IDFC Asset Allocation Fund of Funds

An open ended fund of fund scheme investing in schemes of IDFC Mutual Fund - equity funds and debt funds excluding Gold ETF.

Category: Fund of Funds (Domestic)

: ₹ 8.66 Crores

: ₹ 8.66 Crores

AUM or assets under management refers to the recent / updated cumulative market value of investments managed by a mutual fund or any investment firm.

: ₹ 8.42 Crores

: ₹ 8.42 Crores

AUM or assets under management refers to the recent / updated cumulative market value of investments managed by a mutual fund or any investment firm.

:

:

An employee of the asset management company such as a mutual fund or life insurer, who manages investments of the scheme. He is usually part of a larger team of fund managers and research analysts.

| Total Expense Ratio | |

| Regular | 0.89% |

| Direct | 0.20% |

SIP (Minimum Amount): ₹ 1,000/-

SIP Frequency: Monthly

SIP Dates (Monthly): Investor may choose any day of the month except 29th, 30th and 31st as the date of instalment.

Investment Objective: Click here

Minimum Investment Amount : ₹ 5,000/- and any amount thereafter

Option Available: Growth, IDCW@ - (Payout, Reinvestment and Sweep)

:

:

Exit load is charged at the time an investor redeems the units of a mutual fund. The exit load is deducted from the prevailing NAV at the time of redemption. For instance, if the NAV is ₹ 100 and the exit load is 1%, the redemption price would be ₹ 99 per unit.

▸ Upto 10% of investment:Nil,

▸ For remaining investment: 1% of applicable NAV.

● If redeemed / switched out after 365 days from date of allotment: Nil. (w.e.f. May 08, 2020)

NAV (₹) as on November 30, 2021

| Regular Plan | Growth | 25.8211 |

| Regular Plan | IDCW@ | 16.1377 |

Category: Fund of Funds (Domestic)

: ₹ 18.94 Crores

: ₹ 18.94 Crores

AUM or assets under management refers to the recent / updated cumulative market value of investments managed by a mutual fund or any investment firm.

: ₹ 19.06 Crores

: ₹ 19.06 Crores

AUM or assets under management refers to the recent / updated cumulative market value of investments managed by a mutual fund or any investment firm.

:

:

An employee of the asset management company such as a mutual fund or life insurer, who manages investments of the scheme. He is usually part of a larger team of fund managers and research analysts.

| Total Expense Ratio | |

| Regular | 1.03% |

| Direct | 0.26% |

SIP (Minimum Amount): ₹ 1,000/-

SIP Frequency: Monthly

SIP Dates (Monthly): Investor may choose any day of the month except 29th, 30th and 31st as the date of instalment.

Investment Objective: Click here

Minimum Investment Amount : ₹ 5,000/- and any amount thereafter

Option Available: Growth, IDCW@ - (Payout, Reinvestment and Sweep)

:

:

Exit load is charged at the time an investor redeems the units of a mutual fund. The exit load is deducted from the prevailing NAV at the time of redemption. For instance, if the NAV is ₹ 100 and the exit load is 1%, the redemption price would be ₹ 99 per unit.

▸ Upto 10% of investment:Nil,

▸ For remaining investment: 1% of applicable NAV.

● If redeemed / switched out after 365 days from date of allotment: Nil. (w.e.f. May 08, 2020)

NAV (₹) as on November 30, 2021

| Regular Plan | Growth | 29.0204 |

| Regular Plan | IDCW@ | 18.9478 |

Category: Fund of Funds (Domestic)

: ₹ 18.59 Crores

: ₹ 18.59 Crores

AUM or assets under management refers to the recent / updated cumulative market value of investments managed by a mutual fund or any investment firm.

: ₹ 18.01 Crores

: ₹ 18.01 Crores

AUM or assets under management refers to the recent / updated cumulative market value of investments managed by a mutual fund or any investment firm.

:

:

An employee of the asset management company such as a mutual fund or life insurer, who manages investments of the scheme. He is usually part of a larger team of fund managers and research analysts.

| Expense Ratio | |

| Regular | 1.35% |

| Direct | 0.50% |

SIP (Minimum Amount): ₹ 1,000/-

SIP Frequency: Monthly

SIP Dates (Monthly): Investor may choose any day of the month except 29th, 30th and 31st as the date of instalment.

Investment Objective: Click here

Minimum Investment Amount : ₹ 5,000/- and any amount thereafter

Option Available: Growth, IDCW@ - (Payout, Reinvestment and Sweep)

:

:

Exit load is charged at the time an investor redeems the units of a mutual fund. The exit load is deducted from the prevailing NAV at the time of redemption. For instance, if the NAV is ₹ 100 and the exit load is 1%, the redemption price would be ₹ 99 per unit.

▸ Upto 10% of investment:Nil,

▸ For remaining investment: 1% of applicable NAV.

● If redeemed / switched out after 365 days from date of allotment: Nil. (w.e.f. May 08, 2020)

NAV (₹) as on November 30, 2021

| Regular Plan | Growth | 31.0520 |

| Regular Plan | IDCW@ | 20.6628 |

| Name | Conservative Plan | Moderate Plan | Aggressive Plan |

| TRI Party Repo Total | 1.24% | 5.44% | 3.04% |

| Clearing Corporation of India | 1.24% | 5.44% | 3.04% |

| Debt | 72.02% | 48.17% | 33.97% |

| IDFC Low Duration Fund | 49.33% | 14.07% | 15.49% |

| IDFC Bond Fund -Short Term Plan | 22.03% | 31.06% | 13.55% |

| IDFC Cash Fund | 0.66% | 3.03% | 4.94% |

| Equity | 27.69% | 46.64% | 63.40% |

| IDFC Focused Equity Fund | 6.68% | 8.11% | 8.98% |

| IDFC Large Cap Fund | 21.01% | 27.36% | 42.07% |

| IDFC Emerging Businesses Fund | - | 11.17% | 12.36% |

| Net Current Asset | -0.94% | -0.26% | -0.41% |

| Grand Total | 100.00% | 100.00% | 100.00% |

| Standard Allocation | % to net assets | ||

| Particulars | Conservative Plan | Moderate Plan | Aggressive Plan |

| Equity Funds (including Offshore equity) | 10-30% | 25-55% | 40-80% |

| Debt Funds and/or Arbitrage funds (including Liquid fund) | 35-90% | 10-75% | 0-40% |

| Alternate (including Gold/ Commodity based funds) | 0-30% | 0-30% | 0-30% |

| Debt and Money Market Securities | 0-5% | 0-5% | 0-5% |

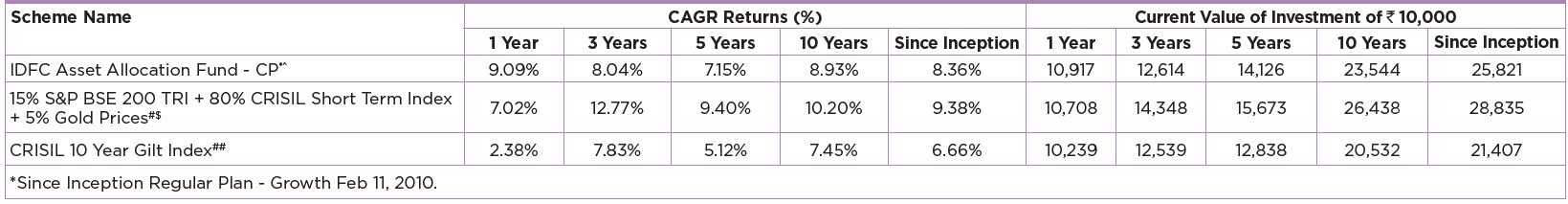

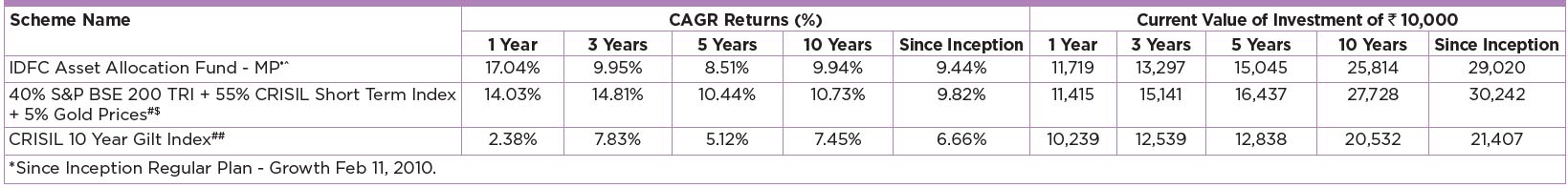

Performance based on NAV as on 30/11/2021. Past performance may or may not be sustained in future.

The performances given are of regular plan growth option.

Click here for other funds managed by the fund manager and refer to the respective fund pages

#Benchmark Returns. ##Alternate Benchmark Returns.

*Inception Date of Regular Plan - Growth Feb 11, 2010.

^The fund has been repositioned w.e.f. May 28, 2018 and since will invest only in the schemes of IDFC Mutual Funds.

$Current Index performance adjusted for the period from since inception to May 28, 2018 with the performance of CRISIL Hybrid 85+15 Conservative Index (Benchmark for IDFC Asset

Allocation Fund- Conservative Plan and IDFC Asset Allocation Fund- Moderate Plan) and CRISIL Hybrid 35+65 - Aggressive Index

(Benchmark for IDFC Asset Allocation Fund - Aggressive Plan).

IDFC Asset Allocation Fund - Conservative Plan

Scheme risk-o-meter

Investors understand that their principal will be at Moderately High risk

This product is suitable for investors who are seeking*

- To generate capital appreciation and income over long term.

- Investment in different IDFC Mutual Fund schemes based on a defined asset allocation model.

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Benchmark risk-o-meter

^^W.e.f. December 1, 2021, the benchmark of the scheme will change to CRISIL Hybrid 85+15 Conservative Index

IDFC Asset Allocation Fund - Moderate Plan

Scheme risk-o-meter

Investors understand that their principal will be at Moderately High risk

This product is suitable for investors who are seeking*

- To generate capital appreciation and income over long term.

- Investment in different IDFC Mutual Fund schemes based on a defined asset allocation model.

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Benchmark risk-o-meter

^^W.e.f. December 1, 2021, the benchmark of the scheme will change to NIFTY 50 Hybrid Composite debt 50:50 Index

IDFC Asset Allocation Fund - Aggressive Plan

Scheme risk-o-meter

Investors understand that their principal will be at High risk

This product is suitable for investors who are seeking*

- To generate capital appreciation and income over long term.

- Investment in different IDFC Mutual Fund schemes based on a defined asset allocation model.

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Benchmark risk-o-meter

^^W.e.f. December 1, 2021, the benchmark of the scheme will change to CRISIL Hybrid 35+65 Aggressive Index

Regular and Direct Plans have different expense structure. Direct Plan shall have a lower expense ratio excluding distribution expenses, commission expenses etc.