Commentary

GLOBAL MARKETS

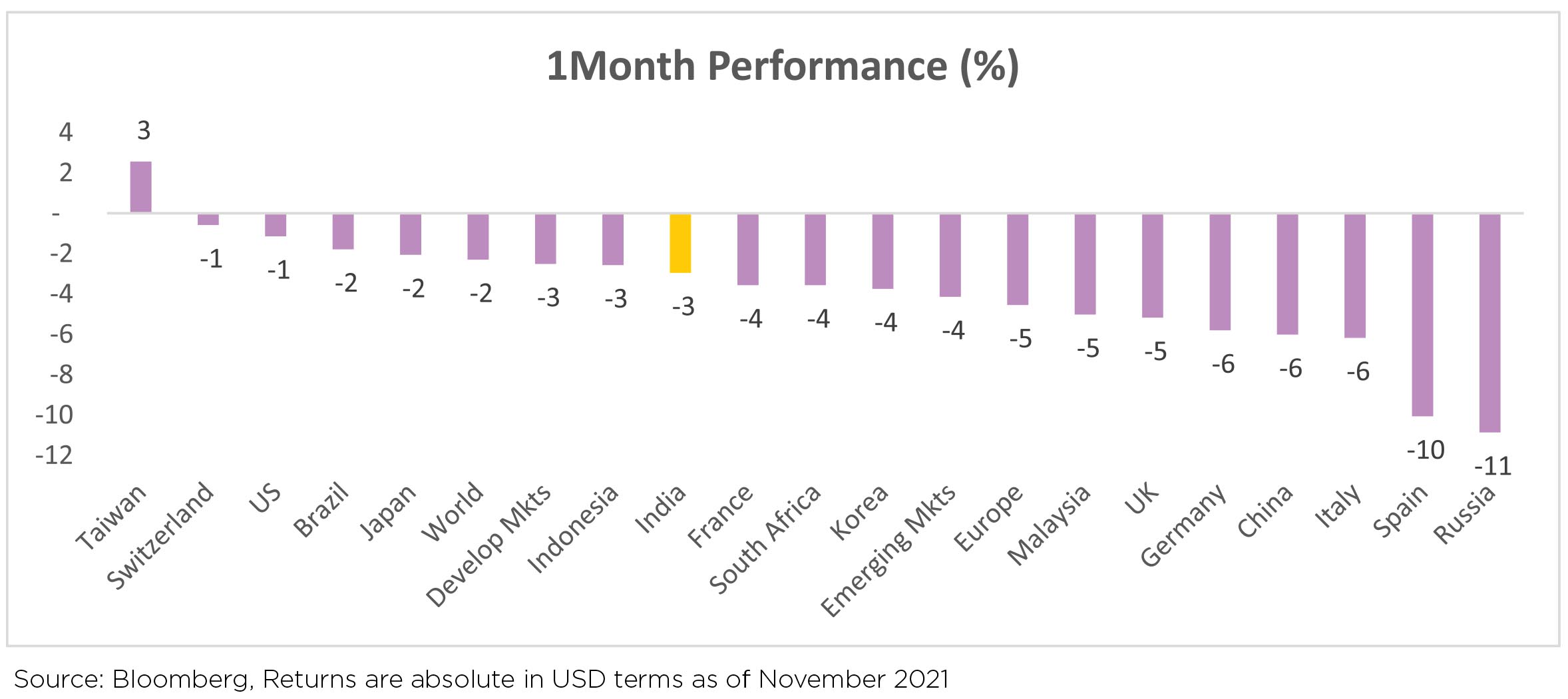

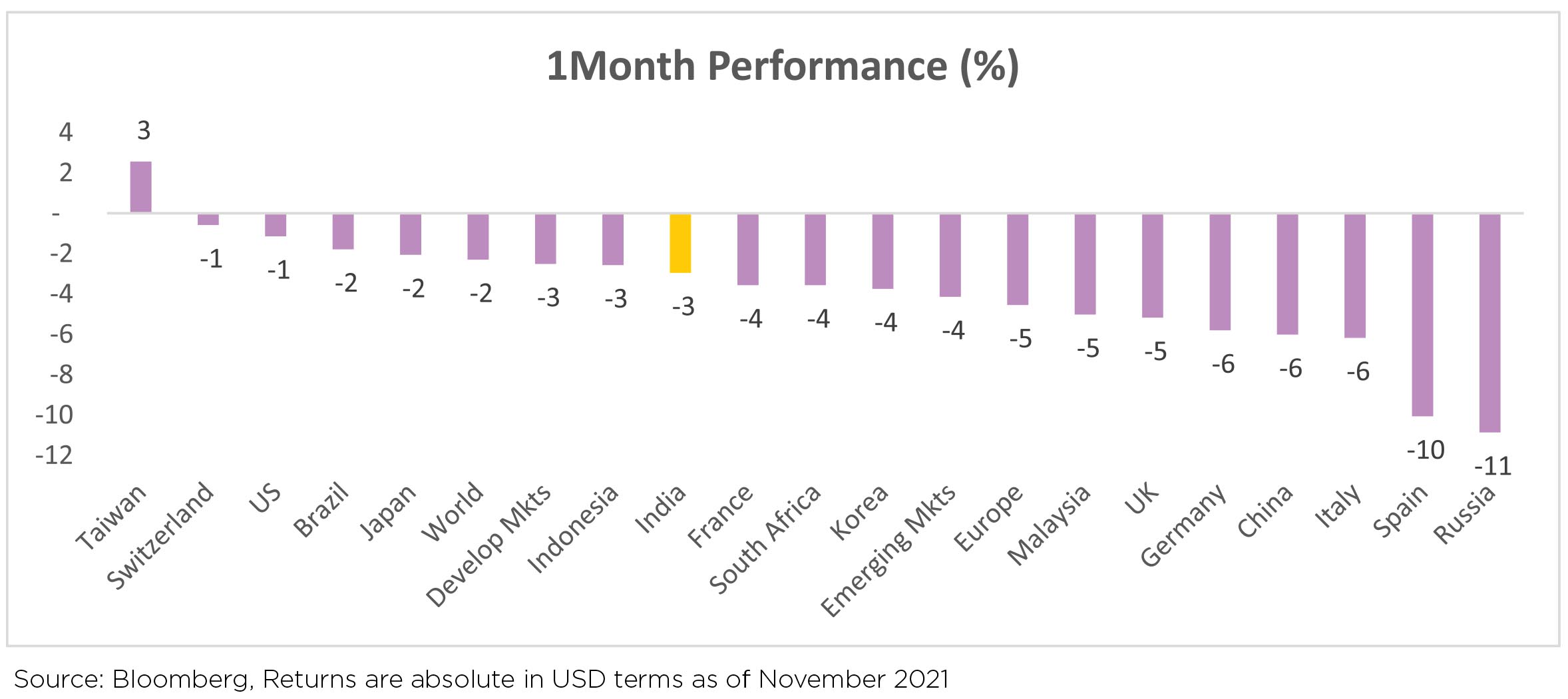

Global equities corrected by 2.5% in November led by uncertainty over the impact of new COVID-19 variant

Omicron. Supply-chain pressures are easing and likely to allow equities to continue to deliver strong

revenue growth and record margins. Even for the cohort that faces meaningful disruptions, we expect

these issues largely to abate by 2HFY22, resulting in delayed revenues rather than demand destruction.

The global expansion is in the midst of its first resiliency test, but we remain positive on growth. Looking

ahead, we continue to see market upside, though more moderate, on better-than-expected earnings

growth with supply shocks easing, China/EM backdrop improving and normalizing consumer spending

habits (e.g. spending broadening to services).

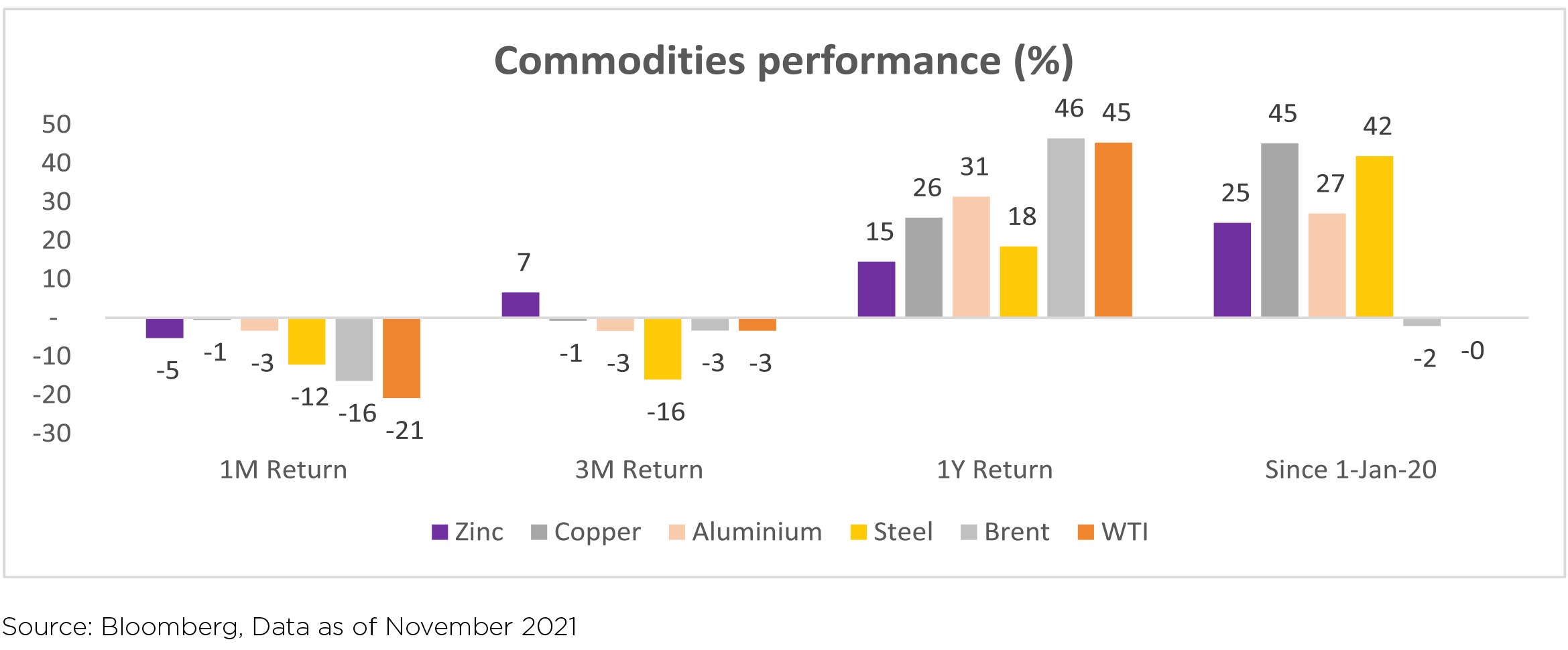

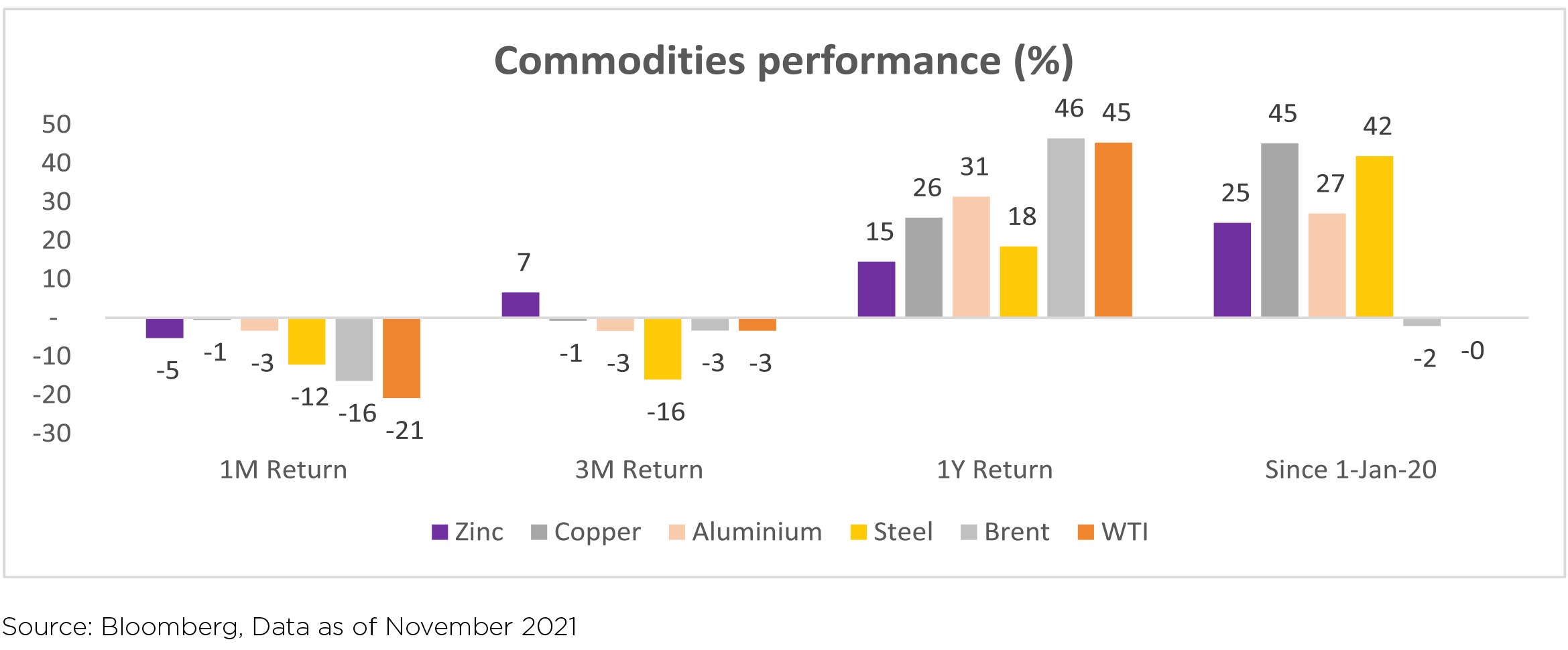

Brent and Commodities: Oil prices suffered a dip after two months of price rally, shedding 16.9% to near $70/barrel in November as an emerging, heavily mutated COVID variant in South Africa/Botswana sparked fears that renewed lockdowns and travel bans could hurt global demand. Going forward, the trend would largely depends on whether the initial fears around Omicron are realized. China retail steel stocks in warehouses fell to over 9 months low despite severe production cuts. HRC, Billet and Rebar prices fell by 5%, 2% and 2% respectively, following sharp fall in domestic met coke prices (down 24% MoM). Export HRC prices also fell 7.1% MoM.

Brent and Commodities: Oil prices suffered a dip after two months of price rally, shedding 16.9% to near $70/barrel in November as an emerging, heavily mutated COVID variant in South Africa/Botswana sparked fears that renewed lockdowns and travel bans could hurt global demand. Going forward, the trend would largely depends on whether the initial fears around Omicron are realized. China retail steel stocks in warehouses fell to over 9 months low despite severe production cuts. HRC, Billet and Rebar prices fell by 5%, 2% and 2% respectively, following sharp fall in domestic met coke prices (down 24% MoM). Export HRC prices also fell 7.1% MoM.

Domestic Markets

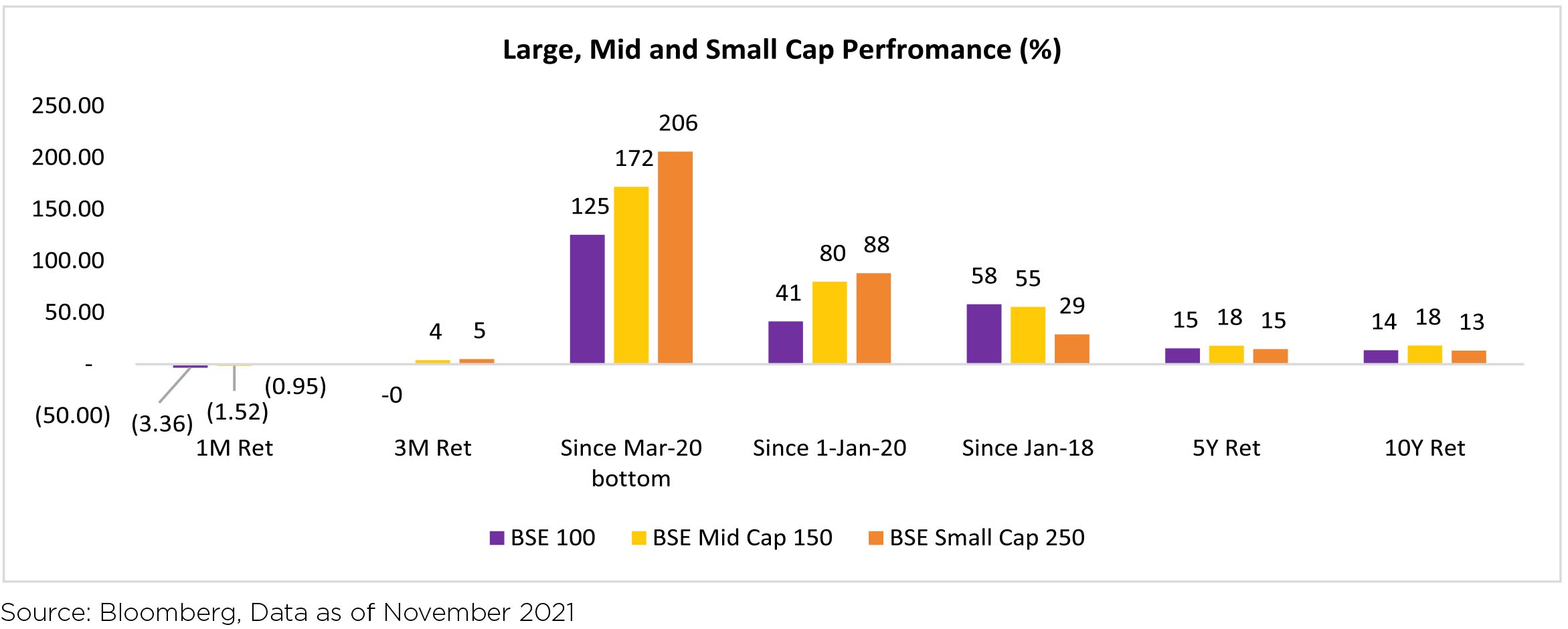

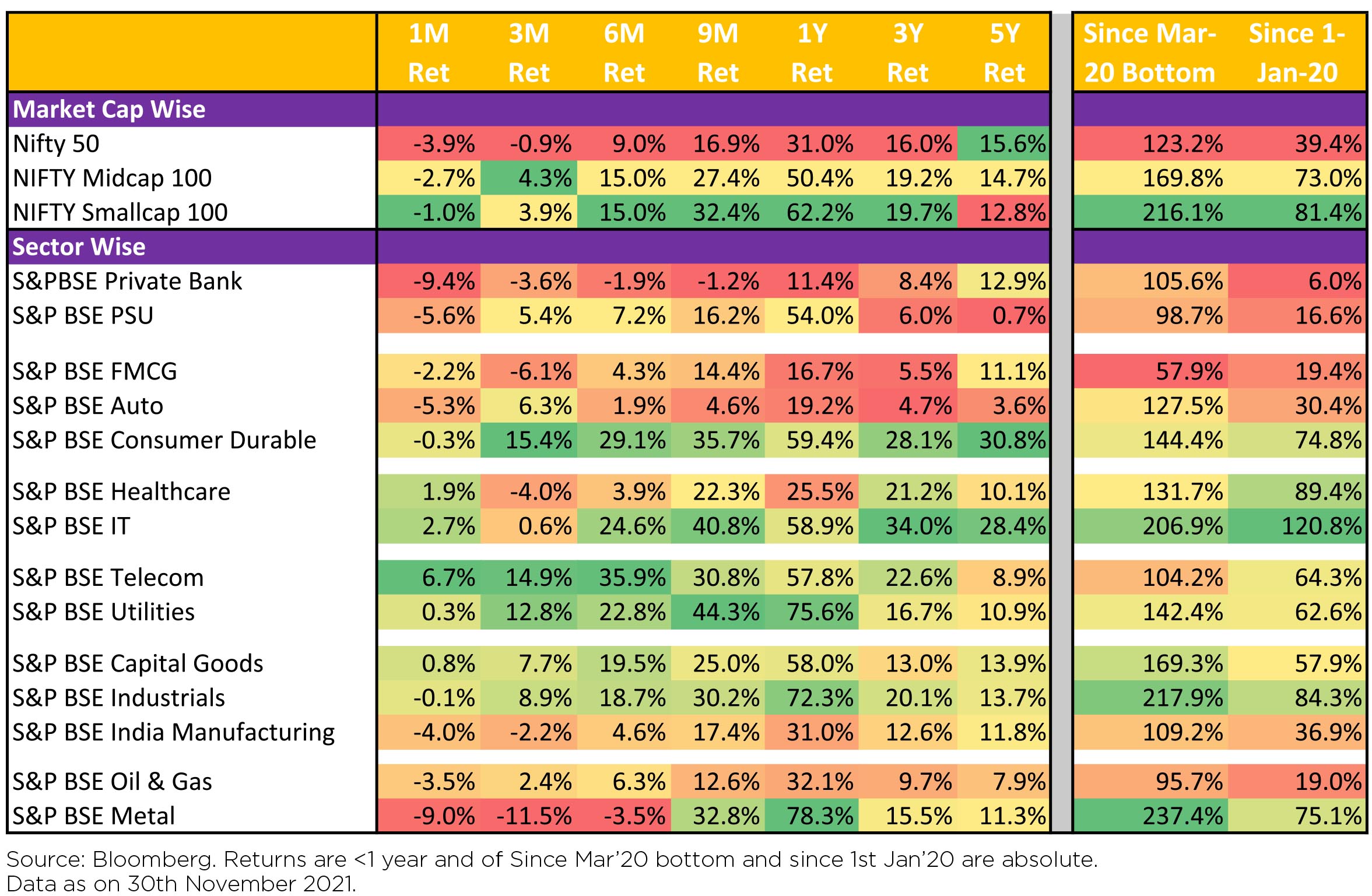

Indian equities fell by 3.1% (USD terms) but performed better than broader markets in November'21 - MSCI APxJ/EM (-4.4%/-4.1%). Indian markets corrected on uncertainty over the Omicron variant, with the NIFTY closing below 17,000 levels at month-end. However, on a FY YTD basis Indian equities are up 24%+, riding the global tide, supported by global liquidity. Strong fiscal support, decent macro prints, the big IPO rush and progressing vaccination drives have underpinned investor sentiment too.

Concerns of a third COVID-19 wave with new variant Omicron have increased too with fresh lockdowns in Europe and surging new infections in various countries. Even though the number of cases are lower in India, the Central govt. has asked states to tighten testing standards and limited resumption of international flights barring specific countries with major impact.

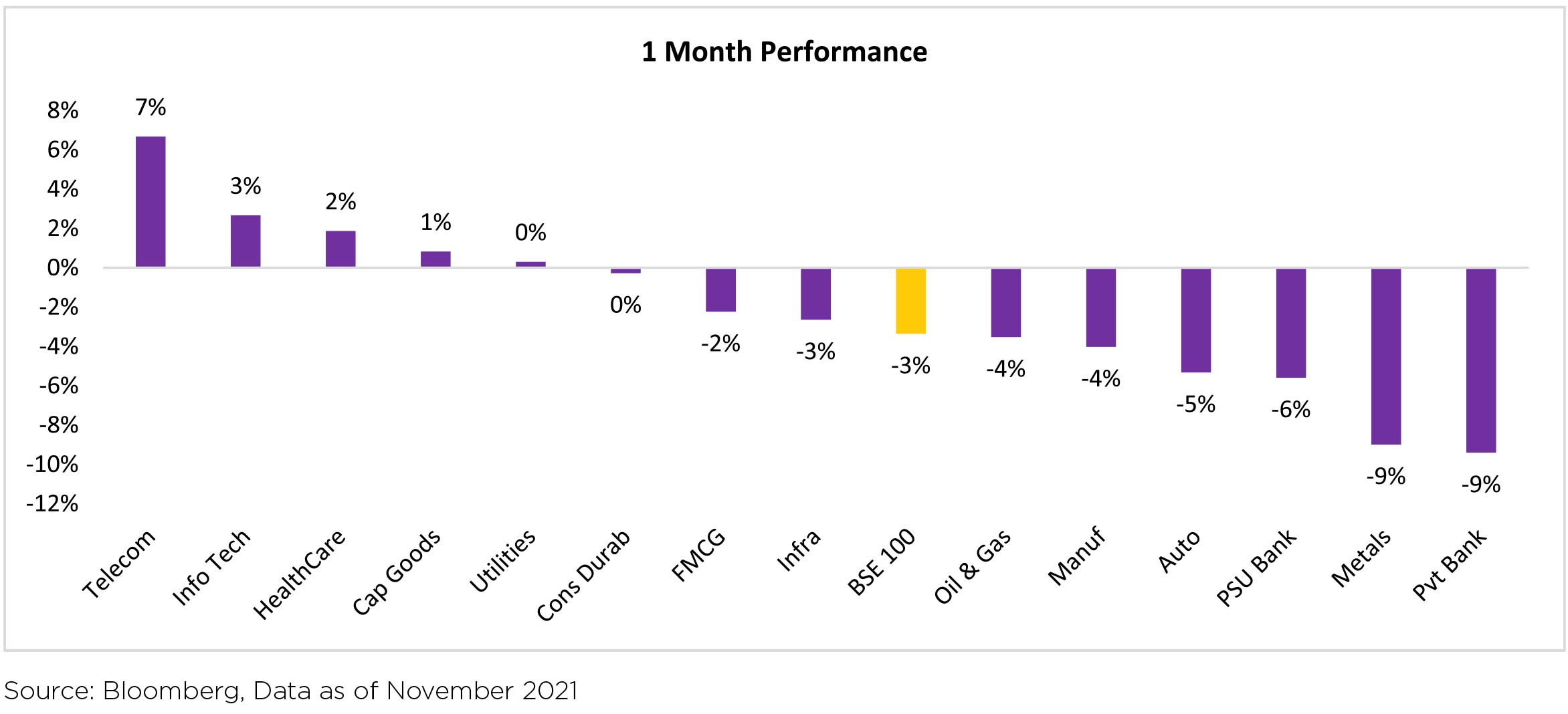

During the month of November, Mid-caps were down 3% YoY, in-line with Large caps. By sector, Utilities, Communication Services, Healthcare, IT and Industrials outperformed, while Financials, Material, Energy and Consumer Discretionary were notable laggards. INR ended at ~75.17/USD, down 0.4% however the DXY rose 2% over the month.

Macro prints have been mixed

• 2QFY22 GDP grew 29% QoQ after the second wave and has crossed the absolute pre-COVID GDP mark of Rs. 204tn and stood at Rs. 218tn.

• October's PMI report revealed no meaningful hit to industrial activity from supply-side issues, and marked a sharp jump in manufacturing firms' input prices in the month.

• CPI inflation gapped down to 4.5% in October.

• GST collections second highest since implementation and grew 24% YoY in October (Rs 1.3tn, from Rs 1.17tn in September).

September-quarter earnings strong on a YoY basis: The S&P BSE AllCAP index delivered 36% YoY growth in adjusted profits in 2QFY22, while ex-Energy/Materials growth showed a modest 15% YoY (Financials accounted for ~60% of this ex-commodity growth). September-quarter results indicates an increasing inflationary pressure and slowing sequential activity/ growth momentum as the tailwind from reopening and a low base fade.

2QFY22 earnings across Financials saw a seminal shift in underlying stock drivers with share prices in the quarter reacting finally to core operating profit numbers v/s asset quality (slippages), which was the primary share price driver over the past five years. For IT, revenue growth acceleration continues with returning margin defence and earnings beats, hiring momentum continues to meet demand, while growth confidence has risen in general.

Other updates:

► The Centre's fertiliser subsidy could reach up to Rs1.5lakh crore this fiscal, 89% higher than Budget estimates, after global prices touched a record on rising demand for the crop nutrients.

► The Farm Laws Repeal Bill, 2021 has been approved by the Union Cabinet as the government could not convince protesting farmers the benefits of these reforms.

► RBI accepts 21/33 recommendations made by Internal Working Group, the standout ones are increasing the cap on promoter stakes to 26% and no decision taken on allowing corporates in the banking sector.

► Govt to introduce new cryptocurrency bill seeking to ban private players whereby, the bill seeks to create a facilitative framework for creation of the official digital currency to be issued by the RBI.

► Assembly elections for 5 states which comprise ~20% of India's population and 14% of GDP are slated to take place over Feb-Mar'22 - UP, Punjab, Uttarakhand, Goa and Manipur.

Global uncertainty continues:

► Soaring inflationary pressure: President Biden puts the objective of controlling high inflation as a top priority for the administration since he believes that inflation is now hurting "Americans pocketbooks".

► Rising crude price, a concern: Global To tackle rising crude oil prices in light of limited supply from OPEC+, the US, along with China, India Japan, and Korea decided to increase oil supply in the market by releasing their strategic reserves. India has agreed to release 5 million barrels.

► Sign of recovery in China: China power supply crunch nearing end as state grid restores supply in many provinces.

► Turkey vows to continue reducing interest rate: The Turkish central bank further cut its policy rate by 100 bps to 15% even as the Lira continued to tumble. The central bank also hinted that it would continue with the loose policy with another rate cut expected in December, even as inflation remains high at 20%, adding more pressure on the Lira.

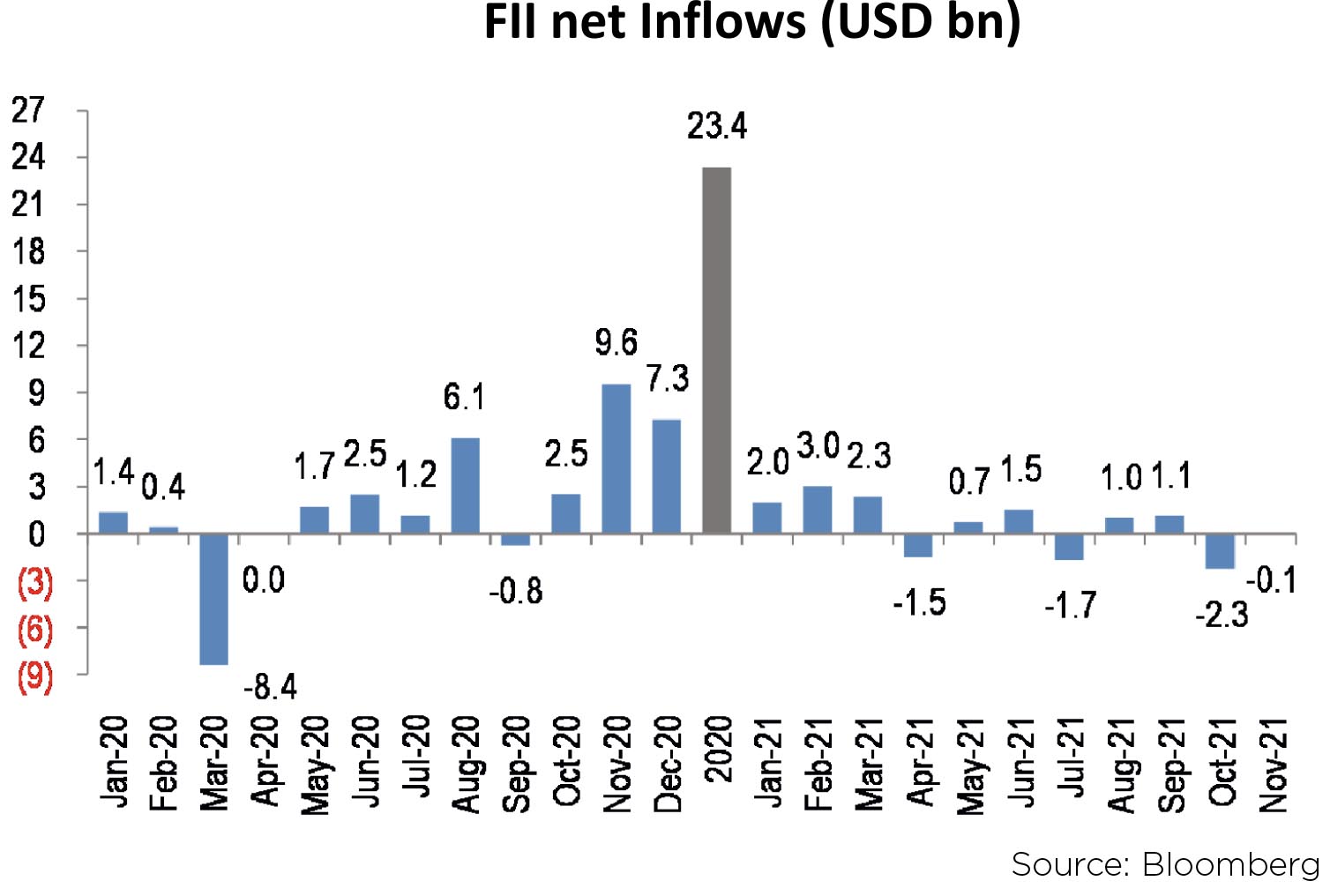

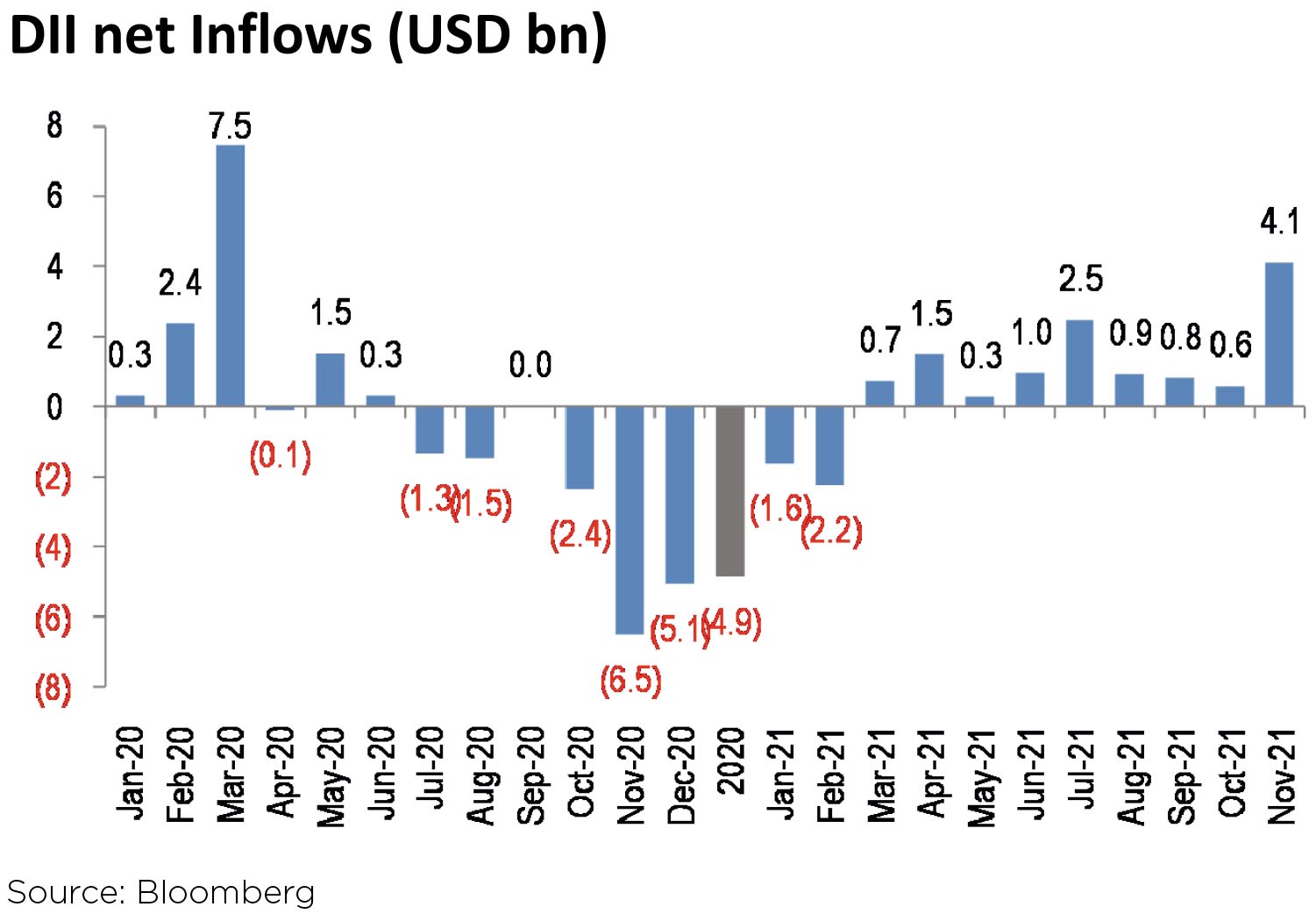

Institutional flows: FIIs turned to be net sellers of Indian equities again (-$58mn, following -$2.3bn in October). Q1CY21 saw $7.3bn of inflows, while Q2CY21 and Q3 CY21 ended at a modest $758mn and $446mn of net buying. FIIs turned net buyers in the debt markets, coming back from selloff in October, with inflows of US$103mn in November.

DIIs remained massive net equity buyers for the ninth month running (+$4.1bn, vs +$597mn in October). Mutual funds were net equity buyers at US$1.8bn while insurance funds net brought US$2.3bn of equities in November.

Market Performance

Outlook

In the recent monetary policy, the RBI maintained its stance as accommodative and kept the policy rate unchanged. On the back of surplus liquidity condition, given the usage of the MSF window has been rare, the RBI has already started the normalisation of the monetary policy towards the road to economic recovery. Additionally, the RBI maintained its GDP as well as Inflation target for FY22 at 9.5% and 5.3% respectively. What it means for the equity market? One, interest rates have bottomed out and the surplus liquidity sloshing in the system would be coming down. Two, it would mean that bond yields would start going up and the yield curve would flatten which would be negative for businesses that borrow at the shorter end of the yield curve and lend at the longer end of the yield curve i.e. negative for wholesale franchises, life insurance companies etc. Three, the equity market should still be fine as we have seen in the previous rate hike cycles of 2005-06, 2009-10 and 2015-16, the first 12-15 months of the rate hike cycle is good for the equity market.

Earnings Update:

Q2 FY22 results ended on a strong note. Aggregate profit of S&P BSE 200 companies touched over Rs.2.19 Lakh cr, higher than the previous peak of Mar'21 quarter (Rs.2.13 Lakh cr). The cycle of upgrades continued (fifth consecutive quarter of upgrades for two-year forward earnings). However, the breadth of upgrade/downgrade cycle reduced, reflecting rising cost pressure across most industries. Banks, Automobiles, Telecom, Oil & Gas are some of the sectors where earnings are forecasted to show strength/ sustain going forward. EBIDTA Margin, after peaking last year, reflected the rising cost pressures. Some help on this front, could be provided by the recent push back on shipping freight front/ falling crude oil prices and some pull back across select commodities. At least the pace of increase registered in Jan- June 2021 appears to be more moderate (Refer our Equity Market Earnings Review - Q2FY22: The first "real" correction of this bull market was registered over the last few weeks. While at the index level, this may not have registered the same depth as on an individual stock level, it did leave a bad taste. Any correction could get accentuated in the short term by the nature of the Omicron variant -deadlier; more transmissible etc. As a matter of precaution, already several countries have imposed travel restrictions. More importantly, the US Fed Chairman in his latest testament in the US Senate has finally dropped "transitory" to describe the nature of price inflation registered over the last few months. Unless, the printed CPI/PCE inflation drops off magically, a rate hike from the US Fed gathers higher probability in CY22. The US Fed, like many other Central bankers, appears to be "behind the curve". Brace yourself for a choppier CY22 - India has the added worry of state elections. Hopefully, the earnings estimate for FY22 and 23 maintain the path of surprise, as has been the case till now.

Note: The above charts & tables are for representation purposes only and should not be used for the development or implementation of an investment strategy. Past performance may or may not be sustained in the future.

WHAT WENT BY

Taking cues from global markets, where the expectations of a faster tapering by US Fed, discovery of new Covid

variant Omicron and falling crude oil prices were the major triggers last month, the 10-year Gsec bond yields

declined 6bps to end the month at 6.33%. With RBI absorbing the bulk of system liquidity via the so called variable

rate reverse repo (VRRR) facility, the short term rates have moved up. 1 year Gsec yield has moved up by 15bps last

month, to end November'21 at 4.26%.

In the December monetary policy review, the RBI / MPC kept all rates unchanged while the stance was retained as accommodative as well with the same earlier 5:1 vote. The decision was in line with majority expectations even as front end swap rates had been indicating expectation of some hike in reverse repo. The commentary recognized that domestic recovery is gaining traction but recognized that since activity levels are just about catching up with prepandemic levels, "it will have to be assiduously nurtured by conducive policy settings till it takes root and becomes self-sustaining". In particular, the MPC seemed to be looking for a private investment recovery to lead the revival along with a strong impetus from exports. Private consumption, though posting a strong recovery in Q2 FY22, remains below pre-pandemic levels and there are risks from global spillovers, Omicron, persistence shortages and bottlenecks, and "the widening divergences in policy actions and stances across the world as inflationary pressures persist". The balance of these assessments led to RBI keeping the growth forecast unchanged and for the MPC to retain its accommodative stance.

On inflation, while the usual risks were recognized, the full year forecast itself wasn't changed. This was contrary to market (and our own) expectation which is giving more weight to recent developments like the spike in food prices (not just vegetables), telecom tariff hikes, and incomplete pass through in electricity and LPG prices. RBI / MPC instead are relying on the cushions provided by the anticipated fall ahead in vegetable prices, good Rabi sowing, recent supply side measures from government on edible oil prices as well as the decision to cut taxes on fuel products, and firms lesser capacity to pass through owing to slack in the economy as mitigating factors that will still keep their previously assessed CPI trajectory unchanged.

India's September quarter real GDP grew by 8.4% y/y, driven by private consumption at 8.6% and private investment at 11% while the drag from net exports increased. Although government consumption grew by 8.7% y/y, it continued to be negative for the second quarter at -3.5% q/q on a seasonally adjusted basis. Real GVA grew by 12.4% q/q, with the rebound in services being the major driver. Thus, q/q growth in core-real-GVA (headline GVA excluding agriculture, public administration, defence and other services) was 16.1% after -19% in the June quarter.

Consumer Price Index (CPI) inflation was 4.5% y/y in October, down from 6.3% in May but up from 4.3% in September. However, sequential momentum in both food and core baskets (latter defined as headline CPI excluding food and beverages, fuel and light) picked up. Core inflation was at 6.1% y/y in October, after 5.8% in August and September, and it has remained sticky at an average of 5.9% since April 2021.

Central government tax revenue collected in October continued to be robust, while expenditure eased. During April to October 2021, net tax revenue was 68% of FY22BE (vs. 50% of actuals each in FY19 and FY20) while total expenditure was 52% of FY22BE (vs. 63% and 62% of actuals in FY19 and FY20 respectively). Thus, fiscal deficit during April-October 2021 was 36% of FY22BE (vs. 100% and 77% of actuals in FY19 and FY20 respectively). Small savings collection during April-October was Rs. 20,621cr higher than that during the same period last year. GST collection during November was the second highest ever at Rs. 1.32 lakh crore and 25.3% y/y. Separately, the central government recently sought parliament approval through the second batch of supplementary demands for grants for net additional spending of Rs. 3 lakh crore in FY22 for additional fertiliser subsidies, pending export incentives, repayment of Air India's liabilities, additional MGNREGA expenditure, various schemes of food storage & warehousing, etc.

Industrial production (IP) growth for September was 3.1% y/y (12% in August) and -2.8% on a m/m seasonally adjusted (-0.7% in August). Output in all use-based classifications (primary, capital, intermediate, infra & construction, consumer durable and consumer non-durable goods) turned negative month-on-month. October Infrastructure Industries output (40% weight in IP) was up 7.5% y/y and 2.3% m/m seasonally adjusted, with output of crude oil and natural gas falling sequentially while that of coal, cement and electricity turned positive.

Bank credit outstanding as on 19th November was up 7% y/y, close to the 7.1% for the fortnight ending 5th November but up from the average of 6.2% for all the fortnights during April-October 2021. By sector, bank credit flow during October to services turned strongly positive and improved for personal loans & industries. During April-October 2021, overall bank credit flow was negative to industries and services, while it was positive for agriculture and personal loans.

Merchandise trade deficit for November registered an all-time high of USD 23.3bn, above USD 22.6bn in September and USD 19.7bn in October, as the sequential fall in exports was higher than that in imports. Both oil and non-oil trade deficits increased sequentially. Non-oil-non-gold imports fell by USD 1.6bn m/m, after picking up by USD 7.2bn cumulatively in the previous two months.

Among high-frequency variables, motor vehicles registered sequentially picked up since mid-October but primarily driven by two wheelers. Some mobility indicators have flattened a bit after picking up till mid-November while GST e-way bills generated moderated in November from the high in October, both likely also due to the end of the festive season. Energy consumption level has improved a bit from its low in early-November.

In China, in line with the issues faced in the real estate sector, y/y growth in property prices, floor space under construction and floor space sold fell further in October. The PBoC deleted a few key phrases from its Q3 monetary policy report and also cut the Reserve Requirement Ratio (RRR) by 50bps, both of which suggested incrementally mildly-easier policy. In the US, October CPI was high at 6.2% y/y and core CPI was at 4.6%, with price of most of the major components moving up. The Federal Open Market Committee (FOMC) in its early-November meeting had announced the start of a moderation in the pace (taper) of its asset purchases. Following this, Fed Chair Jerome Powell in his testimony before the Committee on Banking on 30th November said a) the risk of more persistent inflation has clearly risen, b) a long expansion and price stability is needed to get back to a strong labour market like before and c) it is appropriate to consider ending the taper a few months sooner and will be discussed at the FOMC's upcoming December meeting. US non-farm payroll addition in November was only 210,000 persons (down from 546,000 persons in October) but unemployment rate fell to 4.2% (from 4.6% in October) and m/m growth in average weekly earnings picked up.

Central banks have been focused on a point pre-pandemic that the economy needs to re-attain and then grow beyond. This thought has been apparent in the US Fed's commentary on labor markets as well as RBI / MPC commentary in the recently concluded policy. However, what matters from a macro-stability context is also the speed of travel to that point. This is especially true as the supply side is nowhere near what it used to be. Thus impatience towards attainment of the pre-pandemic state may be fraught with significant risks, and has potential to render the environment more volatile which, ironically, can further delay the attainment of the said state. The Fed seems to have recognized this which is apparent in the 'variable switch' that it has recently executed. Thus from a de-facto labor market targetter till recently (believing from the pre-Covid experience that inflation won't be a bother till that state of labor market was achieved) the Fed has now understood that the path to that labor market may take longer and needs stable prices in the meanwhile. This implies that the variable of importance is now inflation basis a recognition that the speed of travel matters especially when the underlying supply side may not be as the Fed initially thought.

To be clear, and as we have highlighted before, the extent of disequilibrium in India is nowhere near what it is in the US. This is because both monetary and fiscal loosening were well calibrated and therefore largely avoided the risk of near term overheating. However, that is not to say that the framework as described above is irrelevant to India. Speed of travel (recovery) has picked up for India as well. Furthermore, there is evidence for now that supply side may be struggling to keep up. This is seen in core CPI as well as a more tried and tested concurrent indicator, the trade account. Further, a very conservative fiscal dynamic year to date is potentially set to turn as recent developments point to bunched up spending by the government (net spending of the order of almost INR 3 lakh crores basis the latest supplementary grant).

All told, and given the current emergency levels of overnight rate at 3.35%, RBI doesn't need a full all clear to start to lift this rate. Monetary policy will still be accommodative long after the overnight rate starts to go up. If our view that RBI may be too sanguine on inflation turns out to be correct, and when looked at in conjunction with the recent pick up in trade deficit and the anticipated government spending lined up as described above, the start of reverse repo rate hikes in February may well lose the opportunity to be on top of the narrative. CPI targeting in India is still not very old, and the mere fact that RBI is a CPI targetter may not be enough to continue to anchor expectations if reaffirming actions are missing.

From a bond market perspective, volatility in money market rates will likely continue as RBI moves to further expand the VRRR program as flagged in the policy. This reaffirms our long preferred bar-belling approach to risk management in this environment. For the bond curve more generally, a point of anchor has been the relatively subdued state development loan (SDL) supply so far. This is most likely expected to change in Q4 even assuming a very conservative fiscal stance by states. Also if one were to take the comments on marginally higher than expected central government fiscal deficit at face value, it implies either very aggressive cash drawdowns / treasury bill supplies or some risk that some part of the back to back borrowing for GST compensation to states comes back (it will be recalled the central government has so far subsumed this into its own borrowing calendar, thereby effectively borrowing much lesser than budgeted for itself), possibly in the Q4 calendar.

Disclaimer: MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

The Disclosures of opinions/in house views/strategy incorporated herein is provided solely to enhance the transparency about the investment strategy / theme of the Scheme and should not be treated as endorsement of the views / opinions or as an investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document has been prepared on the basis of information, which is already available in publicly accessible media or developed through analysis of IDFC Mutual Fund. The information/ views / opinions provided is for informative purpose only and may have ceased to be current by the time it may reach the recipient, which should be taken into account before interpreting this document. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision and the security may or may not continue to form part of the scheme's portfolio in future. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. The decision of the Investment Manager may not always be profitable; as such decisions are based on the prevailing market conditions and the understanding of the Investment Manager. Actual market movements may vary from the anticipated trends. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alterations to this statement as may be required from time to time. Neither IDFC Mutual Fund / IDFC AMC Trustee Co. Ltd./ IDFC Asset Management Co. Ltd nor IDFC, its Directors or representatives shall be liable for any damages whether direct or indirect, incidental, punitive special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information.

In the December monetary policy review, the RBI / MPC kept all rates unchanged while the stance was retained as accommodative as well with the same earlier 5:1 vote. The decision was in line with majority expectations even as front end swap rates had been indicating expectation of some hike in reverse repo. The commentary recognized that domestic recovery is gaining traction but recognized that since activity levels are just about catching up with prepandemic levels, "it will have to be assiduously nurtured by conducive policy settings till it takes root and becomes self-sustaining". In particular, the MPC seemed to be looking for a private investment recovery to lead the revival along with a strong impetus from exports. Private consumption, though posting a strong recovery in Q2 FY22, remains below pre-pandemic levels and there are risks from global spillovers, Omicron, persistence shortages and bottlenecks, and "the widening divergences in policy actions and stances across the world as inflationary pressures persist". The balance of these assessments led to RBI keeping the growth forecast unchanged and for the MPC to retain its accommodative stance.

On inflation, while the usual risks were recognized, the full year forecast itself wasn't changed. This was contrary to market (and our own) expectation which is giving more weight to recent developments like the spike in food prices (not just vegetables), telecom tariff hikes, and incomplete pass through in electricity and LPG prices. RBI / MPC instead are relying on the cushions provided by the anticipated fall ahead in vegetable prices, good Rabi sowing, recent supply side measures from government on edible oil prices as well as the decision to cut taxes on fuel products, and firms lesser capacity to pass through owing to slack in the economy as mitigating factors that will still keep their previously assessed CPI trajectory unchanged.

India's September quarter real GDP grew by 8.4% y/y, driven by private consumption at 8.6% and private investment at 11% while the drag from net exports increased. Although government consumption grew by 8.7% y/y, it continued to be negative for the second quarter at -3.5% q/q on a seasonally adjusted basis. Real GVA grew by 12.4% q/q, with the rebound in services being the major driver. Thus, q/q growth in core-real-GVA (headline GVA excluding agriculture, public administration, defence and other services) was 16.1% after -19% in the June quarter.

Consumer Price Index (CPI) inflation was 4.5% y/y in October, down from 6.3% in May but up from 4.3% in September. However, sequential momentum in both food and core baskets (latter defined as headline CPI excluding food and beverages, fuel and light) picked up. Core inflation was at 6.1% y/y in October, after 5.8% in August and September, and it has remained sticky at an average of 5.9% since April 2021.

Central government tax revenue collected in October continued to be robust, while expenditure eased. During April to October 2021, net tax revenue was 68% of FY22BE (vs. 50% of actuals each in FY19 and FY20) while total expenditure was 52% of FY22BE (vs. 63% and 62% of actuals in FY19 and FY20 respectively). Thus, fiscal deficit during April-October 2021 was 36% of FY22BE (vs. 100% and 77% of actuals in FY19 and FY20 respectively). Small savings collection during April-October was Rs. 20,621cr higher than that during the same period last year. GST collection during November was the second highest ever at Rs. 1.32 lakh crore and 25.3% y/y. Separately, the central government recently sought parliament approval through the second batch of supplementary demands for grants for net additional spending of Rs. 3 lakh crore in FY22 for additional fertiliser subsidies, pending export incentives, repayment of Air India's liabilities, additional MGNREGA expenditure, various schemes of food storage & warehousing, etc.

Industrial production (IP) growth for September was 3.1% y/y (12% in August) and -2.8% on a m/m seasonally adjusted (-0.7% in August). Output in all use-based classifications (primary, capital, intermediate, infra & construction, consumer durable and consumer non-durable goods) turned negative month-on-month. October Infrastructure Industries output (40% weight in IP) was up 7.5% y/y and 2.3% m/m seasonally adjusted, with output of crude oil and natural gas falling sequentially while that of coal, cement and electricity turned positive.

Bank credit outstanding as on 19th November was up 7% y/y, close to the 7.1% for the fortnight ending 5th November but up from the average of 6.2% for all the fortnights during April-October 2021. By sector, bank credit flow during October to services turned strongly positive and improved for personal loans & industries. During April-October 2021, overall bank credit flow was negative to industries and services, while it was positive for agriculture and personal loans.

Merchandise trade deficit for November registered an all-time high of USD 23.3bn, above USD 22.6bn in September and USD 19.7bn in October, as the sequential fall in exports was higher than that in imports. Both oil and non-oil trade deficits increased sequentially. Non-oil-non-gold imports fell by USD 1.6bn m/m, after picking up by USD 7.2bn cumulatively in the previous two months.

Among high-frequency variables, motor vehicles registered sequentially picked up since mid-October but primarily driven by two wheelers. Some mobility indicators have flattened a bit after picking up till mid-November while GST e-way bills generated moderated in November from the high in October, both likely also due to the end of the festive season. Energy consumption level has improved a bit from its low in early-November.

In China, in line with the issues faced in the real estate sector, y/y growth in property prices, floor space under construction and floor space sold fell further in October. The PBoC deleted a few key phrases from its Q3 monetary policy report and also cut the Reserve Requirement Ratio (RRR) by 50bps, both of which suggested incrementally mildly-easier policy. In the US, October CPI was high at 6.2% y/y and core CPI was at 4.6%, with price of most of the major components moving up. The Federal Open Market Committee (FOMC) in its early-November meeting had announced the start of a moderation in the pace (taper) of its asset purchases. Following this, Fed Chair Jerome Powell in his testimony before the Committee on Banking on 30th November said a) the risk of more persistent inflation has clearly risen, b) a long expansion and price stability is needed to get back to a strong labour market like before and c) it is appropriate to consider ending the taper a few months sooner and will be discussed at the FOMC's upcoming December meeting. US non-farm payroll addition in November was only 210,000 persons (down from 546,000 persons in October) but unemployment rate fell to 4.2% (from 4.6% in October) and m/m growth in average weekly earnings picked up.

Outlook

Central banks have been focused on a point pre-pandemic that the economy needs to re-attain and then grow beyond. This thought has been apparent in the US Fed's commentary on labor markets as well as RBI / MPC commentary in the recently concluded policy. However, what matters from a macro-stability context is also the speed of travel to that point. This is especially true as the supply side is nowhere near what it used to be. Thus impatience towards attainment of the pre-pandemic state may be fraught with significant risks, and has potential to render the environment more volatile which, ironically, can further delay the attainment of the said state. The Fed seems to have recognized this which is apparent in the 'variable switch' that it has recently executed. Thus from a de-facto labor market targetter till recently (believing from the pre-Covid experience that inflation won't be a bother till that state of labor market was achieved) the Fed has now understood that the path to that labor market may take longer and needs stable prices in the meanwhile. This implies that the variable of importance is now inflation basis a recognition that the speed of travel matters especially when the underlying supply side may not be as the Fed initially thought.

To be clear, and as we have highlighted before, the extent of disequilibrium in India is nowhere near what it is in the US. This is because both monetary and fiscal loosening were well calibrated and therefore largely avoided the risk of near term overheating. However, that is not to say that the framework as described above is irrelevant to India. Speed of travel (recovery) has picked up for India as well. Furthermore, there is evidence for now that supply side may be struggling to keep up. This is seen in core CPI as well as a more tried and tested concurrent indicator, the trade account. Further, a very conservative fiscal dynamic year to date is potentially set to turn as recent developments point to bunched up spending by the government (net spending of the order of almost INR 3 lakh crores basis the latest supplementary grant).

All told, and given the current emergency levels of overnight rate at 3.35%, RBI doesn't need a full all clear to start to lift this rate. Monetary policy will still be accommodative long after the overnight rate starts to go up. If our view that RBI may be too sanguine on inflation turns out to be correct, and when looked at in conjunction with the recent pick up in trade deficit and the anticipated government spending lined up as described above, the start of reverse repo rate hikes in February may well lose the opportunity to be on top of the narrative. CPI targeting in India is still not very old, and the mere fact that RBI is a CPI targetter may not be enough to continue to anchor expectations if reaffirming actions are missing.

From a bond market perspective, volatility in money market rates will likely continue as RBI moves to further expand the VRRR program as flagged in the policy. This reaffirms our long preferred bar-belling approach to risk management in this environment. For the bond curve more generally, a point of anchor has been the relatively subdued state development loan (SDL) supply so far. This is most likely expected to change in Q4 even assuming a very conservative fiscal stance by states. Also if one were to take the comments on marginally higher than expected central government fiscal deficit at face value, it implies either very aggressive cash drawdowns / treasury bill supplies or some risk that some part of the back to back borrowing for GST compensation to states comes back (it will be recalled the central government has so far subsumed this into its own borrowing calendar, thereby effectively borrowing much lesser than budgeted for itself), possibly in the Q4 calendar.

Disclaimer: MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

The Disclosures of opinions/in house views/strategy incorporated herein is provided solely to enhance the transparency about the investment strategy / theme of the Scheme and should not be treated as endorsement of the views / opinions or as an investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document has been prepared on the basis of information, which is already available in publicly accessible media or developed through analysis of IDFC Mutual Fund. The information/ views / opinions provided is for informative purpose only and may have ceased to be current by the time it may reach the recipient, which should be taken into account before interpreting this document. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision and the security may or may not continue to form part of the scheme's portfolio in future. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. The decision of the Investment Manager may not always be profitable; as such decisions are based on the prevailing market conditions and the understanding of the Investment Manager. Actual market movements may vary from the anticipated trends. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alterations to this statement as may be required from time to time. Neither IDFC Mutual Fund / IDFC AMC Trustee Co. Ltd./ IDFC Asset Management Co. Ltd nor IDFC, its Directors or representatives shall be liable for any damages whether direct or indirect, incidental, punitive special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information.