IDFC Bond Fund - Medium Term Plan

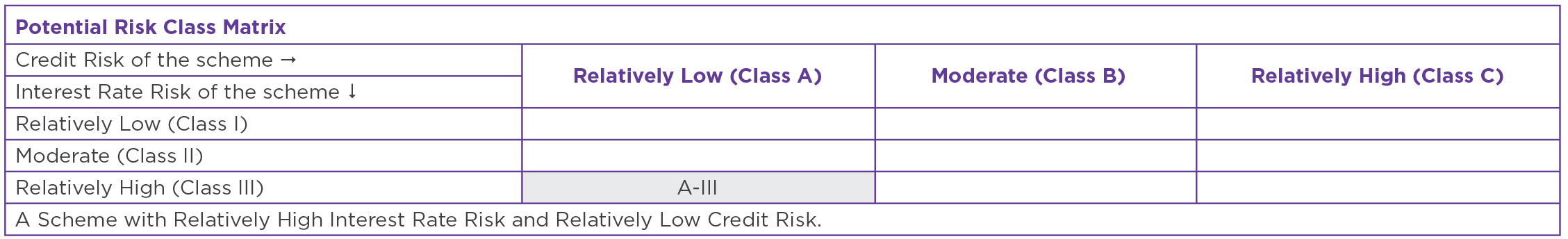

An open ended medium term debt scheme investing in instruments such that the Macaulay duration of the portfolio is between 3 years and 4 years. A Scheme with Relatively High Interest Rate Risk and Relatively Low Credit Risk. (In case of anticipated adverse situation, macaulay duration of the portfolio could be between 1 year and 4 years)

IDFC Bond Fund - Medium Term Plan

An open ended medium term debt scheme investing in instruments such that the Macaulay duration of the portfolio is between 3 years and 4 years. A Scheme with Relatively High Interest Rate Risk and Relatively Low Credit Risk. (In case of anticipated adverse situation, macaulay duration of the portfolio could be between 1 year and 4 years)

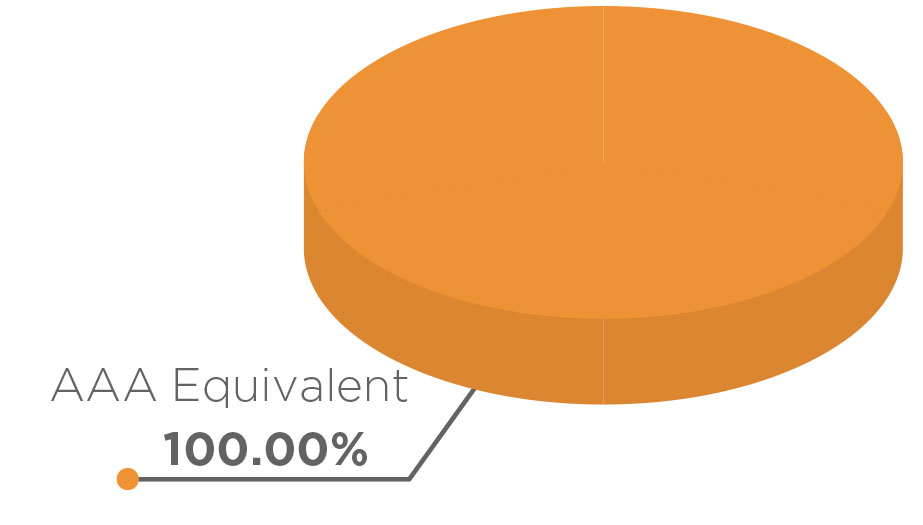

• This fund emphasizes on high quality - currently 100%

AAA and equivalent instruments (limit your credit risk).

• This fund is actively managed within SEBI’s prescribed

duration limit – Macaulay duration band of 3-4 years

(limit your duration risk).

• This fund diversifies your allocation across government

securities, corporate bonds, money market

instruments, depending on fund manager’s views.

• Ideal to form part of ‘Core’ Bucket – due to its high

quality and moderate duration profile

ASSET QUALITY

FUND FEATURES: (Data as on 30th November'21)

Category:Medium Duration

Monthly Avg AUM: Rs3,933.54 Crores

Inception Date: 8th July 2003

Fund Manager:

Mr. Suyash Choudhary

(w.e.f. 15th September 2015)

Standard Deviation (Annualized): 2.07%

Modified duration 1.02 years

Average Maturity: 1.17 years

Macaulay Duration: 1.05 years

Yield to Maturity: 4.04%

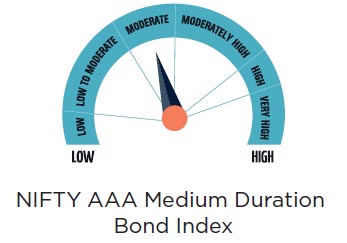

Benchmark^^: NIFTY AAA Medium Duration

Bond Index (with effect from November 11,

2019)

Minimum Investment Amount: Rs5,000/- and any amount thereafter

Exit Load: NIL (w.e.f. 15th January 2019)

Options Available : Growth, IDCW@ - Daily

(Reinvestment only) and Fortnightly, Monthly,

Bi-monthly, Quarterly and Periodic frequency

(each with payout, reinvestment and sweep

facility).

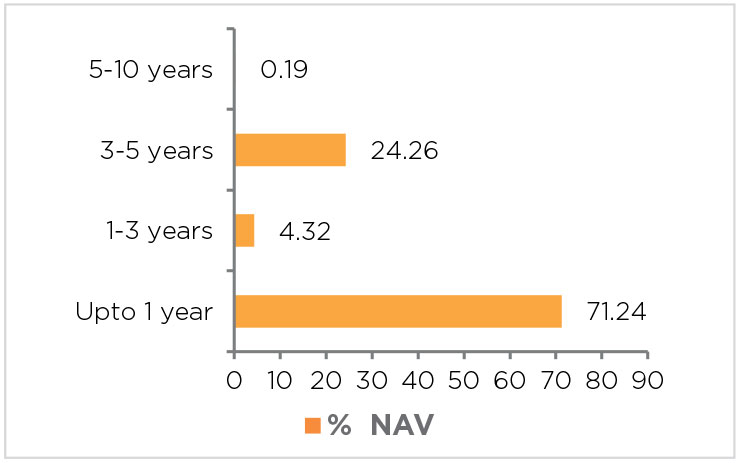

Maturity Bucket:

@Income Distribution cum capital withdrawal

| PORTFOLIO | (30 November 2021) |

| Name | Rating | Total (%) |

| Government Bond | 23.36% | |

| 5.63% - 2026 G-Sec | SOV | 23.23% |

| 7.17% - 2028 G-Sec | SOV | 0.12% |

| 6.79% - 2027 G-Sec | SOV | 0.01% |

| 8.24% - 2027 G-Sec | SOV | 0.004% |

| Corporate Bond | 8.06% | |

| REC | AAA | 3.51% |

| HDFC | AAA | 2.31% |

| NABARD | AAA | 1.48% |

| Indian Railway Finance Corporation | AAA | 0.73% |

| Reliance Industries | AAA | 0.03% |

| Commercial Paper | 2.13% | |

| Kotak Mahindra Prime | A1+ | 2.13% |

| State Government Bond | 1.00% | |

| 8.2% Gujarat SDL - 2025 | SOV | 0.47% |

| 8.25% Maharastra SDL - 2025 | SOV | 0.47% |

| 8.37% Tamil Nadu SDL - 2028 | SOV | 0.06% |

| 8.25% Andhra Pradesh SDL - 2023 | SOV | 0.001% |

| 8.68% Gujarat SDL - 2023 | SOV | 0.0001% |

| PTC | 0.91% | |

| First Business Receivables Trust | AAA(SO) | 0.91% |

| Net Cash and Cash Equivalent | 64.55% | |

| Grand Total | 100.00% |

(PTC originated by Reliance Industries Limited)

POTENTIAL RISK CLASS MATRIX

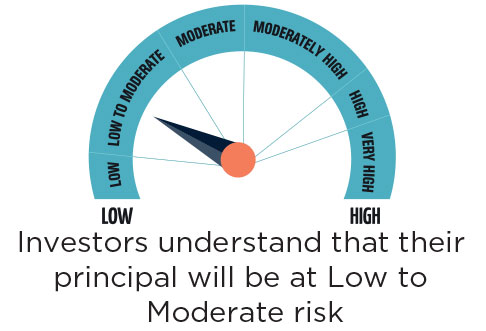

RISKOMETER

Scheme risk-o-meter

Benchmark risk-o-meter

This product is suitable for investors who are seeking*:

• To generate optimal returns over medium term

• Investments in Debt & Money Market securities such that the Macaulay

duration of the portfolio is between 3 years and 4 years

*Investors should consult their financial advisers if in doubt about

whether the product is suitable for them.

Gsec/SDL yields have been annualized wherever applicable

Standard Deviation calculated on the basis of 1 year history of monthly data

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

| Contact your Financial Advisor |

| Call toll free 1800-2-6666-88 |

Contact your Financial Advisor |  Call toll free 1800-2-6666-88 |

Invest online at www.idfcmf.com |  www.facebook.com/idfcamc |

@IDFCMF | |