IDFC DYNAMIC BOND FUND

IDFC DYNAMIC BOND FUND

An open ended dynamic debt scheme investing across duration

The fund is positioned in the dynamic bond fund

category to take exposure across the curve

depending upon the fund manager’s underlying

interest rate view where we employ the majority of

the portfolio. It is a wide structure and conceptually

can go anywhere on the curve.

OUTLOOK

This is the second phase of global financial repression and is

likely to be pronounced and sustained for developed markets.

For countries like India, where long term financing needs are

substantial, the saver will have to come into focus at some

juncture. Meanwhile, investors are living with very low

absolute yields on quality bonds with lower duration risk.

Steep yield curves and wider credit risk premia are tempting

avenues to increase returns. However, both these phenomena

are logical pricing of the risks embedded in the system.

Importantly, the magnitude of shock underway is

unprecedented and the information available to assess its

impact is thin. Therefore, it is very critical that investors follow

a logical framework for allocation and not get pushed into

taking risks that are outside their realm of appetite and / or

aren’t well thought out. Outside of agriculture, the macro

narrative hasn’t changed discerningly for the better for the

rest of the economy. Hence, this isn’t time to move into

diluted credits despite the collapse in quality rates & it is

critical to wait for an improvement in the underlying

environment. In the meanwhile, one has to live with this

period in the least damaging way possible. In our view this is

accepting lower returns for now rather than unnaturally

expanding risk appetite.

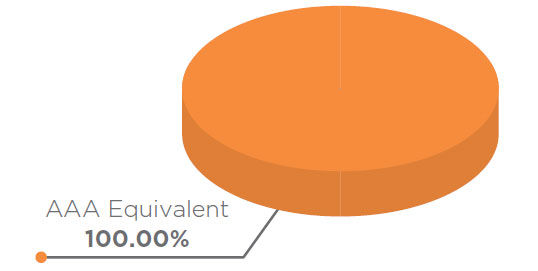

ASSET QUALITY

FUND FEATURES: (Data as on 31st July'20)

Category: Dynamic Bond

Monthly Avg AUM: Rs2,459.67 Crores

Inception Date: 25th June 2002

Fund Manager:

Mr. Suyash

Choudhary (Since 15th October 2010)

Standard Deviation (Annualized): 2.91%

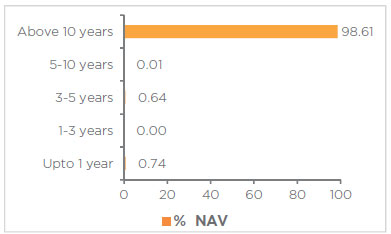

Modified duration: 8.86 years

Average Maturity: 13.58 years

Macaulay Duration: 9.14 years

Yield to Maturity: 6.29%

Benchmark: CRISIL Composite Bond

Fund Index

Minimum Investment Amount: Rs5,000/- and any amount thereafter.

Exit Load: Nil (w.e.f. 17th October

2016)

Options Available: Growth, Dividend -

Periodic, Quarterly, Half Yearly, Annual

and Regular frequency (each with

Reinvestment, Payout and Sweep

facility)

Maturity Bucket:

| PORTFOLIO | (31 July 2020) |

| Name | Rating | Total (%) |

| Government Bond | 99.26% | |

| 6.19% - 2034 G-Sec | SOV | 61.33% |

| 7.57% - 2033 G-Sec | SOV | 37.29% |

| 7.35% - 2024 G-Sec | SOV | 0.64% |

| 8.20% - 2025 G-Sec | SOV | 0.004% |

| 7.17% - 2028 G-Sec | SOV | 0.004% |

| Net Cash and Cash Equivalent | 0.74% | |

| Grand Total | 100.00% |

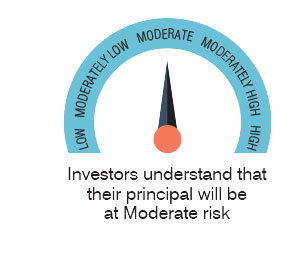

RISKOMETER

This product is suitable for investors who are seeking*:

• To generate long term optimal returns by active management

• Investments in money market & debt instruments including G-Sec across duration

*Investors should consult their financial advisors if in doubt about

whether the product is suitable for them.

Standard Deviation calculated on the basis of 1 year history of monthly data

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

| Contact your Financial Advisor |

| Call toll free 1800-2-6666-88 |

Contact your Financial Advisor |  Call toll free 1800-2-6666-88 |

Invest online at www.idfcmf.com |  www.facebook.com/idfcamc |

@IDFCMF | |