Commentary

30th September 2021

GLOBAL MARKETS

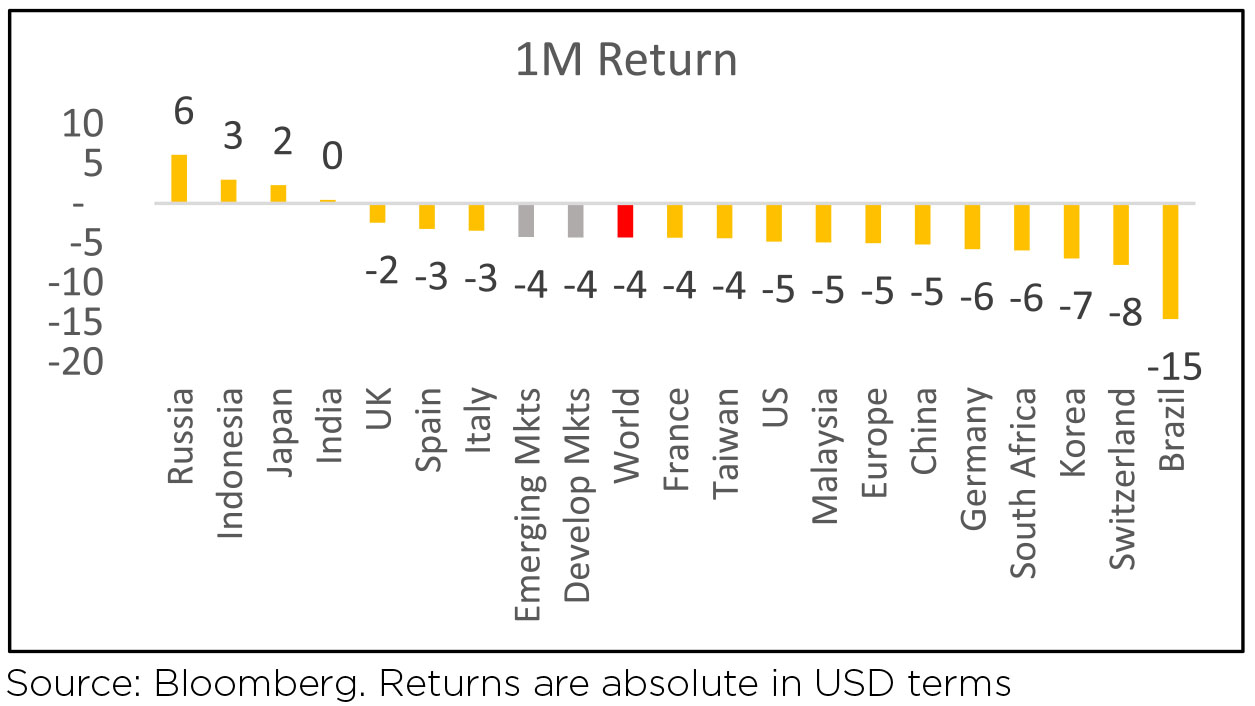

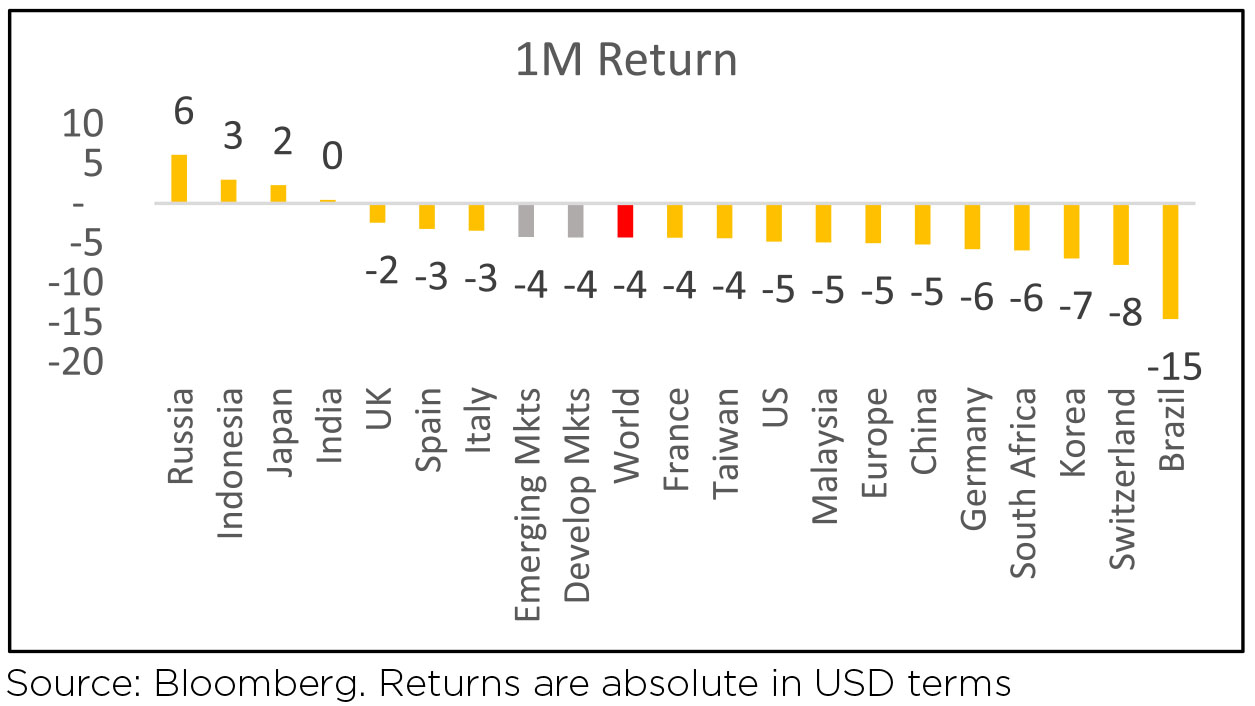

Global equities fell 4.3% in September

primarily driven by technical selling flows

and some concerns over the downward

shift in economic and business cycle

momentum. Indian equities were broadly

flat (in USD terms), but still outperformed

broader markets in September.

In Equities, we expect the market leadership to continue to shift to Cyclicals/Value, as receding virus cases and higher rates help this internal consolidation along.

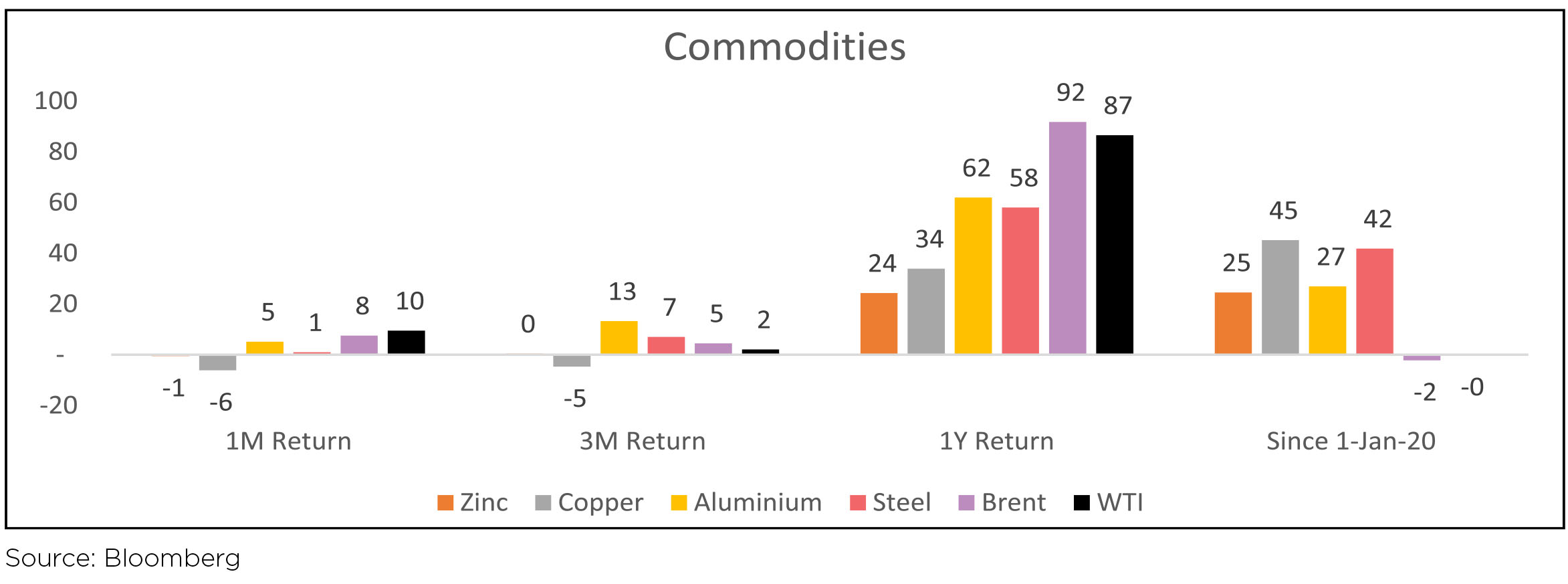

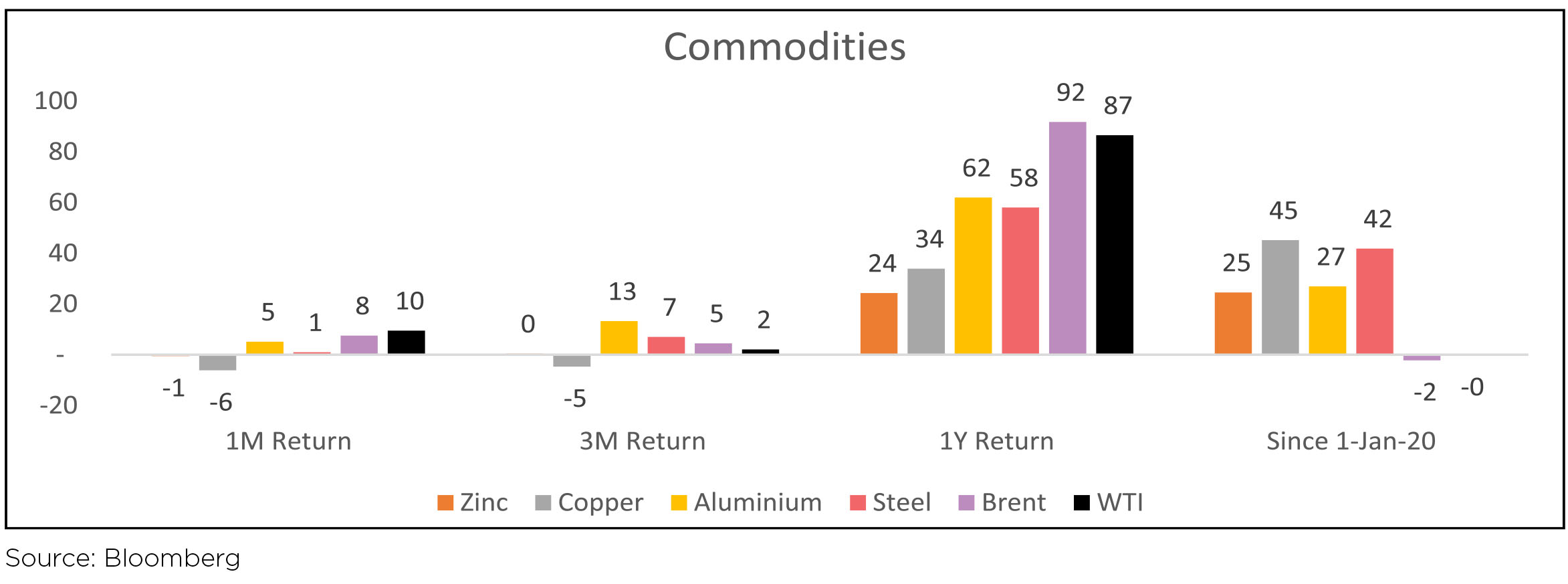

Brent and Commodities: Oil prices gained a whopping 10%+ in September, closing at $79/barrel. Oil prices rose helped by growing fuel demand and a fall in U.S. crude inventories as production remained hampered in the Gulf of Mexico after two hurricanes.

Average weekly prices indicate that prices increased across pulses, and oilseeds while vegetables fell and cereals are flat. Price inflation remained high for pulses and oils compared to last year's levels.

In Equities, we expect the market leadership to continue to shift to Cyclicals/Value, as receding virus cases and higher rates help this internal consolidation along.

Brent and Commodities: Oil prices gained a whopping 10%+ in September, closing at $79/barrel. Oil prices rose helped by growing fuel demand and a fall in U.S. crude inventories as production remained hampered in the Gulf of Mexico after two hurricanes.

Average weekly prices indicate that prices increased across pulses, and oilseeds while vegetables fell and cereals are flat. Price inflation remained high for pulses and oils compared to last year's levels.

Domestic Markets

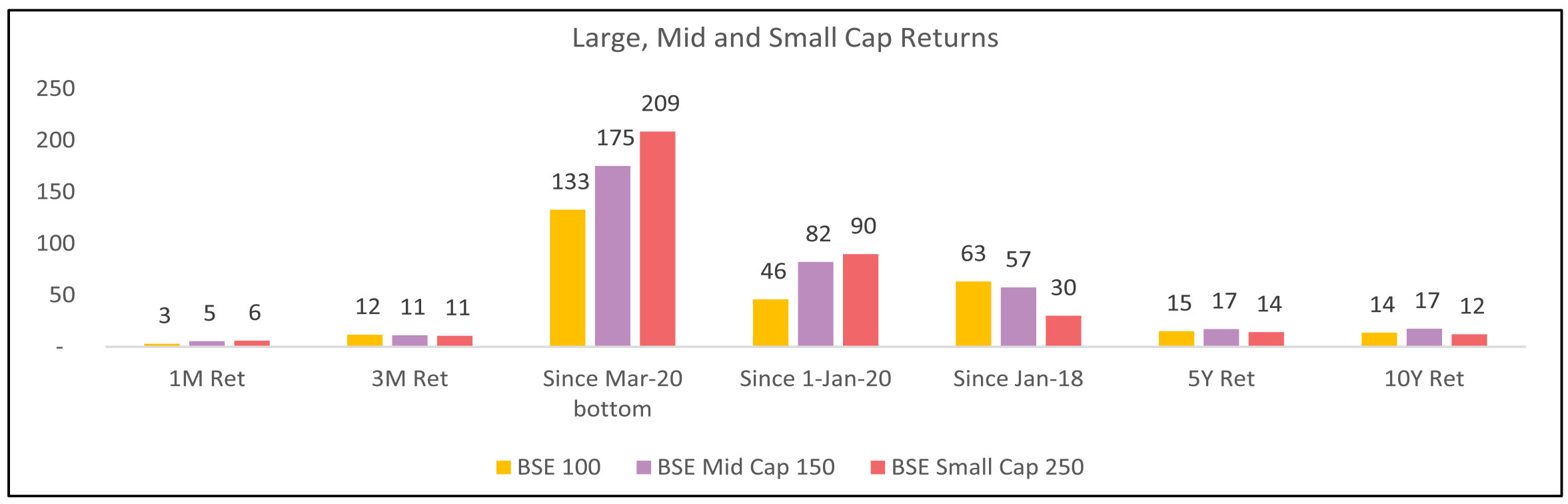

MSCI India (in local currency) was up 2.2% over the month. Indian markets continue to enjoy the massive bull-run, with NIFTY closing above 17500 levels at month-end. YTD, Indian equities are up 25%+, tracking SPX moves up.

Record low interest rates, government reform/relief measures (telecoms, autos and banks), improved vaccine access and subsequent pick-up in service sector activity kept the momentum strong. Some cooling off was seen over the last week with concerns over the US debt ceiling and uptick in global bond yields. MSCI India is now trading at 23.3x on forward earnings, well above its 15Y average of 16.4.

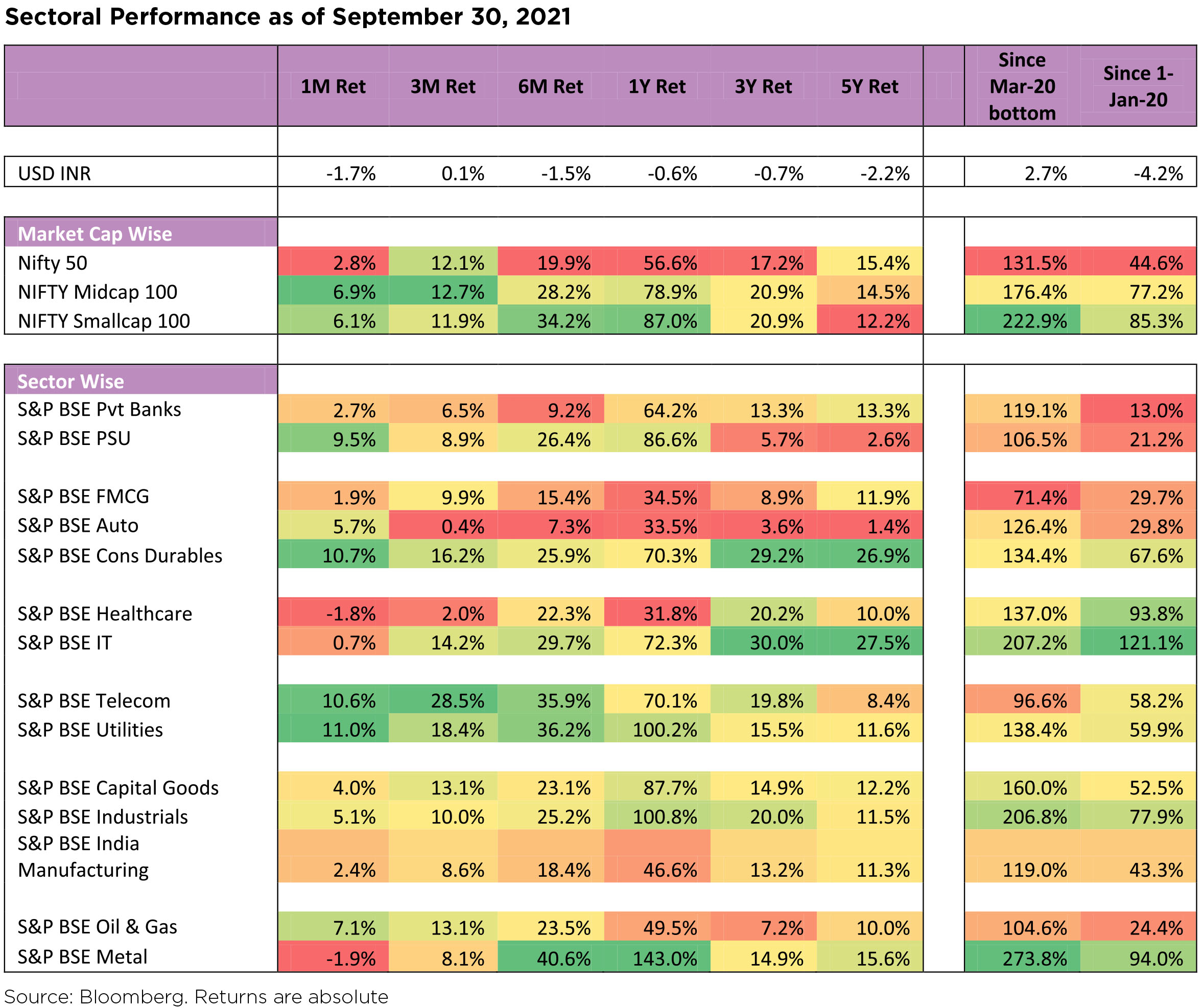

Mid-cap stocks performed broadly in line with large caps, while small caps outperformed by c.4% in September. By sector, Energy, Utilities, Communication Services and Discretionary outperformed while Materials, Health Care and IT were notable laggards. INR ended at ~74.24/USD, down 1.7%. On the flip, DXY rose 1.7% over the month.

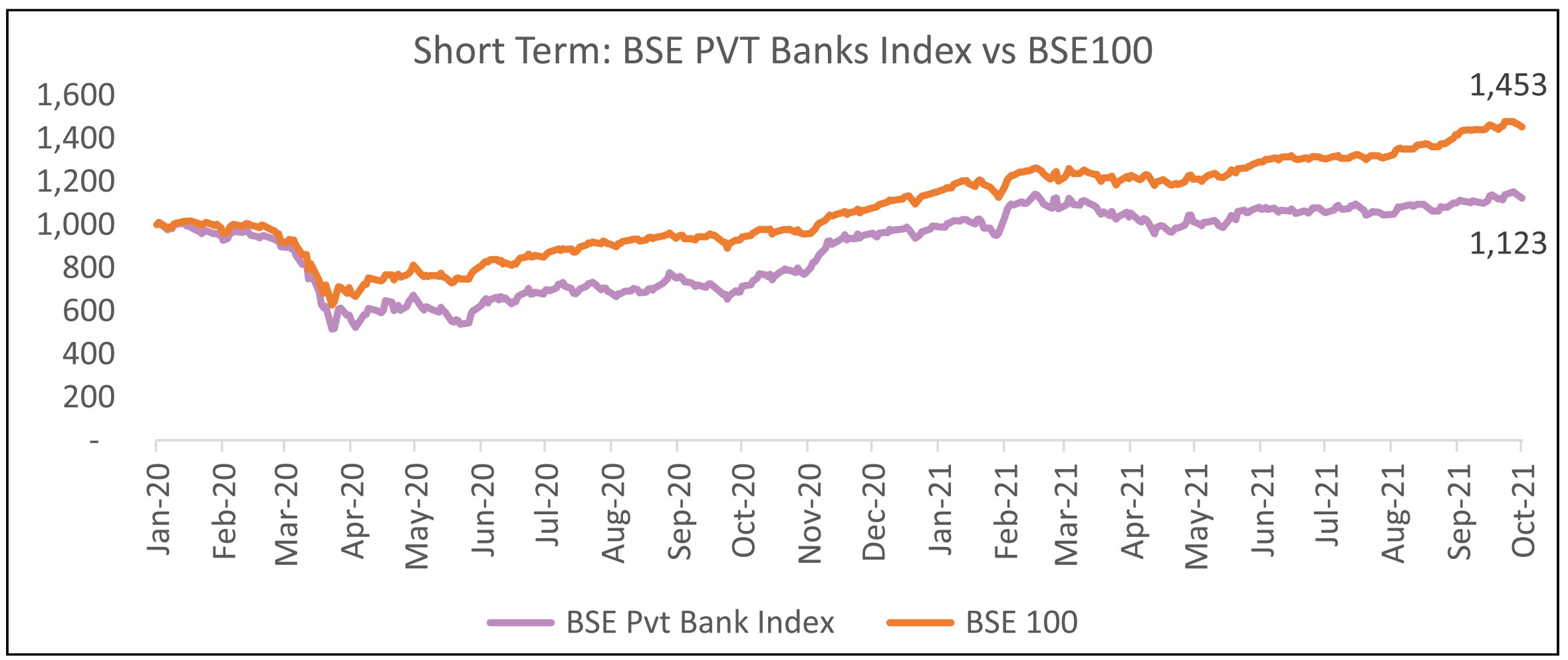

Source: Bloomberg. Less than 1-year absolute returns, Greater than 1-year CAGR. The above graph is for representation purposes only and should not be used for the development or implementation of an investment strategy. Past performance may or may not be sustained in the future.

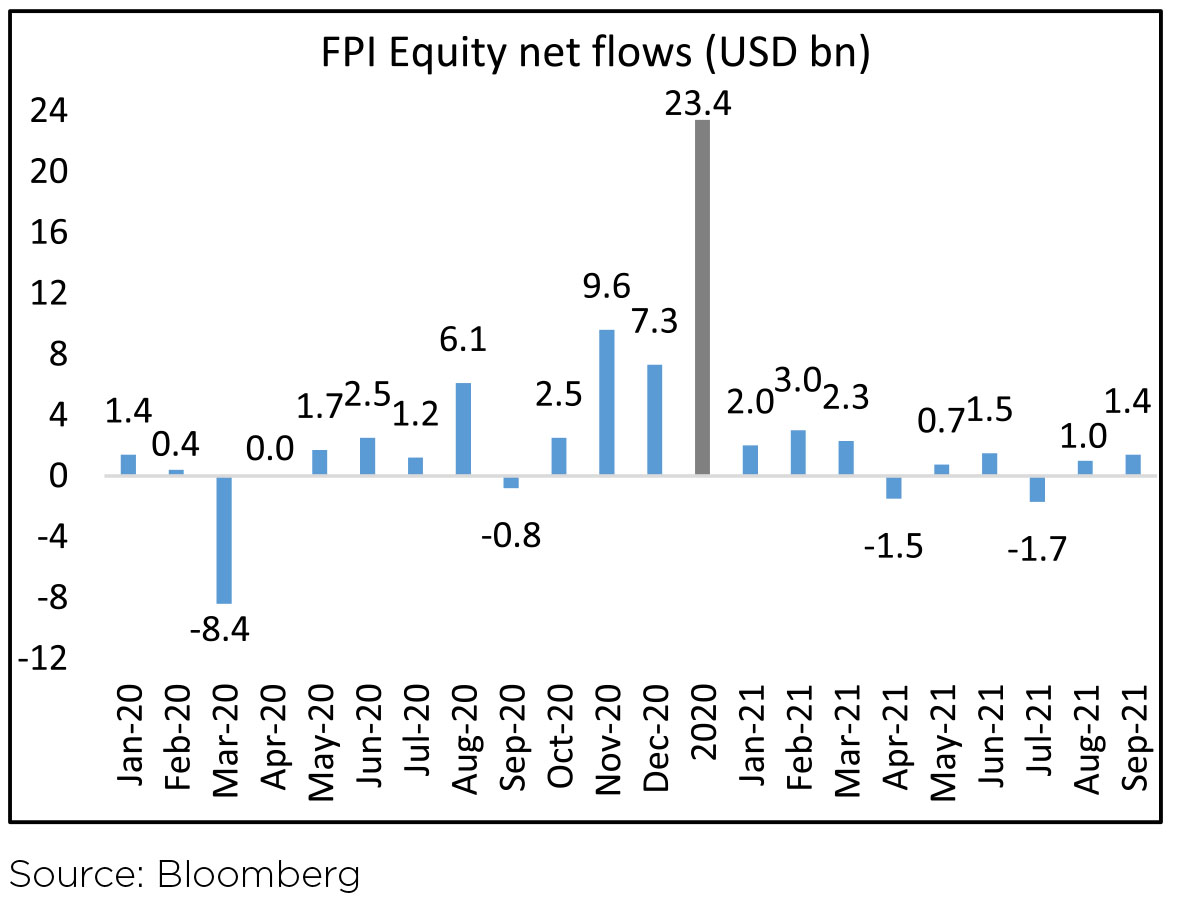

Institutional flows: FIIs remained net buyers of Indian equities again (+$1.4bn, following +$1.0bn in August). FIIs continued to be net buyers in the debt markets too, for the second month, with inflows of US$1.5bn in September.

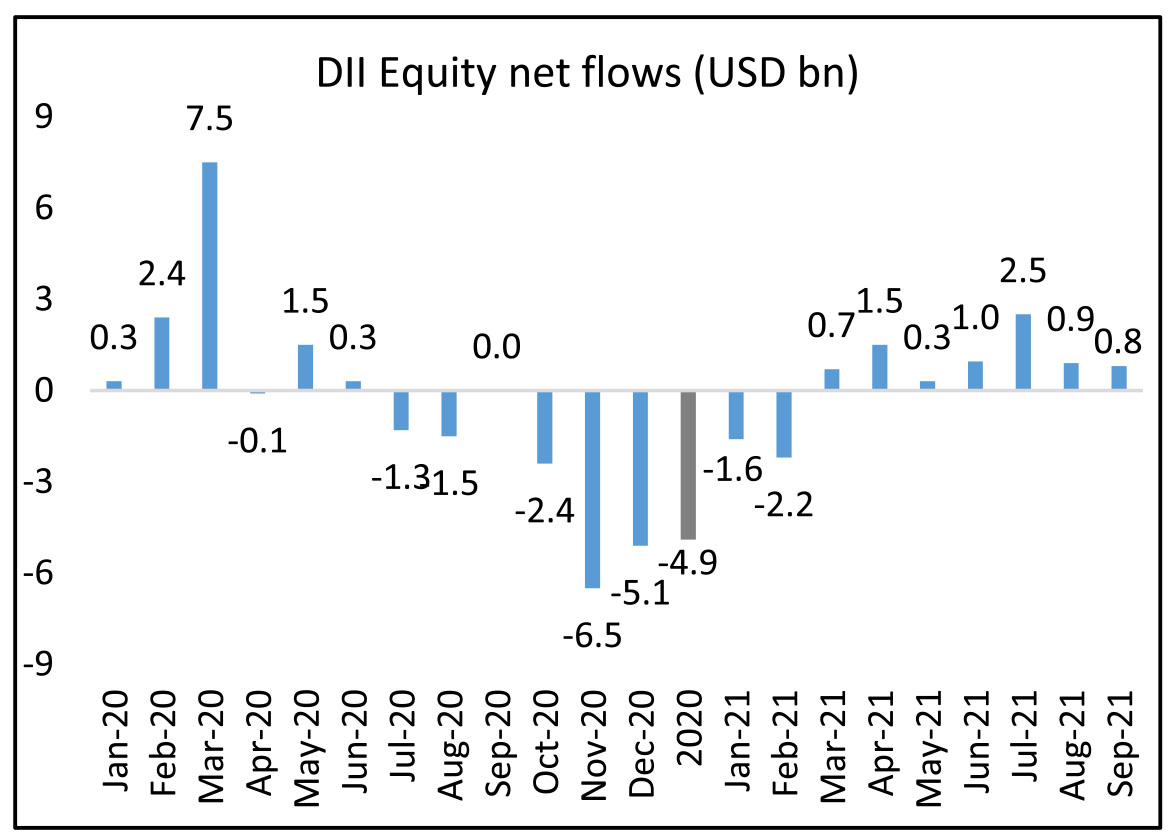

DIIs remained massive net equity buyers for the seventh month running (+$809mn, vs +$930mn in August). Mutual funds were net equity buyers at US$911mn while insurance funds net sold US$559mn of equities in September. Mutual fund and insurance fund flow data is as of 28th September.

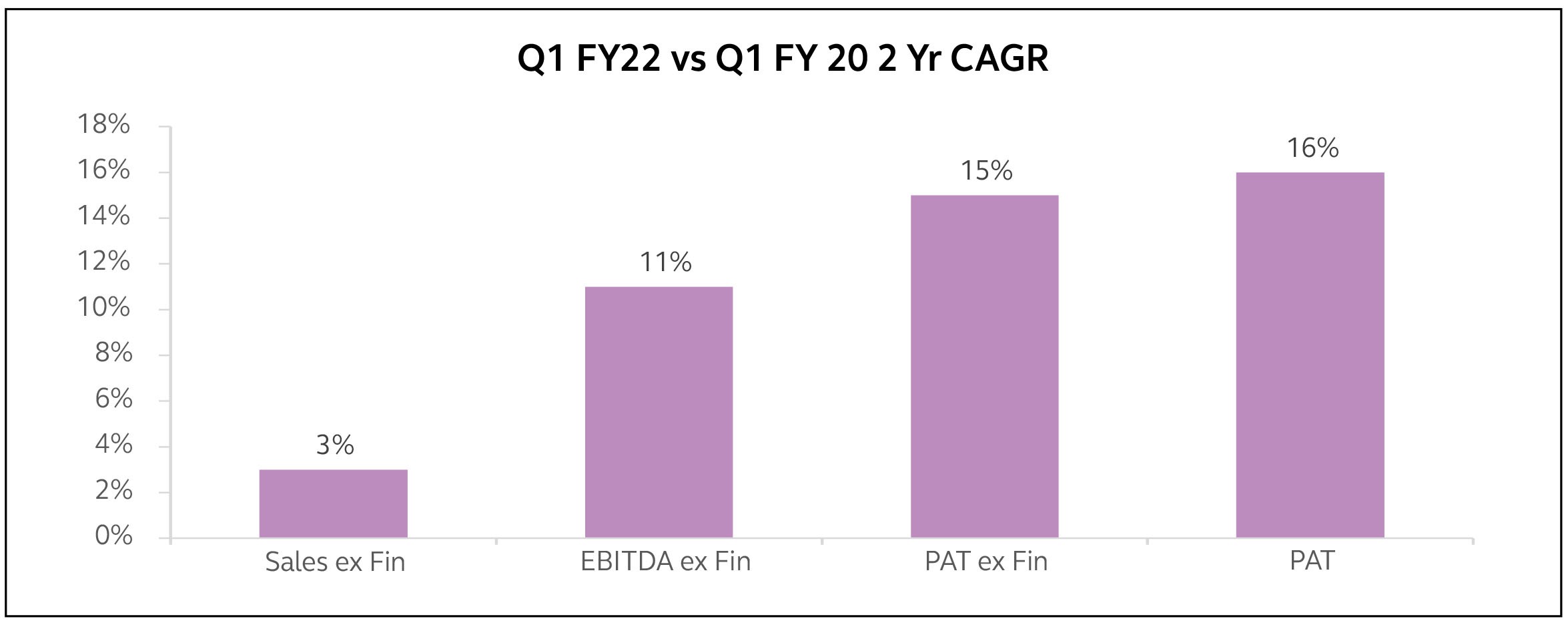

Q1FY22 Earnings

June-quarter results were strong (benefitting from lower base last year), but reflected increasing margin

pressure and moderation in top-line momentum. BSE index (864 stocks) delivered 166% YoY growth

in adjusted profits in 1QFY22 - in part due to favourable base effects from 2020. Close to 45% of YoY

growth was on account of materials companies.Rural demand encouraging: Steady improvement in consumer sentiment in Rural has been aided by-

► Rainfall normalisation (from -9% of LPA at end Aug'21 to -2% as of 24Sep'21),

► Continued vaccination progress (43% population with dose 1 as of 20Sep'21) and limited COVID infections (c.30K/daily)

► Resumption of schools/colleges in the last one month has further boosted sentiment, particularly in North and Eastern India

Sectoral Impact

By sector, IT Services, Telecom, and Oil & Gas outperformed while Materials, Auto and Health Care were notable laggards in August.

The push-in IT services was so strong that even the unexpected INR strengthening during the last days of August/ early days of September didn't seem to have any impact on the underlying sentiments for the favoured sector. It was the sector of the month.

The Macro Picture

Macro prints have been mixed - service sector PMI rebounded to a 18mth high, while core prices proving to be much stickier.

► August PMI was a mixed bag with Services PMIs bounced back but to varying degrees and manufacturing index falling 3pts to print at 52.3 - reflecting the relaxation of restrictions, fading risk-aversion and improved vaccine access.

► August CPI was at 5.3% YoY with softer food prices (though vegetable prices remained volatile)

► IP printed above expectations at 11.5% YoY in July

► GST collections grew 23% YoY in September to Rs 1.17tn - the 11th consecutive month with collections of more than Rs1tn starting October last year (exception of June 2021)

► FYTD22 net direct tax collection until 22Sep'21 expanded 74.4% YoY, with securities transaction tax almost touching the budget target in Sep'21 itself

► Fiscal deficit for Apr-August came at Rs4.68tn or 31.1% of the budgeted FY22 deficit

Global uncertainty emerges

• FED tapering: The FED signaled to soon commence tapering with median forecasts hinting at rate hikes in 2022

• Evergrande Crisis: China's 2nd largest real estate company, Evergrande is struggling to avoid default which could led to a contagion that permeates across overall liability default risk worth USD 500bn is an extension of the evolving Chinese construction sector stress over the past 3-6 months.

• China's power crises which is slowing down several industries in China. Factories in several provinces including Guangdong, an industrial hub, have been directed to conserve power which forced factories to reduce output with some even temporarily suspending operations. These restrictions have intensified further. China's efforts to source coal have led to a sharp surge in demand but supply remains short due to supplies from Indonesia and Colombia being impacted by heavy rains while some mines elsewhere have closed because of the pandemic. Europe has seen the energy crisis deepen as well with the fear being that as winter sets in, the situation in China & EU could worsen further.

Other Updates

• India Telecom: The Union Cabinet approved reforms to address near-term liquidity needs for the Telecom sector: 1) a 4-year moratorium on AGR & spectrum dues, 2) AGR redefinition to exclude nontelecom revenues, 3) Rationalization of interest & penalties on license and SUC fees, 4) Options to surrender spectrum and removal of SUC on spectrum acquired in future, 5) Option to Telecoms to pay interest from deferment by equity.

• Airlines: (i) The Aviation ministry raised airlines capacity to 85%, up from 72.5%; (ii) Tata group has reportedly won the bid for Air India's acquisition.

• Metals: (i) India's crude steel output is expected to increase 18% to 120 million tonnes by the end of this FY; (ii) Coal India Ltd to augment fuel supply to power utilities to replenish the lowering coal stocks; (iii) Vedanta Resources Ltd, MEIL and Great Eastern Shipping have also submitted expressions of interest for buying out the government's 63.75% stake in Shipping Corp.

• Oil & Gas: (i) CCI approves acquisition of ONGC Tripura Power Company Limited by GAIL (India) Limited; (ii) BPCL Chairman states completion of BPCL disinvestment by FY22; and (iii) Government hikes the price of natural gas by 63%.

• Financials: (i) The Finance Ministry extended the ECLGS scheme till FY22, or till guarantees for the overall ceiling of Rs 4.5 trillion are issued, whichever is earlier; (ii) The GoI announced a guarantee for Bad bank or National ARC (NARCL) of up to Rs.306bn for security receipts issued by entity which is approximately 15% of loans being bought by it.; and (iii) India's Account Aggregator (AA) framework went live on 2nd Sept. The objective is to increase financial services penetration & approval rates for loan applications.

• Banking liquidity in record surplus on large-scale RBI bond buying and unsterilized FX intervention

• Production-linked incentive (PLI) scheme was unveiled for the auto and drone sector

Outlook

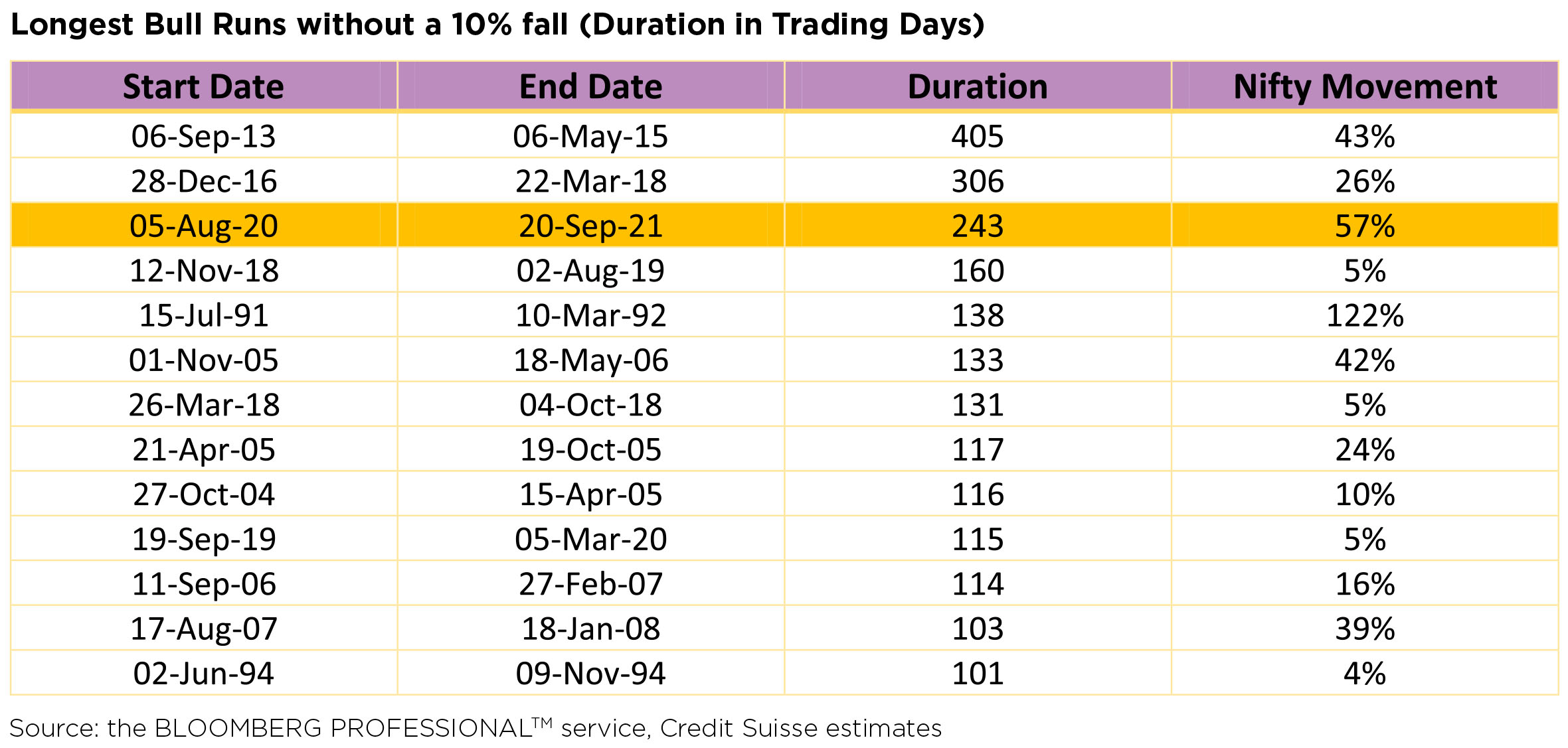

"The most hated bull markets" as many observers have termed the current market uptrend since Mar'20 is poised at an interesting juncture. Well, the same could have been said at the end of Q1 CY 21 or Q2 CY 21 or as of today.

Except for a minor "bump" during H1 CY 20, the Indian equity market has been on a roll.

For many investors waiting on the sidelines, this has been a key grouse. As this "one-way" move sustains, the murmurs get louder. Market corrections, are part of a bull market. However, this one seems keen to skip the "tradition" making many grate their teeth (in disbelief and anger).

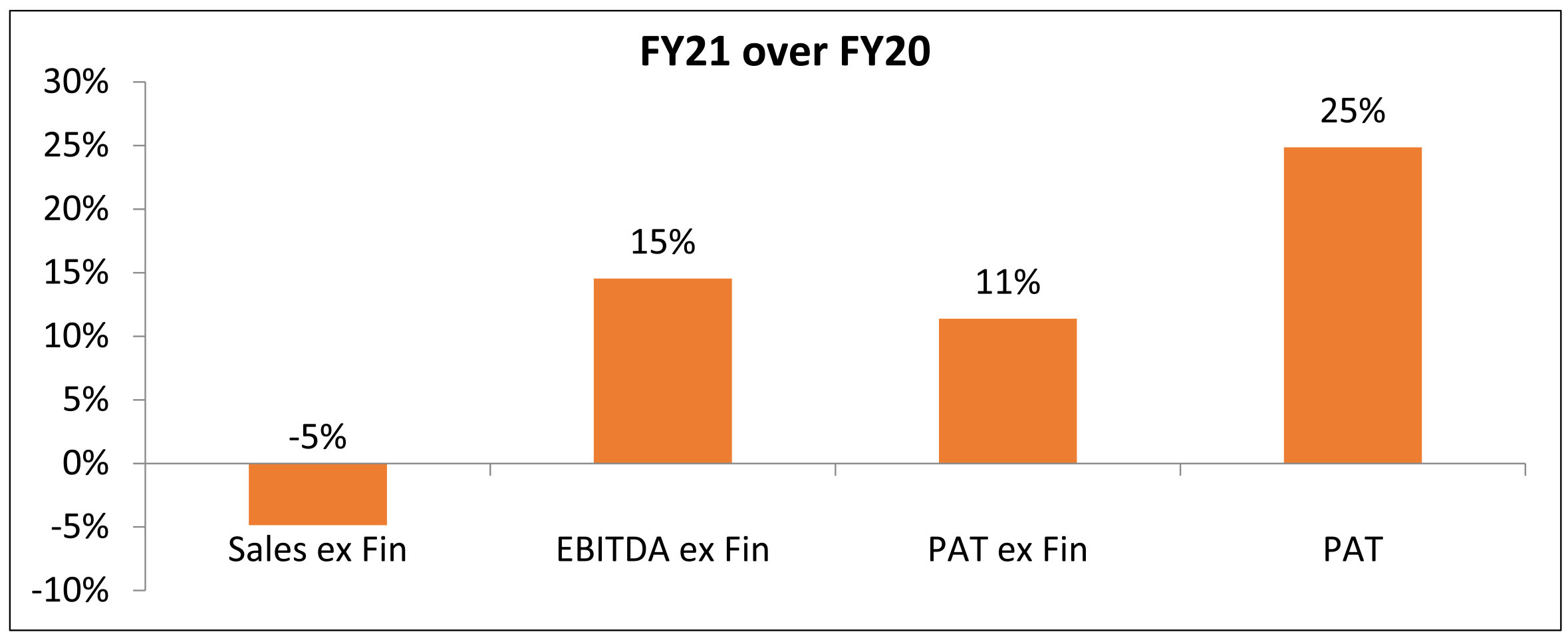

FY 21 was a unique year in many ways. For one, it registered record profits on negative sales growth, an equation few could have foreseen before the pandemic. The power of cost cutting and running operations at bare minimum cannot sustain year on year. Thankfully, for most BSE 500 companies this was not achieved by slashing employee costs - cost cutting was mainly driven by lower SGA (Selling & General expenses). FY 22 onwards, sales growth may be the key driver for profit growth across most sectors. Banks, may be an exception, as a large push to their FY 22 PAT may come through "normalised" credit costs rather than loan growth.

This is reflected in Q1 FY 22 result analysis as well. Sales growth remains tepid, when compared with Q1 FY 20, with profits being boosted by sharply reduced costs. This equation may not sustain further. Hence, investors would need to focus on topline growth - revival of demand as a key factor to focus during the upcoming earnings season.

Will private sector banks find their mojo back? Since FY 11, a key trade has been to be overweight on private sector banks led by HDFC Bank, Indus Ind Bank and Kotak, (while exiting PSU banks) and since FY 18 adding ICICI Bank to this list. However, the emergence of fintechs and the fairly pedestrian growth reported by the private sector banks has led to a quiet de-rating of this trade. The segment which is expected to sustain growth - Bajaj twins and Chola Finance have and continue being rewarded by growth focused investors. Add to this group, the emergence of fintechs. FIIs who have been the most dominant investor group in the private sector banks sweepstakes, appear to be changing tack, especially after the crackdown in China on its homegrown internet plays. As these investors are growth focused and appear to believe that Fintechs may be best placed to register faster growth than private sector banks, could it be start of a "secular" trend or is it just a "temporary" dip?

Given that private sector banks remain the largest weight across most MF schemes, is this a temporary loss of form or a sustained struggle going forward?

As a corollary, IT services has been one of the biggest beneficiaries of the pandemic. Steadily, IT services, has emerged as the second largest sector within NSE 100, the proxy for large caps. It has quietly displaced Consumer staples from the #2 perch. Will this move continue to gather further momentum? While order book; sales visibility remains strong, the sector could face headwinds on the employee cost front. Most Domestic funds are overweight this sector, this has been a "too good to be true" kind of story, especially the stock price movement of the las month or so. Will Q2 FY 22 results bolster this momentum or will the headwinds on the employee cost front, slow down this juggernaut?

Strong economic data forecasts for CY 21 and 22 have been a strong underpinning for the robust earnings growth story globally. In India, could the solid export growth registered during first 5 months of FY 22 fortify these estimates? Export growth was a key element of India's economic "miracle" years between 2003-2011, the same was missing during 2017-20 phase. Does the revival of exports in H1 FY 22 point to a greater possibility of economic growth breaking out from the 5.5-6.5% "ceiling"? China +1, leading to new enquiries from markets like ASEAN and Latin America, coupled with a revival in India's traditional export markets of US and Europe portends well for exports to revive and report strong growth during CY 21/Fy22. Now, if households restart personal consumption, as the fears of a 3rd wave recede, along with Government's sustained push on Infrastructure spending, then could the days of 7% + GDP growth return?

WHAT WENT BY

During the month bond markets saw the yields moving down on account of positive sentiments with

news of inclusion of domestic debt in global indices, demand from FPIs and surplus liquidity situation.

However later on, yields moved up tracking the rise in US bond yields and rising crude oil prices. The

10-year benchmark, 6.10% GSec 2031, saw yield move down and then move up again to close the month

almost flat at 6.22%. The 5-year GSec yield too ended the month almost flat at 5.66%.

RBI in its monetary policy on 8th October 2021 covered substantial further ground in the path towards policy normalization but continued to respect for the most part the importance of market signaling (and thereby the risk of signal amplification if market isn't guided well). Thus all rates were kept unchanged but more importantly the guidance with respect to the accommodative stance was retained: "as long as necessary to revive and sustain growth on a durable basis and continue to mitigate the impact of COVID- 19 on the economy, while ensuring that inflation remains within the target going forward". The dissent on stance by one external member was carried forward from the last time.

Consumer Price Index (CPI) inflation was 5.3% y/y in August, after 5.6% in July and, down from 6.3% in both May and June. Sequential momentum in food items continued to slow, and this was broader in August, while that in core CPI (headline excluding food and beverages, fuel and light) eased a bit from July. However, core inflation is still at 5.8% y/y in August and has remained sticky with an average of 5.9% since April 2021.

Central government tax collection in August continued to be healthy, with gross and net tax revenue levels very similar to July, while revenue and capital expenditure picked up. Since April 2021, direct taxes, excise duty and GST collections have been robust and thus net tax revenue is 41.7% of FY22BE vs. 28% of actuals in FY19 and 30% in FY20. However, expenditure has been restrained at 37% of FY22BE so far. Thus, fiscal deficit till end of August is 31% of FY22BE vs. 91% of actuals in FY19 and 59% in FY20. Further, small savings collection from April till August has been Rs. 18,000cr higher than that during the same period of last year. GST collection during the month of September was 22.5% higher y/y at Rs. 1.17 lakh crore.

Industrial production (IP) growth for July was 11.5% y/y, partly due to base effect, while it was 3.4% on a m/m seasonally adjusted basis after -11.3% in May and 8.1% in June. Infrastructure Industries output (core IP), up 11.6% y/y and 1.5% m/m seasonally adjusted in August, was at 100.2% of the pre-pandemic (Feb20) level with 6 of its 8 sub-industries above 100%.

Bank credit outstanding as on 24th September was up 6.7% y/y, same as in the previous 2 fortnights and above 6% at end of July. However, bank credit flow in August weakened from July. During April to August, overall bank credit flow was negative to industries and services (although relatively better for services), while it was positive for agriculture and personal loans.

Merchandise trade data for September surprised with a deficit of USD 22.9bn, after USD 13.8 in August, as oil imports surged by USD 5.8bn m/m. The exact reason for this spike is not fully clear, although higher oil import volume could be one major factor. Non-oil-non-gold imports too increased by USD 5.2bn m/m. Exports in September were flat at USD 33.4bn.

High frequency variables like mobility indicators, railway passenger revenue and number of GST e-way bills generated were strong in September. However, some indicators like energy consumption level, railway freight revenue and non-transport motor vehicle registrations were a bit weaker.

Globally, issues faced by the real estate development company Evergrande and the power crunch in China were noteworthy. On the former, the impact on property prices, banking sector, private consumption, etc. is being keenly watched. On the latter, government response to the coal shortage and some companies not meeting energy consumption targets, impact on industrial production, consumption, investment, inflation, etc. has been deemed crucial. In the US, as per the September Federal Open Market Committee (FOMC) meeting, a moderation in the pace (taper) of asset purchases may soon be warranted if the economy's progress towards the Committee's goals continues broadly as expected. Also, the path of interest rates as per the Summary of Economic Projections (although this is not the Committee's official forecast) suggested an early lift off of interest rate in 2022 and more hikes in 2023 vs. the previous projection, which leaves the median Fed funds target rate at 1% at end-2023 vs. 0.6% in June. US inflation momentum in August, for some of the reopening related items like used cars and trucks which had strongly driven inflation in previous months, eased and thus the headline and core inflation m/m momentum was the slowest since January and February 2021 respectively. However, house rental price (a more sticky component) has been rising. US non-farm payroll addition in August was 235,000 (persons) which was well below 0.96mn in June, 1.05mn in July and also market expectation for August, as number of Covid infections increased but wage growth continued to remain strong.

We have recently explained in detail our current bond framework (https://idfcmf.com/article/5730). We do believe that the current level of overnight rate is at emergency levels and have to be lifted soon enough. That said, a view on when to lift this is a matter of perspective and RBI's threshold on the amount of assurance it wants on growth being self-sustaining is probably somewhat higher than what many in the market (including ourselves) may have. However, we don't believe that just basis this one can characterize RBI as being behind the curve. This follows from the other pillar of our framework, which arguably is more important at this juncture now that the process of normalization is underway: peak policy rates in this cycle are likely to be lower than in the last. Therefore even if RBI's view is towards a later lift-off, given our expectation of a shallower normalization cycle anyway, we would be loath to characterize it as being behind the curve.

Our one slight disagreement with market consensus is probably with respect to what we think is the best play for the policy normalization cycle that has already commenced in some way. Thus in our view 5 - 10 - 15 year spreads are unlikely to narrow much from here (bulk of flattening may happen between 1 and 5 years and various combinations therein, of course this is as per market consensus view as well) whereas at least recent price action seems to suggest that general market opinion is that 10 and 15 year points provide better safety. We say this because despite a much lower borrowing calendar for the second half of the year in the 5 year space, we didn't see an appreciable tightening of spread between 5 and 10 years (of course 'technical' factors could be at play as well, including that we are being too impatient with this!). Our view is basis our third framework pillar that bond demand versus supply dynamics may remain a longer term issue. The discontinuation of GSAP is (at least temporarily) leading to some steepening between 5 year and longer but our issue is much longer term. We continue to be heavily overweight 5 year (4.5 years now) in our actively managed bond and gilt funds. As before, and as a matter of standard disclaimer, what has been presented here reflects our current thinking. As always this can change at any point in time.

Disclaimer: MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

The Disclosures of opinions/in house views/strategy incorporated herein is provided solely to enhance the transparency about the investment strategy / theme of the Scheme and should not be treated as endorsement of the views / opinions or as an investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document has been prepared on the basis of information, which is already available in publicly accessible media or developed through analysis of IDFC Mutual Fund. The information/ views / opinions provided is for informative purpose only and may have ceased to be current by the time it may reach the recipient, which should be taken into account before interpreting this document. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision and the security may or may not continue to form part of the scheme's portfolio in future. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. The decision of the Investment Manager may not always be profitable; as such decisions are based on the prevailing market conditions and the understanding of the Investment Manager. Actual market movements may vary from the anticipated trends. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alterations to this statement as may be required from time to time. Neither IDFC Mutual Fund / IDFC AMC Trustee Co. Ltd./ IDFC Asset Management Co. Ltd nor IDFC, its Directors or representatives shall be liable for any damages whether direct or indirect, incidental, punitive special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information.

RBI in its monetary policy on 8th October 2021 covered substantial further ground in the path towards policy normalization but continued to respect for the most part the importance of market signaling (and thereby the risk of signal amplification if market isn't guided well). Thus all rates were kept unchanged but more importantly the guidance with respect to the accommodative stance was retained: "as long as necessary to revive and sustain growth on a durable basis and continue to mitigate the impact of COVID- 19 on the economy, while ensuring that inflation remains within the target going forward". The dissent on stance by one external member was carried forward from the last time.

Consumer Price Index (CPI) inflation was 5.3% y/y in August, after 5.6% in July and, down from 6.3% in both May and June. Sequential momentum in food items continued to slow, and this was broader in August, while that in core CPI (headline excluding food and beverages, fuel and light) eased a bit from July. However, core inflation is still at 5.8% y/y in August and has remained sticky with an average of 5.9% since April 2021.

Central government tax collection in August continued to be healthy, with gross and net tax revenue levels very similar to July, while revenue and capital expenditure picked up. Since April 2021, direct taxes, excise duty and GST collections have been robust and thus net tax revenue is 41.7% of FY22BE vs. 28% of actuals in FY19 and 30% in FY20. However, expenditure has been restrained at 37% of FY22BE so far. Thus, fiscal deficit till end of August is 31% of FY22BE vs. 91% of actuals in FY19 and 59% in FY20. Further, small savings collection from April till August has been Rs. 18,000cr higher than that during the same period of last year. GST collection during the month of September was 22.5% higher y/y at Rs. 1.17 lakh crore.

Industrial production (IP) growth for July was 11.5% y/y, partly due to base effect, while it was 3.4% on a m/m seasonally adjusted basis after -11.3% in May and 8.1% in June. Infrastructure Industries output (core IP), up 11.6% y/y and 1.5% m/m seasonally adjusted in August, was at 100.2% of the pre-pandemic (Feb20) level with 6 of its 8 sub-industries above 100%.

Bank credit outstanding as on 24th September was up 6.7% y/y, same as in the previous 2 fortnights and above 6% at end of July. However, bank credit flow in August weakened from July. During April to August, overall bank credit flow was negative to industries and services (although relatively better for services), while it was positive for agriculture and personal loans.

Merchandise trade data for September surprised with a deficit of USD 22.9bn, after USD 13.8 in August, as oil imports surged by USD 5.8bn m/m. The exact reason for this spike is not fully clear, although higher oil import volume could be one major factor. Non-oil-non-gold imports too increased by USD 5.2bn m/m. Exports in September were flat at USD 33.4bn.

High frequency variables like mobility indicators, railway passenger revenue and number of GST e-way bills generated were strong in September. However, some indicators like energy consumption level, railway freight revenue and non-transport motor vehicle registrations were a bit weaker.

Globally, issues faced by the real estate development company Evergrande and the power crunch in China were noteworthy. On the former, the impact on property prices, banking sector, private consumption, etc. is being keenly watched. On the latter, government response to the coal shortage and some companies not meeting energy consumption targets, impact on industrial production, consumption, investment, inflation, etc. has been deemed crucial. In the US, as per the September Federal Open Market Committee (FOMC) meeting, a moderation in the pace (taper) of asset purchases may soon be warranted if the economy's progress towards the Committee's goals continues broadly as expected. Also, the path of interest rates as per the Summary of Economic Projections (although this is not the Committee's official forecast) suggested an early lift off of interest rate in 2022 and more hikes in 2023 vs. the previous projection, which leaves the median Fed funds target rate at 1% at end-2023 vs. 0.6% in June. US inflation momentum in August, for some of the reopening related items like used cars and trucks which had strongly driven inflation in previous months, eased and thus the headline and core inflation m/m momentum was the slowest since January and February 2021 respectively. However, house rental price (a more sticky component) has been rising. US non-farm payroll addition in August was 235,000 (persons) which was well below 0.96mn in June, 1.05mn in July and also market expectation for August, as number of Covid infections increased but wage growth continued to remain strong.

Outlook

We have recently explained in detail our current bond framework (https://idfcmf.com/article/5730). We do believe that the current level of overnight rate is at emergency levels and have to be lifted soon enough. That said, a view on when to lift this is a matter of perspective and RBI's threshold on the amount of assurance it wants on growth being self-sustaining is probably somewhat higher than what many in the market (including ourselves) may have. However, we don't believe that just basis this one can characterize RBI as being behind the curve. This follows from the other pillar of our framework, which arguably is more important at this juncture now that the process of normalization is underway: peak policy rates in this cycle are likely to be lower than in the last. Therefore even if RBI's view is towards a later lift-off, given our expectation of a shallower normalization cycle anyway, we would be loath to characterize it as being behind the curve.

Our one slight disagreement with market consensus is probably with respect to what we think is the best play for the policy normalization cycle that has already commenced in some way. Thus in our view 5 - 10 - 15 year spreads are unlikely to narrow much from here (bulk of flattening may happen between 1 and 5 years and various combinations therein, of course this is as per market consensus view as well) whereas at least recent price action seems to suggest that general market opinion is that 10 and 15 year points provide better safety. We say this because despite a much lower borrowing calendar for the second half of the year in the 5 year space, we didn't see an appreciable tightening of spread between 5 and 10 years (of course 'technical' factors could be at play as well, including that we are being too impatient with this!). Our view is basis our third framework pillar that bond demand versus supply dynamics may remain a longer term issue. The discontinuation of GSAP is (at least temporarily) leading to some steepening between 5 year and longer but our issue is much longer term. We continue to be heavily overweight 5 year (4.5 years now) in our actively managed bond and gilt funds. As before, and as a matter of standard disclaimer, what has been presented here reflects our current thinking. As always this can change at any point in time.

Disclaimer: MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

The Disclosures of opinions/in house views/strategy incorporated herein is provided solely to enhance the transparency about the investment strategy / theme of the Scheme and should not be treated as endorsement of the views / opinions or as an investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document has been prepared on the basis of information, which is already available in publicly accessible media or developed through analysis of IDFC Mutual Fund. The information/ views / opinions provided is for informative purpose only and may have ceased to be current by the time it may reach the recipient, which should be taken into account before interpreting this document. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision and the security may or may not continue to form part of the scheme's portfolio in future. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. The decision of the Investment Manager may not always be profitable; as such decisions are based on the prevailing market conditions and the understanding of the Investment Manager. Actual market movements may vary from the anticipated trends. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alterations to this statement as may be required from time to time. Neither IDFC Mutual Fund / IDFC AMC Trustee Co. Ltd./ IDFC Asset Management Co. Ltd nor IDFC, its Directors or representatives shall be liable for any damages whether direct or indirect, incidental, punitive special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information.