IDFC BANKING & PSU DEBT FUND

(The Fund (erstwhile IDFC Banking Debt Fund) has been

repositioned with effect from June 12, 2017$$)

An open ended debt scheme predominantly investing in debt

instruments of banks, Public Sector Undertakings, Public Financial

Institutions and Municipal Bonds.

IDFC BANKING & PSU DEBT FUND

(The Fund (erstwhile IDFC Banking Debt Fund) has been

repositioned with effect from June 12, 2017$$)

An open ended debt scheme predominantly investing in debt

instruments of banks, Public Sector Undertakings, Public Financial

Institutions and Municipal Bonds.

The scheme is currently following a ‘roll down’ investment strategy as a tactical approach. This means that ordinarily the average maturity of the scheme’s portfolio is unlikely to increase significantly and may be expected to generally reduce with the passage of time, subject to intermittent periods of volatility in the maturity profile owing to AUM movement and market conditions.*

FUND FEATURES: (Data as on 31st August'20)

Category: Banking and PSU

Monthly Avg AUM: Rs17,583.48 Crores

Inception Date: 7th March 2013

Fund Manager: Mr. Anurag Mittal

(w.e.f. 15th May 2017)

Standard Deviation (Annualized): 2.38%

Modified duration 2.23 years

Average Maturity: 2.57 years

Macaulay Duration: 2.34 years

Yield to Maturity: 5.05%

Benchmark: NIFTY Banking & PSU

Debt Index (w.e.f 11/11/2019)

Minimum Investment Amount: Rs5,000/- and any amount thereafter

Exit Load: Nil (w.e.f. 12th June 2017)

Options Available : Growth, Dividend -

Daily, Fortnightly, Monthly

(Reinvestment), Quarterly (Payout),

Annual (Payout) & Periodic (Payout &

Reinvestment)

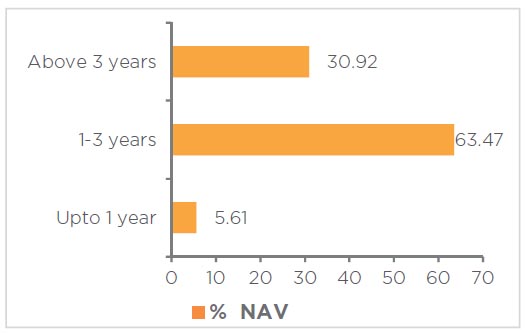

Maturity Bucket:

| PORTFOLIO | (31 August 2020) |

| Name | Rating | Total (%) |

| Corporate Bond | 91.42% | |

| NABARD | AAA | 11.77% |

| LIC Housing Finance | AAA | 8.07% |

| Power Finance Corporation | AAA | 8.04% |

| REC | AAA | 6.99% |

| National Housing Bank | AAA | 5.99% |

| National Highways Auth of Ind | AAA | 5.82% |

| Indian Railway Finance Corporation | AAA | 5.72% |

| Hindustan Petroleum Corporation | AAA | 5.64% |

| Axis Bank | AAA | 5.58% |

| HDFC | AAA | 5.40% |

| Small Industries Dev Bank of India | AAA | 5.08% |

| Reliance Industries | AAA | 4.08% |

| Export Import Bank of India | AAA | 3.06% |

| Power Grid Corporation of India | AAA | 2.30% |

| ICICI Bank | AAA | 2.22% |

| Housing & Urban Development Corporation | AAA | 1.83% |

| NTPC | AAA | 1.31% |

| NHPC | AAA | 1.00% |

| Larsen & Toubro | AAA | 0.89% |

| Indian Oil Corporation | AAA | 0.63% |

| Tata Sons Private | AAA | 0.02% |

| Government Bond | 1.89% | |

| 7.68% - 2023 G-Sec | SOV | 1.22% |

| 7.32% - 2024 G-Sec | SOV | 0.67% |

| Certificate of Deposit | 1.13% | |

| Export Import Bank of India | A1+ | 0.85% |

| Bank of Baroda | A1+ | 0.27% |

| Treasury Bill | 0.81% | |

| 182 Days Tbill - 2020 | SOV | 0.56% |

| 182 Days Tbill - 2021 | SOV | 0.25% |

| State Government Bond | 0.65% | |

| 9.25% Haryana SDL - 2023 | SOV | 0.31% |

| 8.62% Maharashtra SDL - 2023 | SOV | 0.24% |

| 7.93% Chattisgarh SDL - 2024 | SOV | 0.06% |

| 5.93% ODISHA SDL - 2022 | SOV | 0.02% |

| 8.48% Tamilnadu SDL - 2023 | SOV | 0.01% |

| 8.10% Tamil Nadu SDL - 2023 | SOV | 0.003% |

| Zero Coupon Bond | 0.61% | |

| LIC Housing Finance | AAA | 0.61% |

| Commercial Paper | 0.02% | |

| Reliance Industries | A1+ | 0.02% |

| Net Cash and Cash Equivalent | 3.47% | |

| Grand Total | 100.00% |

ASSET QUALITY

RISKOMETER

This product is suitable for investors who are seeking*:

• To generate optimal returns over short to medium term

• Investments predominantly in debt & money market instruments

issued by PSU, Banks & PFI

*Investors should consult their financial advisors if in doubt

about whether the product is suitable for them.

$$For details please refer Notice ( https://www.idfcmf.com/uploads/090520171306No-18-Change-in-Scheme-features-of-IDFC-Banking-Debt-Fund.pdf )

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

| Contact your Financial Advisor |

| Call toll free 1800-2-6666-88 |

Contact your Financial Advisor |  Call toll free 1800-2-6666-88 |

Invest online at www.idfcmf.com |  www.facebook.com/idfcamc |

@IDFCMF | |