Commentary

28th February 2021

WHAT WENT BY

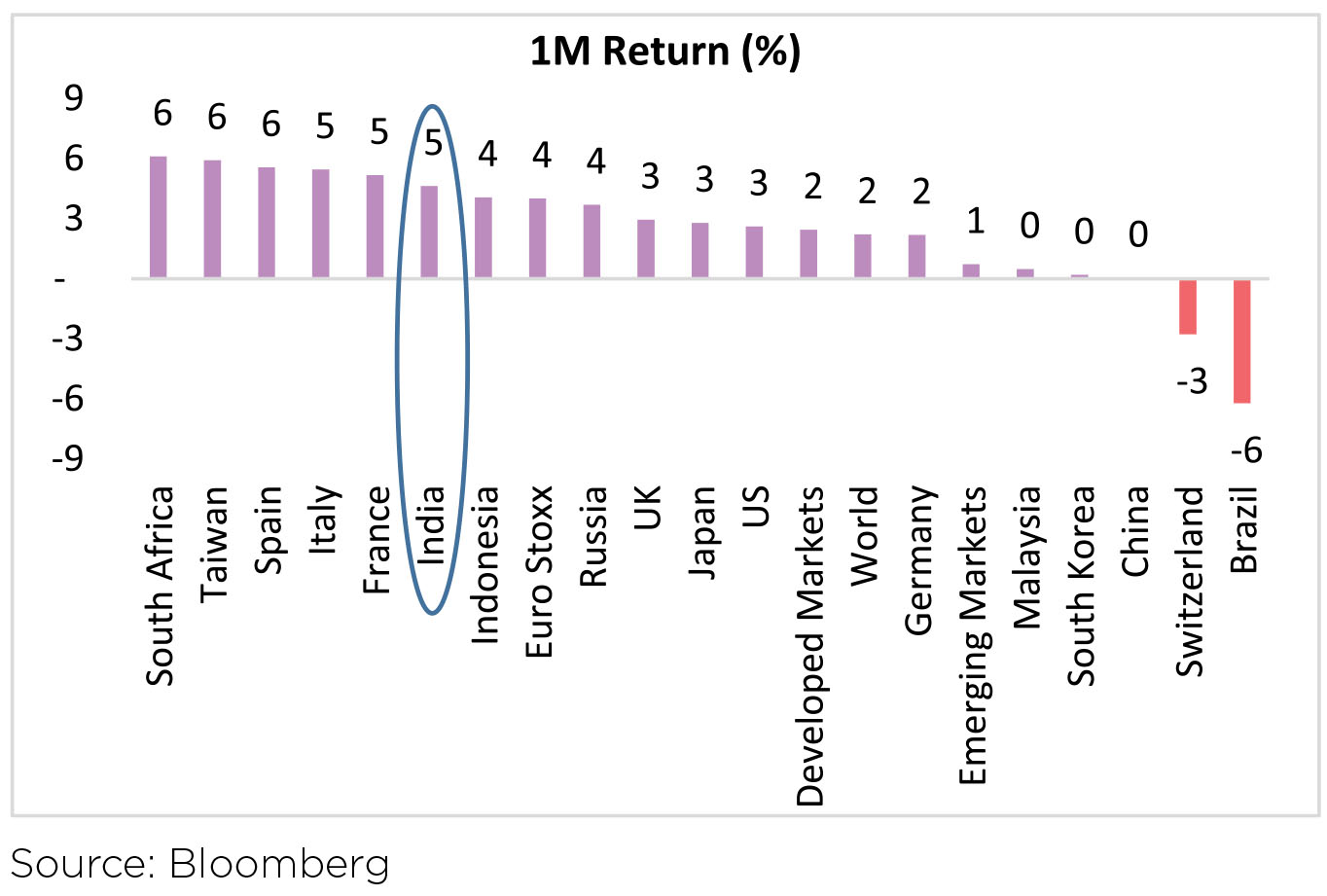

Global equities continued to trade

higher and exhibited unusually broad

momentum, delivering 12-month highs on

several equities benchmarks up until the

middle of the month. The last two weeks,

however, saw broad deleveraging across

equities and global asset classes. Equities

saw a global sell-off in risky assets amidst

a sharp rise in US bond yields. Investors

weighed a rise in bond yields on worries

about potential inflation with oil prices at

a 12-month high and copper prices near

a decade-high. Global growth outlook

has been revised higher with economic

output expected to grow at 5-6% this

year, making it the fastest pace since the

mid-80s.

The ongoing bond bear market is unlikely to derail global equities as yet. By the standards of a post-recession expansion cycle, neither the direction nor the magnitude of yield increase appears odd. The underlying drivers behind the bond yields' move matter more than their levels. Study of US bond yield cycles depicts stocks-bonds correlation over shorter and longer timeframes. In fact, in the last decade, whenever bond yields spiked by 50bps or more in a short period of time, equities performed well. Generally, equity prices and P/E multiples have been positively linked to bond yields.

FOMC officials - Recovery far from central bank's goals: Minutes from the Federal Reserve's January policy meeting indicate that the FOMC officials see the economy "far from" the central bank's goals. The meeting summary indicates it will likely "take some time for substantial further progress to be achieved", highlighting that the policy is unlikely to change soon. Fed Chair Powell adds that the discussion on tapering is "premature"; indicates that "substantial further progress" towards the FOMC's goals of labour market recovery and inflation of at least 2% is required for changing the asset purchase guidance.

Covid & Vaccines: The progress on vaccination is being watched by markets for demand cues. The US seems to be on track to achieve near herd immunity by mid-year and could be a turning point for global markets. Israel has vaccinated 82% of its population with 33% of its population receiving both doses. However, we don't yet see a sharp improvement in Google mobility for retail and recreation in Israel which is even weaker than India's.

Outperformance in Covid containment leading to marginal hospitalization rate and death rate has probably lowered risk perception on the street in India and hence driving retail participation. Daily new Covid-19 confirmed cases averaged ~12.5k in Feb vs. ~15k in Jan and ~25k in Dec. Although daily tests at 709k/day in Feb were lower vs. Jan (774k/day), the positive rate increased marginally to 2.0% in end-Feb vs. 1.9% in end-Jan.

India has administered only 14mn vaccines until 26 Feb. The current rate is way below the intended pace of vaccination expected. The second phase starting 01 Mar will cover bulk of the 300mn targeted to be vaccinated by Jul-Aug-21. In a bid to expand the Covid-19 vaccination drive amid fears of a second wave in some states, the Union Cabinet will allow anyone above the age of 60 or above 45 and with comorbidities to sign up to receive the Covid vaccines at government as well as private hospitals from 1 Mar'21.

The ongoing bond bear market is unlikely to derail global equities as yet. By the standards of a post-recession expansion cycle, neither the direction nor the magnitude of yield increase appears odd. The underlying drivers behind the bond yields' move matter more than their levels. Study of US bond yield cycles depicts stocks-bonds correlation over shorter and longer timeframes. In fact, in the last decade, whenever bond yields spiked by 50bps or more in a short period of time, equities performed well. Generally, equity prices and P/E multiples have been positively linked to bond yields.

FOMC officials - Recovery far from central bank's goals: Minutes from the Federal Reserve's January policy meeting indicate that the FOMC officials see the economy "far from" the central bank's goals. The meeting summary indicates it will likely "take some time for substantial further progress to be achieved", highlighting that the policy is unlikely to change soon. Fed Chair Powell adds that the discussion on tapering is "premature"; indicates that "substantial further progress" towards the FOMC's goals of labour market recovery and inflation of at least 2% is required for changing the asset purchase guidance.

Covid & Vaccines: The progress on vaccination is being watched by markets for demand cues. The US seems to be on track to achieve near herd immunity by mid-year and could be a turning point for global markets. Israel has vaccinated 82% of its population with 33% of its population receiving both doses. However, we don't yet see a sharp improvement in Google mobility for retail and recreation in Israel which is even weaker than India's.

Outperformance in Covid containment leading to marginal hospitalization rate and death rate has probably lowered risk perception on the street in India and hence driving retail participation. Daily new Covid-19 confirmed cases averaged ~12.5k in Feb vs. ~15k in Jan and ~25k in Dec. Although daily tests at 709k/day in Feb were lower vs. Jan (774k/day), the positive rate increased marginally to 2.0% in end-Feb vs. 1.9% in end-Jan.

India has administered only 14mn vaccines until 26 Feb. The current rate is way below the intended pace of vaccination expected. The second phase starting 01 Mar will cover bulk of the 300mn targeted to be vaccinated by Jul-Aug-21. In a bid to expand the Covid-19 vaccination drive amid fears of a second wave in some states, the Union Cabinet will allow anyone above the age of 60 or above 45 and with comorbidities to sign up to receive the Covid vaccines at government as well as private hospitals from 1 Mar'21.

Domestic Markets

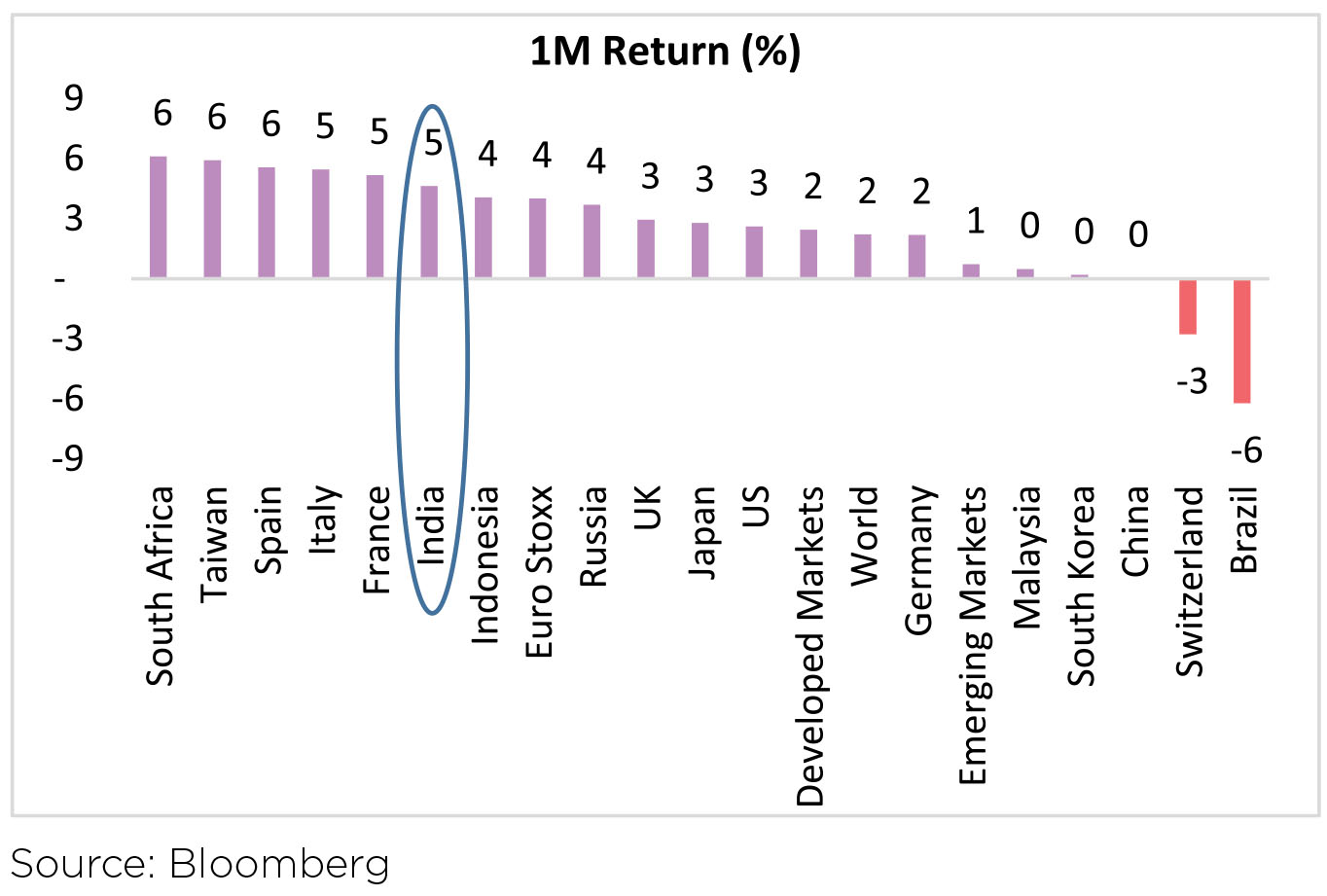

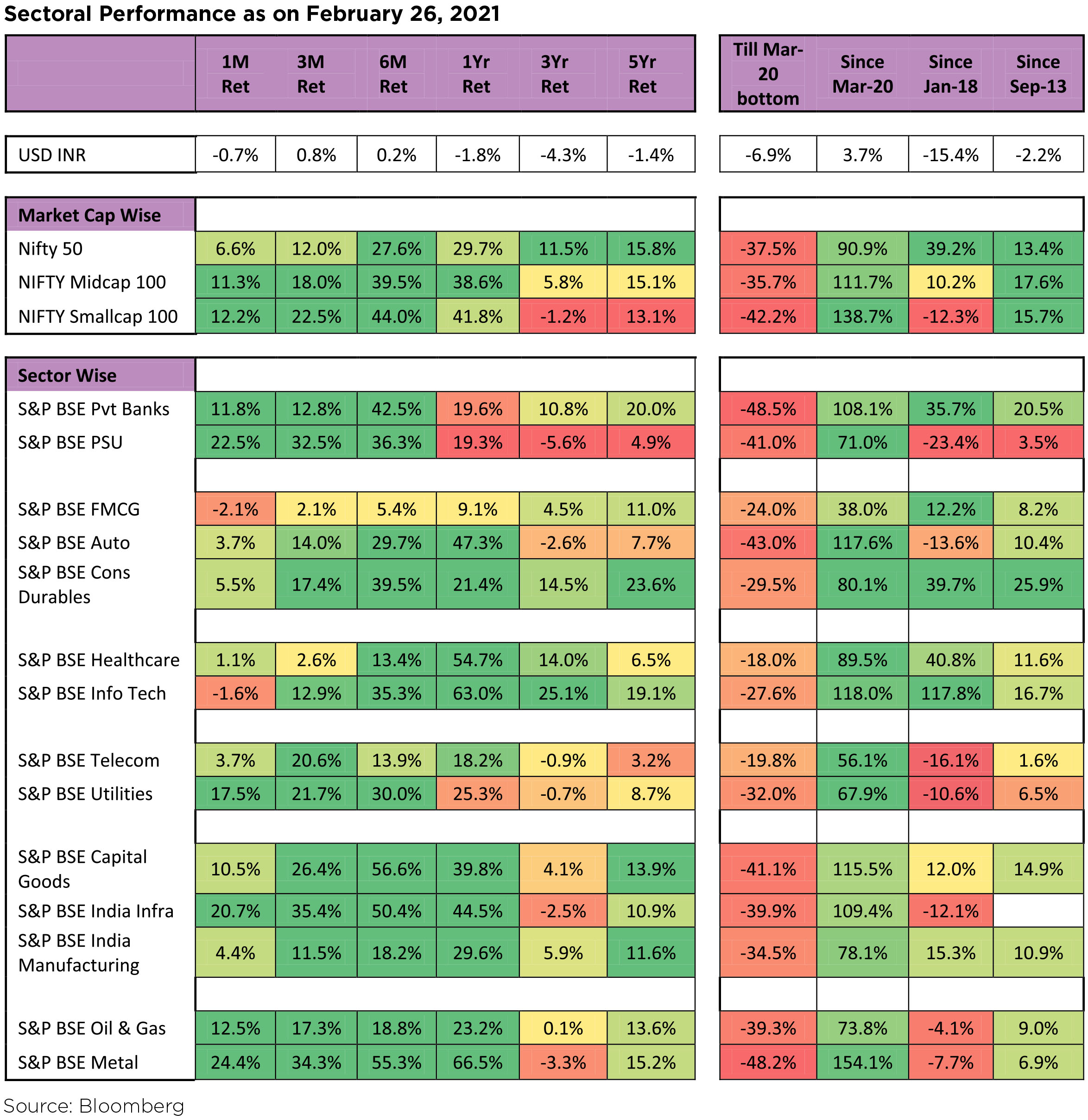

After lagging behind significantly in Jan, MSCI India (USD) rose 5.1% in Feb and significantly outperformed peers MSCI AC Asia Pacific ex Japan (+3.8%) and MSCI EM (+4.4%) on post-budget euphoria. Mid-caps and small-caps outperformed large caps by ~4%/5%, respectively, in Feb.

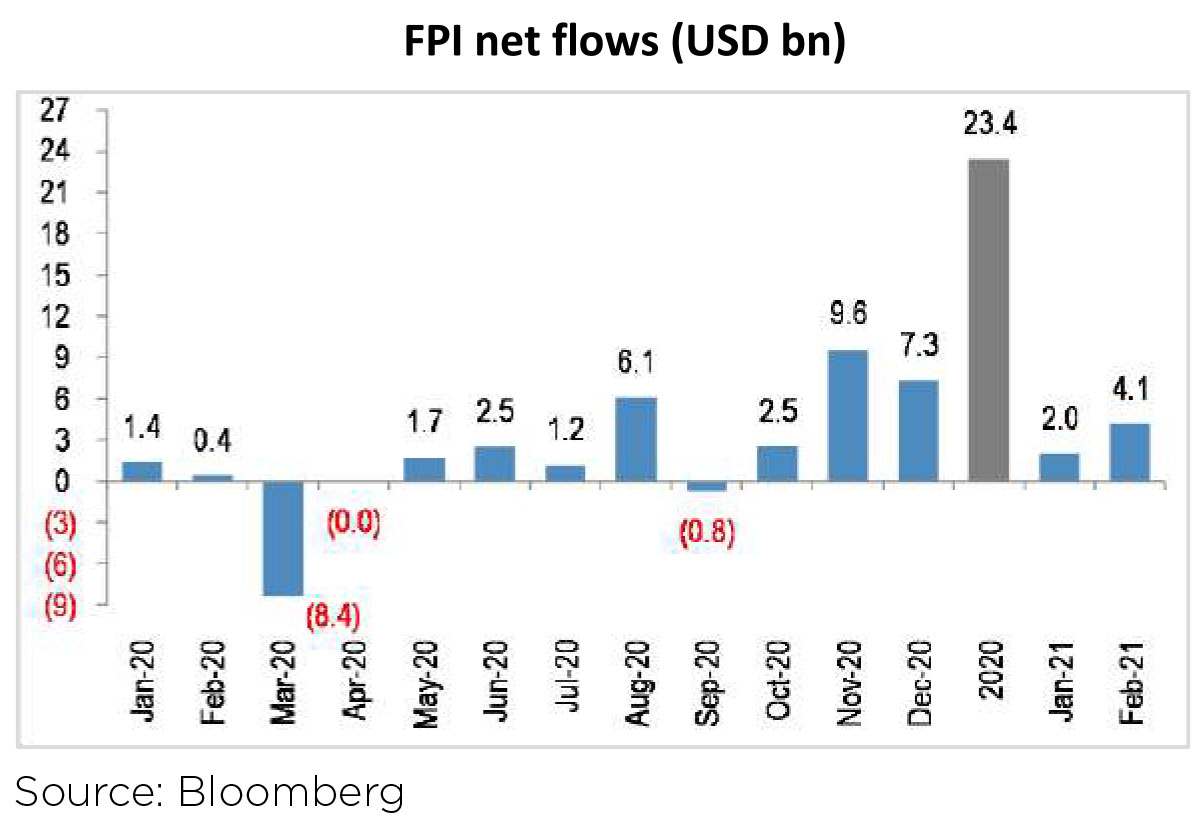

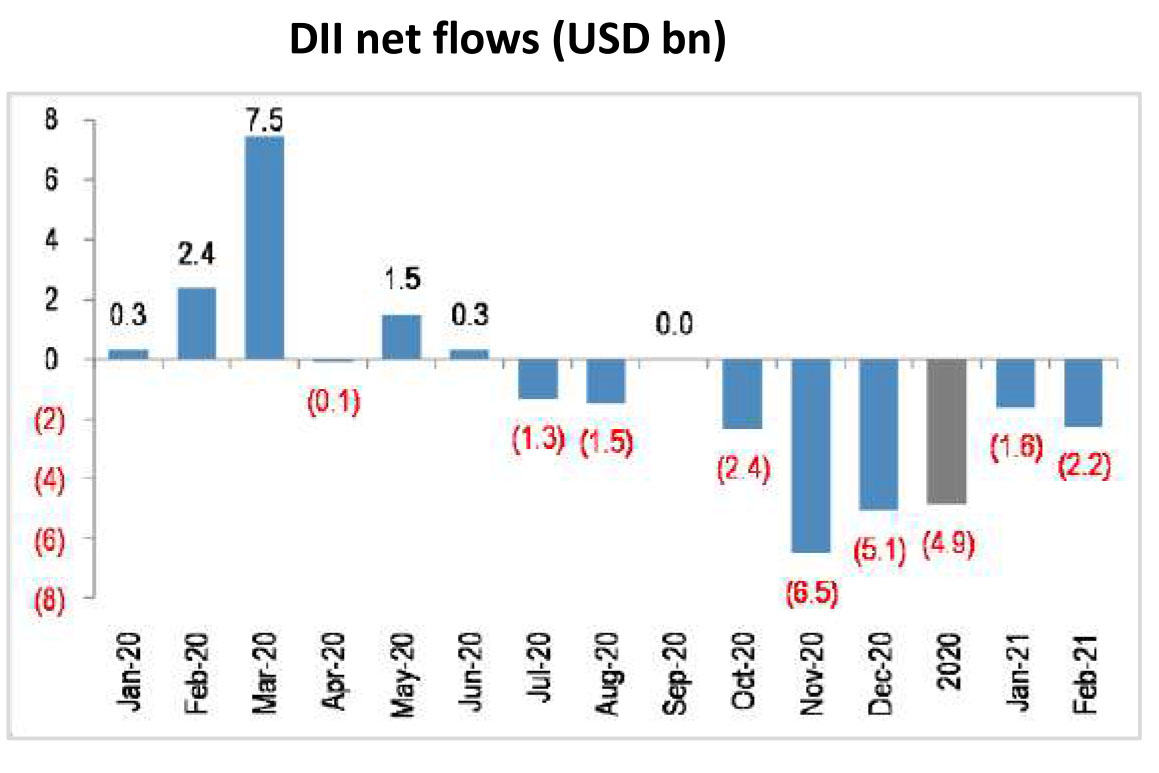

Capital Flows: FPIs recorded net inflows of USD4.1bn into Indian equities in Feb and remained net sellers in the debt markets with net outflows of USD868mn. DIIs remained net equity sellers at USD2.2bn in Feb, while insurance funds bought USD206mn of equities in Feb.

Bond Markets and Currency: Benchmark 10-year treasury yields averaged at 6.09% in Feb (19bps higher vs. Jan avg.). On month end values, the 10Y yield was up 33bps to end the month at 6.23%. US 10Y yield is at 1.40% (+34bps MoM, +26bps YoY).

INR lost 0.7% and ended the month at 73.47 per USD in Feb. In the last 12 months, INR (-1.8%) has outperformed the broader EM FX (-2.6%). DXY gained +0.3% in Feb (vs. +0.7% in Jan) and ended the month at 90.88 (-7.4% in the last 12 months).

India's FX reserves are close to their all-time peak at USD584bn as of 19 Feb. FX reserves have decreased by USD1.5bn in the last 4 weeks.

While, fiscal deficit for Apr-Jan was Rs12.3tn or 67% of the budgeted FY21 deficit (Rs.18.5tn). This compares to 106% reached during the same time frame in FY20.

RBI policy: The RBI kept policy rates on hold, reiterated its accommodative stance, indicated a phased withdrawal of last year's reserve requirement cut, but simultaneously pledged to keep liquidity conditions accommodative to ensure the government's larger-than-expected borrowing program goes through nondisruptively - all of which was expected.

Q3 FY21 Earnings Season

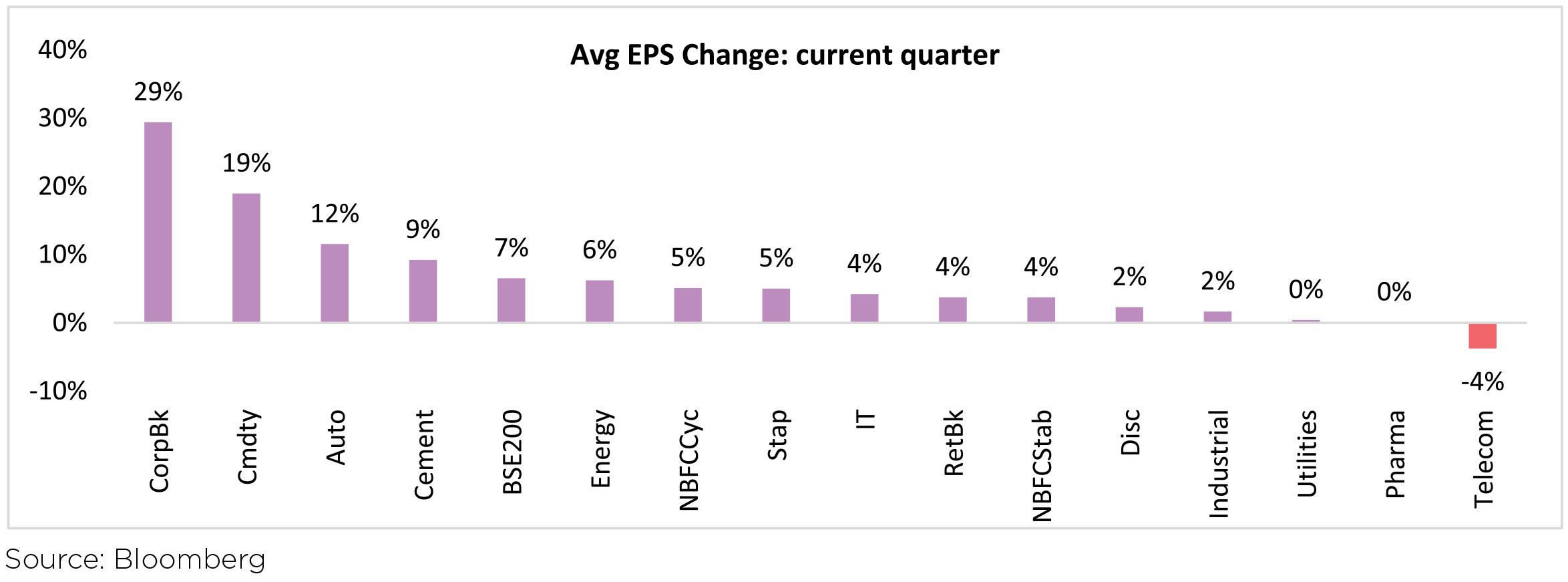

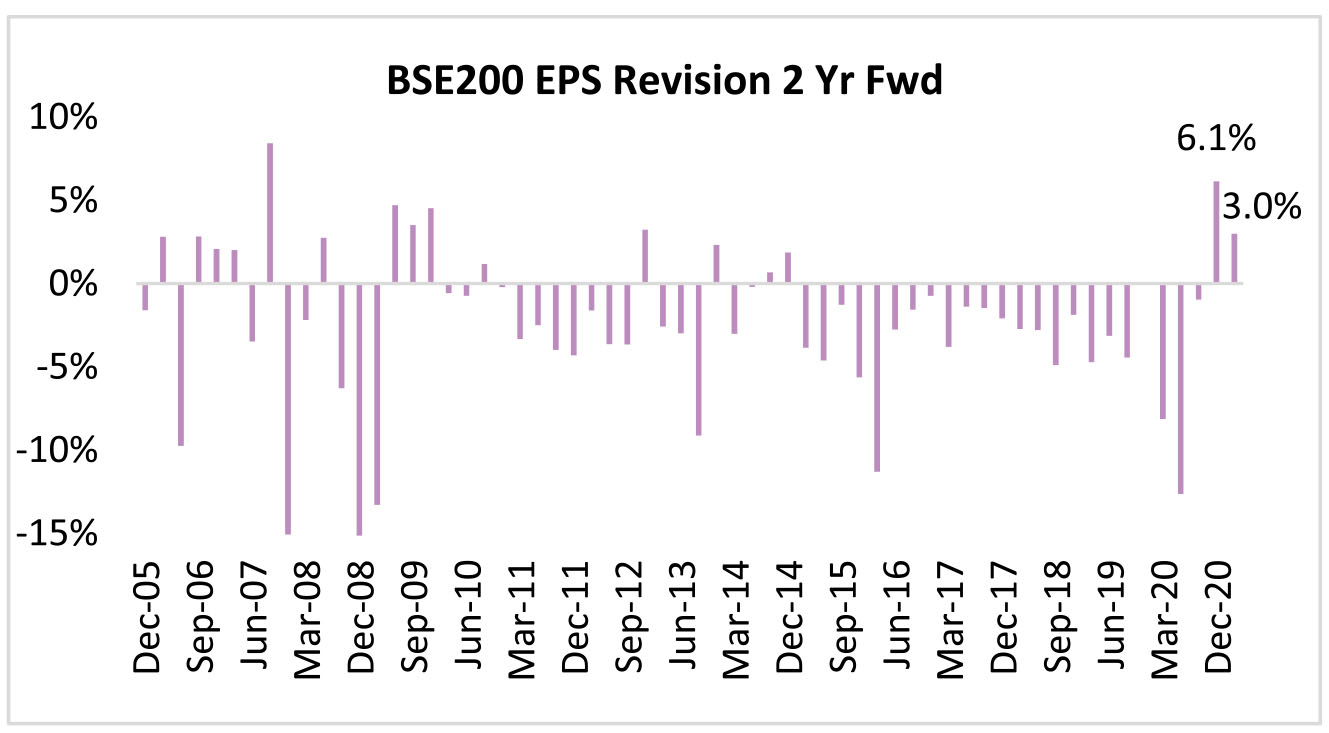

Corporate India's Q3FY21 performance is noteworthy with more surprises than disappointments. Earnings continue to beat estimates with almost 3 upgrades for every 1 downgrade in BSE200, highest in several quarters.

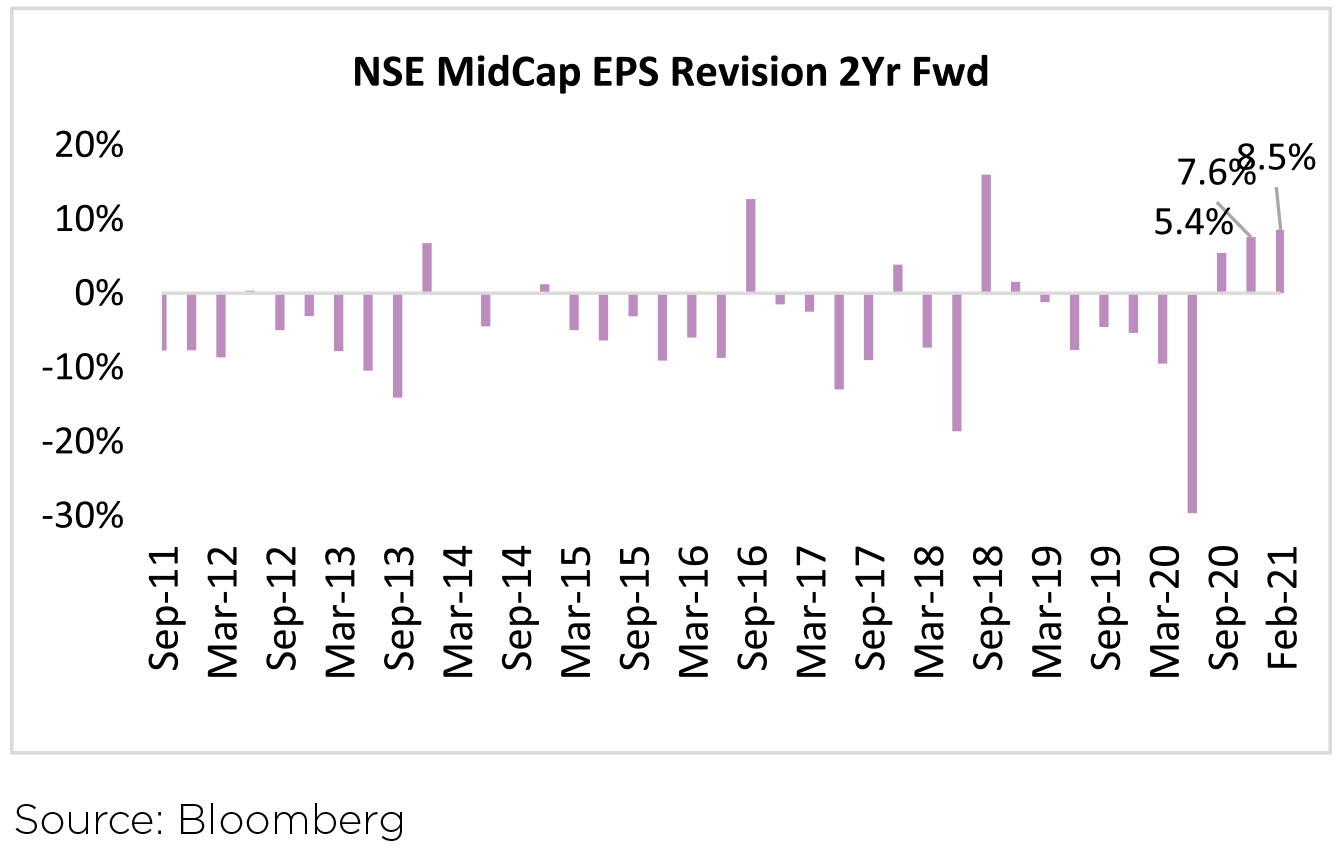

The earnings momentum accelerated

further in 3QFY21, aided by pickup in

sales growth. Aggregate sales growth

of domestically-oriented companies has

turned positive after five consecutive

quarters of contraction, and points to a

recovering domestic demand. BSE 200 saw

second quarter of upward revision, whereas

the mid-cap index has seen 3 consecutive

quarters of upward revision in EPS estimates.

Adjusted PAT for the BSE All Cap (~840 stocks) grew a handsome 33% YoY in 3QFY21 which is the highest in nearly 4 years, after similar strength in 2Q. Close to 70% of this was on account of Materials/Energy - benefitting from ongoing commodity inflation (including oil inventory gains). Ex-Metals, growth stands at 24% YoY.

Metals, Oil, Auto, IT and Pharma sectors are key contributors to the earnings growth, while BFSI, Engineering and Media disappointed. Consensus estimates continue to be upgraded and are now implying aggregate PAT growth of ~30-35% YoY in FY22.

Adjusted PAT for the BSE All Cap (~840 stocks) grew a handsome 33% YoY in 3QFY21 which is the highest in nearly 4 years, after similar strength in 2Q. Close to 70% of this was on account of Materials/Energy - benefitting from ongoing commodity inflation (including oil inventory gains). Ex-Metals, growth stands at 24% YoY.

Metals, Oil, Auto, IT and Pharma sectors are key contributors to the earnings growth, while BFSI, Engineering and Media disappointed. Consensus estimates continue to be upgraded and are now implying aggregate PAT growth of ~30-35% YoY in FY22.

Sectoral Impact

Metals, PSU Banks and Industrials outperformed while Healthcare, Staples and IT were notable laggards in Feb.

The Macro Picture

PMI: Composite PMI increased by 0.9pt MoM to 55.8 in Jan after a 1.4pt MoM decline in Dec. Helped by stronger demand conditions, Services PMI rose to 52.8 in Jan from 52.3 in Dec, while Manufacturing PMI inched up to 57.7 in Jan from 56.4 in Dec. The forward-looking demand indicators remained constructive with composite new orders remaining strong at 55.9, increasing 1.0pt MoM.

Inflation: Jan CPI inflation came in at 4.1%, softening further from 4.6% in Dec. Food prices led the downside surprise, dropping 1% MoM on the back of last month's 1.5% fall. Vegetable prices continued to mean-revert, plunging 11.5% MoM in Jan after a 9% fall in Dec. Most other food prices, including pulses, came in soft as expected, except oilseeds, which reflected rising global prices. As a result, food inflation softened to 2.7% YoY in Jan from 3.9% in Dec. Core prices (core inflation ex. gasoline and diesel) increased 0.5% MoM in Jan after a 0.3% rise in Dec, likely reflecting a combination of pent-up demand and input cost pressures.

Import Export: India's exports up 6.16% in Jan; trade deficit narrows USD14.54bn, following healthy growth in pharma and engineering sectors. Similarly, imports dropped by about 26% to USD300.26bn during April-Jan this fiscal.

GDP at 96% of its 1QFY20 pre-pandemic levels: India's GDP grew 0.4% in Q3 of FY21, underpinned by weak service sector growth. Few key highlights were (i) trade, hotels, transport, and communication services continued to contract, much more than some of the formal sector indicators had suggested, indicating continued weakness in the informal sector; and (ii) government consumption continued to contract, despite a material pickup in central government spending, suggesting contractions in state government spending offset the central government impulse. Sequential growth was strong at 25% QoQ, taking GDP to 96% of its 1QFY20 pre-pandemic level.

Economic growth revised upwards: Global forecasting firm Oxford Economics revised India's economic growth projection for 2021 to 10.2% from the earlier 8.8%, citing receding Covid-19 risks and the shift in the monetary policy outlook.

GST collections: GST collections in Feb'21 stood at INR 1.13trn (7.4% YoY), crossing the Rs1trn mark for the 5th consecutive month. The govt. has credited this to economic recovery and the various measures taken by tax administration to improve compliance.

▶ The upcoming GST Council meeting in Mar'21 will likely take up rationalizing tax rates and mergers of multiple slabs, to bring them close to being revenue-neutral and make the indirect tax regime simpler (The 15th Finance Commission has recommended merging the 12% and 18% tax rates).

▶ As part of efforts to bring parity in taxation on Agri-inputs, the Department of Chemical and Petrochemicals has approached the Finance Ministry for reducing GST on pesticides from 18% to 5%.

▶ Prime Minister Narendra Modi expressed government's commitment to bring natural gas under the GST regime to make prices cheaper and uniform across the country. He also informed that the govt. was spending Rs7.5trn over 5 years to build oil and gas infrastructure.

▶ Renewed interest in bringing petroleum products under the ambit of GST, something that has invited resistance from states in the past since VAT from these forms ~25-30% of states' own tax revenue.

IPO, M&A and PE investments: M&A deal activity in 2020 jumps 33% to USD36.9bn. While, PE/ VC investments in Jan'21 reported a 35% drop YoY to USD1.6bn from USD2.5bn. The number of deals reported also remained flat at 80, according to EY-IVCA data. SEBI eased the listing norms for large companies, apparently paving the way for the much-awaited mega float of Life Insurance Corporation (LIC). The regulator said large companies can now divest a minimum 5% in the IPO, instead of 10%. Further, they will get five years, instead of three, to raise the public float to 25%.

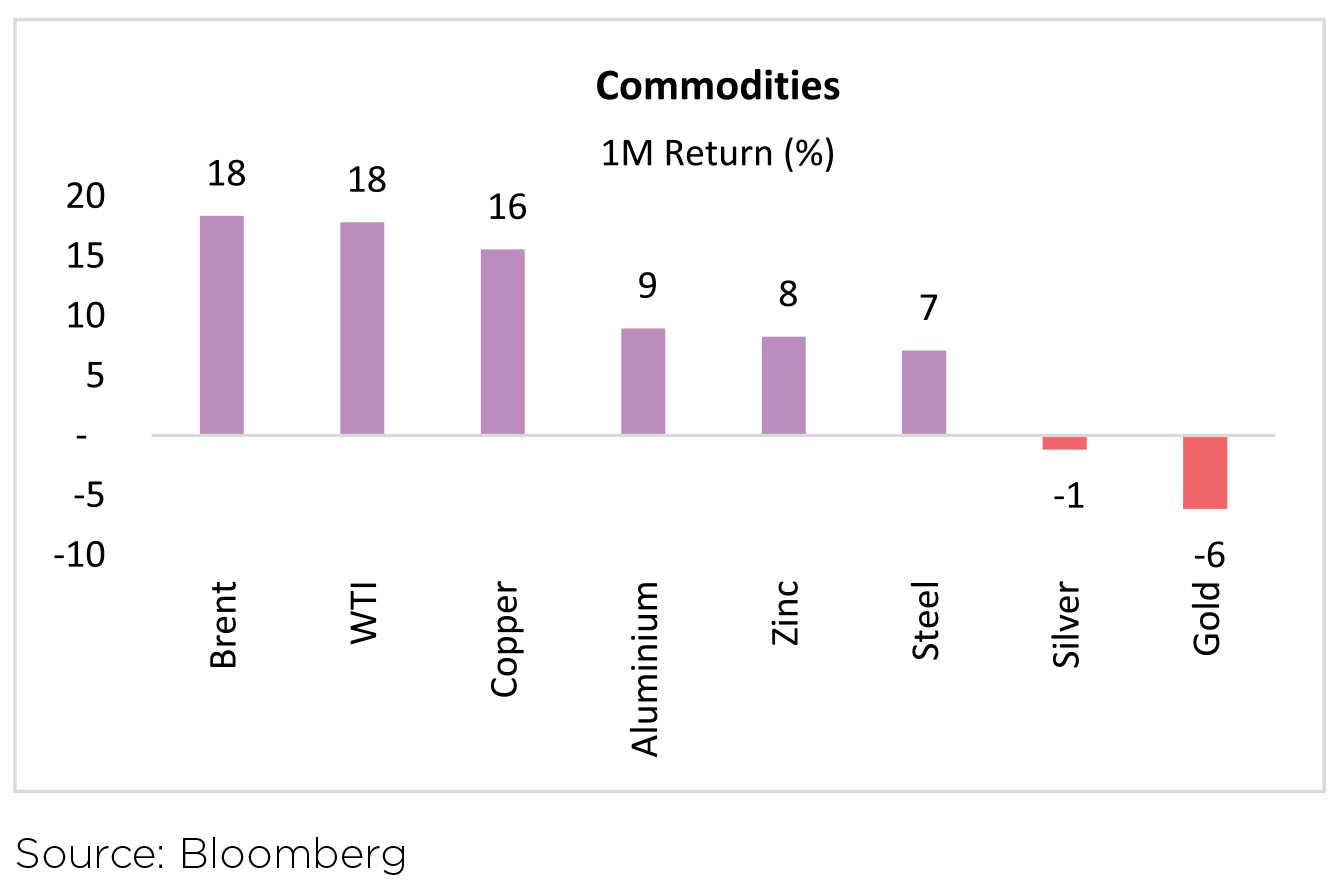

Commodities: The run-up in international commodity prices is on expectations of stimulus-led demand coming ahead of supply normalization. Brent gained a whopping 17.5% MoM in Feb to end the month at USD64.4/bbl. It made the 1-year peak at USD67/bbl, as the market looks ahead toward an accelerated decline in record inventories. On the supply side, OPEC+ discipline and Saudi Arabia's decision to reduce output by 1mbd through March were further amplified over the last week when US crude production fell 3.2mbd amid an unprecedented polar blast. From the demand perspective, the winter of 2021 stands out as one of the coldest in decades, upending energy markets and sending prices for electricity, fuel and vessels to record highs.

Thrust on Atma-Nirbhar Bharat through production-linked incentive (PLI) schemes

PLI scheme for Telecom: The government approved a Rs121.95bn PLI scheme for Telecom gear manufacturing in India, a move that will position the nation as a global powerhouse for production of such equipment ahead of 5G roll-outs. There will be a minimum investment threshold of Rs100mn for MSMEs with incentives from 7% to 4% over five years and Rs1bn for others with incentives from 6% to 4% over five years above base year (FY2020). The government expects around Rs2.4tn of incremental production (with Rs2tn in exports) and investment of more than Rs30 bn.

PLI scheme for IT hardware: The Union Cabinet approved the PLI scheme for IT hardware (laptops, tablets, all-in-one PCs and servers) with an outlay of Rs73.5bn. The aim is to enhance the development of the electronics ecosystem in India. The scheme is likely to benefit five major global players and 10 domestic champions. The scheme shall extend an incentive of 4% to 2% / 1% on net incremental sales (over FY2020) of goods manufactured in India and covered under the target segment, to eligible companies, for a period of four years. The government expects domestic value addition to increase to 20-25% by FY20225 and employment generation potential of over 180,000.

PLI scheme for Pharmaceuticals: The Union Cabinet approved the PLI scheme for pharmaceuticals with an outlay of Rs150bn. The aim is to increase production and export of (1) biopharmaceuticals; complex generic drugs; patented drugs or drugs nearing patent expiry; cell based or gene therapy drugs; orphan drugs; special empty capsules; complex excipients; phytopharmaceuticals, (2) KSMs/DIs/APIs, and (3) repurposed drugs; auto immune drugs, anti-cancer drugs, anti-diabetic drugs, anti-infective drugs, cardiovascular drugs, psychotropic drugs and anti-retroviral drugs; in vitro diagnostic devices; other drugs as approved; other drugs not manufactured in India. The scheme will be available for three categories of companies having global revenue (1) greater than Rs50 bn (incentive of Rs110 bn), (2) between Rs5 bn and Rs50 bn (incentive of Rs22.5 bn), and (3) less than Rs5 bn (incentive of Rs17.5 bn). Between FY2023 and FY2028, the government expects total incremental sales of Rs2.94tn and total incremental exports of Rs1.96tn along with 20,000 direct jobs and 80,000 indirect jobs.

Other Government policy updates

▶ Monetization policy: PM Modi has said that about 100 under-utilized or unutilized assets with PSUs will be monetized to create Rs2.5trn of investment opportunities. India's government has shortlisted four mid-sized state-run banks for privatization (Bank of Maharashtra, Bank of India, Indian Overseas Bank and the Central Bank of India), under a new push to sell state assets and shore up government revenues. Two of these banks will be selected for sale in FY22.

▶ RBI has set up an expert committee on urban co-operative banks (UCBs) to provide a road map for strengthening the sector and also evaluate the prospects for consolidating the sector.

▶ Finance Ministry directed departments and ministries to surrender savings anticipated in the Grants for FY21 by 20 Mar'21.

▶ Ministry of Agriculture has informed that India's food grain production is estimated to rise by 2% in 2020-21 crop year to an all-time high of 303.3MT due to better output of rice, wheat, pulses and coarse cereals.

Other Key snippets:

▶ State Budgets: Some state governments have given preference to the agriculture sector in their Budgets for FY22 amid the ongoing farmers' protest against the Centre's three farm laws- i) Rajasthan: has announced a separate budget on agriculture from next year onwards, along with provision of interestfree crop loans worth Rs160bn to the farmers, ii) UP: has proposed Rs1bn for the Aatmanirbhar Krishak Samanvit Vikas Yojana and Rs6bn for the Mukhyamantri Krishak Durghatna Kalyan Yojana, iii) Bihar: has earmarked Rs5.5bn for the Har Khet Ko Pani scheme.

▶ The Election Commission has announced the schedule for upcoming Assembly elections- West Bengal will go to polls in eight phases, Assam will see three-phase voting starting 27 Mar'21. Assembly elections in Tamil Nadu, Kerala and Puducherry will be held in a single phase on 6 Apr'21. (Source: Indian Express)

▶ Increase in the fuel prices throughout the country with petrol prices crossing the Rs100 mark in MP and Rajasthan.

Key Sectoral Trends:

▶ Banking & Finance: Key trends observed in the credit card data put out by the RBI for Dec-20 are: i) net card additions were much lower, ii) monthly spends/card increased 2% MoM in Dec-20, after the decline in Nov-20, and iii) total industry spends were 4% lower YoY in Dec-20.

▶ Capital Goods: Capital Goods companies sailed through last-mile hiccups in productivity and supply chain in 3Q, and are targeting strong growth in execution for 4QFY21, led by normalcy in operations and acceleration in government & private spending. Valuation re-rating continues, in line with growing optimism across quality plays.

▶ Telecom: We look at a few interesting data points from the recently-released Nokia MBiT Index Report - 2021. At 311PB/day in Dec-20, 4G constituted 99% of data traffic across network. Per-capita usage is up, while subscriber adds have slowed down. Strong rural and class C circle data traffic growth (traditional stronghold of Jio) and Jio's slowdown in data traffic growth suggests that Bharti is probably making inroads here.

▶ Infrastructure: Road contractors reported healthy improvement in revenues and profitability during 3QFY21, as project execution normalized to pre-Covid19 days. The outlook remains strong, with all companies boasting of good order books and strong award pipelines.

▶ Pharma: The sector results were a mixed bag, with one half of the sector beating consensus EBITDA estimates while other half missing expectations. Although growth recovered for most of the companies in the India formulations market, the US business listed weakness across the board, owing to lower sales of seasonal products and base-price erosion.

▶ Agriculture and Chemicals: In the chemical markets, the global recovery continues, with world chemical production up 1.8% MoM in Dec-2020. India's chemical exports grew 2.6% YoY in Jan'21, while imports grew 16.0% YoY. Global crop futures were largely stable last month. In India, corn and soybean prices rose 3-7% MoM.

▶ FMCG: The FMCG industry in India has recorded a value growth of 7.3% in Oct-Dec'20 quarter helped by consumption-led recovery during the festive period and increase in sales from traditional as well as organized trade, according to data analytics firm Nielsen.

▶ Advertising spends across media platforms in India will grow by 23.5% in 2021 to Rs801.23bn in 2021 after a sharp 21.5% decline in the pandemic-hit 2020.

▶ The Indian IT industry revenues are set to grow by 2.3% to USD194bn in FY2020-21 and the exports will go up by 1.9% to USD150bn.

▶ Non-life insurance companies registered a 6.7% increase in their gross direct premium collection in Jan at Rs184.88bn

Outlook

From Indian equities point of view, the solid Dec quarter earnings was clearly a key highlight. Few, if any, would have been able to forecast, at the start of the current fiscal in April'20, that Dec '20 quarter would deliver the highest ever quarterly profits for the BSE200 set of companies! Globally, however, the worries on inflation and the unsettling moves on the US 10-year yield gave a glimpse, a "trailer" of reality - valuations could compress; economic growth could get stunted, if bonds yields sustained and moved ahead.

For the current economic recovery to sustain, containing bond yields, not through "yield curve management" but through moderating inflation expectation will be a key variable to track for the rest of the year. On this front, last week's correction of crude oil and copper may be a sign in the right direction. If the recent surge in commodity prices can be "managed" then future inflation expectations will get moderated helping bond yields to calm down. Equity investors may be well advised to add declining bond yields, in their daily prayers!

WHAT WENT BY

Global bond markets continued to sell off amidst improved economic outlook, rise in commodity

prices, and resultant higher inflation expectations. Globally, the increase in bond yields was led by the

long end of the curve possibly suggesting markets being more fearful of the increased bond supply

& inflation surge rather than premature tightening. The sell-off for Indian bonds started from the

budget day with announced fiscal deficit and consequent government borrowing much higher than

consensus expectations (Fiscal deficit for FY 21 at 9.5% and for FY 22 at 6.8%; market estimates 7%

and 5.5% respectively) and continued with the rise in global bond yields amidst an intermittent central

bank support. India, however, was a notable exception where the 10-year benchmark government

bond continued to be an outperformer due to stronger central bank intervention although still

ended 17bps higher at 6.23% at the month end. Points on the curve where RBI did not intervene as

aggressively as the 10-year benchmark closed much higher with the rest of the curve repricing 35-

50bps higher.

3QFY21 real GDP grew 0.4% (Consensus: 0.6%) led by investment (GFCF) growth of 2.6%. Private consumption grew -2.4% (-11.3% in 2QFY21) while government expenditure grew (-)1.1% (-24% in 2QFY21). For full-year, the CSO revised down its GDP growth estimate to -8% YoY (from -7.7% earlier). On the supply side, GVA growth picked up to 1% YoY in Q4 vs -7.3% in Q3. Agricultural GVA growth rose at a faster pace (3.9% YoY in Q3 from 3% in Q2), aided by robust food grain production, while non-agricultural GVA growth rose 0.3% from -8.6%, led by a recovery in both the industrial and services sectors.

January'21 CPI inflation fell to 4.06% (4.59% in December'20), below the Bloomberg consensus of 4.4% led by a sharp drop in vegetable prices; with core inflation holding steady. Food inflation slowed further from 3.9% in December'20 to 18-month low of 2.6% in January'21 compared to 8.1% average seen between April-Dec 2020. Core CPI inflation remained stable at 5.5% YoY in January'21.

IIP growth rose to 1.0% YoY in December'20 vs -2.1% in November'20, above expectations (Consensus: -0.1%). Mining production fell 4.8% while manufacturing was up 1.6%. Consumer durables production grew 4.9%. Consumer non-durables and capital goods production increased 0.6% and 2%, respectively.

The MPC minutes for February'21 policy suggested comfort amongst MPC members with the current accommodative stance. Members continue to highlight upside risks to inflation, but view downside risks to growth as being more significant and in need of continuing policy support. Comments by the RBI members on liquidity policy, suggest that RBI might continue to try to curb significant moves higher in long-term rates, and that the central bank is likely to replenish the durable liquidity reduction (~1.5tn INR) on cash-reserve ratio hikes in March'21 and May'21 this year by further bond purchases in coming months.

RBI released the Report on Currency and Finance (RCF). The report assesses that the current inflation target band of 4% +/- 2% remains appropriate for the next five years. The report states that the MPC size and composition, decision-making process, communication practices and accountability mechanisms are in line with international best practices, while noting that some operational aspects of forward guidance, the release of MPC minutes and transcripts, and the onboarding process for MPC members may warrant an evaluation.

The global reflation trade is completely logical in its direction of pricing. Some acceleration in the trend may also have been justifiable as the size of US fiscal response picked up. However, it is still likely that bulk of this adjustment may have run its course for now and the repricing now falls back to a more sustainable pace. There may even be givebacks from time to time as market adjusts to a most likely pace of change. There is also an element of longer term repricing here as for example to US inflation expectations and hence the neutral Fed funds rate. This will unlikely be called into question while we are in the current bout of reflation. The key test to these will come when the pent up phase is done and we have a "cleaner" set of data and drivers to work with. As for our local bond markets while our ongoing cyclical recovery and eventual improvement in perceived credit profile may argue for a gradual reduction in yield spreads over developed markets over time (as what happened in the pre-2008 period) which may reduce the impact of say US yield changes into ours, the near term correlations may nevertheless be strong enough. However, it is really the pace of change in bond yields that matters. When yield curves are this steep, one can no longer think only in terms of being "long or not". Additionally, the traditional way of thinking about risk reduction through moving to short duration money market assets may not work in an environment where it is actually the overnight rate that needs to shoulder the bulk of the readjustment ahead and hence assets most closely priced off the overnight rate may be at the most risk of readjusting. It is for this reason that some amount of "bar-belling" alongside exposure to quality roll down products may make sense. It is relevant to note that these strategies account for a rise in yields over the period ahead, and the possible volatility can be mitigated by having reasonably long investment horizons.

Disclaimer: MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

The Disclosures of opinions/in house views/strategy incorporated herein is provided solely to enhance the transparency about the investment strategy / theme of the Scheme and should not be treated as endorsement of the views / opinions or as an investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document has been prepared on the basis of information, which is already available in publicly accessible media or developed through analysis of IDFC Mutual Fund. The information/ views / opinions provided is for informative purpose only and may have ceased to be current by the time it may reach the recipient, which should be taken into account before interpreting this document. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision and the security may or may not continue to form part of the scheme's portfolio in future. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. The decision of the Investment Manager may not always be profitable; as such decisions are based on the prevailing market conditions and the understanding of the Investment Manager. Actual market movements may vary from the anticipated trends. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alterations to this statement as may be required from time to time. Neither IDFC Mutual Fund / IDFC AMC Trustee Co. Ltd./ IDFC Asset Management Co. Ltd nor IDFC, its Directors or representatives shall be liable for any damages whether direct or indirect, incidental, punitive special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information.

3QFY21 real GDP grew 0.4% (Consensus: 0.6%) led by investment (GFCF) growth of 2.6%. Private consumption grew -2.4% (-11.3% in 2QFY21) while government expenditure grew (-)1.1% (-24% in 2QFY21). For full-year, the CSO revised down its GDP growth estimate to -8% YoY (from -7.7% earlier). On the supply side, GVA growth picked up to 1% YoY in Q4 vs -7.3% in Q3. Agricultural GVA growth rose at a faster pace (3.9% YoY in Q3 from 3% in Q2), aided by robust food grain production, while non-agricultural GVA growth rose 0.3% from -8.6%, led by a recovery in both the industrial and services sectors.

January'21 CPI inflation fell to 4.06% (4.59% in December'20), below the Bloomberg consensus of 4.4% led by a sharp drop in vegetable prices; with core inflation holding steady. Food inflation slowed further from 3.9% in December'20 to 18-month low of 2.6% in January'21 compared to 8.1% average seen between April-Dec 2020. Core CPI inflation remained stable at 5.5% YoY in January'21.

IIP growth rose to 1.0% YoY in December'20 vs -2.1% in November'20, above expectations (Consensus: -0.1%). Mining production fell 4.8% while manufacturing was up 1.6%. Consumer durables production grew 4.9%. Consumer non-durables and capital goods production increased 0.6% and 2%, respectively.

The MPC minutes for February'21 policy suggested comfort amongst MPC members with the current accommodative stance. Members continue to highlight upside risks to inflation, but view downside risks to growth as being more significant and in need of continuing policy support. Comments by the RBI members on liquidity policy, suggest that RBI might continue to try to curb significant moves higher in long-term rates, and that the central bank is likely to replenish the durable liquidity reduction (~1.5tn INR) on cash-reserve ratio hikes in March'21 and May'21 this year by further bond purchases in coming months.

RBI released the Report on Currency and Finance (RCF). The report assesses that the current inflation target band of 4% +/- 2% remains appropriate for the next five years. The report states that the MPC size and composition, decision-making process, communication practices and accountability mechanisms are in line with international best practices, while noting that some operational aspects of forward guidance, the release of MPC minutes and transcripts, and the onboarding process for MPC members may warrant an evaluation.

Outlook

The global reflation trade is completely logical in its direction of pricing. Some acceleration in the trend may also have been justifiable as the size of US fiscal response picked up. However, it is still likely that bulk of this adjustment may have run its course for now and the repricing now falls back to a more sustainable pace. There may even be givebacks from time to time as market adjusts to a most likely pace of change. There is also an element of longer term repricing here as for example to US inflation expectations and hence the neutral Fed funds rate. This will unlikely be called into question while we are in the current bout of reflation. The key test to these will come when the pent up phase is done and we have a "cleaner" set of data and drivers to work with. As for our local bond markets while our ongoing cyclical recovery and eventual improvement in perceived credit profile may argue for a gradual reduction in yield spreads over developed markets over time (as what happened in the pre-2008 period) which may reduce the impact of say US yield changes into ours, the near term correlations may nevertheless be strong enough. However, it is really the pace of change in bond yields that matters. When yield curves are this steep, one can no longer think only in terms of being "long or not". Additionally, the traditional way of thinking about risk reduction through moving to short duration money market assets may not work in an environment where it is actually the overnight rate that needs to shoulder the bulk of the readjustment ahead and hence assets most closely priced off the overnight rate may be at the most risk of readjusting. It is for this reason that some amount of "bar-belling" alongside exposure to quality roll down products may make sense. It is relevant to note that these strategies account for a rise in yields over the period ahead, and the possible volatility can be mitigated by having reasonably long investment horizons.

Disclaimer: MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

The Disclosures of opinions/in house views/strategy incorporated herein is provided solely to enhance the transparency about the investment strategy / theme of the Scheme and should not be treated as endorsement of the views / opinions or as an investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document has been prepared on the basis of information, which is already available in publicly accessible media or developed through analysis of IDFC Mutual Fund. The information/ views / opinions provided is for informative purpose only and may have ceased to be current by the time it may reach the recipient, which should be taken into account before interpreting this document. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision and the security may or may not continue to form part of the scheme's portfolio in future. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. The decision of the Investment Manager may not always be profitable; as such decisions are based on the prevailing market conditions and the understanding of the Investment Manager. Actual market movements may vary from the anticipated trends. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alterations to this statement as may be required from time to time. Neither IDFC Mutual Fund / IDFC AMC Trustee Co. Ltd./ IDFC Asset Management Co. Ltd nor IDFC, its Directors or representatives shall be liable for any damages whether direct or indirect, incidental, punitive special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information.