IDFC CORPORATE BOND FUND

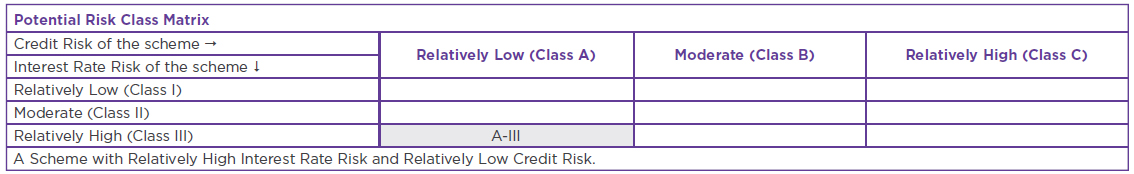

An open ended debt scheme predominantly investing in AA+ and above rated corporate bonds. A Scheme with Relatively High Interest Rate Risk and Relatively Low Credit Risk.

IDFC CORPORATE BOND FUND

An open ended debt scheme predominantly investing in AA+ and

above rated corporate bonds. A Scheme with Relatively High

Interest Rate Risk and Relatively Low Credit Risk.

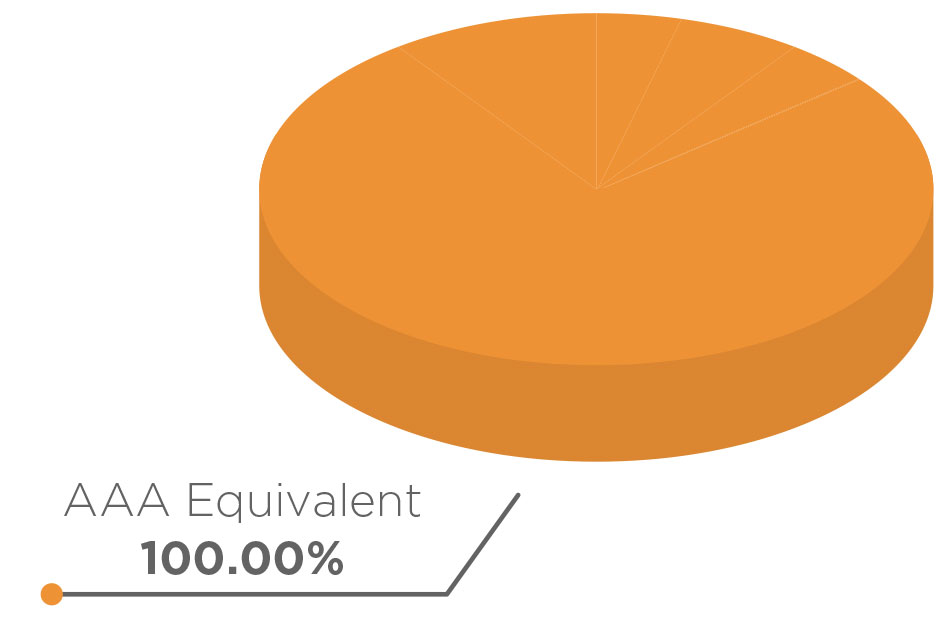

• A portfolio that emphasizes on high quality, currently

100% AAA and equivalent instruments.

• By investing in one single fund you get to diversify

your allocation across high quality corporate

instruments.

• Ideal to form part of ‘Core’ Bucket – due to its high

quality and low to moderate duration profile*

FUND FEATURES: (Data as on 30th November'21)

Category: Corporate Bond

Monthly Avg AUM: Rs20,332.33 Crores

Inception Date: 12th January 2016

Fund Manager:

Mr. Suyash Choudhary (w.e.f.

28th July 2021) Mr. Gautam Kaul (w.e.f. 1st

Dcember 2021)

Standard Deviation (Annualized): 1.85%

Modified duration 2.02 years

Average Maturity: 2.30 years

Macaulay Duration: 2.11 years

Yield to Maturity: 5.06%

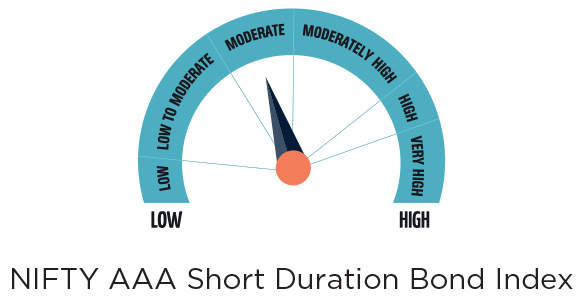

Benchmark^^: NIFTY AAA Short Duration

Bond Index (w.e.f 11/11/2019)

Minimum Investment Amount: Rs5,000/- and any amount thereafter

Exit Load: Nil

Options Available : Growth & IDCW@ Option

- Payout, Reinvestment & Sweep and

Monthly, Quarterly, Half Yearly, Annual &

Periodic.

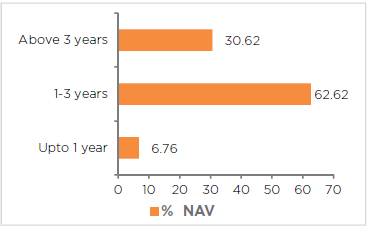

Maturity Bucket:

@Income Distribution cum capital withdrawal

| PORTFOLIO | (30 November 2021) |

| Name | Rating | Total (%) |

| Corporate Bond | 70.78% | |

| NABARD | AAA | 11.44% |

| REC | AAA | 10.59% |

| Reliance Industries | AAA | 8.62% |

| HDFC | AAA | 8.53% |

| National Housing Bank | AAA | 5.95% |

| Larsen & Toubro | AAA | 5.63% |

| Power Finance Corporation | AAA | 4.59% |

| Indian Railway Finance Corporation | AAA | 3.38% |

| Hindustan Petroleum Corporation | AAA | 2.58% |

| Axis Bank | AAA | 1.46% |

| UltraTech Cement | AAA | 1.35% |

| ICICI Bank | AAA | 1.24% |

| Indian Oil Corporation | AAA | 1.18% |

| Mahindra & Mahindra | AAA | 1.01% |

| Export Import Bank of India | AAA | 0.85% |

| Small Industries Dev Bank of India | AAA | 0.64% |

| Oil & Natural Gas Corporation | AAA | 0.49% |

| LIC Housing Finance | AAA | 0.47% |

| Power Grid Corporation of India | AAA | 0.43% |

| NTPC | AAA | 0.15% |

| HDB Financial Services | AAA | 0.12% |

| National Highways Auth of Ind | AAA | 0.07% |

| Government Bond | 20.37% | |

| 5.22% - 2025 G-Sec | SOV | 17.60% |

| 7.32% - 2024 G-Sec | SOV | 2.75% |

| 7.68% - 2023 G-Sec | SOV | 0.03% |

| State Government Bond | 3.73% | |

| 9.22% Gujarat SDL - 2023 | SOV | 0.74% |

| 6.64% Rajasthan SDL - 2024 | SOV | 0.36% |

| 8.10% Tamil Nadu SDL - 2023 | SOV | 0.34% |

| 8.83% Tamilnadu SDL - 2024 | SOV | 0.27% |

| 9.25% Haryana SDL - 2023 | SOV | 0.27% |

| 5.46% Tamilnadu SDL - 2024 | SOV | 0.25% |

| 5.6% Haryana SDL - 2024 | SOV | 0.21% |

| 9.47% Haryana SDL - 2024 | SOV | 0.19% |

| 9.55% Karnataka SDL - 2024 | SOV | 0.19% |

| 9.63% Andhra Pradesh SDL - 2024 | SOV | 0.16% |

| 9.80% Haryana SDL - 2024 | SOV | 0.14% |

| 8.96% Maharashtra SDL - 2024 | SOV | 0.13% |

| 5.6% Maharashtra SDL - 2024 | SOV | 0.12% |

| 9.48% Andhra Pradesh SDL - 2024 | SOV | 0.11% |

| 9.5% Gujrat SDL - 2023 | SOV | 0.08% |

| 9.71% Haryana SDL - 2024 | SOV | 0.05% |

| 9.24% Haryana SDL - 2024 | SOV | 0.05% |

| 9.11% Maharashtra SDL - 2024 | SOV | 0.03% |

| 9.37% Gujarat SDL - 2024 | SOV | 0.03% |

| 5.75% Tamilnadu SDL - 2025 | SOV | 0.01% |

| 9.10% Tamil Nadu SDL - 2022 | SOV | 0.004% |

| Commercial Paper | 0.24% | |

| HDFC | A1+ | 0.24% |

| Zero Coupon Bond | 0.01% | |

| Power Finance Corporation | AAA | 0.01% |

| Net Cash and Cash Equivalent | 4.87% | |

| Grand Total | 100.00% | |

ASSET QUALITY

POTENTIAL RISK CLASS MATRIX

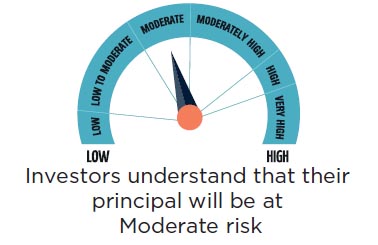

RISKOMETER

Scheme risk-o-meter

Benchmark risk-o-meter

This product is suitable for investors who are seeking*:

• To generate medium to long term optimal returns.

• Investments predominantly in high quality corporate bonds.

*Investors should consult their financial advisors if in doubt

about whether the product is suitable for them.

IDFC Corporate Bond Fund was being managed by Mr. Anurag Mittal upto 14th October 2021.

*The scheme is currently following a ‘roll down’ investment approach on a tactical basis. This means that ordinarily the average maturity of the scheme’s portfolio is unlikely to increase significantly and may be expected to generally reduce with the passage of time, subject to intermittent periods of volatility in the maturity profile owing to AUM movement and market conditions. The approach being followed currently is tactical in nature and would be subject to change depending on investment opportunities available without prior notice.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

| Contact your Financial Advisor |

| Call toll free 1800-2-6666-88 |

Contact your Financial Advisor |  Call toll free 1800-2-6666-88 |

Invest online at www.idfcmf.com |  www.facebook.com/idfcamc |

@IDFCMF | |