IDFC TAX ADVANTAGE (ELSS) FUND

IDFC TAX ADVANTAGE (ELSS) FUND

An open ended equity linked saving scheme with a

statutory lock in of 3 years and tax benefit

The Fund is an Equity Linked Savings

Scheme (ELSS) that aims to generate long

term capital growth from a diversified

equity portfolio and enables investors to

avail of a deduction from total income, as

permitted under the Income Tax Act, 1961.

OUTLOOK

Q2 FY22 corporate earnings result ended on a strong

note and RBI maintained its stance as accommodative

and kept the policy rate unchanged in its bi-monthly

policy.

Aggregate profit of S&P BSE 200 companies touched

higher than the previous peak of Mar’21 quarter.

Going forward, factors which would largely drive the

market could be the macroeconomic data and the

upcoming state elections on domestic side, while on

the global term it would be the decision of central

banks as well as the highly mutated Omicron variant of

Covid-19 which could change the course of the

pandemic.

Key sectors where earnings are forecasted to show

strength/sustain in the near term could be the Banks,

Automobiles, Telecom and Oil & Gas. Hopefully, the

earnings estimate for FY22 and 23 could maintain the

path of surprise, as has been the case till now.”

FUND FEATURES : (Data as on 30th November'21)

Category: ELSS

Monthly Avg AUM: Rs3,535.59 Crores

Inception Date: 26th December 2008

Fund Manager:

Mr. Daylynn Pinto (w.e.f. 20/10/2016)

Other Parameters:

Beta: 1.16

R Square: 0.92

Standard Deviation (Annualized): 26.09%

Benchmark^^: S&P BSE 200 TRI

Minimum Investment Amount: Rs500/-

Exit Load: Nil

SIP Frequency Monthly (Investor

may choose any day of the month

except 29th, 30th and 31st as the date

of instalment.)

Options Available: Growth, IDCW@

- Payout and Sweep (from Equity

Schemes to Debt Schemes Only)

| PLAN | IDCW@ RECORD DATE | ₹/UNIT | NAV |

| REGULAR | 22-Jul-21 | 1.27 | 25.5500 |

| 27-Mar-19 | 0.37 | 16.7300 | |

| 27-Sep-18 | 0.48 | 16.8600 | |

| DIRECT | 22-Jul-21 | 1.60 | 32.1300 |

| 27-Mar-19 | 0.58 | 20.5000 | |

| 27-Sep-18 | 0.52 | 20.5200 |

Face Value per Unit (in ₹) is 10

Income Distribution cum capital withdrawal is not guaranteed and past performance may or may not be sustained in future. Pursuant to payment of Income Distribution cum capital withdrawal, the NAV of the scheme would fall to the extent of payout and statutory levy (as applicable).

| PORTFOLIO | (30 November 2021) |

| Name | % of NAV |

| Equity and Equity related Instruments | 97.74% |

| Banks | 19.29% |

| ICICI Bank | 7.88% |

| State Bank of India | 4.94% |

| HDFC Bank | 4.23% |

| Axis Bank | 2.25% |

| Software | 14.84% |

| Infosys | 7.15% |

| HCL Technologies | 2.38% |

| Mastek | 2.06% |

| Tata Consultancy Services | 1.79% |

| Zensar Technologies | 1.46% |

| Auto | 6.07% |

| Tata Motors | 3.83% |

| Mahindra & Mahindra | 2.24% |

| Cement & Cement Products | 5.31% |

| UltraTech Cement | 1.99% |

| The Ramco Cements | 1.40% |

| Nuvoco Vistas Corporation | 1.03% |

| Sagar Cements | 0.88% |

| Chemicals | 4.98% |

| Deepak Nitrite | 3.03% |

| Tata Chemicals | 1.95% |

| Consumer Durables | 4.77% |

| Greenpanel Industries | 2.68% |

| Voltas | 1.61% |

| Khadim India | 0.48% |

| Industrial Products | 4.59% |

| Bharat Forge | 1.91% |

| Apollo Pipes | 1.46% |

| Graphite India | 1.22% |

| Pharmaceuticals | 4.41% |

| Cipla | 2.17% |

| Laurus Labs | 1.25% |

| Aurobindo Pharma | 0.98% |

| Auto Ancillaries | 4.12% |

| Minda Industries | 1.76% |

| Bosch | 1.59% |

| Sandhar Technologies | 0.77% |

| Petroleum Products | 4.11% |

| Reliance Industries | 3.94% |

| Bharat Petroleum Corporation | 0.17% |

| Consumer Non Durables | 3.86% |

| United Spirits | 2.24% |

| Tata Consumer Products | 1.62% |

| Ferrous Metals | 3.73% |

| Jindal Steel & Power | 1.84% |

| Tata Steel | 0.96% |

| Kirloskar Ferrous Industries | 0.93% |

| Telecom - Services | 3.38% |

| Bharti Airtel | 3.38% |

| Leisure Services | 2.59% |

| The Indian Hotels Company | 1.37% |

| EIH | 1.22% |

| Finance | 2.18% |

| Poonawalla Fincorp | 1.30% |

| Mas Financial Services | 0.88% |

| Transportation | 2.10% |

| VRL Logistics | 2.10% |

| Power | 2.03% |

| KEC International | 2.03% |

| Construction Project | 1.90% |

| NCC | 1.90% |

| Industrial Capital Goods | 1.38% |

| CG Power and Industrial Solutions | 1.38% |

| Insurance | 1.06% |

| ICICI Prudential Life Insurance Company | 1.06% |

| Construction | 1.04% |

| PSP Projects | 1.04% |

| Preference Shares | 0.002% |

| Entertainment | 0.002% |

| Zee Entertainment Enterprises | 0.002% |

| Net Cash and Cash Equivalent | 2.26% |

| Grand Total | 100.00% |

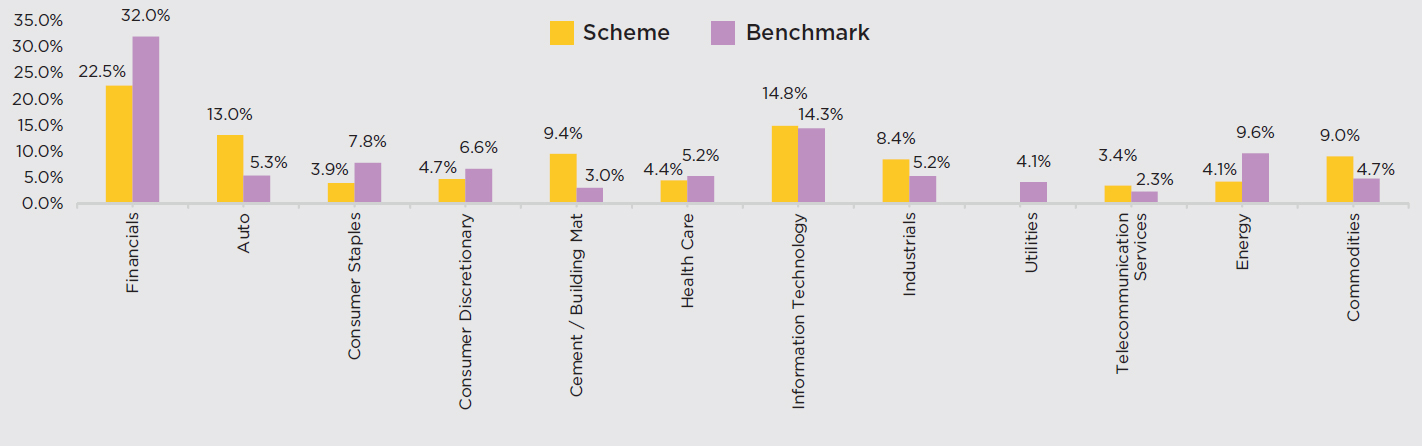

SECTOR ALLOCATION

RISKOMETER

Scheme risk-o-meter

Benchmark risk-o-meter

This product is suitable for investors who are seeking*:

• To create wealth over long term

• Investment predominantly in Equity and Equity related securities

with income tax benefit u/s 80C and 3 years lock-in

*Investors should consult their financial advisors if in doubt about

whether the product is suitable for them.

Ratios calculated on the basis of 3 years history of monthly data.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

| Contact your Financial Advisor |

| Call toll free 1800-2-6666-88 |

Contact your Financial Advisor |  Call toll free 1800-2-6666-88 |

Invest online at www.idfcmf.com |  www.facebook.com/idfcamc |

@IDFCMF | |