Commentary

Global Markets

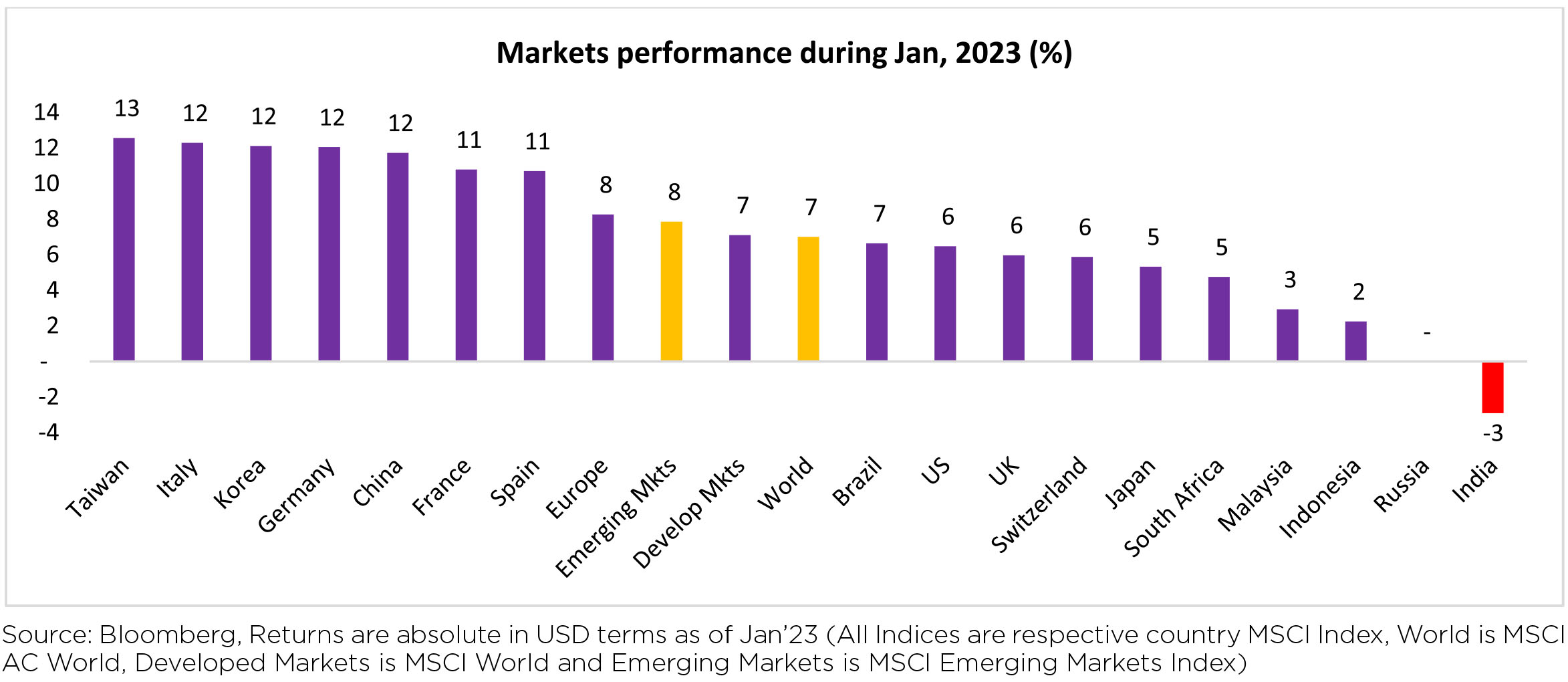

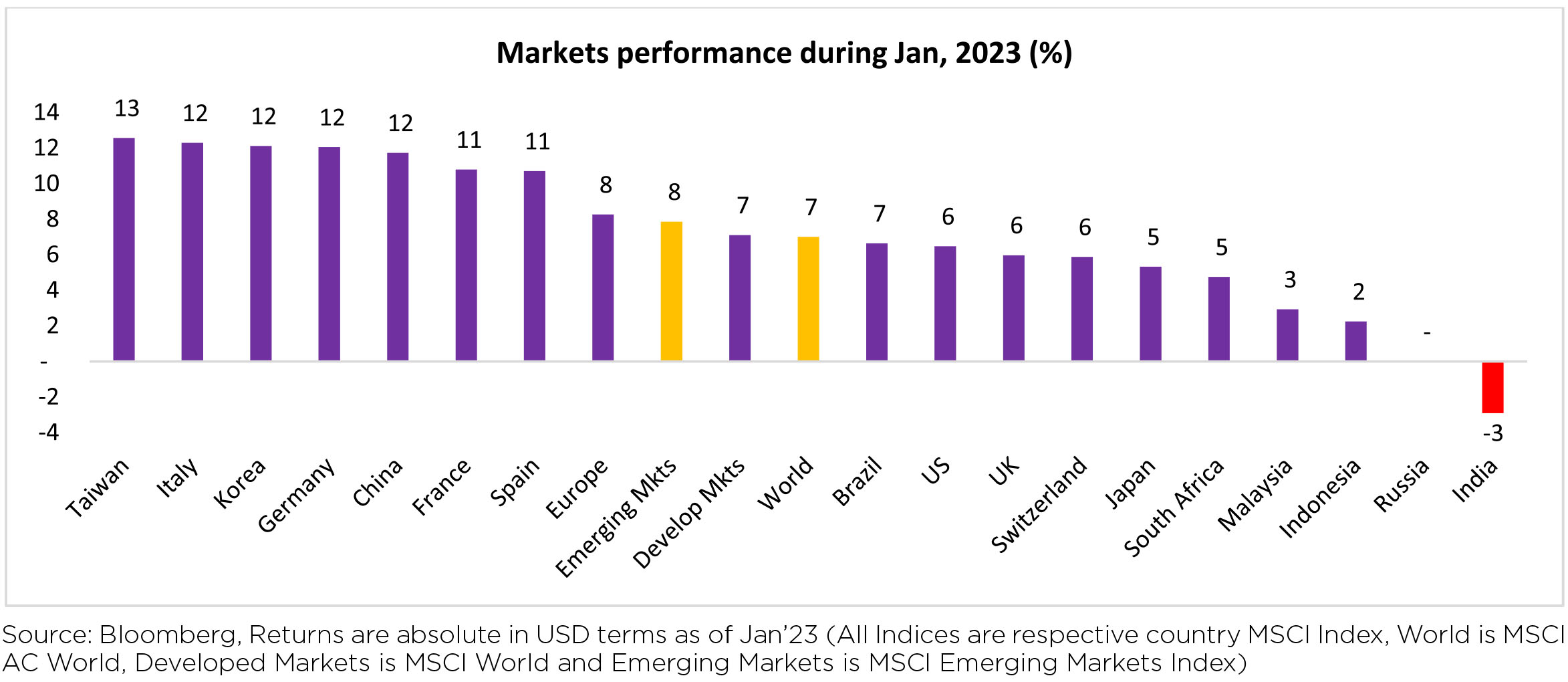

Global equities were stronger across regions (MSCI World +7.1% MoM). India (-3.1% MoM) was the only

major outlier in the month, as China (+11.8% MoM) and Euro area (+8.3% MoM) too delivered strong

positive performance.

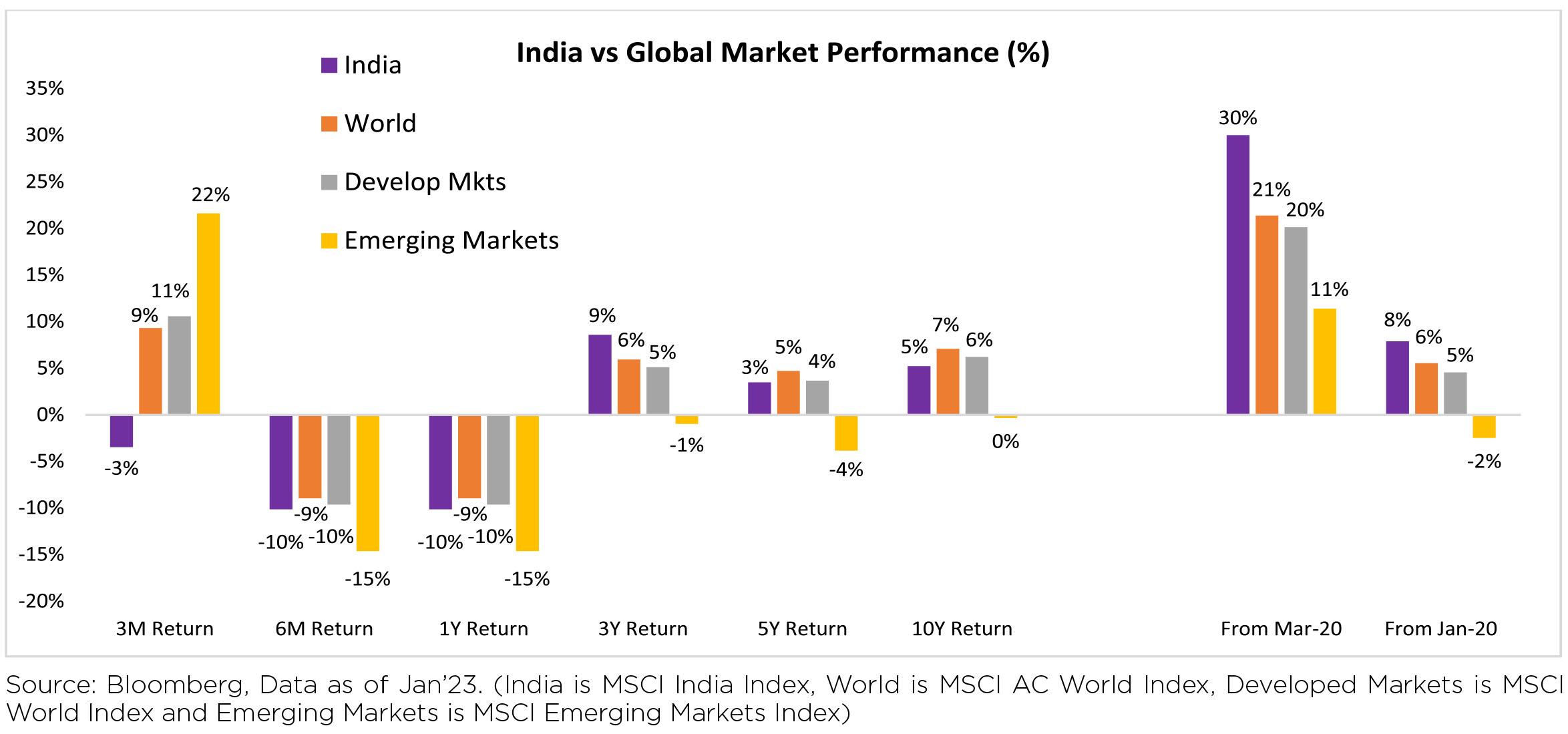

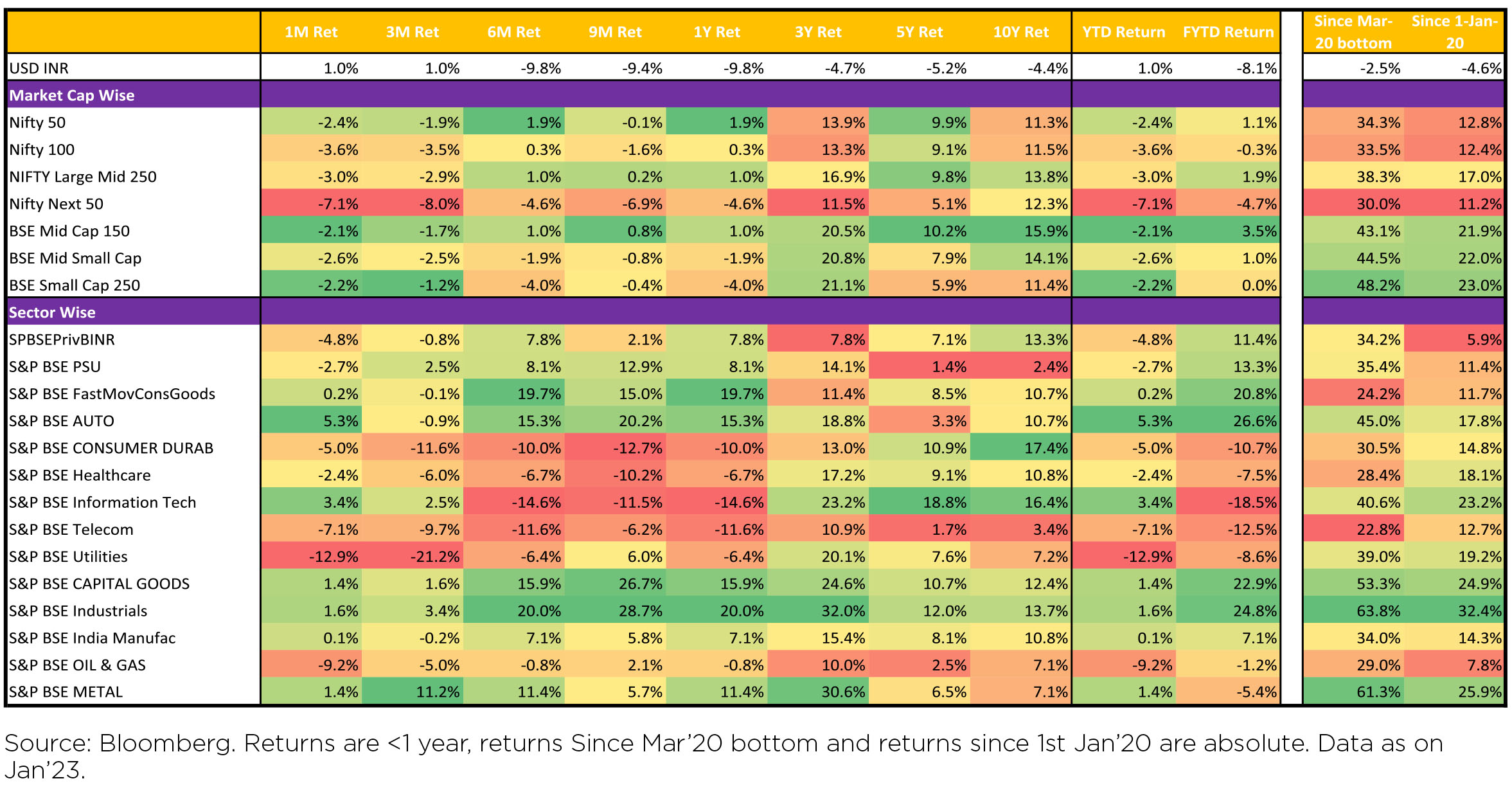

Indian equities fell ($ terms, -2.9% MoM/-9.4% FYTD) while underperforming the region and peers (MSCI

APxJ/EM: +8.6%/+7.9% MoM).

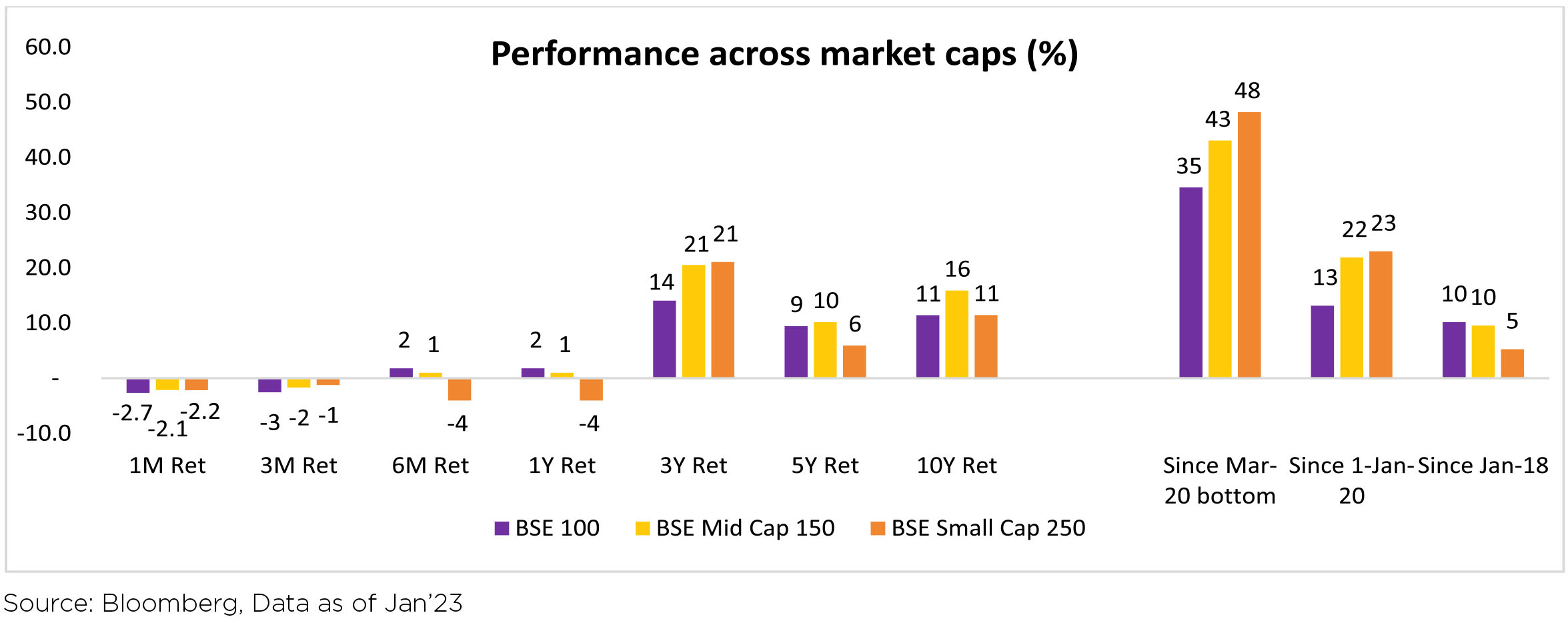

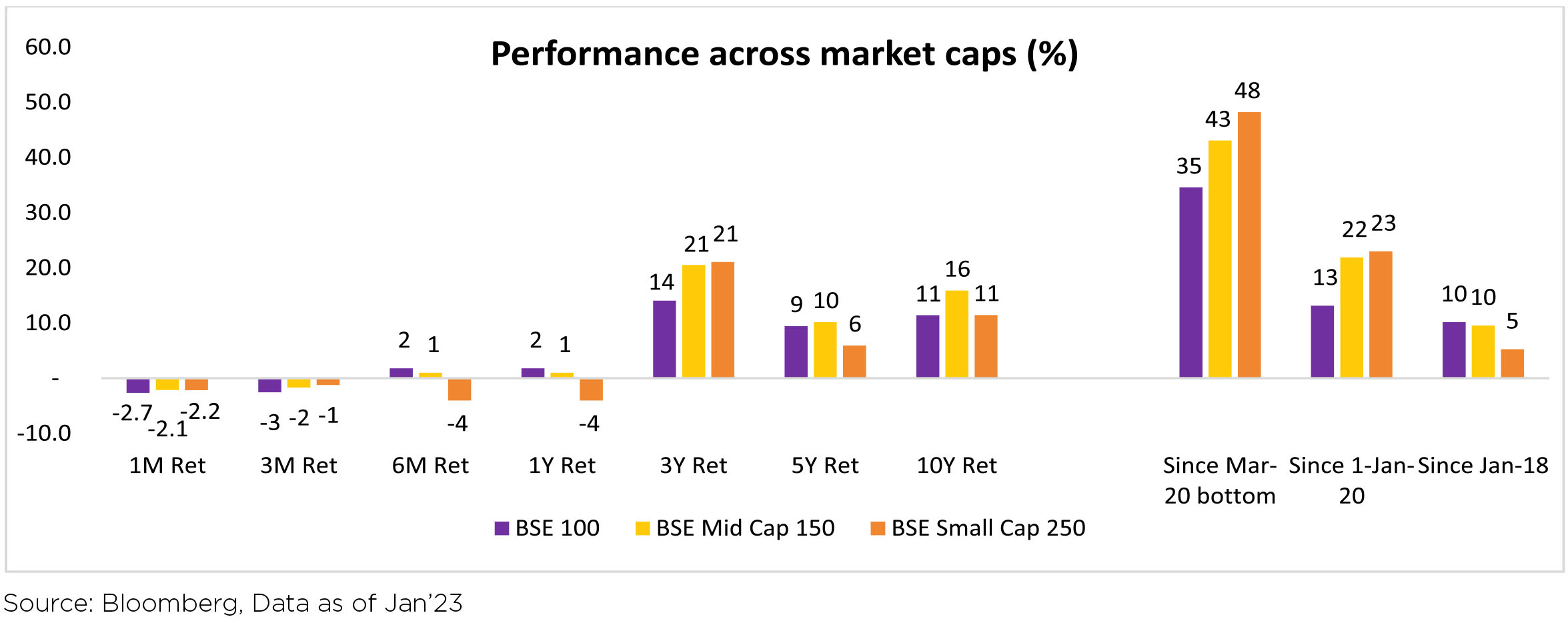

Mid-caps (-2.1% MoM) and small caps (-2.2% MoM) though weak, outperformed the large caps (-2.7% MoM).

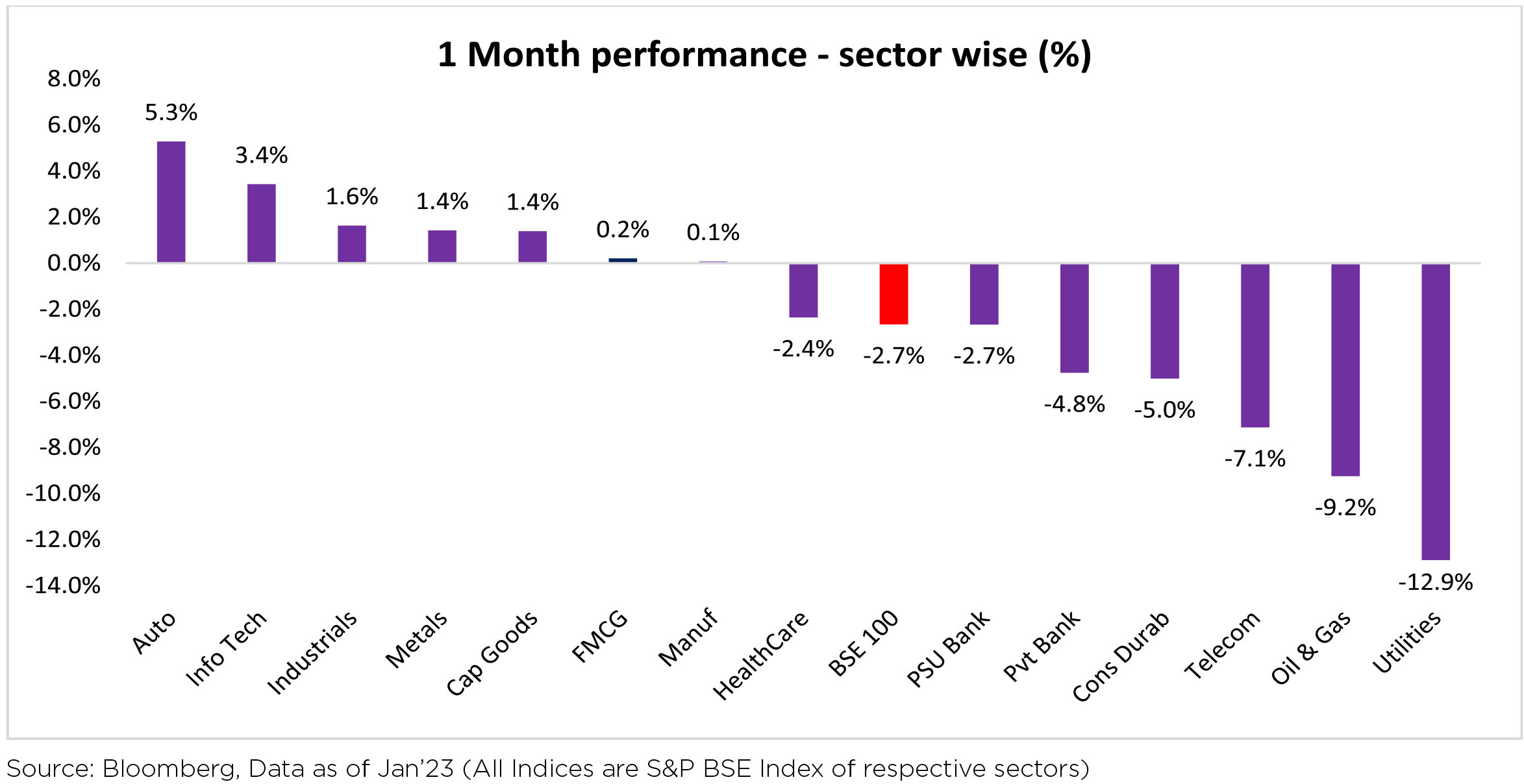

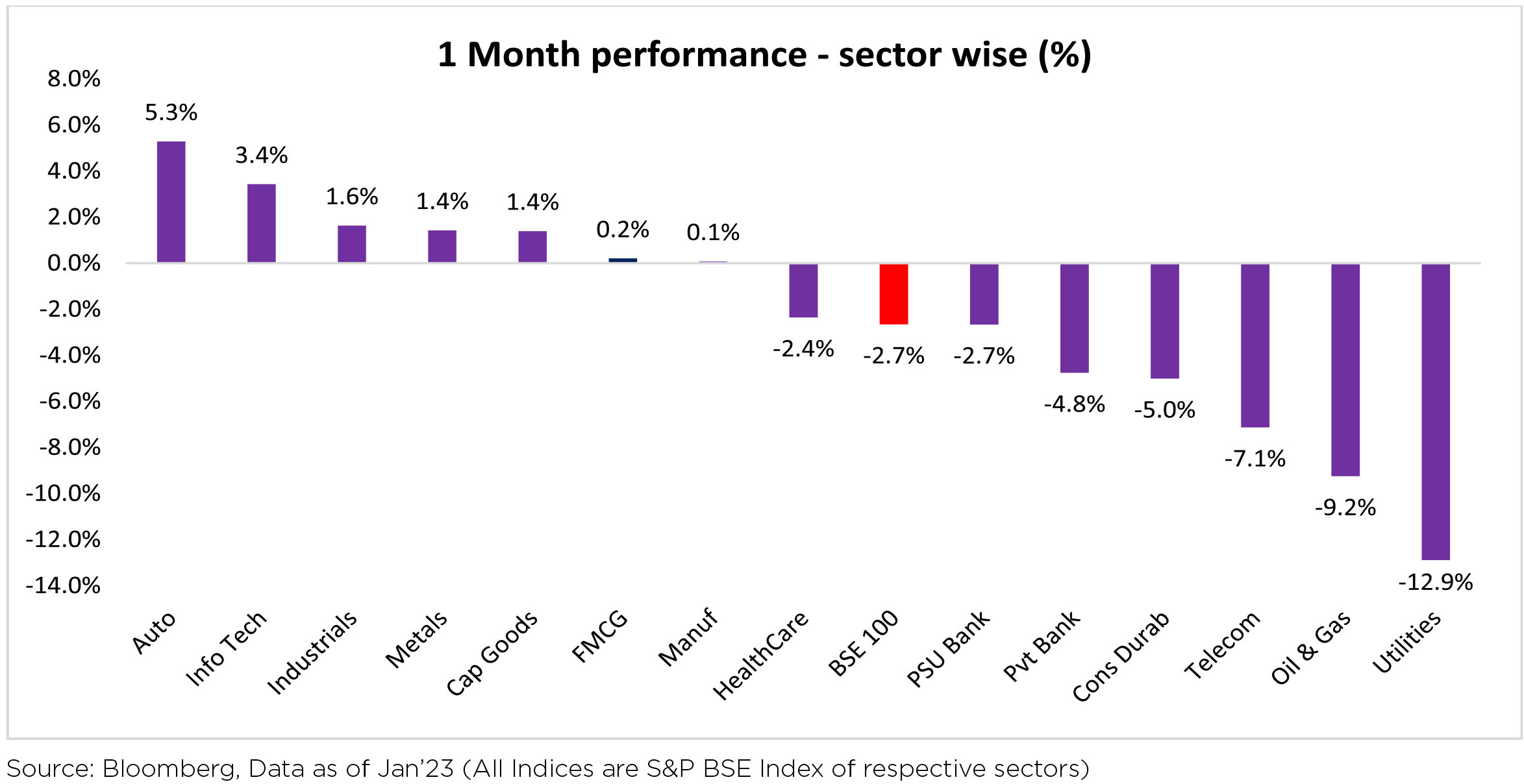

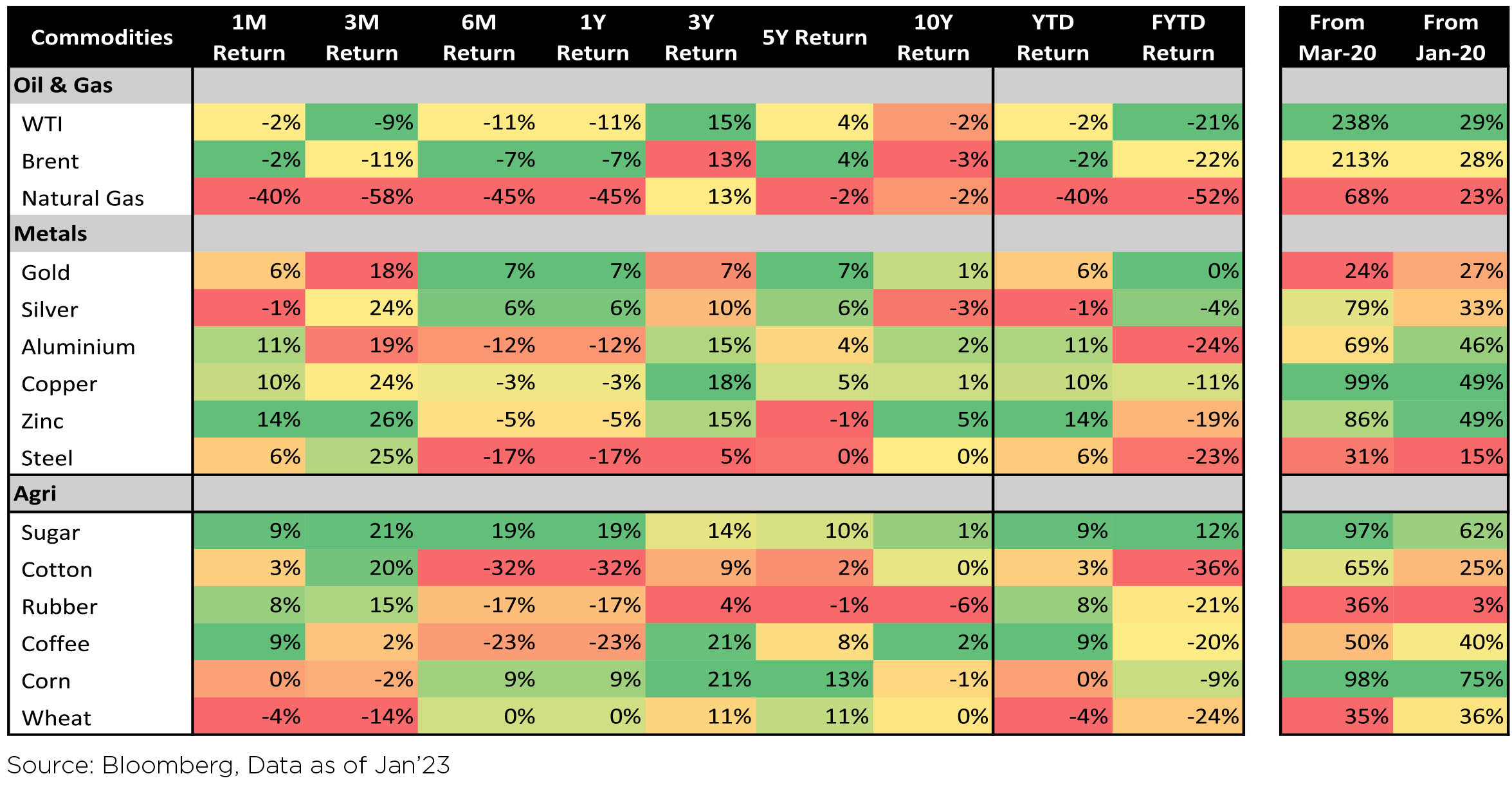

Sector performance was a mixed bag as NIFTY ended the month in red near 17,600 levels declining -2.4% MoM. Auto and IT sector were the positive drivers of performance for the month, however, the major drags were Oil & Gas and Utilities sector.

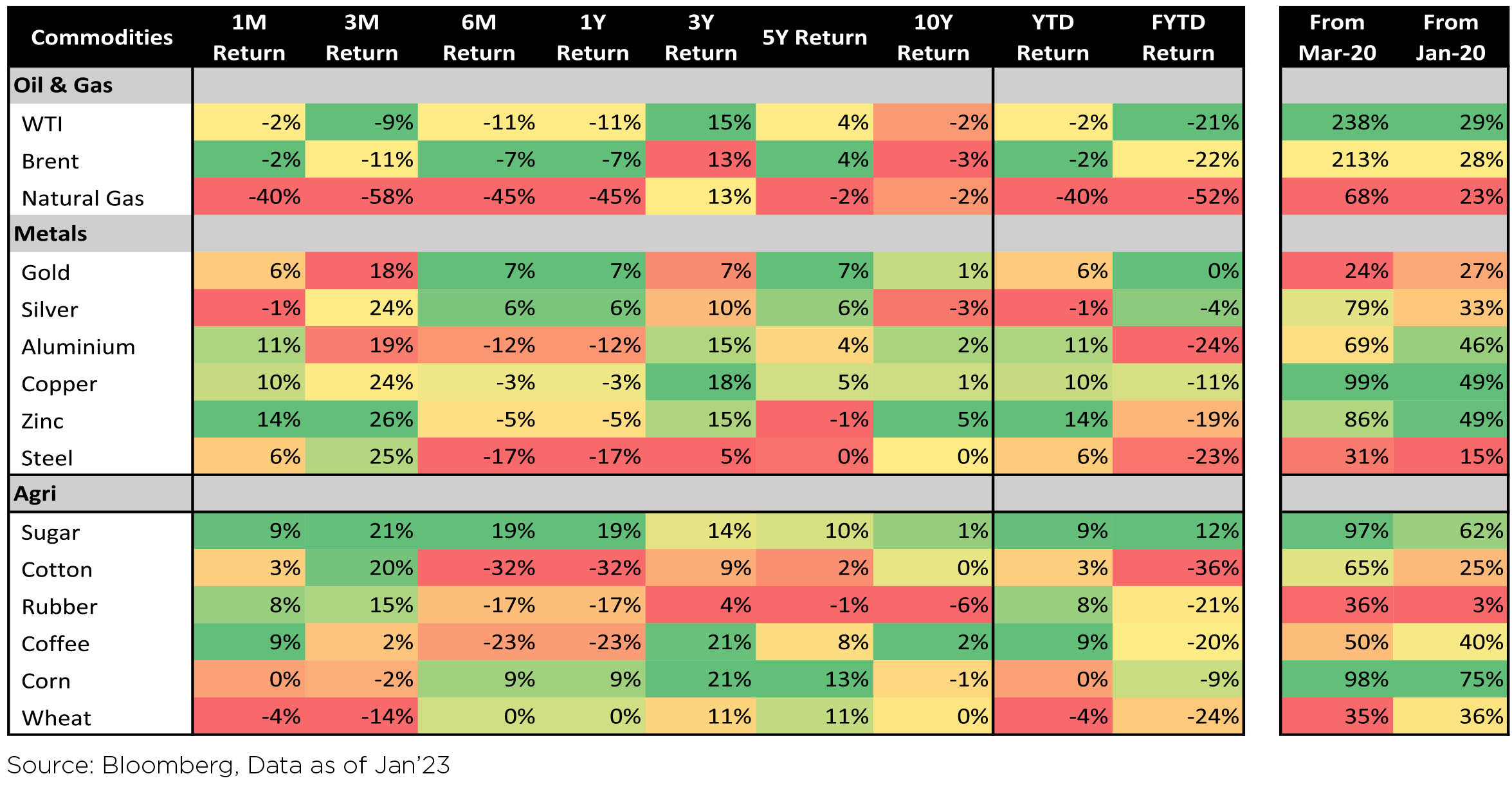

INR appreciated by 1% MoM, reaching ~81.92/USD in January with the weakening in Greenback (USD). The DXY (Dollar Index) weakened 1.4% over the month, which augurs well for flows into EMs. Oil prices declined by ~2% over January. Benchmark 10-year treasury yields averaged at 7.34% in January (5bps higher viz-a-viz. December average). On month-end values, the 10Y yield was up and ended the month at 7.34%.

Macro concerns easing:

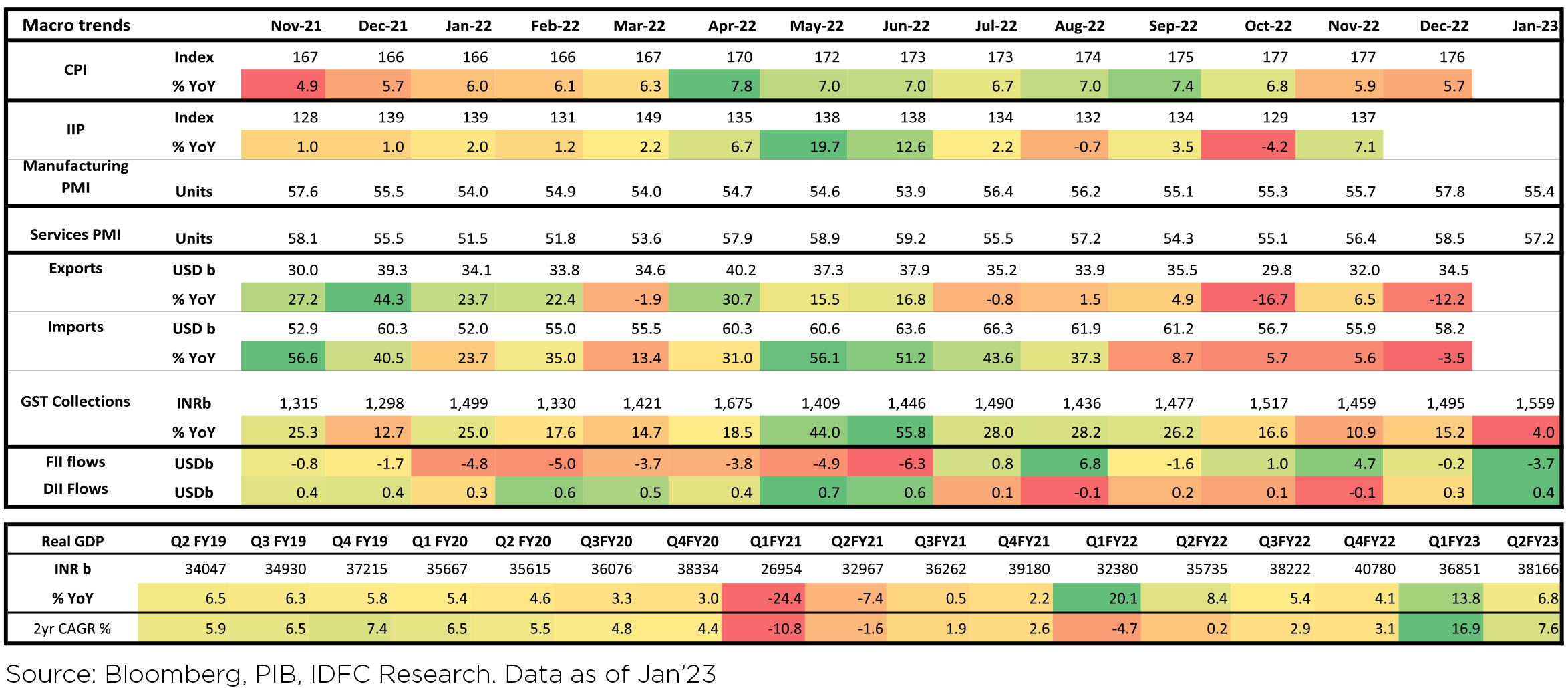

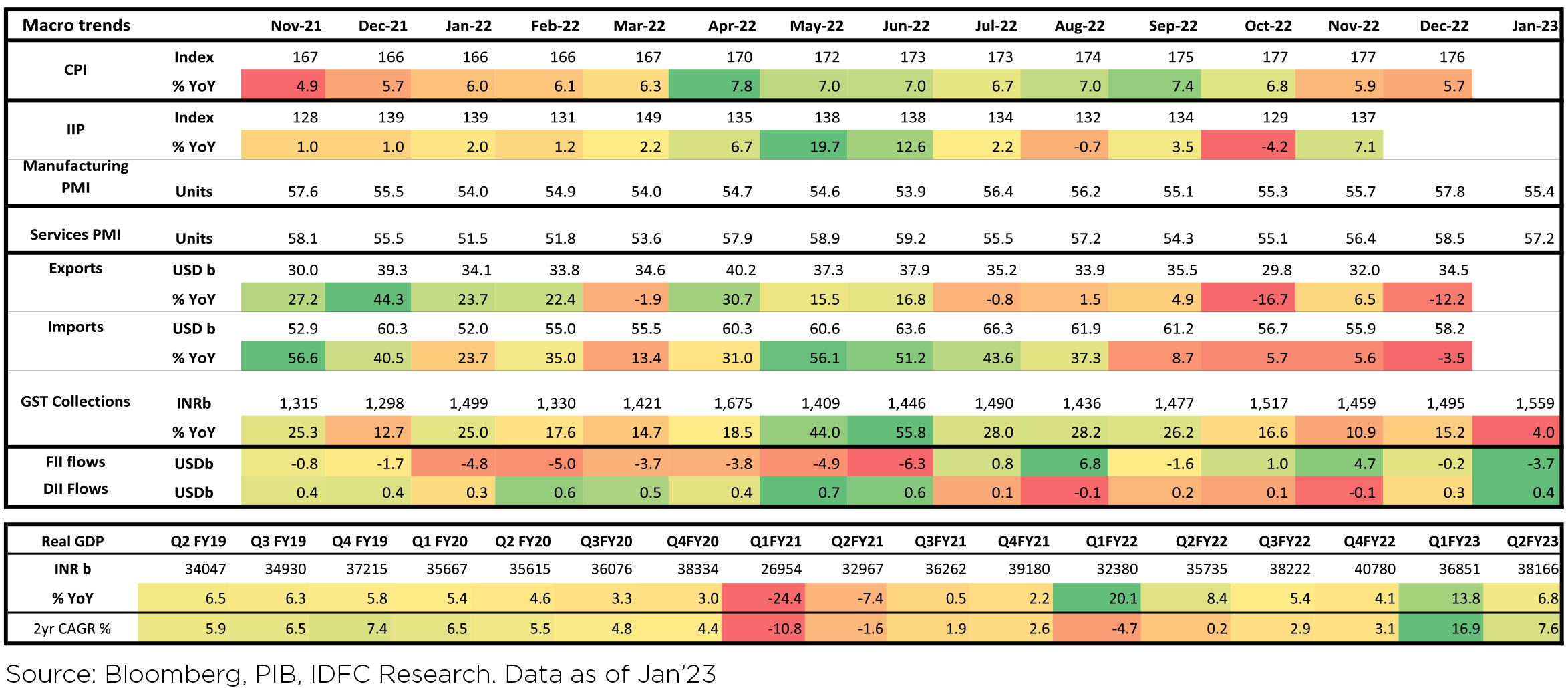

• December CPI came in at 5.72%, continuing its softening momentum. WPI softened to a 22-month low of 4.95% in December (v/s +5.85% YoY in November).

• November's industrial production improved (+7.1% YoY).

• India's FX reserves came in at $573bn. FX reserves have improved by US$10.9bn in the last four weeks.

• PMIs indicate sturdy sequential momentum in both manufacturing and services though there is a slight dip versus the previous month. Services firms indicate robust growth in new business, which is resulting in capacity issues, but this is not yet transforming into inflation concerns with prices charged rising at a slower pace.

• December trade deficit held steady at USD 23.8 bn (vs. USD 23.4 bn in November). FY23RE fiscal deficit was maintained at 6.4% of GDP while FY24BE fiscal deficit is estimated at 5.9% of GDP. The Finance minister reiterated their commitment to consolidation, with a Fiscal deficit below 4.5% of GDP by FY26.

• GST collections continued to be steady, with December collections at Rs. 1.56 bn growing at 4%.

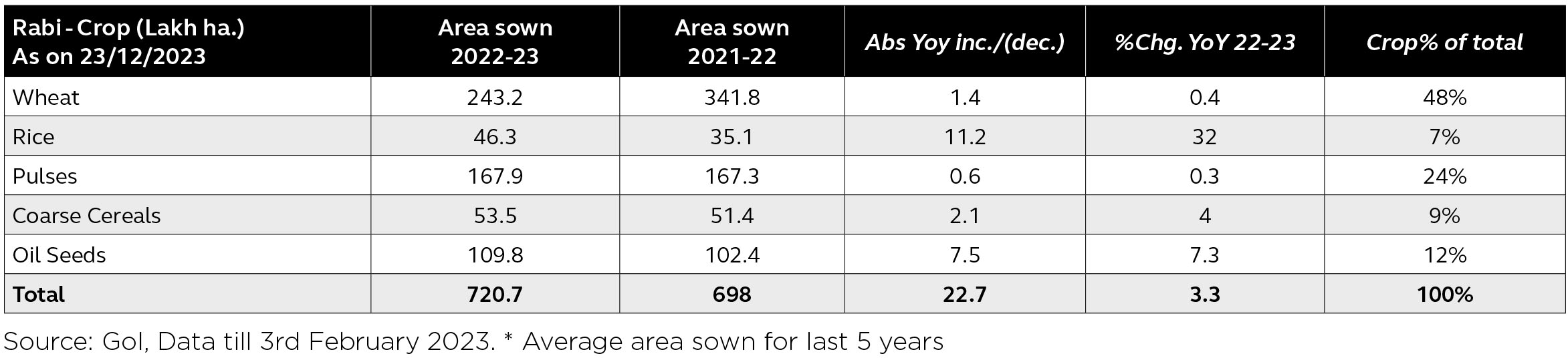

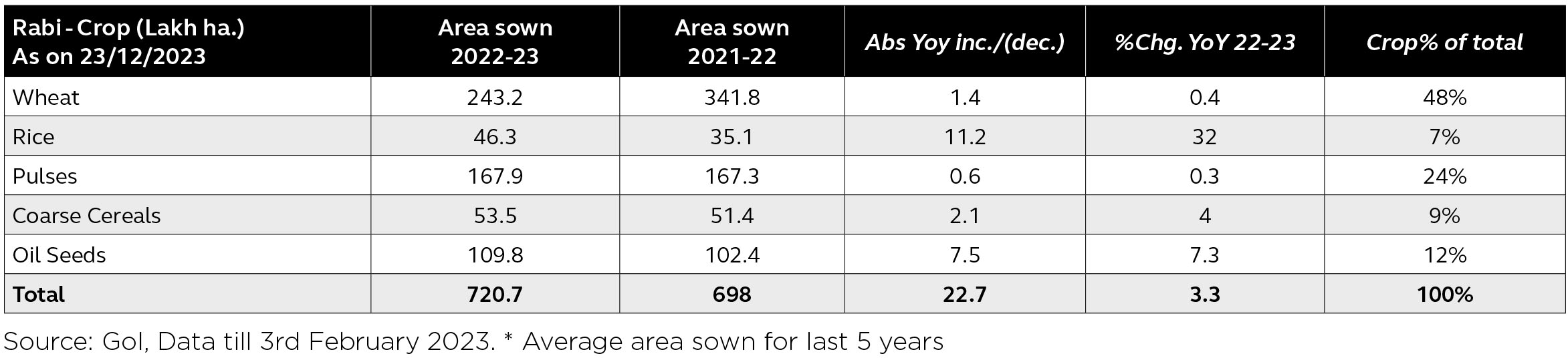

• As per the recently published data by the Ministry of Agriculture & Farmer Welfare, Overall sowing stands at 720.7 Lacs Hr, up by 3.3% YoY.

• FIIs continued their selling momentum in January (-$3.7bn, following -$0.2bn in December). DIIs saw buying of $ 0.4bn in January, keeping on trend with the previous month (+$ 0.3 bn).

Domestic Markets

Mid-caps (-2.1% MoM) and small caps (-2.2% MoM) though weak, outperformed the large caps (-2.7% MoM).

Sector performance was a mixed bag as NIFTY ended the month in red near 17,600 levels declining -2.4% MoM. Auto and IT sector were the positive drivers of performance for the month, however, the major drags were Oil & Gas and Utilities sector.

INR appreciated by 1% MoM, reaching ~81.92/USD in January with the weakening in Greenback (USD). The DXY (Dollar Index) weakened 1.4% over the month, which augurs well for flows into EMs. Oil prices declined by ~2% over January. Benchmark 10-year treasury yields averaged at 7.34% in January (5bps higher viz-a-viz. December average). On month-end values, the 10Y yield was up and ended the month at 7.34%.

Macro concerns easing:

• December CPI came in at 5.72%, continuing its softening momentum. WPI softened to a 22-month low of 4.95% in December (v/s +5.85% YoY in November).

• November's industrial production improved (+7.1% YoY).

• India's FX reserves came in at $573bn. FX reserves have improved by US$10.9bn in the last four weeks.

• PMIs indicate sturdy sequential momentum in both manufacturing and services though there is a slight dip versus the previous month. Services firms indicate robust growth in new business, which is resulting in capacity issues, but this is not yet transforming into inflation concerns with prices charged rising at a slower pace.

• December trade deficit held steady at USD 23.8 bn (vs. USD 23.4 bn in November). FY23RE fiscal deficit was maintained at 6.4% of GDP while FY24BE fiscal deficit is estimated at 5.9% of GDP. The Finance minister reiterated their commitment to consolidation, with a Fiscal deficit below 4.5% of GDP by FY26.

• GST collections continued to be steady, with December collections at Rs. 1.56 bn growing at 4%.

• As per the recently published data by the Ministry of Agriculture & Farmer Welfare, Overall sowing stands at 720.7 Lacs Hr, up by 3.3% YoY.

• FIIs continued their selling momentum in January (-$3.7bn, following -$0.2bn in December). DIIs saw buying of $ 0.4bn in January, keeping on trend with the previous month (+$ 0.3 bn).

Market Performance

Outlook

The Union Budget 2023 was presented amidst high expectations since this was the last full budget before the 2024 General Elections. However, the government did not give in to these expectations and continued with its investment-led spending growth strategy along with modest fiscal consolidation. The budget emphasized on improving macroeconomic stability, adherence to the fiscal deficit glide path and push toward growth. This was despite a robust increase in capital expenditure and conservative revenue projections. The budget had something for everyone! Direct tax benefit to individuals - which would give an impetus to consumer spending; no significant change in capital gains tax structure - offering stability for markets; Focus on supporting local manufacturing sector through custom duty changes. Overall, it was a relief to see the government resisting populist pressures and that has been cheered by the market.

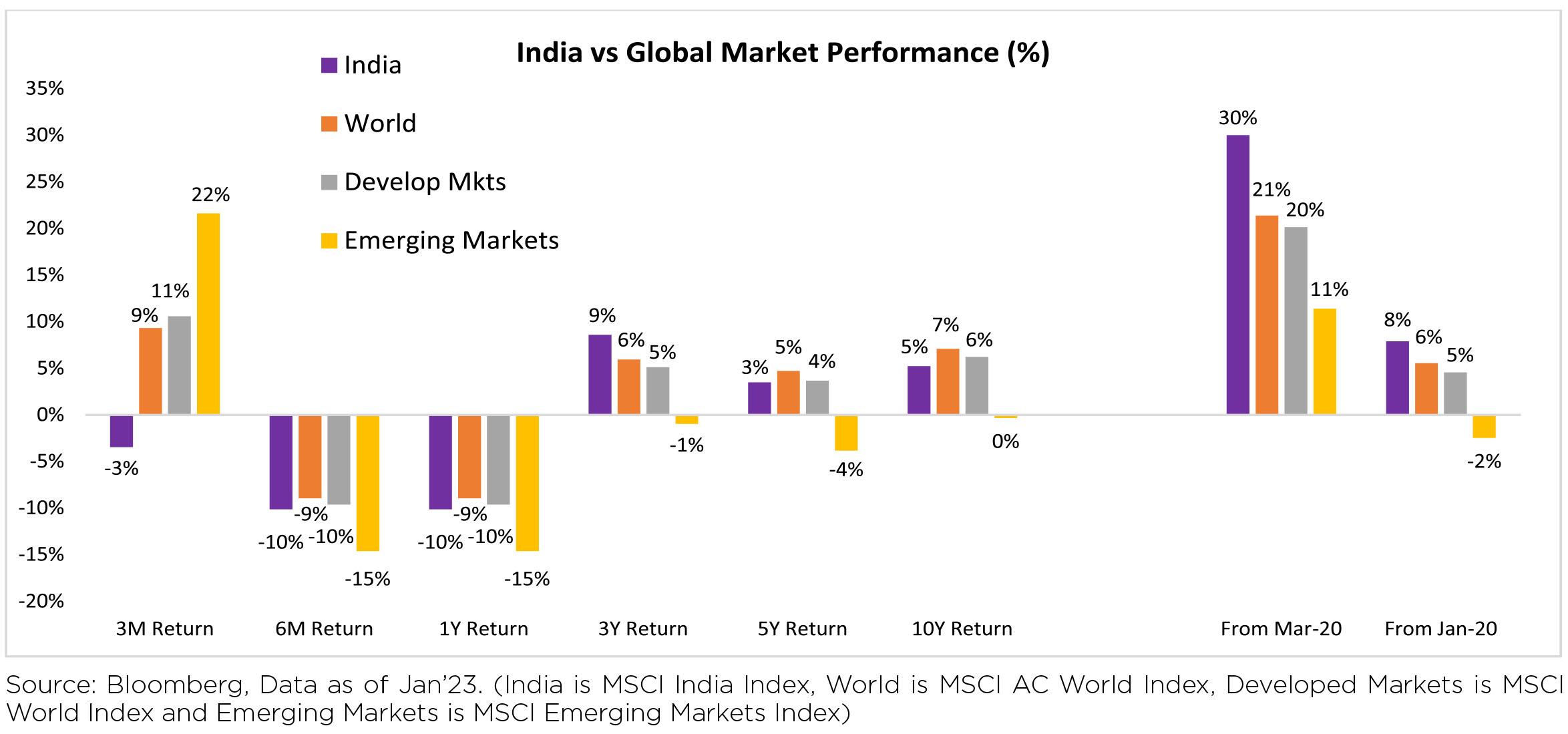

After outperforming the other emerging markets handsomely in the Calendar year 2022, the Indian market has lagged recently in the last three months. It is trailing the emerging market index by ~25%. Emerging markets have bounced back after a tough CY 2022 on the prospects of growth revival in China as it opens up post COVID along with the optimism that the worst of the inflation scare is behind us, and hence monetary policy globally will gradually ease.

On one hand, India is faced with challenges of slightly above-average valuations and higher interest rates globally. On the other hand, there is relatively higher earnings visibility in India compared to most other markets. The currency has underperformed in the last few months making it more attractive given that the long-term growth prospects of the economy are bright. Overall, we feel that the market offers steady returns for the long-term investor at this point.

Note: The above graphs are for representation purposes only and should not be used for the development or implementation of an investment strategy. Past performance may or may not be sustained in the future.

India's union budget, presented last week, estimates nominal growth in FY24 to be 10.5%, a tad above market

expectations. It envisages a path of fiscal consolidation (fiscal deficit budgeted to fall to 5.9% of GDP in FY24

from 6.4% in FY23), continued its focus on capex (on-budget capex at Rs. 10tn in FY24 after Rs. 7.3tn in FY23)

and budgeted revenue estimates not as conservatively as last year and possibly towards the upper end of likely

outcomes. Although overall public sector deficit has been consolidating quite fast, also due to states' deficit turning

out to be well lower recently, total (centre plus states) borrowing levels have been rising. On FYTD fiscal data during

April-December of FY23, central government net tax revenue growth was 5.6% y/y while total expenditure grew

11.8%. Fiscal deficit so far is thus 56.6% of FY23 revised estimate vs. 47.9% this time last year. Small savings inflow

during April-December 2022 was lower than that during the same period of last year and needs to be ~Rs. 79,000cr

higher during the remaining fiscal year (vs. last year). GST collection remained strong at Rs. 1.56 lakh crore and 12.7%

y/y during January.

Consumer Price Index (CPI) inflation in India moved lower to 5.7% y/y in December, after 5.9% in November and 6.8% in October, as momentum in food prices turned negative due to the fall in vegetable prices. Core inflation (CPI excluding food and beverages, fuel and light) stayed high and sticky at 6.1% in December and has averaged the same till date from April 2022, after 6% in FY22. Real time prices of vegetables continue to ease sequentially, albeit at a slower pace, while that of cereals continue to move up although the recently commenced open market sale of wheat by the Food Corporation of India (FCI) should help.

Industrial production (IP) growth was 7.1% y/y in November after -4.2% in October. On a seasonally adjusted monthon- month basis, it was +6.7% in November after -4.7% in October, likely also due to a rebound from the reduced number of working days in October due to festivals. Output momentum turned positive in all categories of goods produced. Infrastructure Industries output (40% weight in IP) continued to be strong in December, registering a +2.7% m/m seasonally adjusted momentum, after +2.8% in November.

Bank credit outstanding as on 13th January was up 16.5% y/y and has averaged 14.6% since April 2022 (up from 8% during January-March), partly also due to higher inflation and thus higher demand for working capital. Bank deposit growth moved up to 10.6% from 9.2% at end of December. Credit flow till date during the financial year has been much higher, than in the previous two financial years, with strong flows to personal loans (39% of total flow) and services (34% of total flow).

Merchandise trade deficit increased marginally to USD 23.8bn in December from USD 23.4bn in November, but has moved down from USD 29.2bn in September. In December, oil exports moderated sequentially while nonoil exports increased for the second month after moderating for four months. While oil imports also continue to moderate, non-oil-non-gold imports picked up after easing for two months. Trade deficit has averaged USD 22.3bn since September 2021 vs. USD 10.8bn during April-August 2021. During the same periods, non-oil-non-gold imports picked up to an average of USD 38.6bn vs. USD 29.3bn.

Among higher-frequency variables, number of two-wheelers registered picked up sharply from October (likely also festive season effect) but eased thereafter. However, this has improved a bit in January. Energy consumption level picked up from November and is above previous year levels. Monthly number of GST e-way bills generated continues to remain strong, at 8.4cr units in December. It averaged 7.9cr in the September quarter and 8.1cr in the December quarter.

US headline CPI was at 6.5% y/y in December after 7.1% in November, driven mainly by softer inflation in energy, durable goods and some parts of services. House rent increased and continued to stay strong. Core CPI was at 5.7% in December after 6% in November. US non-farm payroll addition in January (517,000 persons) was a very strong surprise vs. expectations after December (260,000 persons). Unemployment rate eased further to a low of 3.4% and Labour Force Participation Rate inched up. Sequential growth in average hourly earnings was at 0.3% in January after 0.4% in November. Non-farm job openings as per the Job Openings and Labor Turnover Survey (JOLTS) increased by 0.6mn in December after moving down mildly in the previous two months. All this points to a strong US labour market. The FOMC (Federal Open Market Committee) raised the target range for the federal funds rate, by 25 bps on 01st February and a total of 450bps since 2022, to the 4.50-4.75% range. The FOMC meeting statement said inflation has eased somewhat but remains elevated. The Fed Governor in his interaction after the FOMC meeting said the focus is not on short-term moves in financial conditions (which have eased recently) but on sustained changes, that it expects to see disinflation in core-services-ex-housing, although he pushed back on likely rate cuts in 2023.

The European Central Bank's Governing Council, in its monetary policy decision on 01st February, raised all the three key interest rates by 50bps, a total of 300bps so far in this cycle. It said it will stay the course in raising rates significantly at a steady pace and in keeping it at levels that are sufficiently restrictive to ensure a timely return of inflation to 2%. It also said it intends to raise rates by another 50bps in March (unless there is some extreme scenario) after which it will then evaluate the subsequent path. Recent commentary from various ECB Governing Council members continue to be about the need to tame inflation through further rate hikes, even at the cost of low growth.

The MPC hiked repo rate by 25 bps to 6.50% as was widely expected. It did so with a 4 : 2 vote, also widely expected. The stance was retained at 'withdrawal of accommodation' which, though within the realm of expectations, was nevertheless a touch disappointing for the market given that on literal reading it keeps the rate hike cycle still in play. The fall in food prices was acknowledged but the stickiness in core inflation was flagged, again very consistent with recent RBI communication.

Outlook

We retain our view that RBI growth forecast is somewhat optimistic and we currently lean towards expecting around 100 bps or thereabouts undershoot to the 6.4% growth forecasted by RBI for FY24. If we are right in this then core inflation pressures should also start to abate over the year ahead, assuming no further meaningful supply shocks / rigidities.

Our view is that RBI will move to neutral stance in the April policy. The real rate will progressively increase without further change in nominal policy rates since projected inflation continues to fall. The more important point is around liquidity. While the Governor has referred to the drain from the upcoming scheduled redemption of LTRO and TLTRO funds, an even bigger drain will be on account of seasonal currency in circulation rise between now and early May. This could be of the order of INR 2 lakh crores. Even assuming some modest inflows on forex, this will still take core liquidity close to neutral by early May. This will likely meet the other condition on liquidity for turning stance to neutral. The modest but continuous OMO sales in secondary market are somewhat bewildering if one sees the future core liquidity forecast. If at all, the question will likely soon move to when to expect permanent liquidity infusion from RBI.

While initially disappointing for the bond market, the policy does nothing to change our view that policy rate has peaked in India. If anything some back up in yields may provide a welcome opportunity to continue allocating to quality fixed income. The broader narrative, in our view, is that worst of the pressures on our current account deficit and inflation that emanated from the commodity shock seem to be behind us. Global bond volatility has largely stabilised, or at least is now following tradeable ranges, reflecting terminal policy rate expectations stabilising in most major markets. India's policy cycle has peaked but (as an example) 4 year government bond yield is still almost 75 bps over this peak, at the time of writing. Further real yields are now positive across all tenors assuming a reasonable expected inflation in the future. Finally, given the relative flatness of the yield curve and low credit spreads, investors don't have to take either too much of duration or credit risk in building fixed income allocations.

We reiterate our overweight stance on 3 - 6 year government bonds for medium term investments. For shorter horizons of 6 - 9 months onwards, quality money market rates have also repriced significantly thereby making money market / ultra short / low duration funds investable for these time horizons.

Consumer Price Index (CPI) inflation in India moved lower to 5.7% y/y in December, after 5.9% in November and 6.8% in October, as momentum in food prices turned negative due to the fall in vegetable prices. Core inflation (CPI excluding food and beverages, fuel and light) stayed high and sticky at 6.1% in December and has averaged the same till date from April 2022, after 6% in FY22. Real time prices of vegetables continue to ease sequentially, albeit at a slower pace, while that of cereals continue to move up although the recently commenced open market sale of wheat by the Food Corporation of India (FCI) should help.

Industrial production (IP) growth was 7.1% y/y in November after -4.2% in October. On a seasonally adjusted monthon- month basis, it was +6.7% in November after -4.7% in October, likely also due to a rebound from the reduced number of working days in October due to festivals. Output momentum turned positive in all categories of goods produced. Infrastructure Industries output (40% weight in IP) continued to be strong in December, registering a +2.7% m/m seasonally adjusted momentum, after +2.8% in November.

Bank credit outstanding as on 13th January was up 16.5% y/y and has averaged 14.6% since April 2022 (up from 8% during January-March), partly also due to higher inflation and thus higher demand for working capital. Bank deposit growth moved up to 10.6% from 9.2% at end of December. Credit flow till date during the financial year has been much higher, than in the previous two financial years, with strong flows to personal loans (39% of total flow) and services (34% of total flow).

Merchandise trade deficit increased marginally to USD 23.8bn in December from USD 23.4bn in November, but has moved down from USD 29.2bn in September. In December, oil exports moderated sequentially while nonoil exports increased for the second month after moderating for four months. While oil imports also continue to moderate, non-oil-non-gold imports picked up after easing for two months. Trade deficit has averaged USD 22.3bn since September 2021 vs. USD 10.8bn during April-August 2021. During the same periods, non-oil-non-gold imports picked up to an average of USD 38.6bn vs. USD 29.3bn.

Among higher-frequency variables, number of two-wheelers registered picked up sharply from October (likely also festive season effect) but eased thereafter. However, this has improved a bit in January. Energy consumption level picked up from November and is above previous year levels. Monthly number of GST e-way bills generated continues to remain strong, at 8.4cr units in December. It averaged 7.9cr in the September quarter and 8.1cr in the December quarter.

US headline CPI was at 6.5% y/y in December after 7.1% in November, driven mainly by softer inflation in energy, durable goods and some parts of services. House rent increased and continued to stay strong. Core CPI was at 5.7% in December after 6% in November. US non-farm payroll addition in January (517,000 persons) was a very strong surprise vs. expectations after December (260,000 persons). Unemployment rate eased further to a low of 3.4% and Labour Force Participation Rate inched up. Sequential growth in average hourly earnings was at 0.3% in January after 0.4% in November. Non-farm job openings as per the Job Openings and Labor Turnover Survey (JOLTS) increased by 0.6mn in December after moving down mildly in the previous two months. All this points to a strong US labour market. The FOMC (Federal Open Market Committee) raised the target range for the federal funds rate, by 25 bps on 01st February and a total of 450bps since 2022, to the 4.50-4.75% range. The FOMC meeting statement said inflation has eased somewhat but remains elevated. The Fed Governor in his interaction after the FOMC meeting said the focus is not on short-term moves in financial conditions (which have eased recently) but on sustained changes, that it expects to see disinflation in core-services-ex-housing, although he pushed back on likely rate cuts in 2023.

The European Central Bank's Governing Council, in its monetary policy decision on 01st February, raised all the three key interest rates by 50bps, a total of 300bps so far in this cycle. It said it will stay the course in raising rates significantly at a steady pace and in keeping it at levels that are sufficiently restrictive to ensure a timely return of inflation to 2%. It also said it intends to raise rates by another 50bps in March (unless there is some extreme scenario) after which it will then evaluate the subsequent path. Recent commentary from various ECB Governing Council members continue to be about the need to tame inflation through further rate hikes, even at the cost of low growth.

The MPC hiked repo rate by 25 bps to 6.50% as was widely expected. It did so with a 4 : 2 vote, also widely expected. The stance was retained at 'withdrawal of accommodation' which, though within the realm of expectations, was nevertheless a touch disappointing for the market given that on literal reading it keeps the rate hike cycle still in play. The fall in food prices was acknowledged but the stickiness in core inflation was flagged, again very consistent with recent RBI communication.

Outlook

We retain our view that RBI growth forecast is somewhat optimistic and we currently lean towards expecting around 100 bps or thereabouts undershoot to the 6.4% growth forecasted by RBI for FY24. If we are right in this then core inflation pressures should also start to abate over the year ahead, assuming no further meaningful supply shocks / rigidities.

Our view is that RBI will move to neutral stance in the April policy. The real rate will progressively increase without further change in nominal policy rates since projected inflation continues to fall. The more important point is around liquidity. While the Governor has referred to the drain from the upcoming scheduled redemption of LTRO and TLTRO funds, an even bigger drain will be on account of seasonal currency in circulation rise between now and early May. This could be of the order of INR 2 lakh crores. Even assuming some modest inflows on forex, this will still take core liquidity close to neutral by early May. This will likely meet the other condition on liquidity for turning stance to neutral. The modest but continuous OMO sales in secondary market are somewhat bewildering if one sees the future core liquidity forecast. If at all, the question will likely soon move to when to expect permanent liquidity infusion from RBI.

While initially disappointing for the bond market, the policy does nothing to change our view that policy rate has peaked in India. If anything some back up in yields may provide a welcome opportunity to continue allocating to quality fixed income. The broader narrative, in our view, is that worst of the pressures on our current account deficit and inflation that emanated from the commodity shock seem to be behind us. Global bond volatility has largely stabilised, or at least is now following tradeable ranges, reflecting terminal policy rate expectations stabilising in most major markets. India's policy cycle has peaked but (as an example) 4 year government bond yield is still almost 75 bps over this peak, at the time of writing. Further real yields are now positive across all tenors assuming a reasonable expected inflation in the future. Finally, given the relative flatness of the yield curve and low credit spreads, investors don't have to take either too much of duration or credit risk in building fixed income allocations.

We reiterate our overweight stance on 3 - 6 year government bonds for medium term investments. For shorter horizons of 6 - 9 months onwards, quality money market rates have also repriced significantly thereby making money market / ultra short / low duration funds investable for these time horizons.