Commentary

30th June 2021

GLOBAL MARKETS

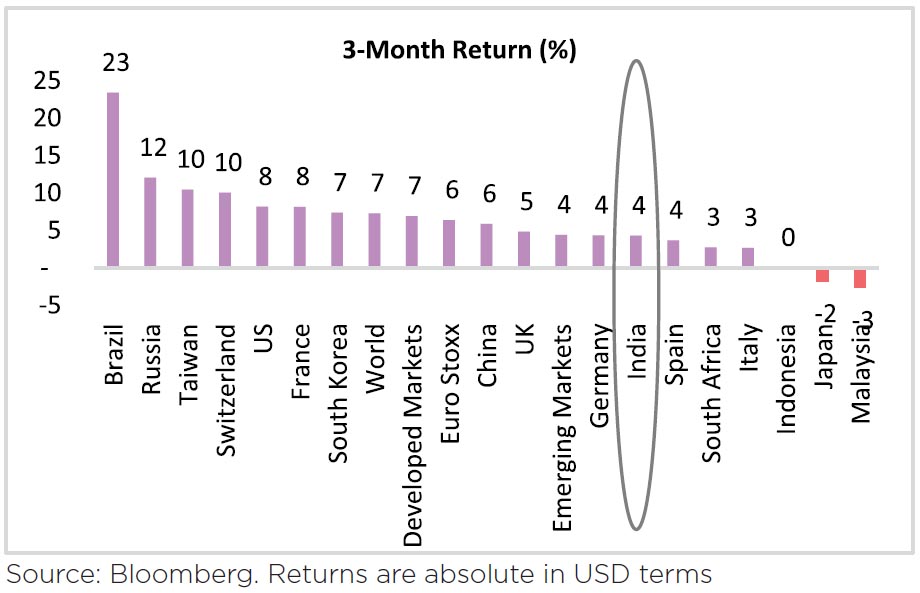

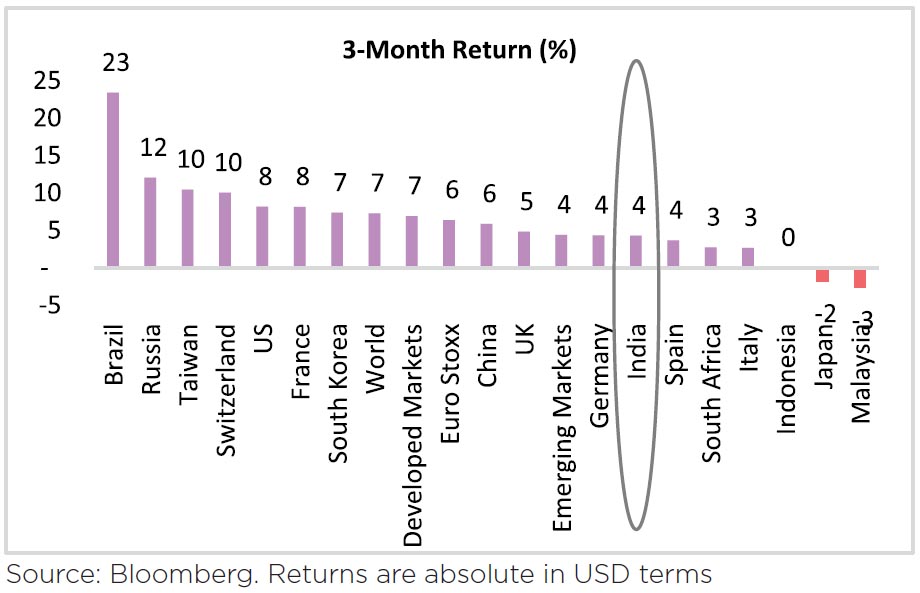

Global equities traded higher, with the

US continuing to lead other developed

markets (the US up +8.5% vs. Europe +6.4%

over 2Q). The FOMC shifted its guidance

in a slightly hawkish direction mid-month.

May 2021 CPI reports highlighted the

sharp and broad-based acceleration in

global inflation. In the first 6 months

of CY2021, global growth was strong,

but gains were uneven across regions,

owing to variations in policy support and

vaccination programs. Growth leadership

has shifted to the US, which is booming

on the back of full-bodied monetary and

fiscal stimulus, and away from China,

where fiscal and credit tightening slowed

growth below trend.

The upbeat macro backdrop, strong consumer spending outlook, and widening gap between strength in earnings and stalling price relatives portend further equity upside and outperformance of Cyclicals vs Defensives.

Federal Reserve (Fed) heading into early normalization, starting with QE (quantitative easing) rollback: The FOMC's (Federal Open Market Committee) advancement of rate lift-off to 2023 with two rate hikes is an acknowledgment that its macro-economic goals are being met sooner than anticipated. The estimated Fed rate fair value is 0.20-0.25%. It has been above 0% since Jan'21 or in just 7 months after the Covid-19 shock, much sooner than the 36 months it took after the 2008 GFC (global financial crisis)

Covid & Vaccines: India's second Covid-19 wave peaked and rolled over in early May, with new cases now trending down to 47k. The 7DMA of vaccine shots administered has increased sharply from under 2mn a day in the middle of May to over 5.7mn now. As of 30 June, ~20% of the population has taken at least one shot). Urban locations (districts with at least 60% urban population) have administered at least one shot to 1/4th of their people, while non-urban is at 14%. This means reopening (urban services) can happen sooner. The vaccination pace is expected to increase with the announcement of free vaccines for all above the age of 18 years at the cost of the Centre.

The upbeat macro backdrop, strong consumer spending outlook, and widening gap between strength in earnings and stalling price relatives portend further equity upside and outperformance of Cyclicals vs Defensives.

Federal Reserve (Fed) heading into early normalization, starting with QE (quantitative easing) rollback: The FOMC's (Federal Open Market Committee) advancement of rate lift-off to 2023 with two rate hikes is an acknowledgment that its macro-economic goals are being met sooner than anticipated. The estimated Fed rate fair value is 0.20-0.25%. It has been above 0% since Jan'21 or in just 7 months after the Covid-19 shock, much sooner than the 36 months it took after the 2008 GFC (global financial crisis)

Covid & Vaccines: India's second Covid-19 wave peaked and rolled over in early May, with new cases now trending down to 47k. The 7DMA of vaccine shots administered has increased sharply from under 2mn a day in the middle of May to over 5.7mn now. As of 30 June, ~20% of the population has taken at least one shot). Urban locations (districts with at least 60% urban population) have administered at least one shot to 1/4th of their people, while non-urban is at 14%. This means reopening (urban services) can happen sooner. The vaccination pace is expected to increase with the announcement of free vaccines for all above the age of 18 years at the cost of the Centre.

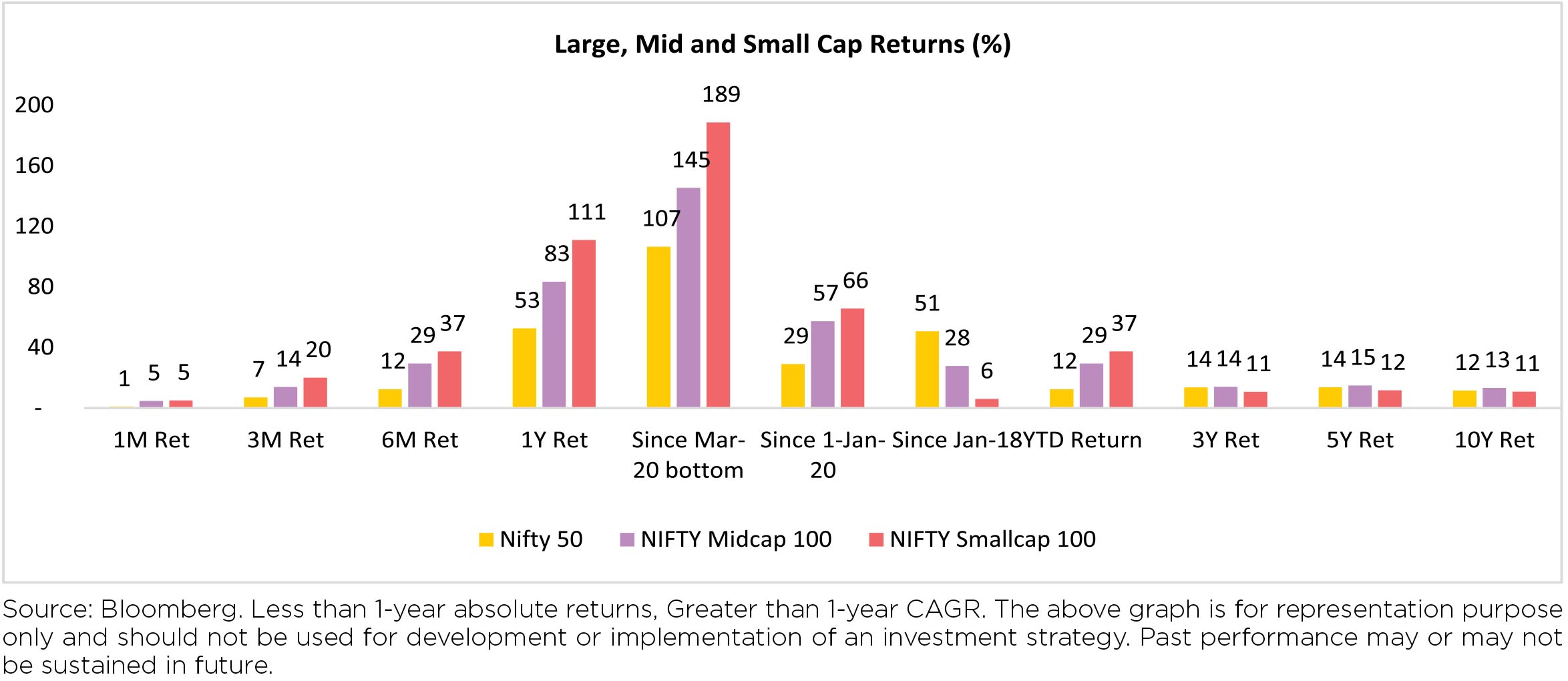

Domestic Markets

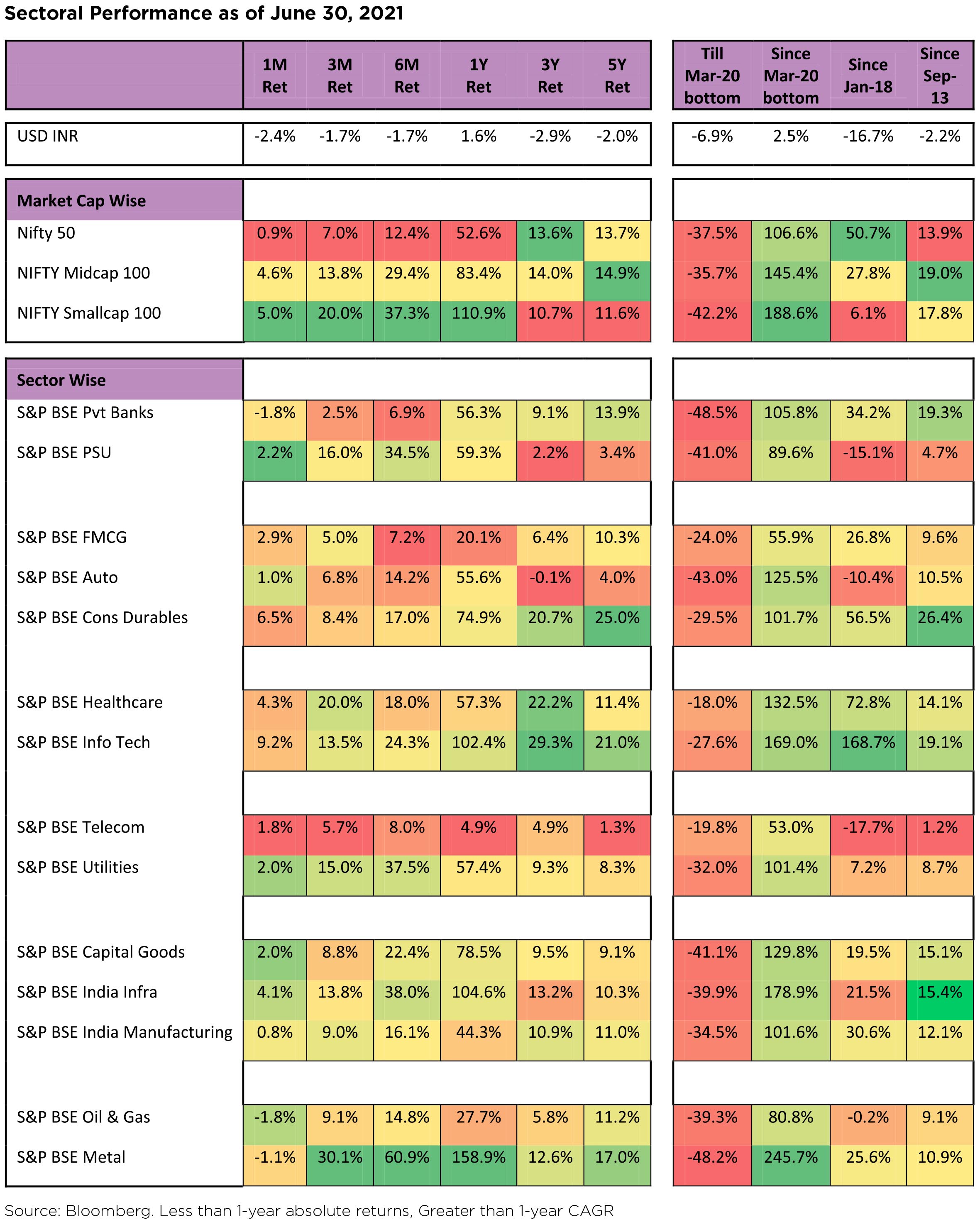

The Nifty has been trading in a close range of 15,600-15,800. As the number of Covid-19 cases has been going down, markets are pricing in an improving demand outlook as states ease restrictions. SMID (Small and Midcaps) have been leading YTD, the Nifty Midcap index is up 29% vs. the Nifty 50 up by 12%. Increased retail participation has also contributed to the theme.

After being resilient over the first two months of 2QCY21, Indian equities traded flat compared to the broader markets in June: -0.8% over the month (USD terms). Mid and small caps were up 83% and 111% y-oy, outperforming large caps in June.

Both the mid and small-cap indices are currently trading higher than the 2017 peak valuations; the smallcap index is at 75% of the benchmark valuation, close to the Dec 2017 peak.

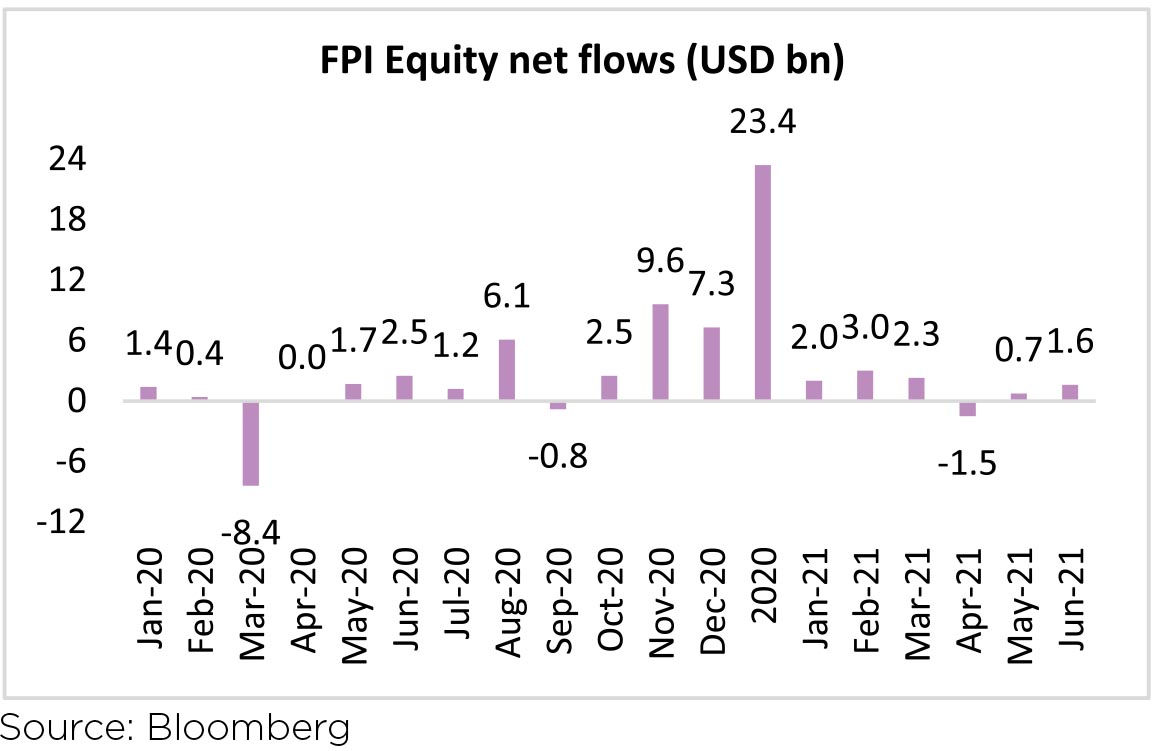

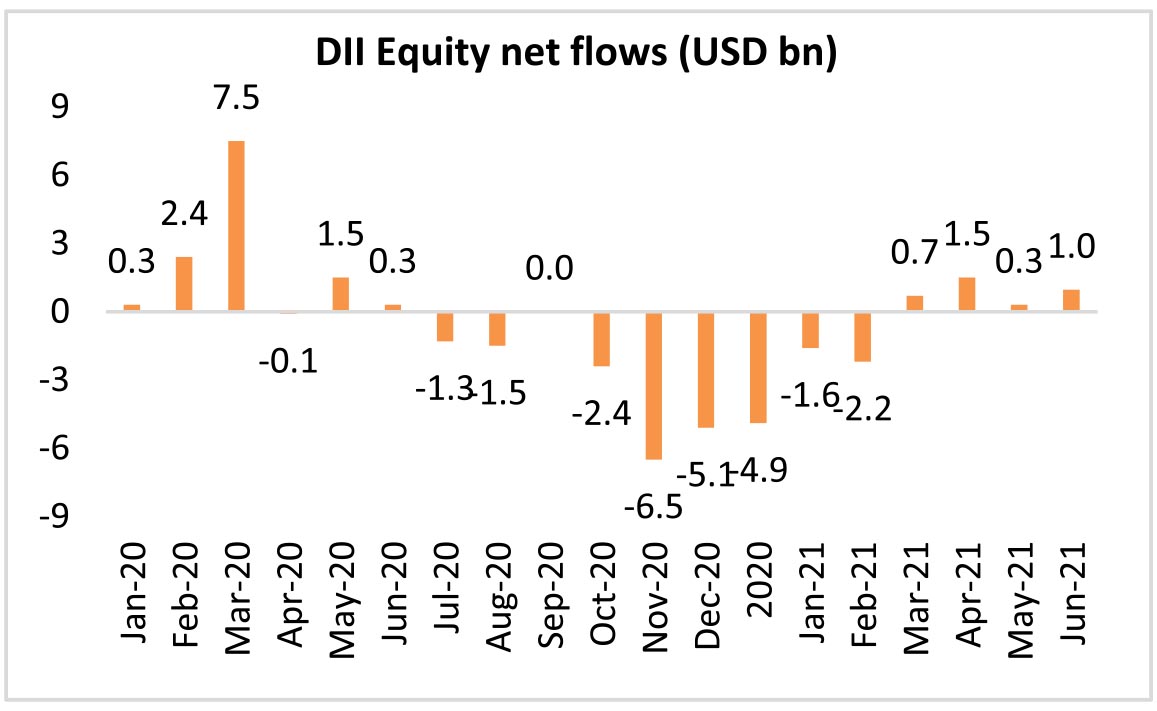

Capital Flows: FPIs continued to be net buyers of Indian equities for the second month (+USD1.6bn, following +USD749mn in May). In April, FIIs, net sold USD1.5bn in equities, breaking the 6mth inflows streak that started in October last year. In May and June, they again turned into net buyers. 1QCY21 saw USD7.3bn of inflows, while 2Q ended at a modest USD908mn of net buying.

On the contrary, FPIs remained net sellers in the debt markets for the sixth month running, with outflows of USD583mn in June (vs. outflows of USD188mn in May). DIIs remained net equity buyers for the fourth month (+USD958mn, vs +USD282mn in May).

Bond Markets and Currency: Benchmark 10-year Treasury yields averaged at 6.02% in June (3bp higher vs. the May avg.). The US 10Y yield is at 1.47% (-13bps m-o-m, +81bps y-oy).

INR lost 2.3% and ended the month at 74.33p per USD in June. In the last 12 months, INR (+1.6%) has underperformed the broader EM FX (+5.4%).

India's Forex (FX) reserves are at an all-time peak, standing at USD604bn currently. FX reserves have increased by USD11.0bn in the last 4 weeks.

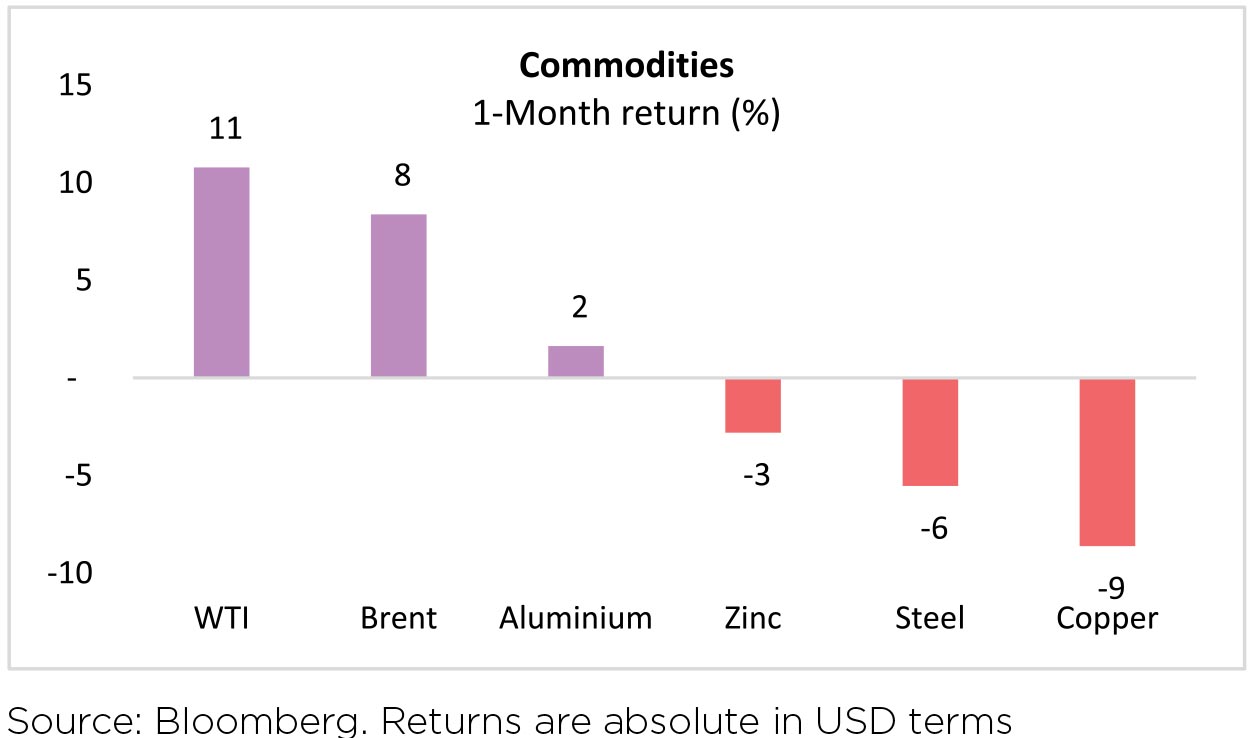

Commodities: The Brent oil price rose a whopping 9.3% in June, following a 3.3% increase in May (up 20.4% in 2QCY21). Oil prices are heading higher on the heels of demand recovery as well as OPEC+'s (Organization of the Petroleum Exporting Countries) cautious and disciplined approach to keeping supply out of the market. Demand is typically seasonally strong from May through August, while OPEC's reaction function will continue to largely be driven by demand.

Steel Prices: China steel prices fell after government intervention; likely to stabilize now before moving up. While steel demand remains firm in China, the average HRC (hotrolled coil) domestic steel price corrected by ~8% m-o-m in June 2021 to USD854/t after the Chinese government tried to remove the froth at prices by eliminating speculation.

Possibility of production cuts in China and imposition of Chinese HRC export tax exists, which will be beneficial for world ex-China prices. Russia, the 2nd largest steel exporter announced a 15% export duty on steel for five months (August-December 2021), beneficial for world steel prices in the medium term.

Agriculture commodities: Historically, high global agriculture prices have coincided at times with high domestic food inflation. But the coincidence was due to weak monsoons rather than pass-through of global prices. Monsoons are expected to be normal for the third consecutive year. Currently, India's largest agriculture import is vegetable oil, which has a weightage of 3.6% in CPI and has seen one of the sharpest price increases.

Q4 and FY21 Earnings

March 2021 quarter earnings were broadly in-line: Strong y-o-y earnings growth came off a low base last quarter. Sequentially, Nifty 4QFY21 earnings grew by 13%. Ex-Financials, 4Q earnings grew at 18% q-o-q. 4QFY21 net profits of the Nifty-50 Index increased 143% y-o-y and EBITDA increased 76% y-o-y. 4QFY21 revenue, cost, and profitability trends were fairly robust across sectors although management commentary for 1QFY22 is understandably muted given lockdowns across several states.

Corporate earnings in 4QFY21 continued the momentum of the preceding two quarters and FY21 ended on a strong note - no doubt aided by the deflated base in 4QFY20 and healthy demand recovery post 1QFY21. However, 1QFY22 has seen a familiar disruption, with the second Covid wave engulfing India and several states imposing lockdowns in Apr'21 and May'21. The trend of earnings revision has changed in favor of downgrades again in 4QFY21 after two consecutive quarters (2Q and 3QFY21) of upgrades. The downgrade-to-upgrade ratio stood at 1.6:1.

Key factors that drove the earnings: 1) Metals earnings were up 4.2x y-o-y and have contributed 26% of incremental PAT growth on strong pricing and volumes. The deleveraging trend continues on the back of robust OCF (Operating Cash Flow) generation. 2) Automobiles, largely led by a low base and global cyclical names, benefitted from a strong global recovery. 3) The healthy performance in Private Banks and NBFCs can be attributed to moderation in slippages and improved efficiency in disbursement/collection. 4) IT companies saw a continuous improvement in the order book and deal wins on robust demand. 5) Oil & Gas, led by OMCs (Oil Marketing Companies), benefitted from inventory gains and higher GRMs (Gross refining margins) and marketing margins.

Sectoral Impact

By sector, IT Services, Consumer Durables and Health Care outperformed while Energy, Financials and Metals were the notable laggards in June.

The Macro Picture

Some positive developments

▶ The Finance Minister unveiled a set of relief measures on 28th June, largely focused on broadening credit guarantees instituted last year, to help alleviate economic stress induced by the second Covid-19 wave. These include:

• Additional lending of INR1.5 trillion (0.7% of GDP) under the Emergency Credit Line Guarantee Scheme (ECLGS) announced last year, taking its total to INR4.5 trillion (2% of GDP);

• INR1.1 trillion (0.5% of GDP) lending under a loan guarantee scheme for Covid-affected sectors;

• INR75bn lending under a credit guarantee scheme for Micro Finance Institutions (MFI).

The broadened credit guarantees should help mitigate stress for SMEs and those at the bottom of the pyramid. It confirms that the government prefers this route to direct income support and also suggests a keenness by the Centre to stick to its budgeted deficit target of 6.8% of GDP, likely reflecting concerns around debt dynamics and a desire to keep borrowing costs contained in the bond market.

Industrial Production (IP): IP printed above expectations in April, expanding 134% y-o-y, largely on account of very favorable base effects from last April, when the country had just entered a national lockdown. IP rose 1.1% m-o-m in April, in contrast to the expected sequential contraction on the back of the local lockdowns that began in the second half of April. What likely supported IP in April-and underpinned the upside surprise-is the sheer strength of global demand, with manufacturing exports surging 5% m-o-m after 6% growth in March. Therefore, the strength of external demand likely offsets the softening in domestic demand.

GST collections lowest in 8-months but still ahead of the INR1trn mark: GST collections in May moderated after record-high monthly collection in April (INR1.03tn, from INR1.41tn in April, -27% m-o-m, +66% y-o-y). This was the 8th consecutive month with collections of more than INR1tn.

The MPC voted unanimously to keep the Repo Rate on hold at 4%. The Committee unanimously voted to continue with the accommodative stance as long as necessary to revive and sustain growth on a durable basis and continue to mitigate the impact of Covid-19 on the economy, while ensuring that inflation remains within the target going forward.

Measures were taken by the RBI:

• Announced the next stage of its bond-buying program (G-Sec Acquisition Program (GSAP) 2.0) of INR1.2 trillion over the next quarter, higher than the INR1.0 trillion announced in GSAP 1.0.

• Also announced an on-tap window for lending to contact intensive-sectors to the tune of INR150bn with tenors of up to three years at the repo rate.

• On the regulatory front, the Resolution Framework 2.0 announced by the RBI for MSME, small businesses, and individual business loans was expanded by raising the threshold from INR250 million to INR500 million.

Other support: fertilizer subsidy, food grain distribution, increase in MSP, and public health: A few announcements related to subsidies and short-term public health preparations have an immediate fiscal impact. As announced earlier: (1) distribution of free food grains during May-November will incur additional food subsidy of around INR940 bn (2) additional fertilizer subsidy will incur additional spending of around INR148 bn and (3) Government raised MSP for Kharif crops by 2-5% y-o-y.

Prediction of a normal monsoon: Rainfall recorded was 24% higher than LPA in the week ended 25th Jun'21. The start of the monsoon has been strong, Kharif sowing is progressing well and consequent farm income (40% of rural income) support is likely to sustain agri-investments.

Some concerns to be watched for:

The second wave abates but economic costs linger: India's second Covid-19 wave appears to be abating almost as rapidly as it rose with daily reported cases declining from about 400,000/day in early May to less than 47,000/day by the last week of June. But, the economic hit, though less than the first wave, is likely to be meaningful.

The 1Q GDP print highlighted private consumption growth was much weaker (2.7% y-o-y), reinforcing the notion that pandemic-induced scarring was already weighing on consumption even before the second wave. A booming global economy will serve as a tailwind with exports growth of 8.8% in the quarter and likely to strengthen further. Elevated uncertainty increases the relative efficacy of fiscal policy.

The composite PMI in May contracted sharply to 48.1 in May, from 55.4 in April, as the deepening of the second wave crisis hit business and output. The manufacturing index fell to 50.8 in May, down from 55.5 in April. The service index fell to 46.4 in May, down from 54.0 in April. This was the first decline in 8 months.

May CPI shocked expectations by printing at 6.3%, almost a percentage point higher than what consensus had anticipated (consensus: 5.4%) and also much higher than the RBI's imputed forecast for May. On a sequential basis, headline prices surged 1.5% m-o-m underpinned both by firming food prices (1.2% m-o-m) and an unprecedented increase in core-core prices (1.5% m-o-m).

Re-emergence of margin squeeze: With major commodity indices rising by 80-200% from the bottom, the initial margin tailwind from the post-pandemic decline in commodity prices has been short-lived. RM (raw material) /Sales for the manufacturing sector increased from 57% in 1QFY21 to 66% in 4QFY21.

Outlook

The pandemic's second wave appears to have peaked and a long "plateau" lies in front of us (similar to Jul-Sept 2020). The pace of vaccination will be an important factor to re-start the economic engine - which thankfully was in neutral rather than switched off as the case last year. Supply bottlenecks have led to prices firming at an alarming pace, raising the bogey of inflation. How fast these supply bottlenecks are reduced will impact the fight against inflation. Consumer demand, remains, robust, though fears of the second wave impacting near-term consumption could be a possibility. Global liquidity and interest rates remain benign, most Central banks (excluding China and Brazil) are focusing on economic revival, terming recent inflation spurt as "transitory" (catchword of CY21!). Global markets led by the US remain buoyant, US Dollar despite talks of gloom at the start of the year has made a smart recovery, a negative for emerging markets. Crude oil remains strong, aided and abetted by production cutbacks (by the largest "official" cartel - OPEC+) rather than driven by robust demand - which has been dented by the advent of electrification and renewables.

For India, macros economic indicators - inflation and crude oil remain the two key variables to track. RBI's recent pronouncement indicates a focus on economic revival while hoping for the best on the inflation front. Food inflation should subdue driven by increasing belief in another "normal" monsoon. This could halt the food-related inflation pressure (54% of the CPI) in the coming months. Robust exports and FDI should limit the current account deficit driven by higher crude oil imports and higher capital machinery/ raw material imports, reflecting a general pick up in economic activity. GDP forecast for FY22 has been downgraded by over 200 bps to 8-5-9.5% range from the earlier levels of 10-11%, a direct fallout of the severity of the second wave of the pandemic. Critically, Nominal GDP even after these downgrades, remains above the 13% level!

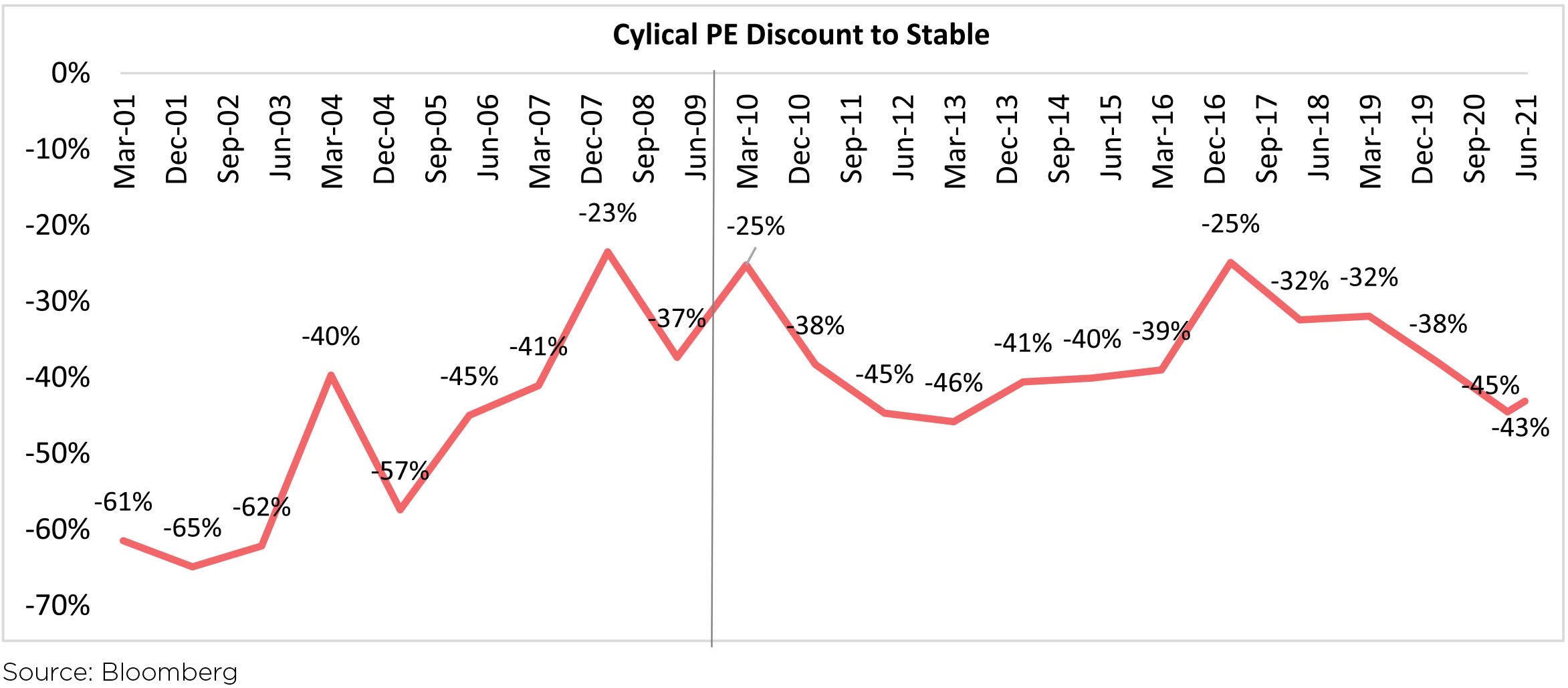

Coming to the markets, FY11-20 has been a decade of Stable sectors' well-deserved victory over cyclical sectors. Investors who foresaw this development and backed the right sectors have registered handsome gains. However, the pendulum in the stock market rarely stays in the same zone permanently.

While the cyclical sectors will never match the profitability ratios of their stable sector peers, the myth that free cash flow (FCF) generation is solely the domain of the latter has seen initial cracks during FY21. If FY22 sustains the path of debt moderation and positive FCF generation, then the re-rating process of cyclical sectors could surprise, even the skeptics. While we do not advocate cyclical sector companies to trade at multiples equivalent to stable sectors, during the last decade, when most of the cyclical sectors could be ignored or valued at liquidation multiples. The market will have to re-discover the art of valuing a cyclical sector with moderating debt levels and as a going concern.

How does one place the coming decade, will it be a repeat of CY02-10 or CY11-20? These two simplistic scenarios are often touted when talking about Indian equities. It may be best to break down the coming decade into shorter more "forecastable" phases of 3 years or so. FY21-23, we believe, could be a phase where a broad-based rally may be witnessed, with cyclical sectors continuing on the path to building on their return to profitability in FY20 -21, while stable sectors chug along at a steady clip. From a macro point of view, the debate of Cyclical vs Growth will rage till the time RBI policy - which currently focuses entirely on Growth, pivots its focus solely on inflation. It may be difficult to predict how long this phase will last. For smart investors, observing/ keeping track of key macro trends will need to become an integral part of the investment process - domestic as well as global.

More importantly, current market valuations should make most investors wary of forecasting juicy market returns, even if investing horizon exceeds 3 years. Markets at current elevated levels need the support of strong earnings growth and continuation of the loose monetary policy globally, especially in the US. Any perception of change to the worse on both counts will make the markets nervous and twitchy. Market corrections, as a result, will not be slow and suffocating, they will be short and sharp. FY21-23 market move may be more broad-based as compared to the FY17-20 phase. The same may be necessitated across equity portfolios!

WHAT WENT BY

Bonds sharply fell in the month of June as market participants re-anchored their expectations of the timing

and quantum of RBI policy reversal (although still very gradual) after relatively higher inflation surprises

on the upside & sharp increases in global commodity prices, especially crude. The MPC members in June

4 policy had taken comfort from the soft April CPI & a 5.1% projected CPI for FY22 which was within

their tolerance band (2-6%). With elevated global commodity prices, market participants now expect

revisions to RBI's inflation projections going ahead. The 5-year Government bond benchmark rose 12bps

while the 14-year benchmark rose 7bps to end at 5.70% & 6.72%, respectively. The 10-year Government

bond benchmark traded range-bound between 6.0%-6.05% due to active RBI intervention in the form of

devolvement & rejection of auction bids.

RBI released its MPC committee minutes on 18th June 2021 where MPC members detailed their rationale for a continued accommodative stance to revive and sustain growth on a durable basis and mitigate the impact of COVID-19 on the economy. Some of the MPC members remained watchful of generalized inflation after the initial impact of cost-push inflation. MPC members also assessed the impact of 2nd wave to be transitory and expected to pick up of growth momentum from Q2FY22.

Headline inflation rose more than expected (consensus: 5.4%) to 6.3% YoY in May-21 from revised 4.23% YoY in Apr-21 while core CPI inflation jumped to 6.7% from 5.3%. The spike in inflation was broad-based with Food & Beverage inflation rising sharply from 2.6% in April to 5.2% y-o-y in May. Fuel inflation picked sharply, rose to 11.6% YoY in May from 8% in April.

FOMC in its June policy meeting acknowledged the progress on vaccinations but continued with its assessment that risks to economic outlook remain, and maintained rates at the 0.00%-0.25% range. For 2021, it increased its real GDP, PCE, and core-PCE projections (while unemployment rate projection remained the same), but its projections for 2022, 2023, and the long run were mostly the same or only marginally different from those in March.

With supply chain disruptions impacting the auto sector (used vehicles +7.3%) and relative normalization in the travel sector (airfares +7%), May CPI inflation for the US came at 5.0% YoY while the core was up 3.8% YoY (consensus estimates 4.7% & 3.5%, respectively). Owners' equivalent rent increased 0.31% in May, one of the largest monthly gains reported in recent years, while tenants' rent rose 0.24% that month, the highest increase since March 2020 but still below the pre-COVID trend.

The ECB in its June policy made no changes to its interest rates or its unconventional policy instruments. ECB projected real GDP growth of 4.6% YoY (+0.6pp) in 2021, 4.7% YoY (+0.6pp) in 2022 and 2.1% YoY (unchanged) in 2023. Risks to the outlook were judged to be broadly balanced. The inflation outlook remained largely unchanged save for some "temporary factors".

It is hard not to conclude that prospects for bond market volatility have risen meaningfully owing to developments of the past few days and weeks. One also has to pay heed to the way oil prices seem to be on a climb lately. Coming on top of an already large interpretational issue on local CPI, this does serve to further curtail degrees of freedom for RBI in maintaining the current aggressive level of monetary accommodation.

This doesn't necessarily mean that the central bank will start to respond to this right away. However, the bond market may step up speculation concerning the shelf-life for RBI's current ultra-dovishness. This may make the task of dictating yields to the market that much more difficult for the central bank. At any rate, in our base case view, RBI would have started to dial back on its level of intervention at some point and we were budgeting for a gradual rise in yields over time. Also, it makes sense to assume in the base case that if re-opening were to progress smoothly, RBI will re-initiate its path to normalization especially now as the comfort with CPI is that much lower. This will probably take the form of longer-term variable reverse repo rate (VRRR) auctions to begin with and then the start of gradual reverse repo rate hikes. At this juncture, we would think the first such hike may happen somewhere in the October - December period of this year.

From an investor's standpoint, it is quite important in our view that portfolio yields be looked at somewhat dynamically. Thus after a 3-year bull run in bonds if the portfolio manager is creating some hedges and flexibilities that in turn are showing up as a reduction in yield, then this may even be looked at as a source of comfort for investors (please refer to our note 'Hedging fixed income in volatile times', dated 22nd June'21 - https://idfcmf.com/article/4984 for further details). Similarly, if corporate / credit spreads have narrowed to unsustainable levels in some cases and the manager hence decides to move to more quality assets, this could be a move to protect against future risks to spread expansion even as it entails some dilution in portfolio yields of the current portfolio. Thus a static analysis of portfolio yields and choosing the highest of these for every category of funds may not optimize risk versus reward, especially at cycle turning points.

We had discussed in our last note the analysis leading up to our decision to raise cash levels in our actively managed bond and gilt funds. Events since then have further emphasized to us the importance of this flexibility and the need to have it in amounts that can significantly buffer us against market volatility. Also, the evolution of RBI's normalization process has to be looked at on a continuum and is always subject to delays should the recovery get hampered again or the strength of it was to underwhelm. As always, these as well as overall duration can change at anytime basis our evolving assessment of various factors.

Disclaimer: MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

The Disclosures of opinions/in house views/strategy incorporated herein is provided solely to enhance the transparency about the investment strategy / theme of the Scheme and should not be treated as endorsement of the views / opinions or as an investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document has been prepared on the basis of information, which is already available in publicly accessible media or developed through analysis of IDFC Mutual Fund. The information/ views / opinions provided is for informative purpose only and may have ceased to be current by the time it may reach the recipient, which should be taken into account before interpreting this document. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision and the security may or may not continue to form part of the scheme's portfolio in future. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. The decision of the Investment Manager may not always be profitable; as such decisions are based on the prevailing market conditions and the understanding of the Investment Manager. Actual market movements may vary from the anticipated trends. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alterations to this statement as may be required from time to time. Neither IDFC Mutual Fund / IDFC AMC Trustee Co. Ltd./ IDFC Asset Management Co. Ltd nor IDFC, its Directors or representatives shall be liable for any damages whether direct or indirect, incidental, punitive special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information.

RBI released its MPC committee minutes on 18th June 2021 where MPC members detailed their rationale for a continued accommodative stance to revive and sustain growth on a durable basis and mitigate the impact of COVID-19 on the economy. Some of the MPC members remained watchful of generalized inflation after the initial impact of cost-push inflation. MPC members also assessed the impact of 2nd wave to be transitory and expected to pick up of growth momentum from Q2FY22.

Headline inflation rose more than expected (consensus: 5.4%) to 6.3% YoY in May-21 from revised 4.23% YoY in Apr-21 while core CPI inflation jumped to 6.7% from 5.3%. The spike in inflation was broad-based with Food & Beverage inflation rising sharply from 2.6% in April to 5.2% y-o-y in May. Fuel inflation picked sharply, rose to 11.6% YoY in May from 8% in April.

FOMC in its June policy meeting acknowledged the progress on vaccinations but continued with its assessment that risks to economic outlook remain, and maintained rates at the 0.00%-0.25% range. For 2021, it increased its real GDP, PCE, and core-PCE projections (while unemployment rate projection remained the same), but its projections for 2022, 2023, and the long run were mostly the same or only marginally different from those in March.

With supply chain disruptions impacting the auto sector (used vehicles +7.3%) and relative normalization in the travel sector (airfares +7%), May CPI inflation for the US came at 5.0% YoY while the core was up 3.8% YoY (consensus estimates 4.7% & 3.5%, respectively). Owners' equivalent rent increased 0.31% in May, one of the largest monthly gains reported in recent years, while tenants' rent rose 0.24% that month, the highest increase since March 2020 but still below the pre-COVID trend.

The ECB in its June policy made no changes to its interest rates or its unconventional policy instruments. ECB projected real GDP growth of 4.6% YoY (+0.6pp) in 2021, 4.7% YoY (+0.6pp) in 2022 and 2.1% YoY (unchanged) in 2023. Risks to the outlook were judged to be broadly balanced. The inflation outlook remained largely unchanged save for some "temporary factors".

Outlook

It is hard not to conclude that prospects for bond market volatility have risen meaningfully owing to developments of the past few days and weeks. One also has to pay heed to the way oil prices seem to be on a climb lately. Coming on top of an already large interpretational issue on local CPI, this does serve to further curtail degrees of freedom for RBI in maintaining the current aggressive level of monetary accommodation.

This doesn't necessarily mean that the central bank will start to respond to this right away. However, the bond market may step up speculation concerning the shelf-life for RBI's current ultra-dovishness. This may make the task of dictating yields to the market that much more difficult for the central bank. At any rate, in our base case view, RBI would have started to dial back on its level of intervention at some point and we were budgeting for a gradual rise in yields over time. Also, it makes sense to assume in the base case that if re-opening were to progress smoothly, RBI will re-initiate its path to normalization especially now as the comfort with CPI is that much lower. This will probably take the form of longer-term variable reverse repo rate (VRRR) auctions to begin with and then the start of gradual reverse repo rate hikes. At this juncture, we would think the first such hike may happen somewhere in the October - December period of this year.

From an investor's standpoint, it is quite important in our view that portfolio yields be looked at somewhat dynamically. Thus after a 3-year bull run in bonds if the portfolio manager is creating some hedges and flexibilities that in turn are showing up as a reduction in yield, then this may even be looked at as a source of comfort for investors (please refer to our note 'Hedging fixed income in volatile times', dated 22nd June'21 - https://idfcmf.com/article/4984 for further details). Similarly, if corporate / credit spreads have narrowed to unsustainable levels in some cases and the manager hence decides to move to more quality assets, this could be a move to protect against future risks to spread expansion even as it entails some dilution in portfolio yields of the current portfolio. Thus a static analysis of portfolio yields and choosing the highest of these for every category of funds may not optimize risk versus reward, especially at cycle turning points.

We had discussed in our last note the analysis leading up to our decision to raise cash levels in our actively managed bond and gilt funds. Events since then have further emphasized to us the importance of this flexibility and the need to have it in amounts that can significantly buffer us against market volatility. Also, the evolution of RBI's normalization process has to be looked at on a continuum and is always subject to delays should the recovery get hampered again or the strength of it was to underwhelm. As always, these as well as overall duration can change at anytime basis our evolving assessment of various factors.

Disclaimer: MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

The Disclosures of opinions/in house views/strategy incorporated herein is provided solely to enhance the transparency about the investment strategy / theme of the Scheme and should not be treated as endorsement of the views / opinions or as an investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document has been prepared on the basis of information, which is already available in publicly accessible media or developed through analysis of IDFC Mutual Fund. The information/ views / opinions provided is for informative purpose only and may have ceased to be current by the time it may reach the recipient, which should be taken into account before interpreting this document. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision and the security may or may not continue to form part of the scheme's portfolio in future. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. The decision of the Investment Manager may not always be profitable; as such decisions are based on the prevailing market conditions and the understanding of the Investment Manager. Actual market movements may vary from the anticipated trends. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alterations to this statement as may be required from time to time. Neither IDFC Mutual Fund / IDFC AMC Trustee Co. Ltd./ IDFC Asset Management Co. Ltd nor IDFC, its Directors or representatives shall be liable for any damages whether direct or indirect, incidental, punitive special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information.