Commentary

28th February 2020

Mr. Anoop Bhaskar

Head - Equity

WHAT WENT BY

Global Equity Markets:

February 28th, the last trading day of the month, conjured images of the GFC (Global

Financial crisis). Across the globe, markets shuddered, as if at last, reacting to the harsh realities of COVID-19. S&P

reported its highest decline on a single day in its history. On the same day, the World Health Organization (WHO)

raised its assessment of the global COVID-19 risk from high to very high, which is the most serious assessment in

its new four-stage alert system. However, they have refrained from describing the outbreak as a pandemic, which is

defined as a worldwide spread of a new disease.

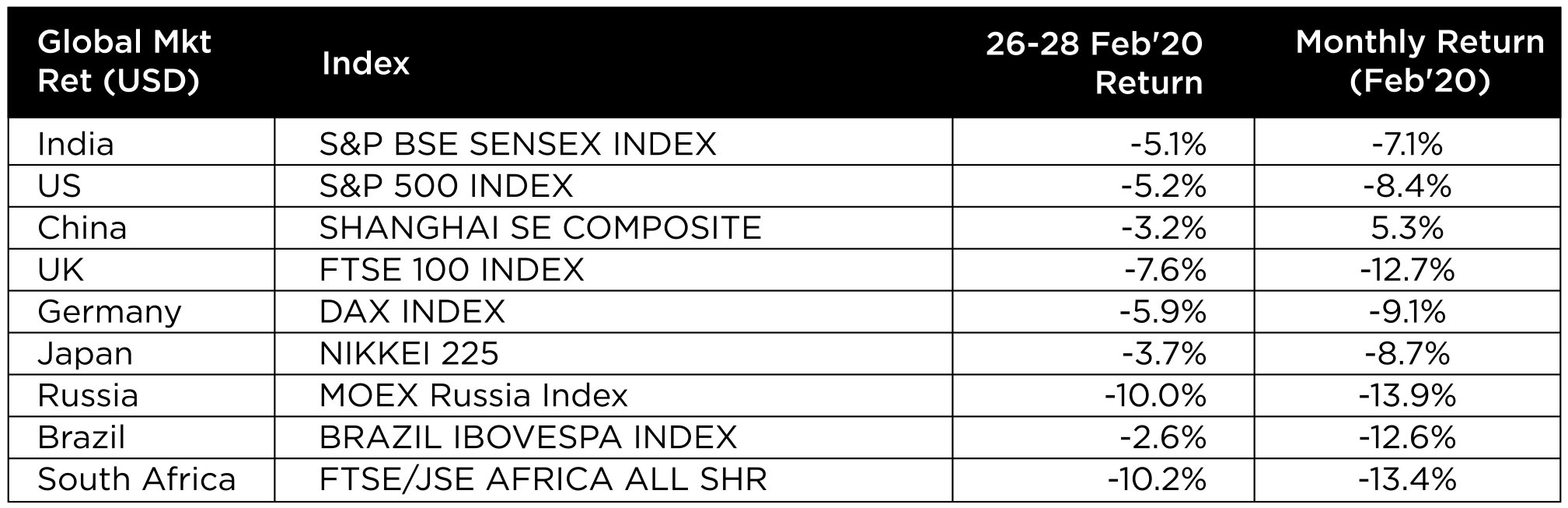

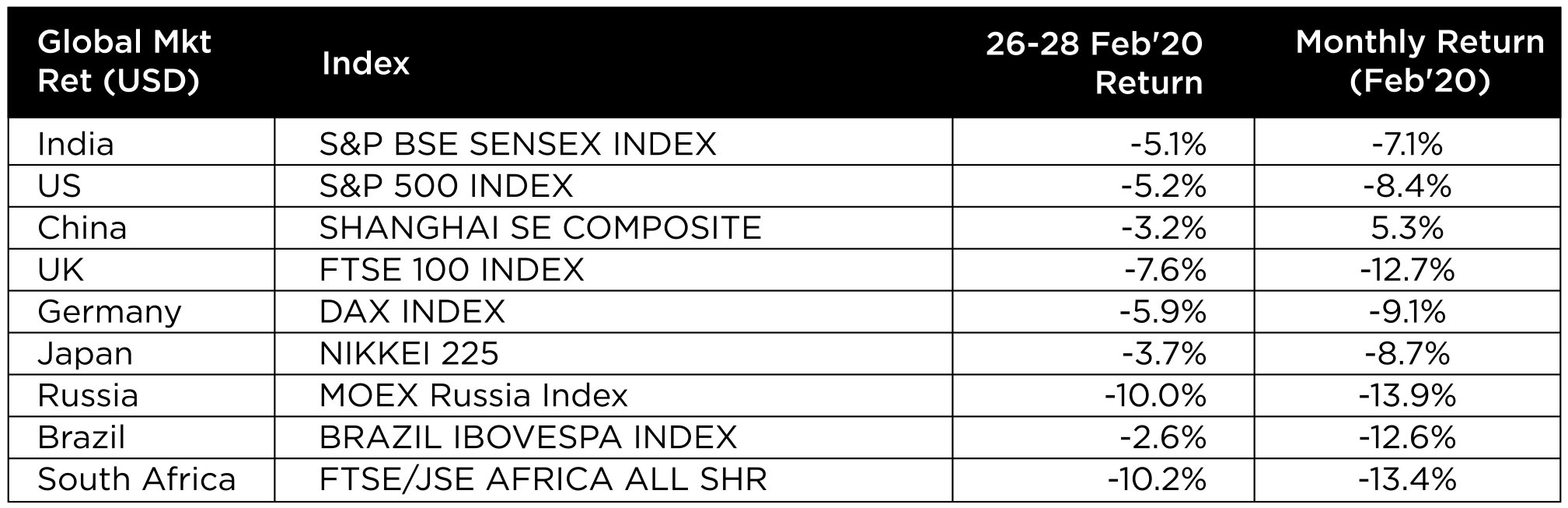

MSCI World Index fell 8.2% MoM, led by MSCI Developed Market Index (-8.6% MoM) whereas the fall in MSCI Emerging Markets Index was 5.3% MoM, buffered by the Chinese market. China had sold off sharply in Jan'20 (-10.7%), and recovered in Feb'20 as the pace of new infections in China fell. With USD return of -7.1% MoM, India was one of the better performing large markets.

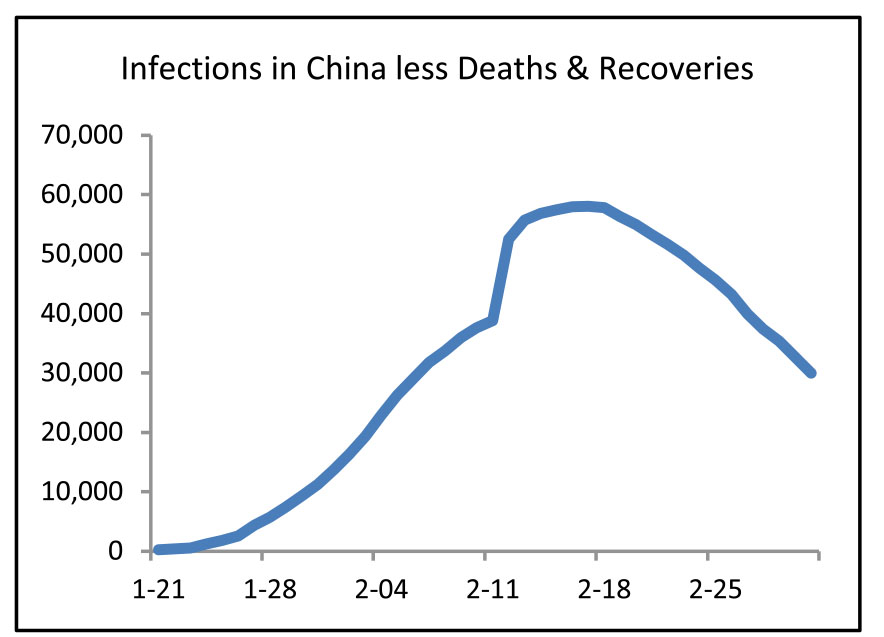

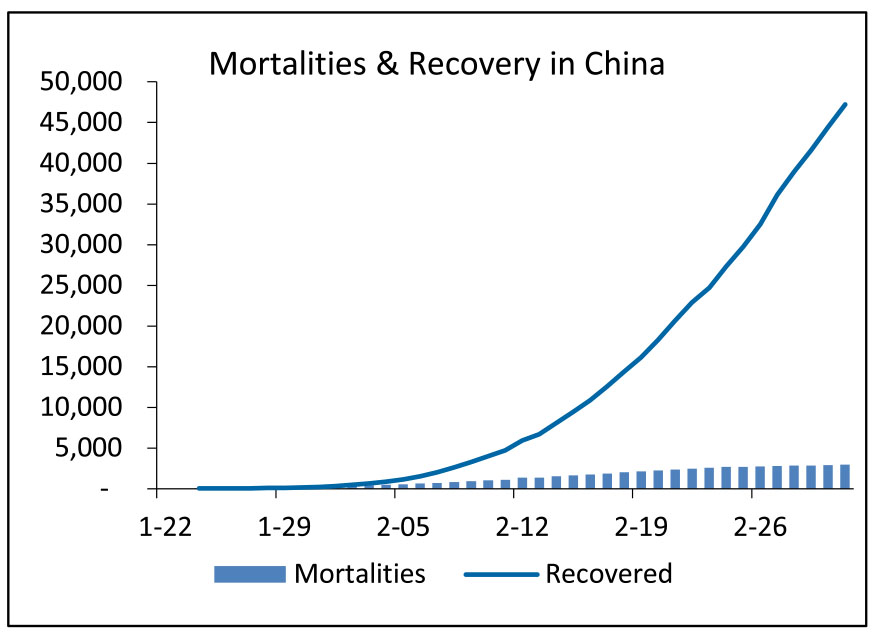

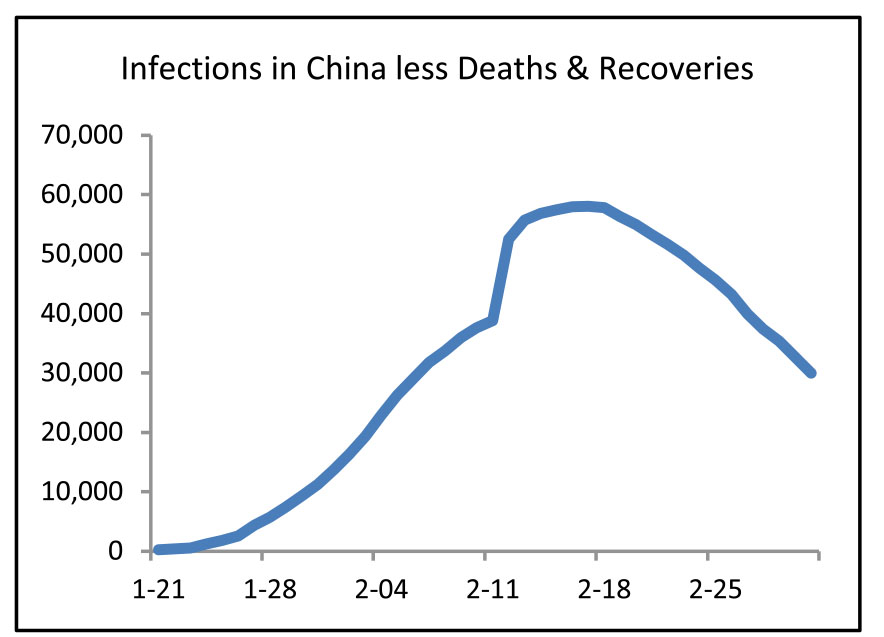

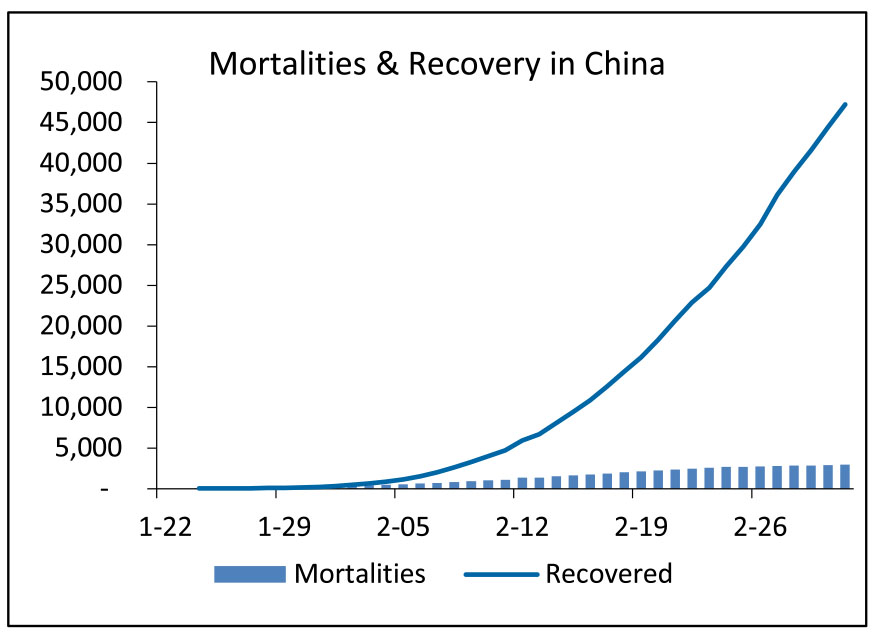

Coronavirus: The 2019 Coronavirus has caused increasing global concerns with ~90,000 confirmed cases; and death toll of ~3,000, while ~50,000 have recovered. The death toll is significantly higher than that from the SARS epidemic, which felled 349 people. As new cases in China have been declining, new infections around the world have begun to rise. Markets have sold off on fears of the shutdown in China, disrupting global supply chains and slowing down global growth. Also, the rise in cases around the world will impact travel and business - could potentially result in significant slowdown globally.

With summer approaching, as the weather warms up, new cases should see a slowdown. Also, with recoveries surpassing currently infected, the number of people still infected in China has started to fall.

Crude & other metals correct on growth concerns: Global Commodities continued to fall with crude falling 13% MoM (-23% YoY) to close at $50.52/barrel. Most global commodities Steel, Aluminum, Zinc etc. continued to fall and are down 11% to 27% on a YoY basis.

Interest rates benign; currencies stable: COn the currency side, USD continues to gain strength (+0.8% MoM). INR fell 1.4% MoM in line with the strong USD. UK Pound fell 3% whereas most commodity exporters (Russia, Brazil, South Africa) saw their currencies correct 4-5%. On a 1 year basis, the Brazilian and South African currencies are down 16% and 10% respectively. Interest rates (10 year yields) continue to be fall globally. US 10 year is lower 157 bps from a year ago period and is currently quoting at 1.15% (down 36 bps MoM). Even the Indian 10-Year yield is lower 104bps YoY and 23bps MoM at 6.37%.

Equity Markets:

Q3 FY 20 Earnings:

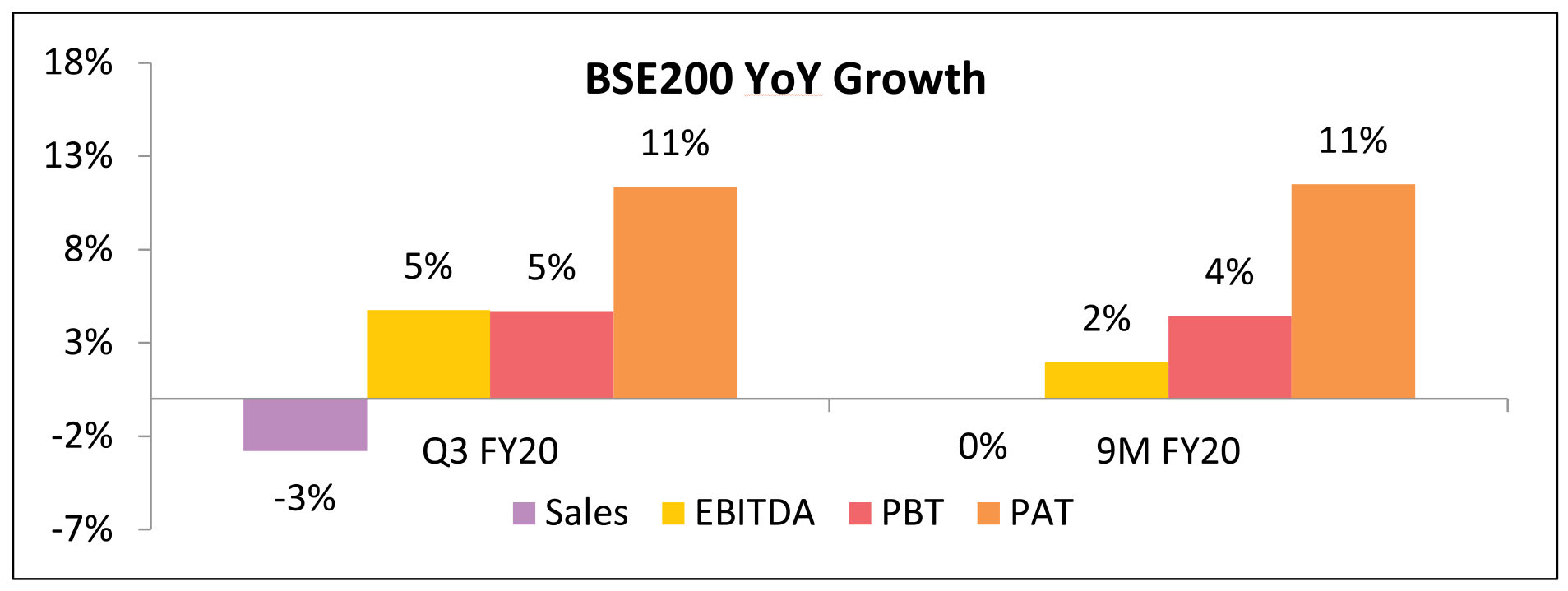

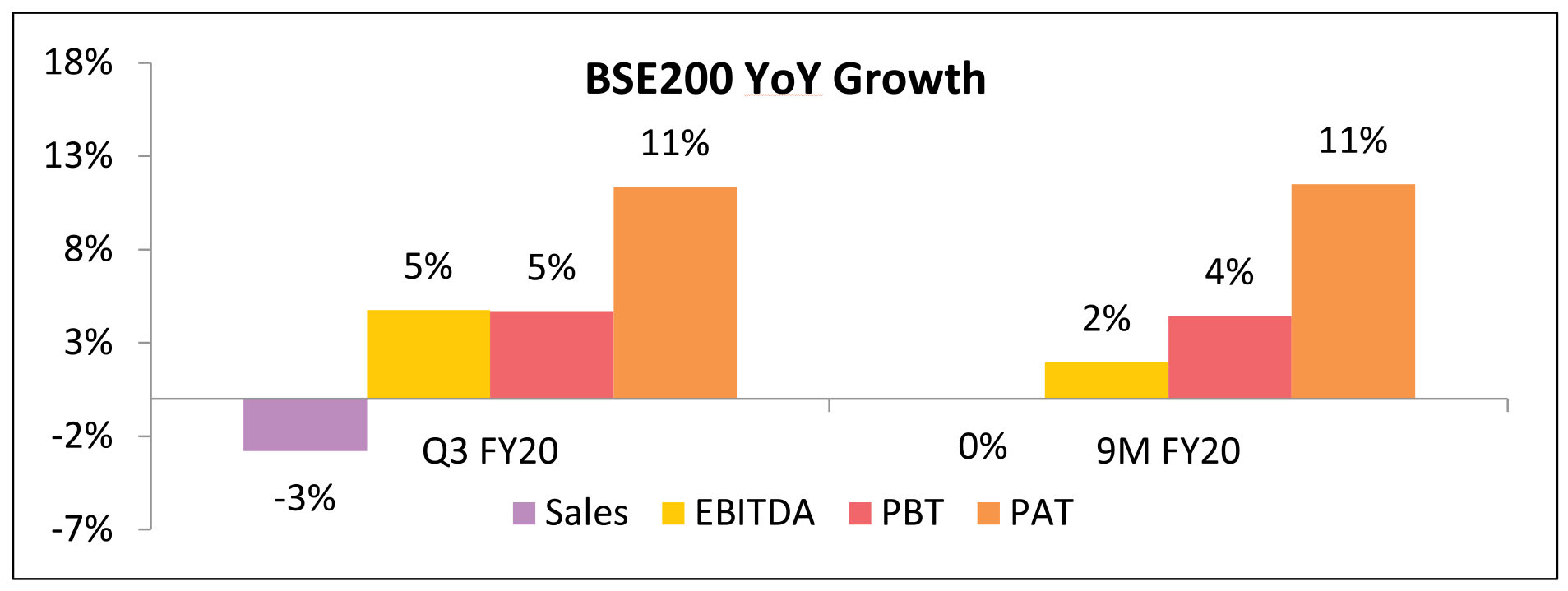

Q3FY20 was a weak quarter with Sales, EBITDA, PBT & PAT of BSE200 moving -3.5%, 5% and 11% respectively. About 35% of companies reported top-line contraction. EBITDA growth however, held up, +5% YoY aided by lower input prices and cost control. Businesses across sectors are curtailing costs/conserving cash, causing delays in capex and supressing expenses. 9M FY 20 PAT is up 11%, despite Sales growth being flat - aided by recovery in Corporate bank profitability and Corporate tax cuts.

Though, Metals and Oil/Gas were the key drags for Sales growth, slowdown in Sales growth has been broad based across sectors and management commentary points to a gradual recovery.

▶ Global exporters: IT & Pharma companies posted the best Sales Growth, though still single digit.

▶ Domestic consumption: There is a broad-based revenue slowdown (<5%), although lower input prices and cost rationalisation boosted EBITDA growth. Going ahead, weak consumer sentiment and slower household income growth (amid cost rationalisation) would weigh on consumption demand.

▶ Domestic investment: Slowdown in government and private spending has impacted volume growth, though margins are better on account of lower commodity costs.

▶ Resources: Lower Global commodity prices on account of fears of global slowdown (Corona virus), coupled with degrowth in volumes impacted topline in this segment.

▶ Financials: In this quarter, aggregate loan growth slowed to 6% YoY (versus 12% a year ago) with a sharp slowdown in lending to MSMEs. Slippages increased across segments.

While topline growth has been weak, EBITDA growth is still respectable at 5% and at around 12% ex commodities. However, adjusted for Ind AS accounting adjustments, growth is 8% ex commodities. The main reason, why EBITDA growth is holding up is owing to tailwinds from lower input prices which has improved gross margins and strong cost cutting, especially Advertising spend. Raw material (RM) cost gains appear to be limited going forward. Non- RM costs have been curtailed significantly, as sales growth has slowed sharply. Even on a 9M basis, EBITDA growth ex Commodities is up 13%; 9% adjusted for Ind AS 116.

PBT was up 5% for the quarter aided by recovery in profitability of Corporate Banks, though it fell short of expectations Corporate Banks reported a PBT of INR 20,800cr as compared to INR 3,600cr in Dec'18. A large portion of these gains were taken away by Commodities where the PBT fell from INR 26,000cr to INR 16,100cr. PAT was aided by tax cuts and grew 11% in Q3 and 9M FY20. Despite the weak economic environment, BSE200 seems to be headed for a double digit PAT growth in FY20.

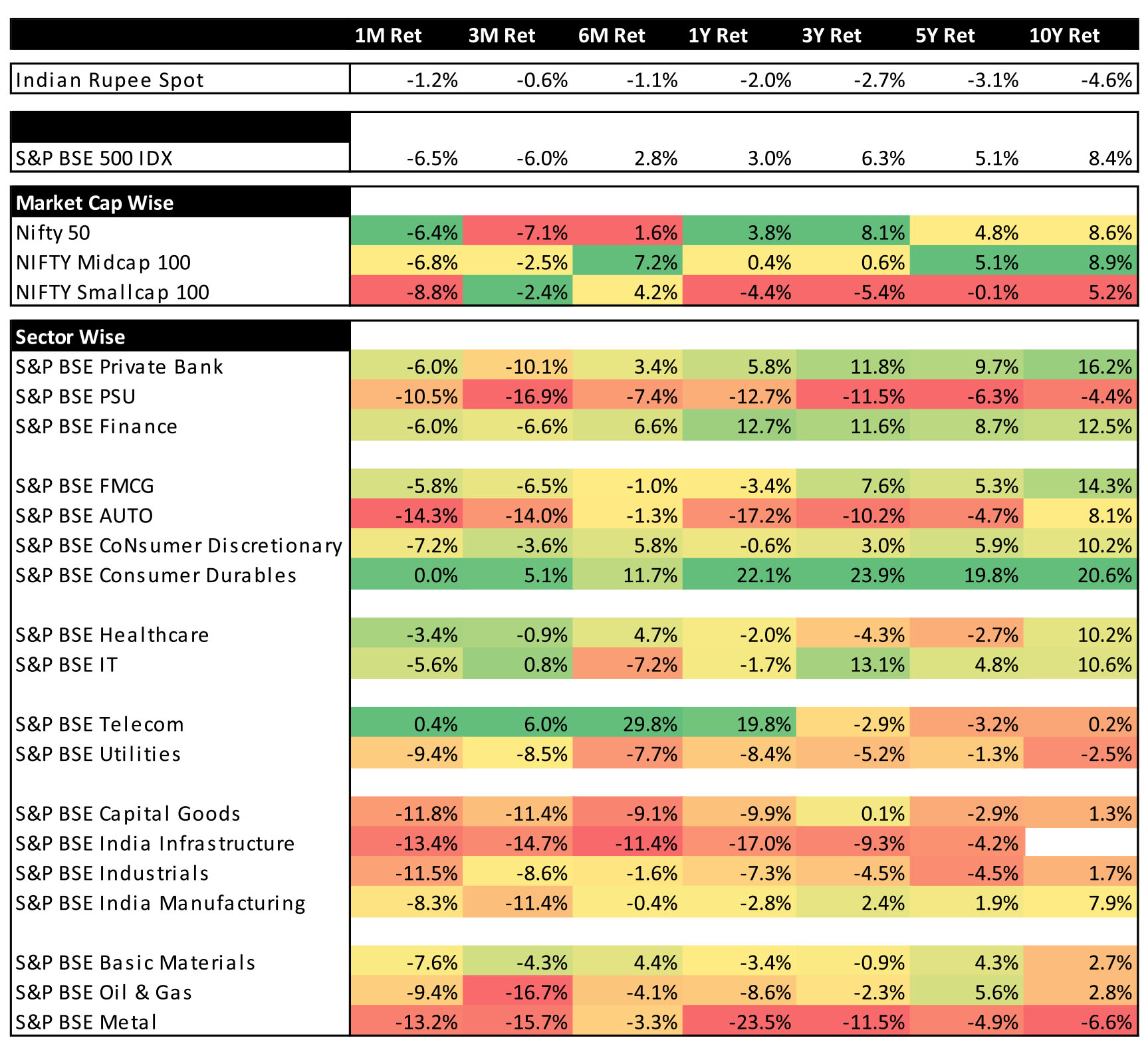

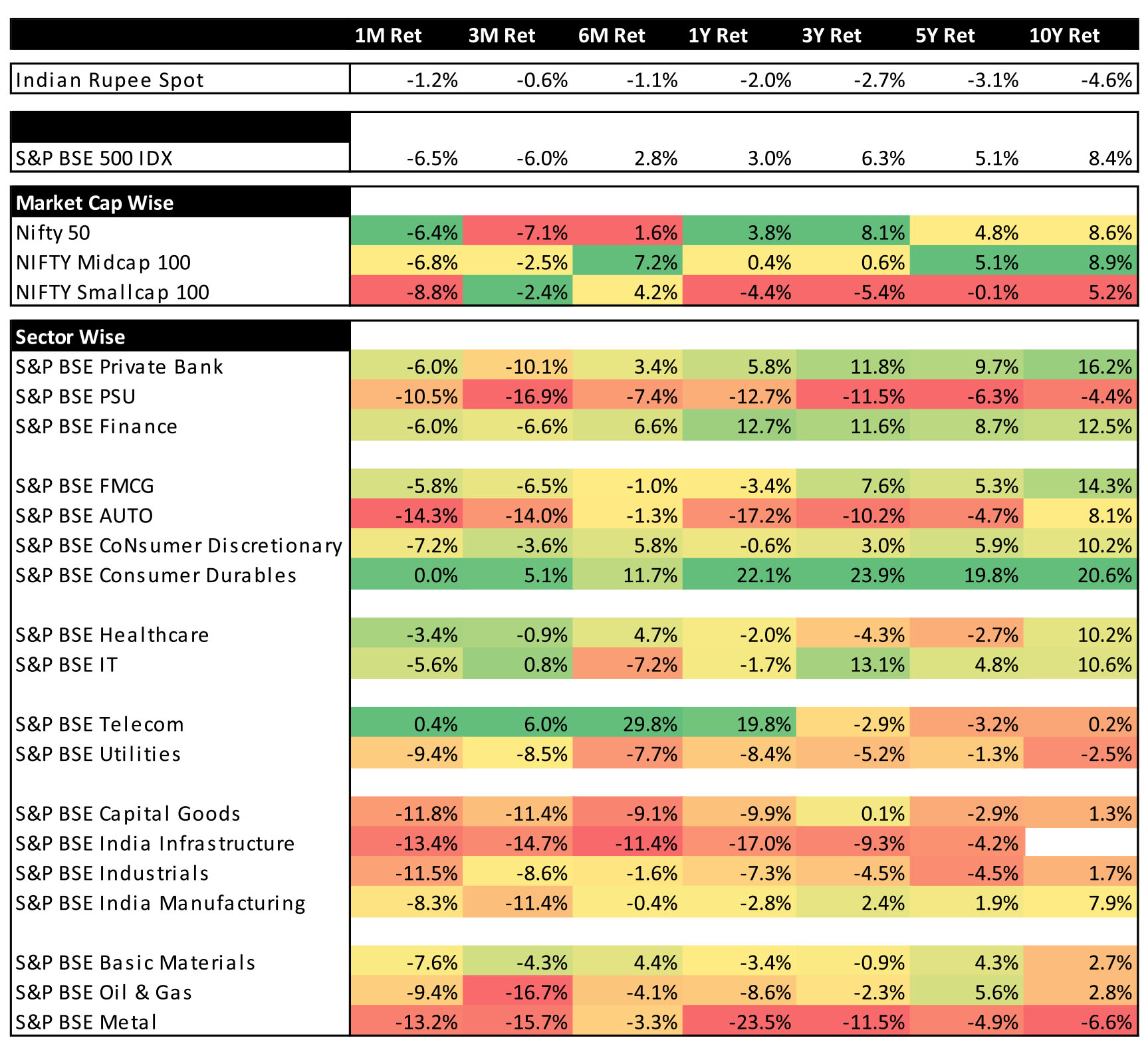

Equity Markets: Indian equity markets pared losses post the market sell-off on 1st February (FY21E Union Budget announcement) but were not insulated from the global market correction in the second half given increasing concerns from COVID-19 both through weaker exports and imports. All market segments corrected sharply with NIFTY 50, NSE Mid cap 100 and NSE Small Cap 100 falling 6.4%, 6.8% and 8.8% respectively.

On a sectoral front, Telecom and Consumer Durables were flat whereas all other sectors were negative. Auto was the worst performer (-14.3% MoM) followed by global cyclicals - Oil (-9.4%) and Metals (-13.2%).

CPI rose for third month running, driven by food inflation: Headline CPI rose to 7.6% in January (vs. 7.4% in December) and came above consensus estimates (7.4%). This was the highest inflation print in approx. 6 years. The increase was largely on the back of high food inflation (13.6%oya). Core-core inflation also firmed up in January (+0.7% MoM) aided by some one-offs (gold prices and mobile tariff hikes). Adjusting for these one-offs, core prices firmed +0.4% MoM (vs. 0.2% MoM in Dec).

Composite PMI readings positive: Composite PMI for January rose sequentially +2.5pts MoM to 56.3, a 7-year high. The improvement in January PMI was led by Manufacturing which improved +2.6pts MoM to 55.3 while Services gained +2.2pts MoM to 55.5. The internals of the PMI report were also encouraging with the forward-looking composite new orders rising +2.6pts to 56.6, across both services and manufacturing. Composite new export orders gained +0.5pts MoM to 52.4.

Monetary Policy continues to be accommodative: In its last MPC meeting on 6th Feb'20, RBI kept policy rates on hold in line with consensus expectations, while maintaining its accommodative stance. RBI explicitly noted that "there is policy space available for future action". RBI announced a number of measures to boost monetary transmission by a) Long Term Repos (LTROs) of one-year and three-year tenors for Rs. 1 trillion (~0.5% of GDP); b) RBI also announced that banks' incremental credit disbursal to housing, autos, and small and medium enterprises (MSMEs) would not attract reserve requirements (CRR) of 4%; c) Some regulatory easing for the real estate sector (although short of a full restructuring). The RBI extended the date of commencement of commercial operations (DCCO) of project loans for commercial real estate, delayed for reasons beyond the control of promoters, by another one year without downgrading the asset classification.

FII flows continue to be positive: FPIs recorded net inflows of USD 877mn in Indian equities in the month of February (vs. net inflows of USD 1.4bn in January). February is the sixth consecutive month of FII inflows in Indian equities. FIIs recorded net inflows in debt markets at USD 316mn in February (vs. net outflows of USD 1.6bn in January). February is the first month of inflows after three consecutive months of FPI outflows from the debt markets. DIIs were net equity buyers at USD 2.4bn in February, highest inflow in the last 6 months (vs. net inflows of USD 316mn in January). Mutual funds were net equity buyers at USD 663mn in February (vs. inflows of USD 194mn in January) while Insurance funds were net equity buyers of USD 640mn in February (vs. inflows of USD 121mn in January).

Earnings Outlook:

The December-quarter earnings turned out to be in line but still modest/narrow (BFSI driven) and underscored the weak underlying operational trends (BSE200 PBT Ex-BFSI declined 7% YoY). Sales de-grew for the second quarter running, but higher margins (lower cost), lower corporate bank provisioning and tax cuts ensured a double digit earnings growth for both 3Q and 9M FY20.

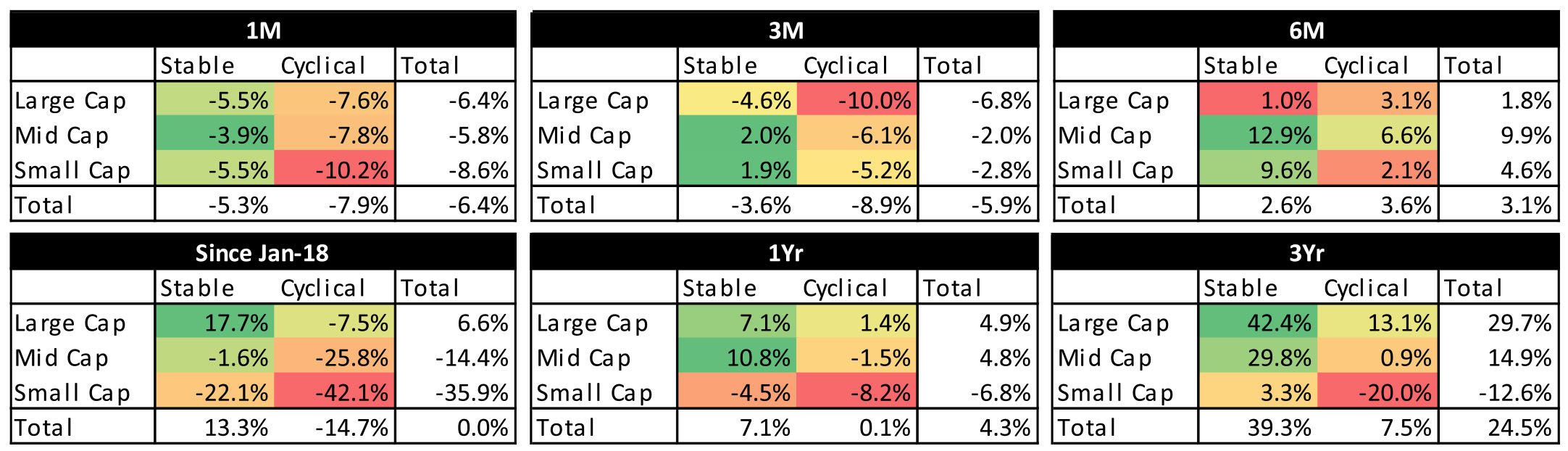

FY20 Earnings growth projected at 13.5% (11% in 9M FY20) seems to be reasonable. A large portion of this growth in Q4 is to be delivered by Corporate Banks with a) Stable sectors expected to grow 8% (as compared to 11% in 9M); b) Cyclical sectors ex Corp Banks expected to degrow 18%( as compared to -3% in 9M) and c) Corp Banks expected to post profit of INR 18,200cr (INR 15,900cr in Q3) from a loss of INR 11,200cr in Q3 FY 19. FY 21 earnings estimate are currently building a broad based recovery across sectors, which could be at risk given the global headwinds related to the corona virus. Also, Corporate Bank profitability is expected to improve further. This implies lower credit costs which could be at risk if the economic slowdown sustain longer then.

The factors supporting the argument for economic led earnings recovery are:

▶ The government and RBI measures announced since Aug'19 to revive growth.

▶ Recent pick-up in inflation and potential bumper Rabi crop offer hope for rural consumption recovery - agri incomes are likely to grow 10-11% vs 6-7% in the previous two years.

▶ Liquidity conditions have certainly improved owing to RBI's measures. This should trickle down to real economy going ahead.

▶ Low base of FY20 across sectors helping a YoY comparison

Investors need to watch out for key risks emanating out of:

▶ The impact of Corona virus on global supply chains and the timelines for resolution.

▶ Government spending in FY21 is heavily dependent on success of divestment drive + significant inflow from telecom sector. Both these are event dependent, and failure on any of these counts can result in lower government spending impacting aggregate demand.

▶ In FY20, the fall in input prices boosted margins. However, this is now largely in the base and incremental tailwinds are unlikely unless, there is a fresh leg down in international commodity prices.

The market remains two tiered, with companies and segments which are reporting consistent earnings trading at valuations which may be close to 2 standard deviation above their last 5 years average. At the altar of earnings consistency, valuations have been ignored by investor in the belief that economic growth will remain stilted and only few pockets will remain unaffected by the sluggish economy. On the other hand, the broader market, where earnings have been erratic continue to be ignored by smart investors. Most of these "value" segments are those, which have close ties with Government spending or are dependent on investment cycle revival. The outlook for both these segments remains hazy at the current juncture. Emergence of small cap as a new segment, where investor flows have commenced over the last couple of months, is an interesting development. Could be a fore runner to broad basing of the equity market moves, going forward?

MSCI World Index fell 8.2% MoM, led by MSCI Developed Market Index (-8.6% MoM) whereas the fall in MSCI Emerging Markets Index was 5.3% MoM, buffered by the Chinese market. China had sold off sharply in Jan'20 (-10.7%), and recovered in Feb'20 as the pace of new infections in China fell. With USD return of -7.1% MoM, India was one of the better performing large markets.

Coronavirus: The 2019 Coronavirus has caused increasing global concerns with ~90,000 confirmed cases; and death toll of ~3,000, while ~50,000 have recovered. The death toll is significantly higher than that from the SARS epidemic, which felled 349 people. As new cases in China have been declining, new infections around the world have begun to rise. Markets have sold off on fears of the shutdown in China, disrupting global supply chains and slowing down global growth. Also, the rise in cases around the world will impact travel and business - could potentially result in significant slowdown globally.

With summer approaching, as the weather warms up, new cases should see a slowdown. Also, with recoveries surpassing currently infected, the number of people still infected in China has started to fall.

Crude & other metals correct on growth concerns: Global Commodities continued to fall with crude falling 13% MoM (-23% YoY) to close at $50.52/barrel. Most global commodities Steel, Aluminum, Zinc etc. continued to fall and are down 11% to 27% on a YoY basis.

Interest rates benign; currencies stable: COn the currency side, USD continues to gain strength (+0.8% MoM). INR fell 1.4% MoM in line with the strong USD. UK Pound fell 3% whereas most commodity exporters (Russia, Brazil, South Africa) saw their currencies correct 4-5%. On a 1 year basis, the Brazilian and South African currencies are down 16% and 10% respectively. Interest rates (10 year yields) continue to be fall globally. US 10 year is lower 157 bps from a year ago period and is currently quoting at 1.15% (down 36 bps MoM). Even the Indian 10-Year yield is lower 104bps YoY and 23bps MoM at 6.37%.

Equity Markets:

Q3 FY 20 Earnings:

Q3FY20 was a weak quarter with Sales, EBITDA, PBT & PAT of BSE200 moving -3.5%, 5% and 11% respectively. About 35% of companies reported top-line contraction. EBITDA growth however, held up, +5% YoY aided by lower input prices and cost control. Businesses across sectors are curtailing costs/conserving cash, causing delays in capex and supressing expenses. 9M FY 20 PAT is up 11%, despite Sales growth being flat - aided by recovery in Corporate bank profitability and Corporate tax cuts.

Though, Metals and Oil/Gas were the key drags for Sales growth, slowdown in Sales growth has been broad based across sectors and management commentary points to a gradual recovery.

▶ Global exporters: IT & Pharma companies posted the best Sales Growth, though still single digit.

▶ Domestic consumption: There is a broad-based revenue slowdown (<5%), although lower input prices and cost rationalisation boosted EBITDA growth. Going ahead, weak consumer sentiment and slower household income growth (amid cost rationalisation) would weigh on consumption demand.

▶ Domestic investment: Slowdown in government and private spending has impacted volume growth, though margins are better on account of lower commodity costs.

▶ Resources: Lower Global commodity prices on account of fears of global slowdown (Corona virus), coupled with degrowth in volumes impacted topline in this segment.

▶ Financials: In this quarter, aggregate loan growth slowed to 6% YoY (versus 12% a year ago) with a sharp slowdown in lending to MSMEs. Slippages increased across segments.

While topline growth has been weak, EBITDA growth is still respectable at 5% and at around 12% ex commodities. However, adjusted for Ind AS accounting adjustments, growth is 8% ex commodities. The main reason, why EBITDA growth is holding up is owing to tailwinds from lower input prices which has improved gross margins and strong cost cutting, especially Advertising spend. Raw material (RM) cost gains appear to be limited going forward. Non- RM costs have been curtailed significantly, as sales growth has slowed sharply. Even on a 9M basis, EBITDA growth ex Commodities is up 13%; 9% adjusted for Ind AS 116.

PBT was up 5% for the quarter aided by recovery in profitability of Corporate Banks, though it fell short of expectations Corporate Banks reported a PBT of INR 20,800cr as compared to INR 3,600cr in Dec'18. A large portion of these gains were taken away by Commodities where the PBT fell from INR 26,000cr to INR 16,100cr. PAT was aided by tax cuts and grew 11% in Q3 and 9M FY20. Despite the weak economic environment, BSE200 seems to be headed for a double digit PAT growth in FY20.

Equity Markets: Indian equity markets pared losses post the market sell-off on 1st February (FY21E Union Budget announcement) but were not insulated from the global market correction in the second half given increasing concerns from COVID-19 both through weaker exports and imports. All market segments corrected sharply with NIFTY 50, NSE Mid cap 100 and NSE Small Cap 100 falling 6.4%, 6.8% and 8.8% respectively.

On a sectoral front, Telecom and Consumer Durables were flat whereas all other sectors were negative. Auto was the worst performer (-14.3% MoM) followed by global cyclicals - Oil (-9.4%) and Metals (-13.2%).

CPI rose for third month running, driven by food inflation: Headline CPI rose to 7.6% in January (vs. 7.4% in December) and came above consensus estimates (7.4%). This was the highest inflation print in approx. 6 years. The increase was largely on the back of high food inflation (13.6%oya). Core-core inflation also firmed up in January (+0.7% MoM) aided by some one-offs (gold prices and mobile tariff hikes). Adjusting for these one-offs, core prices firmed +0.4% MoM (vs. 0.2% MoM in Dec).

Composite PMI readings positive: Composite PMI for January rose sequentially +2.5pts MoM to 56.3, a 7-year high. The improvement in January PMI was led by Manufacturing which improved +2.6pts MoM to 55.3 while Services gained +2.2pts MoM to 55.5. The internals of the PMI report were also encouraging with the forward-looking composite new orders rising +2.6pts to 56.6, across both services and manufacturing. Composite new export orders gained +0.5pts MoM to 52.4.

Monetary Policy continues to be accommodative: In its last MPC meeting on 6th Feb'20, RBI kept policy rates on hold in line with consensus expectations, while maintaining its accommodative stance. RBI explicitly noted that "there is policy space available for future action". RBI announced a number of measures to boost monetary transmission by a) Long Term Repos (LTROs) of one-year and three-year tenors for Rs. 1 trillion (~0.5% of GDP); b) RBI also announced that banks' incremental credit disbursal to housing, autos, and small and medium enterprises (MSMEs) would not attract reserve requirements (CRR) of 4%; c) Some regulatory easing for the real estate sector (although short of a full restructuring). The RBI extended the date of commencement of commercial operations (DCCO) of project loans for commercial real estate, delayed for reasons beyond the control of promoters, by another one year without downgrading the asset classification.

FII flows continue to be positive: FPIs recorded net inflows of USD 877mn in Indian equities in the month of February (vs. net inflows of USD 1.4bn in January). February is the sixth consecutive month of FII inflows in Indian equities. FIIs recorded net inflows in debt markets at USD 316mn in February (vs. net outflows of USD 1.6bn in January). February is the first month of inflows after three consecutive months of FPI outflows from the debt markets. DIIs were net equity buyers at USD 2.4bn in February, highest inflow in the last 6 months (vs. net inflows of USD 316mn in January). Mutual funds were net equity buyers at USD 663mn in February (vs. inflows of USD 194mn in January) while Insurance funds were net equity buyers of USD 640mn in February (vs. inflows of USD 121mn in January).

Earnings Outlook:

The December-quarter earnings turned out to be in line but still modest/narrow (BFSI driven) and underscored the weak underlying operational trends (BSE200 PBT Ex-BFSI declined 7% YoY). Sales de-grew for the second quarter running, but higher margins (lower cost), lower corporate bank provisioning and tax cuts ensured a double digit earnings growth for both 3Q and 9M FY20.

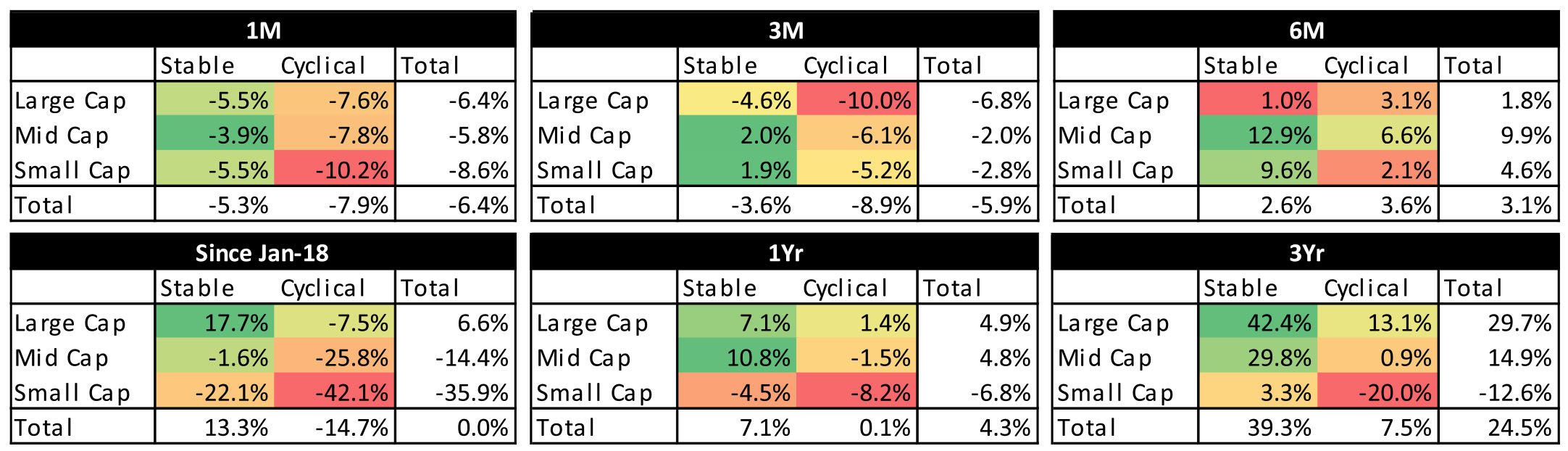

FY20 Earnings growth projected at 13.5% (11% in 9M FY20) seems to be reasonable. A large portion of this growth in Q4 is to be delivered by Corporate Banks with a) Stable sectors expected to grow 8% (as compared to 11% in 9M); b) Cyclical sectors ex Corp Banks expected to degrow 18%( as compared to -3% in 9M) and c) Corp Banks expected to post profit of INR 18,200cr (INR 15,900cr in Q3) from a loss of INR 11,200cr in Q3 FY 19. FY 21 earnings estimate are currently building a broad based recovery across sectors, which could be at risk given the global headwinds related to the corona virus. Also, Corporate Bank profitability is expected to improve further. This implies lower credit costs which could be at risk if the economic slowdown sustain longer then.

The factors supporting the argument for economic led earnings recovery are:

▶ The government and RBI measures announced since Aug'19 to revive growth.

▶ Recent pick-up in inflation and potential bumper Rabi crop offer hope for rural consumption recovery - agri incomes are likely to grow 10-11% vs 6-7% in the previous two years.

▶ Liquidity conditions have certainly improved owing to RBI's measures. This should trickle down to real economy going ahead.

▶ Low base of FY20 across sectors helping a YoY comparison

Investors need to watch out for key risks emanating out of:

▶ The impact of Corona virus on global supply chains and the timelines for resolution.

▶ Government spending in FY21 is heavily dependent on success of divestment drive + significant inflow from telecom sector. Both these are event dependent, and failure on any of these counts can result in lower government spending impacting aggregate demand.

▶ In FY20, the fall in input prices boosted margins. However, this is now largely in the base and incremental tailwinds are unlikely unless, there is a fresh leg down in international commodity prices.

The market remains two tiered, with companies and segments which are reporting consistent earnings trading at valuations which may be close to 2 standard deviation above their last 5 years average. At the altar of earnings consistency, valuations have been ignored by investor in the belief that economic growth will remain stilted and only few pockets will remain unaffected by the sluggish economy. On the other hand, the broader market, where earnings have been erratic continue to be ignored by smart investors. Most of these "value" segments are those, which have close ties with Government spending or are dependent on investment cycle revival. The outlook for both these segments remains hazy at the current juncture. Emergence of small cap as a new segment, where investor flows have commenced over the last couple of months, is an interesting development. Could be a fore runner to broad basing of the equity market moves, going forward?

| Equity Markets | Index | % Change YTD | % Change MTD | P/E |

| Nifty | 11,201.75 | -7.94% | -6.36% | 19.33 |

| Sensex | 38,297.29 | -7.17% | -5.96% | 20.15 |

| Dow Jones | 25,409.36 | -10.96% | -10.07% | 16.68 |

| Shanghai | 2,880.30 | -5.57% | -3.23% | 11.12 |

| Nikkei | 21,142.96 | -10.63% | -8.89% | 16.41 |

| Hang Sang | 26,129.93 | -7.31% | -0.69% | 10.17 |

| FTSE | 6,580.61 | -12.75% | -9.68% | 12.33 |

| MSCI E.M. (USD) | 1,005.52 | -9.79% | -5.35% | 12.75 |

| MSCI D.M.(USD) | 2,141.12 | -9.22% | -8.59% | 16.32 |

| MSCI India (INR) | 1,272.51 | -7.09% | -6.30% | 20.52 |

| Currency & Commodities | Last Price % | Change YTD % | Change MTD |

| USD / INR | 72.175 | 1.11% | 1.15% |

| Dollar Index | 98.13 | 1.81% | 0.76% |

| Gold | 1,585.69 | 4.51% | -0.22% |

| WTI (Nymex) | 44.76 | -26.70% | -13.19% |

| Brent Crude | 50.52 | -23.45% | -13.14% |

| India Macro Analysis | Latest | Equity Flows | USD Mn |

| GDP | 4.70 | FII (USD mln) | |

| IIP | -0.30 | YTD | 2,371.79 |

| Inflation (WPI Monthly) | 3.10 | MTD | 395.50 |

| Inflation (CPI Monthly) | 7.59 | *DII (USD mln) | |

| Commodity (CRB Index) | 395.11 | YTD | 925.55 |

| Source: Bloomberg | MTD | 1,237.47 | |

| *DII : Domestic Mutual Funds Data as on 28th February 2020 | |||

Mr. Suyash Choudhary

Head - Fixed Income

WHAT WENT BY

Bond markets witnessed a sharp rally last month with the 10 year benchmark government bond yield closing at 6.37% compared to 6.60% at the beginning of the month on the surprise announcement of Long term repo operations by RBI in its policy & global cues on spread of Corona Virus (COVID-19). RBI in its Feb'20 policy announced 1 year & 3 year Long term repo operations (LTROs) totaling INR 1 lakh cr (~0.7% of bank net demand and time liabilities or NDTL) at the policy repo rate. The curve steepened on expectation of robust demand in shorter to medium term bonds due to LTRO driven liquidity. The spread between 10 year to 4 year Gsec widened to 50bps from 20bps at the beginning of the month while the spread between 10 year AAA corporate bond & 3 year widened to 126bps from 104bps.

The escalation of COVID-19 in China & its spread globally has quickly led to intensification of downside risks for global growth prospects as its high infection rate & accompanying lockdowns and quarantines are not only extremely negative for local economies but could lead to global supply chain disruptions. Policymakers from both the government and central banks intervened to contain the economic fallout of the epidemic. Central banks across Asia begun to cut policy rates, mostly citing a pre-emptive response to the COVID-19 outbreak, in Malaysia (50bps), Thailand (25bps), Indonesia (25bps) and the Philippines (25bps). Many of these central banks had prepared to ease further amid weaker-than-expected Q4 GDP growth readings, while the COVID-19 outbreak helped justify a quicker response. The PBoC cut interest rates by 10bps as the Chinese government focused more on providing financial system liquidity, funding for lending scheme to SMEs with cash flow problems, increasing loan quotas for policy banks and bond issuance quotas for local governments, many directives that delay tax and debt payments and lower the cost of utility bills.

CPI inflation for India accelerated further to 7.6% YoY in January v/s an 7.4% in December. While food price inflation moderated somewhat to 13.6% YoY v/s 14.1% in December, Core inflation (CPI ex-food and beverages, fuel) increased to 4.2% YoY in January v/s 3.8% in December primarily reflecting a sharp MoM escalation in personal care (higher gold prices) and transport & communication (elevated telecom prices) segments.

India's GDP growth slid further to 4.7% YoY in Q3FY20 from an upwardly revised 5.1% in Q2FY20 (previously 4.5%). Growth was largely held up due to higher government spending and a positive contribution from net exports (reflecting weak imports) - the two together contributed 2.7% to the 4.7% YoY GDP growth. FY20 GDP growth was retained at the advance estimate level of 5%. The GDP deflator inched higher (to 2.9% YoY versus 1.2% in Q3), due to higher CPI inflation, pulling up nominal GDP growth this quarter (to 7.7% v/s. 6.4%).

Outlook

It is reasonably obvious that a more widespread global easing should be forthcoming. This was indicated somewhat by the Fed Chair in the press conference after the 50bps pre-policy cut on 3rd March but also for the reason that no other major economy can afford a tightening in their relative financial conditions with respect to the US. So now that US has moved, other central banks may anyway have to move as well. However, the quantum and form will depend upon space and format respectively, and individual revealed preferences.

The Coronavirus comes in the midst of a global expansion that was already late stage. Thus while owing to inventory re-stocking and the beneficial effects of last year's Fed policy pivot some initial rebound was expected in the initial part of the year, the two large economies of the world (US and China) were still expected to continue to slow. Now the virus has cut short the expected first half rebound. Indeed, some new assessments are already projecting substantial cuts to global growth this year. Also while manufacturing rebound at a later stage may compensate for ground lost now, it is difficult for services to behave the same way.

All this implies that global monetary policy will continue to be extremely supportive. In India too, the RBI's revealed preference will get a further leg up and conventional easing may start supporting unconventional tools already in deployment. Indeed the swap market is already pricing the next 40 - 50 bps of repo rate cuts. This means a continued constructive environment for quality interest rates and a continued widening of the gap between the "haves" and the "have-nots". Finally, it is likely that fiscal policy finds itself getting more restive despite the obvious constraints on the revenue side.

The above means that there is a greater likelihood of more steepening pressure on the yield curve. However, this statement needs some qualifications: the very front end of the government bond curve (up to 3 - 4 years) has clearly outperformed massively since the announcement of the long term repo operations from the RBI. There may be limited relative gains to be made here incrementally for real money, given the lower duration as well. However, the spread between 4 year to 7 - 8 year government bonds has, at the time of writing, widened to almost 80 bps. Subsequent spreads (longer bonds spread over 7 - 8 year bonds) are still relatively low. In our view, this makes the 7 - 8 year government bonds the "sweet-spot", with a strong likelihood that the very wide spreads on offer versus shorter end bonds will likely compress over the coming months. The longer end may struggle once the current momentum fades, also in part due to the significantly higher state loan supply expected over the year ahead. The same anticipated state loan supply makes the 10 year point on the AAA corporate curve less attractive.