Commentary

30th April 2020

Mr. Anoop Bhaskar

Head - Equity

WHAT WENT BY

Global equities witnessed a sharp recovery as central banks further expanded stimulus plans coupled

with flattening of COVID-19 infection curves across countries. Market sentiment was further buoyed by

Gilead's announcement of positive data from Phase-3 trials for antiviral drug, Remdesivir in the ongoing

battle against COVID-19.

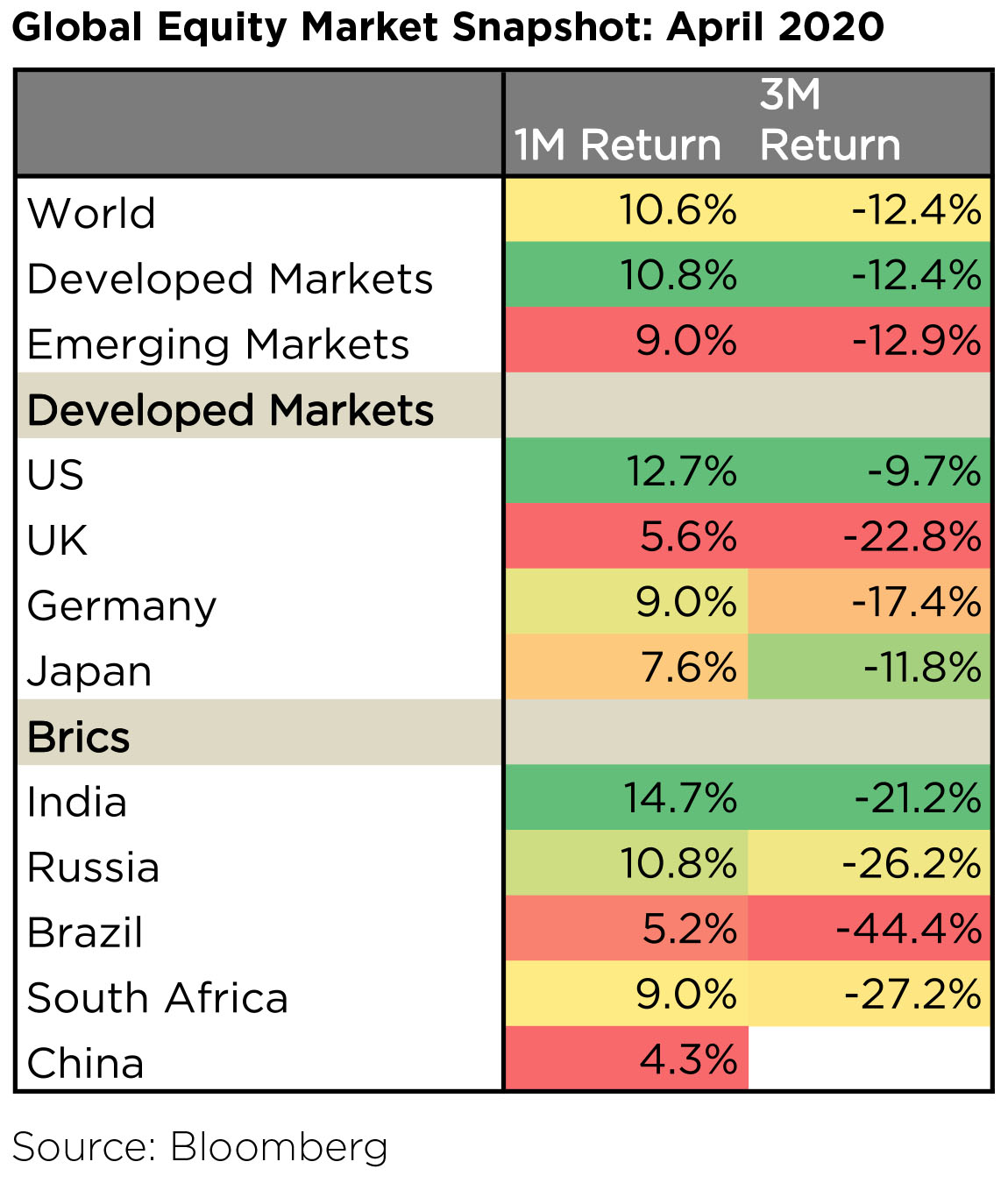

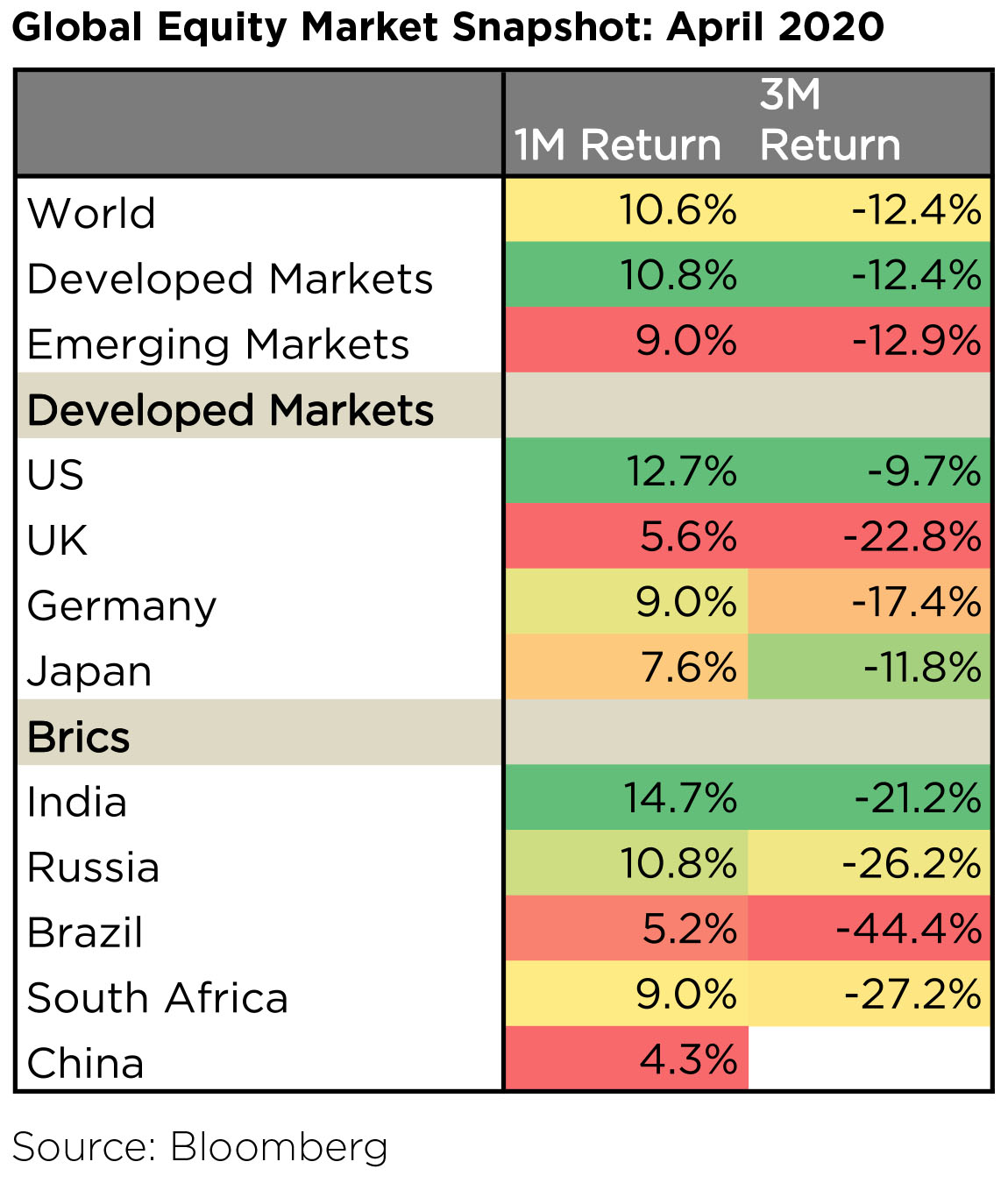

MSCI Developed Markets index was up 10.8% MoM led by US (+12.7%) whereas MSCI Emerging Market Index was up 9%. April became the first month in 2020 to register gains for Indian Markets with Nifty +14.7% (outperforming regional markets), tracking the rally in S&P 500 (U.S) +12.7%. On a 3 month basis though, India (-21.2%) has underperformed most Developed Markets (-12.4%) and China. It has outperformed other BRIC and Emerging Market countries.

Crude: Lockdowns across the world dragged the demand for oil lower by >20% and OPEC+ agreed to unprecedented supply cuts to counter the demand collapse, but cuts weren't enough to address the immediate storage distress which sent WTI futures to negative territory. WTI and Brent closed the month at $18.84 and $25.27 per barrel respectively. Commodities like Steel, Zinc etc. were marginally positive for the month but are lower by 17% to 31% from a year ago period.

Currencies & Global Bond Yields: The INR outperformed JPM EM FX (- 0.8%) in April. YTD, the INR (-5.0%) has significantly outperformed the broader EM FX (-13.7%). Note the DXY declined marginally (-0.03%) in April (vs. +0.9 gain in March) and ended the month at 99.02.

Interest rates globally have fallen to record lows with US 10-year hitting 0.64% and many countries like Germany, Japan, Switzerland, France etc. witnessing negative 10-year yields. Global yields have eased meaningfully as central banks globally have cut policy rates aggressively and have announced large QE programs, to counter the negative impact on global growth from the COVID-19 outbreak. US 10Y yields are at 0.61% (-6bps in 1M, -179bps over the last 1 year).

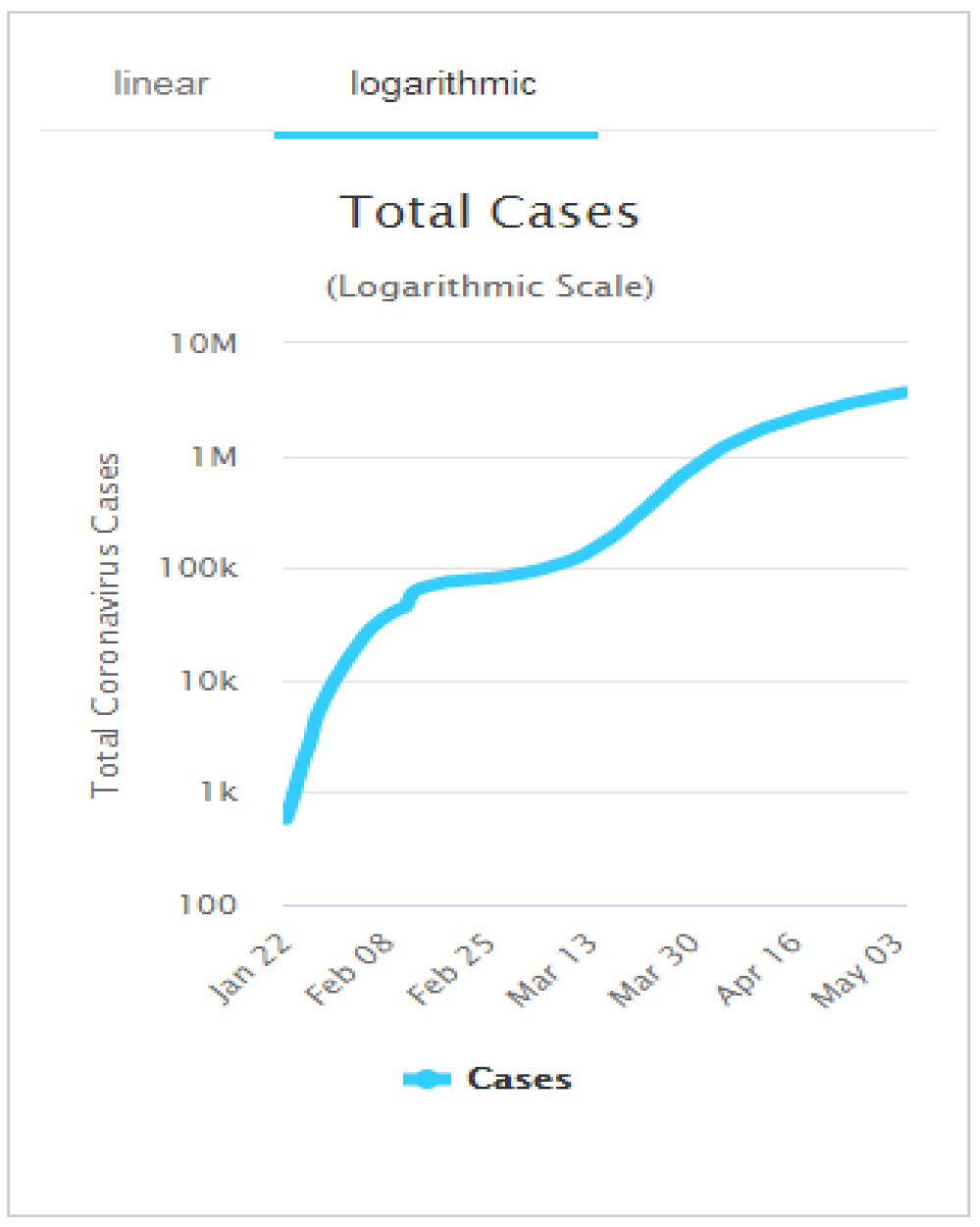

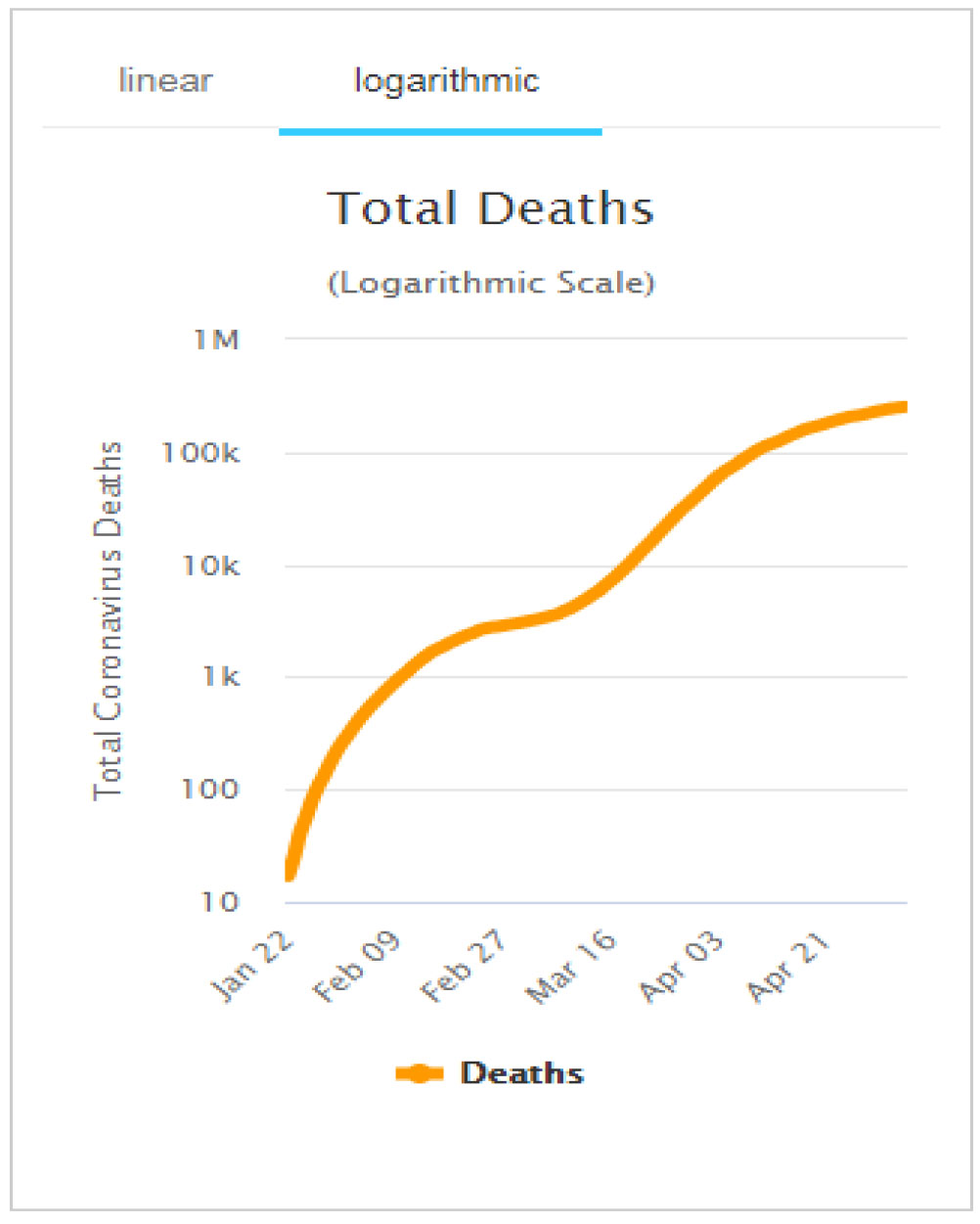

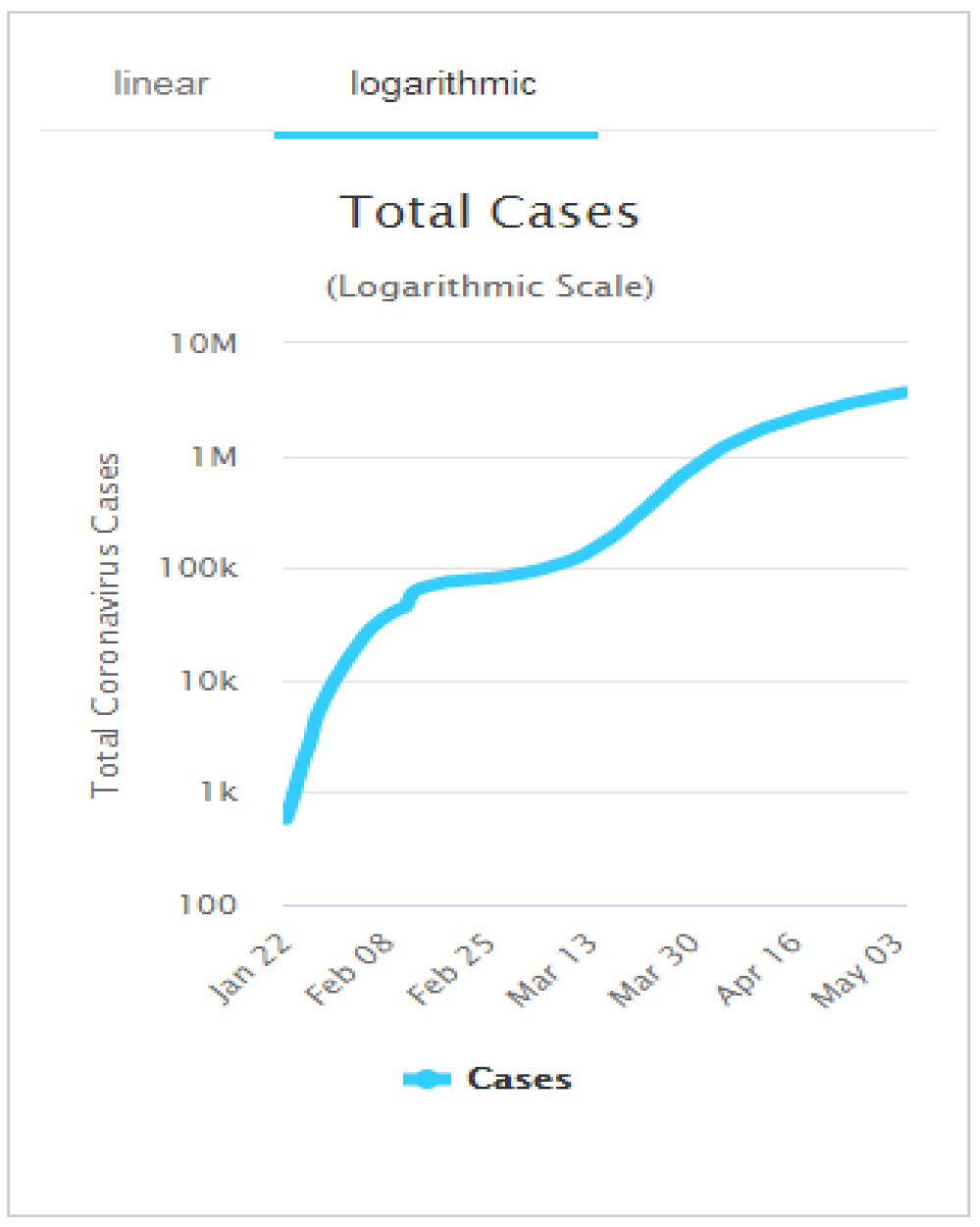

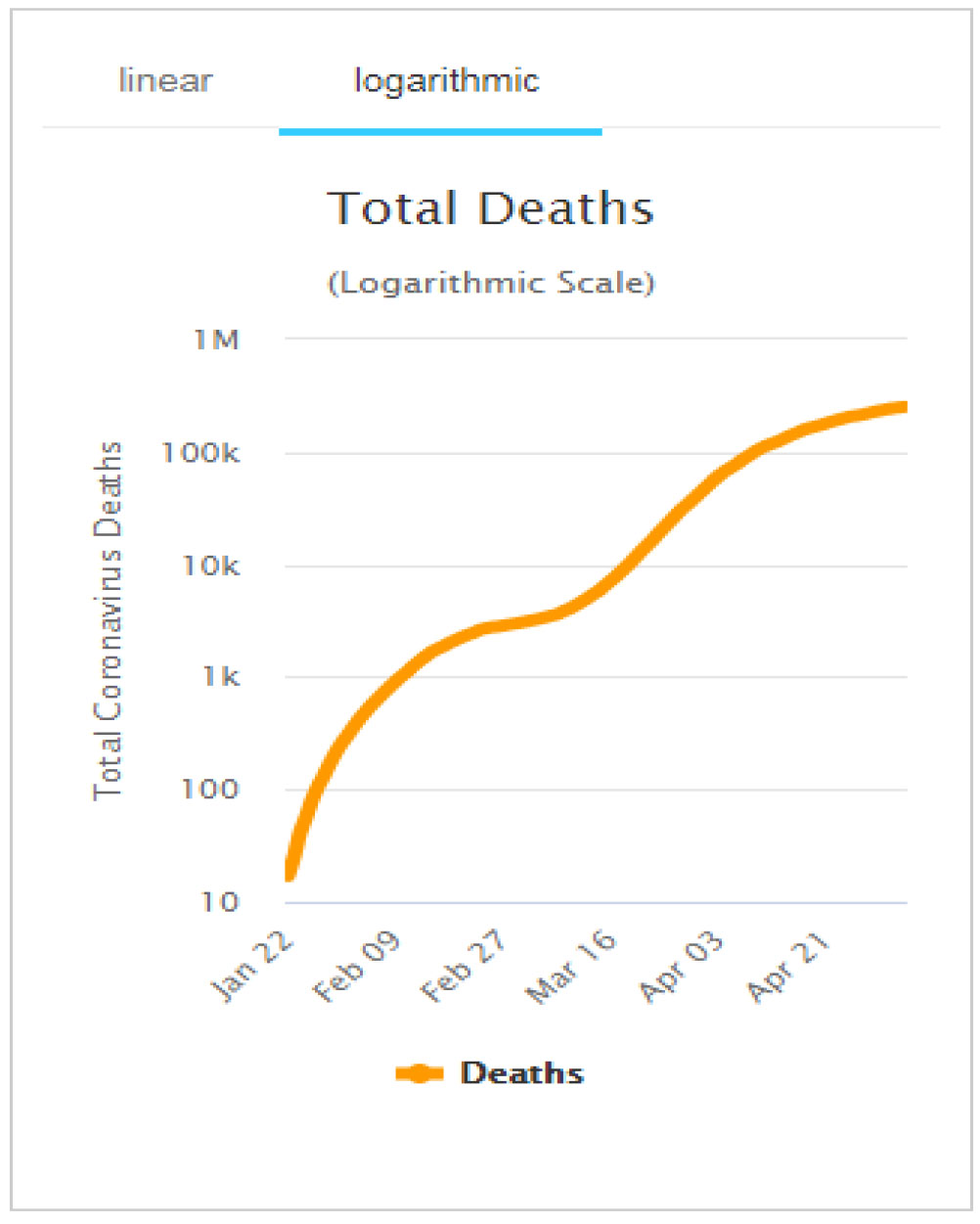

Corona Virus: Confirmed cases globally rose 3-fold (vs 9x in Mar) to ~3.1mn with deaths crossing ~210k. US has become the most impacted country, reporting highest number of cases and deaths. Lockdowns globally, have helped flatten the curve somewhat.

Source: www.worldometers.info

On the domestic front, to curtail the spread of COVID-19, the government has extended the nationwide lockdown for a third time up to 17 May, albeit with certain relaxations depending on containment zones. The government did extend the lockdown previously from 14 April to 3 May. However, after the second extension, the government did announce partial (yet significant) relaxation for construction, transportation and industrial activity from 20 April onwards, excluding COVID-19 hotspots or containment zones. The selective relaxation post-20 April in non-containment regions has not resulted in a material pickup in activity, as peak power demand and daily power consumption are currently still at similar levels vs. before 20 April. India's COVID-19 confirmed cases crossed 37,000, but the curve continues to flatten with the rate of doubling slowing to 11 days compared to nine days a week ago and seven days two weeks ago.

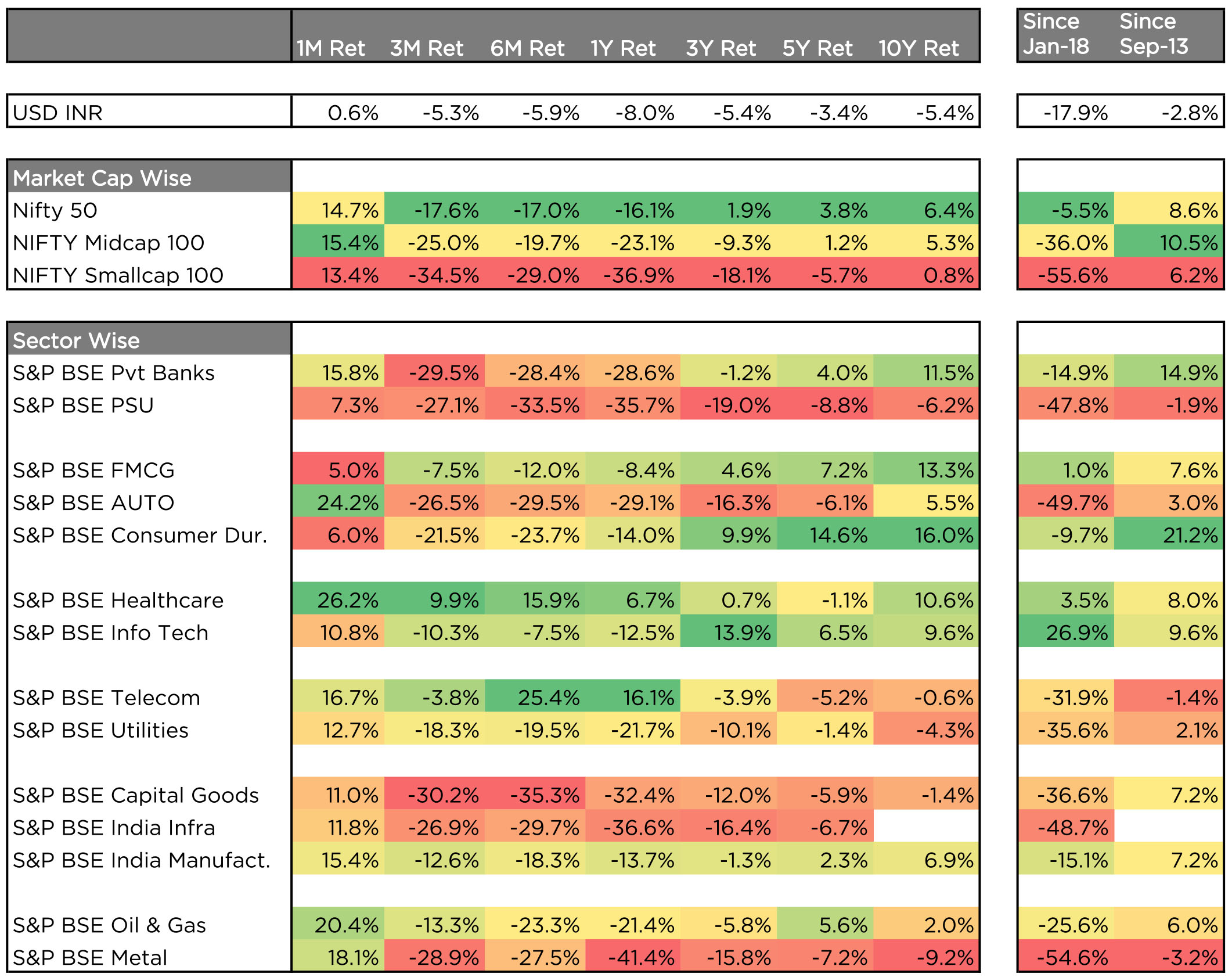

After hitting a low of 7,610 on 23rd Mar'20, the Nifty bounced back more than 29% from its lows. As on 30th Apr'20, the Nifty was down ~20% to 9,860 from its 52-week high of 12,362. Nifty, NSE Mid Cap 100 and NSE Small Cap 100 were up 14.7%, 15.4% and 13.4% respectively for the month. Though, on a 3-month basis, the indices are down 17.6%, 25.0% and 34.5% respectively.

Polarization has continued unabated between the Nifty Top-15 and the Other-35 Nifty constituents. More importantly, even during this COVID-19 led correction, the Top-15 have outperformed with a fall of 10% while the Other-35 basket is down 26%.

FPIs outflows continue: FPIs recorded net outflows of US$400mn from Indian equities in the month of April after record outflows of US$8.4bn in Mar-20 (largest monthly outflow ever). YTD, FPIs have sold US$7.0bn of Indian equities. FPIs recorded net outflows from debt markets at US$1.3bn in April after record outflows of US$8.2bn in Mar-20, (largest monthly outflow ever). YTD, FPIs have sold US$11.0bn in the debt markets.

DIIs were net equity sellers at US$107mn in April after record inflows of US$7.5bn in Mar-20 (largest monthly inflow ever). Mutual funds were net sellers while insurance funds were net buyers of equities in April. Mutual funds were net equity sellers at US$726mn while insurance funds were net equity buyers at US$531mn in April.

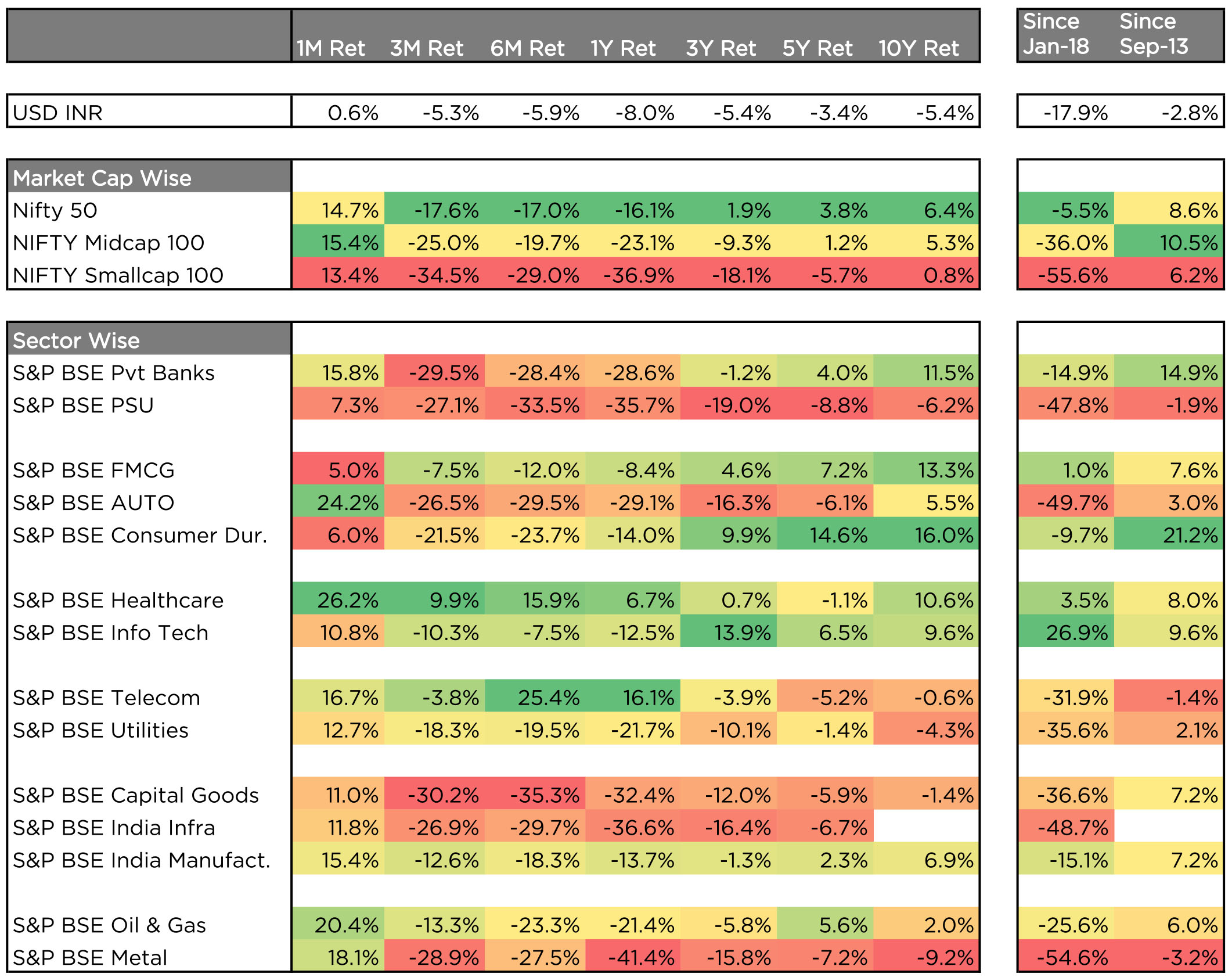

Sectoral Performance as on April 30, 2020

Inflation: March CPI print fell to 5.9% along expected lines, as reversal of vegetable prices continued to drive the decline. Core CPI remained unchanged at 4.1%, could open up space for further rate cuts as it falls on subdued activity.

Trade Deficit: India's exports slumped by ~35% in March, more than the decline in imports (~29%) narrowing trade deficit to $9.8bn. For full year ending Mar'20, trade deficit stood at $153bn.

Treasury Yields and INR: Benchmark 10-year treasury yields averaged at 6.28% in April (3bps lower vs. March avg.). On month-end values, a similar decline was observed, 10Y yields ended the month at 6.11%. However, yields rose to 6.5% during the first half of the month before easing gradually to 6.1%.

The INR appreciated by 0.7% and ended the month at Rs.75.10/$ in April. However, the month-end value masks the fact that the INR traded lower than the March close throughout most of April before recording strong gains on the last day of the month (+0.8%), aided by the "risk-on" rally.

India's FX reserves: It declined from an all-time peak of US$487.2bn on 6 March to US$479.6bn on 17 April. FX reserves have improved by US$9.7bn after reaching a low of US$469.9bn on 20 March. Fiscal Deficit: Fiscal deficit for Apr-Feb 2020 came in at Rs10.4tn, or 135.2% of the revised FY20 deficit (Rs.7.7tn). This compares to 131.1% reached in the last fiscal during the same time frame.

All indices correct - though Large caps outperform in the end: Though, initially, mid and small cap indices fell in line with the NIFTY, NIFTY recovered towards the month-end, whereas the broader markets continued to languish, resulting in significant gap in 1M performance between the NIFTY and broader markets. From the peak of Jan-18 NIFTY, NSE Mid Cap and NSE Small Cap have fallen 29.7%, 34.9% and 42.4% respectively. Interestingly, markets are now at levels close to the Sep-13 bottom.

A Big caveat to the above postulation is the discovery of a medical breakthrough in the treatment of Corona Virus leading to a dramatic fall in morbidity rate (currently at 5%). Such a positive development may lead to a significant, sharp relief rally. This was reflected by the rally on Wall Street, when Remedesivir, was mentioned positively. However, scaling up the drug and making it available world over, remain a challenge. India, faces another, more basic challenge, upping its rate of testing. Without doubt, lockdowns have curtailed the spread of the virus across the country. However, without adequate testing, India's "flattening of the curve" remains unproven.

The April upmove in the markets may not last given the ground realities - stagnant earnings, at best for FY21 and valuations at long term average. With companies continuing to report numbers for March ended fiscal FY20, estimates for the coming year could get further downgraded. Clearly, while looking at companies, FY22 will be the year of reckoning rather than FY21. This could easily make the earnings season till December'20, a "hotspot" of volatility. To "contain" these "hotspots", markets expects a regular dose of Government Stimuli packages aimed at different strata of societies and businesses, an agile and able administration at the ground level and more holistic planning at the Centre.

Stay Safe, Stay at home.

MSCI Developed Markets index was up 10.8% MoM led by US (+12.7%) whereas MSCI Emerging Market Index was up 9%. April became the first month in 2020 to register gains for Indian Markets with Nifty +14.7% (outperforming regional markets), tracking the rally in S&P 500 (U.S) +12.7%. On a 3 month basis though, India (-21.2%) has underperformed most Developed Markets (-12.4%) and China. It has outperformed other BRIC and Emerging Market countries.

Crude: Lockdowns across the world dragged the demand for oil lower by >20% and OPEC+ agreed to unprecedented supply cuts to counter the demand collapse, but cuts weren't enough to address the immediate storage distress which sent WTI futures to negative territory. WTI and Brent closed the month at $18.84 and $25.27 per barrel respectively. Commodities like Steel, Zinc etc. were marginally positive for the month but are lower by 17% to 31% from a year ago period.

Currencies & Global Bond Yields: The INR outperformed JPM EM FX (- 0.8%) in April. YTD, the INR (-5.0%) has significantly outperformed the broader EM FX (-13.7%). Note the DXY declined marginally (-0.03%) in April (vs. +0.9 gain in March) and ended the month at 99.02.

Interest rates globally have fallen to record lows with US 10-year hitting 0.64% and many countries like Germany, Japan, Switzerland, France etc. witnessing negative 10-year yields. Global yields have eased meaningfully as central banks globally have cut policy rates aggressively and have announced large QE programs, to counter the negative impact on global growth from the COVID-19 outbreak. US 10Y yields are at 0.61% (-6bps in 1M, -179bps over the last 1 year).

Corona Virus: Confirmed cases globally rose 3-fold (vs 9x in Mar) to ~3.1mn with deaths crossing ~210k. US has become the most impacted country, reporting highest number of cases and deaths. Lockdowns globally, have helped flatten the curve somewhat.

Source: www.worldometers.info

On the domestic front, to curtail the spread of COVID-19, the government has extended the nationwide lockdown for a third time up to 17 May, albeit with certain relaxations depending on containment zones. The government did extend the lockdown previously from 14 April to 3 May. However, after the second extension, the government did announce partial (yet significant) relaxation for construction, transportation and industrial activity from 20 April onwards, excluding COVID-19 hotspots or containment zones. The selective relaxation post-20 April in non-containment regions has not resulted in a material pickup in activity, as peak power demand and daily power consumption are currently still at similar levels vs. before 20 April. India's COVID-19 confirmed cases crossed 37,000, but the curve continues to flatten with the rate of doubling slowing to 11 days compared to nine days a week ago and seven days two weeks ago.

Domestic Markets:

Indian equity markets witnessed a sharp rebound from four year lows in March. The RBI announced a slew

of measures in mid-April to counter the ensuing economic downturn from COVID-19 with the Governor

reinforcing the notion that the RBI will do "whatever it takes". The RBI reduced the reverse repo rate by

another 25 bps (after the 90 bps in end March) to 3.75% to further incentivize banks to lend. The RBI took

significant steps to ease financial conditions and inject liquidity in the system as follows: a second round

of TLTRO of Rs.0.5trn, specific refinancing facilities of Rs.0.5trn to certain institutions, special liquidity

facility for mutual funds of Rs.0.5trn and OMO operations. Total liquidity injected by the RBI so far to

tackle the COVID-19 crisis is in excess of ~Rs.5trn.After hitting a low of 7,610 on 23rd Mar'20, the Nifty bounced back more than 29% from its lows. As on 30th Apr'20, the Nifty was down ~20% to 9,860 from its 52-week high of 12,362. Nifty, NSE Mid Cap 100 and NSE Small Cap 100 were up 14.7%, 15.4% and 13.4% respectively for the month. Though, on a 3-month basis, the indices are down 17.6%, 25.0% and 34.5% respectively.

Polarization has continued unabated between the Nifty Top-15 and the Other-35 Nifty constituents. More importantly, even during this COVID-19 led correction, the Top-15 have outperformed with a fall of 10% while the Other-35 basket is down 26%.

FPIs outflows continue: FPIs recorded net outflows of US$400mn from Indian equities in the month of April after record outflows of US$8.4bn in Mar-20 (largest monthly outflow ever). YTD, FPIs have sold US$7.0bn of Indian equities. FPIs recorded net outflows from debt markets at US$1.3bn in April after record outflows of US$8.2bn in Mar-20, (largest monthly outflow ever). YTD, FPIs have sold US$11.0bn in the debt markets.

DIIs were net equity sellers at US$107mn in April after record inflows of US$7.5bn in Mar-20 (largest monthly inflow ever). Mutual funds were net sellers while insurance funds were net buyers of equities in April. Mutual funds were net equity sellers at US$726mn while insurance funds were net equity buyers at US$531mn in April.

Sectoral Impact

On a sectoral front, pharma (+26.2%) and Auto (+24.2%) were the best performing sectors whereas

FMCG (+5%) and Consumer Durables (+6%) were the laggards. On a 3-month basis, Healthcare (+9.9%)

is the only sector with positive returns.Sectoral Performance as on April 30, 2020

The Macro Picture

GDP Growth: Economic activity was just recovering (Feb IIP at 7m high) when the COVID-19 pandemic

forced the nation-wide lockdown. Post the extension of lockdown to 3 May, IMF slashed India's growth

estimate for FY21 to 1.9%.Inflation: March CPI print fell to 5.9% along expected lines, as reversal of vegetable prices continued to drive the decline. Core CPI remained unchanged at 4.1%, could open up space for further rate cuts as it falls on subdued activity.

Trade Deficit: India's exports slumped by ~35% in March, more than the decline in imports (~29%) narrowing trade deficit to $9.8bn. For full year ending Mar'20, trade deficit stood at $153bn.

Treasury Yields and INR: Benchmark 10-year treasury yields averaged at 6.28% in April (3bps lower vs. March avg.). On month-end values, a similar decline was observed, 10Y yields ended the month at 6.11%. However, yields rose to 6.5% during the first half of the month before easing gradually to 6.1%.

The INR appreciated by 0.7% and ended the month at Rs.75.10/$ in April. However, the month-end value masks the fact that the INR traded lower than the March close throughout most of April before recording strong gains on the last day of the month (+0.8%), aided by the "risk-on" rally.

India's FX reserves: It declined from an all-time peak of US$487.2bn on 6 March to US$479.6bn on 17 April. FX reserves have improved by US$9.7bn after reaching a low of US$469.9bn on 20 March. Fiscal Deficit: Fiscal deficit for Apr-Feb 2020 came in at Rs10.4tn, or 135.2% of the revised FY20 deficit (Rs.7.7tn). This compares to 131.1% reached in the last fiscal during the same time frame.

All indices correct - though Large caps outperform in the end: Though, initially, mid and small cap indices fell in line with the NIFTY, NIFTY recovered towards the month-end, whereas the broader markets continued to languish, resulting in significant gap in 1M performance between the NIFTY and broader markets. From the peak of Jan-18 NIFTY, NSE Mid Cap and NSE Small Cap have fallen 29.7%, 34.9% and 42.4% respectively. Interestingly, markets are now at levels close to the Sep-13 bottom.

Outlook

The 2008 crash lasted around 300 days and the Nifty fell a total of 60%. But the fall wasn't unidirectional;

the market fell in 3 steps. After each fall, market saw a small (sharp) rebound only to fall lower in the

next crash. The current crash, as such, has seen only the first step of the crash, though the correction has

been much sharper. NIFTY fell 38% from peak to bottom over a period of 66 days. Very rarely have bear

markets in the past seen one sharp fall followed by a continued upmove. Historically, most bear markets

last for at least 3 months. As a result, depending on the extent of the lockdown in India and the rate of

spread of COVID-19 across the world, market may see further correction in the coming months.A Big caveat to the above postulation is the discovery of a medical breakthrough in the treatment of Corona Virus leading to a dramatic fall in morbidity rate (currently at 5%). Such a positive development may lead to a significant, sharp relief rally. This was reflected by the rally on Wall Street, when Remedesivir, was mentioned positively. However, scaling up the drug and making it available world over, remain a challenge. India, faces another, more basic challenge, upping its rate of testing. Without doubt, lockdowns have curtailed the spread of the virus across the country. However, without adequate testing, India's "flattening of the curve" remains unproven.

The April upmove in the markets may not last given the ground realities - stagnant earnings, at best for FY21 and valuations at long term average. With companies continuing to report numbers for March ended fiscal FY20, estimates for the coming year could get further downgraded. Clearly, while looking at companies, FY22 will be the year of reckoning rather than FY21. This could easily make the earnings season till December'20, a "hotspot" of volatility. To "contain" these "hotspots", markets expects a regular dose of Government Stimuli packages aimed at different strata of societies and businesses, an agile and able administration at the ground level and more holistic planning at the Centre.

Stay Safe, Stay at home.

Mr. Suyash Choudhary

Head - Fixed Income

WHAT WENT BY

Bonds rallied sharply during April with 10-year Government bond yield ending at 6.11% from 6.31% at beginning

of the month. The RBI in mid-April announced another set of measures as a follow up to its emergency March

policy meeting, in support to the economy. The rate corridor was further widened by 25 basis points as the

fixed reverse repo was reduced to 3.75%, while the Marginal Standing Facility (MSF) and bank rate was left

unchanged. To provide relief to the NBFC/MFI sector which did not see material investment in the initial

TLTRO, RBI announced TLTRO 2.0 of Rs. 500Bn for the NBFC sector with tenor of 3 years. With a provision to

invest minimum 50% in small and mid-sized NBFCs/MFIs, RBI further demonstrated its commitment to bring

rates down across the risk curve.

A total of Rs. 500 bn of special refinance facilities was extended to the National Bank for Agriculture and Rural Development (Rs 250 bn), Small industries Development Bank of India (Rs 150 bn) and the National Housing Bank (Rs 100 bn) to provide financing to the vulnerable segments such as the rural sector, small industries, housing finance companies, NBFCs and MFIs. The Governor also mentioned that these refinance facilities were provided after consultation with the respective institutions and understanding their current demand and that more support could be provided if needed after assessing the situation.

The RBI released the minutes of the March monetary policy meeting, which was moved forward in the wake of COVID-19. MPC members noted that the weakening global and domestic demand, and the tightening financial conditions has put a significant downward pressure on growth; and that the current situation requires both fiscal and monetary action, while keeping inflation in check. the MPC agreed to maintain an accommodative stance as long as it was necessary to revive growth and cushion the impact of COVID-19 on the economy.

India's Nikkei Markit services PMI fell to a six-month low of 49.3 in March from 57.5 in February, led by sharp decline in new export orders and new business indices. The composite PMI reduced to 50.6 in March from 57.6. At US$9.8bn, India's goods trade deficit in March remained almost the same as in February (US$9.9bn). Export growth fell to -34.6% yoy in March after posting +2.9% yoy in the previous months while imports growth fell to -28.7% yoy in March from a 2.5% yoy rise in February. Major export items that recorded high negative growth included oil meals, engineering goods, gems & jewelry & minerals while major import categories that experienced significant declines included pearls, precious and semi-precious stones, machinery, electrical and non-electrical & electronic goods.

India's headline CPI inflation declined to 5.9%yoy in March from 6.6%yoy in February in line with market expectations. Food inflation slowed further to 7.8% yoy in March from 9.5% yoy in February on further moderation of vegetable and egg prices. Core inflation (headline excluding food and fuel) stayed broadly steady at 4.1%yoy in March.

With these steps around hiking short term financing support to the government and starting monetizing apparently, the bond market will now be significantly comforted that a financing plan is beginning to emerge for the substantial fiscal expansion ahead. Term spreads at the mid-long end of the curve have been the highest in the past 10 years, and significantly higher when compared with the expected nominal GDP growth rate for the year ahead. These should now compress but provided that the total size of RBI measures turn out to be meaningful in relation with the financing requirements of the government. Other supporting measures can also be deployed including hiking the held to maturity limit (HTM) for banks for a period of time in order to incentivize demand for bonds in the system. Finally, states may perhaps require some greater support still given that the only avenue provided to them so far is the enhancement in their Ways and Means Advances (WMA) limits. This increase may still be very small when compared with their overall borrowing requirements.

We believe, from an absolute risk versus reward perspective, front end (up to 5 year) quality bondsare attractive. Long duration is quite attractive as well, both on term spreads as well as on gap from expected nominal GDP. However, its sustained performance will importantly depend upon the RBI unveiling a credible plan for financing the substantially expanded fiscal deficit in the year ahead.

A total of Rs. 500 bn of special refinance facilities was extended to the National Bank for Agriculture and Rural Development (Rs 250 bn), Small industries Development Bank of India (Rs 150 bn) and the National Housing Bank (Rs 100 bn) to provide financing to the vulnerable segments such as the rural sector, small industries, housing finance companies, NBFCs and MFIs. The Governor also mentioned that these refinance facilities were provided after consultation with the respective institutions and understanding their current demand and that more support could be provided if needed after assessing the situation.

The RBI released the minutes of the March monetary policy meeting, which was moved forward in the wake of COVID-19. MPC members noted that the weakening global and domestic demand, and the tightening financial conditions has put a significant downward pressure on growth; and that the current situation requires both fiscal and monetary action, while keeping inflation in check. the MPC agreed to maintain an accommodative stance as long as it was necessary to revive growth and cushion the impact of COVID-19 on the economy.

India's Nikkei Markit services PMI fell to a six-month low of 49.3 in March from 57.5 in February, led by sharp decline in new export orders and new business indices. The composite PMI reduced to 50.6 in March from 57.6. At US$9.8bn, India's goods trade deficit in March remained almost the same as in February (US$9.9bn). Export growth fell to -34.6% yoy in March after posting +2.9% yoy in the previous months while imports growth fell to -28.7% yoy in March from a 2.5% yoy rise in February. Major export items that recorded high negative growth included oil meals, engineering goods, gems & jewelry & minerals while major import categories that experienced significant declines included pearls, precious and semi-precious stones, machinery, electrical and non-electrical & electronic goods.

India's headline CPI inflation declined to 5.9%yoy in March from 6.6%yoy in February in line with market expectations. Food inflation slowed further to 7.8% yoy in March from 9.5% yoy in February on further moderation of vegetable and egg prices. Core inflation (headline excluding food and fuel) stayed broadly steady at 4.1%yoy in March.

Outlook

There has been a strong case for the RBI beginning to outright monetize the fiscal deficit given the exceptional

growth challenge that the world and India is currently facing. Our base case is for India's nominal GDP growth

of just 3 - 4% for the current financial year. If true this will be the largest growth shock in multiple decades.

Basis an anticipated sharp revenue slowdown and the need for a discretionary expenditure expansion, we are

also looking for anywhere between 4 - 6% of a deficit expansion at a combined center and state level. This

throws up a big ask for financing, a majority of which has to be financed by the central bank. Indeed this is the

template that seems to have evolved, in some form or fashion, in most major economies across the world.With these steps around hiking short term financing support to the government and starting monetizing apparently, the bond market will now be significantly comforted that a financing plan is beginning to emerge for the substantial fiscal expansion ahead. Term spreads at the mid-long end of the curve have been the highest in the past 10 years, and significantly higher when compared with the expected nominal GDP growth rate for the year ahead. These should now compress but provided that the total size of RBI measures turn out to be meaningful in relation with the financing requirements of the government. Other supporting measures can also be deployed including hiking the held to maturity limit (HTM) for banks for a period of time in order to incentivize demand for bonds in the system. Finally, states may perhaps require some greater support still given that the only avenue provided to them so far is the enhancement in their Ways and Means Advances (WMA) limits. This increase may still be very small when compared with their overall borrowing requirements.

We believe, from an absolute risk versus reward perspective, front end (up to 5 year) quality bondsare attractive. Long duration is quite attractive as well, both on term spreads as well as on gap from expected nominal GDP. However, its sustained performance will importantly depend upon the RBI unveiling a credible plan for financing the substantially expanded fiscal deficit in the year ahead.