Commentary

31st March 2021

WHAT WENT BY

Globally, equities remained volatile after

US 10 Year bond yields crossed 1.7%, a level

that was being considered as a tipping

point for equity risk by many investors.

DXY (US Dollar Index) too mirrored

the rise in US yields and gained 2.5%+

during March, putting some pressure

on EM (Emerging Markets) equities.

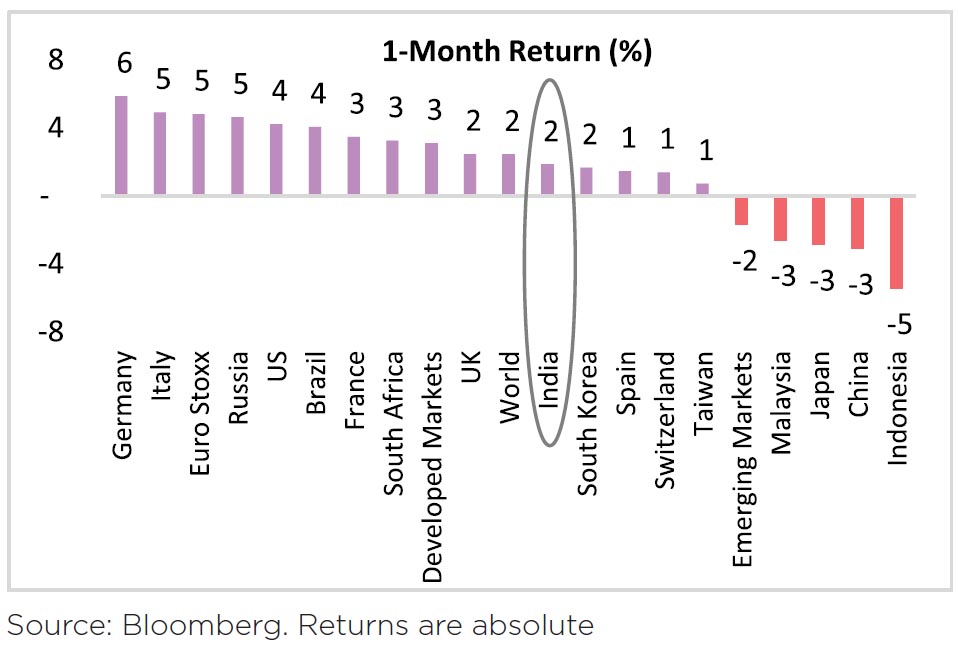

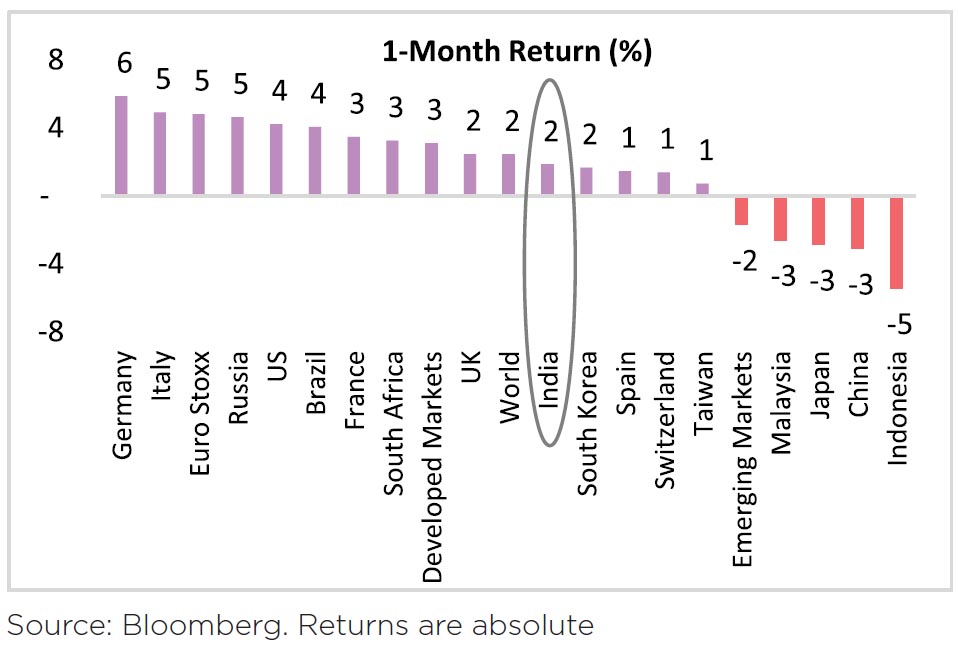

Global equities traded higher, but exhibited divergent regional trends. EM equities underperformed (MXEF -1.7%) as the resurgence of virus outbreak and rising US yields wore down risk appetite. In the developed space, European equities (SXXP +6.1%) outperformed relative to their US peers (SPX +4.2%). Intuitive consideration for this is the Value/ Growth tilt, given the US bias to Technology, and Eurozone bias to Value/Banks.

Bond yields continued to advance higher on accelerating growth / inflation expectations and positive economic data, despite downside surprise on US core inflation. With the passage of USD1.9trn of US fiscal stimulus, the focus now has turned to President Biden's infrastructure package, where proposals range from USD2trn to USD4trn.

Covid & Vaccines: India witnessed a second wave of COVID in March with several major states reporting a rise in active cases. Various parts of the country saw new restrictions, though a strict lockdown wasn't announced in any state. The daily number of new cases (7DMA) has increased from 11,000 in mid-February to ~ 62,000 now. (the first wave peaked at 93,000 in mid-September). The positivity rate (new cases per 100 tests), has more than tripled over the last 6 weeks from 1.6% in mid-February to 5.9%.

India's active COVID cases are now 42% of September 2020 peak. However, the surge is not widespread with 61% of all active cases from Maharashtra (MH). MH averaged about 30% of active cases through last year. The active case load is concentrated in Maharashtra, Kerala, Punjab, Karnataka, Tamil Nadu, Chhattisgarh, and Madhya Pradesh.

India inoculated ~60mn+ citizens against COVID by end-March. Starting April, the government planned to extend the vaccinations to all citizens above the age of 45 years, irrespective of their medical history.

Global equities traded higher, but exhibited divergent regional trends. EM equities underperformed (MXEF -1.7%) as the resurgence of virus outbreak and rising US yields wore down risk appetite. In the developed space, European equities (SXXP +6.1%) outperformed relative to their US peers (SPX +4.2%). Intuitive consideration for this is the Value/ Growth tilt, given the US bias to Technology, and Eurozone bias to Value/Banks.

Bond yields continued to advance higher on accelerating growth / inflation expectations and positive economic data, despite downside surprise on US core inflation. With the passage of USD1.9trn of US fiscal stimulus, the focus now has turned to President Biden's infrastructure package, where proposals range from USD2trn to USD4trn.

Covid & Vaccines: India witnessed a second wave of COVID in March with several major states reporting a rise in active cases. Various parts of the country saw new restrictions, though a strict lockdown wasn't announced in any state. The daily number of new cases (7DMA) has increased from 11,000 in mid-February to ~ 62,000 now. (the first wave peaked at 93,000 in mid-September). The positivity rate (new cases per 100 tests), has more than tripled over the last 6 weeks from 1.6% in mid-February to 5.9%.

India's active COVID cases are now 42% of September 2020 peak. However, the surge is not widespread with 61% of all active cases from Maharashtra (MH). MH averaged about 30% of active cases through last year. The active case load is concentrated in Maharashtra, Kerala, Punjab, Karnataka, Tamil Nadu, Chhattisgarh, and Madhya Pradesh.

India inoculated ~60mn+ citizens against COVID by end-March. Starting April, the government planned to extend the vaccinations to all citizens above the age of 45 years, irrespective of their medical history.

Domestic Markets

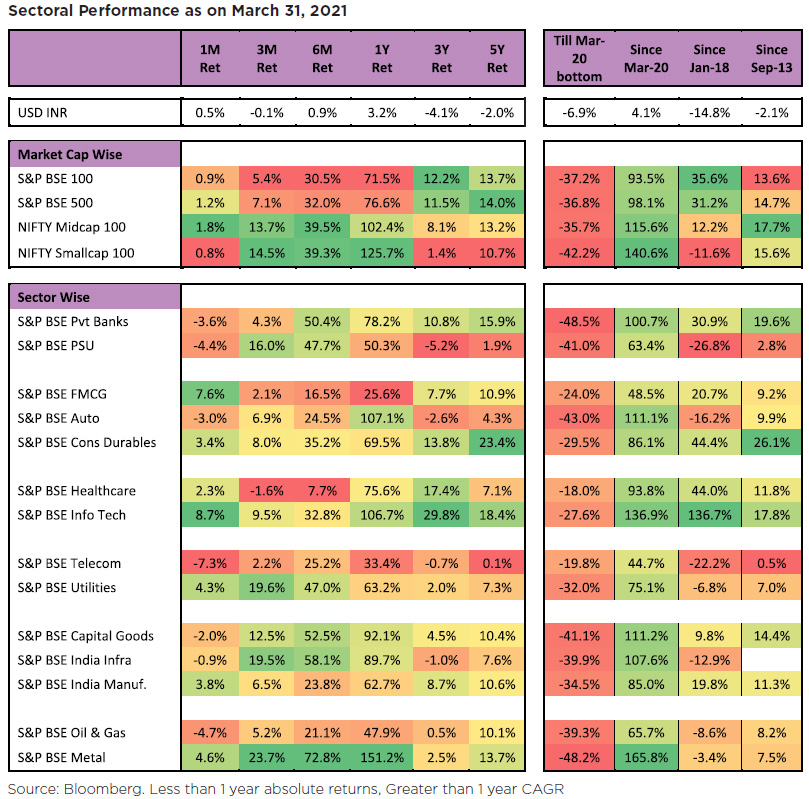

MSCI India (USD) rose 2.2% in March and significantly outperformed peers MSCI APxJ (-2.3%) and MSCI EM (-1.7%).

Indian equities rallied 2% over the month, beating concerns over increasing COVID-19 cases and building inflationary pressure. Markets started on an upward trend on supportive global cues, with NIFTY hovering close to 15,000-15,200 levels. However, performance was choppy later as markets traded in line with global markets on worries over increasing bond yields. Sideways oil prices were an overall tailwind.

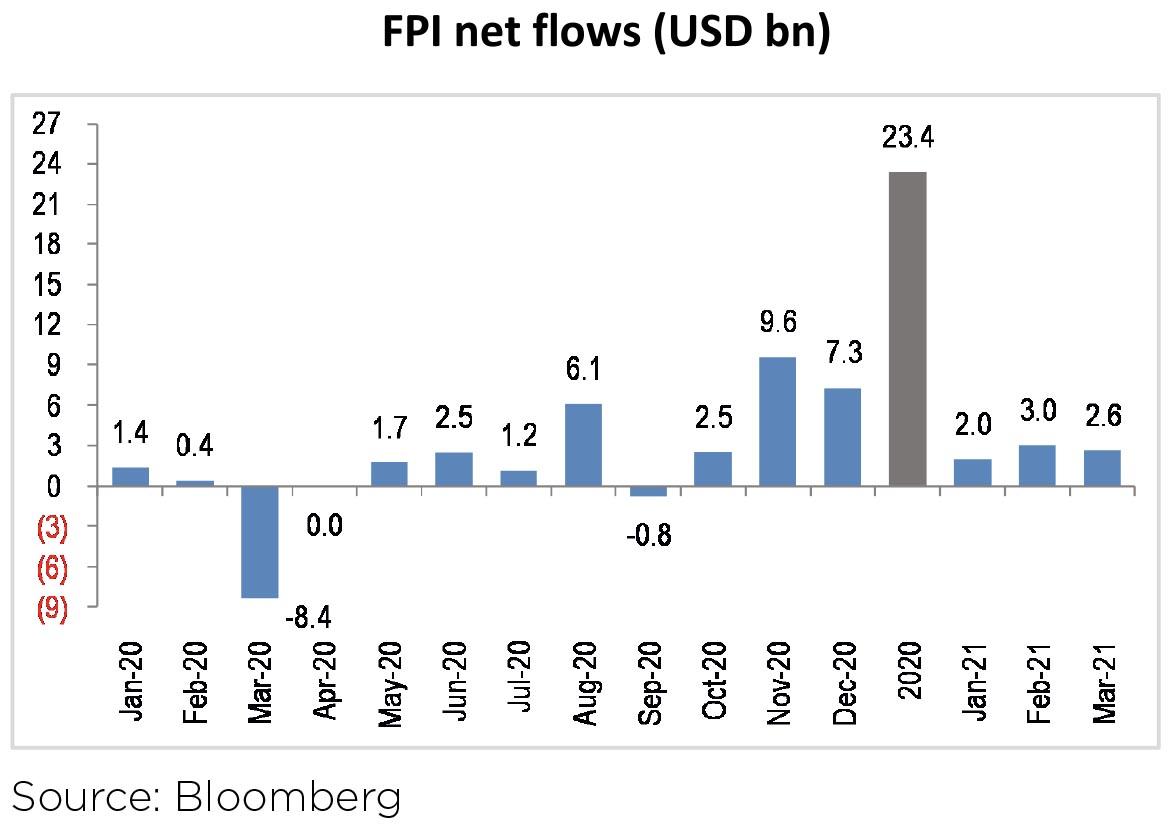

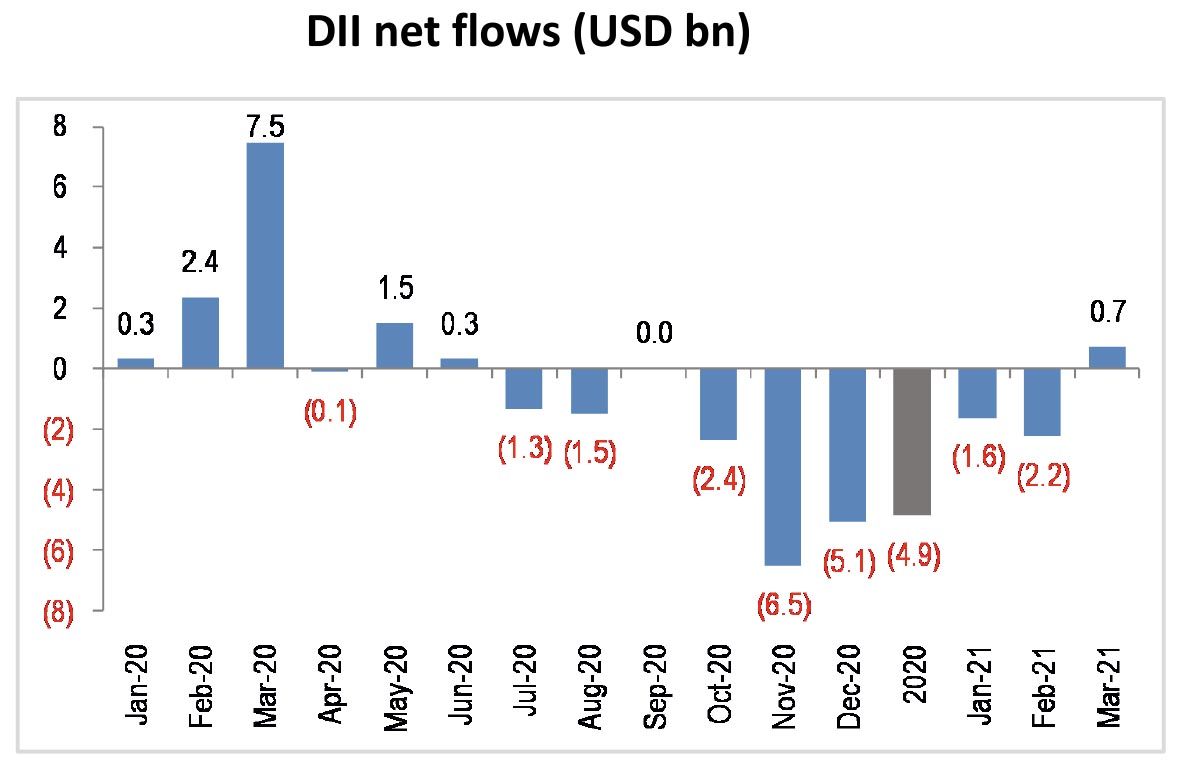

Capital Flows: FPIs buying moderated slightly to ~USD2.6bn in March (CYTD +USD7.6bn) vs net inflows of ~USD3bn witnessed in February. FPIs remained net sellers in the debt markets with outflows of USD756mn in March (vs outflows of USD986mn in February).

It was encouraging to see DIIs turn net buyers for the first time in 2021 with net inflows of ~USD0.7bn (YTD -USD3.2bn) during the month as the incessant selling by Domestic Mutual Funds paused likely due to reversal in Mutual Fund flow trends.

Bond Markets and Currency: Benchmark 10 Year treasury yields averaged at 6.19% in March (11bp higher vs February avg.). On month end values, the 10 Year yield was down 7bps to end the month at 6.17%. US 10 Year yield is at 1.74% (+34bps m-o-m, +107bps y-o-y).

INR gained 0.5% and ended the month at 73.11 per USD in March. INR substantially outperformed JPM EM FX (-1.0%) in March. In the last 12 months, INR (+3.3%) has underperformed the broader EM FX (+5.2%). DXY gained +2.6% in March (vs +0.3% in Feb) and ended the month at 93.23 (-5.9% in the last 12 months).

India's FX reserves are close to their all-time peak at USD582bn as of 19 March. FX reserves have decreased by USD1.6bn in the last four weeks.

Sectoral Impact

IT, Consumer Staples and Metals outperformed while Telecom and Energy were notable laggards in March.

Key Sectoral Trends:

▶ Financials welcomed the Supreme Court decision to lift the standstill on NPA recognition, however the compound interest waiver for all loans raised questions as to who will bear the burden for loans >INR 20mn. Indian Banks' Association requested the government to compensate lenders for the incremental waiver.

▶ Auto: Wholesale volumes in February were a mixed bag wherein passenger vehicles and 2W reported weak trends while tractors and commercial vehicles were still strong. Major players have announced price hikes effective April, to offset the impact of rising commodity prices. The draft guidelines of the much-awaited Vehicle Scrapping policy fell slightly short of market expectations as it was voluntary and government incentives were limited.

▶ Realty: Housing sales in top 7 cities surged in 2021 with MMR & Pune contributing more than half of total sales in top cities. Unsold stocks, however, rose 1% q-o-q to ~642k units due to a robust pipeline of new launches in most cities.

▶ Energy: sector was in focus due to volatility in crude post the OPEC+ surprise outcome. BPCL took steps closer to its privatization by concluding the divestment of its Numaligarh Refinery and partial sale of Trust Shares however the quantum of interim dividend disappointed the street. Retail fuel prices were cut multiple times across India as fall in crude prices provided some breathing space to the OMCs.

▶ Pharma: Gland Pharma partnered with Russian Direct Investment Fund to manufacture Sputnik vaccine.

▶ Within Materials, Cement was in focus as price hikes returned in March with ~6-7% in West/East and ~9-13% in South, allaying fears of margin pressure due to RM (raw material) costs. Domestic steel prices on the other hand, saw the first cut since Aug-20.

The Macro Picture

PMI: India's composite PMI increased for a second straight month, rising by 1.5 points to 57.3, the secondhighest level in a year. The increase was led primarily by a sharp rise in services (+2.5 pts) at 55.3, the highest in a year. The manufacturing index retreated gradually (-0.2 pts), but off a high base and still printed at 57.5.

Services has thus far has been lagging the recovery and February revealed signs of some catch-up. With the link between mobility (activity) and virus proliferation breaking-down as consumers continue to normalize, services activity is mean-reverting. Forward-looking new orders also remained strong across both manufacturing and services.

Inflation: Retail inflation in Feb-21 rose to a 3-month high of 5.03% y-o-y v/s 4.1% y-o-y in Jan-21. This was primarily led by a 1.9ppts rise in food inflation to 3.9% y-o-y driven by lower deflation in vegetables and higher inflation in fruits, oils & fats. Fuel and light inflation moderated by 34bps to 3.5% y-o-y led by LPG and electricity. Petrol/diesel inflation however rose 20%+ y-o-y, the highest since Jan-15/Oct-18 respectively. Core inflation (ex. food+, fuel+, petrol and diesel) fell marginally to 5.3% y-o-y in Feb'21 vs. 5.4% last month as the: a) decline in inflation in gold, education, mobile tariffs and housing, was sharper than the, b) rise in medicines, TV/cable charges, domestic help and washing soap/powder.

Industrial Production (IP): While it was a downside surprise, sequentially IP still rose 0.7% m/m, as on the back of the upwardly revised 2.1% increase last month. In level terms, industrial production continued to inch up and was 97% of its pre-pandemic level in January compared to 96% in December.

Within the internals, consumer durables were flat after rising sharply by 4.9% m-o-m, as in December. However, consumer non-durables contracted for a third consecutive month falling by 2.5% m-o-m, as in January. In level terms, consumer durables (99%) is close to its pre-pandemic level, but consumer nondurables have fallen behind at 93%.

Fiscal Deficit: Centre's fiscal deficit for Apr-Feb-21 period came in at 76% of the revised estimate of INR 18.5trn. Even after adjusting for food / fertilizer subsidies worth ~INR 3trn, the targeted expenditure for March seemed like a tall ask.

Despite the emergence of the 2nd wave in India, the RBI and the Chief Economic Advisor do not expect economic growth to get derailed for now. The International Monetary Fund (IMF) has stated that the Indian economy was on the path of gradual recovery. Fitch Ratings has upgraded India's growth projection for 2021-22 to 12.8% from its previous estimate of 11%.

GST collections: GST collections in February came at INR 1.13tn (+7.4% y-o-y). This was the fifth consecutive month with collections of more than INR 1tn. The Centre has released 100% of the total estimated GST compensation shortfall of INR 1.1trn for 2020-21 to states/UTs (union territories). Finance Minister Nirmala Sitharaman has said that the government is open to discussing the issue of bringing petrol and diesel under the indirect tax regime in the next meeting of the GST Council.

IPO, M&A and PE investments: Deal activity accelerated in March with 27 deals worth ~USD4.9bn (vs 11 deals worth ~USD1.7bn in February). Notable ones being BPCL Trust Share sale (~USD0.8bn), Tata Communications OFS (~USD0.7bn), PE Stake Sale in SBI Cards (~USD0.5bn) and a slew of IPOs - Kalyan Jewellers, Craftsman Automation, Anupam Rasayan, Laxmi Organic, Nazara Technologies among others.

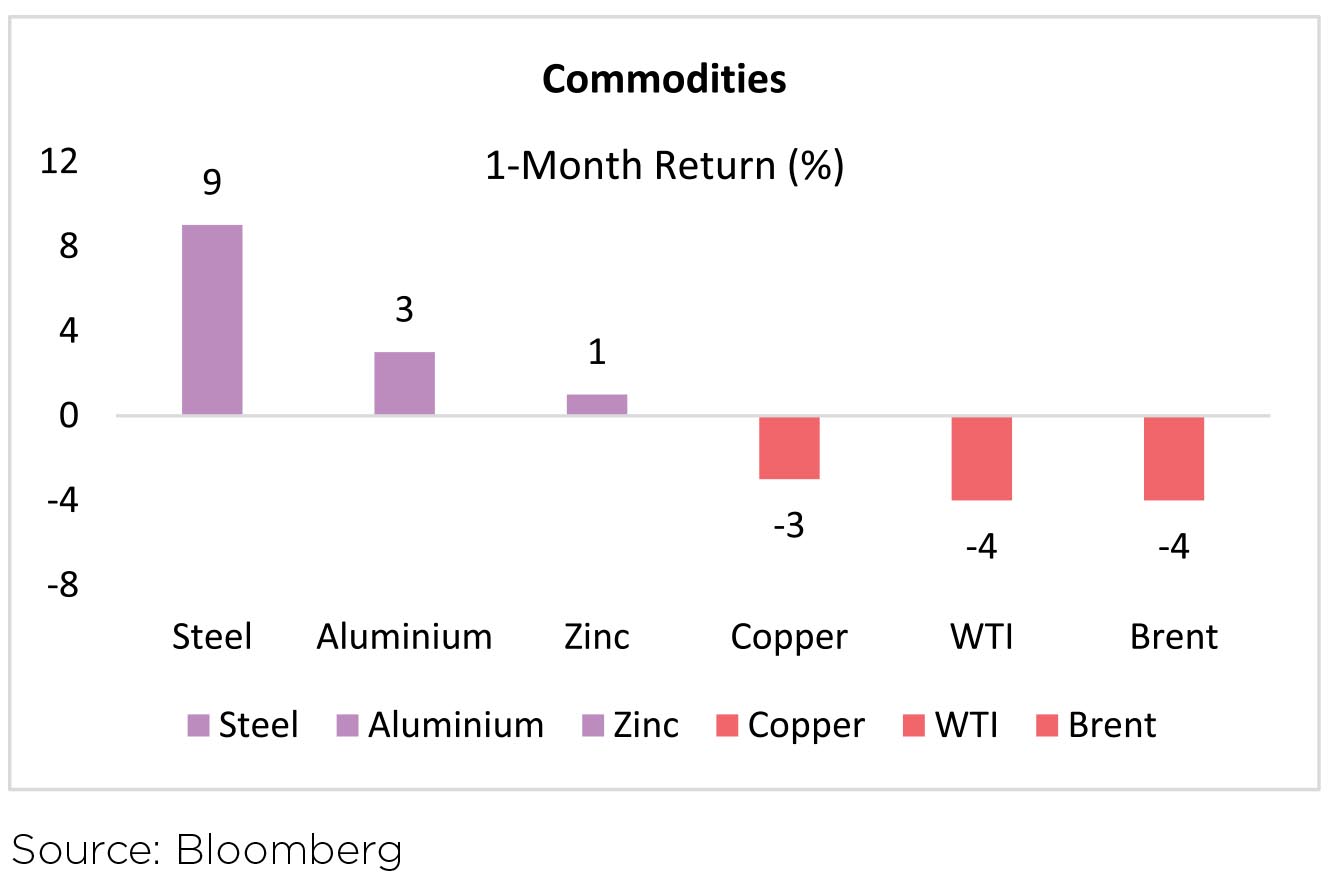

Commodities: The Brent oil price fell 4% in March, after a remarkable 17.5% mom gain in February. OPEC+ agreed to keep production unchanged in April. Oil prices remained choppy over the month with significant 4-7% daily change over the last few weeks. Despite a flurry of relatively bearish demand headlines, a significant part of this selling came from systematic investors. The pace of demand recovery will likely not allow OPEC+ to restore more than 2.5-3 mbd of production this year.

Thrust on Atma-Nirbhar Bharat through production-linked incentive (PLI) schemes

A slew of PLI schemes have already been announced in the past 4 months for industries such as Telecom, IT hardware, Pharmaceuticals etc. April-21 saw approval of PLI scheme for another 2 industries. INR 109bn PLI scheme for the food processing industry and ~USD1bn cash incentive to each semiconductor company that sets up units in India.

State Budget indicates higher spending plans

Aggregate of 16 states that form 91% of the Indian GDP reveal robust spending plans. These are Bihar, Chhattisgarh, Gujarat, Haryana, Jharkhand, Karnataka, Kerala, Maharashtra, Madhya Pradesh, Odisha, Punjab, Rajasthan, Tamil Nadu, Telangana, UP, West Bengal

▶ Total expenditure ex-interest payments growth of 16% y-o-y vs. 12% in FY21RE

▶ Spike in capex growth to 37% y-o-y with rising share of capex in total expenditure

▶ Rural spending growth at 11% y-o-y over 16% y-o-y in FY21RE

▶ Fall in share of committed spending by 2ppts to 42%Other Government policy updates

Other Key snippets:

▶ The Centre cancelled its last auction of FY 21 after assessing cash balance

▶ BPCL divestment is likely to conclude by end Sep-21. Vedanta Group and private equity firms Apollo Global and I Squared Capital's Indian unit Think Gas have put in an expression of interest for buying the government's stake

▶ The Finance Minister expressed disbelief in sovereign rating downgrade on account of larger deficits.

▶ The Supreme Court (SC) has dismissed the petitions seeking: a) total waiver of interest during moratorium, b) extension of moratorium period, c) extension of period of restructuring and d) requests for sector-wise and additional reliefs from RBI and the Centre. However, negatively, the SC directed that interest on interest for the moratorium period should be waived for all borrowers rather than restricting the benefit to borrowers with loans outstanding upto INR 20mn.

▶ The Centre has announced details on the vehicle scrappage policy under which commercial vehicles will be de-registered after 15 years in case of failure to get a fitness certificate and private vehicles will be de-registered after 20 years. The Centre has estimated the vehicle scrappage policy to increase automobile industry turnover to INR 10trn from the current INR 4.5trn.

▶ Aviation: (i) Government has shortlisted Tata group and SpiceJet MD Ajay Singh as the final bidders for Air India. They have 2 months to complete their due diligence before submitting the final offer.

Outlook

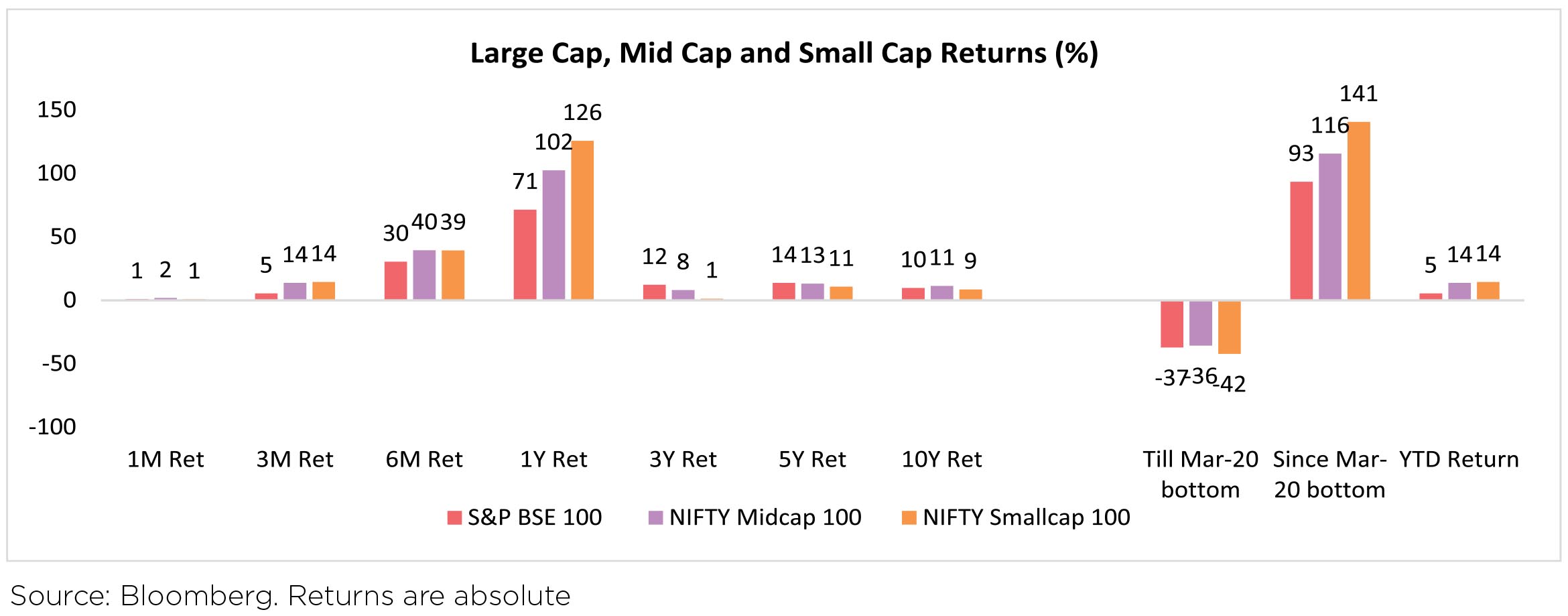

Investing after markets are up 90% +

How does one view markets at current levels? Should you view it in the context of last fiscal year returns - Nifty (Large cap index) up by 72%, Mid Cap index up by 102% and Small cap Index up by 126% or from January 1 2020, before the pandemic - up 21% for Nifty, 38% Mid Cap index and 38% Small cap Index? Either way it would be difficult to ignore the 29x trailing valuation or the two year forward P/E and valuations which are at the upper end of the historical band.

CY 2020 / FY 21 has been an unusual year, which can't and shouldn't be compared with "normal" years. Will economic growth in CY 21/FY 22 rebound with the same intensity as it is being forecasted now? How correct will these forecasters be, after their dismal CY 20 / FY 21 forecasts made at the end of April-June 2020 quarter last year?

The market moves have been nothing short of spectacular for this unusual year. After the fall in March, the markets bottomed on March 23, 2020 and have been practically been on a one-way ticket ...

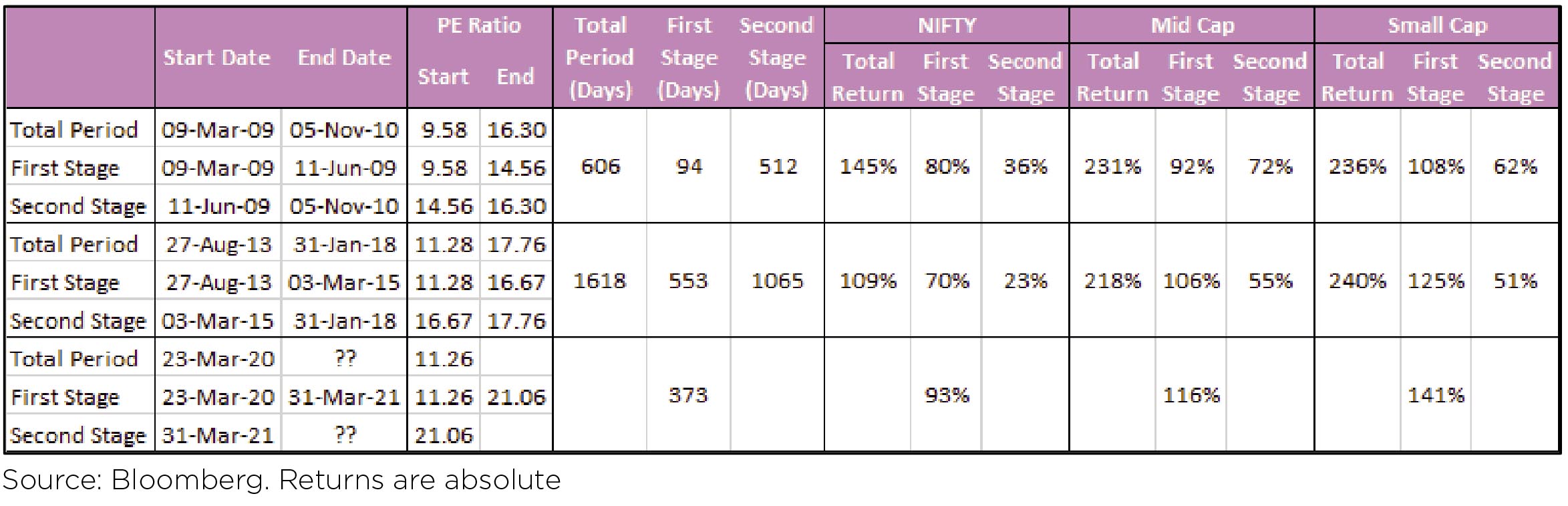

After such a resounding move, how does one position oneself as an investor? We have two examples of recent market rallies - which may help us gather the courage to invest after phase I of the rally is over.

Boosted by the launch of QE (Quantitative easing) by the US Federal Reserve, markets shot up from March 2009 peaking in November 2010 (with an unexpected election result thrown in). During Phase I, as is the case with most Phase I rallies - market move was fast and furious, with most return coming from P/E re-rating rather than earnings growth. Usually broader market participation is visible.

Phase II: Market move is gradual with corrections, earnings revival or lack of it determines the length of this stage. P/E re-rating is limited in this phase of the market uptrend. Usually a prolonged disappointment in earnings growth ends the uptrend.

Clearly, we are in the Phase II of the uptrend, the middle overs of an ODI (one day international), (except as Howard Marks giving the baseball reference mentions, stock market is an endless Baseball match, for our reference, a limited overs ODI, where teams continue to play), to use a cricketing parlance.

Past market trends have shown that valuations by themselves may not lead to a correction, however, investor expectations of earnings growth if not met, have a bigger impact on the burden of high valuations and trigger stock market corrections. While, a few macro events dominate debate today - Inflation, commodity prices uptrend and US 10-year yields, earnings should be the key focus for investors going forward.

This gains even more importance, with March 2021 quarter earnings season just about to start. As investors, be ready for a drop in EBIDTA margins, which touched an all-time high in December 2020 quarter. The unsustainability of the previous quarter margins is a given. What will matter, if sales growth builds on the foundation of 9 months FY 21. Managements will try to shift investor focus from margin to absolute growth at EBDITA and PAT levels. Thankfully, low base effect of last year's March and June quarters builds an easy base for the y-o-y comparison. Operational costs cut effected last year will also be watched with keen interest, were the savings of FY 21 structural or just tactical?

Also watch out for the "undesirable" second wave, not at all as benign and interesting to observe as a Mexican "wave". Vaccination and its impact on numbers of cases is evident from two countries which have achieved over 50% adult vaccination - Israel and UK. Both have reported a sharp drop in number of new cases and hospitalization. The pace of vaccination, currently a shade below 6.5% of adults in India (those having taken the initial jab). The speed with which we cross 25%/33%/50% levels of successfully vaccinating the adult population, may have a direct bearing on how further will our economic trajectory be 7%/9%/11%!

WHAT WENT BY

Bonds stabilized in the later part of March'21 after a weak run since January'21 as market participants

reassessed trajectory of economic recovery and corresponding reversal of RBI's accommodative

stance after resumption of the second wave of Covid-19 in India lead to localized lockdowns &

interruption in mobility. RBI intervention through market operations, cancellation of the last central

government bond auction also aided on the margin. The 10-year benchmark government bond after

reaching an intra-month high of 6.25% on 10th March'21 ended the month at 6.17% while the 5-year

government bond benchmark ended 16bps lower at 5.97% after reaching an intra-month high of

6.13%.

India's February'21 CPI inflation came at 5.03% vs 4.06% previously, primarily on account of adverse base effect alongside pickup in food inflation, with core inflation rising sharply on transportation. January'21 IIP came in at -1.6% vs +0.4% exp, with decline in manufacturing and mining, and pronounced contraction in capital and consumer goods.

India's merchandise goods trade deficit widened to USD14.1bn in March'21. Both exports and imports benefited from the low base effects, with exports rising by 58.2% YoY while imports rose by 52.9% YoY in March'21. Improvement in exports were driven by gems & jewelry (76% YoY) & engineering goods (70.3% YoY) while imports were led by electronic goods (+77% YoY) & machinery (+60% YoY).

February'21 GST collections, collected in March'21, were robust supported by economic recovery and improved compliance. GST collection was at INR 1,239bn for February'21 compared to INR 1,131bn in January'21. CGST collection for February'21 was INR 230bn (January'21: INR 211bn), SGST was INR 293bn (January'21: INR 273bn), IGST at INR 628bn (January'21: INR 553bn), and compensation cess was at INR 88bn (January'21: INR 95 bn).

The borrowing calendar for H1 FY22 was announced by RBI for INR 7.24trn or ~60% of the budgeted FY22 borrowing, broadly in line with market expectations. Net market borrowing stands at INR 5.85trn, lower than INR 6.35trn in the preceding year. Issuances planned in the 10-year maturity segment was reduced to 23% in 1HFY22, in comparison to 28% of the issuance in 1HFY21 while 30 year+ segment saw an increase to 28% of the issuance compared to 23% in 1HFY21. Gross T-bill issuance stood at INR 4.68trn compared to INR 5trn in 1QFY21.

The RBI in its April'21 policy kept all rates on hold as was widely expected. The "time based" guidance (accommodative into next financial year) was dropped while the "state based" guidance was reaffirmed (accommodative stance till prospects for a sustained recovery are well secured). This was the most likely anticipated outcome in terms of guidance given that the RBI/MPC may not have wanted to tie themselves into a time commitment in what is an exceedingly complex and uncertain global economic framework. The RBI announced a new secondary market government bond acquisition program termed G-SAP 1.0 where it committed to purchase of a specific amount of government bonds (pegged at INR 1 lakh crores for Q1 FY22). The program is over and above other tools already in use. The RBI also announced longer term variable rate reverse repo (VRRR) auctions than just the 14-day ones that had been started from January'21 (for more details, refer our note on policy - https://idfcmf.com/article/4383).

The RBI has well-equipped the market for what may otherwise be an uncertain few months ahead in terms of global economic developments. We might witness significant data spikes as both base effects as well as re-opening and fiscal stimulus led spending effects kick into gear. Our current assessment is that the pace of reflation repricing should start settling down thereby providing room for RBI as well to pursue an orderly normalization process ahead. India's lesser reliance on global debt flows lately as well as the slightly modified central bank approach now to focus also on reserve accumulation to buffer macro stability, further support the idea of an orderly normalization.

The yield curve is very steep even at intermediate duration points (5 - 6 years) thereby providing strong compensation for holding bonds as against cash. The important distinction to appreciate here is this: when yield curves are flat as they used to be till a few years back then investing even in medium duration bonds may make sense only if there is an expectation of capital appreciation (that is falling yields). However, when the curve is as steep as it is today the consideration isn't capital gains but rather volatility and / or the pace of rise in yields which will dictate how much of the excess carry on offer will actually get realized by holding the bond. This also means that the optimal 'exploitation' of steepness isn't necessarily by owning longer duration points since the realization of carry there may be more compromised when yields move adversely. Rather one has to choose appropriate points on the curve where 'carry-adjusted-for-duration' makes the most sense. The current yield curve is quite steep till 5 - 7 years and then the additional duration risk taken may start overwhelming the additional carry on offer, in our view. Hence our preference in our active duration mandates remains currently best expressed as an overweight in the 5 - 6-year part of the government bond curve; with the usual caveats on flexibility in strategy retained with us. This also emphasizes the importance of some amount of "bar-belling" where the investor uses intermediate duration products alongside very near term (almost overnight) exposures so that while overall portfolio maturity doesn't go up, the investor is relatively protected when the commencement of the normalization process starts to put upward pressure on money market and short end rates.

Disclaimer: MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

The Disclosures of opinions/in house views/strategy incorporated herein is provided solely to enhance the transparency about the investment strategy / theme of the Scheme and should not be treated as endorsement of the views / opinions or as an investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document has been prepared on the basis of information, which is already available in publicly accessible media or developed through analysis of IDFC Mutual Fund. The information/ views / opinions provided is for informative purpose only and may have ceased to be current by the time it may reach the recipient, which should be taken into account before interpreting this document. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision and the security may or may not continue to form part of the scheme's portfolio in future. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. The decision of the Investment Manager may not always be profitable; as such decisions are based on the prevailing market conditions and the understanding of the Investment Manager. Actual market movements may vary from the anticipated trends. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alterations to this statement as may be required from time to time. Neither IDFC Mutual Fund / IDFC AMC Trustee Co. Ltd./ IDFC Asset Management Co. Ltd nor IDFC, its Directors or representatives shall be liable for any damages whether direct or indirect, incidental, punitive special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information.

India's February'21 CPI inflation came at 5.03% vs 4.06% previously, primarily on account of adverse base effect alongside pickup in food inflation, with core inflation rising sharply on transportation. January'21 IIP came in at -1.6% vs +0.4% exp, with decline in manufacturing and mining, and pronounced contraction in capital and consumer goods.

India's merchandise goods trade deficit widened to USD14.1bn in March'21. Both exports and imports benefited from the low base effects, with exports rising by 58.2% YoY while imports rose by 52.9% YoY in March'21. Improvement in exports were driven by gems & jewelry (76% YoY) & engineering goods (70.3% YoY) while imports were led by electronic goods (+77% YoY) & machinery (+60% YoY).

February'21 GST collections, collected in March'21, were robust supported by economic recovery and improved compliance. GST collection was at INR 1,239bn for February'21 compared to INR 1,131bn in January'21. CGST collection for February'21 was INR 230bn (January'21: INR 211bn), SGST was INR 293bn (January'21: INR 273bn), IGST at INR 628bn (January'21: INR 553bn), and compensation cess was at INR 88bn (January'21: INR 95 bn).

The borrowing calendar for H1 FY22 was announced by RBI for INR 7.24trn or ~60% of the budgeted FY22 borrowing, broadly in line with market expectations. Net market borrowing stands at INR 5.85trn, lower than INR 6.35trn in the preceding year. Issuances planned in the 10-year maturity segment was reduced to 23% in 1HFY22, in comparison to 28% of the issuance in 1HFY21 while 30 year+ segment saw an increase to 28% of the issuance compared to 23% in 1HFY21. Gross T-bill issuance stood at INR 4.68trn compared to INR 5trn in 1QFY21.

The RBI in its April'21 policy kept all rates on hold as was widely expected. The "time based" guidance (accommodative into next financial year) was dropped while the "state based" guidance was reaffirmed (accommodative stance till prospects for a sustained recovery are well secured). This was the most likely anticipated outcome in terms of guidance given that the RBI/MPC may not have wanted to tie themselves into a time commitment in what is an exceedingly complex and uncertain global economic framework. The RBI announced a new secondary market government bond acquisition program termed G-SAP 1.0 where it committed to purchase of a specific amount of government bonds (pegged at INR 1 lakh crores for Q1 FY22). The program is over and above other tools already in use. The RBI also announced longer term variable rate reverse repo (VRRR) auctions than just the 14-day ones that had been started from January'21 (for more details, refer our note on policy - https://idfcmf.com/article/4383).

Outlook

The RBI has well-equipped the market for what may otherwise be an uncertain few months ahead in terms of global economic developments. We might witness significant data spikes as both base effects as well as re-opening and fiscal stimulus led spending effects kick into gear. Our current assessment is that the pace of reflation repricing should start settling down thereby providing room for RBI as well to pursue an orderly normalization process ahead. India's lesser reliance on global debt flows lately as well as the slightly modified central bank approach now to focus also on reserve accumulation to buffer macro stability, further support the idea of an orderly normalization.

The yield curve is very steep even at intermediate duration points (5 - 6 years) thereby providing strong compensation for holding bonds as against cash. The important distinction to appreciate here is this: when yield curves are flat as they used to be till a few years back then investing even in medium duration bonds may make sense only if there is an expectation of capital appreciation (that is falling yields). However, when the curve is as steep as it is today the consideration isn't capital gains but rather volatility and / or the pace of rise in yields which will dictate how much of the excess carry on offer will actually get realized by holding the bond. This also means that the optimal 'exploitation' of steepness isn't necessarily by owning longer duration points since the realization of carry there may be more compromised when yields move adversely. Rather one has to choose appropriate points on the curve where 'carry-adjusted-for-duration' makes the most sense. The current yield curve is quite steep till 5 - 7 years and then the additional duration risk taken may start overwhelming the additional carry on offer, in our view. Hence our preference in our active duration mandates remains currently best expressed as an overweight in the 5 - 6-year part of the government bond curve; with the usual caveats on flexibility in strategy retained with us. This also emphasizes the importance of some amount of "bar-belling" where the investor uses intermediate duration products alongside very near term (almost overnight) exposures so that while overall portfolio maturity doesn't go up, the investor is relatively protected when the commencement of the normalization process starts to put upward pressure on money market and short end rates.

Disclaimer: MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

The Disclosures of opinions/in house views/strategy incorporated herein is provided solely to enhance the transparency about the investment strategy / theme of the Scheme and should not be treated as endorsement of the views / opinions or as an investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document has been prepared on the basis of information, which is already available in publicly accessible media or developed through analysis of IDFC Mutual Fund. The information/ views / opinions provided is for informative purpose only and may have ceased to be current by the time it may reach the recipient, which should be taken into account before interpreting this document. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision and the security may or may not continue to form part of the scheme's portfolio in future. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. The decision of the Investment Manager may not always be profitable; as such decisions are based on the prevailing market conditions and the understanding of the Investment Manager. Actual market movements may vary from the anticipated trends. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alterations to this statement as may be required from time to time. Neither IDFC Mutual Fund / IDFC AMC Trustee Co. Ltd./ IDFC Asset Management Co. Ltd nor IDFC, its Directors or representatives shall be liable for any damages whether direct or indirect, incidental, punitive special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information.