Commentary

31st January 2021

WHAT WENT BY

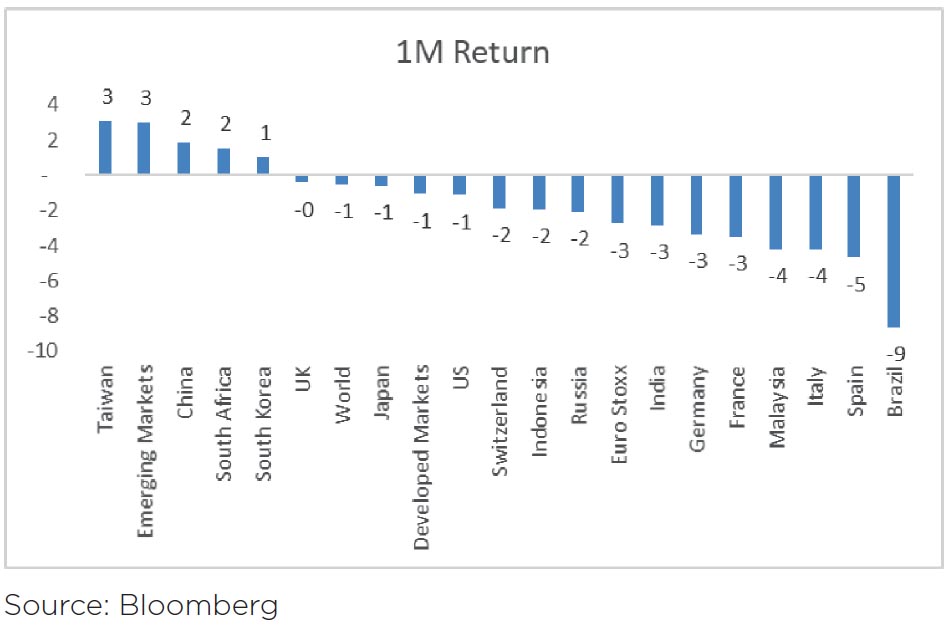

Global equities traded higher during the first

3 weeks of the month but saw sharp decline

in the last week with MSCI ACWI ending the

month down 0.5% in January. This follows

strong returns in the previous two months

with December (+4.5%) and November

(+12.2%). European equities (SXXP -1.6%)

underperformed relative to their US peers

(SPX -1.1%) in January led by a weaker EUR

(-0.7%). VIX index was up 45% MoM to end

the month at 33.09 following an 11% gain in

December. Global growth outlook remains

for a modest Q1 slowdown to below-trend

due to the virus and lockdowns, but a sharp

acceleration from Q2 as economies reopen

and vaccines are deployed.

Covid-19 & Vaccine: Globally, daily cases have come down sharply off the peaks and daily deaths too are showing signs of plateauing.

With vaccination pace picking up across several developed economies, the pace of vaccinations has now hit almost 5 million shots a day. Rapid immunization and reduction in infection rate is key to the expected global recovery in the second half of CY22.

Covid-19 & Vaccine: Globally, daily cases have come down sharply off the peaks and daily deaths too are showing signs of plateauing.

With vaccination pace picking up across several developed economies, the pace of vaccinations has now hit almost 5 million shots a day. Rapid immunization and reduction in infection rate is key to the expected global recovery in the second half of CY22.

Domestic Markets

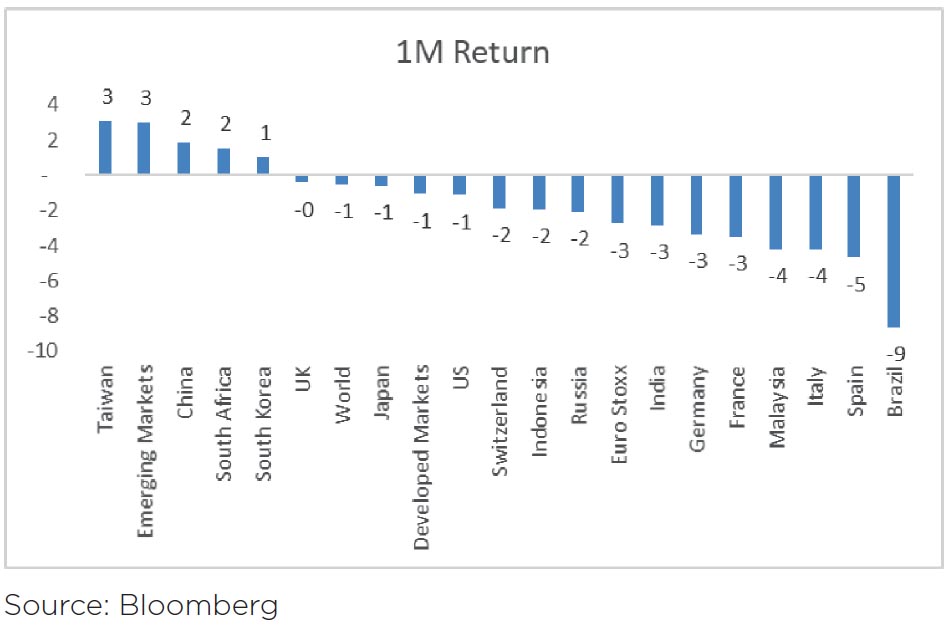

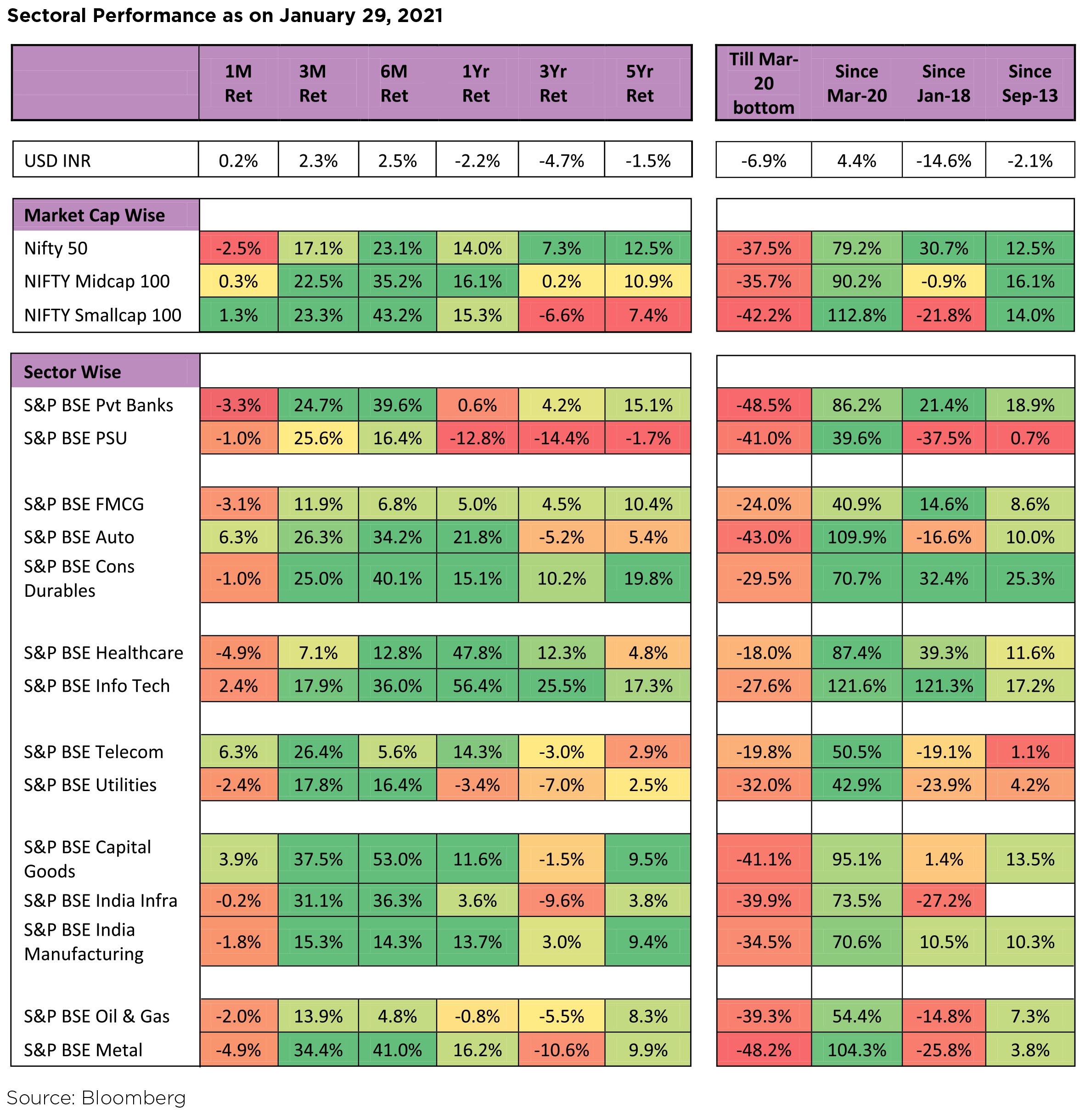

Domestic Markets were flat for the month. After a strong start to the month, markets were weak heading into the budget. From the bottom of Mar-20, Nifty 50, Mid Cap and Small Cap are up 79%, 90% and 113% respectively.

Covid-19 in India: India reached the peak of COVID-19 pandemic in mid-September and has witnessed declines in daily cases and number of deaths since then. Daily new COVID-19 confirmed cases have averaged ~15k in January vs. ~27k in December and ~43k in November. Daily COVID-19 related deaths averaged 176 in January, lower than December (366) and November (517). Although daily tests at 783k/day in January were lower vs. December (1.02mn/ day), the positive rate declined marginally to 1.9% in end-January vs. 2.0% in end-December. Globally, India has the 4th highest number of deaths at ~149k behind US, Brazil and Mexico. However, mortality rate has been trending lower at ~1.4% while recovery rate continues to pick up ~97% (vs. ~96% in end-Dec). The Indian drug regulator approved vaccine applications from Serum Institute (which is manufacturing the University of Oxford/AstraZeneca vaccine candidate) and Bharat Biotech (which has partnered with ICMR) on 3rd Jan. India plans to vaccinate ~300mn people in the first round. India has administered 3.74mn vaccines in the first 15 days of its vaccination drive.

Capital Flows: FPIs recorded net inflows of USD2.6bn into Indian equities in January, the fourth consecutive month of inflows. This follows the highest quarterly inflows by FIIs in 4Q20 (USD19.3bn). FPIs turned net sellers in the debt markets with outflows of USD473mn in January (vs. inflows of USD766mn in December).

DIIs remained net equity sellers in January with outflows of USD1.6bn (vs. outflows of USD5.1bn in December). This follows the highest ever quarterly selling at USD13.9bn by DIIs in 4Q20. Both Insurance funds and Mutual funds (MFs) were net sellers in January. MFs were net equity sellers at USD2.2bn while insurance funds sold USD58mn of equities in January.

Q3 FY21 Earnings Season

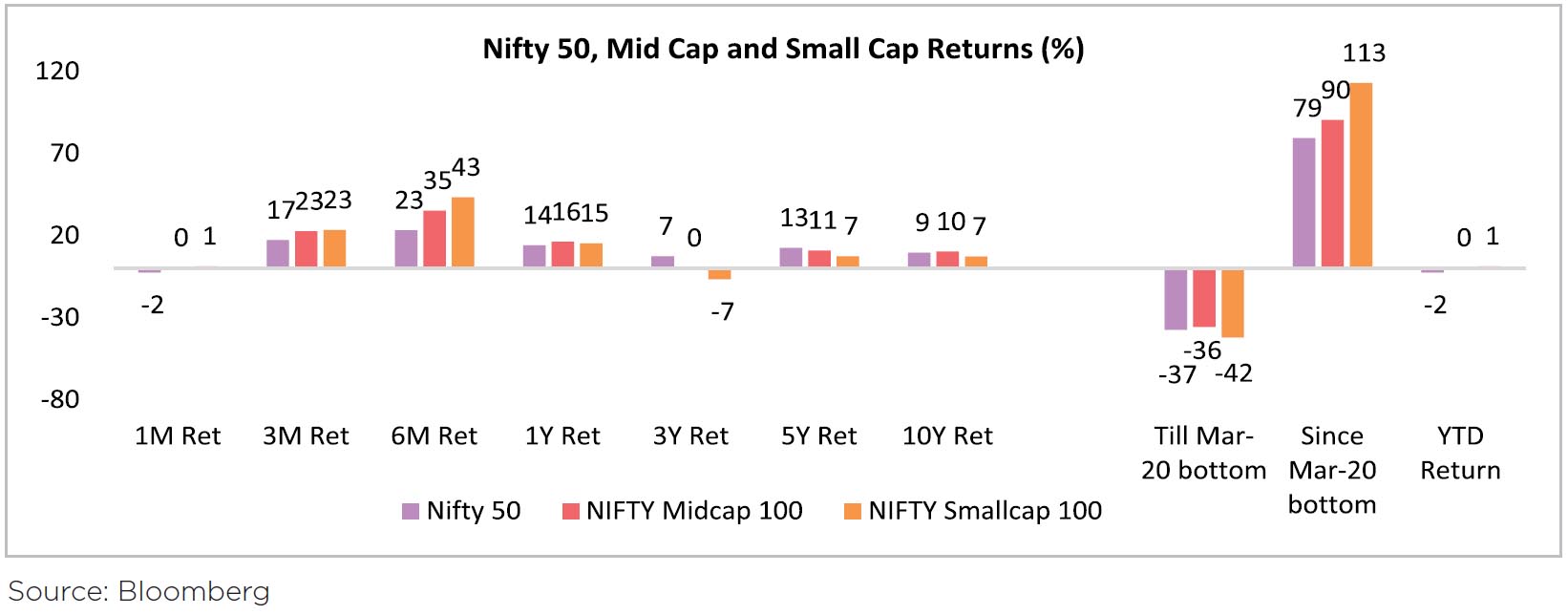

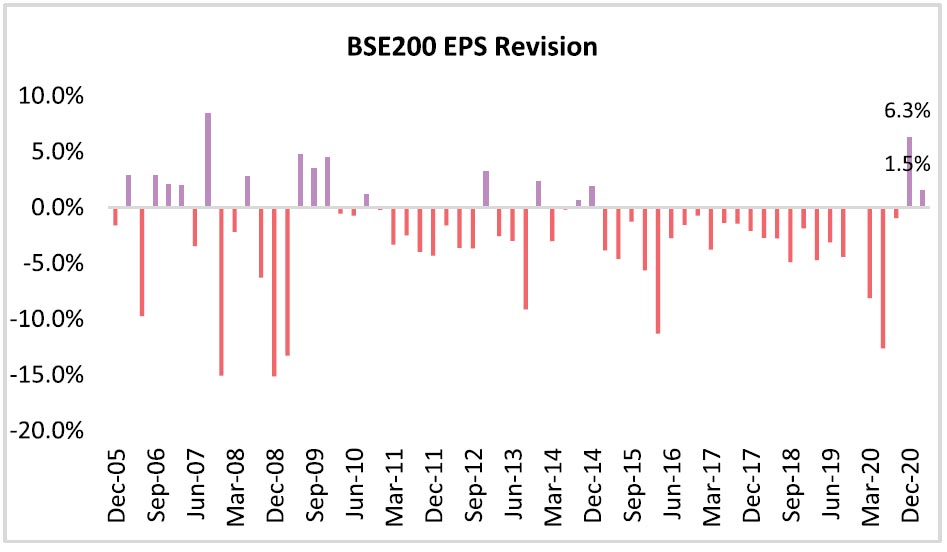

Domestically, the focus was on the Decquarter earnings. Among the Nifty companies, earnings beats to consensus forecasts were seen for more than 70% of the companies which reported in the month of January (~55% of the Nifty companies have reported Dec-quarter earnings).

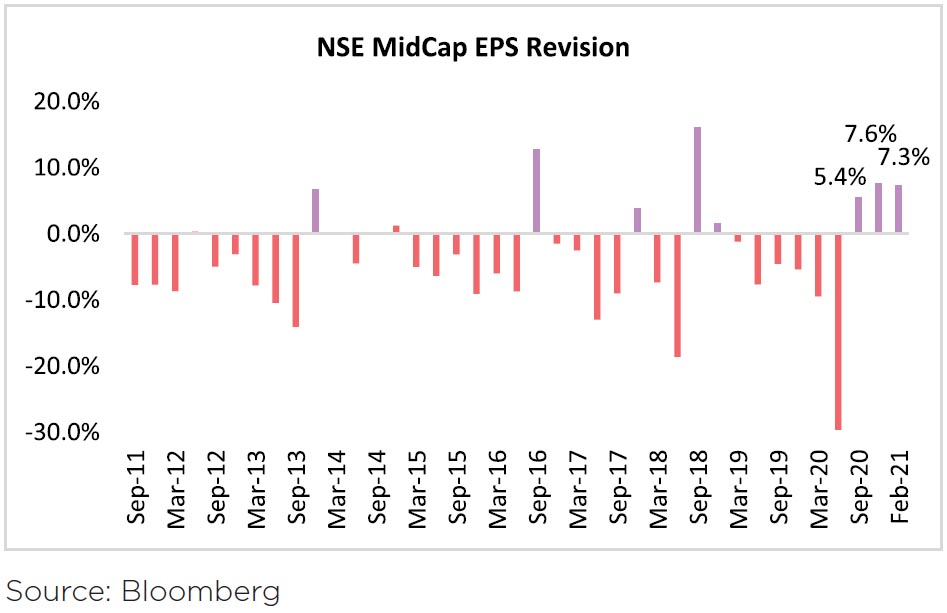

For IT companies, strong beats were seen across revenues, margins and earnings for all the top 4 large IT companies. In terms of FY22 earnings, both BSE 200 and NSE Mid Cap has seen upgrades in the first month of this quarter.

BSE 200 has seen a sharp 6.3% upgrade in FY22 estimates in Dec-quarter. For the mid cap index, FY22 estimates have been upgraded by in excess of 5% in each of the last 3 quarters.

Sectoral Impact

For the month, Auto (+6%) and Telecom (+6%) were the key outperformers whereas Metals and HealthCare underperformed.

The Macro Picture

The latest Economic Survey published ahead of the Union Budget on 1-Feb estimates FY21 GDP contraction at 7.7% and a growth of 11.0% in FY22 (nominal GDP growth of 15.4%). This implies a real GDP growth of 2.4% over FY20. The economic survey estimates GDP growth to be aided by normalization of economic activity supported by roll-out of COVID-19 vaccines, government reforms and pick-up in credit demand given adequate liquidity and low interest rates. Private sector activity levels jumped to ~95% of pre-COVID levels by October, and have been inching upwards since then. This is being complemented by the pick-up in central government spending. Even as state government spending continues to contract, the central government spending, which had remained flat till September, surged 50% YoY in November and is expected to grow strongly in December as well.

Budget: The market celebrated a "non-taxing" budget, with Nifty crossing the 15,000 mark. With reports of a Covid "tax/cess" gaining ground a week before the presentation of the Union Budget, markets heaved a big sigh of relief and thanks to the Finance Minister, when the Budget focused on correcting fiscal maths by including off balance sheet items and forecasting modest revenue collection. The focus on Infrastructure spending, also boosted investor sentiments. Also, the govt seems committed on reforms like strategic disinvestment including PSU banks, higher FDI in insurance, etc.

Key takeaways from the budget as below:

▶ Fiscal deficit for FY21 and FY22 (next year) substantially higher at 9.5% and 6.8% of GDP, respectively. We estimate that approx. 2 ppts and 1 ppt of GDP impact has come through as the Govt has taken onto its own balance sheet, a part of food subsidy (which was earlier off balance sheet) and paid arrears for fertilizer subsidy and certain other off-balance sheet items.

▶ But yet, the adjusted Govt expenditure appears to be higher than initially expected and hence it's a growthoriented budget.

▶ Higher spends from the budget are primarily going in capital expenditure - up 26% YoY. Overall capex growth including the SoEs (state-owned enterprises), is lower at 5% YoY.

▶ Focus on strategic disinvestment for SoEs remains. The Govt has budgeted for Rs. 1,750bn for FY22 as against Rs. 320bn in FY21. Govt intends to conclude the privatisation for BPCL, Concor (Container Corporation), BEML etc by Mar'22. While the privatisation of SoE banks appears ambitious for FY22, the intention is encouraging.

▶ Tax revenue assumption of -5% for FY21 (-3% YTD so far and the low base of 4QFY21 remaining) and 10% for FY22 appears to be broadly reasonable.

PMI: Composite PMI declined by 1.4pt MoM to 54.9 in December. This follows a 1.7pt MoM decline in November after a record October print, which was the highest since Jan-12. The decline in December was led by Services which declined 1.4pt MoM to 52.3; while, the Manufacturing PMI rose marginally by 0.1pt MoM to 56.4.

The forward-looking demand indicators remained constructive with composite new orders remaining strong at 54.9, though easing 0.9pt MoM. However, the composite new export orders readings have remained below 50 throughout the recovery, printing at 46.2 in December (-1.3pt MoM). This weakness is due to services, where the subindex remained lacklustre (37.1) compared to manufacturing (51.8), where export orders have largely recovered.

Inflation: December CPI at 4.6% YoY came below consensus forecasts (consensus: 5.0%) led by food inflation (3.4% in December vs. 9.5% in November) and a favorable base. The core inflation (ex gasoline and diesel) grew 0.2% MoM. On a YoY basis, the core inflation declined to 5.3% in December (vs. 5.5% in November). With inflation still expected to remain above the 4% average over the next two quarters and growth improving faster than the RBI had previously envisioned, economists expect the RBI to remain on hold at the February review.

While, India's monthly merchandise trade balance for December at USD15.44bn came slightly below consensus (USD15.70bn) and widened from USD9.87bn in November. Merchandise exports were up 0.1% YoY in December (vs. 8.7% decline in November) while imports were up 7.6% YoY in December (vs. 13.3% YoY decline in November). Imports ex oil and gold were up +8.0% YoY in December, the first month with positive YoY print after 22 consecutive prints of YoY declines.

IIP (Index of Industrial Production): IIP declined -1.9% YoY in November (vs. +3.6% in October), below consensus forecasts (consensus: -1.0%). Economists note that September and October production likely benefitted from both pent-up demand and pre-Diwali inventory accumulation. The decline in November reflects a post-festival season payback in their view. IP (Industrial Production) was at 94% of its (seasonally-adjusted) pre-pandemic level in November. Production for both consumer durables (98%) and non-durables (99%) is just below pre-pandemic levels. This contrasts with capital goods where production is at 93% of pre-pandemic levels.

GST collections: GST collections in January came at Rs. 1.19tn (+8.1% YoY), the highest monthly collection since GST was implemented in Jul-17. This was the 4th consecutive month with collections of more than Rs. 1tn. Fiscal deficit for Apr-Nov'20 came at Rs. 11.6tn or 145% of the budgeted FY21 deficit (Rs.8.0tn). This compares to 122% reached during the same time frame in FY20.

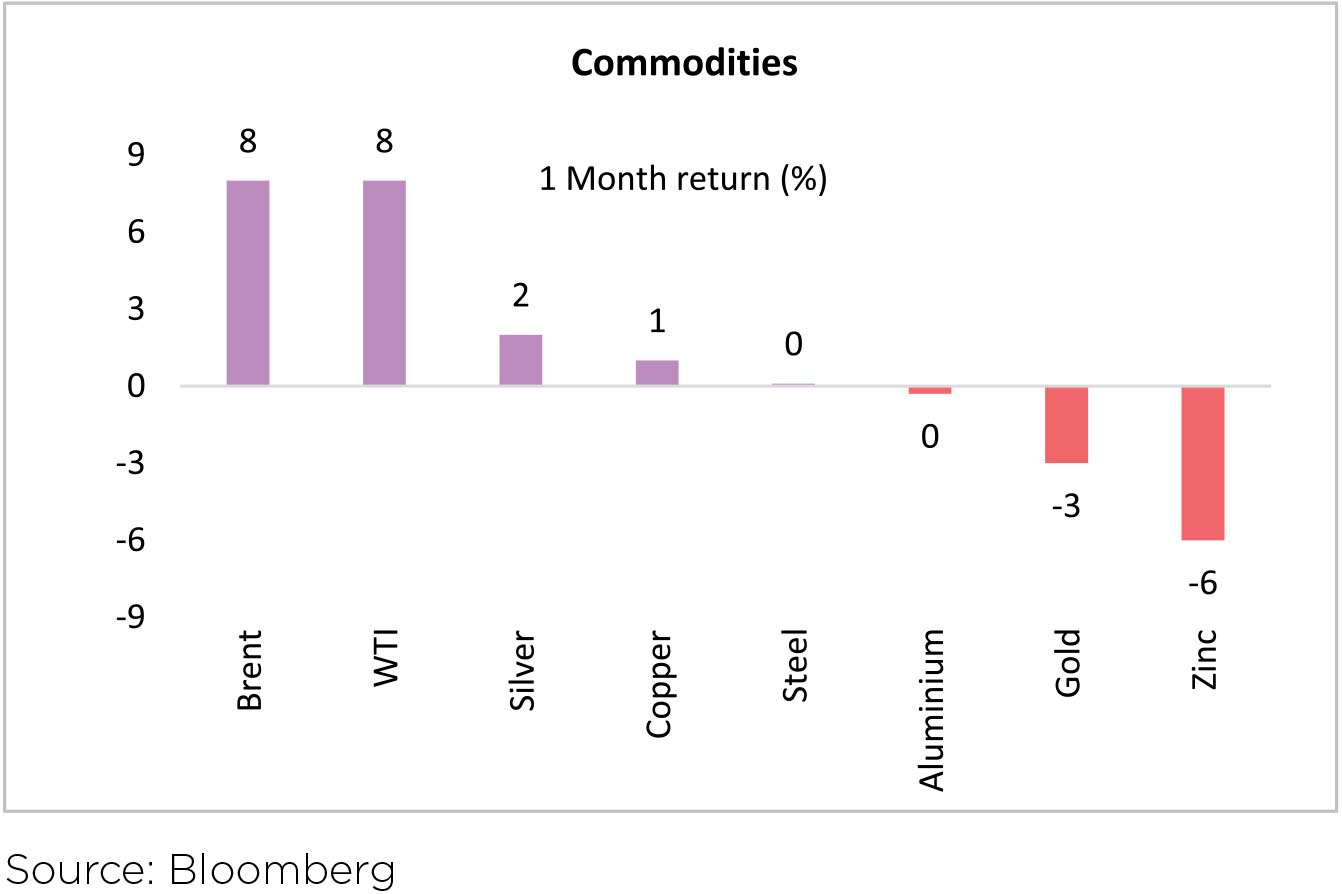

Commodities: Global commodities continued their sharp up move from the bottom, on the hopes of a global recovery. WTI and Brent both closed the month at above USD50/ barrel. Most industrial metals like Steel, Copper, Aluminum, etc. were significantly higher than their levels at the end of Jan-21.

Bond Markets and Currency: Benchmark 10- year government bond yields averaged at 5.90% in January (2bp higher vs. December avg.). On month end values 10-year yield were up 4bps to end the month at 5.91%. US 10-year treasury yields are at 1.07% (+15bps MoM, -44bps YoY).

INR gained 0.2% and ended the month at 72.95 per USD in January. INR outperformed JPM EM FX (-1.5%) in January. In the last 12 months, INR (-2.2%) has outperformed the broader EM FX (-4.6%). DXY gained +0.7% in January (vs. -2.1% in Dec) and ended the month at 90.58 (-7.0% in last 12 months).

India's Forex (FX) reserves are close to their all-time peak at USD585.3bn as of 22nd January. FX reserves have increased by USD4.5bn in the last 4 weeks.

Outlook

As expected, the Finance Minister delivered a Bill with highlights least expected by the Economic Pundits and Forecasters. Focusing on strengthening fiscal math, credibility of the Budget estimates, has gone up, save for the ever ambitious divestment target. Revenue collections are modest and for a welcome change may be higher than the Budgeted at the year end, if the current economic recovery is not interrupted by a spike in the reported Covid cases.

The baton shifted to RBI, which did not fail to support the Government in the its Monetary Policy announcement on February 5th. While debt markets could remain nervous, given the large debt raising target for FY22, adroit liquidity management plus flow of debt issuance will be critical for not upsetting the applecart of a V shaped recovery, moderate interest rates and a stable forex currency. The pace of inflation and inflation expectations, continue to hold centre stage for these objectives to be achieved.

For equities, result season, local as well as global, does point to a V shaped earnings recovery. Over 70% of the Nifty companies to have reported earnings in Jan'21 have beaten estimates, a similar trend was evident in the result season across US, Europe and Japan. With most stocks trading above 1x SD (Std Deviation) of their last 5 years average P/E multiples, market is not cheap. Such elevated levels make the market more dependent on liquidity and strong earnings growth (as compared to the situation post Apr'20) to sustain and move forward.

WHAT WENT BY

Bonds sold off in January across the curve with the short to medium (1-5 year) part of the curve facing

the biggest brunt. While the 10-year government bond benchmark largely remained rangebound

between 5.85%-5.90% & ended the month 3bps higher at 5.91%, the 5-year government bond

benchmark ended 44bps higher at 5.49%. Corporate bonds also exhibited similar bias with 10-year

AAA PSU bond closing flat at 6.58% while the 5-year AAA PSU bond ended 20bps higher at 5.54%.

The selloff started with the resumption of the 14-day variable rate reverse repo on 8th January which some market participants possibly interpreted as an initial monetary signal towards more reversal concrete measures ahead. We believe the restoration of the variable rate reverse repo, is largely a continuation of other recent normalization measures like extension of market timings (for more details pls refer to our note pls attach link to our note on VRR). With the uncertainty on budget & RBI's exit policy over the course of the year, market participants are preferring to wait for RBI's decisive intervention in market before committing positions.

CPI inflation fell more than expected to 4.6% y-o-y in December (Bloomberg consensus:5%) vs 6.9% in November after being above the MPC's upper tolerance level of 6% for the last eight successive months. A sharp correction in vegetable prices & high base from last year led to easing of price pressures.

Industrial production (IP) growth fell to -1.9% y-o-y in November vs an upward revised

4.2% in October (vs 3.6% earlier), below expectations (Bloomberg consensus: -1.0%). Capital goods weakened the most, contracting by 7.1% y-o-y, followed by intermediate and primary goods (-3.0% and -2.6% respectively) while consumer goods contracting by around 0.7%.

The January FOMC meeting continued the status quo with no changes to policy or forward guidance. As expected, the committee kept the target range for the federal funds rate fixed at 0 to 0.25%, and pledged to continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage-backed securities by at least $40 billion per month until "substantial further progress" has been made toward its dual mandate goals. Forward guidance regarding the funds rate was also left unchanged, with the committee still expecting to maintain the current target range until labor market conditions have reached levels consistent with maximum employment, and inflation has risen to 2 percent and on track to moderately exceed 2 percent for some time.

RBI in its February 2021 kept all rates as well as the accommodative stance and elements of forward guidance unanimously unchanged. Other developmental and regulatory measures taken include:

a. Restoration of cash reserve ratio (CRR) dispensation of 1% of net demand and time liabilities (NDTL) given last year to be unwound in 2 phases of 50 bps each beginning late March and late May.

b. Additional 1% of NDTL dispensation given on statutory liquidity ratio (SLR) for availing funds under the marginal standing facility (MSF) extended by 6 months to end September.

c. Held to maturity (HTM) hike of 2.5% for SLR securities acquired between September - March, now extended by 1 year to 31st March 2022. Accordingly, eligible SLR securities are now expanded to include securities acquired over FY 22. Importantly, this relaxation will now start unwinding from the quarter ending June 23. This is an important issue for the bond market (more on this below)

d. Retail investors are being allowed to open gilt accounts with RBI. This is an important measure and the move is to provide retail investors online access to the government securities market - both primary and secondary - along with the facility to open their gilt securities account ('Retail Direct') with the RBI.

It is well understood that the level of India's overnight rate is at emergency levels and hence must be normalized over a period of time. This is also significantly discounted even in instruments like swaps where pricing doesn't get distorted (unlike bonds) with the pressures of demand and supply. The real challenge when executing the unwind (irrespective of slight variations in the pace) is that the starting point is one of already very steep yield curves. To go back to one of our favorite examples, the 6 year government bond is already in the vicinity of 6%. A further 25 bps rise over a year means that a 5 year bond 1 year from now will be at 6.25%. Even then holding on to the bond over this period and provided the rise in yield is not greater, makes better return than what even a 1 year NBFC commercial paper may provide if bought today. As the overnight rate normalizes, the curve could flatten. So purely hypothetically (not a view) a 6.25% rate on the 5 year can be seen consistent with a close to 5% on the overnight rate, and still the curve would be quite steep.

While we have made the above argument before in context of our portfolio strategies, it also to us represents the best quantification of the dilemma that the RBI currently faces. It is not enough for analysts to suggest that RBI should accelerate the unwind in light of evolving factors, till they simultaneously incorporate this dilemma into their recommendations. Left to its own devices, the bond market will keep travelling on the path of transmission unwind irrespective of the Governor's call for an orderly evolution of the yield curve. This is because we continuously overestimate the capacity / propensity / appetite to intermediate with market participants. A mini version of this has been on display over the past month when a flawed understanding of the intent behind VRR, alongside the bond supply shocks in the budget, have already caused a 50 bps unwind destroying significant portions of market risk appetite along the way.

Given the above, the RBI needs to mute (not break) the linkage between the recalibration in the overnight rate and its exaggerated transmission to higher up the curve. A hint around this was already given when the Governor referred to the CRR unwind opening up "space for a variety of market operations to inject additional liquidity". Thus we expect unwind / absorption measures ahead around liquidity (CRR unwinds, term reverse repos, MSS issuances at some point) to coexist with twist and outright OMOs to ensure that the effect higher up the curve is blunted. The extension on HTM dispensation is welcome but will be more helpful if the unwind schedule isn't too aggressive, without which it doesn't really help the problem described above very meaningfully.

Our view remains one of gentle bear flattening, with the bulk of the heavy lifting being done by the very front-end rates as RBI's normalization schedule commences. This will continue to allow for positioning at various points on the yield curve where the carry obtained adjusted for price erosion due to yield rise will still make sense. This has been and remains our guiding principle. The corresponding strategy for investors may involve some amount of "bar-belling" where, alongside traditional core investments like quality roll down products, some combination of very short end (overnight funds, near term deposits) and intermediate duration strategies (focused on maturities largely in the 6 - 7-year area) may be deployed to optimize on the RBI's gradual normalization in context of an already very steep yield curve. It is important that investors remember to weigh intermediate duration strategies with very short maturity instruments as well so that average maturity of their investment portfolios does not rise. It is also relevant to note that these strategies account for a rise in yields over the period ahead, provided these aren't disruptive over the time frame. This risk can also partly be mitigated by having sufficiently long investment horizons.

Disclaimer: MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

The Disclosures of opinions/in house views/strategy incorporated herein is provided solely to enhance the transparency about the investment strategy / theme of the Scheme and should not be treated as endorsement of the views / opinions or as an investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document has been prepared on the basis of information, which is already available in publicly accessible media or developed through analysis of IDFC Mutual Fund. The information/ views / opinions provided is for informative purpose only and may have ceased to be current by the time it may reach the recipient, which should be taken into account before interpreting this document. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision and the security may or may not continue to form part of the scheme's portfolio in future. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. The decision of the Investment Manager may not always be profitable; as such decisions are based on the prevailing market conditions and the understanding of the Investment Manager. Actual market movements may vary from the anticipated trends. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alterations to this statement as may be required from time to time. Neither IDFC Mutual Fund / IDFC AMC Trustee Co. Ltd./ IDFC Asset Management Co. Ltd nor IDFC, its Directors or representatives shall be liable for any damages whether direct or indirect, incidental, punitive special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information.

The selloff started with the resumption of the 14-day variable rate reverse repo on 8th January which some market participants possibly interpreted as an initial monetary signal towards more reversal concrete measures ahead. We believe the restoration of the variable rate reverse repo, is largely a continuation of other recent normalization measures like extension of market timings (for more details pls refer to our note pls attach link to our note on VRR). With the uncertainty on budget & RBI's exit policy over the course of the year, market participants are preferring to wait for RBI's decisive intervention in market before committing positions.

CPI inflation fell more than expected to 4.6% y-o-y in December (Bloomberg consensus:5%) vs 6.9% in November after being above the MPC's upper tolerance level of 6% for the last eight successive months. A sharp correction in vegetable prices & high base from last year led to easing of price pressures.

Industrial production (IP) growth fell to -1.9% y-o-y in November vs an upward revised

4.2% in October (vs 3.6% earlier), below expectations (Bloomberg consensus: -1.0%). Capital goods weakened the most, contracting by 7.1% y-o-y, followed by intermediate and primary goods (-3.0% and -2.6% respectively) while consumer goods contracting by around 0.7%.

The January FOMC meeting continued the status quo with no changes to policy or forward guidance. As expected, the committee kept the target range for the federal funds rate fixed at 0 to 0.25%, and pledged to continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage-backed securities by at least $40 billion per month until "substantial further progress" has been made toward its dual mandate goals. Forward guidance regarding the funds rate was also left unchanged, with the committee still expecting to maintain the current target range until labor market conditions have reached levels consistent with maximum employment, and inflation has risen to 2 percent and on track to moderately exceed 2 percent for some time.

RBI in its February 2021 kept all rates as well as the accommodative stance and elements of forward guidance unanimously unchanged. Other developmental and regulatory measures taken include:

a. Restoration of cash reserve ratio (CRR) dispensation of 1% of net demand and time liabilities (NDTL) given last year to be unwound in 2 phases of 50 bps each beginning late March and late May.

b. Additional 1% of NDTL dispensation given on statutory liquidity ratio (SLR) for availing funds under the marginal standing facility (MSF) extended by 6 months to end September.

c. Held to maturity (HTM) hike of 2.5% for SLR securities acquired between September - March, now extended by 1 year to 31st March 2022. Accordingly, eligible SLR securities are now expanded to include securities acquired over FY 22. Importantly, this relaxation will now start unwinding from the quarter ending June 23. This is an important issue for the bond market (more on this below)

d. Retail investors are being allowed to open gilt accounts with RBI. This is an important measure and the move is to provide retail investors online access to the government securities market - both primary and secondary - along with the facility to open their gilt securities account ('Retail Direct') with the RBI.

Outlook

It is well understood that the level of India's overnight rate is at emergency levels and hence must be normalized over a period of time. This is also significantly discounted even in instruments like swaps where pricing doesn't get distorted (unlike bonds) with the pressures of demand and supply. The real challenge when executing the unwind (irrespective of slight variations in the pace) is that the starting point is one of already very steep yield curves. To go back to one of our favorite examples, the 6 year government bond is already in the vicinity of 6%. A further 25 bps rise over a year means that a 5 year bond 1 year from now will be at 6.25%. Even then holding on to the bond over this period and provided the rise in yield is not greater, makes better return than what even a 1 year NBFC commercial paper may provide if bought today. As the overnight rate normalizes, the curve could flatten. So purely hypothetically (not a view) a 6.25% rate on the 5 year can be seen consistent with a close to 5% on the overnight rate, and still the curve would be quite steep.

While we have made the above argument before in context of our portfolio strategies, it also to us represents the best quantification of the dilemma that the RBI currently faces. It is not enough for analysts to suggest that RBI should accelerate the unwind in light of evolving factors, till they simultaneously incorporate this dilemma into their recommendations. Left to its own devices, the bond market will keep travelling on the path of transmission unwind irrespective of the Governor's call for an orderly evolution of the yield curve. This is because we continuously overestimate the capacity / propensity / appetite to intermediate with market participants. A mini version of this has been on display over the past month when a flawed understanding of the intent behind VRR, alongside the bond supply shocks in the budget, have already caused a 50 bps unwind destroying significant portions of market risk appetite along the way.

Given the above, the RBI needs to mute (not break) the linkage between the recalibration in the overnight rate and its exaggerated transmission to higher up the curve. A hint around this was already given when the Governor referred to the CRR unwind opening up "space for a variety of market operations to inject additional liquidity". Thus we expect unwind / absorption measures ahead around liquidity (CRR unwinds, term reverse repos, MSS issuances at some point) to coexist with twist and outright OMOs to ensure that the effect higher up the curve is blunted. The extension on HTM dispensation is welcome but will be more helpful if the unwind schedule isn't too aggressive, without which it doesn't really help the problem described above very meaningfully.

Our view remains one of gentle bear flattening, with the bulk of the heavy lifting being done by the very front-end rates as RBI's normalization schedule commences. This will continue to allow for positioning at various points on the yield curve where the carry obtained adjusted for price erosion due to yield rise will still make sense. This has been and remains our guiding principle. The corresponding strategy for investors may involve some amount of "bar-belling" where, alongside traditional core investments like quality roll down products, some combination of very short end (overnight funds, near term deposits) and intermediate duration strategies (focused on maturities largely in the 6 - 7-year area) may be deployed to optimize on the RBI's gradual normalization in context of an already very steep yield curve. It is important that investors remember to weigh intermediate duration strategies with very short maturity instruments as well so that average maturity of their investment portfolios does not rise. It is also relevant to note that these strategies account for a rise in yields over the period ahead, provided these aren't disruptive over the time frame. This risk can also partly be mitigated by having sufficiently long investment horizons.

Disclaimer: MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

The Disclosures of opinions/in house views/strategy incorporated herein is provided solely to enhance the transparency about the investment strategy / theme of the Scheme and should not be treated as endorsement of the views / opinions or as an investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document has been prepared on the basis of information, which is already available in publicly accessible media or developed through analysis of IDFC Mutual Fund. The information/ views / opinions provided is for informative purpose only and may have ceased to be current by the time it may reach the recipient, which should be taken into account before interpreting this document. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision and the security may or may not continue to form part of the scheme's portfolio in future. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. The decision of the Investment Manager may not always be profitable; as such decisions are based on the prevailing market conditions and the understanding of the Investment Manager. Actual market movements may vary from the anticipated trends. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alterations to this statement as may be required from time to time. Neither IDFC Mutual Fund / IDFC AMC Trustee Co. Ltd./ IDFC Asset Management Co. Ltd nor IDFC, its Directors or representatives shall be liable for any damages whether direct or indirect, incidental, punitive special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information.