Commentary

Global Markets

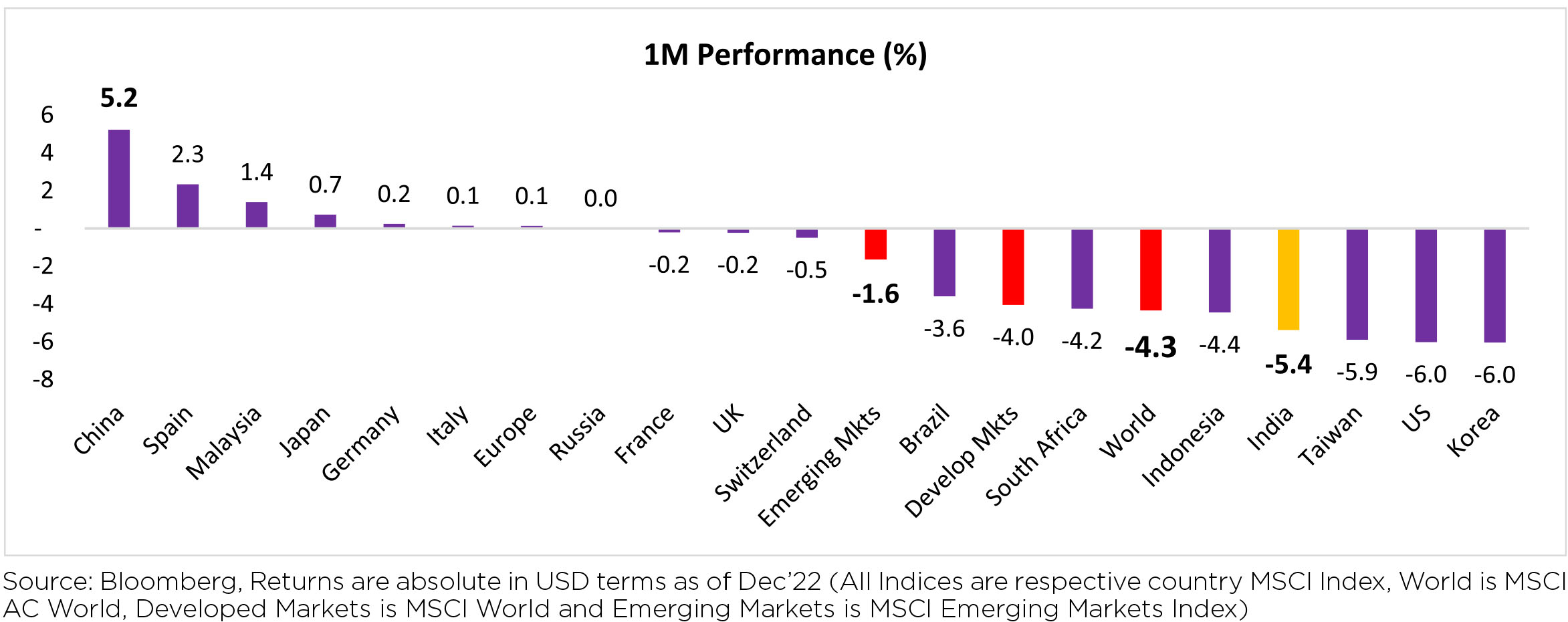

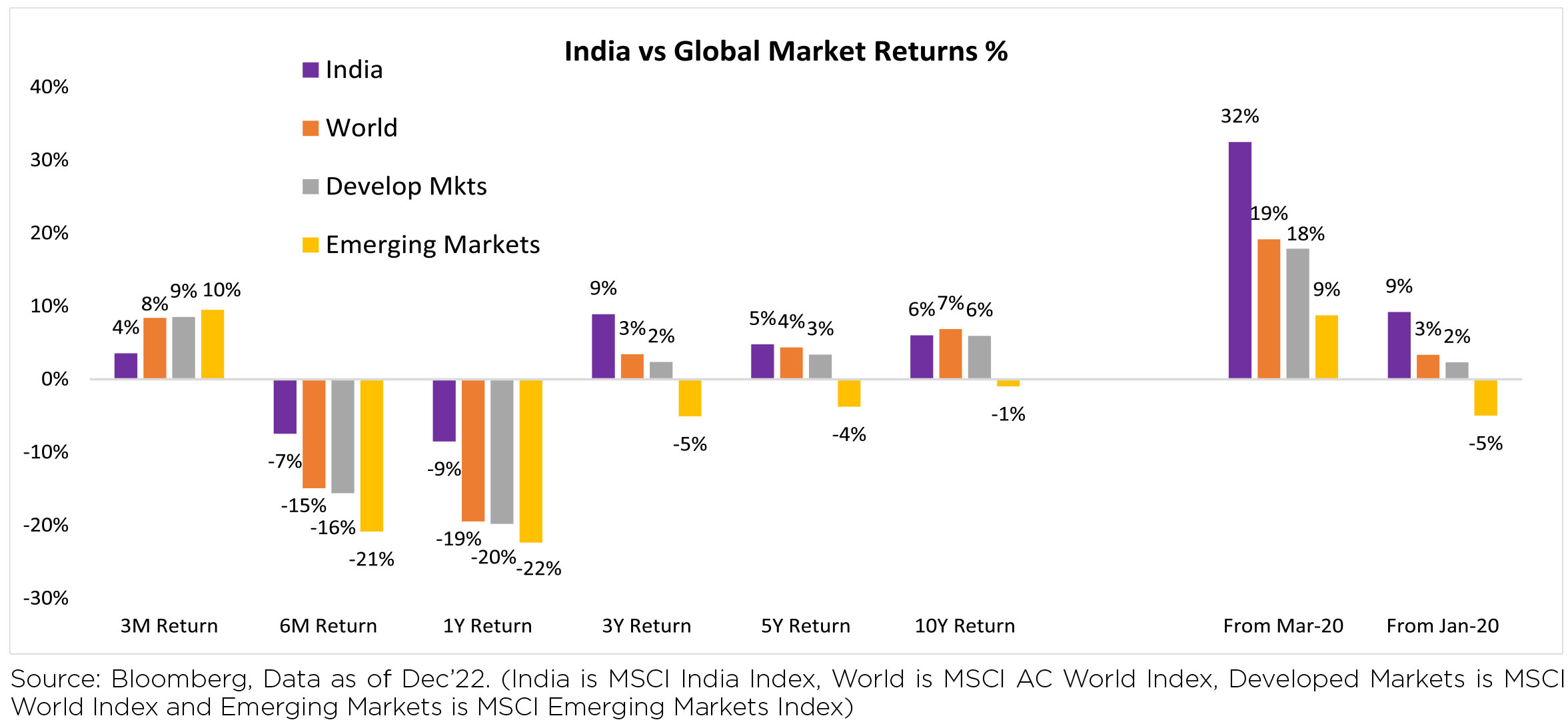

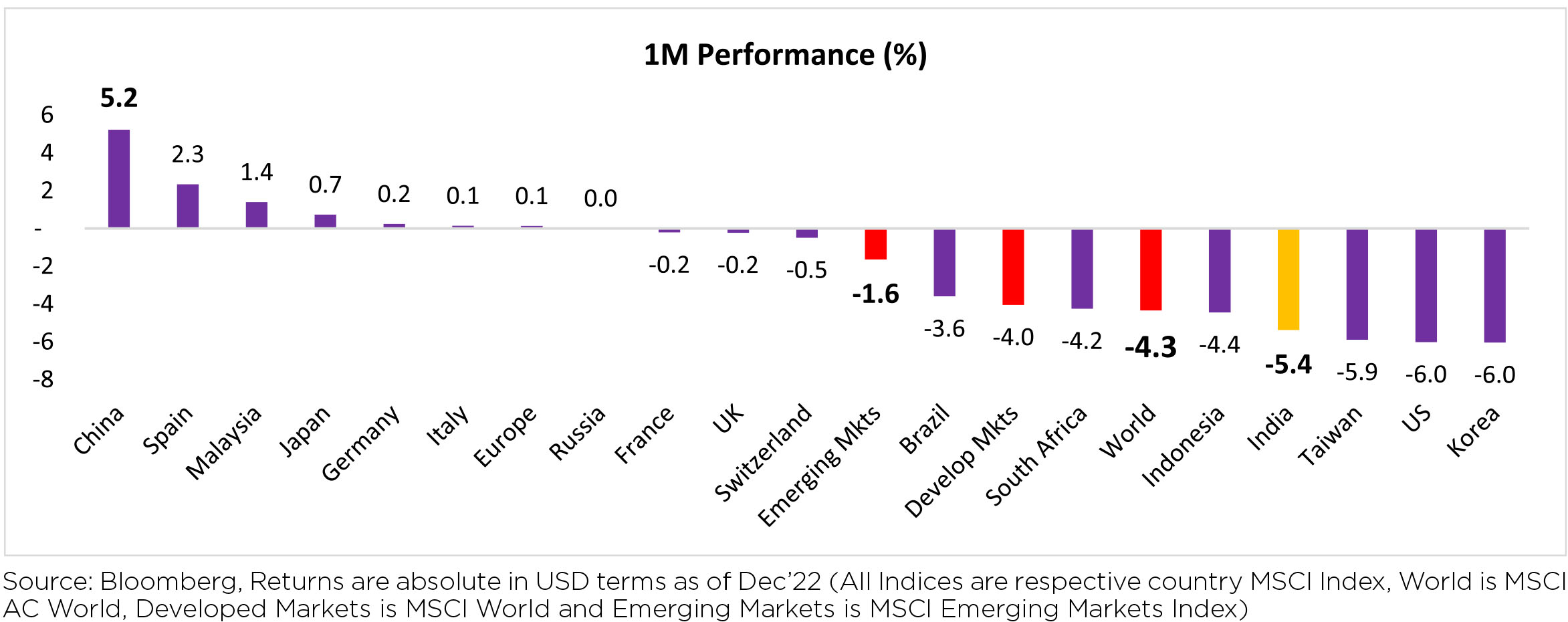

Global equities declined by 4.3% MoM, positive returns from China, Spain, Malaysia and Japan were not

sufficient to cushion downturn. Emerging markets lost 1.6% MoM while India underperformed with a

decline of 5.4% MoM after touching all time high, due to stretched valuations, covid fears returning,

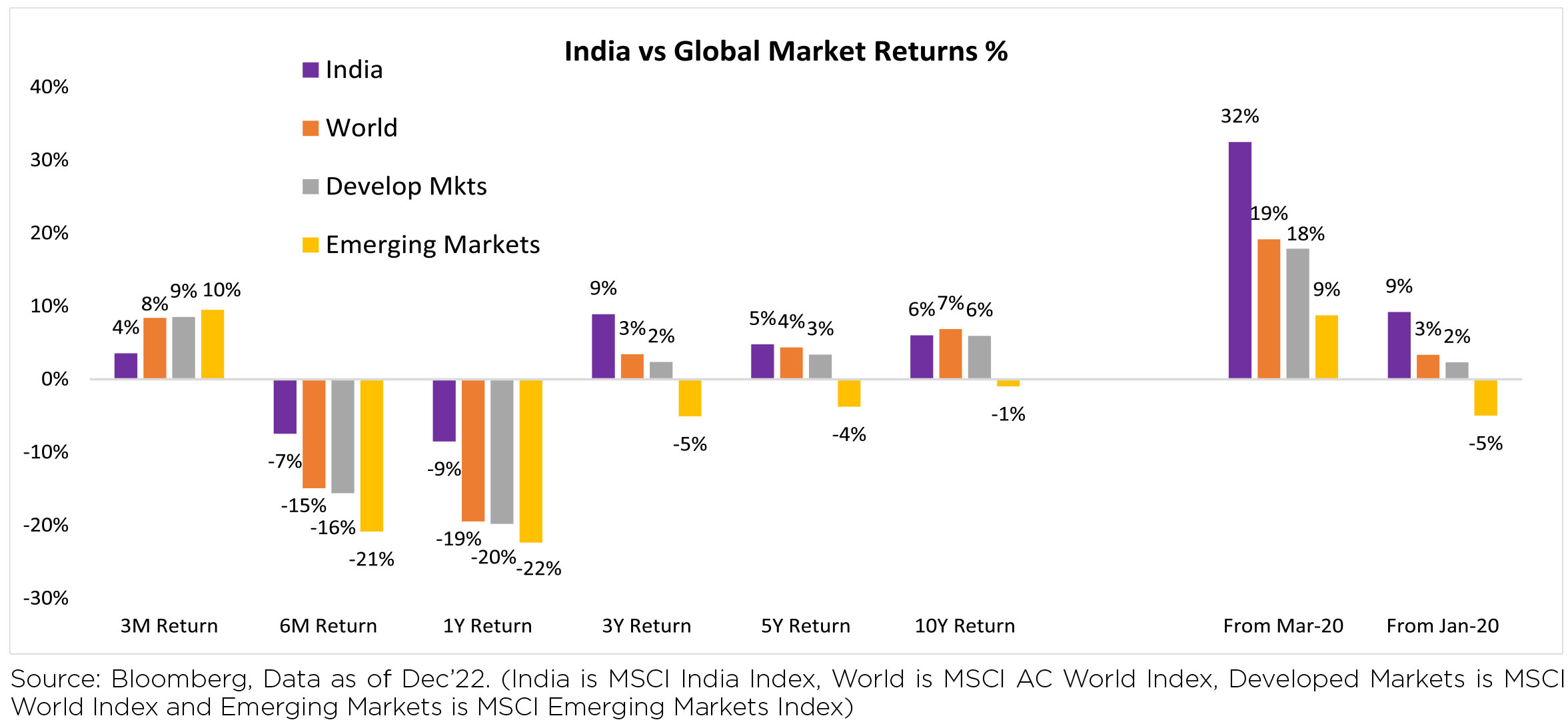

persisting Central Banks' hawkish stance, and FII outflows. However, India has outperformed on 6 month,

1 year and 3 year basis by a decent margin. Indian markets closed the year in red in USD terms, however

In local currency Indian markets were slightly in green.

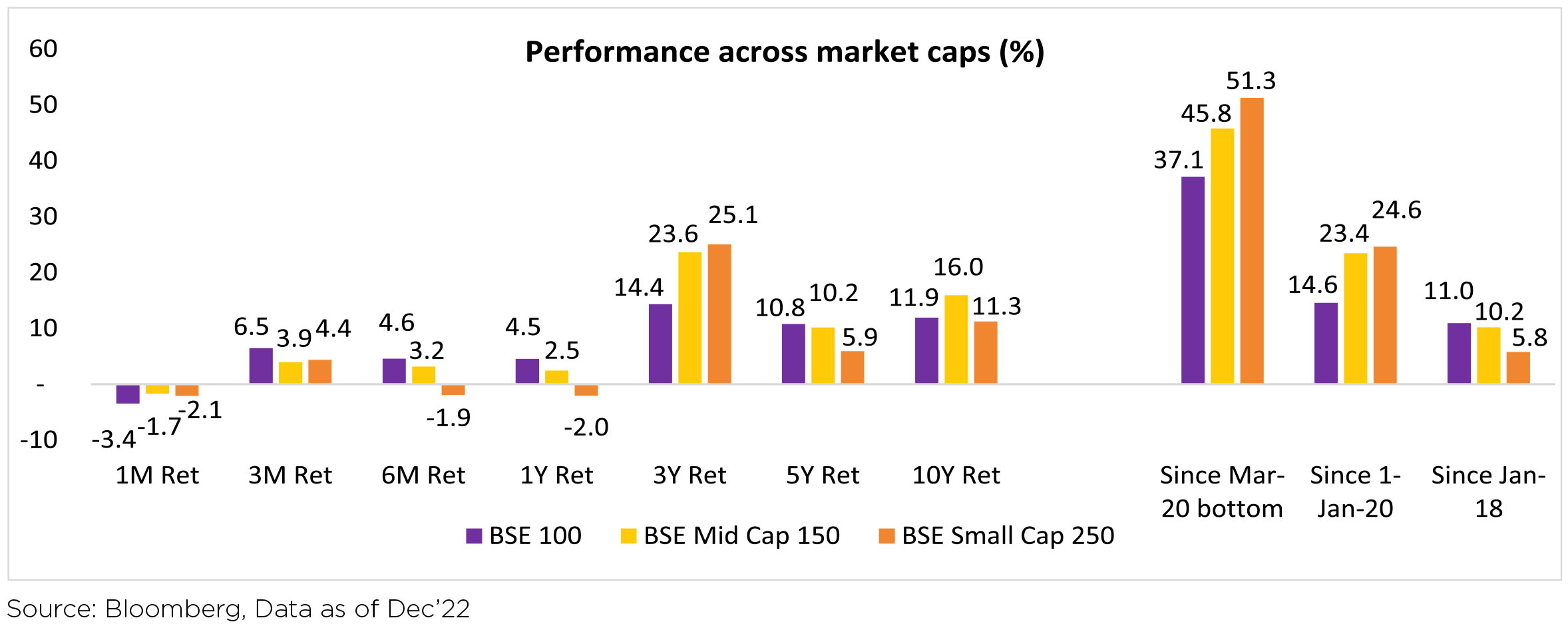

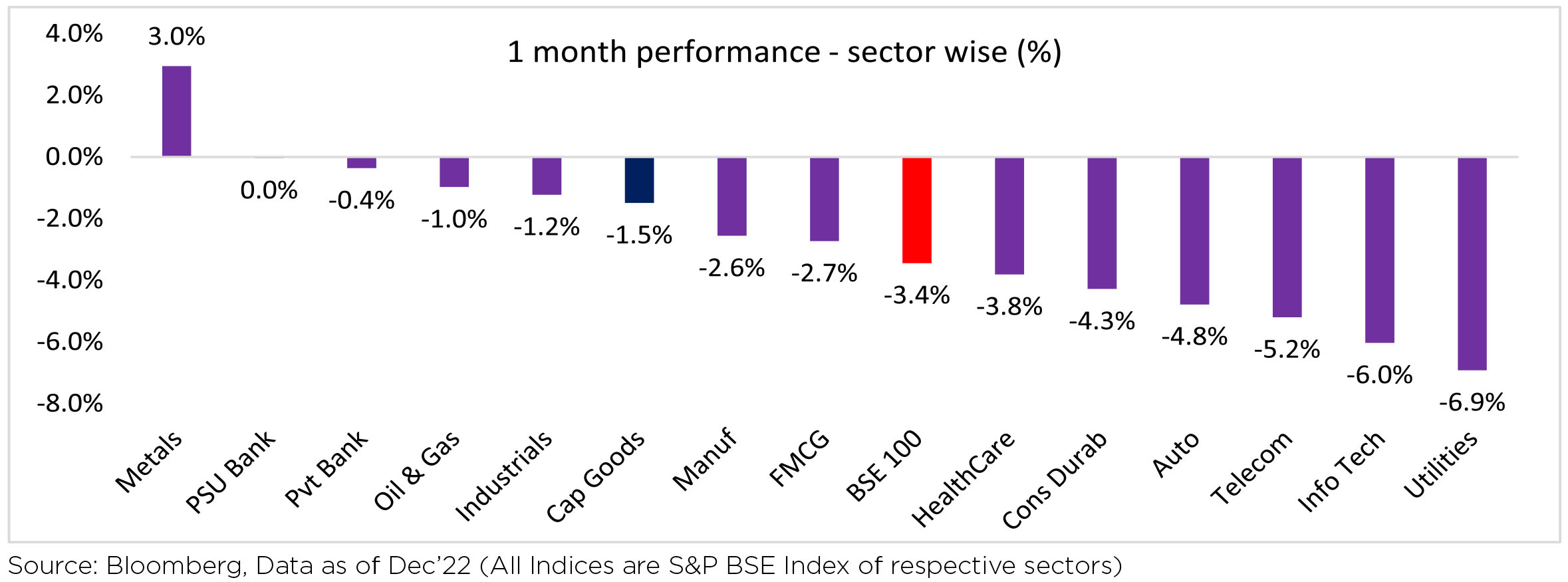

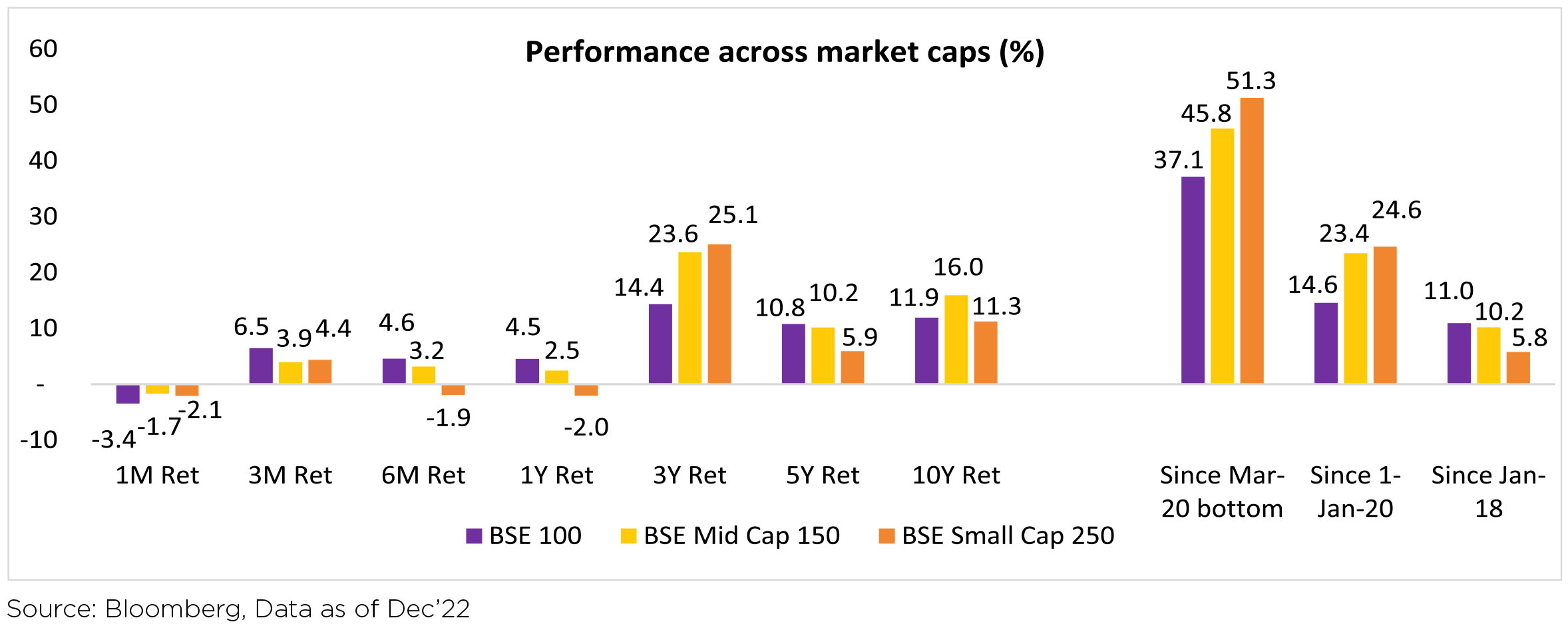

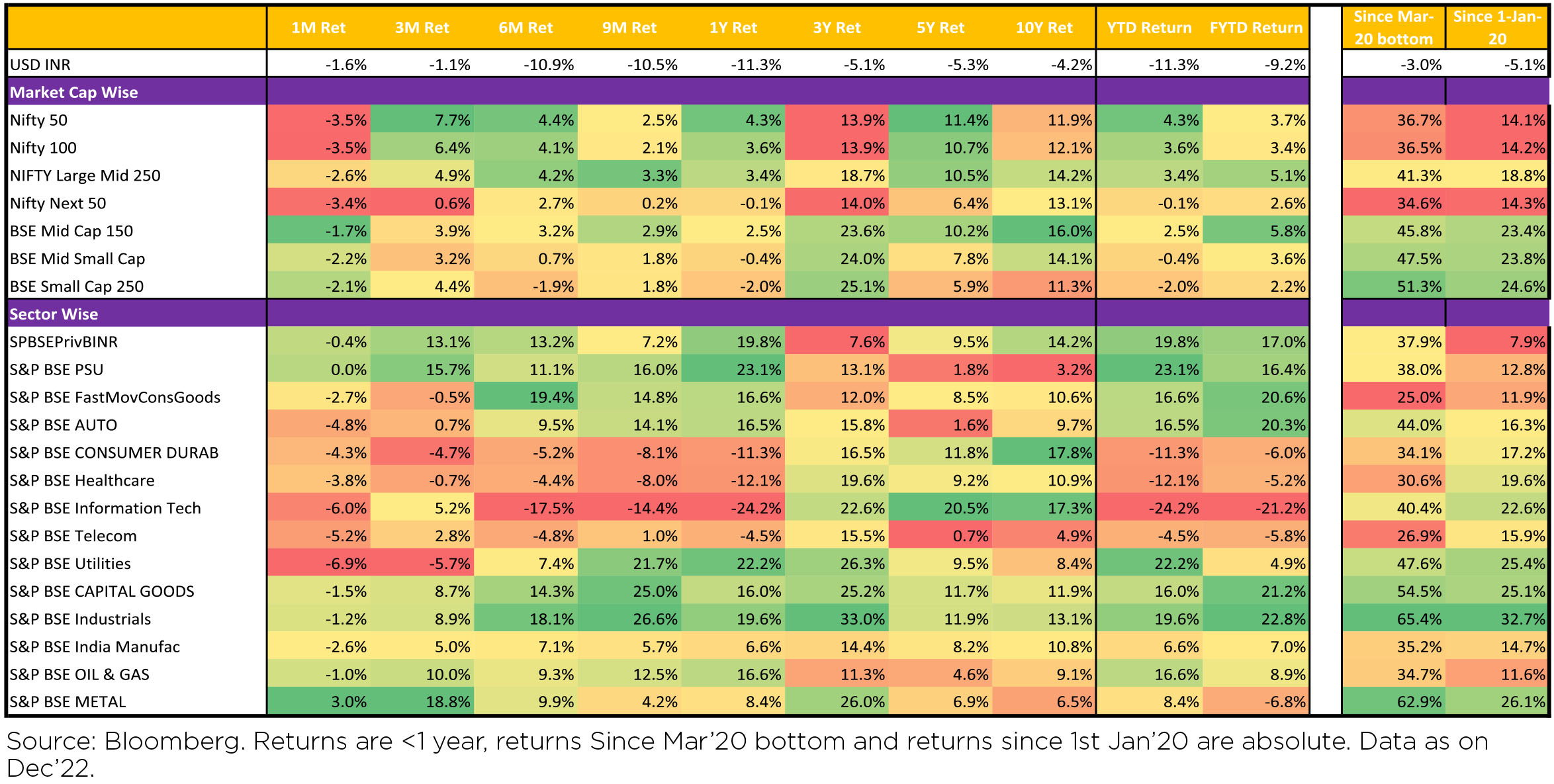

The Indian stock market delivered 4.3% returns in CY 2022 in INR terms however falling 5.1% in USD

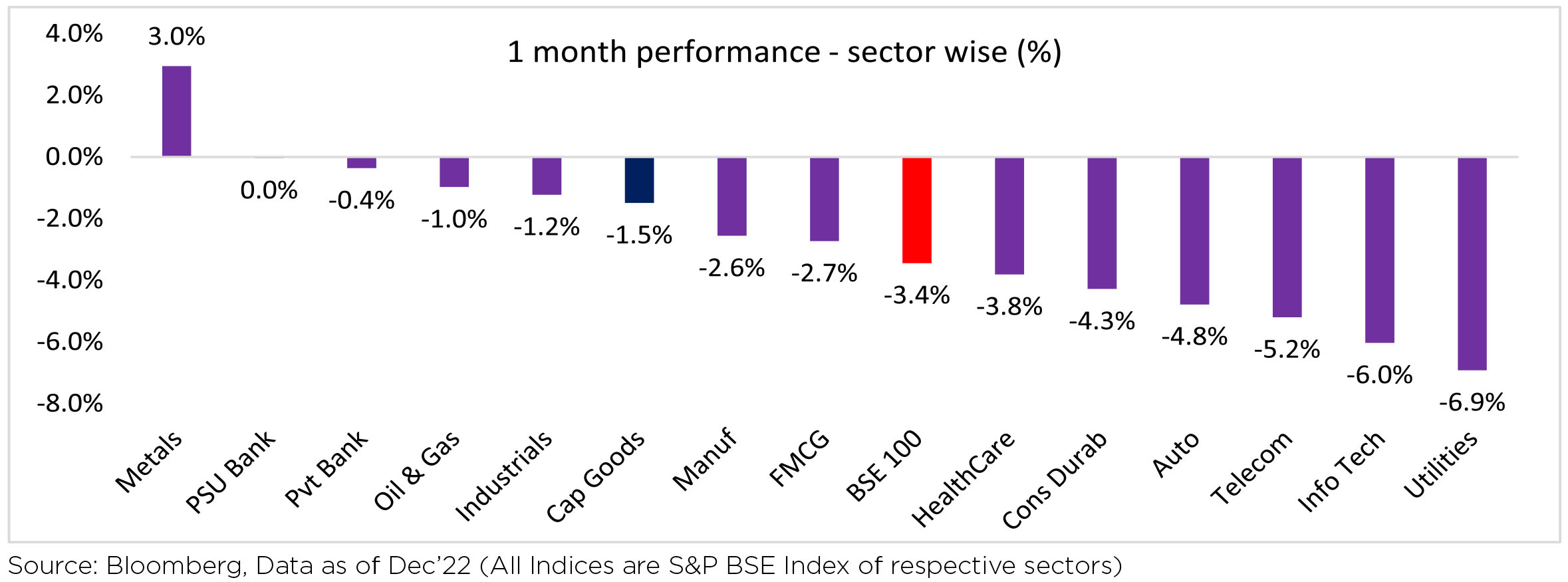

terms. PSUs, Financials, Utilities and Industrials outperformed the market, while IT Services, healthcare

and consumer durables underperformed the market. Large caps (BSE 100) did better than the mid-caps

(BSE 150 Mid Cap) while small-caps (BSE 250 Small Cap) ended the CY2022 with a negative 2% return.

Performance of both mid-caps (down 1.7% MoM) and small caps (down 2.1% MoM) was negative, though

better than large caps (down 3.5% MoM). INR depreciated by another 1.7% MoM, reaching ~82.74/USD

in December. DXY (Dollar Index) weakened 2.3% over the month, closing the month at 103.5 (from 95.7 a year earlier). Currently, Nifty is trading at 1-year fwd PE of 18.9x. FMCG, Metals and Energy indices are

trading above +1SD; Autos, IT, Realty and Service index above their long-term average.

Macro concerns easing:

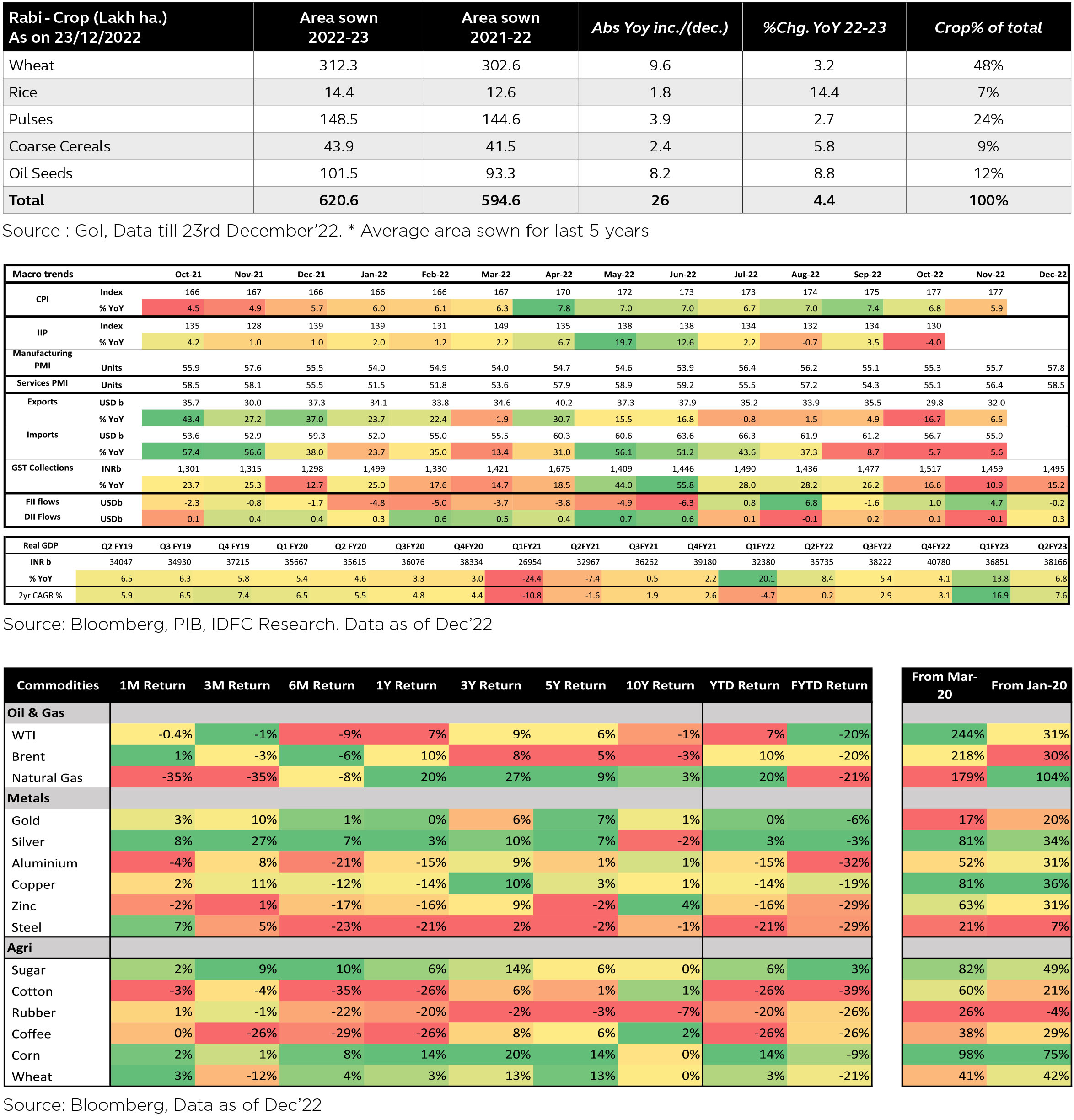

• CPI for Nov, 2022 cooled down to 5.9% YoY led by food price softening. Overall core inflation remained sticky at 6.0% due to rising transportation costs

• December Manufacturing PMI saw robust improvement to 57.8 vs. 55.7 last month led by demand resilience. Manufacturers also saw increase in employment levels and supply chains normalized. Services PMI number were robust at 58.5 viz a viz 56.4 last month.

• Current account deficit increased to 4.4% of the GDP in Q2FY23. Fiscal deficit remained at ~59% of FY23BE. Gross tax revenue in 8M FY23 was at 64.6% of FY2023BE (growth of 15.5%), while expenditure was at 61.9% (growth of 17.7%).

• India's FX reserves have risen US$34bn from recent lows as DXY (Dollar Index) has weakened. Although Public debt to GDP remains high, but govt is working towards bringing it down to manageable levels in the medium term.

• GST collections continued to be steady, with November collections at Rs1.49 tn growing at 15% yoy

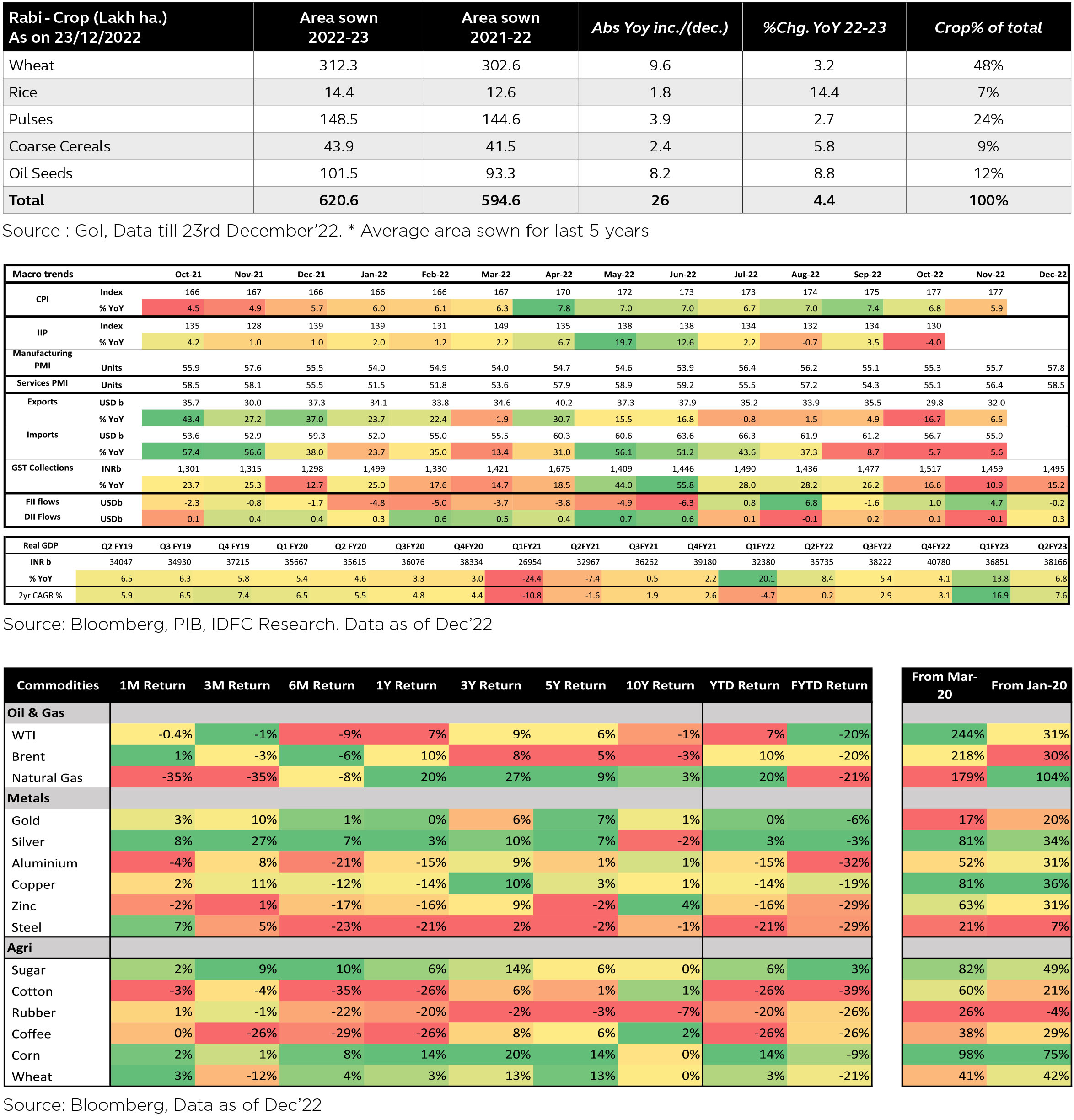

• As per the recently published data by Ministry of Agriculture & Farmer Welfare, Overall sowing stands at 620.6 Lacs Hr, up by 4.4% YoY. Wheat (48% of Rabi Crop) sowing up by 3.2% YoY.

FII flows remained flattish (USD -0.2bn for Dec'22) while DII were buyers of Indian equities (+USD 0.3bn). In CY22, India has seen FII outflows of USD 17bn which was offset by DII buying to a large extent.

Brent Crude prices remained stable (+0.6% MoM) in December, and is up 10.5% in CY2022. Metals prices remained mix. Benchmark 10-year treasury yields closed at 7.3% in December. US 10Y yields are at 3.87%.

Domestic Markets

Macro concerns easing:

• CPI for Nov, 2022 cooled down to 5.9% YoY led by food price softening. Overall core inflation remained sticky at 6.0% due to rising transportation costs

• December Manufacturing PMI saw robust improvement to 57.8 vs. 55.7 last month led by demand resilience. Manufacturers also saw increase in employment levels and supply chains normalized. Services PMI number were robust at 58.5 viz a viz 56.4 last month.

• Current account deficit increased to 4.4% of the GDP in Q2FY23. Fiscal deficit remained at ~59% of FY23BE. Gross tax revenue in 8M FY23 was at 64.6% of FY2023BE (growth of 15.5%), while expenditure was at 61.9% (growth of 17.7%).

• India's FX reserves have risen US$34bn from recent lows as DXY (Dollar Index) has weakened. Although Public debt to GDP remains high, but govt is working towards bringing it down to manageable levels in the medium term.

• GST collections continued to be steady, with November collections at Rs1.49 tn growing at 15% yoy

• As per the recently published data by Ministry of Agriculture & Farmer Welfare, Overall sowing stands at 620.6 Lacs Hr, up by 4.4% YoY. Wheat (48% of Rabi Crop) sowing up by 3.2% YoY.

FII flows remained flattish (USD -0.2bn for Dec'22) while DII were buyers of Indian equities (+USD 0.3bn). In CY22, India has seen FII outflows of USD 17bn which was offset by DII buying to a large extent.

Brent Crude prices remained stable (+0.6% MoM) in December, and is up 10.5% in CY2022. Metals prices remained mix. Benchmark 10-year treasury yields closed at 7.3% in December. US 10Y yields are at 3.87%.

Market Performance

Outlook

After a bumpy 2022, what should investors expect from 2023?

Going ahead, at the global front - trajectory of rate hike by US Fed and the cumulative impact of the rate hikes since 2022 on the economic growth could be the biggest global factor which investors will track and try to predict/forecast. On the geo-political front, the continuing Ukraine/Russia war may impact commodity prices only if it escalates to a higher level. Any resolution, though, could be a sentiment booster. A bigger impact on commodities could be driven by the state of the Chinese economy, which amidst a slowdown faces

the additional challenge of a sharp spurt in Covid -19 related cases. The embattled European economy could slide into a deeper recession if the weight of "oversized" fuel costs does not drop sharply in the coming months. Gas prices today are trading at an equivalent of 2-2.25x current crude oil prices (diesel to generate power would be cheaper than using LNG to generate power in Europe today). Three of our neighboring countries (Bangladesh; Nepal and Sri Lanka) are in different stages of negotiations with World Bank for an economic package to alleviate the post pandemic downturn.

On the domestic macro, the biggest worry remains on the current account deficit - sharp slowdown in exports coupled with higher imports have worsened the current account balance to levels not registered even during the taper tantrum (May-Sept 2013). The comfort of a high FX Reserve of over $600bn at the start of CY22 has been chipped away - import cover now stands at a shade above 9 months, as against a comfortable 12 months at the start of last year. INR has remained relatively unscathed despite US$ strengthening through a major part of Cy 22 - thankfully softening in the last quarter of the year. Despite downgrades, India would still remain the fastest growing "large" economy during Cy23. This could be boosted by benign commodity prices and some revival in exports - the "mythical" China +1, playing out.

Our focus should be on earnings delivery. Surprising to many, yet correct, would be the importance of delivery of earnings growth since Dec '19. While liquidity has been the other pillar on which the market returns have been built upon, earnings growth has been the dominant factor for this uptrend. With valuations at an elevated level - delivery of earnings will be the key driver for the markets ahead. Given the poor track record during Cy 16-20 phase when annual earnings forecast were downgraded each year, confidence in earnings forecast, is not very high. However, given that five sectors (BFSI; Oil & Gas; Autos: IT services and Telecom) are expected to conribute almost 75% of the incremental FY 24 estimated growth of 22% (S&P BSE 200) , it gives us some comfort. Banks, enter Cy23 in the prime of health and lowest level of NPAs in well over a decade, equally important, provisioning across the spectrum - Large Private sector; Small Private sector; large PSU and Small PSU banks is well over 65% gives further cushion to any future pile up of bad loans. Coupled with improving credit demand, banks should report strong quarterly numbers, at least for 1st three quarters of Cy23. Oil & Gas is a "hope" play on normalizing - Diesel "crack/spreads" which have reached an unprecedented level of $30 as against normalized spreads of $12- 16, clearly unsustainable even in the medium term. This will help OMCs earn "normal" marketing margins. Autos should benefit from falling commodity prices and reasonable consumer demand leading to lower selling/discount costs. Also availability of semi-conductor chips has eased thus boosting production and triggering operating leverage. IT services would benefit from reducing cost pressures, even if sales growth is lower than last two years average and stable pricing environment (coupled with international currencies gaining strength against US$) and Telecom should benefit from tariff revision and conversion from 2G to 4G/5G. The Indian corporate sector in 2022 has emerged as much stronger as compared to 2017 or 2018. This crucial difference gives us confidence that earnings forecast for Cy23 should not register sharp downgrades as had been the case in the past.

While global factors are important, delivery of earnings, to us remains paramount. Ceteris paribus, all things remaining the same, market returns would be positive, if earnings get delivered!

Note: The above graph is for representation purposes only and should not be used for the development or implementation of an investment strategy. Past performance may or may not be sustained in the future.

Delusion: A Year In Macros and Bonds

"I know delusion when I see it in the mirror"

-Taylor Swift

Before naming our year end piece around this anchor word, we went back to see the exact dictionary meaning of 'delusion'. We found this: "a false belief or opinion about yourself or your situation". Encouraged thus that we couldn't find anything better to describe what went on over 2022, we have proceeded to put pen to paper.

At the start, however, one must admit to not being entirely unsympathetic towards someone being accused of being deluded. After all so long as they weren't doing anyone any harm, and the state of delusion served to keep them relatively happy, who are we to judge that an alternate state of being may have proved to be better? Also, who is to say who is in delusion and who is not but with the benefit of hindsight; when the evolution of circumstances, the unravelling of the thread as it were, conclusively proves that it were so? Even more, if one considers Bob Dylan's advice to not speak too soon "for the wheel's still in spin" and there's no telling who it is naming, then who is to say that the final reckoning has indeed happened and therefore what is being proclaimed actually is with the benefit of hindsight, and not just a rush to opine, to render verdict, when in fact the game is still not over?

The reader must by now be feeling that, whatever else be the case, the author of this piece is almost certainly delusional. Again, we won't be unsympathetic if this is indeed the conclusion drawn. Though we are often reminded that our prose tends to turn torturous even in our regular investment notes, we reserve the biggest test of the reader's indulgence for these year- end pieces. That said there is a limit to this as well and if, like what is happening with us more and more lately, there is now lesser patience generally with faux intellectualism then we best turn speedily to the matter at hand.

The Delusion of Central Banks

It's easy to forget, but till not very long back the problem in developed markets was too low inflation. Japan had been struggling on this front for ages, Europe seemed to be going that way, and even the US was getting worried along similar lines. The drivers of sub-optimal inflation were deemed to be almost structural in nature. The tightest labour markets in generations had failed to generate any meaningful uptick in wage growth thereby cementing the view. Indeed, the Fed had unveiled an average inflation targeting framework that allowed for inflation to run higher than mandated for a period to compensate for previous episodes for lower than target inflation. In the process, targets would be met on average and inflation expectations would (hopefully) anchor around a point consistent with the 2% target, and not below. Also the Fed would be reactive to inflation rather than proactively trying to anticipate it.

With this backdrop, the Covid shock effectively turned the Fed into a single variable targetter (only employment) since the risk that inflation would return seemed not even worth a thought. Unfortunately this coincided with a super aggressive fiscal expansion with a significant portion of this involving direct cash transfers to people, a shrinkage in labour force, supply side congestions, and finally, a massive supply side shock with the Russia - Ukraine war. A similar story, with some variations, played in other developed markets with unwieldy inflation now almost a consistent theme in many such geographies.

The delusion started cracking sometime late last year, but did not break conclusively till well into the current one. Thus, for example, even though the Fed started to realise that something wasn't quite right with its view of the world, it nevertheless persisted with balance sheet expansion and in the process continued supporting an already overheated housing market, amongst other things. Elsewhere in the world as well, central banks still seemed reluctant to show anything but a planned pivot to tightening till as late as early this year. This was despite concurrent inflation readings running much in excess of targets. Eventually, however, the gravity of the situation sunk in and pretensions that the tightening process could be orderly or that central banks could get inflation back to target while guiding respective economies to a soft landing were conclusively set aside. Instead, as the year turns, shelter is now being sought in the age old truism that inflation control is necessary for sustenance of an economic expansion. Put another way, central banks are now having to defocus attention from near term economic pain that will possibly be inevitable if sufficient dis-inflation is to be achieved to get back to targets over time. They are also having to rely less and less on their powers of forecasting given recent history there, and instead accord more importance to concurrent data. It isn't lost on them that monetary policy acts with 'long and variable lags', and that the level of uncertainty may be especially larger this time given the unprecedented pace of tightening that has been undertaken over such a short span of time. However, given that there is no means to rewind the clock, they are settling for the least undesirable option presented to them currently.

India's case has been somewhat different. The scale of fiscal and monetary stimulus was nowhere as aggressive in the first place. Also, after an initial hesitant start, the unwind process has been largely proactive, especially when one also takes into account the shrinkage in RBI balance sheet (even adjusted for revaluation effects of our forex reserves). Thus while inflation here has proven to be stickier as well, and with the benefit of hindsight would have possibly been better served had we got off emergency levels of accommodation a bit sooner, the extent of deviation is much more modest as compared with developed markets. Also, the policy normalisation cycle itself has well and truly caught up, and with a lag should have the requisite impact on aggregate demand.

The Delusion of Markets

Central bank bashing this year reminds one of a pinata, except that it's unlikely that toys and sweets are waiting to tumble out at the end of the exercise. That is to say, at a macro level the prospect of a soft landing as noted above seems to have got significantly darker for developed markets. The path to a sustained lower inflation profile is via softer wage growth, which in turn requires appreciably higher levels of unemployment than what is the case currently. Even as headline inflation rates will come off significantly, the discussion next year will likely shift to time frame required to sustainably re-attain targets and how long this will require central banks to keep rates at cycle peak levels. Thus demand destruction in goods and housing won't likely be enough even as it pulls down headline inflation. Only percolation into employment and wages may provide the necessary signals on durable inflation fall. This means that there is little chance of a central bank 'put' emerging even when signs of growth destruction get much worse than what is the case currently. With this backdrop we turn to some observations on the markets, specifically the US.

At the time of writing, markets are broadly pricing terminal Fed funds rate at 5% and cuts of approximately 60 - 65 bps over late 2023 into early 2024, and then sharper cuts over the rest of 2024. The US yield curve is deeply inverted, with the 10 year minus 2 year spread broadly the most negative since the early 1980s. Inflation expectations have come off and aren't really portraying any material concerns about the future of inflation. High yield credit spreads on aggregate, though much higher than 2021 lows, are not flashing any great warning and in fact have come off significantly from their mid-year levels. More generally, and sporadic accidents notwithstanding, asset and financing markets are broadly not exhibiting overbearing worries.

A general summary that the above paints, in our interpretation is as follows: Cycle peak in Fed funds rate is much higher than what markets believe the long term neutral is. This is reflected in the shape of the yield curve, with the extent of inversion probably signifying distance of average rates in this cycle (hike, peak, and then cut as denoted by 2 year yield) from the long term neutral (10 year); both adjusted for market dynamics. Markets also believe that the cycle trajectory of Fed funds rate will be enough to curtail inflation (as shown by inflation expectations) while not inflicting an unduly large sacrifice on growth (as evident in credit and asset markets). Indeed, markets are currently assessing the stickiness of the problem to be moderate enough to allow the Fed to actually start easing later in 2024 itself.

Of course, it is possible that the scenario laid out above actually plays out. As US consumers continue working through the accumulated fiscal transfers on their balance sheets, in an environment where real income growth has been negative for a while and on the margin growth clouds are decidedly darkening on the horizon, one may reach a point not too far in the distance where consumption demand falls off sharply with consequent ripples into hiring and wages. One must especially be alive to this possibility, given the 'long and variable lags' on monetary policy impact after such an aggressive rate hike cycle. Thus the turn in inflation may be conclusive enough for the Fed to start to ease policy. Market financial conditions will amplify the signal by easing more and hence a soft landing-ish kind of scenario plays through keeping everyone broadly happy.

Equally almost, one must also consider the possibility that we are still underestimating the scare that developed world central banks have been put through. As discussed above, the issue for the longest time was too little inflation. The bedrock of monetary policy thus was to find ways to generate more inflation, and in the process come up with more and more innovative ways to ease financial conditions beyond the bounds of what was conventionally possible. Suddenly a playbook from four decades back has had to be dusted up and referred to. And the book cautions against the temptation to start easing policy at the first sign of inflation softening. Irrespective whether that literature is relevant today, this is the best that central banks have to go on. Also, to be fair, unanchored inflation would open up a box that would be much more difficult to close than growth collapsing for a while. If the problem is the latter, central banks will be back into familiar territory of operation. Thus their reaction function ahead will be decidedly asymmetrical, with much greater tolerance for continued growth slowdown and much lesser for any interruption to the pace of disinflation. Indeed, the Fed Chair has said as much clearly articulating preference for running the risk of overtightening (which can be unwound later through tried and tested tools) versus finding out that enough tightening wasn't done (which would take macro dynamics into unchartered territory). One wonders whether enough 'skew' is there towards this eventuality in market's current probabilistic distribution of future outcomes.

The Growth Delusion

If it isn't apparent by now, here's an explicit admission: there is some force fitting of section titles here to be consistent with the theme of the piece. This may make the headlines sound harsher at times than how they are intended. On review we find the same admission in last year's piece as well. Chalking this then down to the perils of writing theme-based end-of-year notes, and with this warning in place, we must plod on.

Higher inflation has brought higher nominal growth rates this year. There has, no doubt, been an underpinning of higher demand as well. However, the effect has been somewhat exaggerated when one has looked at nominal variables, owing to the inflation component. However, as one looks ahead it is likely that nominal growth rates come off sharply. This will be both on account of inflation falling as well as real growth rates weakening. Nominal interest rates may fall as well, but it is unlikely that this will happen as sharply if the discussion above proves to hold true. Although hopefully temporarily, but this will on the margin make debt servicing that much more onerous. Nominal revenue assumptions going into budget making exercises will need to take this into account, with the obvious risk being that, after handsome overshoots this year owing to much higher than anticipated inflation, there is a tendency to overestimate these for next year. Central banks, especially in developed markets, who have had a 'free hand' thus far in addressing inflation may find the environment much less conducive next year. As nominal incomes experience the force of gravity and job losses start to bite, it may get that much more difficult to explain the necessity of persisting at peak rates; especially as this would happen not at (say) 7% inflation but at (say) 4%. There may be more fractures within monetary policy committees (MPCs) themselves and more dissents to the eventual decision.

Again, these are less relevant for India but worth a discussion nevertheless. Dissent has already surfaced on policy but given that our MPC is only tasked with setting the repo rate and vocalising the stance, there is only so much additional differences of opinion one can have. This is especially as, if our view is right, we are already at peak cycle repo rate or at worst 25 bps away from it. Once stance turns to neutral, it is likely that for a while action shifts back to RBI measures as opposed to MPC ones, as was true for most of the pandemic period. One of the key things markets will watch for next year is when, how, and by how much RBI chooses to augment system liquidity (core liquidity would have been very close to zero by then). As the year progresses it is possible that MPC discussions get more active again. This is in context of our view that though India will relatively do better on growth than most places around the world, we will nevertheless slow as well reflecting the global slowdown. Basis this we also believe that the general view on domestic growth for next year (including from RBI) is a shade too optimistic.

Outlook

A Look Back At Our Own Delusions...

Over the first part of 2022, there were two factors that weighed on us: One, we were cognisant that a policy normalisation cycle was coming and were on the lookout for active duration management opportunities to help curtail potential portfolio volatility from the same. Two, the yield curve was steep with the 4 - 5 year maturities seemingly providing enough cushion against an eventual normalisation of RBI repo rate towards the pre-pandemic level of 5.15%. The same steepness meant that the carry loss in running cash positions was significantly large whenever one chose to take cash calls in pursuit of navigating volatility. In this context, stickier dovish RBI commentary (refer February 2022 policy as an example, https://idfcmf.com/article/7085) and reluctance to take the first meaningful step towards rate normalisation heightened the carry loss aspect especially since, as mentioned above, 4 year government bond valuations (between 6 - 6.25%) seemed to have enough protection already built in, in a scenario of a slow normalisation cycle to early 5%'s on the repo rate. Our delusion, as it turned out, was to not allow for longer periods of cash calls, assigning greater weightage to carry and valuation considerations mentioned here versus the steadily rising prospects of global volatility. Consequently, we suffered the full impact of the bolt from the blue that arrived in May in the form of an inter-meeting hike in both repo and CRR. This also served to un-anchor terminal rate expectations for the market. In fact almost the entire brunt of rise in yields (save for in the very front end) was felt over approximately just one month between early April and early May. Our most overweight government bond's yield as at time of writing is approximately at the same level as it was in early May, but rose roughly 100 bps over the one month prior to that.

This has probably been one of the more passive years for us in terms of changes to investment strategies. That is because once the damage was done over the short period of one month early in the year, the focus then shifted to reassessing the underlying framework to see whether one should now turn reactive and 'cut out'. While our own assessment of terminal RBI repo rate has been revised higher through the latter part of the year, there were nevertheless certain underpinnings to our framework that we held on to. For one, and even as the Fed rate cycle has turned out to be stronger than earlier envisaged, we rejected the idea that India needs outlier rate hikes (or be in lock-step with the Fed), supposedly to defend the rupee. Reasons behind our thinking have been documented through the year in our various investment notes (as an example, https://idfcmf.com/article/9850). We were looking at the post Covid evolution of India's fiscal and monetary response and didn't find this to be at all excessive, especially when compared with what went on in developed markets. Thus we were comfortable with the idea that at cycle top RBI to Fed policy rate differential can actually be quite narrow, even as it will widen again later on as US inflation comes off and the Fed finds more room to cut than us down the line. This is because the current cycle peak in Fed funds rate is much higher than their long term neutral compared with RBI's cycle peak compared with our long term neutral. As the year closes, we are happy to see this idea having more traction with most of the market now comfortable with the idea of a 6.50% - 6.75% repo rate peak against Fed's 5%. This importantly in turn has lent stability to our investment strategies.

...And A Look Ahead To (Potentially) New Ones

The residual 'nit-picking' that remains with respect to terminal policy rate expectations in major markets (including our own) will hopefully be put to rest in the first few months of the new year without any major further disruptions. Attention will then shift from 'how far' to 'how long'. To state the obvious, the primary driver for expectation changes will be material shifts in inflation and not the continuation of growth slowdown. In the meanwhile financial conditions may remain tight driven by high nominal policy rates and continued central bank balance sheet shrinkage. The latter may indeed require more general attention than has hitherto been given, including in India. Importantly, this will happen at much more subdued nominal growth rates. This may weigh much more on the more fragile balance sheets and business models than hitherto has been the case. Put another way, unless the market expectations channel shifts materially and quickly which seems improbable at this juncture, central banks holding a far higher than neutral nominal rates and progressively shrinking balance sheets will continue to impart tightening pressure without any additional actual rate hikes. The bulk of the pain from this unprecedented rate hike cycle is thus ahead of us in terms of its effect on balance sheets and general economic growth.

In sum, though there is a path towards a 'Goldilocks landing' that we explored above basis summary of various market rates and spreads, this is by no means given. There is a very good chance that the battle against inflation lasts longer, and may continue to be fought much beyond the peak in policy rates via continuation of those rates for longer and progressive central bank balance sheet shrinkage even as nominal growth rates begin to come off meaningfully. Thus in some way the focus will shift from obsessing on peak rates to watching for where and with what intensity damage starts showing up from this unprecedentedly sharp developed market tightening cycle. Needless to say, the longer it takes for the Fed to turn the more the likelihood of such damage. The risk, as discussed here, is that markets globally aren't giving enough importance currently to this period between the end of tightening and the start of easing which may still require very careful navigation.

China will likely continue running an economic cycle that provides counterbalance for the rest of the world, in some sense. Thus Chinese GDP slowed markedly over this period of stimulus fuelled developed market growth, and is set to accelerate sharply probably over second half of the next year once the anticipated disruptions around opening from Covid play themselves out and the full effect of ongoing policy stimulus starts to get felt. By then most of developed world in turn would have slowed aggressively. While US slowed less than earlier expected this year owing to an underestimation probably of the accumulated transfers sitting in consumer balance sheets, Europe saw meaningful fiscal response to partly shield the economy from the energy crisis. Apart from central bank tightening, both these effects are set to fade over the year ahead thus providing further drag to these economies.

For our own market, while peak repo rate is in sight (or may be already in place) it may also have to be held at that level for some time. As noted above, the world will still likely be a very challenging place which argues for continued vigilance on macro-economic stability. Fiscal policy will also have to keep this in mind. While on the one hand, a large part of additional revenue spending to absorb the acute commodity shock this year will not recur next year, on the other nominal growth rates will come off significantly as well. Alongside, the government will have to continue with fiscal consolidation in line with the medium term compression path indicated. Even as the environment will likely still remain challenging, at least for the first part of the year, we expect a lot of the macro-economic concerns from this year to abate into the next. The current account should become more manageable whereas the path to lower inflation should become clearer.

From the perspective of investors, this is for the first time in the recent period that more attention may start to get paid towards liquidity of holdings. This observation is made more in a generic, global sense but may not be entirely irrelevant in a local sense as well. Credit spreads have fallen sharply in India as well owing to a variety of reasons: Balance sheets have cleaned up in many cases thereby improving credit perception. The consequent deleveraging has automatically reduced paper supply. A lot of capex that used to happen via public sector entities has been taken on directly into the centre's budget in order to improve transparency. This has meant lower issuances by these entities and higher government bond supply, ceteris paribus. Some part of financing has shifted from bonds to bank credit reflecting both keener appetite from the latter to lend as well as heightened market volatility this year. Finally, investors have demanded lower liquidity discounts given the generally easy liquidity environment. Some of these factors may very well be turning. Bond supply from both banks as well as companies is picking up. While there is not much of an observable shift in investors' liquidity preference yet, we expect this to gain traction over the next year. Also as attention shifts to RBI having to infuse permanent liquidity down the line, some natural preference may emerge as well for sovereign assets in one's preferred duration bucket, especially if credit spreads aren't particularly attractive.

Given this framework, we continue with our preference for government bonds in the 3 to 5 year maturity segment as we turn the year. For longer duration bonds to rally sustainably, market may need visibility on rate cuts since a starting spread of 100 - 125 bps of 10 year to overnight rate doesn't leave much scope on its own. Should the developed world head towards a 'hard landing' scenario, then this could very well be possible. However, we don't have that visibility yet from our current vantage point. Also there's a good likelihood of yield curve steepening in that scenario if the accompanying fiscal compression in India isn't very meaningful owing to growth concerns. Corporate spreads have opened at the very front end due to the very large supply of bank CDs, but are still very modest for longer durations. We expect that these should start opening up as well as we head deeper into the new year.

And so another year closes. For some time now one hasn't quite got the feeling of having quietly closed one door and now gently turning the knob on the next. Nevertheless there is this door in front and here's to hoping that you enter in good health, that inside you are greeted with cheer and embrace, and that the warmth of the room carries you through the year.

Wishing You A Very Happy New Year.

-Taylor Swift

Before naming our year end piece around this anchor word, we went back to see the exact dictionary meaning of 'delusion'. We found this: "a false belief or opinion about yourself or your situation". Encouraged thus that we couldn't find anything better to describe what went on over 2022, we have proceeded to put pen to paper.

At the start, however, one must admit to not being entirely unsympathetic towards someone being accused of being deluded. After all so long as they weren't doing anyone any harm, and the state of delusion served to keep them relatively happy, who are we to judge that an alternate state of being may have proved to be better? Also, who is to say who is in delusion and who is not but with the benefit of hindsight; when the evolution of circumstances, the unravelling of the thread as it were, conclusively proves that it were so? Even more, if one considers Bob Dylan's advice to not speak too soon "for the wheel's still in spin" and there's no telling who it is naming, then who is to say that the final reckoning has indeed happened and therefore what is being proclaimed actually is with the benefit of hindsight, and not just a rush to opine, to render verdict, when in fact the game is still not over?

The reader must by now be feeling that, whatever else be the case, the author of this piece is almost certainly delusional. Again, we won't be unsympathetic if this is indeed the conclusion drawn. Though we are often reminded that our prose tends to turn torturous even in our regular investment notes, we reserve the biggest test of the reader's indulgence for these year- end pieces. That said there is a limit to this as well and if, like what is happening with us more and more lately, there is now lesser patience generally with faux intellectualism then we best turn speedily to the matter at hand.

The Delusion of Central Banks

It's easy to forget, but till not very long back the problem in developed markets was too low inflation. Japan had been struggling on this front for ages, Europe seemed to be going that way, and even the US was getting worried along similar lines. The drivers of sub-optimal inflation were deemed to be almost structural in nature. The tightest labour markets in generations had failed to generate any meaningful uptick in wage growth thereby cementing the view. Indeed, the Fed had unveiled an average inflation targeting framework that allowed for inflation to run higher than mandated for a period to compensate for previous episodes for lower than target inflation. In the process, targets would be met on average and inflation expectations would (hopefully) anchor around a point consistent with the 2% target, and not below. Also the Fed would be reactive to inflation rather than proactively trying to anticipate it.

With this backdrop, the Covid shock effectively turned the Fed into a single variable targetter (only employment) since the risk that inflation would return seemed not even worth a thought. Unfortunately this coincided with a super aggressive fiscal expansion with a significant portion of this involving direct cash transfers to people, a shrinkage in labour force, supply side congestions, and finally, a massive supply side shock with the Russia - Ukraine war. A similar story, with some variations, played in other developed markets with unwieldy inflation now almost a consistent theme in many such geographies.

The delusion started cracking sometime late last year, but did not break conclusively till well into the current one. Thus, for example, even though the Fed started to realise that something wasn't quite right with its view of the world, it nevertheless persisted with balance sheet expansion and in the process continued supporting an already overheated housing market, amongst other things. Elsewhere in the world as well, central banks still seemed reluctant to show anything but a planned pivot to tightening till as late as early this year. This was despite concurrent inflation readings running much in excess of targets. Eventually, however, the gravity of the situation sunk in and pretensions that the tightening process could be orderly or that central banks could get inflation back to target while guiding respective economies to a soft landing were conclusively set aside. Instead, as the year turns, shelter is now being sought in the age old truism that inflation control is necessary for sustenance of an economic expansion. Put another way, central banks are now having to defocus attention from near term economic pain that will possibly be inevitable if sufficient dis-inflation is to be achieved to get back to targets over time. They are also having to rely less and less on their powers of forecasting given recent history there, and instead accord more importance to concurrent data. It isn't lost on them that monetary policy acts with 'long and variable lags', and that the level of uncertainty may be especially larger this time given the unprecedented pace of tightening that has been undertaken over such a short span of time. However, given that there is no means to rewind the clock, they are settling for the least undesirable option presented to them currently.

India's case has been somewhat different. The scale of fiscal and monetary stimulus was nowhere as aggressive in the first place. Also, after an initial hesitant start, the unwind process has been largely proactive, especially when one also takes into account the shrinkage in RBI balance sheet (even adjusted for revaluation effects of our forex reserves). Thus while inflation here has proven to be stickier as well, and with the benefit of hindsight would have possibly been better served had we got off emergency levels of accommodation a bit sooner, the extent of deviation is much more modest as compared with developed markets. Also, the policy normalisation cycle itself has well and truly caught up, and with a lag should have the requisite impact on aggregate demand.

The Delusion of Markets

Central bank bashing this year reminds one of a pinata, except that it's unlikely that toys and sweets are waiting to tumble out at the end of the exercise. That is to say, at a macro level the prospect of a soft landing as noted above seems to have got significantly darker for developed markets. The path to a sustained lower inflation profile is via softer wage growth, which in turn requires appreciably higher levels of unemployment than what is the case currently. Even as headline inflation rates will come off significantly, the discussion next year will likely shift to time frame required to sustainably re-attain targets and how long this will require central banks to keep rates at cycle peak levels. Thus demand destruction in goods and housing won't likely be enough even as it pulls down headline inflation. Only percolation into employment and wages may provide the necessary signals on durable inflation fall. This means that there is little chance of a central bank 'put' emerging even when signs of growth destruction get much worse than what is the case currently. With this backdrop we turn to some observations on the markets, specifically the US.

At the time of writing, markets are broadly pricing terminal Fed funds rate at 5% and cuts of approximately 60 - 65 bps over late 2023 into early 2024, and then sharper cuts over the rest of 2024. The US yield curve is deeply inverted, with the 10 year minus 2 year spread broadly the most negative since the early 1980s. Inflation expectations have come off and aren't really portraying any material concerns about the future of inflation. High yield credit spreads on aggregate, though much higher than 2021 lows, are not flashing any great warning and in fact have come off significantly from their mid-year levels. More generally, and sporadic accidents notwithstanding, asset and financing markets are broadly not exhibiting overbearing worries.

A general summary that the above paints, in our interpretation is as follows: Cycle peak in Fed funds rate is much higher than what markets believe the long term neutral is. This is reflected in the shape of the yield curve, with the extent of inversion probably signifying distance of average rates in this cycle (hike, peak, and then cut as denoted by 2 year yield) from the long term neutral (10 year); both adjusted for market dynamics. Markets also believe that the cycle trajectory of Fed funds rate will be enough to curtail inflation (as shown by inflation expectations) while not inflicting an unduly large sacrifice on growth (as evident in credit and asset markets). Indeed, markets are currently assessing the stickiness of the problem to be moderate enough to allow the Fed to actually start easing later in 2024 itself.

Of course, it is possible that the scenario laid out above actually plays out. As US consumers continue working through the accumulated fiscal transfers on their balance sheets, in an environment where real income growth has been negative for a while and on the margin growth clouds are decidedly darkening on the horizon, one may reach a point not too far in the distance where consumption demand falls off sharply with consequent ripples into hiring and wages. One must especially be alive to this possibility, given the 'long and variable lags' on monetary policy impact after such an aggressive rate hike cycle. Thus the turn in inflation may be conclusive enough for the Fed to start to ease policy. Market financial conditions will amplify the signal by easing more and hence a soft landing-ish kind of scenario plays through keeping everyone broadly happy.

Equally almost, one must also consider the possibility that we are still underestimating the scare that developed world central banks have been put through. As discussed above, the issue for the longest time was too little inflation. The bedrock of monetary policy thus was to find ways to generate more inflation, and in the process come up with more and more innovative ways to ease financial conditions beyond the bounds of what was conventionally possible. Suddenly a playbook from four decades back has had to be dusted up and referred to. And the book cautions against the temptation to start easing policy at the first sign of inflation softening. Irrespective whether that literature is relevant today, this is the best that central banks have to go on. Also, to be fair, unanchored inflation would open up a box that would be much more difficult to close than growth collapsing for a while. If the problem is the latter, central banks will be back into familiar territory of operation. Thus their reaction function ahead will be decidedly asymmetrical, with much greater tolerance for continued growth slowdown and much lesser for any interruption to the pace of disinflation. Indeed, the Fed Chair has said as much clearly articulating preference for running the risk of overtightening (which can be unwound later through tried and tested tools) versus finding out that enough tightening wasn't done (which would take macro dynamics into unchartered territory). One wonders whether enough 'skew' is there towards this eventuality in market's current probabilistic distribution of future outcomes.

The Growth Delusion

If it isn't apparent by now, here's an explicit admission: there is some force fitting of section titles here to be consistent with the theme of the piece. This may make the headlines sound harsher at times than how they are intended. On review we find the same admission in last year's piece as well. Chalking this then down to the perils of writing theme-based end-of-year notes, and with this warning in place, we must plod on.

Higher inflation has brought higher nominal growth rates this year. There has, no doubt, been an underpinning of higher demand as well. However, the effect has been somewhat exaggerated when one has looked at nominal variables, owing to the inflation component. However, as one looks ahead it is likely that nominal growth rates come off sharply. This will be both on account of inflation falling as well as real growth rates weakening. Nominal interest rates may fall as well, but it is unlikely that this will happen as sharply if the discussion above proves to hold true. Although hopefully temporarily, but this will on the margin make debt servicing that much more onerous. Nominal revenue assumptions going into budget making exercises will need to take this into account, with the obvious risk being that, after handsome overshoots this year owing to much higher than anticipated inflation, there is a tendency to overestimate these for next year. Central banks, especially in developed markets, who have had a 'free hand' thus far in addressing inflation may find the environment much less conducive next year. As nominal incomes experience the force of gravity and job losses start to bite, it may get that much more difficult to explain the necessity of persisting at peak rates; especially as this would happen not at (say) 7% inflation but at (say) 4%. There may be more fractures within monetary policy committees (MPCs) themselves and more dissents to the eventual decision.

Again, these are less relevant for India but worth a discussion nevertheless. Dissent has already surfaced on policy but given that our MPC is only tasked with setting the repo rate and vocalising the stance, there is only so much additional differences of opinion one can have. This is especially as, if our view is right, we are already at peak cycle repo rate or at worst 25 bps away from it. Once stance turns to neutral, it is likely that for a while action shifts back to RBI measures as opposed to MPC ones, as was true for most of the pandemic period. One of the key things markets will watch for next year is when, how, and by how much RBI chooses to augment system liquidity (core liquidity would have been very close to zero by then). As the year progresses it is possible that MPC discussions get more active again. This is in context of our view that though India will relatively do better on growth than most places around the world, we will nevertheless slow as well reflecting the global slowdown. Basis this we also believe that the general view on domestic growth for next year (including from RBI) is a shade too optimistic.

Outlook

A Look Back At Our Own Delusions...

Over the first part of 2022, there were two factors that weighed on us: One, we were cognisant that a policy normalisation cycle was coming and were on the lookout for active duration management opportunities to help curtail potential portfolio volatility from the same. Two, the yield curve was steep with the 4 - 5 year maturities seemingly providing enough cushion against an eventual normalisation of RBI repo rate towards the pre-pandemic level of 5.15%. The same steepness meant that the carry loss in running cash positions was significantly large whenever one chose to take cash calls in pursuit of navigating volatility. In this context, stickier dovish RBI commentary (refer February 2022 policy as an example, https://idfcmf.com/article/7085) and reluctance to take the first meaningful step towards rate normalisation heightened the carry loss aspect especially since, as mentioned above, 4 year government bond valuations (between 6 - 6.25%) seemed to have enough protection already built in, in a scenario of a slow normalisation cycle to early 5%'s on the repo rate. Our delusion, as it turned out, was to not allow for longer periods of cash calls, assigning greater weightage to carry and valuation considerations mentioned here versus the steadily rising prospects of global volatility. Consequently, we suffered the full impact of the bolt from the blue that arrived in May in the form of an inter-meeting hike in both repo and CRR. This also served to un-anchor terminal rate expectations for the market. In fact almost the entire brunt of rise in yields (save for in the very front end) was felt over approximately just one month between early April and early May. Our most overweight government bond's yield as at time of writing is approximately at the same level as it was in early May, but rose roughly 100 bps over the one month prior to that.

This has probably been one of the more passive years for us in terms of changes to investment strategies. That is because once the damage was done over the short period of one month early in the year, the focus then shifted to reassessing the underlying framework to see whether one should now turn reactive and 'cut out'. While our own assessment of terminal RBI repo rate has been revised higher through the latter part of the year, there were nevertheless certain underpinnings to our framework that we held on to. For one, and even as the Fed rate cycle has turned out to be stronger than earlier envisaged, we rejected the idea that India needs outlier rate hikes (or be in lock-step with the Fed), supposedly to defend the rupee. Reasons behind our thinking have been documented through the year in our various investment notes (as an example, https://idfcmf.com/article/9850). We were looking at the post Covid evolution of India's fiscal and monetary response and didn't find this to be at all excessive, especially when compared with what went on in developed markets. Thus we were comfortable with the idea that at cycle top RBI to Fed policy rate differential can actually be quite narrow, even as it will widen again later on as US inflation comes off and the Fed finds more room to cut than us down the line. This is because the current cycle peak in Fed funds rate is much higher than their long term neutral compared with RBI's cycle peak compared with our long term neutral. As the year closes, we are happy to see this idea having more traction with most of the market now comfortable with the idea of a 6.50% - 6.75% repo rate peak against Fed's 5%. This importantly in turn has lent stability to our investment strategies.

...And A Look Ahead To (Potentially) New Ones

The residual 'nit-picking' that remains with respect to terminal policy rate expectations in major markets (including our own) will hopefully be put to rest in the first few months of the new year without any major further disruptions. Attention will then shift from 'how far' to 'how long'. To state the obvious, the primary driver for expectation changes will be material shifts in inflation and not the continuation of growth slowdown. In the meanwhile financial conditions may remain tight driven by high nominal policy rates and continued central bank balance sheet shrinkage. The latter may indeed require more general attention than has hitherto been given, including in India. Importantly, this will happen at much more subdued nominal growth rates. This may weigh much more on the more fragile balance sheets and business models than hitherto has been the case. Put another way, unless the market expectations channel shifts materially and quickly which seems improbable at this juncture, central banks holding a far higher than neutral nominal rates and progressively shrinking balance sheets will continue to impart tightening pressure without any additional actual rate hikes. The bulk of the pain from this unprecedented rate hike cycle is thus ahead of us in terms of its effect on balance sheets and general economic growth.

In sum, though there is a path towards a 'Goldilocks landing' that we explored above basis summary of various market rates and spreads, this is by no means given. There is a very good chance that the battle against inflation lasts longer, and may continue to be fought much beyond the peak in policy rates via continuation of those rates for longer and progressive central bank balance sheet shrinkage even as nominal growth rates begin to come off meaningfully. Thus in some way the focus will shift from obsessing on peak rates to watching for where and with what intensity damage starts showing up from this unprecedentedly sharp developed market tightening cycle. Needless to say, the longer it takes for the Fed to turn the more the likelihood of such damage. The risk, as discussed here, is that markets globally aren't giving enough importance currently to this period between the end of tightening and the start of easing which may still require very careful navigation.

China will likely continue running an economic cycle that provides counterbalance for the rest of the world, in some sense. Thus Chinese GDP slowed markedly over this period of stimulus fuelled developed market growth, and is set to accelerate sharply probably over second half of the next year once the anticipated disruptions around opening from Covid play themselves out and the full effect of ongoing policy stimulus starts to get felt. By then most of developed world in turn would have slowed aggressively. While US slowed less than earlier expected this year owing to an underestimation probably of the accumulated transfers sitting in consumer balance sheets, Europe saw meaningful fiscal response to partly shield the economy from the energy crisis. Apart from central bank tightening, both these effects are set to fade over the year ahead thus providing further drag to these economies.

For our own market, while peak repo rate is in sight (or may be already in place) it may also have to be held at that level for some time. As noted above, the world will still likely be a very challenging place which argues for continued vigilance on macro-economic stability. Fiscal policy will also have to keep this in mind. While on the one hand, a large part of additional revenue spending to absorb the acute commodity shock this year will not recur next year, on the other nominal growth rates will come off significantly as well. Alongside, the government will have to continue with fiscal consolidation in line with the medium term compression path indicated. Even as the environment will likely still remain challenging, at least for the first part of the year, we expect a lot of the macro-economic concerns from this year to abate into the next. The current account should become more manageable whereas the path to lower inflation should become clearer.

From the perspective of investors, this is for the first time in the recent period that more attention may start to get paid towards liquidity of holdings. This observation is made more in a generic, global sense but may not be entirely irrelevant in a local sense as well. Credit spreads have fallen sharply in India as well owing to a variety of reasons: Balance sheets have cleaned up in many cases thereby improving credit perception. The consequent deleveraging has automatically reduced paper supply. A lot of capex that used to happen via public sector entities has been taken on directly into the centre's budget in order to improve transparency. This has meant lower issuances by these entities and higher government bond supply, ceteris paribus. Some part of financing has shifted from bonds to bank credit reflecting both keener appetite from the latter to lend as well as heightened market volatility this year. Finally, investors have demanded lower liquidity discounts given the generally easy liquidity environment. Some of these factors may very well be turning. Bond supply from both banks as well as companies is picking up. While there is not much of an observable shift in investors' liquidity preference yet, we expect this to gain traction over the next year. Also as attention shifts to RBI having to infuse permanent liquidity down the line, some natural preference may emerge as well for sovereign assets in one's preferred duration bucket, especially if credit spreads aren't particularly attractive.

Given this framework, we continue with our preference for government bonds in the 3 to 5 year maturity segment as we turn the year. For longer duration bonds to rally sustainably, market may need visibility on rate cuts since a starting spread of 100 - 125 bps of 10 year to overnight rate doesn't leave much scope on its own. Should the developed world head towards a 'hard landing' scenario, then this could very well be possible. However, we don't have that visibility yet from our current vantage point. Also there's a good likelihood of yield curve steepening in that scenario if the accompanying fiscal compression in India isn't very meaningful owing to growth concerns. Corporate spreads have opened at the very front end due to the very large supply of bank CDs, but are still very modest for longer durations. We expect that these should start opening up as well as we head deeper into the new year.

And so another year closes. For some time now one hasn't quite got the feeling of having quietly closed one door and now gently turning the knob on the next. Nevertheless there is this door in front and here's to hoping that you enter in good health, that inside you are greeted with cheer and embrace, and that the warmth of the room carries you through the year.

Wishing You A Very Happy New Year.