IDFC Bond Fund - Medium Term Plan

(Previously known as IDFC Super Saver Income Fund - Medium Term Plan)

An open ended medium term debt scheme investing in instruments such

that the Macaulay duration of the portfolio is between 3 years and 4 years

IDFC Bond Fund - Medium Term Plan

(Previously known as IDFC Super Saver Income Fund - Medium Term Plan)

An open ended medium term debt scheme investing in instruments such

that the Macaulay duration of the portfolio is between 3 years and 4 years

The fund is positioned in the medium term fund category and invests in a mix of high quality debt and money market instruments, including G Secs.

OUTLOOK

The government has been prudent so far in rationing its stimulus response,

focusing first on sustenance and keeping a growth stimulus for later.

Despite the government’s prudence so far, however, the load on the fiscal

is heavy. A necessary condition for financing this is a well-functioning bond

market. The measures announced in August should now restore normal

functioning and allow the substantial borrowing requirement to start going

through without undoing the transmission channel.

Having said that, it is also true that more than 50% of an INR 20 lakh crore

plus (center and states combined) borrowing program is still ahead of us.

One shouldn’t expect a very large sustainable rally in bonds basis just the

current set of triggers, although one should reasonably expect most of the

recent aggressive sell-off to get unwound. However re-instatement of

orderly functioning now allows participants to start deploying risk capital

with more confidence to take advantage of what are quite attractive

valuations given the underlying backdrop of an unprecedented growth

drawdown and a collapse in credit growth.

The external account is our one significant macro strength today and

provides adequate cushion to RBI to persist with a dovish policy for the

time-being. For all these reasons, our view remains that the important

current pillars of policy will sustain for the foreseeable future. The spike in

inflation presents an interpretation problem for now and it remains our

base case that it will not shift the narrative away from growth for monetary

policy, despite throwing up higher average CPI prints for the year. In our

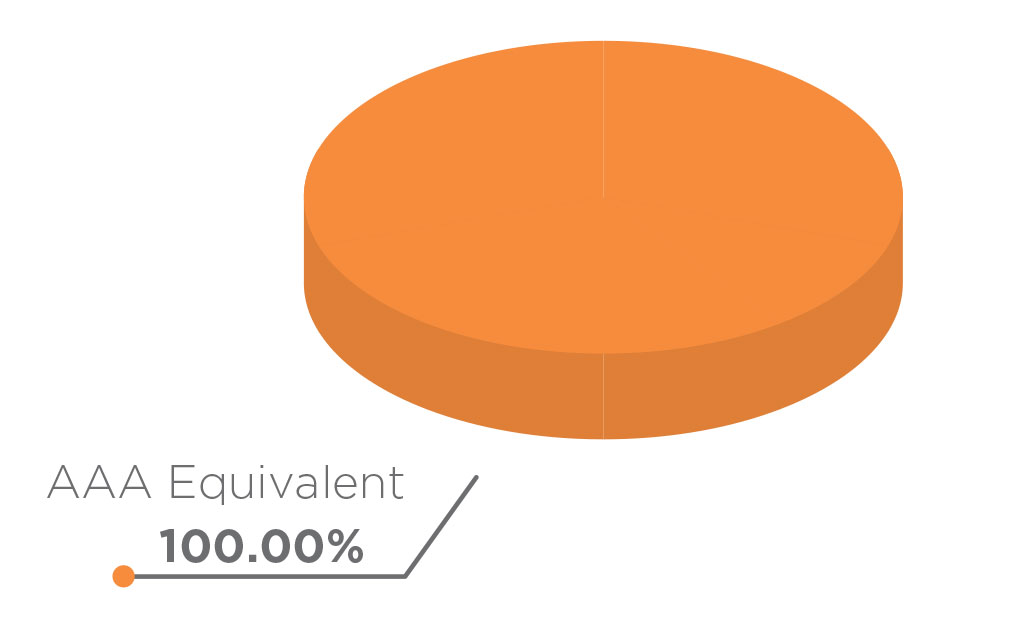

opinion, focus has to be on best quality AAA and sovereign / quasi

sovereign. There is no macro logic whatsoever for pursuing high yield

strategies.

ASSET QUALITY

FUND FEATURES: (Data as on 31st August'20)

Category:Medium Duration

Monthly Avg AUM: Rs3,487.95 Crores

Inception Date: 8th July 2003

Fund Manager:

Mr. Suyash Choudhary

(w.e.f. 15/09/2015)

Standard Deviation (Annualized): 2.82%

Modified duration 3.67 years

Average Maturity: 4.49 years

Macaulay Duration: 3.79 years

Yield to Maturity: 5.63%

Benchmark: NIFTY AAA Medium Duration

Bond Index (w.e.f 11/11/2019)

Minimum Investment Amount: Rs5,000/- and any amount thereafter

Exit Load: NIL (w.e.f. 15th January 2019)

Options Available : Growth, Dividend - Daily

(Reinvestment only) and Fortnightly, Monthly,

Bi-monthly, Quarterly and Periodic frequency

(each with payout, reinvestment and sweep

facility).

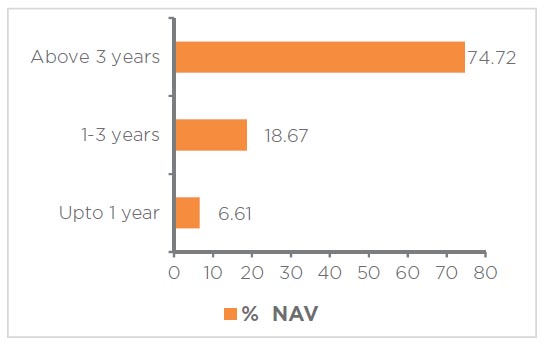

Maturity Bucket:

| PORTFOLIO | (31 August 2020) |

| Name | Rating | Total (%) |

| Government Bond | 68.79% | |

| 6.79% - 2027 G-Sec | SOV | 24.10% |

| 7.35% - 2024 G-Sec | SOV | 17.16% |

| 6.18% - 2024 G-Sec | SOV | 13.72% |

| 7.59% - 2026 G-Sec | SOV | 6.66% |

| 7.17% - 2028 G-Sec | SOV | 4.34% |

| 7.26% - 2029 G-Sec | SOV | 1.51% |

| 6.97% - 2026 G-Sec | SOV | 1.30% |

| Corporate Bond | 27.02% | |

| Power Finance Corporation | AAA | 8.30% |

| Reliance Industries | AAA | 7.73% |

| LIC Housing Finance | AAA | 6.06% |

| REC | AAA | 2.58% |

| HDFC | AAA | 1.62% |

| Indian Railway Finance Corporation | AAA | 0.71% |

| NABARD | AAA | 0.03% |

| PTC | 1.06% | |

| First Business Receivables Trust^ | AAA(SO) | 1.06% |

| State Government Bond | 0.96% | |

| 8.25% Maharastra SDL - 2025 | SOV | 0.45% |

| 8.2% Gujarat SDL - 2025 | SOV | 0.45% |

| 8.37% Tamil Nadu SDL - 2028 | SOV | 0.06% |

| 8.25% Andhra Pradesh SDL - 2023 | SOV | 0.001% |

| 8.68% Gujarat SDL - 2023 | SOV | 0.0001% |

| Net Cash and Cash Equivalent | 2.17% | |

| Grand Total | 100.00% |

RISKOMETER

This product is suitable for investors who are seeking*:

• To generate optimal returns over medium term

• Investments in Debt & Money Market securities such that the Macaulay

duration of the portfolio is between 3 years and 4 years

*Investors should consult their financial advisers if in doubt about

whether the product is suitable for them.

Standard Deviation calculated on the basis of 1 year history of monthly data

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

| Contact your Financial Advisor |

| Call toll free 1800-2-6666-88 |

Contact your Financial Advisor |  Call toll free 1800-2-6666-88 |

Invest online at www.idfcmf.com |  www.facebook.com/idfcamc |

@IDFCMF | |