IDFC CASH FUND

An open ended liquid scheme.

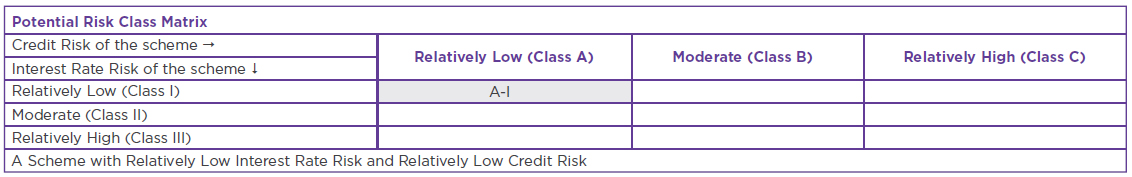

A Scheme with Relatively Low Interest Rate Risk and Relatively Low Credit Risk.

IDFC CASH FUND

An open ended liquid scheme.

A Scheme with Relatively Low Interest Rate Risk and Relatively Low Credit Risk.

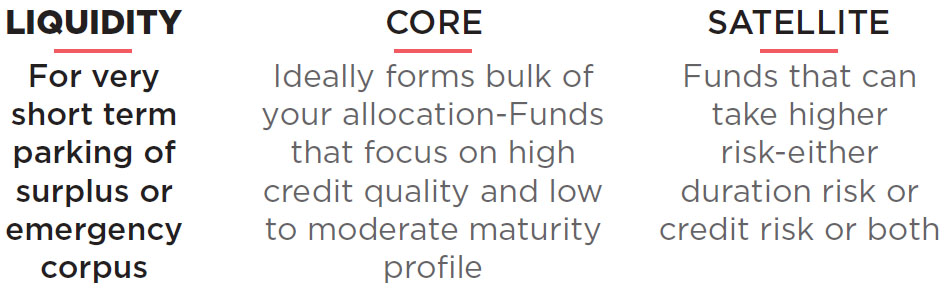

• A fund high on credit quality of its instruments

and low on volatility as it invests in <91 days

instruments

• Offers insta-redemption facility, so access your

money 24*7

• Suitable for building your emergency corpus or to

temporarily park the surplus – as part of ‘Liquidity’

bucket

FUND FEATURES: (Data as on 30th November'21)

Category: Liquid

Monthly Avg AUM: Rs9,316.63 Crores

Inception Date: 2nd July 2001

Fund Manager:

Mr. Harshal Joshi (w.e.f.

15th September 2015) Mr. Brijesh Shah

(w.e.f. 1st Dcember 2021)

Standard Deviation (Annualized): 0.08%

Modified duration 15 days

Average Maturity: 15 days

Macaulay Duration: 15 days

Yield to Maturity: 3.42%

Benchmark: Crisil Liquid Fund Index

Minimum Investment Amount: Rs100/- and any amount thereafter

Options Available : Growth & IDCW@

Option - Daily (Reinvest), Weekly

(Reinvest), Monthly (Payout,Reinvest and

Sweep), Periodic (Payout,Reinvest and

Sweep)

Exit Load*:

| Investor exit upon subscription | Exit load as a % of redemption proceeds |

| Day 1 | 0.0070% |

| Day 2 | 0.0065% |

| Day 3 | 0.0060% |

| Day 4 | 0.0055% |

| Day 5 | 0.0050% |

| Day 6 | 0.0045% |

| Day 7 onwards | 0.0000% |

@Income Distribution cum capital withdrawal

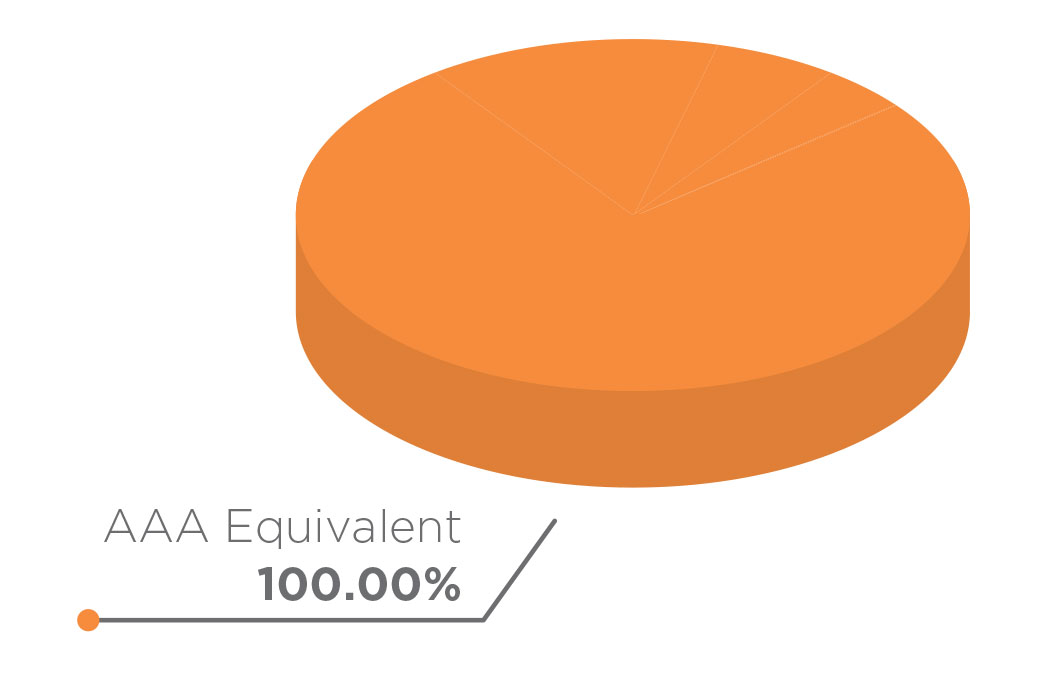

ASSET QUALITY

| PORTFOLIO | (30 November 2021) |

| Name | Rating | Total (%) |

| Commercial Paper | 34.71% | |

| Reliance Jio Infocomm | A1+ | 7.77% |

| Reliance Industries | A1+ | 7.19% |

| Bajaj Finance | A1+ | 6.00% |

| Reliance Retail Ventures | A1+ | 4.50% |

| Export Import Bank of India | A1+ | 3.59% |

| HDFC Securities | A1+ | 2.38% |

| ICICI Securities | A1+ | 2.09% |

| NABARD | A1+ | 1.19% |

| Treasury Bill | 22.96% | |

| 91 Days Tbill - 2021 | SOV | 14.45% |

| 182 Days Tbill - 2021 | SOV | 7.32% |

| 364 Days Tbill - 2021 | SOV | 1.20% |

| Corporate Bond | 6.07% | |

| REC | AAA | 2.71% |

| HDFC | AAA | 2.10% |

| National Highways Auth of Ind | AAA | 1.08% |

| Power Finance Corporation | AAA | 0.18% |

| Net Cash and Cash Equivalent | 36.26% | |

| Grand Total | 100.00% |

POTENTIAL RISK CLASS MATRIX

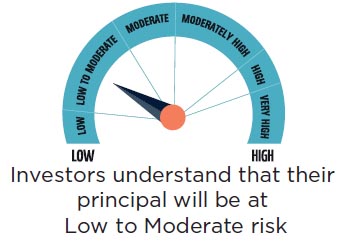

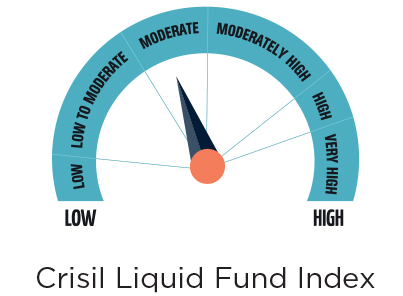

RISKOMETER

Scheme risk-o-meter

Benchmark risk-o-meter

This product is suitable for investors who are seeking*:

• To generate short term optimal returns with stability and high liquidity

• Investments in money market and debt instruments, with maturity

up to 91 days

*Investors should consult their financial advisors if in doubt about

whether the product is suitable for them.

Standard Deviation calculated on the basis of 1 year history of monthly data

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

| Contact your Financial Advisor |

| Call toll free 1800-2-6666-88 |

Contact your Financial Advisor |  Call toll free 1800-2-6666-88 |

Invest online at www.idfcmf.com |  www.facebook.com/idfcamc |

@IDFCMF | |