Commentary

31st December 2020

WHAT WENT BY

CY21: Promise of Delivery or Delivery of Promise?

CY20, was a year when most predictions for the year made in December 2019, literally went for a toss. Sars- CoV-2 virus put most, if not all, of these annual predictions to waste. To recommence on a similar journey of future predictions in December 2020, one needs to make the key assumption - the health pandemic caused by the Covid- 19 virus will not come with any new twist and the roll out of vaccination programs across the world will lead to "normalization". Though the new "normal" could be vastly different from the "normal" of CY19, when, few, if any had imagined the havoc such a virus would cause.

Here are, what we believe, a few issues which could become the key variables of CY21 for Indian investors:

Promise of Delivery vs Delivery of promise - Earnings Estimates vs Actuals

"If wishes were horses, beggars would ride. If turnips were swords, I'd have one by my side. If "ifs" and "ands" were pots and pans. There'd be no work for tinkers' hands".

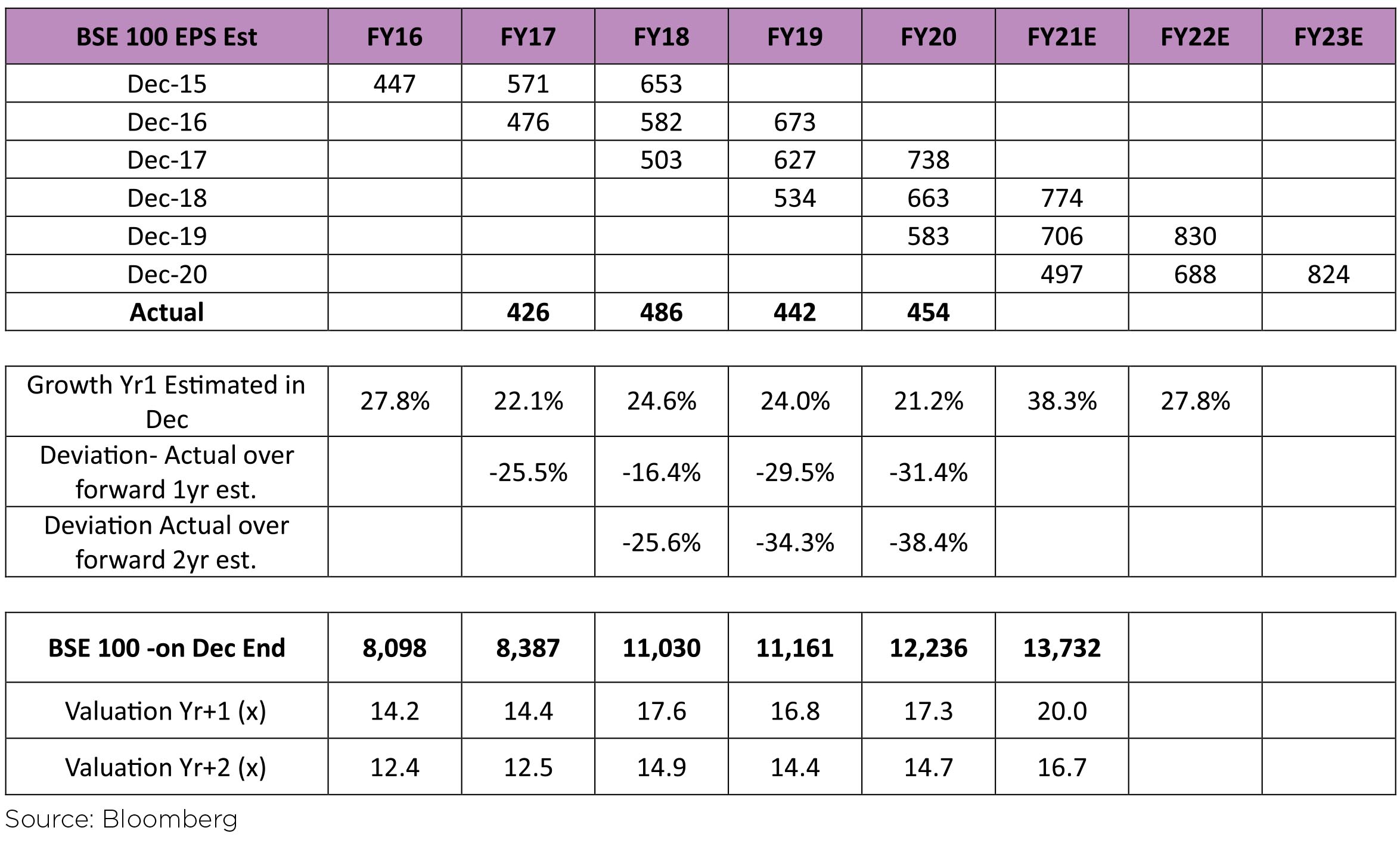

A nursery rhyme, which most of us would have used, especially those with children, on all the birthdays/ new year wishes/demands. For equity investors, 2015 onwards, wishing for Index earnings growth has been an annual exercise of … disappointment. Every December, estimates for the next financial year are compiled and most of these years, the actual vs expected has witnessed a wide gap between Estimates and Actuals.

CY20, was a year when most predictions for the year made in December 2019, literally went for a toss. Sars- CoV-2 virus put most, if not all, of these annual predictions to waste. To recommence on a similar journey of future predictions in December 2020, one needs to make the key assumption - the health pandemic caused by the Covid- 19 virus will not come with any new twist and the roll out of vaccination programs across the world will lead to "normalization". Though the new "normal" could be vastly different from the "normal" of CY19, when, few, if any had imagined the havoc such a virus would cause.

Here are, what we believe, a few issues which could become the key variables of CY21 for Indian investors:

Promise of Delivery vs Delivery of promise - Earnings Estimates vs Actuals

"If wishes were horses, beggars would ride. If turnips were swords, I'd have one by my side. If "ifs" and "ands" were pots and pans. There'd be no work for tinkers' hands".

A nursery rhyme, which most of us would have used, especially those with children, on all the birthdays/ new year wishes/demands. For equity investors, 2015 onwards, wishing for Index earnings growth has been an annual exercise of … disappointment. Every December, estimates for the next financial year are compiled and most of these years, the actual vs expected has witnessed a wide gap between Estimates and Actuals.

Key observations:

▶ Consensus have normally estimated a 1-year forward growth of more than 20%

▶ Past data suggests deviation over 1-year forward estimates and the actual numbers on an average is 25% and is as high as 31%

▶ Consensus 2-year forward estimates are to be taken with caution as there has been a tendency to over-estimate them over actual by more than 25% and as high as 40%.

Clearly, the markets are primed for a strong revival in earnings, after a dismal FY20. The trajectory of this growth will clearly have the closest correlation to market levels. The delivery of promise, on this front, will be the most critical factor which will influence the markets, as valuations boosted by the benign monetary and fiscal policies are at an elevated level.

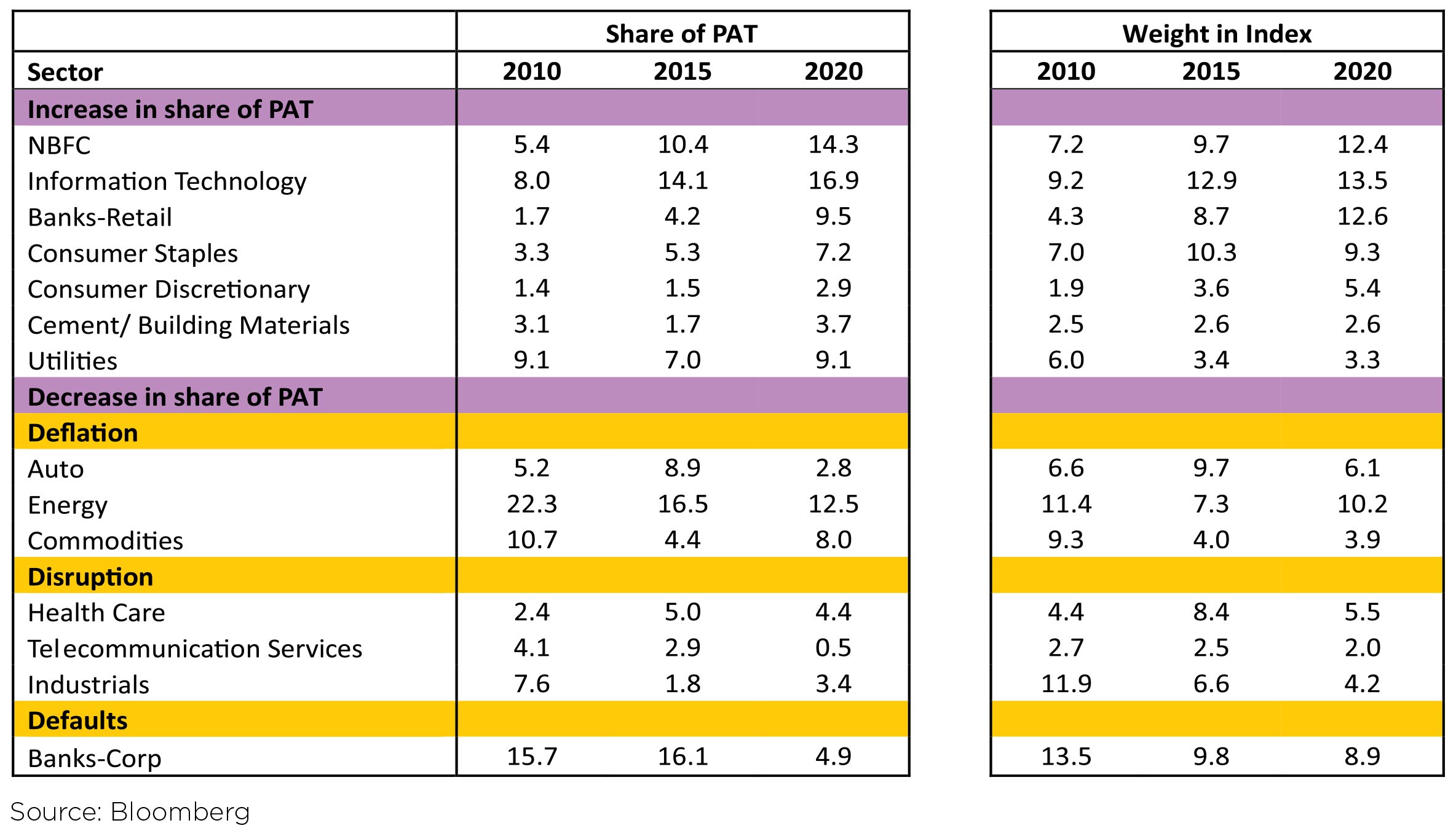

What caused the last decade to become a "lost" decade from the point of earnings? We have analyzed, three broad buckets - Deflationary pressures, Regulatory upheavals (Disruption) and Defaults (refer annexure for details) - high credit cast of the Banking system to have impacted growth in profitability of the Nifty and of the broader market during 2015-2019. To add to these factors, the lockdown and the spread of the pandemic in Mar'20 impacted FY2020 results.

Key observations (please refer annexures):

▶ Earnings growth has been robust only in a handful of sectors like Retail Banks and Consumer Discretionary

▶ Growth has been steady in sectors like Staples, IT Services, etc

▶ Large majority of sectors have seen earnings deterioration due to above mentioned headwinds, resulting in a decade of lost earnings growth

With the spread of the pandemic and the lockdown during Q1 FY21, earnings for the year FY21 were sharply downgraded. GDP estimates forecasted -10% and even -15%, de-growth. However, the swifter than expected economic recovery led to a more robust Q2 FY21. As a result, upgrades exceeded downgrades 3x, a rarity, after years of earnings disappointment. FY21 estimates, quickly rebounded from negative to positive territory, despite the Q1 debacle.

However, FY22 and beyond, is what investors are playing for. In the past, forecasting 2-year forward earnings growth has had a poor track record, with actual earnings lower by 25-30%. As we stand today, estimates for FY23 appear to build growth rates higher than the peak growth achieved in any period during the 2013-19 phase across sectors. Will FY22 and FY23 earnings delivery be another case of "promise of delivery" or "delivery of promise"?

Promise of Delivery vs Delivery of Promise - Growth vs Value, actually, Consistent vs Cyclical Earnings

Over the last five years, since 2014 Government regime change, the debate of Growth vs Value has raged, mainly one sided each year - CY14 and CY17, Value trumped Growth; and in CY15, CY16, CY18 and CY19, Growth has trumped Value. CY20 saw a revival of this debate - after Growth trounced Value in the 1st quarter of CY20, Value has staged a smart comeback.

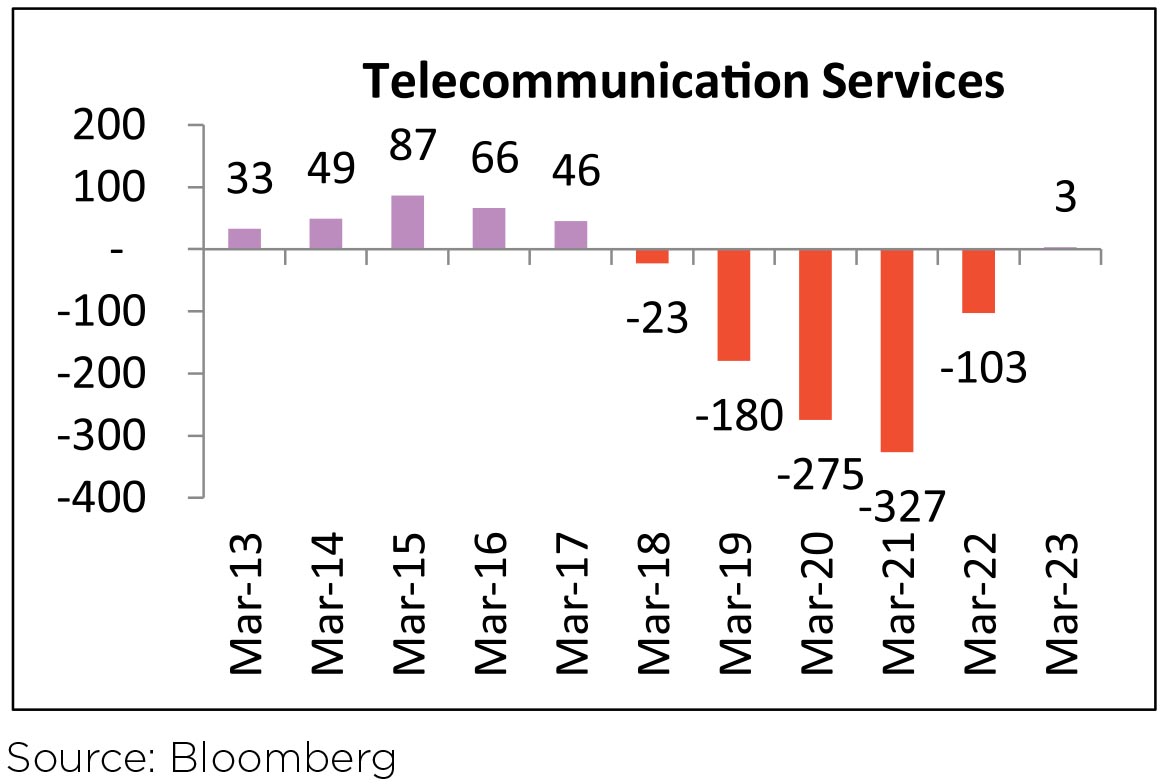

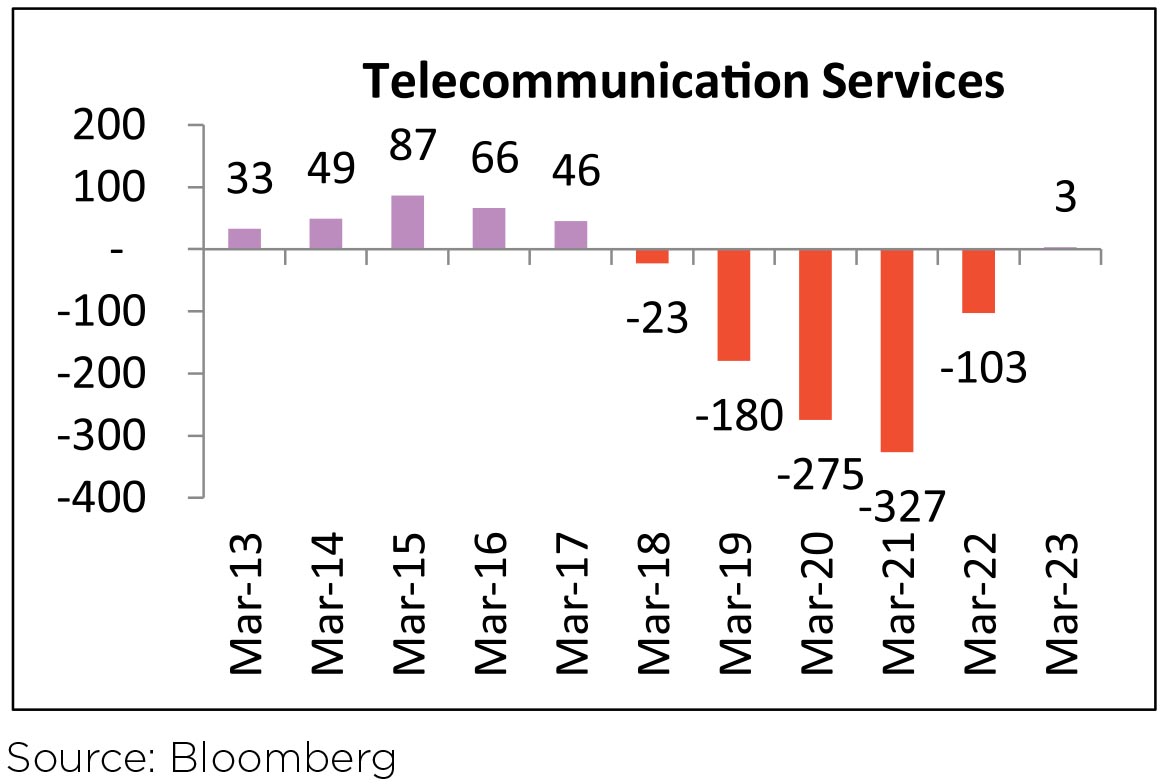

While in US, the debate of Growth vs Value centers around Technology/ (Internet platform) vs Old Economy. In India, with no technology companies like FAANGM, it has become a debate of Consistent Earnings generators, Companies & Sectors, vs Companies & Sectors where earnings growth has been muted or inconsistent. Even within a sector, a sub-segment of companies has reported consistent earnings, while the rest have languished - Domestic facing pharmaceutical companies, MNC or Indian owned vs pharmaceutical companies with substantial US generic exposure. Infrastructure related sectors, Metals, Automobiles and Auto Ancillaries, Telecom and Corporate lending focused banks, especially PSU Banks are other sectors which have reported inconsistent earnings since FY16.

Investors, world over, worship at the altar of stable, consistent earnings. This segment in a large, developed economy is currently represented by new age Technology companies, which are winning business from established "old economy" companies as well as rolling out their services globally (excluding China). Hence, the steady and consistent earnings growth of most of the FAANGM. In India, investors have "replaced" such a genre with those companies and sectors, which though part of the "old" economy have been reporting steady and consistent earnings, the key variable which differentiates the FAANGM from the rest of the S&P 500, the world is their market, hence the belief of their followers of a long, almost endless runway of growth, from across the world (except China, which stays protected within its own Firewall). The Indian "growth" companies, on the other hand, are being rewarded for their consistency, market leadership, shift from unorganized to organized and the upgradation of next gen consumers, as income level rise and awareness increases, yet largely, if not fully, their growth is exclusively a play on Indian economic growth story. Remarkably, these high valued, become even more important places to hide when economic growth slows and their steady earnings easily, outshines their inconsistent and cyclical peer / rest of the market. During periods, when perception moves to an economic revival this group lags, their inconsistent, cyclical peers - CY14, CY17 and post Q1 CY20.

Value pocket, in our opinion, comprises four basic buckets - PSU stocks - PSU Banks, Refiners, Metal, Mining and Heavy Engineering companies; Corporate lending focused & Mid-sized banks; Cyclical sectors - Industrials, Automobile along with Auto Ancillaries and Metal /Commodity companies. The last segment in this pocket is Small cap. Is Small cap after the battering in CY18, CY19 and Q1 CY20, poised for a sustained revival? It, surely, is the most preferred part of the "Value" segment across our portfolios.

Will CY21, witness a revival of Value over Growth, especially Small caps? Till monetary policies, especially, Indian monetary policy remains accommodative, real interest rates do rival the range in 2016-19 period and economic growth is broader rather than "K" shaped, hope of V outperforming G could be sustained.

Promise of Delivery vs Delivery of Promise - USD Weakening, Rest of World to Outperform US market

The previous decade could easily be tagged as America's decade, not only was USD a strong currency, US markets annihilated Rest of World (RoW). Will the coming decade see a U-turn? USD is consensus to be one of the weakest currencies in the global order. A weak USD, has in the past, led to strong Emerging market flows, with Rest of World outperforming US markets. Already metal and crude oil prices have started to inch up, as a corollary to the weakening dollar. A "global" consensus view on USD weakening in 2021 has been built in the past few months, will it deliver in 2021? Will US markets, after a decade of dominance, cede leadership to RoW? If USD weakens, as being forecasted, how long will INR remain weak - it is among the worst performing Emerging currencies in CY20. Will INR strengthen in CY21? Could RBI actually allow INR to strengthen to cushion the blow of inflation? How will that impact export leaning sectors, especially IT services?

Promise of Delivery vs Delivery of Promise - Will Central Banks blink, as inflation picks up, or not?

CY20, saw a new chapter in the playbook of how to tackle a financial crisis, fiscal stimulus was added in CY20. Unlike 08-09 Financial crisis, which was largely "stimulated" through monetary injection by Central Banks in US and Europe, CY20 witnessed large fiscal stimulus by Governments. Even a fiscally conservative state like Germany, opened up its coffers, offering a large stimulus to its citizens and companies, in an effort to alleviate the problems arising out of lockdowns (UK, even offered subsidized meals in pubs during October). As of now, the US Fed governor has maintained holding on to the interest rates at least till the end of CY22, if required even later, "allowing inflation to overshoot its targeted rate of 2% during this period". Will this resolve be maintained, especially if Senate remains under the control of Republicans - who forced the Obama Administration to follow austerity to cut back on the large fiscal deficit (raked up under the previous Republican President, George W Bush Jr)! Politics can always be a wild card!

While, the monetary injection led to a sharp rally in Government debt paper and a more GDP recovery, what will be the outcome of this "twin" strike? Will economic growth recover at a faster clip and mirror the recovery rates of erstwhile downturns, which were far sharper than post GFC (global financial crisis) economic recovery? Or will it just induce another asset bubble? Will the increase in money supply stoke inflation?

This has made several commentators worried, could the specter of inflation return, just as was the case in 1977 period or will a swift control of the virus and strong fiscal and monetary stimuli spur a strong economic recovery, as was visible post economic downturns in the 1980s and 1990s? Even, if inflation crosses the "inflation target" of 2% in US and Europe, equity may be less impacted unlike Government debt, which would make equity to be the "least" bad option amongst all financial assets (save, the new sensation Bitcoin) in either scenario. However, the trajectory of returns for the equity investor will vary dramatically depending on which of the scenarios plays out.

Promise of Delivery vs Delivery of Promise - Will key Government reforms - IBC, GST, Labor, Agriculture PLI (production-linked incentive) deliver growth?

For most equity bulls, economic reforms have always been a key variable for a sustainable bull market. The series of reforms announced by this Government, rival and exceed even the "reformist" Narasimha Rao Government, yet a sustained bull market eludes equity markets! While reforms, are critical, it is their execution and the mindset of those governing these reforms, which is an equally important element to get economic growth from such reforms. Clearly, sequencing, absorption, implementation is as critical as having the political will to announce such important and difficult measures. Will CY21 be the year, when focus will shift to execution rather than more, new and bold announcements? Will GST system stabilize, will e-way bill be matching move from realm of possibility to reality?

Final Comments - What would be "critical" for CY21?

De-coupling of GDP growth and Corporate profitability? A key concern most investors have is the "broken relationship" between GDP growth and corporate sector profitability. The question often asked is "With GDP growth negative, how are companies reporting higher profitability and sales growth"? The answer to this question is nuanced - every sector has an element of imports and presence of unorganized players. This would vary from 12-20% of a sector's overall sales. Given that most of the imports are sourced from China, strong tariff barriers and/or restriction on imports imposed during the pandemic across many segments. The second element is the slower than expected revival of the unorganized sector - labor migration to rural areas, has hit availability of trained manpower; the sourcing of raw materials, esp if dependent on imports, esp from China; Capital preservation or usage for family emergencies, thus limiting scaling up of operations to pre-Covid levels. Thus, for the organized players - Large, Mid or Small caps, even if demand goes back to 90%-95% of pre-Covid levels, it represents growth as share of the market which was being lost to these two segments is now reverting to them. Such a play may not last forever, but during a period when demand has not recovered it has allowed organized players to get a benefit - the longevity of such an advantage should slowly reduce as "normalization" returns. Hence, even with 5-10% reduction in demand, organized players have benefitted and reported stronger than expected numbers across several sectors.

How will the large scale unemployment in the unorganized sector impact personal consumption? By various rough estimates roughly 25 to 45 million people "re-migrated" from urban centres to rural areas during the pandemic. How will this impact personal consumption? How long will agriculture sustain such a large population addition? More than manufacturing, which has made a smart come back, how long will it take for Services, the largest element of our economy, to recover? Services account of roughly 70% of the economy, the strength of its revival during CY21 will determine the gradient of economic recovery.

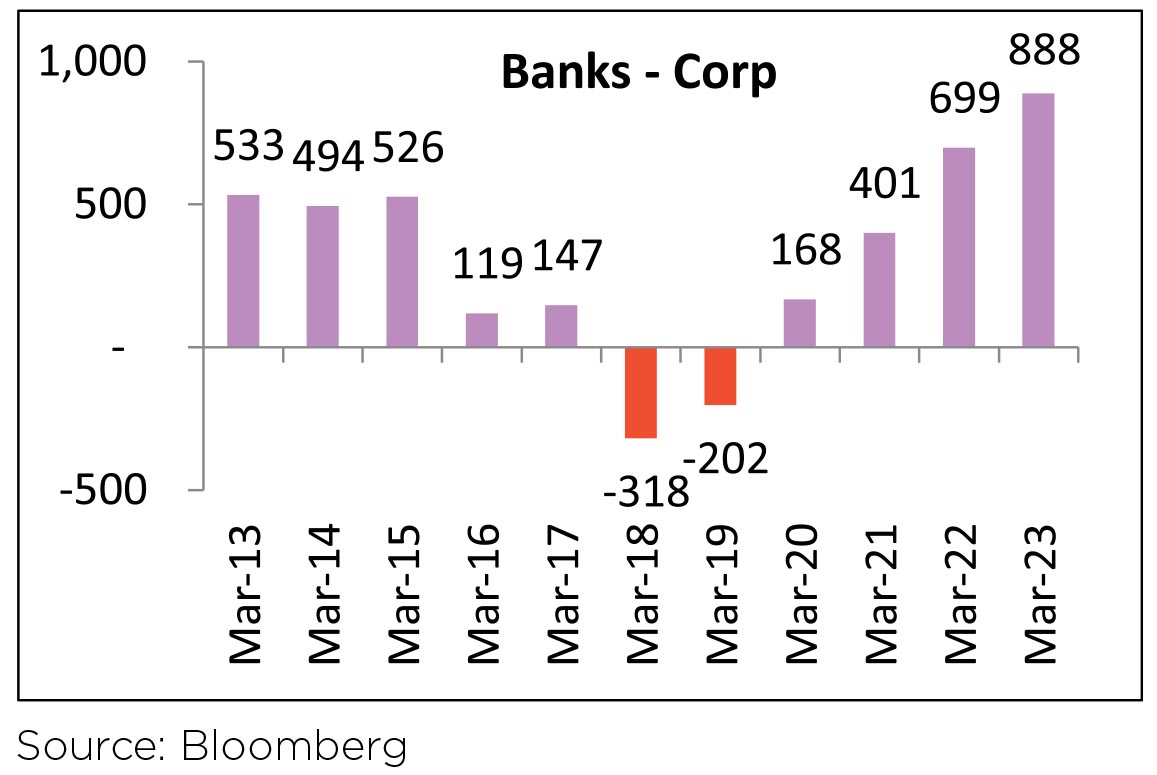

Banks/NBFC, will they face a 2008-09 type of swift recovery or will the NPA pile up reflect the 2015-19 phase? Opinions are divided, most experts believe that NPAs will climb back to 10-11% levels, which will require large scale re-capitalization of banking sector, especially PSU banks. However, the tepid participation from corporates in the restructuring window announced by the banks, gives comfort to others that the NPA pile up could be much lower than what was forecasted by the Cassandra's at the start of the pandemic. For the delivery of earnings in FY22, BFSI, again is in the pole position, expected to contribute almost 60% of the incremental growth in profits. Q4 FY21 results will be the most crucial to answer this question and will also set the direction for the revival in profitability of financials for FY22.

Market moves may be shorter, sharper - deeper on the way down and overshoot on the way up, than the docile 1990s. In short, more vicious. The fall during Mar'20 lasted less than 35 trading days, erasing between 36-43% across the indices - Large, Mid and Small Caps. Supportive action from Central Banks was also quicker, in 2008, while Lehman Brothers collapsed in Oct'08, QE (Quantitative easing) was uncorked only in Mar'09, compare it with the response to the pandemic in Feb/Mar'20 by Central banks - within weeks of the market falling, stimulus had been announced. US Fed crossed over from buying government debt to adding corporate bonds in its buying list. Mainly, to stabilize the corporate bond market, especially the high yield bonds, which had spiraled into double-digit territory. Oaktree and other such financiers, lenders of the "last" resort, to such low rated companies, cried wolf.

Unlike 2008-09, when they earned handsome returns, this time were unable to obtain the same level of returns - US Fed had calmed a nervous market just by announcing its intention to buy high yield bonds. No wonder, these players are targeting markets like India to earn high yields, as yields in US flattened on such interventions. Could RBI intervene in the corporate bond market in the future?

Quick sector rotation: As investors searched for stable earnings, rotation from one sector to another, as exhibited from Apr-Dec'20 phase was evident - Staples after outperforming in Mar-Apr, have underperformed since then. Pharma and IT services outperformed during May-Sept; Banks/NBFC, after underperforming from Mar-Sept, outperformed during Oct-Dec. With earnings growth compressed across few sectors, investors rushed from one segment to another, sector rotation has been fast and furious.

Looking back, the pattern / rationale behind these manic moves was clear - sectors which were perceived to return to pre-covid level of profitability and sales growth out performed - Pharma, IT services, Telecom at the start and as the level of economic activity surprised, other sectors joined in. As we get closer to "normalization" post the vaccine roll out, will such sector rotation continue?

Time for Small caps to shine? After the debacle of Mar'20, Small caps outshone the rest of the market - for the first time since CY17. If economic recovery is robust and RBI does not move aggressively into high real interest zone, Small caps could benefit the most. This is also reflected in market recovery post a sharp fall in 2009 (GFC), 2014 (General elections) and 2017 (post Demonetization) as well. Will CY21 sustain this move? Will the nascent rally in Value/Cyclicals sustain or peter out? Of course, owning consistent earnings growth company is important, so used to be their valuation, unfortunately, not any more. Will the rally in cyclicals/Value sustain, or as many Growth focused Portfolio Manager believe "90% of all value stocks are crap"?

With PE funds looking to exit investments, eager retail investors/HNI funding could fuel an IPO boom? Success of recent IPOs could reinforce the willingness of PE investors to seek an IPO for partial exit. Retail confidence, after tasting such success, will continue to grow… till an overpriced IPO crashes, such is the cycle. Expect a flurry of IPOs, at least in H1 CY2021.

Will the dream run of retail trader continue in CY21 or a sudden correction impairs most of the recently garnered gains? WFA (work from anywhere), it seems has had an "unintended consequence"- the return of the retail investor investing directly in the markets, side stepping mutual funds as the preferred vehicle for their equity investment. In the US, this phenomenon is most closely associated with an app based trading platform, which has caught the imagination of the retail trader, esp millennials. Facilitating investment through an app, it focused exclusively on retail investors, encouraging them to trade rather than be long term investors - allowing them to buy fractional shares etc. India, too, has witnessed a surge in retail investing through online brokerages. It would not be out of place to admit, that during the dark days of Mar'20, retail investors who dived into the market to "bottom fish", while most institutional investors focused on career mitigation, raising cash, the year end results favour the former. With large caps delivering 60% + returns, Small Cap Index registering a gain of 100% from its March lows, the pickings for this segment of intrepid investors has far exceeded what institutional investors have delivered. Success, in stock market, always has followers and the band of retail investors rushing to invest directly has grown "multifold". Another feature of stock market success is that it begets confidence and belief. Will this initial success, sustain? Will the confidence of increasing the size of one's "bet" bear the same fruits as it did during Mar/Apr/May'20? Retail participation in option trading is at an all time high. IPO listing, as mentioned earlier, have seen a frenzy, which traditionally have been an indicator of an overheated market with over enthusiastic participants. Will institutional investor regain some "respect" or will the gravy train of monthly double-digit return for retail investor continue to roll on?

Finally, enjoy a healthy 2021, may this scourge disappear from our lives in 2021. Hope, the anxiety of tracking sites on the pandemic on a daily basis fades from our memory. Hope, all the vaccines bring a long term solution against the virus. May we choose WFA as an alternative rather than be forced to use it as a defense against the virus. May the promises be delivered in 2021 rather than we look to 2022, hoping for delivery of these promises.

Stay safe and wishing you and your loved ones a safe 2021.

Annexures

The three broad buckets - Defaults, Deflationary pressures and Regulatory upheavals (Disruption).

1) Defaults:

▶ From FY13-15, PAT growth for Corporate banks remained flattish. While consensus estimates a 74% CAGR over FY20-23 from a lower base of FY20 and a 49% CAGR over FY21-23.

2) Deflation:

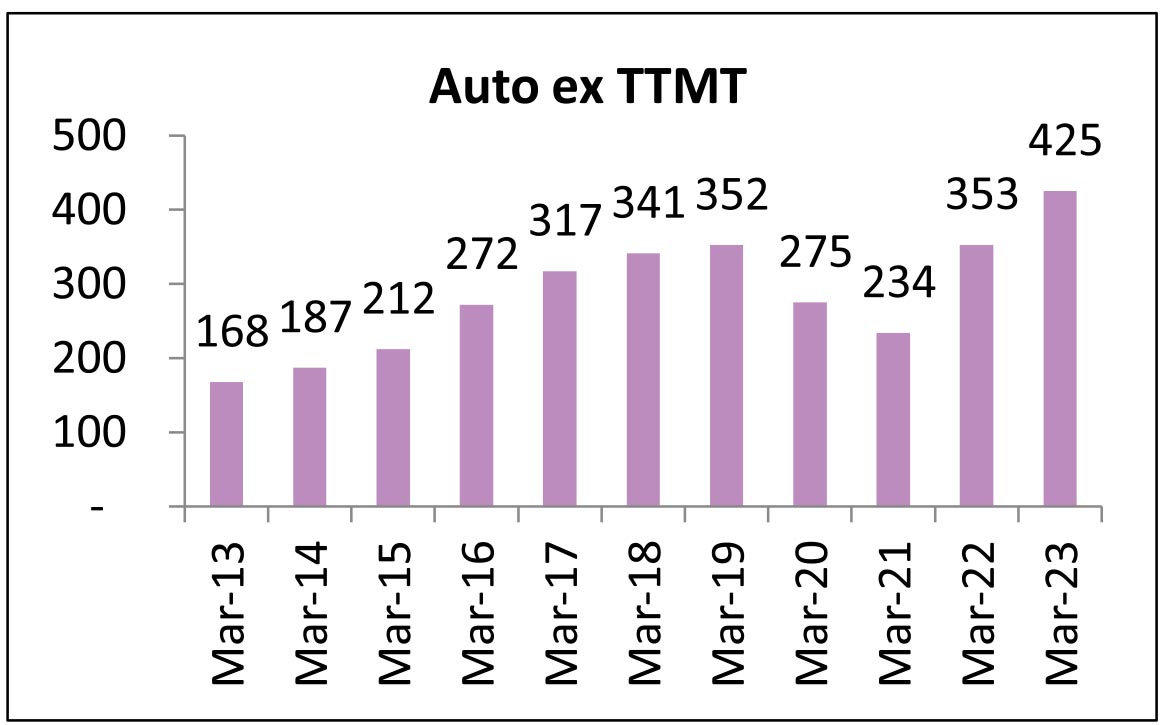

▶ Auto sector ex TTMT (Tata Motors) grew by 9% CAGR over FY16-19 and consensus estimates a 15.6% CAGR over FY20-23.

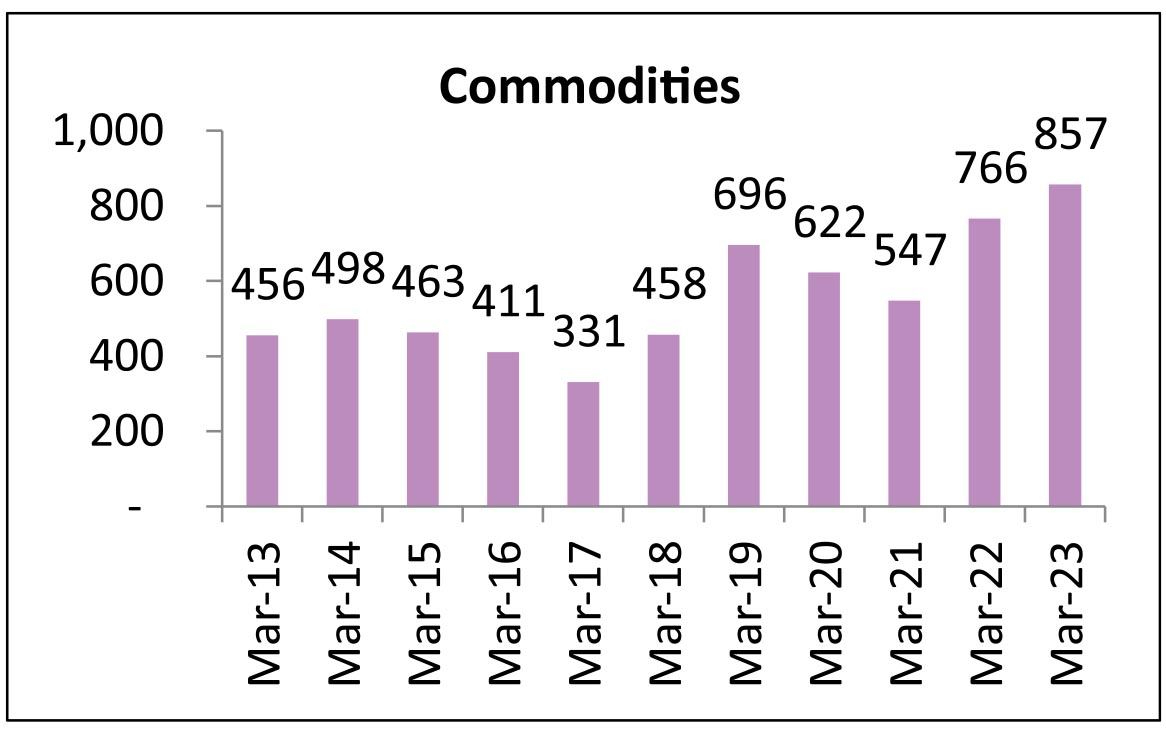

▶ Commodities sector has grown by 19% CAGR over FY16-19 while and consensus estimates a growth of 11% over FY20-23.

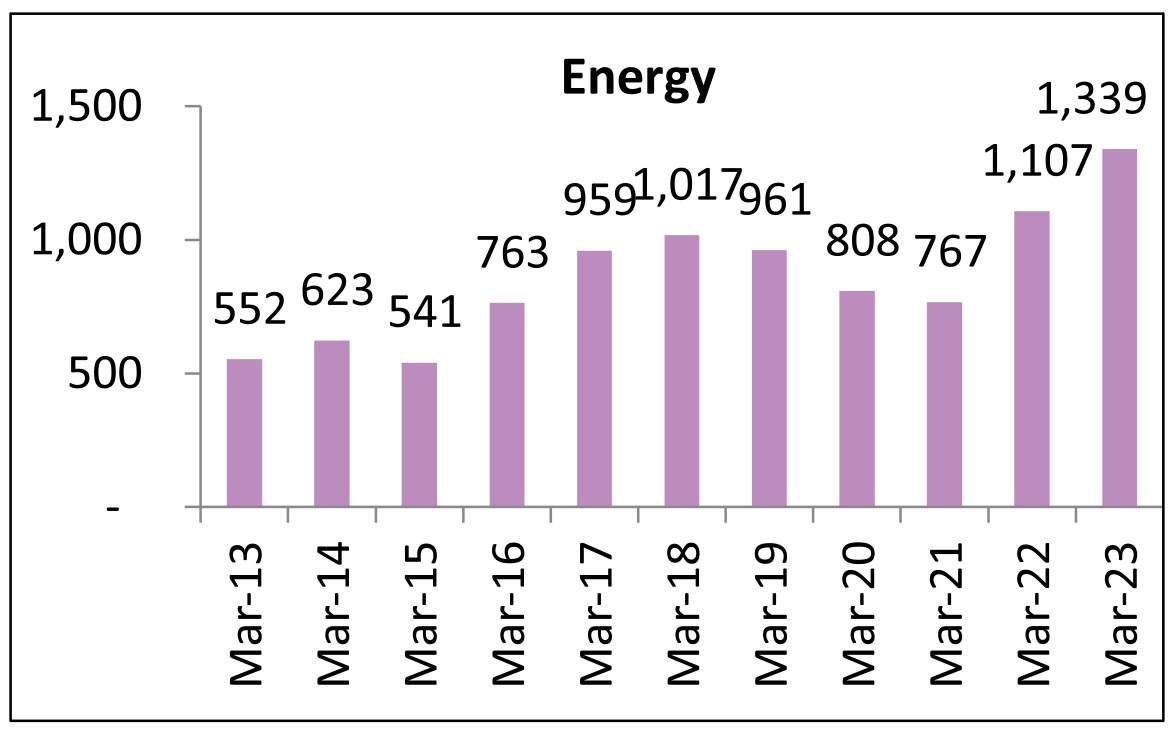

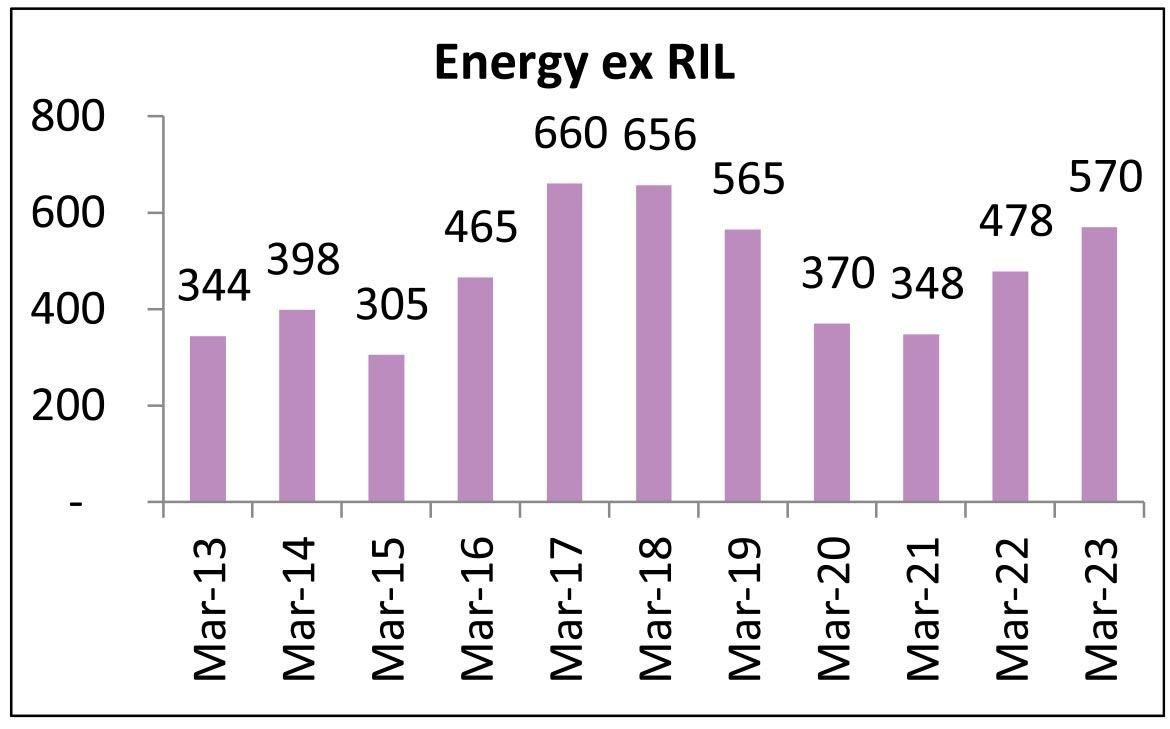

▶ Energy sector has grown by 8% CAGR over FY16-19 and consensus estimates a growth of 18.4% over FY20- 23. This growth is however led by RIL and hence Energy sector ex RIL has grown by 6.7% CAGR over FY16-19 with consensus estimating 15.5% over FY20-23.

▶ From FY13-15, PAT growth for Corporate banks remained flattish. While consensus estimates a 74% CAGR over FY20-23 from a lower base of FY20 and a 49% CAGR over FY21-23.

2) Deflation:

▶ Auto sector ex TTMT (Tata Motors) grew by 9% CAGR over FY16-19 and consensus estimates a 15.6% CAGR over FY20-23.

▶ Commodities sector has grown by 19% CAGR over FY16-19 while and consensus estimates a growth of 11% over FY20-23.

▶ Energy sector has grown by 8% CAGR over FY16-19 and consensus estimates a growth of 18.4% over FY20- 23. This growth is however led by RIL and hence Energy sector ex RIL has grown by 6.7% CAGR over FY16-19 with consensus estimating 15.5% over FY20-23.

Source: Bloomberg

3) Disruption:

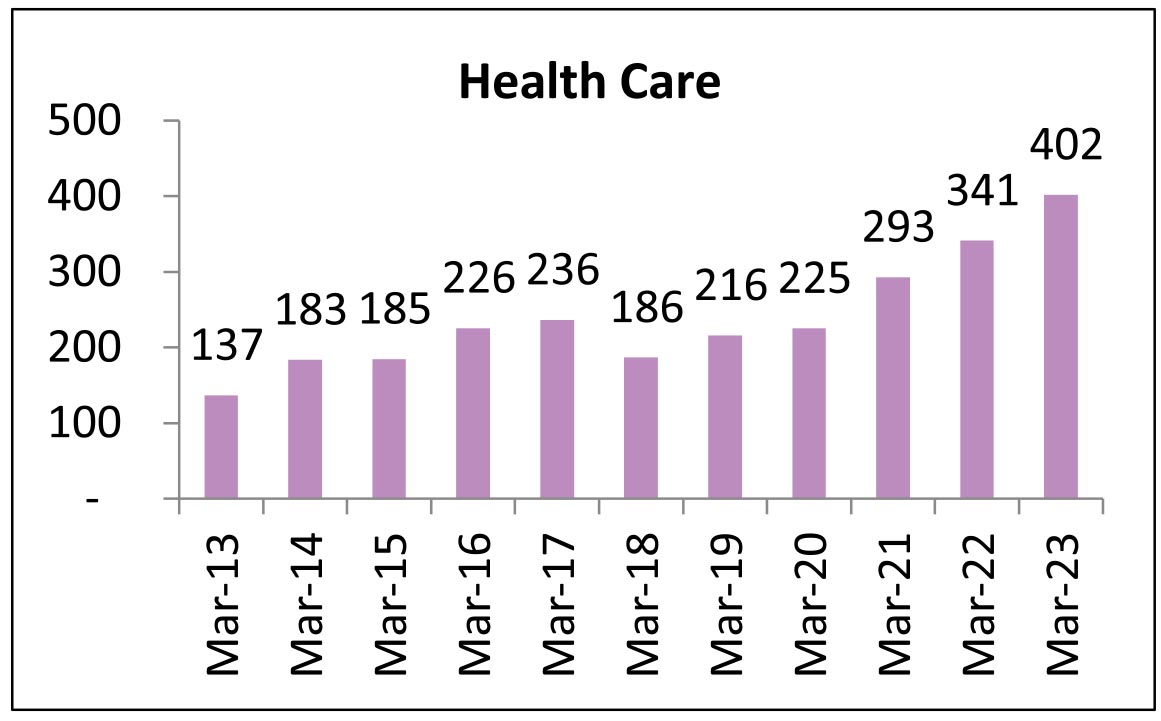

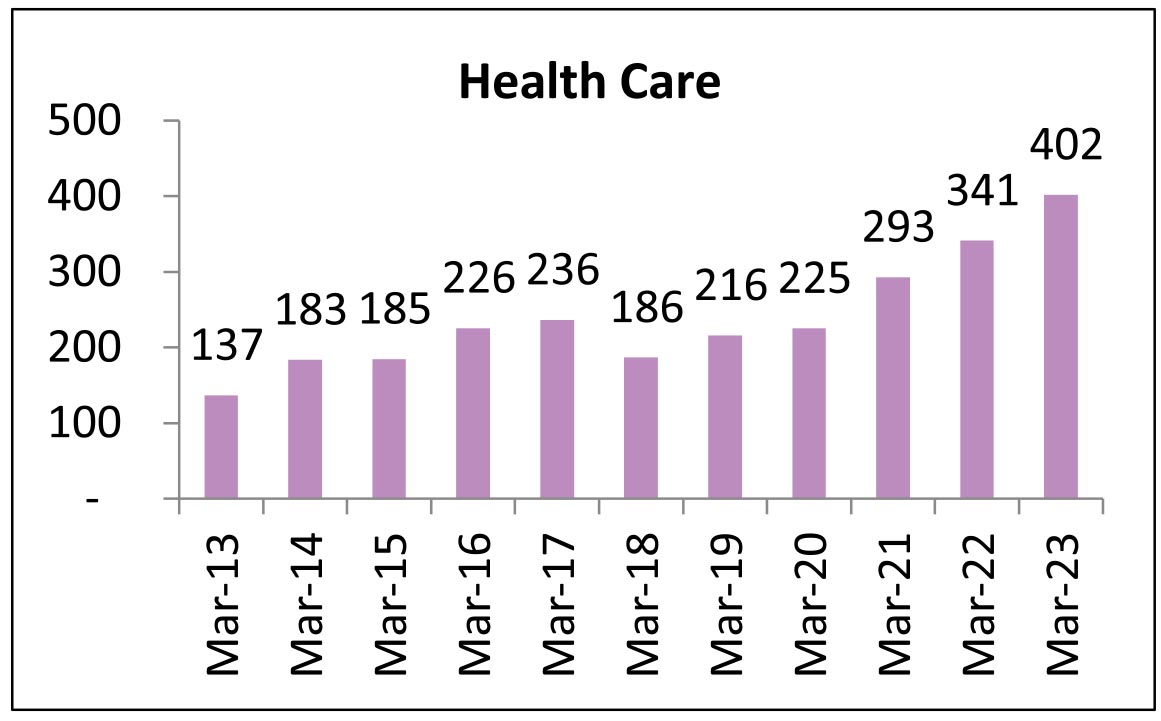

▶ Healthcare sector has recorded a growth 13.3 % over FY13-16 while consensus estimates a CAGR of 21.3% over FY20-23.

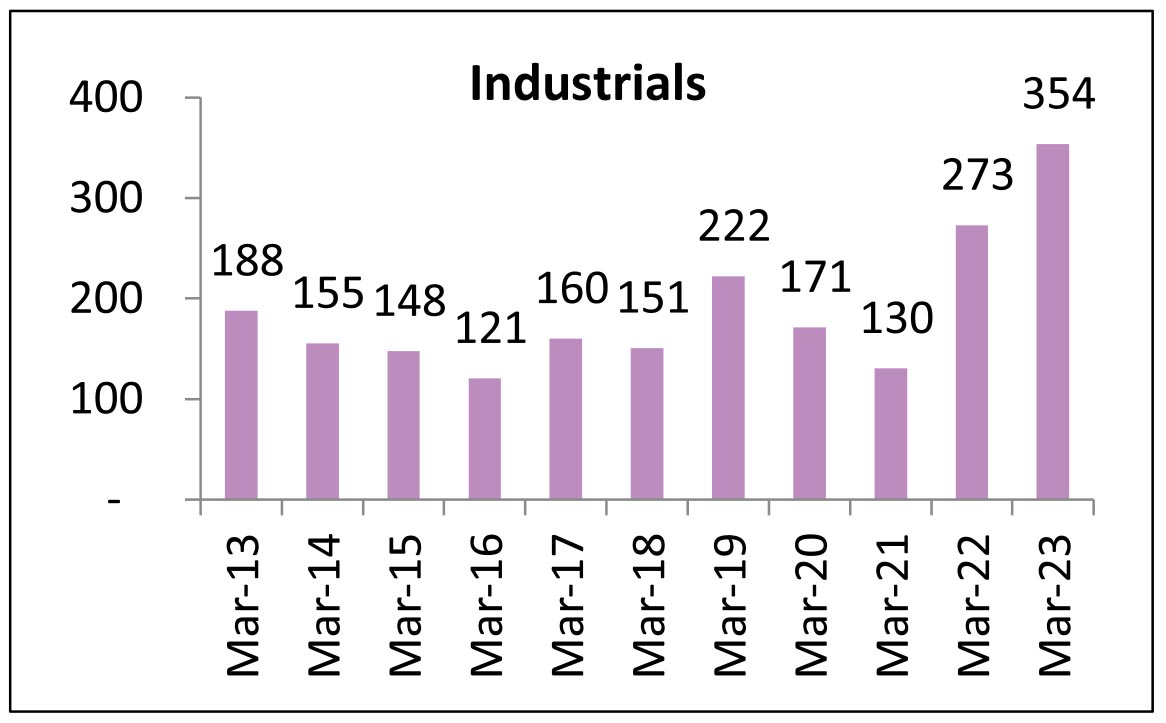

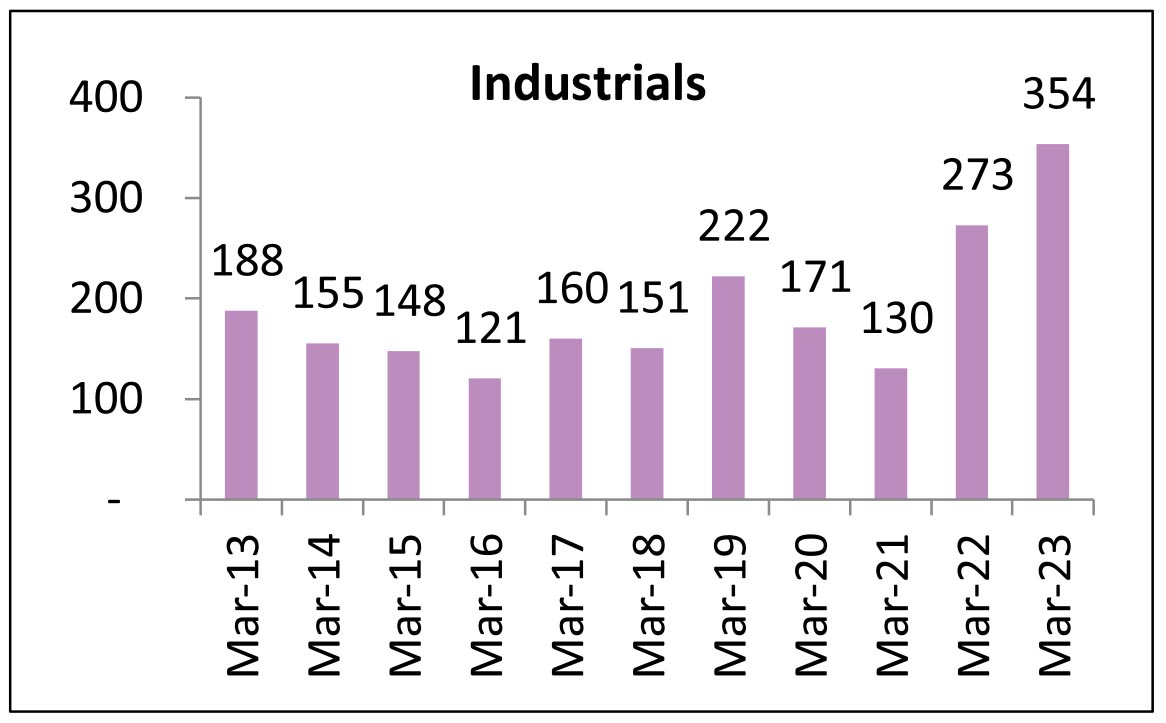

▶ Industrials has grown by 22.6% CAGR over FY16-19 while and consensus estimates a growth of 27.4% over FY20- 23 and a 65% CAGR over FY21-23.

The sectors / stocks mentioned should not be construed as an investment advice from IDFC Mutual Fund and IDFC Mutual Fund may or may not have any future position in these sectors / stocks.

▶ Healthcare sector has recorded a growth 13.3 % over FY13-16 while consensus estimates a CAGR of 21.3% over FY20-23.

▶ Industrials has grown by 22.6% CAGR over FY16-19 while and consensus estimates a growth of 27.4% over FY20- 23 and a 65% CAGR over FY21-23.

The sectors / stocks mentioned should not be construed as an investment advice from IDFC Mutual Fund and IDFC Mutual Fund may or may not have any future position in these sectors / stocks.

WHAT WENT BY

There is an optimism often felt as one runs out of pages on one's calendar; a feeling that what's done is

done and buried in the pages already turned. That the next page will be a new slate, a break as it were

to start things afresh. For those who have travelled well, or can seek comfort from the road behind, there

is gratitude too as these last pages are flipped through one last time and then place is made for the new

calendar to start recording one's ongoing journey as the year turns.

Every new year's resolution at some level reflects this turning of pages, of looking forward or leaving behind, though most such resolutions may not be described with the mediocre prose that the current reader is being subjected to. Nevertheless the emotion runs true, even as ennui soon sets in in many cases and realization dawns that these new pages are very similar to the ones before and that not much changes even in the new dates. The same line of thinking, however, can be turned entirely around and equally a realization may spring that, even though it is part of the same ongoing book, each page is in fact a new one and a day can be seized for new beginnings even if it doesn't coincide with the beginning of a new year.

If the reader finds their patience running thin by now, it is understandable. A fund manager attempting to wax poetic may be looked at with alarm by an investor as being in danger of losing their marbles. In our defense, this has been a year like no other in the last many decades. While life shows kindness and pain to individuals all the time, this year has inflicted much cruelty to the collective of humanity. And it wants to draw as much as it can even as it leaves, refusing to at least bow out with a bit of penance. For all its cruelty, however, it has been met with a wall of human resilience, enterprise, determined execution of duties at almost infinite personal costs, and kindness. It has been a matter of personal astonishment to see this in play daily, almost as if it is routine, and in most cases done silently. For many people all that has mattered, and continues to matter, is simply the doing of the deed and not the telling of it. That such capacity for humanness exists is the greatest reason to both view one's own struggles and ambitions in context as well as seek inspiration for future endeavors.

A Brief Macro Assessment

Let us now hasten and shift narrative to an area where we have some pretense of understanding. That said, even this small cover of make-believe expertise has been severely shaken both by the intensity of this shock as well as the nature of its progression. With the first lockdowns, a hope almost globally was that the virus would run its course soon and that activity will be back to some semblance of normality. A lot of fiscal policy response, even in some emerging markets with obvious resource constraints, were thus designed to be intensive and aimed for a short period of high expenditures as a bridge before normality resumed. As it became clearer that this is a longer drawdown, policy had to start recalibrating towards more medium term handholding. Some of the more resource constrained nations will probably find this recalibration harder to execute as debt sustainability questions start getting asked around by investors.

Growth forecasts have similarly yo-yoed as the year has progressed. In the first few months of lockdowns the concurrent drop-off in the economy was so alarming and the path to resolution so uncertain, that economic forecasts were understandably quite dire even after accounting for a way towards normalization in the time ahead. However, the intensity of global policy response was large and it did prove to be an effective bridge over this dark period in many economies. Then, even as the virus has moved in multiple waves in many major economies, the general return to economic activity has been somewhat more widespread than probably earlier imagined. But most of all the permanent damage to the system, at least on initial assessment, seems to have been lesser than what was earlier feared.

This last point is nuanced and needs further exploration. Imagine companies and consumers as two sets of entities facing one another. When the lock-down induced economic disruption occurred, it brought about a standstill in activity. For companies it meant that capacities idled while consumers faced a fall-off in the discretionary aspects of their consumption. For the relatively well-sized companies while production was halted capacities were relatively preserved. Similarly, the relatively well-off consumers were forced into saving even as their purchasing powers were intact. When economic activity started to return, these companies stepped up production while the more privileged consumers came back with 'revenge spending'. This saw a huge bump up in both production and consumption especially in many goods producing sectors. It is also these sets of economic agents that are better captured in the initial release of many economic data. Sure enough, data also rebounded strongly.

However, the reality may have been quite different for the smaller companies or businesses and for consumers who have been more susceptible economically. For many such enterprises the starting cushions are weak and therefore survivability may depend upon continued business. Here the activity fall-off may have extracted a higher price in the form of permanent shutdowns or capacity reductions. Similarly, for the weaker income groups in consumers, including where purchasing power would have been additionally impacted via loss in pay or jobs, savings may have actually diminished over the lockdown period. In many cases there would have been none to begin with. This diminishing is importantly also to do with the much lower discretionary component of spending here and hence the negligible element of forced saving that could come back as higher spending later. Government policies have been critical like, in the case of India, the credit facilities forwarded to small and medium businesses and the multi-month provisioning of food for the economically vulnerable.

Even so, it is here where the maximum permanent or long period damage will occur. From a welfare standpoint this implies an impact or disruption in means for people who were already vulnerable to begin with. It also means that purchasing power for the collective of consumers has actually gone down and may begin to show when the pent-up phase as described above starts to abate. This is certainly the conclusion one can draw when looking at aggregate labor market commentaries. Thus while aggregate numbers on unemployment have diminished, the incremental healing seems to have stagnated. Importantly, the aggregate quality of employment may have been impacted significantly as more people have had to settle for lower wages / salaries including via return to agricultural employment. For small businesses that have been impaired, the return would be slow as capacities are rebuilt and labor rehired. These will have an element of additional costs for now as well since all sorts of factors-of-production dislocations are slow to normalize. There are also businesses that would have shut down and the revival, including the employment that they used to generate, will take a significant amount of time.

All of the above helps explain the nuance around the economic damage. While the resilience of the relatively larger companies and the more fortunate consumers had probably been underestimated before, there are also aspects of permanent damage that may not be immediately apparent in headline economic numbers or in concurrent lender balance sheet commentaries. It is also not a foregone conclusion that such damage cannot be reversed, provided that public policy continues to actively address these issues. There is reason, however, for caution in future extrapolations. Thus suppose output was 100 as at February 2020. The changes in economic projections basis the faster return of activity so far pertain largely to now many economies re-attaining this level of 100 sooner than earlier envisaged. However, whether there is a stronger growth path from there will crucially depend upon the underlying drivers of aggregate demand (incomes for example) reverting to a more robust path of recovery. The next section examines whether India may be on the cusp of a cyclical upturn in such drivers.

Is It India's Turn Now?

India's cyclical slowdown has been in play for the last few years. It has broadly been marked with muted income growth, elevated stress on aggregate in the financial system, and a somewhat bloated public sector deficit (our apologies for conflating cause and effect in this description). While consumption had been a key anchor for growth it had been backed by rising leverage over the past few years, and investment growth has been weak. Global factors have been in play as well including a manufacturing recession that hit major economies in 2019.

Given the above, it can be argued that a cyclical bounce for India was well overdue just before the virus hit. Indeed, even the world would have probably seen a manufacturing sector rebound as inventory adjustments would have run their course. The same would be true for India as well. Besides there are other potential tailwinds for us. Our outlier stress on banking balance sheet, courtesy a previous corporate loan cycle, seems to be stabilizing as recognition and provisioning seem to be finally ahead of formation. While fresh stresses on account of the current economic shock are to be expected, they may not carry very large exposures per account and most institutions seem to have proactively prepared for them. Given this, an element of tightening in credit conditions may be no longer in play in the few years ahead. This can be supported further by monetary policy that is now genuinely accommodative (more on this later) and leading to very low borrowing rates. Should the real estate sector be able to find some legs as a result, it could feed into better employment prospects via a construction cycle. The corporate tax cuts announced earlier alongside a robust production incentive scheme roll out, may similarly provide some tailwinds to manufacturing. This may especially get a launchpad should global trade witness a cyclical rebound as well over the next few years. Finally, and through a benign channel of positive feedback loop, some of the above may help the government better its revenue profile and hence step up discretionary policy focused public spending which can help buttress another pillar for growth.

Just as the above factors provide cause for optimism, however, we should take caution as well that the sustenance of a cyclical rebound will involve enhancements in the drivers of aggregate demand as well. In particular, and as discussed before, the income slowdown cycle needs to be reversed and the elements of permanent damage to smaller balance sheets be controlled. Reviving the investment cycle, with its attendant job creation and value chain benefits, will thus be a key policy priority in the years ahead.

The Role of Monetary Policy

After the 2013 external account debacle, the macro priorities for India understandably shifted towards prioritizing stability above all else. This was truly required for survival and growth and indeed cannot be ignored at any point in time. However, given the context, the objective was front and center for policy in the years after that crisis. It is within this that the new CPI targeting regime was envisaged and vigorously adopted by the RBI. For a number of years, the central bank's approach to policy rates and liquidity was designed with almost a single-minded focus on a 4% CPI target. Reversals to accommodations provided at points in time also tended to be abrupt given the dominance of the 4% target (for example in the period after demonetization). Partly as a result of this, and significantly owing to a benign food price and wages cycle, CPI objectives were largely met.

At this juncture, however, it may be argued that India's macro-economic priorities have shifted. Thus while macro-stability has to be an enduring objective and policy has to be always anchored in it, there is now an imperative to get an investment cycle going. This is required both for creating productive capacities and thereby reverse the recent few years' decline in our potential growth rates, as well as for the positive feedback loop that it brings for jobs and incomes. It has also been observed by many that while deeply negative real rates are obviously detrimental to savings, it doesn't automatically follow that the level of savings keeps rising with rising real positive rates. Incomes play a much larger role in determining savings once real rates are decently anchored. This also seems corroborated with the years of our "success" with CPI targeting.

In our view, public policy (both fiscal and monetary) is largely aligned to this objective of investment revival at this juncture. This may be partly driven by the context of a once-in-two-lifetimes growth shock and partly by the experience of the last few years. At any rate we think that while the CPI targeting framework is alive and well (and it is unlikely we go back on this after the scare of 2013), the interpretation of it is now truly flexible. Thus, as an example, the unsaid comfort band may already be 4 - 6%. To that extent, any formal change to target may be unnecessary and irrelevant (although it may make sense to move up the bottom of the range which will serve to both narrow the range and move up the mid-point). Equally, the logic that higher inflation may be tolerated when growth is weaker is fundamentally flawed save when inflation is high owing to extreme supply shock / congestions like in the present case. This is because monetary policy works through the channel of muting aggregate demand and hence impacting inflation. If aggregate demand is already weak then by definition demand led inflation must be too. To say otherwise is to basically admit that monetary policy has no role in inflation management.

The Old Crystal Ball

Rather than courting future potential embarrassment for ourselves with definitive predictions put in writing, we will undertake the somewhat less (but only just) daunting task of putting in place some markers.

▶ If the factors detailed above supporting India's cyclical rebound come to fruition, a lot of macroeconomic headaches feared at the beginning of the year will ease. Thus some of the fiscal inflexibilities and associated risks of sovereign rating downgrades will abate, the external account will build even further buffers as capital flows remain strong, and hopefully India's appeal will percolate to global fixed income investors as well (this has seen a very long hiatus).

▶ Monetary policy will gradually move from the level of emergency level accommodation today to one of still high accommodation. This will likely be a slow process and will involve more discretionary adjustments to the price of liquidity (for instance by starting to narrow the repo-reverse repo corridor at some point, most likely in the second half of the calendar) rather than the quantity of it. The latter is currently too large and given likely still substantial capital flows next year will be slow to normalize. Any substantial policy steps taken to reduce the excess liquidity (automatic lapsing of CRR relaxations, minor MSS issuances, etc are par for the course, in the realm of current expectations, and don't count as substantial policy steps in the current description) will risk disrupting markets and send adverse intent signals. For that reason, we think they are unlikely in the current regime or at least a long time away. The market has seen abrupt reversals in accommodation in the previous rigid CPI targeting regime and this fear still colors many market participants' expectations. However, as we have explained here, we don't think that is the policy thinking today and extra cover for looser policy is in any case available for the foreseeable future with a very strong external account, as well as with average CPI print next year likely to be significantly lower than this year. The so-called reflation expected ahead will most likely manifest in the narrowing of WPI vs CPI prints over the year.

▶ Yield curves will gradually bear flatten. Put in the bond market's perspective, the current difference between 10 year bond yield to overnight rate is roughly around 275 - 300 bps. This will likely fall over the year ahead, although it will still be higher than the last few years' average given that monetary policy will likely be more accommodative on average and bond supply will be higher for the next few years when compared with the last few years. It is also very likely that the bulk of this adjustment will be made by the very front end rates. This is not to say that long end rates won't have to adjust. Rather, the quantum of adjustment there may be of a relatively smaller magnitude when compared with rates at the very front end. It is also to be noted that such adjustments are likely to be gradual and the ground to cover till normalization, at least till the first such equilibrium, may not be anywhere as large as has been the case in previous such episodes of very low front end rates.

▶ The starting point today is one of a very steep yield curve. Thus unlike in normal times when the yield curve is quite flat, the decision on duration isn't a binary one any more. Rather, one has to examine the steepness of the curve and position at points where the carry adjusted for duration seems to be the most optimal. That is to say, even if yields are to go up there are points on the curve where the extra carry compensates enough for a limited rise in yields so that the trade still earns better than the rate on offer on (let's say) 1 year treasury bills today. This also means that the cost of keeping cash is quite high, especially as one doesn't expect any abrupt reversals ahead.

▶ Credit spreads, including on lower rated assets, have compressed meaningfully. These reflect the chase for 'carry' in an environment of abundant liquidity and funds flow, as well as the relatively muted supply of paper as companies have belt tightened and focused on cash generation. As activity resumes over the year ahead, issuances will likely increase thereby pressuring spreads to rise. Paper supply may also increase as institutional investors redeem some of their treasury investments to deploy in business. The extent of such expansion will likely be higher for companies that can absorb higher borrowing costs given the nature of their activities or whose paper tends to command lesser liquidity when market turns "two-way". Also, as a general principle, at the bottom of a rate cycle it is prudent to demand higher compensation for deeper commitments of capital. While a steep yield curve is possibly providing this for longer tenor commitments (at least at particular points on the yield curve where implied forward rates are quite attractive), credit spreads on lower rated assets in general may no longer be doing so.

Towards The Light

We would most likely have lost our readers somewhere in this exceptionally long-winded year end piece. What is written now is therefore likely to just gather dust. Irrespective though here's wishing that we can leave this year well and truly behind, that the next page is indeed a chance to begin things anew, that there's a warm and benign light that shines upon us all which brings joy and fulfillment, that we never forget to be grateful for what we have nevertheless, and that we are always awed and inspired by the kindness of strangers.

The Disclosures of opinions/in house views/strategy incorporated herein is provided solely to enhance the transparency about the investment strategy / theme of the Scheme and should not be treated as endorsement of the views / opinions or as an investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document has been prepared on the basis of information, which is already available in publicly accessible media or developed through analysis of IDFC Mutual Fund. The information/ views / opinions provided is for informative purpose only and may have ceased to be current by the time it may reach the recipient, which should be taken into account before interpreting this document. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision and the security may or may not continue to form part of the scheme's portfolio in future. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. The decision of the Investment Manager may not always be profitable; as such decisions are based on the prevailing market conditions and the understanding of the Investment Manager. Actual market movements may vary from the anticipated trends. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alterations to this statement as may be required from time to time. Neither IDFC Mutual Fund / IDFC AMC Trustee Co. Ltd./ IDFC Asset Management Co. Ltd nor IDFC, its Directors or representatives shall be liable for any damages whether direct or indirect, incidental, punitive special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information.

Every new year's resolution at some level reflects this turning of pages, of looking forward or leaving behind, though most such resolutions may not be described with the mediocre prose that the current reader is being subjected to. Nevertheless the emotion runs true, even as ennui soon sets in in many cases and realization dawns that these new pages are very similar to the ones before and that not much changes even in the new dates. The same line of thinking, however, can be turned entirely around and equally a realization may spring that, even though it is part of the same ongoing book, each page is in fact a new one and a day can be seized for new beginnings even if it doesn't coincide with the beginning of a new year.

If the reader finds their patience running thin by now, it is understandable. A fund manager attempting to wax poetic may be looked at with alarm by an investor as being in danger of losing their marbles. In our defense, this has been a year like no other in the last many decades. While life shows kindness and pain to individuals all the time, this year has inflicted much cruelty to the collective of humanity. And it wants to draw as much as it can even as it leaves, refusing to at least bow out with a bit of penance. For all its cruelty, however, it has been met with a wall of human resilience, enterprise, determined execution of duties at almost infinite personal costs, and kindness. It has been a matter of personal astonishment to see this in play daily, almost as if it is routine, and in most cases done silently. For many people all that has mattered, and continues to matter, is simply the doing of the deed and not the telling of it. That such capacity for humanness exists is the greatest reason to both view one's own struggles and ambitions in context as well as seek inspiration for future endeavors.

A Brief Macro Assessment

Let us now hasten and shift narrative to an area where we have some pretense of understanding. That said, even this small cover of make-believe expertise has been severely shaken both by the intensity of this shock as well as the nature of its progression. With the first lockdowns, a hope almost globally was that the virus would run its course soon and that activity will be back to some semblance of normality. A lot of fiscal policy response, even in some emerging markets with obvious resource constraints, were thus designed to be intensive and aimed for a short period of high expenditures as a bridge before normality resumed. As it became clearer that this is a longer drawdown, policy had to start recalibrating towards more medium term handholding. Some of the more resource constrained nations will probably find this recalibration harder to execute as debt sustainability questions start getting asked around by investors.

Growth forecasts have similarly yo-yoed as the year has progressed. In the first few months of lockdowns the concurrent drop-off in the economy was so alarming and the path to resolution so uncertain, that economic forecasts were understandably quite dire even after accounting for a way towards normalization in the time ahead. However, the intensity of global policy response was large and it did prove to be an effective bridge over this dark period in many economies. Then, even as the virus has moved in multiple waves in many major economies, the general return to economic activity has been somewhat more widespread than probably earlier imagined. But most of all the permanent damage to the system, at least on initial assessment, seems to have been lesser than what was earlier feared.

This last point is nuanced and needs further exploration. Imagine companies and consumers as two sets of entities facing one another. When the lock-down induced economic disruption occurred, it brought about a standstill in activity. For companies it meant that capacities idled while consumers faced a fall-off in the discretionary aspects of their consumption. For the relatively well-sized companies while production was halted capacities were relatively preserved. Similarly, the relatively well-off consumers were forced into saving even as their purchasing powers were intact. When economic activity started to return, these companies stepped up production while the more privileged consumers came back with 'revenge spending'. This saw a huge bump up in both production and consumption especially in many goods producing sectors. It is also these sets of economic agents that are better captured in the initial release of many economic data. Sure enough, data also rebounded strongly.

However, the reality may have been quite different for the smaller companies or businesses and for consumers who have been more susceptible economically. For many such enterprises the starting cushions are weak and therefore survivability may depend upon continued business. Here the activity fall-off may have extracted a higher price in the form of permanent shutdowns or capacity reductions. Similarly, for the weaker income groups in consumers, including where purchasing power would have been additionally impacted via loss in pay or jobs, savings may have actually diminished over the lockdown period. In many cases there would have been none to begin with. This diminishing is importantly also to do with the much lower discretionary component of spending here and hence the negligible element of forced saving that could come back as higher spending later. Government policies have been critical like, in the case of India, the credit facilities forwarded to small and medium businesses and the multi-month provisioning of food for the economically vulnerable.

Even so, it is here where the maximum permanent or long period damage will occur. From a welfare standpoint this implies an impact or disruption in means for people who were already vulnerable to begin with. It also means that purchasing power for the collective of consumers has actually gone down and may begin to show when the pent-up phase as described above starts to abate. This is certainly the conclusion one can draw when looking at aggregate labor market commentaries. Thus while aggregate numbers on unemployment have diminished, the incremental healing seems to have stagnated. Importantly, the aggregate quality of employment may have been impacted significantly as more people have had to settle for lower wages / salaries including via return to agricultural employment. For small businesses that have been impaired, the return would be slow as capacities are rebuilt and labor rehired. These will have an element of additional costs for now as well since all sorts of factors-of-production dislocations are slow to normalize. There are also businesses that would have shut down and the revival, including the employment that they used to generate, will take a significant amount of time.

All of the above helps explain the nuance around the economic damage. While the resilience of the relatively larger companies and the more fortunate consumers had probably been underestimated before, there are also aspects of permanent damage that may not be immediately apparent in headline economic numbers or in concurrent lender balance sheet commentaries. It is also not a foregone conclusion that such damage cannot be reversed, provided that public policy continues to actively address these issues. There is reason, however, for caution in future extrapolations. Thus suppose output was 100 as at February 2020. The changes in economic projections basis the faster return of activity so far pertain largely to now many economies re-attaining this level of 100 sooner than earlier envisaged. However, whether there is a stronger growth path from there will crucially depend upon the underlying drivers of aggregate demand (incomes for example) reverting to a more robust path of recovery. The next section examines whether India may be on the cusp of a cyclical upturn in such drivers.

Is It India's Turn Now?

India's cyclical slowdown has been in play for the last few years. It has broadly been marked with muted income growth, elevated stress on aggregate in the financial system, and a somewhat bloated public sector deficit (our apologies for conflating cause and effect in this description). While consumption had been a key anchor for growth it had been backed by rising leverage over the past few years, and investment growth has been weak. Global factors have been in play as well including a manufacturing recession that hit major economies in 2019.

Given the above, it can be argued that a cyclical bounce for India was well overdue just before the virus hit. Indeed, even the world would have probably seen a manufacturing sector rebound as inventory adjustments would have run their course. The same would be true for India as well. Besides there are other potential tailwinds for us. Our outlier stress on banking balance sheet, courtesy a previous corporate loan cycle, seems to be stabilizing as recognition and provisioning seem to be finally ahead of formation. While fresh stresses on account of the current economic shock are to be expected, they may not carry very large exposures per account and most institutions seem to have proactively prepared for them. Given this, an element of tightening in credit conditions may be no longer in play in the few years ahead. This can be supported further by monetary policy that is now genuinely accommodative (more on this later) and leading to very low borrowing rates. Should the real estate sector be able to find some legs as a result, it could feed into better employment prospects via a construction cycle. The corporate tax cuts announced earlier alongside a robust production incentive scheme roll out, may similarly provide some tailwinds to manufacturing. This may especially get a launchpad should global trade witness a cyclical rebound as well over the next few years. Finally, and through a benign channel of positive feedback loop, some of the above may help the government better its revenue profile and hence step up discretionary policy focused public spending which can help buttress another pillar for growth.

Just as the above factors provide cause for optimism, however, we should take caution as well that the sustenance of a cyclical rebound will involve enhancements in the drivers of aggregate demand as well. In particular, and as discussed before, the income slowdown cycle needs to be reversed and the elements of permanent damage to smaller balance sheets be controlled. Reviving the investment cycle, with its attendant job creation and value chain benefits, will thus be a key policy priority in the years ahead.

The Role of Monetary Policy

After the 2013 external account debacle, the macro priorities for India understandably shifted towards prioritizing stability above all else. This was truly required for survival and growth and indeed cannot be ignored at any point in time. However, given the context, the objective was front and center for policy in the years after that crisis. It is within this that the new CPI targeting regime was envisaged and vigorously adopted by the RBI. For a number of years, the central bank's approach to policy rates and liquidity was designed with almost a single-minded focus on a 4% CPI target. Reversals to accommodations provided at points in time also tended to be abrupt given the dominance of the 4% target (for example in the period after demonetization). Partly as a result of this, and significantly owing to a benign food price and wages cycle, CPI objectives were largely met.

At this juncture, however, it may be argued that India's macro-economic priorities have shifted. Thus while macro-stability has to be an enduring objective and policy has to be always anchored in it, there is now an imperative to get an investment cycle going. This is required both for creating productive capacities and thereby reverse the recent few years' decline in our potential growth rates, as well as for the positive feedback loop that it brings for jobs and incomes. It has also been observed by many that while deeply negative real rates are obviously detrimental to savings, it doesn't automatically follow that the level of savings keeps rising with rising real positive rates. Incomes play a much larger role in determining savings once real rates are decently anchored. This also seems corroborated with the years of our "success" with CPI targeting.

In our view, public policy (both fiscal and monetary) is largely aligned to this objective of investment revival at this juncture. This may be partly driven by the context of a once-in-two-lifetimes growth shock and partly by the experience of the last few years. At any rate we think that while the CPI targeting framework is alive and well (and it is unlikely we go back on this after the scare of 2013), the interpretation of it is now truly flexible. Thus, as an example, the unsaid comfort band may already be 4 - 6%. To that extent, any formal change to target may be unnecessary and irrelevant (although it may make sense to move up the bottom of the range which will serve to both narrow the range and move up the mid-point). Equally, the logic that higher inflation may be tolerated when growth is weaker is fundamentally flawed save when inflation is high owing to extreme supply shock / congestions like in the present case. This is because monetary policy works through the channel of muting aggregate demand and hence impacting inflation. If aggregate demand is already weak then by definition demand led inflation must be too. To say otherwise is to basically admit that monetary policy has no role in inflation management.

The Old Crystal Ball

Rather than courting future potential embarrassment for ourselves with definitive predictions put in writing, we will undertake the somewhat less (but only just) daunting task of putting in place some markers.

▶ If the factors detailed above supporting India's cyclical rebound come to fruition, a lot of macroeconomic headaches feared at the beginning of the year will ease. Thus some of the fiscal inflexibilities and associated risks of sovereign rating downgrades will abate, the external account will build even further buffers as capital flows remain strong, and hopefully India's appeal will percolate to global fixed income investors as well (this has seen a very long hiatus).

▶ Monetary policy will gradually move from the level of emergency level accommodation today to one of still high accommodation. This will likely be a slow process and will involve more discretionary adjustments to the price of liquidity (for instance by starting to narrow the repo-reverse repo corridor at some point, most likely in the second half of the calendar) rather than the quantity of it. The latter is currently too large and given likely still substantial capital flows next year will be slow to normalize. Any substantial policy steps taken to reduce the excess liquidity (automatic lapsing of CRR relaxations, minor MSS issuances, etc are par for the course, in the realm of current expectations, and don't count as substantial policy steps in the current description) will risk disrupting markets and send adverse intent signals. For that reason, we think they are unlikely in the current regime or at least a long time away. The market has seen abrupt reversals in accommodation in the previous rigid CPI targeting regime and this fear still colors many market participants' expectations. However, as we have explained here, we don't think that is the policy thinking today and extra cover for looser policy is in any case available for the foreseeable future with a very strong external account, as well as with average CPI print next year likely to be significantly lower than this year. The so-called reflation expected ahead will most likely manifest in the narrowing of WPI vs CPI prints over the year.

▶ Yield curves will gradually bear flatten. Put in the bond market's perspective, the current difference between 10 year bond yield to overnight rate is roughly around 275 - 300 bps. This will likely fall over the year ahead, although it will still be higher than the last few years' average given that monetary policy will likely be more accommodative on average and bond supply will be higher for the next few years when compared with the last few years. It is also very likely that the bulk of this adjustment will be made by the very front end rates. This is not to say that long end rates won't have to adjust. Rather, the quantum of adjustment there may be of a relatively smaller magnitude when compared with rates at the very front end. It is also to be noted that such adjustments are likely to be gradual and the ground to cover till normalization, at least till the first such equilibrium, may not be anywhere as large as has been the case in previous such episodes of very low front end rates.

▶ The starting point today is one of a very steep yield curve. Thus unlike in normal times when the yield curve is quite flat, the decision on duration isn't a binary one any more. Rather, one has to examine the steepness of the curve and position at points where the carry adjusted for duration seems to be the most optimal. That is to say, even if yields are to go up there are points on the curve where the extra carry compensates enough for a limited rise in yields so that the trade still earns better than the rate on offer on (let's say) 1 year treasury bills today. This also means that the cost of keeping cash is quite high, especially as one doesn't expect any abrupt reversals ahead.

▶ Credit spreads, including on lower rated assets, have compressed meaningfully. These reflect the chase for 'carry' in an environment of abundant liquidity and funds flow, as well as the relatively muted supply of paper as companies have belt tightened and focused on cash generation. As activity resumes over the year ahead, issuances will likely increase thereby pressuring spreads to rise. Paper supply may also increase as institutional investors redeem some of their treasury investments to deploy in business. The extent of such expansion will likely be higher for companies that can absorb higher borrowing costs given the nature of their activities or whose paper tends to command lesser liquidity when market turns "two-way". Also, as a general principle, at the bottom of a rate cycle it is prudent to demand higher compensation for deeper commitments of capital. While a steep yield curve is possibly providing this for longer tenor commitments (at least at particular points on the yield curve where implied forward rates are quite attractive), credit spreads on lower rated assets in general may no longer be doing so.

Towards The Light

We would most likely have lost our readers somewhere in this exceptionally long-winded year end piece. What is written now is therefore likely to just gather dust. Irrespective though here's wishing that we can leave this year well and truly behind, that the next page is indeed a chance to begin things anew, that there's a warm and benign light that shines upon us all which brings joy and fulfillment, that we never forget to be grateful for what we have nevertheless, and that we are always awed and inspired by the kindness of strangers.

Wishing You A Very Happy New Year.

Disclaimer: MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.The Disclosures of opinions/in house views/strategy incorporated herein is provided solely to enhance the transparency about the investment strategy / theme of the Scheme and should not be treated as endorsement of the views / opinions or as an investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document has been prepared on the basis of information, which is already available in publicly accessible media or developed through analysis of IDFC Mutual Fund. The information/ views / opinions provided is for informative purpose only and may have ceased to be current by the time it may reach the recipient, which should be taken into account before interpreting this document. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision and the security may or may not continue to form part of the scheme's portfolio in future. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. The decision of the Investment Manager may not always be profitable; as such decisions are based on the prevailing market conditions and the understanding of the Investment Manager. Actual market movements may vary from the anticipated trends. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alterations to this statement as may be required from time to time. Neither IDFC Mutual Fund / IDFC AMC Trustee Co. Ltd./ IDFC Asset Management Co. Ltd nor IDFC, its Directors or representatives shall be liable for any damages whether direct or indirect, incidental, punitive special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information.