Commentary

31st May 2021

GLOBAL MARKETS

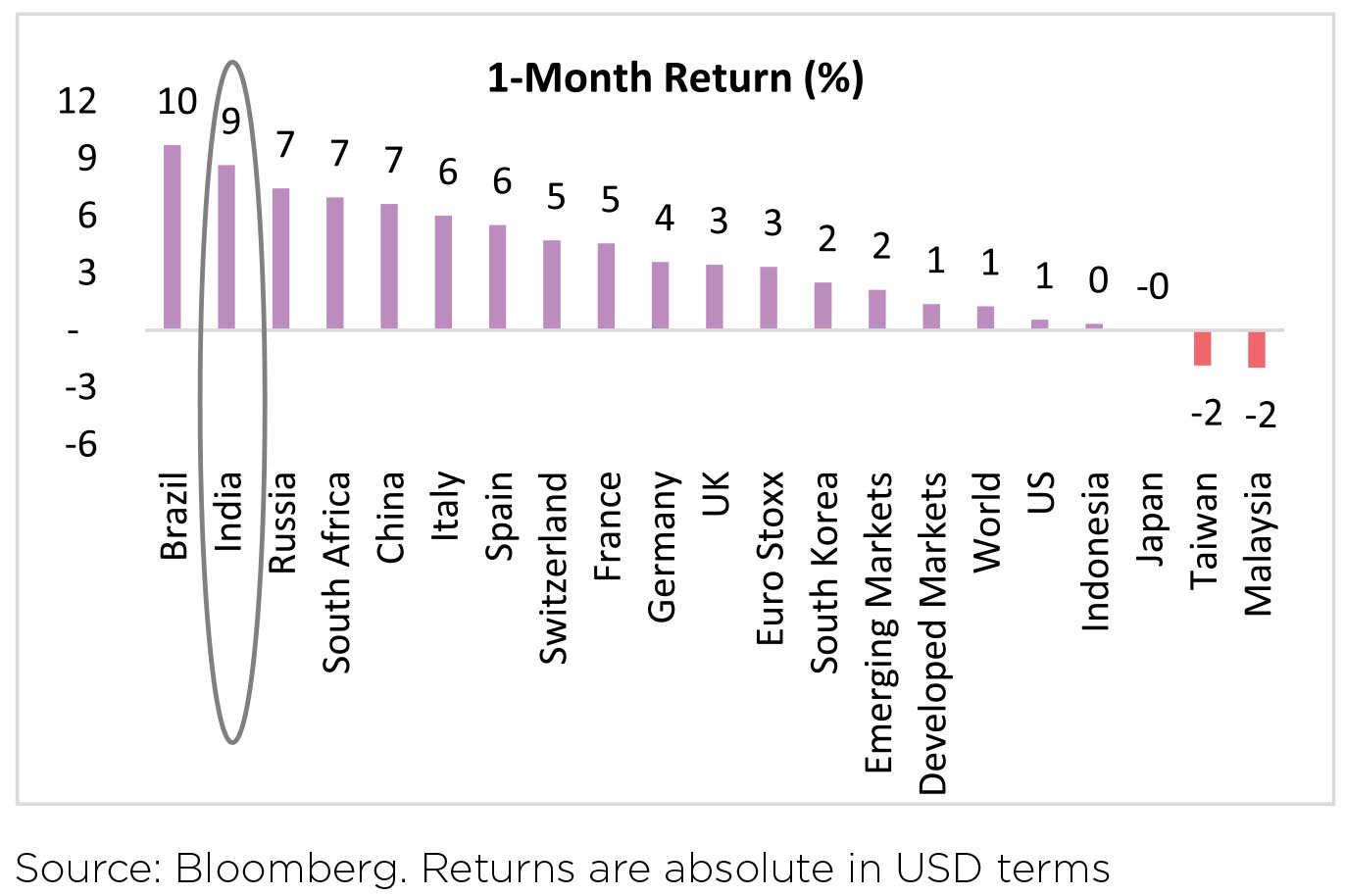

Global equities (+1.4%) traded higher,

with Europe leading other developed

markets. Developed markets' households

are leading this surge, reflecting large

US fiscal supports and the activation of

pent-up demand as Europe's Covid-19

second-wave drag fades. Performance

going forward shall be a function of

supply catching up with growing demand

and progress in vaccine inoculations in

the Emerging market countries. Inflation

has been accelerating more quickly than

imagined but growth and corporate

earnings keep us complacent. MSCI India

(USD) gained 8.5% in May, outperforming

peers MSCI AC Asia Pacific ex Japan Index

(+1.2%) and MSCI Emerging Markets Index

(+2.1%).

Covid & Vaccines: After a very challenging few months, India's second Covid-19 wave peaked and rolled over in early May, with new cases trending down to 127k now. This reflects the progressive application of local restrictions across states - positivity rates for states have seen a sharp fall.

As per the reports, at present, 50% of new infections are coming from rural districts vs. 38% in March 2021 and almost 25-30% last year till June 2020. Also, East and Central India, which have weaker medical infrastructure are now accounting for 40% share in new infections vs. 15% in end March 2021, indicating high medical stress in these regions.

As per the reports, the absolute pace of vaccinations, however, has slowed from 3.0 million/day in April 2021 to 1.9 million/day in May 2021. India has vaccinated close to 12% of its population so far. Indian vaccine production is expected to increase by the end of June, with reports suggesting SII (Serum Institute of India) and Bharat Biotech could produce close to 5 million doses a day (of the two vaccines) by the end of June/early July. In addition, Biological E is reported to have capacity to produce another close to 2million doses a day (its vaccine candidates are expected to receive approval around August/September). Assuming India administers ~4 million shots a day post June (2.5 million until), reports suggest that ~60% of the population above the age of 18 can receive at least one shot by the end of 2021 (~48% should receive both shots).

Covid & Vaccines: After a very challenging few months, India's second Covid-19 wave peaked and rolled over in early May, with new cases trending down to 127k now. This reflects the progressive application of local restrictions across states - positivity rates for states have seen a sharp fall.

As per the reports, at present, 50% of new infections are coming from rural districts vs. 38% in March 2021 and almost 25-30% last year till June 2020. Also, East and Central India, which have weaker medical infrastructure are now accounting for 40% share in new infections vs. 15% in end March 2021, indicating high medical stress in these regions.

As per the reports, the absolute pace of vaccinations, however, has slowed from 3.0 million/day in April 2021 to 1.9 million/day in May 2021. India has vaccinated close to 12% of its population so far. Indian vaccine production is expected to increase by the end of June, with reports suggesting SII (Serum Institute of India) and Bharat Biotech could produce close to 5 million doses a day (of the two vaccines) by the end of June/early July. In addition, Biological E is reported to have capacity to produce another close to 2million doses a day (its vaccine candidates are expected to receive approval around August/September). Assuming India administers ~4 million shots a day post June (2.5 million until), reports suggest that ~60% of the population above the age of 18 can receive at least one shot by the end of 2021 (~48% should receive both shots).

Domestic Markets

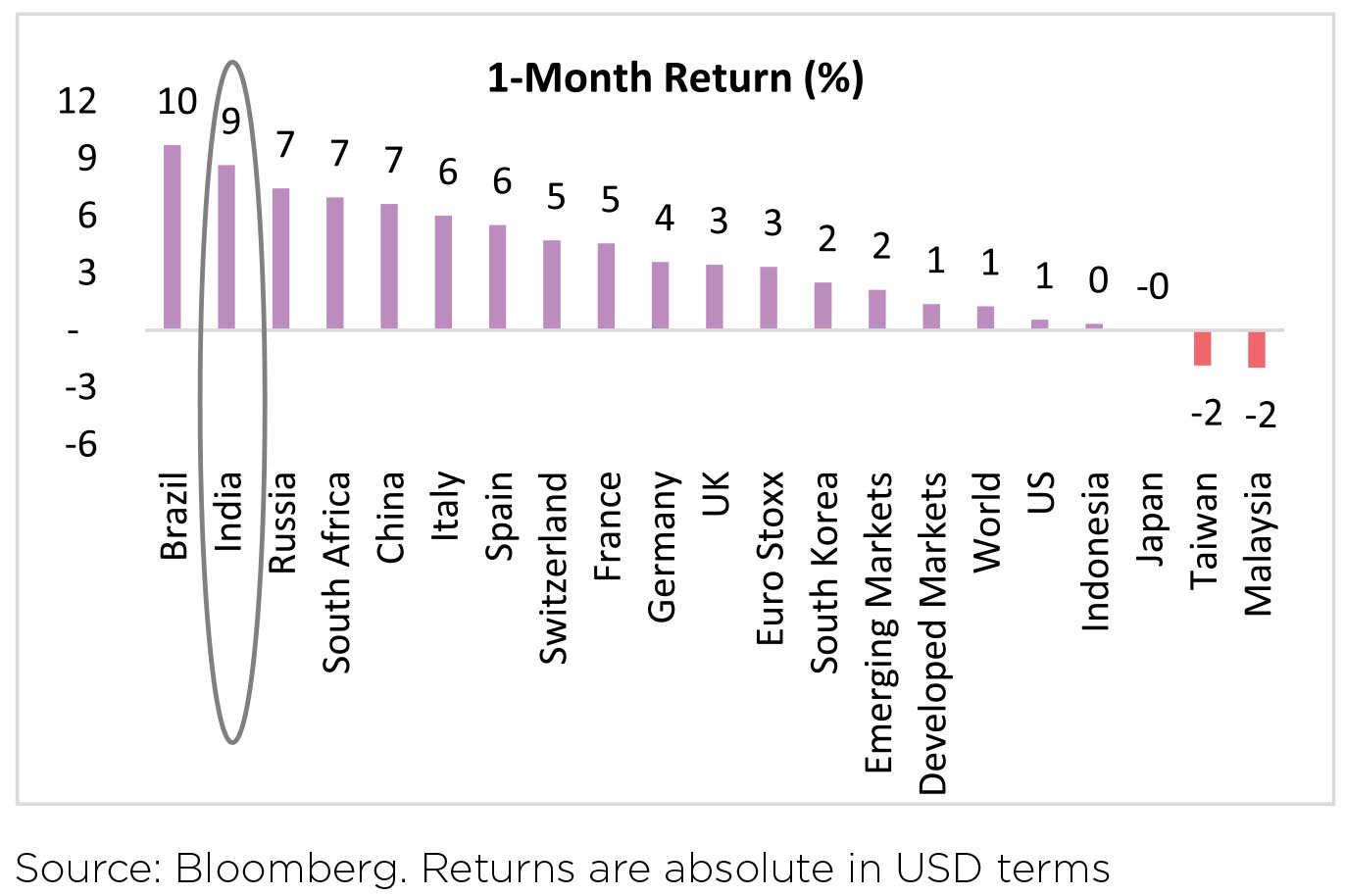

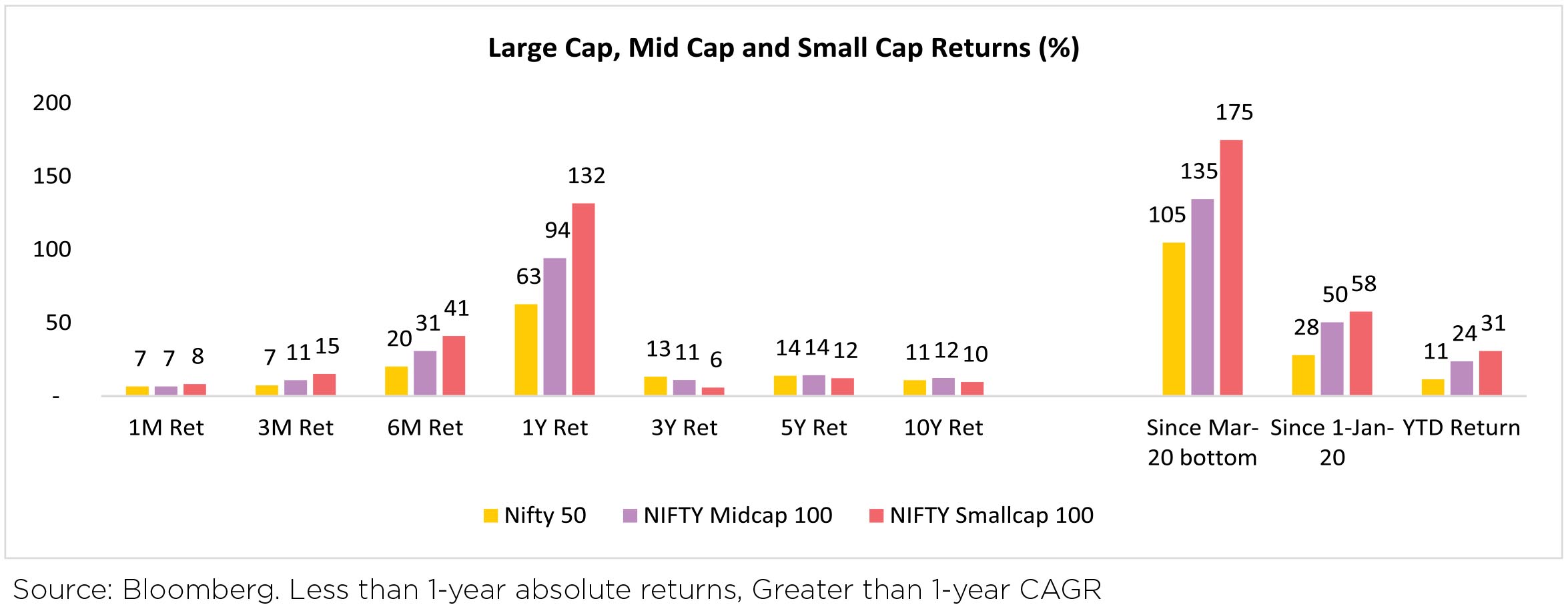

Domestically, Indian equities have been remarkably resilient - up 6.4% over the month. Nifty50 closed at an all-time high of 15,583 (as of May 31) as investors looked beyond the new cases peak. Focus likely remained on medium term vaccination outlook, in-line earnings season and lifting of activity constraints. Along with declining cases, assurances from global central banks on liquidity and firmer global equity markets also helped broader investor sentiment. Increased non-institutional participation has also increased overall trading activity over the last year.

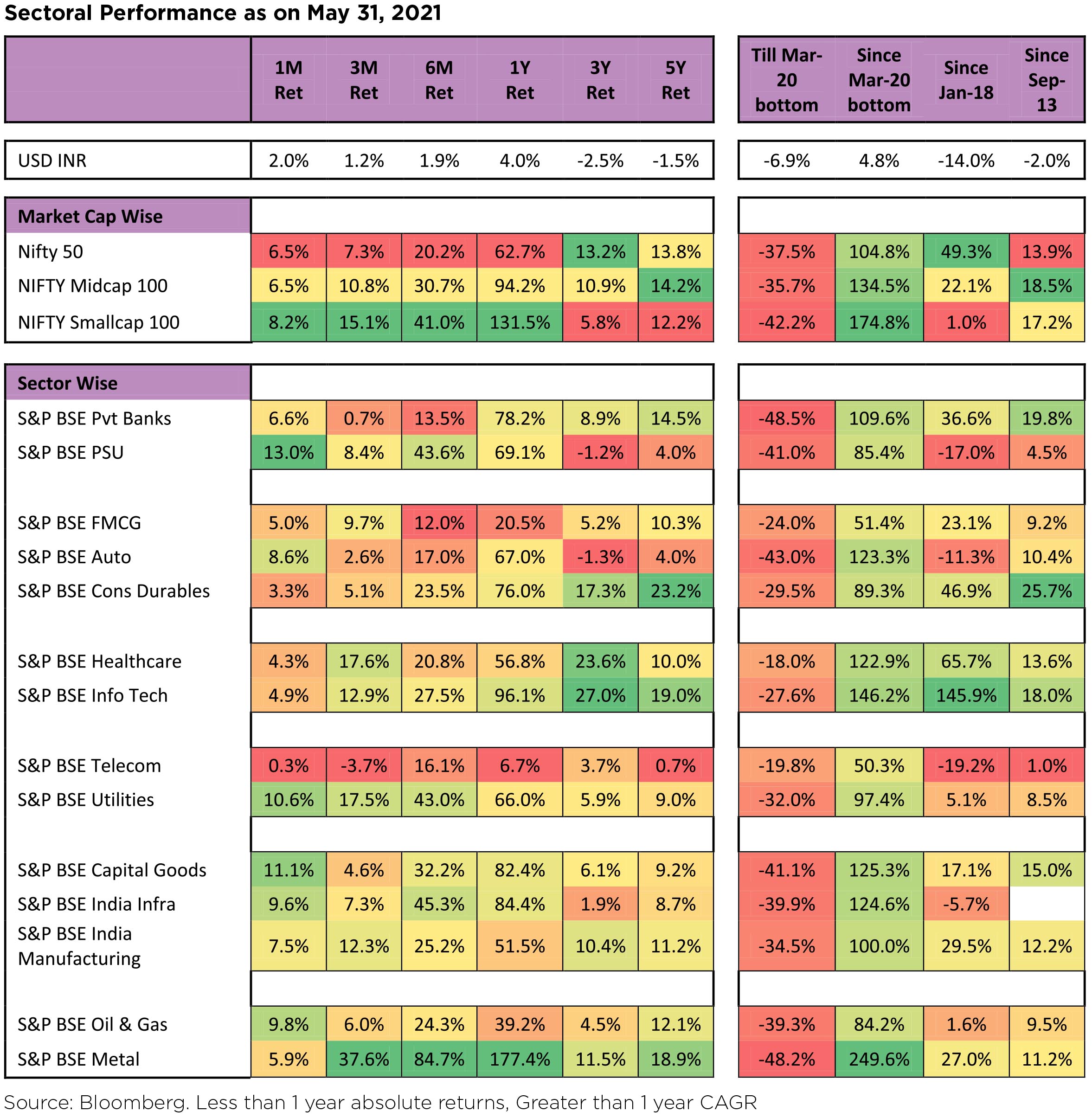

The S&P BSE Mid-cap and S&P BSE Small-cap indices also recorded new highs, gaining 7.1% and 8.9% respectively. Small-caps were up 8%, outperforming Large-caps in May.

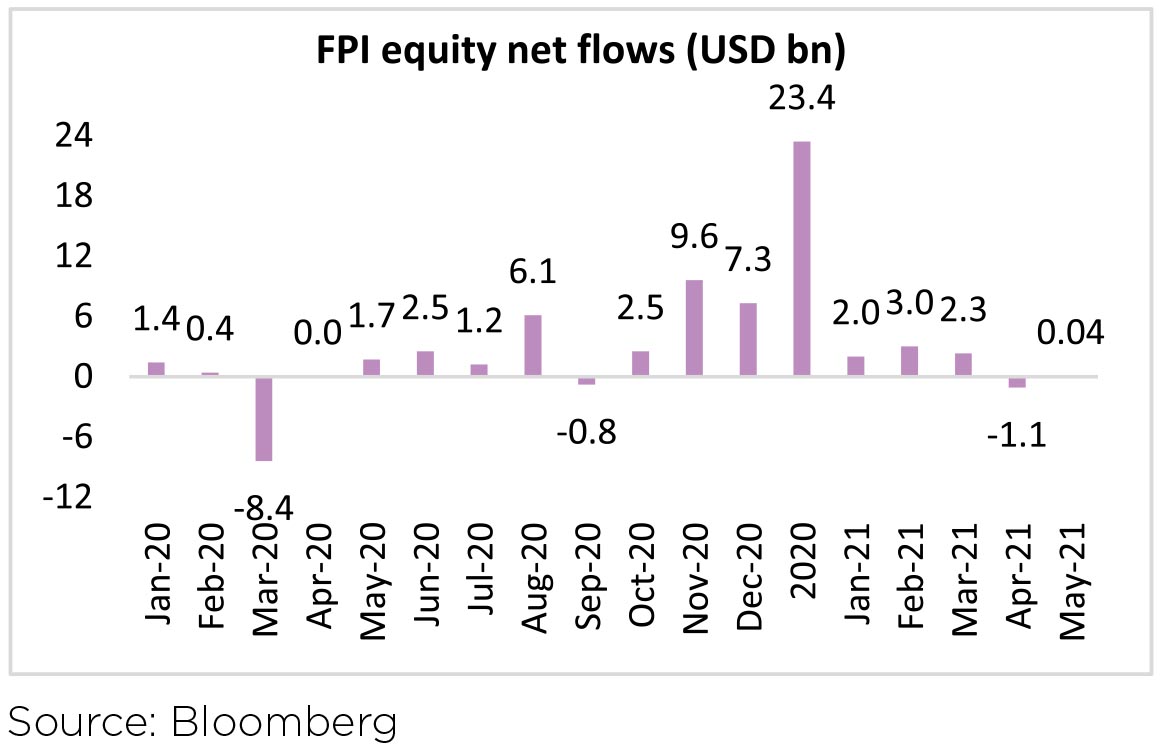

Capital Flows: FPIs have turned consistent net buyers over the last two weeks and ended the month at a modest USD37 million of net buying in May. In April, FPIs, net sold USD1.5 billion in equities, breaking the 6- month inflows streak that started in October last year. Q1 saw USD7.3 billion of inflows. This followed the highest quarterly inflows by FPIs in 4Q20 (USD19.3 billion). On the contrary, FPIs remained net sellers in the debt markets with outflows of USD115 million in May (vs. outflows of US$365mn in April).

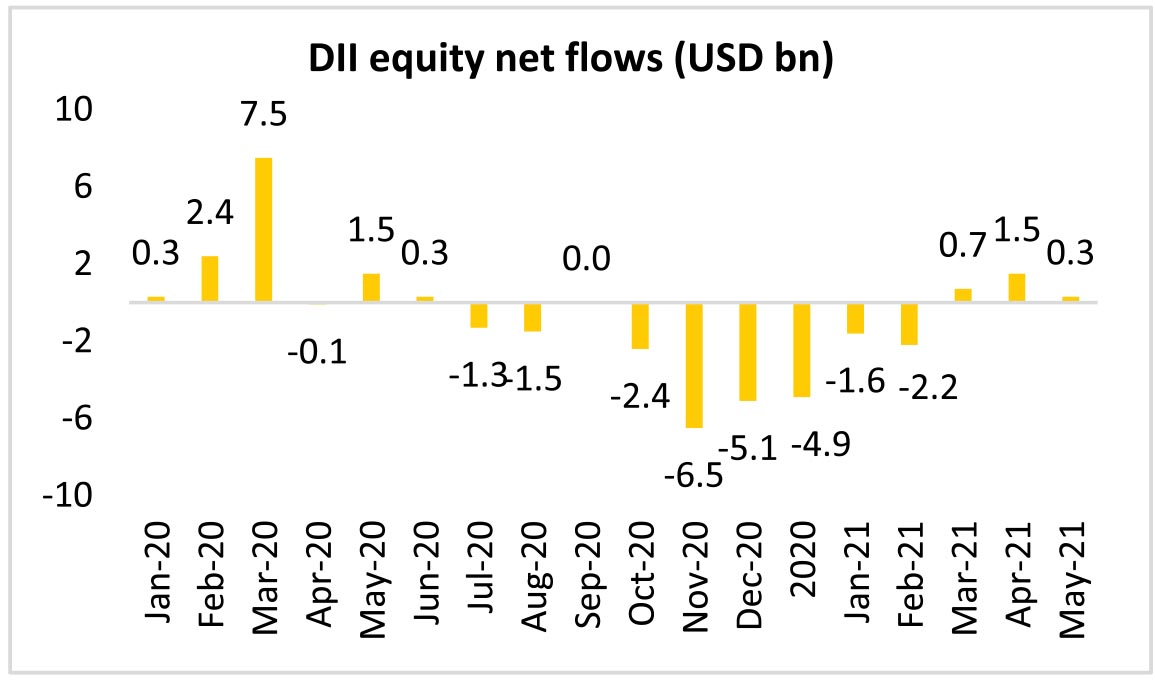

DIIs remained net equity buyers for the third month (+USD282 million, vs +USD1.5 billion in Apr). Both Mutual funds (+USD27 million) and Insurance funds (+USD178 million) were net buyers in May.

Bond Markets and Currency: Benchmark 10-year treasury yields averaged at 5.99% in May (7bp lower vs. April avg.). On month end values, the 10Y yield was flat and ended the month at 6.02%. US 10Y yield is at 1.59% (-3bps m-o-m, +94bps y-o-y).

INR gained 2.0% and ended the month at 72.62 per USD in May. In the last 12 months, INR (+4.1%) has underperformed the broader EM FX (+5.8%). DXY fell 1.6% in May (following 2.1% decline in Apr) and ended the month at 89.83 (-8.7% in the last 12 months). India's Forex (FX) reserves are at their all-time peak, at USD593 billion currently. FX reserves have increased by USD8.8 billion in the last 4 weeks.

Sectoral Impact

All sector indices closed in green, with S&P BSE PSU, Capital Goods and Utilities indices gaining 13.0%, 11.1% and 10.6% in May; while Communication Services, Consumer Durables and HealthCare were notable laggards in May.

Key Sectoral Trends:

▶ Financials(i) There has been disbursement de-growth of 20-40% from normal in the 2nd half of April 2021; (ii) There is an increased concern on collections because borrowers' focus is shifting towards conserving money for medical expenses, (iii) National Asset Reconstruction Company (NARCL), a proposed entity for taking over bad loans of lenders is expected to be operational in June 2021; and (iv) Additional Liquidity measures announced by RBI Governor Shaktikanta Das.

▶ Aviation:a) Ministry of Civil Aviation (MoCA) increased the lower limit on domestic airfares by 13% - 16% starting 1st June 2021, b) MoCA has also reduced maximum airline capacity to 50% from 80% to limit the spread of Covid-19, c) Go Airlines (GoAir) has filed DRHP to raise INR36 billion via a fresh issue of shares.

▶ India Metals: (i) Government is considering FDI policy tweak to facilitate BPCL privatization; and (ii) Industry body IPMA (International Project Management Association) seeks government intervention to regulate rising steel prices.

▶ Automobiles: (i) There is an increased caution in all transactions and so "advancing in tractors" which is an unsecured credit provided by the dealer has reduced which would impact near term growth, (ii) Financiers have become more reluctant towards disbursement. However, the underlying demand for PVs (passenger vehicles) still remain and there are sales happening even in lockdown period through service centres and using digital means.

▶ Consumption: (i) There is a shift towards essentials - medical, health and hygiene related areas take precedence, (ii) There is likely to be cut back on the marriage related spending which would impact discretionary consumption in 1QFY22.

The Macro Picture

Composite PMI: The composite PMI in April shows only marginal decline to 55.4 from 56 in March. However, output momentum declined across both manufacturing and services, and a significant amount of sampling may have been conducted before the stress in the second half of the month.

Inflation: April CPI gaps down to 4.3% from 5.5% in March. Food inflation drove a hefty 0.5% m-o-m increase in the headline CPI. The real story in India's inflation outturn has been the stickiness and stubbornness of core inflation. The recent pressures could be emanating from cost-push inflation in the wake of a recovering economy pre-second wave. Led by global commodity prices, input prices have surged in recent months but this has not translated into commensurate output prices, as seen in the PMI surveys.

Rising global agriculture prices and metal prices are being seen as constant risks for India's inflation. However, given the: (1) external trade structure, and (2) weightage matrix of CPI basket, there is only a slight risk of global inflation flowing through to domestic retail inflation.

Agriculture commodities: Historically, high global agriculture prices have coincided at times with high domestic food inflation. But the coincidence was due to weak monsoons rather than pass-through of global prices. Monsoons are expected to be normal for the third consecutive year. Currently, India's largest agriculture import is vegetable oil, which has weightage of 3.6% in CPI and has seen one of the sharpest price increases.

Metals: The direct impact of metal prices is visible in the WPI basket rather than the CPI basket. The passthrough to CPI from WPI is weak. There have been price hikes in certain segments such as automobiles. If we expand to all possible metal products, it would constitute 3-4% of the CPI basket. Being relatively dominated by services, the CPI basket should weather the global commodities cycle better than anticipated.

Industrial Production (IP): March IP expanded 22.4% y-o-y largely on account of favorable base effects given the sharp lockdown-induced contraction in March 2020. Sequentially, IP rose 1.0% m-o-m in March, a fourth consecutive increase that took IP to 99% of the pre-pandemic level.

Fiscal Deficit: India's FY21 fiscal deficit stands at 9.3% of GDP. Absolute basis, fiscal deficit for FY21 was INR18.2 trillion or 98.5% of the budgeted FY21 deficit (INR18.5 trillion). For April, deficit printed at INR787 billion, nearly 5.2% of the annual FY22 estimate (INR15.1 trillion / 6.8% of GDP).

GDP data suggests consumption slowdown: India's 4QFY21 printed at 1.6% y-o-y and was expectedly much stronger than the National Statistics Office (NSO) advance estimate (-1.1% y-o-y). Full year GDP contracted 7.3% (vs NSO's advance estimate of an 8% contraction). GVA (Gross value added) contracted less at -6.2% but pandemic-induced subsidies resulted in a sharp contraction of Net Indirect Taxes (indirect taxes minus subsidies) and dragged down GDP computation. GDP data states that private consumption growth last quarter was - relative to other components of demand was much weaker at 2.7% y-o-y v/s investment growth of 13.8%, exports growth of 8.8%, and imports growth of 12.3%. All this reinforces the notion that pandemic-induced scarring was already weighing on consumption even before the second wave.

Policymakers are likely to become more conservative on the restrictions front. Household income uncertainty and precautionary savings can only be expected to rise. Additionally, private investment should take time to pick up. Some silver linings to the outlook include signs of growing export strength from a booming global economy, though this will be partially offset by the negative terms of-trade impulses from higher crude prices.

Targeted measures by RBI: RBI announced some targeted measures to help buffer the impact of the second wave on 5th May. With growing concerns that the second wave could disproportionately impact the retail and small business sector, another round of regulatory forbearance aimed at this sector was unveiled.

Financial conditions improve moderately in April 2021: To minimize the impact of the second wave on the economy, it is critical for the central bank and other authorities to keep financial conditions benign so that the fragile recovery can gain traction. While conditions in the stock, debt and aggregate demand markets worsened, money and forex markets provided support to financial conditions.

GST collections: GST collections in April21 at INR1.41 trillion (from INR1.24 trillion in March, +14.1% m-o-m). The GST Council has estimated a shortfall of INR1.58 trillion for GST compensation to states uncovered by cess collections. This will be borrowed by the Centre will be transferred to states via back-to back loans. GST council also recommended Amnesty scheme to reduce late fee which will benefit 89% GST taxpayers.

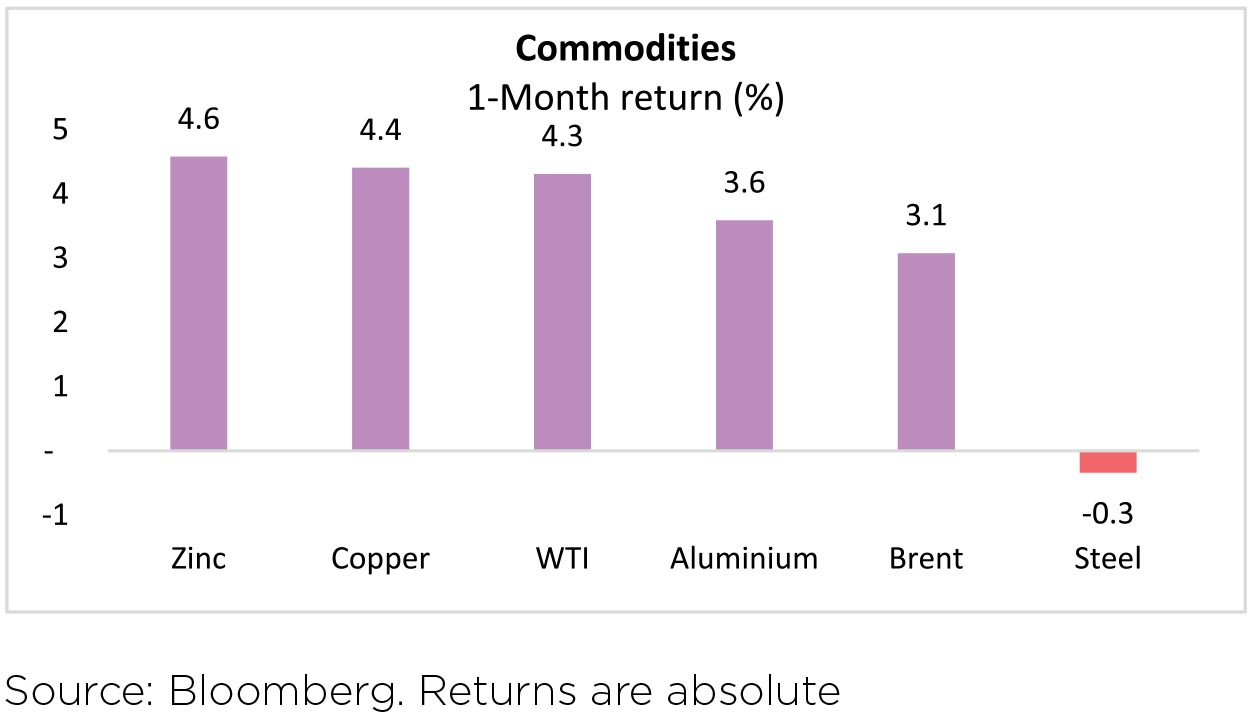

Commodities: The Brent oil price rose another 3.3% in May, following 6.6% increase in April. The price of Brent crude oil briefly breached USD70/bbl mid-month, before a slew of headlines indicating constructive progress at the fourth round of US-Iran nuclear negations in Vienna dragged prices back down.

Steel prices in China saw a correction in the middle of the month following months of soaring levels. Chinese HRC (hot rolled coil) prices corrected from a shade above of USD1000/MT to USD825/MT in a span of two weeks. The price drops came after Chinese authorities launched a new round of measures to curb soaring prices in a bid to ease the cost pressures on downstream industries.

According to observers, commodity inflation has two elements - supply/demand driven by actual users and producers and Financial, based on financial investors buying/selling on metal exchanges. This sharp price correction would limit "financial" element in steel price inflation and in the near term will be largely driven by supply-demand equation.

Other Key snippets:

▶ Provisional April trade report upbeat with both exports and imports registering strong sequential growth: The non-oil export grew 5.7% m-o-m in April - the fifth successive rise - suggesting that India is benefitting from strong global growth impulses. Non-oil-non-gold (NONG) imports also grew at a strong 3.6% m-o-m in April - the eighth successive increase.

▶ PLI scheme for ACC battery storage: The Union Cabinet has approved an INR181 billion worth of production-linked incentive (PLI) scheme for Advance Chemistry Cell (ACC) Battery Storage aimed at achieving 50GWh of ACC and 5GWh of niche ACC. The scheme envisions direct investment of INR450 billion with domestic value addition of 25% within two years (at mother unit level) and 60% within five years.

▶ Higher expenditure with increased diammonium phosphate (DAP) fertilizer subsidy (INR148 billion increase).

▶ The US President unveiled a USD6 trillion budget proposal to be funded by higher taxes - Corporates as well as rich individuals.

Outlook

The severity of the second wave has taken most by surprise, especially after the hubris of having "tamed" the virus which was prevalent during Jan/Feb 2021 period. Thankfully, though after a huge cost, the severity of the second wave started to register a noticeable decline by the fourth week of May 2021. Yet, the human cost of the second wave - almost 1.3 lakhs reported deaths (for the month) far exceed the death toll of the 1st wave.

Markets, however, continued to chug along, almost unconcerned. The positive outcome of the March 2021 quarterly results was overshadowed by muted outlook for Q1FY21 in most management commentaries. With local lockdowns across most states, economic activity was impacted though not as severe as the National lockdown announced last year.

Economic fall out of the second wave, however, is difficult to fathom. Anecdotally driven and derived from the high casualties suffered during the month, a narrative of pessimism appears to be the most well accepted narrative as of now. No one can deny the human suffering encountered during the last six-eight weeks. However, such economic pessimism may not be gloom or doom for listed Corporate India, the space in which we invest. As shown in FY21, earnings and sales growth of the organised players were not negatively impacted during the last fiscal. The same could be the case going ahead in FY22. Moreover, a few positives also need to be highlighted - forecast of a normal monsoon, being at the top of this list; exports as an emerging growth opportunity for Indian corporate sector; a weakened unorganised sector/ imports restriction have provided organised (listed) players an opportunity to grab market share gains; a deleveraged balance sheet of the Corporate sector & a well-capitalised Banking system.

The pace of vaccination and a return to normalcy will hold the key for economic growth to remain above the forecasted trend line. Economic forecasts are rarely, if ever derived from a "bottom up" approach, rather they tend to reflect the prevailing sentiments and impacted by the "recency" bias. In the meanwhile, developed countries continues to push ahead of their emerging peers over the pace of vaccination and return to normalization. As such, this may lead to a strong export push for countries like India, especially in the prevalent "China +1" push across several sectors.

The narrative for FY22 will be the return of Urban India as the driver of economic growth - better vaccine acceptance; improving availability (pray, Serum delivers on its promise of 100 million doses in June and builds upon it in the coming months) & better personal compliance could lead to a quicker coverage of urban population and return to normalcy (all ok and much needed except back to office and the daily commute!). Rural, on the other hand, may take longer to return to normal - vaccine hesitancy; poor health infrastructure and differing levels of efficacy of the local administration across states and within a state. However, robust agricultural product pricing - national as well as international, should keep income levels stable during FY22. Yet, it would be the turn of Urban India, to do the heavy lifting to sustain the hopes of an economic recovery in FY22. It would also mean that services could re-emerge as a driver of growth, an area which was lagging during FY21. As usual, the festival season will be a good reflection of the mood of households and that would set the tone for the strength of economic recovery for FY22.

WHAT WENT BY

Bonds remained rangebound in May'21 as rising commodity prices and improving global demand conditions

buoyed by rapid vaccination progress were offset by downside risks to local growth outlook due to the

vicious second wave and expectations of continued RBI intervention to keep bond yields in order. The

10-year government bond benchmark traded in a narrow range of 5.97%-6.02%. Apart from open market

operations, RBI also tried to modulate bond market through its actions in the primary auctions, especially

on the 10 year benchmark. It rejected bids for the 10 year benchmark on auction dated 14th May'21 while

devolving Rs. 74.36 billion on primary dealers on 28th May'21.

Headline CPI inflation for April'21 declined to 4.29% YoY from 5.52% YoY in March'21, primarily driven by a favourable base effect from the national lockdown last year. Food inflation cooled to 2.02% YoY in April'21 from 4.87% YoY in March'21, led principally by a sharp widening in disinflation for vegetables (led by arrivals of the rabi harvest) and sugar, while other categories which saw a moderation in inflation momentum included cereals, milk & products, pulses and spices.

Headline WPI inflation rose to a record high of 10.5% in April 2021 from 7.4% in March 2021. On an annualized basis, broad based increase was recorded in fuel, consolidated food and core (non-food manufacturing) inflation.

IIP growth surged to 22.4% YoY in March 2021, compared to a -18.7% YoY de-growth in March 2020 due to the base effect. For the whole year FY2020-21, IIP registered a contraction of 8.6% versus a contraction of 0.8% in FY2019-20.

Government of India indicated additional borrowing this year of Rs 1.58 trillion during the current fiscal year to fund the shortfall in cess collections required to compensate states. The government projected the compensation for FY22 at Rs 2.7tn, assuming nominal GDP growth at 7% for FY22. Out of this, compensation cess collections were expected to net Rs 1-1.1 trillion, with the remaining Rs 1.58 trillion raised through additional borrowing. India's revenue secretary said that the economy had not suffered as much as last year, and argued that the additional borrowing corresponded to a monthly average GST collection of Rs 1.1tn.

Real GDP growth in 4QFY21 came in stronger than expected at 1.6%YoY (consensus: 1.0%). In annual terms, FY21 real GDP growth stood -7.3%YoY, better than CSO advance estimate of -8.0%. GDP deflator rose to a 7-year high of 7%YoY, pushing nominal GDP growth to 8.7%YoY in 4QFY21 (vs 5.2% in 3Q).

On account of the 2nd wave related disruptions caused by the pandemic, Government further enlarged the scope of Emergency Credit Line Guarantee Scheme as follows:

▶ ECLGS 4.0: 100% guarantee cover to loans up to Rs.20 million to hospitals/nursing homes/clinics/ medical colleges for setting up on-site oxygen generation plants, interest rate capped at 7.5%.

▶ Borrowers who were eligible for restructuring as per RBI guidelines of May 05, 2021, and had availed loans under ECLGS 1.0 of overall tenure of four years comprising of repayment of interest only during the first 12 months with repayment of principal and interest in 36 months thereafter will now be able to avail a tenure of five years for their ECLGS loan i.e. repayment of interest only for the first 24 months with repayment of principal and interest in 36 months thereafter.

▶ Additional ECLGS assistance of upto 10% of the outstanding as on Feb 29, 2020, to borrowers covered under ECLGS 1.0, in tandem with restructuring as per RBI guidelines of May 05, 2021.

▶ Current ceiling of Rs. 5000 million of loan outstanding for eligibility under ECLGS 3.0 to be removed, subject to maximum additional ECLGS assistance to each borrower being limited to 40% or Rs.2000 million, whichever is lower.

▶ Civil Aviation sector to be eligible under ECLGS 3.0.

▶ Validity of ECLGS extended to Sep 30, 2021, or till guarantees for an amount of Rs.3 trillion are issued. Disbursement under the scheme permitted up to Dec 31, 2021.

RBI transferred a surplus of Rs. 991bn substantially higher than the aggregate dividend budgeted from RBI, nationalized banks & other Public financial institutions at around INR 535 bn for FY22 and the Rs. 571.3bn that the government received from the RBI in FY21. The increase in surplus transfer was largely due to the lower risk capital provisioning this year, compared to last year.

US CPI rose by 4.2% YoY (consensus: 3.6%) in April'21, sharpest since Sep'08 mainly on account of base effects due to unusually depressed prices last year in the initial stages of the Covid-19 pandemic. US Producer Price Index (PPI) spiked 6.2% YoY (consensus: 5.3%) in April'21, the largest increase since 2010. April'21 PCE inflation came at 0.6% MoM as vs 0.7% exp, and 3.6% YoY rising from 1.9% last month. Within this, monthly inflation was mostly driven by both food and services, while energy inflation slowed. Core PCE inflation was at 0.7% vs 0.3% exp and at 3.1% YoY vs 2.6% expected.

Monetary policy (read our detailed note here: https://idfcmf.com/article/4807) seems very focused on being predictable for now, recognizing fully that there may be a considerable impact of the second wave on incomes and hence demand. Thus even as the recent evolution of global commodity prices and their local spillovers pose interpretational challenges for inflation, the guidance is unaltered and RBI's enhanced level of commitment to maintain easy financial conditions stands reaffirmed. Our base case would remain that eventually RBI's intensity of intervention will need to get dialed back over a period of time and hence we would continue to budget for an orderly rise in yields over time. However, this by itself provides for reasonable opportunities given the current steepness of the curve even at intermediate duration points (3 - 6 years). Put another way so long as the RBI is broadly committed to containing volatility and muting the impact of excess bond supply, the steepness of the curve provides for enough cushion even if one has to give some of this away as mark-to-market losses. However, one has to be careful not to extend duration so much that potential mark-to-market losses start overwhelming the excess carry made.

Thus local factors are unlikely to pose a significant challenge to a somewhat constructive view on intermediate duration at least for the foreseeable future. The risk is rather from the prospects of 'imported tightening' (developed market bond yields go up and that rubs off on us). One has to take this aspect as it comes and we can only note the following mitigating factors for now: 1> The US Fed is much more patient in this cycle given its revised reaction function (average inflation targeting, responding to realized rather than anticipated outcomes, and higher implicit relative importance to an equitable recovery of the labor market) 2> A rather sharp round of a reflation trade seems to already have been played as both US bond yields as well as rate hike expectations have stopped climbing since early April (although this can very easily change with incoming data) 3> The RBI's own preference for first using the forex reserve defense while persisting with pursuing easier local financial conditions to the extent required by local growth versus inflation trade-offs.

Disclaimer: MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

The Disclosures of opinions/in house views/strategy incorporated herein is provided solely to enhance the transparency about the investment strategy / theme of the Scheme and should not be treated as endorsement of the views / opinions or as an investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document has been prepared on the basis of information, which is already available in publicly accessible media or developed through analysis of IDFC Mutual Fund. The information/ views / opinions provided is for informative purpose only and may have ceased to be current by the time it may reach the recipient, which should be taken into account before interpreting this document. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision and the security may or may not continue to form part of the scheme's portfolio in future. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. The decision of the Investment Manager may not always be profitable; as such decisions are based on the prevailing market conditions and the understanding of the Investment Manager. Actual market movements may vary from the anticipated trends. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alterations to this statement as may be required from time to time. Neither IDFC Mutual Fund / IDFC AMC Trustee Co. Ltd./ IDFC Asset Management Co. Ltd nor IDFC, its Directors or representatives shall be liable for any damages whether direct or indirect, incidental, punitive special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information.

Headline CPI inflation for April'21 declined to 4.29% YoY from 5.52% YoY in March'21, primarily driven by a favourable base effect from the national lockdown last year. Food inflation cooled to 2.02% YoY in April'21 from 4.87% YoY in March'21, led principally by a sharp widening in disinflation for vegetables (led by arrivals of the rabi harvest) and sugar, while other categories which saw a moderation in inflation momentum included cereals, milk & products, pulses and spices.

Headline WPI inflation rose to a record high of 10.5% in April 2021 from 7.4% in March 2021. On an annualized basis, broad based increase was recorded in fuel, consolidated food and core (non-food manufacturing) inflation.

IIP growth surged to 22.4% YoY in March 2021, compared to a -18.7% YoY de-growth in March 2020 due to the base effect. For the whole year FY2020-21, IIP registered a contraction of 8.6% versus a contraction of 0.8% in FY2019-20.

Government of India indicated additional borrowing this year of Rs 1.58 trillion during the current fiscal year to fund the shortfall in cess collections required to compensate states. The government projected the compensation for FY22 at Rs 2.7tn, assuming nominal GDP growth at 7% for FY22. Out of this, compensation cess collections were expected to net Rs 1-1.1 trillion, with the remaining Rs 1.58 trillion raised through additional borrowing. India's revenue secretary said that the economy had not suffered as much as last year, and argued that the additional borrowing corresponded to a monthly average GST collection of Rs 1.1tn.

Real GDP growth in 4QFY21 came in stronger than expected at 1.6%YoY (consensus: 1.0%). In annual terms, FY21 real GDP growth stood -7.3%YoY, better than CSO advance estimate of -8.0%. GDP deflator rose to a 7-year high of 7%YoY, pushing nominal GDP growth to 8.7%YoY in 4QFY21 (vs 5.2% in 3Q).

On account of the 2nd wave related disruptions caused by the pandemic, Government further enlarged the scope of Emergency Credit Line Guarantee Scheme as follows:

▶ ECLGS 4.0: 100% guarantee cover to loans up to Rs.20 million to hospitals/nursing homes/clinics/ medical colleges for setting up on-site oxygen generation plants, interest rate capped at 7.5%.

▶ Borrowers who were eligible for restructuring as per RBI guidelines of May 05, 2021, and had availed loans under ECLGS 1.0 of overall tenure of four years comprising of repayment of interest only during the first 12 months with repayment of principal and interest in 36 months thereafter will now be able to avail a tenure of five years for their ECLGS loan i.e. repayment of interest only for the first 24 months with repayment of principal and interest in 36 months thereafter.

▶ Additional ECLGS assistance of upto 10% of the outstanding as on Feb 29, 2020, to borrowers covered under ECLGS 1.0, in tandem with restructuring as per RBI guidelines of May 05, 2021.

▶ Current ceiling of Rs. 5000 million of loan outstanding for eligibility under ECLGS 3.0 to be removed, subject to maximum additional ECLGS assistance to each borrower being limited to 40% or Rs.2000 million, whichever is lower.

▶ Civil Aviation sector to be eligible under ECLGS 3.0.

▶ Validity of ECLGS extended to Sep 30, 2021, or till guarantees for an amount of Rs.3 trillion are issued. Disbursement under the scheme permitted up to Dec 31, 2021.

RBI transferred a surplus of Rs. 991bn substantially higher than the aggregate dividend budgeted from RBI, nationalized banks & other Public financial institutions at around INR 535 bn for FY22 and the Rs. 571.3bn that the government received from the RBI in FY21. The increase in surplus transfer was largely due to the lower risk capital provisioning this year, compared to last year.

US CPI rose by 4.2% YoY (consensus: 3.6%) in April'21, sharpest since Sep'08 mainly on account of base effects due to unusually depressed prices last year in the initial stages of the Covid-19 pandemic. US Producer Price Index (PPI) spiked 6.2% YoY (consensus: 5.3%) in April'21, the largest increase since 2010. April'21 PCE inflation came at 0.6% MoM as vs 0.7% exp, and 3.6% YoY rising from 1.9% last month. Within this, monthly inflation was mostly driven by both food and services, while energy inflation slowed. Core PCE inflation was at 0.7% vs 0.3% exp and at 3.1% YoY vs 2.6% expected.

Outlook

Monetary policy (read our detailed note here: https://idfcmf.com/article/4807) seems very focused on being predictable for now, recognizing fully that there may be a considerable impact of the second wave on incomes and hence demand. Thus even as the recent evolution of global commodity prices and their local spillovers pose interpretational challenges for inflation, the guidance is unaltered and RBI's enhanced level of commitment to maintain easy financial conditions stands reaffirmed. Our base case would remain that eventually RBI's intensity of intervention will need to get dialed back over a period of time and hence we would continue to budget for an orderly rise in yields over time. However, this by itself provides for reasonable opportunities given the current steepness of the curve even at intermediate duration points (3 - 6 years). Put another way so long as the RBI is broadly committed to containing volatility and muting the impact of excess bond supply, the steepness of the curve provides for enough cushion even if one has to give some of this away as mark-to-market losses. However, one has to be careful not to extend duration so much that potential mark-to-market losses start overwhelming the excess carry made.

Thus local factors are unlikely to pose a significant challenge to a somewhat constructive view on intermediate duration at least for the foreseeable future. The risk is rather from the prospects of 'imported tightening' (developed market bond yields go up and that rubs off on us). One has to take this aspect as it comes and we can only note the following mitigating factors for now: 1> The US Fed is much more patient in this cycle given its revised reaction function (average inflation targeting, responding to realized rather than anticipated outcomes, and higher implicit relative importance to an equitable recovery of the labor market) 2> A rather sharp round of a reflation trade seems to already have been played as both US bond yields as well as rate hike expectations have stopped climbing since early April (although this can very easily change with incoming data) 3> The RBI's own preference for first using the forex reserve defense while persisting with pursuing easier local financial conditions to the extent required by local growth versus inflation trade-offs.

Disclaimer: MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

The Disclosures of opinions/in house views/strategy incorporated herein is provided solely to enhance the transparency about the investment strategy / theme of the Scheme and should not be treated as endorsement of the views / opinions or as an investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document has been prepared on the basis of information, which is already available in publicly accessible media or developed through analysis of IDFC Mutual Fund. The information/ views / opinions provided is for informative purpose only and may have ceased to be current by the time it may reach the recipient, which should be taken into account before interpreting this document. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision and the security may or may not continue to form part of the scheme's portfolio in future. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. The decision of the Investment Manager may not always be profitable; as such decisions are based on the prevailing market conditions and the understanding of the Investment Manager. Actual market movements may vary from the anticipated trends. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alterations to this statement as may be required from time to time. Neither IDFC Mutual Fund / IDFC AMC Trustee Co. Ltd./ IDFC Asset Management Co. Ltd nor IDFC, its Directors or representatives shall be liable for any damages whether direct or indirect, incidental, punitive special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information.