IDFC STERLING VALUE FUND

IDFC STERLING VALUE FUND

(Previously known as IDFC Sterling Equity Fund w.e.f. May 28, 2018)

An open ended equity scheme following a value investment strategy

IDFC Sterling Value Fund is a value

oriented fund with the current focus on

the mid and small cap segment*.

FUND PHILOSOPHY*

The focus of IDFC Sterling Value Fund has been on building a portfolio of Leader/Challengers and Emerging businesses with an emphasis on bottom up stock selection. As part of the current strategy, the portfolio looks to build on the leaders/challengers – these are the market leaders in the Non-Nifty sectors (like Tyres, Bearings) or Top Challengers in the Nifty sectors (such as FMCG, Banks). The key parameters that we look at while selecting the companies here are low debt to operating cash flow and ROIC (Return on Invested Capital) greater than the Cost of Capital (CoC). The other part of the portfolio focuses on the Emerging Businesses. These are businesses in down cycles or where scale is yet to be achieved or where companies can fund growth without repeated dilutions. Many a times, earnings do not capture fair value of the businesses in down cycles or that are yet to achieve scale and hence popular ratios such as P/E ratio might not be the relevant metric to value the company. Thus, we believe that a better parameter for relative value evaluation could be the Enterprise Value (EV)/Sales ratio & Price/Book (P/B). We also filter stocks for Sustained improvement in RoE (Return on Equity) and RoCE (Return on Capital Employed) and those with Earnings Growth higher than Nifty. This segregation helps in easy management of risk & liquidity aspects of the portfolio.

OUTLOOK

Indian equities continued their upward momentum in July with

markets rebounding by 46% from March lows despite the

relentless increase in daily new Covid cases and sharp earnings

downgrades.

Going forward, the pace of economic recovery would depend

largely on the extent of local lockdowns on account of spread

of Covid-19. Markets seems to have run ahead of fundamentals

and are less than 10% lower than all-time highs. Global and

domestic liquidity seems to have played a significant part in

the sharp upmove seen in the markets. Investors should tread

with caution as the number of cases and deaths in India

continue to rise. Also, earnings uncertainty for FY21 is fairly

high with a wide range of analyst estimates. Various valuation

parameters after dropping to an “attractive” zone in April'20

have moved into the “expensive” zone. Investors need to be

cautious at current levels given the combination of higher

valuation and a possibility of a slower than expected earnings

recovery in FY21.

FUND FEATURES: (Data as on 31st July'20)

Category: Value

Monthly Avg AUM: Rs2,401.33 Crores

Inception Date: 7th March 2008

Fund Manager:

Mr. Anoop Bhaskar (w.e.f. 30/04/2016) & Mr. Daylynn Pinto (w.e.f. 20/10/2016)

Beta: 1.02

R Square: 0.95

Standard Deviation (Annualized): 27.99%

Benchmark: S&P BSE 400 MidSmallCap

TRI (w.e.f 11/11/2019)

Minimum Investment Amount: Rs5,000/- and any amount thereafter.

Exit Load:

• If redeemed/switched out within 365

days from the date of allotment:

➧ Upto 10% of investment:Nil,

➧ For remaining investment: 1% of

applicable NAV.

•If redeemed / switched out after 365

days from date of allotment: Nil. (w.e.f.

May 08, 2020)

SIP Frequency Monthly (Investor

may choose any day of the month

except 29th, 30th and 31st as the date

of instalment.)

Options Available: Growth, Dividend

(Payout, Reinvestment and Sweep

(from Equity Schemes to Debt

Schemes only))

| PLAN | DIVIDEND RECORD DATE | ₹/UNIT | NAV |

| REGULAR | 20-Mar-20 | 0.73 | 12.8800 |

| 16-Feb-18 | 1.38 | 23.2025 | |

| 10-Mar-17 | 1.31 | 18.6235 | |

| DIRECT | 10-Mar-17 | 1.37 | 19.3894 |

| 21-Mar-16 | 1.50 | 16.3433 | |

| 16-Mar-15 | 2.00 | 20.8582 |

Dividend is not guaranteed and past performance may or may not be sustained in future. Pursuant to payment of dividend, the NAV of the scheme would fall to the extent of payout and statutory levy (as applicable).

| PORTFOLIO | (31 July 2020) |

| Name of the Instrument | % of NAV |

| Equity and Equity related Instruments | 97.69% |

| Auto Ancillaries | 11.80% |

| MRF | 2.67% |

| Exide Industries | 1.81% |

| Minda Industries | 1.66% |

| Tube Investments of India | 1.27% |

| Wheels India | 1.12% |

| WABCO India | 1.07% |

| Asahi India Glass | 1.00% |

| Bosch | 0.59% |

| Sterling Tools | 0.38% |

| Igarashi Motors India | 0.22% |

| Cement | 10.26% |

| JK Cement | 3.44% |

| The Ramco Cements | 3.02% |

| ACC | 2.25% |

| Prism Johnson | 1.01% |

| Sagar Cements | 0.54% |

| Pharmaceuticals | 8.02% |

| IPCA Laboratories | 3.90% |

| Aurobindo Pharma | 2.73% |

| Dishman Carbogen Amcis | 1.39% |

| Finance | 7.25% |

| ICICI Lombard General Insurance Company | 2.44% |

| ICICI Securities | 2.41% |

| Mas Financial Services | 1.95% |

| Magma Fincorp | 0.44% |

| Banks | 6.64% |

| ICICI Bank | 3.46% |

| Axis Bank | 1.98% |

| RBL Bank | 1.20% |

| Consumer Durables | 6.06% |

| Voltas | 2.24% |

| Crompton Greaves Consumer Electricals | 1.93% |

| Greenply Industries | 1.07% |

| Greenpanel Industries | 0.49% |

| Butterfly Gandhimathi Appliances | 0.32% |

| Consumer Non Durables | 5.78% |

| Tata Consumer Products | 1.69% |

| Emami | 1.60% |

| Radico Khaitan | 1.53% |

| Procter & Gamble Hygiene and Health Care | 0.86% |

| HBL Power Systems | 0.09% |

| Software | 5.01% |

| Birlasoft | 2.05% |

| Persistent Systems | 1.91% |

| KPIT Technologies | 1.04% |

| Ferrous Metals | 4.34% |

| Jindal Steel & Power | 3.08% |

| Maharashtra Seamless | 0.74% |

| Kirloskar Ferrous Industries | 0.52% |

| Retailing | 4.28% |

| Future Retail | 1.43% |

| V-Mart Retail | 1.35% |

| Aditya Birla Fashion and Retail | 1.03% |

| Future Lifestyle Fashions | 0.47% |

| Construction Project | 4.19% |

| KEC International | 3.08% |

| NCC | 1.11% |

| Chemicals | 3.61% |

| Deepak Nitrite | 3.61% |

| Industrial Products | 3.28% |

| Bharat Forge | 1.47% |

| Polycab India | 1.23% |

| Graphite India | 0.58% |

| Gas | 2.53% |

| Gujarat Gas | 2.53% |

| Petroleum Products | 2.15% |

| Hindustan Petroleum Corporation | 2.15% |

| Industrial Capital Goods | 2.12% |

| Bharat Electronics | 1.60% |

| Skipper | 0.28% |

| CG Power and Industrial Solutions | 0.25% |

| Pesticides | 1.97% |

| PI Industries | 1.00% |

| Rallis India | 0.97% |

| Hotels, Resorts And Other Recreational Activities | 1.88% |

| The Indian Hotels Company | 1.45% |

| EIH | 0.43% |

| Textiles - Cotton | 1.72% |

| Vardhman Textiles | 1.32% |

| Nitin Spinners | 0.41% |

| Transportation | 1.68% |

| VRL Logistics | 1.29% |

| Future Supply Chain Solutions | 0.39% |

| Power | 1.64% |

| Kalpataru Power Transmission | 1.07% |

| Nava Bharat Ventures | 0.58% |

| Textile Products | 1.31% |

| K.P.R. Mill | 0.95% |

| Dollar Industries | 0.37% |

| Media & Entertainment | 0.16% |

| Entertainment Network (India) | 0.16% |

| Net Cash and Cash Equivalent | 2.31% |

| Grand Total | 100.00% |

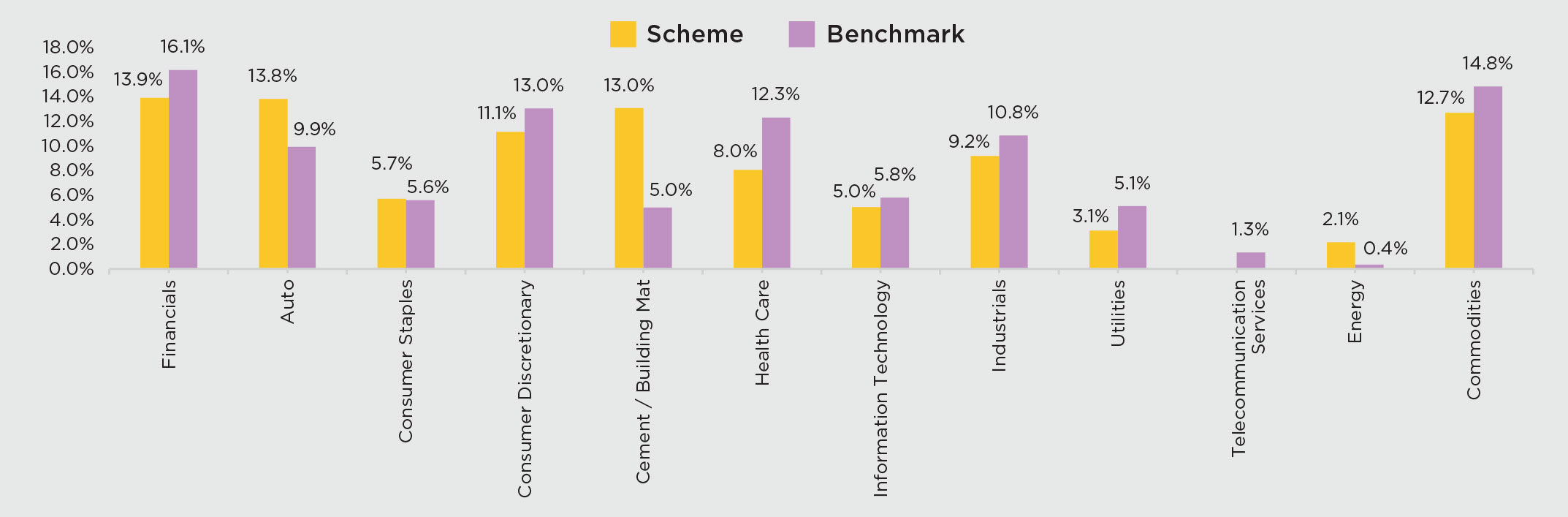

SECTOR ALLOCATION

RISKOMETER

This product is suitable for investors who are seeking*:

• To create wealth over long term

• Investment predominantly in equity and equity related instruments

following a value investment strategy

*Investors should consult their financial advisors if in doubt about

whether the product is suitable for them.

The above mentioned is the current strategy of the Fund Manager. However, asset allocation and investment strategy shall be within broad parameters of Scheme Information Document.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

| Contact your Financial Advisor |

| Call toll free 1800-2-6666-88 |

Contact your Financial Advisor |  Call toll free 1800-2-6666-88 |

Invest online at www.idfcmf.com |  www.facebook.com/idfcamc |

@IDFCMF | |