IDFC EMERGING BUSINESSES FUND

IDFC EMERGING BUSINESSES FUND

(Small Cap Fund – An open ended equity scheme

predominantly investing in small cap stocks)

• Fund focuses on building a diversified portfolio

within the small cap segment.

• Portfolio will contain buy and hold strategies as well

as opportunistic picks in the cyclical space.

• Fund may also look to participate in new businesses

via IPOs.

FUND PHILOSOPHY*

The fund aims to identify and invest in companies with steady

growth prospects, operating in industries with a stable growth

visibility over the medium term – 2-4 years. The fund would be

willing to pay higher valuation for companies with distinct

segment leadership advantages and/or for companies operating

in segments which are witnessing a boost of growth due to

change in industry dynamics; regulatory changes / geographical

shifts. While not eschewing completely, the fund aims to limit

exposure to “deep” cyclicals and focus more on companies and

sectors with secular growth outlook. Hence, the valuation metrics

of the fund – P/E; EV/EBIDTA; EV/Sales may appear to be more

expensive than the benchmark.

Consumer facing rather than B to B is another focus area of the

fund. The fund aims to ensure participation in non-small caps as a

measure of higher liquidity as well addressability for investing in

sectors where size brings noticeable advantage – BFSI, for

example. The fund aims to hold cash levels of upto 10% across

time periods, both as a measure of liquidity as well as to

capitalize on opportunistic investing. Lastly, rather than try to

outperform the benchmark on the upside, the fund would aim to

conserve capital by limiting downside during periods of

drawdowns, a dominant (and painful) characteristic of small cap

investing.

OUTLOOK

Q2 FY22 corporate earnings result ended on a strong note and

RBI maintained its stance as accommodative and kept the policy

rate unchanged in its bi-monthly policy.

Aggregate profit of S&P BSE 200 companies touched higher than

the previous peak of Mar’21 quarter.

Going forward, factors which would largely drive the market

could be the macroeconomic data and the upcoming state

elections on domestic side, while on the global term it would be

the decision of central banks as well as the highly mutated

Omicron variant of Covid-19 which could change the course of

the pandemic.

Key sectors where earnings are forecasted to show

strength/sustain in the near term could be the Banks,

Automobiles, Telecom and Oil & Gas. Hopefully, the earnings

estimate for FY22 and 23 could maintain the path of surprise, as

has been the case till now.”

FUND FEATURES: (Data as on 30th November'21)

Category: Small Cap Fund

Monthly Avg AUM: Rs 1,433.61 Crores

Inception Date: 25th February 2020

Fund Manager: Mr. Anoop Bhaskar

Benchmark: S&P BSE 250 SmallCap-TRI

Exit Load:

1% if redeemed/switched out within 1

year from the date of allotment

Minimum Investment Amount: Rs100 and in

multiples of Rs1 thereafter

SIP Frequency: Monthly

SIP Dates (Monthly): Investor may

choose any day of the month except

29th, 30th and 31st as the date of

instalment.

Options Available: The Scheme offer

IDCW@ Option & Growth Option.

IDCW@ Option under each Plan further

offers of choice of Payout & Sweep

facilities.

@Income Distribution cum capital withdrawal

| PORTFOLIO | (30 November 2021) |

| Name | % of NAV |

| Equity and Equity related Instruments | 98.73% |

| Consumer Non Durables | 13.85% |

| Radico Khaitan | 5.34% |

| Balrampur Chini Mills | 2.00% |

| DCM Shriram | 1.31% |

| United Spirits | 1.08% |

| Heritage Foods | 1.03% |

| Godfrey Phillips India | 0.92% |

| DFM Foods | 0.78% |

| Emami | 0.77% |

| Jyothy Labs | 0.63% |

| Software | 11.93% |

| Birlasoft | 3.79% |

| Zensar Technologies | 2.76% |

| Cyient | 2.18% |

| eClerx Services | 2.00% |

| Mastek | 1.20% |

| Industrial Products | 11.49% |

| Shaily Engineering Plastics | 3.69% |

| Carborundum Universal | 2.34% |

| Polycab India | 1.94% |

| Graphite India | 1.19% |

| EPL | 0.93% |

| Kirloskar Brothers | 0.77% |

| Huhtamaki India | 0.63% |

| Auto Ancillaries | 8.74% |

| Wheels India | 2.25% |

| Alicon Castalloy | 1.80% |

| GNA Axles | 1.67% |

| Jamna Auto Industries | 1.64% |

| Automotive Axles | 1.38% |

| Chemicals | 7.01% |

| NOCIL | 2.86% |

| Navin Fluorine International | 2.32% |

| Chemplast Sanmar | 1.31% |

| Chemcon Speciality Chemicals | 0.51% |

| Consumer Durables | 6.07% |

| Kajaria Ceramics | 2.68% |

| Mayur Uniquoters | 1.69% |

| Cera Sanitaryware | 1.08% |

| Greenply Industries | 0.62% |

| Pharmaceuticals | 4.98% |

| Gland Pharma | 1.40% |

| Divi's Laboratories | 1.32% |

| FDC | 1.19% |

| Laurus Labs | 1.07% |

| Auto | 4.79% |

| Ashok Leyland | 1.86% |

| Tata Motors | 1.61% |

| Maruti Suzuki India | 1.32% |

| Healthcare Services | 4.36% |

| Narayana Hrudayalaya | 2.16% |

| Krsnaa Diagnostics | 1.17% |

| Krishna Institute of Medical Sciences | 1.03% |

| Leisure Services | 4.19% |

| Westlife Development | 2.17% |

| EIH | 1.37% |

| Burger King India | 0.65% |

| Capital Markets | 4.01% |

| Multi Commodity Exchange of India | 2.09% |

| UTI Asset Management Company | 1.92% |

| Cement & Cement Products | 3.31% |

| Sagar Cements | 1.80% |

| JK Lakshmi Cement | 1.51% |

| Pesticides | 2.58% |

| Heranba Industries | 1.30% |

| Rallis India | 1.27% |

| Banks | 2.23% |

| State Bank of India | 1.85% |

| Suryoday Small Finance Bank | 0.38% |

| Commercial Services | 2.17% |

| TeamLease Services | 2.17% |

| Finance | 1.89% |

| SBI Cards and Payment Services | 0.75% |

| Poonawalla Fincorp | 0.65% |

| JM Financial | 0.49% |

| Petroleum Products | 1.48% |

| Gulf Oil Lubricants India | 1.48% |

| Retailing | 1.45% |

| V-Mart Retail | 1.45% |

| Power | 1.43% |

| Kalpataru Power Transmission | 1.43% |

| Textiles - Cotton | 0.76% |

| Nitin Spinners | 0.76% |

| Net Cash and Cash Equivalent | 1.27% |

| Grand Total | 100.00% |

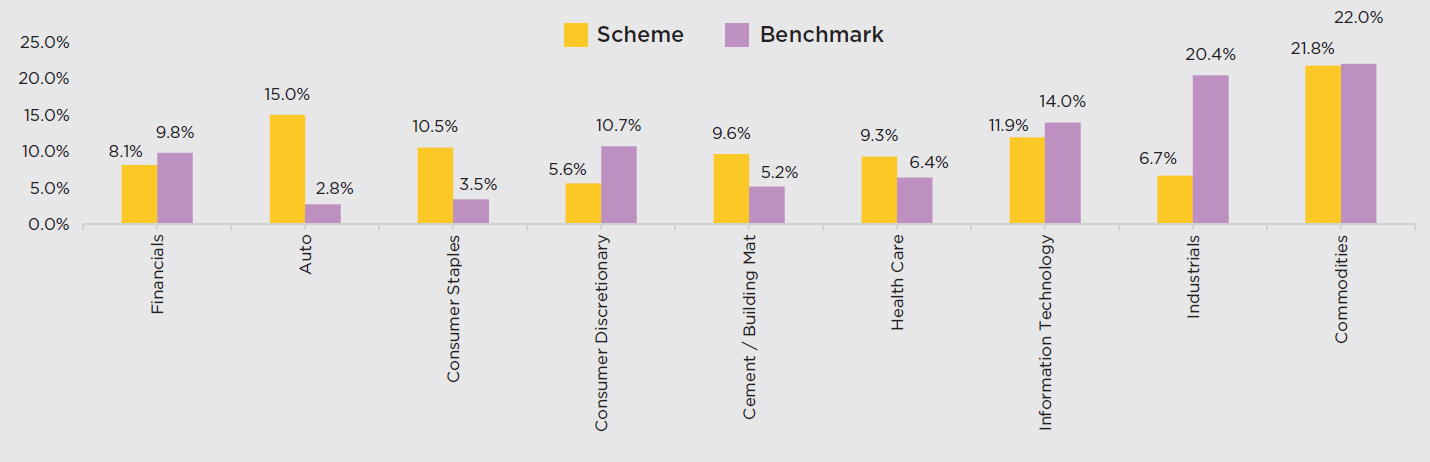

SECTOR ALLOCATION

RISKOMETER

Scheme risk-o-meter

Benchmark risk-o-meter

This product is suitable for investors who are seeking*:

• To create wealth over long term

• Investment in equity and equity related instruments of

Small cap companies.

*Investors should consult their financial advisors if in doubt about

whether the product is suitable for them.

shall be within broad parameters of Scheme Information Document.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

| Contact your Financial Advisor |

| Call toll free 1800-2-6666-88 |

Contact your Financial Advisor |  Call toll free 1800-2-6666-88 |

Invest online at www.idfcmf.com |  www.facebook.com/idfcamc |

@IDFCMF | |