Commentary

Global Markets

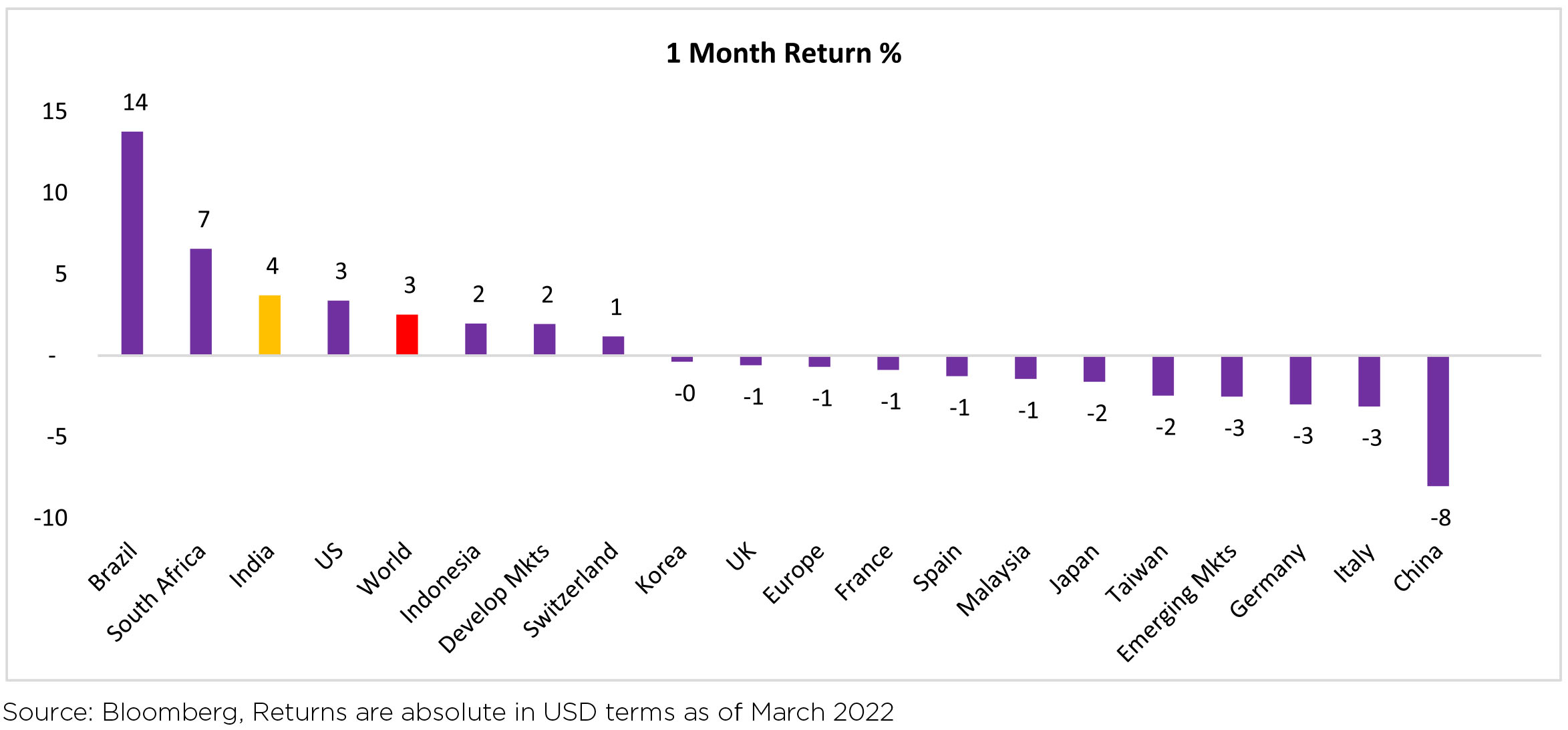

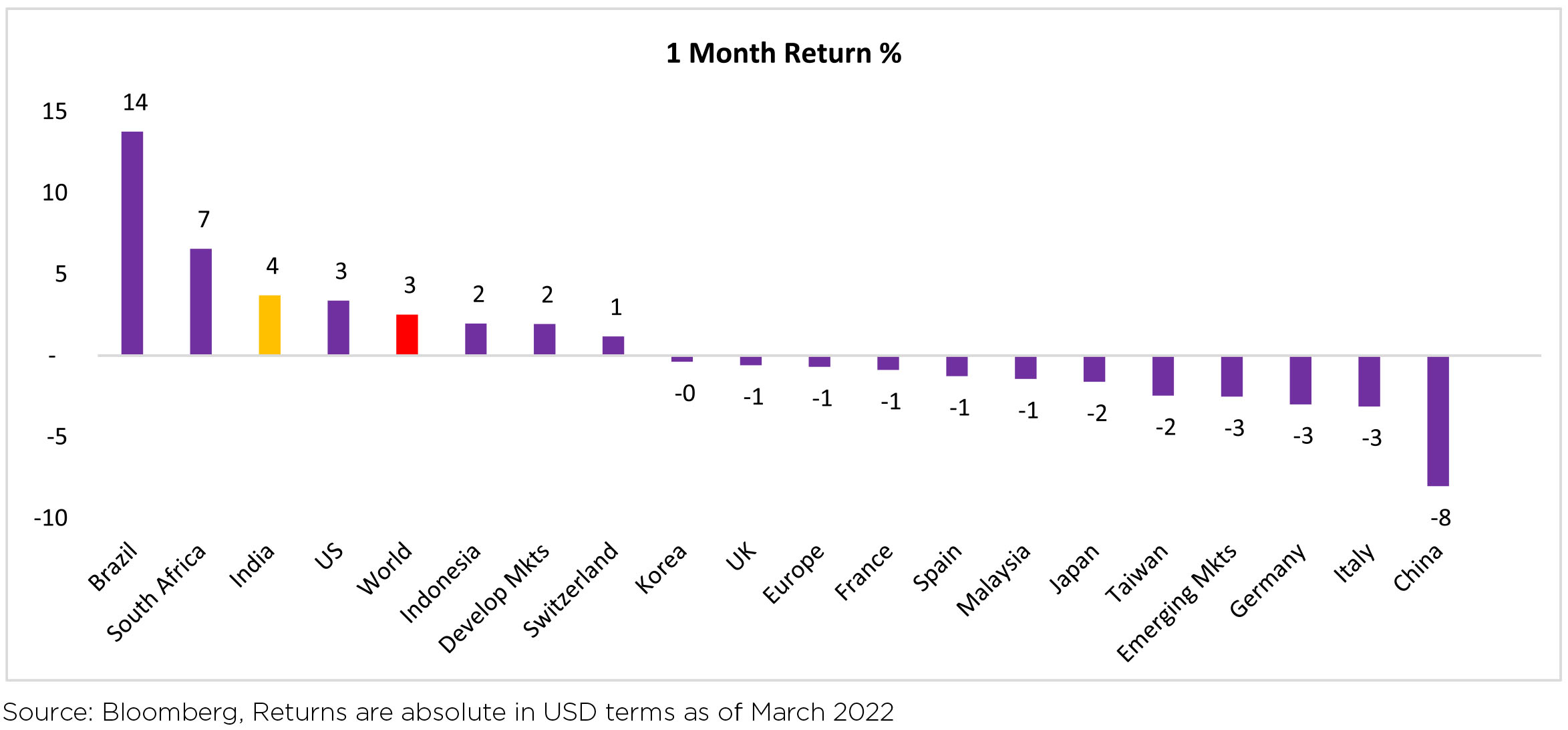

Global equities gained by 1.9% in March 2022. In Equities, geopolitics dominate the narrative, as we

face binary risk from spiking commodity prices, which would be especially damaging for the European

economy. Given that stocks are already down substantially, this drawdown is akin to a probability of

recession, which we think is overdone given buoyant labour markets, healthy consumer, strong bank

balance sheets, and policy pivot in China. The Russia/Ukraine conflict should have low immediate earnings

risk for corporates, but much bigger effect on consumer spending, with the drag of high energy prices

compounded by central bank normalization.

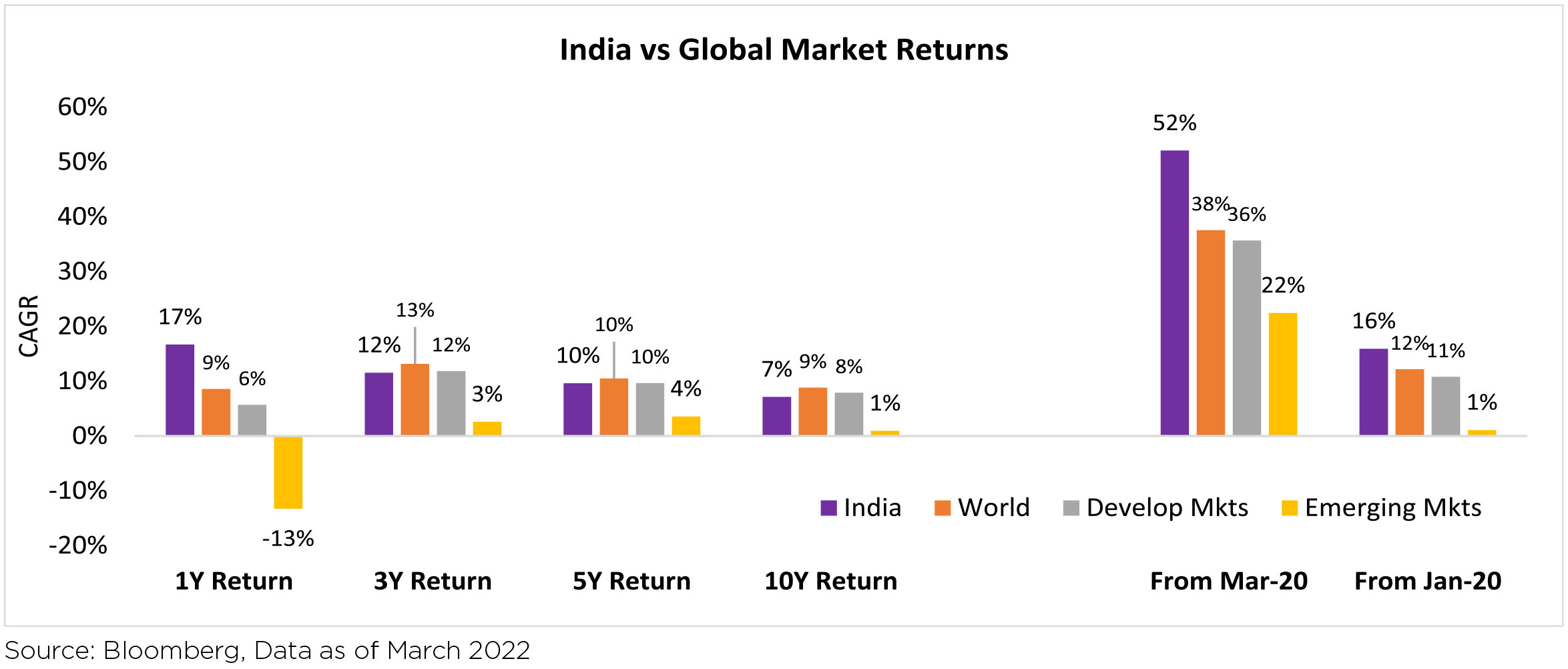

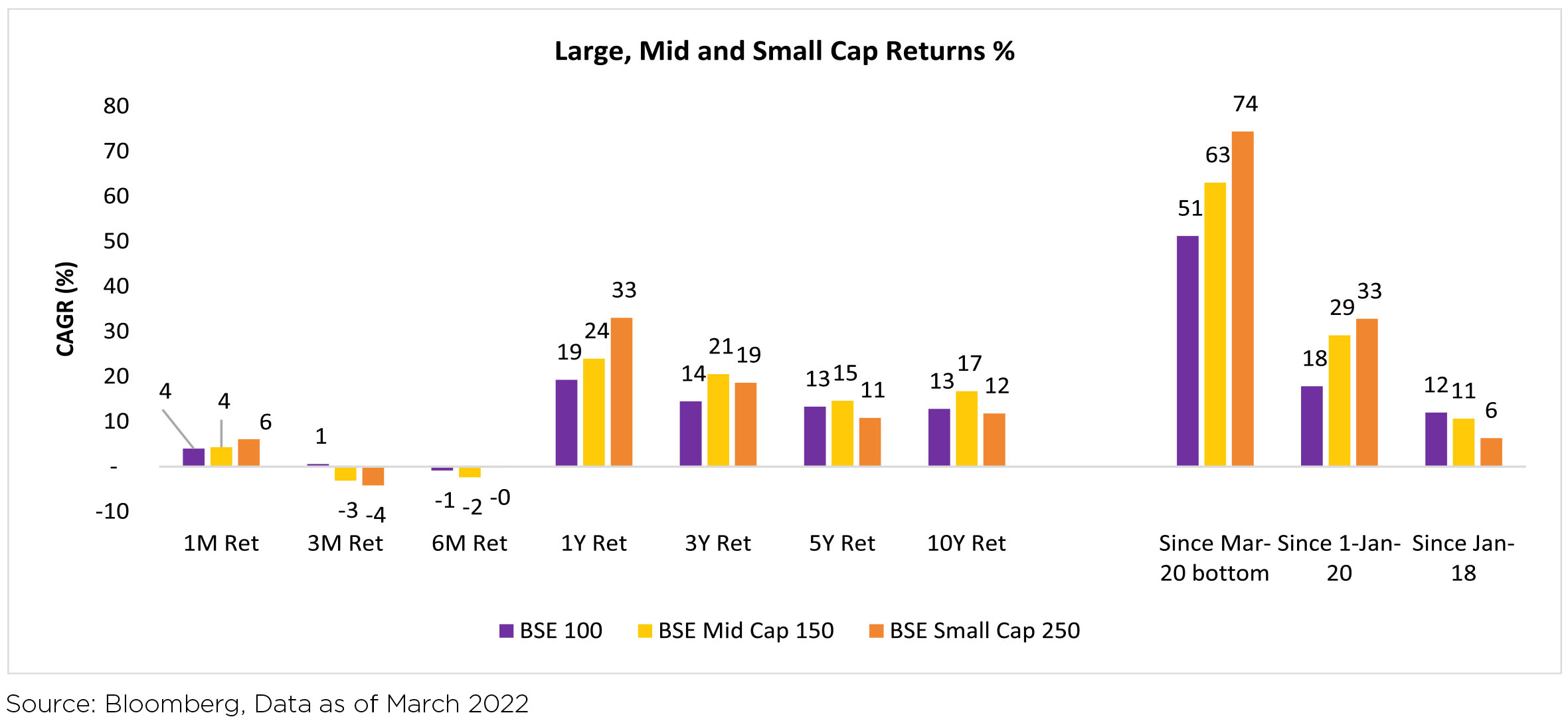

While, the commodity super cycle will persist, in our view, the correction in bubble sectors (innovation, renewables, etc.) is now likely finished and geopolitical risk will likely start abating in a few weeks' time. Markets have been absorbing significant macro and geopolitical shocks amid an aggressive central bank pivot. Most EM countries have attractive earnings yields vs bond yields currently. The drivers of small and Mid-Caps outperformance over the last 30+ years are still very much in place today.

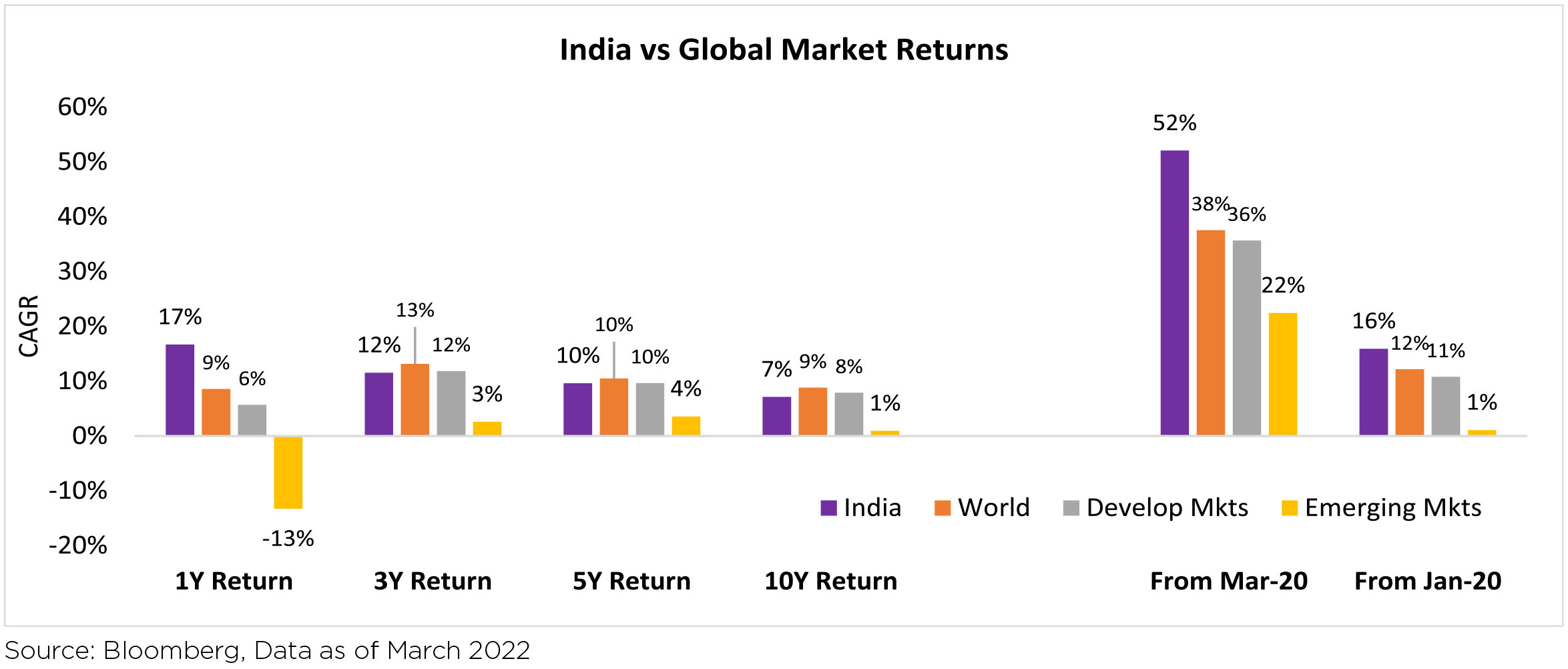

MSCI India (in local currency) gained +4.2% over the month. Indian markets began to make some recovery

from early on in the month, following the declines seen amid rising oil and geopolitical tensions. Most

sectors closed higher with Energy, Utilities, Communication Services and IT outperforming the benchmark.

Only Consumer Staples and Discretionary ended the month in the red.

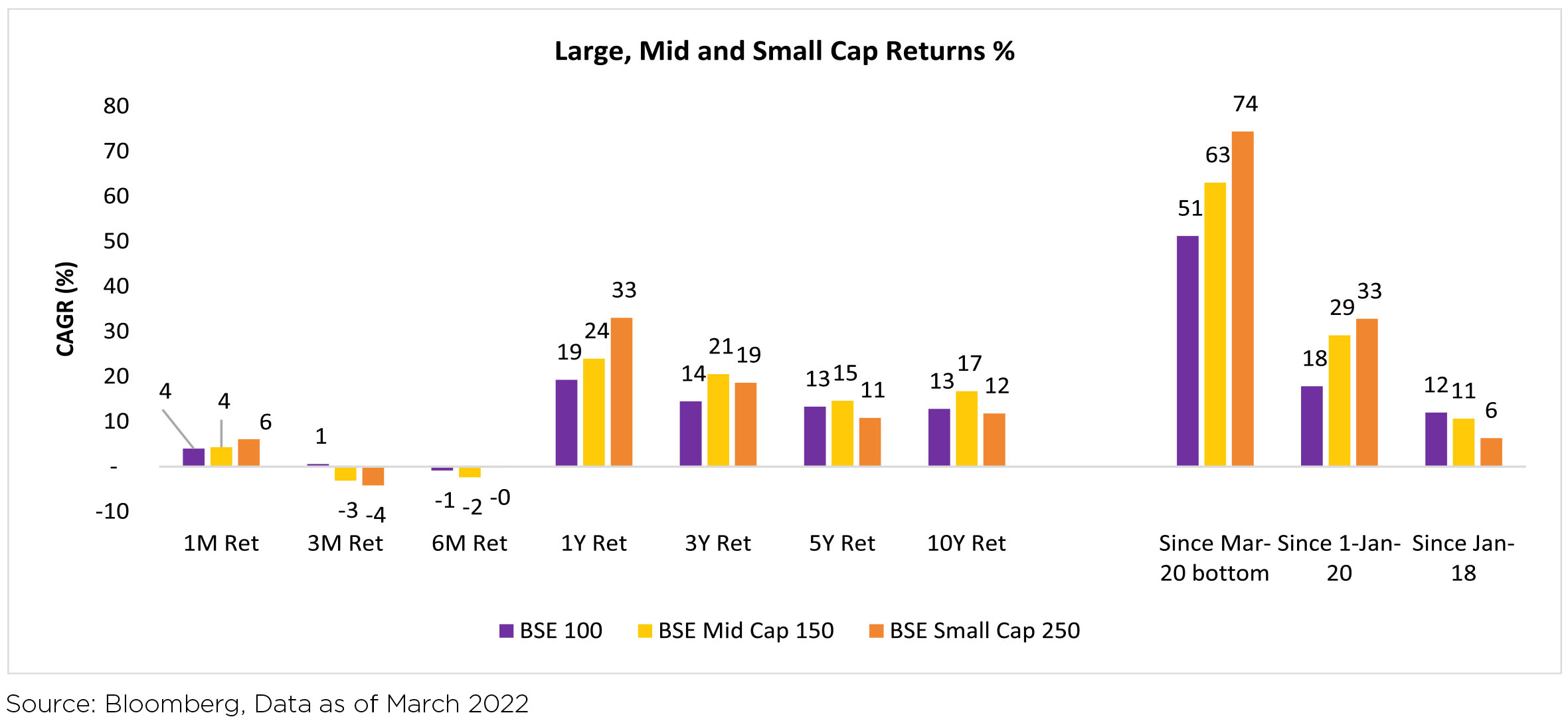

Indian equities rose +3.6% MoM ($ terms) trading higher than broader markets in March 2022 (MSCI APxJ/EM: -0.9%/-2.5%). Performance of both mid caps (-+2.9% MoM) and small caps (+5.2% MoM) was positive, but mixed against large caps (+4.2% MoM). Most sectors ended the month higher (barring Staples and Discretionary) with Energy, Utilities, Communication Services and IT being the major leaders. INR was down 0.6% MoM, reaching ~75.79/USD in March. DXY gained +1.7% over the month.

Performance of major Commodities:

Oil prices continued their momentum from previous month, gaining 5.7% in March (were already up 10.9% in February). As the Russia-Ukraine conflict gets more entrenched, oil prices have surged past US$125/ barrel, with expectations growing that they will stay elevated.

Parity Prices: Average domestic HRC steel prices (ex-Mumbai) improved by ~9.7% MoM to ~Rs72,775/t (up Rs6,450/t MoM) in March 2022 and remain at a discount of 3% to landed price of imports from China.

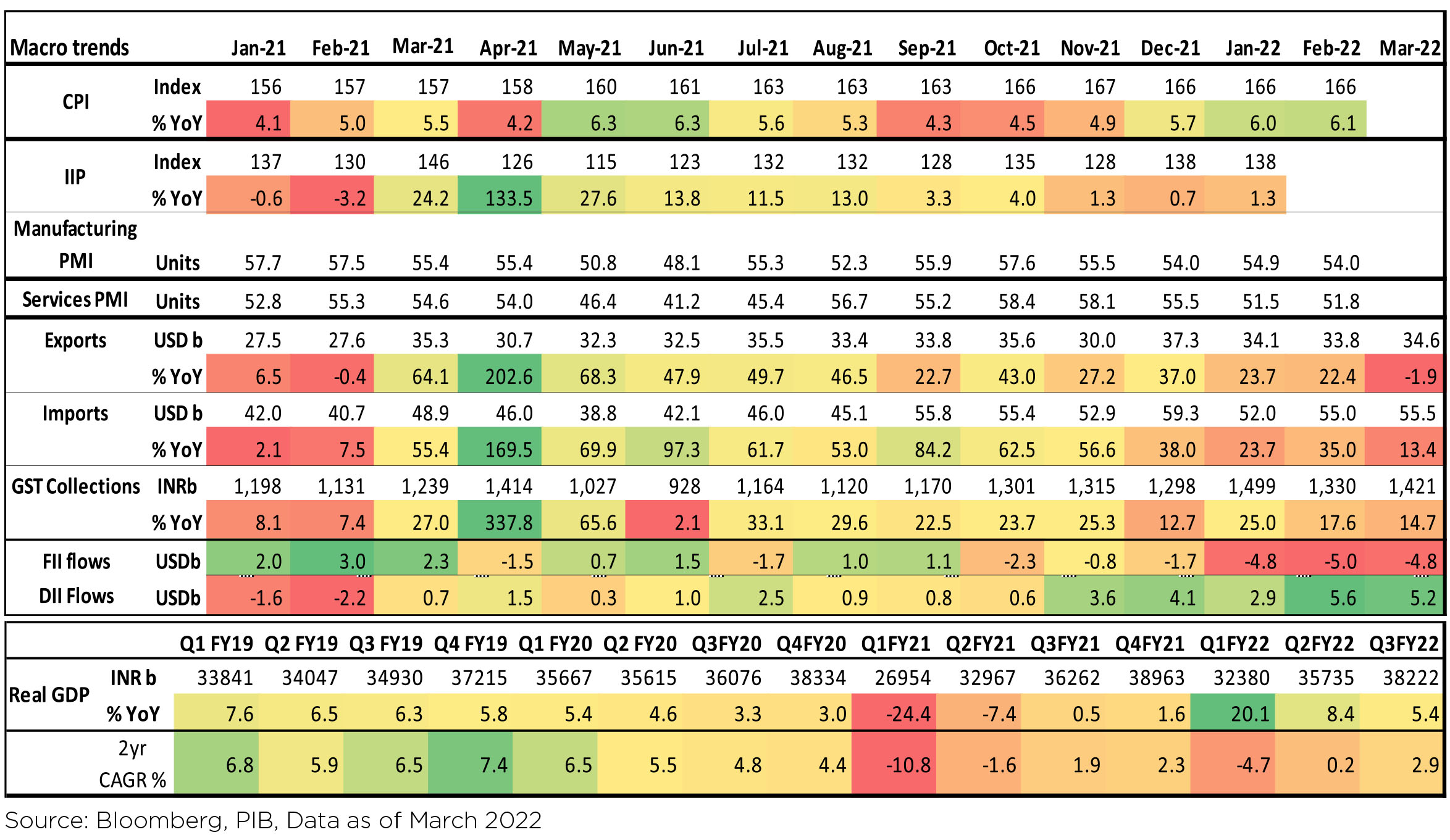

Macro prints were mixed:

► Fiscal deficit for April-February came at Rs13.16tn or 82.7% of the budgeted FY22 deficit (at Rs.15.1tn or 6.8% of GDP).

► February CPI inched higher to 6.1% in-line with consensus expectations. Uptick was led by food inflation while, transport and fuel inflation continue to ease.

► January's Industrial Production showed a sharp improvement despite the Omicron hit (+1.3% YoY; +1.8% MoM).

► CGST+IGST collections likely to exceed FY2022RE. GST collections for February stood at Rs1,421 bn (Rs1,330 bn for January and Rs1,384 bn for December).

► The government announced that India saw exports cross above US$400bn ahead of close of FY22

► Benchmark 10-year treasury yields averaged 6.83% in March (7bps higher vs February avg.). On month end values, the 10Y yield was up and ended the month at 6.84% (up 7bps MoM).

On the political front, India concluded assembly elections in five key states of Uttar Pradesh, Uttarakhand, Manipur, Punjab and Goa, with BJP receiving a clear mandate across four states.

FIIs continued to remain net sellers of Indian equities in March (-$4.8bn, following -$5.0bn in February) - sixth consecutive month of net equity outflows for FIIs. DIIs recorded inflows of $5.2bn in March 2022, maintaining the buying trend observed since March 2021. Mutual funds and Insurance funds were both net buyers during the month.

While, the commodity super cycle will persist, in our view, the correction in bubble sectors (innovation, renewables, etc.) is now likely finished and geopolitical risk will likely start abating in a few weeks' time. Markets have been absorbing significant macro and geopolitical shocks amid an aggressive central bank pivot. Most EM countries have attractive earnings yields vs bond yields currently. The drivers of small and Mid-Caps outperformance over the last 30+ years are still very much in place today.

Domestic Markets

Indian equities rose +3.6% MoM ($ terms) trading higher than broader markets in March 2022 (MSCI APxJ/EM: -0.9%/-2.5%). Performance of both mid caps (-+2.9% MoM) and small caps (+5.2% MoM) was positive, but mixed against large caps (+4.2% MoM). Most sectors ended the month higher (barring Staples and Discretionary) with Energy, Utilities, Communication Services and IT being the major leaders. INR was down 0.6% MoM, reaching ~75.79/USD in March. DXY gained +1.7% over the month.

Performance of major Commodities:

Oil prices continued their momentum from previous month, gaining 5.7% in March (were already up 10.9% in February). As the Russia-Ukraine conflict gets more entrenched, oil prices have surged past US$125/ barrel, with expectations growing that they will stay elevated.

Parity Prices: Average domestic HRC steel prices (ex-Mumbai) improved by ~9.7% MoM to ~Rs72,775/t (up Rs6,450/t MoM) in March 2022 and remain at a discount of 3% to landed price of imports from China.

Macro prints were mixed:

► Fiscal deficit for April-February came at Rs13.16tn or 82.7% of the budgeted FY22 deficit (at Rs.15.1tn or 6.8% of GDP).

► February CPI inched higher to 6.1% in-line with consensus expectations. Uptick was led by food inflation while, transport and fuel inflation continue to ease.

► January's Industrial Production showed a sharp improvement despite the Omicron hit (+1.3% YoY; +1.8% MoM).

► CGST+IGST collections likely to exceed FY2022RE. GST collections for February stood at Rs1,421 bn (Rs1,330 bn for January and Rs1,384 bn for December).

► The government announced that India saw exports cross above US$400bn ahead of close of FY22

► Benchmark 10-year treasury yields averaged 6.83% in March (7bps higher vs February avg.). On month end values, the 10Y yield was up and ended the month at 6.84% (up 7bps MoM).

On the political front, India concluded assembly elections in five key states of Uttar Pradesh, Uttarakhand, Manipur, Punjab and Goa, with BJP receiving a clear mandate across four states.

FIIs continued to remain net sellers of Indian equities in March (-$4.8bn, following -$5.0bn in February) - sixth consecutive month of net equity outflows for FIIs. DIIs recorded inflows of $5.2bn in March 2022, maintaining the buying trend observed since March 2021. Mutual funds and Insurance funds were both net buyers during the month.

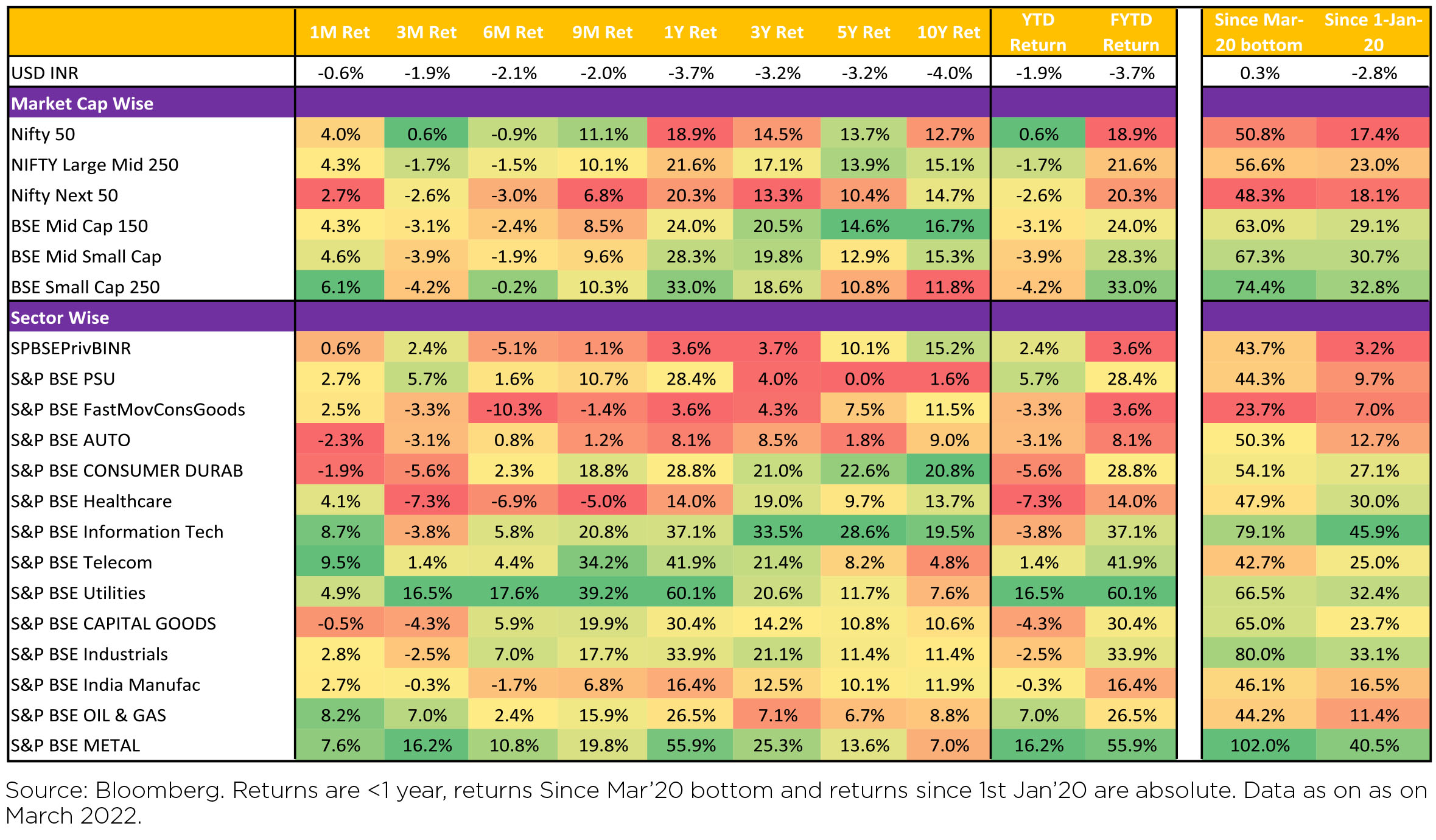

Market Performance

Market Performance

Outlook

Investing during a phase of high inflation expectations, slowing growth and uncertain global macros

is a scenario most investors haven't experienced, especially the millennials who have experienced positive

returns entering the markets post Apr 2020, world over. The taper tantrums of May-Sept 2013 and the

ensuing action of RBI to stabilize the INR as well as to "tame" inflation is, perhaps, one such example.

While, historical examples provide a perspective, context may differ in each case. This time, US has

emerged as a key "unknown, known" with Bond yield inversion; commencement of a Fed rate hike cycle;

slowing growth; dropping consumer sentiments and rising inflationary expectations. Europe reels under

the weight of Gas/crude oil hit on account of Russia/Ukraine, only China has the fiscal room to announce

a modest stimulus. India, remains a relatively well placed economy, amidst such uncertainties. Though,

commodity induced inflation could upend fiscal calculations of the recent Union Budget.On the positive side, corporate score card and banking sector health seems to be strengthening even at a global level. In India, the financial sector induced slowdown from CY16-20 appears to have been repaired - PSU banks are reporting healthy profit growth and their credit costs is similar or lower than their private sector peers with adequate provision coverage ratio (PCR). Corporates are reporting the lowest ever leverage and as per credit rating agencies, CY21 continued to report more upgrades over downgrades. With interest rates close to their historical lows, Corporates boosted by their balance sheet improvement are expected to announce cap-ex. Government policies like PLI, could be another factor which could spur a cap-ex cycle.

In such a context, the upcoming earnings season assumes greater criticality, as FY23 & FY24 estimates will be reviewed post the results. At first glance, the current commodity induced inflation will play havoc to Q1 FY23 estimates as Gross margins will be sharply impacted. This may have been already factored given the sharp fall during the Iast fortnight of March'22. What the market will focus on is the management commentary on rest of FY23 - sales growth momentum, price hikes and EBIDTA margin protection going ahead. Unless the commentary from managements underlines despair, FY24 estimates will be largely left untouched, as of now.

For the next couple of quarters, Indian markets could be influenced more by global gyrations rather than domestic news cycle. For investors, investing in periods of higher inflation, declining growth and uncertain geo-politics, caution over aggression may be a better strategy - give up FOMO (Fear of Missing Out) and embrace ALRE (Accept Lower Return Expectations). As the old adage goes "This too shall pass". The key question would be, whether this market weakness is "transitory" or "structural".

Note: The above graph is for representation purposes only and should not be used for the development or implementation of an investment strategy. Past performance may or may not be sustained in the future.

What Went By

Prices of commodities in general continue to remain elevated post the onset of the Russia-Ukraine war,

although they have receded from the highs witnessed in March. Price of India's crude oil basket, which was

USD 89 per barrel at end-January and spiked to USD 128 per barrel on 09th March, was USD 98 per barrel on

7th April. The impact on growth, inflation, current account deficit and fiscal balance will be crucial but depends

on the persistence of geopolitical issues and global policy response.

Central government gross tax revenue in February was slightly above that in January, but net tax revenue was negative because devolution to states was much higher. Total expenditure picked up sequentially but capex was milder making required spending in March, to meet the FY22 revised estimate from the union budget, quite steep. During April 2021 to February 2022, net tax revenue was 84% of FY22RE (vs. 83% and 82% of actuals in FY19 and FY20 respectively) while total expenditure was 83% of FY22RE (vs. 95% and 92% of actuals in FY19 and FY20 respectively). FY22 fiscal deficit till February 2022 was thus 83% of FY22RE (vs. 131% and 111% of actuals in FY19 and FY20 respectively). GST collection during February was at an all-time high of Rs. 1.42 lakh crore and 15% y/y.

Consumer Price Index (CPI) inflation was 6.1% y/y in February (slightly up from 6% in January) due to lower sequential moderation in food prices and unfavourable base effects. Momentum in core-CPI (CPI excluding food and beverages, fuel and light) was almost flat in February, but it has remained sticky at an average of 5.9% y/y since April 2021.

Industrial production (IP) growth for January was 1.3% y/y and 2.1% m/m on a seasonally adjusted basis. Sequential momentum in IP has been positive after the fall in November. Output momentum in capital, intermediate and infra goods turned stronger in January but output levels in the first two were still below seasonally adjusted pre-pandemic levels. Infrastructure Industries output (40% weight in IP) in February was up 5.8% y/y and 0.9% m/m seasonally adjusted but sequential output growth in coal, crude oil, fertilisers, steel and cement was negative.

Bank credit outstanding as on 25th March was up 8.6% y/y (average fortnightly credit growth since January 2022 is 8%), while bank deposit growth was at 8.9%. Credit-flow to deposit-flow ratio from mid-April to 25th March was higher in FY22 than in FY20 and FY21. During April 2021 to February 2022, overall bank credit flow was the highest for personal loans and lowest for industries.

Merchandise trade deficit fell to USD 18.7bn in March from USD 20.9bn in February, also due to the year-end pick up in exports. In March, gold imports fell sequentially but oil and non-oil-non-gold imports picked up. Trade deficit has averaged USD 20bn during September-March vs. USD 11bn during April-August. Importantly, non-oil-non-gold imports picked up to an average of USD 36.5bn from USD 29.3bn during the same periods.

Among higher-frequency variables, number of motor vehicles registered has improved since January after the sharp fall in December. Mobility indicators continue to increase from the Omicron-wave related fall as workplace-related travel has also picked up. Number of weekly GST e-way bills generated has stayed buoyant while energy consumption level has been sequentially improving since mid-January.

In the US, the FOMC (Federal Open Market Committee) increased the target range for the federal funds rate by 25bps in March and the meeting minutes suggested further aggressive policy rate hikes and commencement of balance sheet run-off. Headline and core CPI move up further to 7.9% y/y and 6.4% respectively in February (7.5% and 6% respectively in January), with price pressures remaining broad-based. Price momentum in food, housing and services stayed strong while that in energy spiked. US non-farm payroll addition in March (431,000 persons) was lower than in February but remained buoyant. Unemployment rate fell further to 3.6% in March from 3.8% in February and close to 3.5% pre-pandemic in February 2020. Labour force participation rate is however at 62.4% in March vs. 63.4% in February 2020. Sequential growth in average hourly earnings picked back up after easing in February. In China, number of reported Covid cases has risen and many cities are reportedly under tight mobility restrictions, in line with its zero-covid policy. With the real estate sector also already slowing, this can potentially impact global supply chains, growth and inflation. The State Council recently mentioned about likely higher monetary policy support in the offing but its timing and magnitude is to be seen.

In its April'22 monetary policy, RBI maintained its accommodative stance 'while focussing on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth'. This was paired with a distinct assurance in the Governor's statement that RBI would engage in a 'gradual and calibrated withdrawal' of liquidity over a 'multi-year time frame in a non-disruptive manner beginning this year'. Further a standing deposit facility (SDF) has been introduced at 3.75%, thereby putting the corridor at a 50 bps spread when defined between the two uncollateralised rates of Marginal Standing Facility (MSF) and SDF. Given that the VRRRs were already nudging effective deployment rates for banks higher, this also could be positioned largely as an operational adjustment; with the added benefit of increasing flexibility for future liquidity absorption without the burden of having enough corresponding collateral. Where things went somewhat 'stickier', or the pivot got hardened, is the explicit change in order of priorities to inflation before growth. Thus one cannot rule out an imminent (June) repo rate hike anymore. Indeed swap yields were up 30 - 40 bps post the policy with market now assigning a rate hike in every policy from here on for the next year or so, with some more to go in year 2. We expect the actual path to be shallower but the swap pricing also reflects an inability of the market (basis last received RBI commentary) to have any sort of a reasonable handle on the upcoming RBI response function.

Outlook

Our own underlying framework has suffered a setback with the recent monetary policy. The policy deemphasizes the relative importance of growth and thus changes the context (for now) in which to look at additional growth worries emerging around the world. It puts prospects of a repo rate hike very much on the table for June. Further, it provides a somewhat more 'panicky' lens with which to view any upward surprises in either commodity prices or in near inflation prints. What is noteworthy from the swap curve mentioned above is that the steepness of the curve hasn't offered much protection. As an example, the 1 year swap was pricing close to 5.5% as effective overnight rate by end of year (or repo rate hike in every policy over the year) and the 1 year swap 1 year forward was at something like 6.25%.

Given the policy description, it is prudent to budget for quicker normalisation than previously envisaged. However, we are still reluctant to yet alter our general expectation of a lower terminal overnight rate in this cycle versus the last. This view also follows from our expectation that this isn't likely to be a normal, long drawn cycle allowing for a very long normalization runway. This now looks even more likely given the aggressive pace of expected monetary policy tightening in the US, the growth damage from the ongoing geopolitical escalations, and the new Chinese slowdown on the back of a renewed Covid outbreak. Thus, we think even as RBI may begin well, it may not get as far in the normalisation cycle as the swap curves are currently pricing. That said, we also recognise that it is hard to push against market pricing in the immediate term.

There is near pain in our portfolio strategies and in our preferred overweight around 4 years on government bonds. This is because, as noted in the context of the swap curve above, there is no protection from steepness when market's assessment of possible RBI's reaction function itself is thrown into chaos. However, as the dust settles we expect the carry-adjusted-for-duration to start to reassert itself. There is some 'balm' that has been offered in the form of 1% hike in held to maturity (HTM) limits of banks till March 23. These may all eventually help in stabilising market curves even as near term participants may seem more reluctant to assume risk. Investors who have the benefit of a longer horizon may want to continue scaling into strategies that optimise duration risk versus curve steepness. These should hold well over a period, given our views on this cycle as expressed in our recent notes.

Central government gross tax revenue in February was slightly above that in January, but net tax revenue was negative because devolution to states was much higher. Total expenditure picked up sequentially but capex was milder making required spending in March, to meet the FY22 revised estimate from the union budget, quite steep. During April 2021 to February 2022, net tax revenue was 84% of FY22RE (vs. 83% and 82% of actuals in FY19 and FY20 respectively) while total expenditure was 83% of FY22RE (vs. 95% and 92% of actuals in FY19 and FY20 respectively). FY22 fiscal deficit till February 2022 was thus 83% of FY22RE (vs. 131% and 111% of actuals in FY19 and FY20 respectively). GST collection during February was at an all-time high of Rs. 1.42 lakh crore and 15% y/y.

Consumer Price Index (CPI) inflation was 6.1% y/y in February (slightly up from 6% in January) due to lower sequential moderation in food prices and unfavourable base effects. Momentum in core-CPI (CPI excluding food and beverages, fuel and light) was almost flat in February, but it has remained sticky at an average of 5.9% y/y since April 2021.

Industrial production (IP) growth for January was 1.3% y/y and 2.1% m/m on a seasonally adjusted basis. Sequential momentum in IP has been positive after the fall in November. Output momentum in capital, intermediate and infra goods turned stronger in January but output levels in the first two were still below seasonally adjusted pre-pandemic levels. Infrastructure Industries output (40% weight in IP) in February was up 5.8% y/y and 0.9% m/m seasonally adjusted but sequential output growth in coal, crude oil, fertilisers, steel and cement was negative.

Bank credit outstanding as on 25th March was up 8.6% y/y (average fortnightly credit growth since January 2022 is 8%), while bank deposit growth was at 8.9%. Credit-flow to deposit-flow ratio from mid-April to 25th March was higher in FY22 than in FY20 and FY21. During April 2021 to February 2022, overall bank credit flow was the highest for personal loans and lowest for industries.

Merchandise trade deficit fell to USD 18.7bn in March from USD 20.9bn in February, also due to the year-end pick up in exports. In March, gold imports fell sequentially but oil and non-oil-non-gold imports picked up. Trade deficit has averaged USD 20bn during September-March vs. USD 11bn during April-August. Importantly, non-oil-non-gold imports picked up to an average of USD 36.5bn from USD 29.3bn during the same periods.

Among higher-frequency variables, number of motor vehicles registered has improved since January after the sharp fall in December. Mobility indicators continue to increase from the Omicron-wave related fall as workplace-related travel has also picked up. Number of weekly GST e-way bills generated has stayed buoyant while energy consumption level has been sequentially improving since mid-January.

In the US, the FOMC (Federal Open Market Committee) increased the target range for the federal funds rate by 25bps in March and the meeting minutes suggested further aggressive policy rate hikes and commencement of balance sheet run-off. Headline and core CPI move up further to 7.9% y/y and 6.4% respectively in February (7.5% and 6% respectively in January), with price pressures remaining broad-based. Price momentum in food, housing and services stayed strong while that in energy spiked. US non-farm payroll addition in March (431,000 persons) was lower than in February but remained buoyant. Unemployment rate fell further to 3.6% in March from 3.8% in February and close to 3.5% pre-pandemic in February 2020. Labour force participation rate is however at 62.4% in March vs. 63.4% in February 2020. Sequential growth in average hourly earnings picked back up after easing in February. In China, number of reported Covid cases has risen and many cities are reportedly under tight mobility restrictions, in line with its zero-covid policy. With the real estate sector also already slowing, this can potentially impact global supply chains, growth and inflation. The State Council recently mentioned about likely higher monetary policy support in the offing but its timing and magnitude is to be seen.

In its April'22 monetary policy, RBI maintained its accommodative stance 'while focussing on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth'. This was paired with a distinct assurance in the Governor's statement that RBI would engage in a 'gradual and calibrated withdrawal' of liquidity over a 'multi-year time frame in a non-disruptive manner beginning this year'. Further a standing deposit facility (SDF) has been introduced at 3.75%, thereby putting the corridor at a 50 bps spread when defined between the two uncollateralised rates of Marginal Standing Facility (MSF) and SDF. Given that the VRRRs were already nudging effective deployment rates for banks higher, this also could be positioned largely as an operational adjustment; with the added benefit of increasing flexibility for future liquidity absorption without the burden of having enough corresponding collateral. Where things went somewhat 'stickier', or the pivot got hardened, is the explicit change in order of priorities to inflation before growth. Thus one cannot rule out an imminent (June) repo rate hike anymore. Indeed swap yields were up 30 - 40 bps post the policy with market now assigning a rate hike in every policy from here on for the next year or so, with some more to go in year 2. We expect the actual path to be shallower but the swap pricing also reflects an inability of the market (basis last received RBI commentary) to have any sort of a reasonable handle on the upcoming RBI response function.

Outlook

Our own underlying framework has suffered a setback with the recent monetary policy. The policy deemphasizes the relative importance of growth and thus changes the context (for now) in which to look at additional growth worries emerging around the world. It puts prospects of a repo rate hike very much on the table for June. Further, it provides a somewhat more 'panicky' lens with which to view any upward surprises in either commodity prices or in near inflation prints. What is noteworthy from the swap curve mentioned above is that the steepness of the curve hasn't offered much protection. As an example, the 1 year swap was pricing close to 5.5% as effective overnight rate by end of year (or repo rate hike in every policy over the year) and the 1 year swap 1 year forward was at something like 6.25%.

Given the policy description, it is prudent to budget for quicker normalisation than previously envisaged. However, we are still reluctant to yet alter our general expectation of a lower terminal overnight rate in this cycle versus the last. This view also follows from our expectation that this isn't likely to be a normal, long drawn cycle allowing for a very long normalization runway. This now looks even more likely given the aggressive pace of expected monetary policy tightening in the US, the growth damage from the ongoing geopolitical escalations, and the new Chinese slowdown on the back of a renewed Covid outbreak. Thus, we think even as RBI may begin well, it may not get as far in the normalisation cycle as the swap curves are currently pricing. That said, we also recognise that it is hard to push against market pricing in the immediate term.

There is near pain in our portfolio strategies and in our preferred overweight around 4 years on government bonds. This is because, as noted in the context of the swap curve above, there is no protection from steepness when market's assessment of possible RBI's reaction function itself is thrown into chaos. However, as the dust settles we expect the carry-adjusted-for-duration to start to reassert itself. There is some 'balm' that has been offered in the form of 1% hike in held to maturity (HTM) limits of banks till March 23. These may all eventually help in stabilising market curves even as near term participants may seem more reluctant to assume risk. Investors who have the benefit of a longer horizon may want to continue scaling into strategies that optimise duration risk versus curve steepness. These should hold well over a period, given our views on this cycle as expressed in our recent notes.