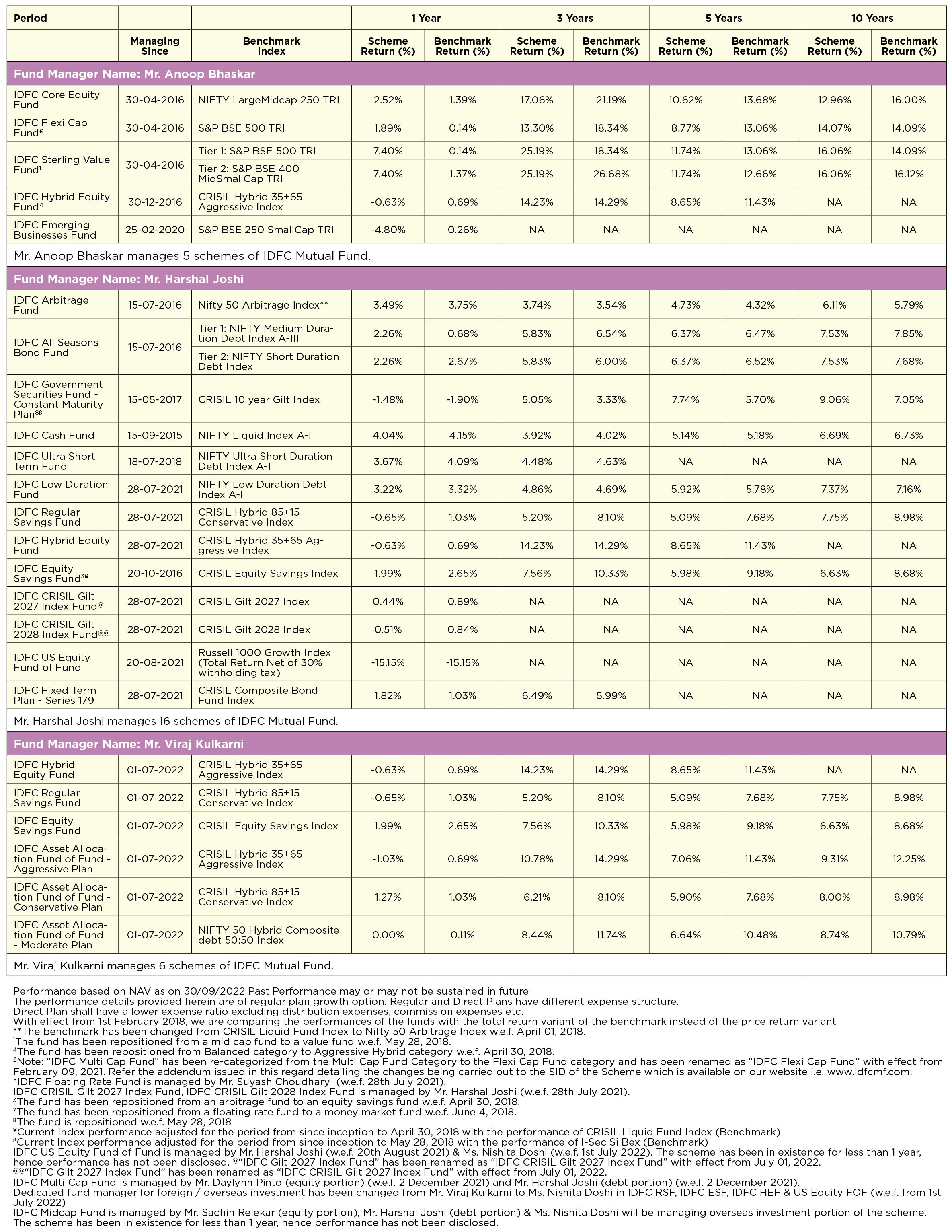

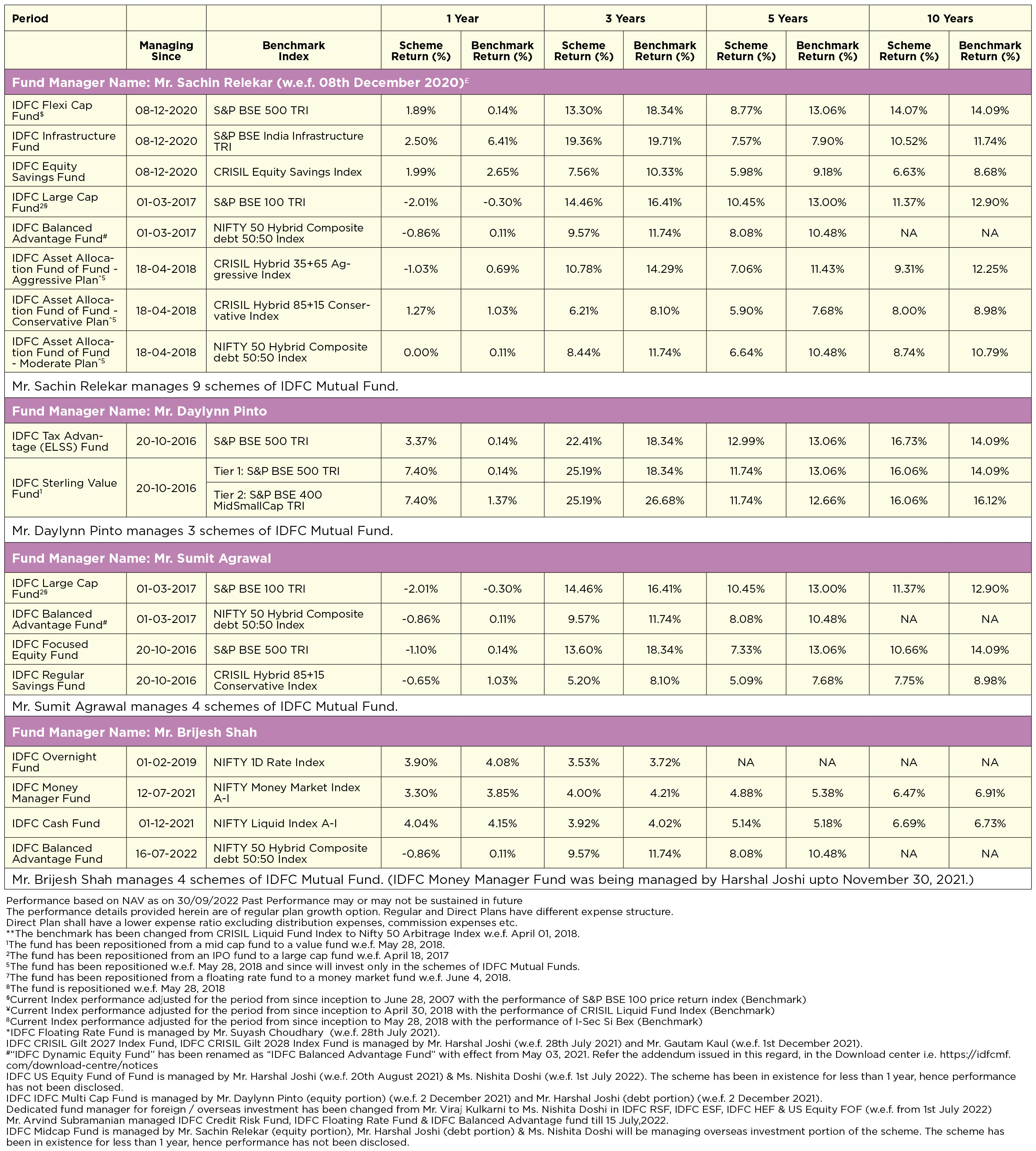

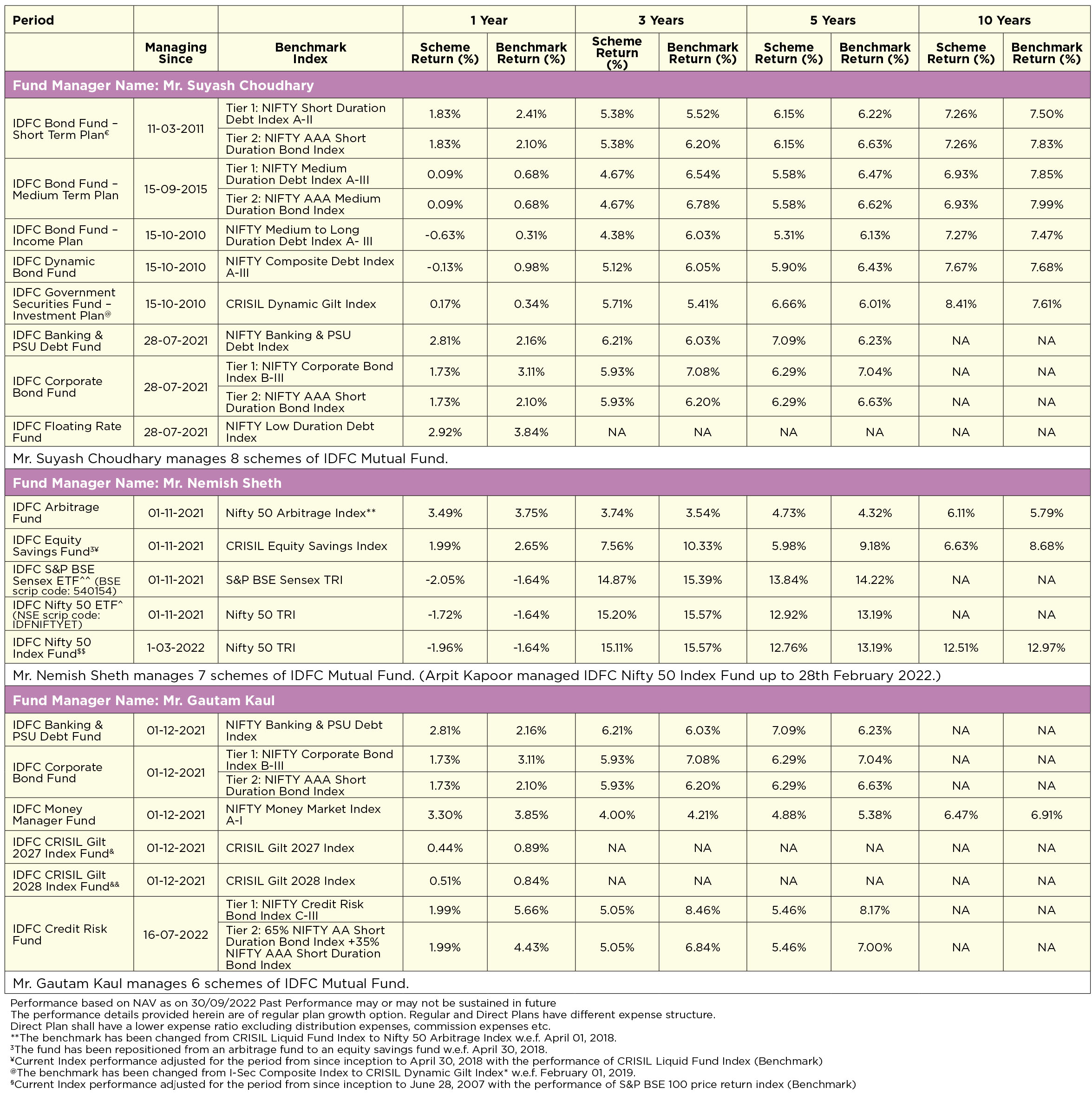

Performance Table

(Others Funds Managed by the Fund Managers)

*IDFC Floating Rate Fund is managed by Mr. Suyash Choudhary (w.e.f. 28th July 2021).

IDFC CRISIL Gilt 2027 Index Fund, IDFC CRISIL Gilt 2028 Index Fund is managed by Mr. Harshal Joshi (w.e.f. 28th July 2021) and Mr. Gautam Kaul (w.e.f. 1st December 2021).

^"IDFC Nifty ETF" has been renamed as "IDFC Nifty 50 ETF" with effect from July 01, 2022.

^^"IDFC Sensex ETF" has been renamed as "IDFC S&P BSE Sensex ETF" with effect from July 01, 2022.

& "IDFC Gilt 2027 Index Fund" has been renamed as "IDFC CRISIL Gilt 2027 Index Fund" with effect from July 01, 2022.

&&"IDFC Gilt 2028 Index Fund" has been renamed as "IDFC CRISIL Gilt 2028 Index Fund" with effect from July 01, 2022.

$$"IDFC Nifty Fund" has been renamed as "IDFC Nifty 50 Index Fund" with effect from July 01, 2022.

#"IDFC Dynamic Equity Fund" has been renamed as "IDFC Balanced Advantage Fund" with effect from May 03, 2021. Refer the addendum issued in this regard, in the Download center i.e. https://idfcmf.com/download-centre/notices

IDFC Nifty 100 Index Fund & IDFC Nifty200 Momentum 30 Index Fund is managed by Mr. Nemish Sheth. The scheme has been in existence for less than 1 year, hence performance has not been disclosed. Dedicated fund manager for foreign / overseas investment has been changed from Mr. Viraj Kulkarni to Ms. Nishita Doshi in IDFC RSF, IDFC ESF, IDFC HEF & US Equity FOF (w.e.f. from 1st July 2022). Mr. Arvind Subramanian managed IDFC Credit Risk Fund, IDFC Floating Rate Fund & IDFC Balanced Advantage fund till 15 July,2022.

IDFC Midcap Fund is managed by Mr. Sachin Relekar (equity portion), Mr. Harshal Joshi (debt portion) & Ms. Nishita Doshi will be managing overseas investment portion of the scheme. The scheme has been in existence for less than 1 year, hence performance has not been disclosed.

Disclaimer: MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

The Disclosures of opinions/in house views/strategy incorporated herein is provided solely to enhance the transparency about the investment strategy / theme of the Scheme and should not be treated as endorsement of the views / opinions or as an investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document has been prepared on the basis of information, which is already available in publicly accessible media or developed through analysis of IDFC Mutual Fund. The information/ views / opinions provided is for informative purpose only and may have ceased to be current by the time it may reach the recipient, which should be taken into account before interpreting this document. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision and the security may or may not continue to form part of the scheme's portfolio in future. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. The decision of the Investment Manager may not always be profitable; as such decisions are based on the prevailing market conditions and the understanding of the Investment Manager. Actual market movements may vary from the anticipated trends. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alterations to this statement as may be required from time to time. Neither IDFC Mutual Fund / IDFC AMC Trustee Co. Ltd./ IDFC Asset Management Co. Ltd nor IDFC, its Directors or representatives shall be liable for any damages whether direct or indirect, incidental, punitive special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information.