Commentary

Global Markets

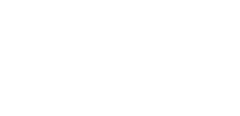

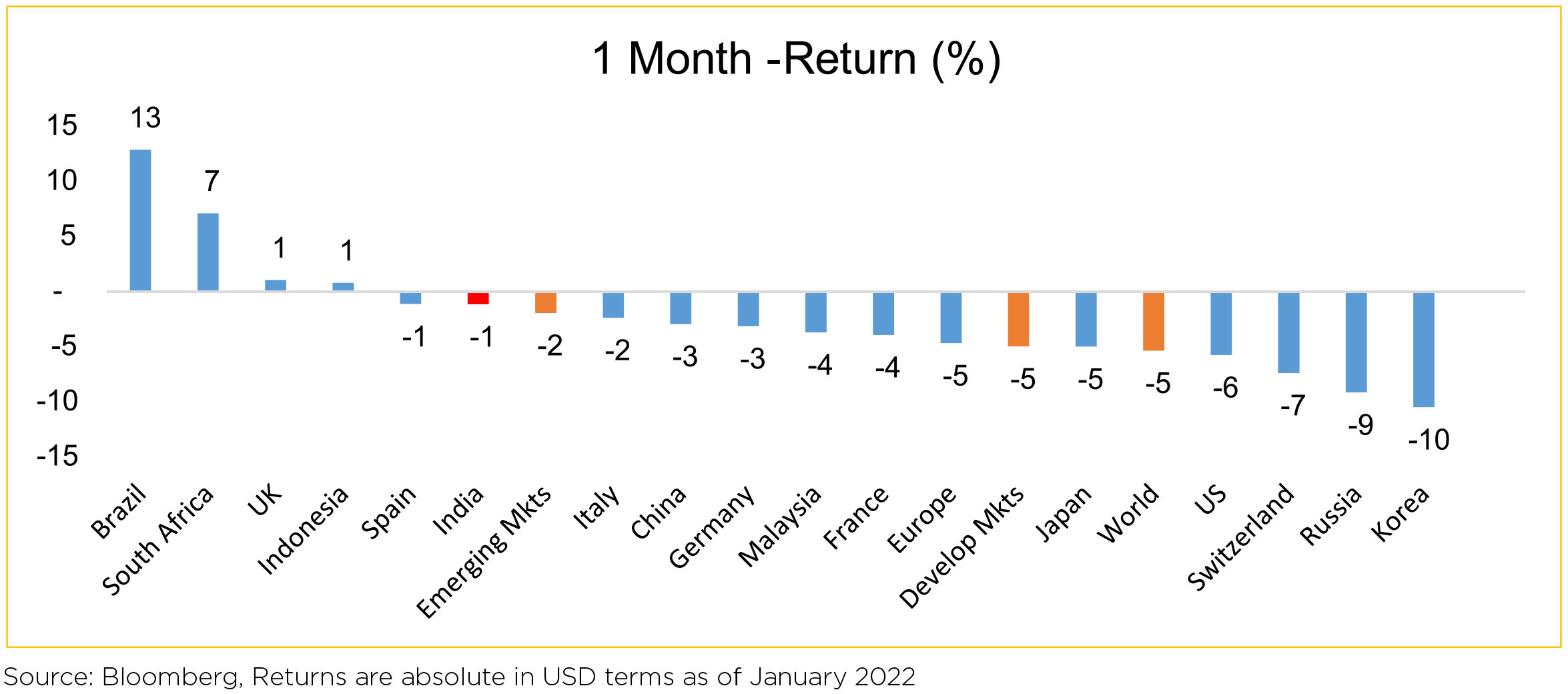

Global equities declined by 5% in January. The first days of the year witnessed a significant rotation, with

Banks, Autos, Mining, Energy, Travel and Insurance all the top performers, while Technology, Healthcare,

Utilities and Real Estate lagged.

The new variant is proving to be milder, and the adverse impact on mobility much more manageable. Small-caps and mid-caps should benefit from a very strong macro outlook. China activity deceleration is by now largely behind us, and economic surprises in key regions are back in positive territory. There are signs of supply constraints potentially passing their worst point, and of the power-prices surge easing. Inventories are very low and the labor market is strong.

Performance of major Commodities:

Oil prices continued their momentum from previous month, gaining 17.4% in January. Oil prices are now at 5-year highs and expected to make further gains. Increase in inflation was led by broad based price pressures across categories with a notable rise in transport and clothing while base effects had a partial role to play.

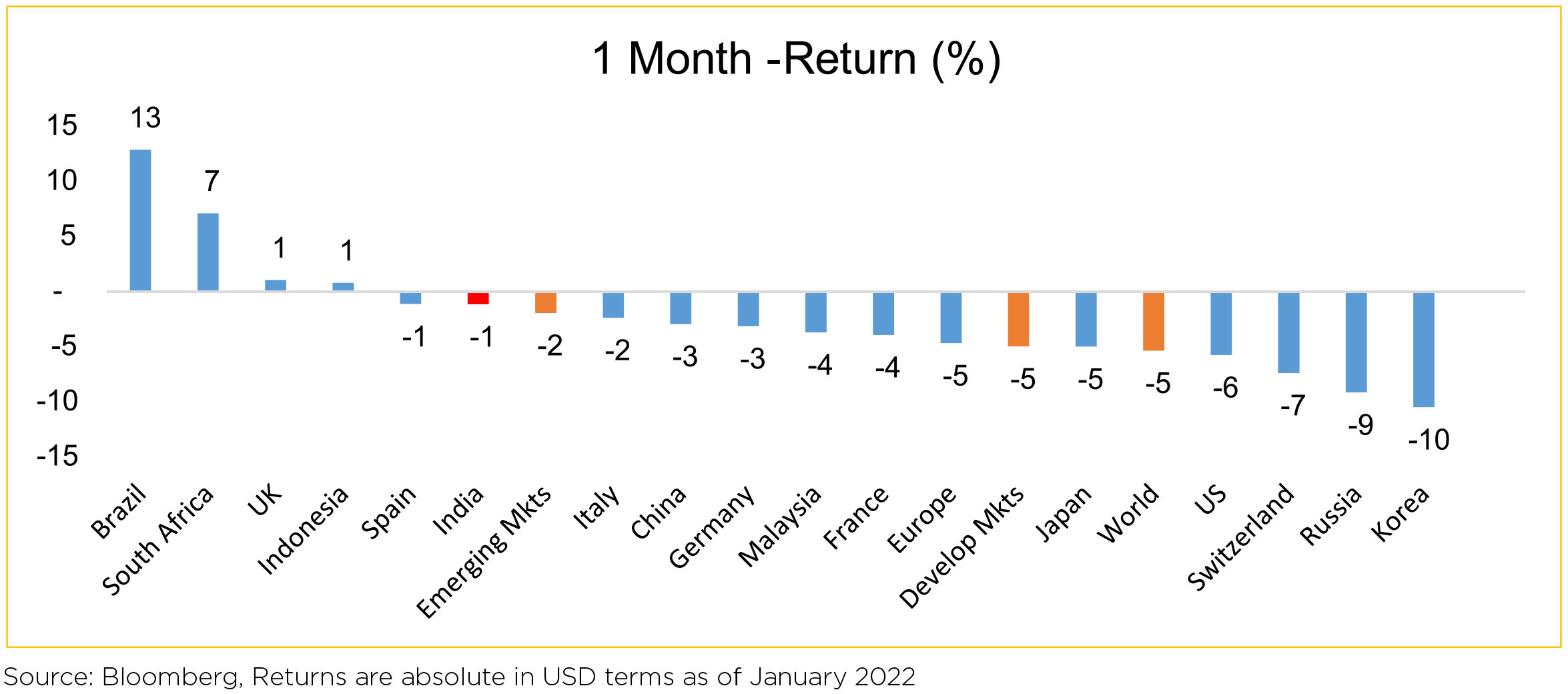

MSCI India (in local currency) was down by 1% over the month. Indian markets had a turbulent month as

the NIFTY (-0.1% MoM) reclaimed the 18,300-level before retreating below 17,000 amid a global sell-off.

Concerns around the third COVID-19 wave were muted as cases showed a steep rise while hospitalizations

remained low.

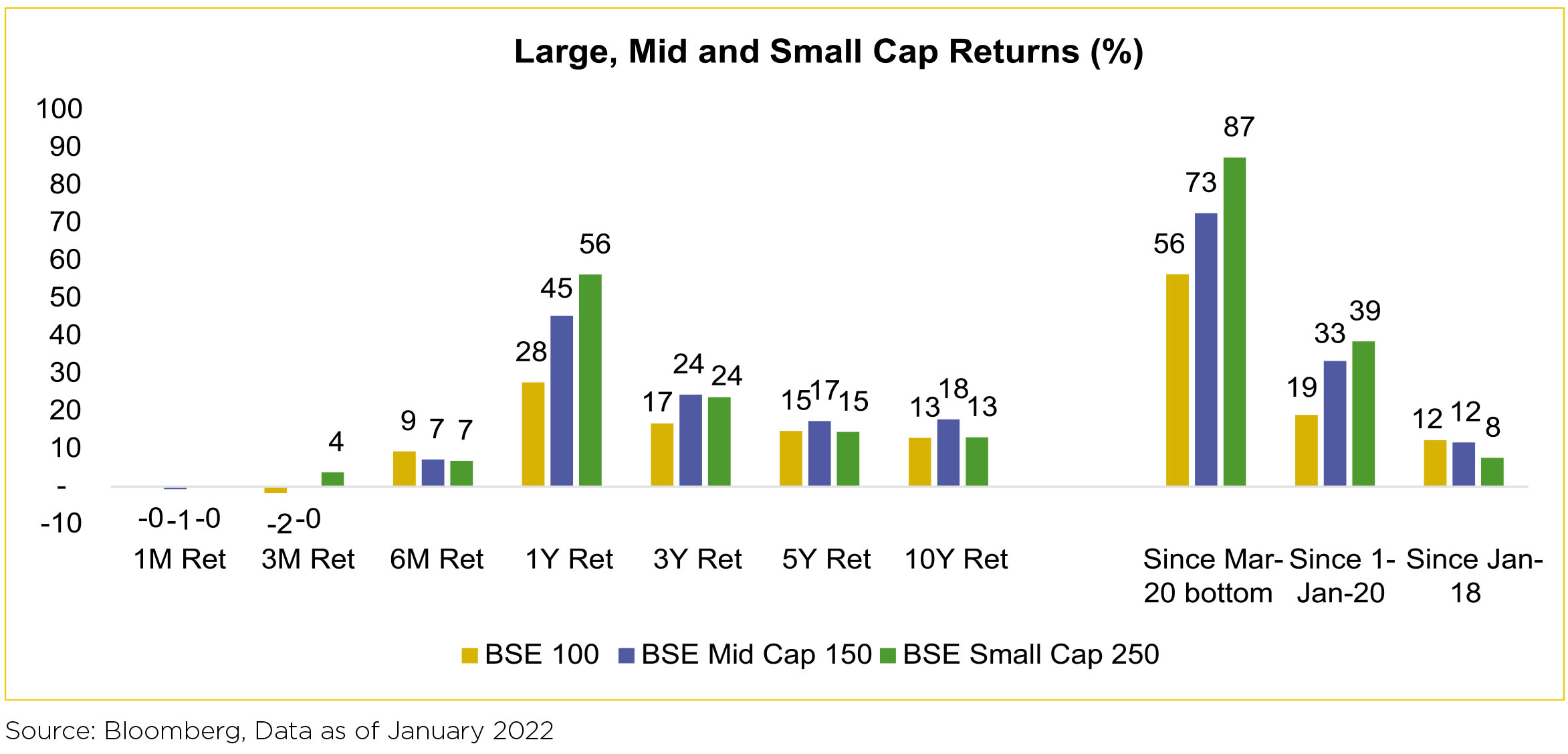

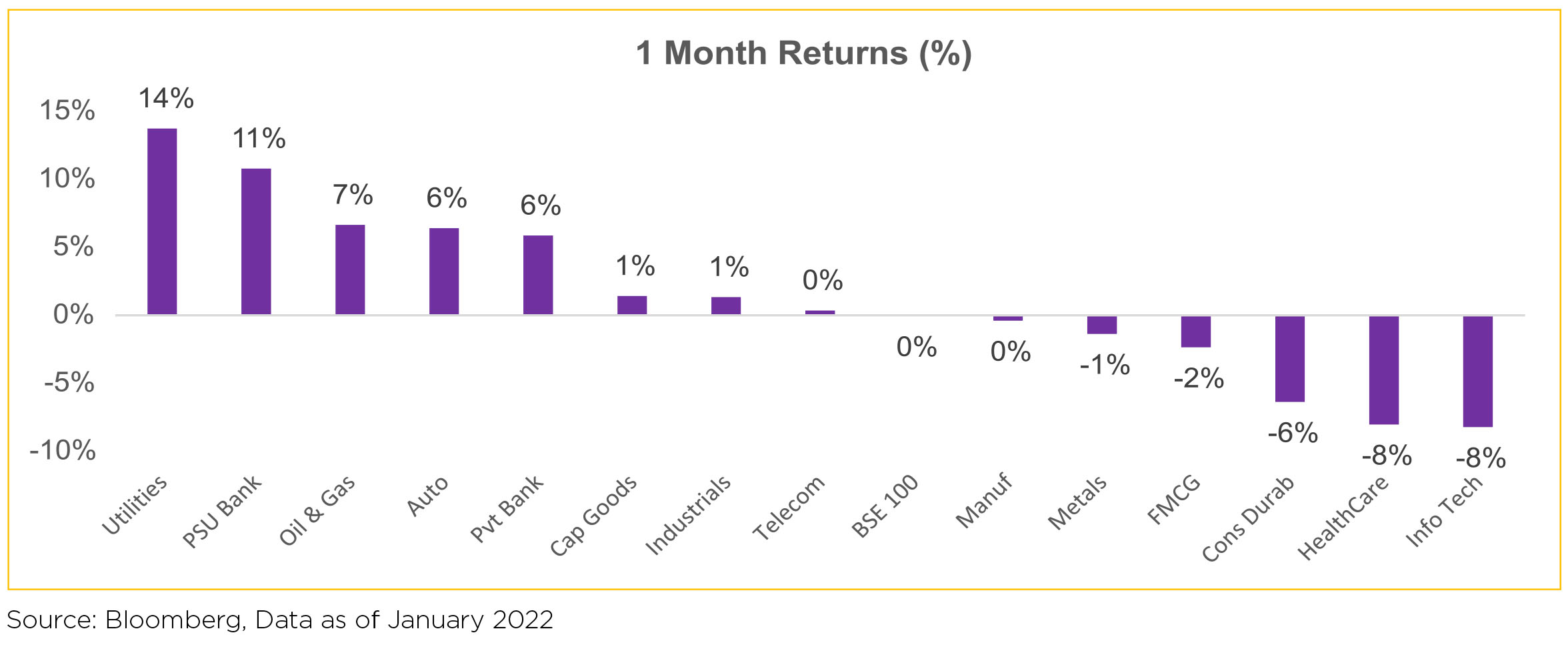

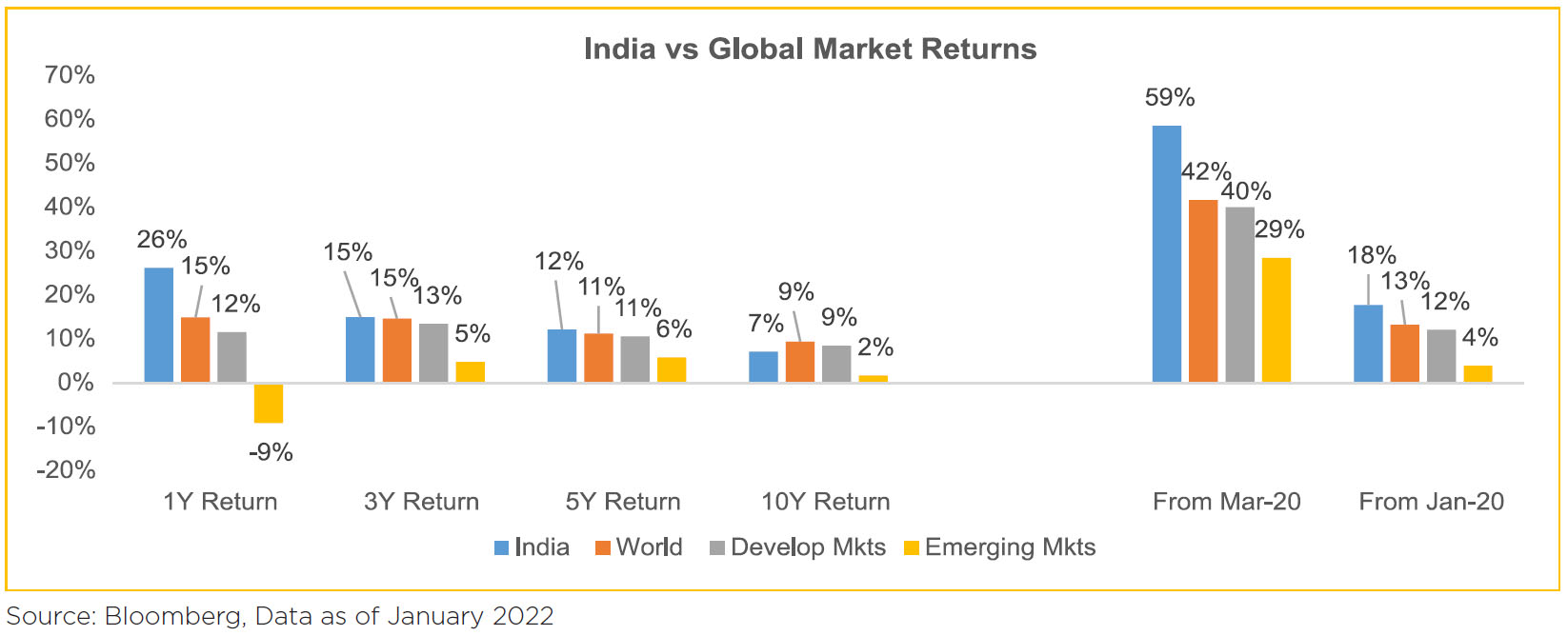

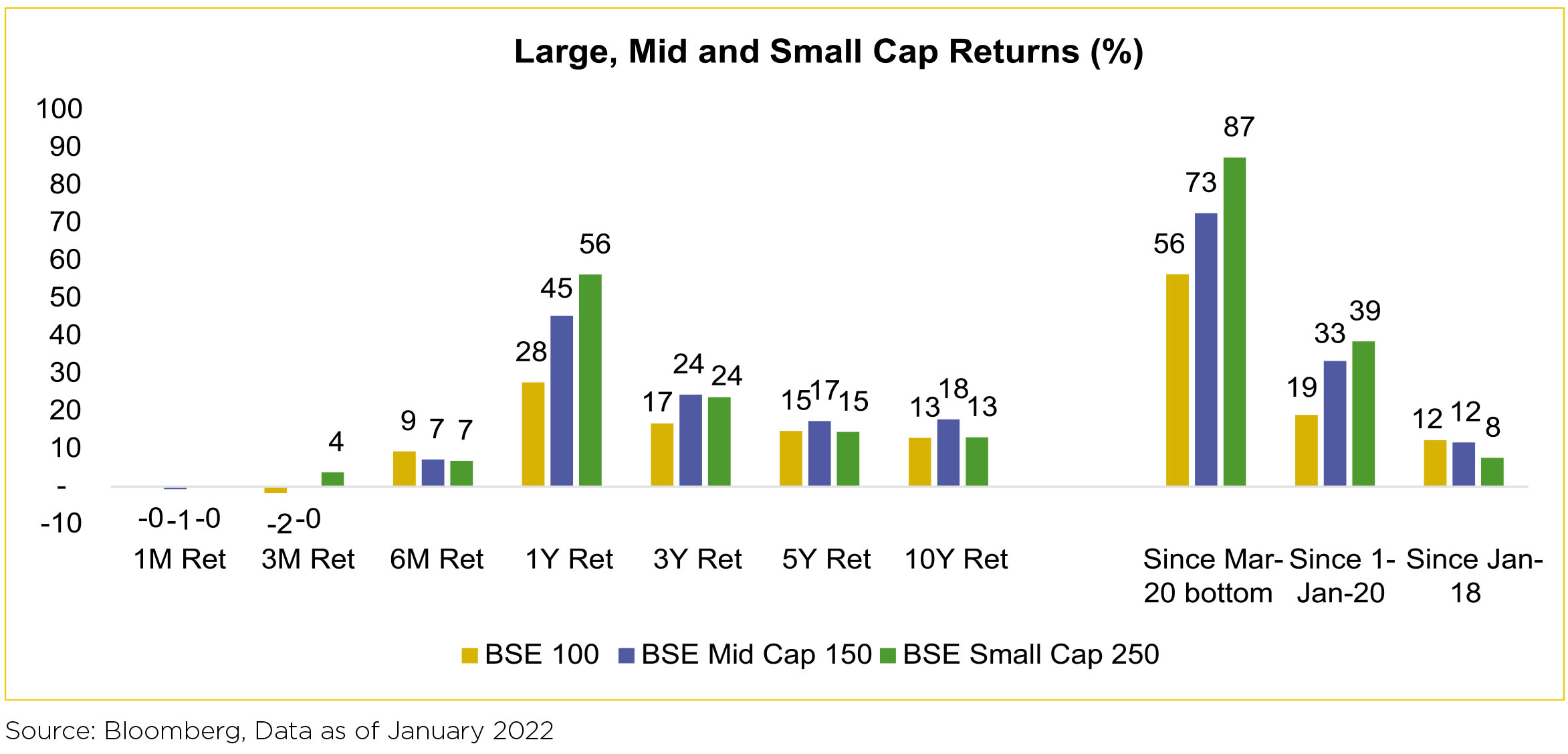

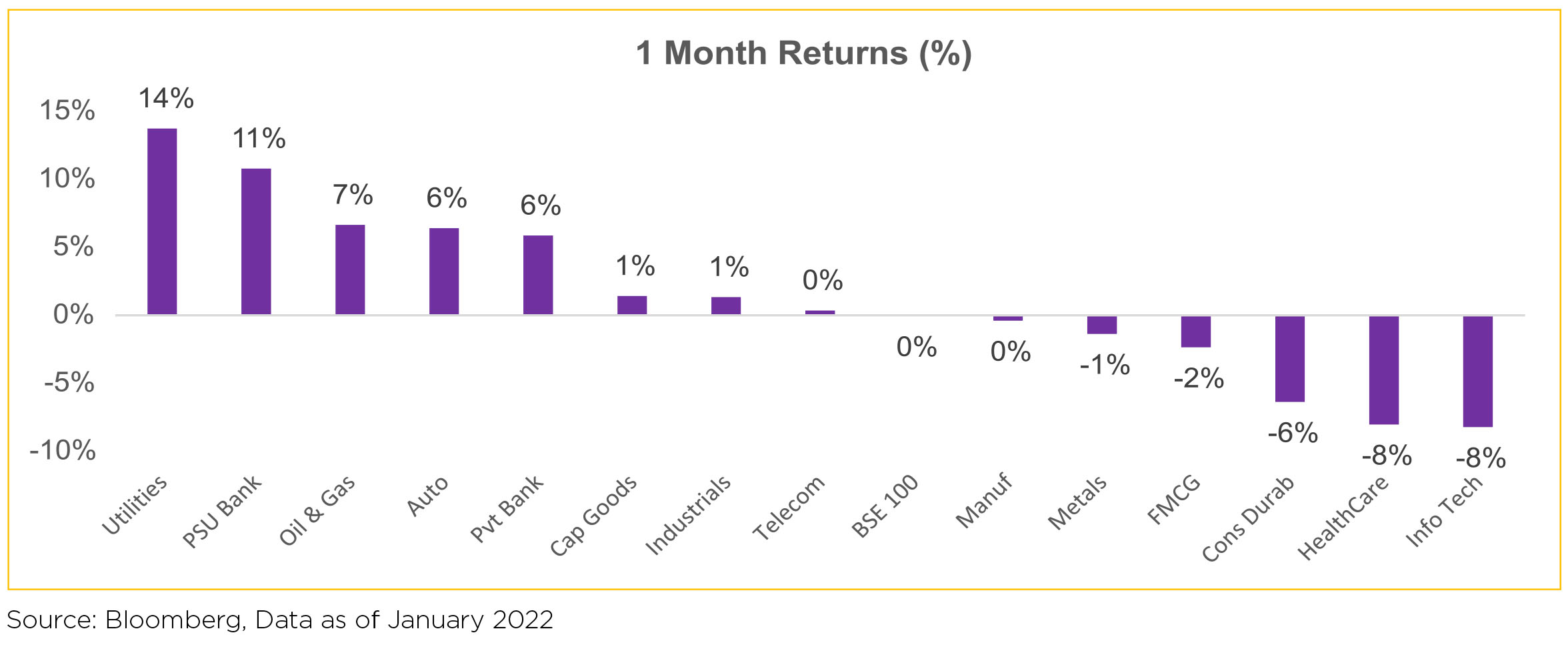

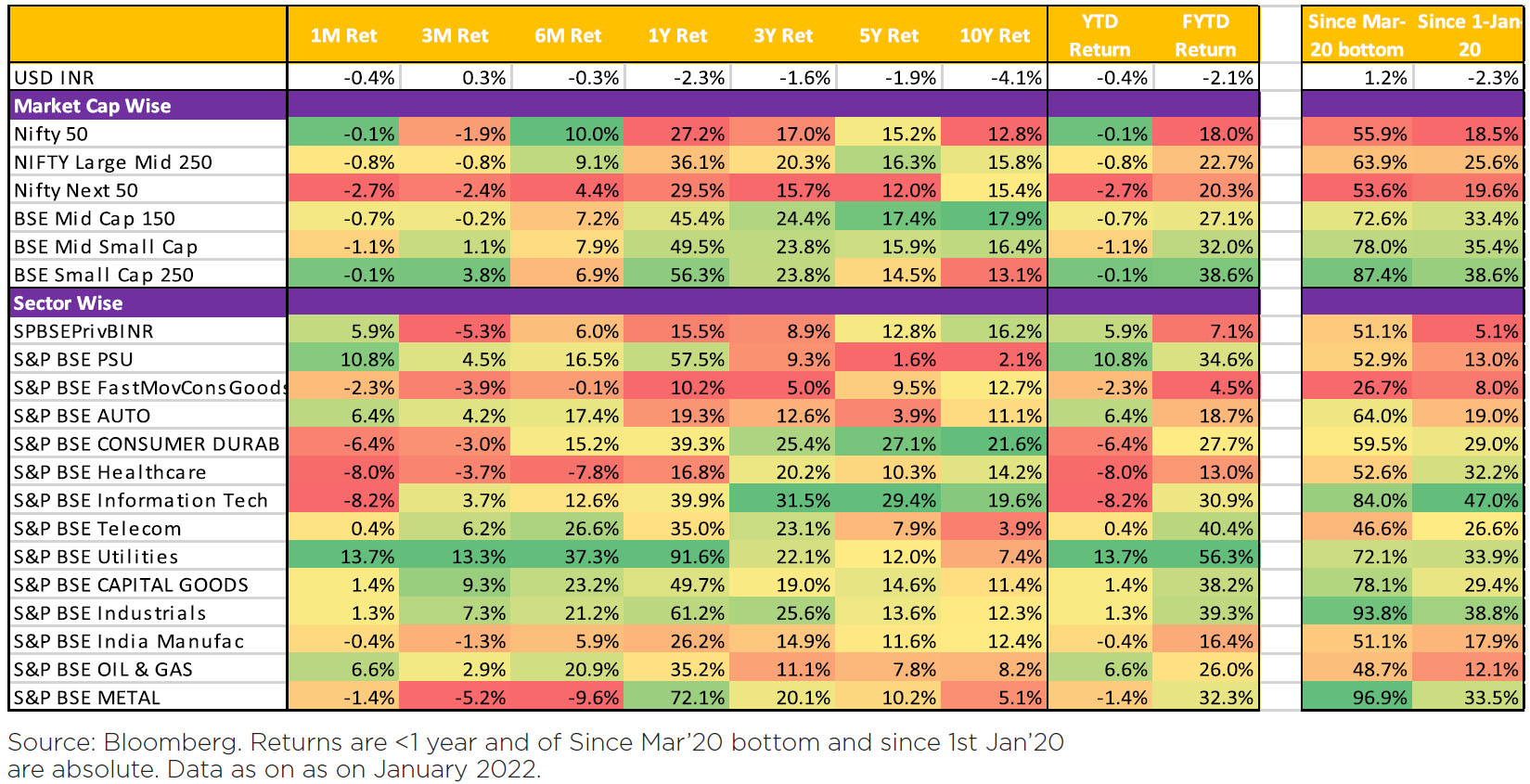

Indian equities declined 1.4% ($ terms) trading higher than broader markets in January (MSCI APxJ/ EM: -4%/-1.93%). Performance of both mid-caps (-2.9% MoM) and small-caps (-1.6% MoM) was weaker than large-caps (-1.0%). By sector, Utilities, Energy, Consumer Discretionary, Communication services and Financials ended the month in the green while IT, Consumer Staples and Healthcare were key laggards.

Budget Takeaways for Equity Market:

Overall from an equity market perspective, we believe the budget, has no unpleasant surprises while, there remains some room for further capex/spending push as the government is likely to overshoot its revenue targets

► LTCG - The maximum surcharge rate on all long term capital gains including units of equity and debt mutual funds have been brought down to 15% which would provide a much needed boost to the mutual funds industry

► Digital Assets - Taxation on gains from the digital asset will help curb speculation and should help channelize savings into well-regulated long-term investments like Mutual Funds

Macro prints were MIXED:

COVID: Omicron cases rose sharply while hospitalizations remained in check. Total India daily case load showed a sharp rise; however, the effect of Omicron variant was much milder. As announced in the previous month, vaccinations for children in the 15 to 18 years age group began.

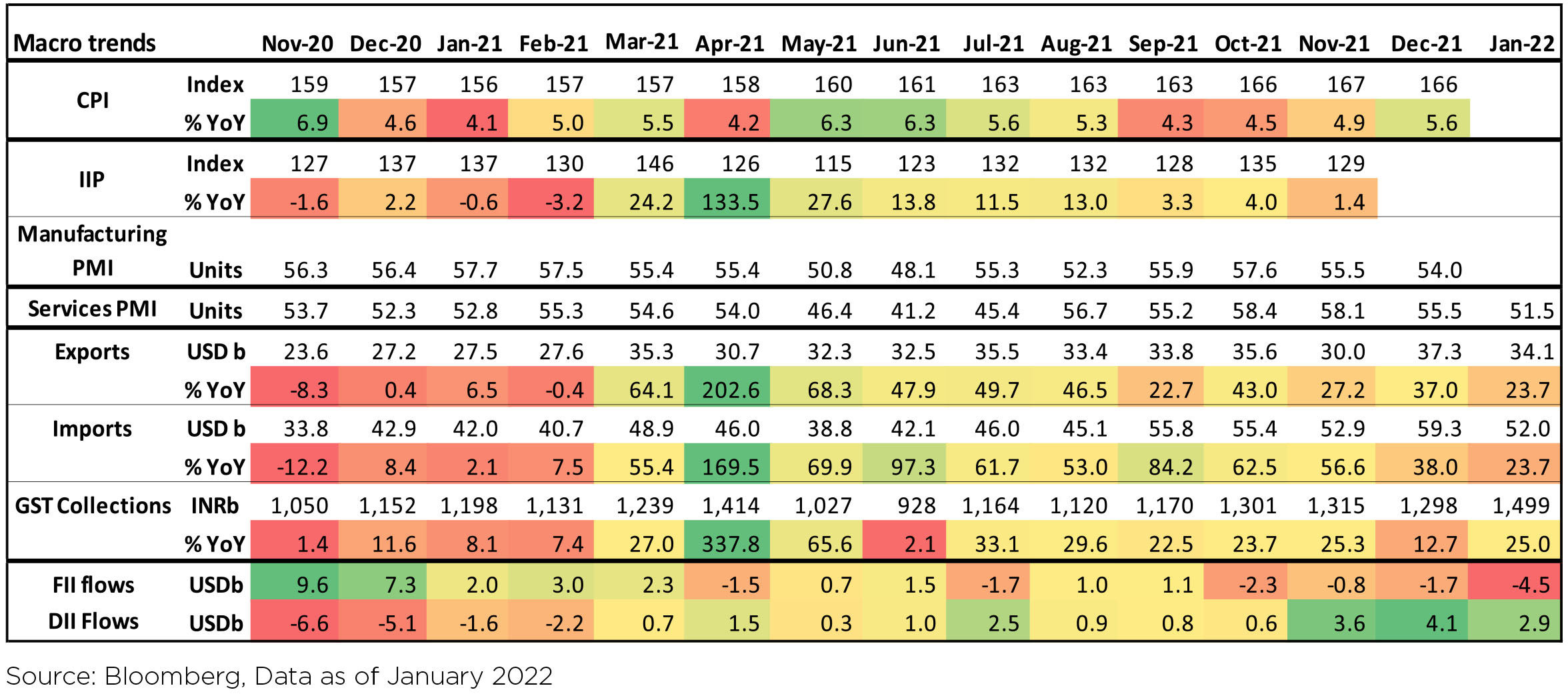

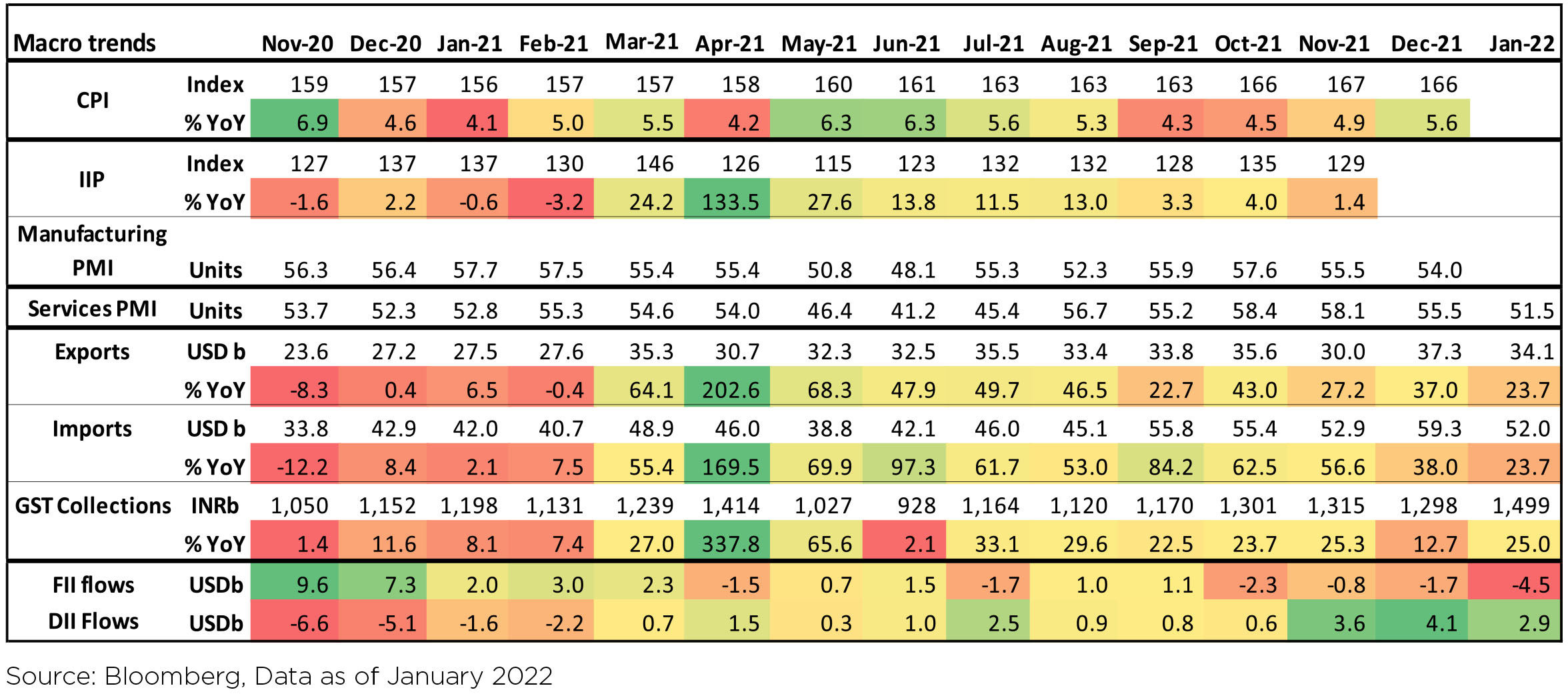

December CPI came in at 5.6%, close to expectations reflecting both firm sequential momentum and the fading away of favourable base effects from previous months. November's Industrial Production also disappointed (-1.4% YoY; -3.3% MoM), much weaker than expected, likely reflecting the effects of economic scarring.

Benchmark 10-year treasury yields averaged at 6.60% in January (19bp higher vs. December avg.). On month-end values, the 10Y yield was up and ended the month at 6.68% (up 23bps MoM). FIIs remained net sellers of Indian equities in January (-$4.5bn, following -$1.7bn in December). DIIs recorded inflows of $2.9bn in January, maintaining the buying trend observed since March 2021.

The new variant is proving to be milder, and the adverse impact on mobility much more manageable. Small-caps and mid-caps should benefit from a very strong macro outlook. China activity deceleration is by now largely behind us, and economic surprises in key regions are back in positive territory. There are signs of supply constraints potentially passing their worst point, and of the power-prices surge easing. Inventories are very low and the labor market is strong.

Performance of major Commodities:

Oil prices continued their momentum from previous month, gaining 17.4% in January. Oil prices are now at 5-year highs and expected to make further gains. Increase in inflation was led by broad based price pressures across categories with a notable rise in transport and clothing while base effects had a partial role to play.

Domestic Markets

Indian equities declined 1.4% ($ terms) trading higher than broader markets in January (MSCI APxJ/ EM: -4%/-1.93%). Performance of both mid-caps (-2.9% MoM) and small-caps (-1.6% MoM) was weaker than large-caps (-1.0%). By sector, Utilities, Energy, Consumer Discretionary, Communication services and Financials ended the month in the green while IT, Consumer Staples and Healthcare were key laggards.

Budget Takeaways for Equity Market:

Overall from an equity market perspective, we believe the budget, has no unpleasant surprises while, there remains some room for further capex/spending push as the government is likely to overshoot its revenue targets

► LTCG - The maximum surcharge rate on all long term capital gains including units of equity and debt mutual funds have been brought down to 15% which would provide a much needed boost to the mutual funds industry

► Digital Assets - Taxation on gains from the digital asset will help curb speculation and should help channelize savings into well-regulated long-term investments like Mutual Funds

Macro prints were MIXED:

COVID: Omicron cases rose sharply while hospitalizations remained in check. Total India daily case load showed a sharp rise; however, the effect of Omicron variant was much milder. As announced in the previous month, vaccinations for children in the 15 to 18 years age group began.

December CPI came in at 5.6%, close to expectations reflecting both firm sequential momentum and the fading away of favourable base effects from previous months. November's Industrial Production also disappointed (-1.4% YoY; -3.3% MoM), much weaker than expected, likely reflecting the effects of economic scarring.

Benchmark 10-year treasury yields averaged at 6.60% in January (19bp higher vs. December avg.). On month-end values, the 10Y yield was up and ended the month at 6.68% (up 23bps MoM). FIIs remained net sellers of Indian equities in January (-$4.5bn, following -$1.7bn in December). DIIs recorded inflows of $2.9bn in January, maintaining the buying trend observed since March 2021.

Market Performance

Outlook

During the month, equity markets across the globe were largely impacted by US Fed utterances regarding

interest rates and balance sheet contraction. Markets roiled at the prospects of tightening liquidity and

a phase of rising interest rates. US markets, despite an encouraging earnings season remained weak

for much of January'22. However, as public pronouncements by US Fed Governor and his colleagues

seemed to have assuaged the market sentiments to some extent - as US markets had a smart pull back

during the last week of January.In India, the Union Budget, which has transformed from an annual exercise of presenting the Government's finances into a media spectacle with breathless and instant commentary, was largely viewed as a Positive by equity markets. The equity markets took solace from the conservative assumptions for revenue collections going in to FY23 and modest expenditure growth with a clear tilt on capital spending across, roads; railways & affordable housing sectors. Debt markets, on the other hand, were a bit shaken by the assumption of additional borrowings. As it came without the announcement of steps to be initiated by the Government as a prelude to India's inclusion in the Global Bond indices. More on this could be read from our Fixed Income commentary.

The early birds in the earnings season have reported a mixed bag - robust sales growth and outlook, shrinking margin due to higher input prices and inability to completely pass on these cost surges. Unseasonal rains had also dampened demand in certain segments/sectors. As a result FY22 & 23 estimates may be downgraded marginally, though analysts seemed to be re-assured by management commentary and FY24 estimates remain largely unchanged. Of course, any prediction on corporate results would entail assuming the dissipation of the Third wave in the coming weeks, as it appears to be the case currently.

Brace yourself for more volatility in the coming weeks, as markets brace for the "event" - March meeting of US Fed and the commencement of the rate hike cycle. Once past this, will the markets calm down or become more skittish? Let's wait and watch. Stay safe and remain invested!!

Note: The above graph is for representation purposes only and should not be used for the development or implementation of an investment strategy. Past performance may or may not be sustained in the future.

What Went By

The bond market has had a relatively rough ride over the past month or so, right upto the RBI policy of February.

This was mostly in sympathy to global developments, but also to some extent with market's assumption that

RBI will intervene sporadically getting frustrated. In fact quite the contrary, the central bank has been selling

bonds in the secondary market since mid-November, even as it has seemingly signaled to the market from

time to time through auction devolutions.

Then the budget unveiled a staggeringly large gross borrowing number in excess of INR 14 lakh crores. Also there was no mention of the bond index inclusion roadmap. With this, the yield on the new 10 yr benchmark, 6.54% GSec 2032, that had ended the month of January'22 at 6.68%, rose to a high of 6.89% post budget. However, just as the bond market was giving up hope, RBI swung into action: first by working with the government to cancel some bond supply and then following that up with an ultra dovish monetary policy review.

Central government tax revenue collected in December continued to be robust and expenditure, particularly capex, picked up. During April to December 2021, net tax revenue was 83% of FY22RE (vs. 71% and 67% of actuals in FY19 and FY20 respectively) while total expenditure was 67% of FY22RE (vs. 79% of actuals each in FY19 and FY20). Thus, fiscal deficit during April-December 2021 was 48% of FY22RE (vs. 108% and 100% of actuals in FY19 and FY20 respectively). Small savings collection during April-December was Rs. 22,319cr higher than that during the same period last year. GST collection during January was strong at Rs. 1.38 lakh crore and 15.5% y/y.

India's FY23 union budget projected fiscal deficit for FY22 at 6.9% of GDP (vs. BE of 6.8%) and for FY23 at 6.4%, with a continued focus on capex. Gross tax revenue for FY22 has been estimated conservatively, implying a 14.5% y/y contraction during January-March, while it is relatively more realistic for FY23 although estimated nominal GDP growth is only 11.1%. On-budget capex growth for FY23 is estimated at 24.5% y/y in FY23, including Rs. 1 lakh crore of 50 year interest free loans to states, but consolidated capex (on and off budget) growth is estimated lower at 10.4%.

As per the first revised estimate of national income for FY21, India's real GDP growth was +3.7% in FY20 (pre- Covid year) and -6.6% in FY21. It is forecasted to grow +9.2% in FY22 as per the first advance estimate.

Consumer Price Index (CPI) inflation was 5.6% y/y in December, up from 4.9% in November, as favourable base effect also waned. However, sequential momentum in the food basket was negative and that in core CPI (headline CPI excluding food and beverages, fuel and light) moderated. Core inflation was still at 6% y/y in December and has remained sticky at an average of 5.9% since April 2021.

Industrial production (IP) growth for November was 1.4% y/y and -3.2% on a m/m seasonally adjusted basis. Sequentially, IP was negative in three of the last four months. Output in all use-based classifications (primary, capital, intermediate, infra & construction, consumer durable and consumer non-durable goods) were negative month-on-month in November. December Infrastructure Industries output (40% weight in IP) was up 3.8% y/y and 1.8% m/m seasonally adjusted, with output of coal, crude oil, fertilisers and natural gas being negative sequentially while that of cement rebounded after the sharp fall in November.

Bank credit outstanding as on 14th January was up 8% y/y, higher than 7.3% a month ago, while bank deposit growth was marginally down at 9.3%. By sector, overall bank credit flow during December picked up as credit to agriculture, industries, services and personal loans picked up. During April-December 2021, overall bank credit flow was the highest for personal loans and lowest for industries.

Merchandise trade deficit fell to USD 17.9bn in January from USD 21.7bn in December, as the sequential fall in imports was higher than that in exports, particularly for oil. Non-oil-non-gold imports, which has been trending higher in recent months, fell only marginally to USD 38.2bn in January from USD 38.6bn in December.

Among high-frequency variables, sequential change in motor vehicles registered has partially recovered since January after the sharp fall in December, but primarily driven by two wheelers. Most mobility indicators have improved from the fall in January while recent readings on weekly GST e-way bills generated have been healthy. Energy consumption level has sequentially improved in the last 3 weeks but is close to levels during the same period in 2021.

In China, indicators broadly continue to point towards slower economic activity. These include real estate investment, property prices, floor space sold, retail sales and consumer confidence. PBoC cut the one-year MLF (medium term lending facility) rate and the seven-day OMO rate by 10bps each, after which they also cut the one-year and five-year Loan Prime Rate by 10bps and 5bps each. PBoC also expressed its concern about the property sector, overall growth and the need for monetary policy to be forward looking. In the US, headline and core CPI moved further up in year-on-year terms to 7.0% and 5.5%, from 6.8% and 4.9%

respectively in November. Sequential momentum in both moderated a bit but stayed high, with price pressure continued to be quite broad based. The Federal Open Market Committee (FOMC) in its January meeting said that labour market continues to be strong, growth expectation is still above potential, inflation risks are still high, it is happy with the market pricing of rate hikes this year and that it plans to significantly reduce the size of the Fed's balance sheet (this will start after rate hikes begin). US non-farm payroll addition in January when infections due to Omicron were high was +467,000, which was only marginally lower than 510,000 in December, while unemployment rate ticked up a bit to 4% from 3.9% in December. However, sequential growth in average hourly earnings was strong at 0.7%, up from 0.5% in December, while average weekly hours moderated. The ECB's MPC meet in early February, unlike in December, did not explicitly mention rate hike in 2022 is 'highly unlikely'. However, it stressed on overall wage growth remaining muted.

The February policy review kept all rates unchanged as well as the accommodative stance maintained, with the usual one dissent. It was more dovish than market assessment in 1> not taking any step whatsoever towards corridor normalization (no hike in reverse repo rate), 2> providing some line of sight that the accommodative stance may continue for a while, and 3> sounding quite dovish on the growth - inflation assessment (second half FY23 inflation forecast seems much below market expectations).

Outlook

Overnight rates will likely remain volatile post the very dovish February Monetary Policy review as the revised liquidity framework progresses; now with the addition of term variable rate repos (VRRs). Thus, while there is now much more comfort that a repo rate hike is far away, money market rates will still have to battle the uncertainty of fluctuating rate of overnight deployment for non-bank participants like mutual funds. For bonds, while there is no quantifiable commitment on imminent explicit support, there are still nevertheless important takeaways. One, the Governor has repeated the desire for orderly evolution of the curve, and the need for market participants to be responsible. Presumably this doesn't imply only a one-sided commitment and entails action from RBI as well, even though not pre-committed. Two, the voluntary retention route (VRR) scheme for FPI participation in bonds has been further enhanced by INR 1 lakh crores. Three, the Governor noted that market's perception of inflation (and the unsaid interpretation therefore of extent of RBI tightening) may have been too pessimistic. Four, he reaffirmed the view expressed by others as well that government borrowing may be getting exaggerated owing to a variety of reasons.

In summary then, with market expectations of a repo rate hike now getting reasonably pushed back post the policy meeting, the demand for carry likely comes back. Thus, a bar-bell strategy that over-weights the 4 - 5 year (our preferred overweight segment) gets extra appeal post this policy. Put another way, even with some mark-to-market volatility assumed, the opportunity loss in holding cash now is higher given the expectation of further delayed repo rate hike after this policy. Longer duration bonds (10 year and beyond) however, still don't have a definitive trigger and will have to await a more sustainable resolution of the medium term demand-supply equation for bonds.

Given the above, we reiterate our preference for overweight stance in the 4 - 5 year government bonds. As always this represents our current thinking and stance. A related point to ponder is that while we need to proceed with a working assumption of how many rate hikes happen ahead, it is more and more apparent that the market may be reasonably overestimating this trajectory. This is especially true given our current expectation that global growth drivers don't seem sustainable (remember US has led global growth in the past year or so on the back of an unsustainably large fiscal stimulus which is now fading). On top of this, if RBI's second half inflation trajectory turns out to be close to the truth then we may just find out that this rate normalization cycle has much weaker legs than what is generally built into market expectations currently.

Disclaimer: MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

The Disclosures of opinions/in house views/strategy incorporated herein is provided solely to enhance the transparency about the investment strategy / theme of the Scheme and should not be treated as endorsement of the views / opinions or as an investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document has been prepared on the basis of information, which is already available in publicly accessible media or developed through analysis of IDFC Mutual Fund. The information/ views / opinions provided is for informative purpose only and may have ceased to be current by the time it may reach the recipient, which should be taken into account before interpreting this document. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision and the security may or may not continue to form part of the scheme's portfolio in future. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. The decision of the Investment Manager may not always be profitable; as such decisions are based on the prevailing market conditions and the understanding of the Investment Manager. Actual market movements may vary from the anticipated trends. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alterations to this statement as may be required from time to time. Neither IDFC Mutual Fund / IDFC AMC Trustee Co. Ltd./ IDFC Asset Management Co. Ltd nor IDFC, its Directors or representatives shall be liable for any damages whether direct or indirect, incidental, punitive special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information.

Then the budget unveiled a staggeringly large gross borrowing number in excess of INR 14 lakh crores. Also there was no mention of the bond index inclusion roadmap. With this, the yield on the new 10 yr benchmark, 6.54% GSec 2032, that had ended the month of January'22 at 6.68%, rose to a high of 6.89% post budget. However, just as the bond market was giving up hope, RBI swung into action: first by working with the government to cancel some bond supply and then following that up with an ultra dovish monetary policy review.

Central government tax revenue collected in December continued to be robust and expenditure, particularly capex, picked up. During April to December 2021, net tax revenue was 83% of FY22RE (vs. 71% and 67% of actuals in FY19 and FY20 respectively) while total expenditure was 67% of FY22RE (vs. 79% of actuals each in FY19 and FY20). Thus, fiscal deficit during April-December 2021 was 48% of FY22RE (vs. 108% and 100% of actuals in FY19 and FY20 respectively). Small savings collection during April-December was Rs. 22,319cr higher than that during the same period last year. GST collection during January was strong at Rs. 1.38 lakh crore and 15.5% y/y.

India's FY23 union budget projected fiscal deficit for FY22 at 6.9% of GDP (vs. BE of 6.8%) and for FY23 at 6.4%, with a continued focus on capex. Gross tax revenue for FY22 has been estimated conservatively, implying a 14.5% y/y contraction during January-March, while it is relatively more realistic for FY23 although estimated nominal GDP growth is only 11.1%. On-budget capex growth for FY23 is estimated at 24.5% y/y in FY23, including Rs. 1 lakh crore of 50 year interest free loans to states, but consolidated capex (on and off budget) growth is estimated lower at 10.4%.

As per the first revised estimate of national income for FY21, India's real GDP growth was +3.7% in FY20 (pre- Covid year) and -6.6% in FY21. It is forecasted to grow +9.2% in FY22 as per the first advance estimate.

Consumer Price Index (CPI) inflation was 5.6% y/y in December, up from 4.9% in November, as favourable base effect also waned. However, sequential momentum in the food basket was negative and that in core CPI (headline CPI excluding food and beverages, fuel and light) moderated. Core inflation was still at 6% y/y in December and has remained sticky at an average of 5.9% since April 2021.

Industrial production (IP) growth for November was 1.4% y/y and -3.2% on a m/m seasonally adjusted basis. Sequentially, IP was negative in three of the last four months. Output in all use-based classifications (primary, capital, intermediate, infra & construction, consumer durable and consumer non-durable goods) were negative month-on-month in November. December Infrastructure Industries output (40% weight in IP) was up 3.8% y/y and 1.8% m/m seasonally adjusted, with output of coal, crude oil, fertilisers and natural gas being negative sequentially while that of cement rebounded after the sharp fall in November.

Bank credit outstanding as on 14th January was up 8% y/y, higher than 7.3% a month ago, while bank deposit growth was marginally down at 9.3%. By sector, overall bank credit flow during December picked up as credit to agriculture, industries, services and personal loans picked up. During April-December 2021, overall bank credit flow was the highest for personal loans and lowest for industries.

Merchandise trade deficit fell to USD 17.9bn in January from USD 21.7bn in December, as the sequential fall in imports was higher than that in exports, particularly for oil. Non-oil-non-gold imports, which has been trending higher in recent months, fell only marginally to USD 38.2bn in January from USD 38.6bn in December.

Among high-frequency variables, sequential change in motor vehicles registered has partially recovered since January after the sharp fall in December, but primarily driven by two wheelers. Most mobility indicators have improved from the fall in January while recent readings on weekly GST e-way bills generated have been healthy. Energy consumption level has sequentially improved in the last 3 weeks but is close to levels during the same period in 2021.

In China, indicators broadly continue to point towards slower economic activity. These include real estate investment, property prices, floor space sold, retail sales and consumer confidence. PBoC cut the one-year MLF (medium term lending facility) rate and the seven-day OMO rate by 10bps each, after which they also cut the one-year and five-year Loan Prime Rate by 10bps and 5bps each. PBoC also expressed its concern about the property sector, overall growth and the need for monetary policy to be forward looking. In the US, headline and core CPI moved further up in year-on-year terms to 7.0% and 5.5%, from 6.8% and 4.9%

respectively in November. Sequential momentum in both moderated a bit but stayed high, with price pressure continued to be quite broad based. The Federal Open Market Committee (FOMC) in its January meeting said that labour market continues to be strong, growth expectation is still above potential, inflation risks are still high, it is happy with the market pricing of rate hikes this year and that it plans to significantly reduce the size of the Fed's balance sheet (this will start after rate hikes begin). US non-farm payroll addition in January when infections due to Omicron were high was +467,000, which was only marginally lower than 510,000 in December, while unemployment rate ticked up a bit to 4% from 3.9% in December. However, sequential growth in average hourly earnings was strong at 0.7%, up from 0.5% in December, while average weekly hours moderated. The ECB's MPC meet in early February, unlike in December, did not explicitly mention rate hike in 2022 is 'highly unlikely'. However, it stressed on overall wage growth remaining muted.

The February policy review kept all rates unchanged as well as the accommodative stance maintained, with the usual one dissent. It was more dovish than market assessment in 1> not taking any step whatsoever towards corridor normalization (no hike in reverse repo rate), 2> providing some line of sight that the accommodative stance may continue for a while, and 3> sounding quite dovish on the growth - inflation assessment (second half FY23 inflation forecast seems much below market expectations).

Outlook

Overnight rates will likely remain volatile post the very dovish February Monetary Policy review as the revised liquidity framework progresses; now with the addition of term variable rate repos (VRRs). Thus, while there is now much more comfort that a repo rate hike is far away, money market rates will still have to battle the uncertainty of fluctuating rate of overnight deployment for non-bank participants like mutual funds. For bonds, while there is no quantifiable commitment on imminent explicit support, there are still nevertheless important takeaways. One, the Governor has repeated the desire for orderly evolution of the curve, and the need for market participants to be responsible. Presumably this doesn't imply only a one-sided commitment and entails action from RBI as well, even though not pre-committed. Two, the voluntary retention route (VRR) scheme for FPI participation in bonds has been further enhanced by INR 1 lakh crores. Three, the Governor noted that market's perception of inflation (and the unsaid interpretation therefore of extent of RBI tightening) may have been too pessimistic. Four, he reaffirmed the view expressed by others as well that government borrowing may be getting exaggerated owing to a variety of reasons.

In summary then, with market expectations of a repo rate hike now getting reasonably pushed back post the policy meeting, the demand for carry likely comes back. Thus, a bar-bell strategy that over-weights the 4 - 5 year (our preferred overweight segment) gets extra appeal post this policy. Put another way, even with some mark-to-market volatility assumed, the opportunity loss in holding cash now is higher given the expectation of further delayed repo rate hike after this policy. Longer duration bonds (10 year and beyond) however, still don't have a definitive trigger and will have to await a more sustainable resolution of the medium term demand-supply equation for bonds.

Given the above, we reiterate our preference for overweight stance in the 4 - 5 year government bonds. As always this represents our current thinking and stance. A related point to ponder is that while we need to proceed with a working assumption of how many rate hikes happen ahead, it is more and more apparent that the market may be reasonably overestimating this trajectory. This is especially true given our current expectation that global growth drivers don't seem sustainable (remember US has led global growth in the past year or so on the back of an unsustainably large fiscal stimulus which is now fading). On top of this, if RBI's second half inflation trajectory turns out to be close to the truth then we may just find out that this rate normalization cycle has much weaker legs than what is generally built into market expectations currently.

Disclaimer: MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

The Disclosures of opinions/in house views/strategy incorporated herein is provided solely to enhance the transparency about the investment strategy / theme of the Scheme and should not be treated as endorsement of the views / opinions or as an investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document has been prepared on the basis of information, which is already available in publicly accessible media or developed through analysis of IDFC Mutual Fund. The information/ views / opinions provided is for informative purpose only and may have ceased to be current by the time it may reach the recipient, which should be taken into account before interpreting this document. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision and the security may or may not continue to form part of the scheme's portfolio in future. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. The decision of the Investment Manager may not always be profitable; as such decisions are based on the prevailing market conditions and the understanding of the Investment Manager. Actual market movements may vary from the anticipated trends. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alterations to this statement as may be required from time to time. Neither IDFC Mutual Fund / IDFC AMC Trustee Co. Ltd./ IDFC Asset Management Co. Ltd nor IDFC, its Directors or representatives shall be liable for any damages whether direct or indirect, incidental, punitive special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information.