Commentary

31st July 2021

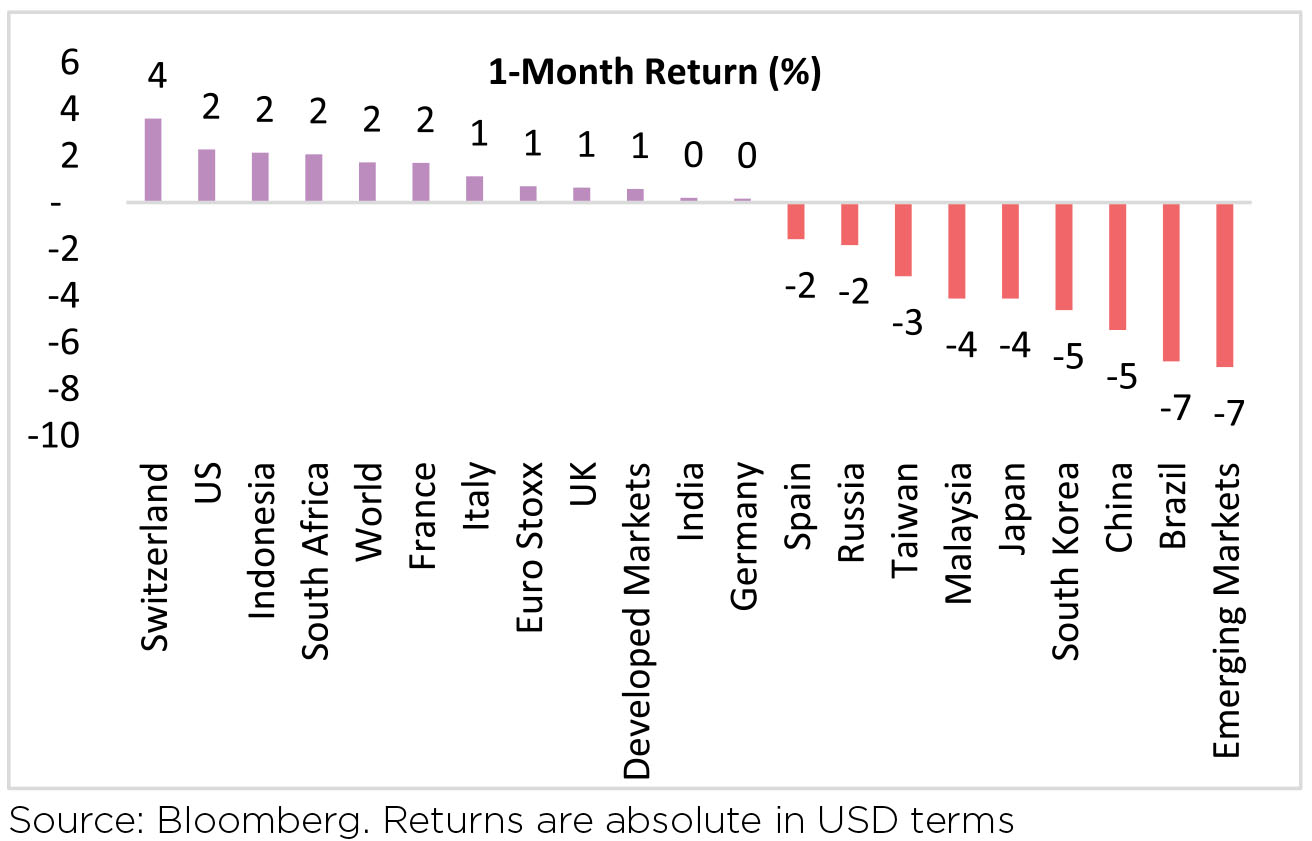

GLOBAL MARKETS

Global equities traded modestly higher,

with developed markets (the US up +2%

vs Europe +1%) leading Emerging Markets

(down 7.0%). The breather in July was

mainly led by fears around the Delta

variant's impact on growth and mobility.

Chinese equities fell 14.2% (before recovering towards the end of the month) (down 5%) as a series of regulatory changes catalyzed a swift correction in new economy stocks (internet, fintech, education, etc).

Covid & Vaccines: India's positivity rate peaked at about 23% in early May but has now declined to below 2.5%. The 7DMA of vaccine shots administered has increased sharply from under 2mn a day in the middle of May to over 5mn now. As of 31 July, close to 27% of the population has taken the first shot.

Chinese equities fell 14.2% (before recovering towards the end of the month) (down 5%) as a series of regulatory changes catalyzed a swift correction in new economy stocks (internet, fintech, education, etc).

Covid & Vaccines: India's positivity rate peaked at about 23% in early May but has now declined to below 2.5%. The 7DMA of vaccine shots administered has increased sharply from under 2mn a day in the middle of May to over 5mn now. As of 31 July, close to 27% of the population has taken the first shot.

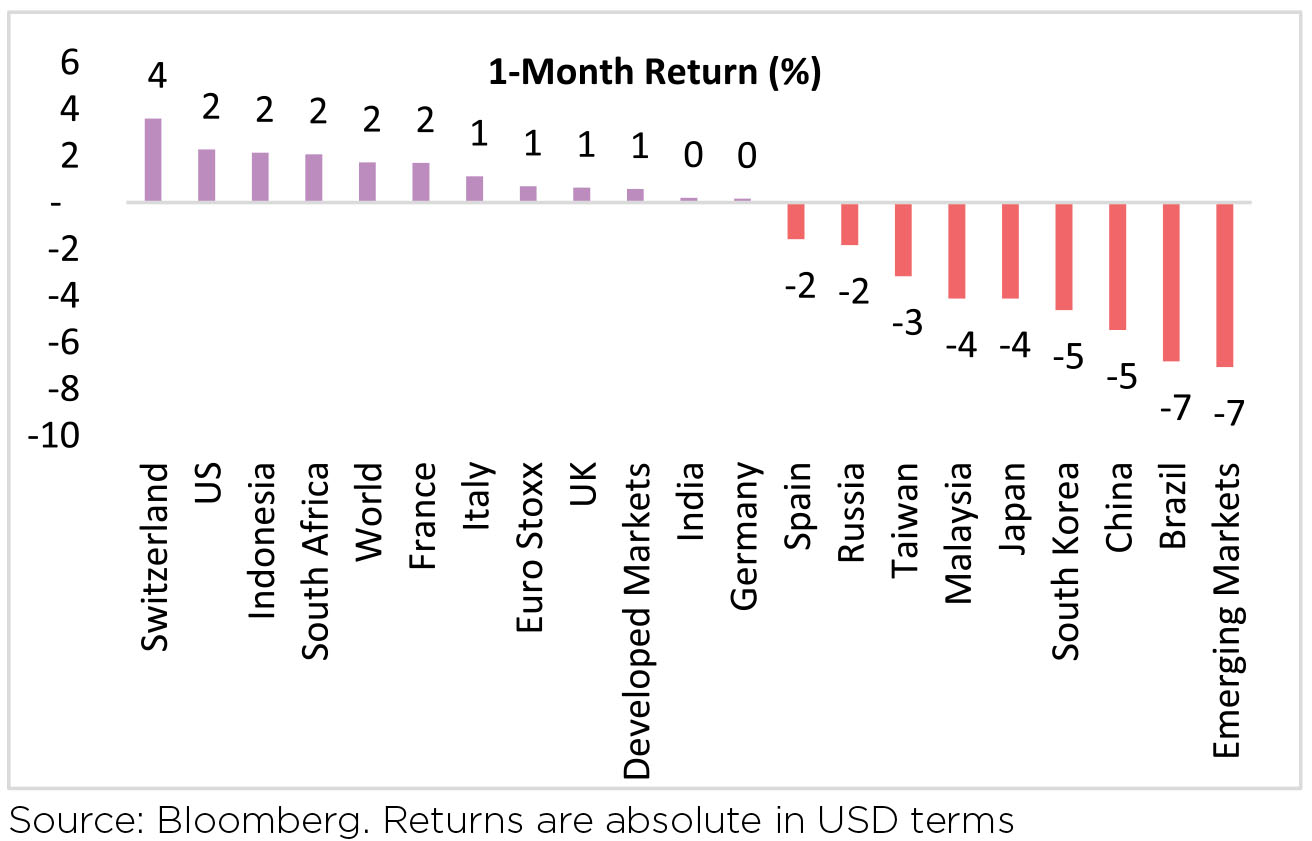

Domestic Markets

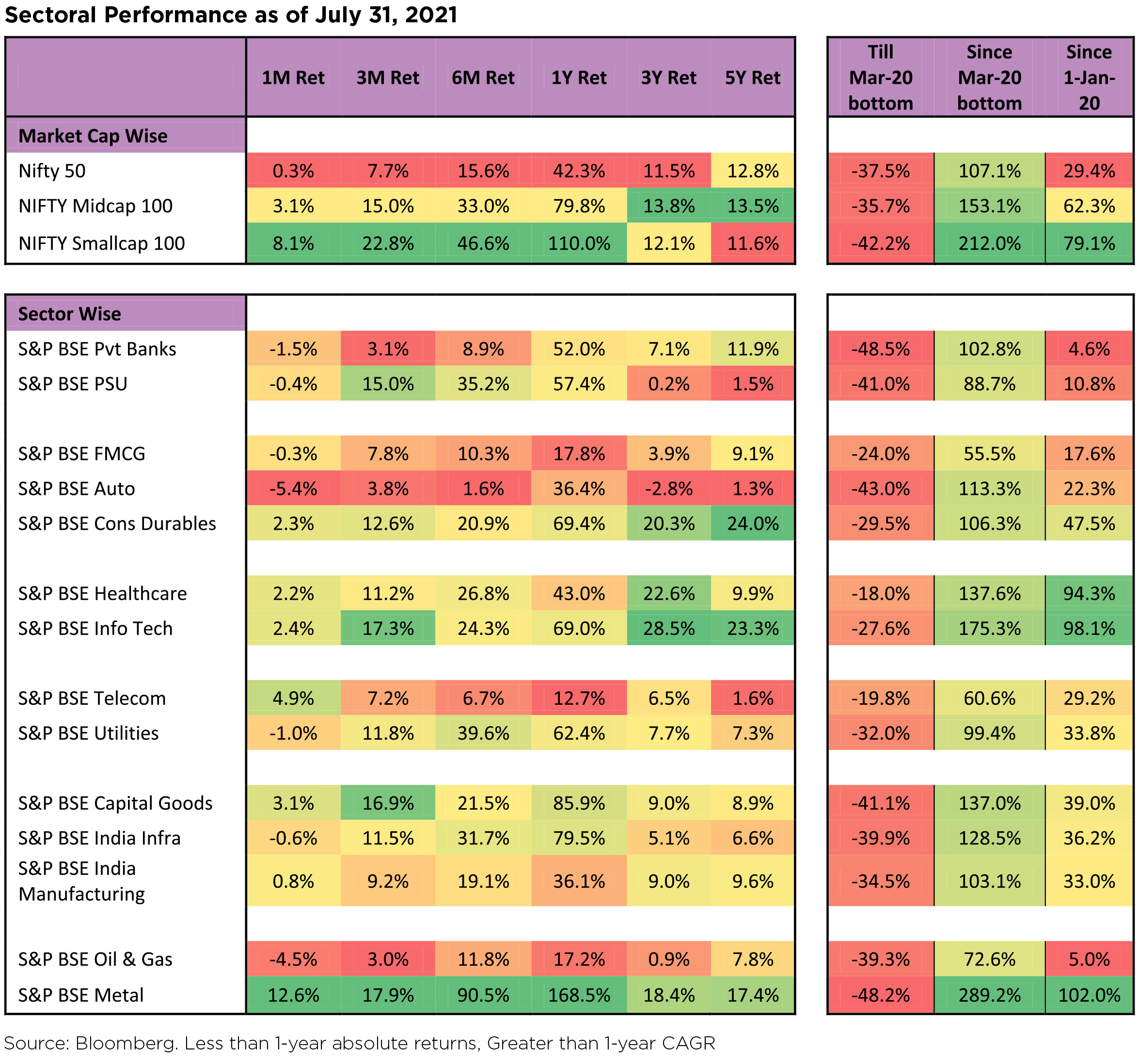

The S&P BSE Sensex Index and Nifty 50 Index ended the roller-coaster ride of the month almost flat. Mid and Small caps were up 3% and 8%, respectively; outperforming Large caps in July.

The above graph is for representation purposes only and should not be used for the development or implementation of an investment strategy. Past performance may or may not be sustained in the future.

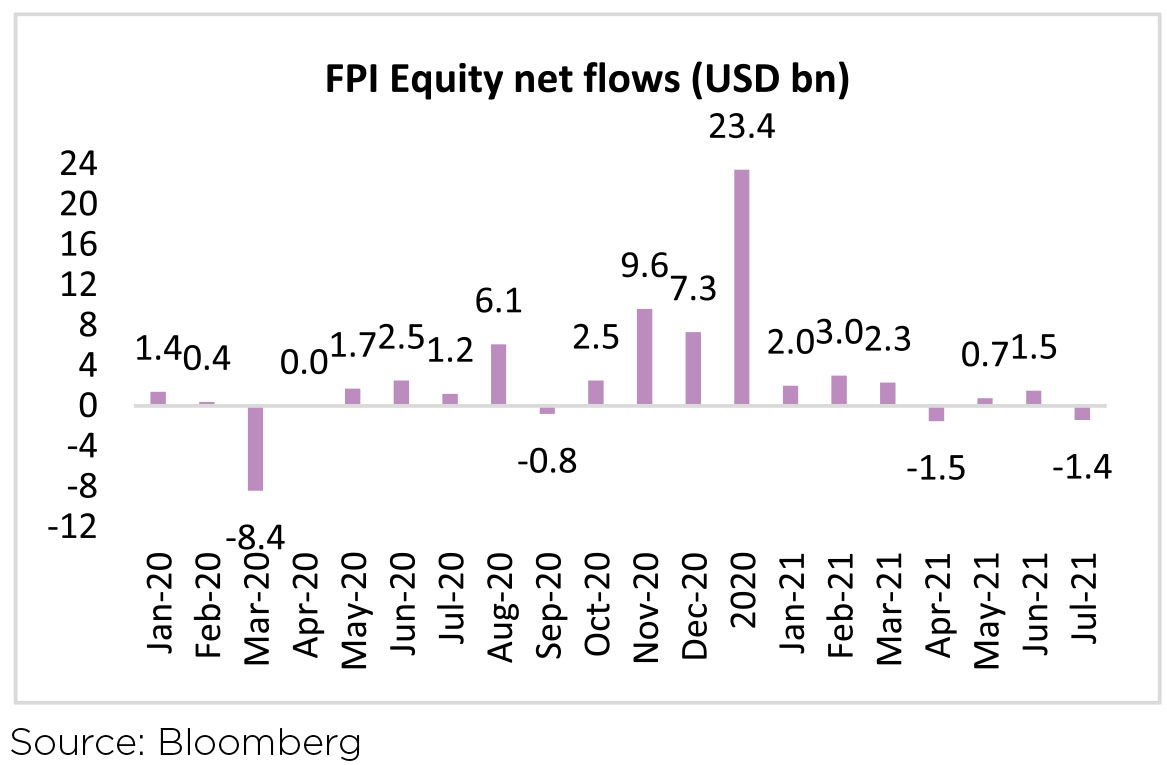

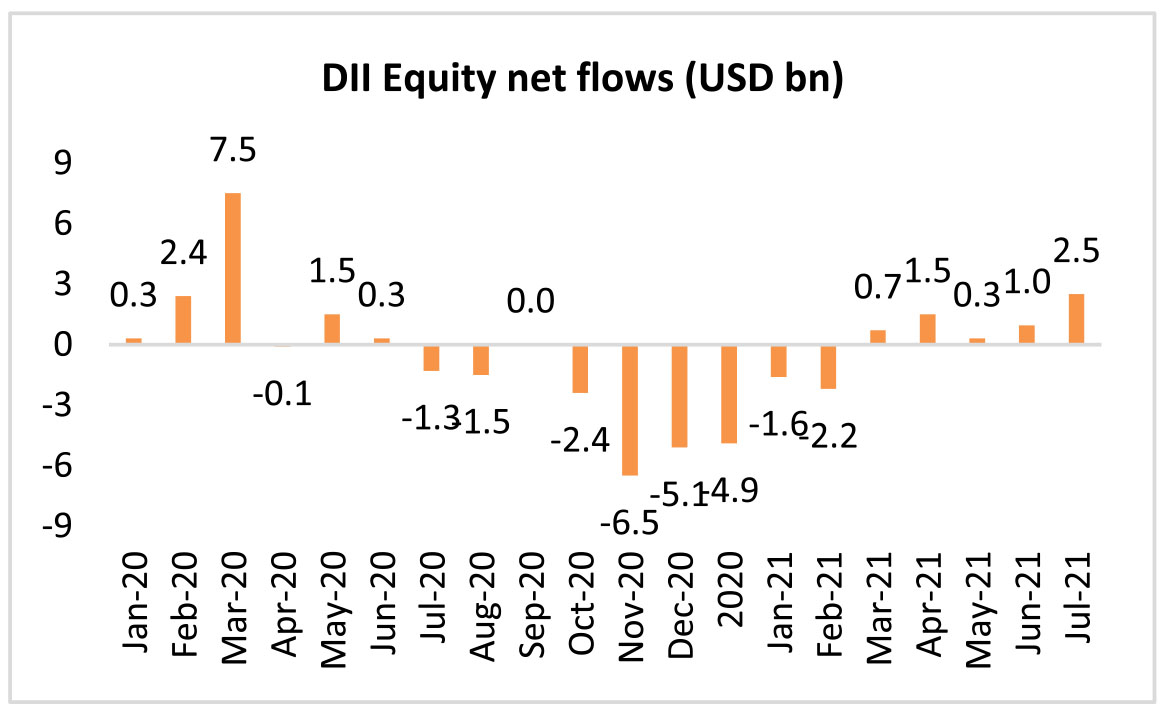

Capital Flows: FPIs turned net sellers of Indian equities, after two months of consecutive buying (-USD1.4bn, following +USD1.5mn in June). DIIs remained net equity buyers for the fifth month (+USD2.5bn, vs +USD1.0bn in June).

Currency: INR ended at ~74.42 per USD, flat in July. DXY (Dollar Index) was down a modest 0.3% over the month.

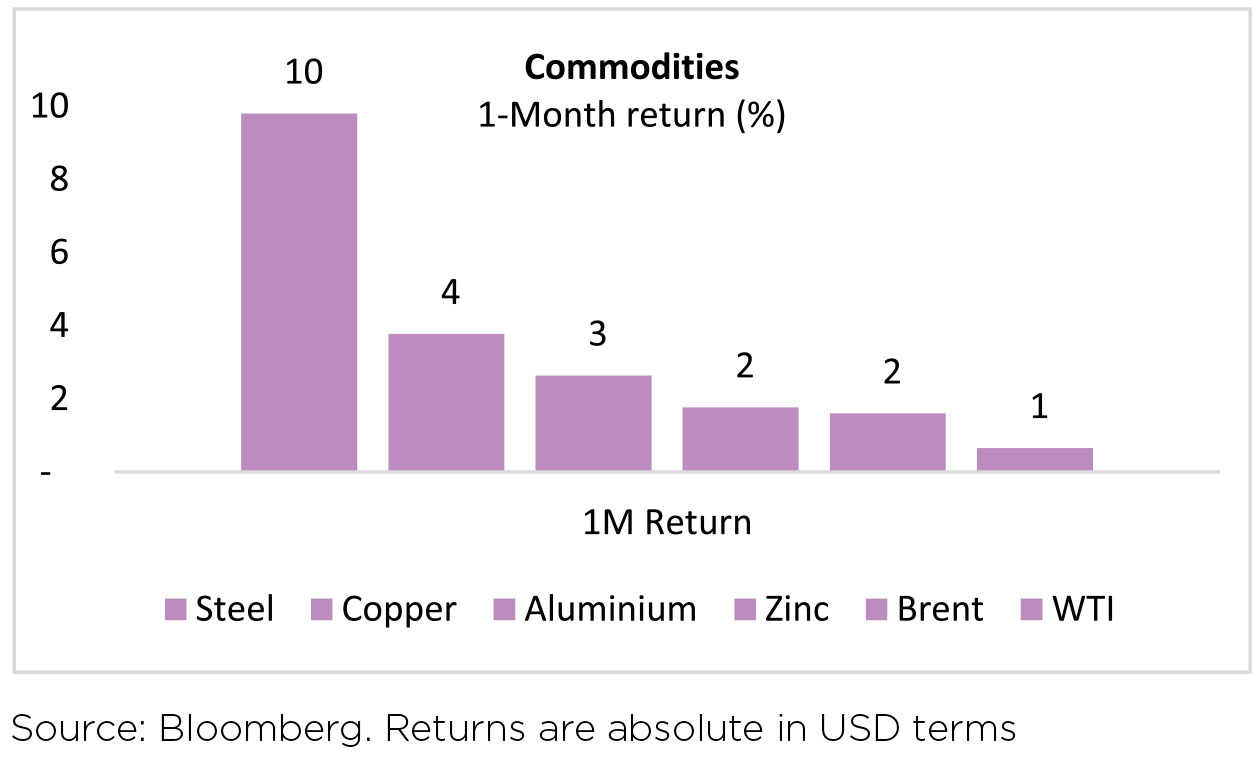

Commodities: The Brent oil was flattish in July, following a 9.3% increase in June. OPEC's members have decided to boost production by 400k bpd per month over the rest of 2021.

Though the London MX index was down by 3% m-o-m, they are significantly higher on a y-o-y basis and pose pressure on the margins in the near term.

Agriculture commodities: Pulses and oils prices fell even as upside pressures continued compared to last year's levels.

The Macro Picture

IMF cuts India's FY2022 GDP forecast to 9.5% from 12.5% as macro prints have been weak:

► PMIs fell sharply in June (43.1 from 48.1 in May) reflecting the lingering impact of lockdown.

► CPI inflation printed at 6.3% y-o-y in June.

► The credit impulse in the economy remained weak throughout last year's recovery.

► Industrial Production (IP) also printed below consensus expectations at 29% y-o-y in May.

Positive being the trade report for June with both exports and imports clocking strong growth. Also, GST collections grew 33% y-o-y in July (INR1.16tn, from INR928bn in June, -25% m-o-m). This was the 9th consecutive month with collections of more than INR1tn starting October last year (exception of June 2021).

March-June 2021 quarter results are mixed - reflecting increasing margin pressure, moderation in top-line momentum, and an increase in retail NPAs for some banks.

Other Updates

► Fiscal deficit in 1QFY22 was at 18.2% of FY2022BE. Gross tax collections for 1QFY22 increased by 97% over 1QFY21 with direct taxes and indirect taxes increasing by 112% and 85%, respectively.

► The Fed kept its rates unchanged and has initiated the promised advance notice for QE tapering.

► LIC IPO - The government invites bids from merchant bankers and legal advisors.

► The Union Cabinet approved the PLI (Production Linked Incentive) scheme for speciality steel which has an outlay of INR63 bn for production between FY2023-27.

► Government permits 100% FDI in oil PSUs approved for disinvestment. This shall aid BPCL sale.

► Power: The government has begun the process to terminate/ re-negotiate five Power Purchase Agreements (PPAs).

► Financials: The Reserve Bank of India (RBI) indefinitely barred MasterCard from issuing new debit or credit cards to domestic customers as they had not complied with data storage rules from 2018 that require foreign card networks to store Indian payments data "only in India".

► Prediction of a normal monsoon: Till July 28, cumulative rainfall was 0.5% above long-term average with the weekly rainfall 15% above the long-term average. On a cumulative basis, the spatial distribution of monsoon was mixed across regions. While, sowing status has been lower than last year's level but picking up.

Sectoral Impact

By sector, Metals, Telcom, and Capital Goods outperformed while Auto, Oil & Gas and Pvt Banks were notable laggards in July.

Outlook

The ongoing earnings season reflects a few key trends:

► Clearly, the momentum of activity visible in the Jan-Mar 2021 quarter stalled during the Apr-Jun 2021 quarter due to the 2nd wave of the pandemic.

► Margins, at the Gross level and EBIDTA level, have been impacted by rising input costs and recommencing of ASP (average selling price) spend.

► Working capital management, which was at a tight leash at the end of 4QFY21, appeared to be a oneoff. As companies across most sectors reflect an expanded working capital - the shrinkage of working capital witnessed during FY21 will not be sustainable as the business expands, which was reflected in Q1FY22 results.

► Management commentary post-Apr-Jun 2021 quarter is more muted about the near term, as worries of a 3rd wave and its impact on business continuity remains an open question.

► The cycle of upgrades witnessed from the Sep 2020 quarter will take a breather with the current quarter. Earnings for FY22 will be marginally downgraded, while earnings for FY23 remain unimpacted.

► Earnings season in the US, on the other hand, has been superlative, as per news reports almost 88% of S&P 500 constituents which have reported earnings, have reported earnings beat, with their earnings upgraded for CY21.

The other big trend, retail participation in equity markets, continues to gather strength. Their participation in IPOs has also been equally strong. The pipeline of IPOs remains robust - as against 27 IPOs on a YTD basis, another 30 odds are lined up in the coming quarters, FY22 will upstage FY21 in record IPO collections. Importantly, several "new-age" businesses are amongst the IPOs scheduled to hit the market in the coming quarters. While valuations and business models of some of these businesses may or may not be sustainable in the future, their issuance will keep Indian markets relevant for FPIs, who are keen to invest in such "new-age" businesses, especially after a slew of regulatory changes announced by an Asian giant. The other big positive of this IPO "rush" would be the much-needed deepening of the markets with more securities available for investing across several new sectors being added. It could also lead to a rush of changes across indices, as most of these listings are in the mid and large-cap space. Interestingly, several of these listings will have no traditional "promoter" group, as holdings will be owned largely by financial investors - PE Funds / Sovereign Wealth Funds/ other financial investors. Hopefully, such listings bring about another level of improvement - corporate governance, fiduciary responsibilities of an independent Board, no selective distribution of financial information. In the 1990s, the listing of Infosys became a starting point for the rollout of corporate governance and fiduciary responsibility towards minority shareholders. While financial investors, especially PE funds have asserted the superiority of their governance track record vis-à-vis traditional "promoters", the next few years will test the level of truth in such claims!

WHAT WENT BY

With minimal intervention by RBI in the bond markets and incrementally accepting bids at market levels,

bond yields especially at the longer end, saw some increase during the month. The new 10-year benchmark,

6.10% GSec 2031, saw the yields move up 10bps to close the month at 6.20%. The 5-year Gsec was almost

flat at 5.73% while the 14-year GSec rose 6bps to end at 6.81%.

June'21 GST revenues (collected in July'21) were higher than May'21 as economic activity picked up following the easing of state-wide restrictions. Based on the monthly PIB release, total GST collection was at INR 1,164bn in June'21 (INR 928bn for May'21 and INR 1,027bn for April'21).

India's CPI inflation was unchanged at 6.3% YoY in June, lower than expected (consensus: 6.6%), although still above the RBI's upper band (2-6%). Core CPI (CPI ex-food & beverages, fuel) inflation moderated more than expected to 6.1% YoY in June from 6.6% in May.

The FAO Food Price Index (which tracks changes in the international prices of the most globally traded food commodities) averaged 123.0 points in July 2021, 1.2 percent lower than the previous month. Industrial production (IP) growth fell to 29.3% YoY from 134.6% in April, marginally below expectations, with the YoY moderation also due to adverse base effects from last year (consensus: 32%).

The IMF maintained its 6% global growth forecast for 2021, upgrading outlook for the US and other wealthy economies but cutting estimates for developing countries which are still struggling with surging COVID infections. The IMF significantly raised its forecasts for the US to 7.0% in 2021 from 4.6% forecasted earlier and 4.9% in 2022 from an earlier estimate of 3.5%. On the other hand, India saw the biggest cut in its growth forecast from 12.5% to 9.5% for FY22 due to the virulent second COVID wave.

The FOMC in its July meeting maintained rates at the 0.00%-0.25% range. It said sectors impacted by pandemic have shown improvement but not fully recovered. In terms of the progress towards its goals (to assess whether 'substantial further progress' has been made), it said progress has been made and that it will continue to assess this in the coming meetings. It continued to think higher inflations seen now is transitory and not broad (although the magnitude and duration is uncertain), expects to see strong gains in the job market (as factors like child care, fear of Covid and UI benefits ease) and estimates economic impact of the delta variant could be limited, although it is watching it closely.

The MPC unanimously and expectedly kept the repo rate unchanged at 4% and continued with its accommodative stance albeit with a 5-1 dissent (Prof Jayanth Verma voted against the accommodative stance) for as long as necessary to revive growth on a durable basis keeping in view the inflation objective. The MPC restated that the nascent and hesitant recovery needs to be nurtured through fiscal, monetary and sectoral policy levers. Meanwhile, as a means of normalizing liquidity, RBI increased the quantum of variable reverse repo (VRRR) to INR 4tn from INR 2tn currently, although in a phased manner until September 24. Further, the RBI announced two more auctions of INR 250bn each to be conducted in August as the next tranche of the INR 1.2tn under G-SAP 2.0 and restated the continuation of OMOs and operation twists to manage the yield curve.

The enhancement in VRRR to double its current amount is being undertaken gradually and with explicit guidance that this shouldn't be read as a reversal of the accommodative policy stance. The so-called GSAP program is now reintroducing 'on-the-run' bonds (benchmark 5 year has already been announced for the next GSAP auction) which is on the margin positive for market participants. However, possibly the dissent in stance as well as a higher than expected revision to CPI may be leading some market participants to fear that we are that much closer to step three in the unwind cycle. This is getting reflected most particularly in the rise in swap rates post policy. While the fears are somewhat understandable, we can't help but observe that market bias seems quite one way. Put another way, there seems to be extreme conviction that significant normalization is coming sooner rather than later despite what the RBI / MPC are saying. To clarify, it is quite logical to expect that the current emergency level of accommodation will expire soon. However, swap curves are pricing in not just an early exit from the current level of accommodation but also a fairly significant increase in overnight rates thereafter. Further, market is not fully considering the possibility that peak policy rates in this cycle may actually turn out to be lower than the last one. Not to extrapolate, but it may be noted that one way expectations with respect to US policy normalization have had serious cause for rethink over the past few weeks and months. Even in the Indian context given a relatively subdued fiscal response and with possibly a global peak on the reflation trade having been achieved, there is two-way risk to the above expectation even as RBI may have to move off the current emergency levels of overnight rate sometime soon (possibly first quarter of calendar 2022).

From investors standpoint, we would reiterate our previous observations.

► It isn't obvious that interest rate swaps are the best protection against future policy normalization given the sizeable rate hikes that they are already pricing and the fact that they don't get directly impacted by bond supply, which is the number one pressure point for Indian markets.

► Intermediate duration points (4 - 6 years) seem well positioned to benefit from carry plus roll down even in an environment of gently rising bond yields.

► Spreads on corporate bonds (including lower rated bonds) generally speaking for tenors beyond 3 - 4 years seem too shallow and such tenors are better played with sovereign assets.

► While some amount of 'bar-belling' may be prudent, the cost of holding cash is large and only makes sense if one wants to hedge against tail risks that may entail sharp and short period rises in yields. In particular, a 'business as usual' gentle rise in yields is not enough grounds to sit on large amounts of cash given the extraordinary steepness even at intermediate duration points.

An additional point, and a recent thought, as expressed above is that if peak reflation is behind us it is likely that market discussions on peak policy rates in this cycle now start taking prominence. In the case of US, market price action recently seems to already be factoring in a lower than last cycle peak policy rate. We currently believe that this will likely be true in the Indian context as well.

Disclaimer: MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

The Disclosures of opinions/in house views/strategy incorporated herein is provided solely to enhance the transparency about the investment strategy / theme of the Scheme and should not be treated as endorsement of the views / opinions or as an investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document has been prepared on the basis of information, which is already available in publicly accessible media or developed through analysis of IDFC Mutual Fund. The information/ views / opinions provided is for informative purpose only and may have ceased to be current by the time it may reach the recipient, which should be taken into account before interpreting this document. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision and the security may or may not continue to form part of the scheme's portfolio in future. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. The decision of the Investment Manager may not always be profitable; as such decisions are based on the prevailing market conditions and the understanding of the Investment Manager. Actual market movements may vary from the anticipated trends. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alterations to this statement as may be required from time to time. Neither IDFC Mutual Fund / IDFC AMC Trustee Co. Ltd./ IDFC Asset Management Co. Ltd nor IDFC, its Directors or representatives shall be liable for any damages whether direct or indirect, incidental, punitive special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information.

June'21 GST revenues (collected in July'21) were higher than May'21 as economic activity picked up following the easing of state-wide restrictions. Based on the monthly PIB release, total GST collection was at INR 1,164bn in June'21 (INR 928bn for May'21 and INR 1,027bn for April'21).

India's CPI inflation was unchanged at 6.3% YoY in June, lower than expected (consensus: 6.6%), although still above the RBI's upper band (2-6%). Core CPI (CPI ex-food & beverages, fuel) inflation moderated more than expected to 6.1% YoY in June from 6.6% in May.

The FAO Food Price Index (which tracks changes in the international prices of the most globally traded food commodities) averaged 123.0 points in July 2021, 1.2 percent lower than the previous month. Industrial production (IP) growth fell to 29.3% YoY from 134.6% in April, marginally below expectations, with the YoY moderation also due to adverse base effects from last year (consensus: 32%).

The IMF maintained its 6% global growth forecast for 2021, upgrading outlook for the US and other wealthy economies but cutting estimates for developing countries which are still struggling with surging COVID infections. The IMF significantly raised its forecasts for the US to 7.0% in 2021 from 4.6% forecasted earlier and 4.9% in 2022 from an earlier estimate of 3.5%. On the other hand, India saw the biggest cut in its growth forecast from 12.5% to 9.5% for FY22 due to the virulent second COVID wave.

The FOMC in its July meeting maintained rates at the 0.00%-0.25% range. It said sectors impacted by pandemic have shown improvement but not fully recovered. In terms of the progress towards its goals (to assess whether 'substantial further progress' has been made), it said progress has been made and that it will continue to assess this in the coming meetings. It continued to think higher inflations seen now is transitory and not broad (although the magnitude and duration is uncertain), expects to see strong gains in the job market (as factors like child care, fear of Covid and UI benefits ease) and estimates economic impact of the delta variant could be limited, although it is watching it closely.

The MPC unanimously and expectedly kept the repo rate unchanged at 4% and continued with its accommodative stance albeit with a 5-1 dissent (Prof Jayanth Verma voted against the accommodative stance) for as long as necessary to revive growth on a durable basis keeping in view the inflation objective. The MPC restated that the nascent and hesitant recovery needs to be nurtured through fiscal, monetary and sectoral policy levers. Meanwhile, as a means of normalizing liquidity, RBI increased the quantum of variable reverse repo (VRRR) to INR 4tn from INR 2tn currently, although in a phased manner until September 24. Further, the RBI announced two more auctions of INR 250bn each to be conducted in August as the next tranche of the INR 1.2tn under G-SAP 2.0 and restated the continuation of OMOs and operation twists to manage the yield curve.

Outlook

The enhancement in VRRR to double its current amount is being undertaken gradually and with explicit guidance that this shouldn't be read as a reversal of the accommodative policy stance. The so-called GSAP program is now reintroducing 'on-the-run' bonds (benchmark 5 year has already been announced for the next GSAP auction) which is on the margin positive for market participants. However, possibly the dissent in stance as well as a higher than expected revision to CPI may be leading some market participants to fear that we are that much closer to step three in the unwind cycle. This is getting reflected most particularly in the rise in swap rates post policy. While the fears are somewhat understandable, we can't help but observe that market bias seems quite one way. Put another way, there seems to be extreme conviction that significant normalization is coming sooner rather than later despite what the RBI / MPC are saying. To clarify, it is quite logical to expect that the current emergency level of accommodation will expire soon. However, swap curves are pricing in not just an early exit from the current level of accommodation but also a fairly significant increase in overnight rates thereafter. Further, market is not fully considering the possibility that peak policy rates in this cycle may actually turn out to be lower than the last one. Not to extrapolate, but it may be noted that one way expectations with respect to US policy normalization have had serious cause for rethink over the past few weeks and months. Even in the Indian context given a relatively subdued fiscal response and with possibly a global peak on the reflation trade having been achieved, there is two-way risk to the above expectation even as RBI may have to move off the current emergency levels of overnight rate sometime soon (possibly first quarter of calendar 2022).

From investors standpoint, we would reiterate our previous observations.

► It isn't obvious that interest rate swaps are the best protection against future policy normalization given the sizeable rate hikes that they are already pricing and the fact that they don't get directly impacted by bond supply, which is the number one pressure point for Indian markets.

► Intermediate duration points (4 - 6 years) seem well positioned to benefit from carry plus roll down even in an environment of gently rising bond yields.

► Spreads on corporate bonds (including lower rated bonds) generally speaking for tenors beyond 3 - 4 years seem too shallow and such tenors are better played with sovereign assets.

► While some amount of 'bar-belling' may be prudent, the cost of holding cash is large and only makes sense if one wants to hedge against tail risks that may entail sharp and short period rises in yields. In particular, a 'business as usual' gentle rise in yields is not enough grounds to sit on large amounts of cash given the extraordinary steepness even at intermediate duration points.

An additional point, and a recent thought, as expressed above is that if peak reflation is behind us it is likely that market discussions on peak policy rates in this cycle now start taking prominence. In the case of US, market price action recently seems to already be factoring in a lower than last cycle peak policy rate. We currently believe that this will likely be true in the Indian context as well.

Disclaimer: MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

The Disclosures of opinions/in house views/strategy incorporated herein is provided solely to enhance the transparency about the investment strategy / theme of the Scheme and should not be treated as endorsement of the views / opinions or as an investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document has been prepared on the basis of information, which is already available in publicly accessible media or developed through analysis of IDFC Mutual Fund. The information/ views / opinions provided is for informative purpose only and may have ceased to be current by the time it may reach the recipient, which should be taken into account before interpreting this document. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision and the security may or may not continue to form part of the scheme's portfolio in future. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. The decision of the Investment Manager may not always be profitable; as such decisions are based on the prevailing market conditions and the understanding of the Investment Manager. Actual market movements may vary from the anticipated trends. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alterations to this statement as may be required from time to time. Neither IDFC Mutual Fund / IDFC AMC Trustee Co. Ltd./ IDFC Asset Management Co. Ltd nor IDFC, its Directors or representatives shall be liable for any damages whether direct or indirect, incidental, punitive special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information.