IDFC REGULAR SAVINGS FUND

An open ended hybrid scheme investing predominantly in debt instruments

IDFC REGULAR SAVINGS FUND

An open ended hybrid scheme investing predominantly in debt instruments

IDFC Regular Savings Fund is a hybrid fund which offers up to 25% participation in the equity markets with the balance invested in fixed income. The Equity portfolio of the fund is an actively managed all cap portfolio. The Fixed Income portfolio is also actively managed with a mix of debt and money market instruments.

FUND FEATURES: (Data as on 30th November'21)

Nature: Conservative Hybrid

Monthly Avg AUM: Rs184.68 Crores

Inception Date: 25th February 2010

Fund Manager:

Equity Portion: Mr. Sumit Agrawal

(w.e.f. 20th October 2016)

Debt Portion:: Mr. Harshal Joshi (w.e.f.

28th July 2021)

Standard Deviation (Annualized): 3.20%

Modified Duration: 2.24 years*

Average Maturity: 2.63 years*

Macaulay Duration: 2.31 years*

Yield to Maturity: 4.90%*

*Of Debt Allocation Only`

Asset allocation:

Equity (including Nifty ETF): 14.99%

Debt: 85.01%

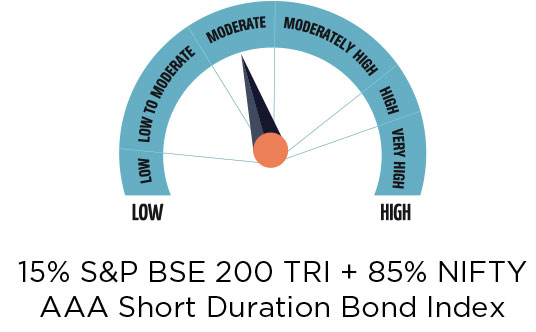

Benchmark^^: 15% S&P BSE 200 TRI +

85% NIFTY AAA Short Duration Bond

Index (w.e.f 11/11/2019)

Minimum Investment Amount: Rs5,000/- and any amount thereafter

Exit Load: In respect of each

purchase of Units:

- For 10% of investment : Nil

- For remaining investment: 1% if

redeemed/switched-out within 365

days from the date of allotment (w.e.f.

24th August 2017)

SIP Frequency: Monthly (Investor

may choose any day of the month

except 29th, 30th and 31st as the date

of instalment.)

Options Available: Growth & IDCW@

Option - Payout, Reinvestment & Sweep

facility and Quarterly & Regular.

| PLAN | DIVIDEND RECORD DATE | ₹/UNIT | NAV |

| REGULAR | 26-Nov-21 | 0.0409 | 13.8713 |

| 28-Oct-21 | 0.0412 | 14.0320 | |

| 28-Sept-21 | 0.0410 | 14.0681 | |

| DIRECT | 26-Nov-21 | 0.0450 | 15.2421 |

| 28-Oct-21 | 0.0452 | 15.4076 | |

| 28-Sept-21 | 0.0449 | 15.4358 |

Income Distribution and Capital Withdrawal is not guaranteed and past performance may or may not be sustained in future. Pursuant to payment of Income Distribution and Capital Withdrawal, the NAV of the scheme would fall to the extent of payout and statutory levy (as applicable).

@Income Distribution and Capital Withdrawal

| PORTFOLIO | (30 November 2021) |

| Name of the Instrument | Ratings | % to NAV |

| Government Bond | 35.49% | |

| 5.63% - 2026 G-Sec | SOV | 24.21% |

| 8.33% - 2026 G-Sec | SOV | 2.96% |

| 7.17% - 2028 G-Sec | SOV | 2.94% |

| 8.24% - 2027 G-Sec | SOV | 1.94% |

| 6.79% - 2027 G-Sec | SOV | 1.90% |

| 8.28% - 2027 G-Sec | SOV | 1.54% |

| Corporate Bond | 16.57% | |

| NABARD | AAA | 5.86% |

| REC | AAA | 4.72% |

| Power Finance Corporation | AAA | 4.56% |

| LIC Housing Finance | AAA | 0.72% |

| Small Industries Dev Bank of India | AAA | 0.71% |

| Britannia Industries | AAA | 0.00% |

| State Government Bond | 5.78% | |

| 8.07% Gujrat SDL - 2025 | SOV | 5.78% |

| Zero Coupon Bond | 1.26% | |

| Sundaram Finance | AAA | 1.26% |

| Equity | 14.99% | |

| Banks | 3.66% | |

| HDFC Bank | 1.25% | |

| ICICI Bank | 1.22% | |

| State Bank of India | 1.20% | |

| Software | 2.89% | |

| Tata Consultancy Services | 1.48% | |

| Infosys | 1.41% | |

| Pharmaceuticals | 1.36% | |

| Divi's Laboratories | 1.36% | |

| Finance | 1.36% | |

| Bajaj Finance | 1.36% | |

| Petroleum Products | 1.17% | |

| Reliance Industries | 1.17% | |

| Consumer Non Durables | 0.94% | |

| Hindustan Unilever | 0.94% | |

| Cement & Cement Products | 0.91% | |

| UltraTech Cement | 0.91% | |

| Auto | 0.91% | |

| Maruti Suzuki India | 0.91% | |

| Construction Project | 0.90% | |

| Larsen & Toubro | 0.90% | |

| Industrial Products | 0.88% | |

| Bharat Forge | 0.88% | |

| Exchange Traded Funds | 6.74% | |

| IDFC Nifty ETF | 6.74% | |

| Net Cash and Cash Equivalent | 19.17% | |

| Grand Total | 100.00% |

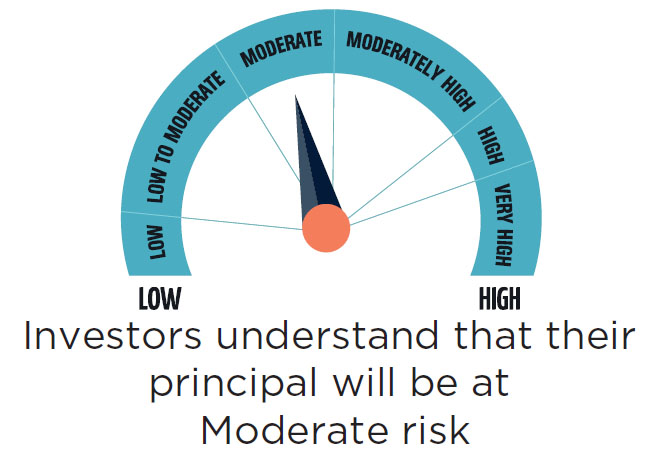

RISKOMETER

Scheme risk-o-meter

Benchmark risk-o-meter

This product is suitable for investors who are seeking*:

• To provide regular income and capital appreciation over

medium to long term

• Investment predominantly in debt and money market instruments

and balance exposure in equity and equity related securities.

*Investors should consult their financial advisors if in doubt about

whether the product is suitable for them.

^^W.e.f. December 1, 2021, the benchmark of the scheme will change to CRISIL Hybrid 85+15 Conservative Index

| Contact your Financial Advisor |

| Call toll free 1800-2-6666-88 |

Contact your Financial Advisor |  Call toll free 1800-2-6666-88 |

Invest online at www.idfcmf.com |  www.facebook.com/idfcamc |

@IDFCMF | |