Commentary

31st August 2020

WHAT WENT BY

Global Markets

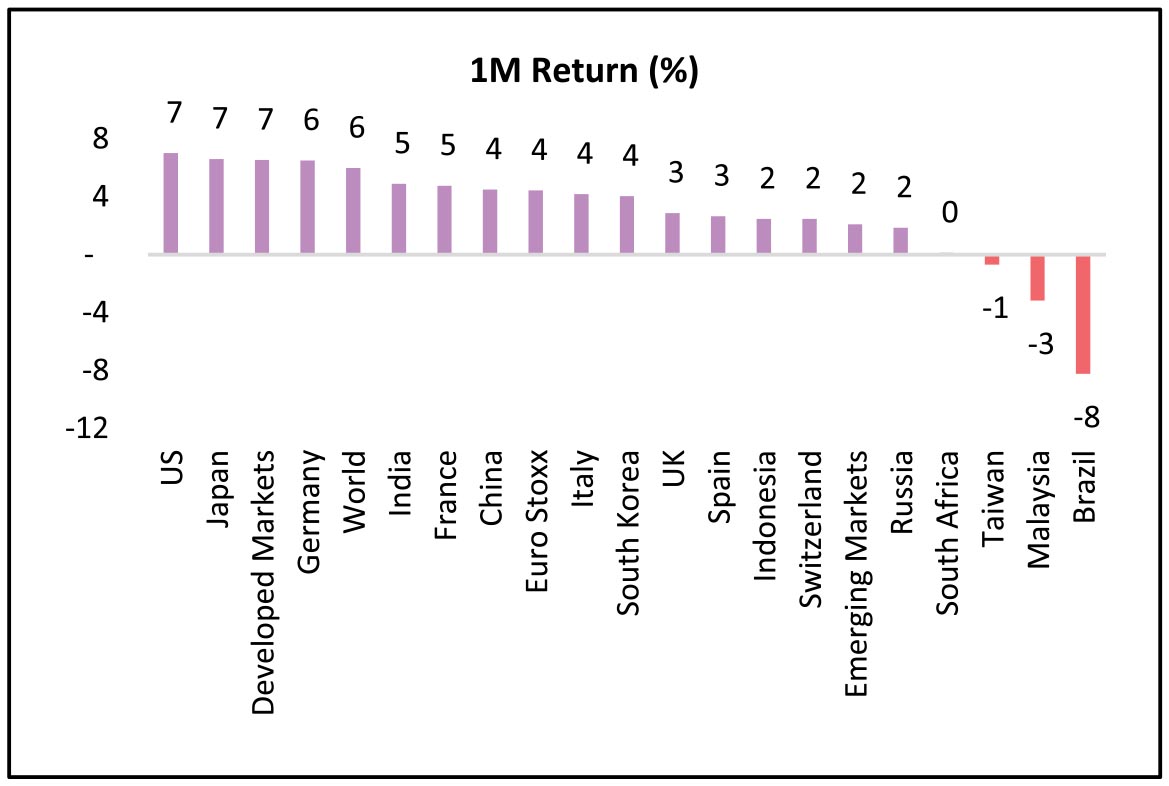

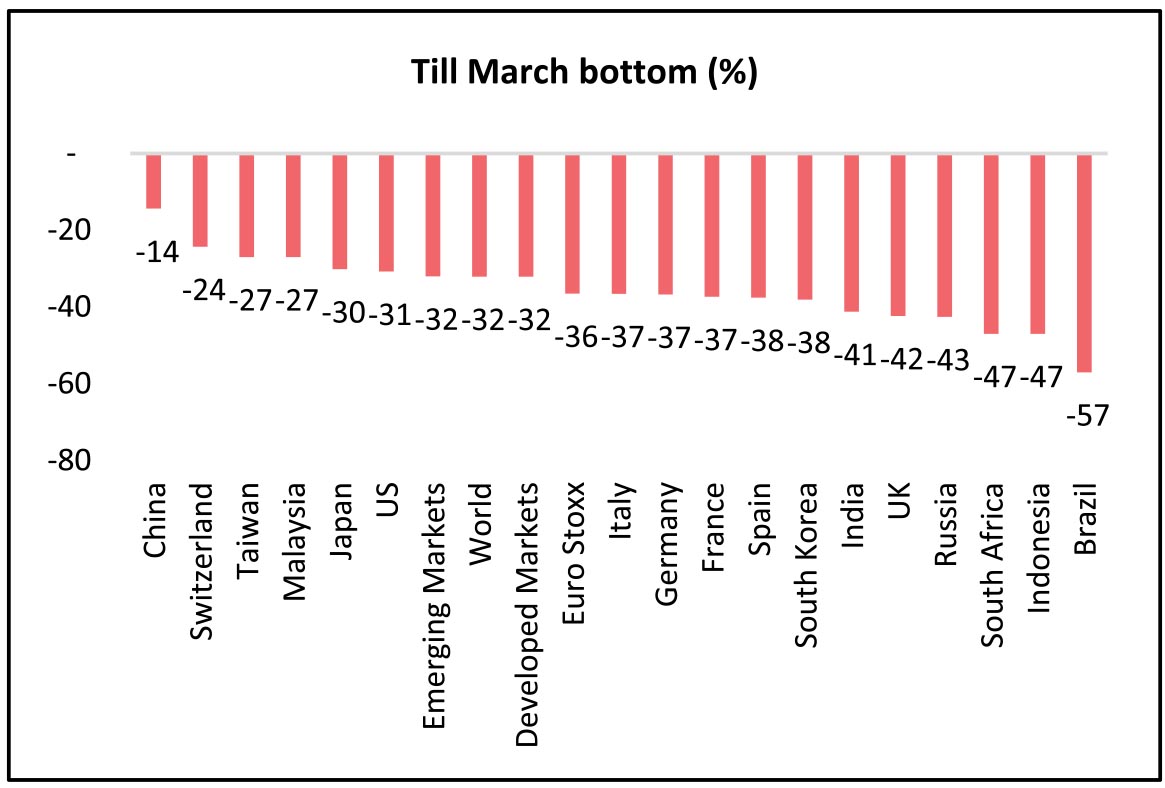

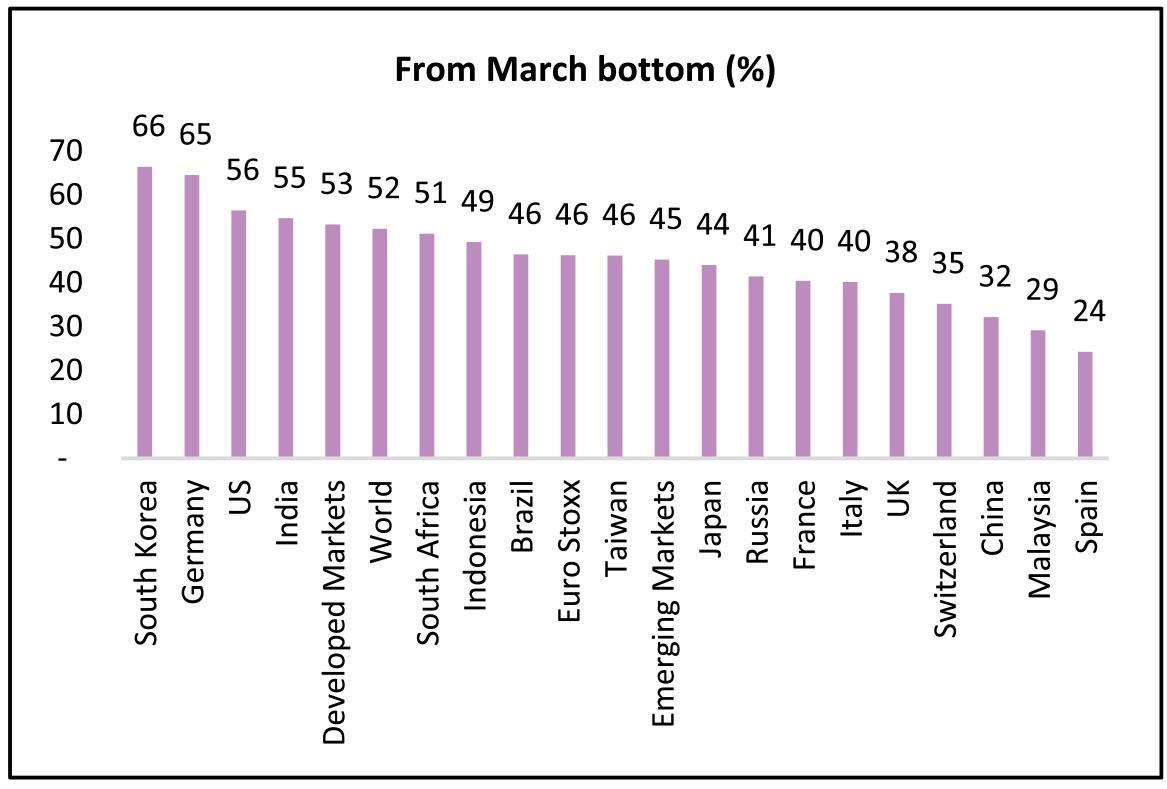

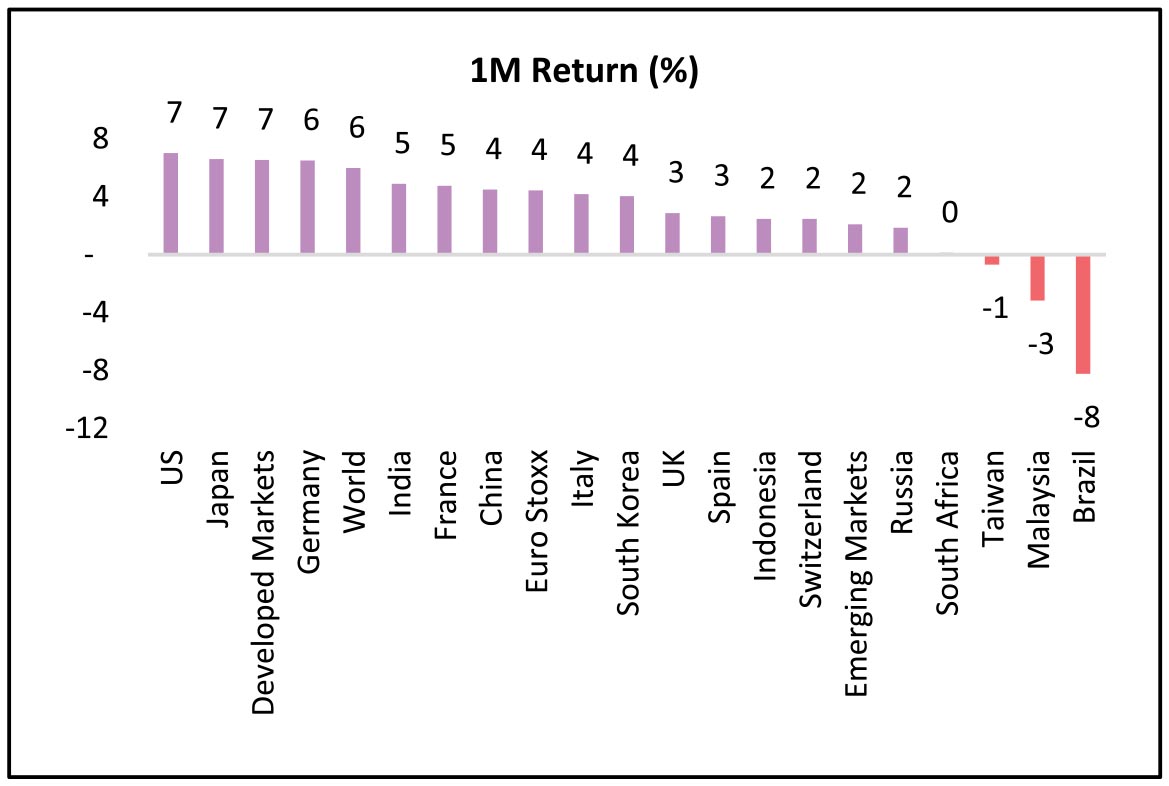

Equities rose further through the month, extending the last quarter's rebound as investors remained optimistic

about the economic outlook despite the surge in cases seen in the US. While worryingly, report of new cases resurfaced

in Germany and Western Europe, the path of unlocking was not reversed by any strong Government

action. Aided by strong fiscal and monetary stimuli and no roll back of re-opening the economy, Developed Markets

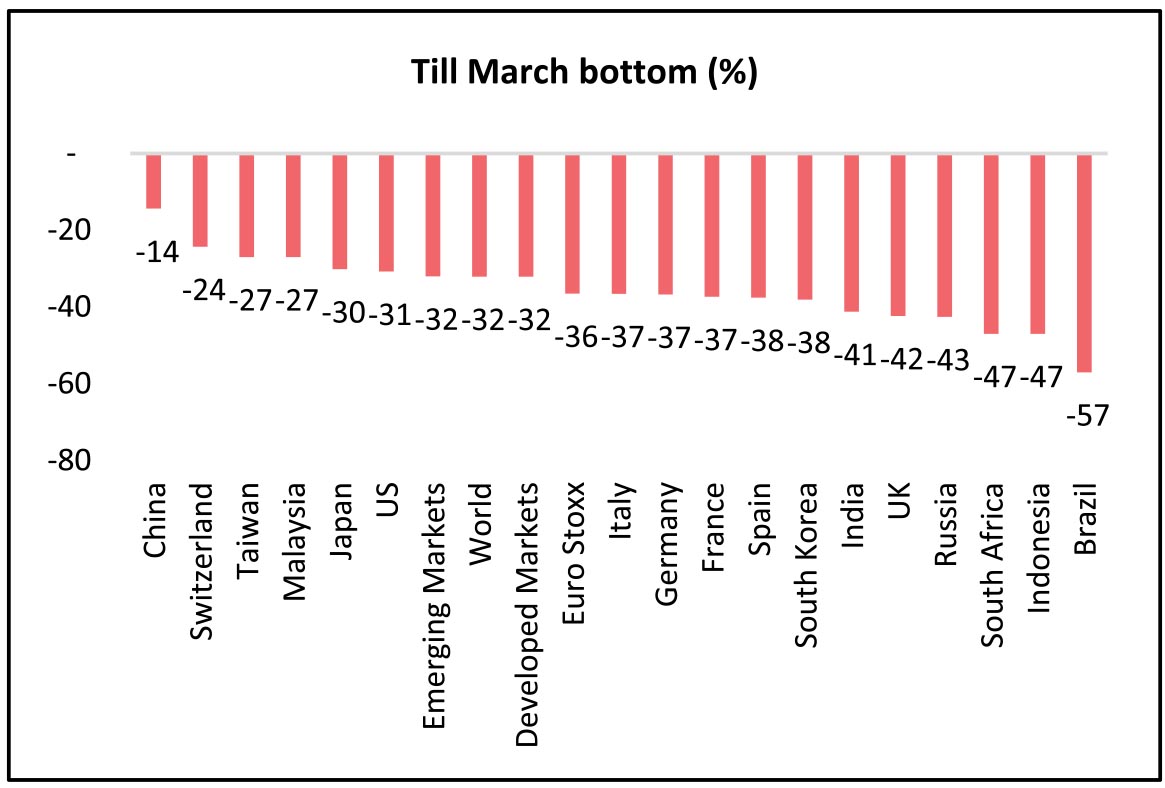

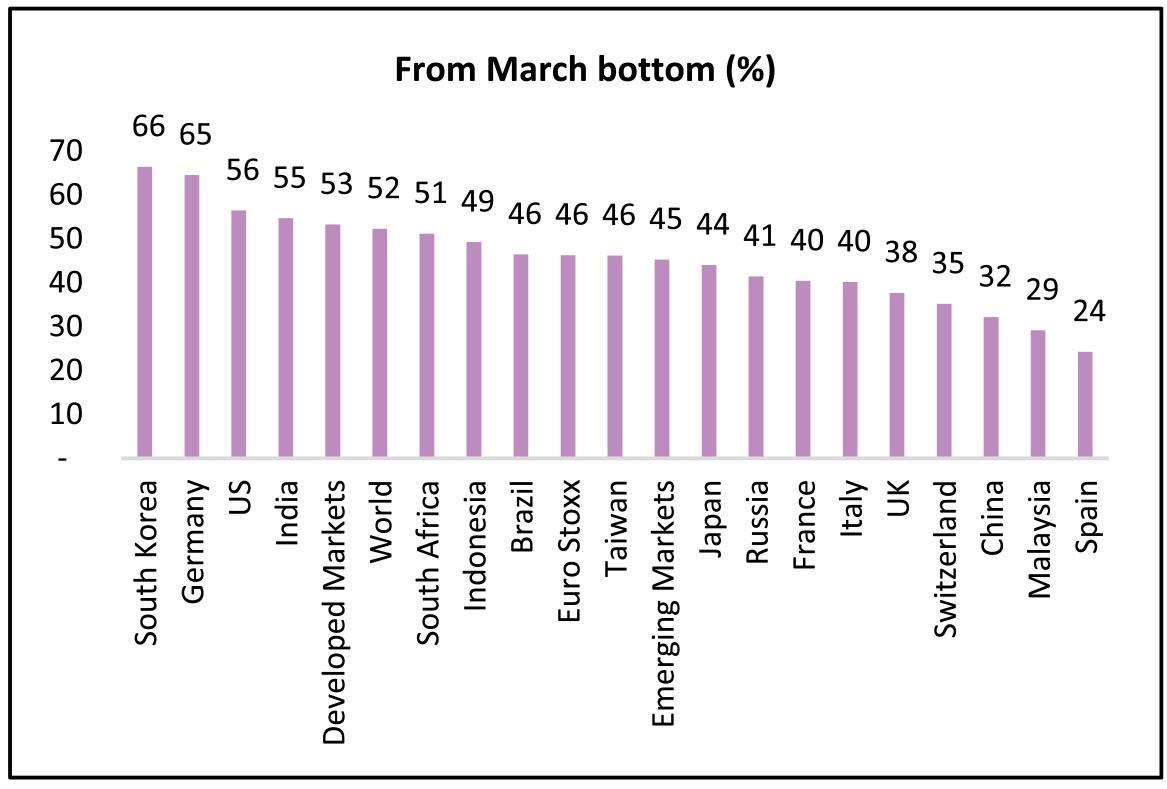

(+7%) led by US (S&P 500 +7%) and Japan (+7%) continued to outshine their Emerging peers. Global Markets have

rallied from the bottom in March with South Korea (+66%), Germany (+65%), US (+56%) and India (+55%) leading

the pack. Developed Markets (+53%) have bounced back faster than Emerging Markets (45%), which reflects faster

recovery in Developed Markets. On a YTD basis, several markets have actually given positive returns led by China

(+13%) and the US (+8%).

Source: Bloomberg

Covid-19 - Vaccine & Reopenings: The pace of recovery from Covid-19 lockdowns - initially strong - appears to have reached a near term "plateau". While in select countries like UK, there was a concentrated effort by the Government to boost consumption - UK Government offered diners a 50% discount for eating/drinking out - "Eat Out to Help Out" scheme. In the US, the phasing out of the unemployment benefits passed in March'20 also led to a fall in consumer confidence, as the extension of these benefits by the US Congress became a political gridlock between the Republicans and Democrats. This impacted consumer confidence. High frequency data shows a deepening drop in trade. The volume of goods arriving at U.S. ports in the four weeks through August 20 is down 8% from January levels.

Currencies and Interest Rates: Global yields, since March 24, have eased meaningfully as central banks globally have cut policy rates aggressively and have announced large QE programs, to counter the negative impact on global growth from the Covid-19 outbreak. US 10 Year yields are at 0.7% (+18bps in 1 month, -79bps over the last 1 year). In India, Benchmark 10 Year Government yield averaged at 5.96% in August (1bp higher vs. August avg.). On month end values, 10 Year yield rose 28bps to end the month at 6.12%.

The Dollar Index continues to weaken, falling 1.3% MoM, op top of a 4.15% fall in July, which was its largest monthly decline in July since 2011 (-4.2%). Most other currencies rallied against the Dollar with GBP (+2.2%) leading. INR appreciated by 2.0% and ended the month at 73.45/$ in August.

Commodities: Brent oil price gained 5.8% MoM in August to end the month at USD45.3/bbl and is up 2% over the last 3 months. YTD, oil prices are still ~31% down. Precious metals - Gold and Silver have seen a sharp surge up 29% and 53% respectively on a 1-Year basis and is now the best performing asset class. As gold took a breather in August (flat MoM), Silver rallied 15% MoM. Most other metals were also up on a MoM basis. Base metals like Aluminium, Steel, Zinc and Copper are now significantly above their levels from a year ago.

Indian equities continued their upward momentum during the month, however the last trading day of the month saw a sharp correction (-2.5%) on account of renewed tensions along the India-China border at Ladakh. India volatility index moderated for the fifth consecutive month and declined 5.6% in August despite witnessing a +25% gain on 31-Aug. Equity markets continued to move higher following the trend in global markets, even as India continues to see a sharp increase in daily new Covid-19 cases.

Domestic Coronavirus updates: India recorded its highest single day increase in new Covid-19 cases at >80,000 in end August which was also the highest daily case load reported by any country. Daily new Covid-19 cases have averaged ~64k+ in August vs ~36k in July. Globally, India has the third highest number of deaths at ~65k after the US and Brazil. However, the mortality rate has been trending lower at ~1.8% (vs 2.2% in end July) while the recovery rate continues to pick up ~77% (vs ~62% in end-July). Covid-19 continues to broaden its geographical reach within the country. Against the reports of highest ever daily cases, both State and Central governments have further eased restrictions in Unlock 4.0 guidelines for September except for containment zones.

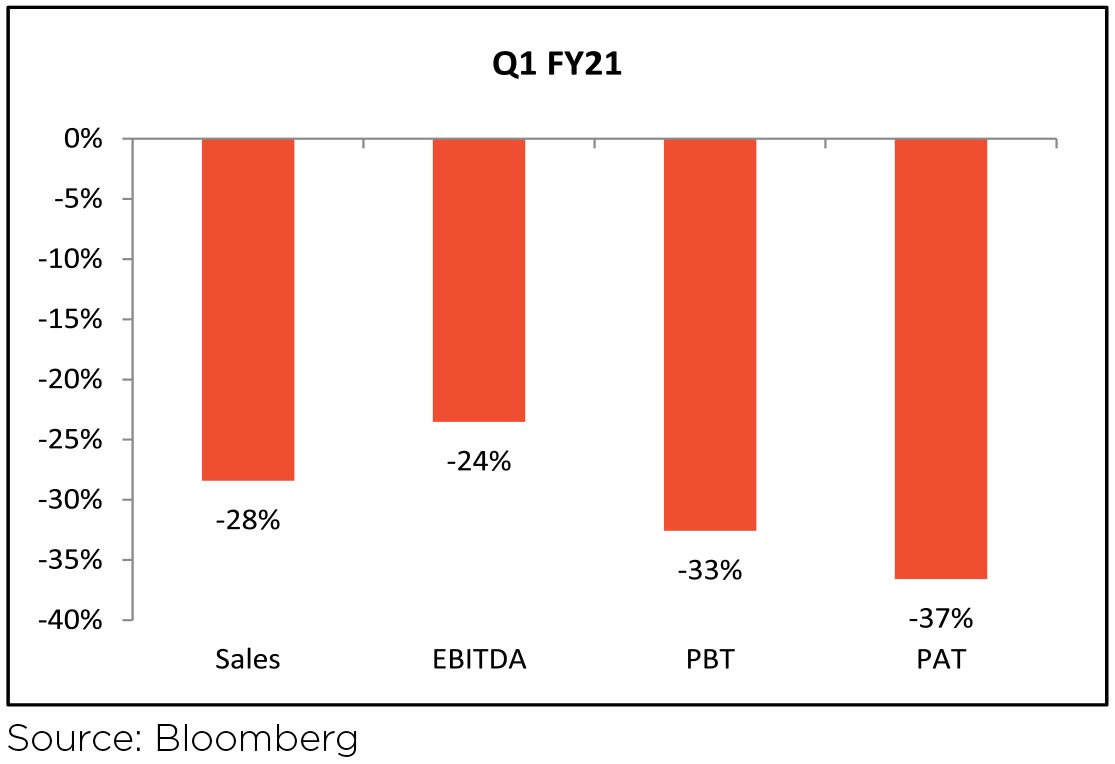

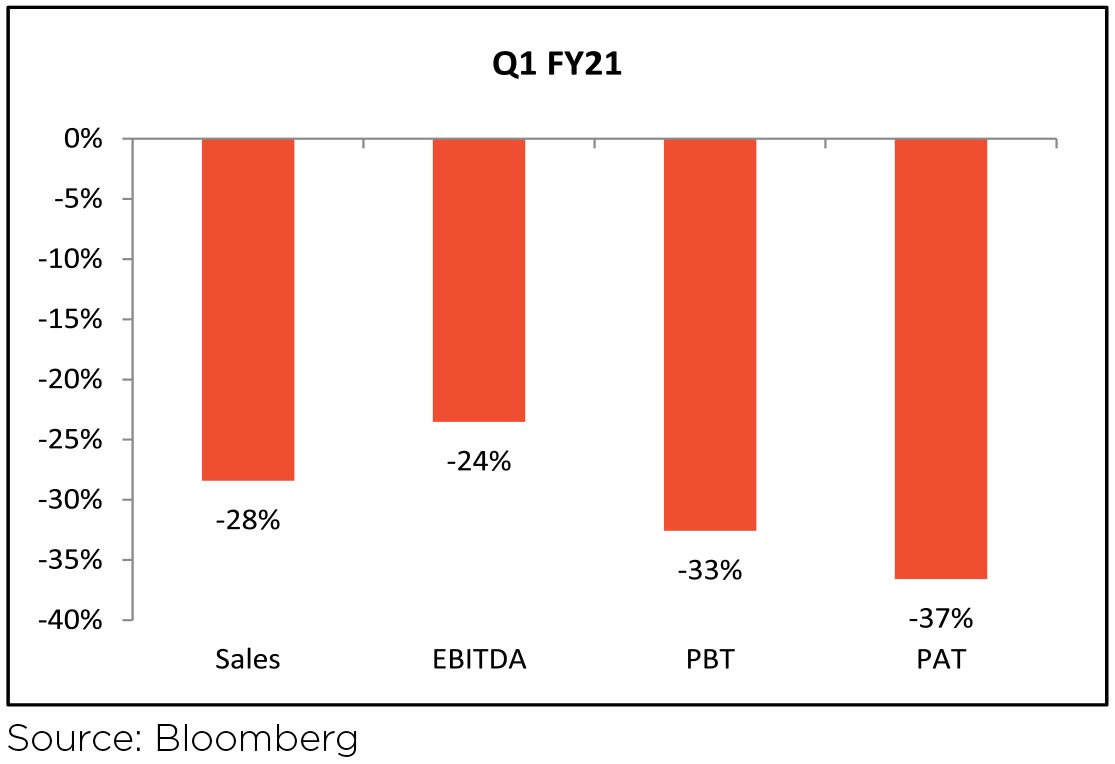

Q1 FY21 Earnings: Of the BSE200 companies, around 182 companies have reported results till date. As expected, delivered earnings by companies in 1QFY21 have fallen YoY and are amongst the weakest they have been for the last several years. Yet, 1QFY21 is also amongst the best (in recent times) in terms of earnings beats, suggesting: a) analysts were too cautious in their forecasts for the quarter given the impaired economic conditions, and b) companies (at least the larger ones) seem to have coped with the lockdowns better than expected, especially in terms of controlling costs. As can be in the chart, EBITDA growth for the aggregate has fallen lesser than the Sales growth which indicates better cost control by most companies.

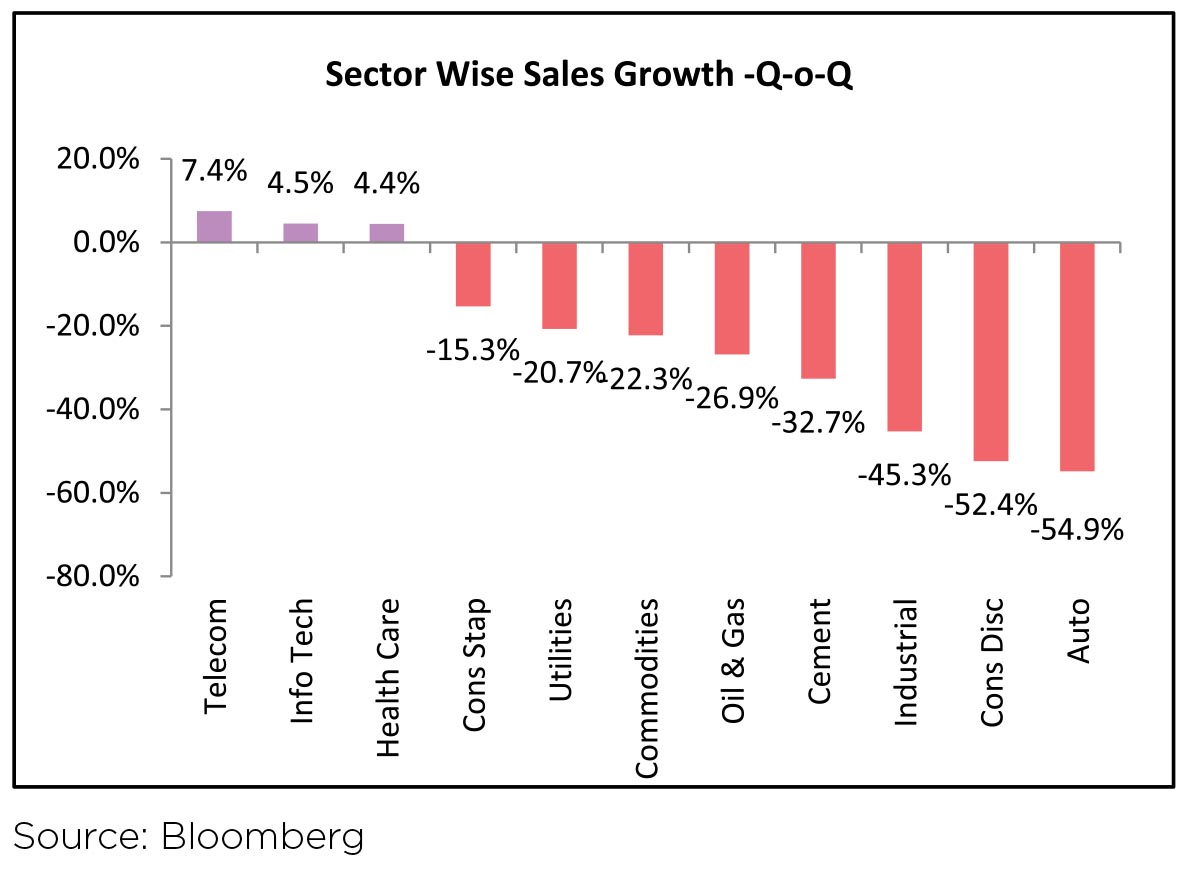

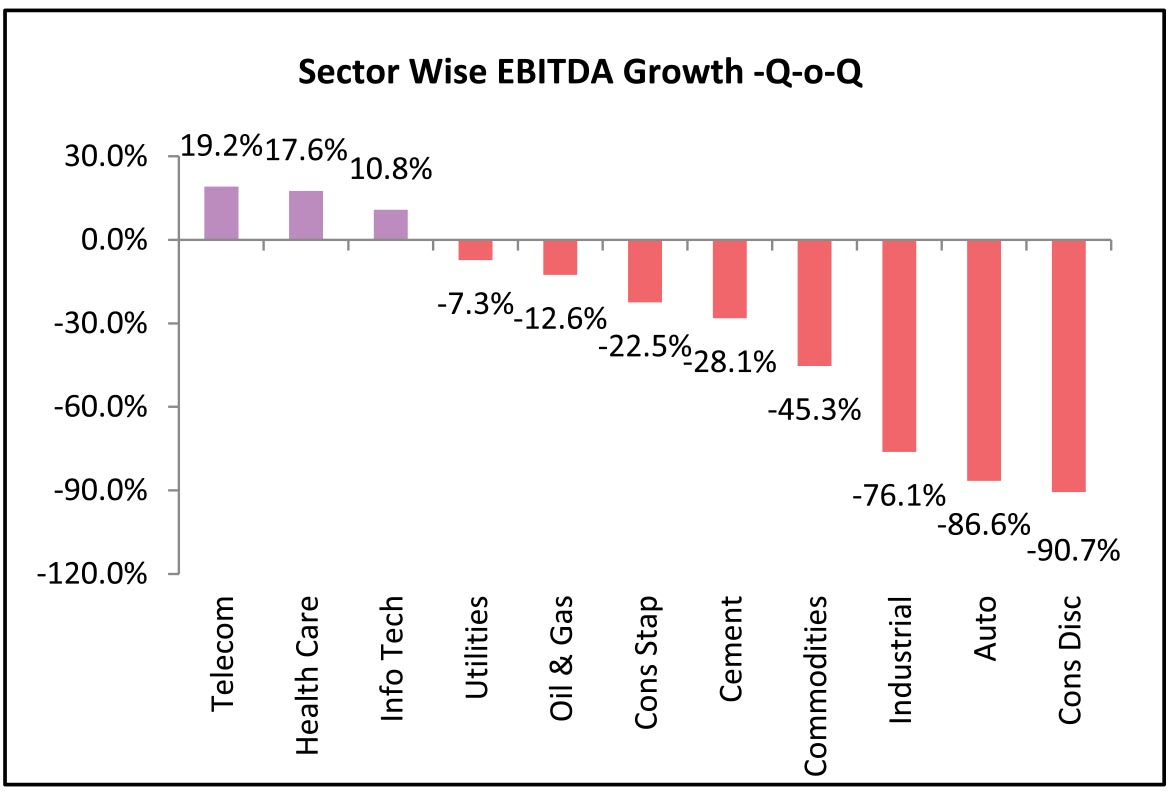

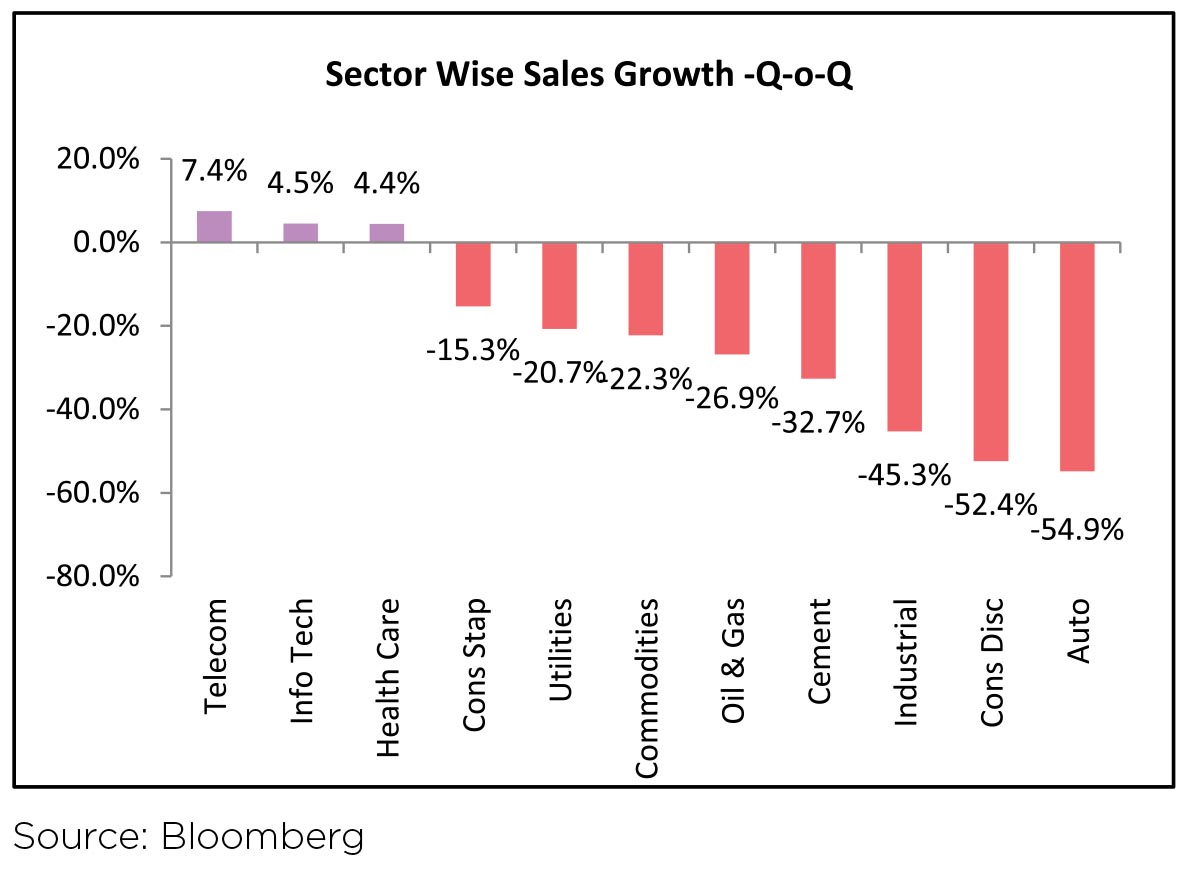

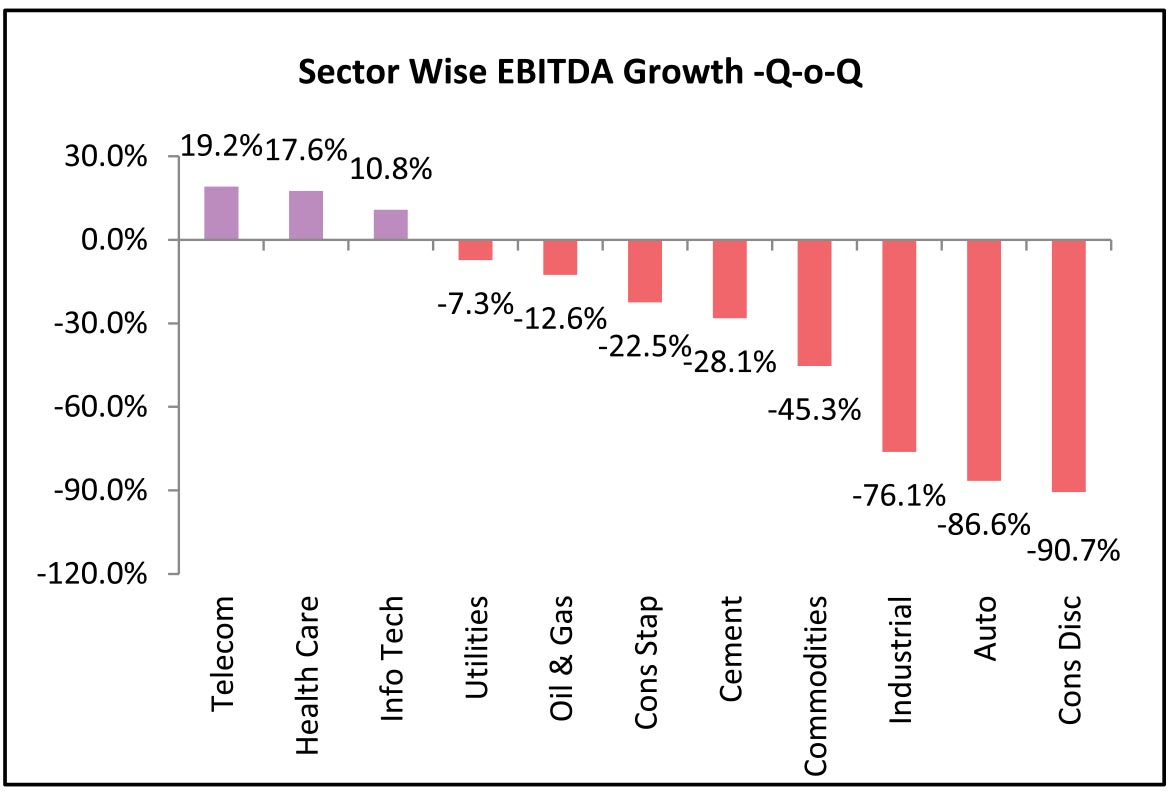

On a sectoral basis, as expected, Telecom, Info Tech and HealthCare were the only sectors with a positive Sales Growth and also reported a double-digit EBITDA growth. Discretionary stocks saw the weakest earnings performance with Auto and Consumer Discretionary the worst impacted sectors. Staples saw a 15% degrowth in Sales as several nonessential categories were barred from being produced and sold in the lockdown.

Source: Bloomberg

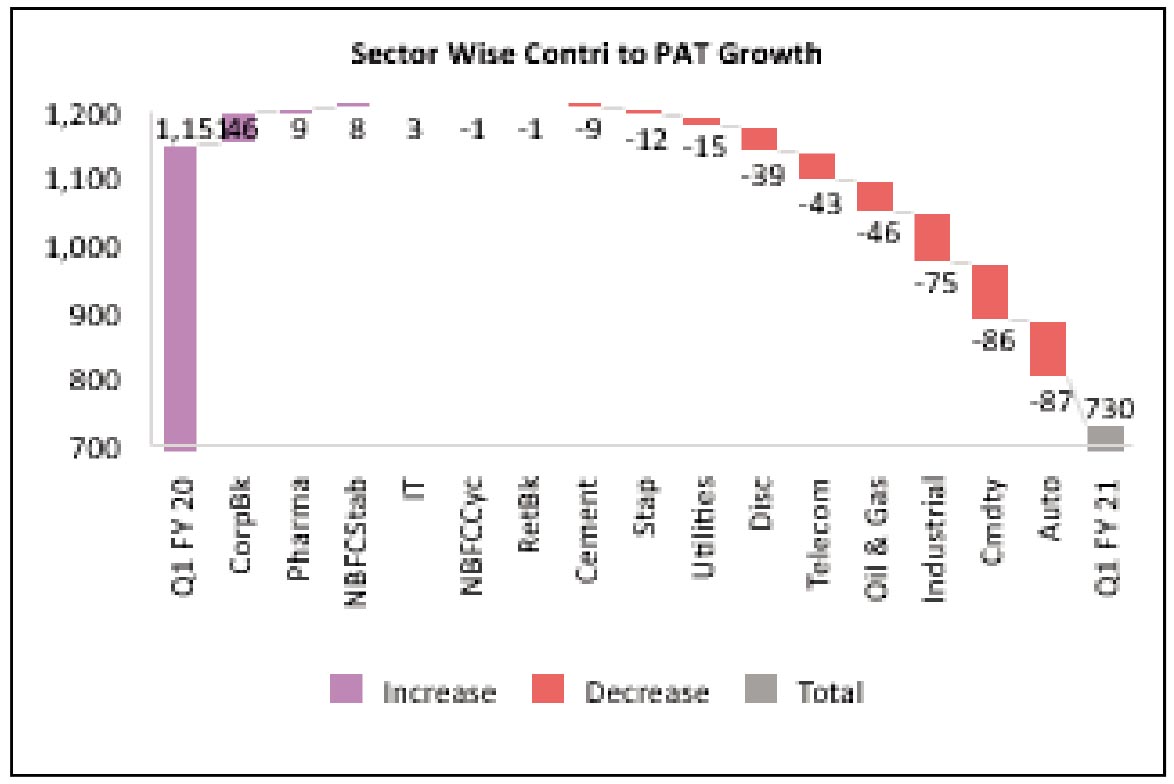

BS200 PAT for reported companies fell from Rs 1,151 bn in Q1 FY20 to Rs 730 bn in Q1 FY21. In absolute terms, Corporate Banks were the only significant positive contributor; whereas Auto and Metals were the key detractors.

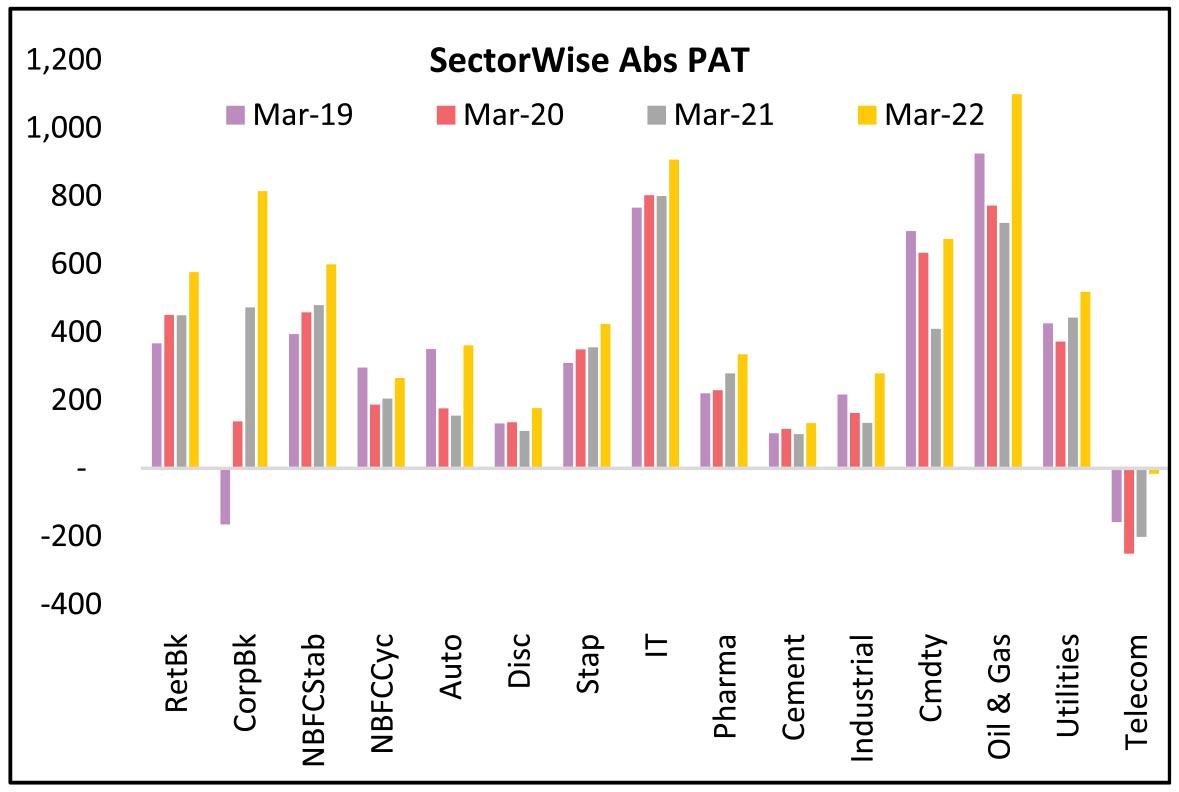

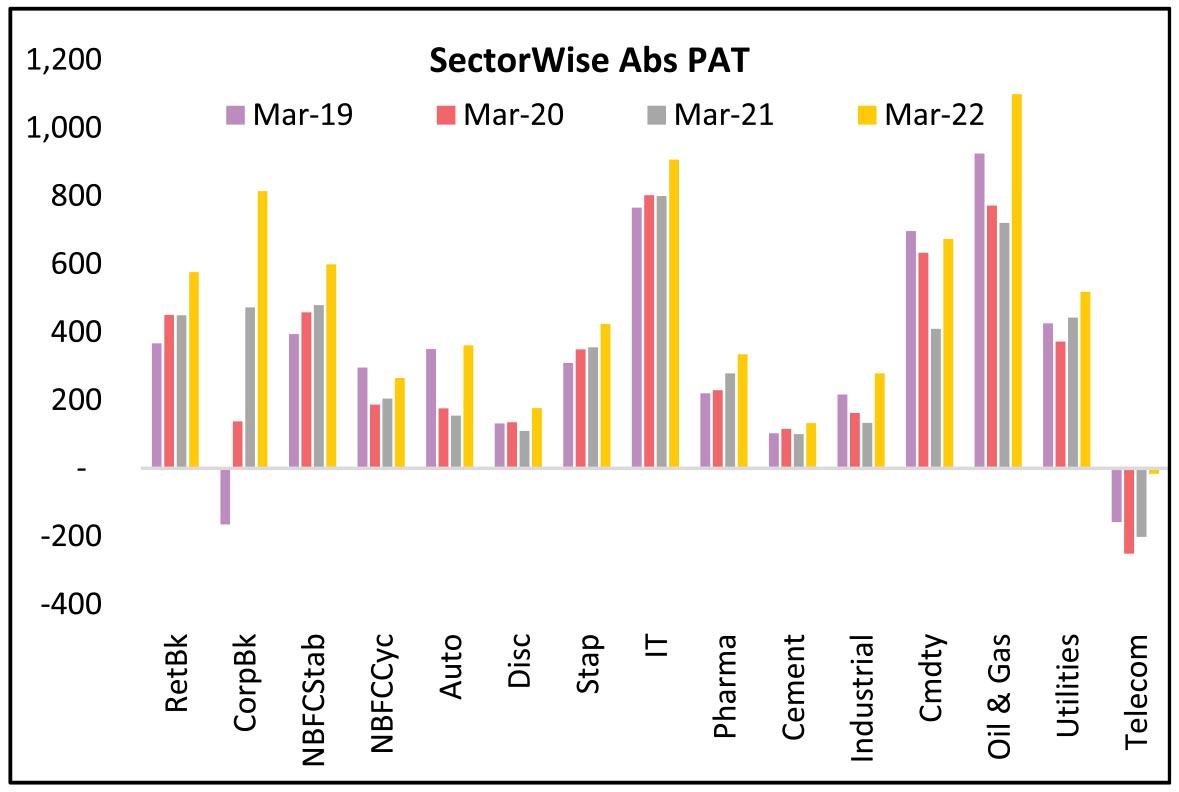

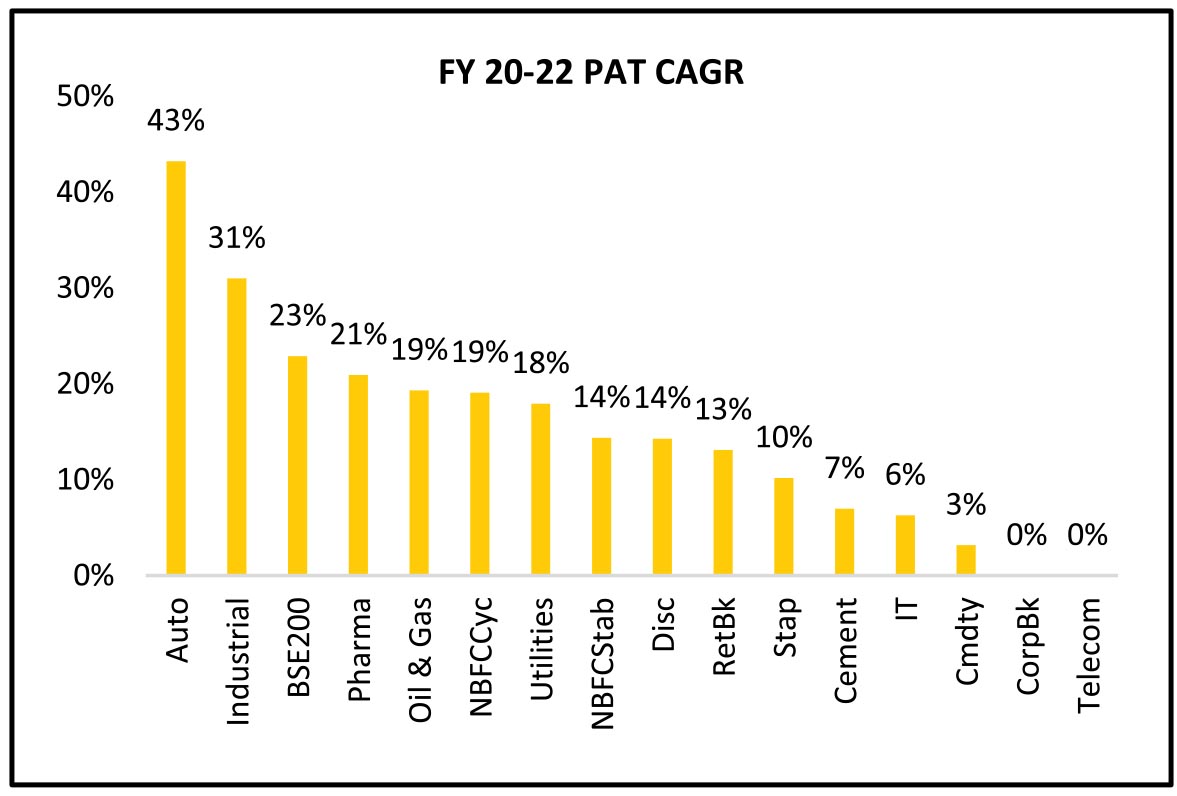

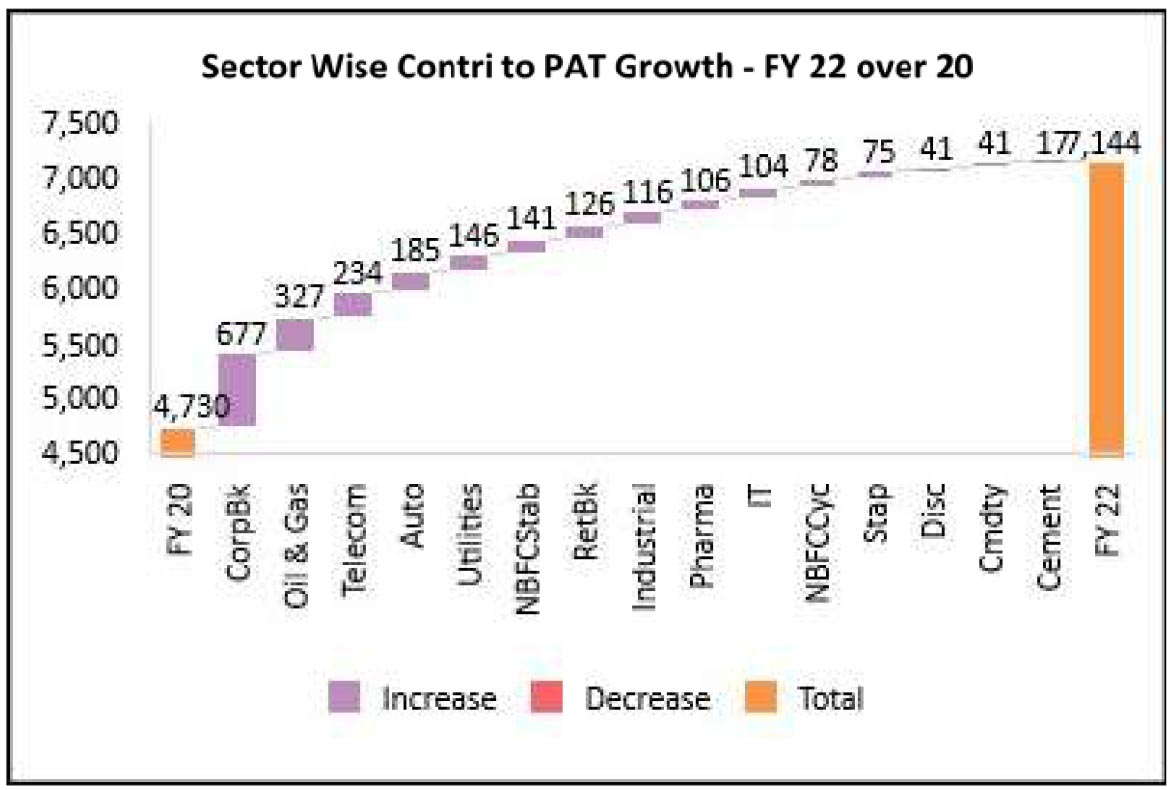

FY21 earnings are highly dependent on the nature and extent of lockdowns in the next few months. As a result, forecasting FY21 earnings is extremely difficult. As of now, most analysts are forecasting FY22 earnings assuming almost full normalization of the economy. Below chart gives absolute PAT trend sector wise for the period of FY 19-22. Corporate Banks and Telecom are expected to continue the recovery in PAT that has been going on. Pharma is the other sector where FY21 PAT is expected to be significantly higher than FY20. Retail Banks, Staples & IT are expected to have a flat FY21 and then going back to earlier levels of growth in FY22. Auto and Discretionary sectors are expected to have a sharp dip in FY21 before bouncing back in FY22.

Source: Bloomberg

Capital Flows: FPIs recorded the highest ever monthly net inflows of USD6.4bn into Indian equities in August (vs inflows of USD1.2bn in July). YTD, FPIs have turned net buyers at USD5.1bn in Indian equities. FPIs recorded net outflows from debt markets at USD532mn in August, the sixth consecutive month of outflows. YTD, FPIs have sold USD15.1bn in the debt markets. DIIs were net equity sellers of USD1.5bn in August (vs outflows of at USD1.3bn in July). Both mutual funds and insurance funds were net sellers in August. Mutual funds were net equity sellers at USD1.2bn while insurance funds sold USD324mn of equities in August.

Inflation: July CPI at 6.9% came ahead of consensus (consensus 6.3%) and higher than the upward revised June print (6.2%). Bulk of the upside surprise was on account of jump in food inflation which printed at 9.6% (vs. 8.7% in June). Moreover, core inflation continued to accelerate and came at a 17-month high of 5.6% in July (vs. 5.3% in June).

India's 1QFY21 (June quarter) GDP: GDP contraction at -23.9% YoY came worse than expectations (consensus: -18%). Core GVA (GDP minus agriculture and public administration) contracted almost 30%. Agriculture grew 3.4%. On the production side, public administration contracted 10.3%. However, government consumption on the expenditure side grew meaningfully at 16.4%, thereby creating an unprecedented deviation between the two series which have historically been strongly correlated. While government consumption grew strongly on the expenditure side, it does not include public investment, which is expected to have witnessed a large contraction in the quarter.

Reserves and Deficit: India's FX reserves are close to their all-time peak at USD537.5bn as of 21st August. FX reserves have increased by USD14.9bn in the last four weeks. Fiscal deficit for Apr-July came at Rs 8.2tn or 103% of the budgeted FY21 deficit (Rs 8.0tn). This compares to 79% reached during the same time frame in FY20.

Trade Data: India's monthly merchandise trade balance normalized and moved back into a modest deficit of USD4.8bn in July (vs. a one-time monthly surplus of USD790mn in 18-years in June). Merchandise exports were down -10% in July (vs. 12% decline in June) and imports were down 28% in July (vs 48% decline in June). Imports ex Oil and Gold declined 29% (vs. 41% decline in June), the 18th consecutive month of YoY declines. Non-oil exports are now at 97% of pre-pandemic levels while Non-oil-non-gold imports (NONG) are still at 73% of pre-pandemic levels. Within imports, consumer goods imports were at 92% of pre-pandemic levels in July while capital goods were at just 62%.

Monsoon trends: Cumulative rainfall is +10% ahead of the long-period average (LPA) levels on an aggregate basis (over June 1 - August 30, 2020). Out of the 36 meteorological subdivisions, rainfall has so far been excess / normal in 33 meteorological subdivisions and deficient in 3. North West India (-10% vs LPA) is lagging while Southern Peninsula (+20% vs LPA) and Central India (+21% vs LPA) have received higher than normal rainfall.

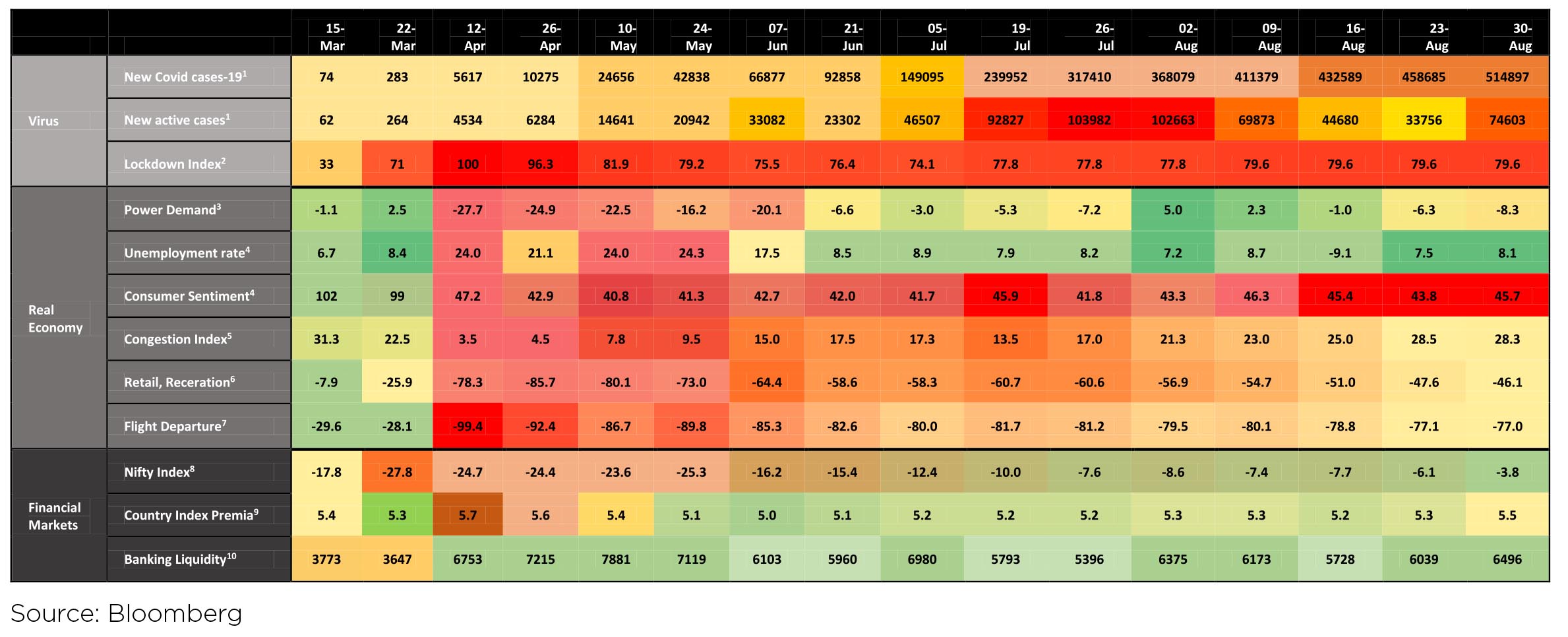

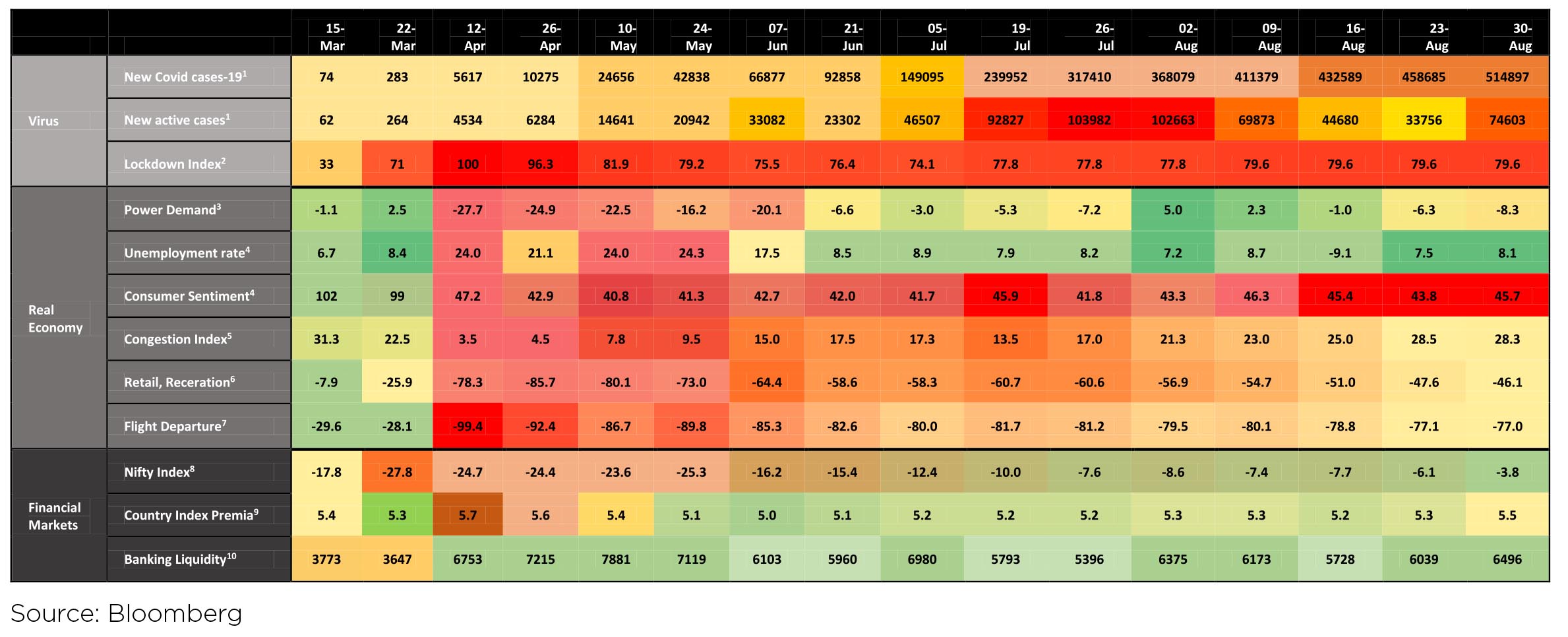

Covid-19 Activity Tracker: Source:

Notes: Green colour signals strength/ less severity, red signals weakness/ greater severity. 1. Active cases calculated by deducting recovered cases and deaths from confirmed cases; data from Bloomberg News and Johns Hopkins University. 2. Oxford Covid-19 lockdown stringency index. 3. Power demand from Monday to Friday (%, YoY) from Ministry of Power. 4. Data sourced from Centre for Monitoring Indian Economy's Consumer Pyramids Household Survey. 5. Average weekly traffic congestion for four metro cities - Delhi, Mumbai, Bangalore and Pune - from location technology company TomTom. 6. Percent change in time spent in retail and recreation places during the week relative to pre-covid baseline period, sourced from Google Community Mobility reports. 7. Percent change relative to average flight departures in December from Flightstats. 8. Percentage change from first 5-weekday average in January from Bloomberg. 9. Premium on India 10-year government bond yield over U.S. yield from Bloomberg. 10. Banking liquidity surplus from Bloomberg Economics.

After plateauing in July, Google Mobility trends picked up in August. Based on weekly average data till 28 August, essential services like groceries and pharmacies are trending -6% below pre-lockdown levels (vs. -11% in last week of July and -3% in last week of June). Mobility for discretionary services like recreation and entertainment is now trending 45% below pre-lockdown levels (vs. -60% in last week of July and June) and workplace mobility is trending at -30% (vs -32% in end-July and 30% in end-June).

Going forward, the pace of economic recovery would depend largely on the extent of local lockdowns on account of spread of Covid-19. Markets seems to have run ahead of fundamentals and are less than 10% lower than alltime highs. Global and domestic liquidity seems to have played a significant part in the sharp up move seen in the markets. Investors should tread with caution as the number of cases and deaths in India continue to rise. Also, earnings uncertainty for FY21 is fairly high with a wide range of analyst estimates.

In economics, economic recoveries are usually identified by an alphabet from the English language, V, U, W or L are usually the single alphabets used to describe or predict an economic recovery. Now a new single alphabet, "K" seems to best describe economic outlook in the post Covid world. Explaining the "K" Economic outlook, Peter Atawater of Financial Insyghts Consultancy, refers to the economic rebound being unequal - sectors which have hardly been impacted, while some sectors are tottering. Similarly, a segment of the population, who can WFH (work from home) has remained unaltered, while a large majority who earn their living as Daily wage earners, Drivers, Domestic help, Factory workers, Small Business owners and employees has seen varying degree of hardship and loss in income. Inequality which has increased since Global Financial Crisis (GFC 2008-09) appears to becoming more wider with the Covid-19 pandemic. This analogy can be extended to sectors - Technology companies (unfortunately only US and China have these goliaths), followed by sectors like Pharmaceuticals, IT services, retailing, Consumer Staples have largely outperformed, while sectors most impacted - Travel, Hotels, Airlines, Utilities, Financials - have underperformed.

This has led many to question the relevance of the stock market gains post April'20. While India, does not have companies equivalent of the FAANG or FAANGM, the Covid-19 pandemic, it appears may further lead to the shift from unorganised to organised, a process which De-monetization and GST had already initiated. In the near term, businesses, large, medium, small - organised/unorganised, which are able to restart operations, will fill gaps left by those, unfortunately left behind. The stock market, at times act as the "ultimate Darwinian Meter" -voting in favour of the strongest who will survive, to thrive later. This, in a nutshell, reflects the stock market movement - across every sector, companies who can benefit from the fall of their weaker peers, players who are better positioned financially will gain market share and market cap. Hence, rather than looking from a classical/traditional Large/Mid/ Small cap mind-set, analyse companies from this perspective, who are their competitors, will all of them survive? Can this company be well placed to benefit from the sector upheaval? March'20 was period when investors were worried on the survival of companies, especially small caps, viewed from a "traditionalist's hat" of being the weakest in the corporate hierarchy. As this pandemic unfolded, the fears of survival have shifted to SME/MSMEs. Who could benefit from their unfortunate demise? What the market may be highlighting, the shift from Unorganised to Organised may have received its strongest push during this unfortunate pandemic. When the going gets tough strongest get moving.

Stay Safe, Stay at home.

Disclaimer: MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

The Disclosures of opinions/in house views/strategy incorporated herein is provided solely to enhance the transparency about the investment strategy / theme of the Scheme and should not be treated as endorsement of the views / opinions or as an investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document has been prepared on the basis of information, which is already available in publicly accessible media or developed through analysis of IDFC Mutual Fund. The information/ views / opinions provided is for informative purpose only and may have ceased to be current by the time it may reach the recipient, which should be taken into account before interpreting this document. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision and the security may or may not continue to form part of the scheme's portfolio in future. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. The decision of the Investment Manager may not always be profitable; as such decisions are based on the prevailing market conditions and the understanding of the Investment Manager. Actual market movements may vary from the anticipated trends. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alterations to this statement as may be required from time to time. Neither IDFC Mutual Fund / IDFC AMC Trustee Co. Ltd./ IDFC Asset Management Co. Ltd nor IDFC, its Directors or representatives shall be liable for any damages whether direct or indirect, incidental, punitive special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information.

Source: Bloomberg

Covid-19 - Vaccine & Reopenings: The pace of recovery from Covid-19 lockdowns - initially strong - appears to have reached a near term "plateau". While in select countries like UK, there was a concentrated effort by the Government to boost consumption - UK Government offered diners a 50% discount for eating/drinking out - "Eat Out to Help Out" scheme. In the US, the phasing out of the unemployment benefits passed in March'20 also led to a fall in consumer confidence, as the extension of these benefits by the US Congress became a political gridlock between the Republicans and Democrats. This impacted consumer confidence. High frequency data shows a deepening drop in trade. The volume of goods arriving at U.S. ports in the four weeks through August 20 is down 8% from January levels.

Currencies and Interest Rates: Global yields, since March 24, have eased meaningfully as central banks globally have cut policy rates aggressively and have announced large QE programs, to counter the negative impact on global growth from the Covid-19 outbreak. US 10 Year yields are at 0.7% (+18bps in 1 month, -79bps over the last 1 year). In India, Benchmark 10 Year Government yield averaged at 5.96% in August (1bp higher vs. August avg.). On month end values, 10 Year yield rose 28bps to end the month at 6.12%.

The Dollar Index continues to weaken, falling 1.3% MoM, op top of a 4.15% fall in July, which was its largest monthly decline in July since 2011 (-4.2%). Most other currencies rallied against the Dollar with GBP (+2.2%) leading. INR appreciated by 2.0% and ended the month at 73.45/$ in August.

Commodities: Brent oil price gained 5.8% MoM in August to end the month at USD45.3/bbl and is up 2% over the last 3 months. YTD, oil prices are still ~31% down. Precious metals - Gold and Silver have seen a sharp surge up 29% and 53% respectively on a 1-Year basis and is now the best performing asset class. As gold took a breather in August (flat MoM), Silver rallied 15% MoM. Most other metals were also up on a MoM basis. Base metals like Aluminium, Steel, Zinc and Copper are now significantly above their levels from a year ago.

Domestic Markets

Indian equities continued their upward momentum during the month, however the last trading day of the month saw a sharp correction (-2.5%) on account of renewed tensions along the India-China border at Ladakh. India volatility index moderated for the fifth consecutive month and declined 5.6% in August despite witnessing a +25% gain on 31-Aug. Equity markets continued to move higher following the trend in global markets, even as India continues to see a sharp increase in daily new Covid-19 cases.

Domestic Coronavirus updates: India recorded its highest single day increase in new Covid-19 cases at >80,000 in end August which was also the highest daily case load reported by any country. Daily new Covid-19 cases have averaged ~64k+ in August vs ~36k in July. Globally, India has the third highest number of deaths at ~65k after the US and Brazil. However, the mortality rate has been trending lower at ~1.8% (vs 2.2% in end July) while the recovery rate continues to pick up ~77% (vs ~62% in end-July). Covid-19 continues to broaden its geographical reach within the country. Against the reports of highest ever daily cases, both State and Central governments have further eased restrictions in Unlock 4.0 guidelines for September except for containment zones.

Q1 FY21 Earnings: Of the BSE200 companies, around 182 companies have reported results till date. As expected, delivered earnings by companies in 1QFY21 have fallen YoY and are amongst the weakest they have been for the last several years. Yet, 1QFY21 is also amongst the best (in recent times) in terms of earnings beats, suggesting: a) analysts were too cautious in their forecasts for the quarter given the impaired economic conditions, and b) companies (at least the larger ones) seem to have coped with the lockdowns better than expected, especially in terms of controlling costs. As can be in the chart, EBITDA growth for the aggregate has fallen lesser than the Sales growth which indicates better cost control by most companies.

On a sectoral basis, as expected, Telecom, Info Tech and HealthCare were the only sectors with a positive Sales Growth and also reported a double-digit EBITDA growth. Discretionary stocks saw the weakest earnings performance with Auto and Consumer Discretionary the worst impacted sectors. Staples saw a 15% degrowth in Sales as several nonessential categories were barred from being produced and sold in the lockdown.

Source: Bloomberg

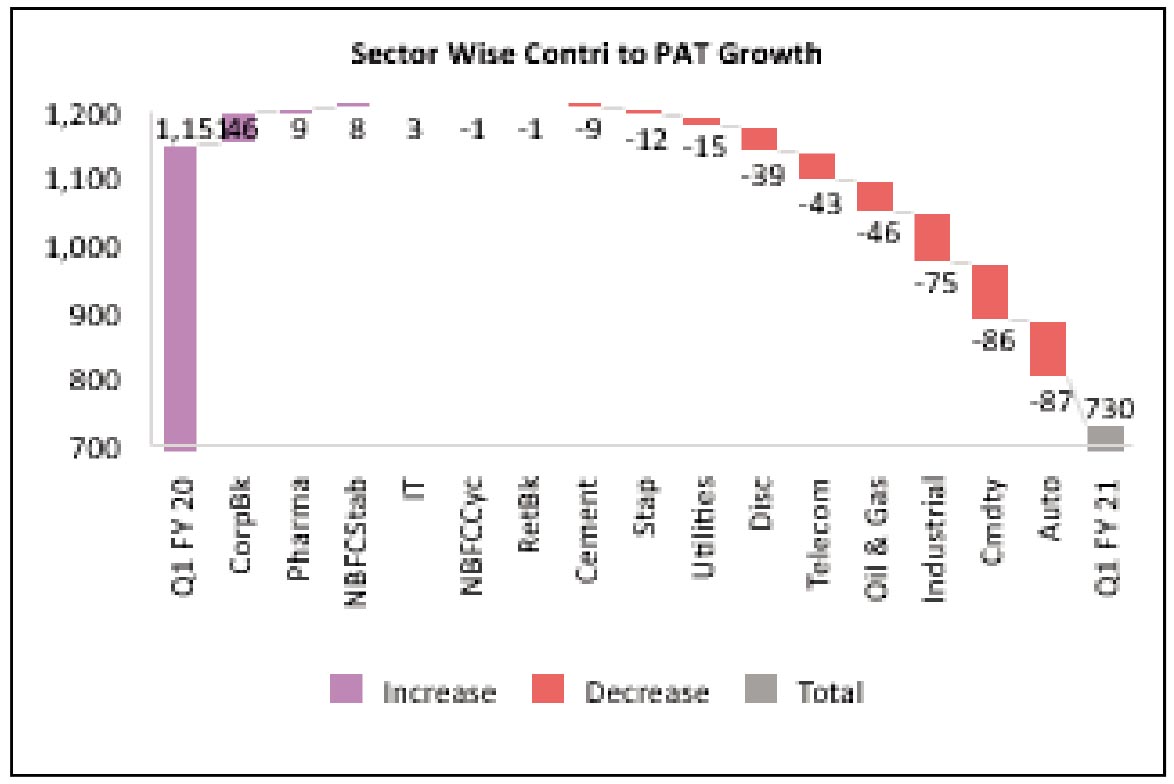

BS200 PAT for reported companies fell from Rs 1,151 bn in Q1 FY20 to Rs 730 bn in Q1 FY21. In absolute terms, Corporate Banks were the only significant positive contributor; whereas Auto and Metals were the key detractors.

FY21 earnings are highly dependent on the nature and extent of lockdowns in the next few months. As a result, forecasting FY21 earnings is extremely difficult. As of now, most analysts are forecasting FY22 earnings assuming almost full normalization of the economy. Below chart gives absolute PAT trend sector wise for the period of FY 19-22. Corporate Banks and Telecom are expected to continue the recovery in PAT that has been going on. Pharma is the other sector where FY21 PAT is expected to be significantly higher than FY20. Retail Banks, Staples & IT are expected to have a flat FY21 and then going back to earlier levels of growth in FY22. Auto and Discretionary sectors are expected to have a sharp dip in FY21 before bouncing back in FY22.

Source: Bloomberg

Capital Flows: FPIs recorded the highest ever monthly net inflows of USD6.4bn into Indian equities in August (vs inflows of USD1.2bn in July). YTD, FPIs have turned net buyers at USD5.1bn in Indian equities. FPIs recorded net outflows from debt markets at USD532mn in August, the sixth consecutive month of outflows. YTD, FPIs have sold USD15.1bn in the debt markets. DIIs were net equity sellers of USD1.5bn in August (vs outflows of at USD1.3bn in July). Both mutual funds and insurance funds were net sellers in August. Mutual funds were net equity sellers at USD1.2bn while insurance funds sold USD324mn of equities in August.

Sectoral Impact

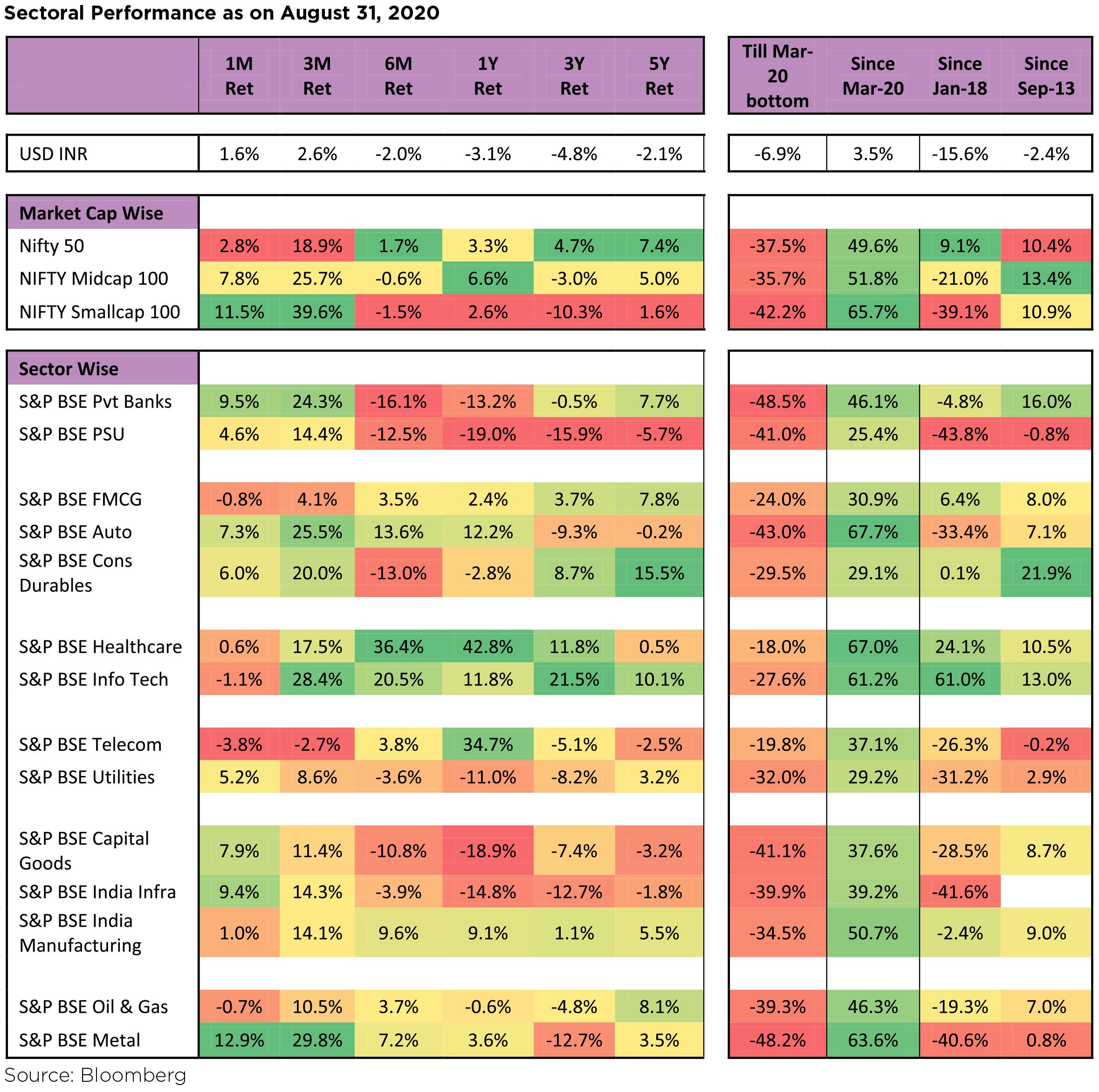

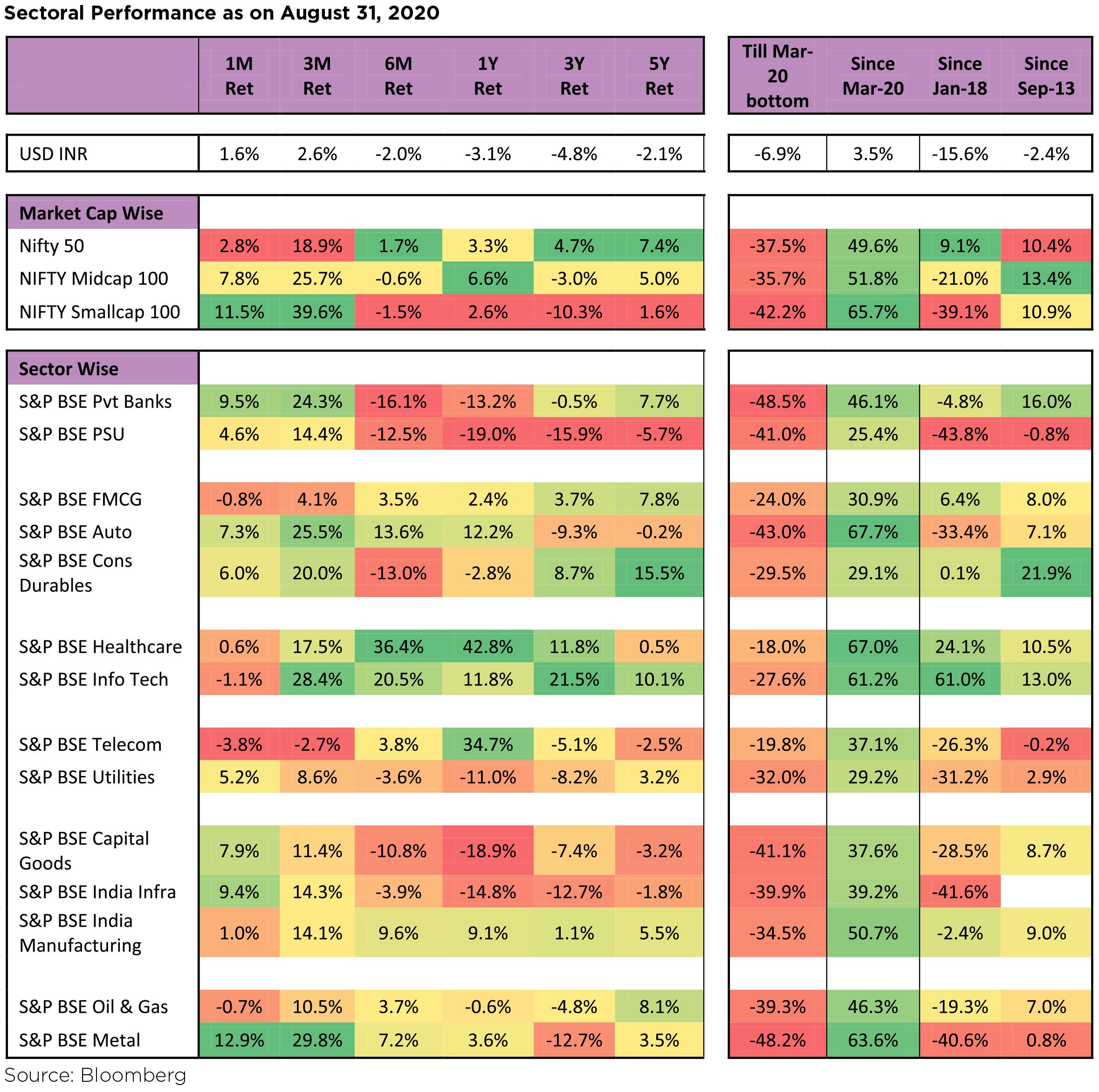

In August and over the last 3-month basis, Small Caps significantly outperformed Mid and Large Caps. Since the

bottom in March-20, Large, Mid and Small Caps have bounced 50%, 52% and 66% respectively. Even on a YTD basis,

Small Cap stocks have fallen 4% as compared to Nifty50 fall of 6%. On a sectoral front, the stars of the year - IT,

Telecom and Pharma were the key laggards for August. Metals, Infra, Capital goods and Private Banks were the key

outperformers. Healthcare has been the best performing sector in the crash as well as the bounce.

The Macro Picture

PMI & IIP: After strong recovery seen in May and June following a single digit print in April, the July Composite

PMI plateaued at 37.2 (vs. 37.8 in June). India's services PMI improved to 34.2 in July (+0.5pt MoM) while the

Manufacturing PMI printed at 46.0 in July (-1.2pt MoM). Within the forward-looking demand indicators recovery

was seen in new export orders at 43.3 (+4.4pt) while new orders came at 45.6 (-0.8pt). June IIP contracted -16.6%

YoY in May (vs -34.7% contraction in May and -57.6% contraction in April) but came ahead of consensus forecasts

(consensus: -21%).Inflation: July CPI at 6.9% came ahead of consensus (consensus 6.3%) and higher than the upward revised June print (6.2%). Bulk of the upside surprise was on account of jump in food inflation which printed at 9.6% (vs. 8.7% in June). Moreover, core inflation continued to accelerate and came at a 17-month high of 5.6% in July (vs. 5.3% in June).

India's 1QFY21 (June quarter) GDP: GDP contraction at -23.9% YoY came worse than expectations (consensus: -18%). Core GVA (GDP minus agriculture and public administration) contracted almost 30%. Agriculture grew 3.4%. On the production side, public administration contracted 10.3%. However, government consumption on the expenditure side grew meaningfully at 16.4%, thereby creating an unprecedented deviation between the two series which have historically been strongly correlated. While government consumption grew strongly on the expenditure side, it does not include public investment, which is expected to have witnessed a large contraction in the quarter.

Reserves and Deficit: India's FX reserves are close to their all-time peak at USD537.5bn as of 21st August. FX reserves have increased by USD14.9bn in the last four weeks. Fiscal deficit for Apr-July came at Rs 8.2tn or 103% of the budgeted FY21 deficit (Rs 8.0tn). This compares to 79% reached during the same time frame in FY20.

Trade Data: India's monthly merchandise trade balance normalized and moved back into a modest deficit of USD4.8bn in July (vs. a one-time monthly surplus of USD790mn in 18-years in June). Merchandise exports were down -10% in July (vs. 12% decline in June) and imports were down 28% in July (vs 48% decline in June). Imports ex Oil and Gold declined 29% (vs. 41% decline in June), the 18th consecutive month of YoY declines. Non-oil exports are now at 97% of pre-pandemic levels while Non-oil-non-gold imports (NONG) are still at 73% of pre-pandemic levels. Within imports, consumer goods imports were at 92% of pre-pandemic levels in July while capital goods were at just 62%.

Monsoon trends: Cumulative rainfall is +10% ahead of the long-period average (LPA) levels on an aggregate basis (over June 1 - August 30, 2020). Out of the 36 meteorological subdivisions, rainfall has so far been excess / normal in 33 meteorological subdivisions and deficient in 3. North West India (-10% vs LPA) is lagging while Southern Peninsula (+20% vs LPA) and Central India (+21% vs LPA) have received higher than normal rainfall.

Covid-19 Activity Tracker: Source:

Notes: Green colour signals strength/ less severity, red signals weakness/ greater severity. 1. Active cases calculated by deducting recovered cases and deaths from confirmed cases; data from Bloomberg News and Johns Hopkins University. 2. Oxford Covid-19 lockdown stringency index. 3. Power demand from Monday to Friday (%, YoY) from Ministry of Power. 4. Data sourced from Centre for Monitoring Indian Economy's Consumer Pyramids Household Survey. 5. Average weekly traffic congestion for four metro cities - Delhi, Mumbai, Bangalore and Pune - from location technology company TomTom. 6. Percent change in time spent in retail and recreation places during the week relative to pre-covid baseline period, sourced from Google Community Mobility reports. 7. Percent change relative to average flight departures in December from Flightstats. 8. Percentage change from first 5-weekday average in January from Bloomberg. 9. Premium on India 10-year government bond yield over U.S. yield from Bloomberg. 10. Banking liquidity surplus from Bloomberg Economics.

After plateauing in July, Google Mobility trends picked up in August. Based on weekly average data till 28 August, essential services like groceries and pharmacies are trending -6% below pre-lockdown levels (vs. -11% in last week of July and -3% in last week of June). Mobility for discretionary services like recreation and entertainment is now trending 45% below pre-lockdown levels (vs. -60% in last week of July and June) and workplace mobility is trending at -30% (vs -32% in end-July and 30% in end-June).

Going forward, the pace of economic recovery would depend largely on the extent of local lockdowns on account of spread of Covid-19. Markets seems to have run ahead of fundamentals and are less than 10% lower than alltime highs. Global and domestic liquidity seems to have played a significant part in the sharp up move seen in the markets. Investors should tread with caution as the number of cases and deaths in India continue to rise. Also, earnings uncertainty for FY21 is fairly high with a wide range of analyst estimates.

Outlook

The pace of economic activity recovery saw a sharp recovery from the lows of April till 1st week of July. During

August, this recovery was mixed, with some improvement in economic activity in Metros and Tier I towns as Covid-

19 related cases registered a decline. On the other hand, upcountry and small towns, where Covid-19 cases surged,

economic activity has been impacted by localized lockdowns and restrictions. Overall, mood in rural has been more

upbeat than in Metros - benefitting from a strong Rabi output and above average rains (though parts of Western

and Central India are reporting sporadic cases of damage to crop from excessive rains). Daily Covid-19 cases remain

at an elevated level. Thankfully, testing has been ramped up across the country to almost a million tests per day. As

per various expert estimates, end-September should see a peak at a national level. This could be important, for the

upcoming festival season sentiments to remain positive.In economics, economic recoveries are usually identified by an alphabet from the English language, V, U, W or L are usually the single alphabets used to describe or predict an economic recovery. Now a new single alphabet, "K" seems to best describe economic outlook in the post Covid world. Explaining the "K" Economic outlook, Peter Atawater of Financial Insyghts Consultancy, refers to the economic rebound being unequal - sectors which have hardly been impacted, while some sectors are tottering. Similarly, a segment of the population, who can WFH (work from home) has remained unaltered, while a large majority who earn their living as Daily wage earners, Drivers, Domestic help, Factory workers, Small Business owners and employees has seen varying degree of hardship and loss in income. Inequality which has increased since Global Financial Crisis (GFC 2008-09) appears to becoming more wider with the Covid-19 pandemic. This analogy can be extended to sectors - Technology companies (unfortunately only US and China have these goliaths), followed by sectors like Pharmaceuticals, IT services, retailing, Consumer Staples have largely outperformed, while sectors most impacted - Travel, Hotels, Airlines, Utilities, Financials - have underperformed.

This has led many to question the relevance of the stock market gains post April'20. While India, does not have companies equivalent of the FAANG or FAANGM, the Covid-19 pandemic, it appears may further lead to the shift from unorganised to organised, a process which De-monetization and GST had already initiated. In the near term, businesses, large, medium, small - organised/unorganised, which are able to restart operations, will fill gaps left by those, unfortunately left behind. The stock market, at times act as the "ultimate Darwinian Meter" -voting in favour of the strongest who will survive, to thrive later. This, in a nutshell, reflects the stock market movement - across every sector, companies who can benefit from the fall of their weaker peers, players who are better positioned financially will gain market share and market cap. Hence, rather than looking from a classical/traditional Large/Mid/ Small cap mind-set, analyse companies from this perspective, who are their competitors, will all of them survive? Can this company be well placed to benefit from the sector upheaval? March'20 was period when investors were worried on the survival of companies, especially small caps, viewed from a "traditionalist's hat" of being the weakest in the corporate hierarchy. As this pandemic unfolded, the fears of survival have shifted to SME/MSMEs. Who could benefit from their unfortunate demise? What the market may be highlighting, the shift from Unorganised to Organised may have received its strongest push during this unfortunate pandemic. When the going gets tough strongest get moving.

Stay Safe, Stay at home.

Disclaimer: MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

The Disclosures of opinions/in house views/strategy incorporated herein is provided solely to enhance the transparency about the investment strategy / theme of the Scheme and should not be treated as endorsement of the views / opinions or as an investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document has been prepared on the basis of information, which is already available in publicly accessible media or developed through analysis of IDFC Mutual Fund. The information/ views / opinions provided is for informative purpose only and may have ceased to be current by the time it may reach the recipient, which should be taken into account before interpreting this document. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision and the security may or may not continue to form part of the scheme's portfolio in future. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. The decision of the Investment Manager may not always be profitable; as such decisions are based on the prevailing market conditions and the understanding of the Investment Manager. Actual market movements may vary from the anticipated trends. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alterations to this statement as may be required from time to time. Neither IDFC Mutual Fund / IDFC AMC Trustee Co. Ltd./ IDFC Asset Management Co. Ltd nor IDFC, its Directors or representatives shall be liable for any damages whether direct or indirect, incidental, punitive special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information.

WHAT WENT BY

The bond markets saw a significant sell off after the release of MPC minutes which were construed as hawkish by

market participants. The 10 year Government benchmark climbed 28bps to end the month at 6.11%. The sell-off was

seen in corporate bonds as well with 5 & 10 year AAA ending 26bps & 40bp higher at 5.80% & 6.77%, respectively.

The rise in yields in the bond market followed a gradual hardening of yields since July and got intensified in the last

few weeks leading to devolvements / large tails in last three G-Sec auctions. After weeks of intense market volatility,

and with participants (including ourselves) bemoaning a premature tightening of financial conditions even as the

growth outlook remains relatively dark, the RBI unveiled a comprehensive response to the situation. These were as

follows:

► Held to Maturity (HTM) hike: This is arguably the most potent of the announcements made, and was on the market's wish-list for a very long time. The RBI allowed an additional 2.5% of deposits for banks as HTM for the second half of the current financial year (September - March). This allows an additional purchase capacity of approximately INR 3.6 lakh crores for banks.

► Additional Twist Operations: Apart from the 2 twist operations of INR 10,000 crores announced earlier and which are currently ongoing, the RBI announced another 2 operations for INR 10,000 crores to be held in successive weeks. Furthermore, these are being backed by an open ended commitment for "further such operations as warranted by market conditions".

► Additional Term Repo: The RBI will conduct term repo operations for INR 1,00,000 crores at floating rate (prevailing repo rate) in the middle of September. While these are purportedly timed with advance taxes, this consideration may be of limited usage in a heavily surplus banking system liquidity environment. Rather, banks are being allowed to reduce cost of their earlier long term repos (taken at 5.15%) with the current rate (4%) through these operations as well. While this may not create incremental demand for assets (since assets would already have been purchased in the earlier operation), it nevertheless constitutes a significant additional spread earned by banks.

RBI released minutes of its August policy. This was the final MPC meet for the three external members as their 4 year tenure came to end. All the MPC members felt that the economy needed further policy support & recommended retaining accommodative stance. The Governor reiterated that there is headroom available for easing which needs to be used judiciously. Members also wanted to wait on further policy transmission of the "cumulative 250 basis points reduction in policy rate since February 2019 to seep into the financial system and further reduce interest rates and spreads". However, the underlying tone of the minutes was seemingly hawkish with members surprised by the sharp rise in CPI during the April-June period. Governor Das reiterated that inflation was expected to remain elevated for another quarter, led by both food as well as core inflation. Deputy Governor Dr. Patra explained that both a good (e.g. the 2016-17 experience) and a bad (e.g. the 2009-10 experience) inflation outcome were possible this time around, and if inflation persists above 6% for another quarter, monetary policy will be constrained by its mandate to undertake remedial action to bring it down. Market participants not only interpreted this as higher bar for further rate cuts as well as higher tolerance for rise in yields.

July inflation printed at 6.9%yoy (consensus: 6.3%), while June inflation was also revised higher by 20bps to 6.2%. Both food inflation and core inflation accelerated in the latest reading. Vegetable price inflation spiked to 11.3% in July as compared to 4% in the previous month. Core inflation (CPI Ex-Food Ex-Fuel) climbed to 5.87% on a year on year basis as compared to 5.33% in June, on substantial price hikes in components like personal care and effects, education and transport and communication.

India's July trade balance reverted to a $4.8 billion deficit (consensus -$1.8Bn) as imports recovered due to demand pickup on easing of lockdown restrictions. Imports in July'20 rose to a 4-month high of $28.5 bn, compared to $21.1 bn in June'20. Oil imports continued to pick up pace, rising to a 4-month high of $6.5 bn while non-oil non gold imports rose by 29.4%MoM to $20.2 bn compared to $15.5 bn in June'20.

The central board of the RBI approved a dividend of Rs 571.28 bn for FY20, slightly lower than budgeted amount of Rs. 600bn (previous year's dividend: Rs 1.76 trl). The board maintained its contingency fund at the lower limit of 5.5% of balance sheet, as recommended by the Bimal Jalan committee.

The government extended the Rs450bn Partial Credit Guarantee Scheme (PCGS) 2.0 by another three months and has also allowed banks to invest more in AA/AA- rated NBFCs (max 50% instead of 25% stipulated earlier). Currently, <50% of the allocation was used by banks.

The RBI came out with its annual report which stated that they expected the recovery to take longer than usual and that the demand destruction had occurred to a large extent. The report also said that the initial green shoots seen during the months of May and June were short lived with the re-imposition of lockdowns by various states and hence the journey to full recovery will be a long and arduous once. The report also mentioned that public finances were already stretched and hence the capacity for a large scale spending to support demand could very well be off the table. However, the report also observed that government consumption would still have to fuel the demand till the economy comes out of shock since private consumption on discretionary items could still remain muted for some time.

1QFY'21 real GDP growth declined by 23.9%YoY (weaker than Bloomberg consensus estimate of -18%YoY) reflecting the impact of the nationwide lockdown imposed through April/May to combat Covid-19. Nominal GDP contracted by 22.6 in April-June'20 vs. +7.5%YoY growth in Jan-March'20. Industrial sector growth contracted 33.8%YoY after remaining flat in Jan-March'20, while services sector growth contracted by 24.3%YoY in April-June'20 vs. +3.5%YoY in Jan-March'20. Agricultural sector growth remained positive at 3.4%YoY, though being lower than the 5.9%YoY outturn in the previous quarter.

The Federal Reserve announced a major policy shift at the conclusion of its Jackson hole symposium on 27th August where it formally agreed to a policy of "average inflation targeting". The changes were codified in a policy blueprint called the "Statement on Longer-Run Goals and Monetary Policy Strategy," first adopted in 2012, that has informed the Fed's approach to interest rates and general economic growth. Previously, there was an overall consensus it was counterproductive to push the economy beyond full employment and that central banks should focus on containing inflation as their primary objective. The changes in the statement make clear that the FOMC has moved beyond that consensus. The FOMC sees significant benefits in pushing the economy beyond conventional measures of full employment and they see diminished risks that such a policy will generate unwanted inflation. The conclusions were in line with what markets expectations. The Fed indicated that it was comfortable keeping interest rates lower for longer even if there were signs of full-employment in labour markets and inflation moves a bit above 2% bound.

The RBI has been trying re-establish the confidence channel of the market. The measures announced in August should now restore normal functioning and allow the substantial borrowing requirement to start going through without undoing the transmission channel.

Having said that, it is also true that more than 50% of an INR 20 lakh crore plus (center and states combined) borrowing program is still ahead of us. To that extent one can argue that the announcements were a "must have" if markets were to continue to behave in an orderly fashion. For that reason one shouldn't expect a very large sustainable rally in bonds basis just the current set of triggers, although one should reasonably expect most of the recent aggressive sell-off to get unwound. However re-instatement of orderly functioning now allows participants to start deploying risk capital with more confidence to take advantage of what are quite attractive valuations given the underlying backdrop of an unprecedented growth drawdown and a collapse in credit growth.

The external account is our one significant macro strength today and provides adequate cushion to RBI to persist with a dovish policy for the time-being. For all these reasons, our view remains that the important current pillars of policy will sustain for the foreseeable future. The spike in inflation presents an interpretation problem for now and it remains our base case that it will not shift the narrative away from growth for monetary policy, despite throwing up higher average CPI prints for the year.

Disclaimer: MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

The Disclosures of opinions/in house views/strategy incorporated herein is provided solely to enhance the transparency about the investment strategy / theme of the Scheme and should not be treated as endorsement of the views / opinions or as an investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document has been prepared on the basis of information, which is already available in publicly accessible media or developed through analysis of IDFC Mutual Fund. The information/ views / opinions provided is for informative purpose only and may have ceased to be current by the time it may reach the recipient, which should be taken into account before interpreting this document. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision and the security may or may not continue to form part of the scheme's portfolio in future. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. The decision of the Investment Manager may not always be profitable; as such decisions are based on the prevailing market conditions and the understanding of the Investment Manager. Actual market movements may vary from the anticipated trends. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alterations to this statement as may be required from time to time. Neither IDFC Mutual Fund / IDFC AMC Trustee Co. Ltd./ IDFC Asset Management Co. Ltd nor IDFC, its Directors or representatives shall be liable for any damages whether direct or indirect, incidental, punitive special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information.

► Held to Maturity (HTM) hike: This is arguably the most potent of the announcements made, and was on the market's wish-list for a very long time. The RBI allowed an additional 2.5% of deposits for banks as HTM for the second half of the current financial year (September - March). This allows an additional purchase capacity of approximately INR 3.6 lakh crores for banks.

► Additional Twist Operations: Apart from the 2 twist operations of INR 10,000 crores announced earlier and which are currently ongoing, the RBI announced another 2 operations for INR 10,000 crores to be held in successive weeks. Furthermore, these are being backed by an open ended commitment for "further such operations as warranted by market conditions".

► Additional Term Repo: The RBI will conduct term repo operations for INR 1,00,000 crores at floating rate (prevailing repo rate) in the middle of September. While these are purportedly timed with advance taxes, this consideration may be of limited usage in a heavily surplus banking system liquidity environment. Rather, banks are being allowed to reduce cost of their earlier long term repos (taken at 5.15%) with the current rate (4%) through these operations as well. While this may not create incremental demand for assets (since assets would already have been purchased in the earlier operation), it nevertheless constitutes a significant additional spread earned by banks.

RBI released minutes of its August policy. This was the final MPC meet for the three external members as their 4 year tenure came to end. All the MPC members felt that the economy needed further policy support & recommended retaining accommodative stance. The Governor reiterated that there is headroom available for easing which needs to be used judiciously. Members also wanted to wait on further policy transmission of the "cumulative 250 basis points reduction in policy rate since February 2019 to seep into the financial system and further reduce interest rates and spreads". However, the underlying tone of the minutes was seemingly hawkish with members surprised by the sharp rise in CPI during the April-June period. Governor Das reiterated that inflation was expected to remain elevated for another quarter, led by both food as well as core inflation. Deputy Governor Dr. Patra explained that both a good (e.g. the 2016-17 experience) and a bad (e.g. the 2009-10 experience) inflation outcome were possible this time around, and if inflation persists above 6% for another quarter, monetary policy will be constrained by its mandate to undertake remedial action to bring it down. Market participants not only interpreted this as higher bar for further rate cuts as well as higher tolerance for rise in yields.

July inflation printed at 6.9%yoy (consensus: 6.3%), while June inflation was also revised higher by 20bps to 6.2%. Both food inflation and core inflation accelerated in the latest reading. Vegetable price inflation spiked to 11.3% in July as compared to 4% in the previous month. Core inflation (CPI Ex-Food Ex-Fuel) climbed to 5.87% on a year on year basis as compared to 5.33% in June, on substantial price hikes in components like personal care and effects, education and transport and communication.

India's July trade balance reverted to a $4.8 billion deficit (consensus -$1.8Bn) as imports recovered due to demand pickup on easing of lockdown restrictions. Imports in July'20 rose to a 4-month high of $28.5 bn, compared to $21.1 bn in June'20. Oil imports continued to pick up pace, rising to a 4-month high of $6.5 bn while non-oil non gold imports rose by 29.4%MoM to $20.2 bn compared to $15.5 bn in June'20.

The central board of the RBI approved a dividend of Rs 571.28 bn for FY20, slightly lower than budgeted amount of Rs. 600bn (previous year's dividend: Rs 1.76 trl). The board maintained its contingency fund at the lower limit of 5.5% of balance sheet, as recommended by the Bimal Jalan committee.

The government extended the Rs450bn Partial Credit Guarantee Scheme (PCGS) 2.0 by another three months and has also allowed banks to invest more in AA/AA- rated NBFCs (max 50% instead of 25% stipulated earlier). Currently, <50% of the allocation was used by banks.

The RBI came out with its annual report which stated that they expected the recovery to take longer than usual and that the demand destruction had occurred to a large extent. The report also said that the initial green shoots seen during the months of May and June were short lived with the re-imposition of lockdowns by various states and hence the journey to full recovery will be a long and arduous once. The report also mentioned that public finances were already stretched and hence the capacity for a large scale spending to support demand could very well be off the table. However, the report also observed that government consumption would still have to fuel the demand till the economy comes out of shock since private consumption on discretionary items could still remain muted for some time.

1QFY'21 real GDP growth declined by 23.9%YoY (weaker than Bloomberg consensus estimate of -18%YoY) reflecting the impact of the nationwide lockdown imposed through April/May to combat Covid-19. Nominal GDP contracted by 22.6 in April-June'20 vs. +7.5%YoY growth in Jan-March'20. Industrial sector growth contracted 33.8%YoY after remaining flat in Jan-March'20, while services sector growth contracted by 24.3%YoY in April-June'20 vs. +3.5%YoY in Jan-March'20. Agricultural sector growth remained positive at 3.4%YoY, though being lower than the 5.9%YoY outturn in the previous quarter.

The Federal Reserve announced a major policy shift at the conclusion of its Jackson hole symposium on 27th August where it formally agreed to a policy of "average inflation targeting". The changes were codified in a policy blueprint called the "Statement on Longer-Run Goals and Monetary Policy Strategy," first adopted in 2012, that has informed the Fed's approach to interest rates and general economic growth. Previously, there was an overall consensus it was counterproductive to push the economy beyond full employment and that central banks should focus on containing inflation as their primary objective. The changes in the statement make clear that the FOMC has moved beyond that consensus. The FOMC sees significant benefits in pushing the economy beyond conventional measures of full employment and they see diminished risks that such a policy will generate unwanted inflation. The conclusions were in line with what markets expectations. The Fed indicated that it was comfortable keeping interest rates lower for longer even if there were signs of full-employment in labour markets and inflation moves a bit above 2% bound.

Outlook

The government has been prudent so far in rationing its stimulus response, focusing first on sustenance and keeping

a growth stimulus for later. This is because a stimulus would entail financing for undertaking activity. This channel

would by definition not work if activity is being held back owing to the virus. Despite the government's prudence so

far, however, the load on the fiscal is heavy. This is partly owing to the starting point, partly since the fall off in receipts

has been large, and partly because more stimulus will necessarily have to be forthcoming. A necessary condition for

financing this is a well-functioning bond market, which is able to absorb the extra load while at the same time not

begin to substantially unwind the mandate of transmission that monetary policy is trying to execute.The RBI has been trying re-establish the confidence channel of the market. The measures announced in August should now restore normal functioning and allow the substantial borrowing requirement to start going through without undoing the transmission channel.

Having said that, it is also true that more than 50% of an INR 20 lakh crore plus (center and states combined) borrowing program is still ahead of us. To that extent one can argue that the announcements were a "must have" if markets were to continue to behave in an orderly fashion. For that reason one shouldn't expect a very large sustainable rally in bonds basis just the current set of triggers, although one should reasonably expect most of the recent aggressive sell-off to get unwound. However re-instatement of orderly functioning now allows participants to start deploying risk capital with more confidence to take advantage of what are quite attractive valuations given the underlying backdrop of an unprecedented growth drawdown and a collapse in credit growth.

The external account is our one significant macro strength today and provides adequate cushion to RBI to persist with a dovish policy for the time-being. For all these reasons, our view remains that the important current pillars of policy will sustain for the foreseeable future. The spike in inflation presents an interpretation problem for now and it remains our base case that it will not shift the narrative away from growth for monetary policy, despite throwing up higher average CPI prints for the year.

Disclaimer: MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

The Disclosures of opinions/in house views/strategy incorporated herein is provided solely to enhance the transparency about the investment strategy / theme of the Scheme and should not be treated as endorsement of the views / opinions or as an investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document has been prepared on the basis of information, which is already available in publicly accessible media or developed through analysis of IDFC Mutual Fund. The information/ views / opinions provided is for informative purpose only and may have ceased to be current by the time it may reach the recipient, which should be taken into account before interpreting this document. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision and the security may or may not continue to form part of the scheme's portfolio in future. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. The decision of the Investment Manager may not always be profitable; as such decisions are based on the prevailing market conditions and the understanding of the Investment Manager. Actual market movements may vary from the anticipated trends. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alterations to this statement as may be required from time to time. Neither IDFC Mutual Fund / IDFC AMC Trustee Co. Ltd./ IDFC Asset Management Co. Ltd nor IDFC, its Directors or representatives shall be liable for any damages whether direct or indirect, incidental, punitive special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information.