IDFC ASSET ALLOCATION FUND OF FUNDS

An open ended fund of fund scheme investing in schemes of IDFC Mutual Fund - equity funds and debt funds excluding Gold ETF.

IDFC ASSET ALLOCATION FUND OF FUNDS

An open ended fund of fund scheme investing in schemes of IDFC Mutual Fund - equity funds and debt funds excluding Gold ETF.

IDFC Asset Allocation Fund of Funds helps

diversify your investment and provides

participation across three asset classes - Debt,

Equity and Gold. Equity allocation is towards a

diversified portfolio that invests across market

capitalizations. The Debt portfolio is

predominantly short term funds. Allocation

towards Gold is to hedge the portfolio against

inflation.

The allocation to the respective asset classes are

rebalanced as per a pre-conceptualized matrix on

a regular basis into three plans- Conservative,

Moderate and Aggressive. Within each asset class

the objective of the fund is to optimize the return

by actively allocating assets to funds which best

reflects the underlying macroeconomic theme.

STANDARD MATRIX

| Standard Matrix | Conservative Plan Plan | Moderate Plan | Aggressive Plan |

| Equity Funds (Including Offshore Equity) | 10-30% | 25-55% | 40-80% |

| Debt Funds and/or Arbitrage Funds (Including Liquid Funds) | 35-90% | 10-75% | 0-40% |

| Alternate (Including Gold/ Commodity based Funds) | 0-30% | 0-30% | 0-30% |

| Debt and Money Market Securities | 0-5% | 0-5% | 0-5% |

Exposure in Derivatives - up to 5% of total assets (w.e.f. 28 May, 2018)

FUND FEATURES: (Data as on 30th November'21)

Category: Fund of Funds (Domestic)

Inception Date: 11th February, 2010

Fund Manager:

Mr. Arpit Kapoor

(w.e.f. 18th April 2018)

Monthly Average AUM :

Conservative Plan: Rs8.66 Crores

Moderate Plan: Rs18.94 Crores

Aggressive Plan:Rs18.59 Crores

Minimum Investment Amount: Rs5,000/- and any amount thereafter.

Exit Load:

● If redeemed/switched out within 365

days from the date of allotment:

► Upto 10% of investment:Nil,

► For remaining investment: 1% of

applicable NAV.

● If redeemed / switched out after 365

days from date of allotment: Nil. (w.e.f.

May 08, 2020)

SIP Frequency: Monthly (Investor

may choose any day of the month

except 29th, 30th and 31st as the date

of instalment.)

Options Available: Growth, IDCW@

- (Payout, Reinvestment and Sweep)

Standard Deviation (Annualized)

CP: 2.71%,

MP: 4.81%,

AP: 7.68%

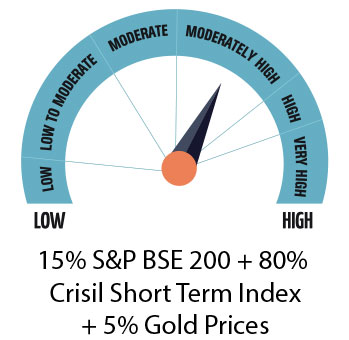

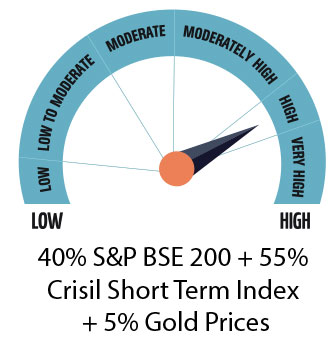

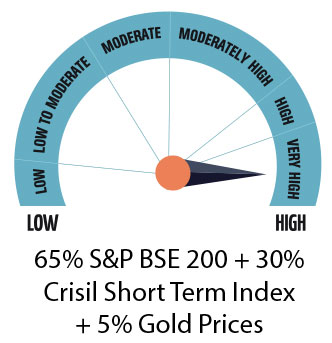

Benchmark: (w.e.f. May 28, 2018)

CP: 15% S&P BSE 200 TRI + 80% CRISIL Short Term Index + 5% Gold Prices

MP: 40% S&P BSE 200 TRI + 55% CRISIL Short Term Index + 5% Gold Prices

AP: 65% S&P BSE 200 TRI + 30% CRISIL Short Term Index + 5% Gold Prices

@Income Distribution cum capital withdrawal

| PORTFOLIO | (30 November 2021) |

| % of NAV | |||

| Name | CP | MP | AP |

| CBLO | 1.24% | 5.44% | 3.04% |

| Clearing Corporation of India | 1.24% | 5.44% | 3.04% |

| Debt | 72.02% | 48.17% | 33.97% |

| IDFC Low Duration Fund | 49.33% | 14.07% | 15.49% |

| IDFC Bond Fund -Short Term Plan | 22.03% | 31.06% | 13.55% |

| IDFC Cash Fund | 0.66% | 3.03% | 4.94% |

| Equity | 27.69% | 46.64% | 63.40% |

| IDFC Focused Equity Fund | 6.68% | 8.11% | 8.98% |

| IDFC Large Cap Fund | 21.01% | 27.36% | 42.07% |

| IDFC Emerging Businesses Fund | - | 11.17% | 12.36% |

| Net Current Asset | -0.94% | -0.26% | -0.41% |

| Grand Total | 100.00% | 100.00 | 100.00% |

RISKOMETER

Scheme risk-o-meter

Benchmark risk-o-meter

This product is suitable for investors who are seeking*:

• To generate capital appreciation and income over

long term.

• Investment in different IDFC Mutual Fund schemes

based on a defined asset allocation model.

Scheme risk-o-meter

Benchmark risk-o-meter

This product is suitable for investors who are seeking*:

• To generate capital appreciation and income over

long term

• Investment in different IDFC Mutual Fund schemes

based on a defined asset allocation model

Scheme risk-o-meter

Benchmark risk-o-meter

This product is suitable for investors who are seeking*:

• To generate capital appreciation and income over long term

• Investment in different IDFC Mutual Fund schemes

based on a defined asset allocation model

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

| Contact your Financial Advisor |

| Call toll free 1800-2-6666-88 |

Contact your Financial Advisor |  Call toll free 1800-2-6666-88 |

Invest online at www.idfcmf.com |  www.facebook.com/idfcamc |

@IDFCMF | |