rd!

▶ Economic growth trajectory / liquidity / credit growth: The conventional wisdom point to a gradual, slow and uneven recovery during the 2nd half of CY 20. Unfortunately, most of this conventional wisdom had not been able to spot the sharp slowdown in CY 19. A good indicator to follow would be incremental Credit/ Deposit ratio of PSU Banks, currently at 65%, one of the lowest over the last decade. With credit being the lubricant to revitalize the economy, any uptick in credit growth will be a good precursor of economic revival.

▶ Real estate, the other "key" link: Since 2014, real estate sector has been in a funk. This has dragged a myriad of companies associated with the sectors - HFCs lending to customers; NBFCs funding realtors. Banks funding both! Scaling of new products like Loan against property (LAP)/ Lease rental discounting (LRD) have further compounded the exposure off the financial sector towards this sector. Any uptick in Real estate will release stress across the financial sector. It seems very similar to Ishant Sharma, the Indian Test bowler commenting "Everybody told me the problems I had, no one suggested solution?" Well, he needed a stint in the English County cricket and guidance of Australian speedster of 1990s - Jason Gillespie to sort his problems. Our CV is not so impressive, yet we venture to suggest, make the sector more attractive for the buyers. Give them a credible incentive to buy today. Don't focus exclusively on supply issue and funding to those involved in supplying inventory, think of incentivizing the buyer, as well!

▶ Operation Twist will it be India's QE: Recently, RBI has taken "baby" steps towards launching a full scale QE (Quantitative Easing). While my Fixed Income colleagues are better placed to comment on this issue, the equity view is "Bring it on, Sir. Bring it on." The crowding out by higher Government borrowings in the short term can be taken care through this measure, boosting the economy, which is gasping for credit. Also, QE in US spawned the longest bull market in equities, any takers of this view in India, though it has failed in Europe and Japan!

▶ Broad market v/s Nifty; Quality v/s Valuation: After two years of "whitewash", the preening of WBWBs (Warren Buffett Wanna Bees) is at its "shrillest loudest." Hardly, any interaction with any MF intermediary goes without "praises" for such a strategy, frankly there is only so much of grating one's teeth one can do. Alas, performance is the sun, whom everyone worships and overlooks any imminent danger. Our one prediction, sometimes during the next eighteen months, "watch out WBWBs", never underestimate the "heart of the underdog". Unless valuations have lost meaning forever, then, this too shall pass…hopefully this year!!!

▶ Earnings growth v/s GDP growth: With the economy slowing, the worries have been on earnings growth. Despite a 3% decline in Sales for Q2 FY 20, BSE 200 companies reported an 8% growth in PAT led largely by lower tax, thanks to the generous tax cuts announced in August 2019. The power of tax cuts as was visible in CY 2018 in the US and could drive earnings growth till Q1 FY 21 in India. Thus, earnings driven by tax cuts as well as continued rebound in profitability of Corporate Banks, we believe, will be the drivers of earnings growth for BSE 200, despite the limping economic growth. The critical question is, will this profit growth remain concentrated in the "Quality" pack or will it disperse beyond? For a broader market rally, this question needs to be answered resoundingly with a Yes.

▶ Sectors - out of favour v/s consensus (staples; discretionary; retail Banks): Could 2020 be the year of the "has beens" - Domestic Pharma - 4 years of under-performance; Autos - 18 months of under- performance; Commodities, a decade of under-performance and Infrastructure - given the persistent questions around sanctity of contracts? On a valuation basis, these four sectors have seen the highest erosion, will they make a comeback in 2020? Or will the "ole favourities" continue their outperformance march?

▶ Will domestic politics impact sentiments? 2020 is a rare year when state elections calendar is relatively less busy. Could this lull be disturbed by protests against some of the recent legislative acts of the Government? Will India after receiving positive, gushing international attention over the last five years, face a sterner test in the coming months?

▶ Flows - MF as well as FPI: Could a revival in Real Estate impact flows into MFs, as investor re-discover their love for Real estate? Will India be a beneficiary of increased international flows if US$ weakens or will our higher valuations and limp economic growth impact flows?

▶ Will change in Large cap / Mid Cap definitions lead to another round of portfolio restructuring: Media reports indicate a proposal to increase large Cap universe from top 100 to 150 and Mid Cap universe from top 250 to 300. Will this lead to another round of shuffling of stocks? If this proposal goes through then the "cut off" for Large cap will drop from currently Rs.22,000 cr market cap to Rs.16,000 cr market cap. Similarly, Mid cap cut off will drop from Rs.11,000 cr to around Rs.6500 cr.

Reviewing the last decade: 4 Phases and different styles

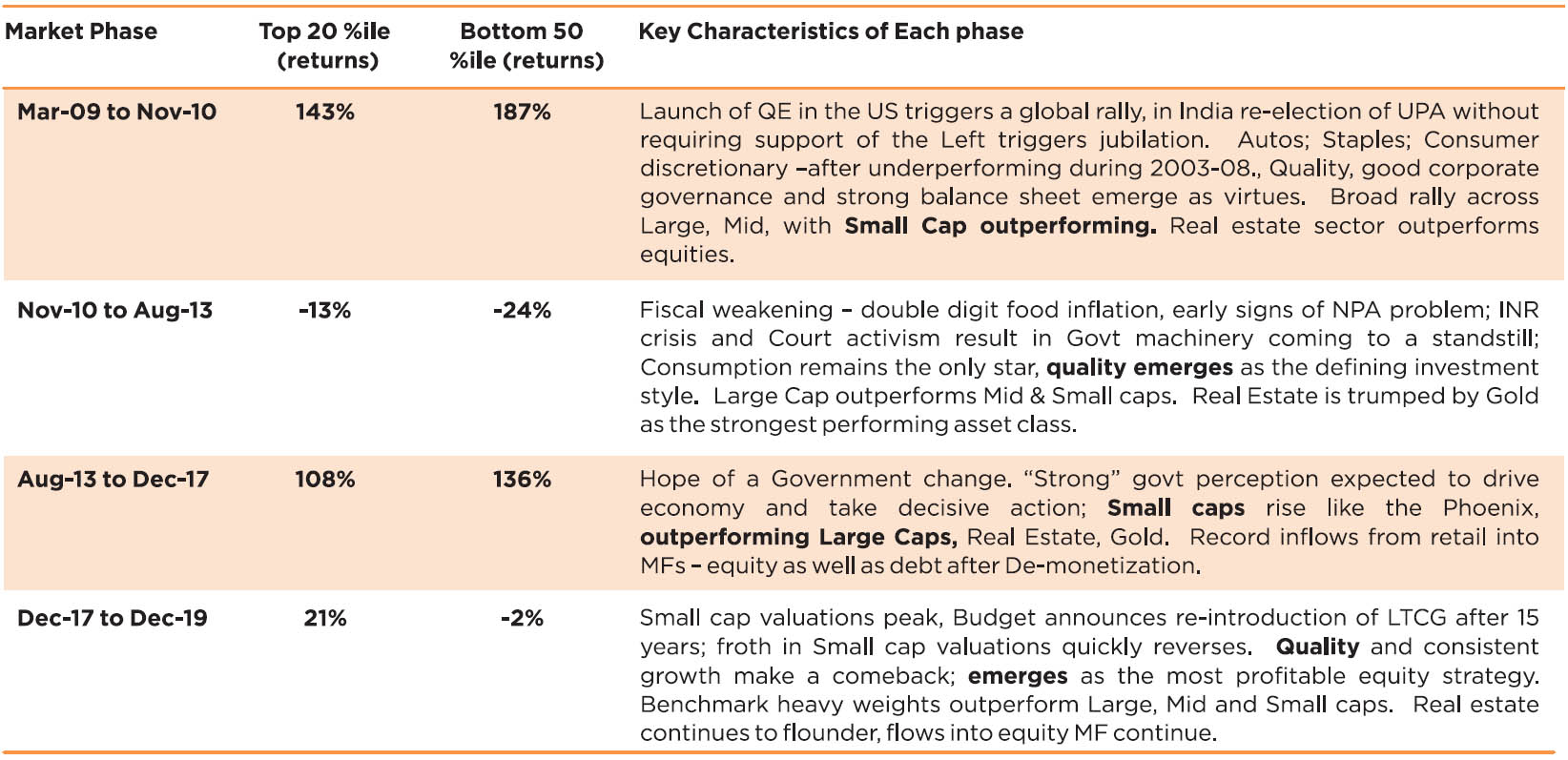

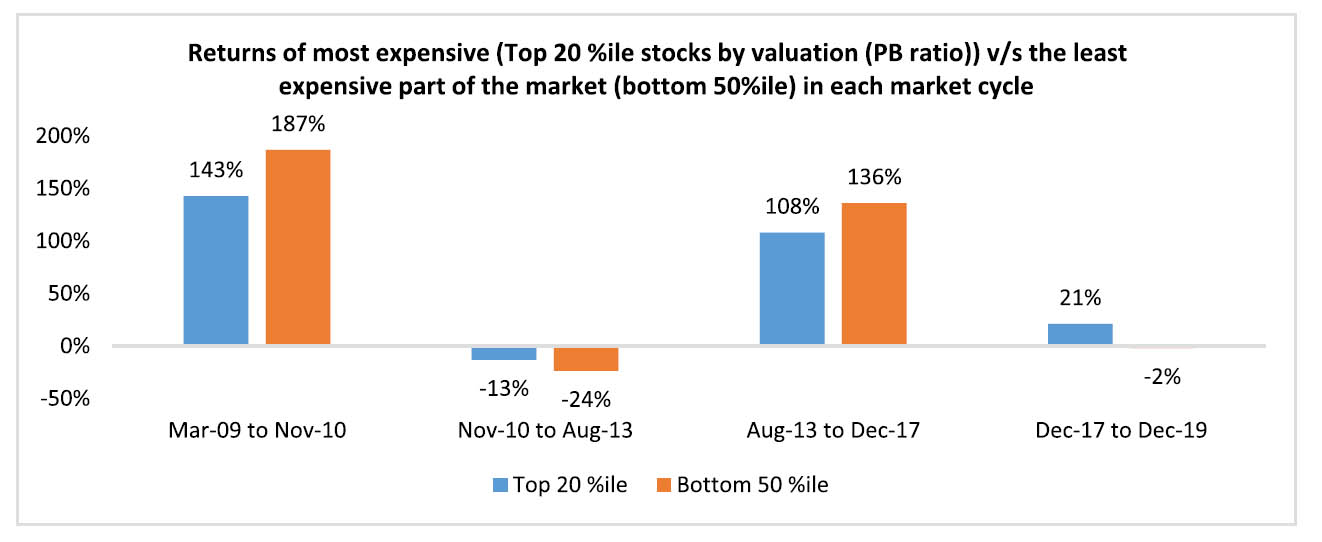

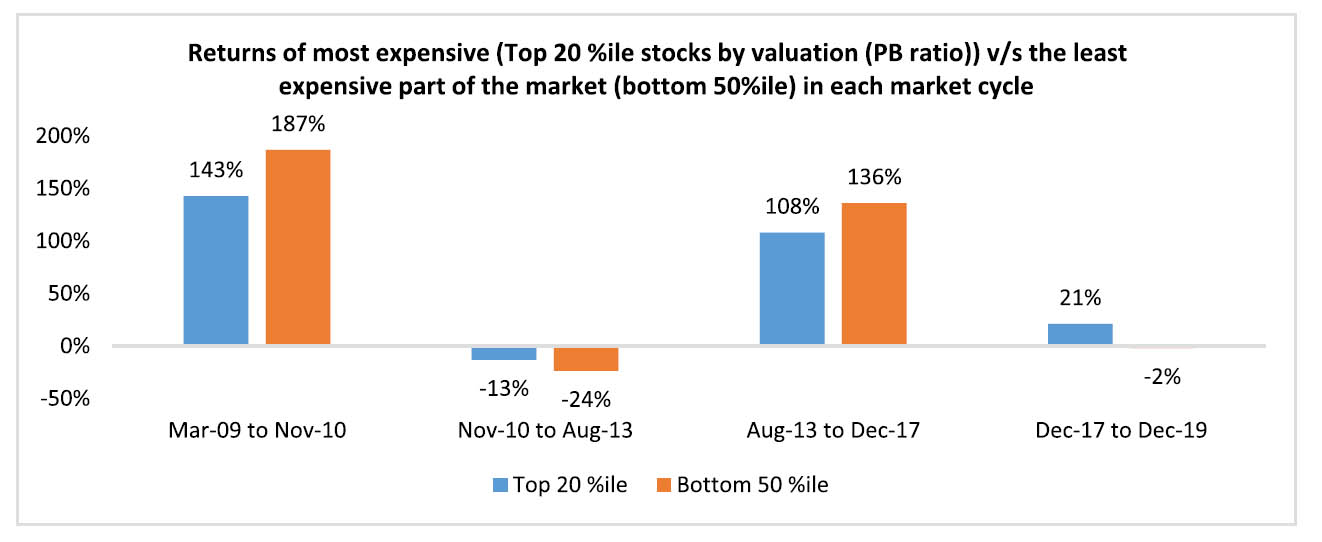

To look at how various investing styles have worked over the last decade, we have calculated the returns of most expensive (Top 20 %ile stocks by valuation (PB ratio)) v/s the least expensive part of the market (bottom 50%ile) in each market cycle.

as different segments of the market have delivered in different market cycle.

The other observation, is the steep drawdowns which a segment like Small cap is unable to escape from, even if the focus is on "quality" or put in another manner, quality without growth gets de-rated swiftly irrespective of the market cap segment.

How the next decade will play out for equity investors is impossible to predict and we are neither brave nor buoyed by strong performance to dive into this issue. However, a diversified portfolio spread across investment styles and with selective sector bets could be the path to use for the next decade. Wishing you a profitable decade ahead and thank you for your support.

- Warren Buffett

Our obsession with identifying "trends" to "justify" portfolio positioning and building an investment hypothesis is an exercise which organized money management has indulged (in the past) and will continue in the future as well. However, reflecting back on 2019, the fragility of such trend "spotting" needs to be reviewed with the same degree of humility as was the confidence with which they were made. Here are three of our key "predictions" for 2019.

▶ Strong election mandates translate into strong broad equity market returns: The stock market reaction of the last three General Election results had highlighted the above. Unfortunately, 2019 laid to rest this hypothesis - Mid and Small Cap indices underperformed the Nifty in CY 2019 despite a strong election mandate for BJP & PM Narendra Modi.

▶ Periods of Rupee appreciation are positive for broader markets: Over the last decade, sharp depreciation of the INR has been followed with a period of INR appreciation, during which broader markets outperform the Nifty. CY 2019 also laid to rest this hypothesis.

▶ Over the last ten years, Nifty has not outperformed the Mid and Small caps for two consecutive years: CY 19 ended with Nifty firmly in the "green" outperforming Mid and Small cap indices for two successive calendar years!

Given the markets performance during CY 19, one does venture to modify the outlook for CY 20 to incorporate key issues which could impact market behavior rather than trying to identify "trends".

Here goes a list of 20 issues which could grab the headlines and investors' 'share of mind' during the coming months. How much they impact stocks, portfolios, unfortunately will be known only at the end of the year!

Starting with 10 international issues:

▶ US-China trade "tango": Phase I appears to be a done deal, with the stage set for negotiations on Phase II. Global markets (mainly the US) already seem to have priced in the relief of no further tariff hikes. Be ready for leaks from both sides indicating dissatisfaction on how the Phase II talks are progressing and the impact on markets.

▶ US$ movement. One of the few "predictions" common across strategists of Global brokerage houses and commentators is the impending weakening of the US$. Implicit to the above, is a "consolidation" of the Renminbi. Historically, weakening of US$ has been positive for flows into emerging markets!

▶ US elections: November 2020, US goes to vote, a yet undeclared Democratic Party candidate or President Trump will be the option. A "socialist" leaning Democratic candidate - Bernie Sanders or Elizabeth Warren, may stir the markets or key US sectors like healthcare closer to the elections.

▶ The much discussed US slowdown or recession: Another favourite of forecasters is the expected slowdown of the US economy, the 800 pound gorilla, which keeps on confounding forecasters. A marked slowdown will raise worries, as US Fed has few if any weapons left to further stimulate the economy, chances of a fiscal stimulus in an election year would be non-existent (Democrats would not allow it to be passed). This will be reflected in the debate on "inverted" yield curve in the US, as well.

▶ US market outperformance v/s rest of the World: The last decade post the Great Financial crisis has truly belonged to the US; S&P 500 is up 256% v/s Europe Stoxx up 86% and MSCI Emerging up 48%. In $ terms the gap is even wider. Will the next decade see the continuation of the outperformance forged in the last decade - this debate has great relevance for Institutional money allocators, in a way reflecting our dilemma of "Large Cap v/s Broader market", only, the canvas is global!

▶ Europe, will growth beckon or will negative interest rate continue: After piling up to $17 Trillion, the basket of negative interest rate debt securities came down by $6 Trillion. Will growth in Europe pick up, will Euro come under pressure again, will Germany agree to a fiscal stimulus, questions which will come up during the coming months, each with the ability to stir the markets. Don't forget the Brexit "drama", like the overbearing Sisterin- law in every Indian family soap opera, it will have the ability to create nuisance but can it stir the market?

▶ China economic trajectory: Enough obsession on US/Europe, China remains the most dynamic large economy in the world. Worries about its economic growth trajectory, internal debt, especially corporate bond NPAs; Real estate and if we can mention Hong Kong protests and the Chinese authorities' actions will be attention grabbers. The movement of Chinese renminbi and opening up of its financial sector to US/Western companies; increasing weight in the MSCI global/emerging indices could have the ability to move the market.

▶ Will emerging market moniker survive 2020s? What is common between China; Brazil; India; South Africa; Argentine; Turkey; Indonesia, very little economically except they are all bandied under the "emerging market" moniker for convenience sake. Given the disparate path each of these countries has taken over the last twenty years, questions will be asked why should they be tagged together. Will the impending index weight rebalancing on China within the MSCI Emerging Market index be the proverbial last straw on the camel's back.

▶ Commodities - Crude; Gold; Silver; Industrial Commodities. Can any of these achieve a sustainable comeback within investor portfolio during the next decade? Can crude oil survive the relentless march of renewables and the electrification of personal transport? Can coal survive the wrath of the "Green and ESG" seeking investor? Tech v/s Commodities has been a one-sided race with the former winning hands down during the 2010s, will the push of tech be relentless in the 2020s?

▶ Will "Asset light with unlimited capital" model replace everything: Today Pay Pal trades at 4x price to book while Goldman Sachs flirts going below 1x book? Will the relentless appetite for "Asset light, Unlimited Capital" model of today's tech companies sustain the 2020s - Uber owns no asset (hence asset light) but has run through $ 15 bln of capital to induce you and me to take an Uber ride. Will AirBnB get listed at a market cap exceeding the aggregate market cap of all the leading hotel chains?, Will the appetite for an "Asset light" business in a world of zero cost of capital give them unlimited capital to burn? Will Vision Fund II buy a country, with the aim to convert it to becoming first digital "citizen" of the world?

The following is the list of ten issues which could dominate the shrill business media in the coming months:

▶ Budget; Fiscal Maths and Credibility of Government Accounts: Will the Budget scheduled to be announced on a Saturday (yeah, weekend gayaa for those who prepare post Budget notes) February 1st, may be one of the most anticipated. Will it be a dream or will it be stern? Along with the Budget announcement, will be the spectre of regaining fiscal credibility or will it be labelled as fiscally credulous? Either way, the immediate reaction (on camera) will be monotonous, think a score of 8/10 as par for the course. However, it may set the tone for the stock market for the rest of the year. Expect some MF to come out with a 30 year trend of Budget and equity markets (We promise, not us), if markets dive on February 3rd!

▶ Economic growth trajectory / liquidity / credit growth: The conventional wisdom point to a gradual, slow and uneven recovery during the 2nd half of CY 20. Unfortunately, most of this conventional wisdom had not been able to spot the sharp slowdown in CY 19. A good indicator to follow would be incremental Credit/ Deposit ratio of PSU Banks, currently at 65%, one of the lowest over the last decade. With credit being the lubricant to revitalize the economy, any uptick in credit growth will be a good precursor of economic revival.

▶ Real estate, the other "key" link: Since 2014, real estate sector has been in a funk. This has dragged a myriad of companies associated with the sectors - HFCs lending to customers; NBFCs funding realtors. Banks funding both! Scaling of new products like Loan against property (LAP)/ Lease rental discounting (LRD) have further compounded the exposure off the financial sector towards this sector. Any uptick in Real estate will release stress across the financial sector. It seems very similar to Ishant Sharma, the Indian Test bowler commenting "Everybody told me the problems I had, no one suggested solution?" Well, he needed a stint in the English County cricket and guidance of Australian speedster of 1990s - Jason Gillespie to sort his problems. Our CV is not so impressive, yet we venture to suggest, make the sector more attractive for the buyers. Give them a credible incentive to buy today. Don't focus exclusively on supply issue and funding to those involved in supplying inventory, think of incentivizing the buyer, as well!

▶ Operation Twist will it be India's QE: Recently, RBI has taken "baby" steps towards launching a full scale QE (Quantitative Easing). While my Fixed Income colleagues are better placed to comment on this issue, the equity view is "Bring it on, Sir. Bring it on." The crowding out by higher Government borrowings in the short term can be taken care through this measure, boosting the economy, which is gasping for credit. Also, QE in US spawned the longest bull market in equities, any takers of this view in India, though it has failed in Europe and Japan!

▶ Broad market v/s Nifty; Quality v/s Valuation: After two years of "whitewash", the preening of WBWBs (Warren Buffett Wanna Bees) is at its "shrillest loudest." Hardly, any interaction with any MF intermediary goes without "praises" for such a strategy, frankly there is only so much of grating one's teeth one can do. Alas, performance is the sun, whom everyone worships and overlooks any imminent danger. Our one prediction, sometimes during the next eighteen months, "watch out WBWBs", never underestimate the "heart of the underdog". Unless valuations have lost meaning forever, then, this too shall pass…hopefully this year!!!

▶ Earnings growth v/s GDP growth: With the economy slowing, the worries have been on earnings growth. Despite a 3% decline in Sales for Q2 FY 20, BSE 200 companies reported an 8% growth in PAT led largely by lower tax, thanks to the generous tax cuts announced in August 2019. The power of tax cuts as was visible in CY 2018 in the US and could drive earnings growth till Q1 FY 21 in India. Thus, earnings driven by tax cuts as well as continued rebound in profitability of Corporate Banks, we believe, will be the drivers of earnings growth for BSE 200, despite the limping economic growth. The critical question is, will this profit growth remain concentrated in the "Quality" pack or will it disperse beyond? For a broader market rally, this question needs to be answered resoundingly with a Yes.

▶ Sectors - out of favour v/s consensus (staples; discretionary; retail Banks): Could 2020 be the year of the "has beens" - Domestic Pharma - 4 years of under-performance; Autos - 18 months of under- performance; Commodities, a decade of under-performance and Infrastructure - given the persistent questions around sanctity of contracts? On a valuation basis, these four sectors have seen the highest erosion, will they make a comeback in 2020? Or will the "ole favourities" continue their outperformance march?

▶ Will domestic politics impact sentiments? 2020 is a rare year when state elections calendar is relatively less busy. Could this lull be disturbed by protests against some of the recent legislative acts of the Government? Will India after receiving positive, gushing international attention over the last five years, face a sterner test in the coming months?

▶ Flows - MF as well as FPI: Could a revival in Real Estate impact flows into MFs, as investor re-discover their love for Real estate? Will India be a beneficiary of increased international flows if US$ weakens or will our higher valuations and limp economic growth impact flows?

▶ Will change in Large cap / Mid Cap definitions lead to another round of portfolio restructuring: Media reports indicate a proposal to increase large Cap universe from top 100 to 150 and Mid Cap universe from top 250 to 300. Will this lead to another round of shuffling of stocks? If this proposal goes through then the "cut off" for Large cap will drop from currently Rs.22,000 cr market cap to Rs.16,000 cr market cap. Similarly, Mid cap cut off will drop from Rs.11,000 cr to around Rs.6500 cr.

Reviewing the last decade: 4 Phases and different styles

To look at how various investing styles have worked over the last decade, we have calculated the returns of most expensive (Top 20 %ile stocks by valuation (PB ratio)) v/s the least expensive part of the market (bottom 50%ile) in each market cycle.

as different segments of the market have delivered in different market cycle.

The other observation, is the steep drawdowns which a segment like Small cap is unable to escape from, even if the focus is on "quality" or put in another manner, quality without growth gets de-rated swiftly irrespective of the market cap segment.

How the next decade will play out for equity investors is impossible to predict and we are neither brave nor buoyed by strong performance to dive into this issue. However, a diversified portfolio spread across investment styles and with selective sector bets could be the path to use for the next decade. Wishing you a profitable decade ahead and thank you for your support.

| Equity Markets | Index | % Change YTD | % Change MTD | P/E |

| Nifty | 12,168.45 | 0.00% | 0.93% | 21.77 |

| Sensex | 41,253.74 | 0.00% | 1.13% | 22.95 |

| Dow Jones | 28,538.44 | 0.00% | 1.74% | 17.23 |

| Shanghai | 3,050.12 | 0.00% | 6.20% | 11.18 |

| Nikkei | 23,656.62 | 0.00% | 1.56% | 17.72 |

| Hang Sang | 28,189.75 | 0.00% | 7.00% | 10.65 |

| FTSE | 7,542.44 | 0.00% | 2.67% | 13.44 |

| MSCI E.M. (USD) | 1,114.66 | 0.00% | 7.17% | 13.15 |

| MSCI D.M.(USD) | 2,358.47 | 0.00% | 2.89% | 17.19 |

| MSCI India (INR) | 1,369.56 | 0.00% | 1.01% | 22.26 |

| Currency & Commodities | Last Price % | Change YTD % | Change MTD |

| USD / INR | 71.380 | 0.00% | -0.50% |

| Dollar Index | 96.39 | 0.00% | -1.92% |

| Gold | 1,517.27 | 0.00% | 3.64% |

| WTI (Nymex) | 61.06 | 0.00% | 10.68% |

| Brent Crude | 66.00 | 0.00% | 5.72% |

| India Macro Analysis | Latest | Equity Flows | USD Mn |

| GDP | 4.50 | FII (USD mln) | |

| IIP | -3.80 | YTD | 14,236.70 |

| Inflation (WPI Monthly) | 0.58 | MTD | 862.02 |

| Inflation (CPI Monthly) | 5.54 | *DII (USD mln) | |

| Commodity (CRB Index) | 401.58 | YTD | 7,954.00 |

| Source: Bloomberg | MTD | 385.60 | |

| *DII : Domestic Mutual Funds Data as on 31st December 2019 | |||

Mr. Suyash Choudhary

Head - Fixed Income

WHAT WENT BY

"We were broken then but now we're borderline".

Leonard Cohen

The year 2019 should probably be counted as a forgettable year for India, given the off-a-cliff kind of growth collapse that we saw during the year. That this was accompanied with significant strains in the credit markets that claimed many an investment book, probably adds to the merits in favor of assigning this year to oblivion. The other view, of course, is that this probably counts as one of those rare years that one should take pains to remember. Experiences like this year serve to enhance one's experience tool-kit by much more than many years spent in linearity. The year almost felt like a culmination of sorts, a final manifestation of a series of things that had built up over a period of time. If this is what is meant by a cycle, then India probably witnessed the end of one such cycle this year. That is why years like these are valuable: in order to understand what's going on now, one is forced to go back and try and trace the whole cycle that led up to this culmination. And in building back these pieces one gathers information and perspectives which are probably far greater in value than what a series of linear years could bring.

Perspectives On Our Growth Fall-Off

For the quarter ended September 2019, our nominal GDP growth almost halved from what it was a year ago. Even for those, like us, who were aligned to the view of a growth slowdown this year this was somewhat of a shock. The intensity of the fall-off invariably makes one remember the period of 2008 - 09. The comparison is instructive and has value but by no means is the parallel exact. The comparison of what tool-kits existed then and got deployed versus what exists now is similarly instructive, while keeping in mind that by no means can one endorse now all that was done then; insofar that the depth and length of the stimulus provided then helped sow the seeds of instability that manifested years down the line. Rather, these 'thought experiments' help put together the narrative as well as put in context the probable efficacy of incremental stimulus that is being announced in this cycle. To us the following things stand out for India's current cycle, and given the current global backdrop:

▶ Many parts of the world are doing better this time around (compared to their own recent histories), than India is. As an example, while our growth this year is comparable to 2008 the US is still growing around trend rate. China has slid but seems to be reconciling to this new reality and seems to be focusing more on sustainability of growth in a context of rising financial sector risks. In particular it has shown no inclination to again backstop a weakening global industrial cycle via a large scale stimulus, like it did in the previous two such downturns post 2009. That said, the world is currently relishing the about turn in Fed policy over the year and the consequent easing of global financial conditions that it brought. It is largely this, alongside a "Phase One" US-China deal, that is carrying a somewhat cheery sentiment with respect to global growth into the new year.

▶ Additionally, the persistence of incremental stimulus on growth seems to be much lower or marginal utility of incremental responses much weaker than what used to be the case. Global monetary easing, especially the experiment with negative rates, is an obvious case in point. A relative recent development is the seeming fall-off in the marginal impact of the US tax cuts as well. Thus US growth seems to have fallen back towards trend, and business fixed investments start to languish, within a little more than a year of the stimulus being administered. The point for us is that the world is unlikely to provide an impactful stimulus that could serve as a meaningful global tailwind to India's domestic growth.

▶ A significant portion of our current slowdown is owing to domestic factors, unlike in 2008 when the slowdown was largely imported via the financing channels. The two things that stand out are a persistent stagnation in income growth and the continuous impairment of lenders' balance sheets. To elaborate, income growth has been broadly weakening now for some time. The macro implications of this, however, were somewhat getting lost since consumption was largely being held up. This strength in consumption in turn was on the back of rising household leverage. A significant part of this incremental leverage was being provided by the so-called shadow banks. With liquidity to parts of this sector suddenly freezing, incremental leverage creation was severely impacted thereby leading to a cut back in private consumption. This also created much avoidable continuity to lenders' balance sheet issues. Thus what was earlier an "old-economy" impairment problem got additional continuity by new sources of stress. As some of the traditional lender balance sheets had started to somewhat stabilize, new lender balance sheets joined in the stress. Thus in some form or the other, our efforts at cleaning up our stresses have sustained for much longer than what we probably earlier envisaged.

▶ Our fiscal problems have been probably misdiagnosed, given the above context. There is sound macro logic if the sovereign decided to step up its role in intermediating savings given persistent troubles in traditional intermediation channels. This is further borne out by the fact that the slowdown in our growth and core inflation has happened despite an effective public deficit of 8% plus of GDP. It is rather the opacity of this deficit and seemingly lack of anchor currently on how much higher it can go that needs to be addressed. Attention also needs to be given to sustainability of the deficit in proportion to the net household financial savings available to finance this deficit. Household savings have been stagnant to falling reflecting similar trends in underlying income growth. Overtime, this may pose a classic 'crowding out' challenge should private investment start stepping up to the plate. It is for this reason that an integral pillar of the solution to our current predicament must necessarily include proactively courting foreign capital for various aspects of our financing needs including public asset disinvestment, stressed asset participation, and even for part financing the government's borrowing program.

▶ A related curious aspect is that bond yields have been behaving as if the crowding out is happening here and now. This is despite only about 30% of deposits garnered for the current financial year so far having gone into credit. And yet term spreads on even sovereign assets have remained very high. This starkly demonstrates the fundamental reluctance to deploy adequate risk capital in the system, even for market risk. Higher term spreads in turn have been, along with higher credit spreads, associated with our transmission problem. Sovereign yields themselves being close to current nominal growth rates of the economy have in turn spoken to the debt unsustainability problem that has crept upon us. It is in this context, as well as considering the aspects on fiscal mentioned above, that the recent "operation twist" from the RBI has to be seen. True this doesn't address the other problem of higher credit spread. However, the absence of "sufficiency" should not come in the way of implementing what may otherwise be "necessary". The point remains, however, that risk capital needs to become higher involvement in both the sovereign and the credit markets. Policy intervention and clarity that facilitates this is welcome and in fact necessary in the current context.

The Credit Market And The Continued Absence Of a "First Principles" Approach

Credit markets have been the source of much anguish over late last year and this year. Probably for the first time at such a scale the binary nature of this risk has been revealed to Indian investors, leading to stampede out from some funds in the market. Widening spreads in some section of issuers, backed by some tentative perceived signs of stability, has led to renewed calls lately in certain quarters to look at the much-beaten asset class of high-yield credit this year. If the discussion is around well-discovered, relatively liquid "mid-yield" credit names then it is probably one worth having. However, the yields here are nowhere close to the double-digits that may be the aspiration. For the higher yield segment, an investment case today will probably be in the realm of contra-investing. Given our inherent discomfort for this style in the illiquid, ill-discovered areas of an otherwise modest return asset class like fixed income, we would look for more signs of stabilization before sounding the all clear. In particular, we would look for balance sheet level funding to restart for some of the impacted entities in the market, as opposed to the asset level financing that they are currently getting. We would also look for how the business models evolve to accommodate for the higher cost of financing even when such financing starts to flow back. Finally, and this is more generic, we would wait for nominal aggregates to pick up so that debt servicing becomes easier more generally for the system.

But there is a more fundamental question to be answered here: Have we re-equipped ourselves in a way that prepares us better for the next such crisis, whenever in the future it happens? If we haven't then we are, somewhat naively, treating this year as an accident rather than probably the natural culmination of a somewhat aggressive financing cycle that is almost bound to repeat itself every few years. The answers here are to be found not in the realms of views but in first principles: first principles with respect to expectations from a mutual fund, and those of a fundamentally robust asset allocation table. Unfortunately, not enough discussion and adoption has happened in these areas yet, in our view. The following are some of the stand-out first principles to us that should help investors prepare better for the future:

▶ An open ended mutual fund has to provide for liquidity first and foremost in the assets that it holds. This means that when faced with redemptions it should, for the most part, have assets that can be liquidated with reasonable certainty and within a reasonable impact costs; barring a market freeze event. Furthermore, the liquidation of these assets should not change the underlying risk profile of the fund in a meaningful fashion. Concepts like "liability tranching" (matching investment maturity to exit load period of investors) are suitable for balance sheets and confusing application of these to an open ended market facing product like a mutual fund scheme has been, in many cases, been visibly proven ill-advised. Questions around the liquidity of the investment book have to be asked frequently and vociferously by investors and allocators to their mutual fund managers. Probably not enough of this is being done even now.

▶ There has to be greater attention given to an overall asset allocation model. Our best effort here is to think about non-cash fixed income products in a "core" and "satellite" bucket. The core bucket contains the bulk of fixed income allocations and provides for counter-cyclicality and a nest-egg to the overall asset allocation of an investor. For that reason, the chief pursuit is that of safety in this bucket. Most products here are thus low on both duration and credit risk. The satellite bucket is where the investor / asset-allocator expresses the reach for higher returns. Products here are thus higher on credit risk or duration risk or both. Depending upon investor risk profile and/or the point one is in the market cycle, the relative allocation between core and satellite buckets can be decided. Similarly the time horizon of investment may decide which products within the core and satellite bucket one should pick. However, what one shouldn't do is pass off a satellite bucket product as a core bucket allocation (as has been done with respect to credit funds over the past few years) or not have any anchor of such an asset allocation table at all.

▶ A related point is this fascination with portfolio yield based selection in our collective screening systems. If risk is introduced at all, it is only volatility that gets measured for the most part. Thus the screener ends up being some variant of a Sharpe ratio that measures excess return over a benchmark per unit of volatility. There is little recognition here of the binary nature of credit risk (especially in an illiquid market like ours) or, for that matter, any sort of an asset allocation framework. This kind of screening has not only further incentivized the proliferation of high yield credit funds, but has also furthered the creation of more diluted generic strategies that still go and implicit sit as core allocation. Both outright credit funds as well as diluted generic strategies have a place in the investor's portfolio insofar as they help round off the entire product suite on a risk-return spectrum. However, such funds have to be clearly marked as a satellite bucket allocation and should not be competing with core bucket generic products in the same screener sheet.

Turning The Page

All in all, 2019 was a year which was stressful for our macro and credits and did take us to the borderline. It was a year that did not try to blend in but instead stood out for its lack of linearity. It was also a year that could potentially lay the foundation for the best ideas and the strongest convictions to emerge. The Indian economy needs a somewhat cohesive diagnosis of its problems and a clear roadmap for both the sequencing of the solution as well as where the response can come from. This can be done, and indeed may be underway already. Fixed income investors need greater adherence to a sound set of first principles as well as a robust asset allocation framework. On their part, fund manufacturers need to be able to construct enough products that fit into such an asset allocation framework instead of every product trying to do everything.

In parting, and until the next time, one can do no better but to end with this message of learning and hope from Green Day:

"So make the best of this test

And don't ask why

It's not a question

But a lesson learned in time."

Our very best wishes for the new year.

Source: Bloomberg