IDFC MULTI CAP FUND

IDFC MULTI CAP FUND

(Previously known as IDFC Premier Equity Fund w.e.f. May 02, 2018)

Multi Cap Fund – An open ended equity scheme investing across large cap, mid cap, small cap stocks.

FUND PHILOSOPHY*

This is a multi-cap fund with equal weights in large, mid and small caps currently.The fund focuses on a benchmark agnostic investing style with a distinct underweight on financials and overweight on consumption and domestic cyclical in the current market conditions. At a stock level, the fund focuses on companies which are operating in segments where penetration of organized is still increasing and conversion to brands will be a key driver for long term growth. The fund favours companies which generate positive operating cash flow and consistently improve their Return on Capital Employed (RoCE). From time to time, the fund identifies stocks which are strong transformational targets both from operating parameters as well as corporate governance. The fund also aims to identify and capitalize on long term themes which could generate superior returns, even if they are present in the small cap segment.

OUTLOOK

Indian equities continued their upward momentum in August

following the trend in global markets, even as India continues

to see a sharp increase in daily new Covid-19 cases. In August

and over the last 3-month basis, Small Caps significantly

outperformed Mid and Large Caps. Since the bottom in

March-20, Large, Mid and Small Caps have bounced 50%, 52%

and 66% respectively.

Going forward, the pace of economic recovery would depend

largely on the extent of local lockdowns on account of spread

of Covid-19. Markets seems to have run ahead of fundamentals

and are less than 10% lower than all-time highs. Global and

domestic liquidity seems to have played a significant part in

the sharp up move seen in the markets. Investors should tread

with caution as the number of cases and deaths in India

continue to rise. Also, earnings uncertainty for FY21 is fairly

high with a wide range of analyst estimates.

FUND FEATURES: (Data as on 31st August'20)

Category: Multicap

Monthly Avg AUM: Rs4,830.22 Crores

Inception Date: 28th September

2005

Fund Manager: Mr. Anoop Bhaskar (w.e.f. 30/04/2016)

Benchmark: S&P BSE 500 TRI

Minimum Investment Amount: Rs10,000/- and any amount thereafter.

(Units of IDFC Multi Cap Fund, shall be

available for lump sum subscription

w.e.f. May 07, 2018)

Exit Load: • If redeemed/switched out within 365

days from the date of allotment:

➧ Upto 10% of investment:Nil,

➧ For remaining investment: 1% of

applicable NAV.

• If redeemed / switched out after 365

days from date of allotment: Nil. (w.e.f.

May 08, 2020)

SIP Frequency: Monthly (Investor

may choose any day of the month

except 29th, 30th and 31st as the date

of instalment.)

Minimum SIP Investment Amount: Rs100/-(Minimum 6 instalments) (w.e.f. 2nd May 2018)

Options Available: Growth, Dividend -

(Payout, Reinvestment and Sweep (from

Equity Schemes to Debt Schemes only))

Beta: 0.91

R Square: 0.92

Standard Deviation (Annualized): 20.61%

| PLAN | DIVIDEND RECORD DATE | ₹/UNIT NAV | NAV |

| REGULAR | 20-Mar-20 | 1.39 | 25.5900 |

| 01-Mar-19 | 1.67 | 32.2300 | |

| 22-Mar-18 | 2.17 | 35.0577 | |

| DIRECT | 20-Mar-20 | 1.46 | 26.8600 |

| 01-Mar-19 | 1.74 | 33.5900 | |

| 22-Mar-18 | 2.25 | 36.2848 |

Dividend is not guaranteed and past performance may or may not be sustained in future. Pursuant to payment of dividend, the NAV of the scheme would fall to the extent of payout and statutory levy (as applicable).

| PORTFOLIO | (31 August 2020) |

| Name of the Instrument | % of NAV |

| Equity and Equity related Instruments | 98.23% |

| Banks | 15.95% |

| ICICI Bank | 5.10% |

| HDFC Bank | 4.37% |

| Axis Bank | 2.61% |

| Kotak Mahindra Bank | 2.37% |

| City Union Bank | 1.50% |

| Consumer Non Durables | 14.41% |

| Britannia Industries | 2.77% |

| Hindustan Unilever | 2.63% |

| ITC | 2.14% |

| Nestle India | 1.82% |

| Asian Paints | 1.65% |

| Procter & Gamble Hygiene and Health Care | 1.49% |

| Jubilant Foodworks | 1.24% |

| S H Kelkar and Company | 0.46% |

| United Spirits | 0.21% |

| Consumer Durables | 10.09% |

| Voltas | 3.05% |

| Bata India | 2.67% |

| Crompton Greaves Consumer Electricals | 2.58% |

| Titan Company | 1.14% |

| Greenlam Industries | 0.65% |

| Finance | 9.06% |

| Multi Commodity Exchange of India | 2.62% |

| ICICI Securities | 1.69% |

| HDFC Life Insurance Company | 1.66% |

| ICICI Lombard General Insurance Company | 1.43% |

| Mas Financial Services | 0.87% |

| JM Financial | 0.79% |

| Pharmaceuticals | 7.11% |

| Sun Pharmaceutical Industries | 1.79% |

| Alembic Pharmaceuticals | 1.51% |

| Lupin | 1.34% |

| Divi's Laboratories | 1.08% |

| Cadila Healthcare | 0.73% |

| Cipla | 0.66% |

| Chemicals | 5.65% |

| Atul | 2.91% |

| Fine Organic Industries | 1.56% |

| Pidilite Industries | 1.18% |

| Industrial Products | 5.39% |

| Supreme Industries | 1.55% |

| Schaeffler India | 1.52% |

| AIA Engineering | 1.36% |

| Kirloskar Pneumatic Company | 0.51% |

| Disa India | 0.44% |

| Auto Ancillaries | 4.90% |

| Minda Industries | 1.48% |

| Amara Raja Batteries | 1.12% |

| MRF | 1.08% |

| Wheels India | 0.75% |

| Bosch | 0.47% |

| Software | 4.86% |

| Infosys | 4.86% |

| Commercial Services | 3.50% |

| 3M India | 3.50% |

| Telecom - Services | 2.72% |

| Bharti Airtel | 2.72% |

| IT Consulting & Other Services | 2.53% |

| Cognizant Technology Solutions Corp - International Equities | 2.53% |

| Cement | 2.37% |

| UltraTech Cement | 2.37% |

| Retailing | 1.73% |

| Avenue Supermarts | 1.27% |

| Future Retail | 0.30% |

| Future Lifestyle Fashions | 0.16% |

| Ferrous Metals | 1.57% |

| APL Apollo Tubes | 1.57% |

| Construction Project | 1.51% |

| Larsen & Toubro | 1.13% |

| Power Mech Projects | 0.38% |

| Auto | 1.32% |

| Mahindra & Mahindra | 1.32% |

| Textiles - Cotton | 1.06% |

| Vardhman Textiles | 1.06% |

| Pesticides | 0.92% |

| Dhanuka Agritech | 0.92% |

| Transportation | 0.64% |

| Transport Corporation of India | 0.64% |

| Industrial Capital Goods | 0.46% |

| ABB India | 0.46% |

| Media & Entertainment | 0.30% |

| Entertainment Network (India) | 0.30% |

| Construction | 0.16% |

| Poddar Housing and Development | 0.16% |

| Net Cash and Cash Equivalent | 1.77% |

| GRAND TOTAL | 100.00% |

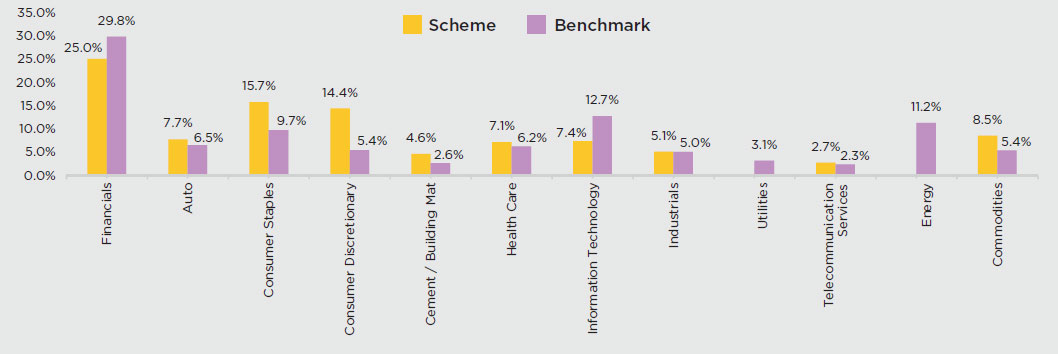

SECTOR ALLOCATION

RISKOMETER

This product is suitable for investors who are seeking*:

• To create wealth over long term

• Investment predominantly in equity and equity related instruments

across market capitalisation.

*Investors should consult their financial advisors if in doubt about

whether the product is suitable for them.

The above mentioned is the current strategy of the Fund Manager. However, asset allocation and investment strategy shall be within broad

parameters of Scheme Information Document.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

| Contact your Financial Advisor |

| Call toll free 1800-2-6666-88 |

Contact your Financial Advisor |  Call toll free 1800-2-6666-88 |

Invest online at www.idfcmf.com |  www.facebook.com/idfcamc |

@IDFCMF | |