IDFC HYBRID EQUITY FUND

An open ended hybrid scheme investing predominantly in equity and equity related instruments

IDFC HYBRID EQUITY FUND

An open ended hybrid scheme investing predominantly in equity and equity related instruments

IDFC Hybrid Equity Fund provides a combination of equity (between 65% and 80%) and debt (between 20% and 35%) so as to provide both relative stability of returns and potential of growth. Both equity and fixed income portions are actively managed.

FUND FEATURES: (Data as on 30th November'21)

Category: Aggressive Hybrid

Monthly Avg AUM: Rs591.70 Crores

Inception Date: 30th December 2016

Fund Manager:

Equity Portion: Mr. Anoop Bhaskar

Debt Portion: Mr. Harshal Joshi (w.e.f. 28th July 2021)

Other Parameters:

Beta: 1.11

R Square: 0.93

Standard Deviation (Annualized): 17.48%

Modified Duration: 1.37 years*

Average Maturity: 1.59 years*

Macaulay Duration: 1.41 years*

Yield to Maturity: 4.36%**Of Debt Allocation Only

Asset allocation:

Equity: 77.93%

Debt: 22.07%

Benchmark^^: 65% S&P BSE 200 TRI +

35% NIFTY AAA Short Duration Bond

Index$ (w.e.f 11/11/2019)

Minimum Investment Amount: Rs5,000/- and any amount thereafter.

Exit Load: 10% of investment: Nil

Remaining investment: 1% if redeemed

/ switched out within 1 year from the

date of allotment.

SIP Frequency: Monthly (Investor may

choose any day of the month except

29th, 30th and 31st as the date of

instalment.)

Options Available: Growth & IDCW@

(Payout, Reinvestment & Sweep facility)

| PLAN | DIVIDEND RECORD DATE | ₹/UNIT NAV | NAV |

| REGULAR | 23-Sept-21 | 0.15 | 15.6300 |

| 09-Feb-18 | 0.20 | 10.6427 | |

| 13-Nov-17 | 0.20 | 10.7448 | |

| DIRECT | 23-Sept-21 | 0.15 | 16.8200 |

| 09-Feb-18 | 0.20 | 10.8951 | |

| 13-Nov-17 | 0.20 | 10.9386 |

Income Distribution cum capital withdrawal is not guaranteed and past performance may or may not be sustained in future. Pursuant to payment of Income Distribution cum capital withdrawal , the NAV of the scheme would fall to the extent of payout and statutory levy (as applicable).

@Income Distribution cum capital withdrawal

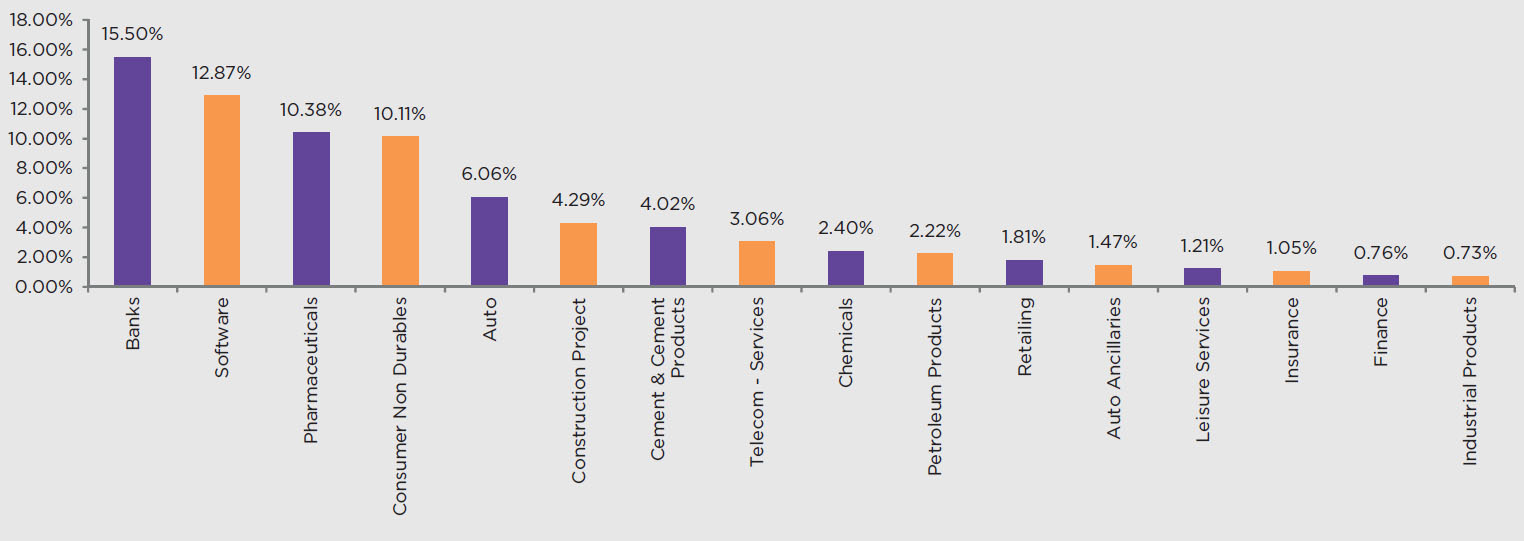

| PORTFOLIO | (30 November 2021) |

| Name of the Instrument | Ratings / Industry | % to NAV |

| Equity and Equity related Instruments | 77.93% | |

| Banks | 15.50% | |

| HDFC Bank | 4.91% | |

| ICICI Bank | 4.84% | |

| State Bank of India | 2.99% | |

| Axis Bank | 2.03% | |

| IndusInd Bank | 0.73% | |

| Software | 12.87% | |

| Infosys | 5.94% | |

| HCL Technologies | 3.27% | |

| Mastek | 2.34% | |

| Zensar Technologies | 1.32% | |

| Pharmaceuticals | 10.38% | |

| Laurus Labs | 2.68% | |

| Gland Pharma | 2.09% | |

| IPCA Laboratories | 1.80% | |

| Sun Pharmaceutical Industries | 1.78% | |

| Cipla | 1.25% | |

| Divi's Laboratories | 0.78% | |

| Consumer Non Durables | 10.11% | |

| Radico Khaitan | 3.41% | |

| Tata Consumer Products | 2.40% | |

| Nestle India | 2.10% | |

| United Spirits | 1.23% | |

| Godrej Consumer Products | 0.97% | |

| Auto | 6.06% | |

| Tata Motors | 3.12% | |

| Mahindra & Mahindra | 1.63% | |

| Maruti Suzuki India | 1.31% | |

| Construction Project | 4.29% | |

| Larsen & Toubro | 4.29% | |

| Cement & Cement Products | 4.02% | |

| UltraTech Cement | 2.03% | |

| The Ramco Cements | 1.02% | |

| Nuvoco Vistas Corporation | 0.98% | |

| Telecom - Services | 3.06% | |

| Bharti Airtel | 3.06% | |

| Chemicals | 2.40% | |

| Deepak Nitrite | 2.40% | |

| Petroleum Products | 2.22% | |

| Reliance Industries | 2.22% | |

| Retailing | 1.81% | |

| Avenue Supermarts | 1.81% | |

| Auto Ancillaries | 1.47% | |

| MRF | 1.47% | |

| Leisure Services | 1.21% | |

| Taj GVK Hotels & Resorts | 1.21% | |

| Insurance | 1.05% | |

| SBI Life Insurance Company | 1.05% | |

| Finance | 0.76% | |

| Muthoot Finance | 0.76% | |

| Industrial Products | 0.73% | |

| Bharat Forge | 0.73% | |

| Government Bond | 7.88% | |

| 7.32% - 2024 G-Sec | SOV | 3.68% |

| 5.63% - 2026 G-Sec | SOV | 1.75% |

| 6.79% - 2027 G-Sec | SOV | 1.09% |

| 8.24% - 2027 G-Sec | SOV | 0.96% |

| 7.17% - 2028 G-Sec | SOV | 0.37% |

| 6.84% - 2022 G-Sec | SOV | 0.02% |

| Corporate Bond | 3.92% | |

| LIC Housing Finance | AAA | 1.34% |

| Power Finance Corporation | AAA | 1.13% |

| HDFC | AAA | 0.89% |

| NABARD | AAA | 0.55% |

| State Government Bond | 0.07% | |

| 9.13% Gujarat SDL - 2022 | SOV | 0.07% |

| Net Cash and Cash Equivalent | 10.21% | |

| Grand Total | 100.00% |

INDUSTRY ALLOCATION

RISKOMETER

Scheme risk-o-meter

Benchmark risk-o-meter

This product is suitable for investors who are seeking*:

• To create wealth over long term

• Investment predominantly in equity and equity related securities

and balance exposure in debt and money market instruments.

*Investors should consult their financial advisors if in doubt about

whether the product is suitable for them.

| Contact your Financial Advisor |

| Call toll free 1800-2-6666-88 |

Contact your Financial Advisor |  Call toll free 1800-2-6666-88 |

Invest online at www.idfcmf.com |  www.facebook.com/idfcamc |

@IDFCMF | |