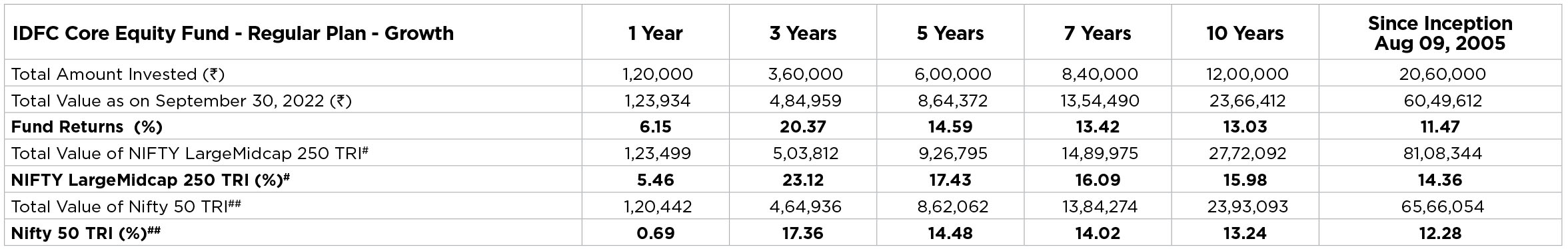

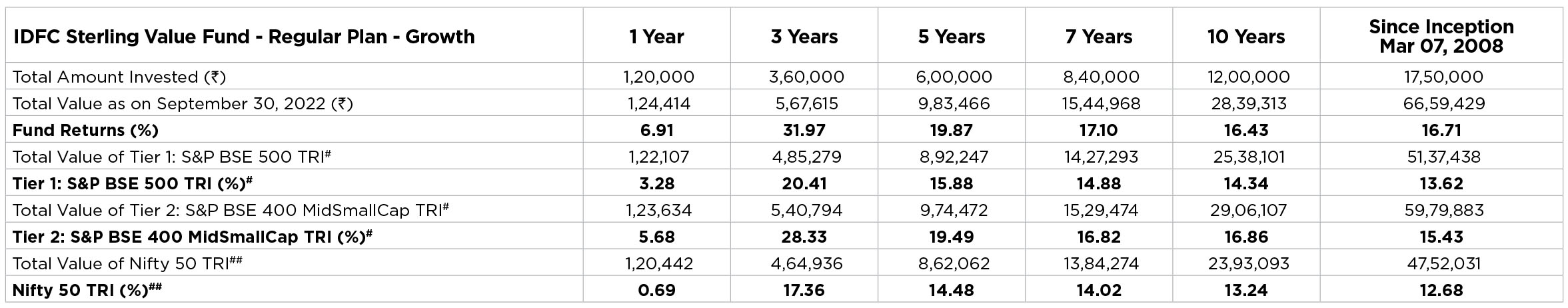

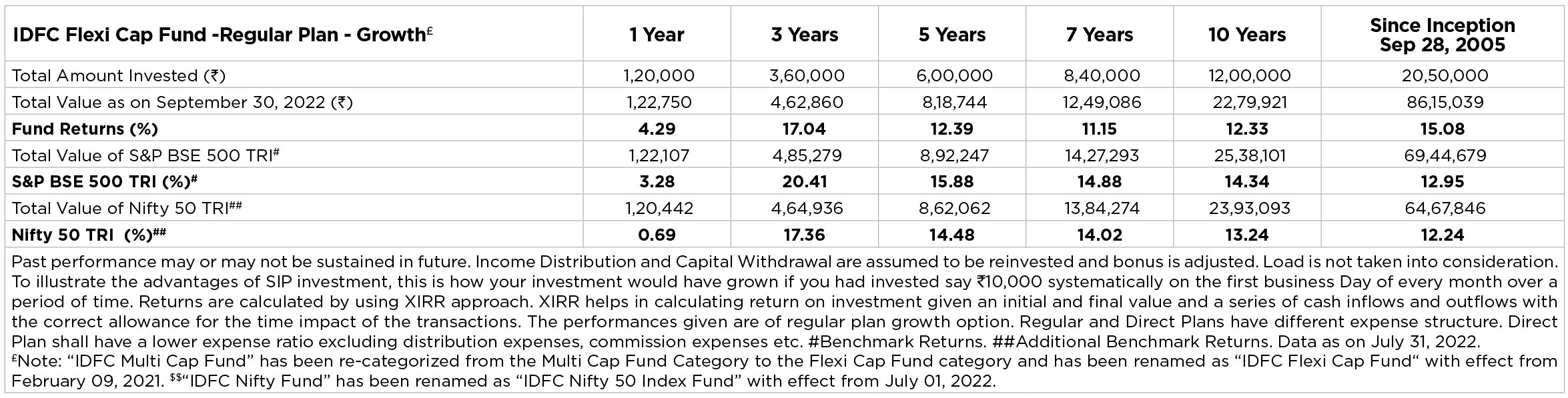

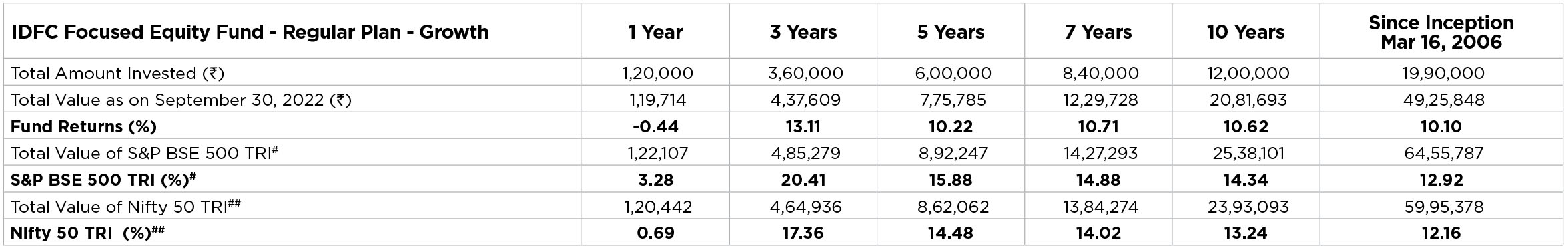

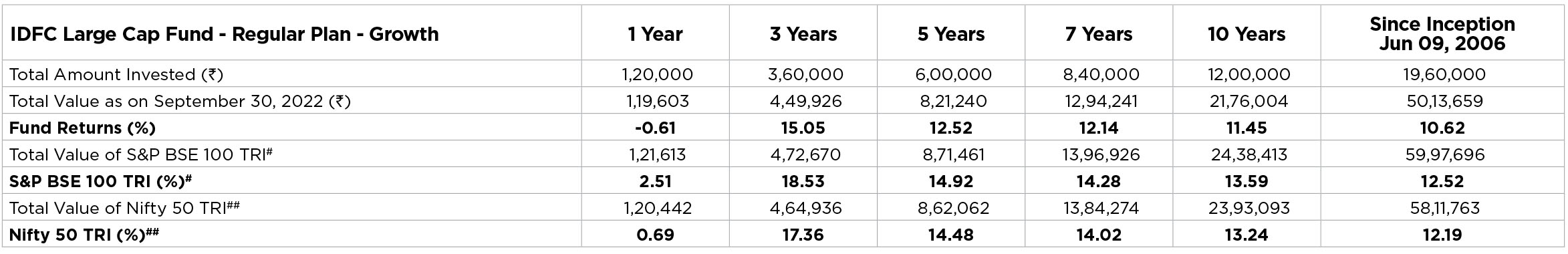

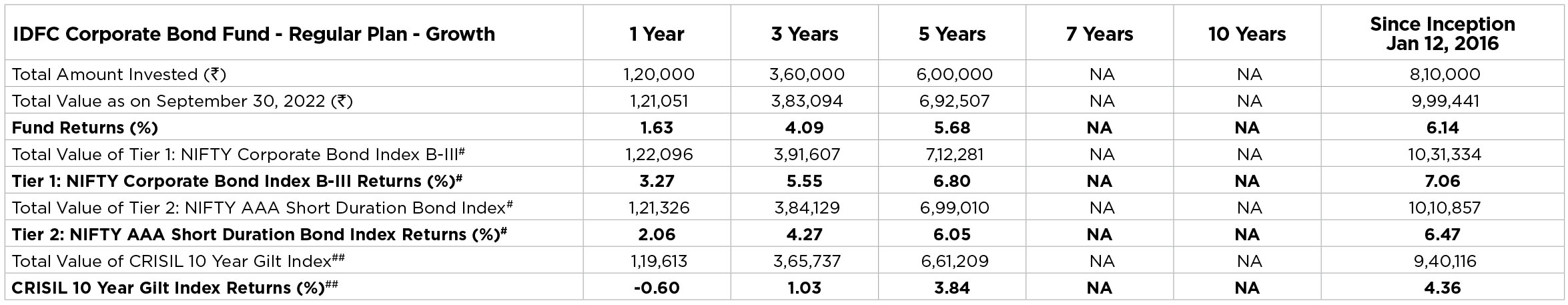

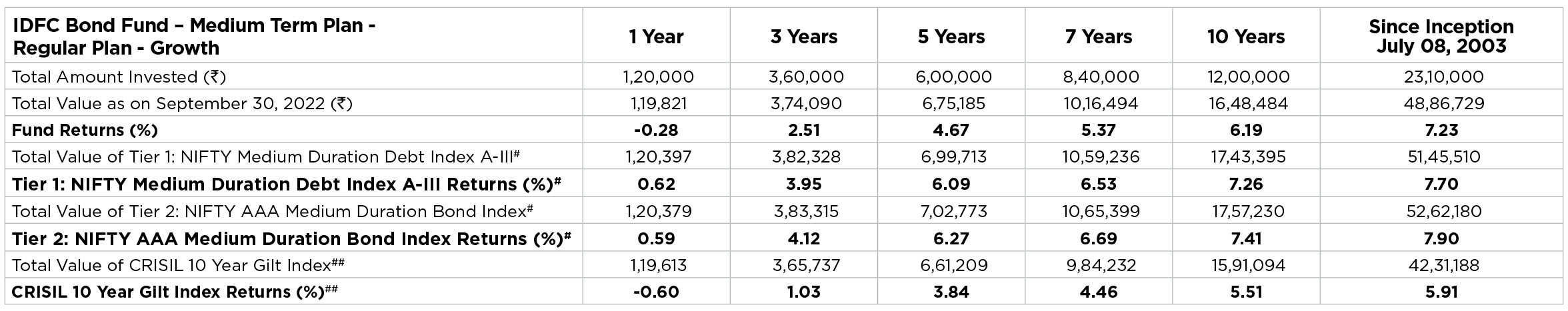

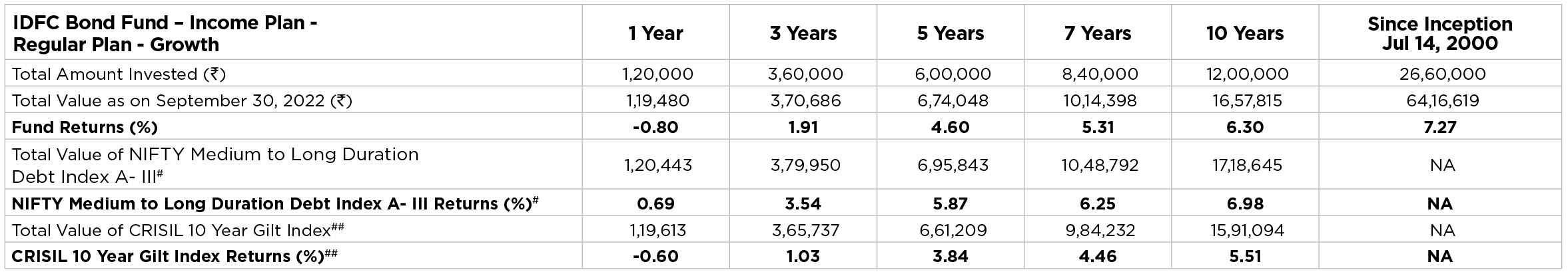

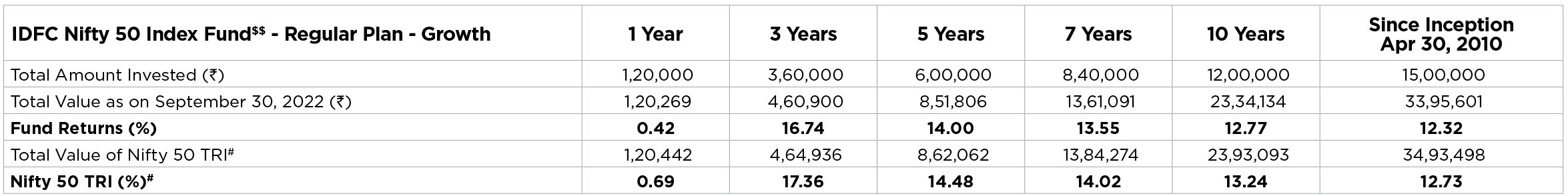

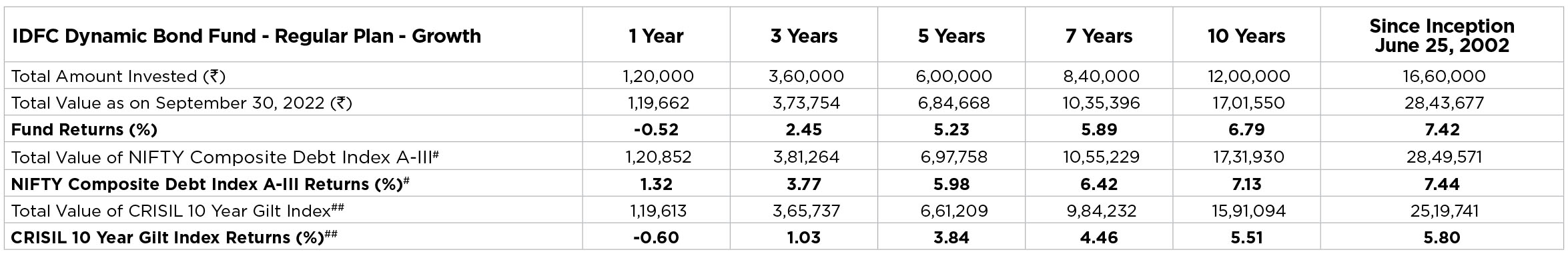

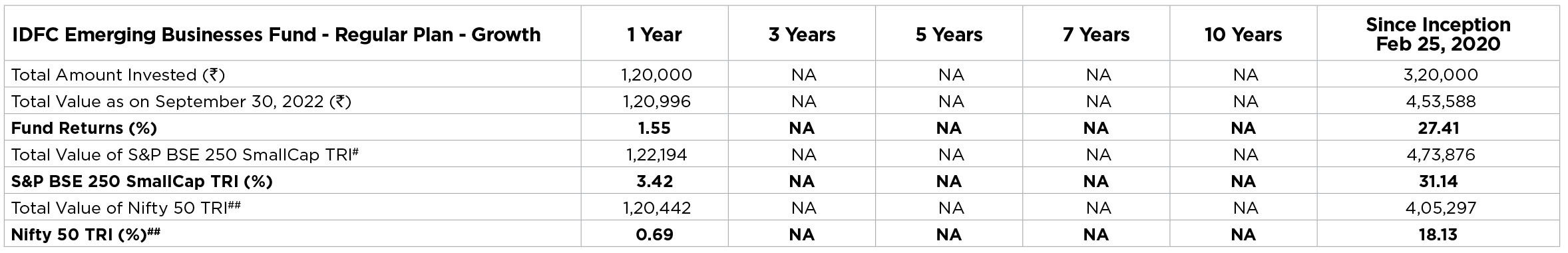

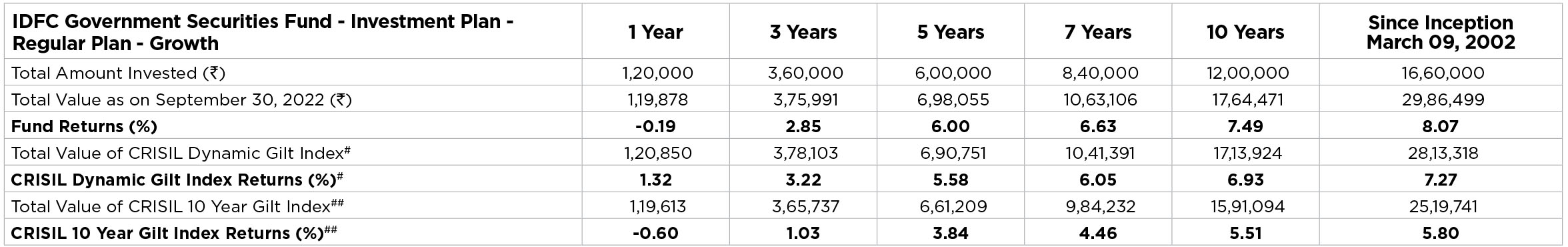

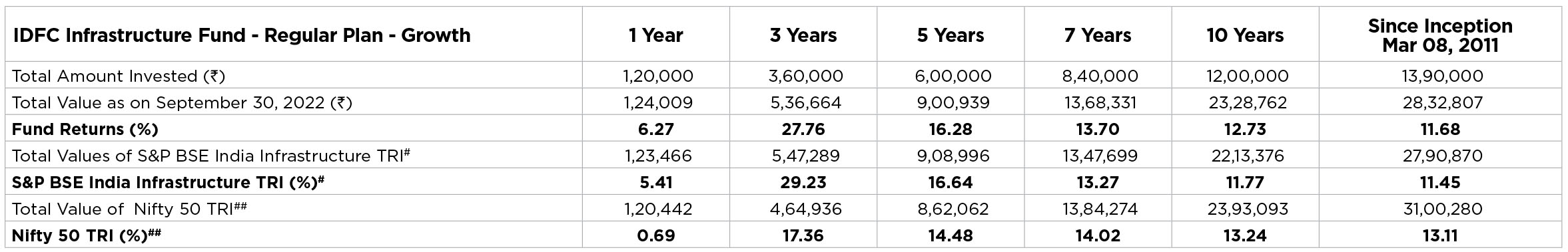

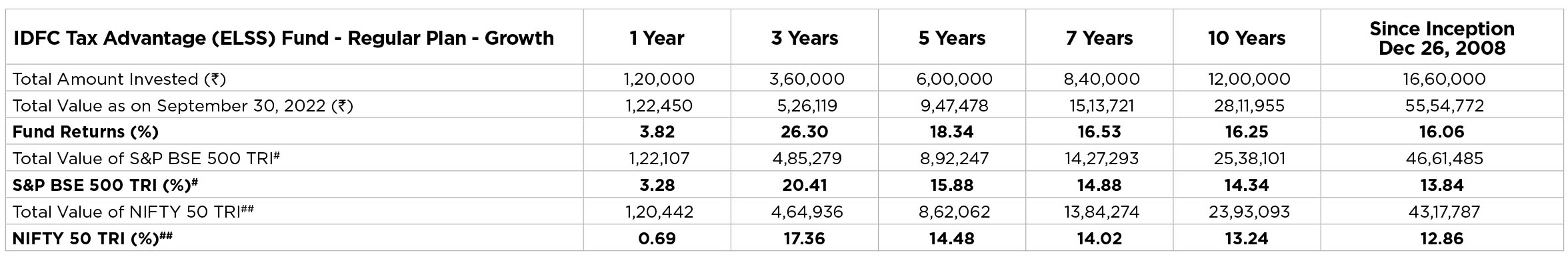

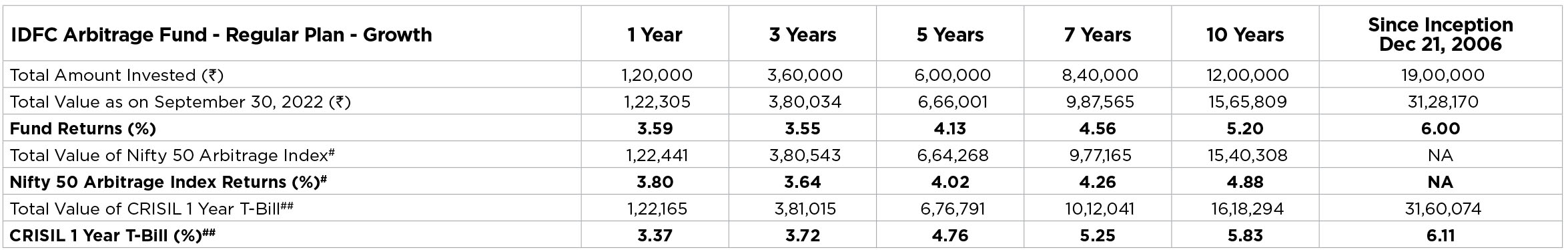

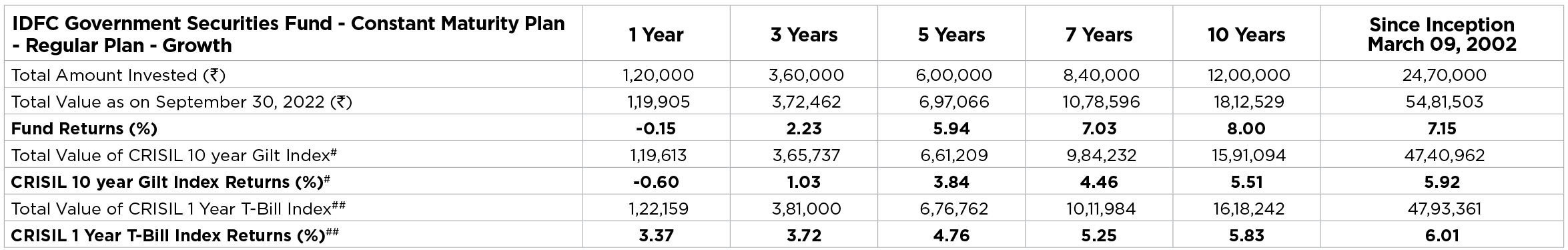

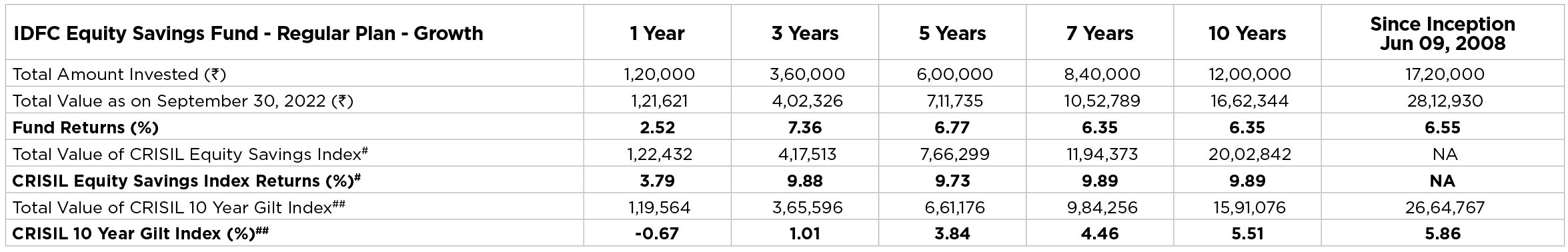

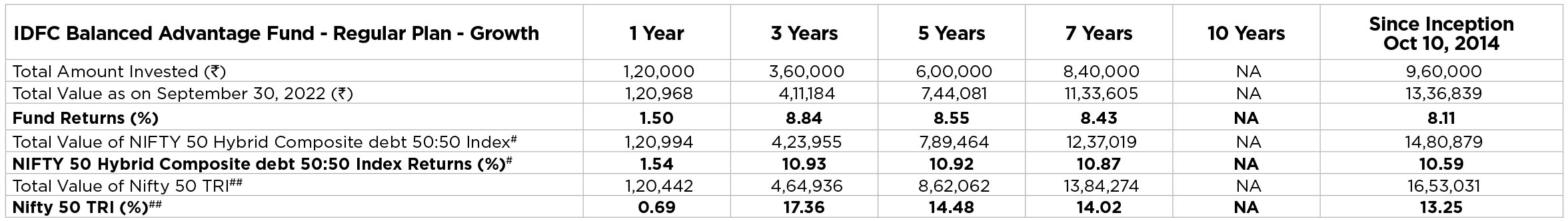

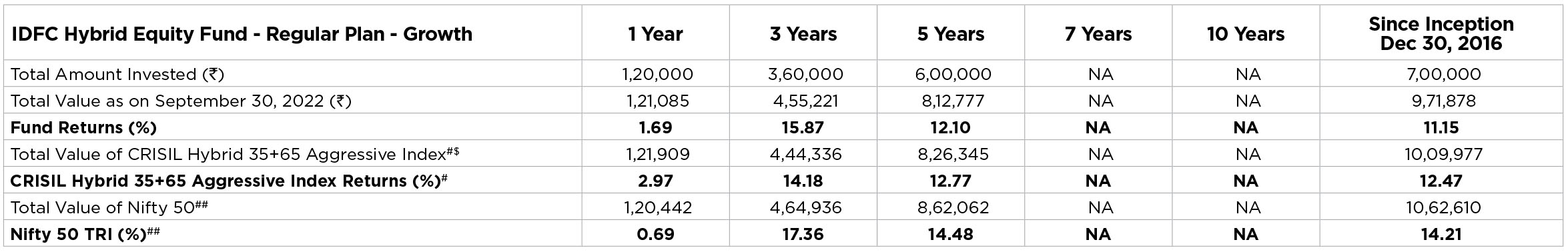

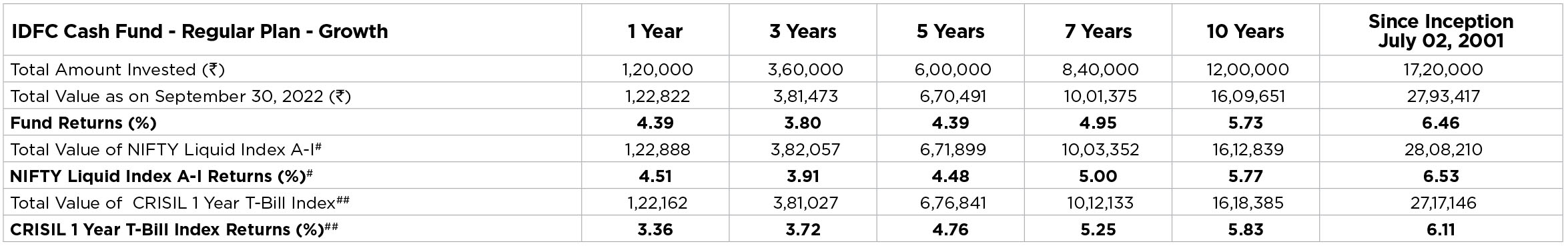

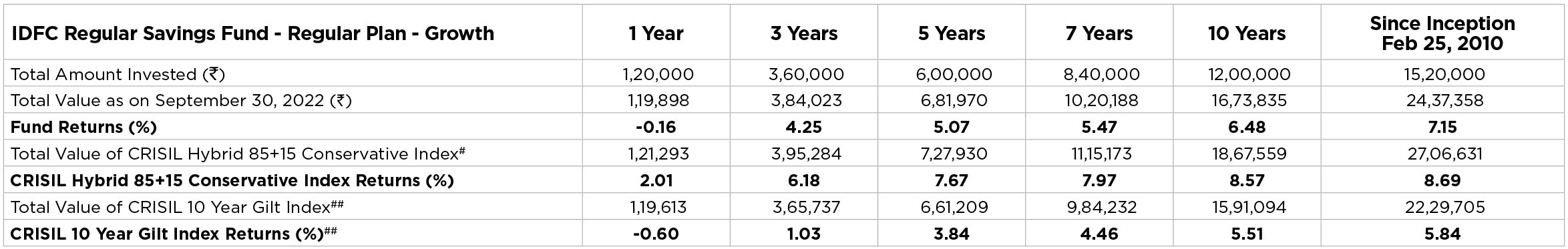

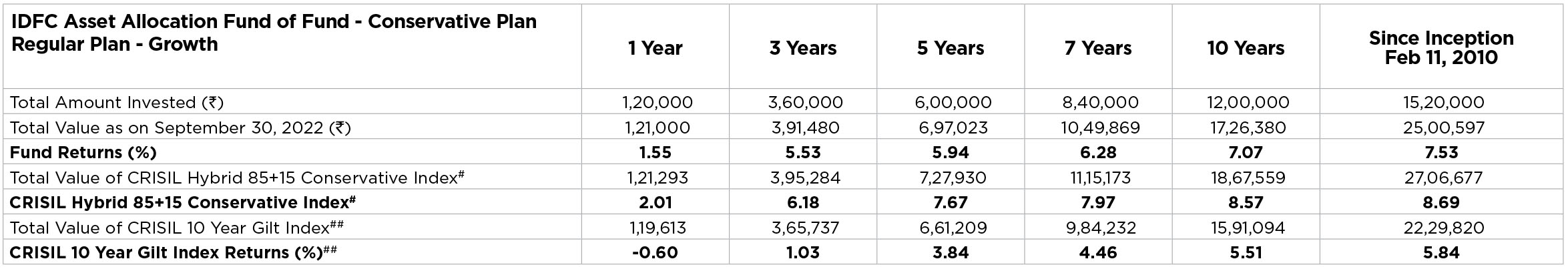

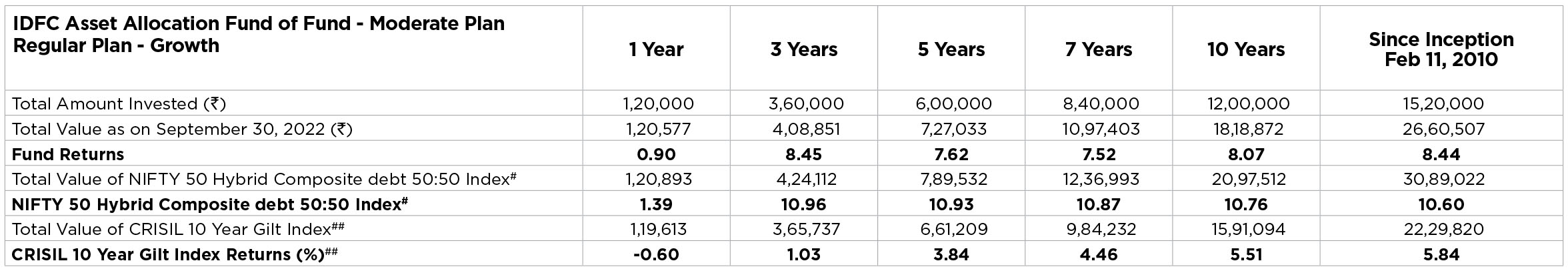

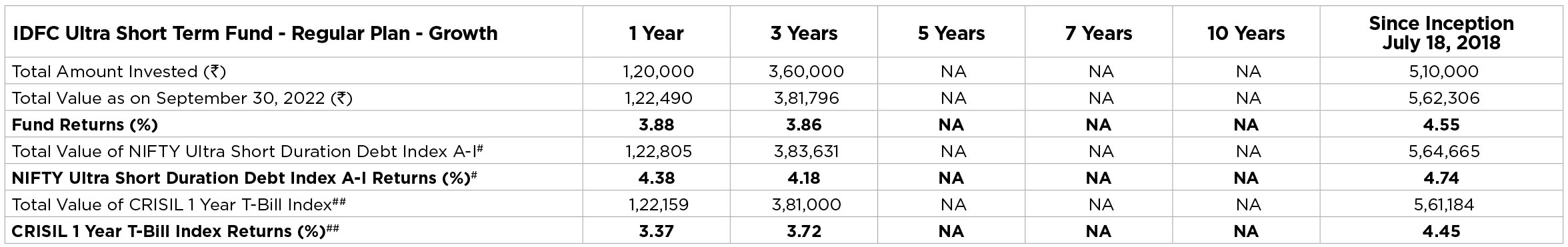

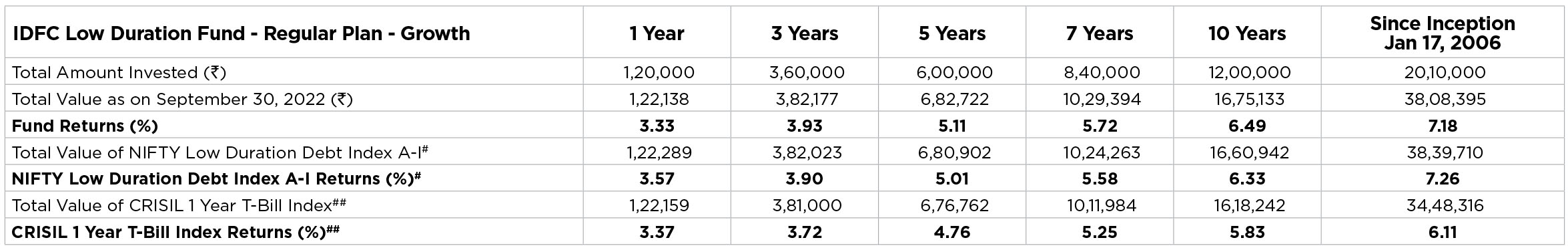

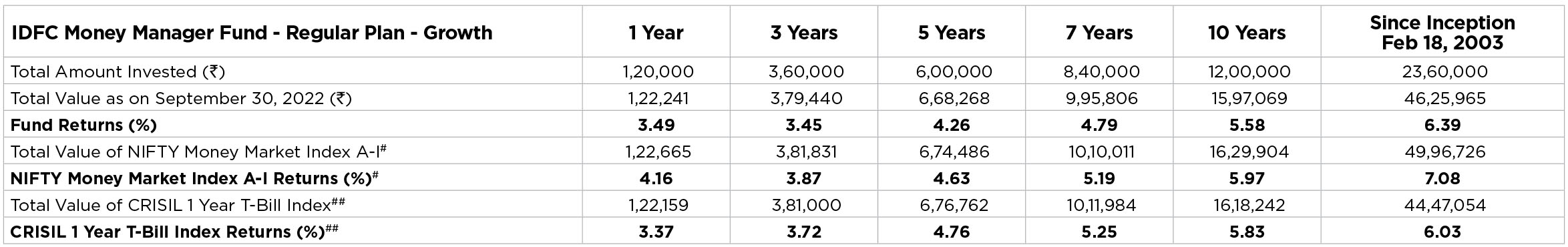

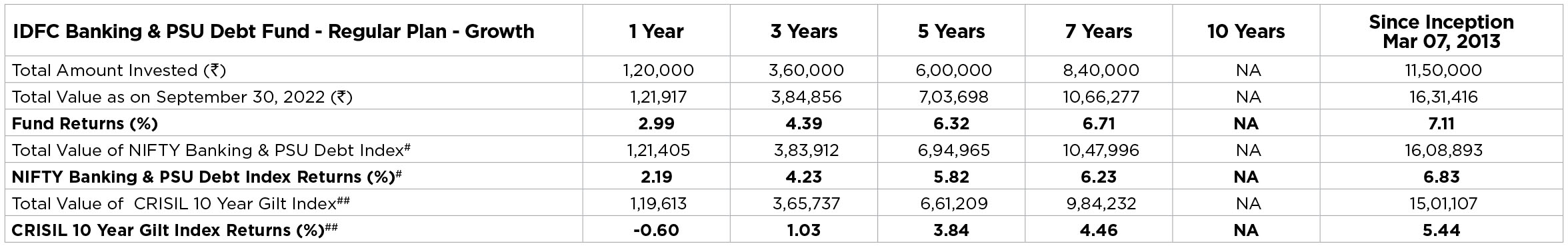

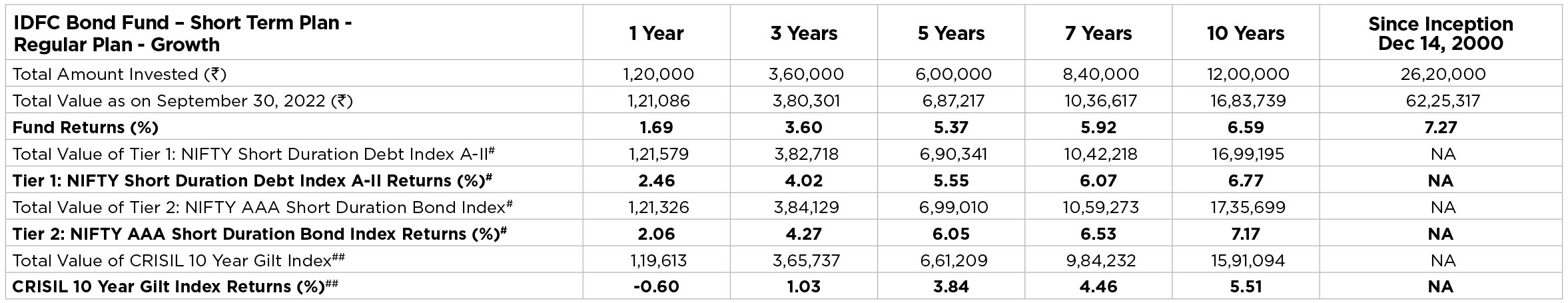

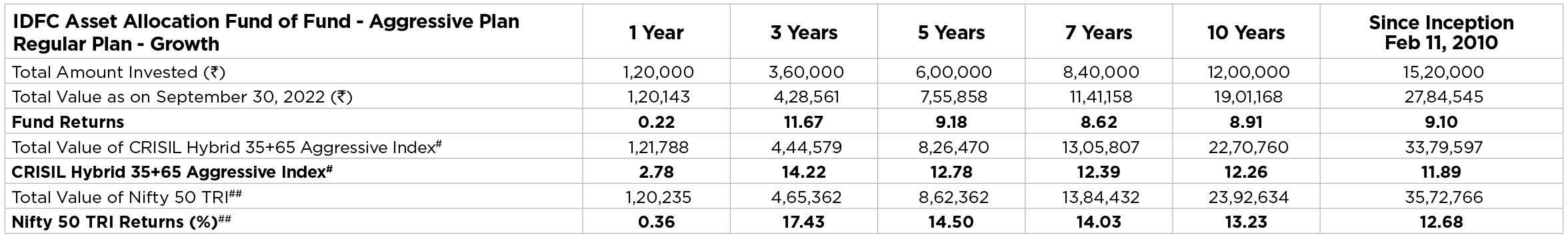

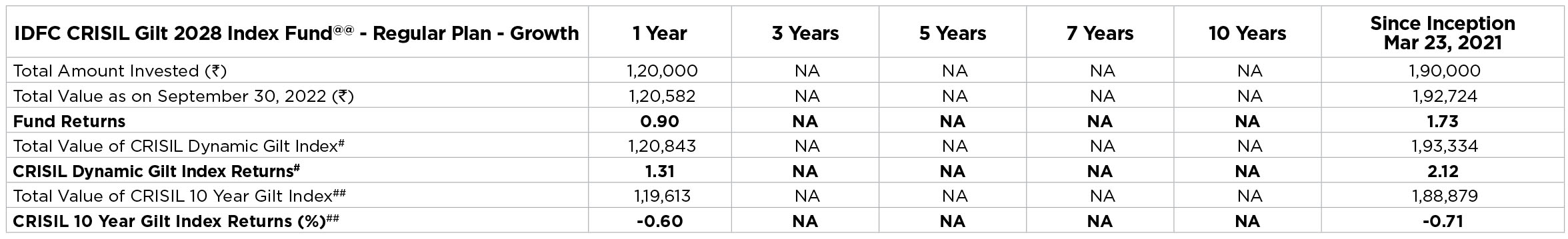

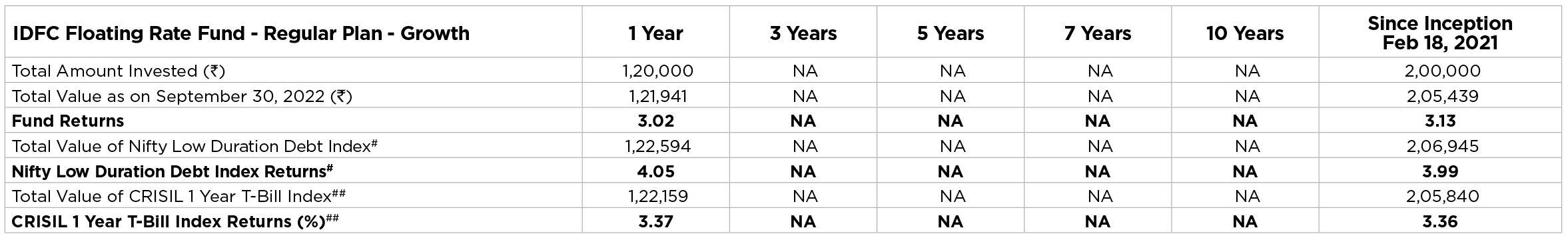

SIP Performance

Monthly SIP of ₹ 10,000

Past performance may or may not be sustained in future. Income Distribution and Capital Withdrawal are assumed to be reinvested and bonus is adjusted. Load is not taken into consideration.

To illustrate the advantages of SIP investment, this is how your investment would have grown if you had invested say ₹10,000 systematically on the first business Day of every month over a

period of time. Returns are calculated by using XIRR approach. XIRR helps in calculating return on investment given an initial and final value and a series of cash inflows and outflows with the

correct allowance for the time impact of the transactions. The performances given are of regular plan growth option. Regular and Direct Plans have different expense structure. Direct Plan

shall have a lower expense ratio excluding distribution expenses, commission expenses etc. #Benchmark Returns. ##Additional Benchmark Returns. Data as on September 30, 2022.

£Note: "IDFC Multi Cap Fund" has been re-categorized from the Multi Cap Fund Category to the Flexi Cap Fund category and has been renamed as "IDFC Flexi Cap Fund" with effect from

February 09, 2021. $$"IDFC Nifty Fund" has been renamed as "IDFC Nifty 50 Index Fund" with effect from July 01, 2022.

@ "IDFC Gilt 2027 Index Fund" has been renamed as "IDFC CRISIL Gilt 2027 Index Fund" with effect

from July 01, 2022. @@ "IDFC Gilt 2028 Index Fund" has been renamed as "IDFC CRISIL Gilt 2028 Index Fund" with effect from July 01, 2022.