Commentary

29th May 2020

Mr. Anoop Bhaskar

Head - Equity

WHAT WENT BY

Equities rose further through the month, extending April's rebound as investors remained optimistic

about the economic outlook while shrugging off rising political tensions. As Covid-19 remained at the

forefront and economies continued to reopen, there was particular strength in the US (S&P 500 +4.53%,

Nasdaq +6.17%, Russell +6.36%) and in Japan (Nikkei +8.34%, Topix +6.81%), while Asia underperformed

(SHCOMP -0.27%, Hang Seng -6.83%). Europe was mixed (Stoxx50 +4.18%, DAX +6.68%, FTSEMIB +2.87%,

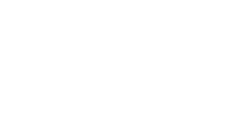

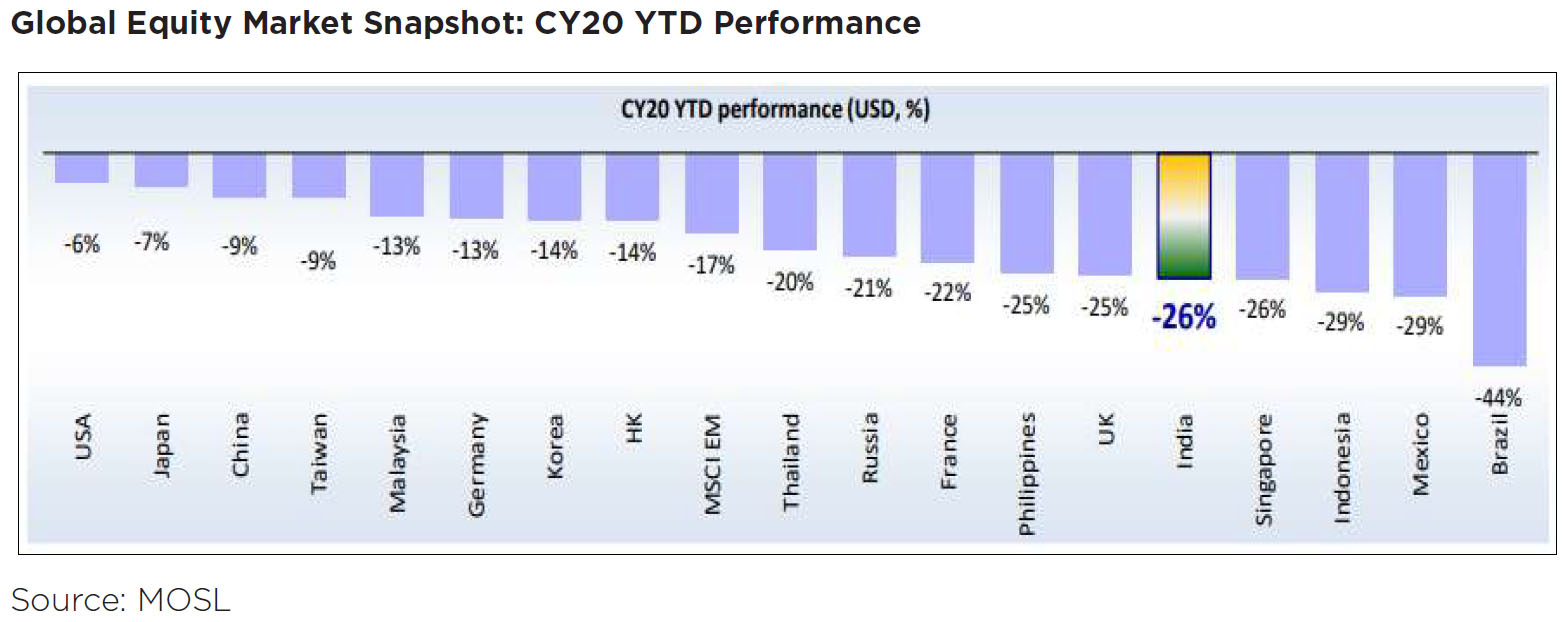

FTSE100 +2.97%). Developed Markets outperformed Emerging Markets as can be seen below, mainly on

account of larger stimulus programs.

Developed World ahead on Economy re-opening, further boosting sentiments: New infections peaked in most Developed countries, though cases still continue to rise across Developing world. As the situation, it seems Developed countries will be successful to reboot their economies, sparking optimism in investors and pushing markets higher. In the US, all 50 states took measures to ease lockdowns (though many activity restrictions remain in place). In Europe, countries continued to ease their strict measures and the positive was that there was overall no evidence that the lifting of the lockdowns has led to rising infection levels.

Rising geopolitical tensions: US-China tensions rose again as well as tensions within Europe as the German court challenged the legality of the ECB'S QE programme and with regards to the aforementioned EU recovery fund. For the US-China tensions, Trump's 'Blame China' Campaign reflected another pillar of uncertainty (recall 2018, 2019), and acted as a headwind for markets. This resulted in a series of retaliatory actions between the two nations and was aggravated as Hong Kong and China relations deteriorated.

Currencies & Commodities: The Dollar (DXY) fell -0.68%, the Yen (JPYUSD) fell -0.58%. The Euro rose +1.68%, the Pound weakened -2.70%. JP EMFX index +3.40%. The dollar and Japanese yen declined as equities and risky asset rose through the month. Brent +39.81%, WTI +88.38%. Oil jumped as demand in China returned to near pre-virus levels and output curbs continued in the US and across the OPEC + Russia combine. Gold rose +2.60%, Silver rose +19.34%. As the dollar declined, precious metals managed to post some gains in the risk-on environment. Aluminium rose +5.66%, Copper +3.04% and Iron Ore +20.10% & Steel +5.68%.

Domestic Coronavirus updates: India entered the list of top 10 countries hit by coronavirus as confirmed cases rose fivefold to 170k by month-end and crossing 2 lakhs by the time of this report; but death rates still remained much lower than global average. While the lockdown was extended for 2 more weeks to end-May, albeit, with significant relaxations for non-containment zones. Activity levels continued to improve month on month, though y-o-y decline was sharp, raising fears of negative print on GDP.

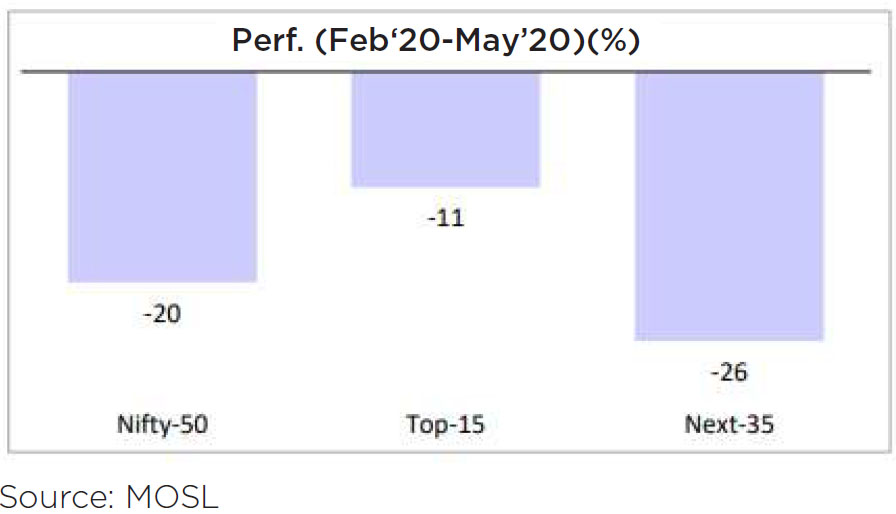

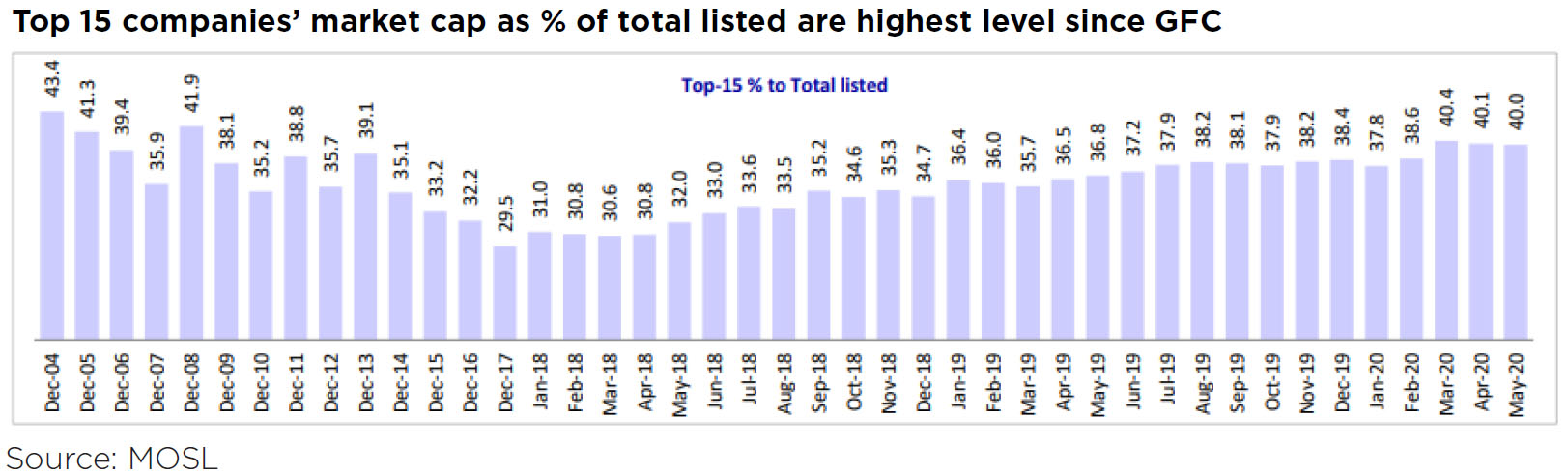

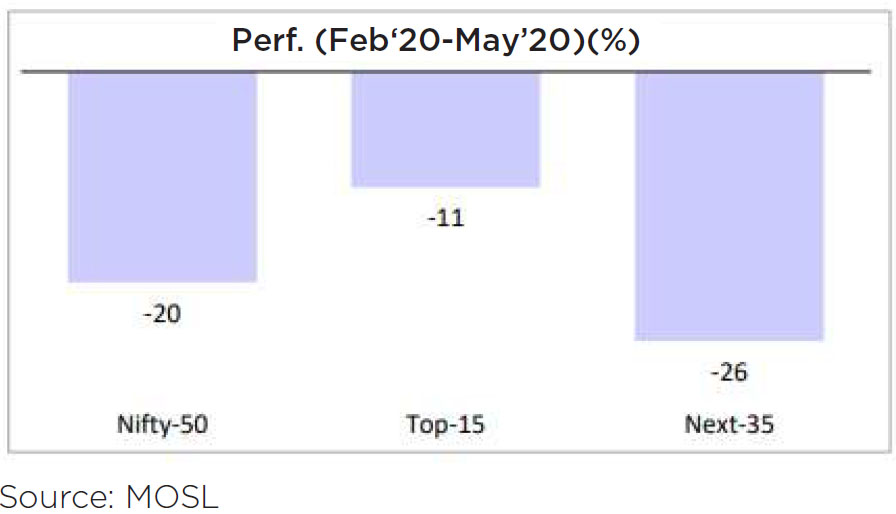

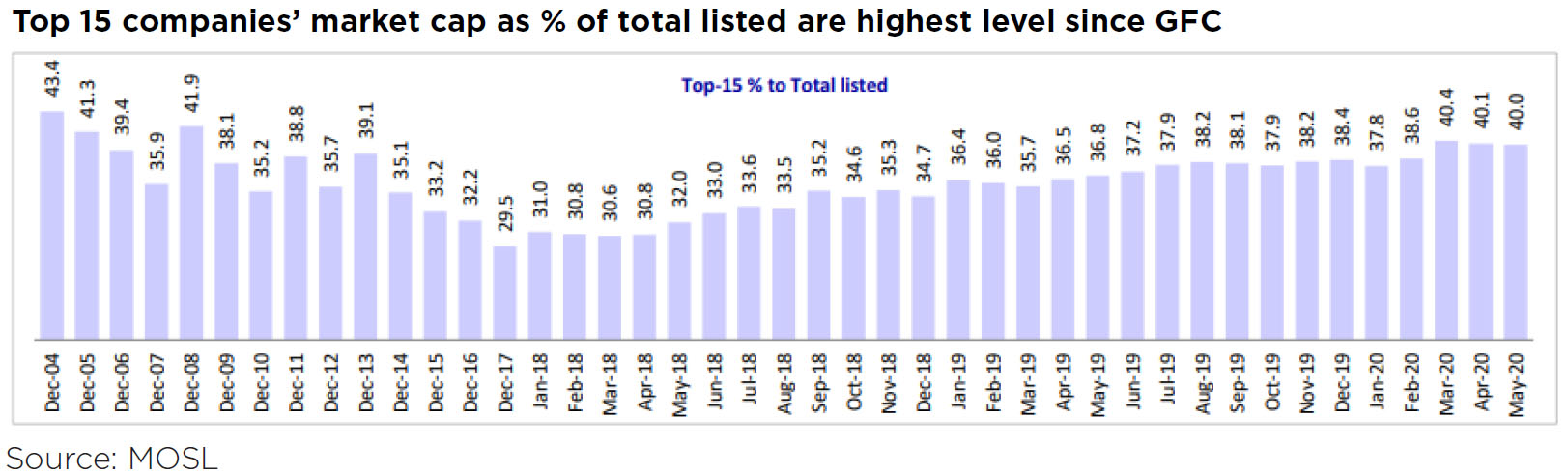

Top 15 stocks continue to outperform the rest of the market, resulting in increasing weight of top 15 stocks in the Nifty, now close to 2008 GFC (Global Financial Crisis) highs.

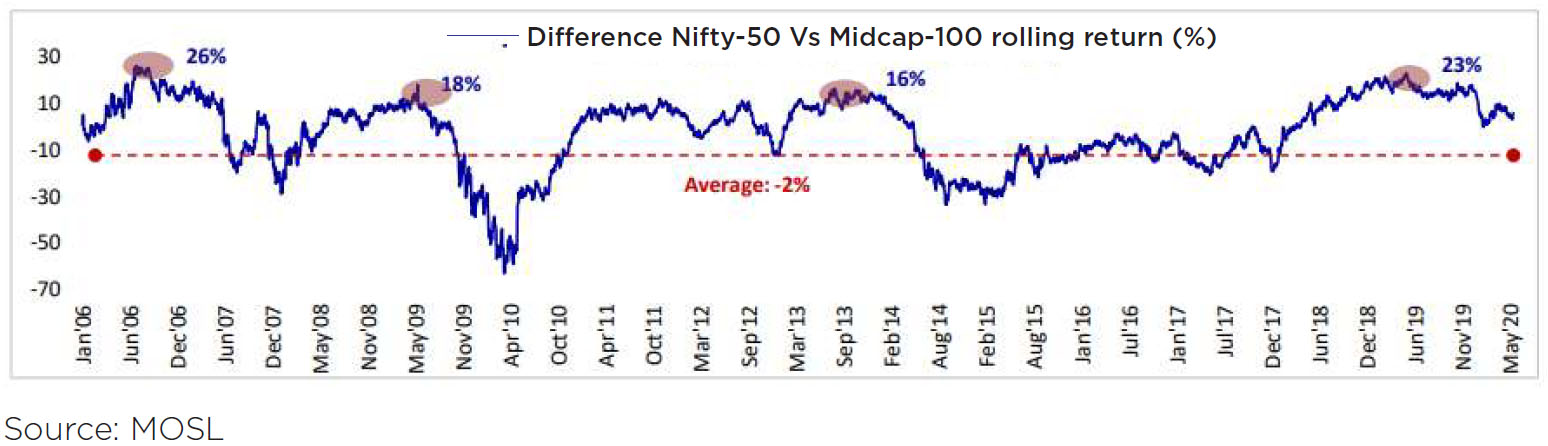

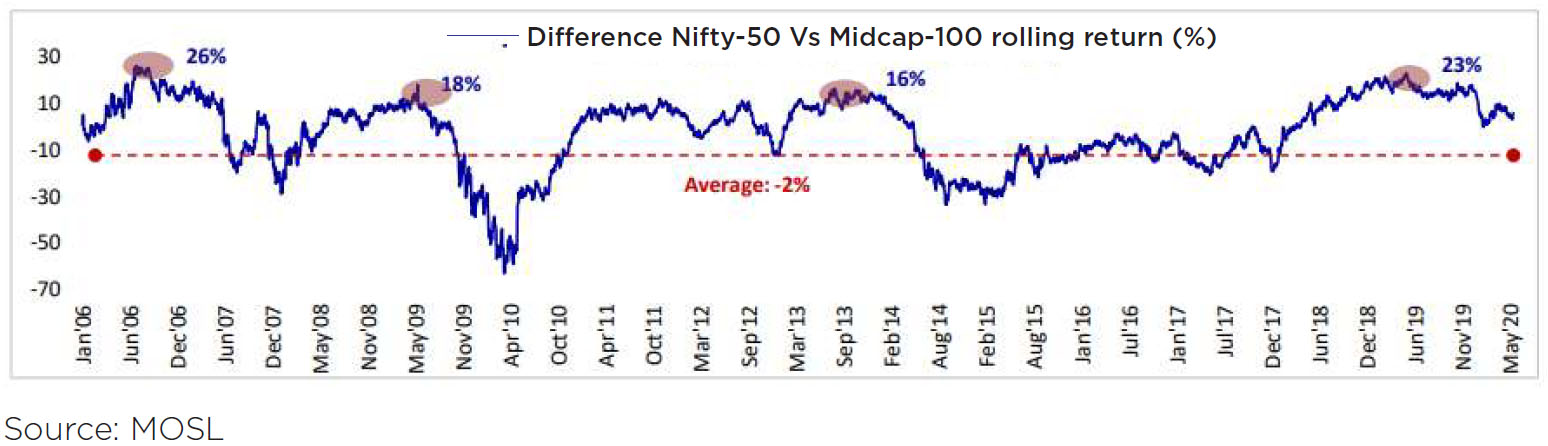

Large Cap stocks continue to significantly outperform Mid & Small Cap stocks.

Q4 FY20 Earnings: So far 27 companies (54% by number of companies and 38% by top line) in the Nifty Index have reported 4QFY20 results. On an aggregate basis revenue/EBITDA/PAT growth for 4QFY20 is at +2%/+5%/-28% y-o-y, while median is +7%/+7%/-10% y-o-y, respectively. The large aggregate PAT de-growth is due to financials from higher provisions in 4QFY20, particularly Axis Bank (Rs.13bn loss) and Yes Bank (Rs.37bn loss, part of Nifty Index till Mar-Q). Also, Bharti Airtel reported a large loss of Rs.50bn in 4QFY20. Excluding the aforementioned disproportionate losses, the aggregate PAT decline was -9% y-o-y.

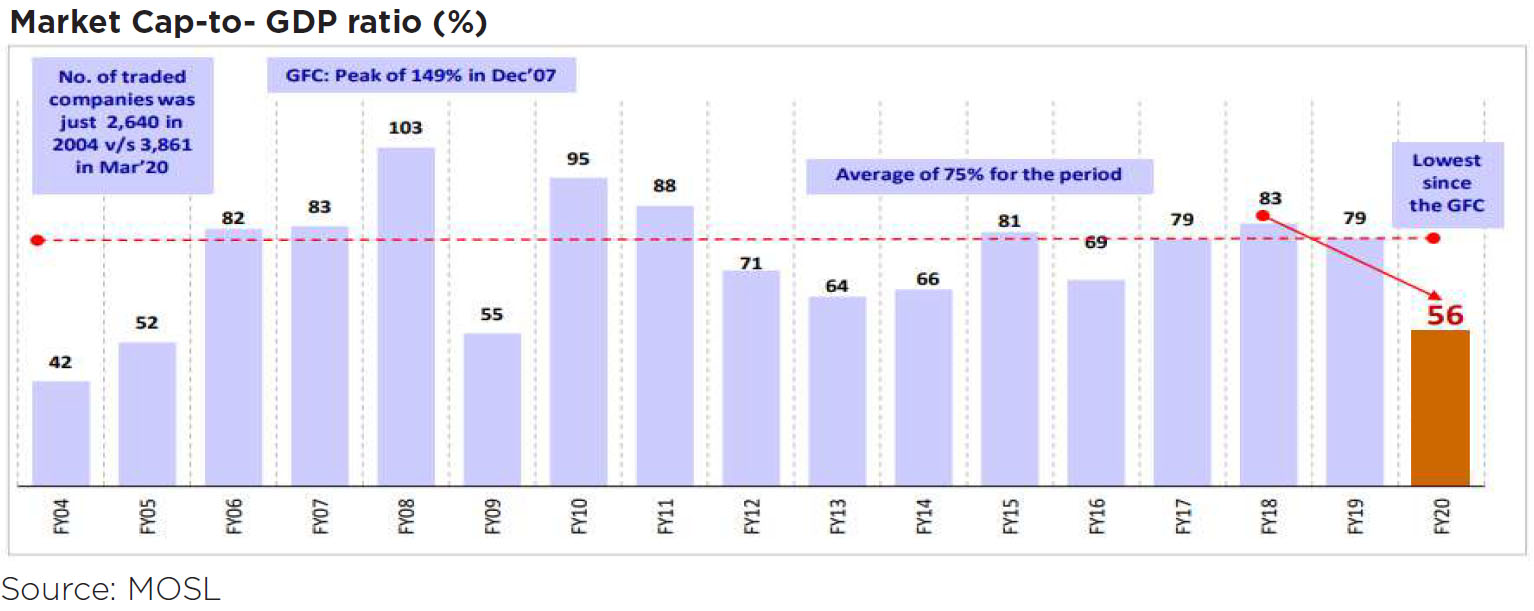

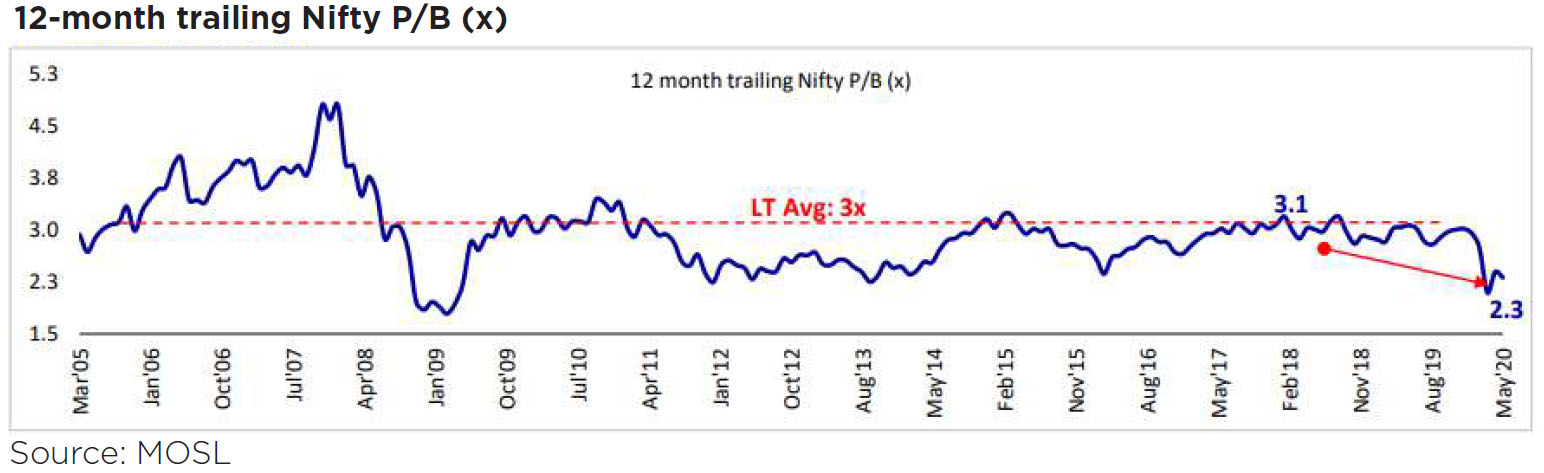

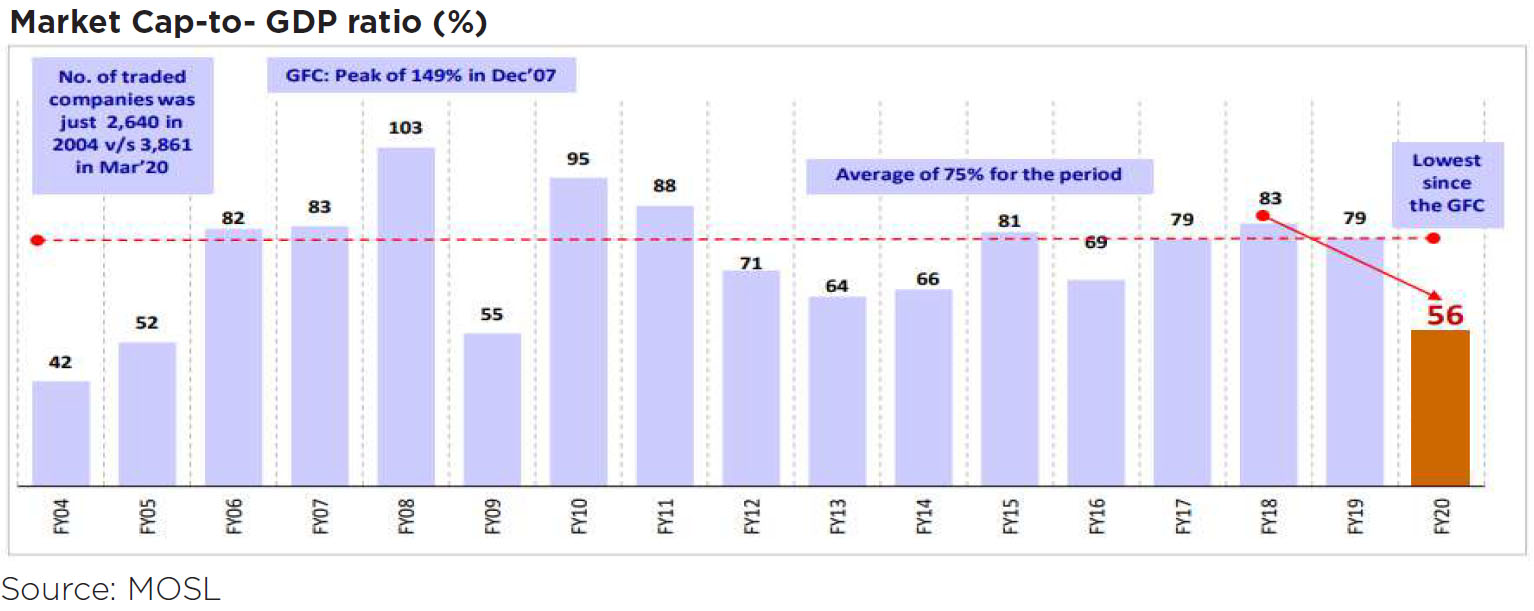

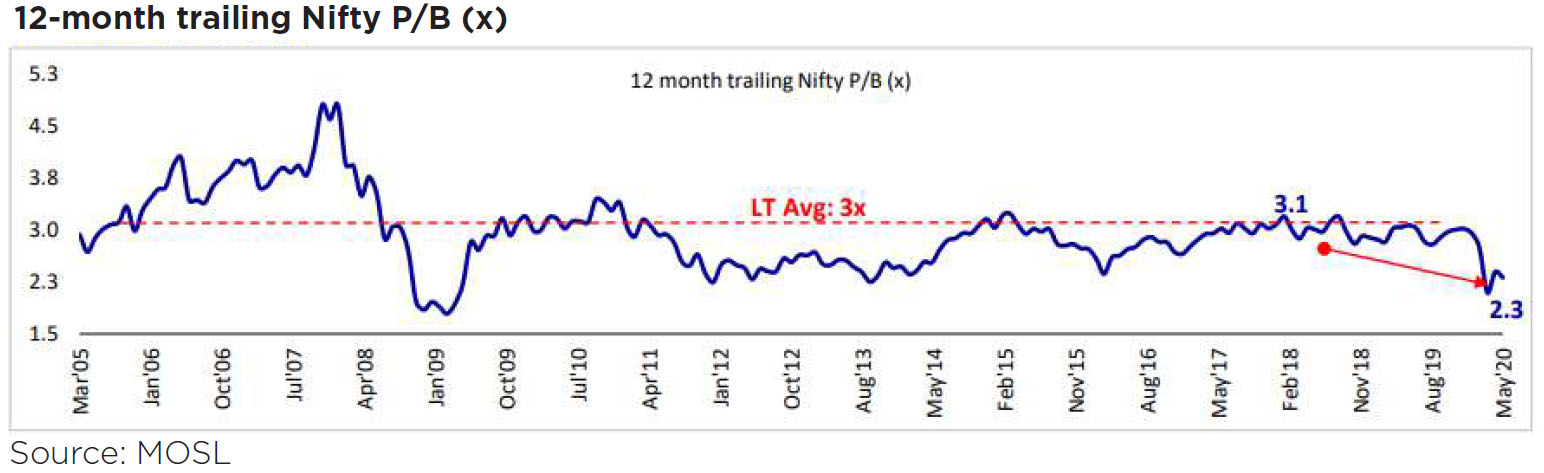

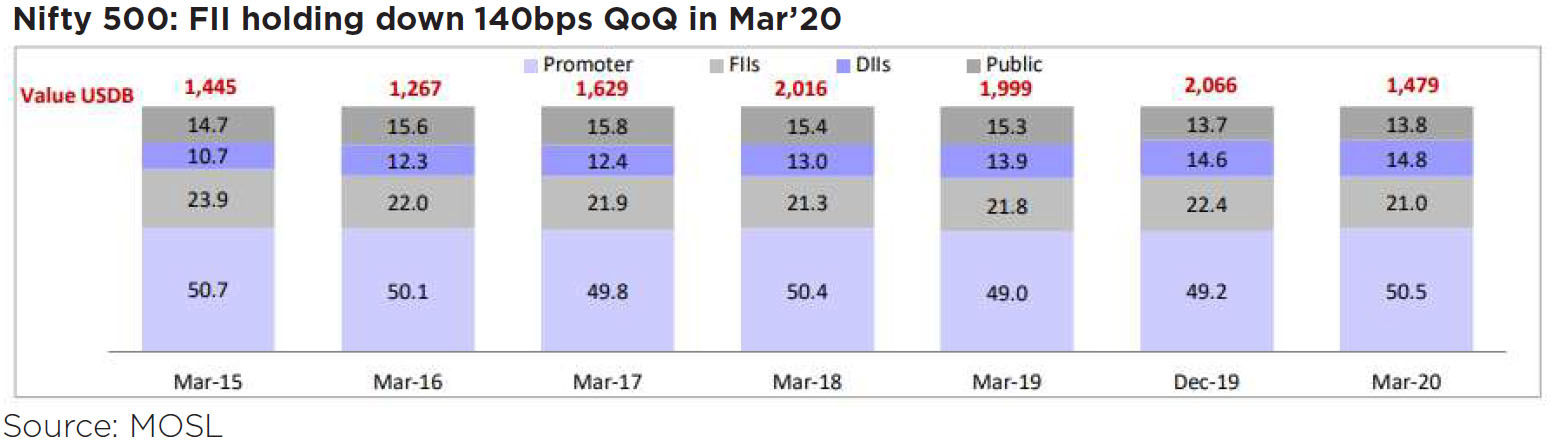

Valuation: Despite the recent uptick in the markets, valuations remain in the reasonable zone. Market Cap to GDP is close to FY09 lows at 56%. Nifty 12-month trailing P/E of 20.2x is trading at ~9% premium to its LT average of 18.5x since Mar'05. At 2.3x, the Nifty 12-month trailing P/B is well below the historical average of 3x. However, if economic growth is being forecasted to be negative, earnings could take further downgrading from the current estimates for FY21. As has been the case in the past, the initial estimates could be sanguine (against the actual numbers for H1 FY21) leading to a sharp purge for the second half, when actuals could be better than the estimates. Any scenario builds a non-occurrence of a "second" wave of infections in India and across the world.

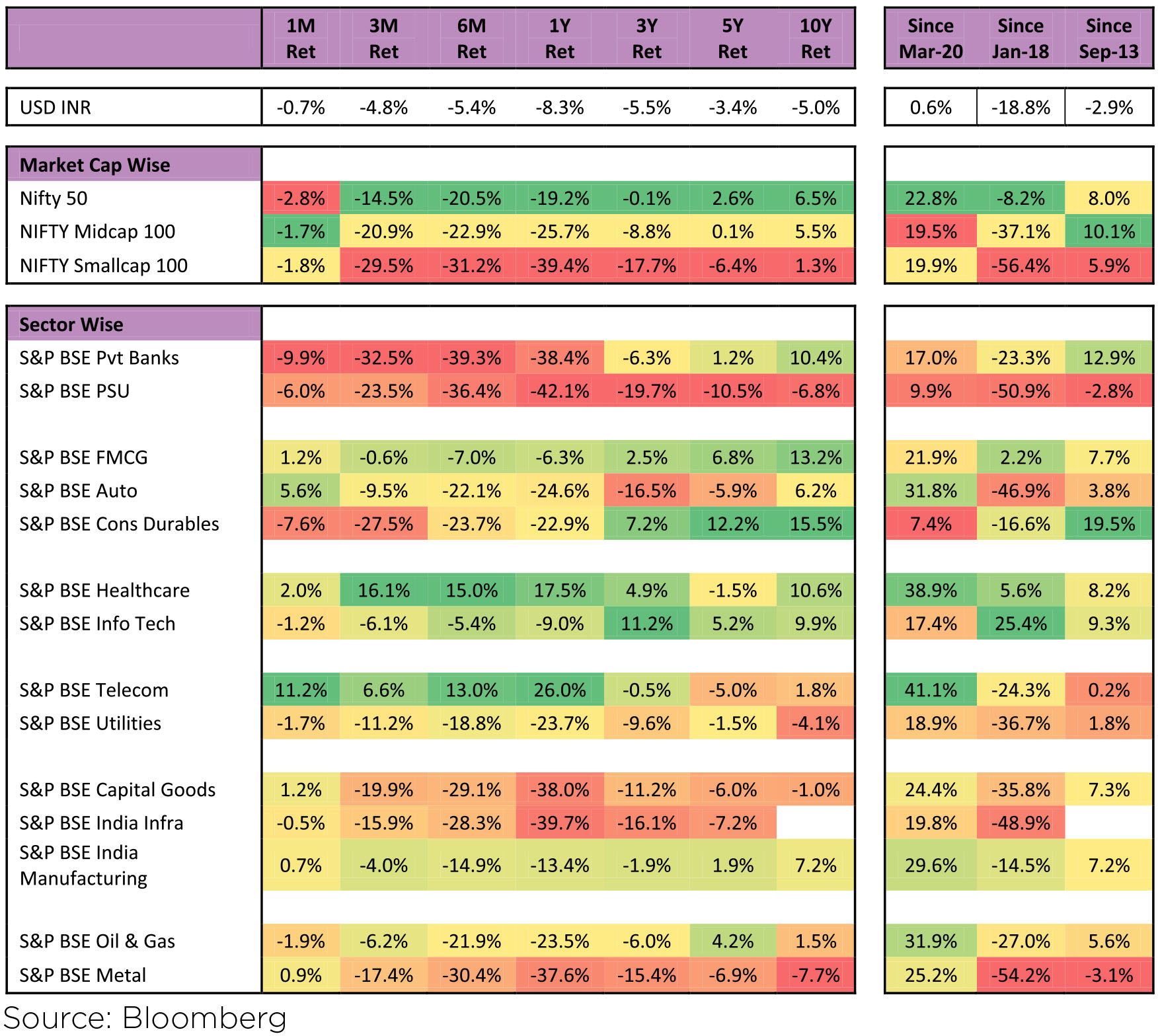

Sectoral Performance as on May 29, 2020

Inflation: Headline CPI for April could not be released as nationwide lockdown affected collection of price data. Sample data suggested that food inflation bottomed out as supply-chain disruption led to increase in prices.

Fiscal Deficit: Even before fiscal stimulus announcement, the government increased its FY21 borrowing target to Rs12trn from Rs7.8trn, which led to speculation on further upward revision as street estimated a higher fiscal slippage.

Monetary Policy: After the Fiscal Stimulus 2.0, RBI Governor made an unscheduled announcement during the month, the second consecutive, "inter-meeting" announcement. After due deliberations, the MPC voted for repo rate to be cut further by 40bps to 4%, importantly maintaining an accommodative stance. RBI also extended the moratorium period by 3 months to 31st August factoring in the lockdown extension. Interest accumulated on working capital facilities for 6 months of moratorium was allowed to be converted to a term loan and large exposure limits for banks was eased from 25% to 30% of capital. The request for a one-time restructuring by the Banks and NBFCs was not considered by the RBI in this policy announcement as well.

Fiscal Stimulus 2.0: PM Modi announced a larger than expected Rs20trn (~10% of GDP) economic package in response to the economic fallout from Covid-19 induced lockdown. Finer details, however, disappointed the street for the lack of direct stimulus measures and limited fiscal impact (~1.3% of GDP). The measures focused on the needy, rural incomes, improving farm infrastructure and reducing the solvency risk / credit risk of MSMEs. PM Modi announced extending the nation-wide lockdown for 2 more weeks to May 31 but with major relaxations, permitting almost all economic activities and significant public movement. Post June 1, India prepared for significant opening up in non-hotspots with only containment zones seeing extension of lockdown till June 30. Fighting Covid-19 had been the unilateral theme from March 23rd. By mid-May, the clamor for fighting Economic hardship took the center stage, despite spread of the virus. Balancing, the two will be a delicate exercise, any misstep in either direction could be…

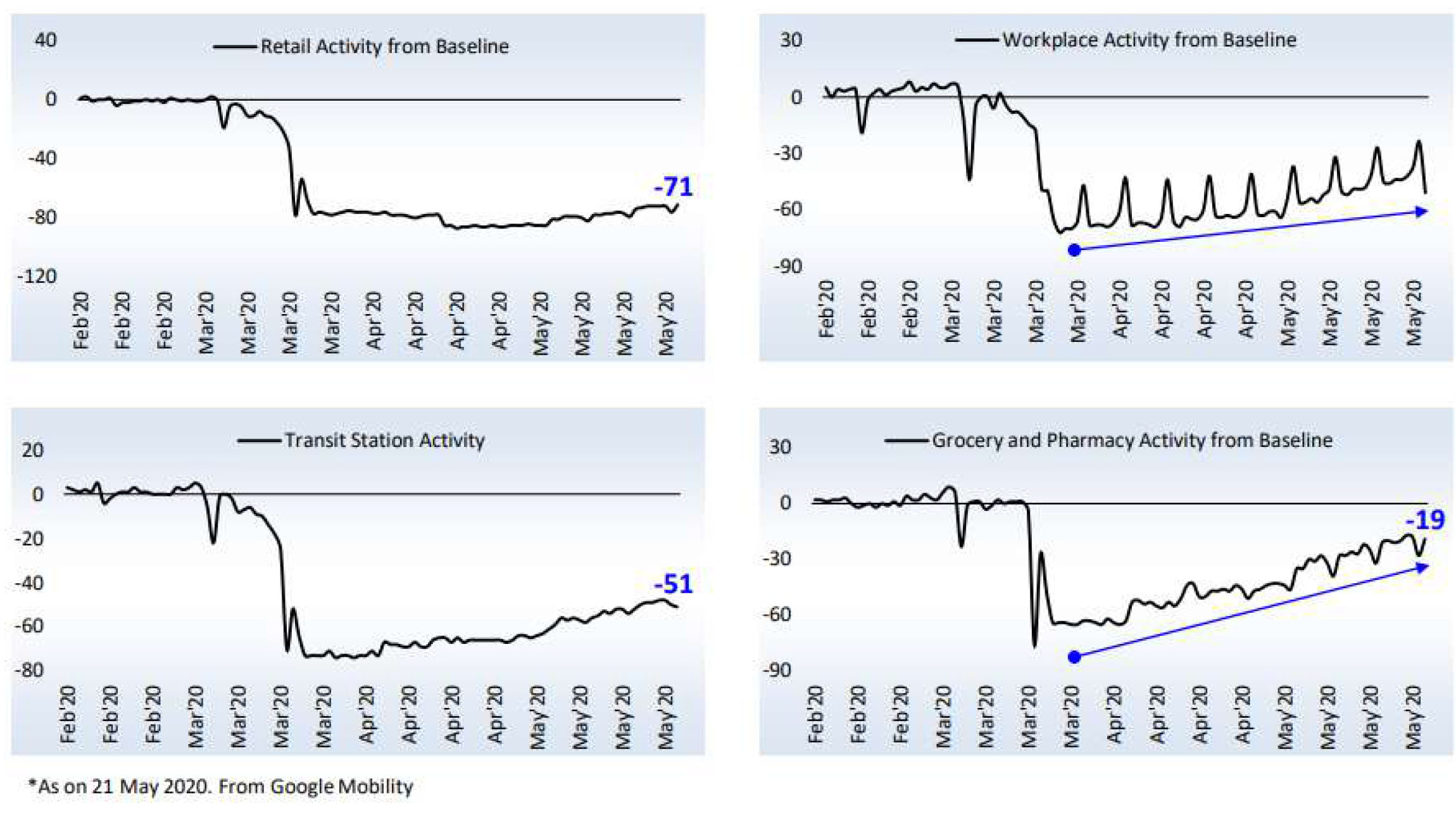

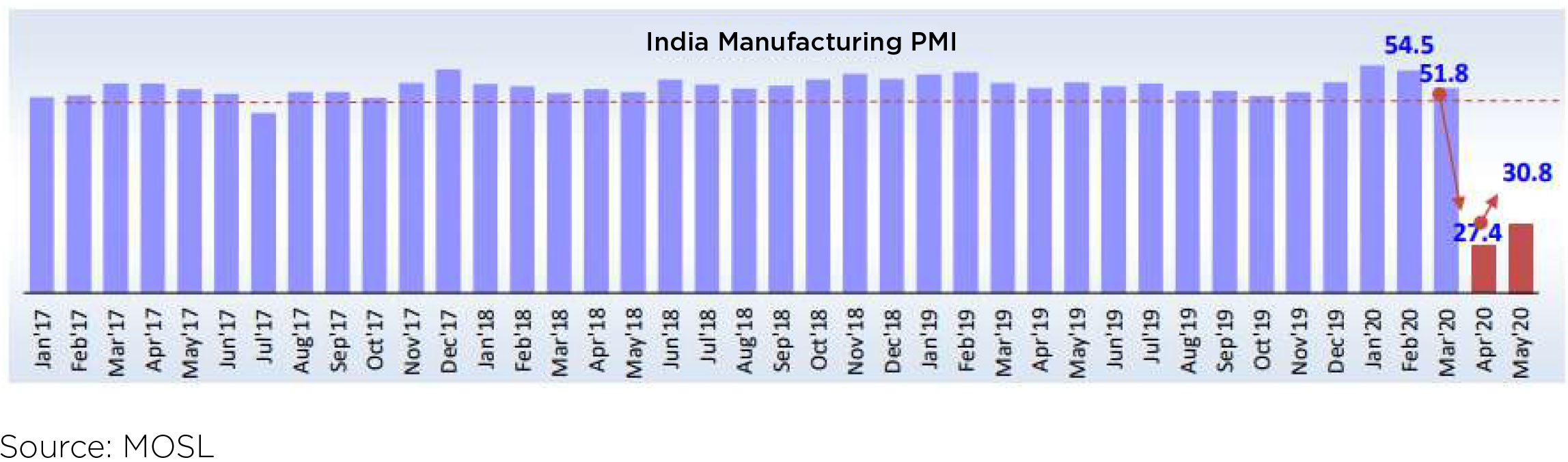

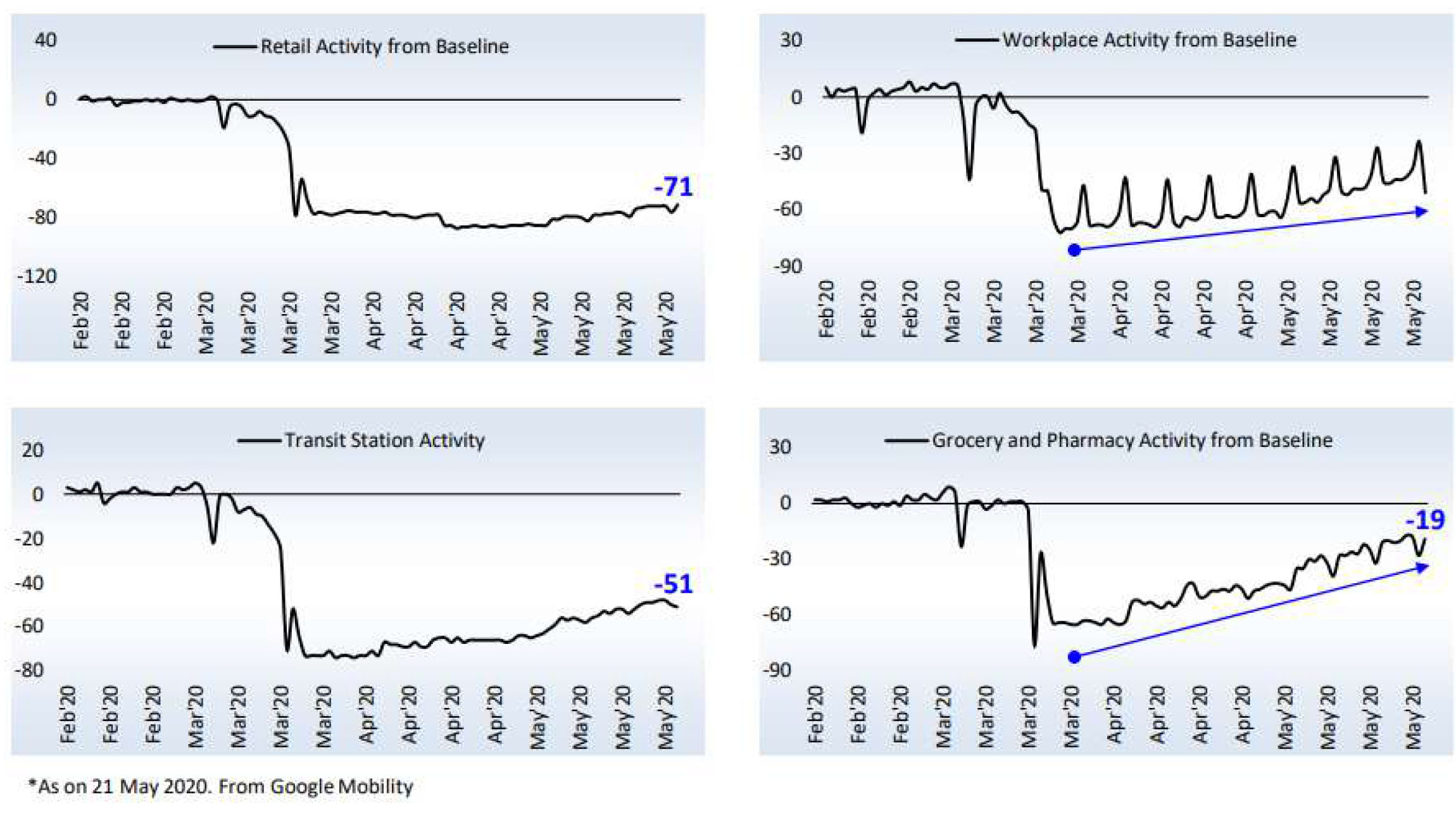

Unlock 1.0: As states begin the unlock process, several high-frequency indicators indicate pick-up in economic activity from the troughs of Lockdown 1.0 & 2.0; though significantly lower than pre-Corona levels. With large consumption centres like Mumbai, Delhi and Chennai still recording large increase in number of cases, recovery in economic activity will be gradual.

While, investors might be bracing themselves for such an eventuality, the possibility of the actual being more sombre than what was forecasted is a factor which one should not overrule. On the other hand, March "Mayhem" - just as 9th March'09 has been underlined as the turning point during the GFC, could 23rd March'20 become the low point of this downward spiral? However, a downward plunge from current levels should not be ruled out in the coming weeks. Though, breaching March lows, may not be driven by disappointing June quarter results alone. So, don't overlook the virus even when Unlock 1.0 is in full swing!

Disclaimer: MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

The Disclosures of opinions/in house views/strategy incorporated herein is provided solely to enhance the transparency about the investment strategy / theme of the Scheme and should not be treated as endorsement of the views / opinions or as an investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document has been prepared on the basis of information, which is already available in publicly accessible media or developed through analysis of IDFC Mutual Fund. The information/ views / opinions provided is for informative purpose only and may have ceased to be current by the time it may reach the recipient, which should be taken into account before interpreting this document. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision and the security may or may not continue to form part of the scheme's portfolio in future. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. The decision of the Investment Manager may not always be profitable; as such decisions are based on the prevailing market conditions and the understanding of the Investment Manager. Actual market movements may vary from the anticipated trends. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alterations to this statement as may be required from time to time. Neither IDFC Mutual Fund / IDFC AMC Trustee Co. Ltd./ IDFC Asset Management Co. Ltd nor IDFC, its Directors or representatives shall be liable for any damages whether direct or indirect, incidental, punitive special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information.

Developed World ahead on Economy re-opening, further boosting sentiments: New infections peaked in most Developed countries, though cases still continue to rise across Developing world. As the situation, it seems Developed countries will be successful to reboot their economies, sparking optimism in investors and pushing markets higher. In the US, all 50 states took measures to ease lockdowns (though many activity restrictions remain in place). In Europe, countries continued to ease their strict measures and the positive was that there was overall no evidence that the lifting of the lockdowns has led to rising infection levels.

Rising geopolitical tensions: US-China tensions rose again as well as tensions within Europe as the German court challenged the legality of the ECB'S QE programme and with regards to the aforementioned EU recovery fund. For the US-China tensions, Trump's 'Blame China' Campaign reflected another pillar of uncertainty (recall 2018, 2019), and acted as a headwind for markets. This resulted in a series of retaliatory actions between the two nations and was aggravated as Hong Kong and China relations deteriorated.

Currencies & Commodities: The Dollar (DXY) fell -0.68%, the Yen (JPYUSD) fell -0.58%. The Euro rose +1.68%, the Pound weakened -2.70%. JP EMFX index +3.40%. The dollar and Japanese yen declined as equities and risky asset rose through the month. Brent +39.81%, WTI +88.38%. Oil jumped as demand in China returned to near pre-virus levels and output curbs continued in the US and across the OPEC + Russia combine. Gold rose +2.60%, Silver rose +19.34%. As the dollar declined, precious metals managed to post some gains in the risk-on environment. Aluminium rose +5.66%, Copper +3.04% and Iron Ore +20.10% & Steel +5.68%.

Domestic Coronavirus updates: India entered the list of top 10 countries hit by coronavirus as confirmed cases rose fivefold to 170k by month-end and crossing 2 lakhs by the time of this report; but death rates still remained much lower than global average. While the lockdown was extended for 2 more weeks to end-May, albeit, with significant relaxations for non-containment zones. Activity levels continued to improve month on month, though y-o-y decline was sharp, raising fears of negative print on GDP.

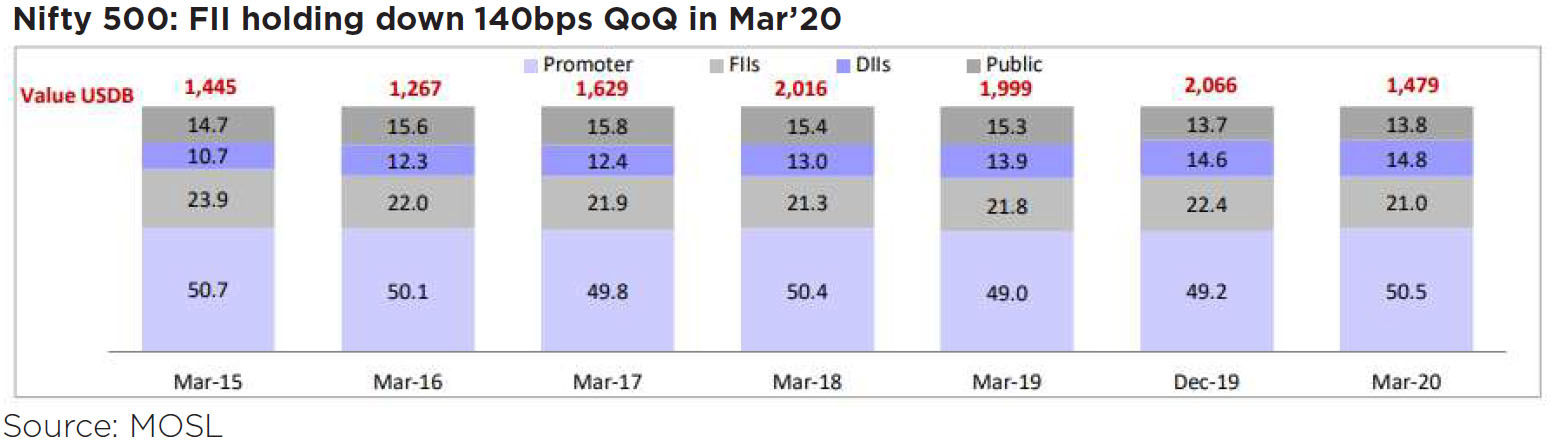

Domestic Markets:

May could be dissected into two halves - Nifty (-2.8%) falling in the first half on disappointment on fiscal

stimulus front and gaining in the second half on improving global sentiment as economies across the world

emerged out of lockdowns. This was despite tensions between US-China escalating with US's threat to

delist Chinese companies and China's signing of HK security legislation. Border tensions between India-

China, too escalated, as Chinese troops moved into sensitive areas along the Himalayan frontier.

Top 15 stocks continue to outperform the rest of the market, resulting in increasing weight of top 15 stocks in the Nifty, now close to 2008 GFC (Global Financial Crisis) highs.

Large Cap stocks continue to significantly outperform Mid & Small Cap stocks.

Q4 FY20 Earnings: So far 27 companies (54% by number of companies and 38% by top line) in the Nifty Index have reported 4QFY20 results. On an aggregate basis revenue/EBITDA/PAT growth for 4QFY20 is at +2%/+5%/-28% y-o-y, while median is +7%/+7%/-10% y-o-y, respectively. The large aggregate PAT de-growth is due to financials from higher provisions in 4QFY20, particularly Axis Bank (Rs.13bn loss) and Yes Bank (Rs.37bn loss, part of Nifty Index till Mar-Q). Also, Bharti Airtel reported a large loss of Rs.50bn in 4QFY20. Excluding the aforementioned disproportionate losses, the aggregate PAT decline was -9% y-o-y.

Valuation: Despite the recent uptick in the markets, valuations remain in the reasonable zone. Market Cap to GDP is close to FY09 lows at 56%. Nifty 12-month trailing P/E of 20.2x is trading at ~9% premium to its LT average of 18.5x since Mar'05. At 2.3x, the Nifty 12-month trailing P/B is well below the historical average of 3x. However, if economic growth is being forecasted to be negative, earnings could take further downgrading from the current estimates for FY21. As has been the case in the past, the initial estimates could be sanguine (against the actual numbers for H1 FY21) leading to a sharp purge for the second half, when actuals could be better than the estimates. Any scenario builds a non-occurrence of a "second" wave of infections in India and across the world.

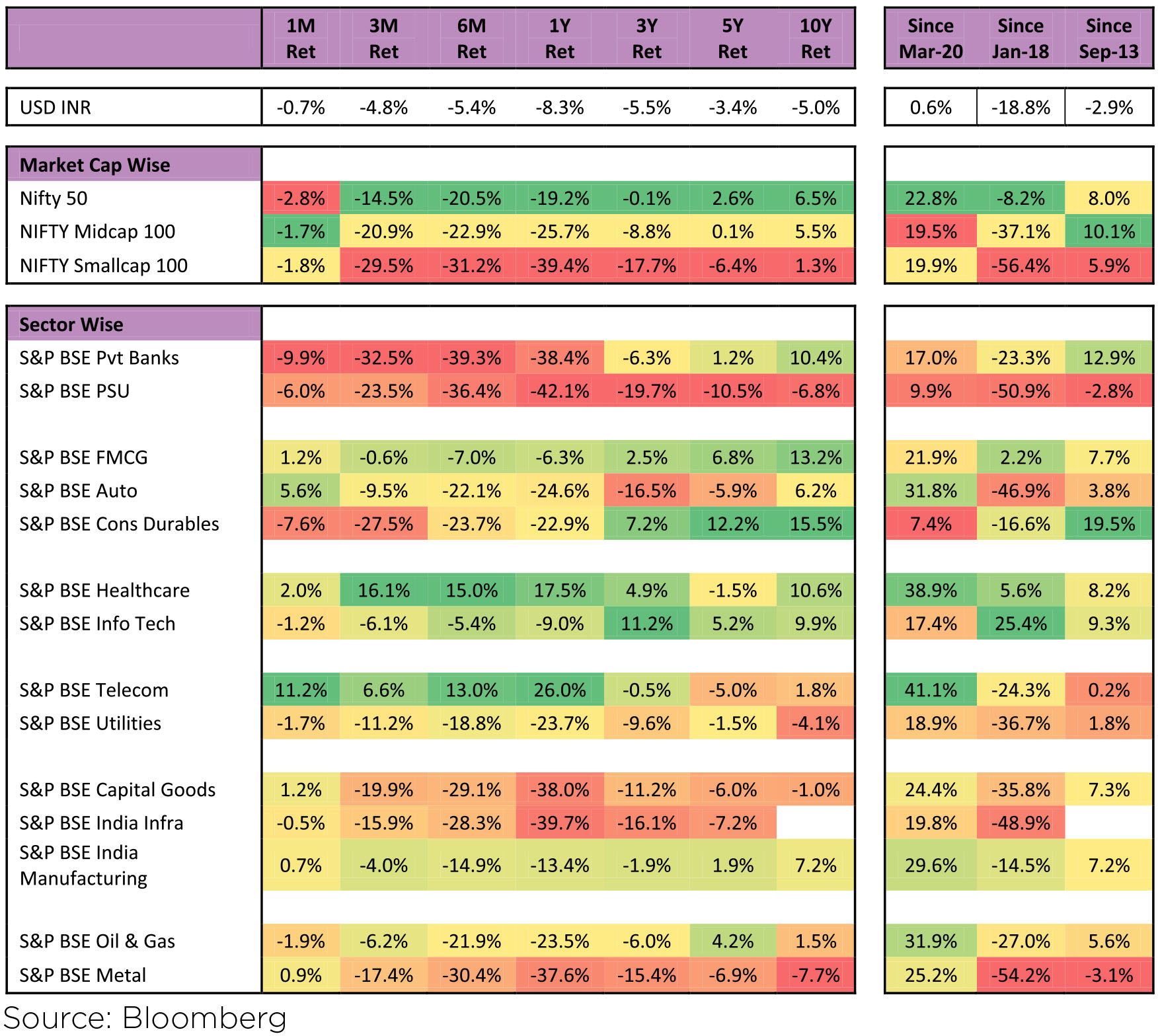

Sectoral Impact

Among sectoral trends, Banks (asset quality woes, moratorium extension) were the top losers in May

whereas Telecom and Cement (better than expected earnings) topped the chart.Sectoral Performance as on May 29, 2020

The Macro Picture

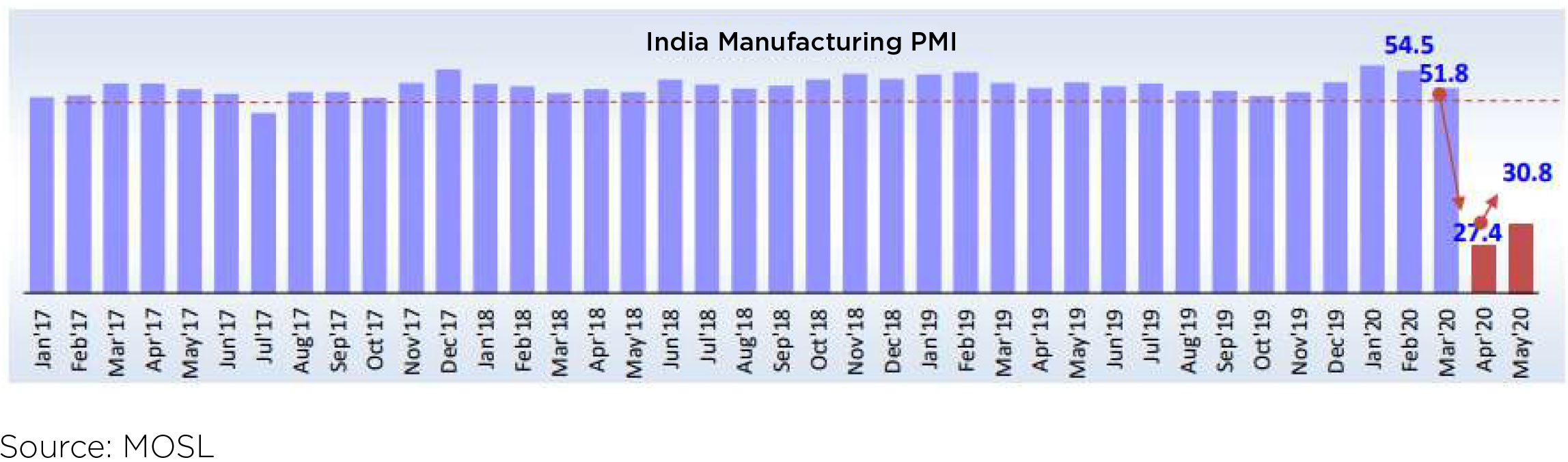

Growth forecasts turn negative: ERBI Governor, during his unscheduled policy announcement, alluded

to the possibility of FY21E growth likely to be negative. Observers, experts and economists were not

satisfied by this brief allusion to negative territory, wanting a more formal growth forecast to be laid down

by the RBI. Rating agencies slashed India's growth forecasts and expected the economy to contract in

the range of 4.5-5% in the current fiscal. At the start of June, Moody's downgraded India's rating to junk

(in line with other global rating agencies) as well as gave a negative outlook, equity markets cheered by

moving up the most since March'20!Inflation: Headline CPI for April could not be released as nationwide lockdown affected collection of price data. Sample data suggested that food inflation bottomed out as supply-chain disruption led to increase in prices.

Fiscal Deficit: Even before fiscal stimulus announcement, the government increased its FY21 borrowing target to Rs12trn from Rs7.8trn, which led to speculation on further upward revision as street estimated a higher fiscal slippage.

Monetary Policy: After the Fiscal Stimulus 2.0, RBI Governor made an unscheduled announcement during the month, the second consecutive, "inter-meeting" announcement. After due deliberations, the MPC voted for repo rate to be cut further by 40bps to 4%, importantly maintaining an accommodative stance. RBI also extended the moratorium period by 3 months to 31st August factoring in the lockdown extension. Interest accumulated on working capital facilities for 6 months of moratorium was allowed to be converted to a term loan and large exposure limits for banks was eased from 25% to 30% of capital. The request for a one-time restructuring by the Banks and NBFCs was not considered by the RBI in this policy announcement as well.

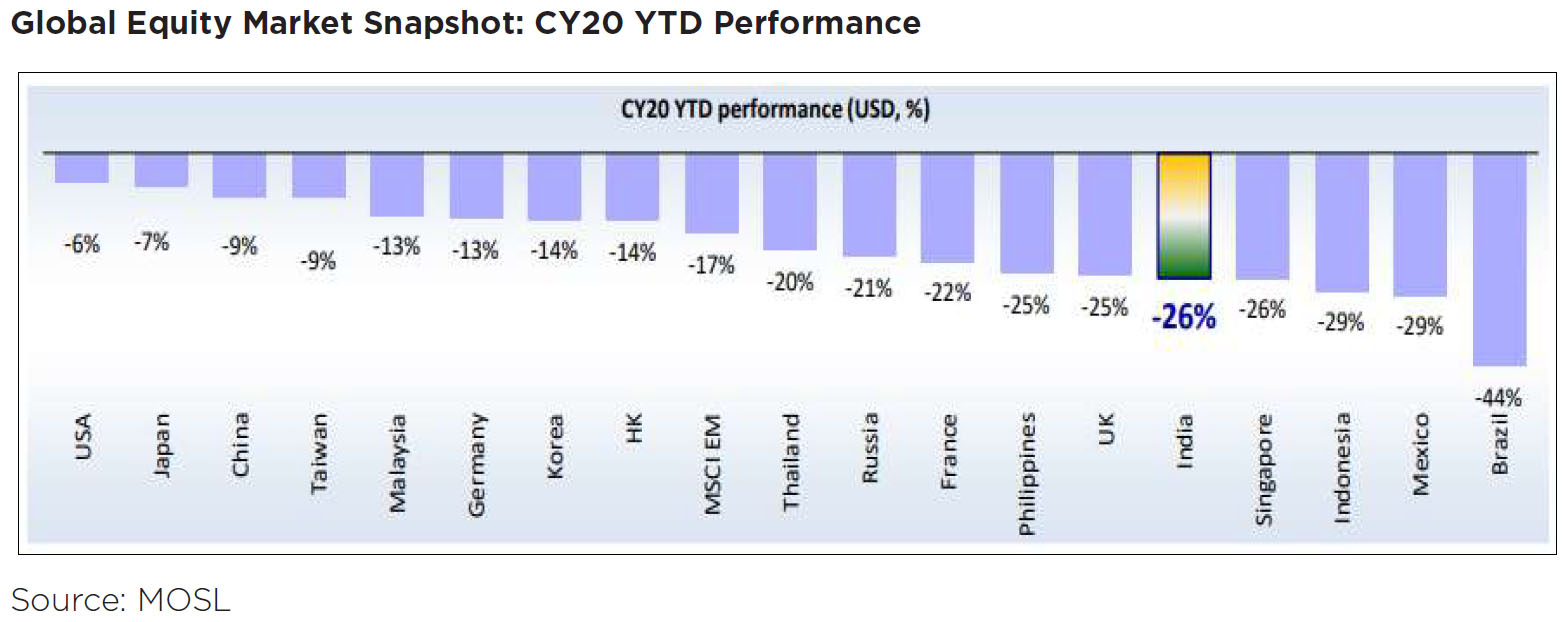

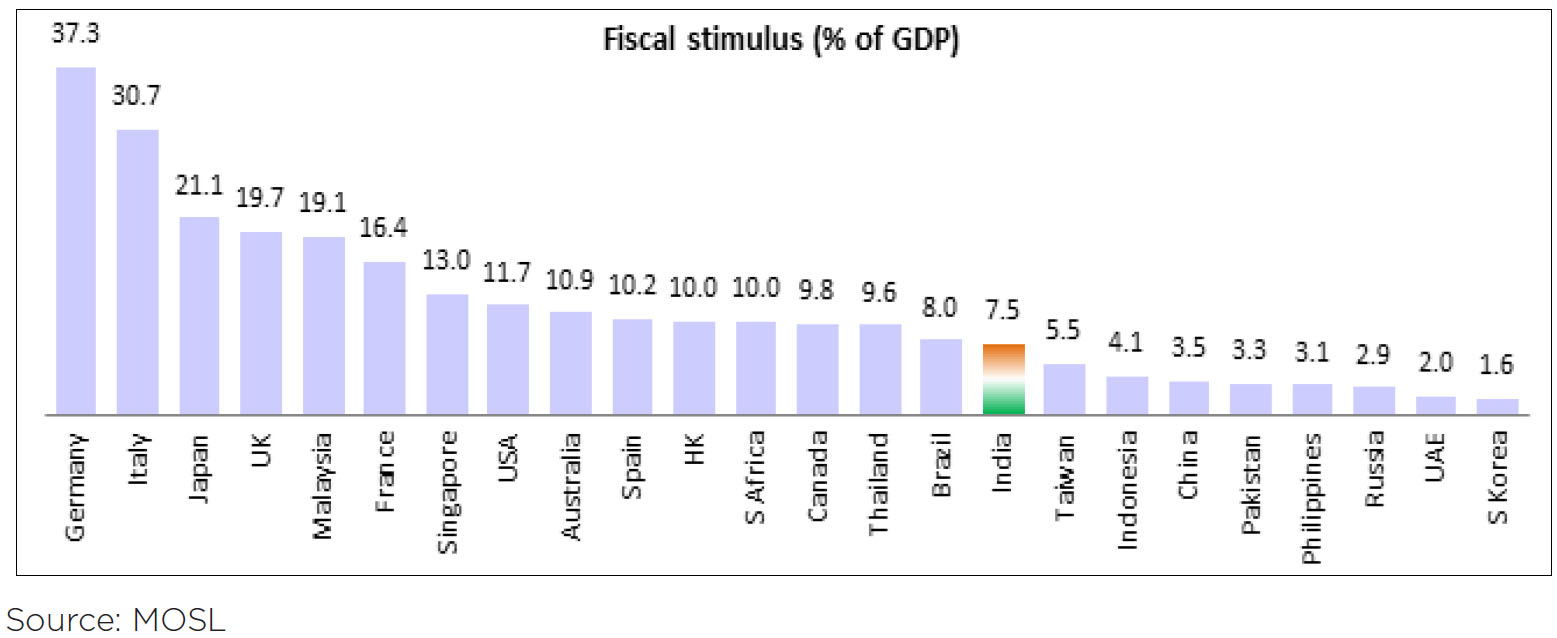

Fiscal Stimulus 2.0: PM Modi announced a larger than expected Rs20trn (~10% of GDP) economic package in response to the economic fallout from Covid-19 induced lockdown. Finer details, however, disappointed the street for the lack of direct stimulus measures and limited fiscal impact (~1.3% of GDP). The measures focused on the needy, rural incomes, improving farm infrastructure and reducing the solvency risk / credit risk of MSMEs. PM Modi announced extending the nation-wide lockdown for 2 more weeks to May 31 but with major relaxations, permitting almost all economic activities and significant public movement. Post June 1, India prepared for significant opening up in non-hotspots with only containment zones seeing extension of lockdown till June 30. Fighting Covid-19 had been the unilateral theme from March 23rd. By mid-May, the clamor for fighting Economic hardship took the center stage, despite spread of the virus. Balancing, the two will be a delicate exercise, any misstep in either direction could be…

Unlock 1.0: As states begin the unlock process, several high-frequency indicators indicate pick-up in economic activity from the troughs of Lockdown 1.0 & 2.0; though significantly lower than pre-Corona levels. With large consumption centres like Mumbai, Delhi and Chennai still recording large increase in number of cases, recovery in economic activity will be gradual.

Outlook

The protracted Q4 FY20 earnings season has still not ended. Q1 FY21, is poised to create several economic

historical milestones - 1st negative GDP print; an alarming fiscal deficit situation and an earnings season

like never before. Companies across several sectors - Auto, Auto Ancillary, Capital goods, Construction,

Retail - Apparel, Travel, Tourism, Malls & Multiplexes, Airlines, Paints, Ceramic tiles and several more "non"

essential sectors - having reported negligible sales for at least 50% of the duration of the quarter.While, investors might be bracing themselves for such an eventuality, the possibility of the actual being more sombre than what was forecasted is a factor which one should not overrule. On the other hand, March "Mayhem" - just as 9th March'09 has been underlined as the turning point during the GFC, could 23rd March'20 become the low point of this downward spiral? However, a downward plunge from current levels should not be ruled out in the coming weeks. Though, breaching March lows, may not be driven by disappointing June quarter results alone. So, don't overlook the virus even when Unlock 1.0 is in full swing!

Disclaimer: MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

The Disclosures of opinions/in house views/strategy incorporated herein is provided solely to enhance the transparency about the investment strategy / theme of the Scheme and should not be treated as endorsement of the views / opinions or as an investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document has been prepared on the basis of information, which is already available in publicly accessible media or developed through analysis of IDFC Mutual Fund. The information/ views / opinions provided is for informative purpose only and may have ceased to be current by the time it may reach the recipient, which should be taken into account before interpreting this document. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision and the security may or may not continue to form part of the scheme's portfolio in future. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. The decision of the Investment Manager may not always be profitable; as such decisions are based on the prevailing market conditions and the understanding of the Investment Manager. Actual market movements may vary from the anticipated trends. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alterations to this statement as may be required from time to time. Neither IDFC Mutual Fund / IDFC AMC Trustee Co. Ltd./ IDFC Asset Management Co. Ltd nor IDFC, its Directors or representatives shall be liable for any damages whether direct or indirect, incidental, punitive special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information.

Mr. Suyash Choudhary

Head - Fixed Income

WHAT WENT BY

Bonds continued to rally into May with the new 10 year benchmark government bond cut off coming at 5.79%,

the lowest since February 2009 on expectations of continued RBI easing.

The government unveiled the stimulus package totalling almost INR 21 lakh crore. This includes approximately INR 8 lakh crore worth measures announced by the RBI. For the rest, a substantial portion takes the form of liquidity and lending support programs run by entities in the public sector as well as support in form of guarantees by the sovereign that is aimed to incentivize commercial lending to parts of the economy. In our assessment, the direct near impact on the fiscal from the total announced package is approximately 1% of GDP. However, this will likely rise with the passage of time as some of the credit support provided may turn out to be actual liabilities for the government down the line.

The broad design of the Indian package is consistent with the global template, in our view. The relatively lighter direct fiscal touch seems anchored in a legitimate appreciation of the fact that our fiscal resources were somewhat more constrained to begin with. This in turn is probably due to the fact that our economy has been slowing for the last few years and that the desired buoyancy of the goods and services tax reform was yet to show through before the virus struck. An added challenge for India is that the financial system has already been struggling under the strain of substantial stress. Therefore, risk capital with lenders in aggregate has been already quite thin. Thus, the level of incentive required to assure financing to more vulnerable balance sheets in the system has had to be substantial, a fact quite visible in the design of our response package.

The package is light on direct spending even as revenue enhancement has been opportunistically pursued. Furthermore, we expect some more expenditure switching ahead as well. All told, we are comfortable with our initial expectation of the combined center plus state deficit going from budgeted figure of 6% of GDP to between 10 - 12% of GDP now. Although explicit additional borrowing enhancements so far indicate the lower end of this range, we don't rule out additional borrowings or short term financing enhancements in the time ahead. This may take the eventual expansion towards the upper end of the range.

The monetary policy committee (MPC) had yet another out of policy meeting and delivered a 40 bps repo rate cut with commensurate changes to the rest of the rates in the corridor. In its assessment, the committee noted the further deterioration in growth prospects. Importantly, the forward guidance was strong noting space for further easing will open up if CPI behaves as expected. The summary assessment hence is that risks to growth are acute while those to inflation may be temporary. Although the RBI didn't provide an explicit growth forecast, it acknowledged a negative print for FY 21.

The RBI rolled over the refinancing facility for SIDBI by another 90 days. It also extended the utilization of voluntary retention route (VRR) scheme for foreign portfolio investors (FPIs) by an additional 3 months. Importantly, the loan moratorium facility was extended by 3 months as well and the accumulated interest on working capital facilities over the deferment period can now be converted into a term loan payable by end of the financial year. Group exposure limit under the large exposure framework was hiked for single exposure to 30% of banks' eligible capital base from 25% before.

For State Governments, withdrawal from the Consolidated Sinking Fund (CSF) maintained by states with the RBI (buffer for repayment of liabilities) has been relaxed, with immediate effect till 31st March 2021, which will release Rs. 13,300cr. Along with normally permissible withdrawal, it will enable states to meet 45% of redemptions due in FY21 (Rs. 1.36 lakh crore). The Rs. 13,300cr immediately released would be 9.8% of FY21 state redemptions.

Gross Domestic Product (GDP) growth printed higher than consensus at 3.1% YoY (exp.:1.6%), while Gross Value Added (GVA) growth came in at 3.0% YoY. Consumption and investment were seen losing further momentum sequentially, although Government spending remained robust. GDP growth for the first three quarters of FY2020 also saw significant downward revisions, being revised lower to the tune of ~37-67 basis points in each quarter.

The 3 clear themes for the bond market continue:

▶ Focus has to be on best quality AAA and sovereign / quasi sovereign. There is no macro logic whatsoever for pursuing high yield strategies. The inherent illiquidity in that segment has now been amplified while many balance sheets will possibly continue to see steady deterioration.

▶ In our view, the best risk versus reward continues to be in the front end (upto 5 year).

▶ While duration is attractive given the wider term spread and when compared to nominal growth rate expectations, sustained performance here is still dependent upon the unveiling of a credible financing plan from the RBI for the enhanced borrowing program of the sovereign.

Given the sizeable borrowing requirement ahead, the RBI may have to turn more proactive both on intervention and incentivization (time bound held to maturity ceiling hike for instance).

Stay Safe, Stay at home.

Disclaimer: MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

The Disclosures of opinions/in house views/strategy incorporated herein is provided solely to enhance the transparency about the investment strategy / theme of the Scheme and should not be treated as endorsement of the views / opinions or as an investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document has been prepared on the basis of information, which is already available in publicly accessible media or developed through analysis of IDFC Mutual Fund. The information/ views / opinions provided is for informative purpose only and may have ceased to be current by the time it may reach the recipient, which should be taken into account before interpreting this document. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision and the security may or may not continue to form part of the scheme's portfolio in future. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. The decision of the Investment Manager may not always be profitable; as such decisions are based on the prevailing market conditions and the understanding of the Investment Manager. Actual market movements may vary from the anticipated trends. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alterations to this statement as may be required from time to time. Neither IDFC Mutual Fund / IDFC AMC Trustee Co. Ltd./ IDFC Asset Management Co. Ltd nor IDFC, its Directors or representatives shall be liable for any damages whether direct or indirect, incidental, punitive special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information.

The government unveiled the stimulus package totalling almost INR 21 lakh crore. This includes approximately INR 8 lakh crore worth measures announced by the RBI. For the rest, a substantial portion takes the form of liquidity and lending support programs run by entities in the public sector as well as support in form of guarantees by the sovereign that is aimed to incentivize commercial lending to parts of the economy. In our assessment, the direct near impact on the fiscal from the total announced package is approximately 1% of GDP. However, this will likely rise with the passage of time as some of the credit support provided may turn out to be actual liabilities for the government down the line.

The broad design of the Indian package is consistent with the global template, in our view. The relatively lighter direct fiscal touch seems anchored in a legitimate appreciation of the fact that our fiscal resources were somewhat more constrained to begin with. This in turn is probably due to the fact that our economy has been slowing for the last few years and that the desired buoyancy of the goods and services tax reform was yet to show through before the virus struck. An added challenge for India is that the financial system has already been struggling under the strain of substantial stress. Therefore, risk capital with lenders in aggregate has been already quite thin. Thus, the level of incentive required to assure financing to more vulnerable balance sheets in the system has had to be substantial, a fact quite visible in the design of our response package.

The package is light on direct spending even as revenue enhancement has been opportunistically pursued. Furthermore, we expect some more expenditure switching ahead as well. All told, we are comfortable with our initial expectation of the combined center plus state deficit going from budgeted figure of 6% of GDP to between 10 - 12% of GDP now. Although explicit additional borrowing enhancements so far indicate the lower end of this range, we don't rule out additional borrowings or short term financing enhancements in the time ahead. This may take the eventual expansion towards the upper end of the range.

The monetary policy committee (MPC) had yet another out of policy meeting and delivered a 40 bps repo rate cut with commensurate changes to the rest of the rates in the corridor. In its assessment, the committee noted the further deterioration in growth prospects. Importantly, the forward guidance was strong noting space for further easing will open up if CPI behaves as expected. The summary assessment hence is that risks to growth are acute while those to inflation may be temporary. Although the RBI didn't provide an explicit growth forecast, it acknowledged a negative print for FY 21.

The RBI rolled over the refinancing facility for SIDBI by another 90 days. It also extended the utilization of voluntary retention route (VRR) scheme for foreign portfolio investors (FPIs) by an additional 3 months. Importantly, the loan moratorium facility was extended by 3 months as well and the accumulated interest on working capital facilities over the deferment period can now be converted into a term loan payable by end of the financial year. Group exposure limit under the large exposure framework was hiked for single exposure to 30% of banks' eligible capital base from 25% before.

For State Governments, withdrawal from the Consolidated Sinking Fund (CSF) maintained by states with the RBI (buffer for repayment of liabilities) has been relaxed, with immediate effect till 31st March 2021, which will release Rs. 13,300cr. Along with normally permissible withdrawal, it will enable states to meet 45% of redemptions due in FY21 (Rs. 1.36 lakh crore). The Rs. 13,300cr immediately released would be 9.8% of FY21 state redemptions.

Gross Domestic Product (GDP) growth printed higher than consensus at 3.1% YoY (exp.:1.6%), while Gross Value Added (GVA) growth came in at 3.0% YoY. Consumption and investment were seen losing further momentum sequentially, although Government spending remained robust. GDP growth for the first three quarters of FY2020 also saw significant downward revisions, being revised lower to the tune of ~37-67 basis points in each quarter.

Outlook

A traditional easing is now rapidly diminishing in utility and effectiveness as it is not able to solve for either

the substantial steepness of the curve (reflecting reluctance to take on duration risk) or the higher levels of

spreads on lower rated issuers (reflecting credit risk aversion). Both are reflective of inadequate availability of

deployable risk capital in the system. The RBI can incentivize deployment of existing capital to some extent by

reducing perceived risks effectively and to the extent is possible without creating a substantial moral hazard

issue that sustains a more medium term cycle of perverse allocation that may in turn end up causing bigger

problems down the line than what gets solved now. The tool of a continued collapse in the overnight rate, like

noted here, is limited in utility to offer this incentivization beyond a time.The 3 clear themes for the bond market continue:

▶ Focus has to be on best quality AAA and sovereign / quasi sovereign. There is no macro logic whatsoever for pursuing high yield strategies. The inherent illiquidity in that segment has now been amplified while many balance sheets will possibly continue to see steady deterioration.

▶ In our view, the best risk versus reward continues to be in the front end (upto 5 year).

▶ While duration is attractive given the wider term spread and when compared to nominal growth rate expectations, sustained performance here is still dependent upon the unveiling of a credible financing plan from the RBI for the enhanced borrowing program of the sovereign.

Given the sizeable borrowing requirement ahead, the RBI may have to turn more proactive both on intervention and incentivization (time bound held to maturity ceiling hike for instance).

Stay Safe, Stay at home.

Disclaimer: MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

The Disclosures of opinions/in house views/strategy incorporated herein is provided solely to enhance the transparency about the investment strategy / theme of the Scheme and should not be treated as endorsement of the views / opinions or as an investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document has been prepared on the basis of information, which is already available in publicly accessible media or developed through analysis of IDFC Mutual Fund. The information/ views / opinions provided is for informative purpose only and may have ceased to be current by the time it may reach the recipient, which should be taken into account before interpreting this document. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision and the security may or may not continue to form part of the scheme's portfolio in future. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. The decision of the Investment Manager may not always be profitable; as such decisions are based on the prevailing market conditions and the understanding of the Investment Manager. Actual market movements may vary from the anticipated trends. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alterations to this statement as may be required from time to time. Neither IDFC Mutual Fund / IDFC AMC Trustee Co. Ltd./ IDFC Asset Management Co. Ltd nor IDFC, its Directors or representatives shall be liable for any damages whether direct or indirect, incidental, punitive special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information.